Clarksdale Baptist Church v. Green Brief for Respondents William H. Green in Opposition to Certiorari

Public Court Documents

January 1, 1984

Cite this item

-

Brief Collection, LDF Court Filings. Clarksdale Baptist Church v. Green Brief for Respondents William H. Green in Opposition to Certiorari, 1984. 06caadb0-ad9a-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/0baeec65-4b9c-4960-a377-24c56004991d/clarksdale-baptist-church-v-green-brief-for-respondents-william-h-green-in-opposition-to-certiorari. Accessed February 21, 2026.

Copied!

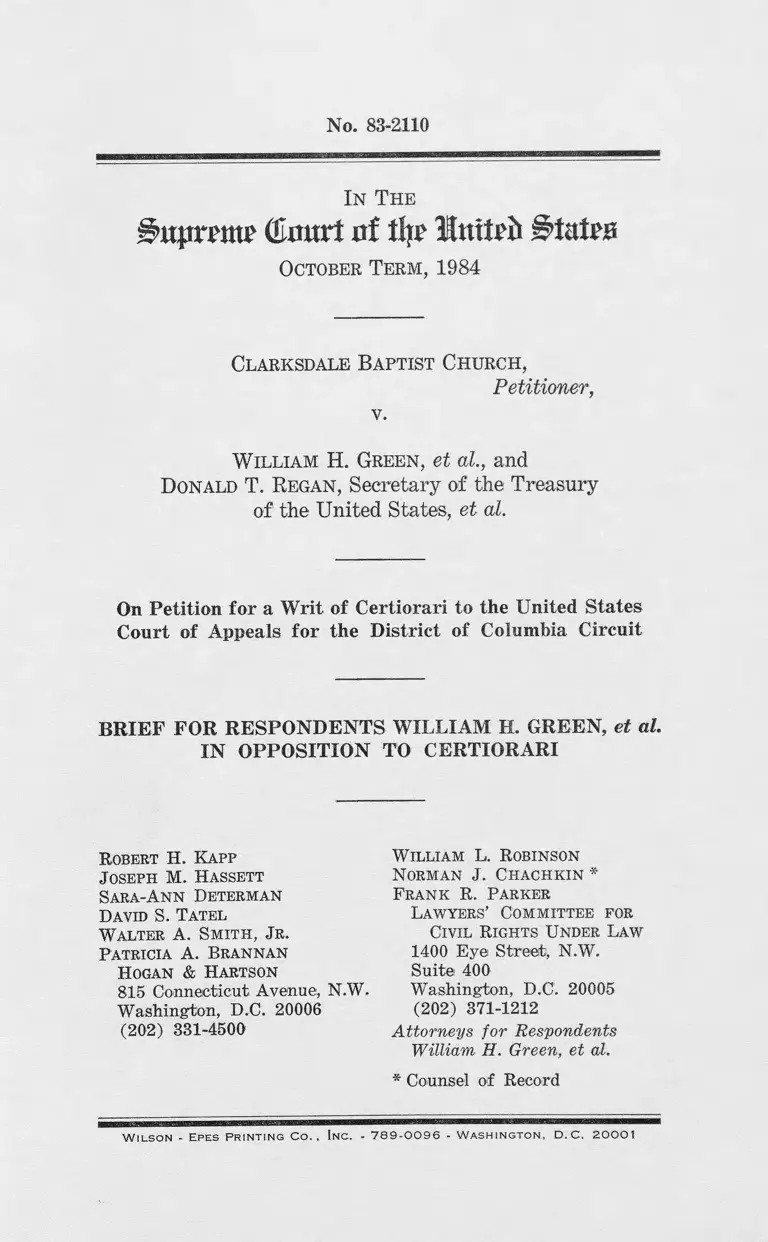

No. 83-2110

In The

§ u jrn w (kmtri nf % UnttFii i>tatp£

October Term, 1984

Clarksdale Baptist Church,

Petitioner,

v.

W illiam H. Green, et at., and

Donald T. Regan, Secretary of the Treasury

of the United States, et al.

On Petition for a Writ of Certiorari to the United States

Court of Appeals for the District of Columbia Circuit

BRIEF FOR RESPONDENTS WILLIAM H. GREEN, et al.

IN OPPOSITION TO CERTIORARI

Robert H. Kapp

Joseph M. Hassett

Sara-A nn Determan

David S. Tatel

Walter A. Smith , Jr.

Patricia A. Brannan

Hogan & Hartson

815 Connecticut Avenue, N.W.

Washington, D.C. 20006

(202) 331-4500

William L. Robinson

Norman J. Chachkin *

Frank R. Parker

Lawyers’ Committee for

Civil Rights Under Law

1400 Eye Street, N.W.

Suite 400

Washington, D.C. 20005

(202) 371-1212

Attorneys for Respondents

William H. Green, et al.

* Counsel of Record

W i l s o n - Ep e s Pr i n t i n g C o . , In c . . 7 8 9 - 0 0 9 6 - W a s h i n g t o n , D .C , 2 0 0 0 1

A 1980 decree in this case requires the Internal Reve

nue Service (IRS) to apply specified evidentiary stand

ards, derived from federal court rulings in analogous

suits, in determining whether or not Mississippi private

schools (including those operated by churches) follow a

racially discriminatory policy which makes them ineligi

ble for federal tax exemption (and consequent tax de

ductibility of contributions to them). Petitioner operates

a private school in Mississippi and seeks to maintain its

federal tax-exempt status without being required to dem

onstrate that it is nondiseriminatory, in accordance with

those standards. The questions presented are:

1. Does a requirement that the IRS collect and con

sider information regarding the establishment, history,

student enrollment (by race) and staff employment (by

race) of Mississippi non-public schools which are affili

ated with churches, when IRS determines whether those

schools are eligible for federal tax exemption, violate the

Establishment Clause of the First Amendment because it

creates “ excessive entanglement” between the federal gov

ernment and the churches?

2. Is it irrational, arbitrary, and violative of the

First Amendment to infer that a Mississippi church-

operated non-public school— which (a) opened its doors

the very day when local public school desegregation be

gan, (b) tripled its white student enrollment five years

later when public school integration accelerated, and (c)

has never enrolled a black student nor employed a black

teacher— follows a racially discriminatory policy and is

ineligible for federal tax exemption unless the school can

demonstrate by clear and convincing evidence that it is

nondiseriminatory?

3. Does the district court’s order require petitioner, or

any other Mississippi church school, as a condition of

QUESTIONS PRESENTED

(i)

11

eligibility for federal tax exemption, to take any specific

action contrary to its religious beliefs, thus violating any

rights under the Free Exercise Clause of the First

Amendment?

4. Did the plaintiffs, parents of black public school

children, have standing to bring this case and seek effec

tive relief, in light o f the findings that federal tax exemp

tions were critically important to the continued opera

tion of racially discriminatory Mississippi private schools,

and that such institutions materially impeded public

school desegregaton throughout the state (including the

minor plaintiffs’ school districts) ?

TABLE OF CONTENTS

Page

QUESTIONS PRESENTED ___ i

STATEMENT ...................... 1

Proceedings B elow ........ .......... 2

Statement of Facts............... 6

REASONS WHY THE WRIT SHOULD BE DENIED.. 8

CONCLUSION ________________ 18

TABLE OF AUTHORITIES

Cases:

Alexander v. Holmes County Board of Education,

396 U.S. 19 (1969) .... ............. ........................... 7n

Allen v. Wright, 52 U.S.L.W. 5110 (U.S. July 3,

1984) .............................. ........................................... 2, 12

Bob Jones University v. United States, 461 U.S.

------ •, 76 L. Ed. 2d 157 (1983)............................... 8, 9n

Bob Jones University v. United States, 639 F.2d

147 (4th Cir. 1980), aff’d, 461 U .S .------ , 76 L.

Ed. 2d 157 (1983)_________ ___________ __ _____ 9n

Brumfield v. Dodd, 425 F!. Supp. 528 (E.D. La.

1976) ................ ........................................ ..............lOn, 1 In

Coffey v. State Educational Finance Commission,

296 F. Suppi. 1387 (S.D. Miss. 1969) ..................7n, l ln

Coit v. Green, 404 U.S. 997 (1971), aff’g mem.

Green v. Connolly, 330 F. Supp. 1150 (D.D.C.

1971) ..........- __________ ____ _________________ 12n

EEOC v. Mississippi College, 626 F.2d 477 (5th

Cir. 1980), cert, denied, 453 U.S. 1272 (1981) ....9n, lOn

Gilmore v. City of Montgomery, 337 F. Supp. 22

(M.D. Ala. 1972), aff’d in relevant part, 473

F.2d 832 (5th Cir. 1973), aff’d in relevant part,

417 U.S. 556 (1974)........... ......... ................ ........lOn, l ln

(iii)

IV

TABLE OF AUTHORITIES—Continued

Page

Goldsboro Christian Schools, Inc. v. United States,

436 F. Supp. 1314 (E.D.N.C. 1977), aff’d mem.,

464 F.2d 879 (4th Cir. 1981), aff’d sub nom. Bob

Jones University v. United States, 461 U .S.------ ,

76 L. Ed. 157 (1983)............... ................................. 9n

Green v. Connally, 330 F. Supp. 1150 (D.D.C.),

aff’d mem. sub nom. Coit v. Green, 404 U.S. 997

(1971) ___________________ ______ ___ ____ __ _ 2, l ln

Green v. Kennedy, 309 F. Supp. 1127 (D.D.C.),

appeal dismissed sub nom. Cannon v. Green, 398

U.S. 956 (1970) ............ .................. ........................ 11

Henry v. Clarksdale Municipal Separate School

District, 433 F.2d 387 (5th Cir. 1970).............. . 7n

Henry v. Clarksdale Municipal Separate School

District, 409 F.2d 682 (5th Cir.), cert, denied,

396 U.S. 940 (1969)____________ _______ ______ 7n

Jones v. Wolf, 443 U.S. 595 (1979) ........................ l ln

Knowles v. Board of Public Instruction of Leon

County, 405 F.2d 1206 ( 5th Cir. 1969) ............... 13

Leary v. United States, 395 U.S. 6 (1969)............. l ln

McCormick v. Hirsch, 460 F. Supp. 1337 (M.D.

Pa. 1978) _________________ ______ ___ - ....... 9n

Meek v. Pittenger, 421 U.S. 349 (1978) _________ 9n

Moore v. Tangipahoa Parish School Board, 298 F.

Supp. 288 (E.D. La. 1969).................................. . 13

NLRB v. Catholic Bishop of Chicago, 440 U.S. 490

(1979) ........................... ........................................... 9n

Norwood v. Harrison, 413 U.S. 455 (1973)............. 3

Norwood v. Harrison, 410 F. Supp. 133 (N.D.

Miss. 1976), aff’d and remanded, 581 F.2d 518

(5th Cir. 1976)..... ................................... ................ 4n

Norwood v. Harrison, 382 F. Supp. 921 (N.D.

Miss. 1974) ___________ _________—.3, 4, 6, 9, lOn, l ln

Stell v. Savannah-Chatham County Board of Edu

cation, 255 F. Supp. 88 (S.D. Ga. 1966) ......... . 13

Synanon Foundation, Inc. v. California, 444 U.S.

1307 (1979) (Rehnquist, J., Circuit Justice).... l ln

Tot v. United States, 319 U.S. 643 (1943)______ l ln

V

United States v. California Cooperative Canneries,

279 U.S. 553 (1929).......... .................... ................ 13

United States v. Freedom Church, 613 F.2d 316

(1st Cir. 1979) ........................................................ l ln

United States v. Mississippi, 499 F.2d 425 (5th

Cir. 1974) .................................................................. lOn

United States v. School District of Omaha, 376 F.

Supp. 198 (D. Neb. 1973) .............. ...................... 13

Usery v. Turner Elkhorn Mining Company, 428

U.S. 1 (1976)............................... ................ ............ 12n

Walz v. Tax Commission, 397 U.S. 644 (1970)____ 8n, 9n

Other Authorities:

U.S, Sup. Ct. Rule 17.1 ( c ) ...... ................................... 12

TABLE OF AUTHORITIES—Continued

Page

In The

(tart nf tl|r Imtrit

October Term, 1984

No. 83-2110

Clarksdale Baptist Church,

Petitioner,

v.

W illiam H. Green, et at., and

Donald T. Regan, Secretary of the Treasury

of the United States, et at.

On Petition for a Writ of Certiorari to the United States

Court of Appeals for the District of Columbia Circuit

BRIEF FOR RESPONDENTS WILLIAM H. GREEN, et al.

IN OPPOSITION TO CERTIORARI

STATEMENT

This case involves the entitlement to federal tax ex

emption of “ large numbers of segregated private schools

. . . established in the State [of Mississippi] for the pur

pose of avoiding a unitary public school system,” where

“ tax exemptions were critically important to the ability

of such schools to succeed” and “ the connection between

the grant of tax exemptions to discriminatory schools and

2

desegregation of the public schools . . . was close enough

to warrant the conclusion that irreparable injury to the

interest in desegregated education was threatened if the

tax exemptions continued.” Allen v. Wright, 52 U.S.L.W.

5110, 5118 (U.S. July 3, 1984).

Proceedings Below

In 1971 the district court directed the Internal Reve

nue Service to follow certain specified procedures in de

termining whether Mississippi private schools, including

those operated by churches,1 were eligible for tax-exempt

status. Green v. Connolly, 330 F. Supp. 1150 (D.D.C.),

aff’d mem. sub north. Coit v. Green, 404 U.S. 997 (1971).

In 1976 the plaintiffs sought further relief, alleging that

the 1971 decree had proved ineffective— as demonstrated

by the continued federal tax exemption of Mississippi

private schools determined to be racially discriminatory

in contested federal court proceedings.

Plaintiffs’ motion2 asserted that while the three-judge

court had, in 1971, declined to impose more specific in

junctive relief because IRS Commissioner Thrower had

promised to review the tax-exempt status of nine named

Mississippi private schools in accordance with proper

legal standards,3 six o f these schools were still tax-exempt

in 1976. More significant, these six private schools also

had been unable to meet the criteria established by the

United States District Court in Mississippi for demon

strating that they were not racially discriminatory— a

1 See Plaintiffs’ Opposition to Application of Clarksdale Baptist

Church for Stay Pending- Appeal, Clarksdale Baptist Church v.

Green, No. A-162 (U.S. Oct. 3, 1983) [hereinafter cited as “ Stay

Opposition” ] 7-8 n.9.

2 Plaintiffs’ 1976 Motion for an Order Substituting Parties De

fendant, to Enforce Decree and for Further Relief was reproduced

as Appendix “A” to their Stay Opposition herein.

3 See Green v. Connally, 330 F. Supp. at 1176 n.53 and ac

companying text.

3

necessary precondition to obtaining free textbooks for

their students. See Norwood v. Harrison, 413 U.S. 455

(1973),4 on remand, 382 F. Supp. 921 (N.D. Miss.

1974).® Indeed, in passing upon disputed private school

4 Norwood was a. suit challenging the constitutionality of a pro

gram under which the State of Mississippi was providing free

textbooks for use by white pupils enrolled in private segregation

academies established to avoid public school desegregation. This

Court reversed the dismissal of the case because

. . . the Mississippi textbook program . . . significantly aids

the organization and continuation of a separate system of

private schools which, under the District Court holding, may

discriminate if they so desire. A State’s constitutional obli

gation requires it to steer clear, not only of operating the old

dual system of racially segregated schools, but also of giving

significant aid to' institutions that practice racial or other

invidious discrimination.

413 U.S. at 467. On remand, this Court suggested,

The District Court can appropriately direct the appellee [Text

book Board members] to submit for approval a certification

procedure under which any school seeking textbooks for its

pupils may apply for participation on behalf of pupils. The

certification by the school to the Mississippi Textbook Pur

chasing Board should, among other factors, affirmatively de

clare its admission, policies and practices, state the number of

its racially and religiously identifiable minority students and

such other relevant data as is consistent with this opinion.

The State’s certification of eligibility would, of course, be sub

ject to judicial review.

Id. at 471.

6 All of the schools initially participated in Mississippi’s pro

gram to make available free textbooks to private school students.

After this Court’s ruling that pupils at racially discriminatory

institutions could not be given books consistent with the Four

teenth Amendment, see swpra note 4, the district court established

a certification procedure to be administered by the state Textbook

Purchasing Board and articulated standards for determining

whether a private academy was being operated on a nondiscrimina-

tory basis. Three of the six schools immediately returned the text

books they had received and withdrew from the program. Two

others were initially approved by the Board but after the Norwood

4

certifications by the Mississippi Textbook Purchasing

Board, the Norwood trial judge pointedly noted that one

school which he found to be racially discriminatory still

retained its federal tax-exempt status after the 1971 rul

ing in this case1 * * * *— and the school sought to defend its en

titlement to textbooks on this ground. See 382 F. Supp.

at 929 (supposed non-discrimination policy “ obviously

stated perfunctorily, at isolated intervals, and only to ob

tain tax advantages” ). Even after the Norwood court’s

ruling, however, this school continued to enjoy the bene

fits of federal tax exemption, as did academies which re

turned their books rather than attempt to meet the Nor

wood requirements for showing nondiscrimination.6

Plaintiffs’ evidence in this case also established that

the IRS had made no effort to determine whether the

numerous Mississippi private schools claiming exemption

by virtue of their affiliation with churches which did not

have to apply formally for tax-exempt status7 were non

plaintiffs filed objections in. the district court, also- gave back their

books and left the program. The sixth school was held to- be- dis

criminatory by the district court after an evidentiary hearing and

was ordered to turn in its books- See Stay Opposition, Exhibit

“ 1” to Appendix “A” ; 382 F, Supp. at 928-29, 935.

6 See 382 F. Supp. at 935 n.19 and accompanying text; Stay

Opposition, Exhibits “ 1,” “3” to- Appendix “A.”

7 See Stay Opposition at 4 n.5. For example, the school operated

by petitioner was not included on a 1977 IRS list of tax-exempt

Mississippi private educational institutions, see Memorandum of

Points and Authorities in Support of Plaintiffs’ Motion for Sum

mary Judgment, Green v. Miller, Civ. No. 1355-69 (D.D.C. January

7, 1980), Attachment “D” (filed under seal). Nor was the Pres

byterian Day School, which received only conditional approval from

the court in Norwood, see 382 F. Supp. at 934 ( “the Presbyterian

Day School, as an entity of the church, enjoys tax exempt status,

and apparently has had no involvement with the orders in Green

v. Connally . . .” ) and later withdrew from the program, see id.,

410 F. Supp. 133, 138 n.3 (N.D. Miss. 1976), aff’d and remanded,

581 F.2d 518 (5th Cir. 1976).

5

discriminatory.8 In 1980, the district court concluded

“ that the defendants have not violated the order o f June

30, 1971, but that said order requires supplementation

and modification,” Pet. App. A-2 - A-3, and it granted

the additional relief which is now at issue.

Petitioner then intervened in the case and moved to

modify the 1980 order so as to exempt all church-operated

schools from its application. On July 22, 1983, following

the submission of affidavits and presentation of evidence

through depositions, the trial court denied the Church’s

motion to modify the injunction, finding “ [u]pon the

basis of all of the evidence” that

intervenor [Clarksdale Baptist Church] has failed

to establish that application by the Internal Reve

nue Service of the procedures and standards con

tained in the Court’s injunctive decree of May 5,

1980 (as amended June 2, 1980) to the Clarksdale

Baptist Church or to church-connected schools in

Mississippi, generally, violates any statutory or con

stitutional right of the intervenor.9

Petitioner’s appeal to the D.C. Circuit was dismissed after

oral argument before a panel, which held “ the First

Amendment issues presented by the Intervenor to be

plainly insubstantial” (Pet. App. A -l, A-15).

8 See Deposition of James L. Bloom, Attachment “ D” to Plain

tiffs’ Submission in Response to the Court’s March 9 Order, Green

v. Miller, Civ. No, 1355-69 (D.D.C. October 12, 1979) 23 (filed

under seal). IRS argued that it was required by the letter of the

1971 decree only to deny applications for exemption or to withdraw

favorable rulings which had been issued upon prior applications.

Memorandum of Defendants in Response to Plaintiffs’ Submission

on the Merits, Green v. Miller (November 27, 1979) 17.

9 Accordingly, the question of whether the district court appro

priately granted summary judgment against petitioner, see Pet. at

3 n.l, is not in the case. The district court “ further, and alterna

tively, rule[d] directly upon intervenor’s Motion to Modify Injunc

tion, since intervenor contends that summary judgment is inappro

priate,” The 1983 district court order affirmed by the court below

was omitted from the Petition but is reprinted infra, Appendix “A.”

6

Statement of Facts

The 1980 district court decree requires the IRS to

deny or to withdraw the tax-exempt status of any Mis

sissippi private school which either

(a) was held, in prior adversary or administrative

proceedings, to1 be racially discriminatory, or

(b) was founded or expanded at the time of public

school desegregation in the area it serves and cannot

demonstrate “ that [it does] not racially discriminate

in admissions, employment, scholarships, loan pro

grams, athletics, and extra-curricular programs.”

See Pet. App. at A-3, A-8. The decree instructs IRS that

the existence of either of these conditions creates an in

ference of discrimination which a school seeking exemp

tion “ may overcome by [furnishing] evidence which

clearly and convincingly reveals objective acts and dec

larations establishing that” it follows nondiscriminatory

policies.10 It further provides examples of the sort of in

formation which might be presented to IRS by a private

school to dispel the inference of discrimination,11 while

explicitly directing IRS to consider “ any other similar

evidence calculated to show that the doors of the private

school and all facilities and programs therein are indeed

open to students or teachers of both the black and white

races upon the same standard of admission or employ

ment.” Pet. App. at A-4. In essence, the decree requires

Mississippi private schools seeking federal tax exemption

to do no more than they were already required to do

under Norwood in order to obtain free textbooks for their

pupils.

Finally, the decree requires IRS to collect, from Mis

sissippi private schools, information adequate to permit

10 Pet. App. at A-3. Thei language used in the decree was taken

from the opinion of the district court in Norwood, 382 F. Supp. 921

(N.D. Miss. 1974).

11 These examples were also- taken from the Norwood opinion,

supra note 10.

it to decide whether a school is subject to the inference

of discrimination.12

Petitioner operates a private school which opened in

the fall of 1964— immediately after the summer extraor

dinary session of the Mississippi Legislature which en

acted unconstitutional tuition grant legislation to impede

public school desegregation.13 Integration of the Clarks-

dale public schools under a “ freedom of choice” plan ap

plicable to grades 1 and 2 began in 1964-65; Clarksdale

Baptist School opened to serve the same grades that

year. As “ freedom of choice” was extended to additional

grades in the public schools, so the Clarksdale Baptist

School added one grade each year from 1965-66 to 1968-

69. When desegregation accelerated in 1969 and 1970,14 15

enrollment in the Clarksdale Baptist School substantially

increased and the school added grades 7 and 8 in the

middle of a school year to accommodate white students

who had previously attended public schools. Clarksdale

Baptist also tripled the size of its teaching staff in 1969

and 1970 by hiring a substantial number of white teach

ers from the public school system.16

The Clarksdale Baptist School participated in the Mis

sissippi textbook program until after Norwood v. Harri

son was filed, when it withdrew. The school has never

12 The decree required IRS to conduct a survey of all Mississippi

private schools, including- church schools, to determine which are

subject to the inference of discrimination. See Stay Opposition

at 4 n.5.

13 See Coffey v. State Educational Finance Commission, 296

F. Supp. 1389, 1391 (S.D. Miss. 1969) (3-judge court).

14 See Alexander v. Holmes County Board of Education, 396 U.S.

19 (1969) ; Henry v. Clarksdale Municipal Separate School District,

433 F.2d 387 (5th Cir. 1970); id., 409 F.2d 682 (5th Cir.), cert,

denied, 396 U.S. 940 (1969).

15 The facts summarized in this and the following paragraphs are

unoontested. See Stay Opposition, Appendix “D.”

8

enrolled a black student nor employed a black staff mem

ber. Accordingly, after the 1980 decree in this case was

issued, IRS notified the school that it was subject to the

inference of discrimination and should furnish evidence

that it operated on a nondiscriminatory basis.16 Peti

tioner then intervened in this case. IRS has not yet made

any determination whether the school is entitled to retain

its exemption.

REASONS WHY THE WRIT SHOULD BE DENIED

As the court below correctly held, petitioner presents

no substantial or important First Amendment questions;

rather, petitioner’s arguments are based upon theories

which are demonstrably incorrect according to settled

law.

It is now clear that federal law—-consistently with the

First Amendment— denies tax-exempt status to religious

private schools which practice racial discrimination.

Bob Jones University v. United States, 461 U.S. —— , 76

L. Ed. 2d 157 (1983). It is therefore obvious that IRS

must investigate the policies and practices of religious

private schools to determine whether or not they are dis

criminatory; a religious school’s simply claiming non

discrimination is not controlling. See Bob Jones, 76 L.

Ed. 2d at 182 (school claimed it was not discriminatory

because it only prohibited interracial dating or marriage

by students). Petitioner’ s argument that IRS may not

constitutionally require church schools seeking exemption

to provide information 17 about their founding and opera

16 The IRS communications to petitioner’s school are reproduced

as Appendix “B” to- the Stay Opposition.

17 Petitioner invokes the spectre of “widespread surveillance of

religious institutions” based upon the district: court’s decree, which

it says “create[s] excessive entanglement between government and

a church in violation of the Establishment Clause,” Pet. at 8, 12.

But, as this Court recognized in Walz v. Tax Commission, 397 U.S.

664, 674 (1970), “ [ejither course, taxation of churches or exemp-

9

tion thus raises no serious issues worthy of this Court’s

plenary consideration.* 18

Petitioner’s contention that the decree mandates that it

engage in specific acts contrary to its beliefs is also un

tenable. All that the decree requires is that the school do

more than remain silent in the face of circumstantial

evidence giving rise to an inference that it was founded

or expanded for racially discriminatory reasons and con

tinues to function on that basis. The decree provides ex

amples, drawn from Norwood, of evidence which would

tend to indicate that a school follows a nondiscrimina-

tory policy. However, under the decree that determina

tion, occasions some degree of involvement with religion.” The

district court’s order in this case is fully consistent with the

First Amendment because it avoids “ excessive entanglement.” The

information sought by the IRS pursuant to the 1980 decree con

sists of statistical data and objective facts about a private school’s

historical development. See Stay Opposition, Appendix “B.” The

information requests are focused narrowly upon the admissions

and employment; policies of Mississippi private schools and are

directly and cogently relevant to determining whether nondiserim-

inatory policies are in effect. Bob Jones University v. United

States, 639 F.2d 147, 155 (4th Cir. 1980), aff’d, 461 U.S. ------ , 76

L. Ed. 2d 157 (1983); Goldsboro Christian Schools, Inc. v. United

States, 436 F. Supp. 1314, 1320 (E.D.N.C. 1977), aff’d mem., 464

F.2d 879 (4th Cir. 1981), aff’d sub nom. Bob Jones University v.

United States; cf. EEOC v. Mississippi College, 626 F.2d 477, 486-

88 (5th Cir. 1980), cert, denied, 453 U.S. 1272 (1981). IRS makes

no inquiry about, religious beliefs,, and it does not seek to trace

the use of any funds. Compare Meek v. Pittenger, 421 U.S. 349

(1978); McCormick v. Hirsch, 460 F. Supp. 1337, 1357 (M.D. Pa.

1978).

18 Petitioner’ s, reliance upon NLRB v. Catholic Bishop of Chicago,

440 U.S. 490 (1979), is entirely misplaced. Petitioner is subject, to

IRS scrutiny only because it desires to be recognized as exempt

from federal taxation, not because the government has sought, to

regulate it. The First Amendment permits, but does not require,

tax exemption for churches, see Walz, and Congress has properly

conditioned the grant, of such exemption upon a showing of non

discrimination. Bob Jones University v. United States.

10

tion is explicitly one for IKS to make, and the Service is

directed explicitly to consider “ any other similar evidence

calculated to show that the doors of the private school

and all facilities and programs therein are indeed open

to students or teachers of both the black and white races

upon the same standard of admission or employment.”

Pet. App. at A-4. Indeed, the examples in the decree are

prefaced by the phrase, “ Such evidence might include,

but is not limited to, . . . ,” Pet. App. at A-3. Wholly

apart from its exaggerated interpretation of individual

paragraphs within the decree,19 therefore, it is disingen

uous for petitioner to claim that it is being enjoined to

take any specific actions contrary to its doctrinal beliefs

in order to keep its tax-exempt status.

Petitioner also asserts that the inference of discrimi

nation arising from an adjudication, or from the rela

tionship between the founding or expansion of a private

school and public school desegregation (where the private

school cannot demonstrate its nondiscriminatory policy)

is “ without rational basis or justification” (Pet. at 11).

This aspect of the district court’s decree, however, is

based upon evidentiary principles developed over the

years by federal courts, in order to determine whether

private schools follow policies of nondiscrimination.20

is For instance, petitioner errs in equating the decree’s refer

ences to recruitment, publication, and communications with black

community representatives with “ evangelizing,” see Pet. at 9, 10.

The school must hire staff and inform potential students of its

existence and admisisions requirements in some manner. Requiring

that it include information about; its commitment k> racial non

discrimination and make efforts to ensure that this knowledge

reaches possible sources of minority-race teachers or students

simply does not amount to proselytizing for new adherents to peti

tioner’s religious faith. See Norwood, 382 F. Supp. at 935; EEOC

v. Mississippi College, 626 F.2d at 485 n.10.

20 See, e.g., United States v. Mississippi, 499 F.2d 425, 430 (5th

Cir. 1974) (en banc) ; Brumfield v. Dodd, 425 F. Supp. 528, 531-32

(E.D. La. 1976); Norwood, 382 F. Supp. at 924; Gilmore v. City

of Montgomery, 337 F. Supp. 22, 24 n.2, 25 (M.D. Ala. 1972), aff’d

11

Such evidentiary rules are equally applicable to religious

and non-religious institutions.21 22 Moreover, there is a

manifest “ rational connection between the fact proved

and the fact presumed” 2:2 under the district court’s de

cree. The Mississippi private schools which refused to

adopt policies of nondiscrimination after the three-judge

court issued the preliminary injunction herein, Green v.

Kennedy, 309 F. Supp. 1127 (D.D.C.), appeal dismissed

sub nom. Cannon v. Green, 398 U.S. 956 (1970), and

which consequently lost their entitlements to1 federal tax

exemptions, were almost all founded “ in the wake of”

public school desegregation.23 Thus, application of the re

buttable inference of discrimination to church-connected

schools founded or expanded in the wake of desegregation

is entirely proper.24

in relevant part, 473 F.2d 832 (5th Cir. 1973), aff’d in relevant

part, 417 U.S. 556 (1974) ; Green v. Connolly, 330' F. Supp. at

1173.

21 See Jones v. Wolf, 443 U.S. 595, 607-09 (opinion of the Court),

615-16 (dissenting opinion) (1979) (courts may apply rebuttable

presumption that majority of congregation represents local church

entity in dispute over right to church property); Synanen Founda

tion, Inc. v. California, 444 U.S. 1307, 1307-08 (Rehnquist, J., Cir

cuit Justice) (1979) (churches are not entitled to different treat

ment from other charitable trusts in state courts); cf. United

States v. Freedom Church, 613 F.2d 316, 322 (1st Cir. 1979) (dis

trict court may infer existence of records and possession by min

ister of church).

22 Leary v. United States, 395 U.S. 6, 33 (1969), quoting Tot v.

United States, 319 U.S. 463, 467 (1943).

23 gee Coffey v. State Educational Finance Commission; Norwood

v. Harrison.

24 Moreover, a number of federal courts have specifically found,

after full hearings, that; church-connected schools to' which the in

ference attached did in fact maintain discriminatory practices

which disqualified them for governmental assistance. E.g., Brum

field v. Dodd, 425 F. Supp. at; 534-35 (Grawood Christian School) ;

Norwood v. Harrison, 382 F. Supp. at 927-28 (South Haven Men-

nonite School) ; Gilmore v. City of Montgomery, 337 F. Supp. at

12

Finally, the standing issue raised by petitioner is not

worthy of review for several reasons. First, this Court

has only recently articulated the principles of standing

applicable in this area in Allen v. Wright. In its opinion

in that case, the Court specifically distinguished the in

stant matter on the basis of the extensive record evidence

demonstrating the link between federal tax-exempt sta

tus, racially discriminatory private schools, and ineffec

tive public school desegregation in Mississippi. 52 U.S.

L.W. at 5118.24 25 The recognition of the plaintiffs’ stand

ing in this suit therefore is not “ in conflict with appli

cable decisions of this Court” nor does it represent “ an

important question of federal law which has not been,

but should be, settled by this Court . . . U.S. Sup. Ct.

Rule 17.1(c). Second, the lower courts in this case have

not had an opportunity to consider what effect, if any,

the decision in Allen should have on this matter; but the

Court of Appeals explicitly stated that “ [i] n the event

that Wright [v. Allen] is modified or reversed by the

Supreme Court, the Government may choose to return to

the District Court for appropriate relief” (Pet. App. at

A - l ). Hence, no action by this Court at this time is nec

essary. Third, there is a serious question whether peti

tioner, as an intervenor, may appropriately raise the is

sue at all. Plaintiffs’ standing to sue had been upheld

prior to petitioner’s entry into this case, and an inter

venor takes the case in the posture in which he finds it—

24 (St. James School); see also, Norwood, 382 F. Supp. at 928

(County Day School, held ineligible for textbooks, started in facili

ties provided rent-free by Presbyterian Church). This buttresses

the rationality of applying the inference to church schools. See,

e.g., Usery v. Turner Elkhorn Mining Co., 428 U.S. 1, 20-31 (1976).

25 The Court found it unnecessary to “consider whether standing

was properly found to exist in Coit \_v. Green, 404 U.S. 997 (1971),

ajf’g mem. Green v. Connally, 3301 F. Supp. 1150 (D.D.C. 1971)]”

because the distinctions between Allen and this case suggest that

the results in the two cases are not necessarily or irreconcilably in

conflict. 52 U.S.L.W. at 5118,

13

and may not reopen issues already determined. Knowles

v. Board of Public Instruction of Leon County, 405 F.2d

1206, 1207 (5th Cir. 1969) ; United States v. School Dis

trict of Omaha, 367 F. Supp. 198, 201 (D. Neb. 1973);

Moore v. Tangipahoa Parish School Board, 298 F. Supp.

288, 293 (E.D. La. 1969) ; Stell v. Savannah-Chatham

County Board of Education, 255 F. Supp. 88, 92 (S.D.

Ga. 1966); see United States v. California Cooperative

Canneries, 279 U.S. 553, 556 (1929) (Brandeis, J.) (re

ferring to “ settled rule of practice that intervention will

not be allowed for the purpose of impeaching a decree

already made” ).

CONCLUSION

For the foregoing reasons, the petition should be

denied.

Respectfully submitted,

Robert H. Kapp

Joseph M. Hassett

Sara-A nn Determan

David S. Tatel

Walter A. Smith , Jr.

Patricia A. Brannan

Hogan & Hartson

815 Connecticut Avenue, N.W.

Washington, D.C. 20006

(202) 381-4500

W illiam L. Robinson

Norman J. Chachkin *

Frank R. Parker

Lawyers’ Committee for

Civil Rights Under Law

1400 Eye Street, N.W.

Suite 400

Washington, D.C. 20005

(202) 371-1212

Attorneys for Respondents

William H. Green, et al.

* Counsel of Record

APPENDIX

la

APPENDIX

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF COLUMBIA

Civil Action No. 1355-69

W illiam H. Green, et al,

Plaintiffs,

v.

Donald T. Regan, et al,

Defendants.

ORDER

[Filed Jul. 22, 1983]

All proceedings in this matter were stayed pursuant to

the prior Order of January 6, 1982, awaiting the Su

preme Court’s decision in Bob Jones University v. United

States and Goldsboro Christian Schools, Inc. v. United

States, 51 U.S.L.W. 4593 (U.S. May 24, 1983). That

stay of proceedings was vacated on June 15, 1983 and on

July 8, 1983, the Court heard arguments of counsel for

the parties upon (a) defendant-intervenor Clarksdale

Baptist Church’s Motion to Modify Injunction, and (b)

plaintiffs’ Motion for Summary Judgment with respect to

the Church’s claims. (These substantive motions were

pending in this matter when the stay of proceedings was

entered.)

Upon consideration of the arguments of counsel, the

pleadings and evidence tendered in this cause, and after

review of the entire record herein, it is ORDERED that

plaintiffs’ Motion for Summary Judgment in their favor

2a

with respect to the constitutional and statutory claims

raised by intervenor’s Motion to Modify Injunction is

hereby GRANTED.

The Court further, and alternatively, rules directly

upon intervenor’s Motion to Modify Injunction, since in-

tervenor contends that summary judgment is inappro

priate. Upon the basis of all of the evidence (including

specifically the deposition testimony of the witnesses for

the intervenor), the Court finds that intervenor has

failed to establish that application by the Internal Reve

nue Service of the procedures and standards contained

in the Court’s injunctive decree of May 5, 1980 (as

amended June 2, 1980) to the Clarksdale Baptist Church

or to church-connected schools in Mississippi, generally,

violates any statutory or constitutional right of the in

tervenor. Accordingly, it is further ORDERED that the

Motion to Modify Injunction filed by the Clarksdale Bap

tist Church is DENIED.

On July 13, 1981 the Court suspended application of

its 1980 decrees as to church-connected schools in Missis

sippi, pending disposition of the claims raised by inter

venor Clarksdale Baptist Church. The Court now having

ruled upon those claims, it is further ORDERED that

the previous Order of July 13, 1981 is VACATED, and

defendants shall apply the May 5, 1980 and June 2, 1980

decrees of this Court to church-connected private schools

in Mississippi.

Because application of the Court’s prior rulings to

church-connected schools was suspended for two years, it

is further ORDERED that defendants shall file two addi

tional annual reports with the Court (and serve copies

thereof upon counsel for the parties), containing the in

formation required by paragraph (10) of the Court’s

Order of May 5, 1980, said reports to be filed on July 1,

1984 and July 1, 1985.

It is further ORDERED that the effectiveness of this

Order shall be stayed for a period of twenty (20) days

3a

from the date of entry hereof, so that defendants or de-

fendant-intervenor may have an opportunity to seek a

further stay of this Court’s rulings from the United

States Court of Appeals for the District of Columbia

Circuit, in connection with any appeal they may desire

to prosecute.

Dated: July 22, 1983

/ s / George L. Hart, Jr.

George L. Hart, Jr.

United States District Judge