Green v. Miller Brief for Plaintiffs-Appellees

Public Court Documents

October 8, 1980

Cite this item

-

Brief Collection, LDF Court Filings. Green v. Miller Brief for Plaintiffs-Appellees, 1980. 77564a4c-b49a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/0ed48f89-23eb-471d-b71b-1345d5c9ce30/green-v-miller-brief-for-plaintiffs-appellees. Accessed February 21, 2026.

Copied!

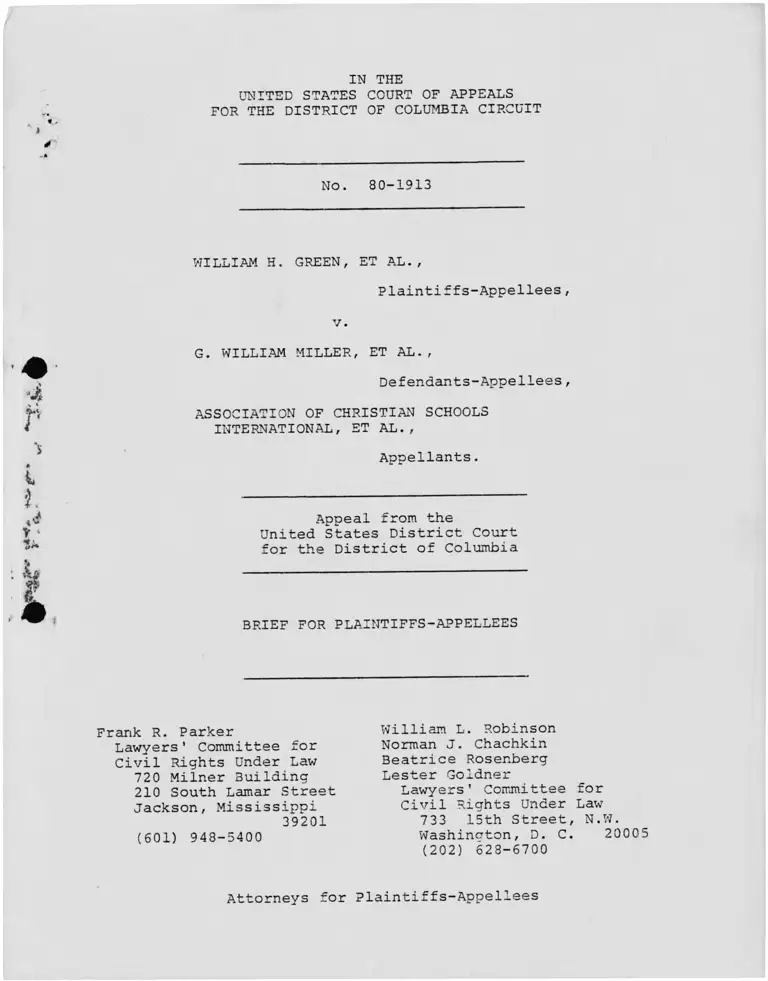

IN THE

UNITED STATES COURT OF APPEALS

FOR THE DISTRICT OF COLUMBIA CIRCUIT

t.,

4"

i

No. 80-1913

WILLIAM H. GREEN, ET AL.,

Plaintiffs-Appellees,

‘S

l

V •

v*

v.

G. WILLIAM MILLER, ET AL.,

Defendants-Appellees,

ASSOCIATION OF CHRISTIAN SCHOOLS

INTERNATIONAL, ET AL.,

Appellants.

Appeal from the

United States District Court

for the District of Columbia

BRIEF FOR PLAINTIFFS-APPELLEES

Frank R. ParkerLawyers’ Committee for

Civil Rights Under Law

720 Milner Building

210 South Lamar Street

Jackson, Mississippi

39201

(601) 948-5400

William L. Robinson

Norman J. Chachkin

Beatrice Rosenberg

Lester Goldner

Lawyers' Committee for

Civil Ricrhts Under Law

733 15th Street, N.W.

Washington, D. C. 20005

(202) 628-6700

Attorneys for Plaintiffs-Appellees

IN THE

UNITED STATES COURT OF APPEALS

FOR THE DISTRICT OF COLUMBIA CIRCUIT

No. 80-1913

WILLIAM H. GREEN, ET AL.,

Plaintiffs-Appellees,

v.

G. WILLIAM MILLER, ET AL.,

Defendants-Appellees,

ASSOCIATION OF CHRISTIAN SCHOOLS

INTERNATIONAL ET AL.,

Appellants.

CERTIFICATE OF COUNSEL

required by Rule 8(c) of the General Rules

of the United States Court of Appeals for

the District of Columbia Circuit

The undersigned, counsel of record for plaintiffs-appellees

certifies that the following parties appeared below:

Plaintiffs:

William H. Green, on his own behalf and on behalf of his minor

children, Connie Green, Belinda Green, Ronnie Green, and Bessie

Green,

Vernon Tom Griffin, on his own behalf and on behalf of his minor

son, Vernon Tom Griffin, Jr.,

John D. Wesley, on his own behalf and on behalf of his minor

children, Shirley Ann Wesley, Florence Wesley, and Jessie Lee

Wesley,

Warren G. Booker, on his own behalf and on behalf of his minor

adopted son, Adam Wayne Gilley, and

Essie Bernice Austin.

Defendants:

G. William Miller, as Secretary of the Treasury of the United

States, and

Jerome Kurtz, as Commissioner of Internal Revenue.

Intervenor Defendants:

Dan Coit, on his own behalf and on behalf of his minor children,

Lauren Faye Coit and Linda Ann Coit.

Proposed Intervenors:

First Presbyterian Church, Jackson, Mississippi,

Association of Christian Schools International.

Joe K. Treloar, Reverend William K. Wymond, Mary Elizabeth Blanton,

Theresa 0. Younce, Judy C. Hand, James L. Moore and Elizabeth r>.

Moore, his wife; David T. Hagenr.an and Lynn T. Hagerman, his wife,

S. Kent Dear and Janie C. Dear, his wife.

These representations are made in order that Judges of this

Court, inter alia, may evaluate possible disqualification or

recusal.

Plaintiffs-Appellees.

TABLE OF CONTENTS

Page

1Counter-Statement of Issue Presented

Prior and Related Proceedings 2

Statutes and Rules Involved 2

Reference to Parties and Rulings 2

STATEMENT 3

A. The Original Action 4

B. The Supplementary Proceedings 6

C. The Motion to Intervene 12

ARGUMENT —

THE DISTRICT COURT'S DENIAL OF

ARGUMENT —

THE DISTRICT COURT'S DENIAL OF

THE MOTION TO INTERVENE WAS PROPER 15

A. The motion to intervene

was not timely. 16

B. The proposed intervenors1 interests

can be fully adjudicated in a sepa

rate action under 26 U.S.C. § 7428,

which would develop the particular

facts of appellants' particular sit

uation without the necessity of dis

turbing the final judgment in this

case. 27

Conclusion 31

Appendices

A — Rule 24, F.R. CIV. P., and 26 U.S.C. § 7428

B — IRS News Releases of July 10, 1970 and July 19, 1970

C — IRS Commissioner Thrower's December 10, 1970 affidavit

D — Plaintiffs' 1976 motion for further relief

E — Excerpts from December 5, 1978 hearing on IRS proposed

Revenue Procedure

Cases: Page

*Alaniz v. Tillie Lewis Foods, 572 F.2d 657 (9th Cir.) ,

cert, denied sub nom. Beaver v. Alaniz, 439 U.S.

837 (1978)............................................. 26

Bob Jones University v. Simon, 416 U.S. 725 (1974)........ 20n

Brumfield v. Dodd, 425 F. Supp. 528 (E.D. La. 1976) . . . . 9n, 16n,

22n, 27, 31

Brumfield v. Dodd, 405 F. Supp. 338 (E.D. La. 1975) . . . . 9n, 22n

Gilmore v. City of Montgomery, 417 U.S. 556 (1974)........ 21

Gilmore v. City of Montgomery, 337 F. Supp. 22

(M.D. Ala. 1972), rev'd in part, 473 F.2d 832

(5th Cir. 1973), rev'd in part and remanded,

417 U.S. 556 (1974)..................................... 22n

Goldsboro Christian Schools v. United States,

436 F. Supp. 1314 (E.D. N.C. 1977)...................... 29n

*Green v. Connally, 330 F. Supp. 1150 (D.D.C.),

aff'd sub nom. Coit v. Green, 404 U.S. 997 (1971). . . . 2, 4, 5,

7n, 21, 29

Green v. Kennedy, 309 F. Supp. 1127 (D.D.C. 1970) ........ 2,4

Hodgson v. United Mine Workers, 153 U.S. App. D.C. 407,

473 F . 2d 118 (1972)..................................... 16 , 31

Moten v. Bricklayers, Masons, and Plasterers

International Union, 177 U.S. App. D.C. 17,

543 F . 2d 224 (1976) ................................... 16

*NAACP v. New York, 413 U.S. 345 (1973).................... 16 , 17 ,

19n, 31

Nevilles v. EEOC, 511 F.2d 303 (8th Cir. 1975)............ 26

Newman v. Piggie Park Enterprises, Inc., 256 F. Supp.

941 (D.S.C. 1966), rev'd in part, 377 F.2d 433

(4th Cir. 1967), modified and aff'd, 390 U.S. 400

(1968)................................................. 19n

-11-

Table of Authorities

* Cases or authorities chiefly relied upon are marked by asterisks.

— x x x—

Cases (continued): Page

Norwood v. Harrison, 413 U.S. 455 (1973)................. 6 , 21

*Norwood v. Harrison, 382 F. Supp. 921 (N.D.

Miss.1974)........................................... 6,7,8,

21, 22n

Prince Edward School Foundation v. Commissioner,

478 F. Supp. 107 (D.D.C. 1979), aff'd

____ U.S. App. D.C. ____, ____ F. 2d ____

(June 30, 1980), petition for cert, filed,

U.S. No. 80-484 (September 25, 1980)................. 2

Stallworth v. Monsanto Co., 558 F.2d 257

(5th Cir. 1977)....................................... 17

United States v. Freedom Church, 613 F.2d 316

(1st Cir. 1979)....................................... 27

United States v. Marion County School Dist.,

590 F. 2d 146 (5th Cir. 1979)........................ 31

Wright v. Miller, 480 F. Supp. 790 (D.D.C. 1979),

appeal pending, No. 30-1124 (D.C. Cir.).............. 2

Statutes, Regulations and Rules:

26 U.S.C. § 7428 ....................................... 2, 16 ,

27, 29

26 C.F.R. § 1.6033-2 (g) (1979).......................... 9n

*F.R. CIV. P. 2 4 ......................................... 2, 16

F.R. CIV. P. 25 (d) ( 1 ) ................................... 3n

Table of Authorities (continued)

* Cases or authorities chiefly relied upon are marked by asterisks.

-iv-

Other Authorities Page

Proposed Internal Revenue Procedure, 44 Fed. Reg.

9451-55 (February 9 , 1979)........................ 10

Proposed Internal Revenue Procedure, 43 Fed. Reg.

37296-98 (August 22 , 1978)........................ 10

Internal Revenue Service Regulation, 42 Fed. Reg.

767-68 (January 4, 1977).......................... 9n

Internal Revenue Procedure 75-50, 1975-2 Cum. Bull. 587 . 9n

Internal Revenue Ruling 75-231, 1975-1 Cum. Bull. 158 . . 9

Internal Revenue Service News Release IR-1930 .......... 23n

Internal Revenue Service Technical Information

Release No. 1449................................... 9n

Internal Revenue Service, Hearing: Proposed Revenue

Procedure on Tax Exempt Private Schools

(December 5, 1978). . . I ̂ ̂ ! ! ! T

Table of Authorities (continued)

2 5n

IN THE

UNITED STATES COURT OF APPEALS

FOR THE DISTRICT OF COLUMBIA CIRCUIT

No. 80-1913

WILLIAM H. GREEN, ET AL.,

Plaintiffs-Appellees,

v.

G. WILLIAM MILLER, ET AL.,

Defendants-Appellees,

ASSOCIATION OF CHRISTIAN SCHOOLS

INTERNATIONAL, ET AL.,

Appellants.

Appeal from the

United States District Court

for the District of Columbia

BRIEF FOR PLAINTIFFS-APPELLEES

COUNTER-STATEMENT OF

ISSUE PRESENTED

Whether the district court properly declined in 1980 to

permit appellants to intervene in a suit instituted in 1969 in

which a final judgment had been entered, where appellants should

have known, from the time the suit was instituted and at various

stages thereafter, that their school would fall within the orbit

-2-

of the action, and where the intervenors can fully protect their

interest by a separate action under 26 U.S.C. §7428.

PRIOR AND RELATED PROCEEDINGS

The instant matter was commenced in 1969. A preliminary in

junction was issued in 1970 sub nom. Green v. Kennedy, 309 F. Supp.

1127. A permanent injunction was issued by a three-judge court in

1971 sub nom. Green v. Connally, 330 F. Supp. 1150; this judgment

was affirmed by the Supreme Court sub nom. Coit v. Green, 404 U.S.

997 (1971).

In 1976 a nationwide class action was filed seeking relief

similar to that sought by plaintiffs in the instant case. The

District Court's ruling dismissing that action, Wright v. Miller,

480 F. Supp. 790 (D.D.C. 1979), is presently pending before this

Court on appeal, D.C. Cir. No. 80-1124. A case involving issues

similar to claims which appellants v/ould seek to litigate here if

granted intervention is Prince Edward School Foundation v. Commis-

sioner, 478 F. Supp. 107 (D.D.C. 1979) , aff'd ___ U.S. App. D.C.

___, ___ F.2d ___ (June 30, 1980), petition for cert, filed, U.S.

No. 80-484 (September 25, 1980).

STATUTES AND RULES INVOLVED

Rule 24 of the Federal Rules of Civil Procedure and

26 U.S.C. 7428 are set forth in Appendix A to this brief.

REFERENCE TO PARTIES AND RULINGS

This is an appeal from an order of Judge George L. Hart,

Jr., of the United States District Court of the District of

Columbia, entered July 9, 1980, denying a motion to intervene.

-3-

The ruling is not reported but appears at pp. 124-25 of the Ap

pendix.

The appellants, proposed intervenors, are the Association

of Christian Schools International, the First Presbyterian Church

of Jackson, Mississippi, and various members of that church.

The plaintiffs in the action are black federal taxpayers

and their minor children attending public schools in Mississippi.

The adult plaintiffs are William H. Green, Vernon Tom Griffin,

John D. Wesley, Warren G. Booker, and Essie Bernice Austin.

Defendants in the action are G. William Miller as Secretary

of the Treasury of the United States and Jerome Kurtz as Commis—

JVsioner of Internal Revenue.

Persons previously allowed to intervene are Dan Coit and

his minor children, Lauren and Linda Coit.

STATEMENT

Appellants (Association of Christian Schools International,

the First Presbyterian Church, Jackson, Mississippi, and some of

its members) appeal from an order entered July 9, 1980 denying

their motion to intervene in this case, which had been commenced

in 1969. The District Court held that the motion was untimely,

that the movants lacked a protectable interest, and that allow

ance of intervention would delay and prejudice the rights of the

original plaintiffs. (A. 124.)

1/ The current defendants have been substituted for their pred

ecessors pursuant to F.R. CIV. P. 25(d)(1).

-4-

A. The Original Action

The action in which appellants sought to intervene is a

class action, commenced in 1969, by which black taxpayers and

their minor children attending public schools in Mississippi

sought to enjoin the Secretary of the Treasury and the Commis

sioner of Internal Revenue from according tax-exempt status to

private schools in Mississippi which exclude students on the

basis of race. See Green v. Connally, 330 F. Supp. 1150 (D.D.C.),

aff'd VTithout opinion sub nom. Coit v. Green, 404 U.S. 997 (1971) .

Permitted to intervene in that action on January 21, 1970, were

representatives of the class of parents and children who support

or attend private nonprofit, hitherto tax-exempt schools in Mis-

_2/sissippi having an all-white enrollment,established as a means

of enabling white students to avoid desegregated public schools.

See 330 F. Supp. at 1155.

In January, 1970, the District Court enjoined the IRS from

approving any pending or future application for tax-exempt status

unless it "first affirmatively determine[s] pursuant to appropriate

directives and procedures satisfactory to this Court that the

applicant school is not part of a system of private schools oper

ated on a racially segregated basis as an alternative to white

students seeking to avoid desegregated public schools." Green v.

Kennedy, 309 F. Supp. 1127, 1140 (D.D.C. 1970).

2/ Applications to intervene by persons and schools outside the

"state of Mississippi were denied.

-5-

On June 30, 1971, the District Court issued an injunction

restraining the Secretary of the Treasury and the Commissioner

of Internal Revenue from approving tax-exempt status under Sec

tion 501(c)(3) of the Internal Revenue Code for any private

school located in the State of Mississippi unless such school

made a showing that it had adopted and publicized, in a manner

reasonably effective to bring the matter to the attention of

minority students and parents, a racially non-discriminatory

admissions policy; and unless the school supplied to the IRS in

formation concerning the organization of the school and the ra

cial composition of its student body (see 330 F. Supp. at 1179-

80) .

As the District Court noted in its 1971 opinion, while the

case was pending before it the Internal Revenue Service, on

July 10, 1970, had itself announced in a press release that it

would grant tax exemption only to schools having "racially non-

discriminatory admission policies." See 330 F. Supp. at 1172.

In a press release of July 19, 1970 explaining its earlier state

ment, the IRS added that its "statement of position on racially

nondiscriminatory admissions policies would be applicable to all

_3/private schools, whether church related or not."

In an affidavit filed in this case on December 10, 1970,

3/ Both press releases are attached to the August 21, 1970 affi

davit of IRS Commissioner Randolph Thrower, filed in this case

along with the government's Motion to Dismiss of that date, and

contained in that portion of the record which has not been trans

mitted to this Court. For the convenience of the Court, we have

reproduced the news releases in Appendix B infra.

-6-

_£/

before issuance of the permanent injunction, the Commissioner

of Internal Revenue stated that the Service had mailed letters

to approximately 5,000 private schools in the United States which

had previously received favorable rulings on tax exemption. He

also said:

It is estimated that there are, in addi

tion, more than 10,000 private schools

which are covered by group rulings, as

through a ruling given to a church cover

ing all of the church-owned private schools.

Similar information is being obtained as to

the admission policies of such schools.

B . The Supplementary Proceedings

In 1976, the plaintiffs, contending that the IRS had failed

to comply with the 1971 orders of the District Court, moved for

_5/additional relief. The motion arose in part out of develop

ments in the case of Norwood v. Harrison, 413 U.S. 455 (1973),

in which the Supreme Court had held that Mississippi schools

which discriminated on the basis of race were ineligible to re

ceive state-loaned textbooks.

On remand of that case (see 382 F. Supp. 921 [N.D. Miss.

1974]), the District Court for the Northern District of Missis

sippi ordered the establishment of a certification procedure

4/ The affidavit was attached to the government's Memorandum

of Points and Authorities in Opposition to Plaintiffs' Motion

for Summary Judgment and Intervenors1 Motion for Summary Judg

ment. It is reprinted in Appendix C infra.

5/ That motion, which was also not included in the portions of

the record transmitted to this Court, is reproduced in Appendix

D infra.

-7-

whereby schools applying for textbooks were required to give in

formation as to their organization and student body, including

answers to questions about whether and how they had publicized a

policy of nondiscrimination. (The form is attached as an appen

dix to the District Court's opinion, 382 F. Supp. at 936-39.)

Thereafter, in reviewing evidence as to schools whose eligibility

was disputed, Chief Judge Ready held that a prima facie case of

racial discrimination was shown by evidence that a "school's

existence began close upon the heels of" public school desegrega

tion in the area, and that the school had never enrolled a black

_6/

student nor employed a black teacher or administrator.

(382 F. Supp. at 924-925.) He then listed illustrative factors

which could overcome the presumption, including publicity of a

nondiscriminatory policy, communication with black community

6/ In 1971, the three-judge court had held (330 F. Supp. at

1173-74) (emphasis supplied):

The history of state-established seg

regation in Mississippi, coupled with the

founding of new private schools there at

times reasonably proximate to public school

desegregation litigation, leaves private

schools in Mississippi carrying a badge of

doubt. The finding in the Coffey case,

supra, which has not been controverted and

which we accept, that the new schools were

established as segregated schools leads us

to declare that it is the duty of the

Internal Revenue Service to seek out sup

plementary information, whether or not

required for schools elsewhere, before

granting final rulings of tax-exempt~status

and deductibility of contributions to those

private Mississippi schools applying for

such benefits. The same condition of rea

sonable proximity to desegregation litiga

tion applies not only to schools organized

in contemplation of litigation about to

start, but also to schools subsequently

organized in the wake of a decree.

-8-

leaders, etc. (See 382 F. Supp. at 926.)

Judge Ready's opinion dealt specifically with a number of

religious schools, i.e., the South Haven Mennonite School, which

--- J Jhe held ineligible for textbook loans (382 F. Supp. at 927-28);

the Christ Episcopal Day School, which he found nondiscriminatory

even though the step of adopting a nondiscriminatory policy was

"taken as a direct result of Green v. Connally" (i.e. , this case) ,

(382 F. Supp. at 931-32); and the Presbyterian Day School of

Cleveland, which was approved only conditionally because, al

though the church itself did not discriminate, the school had

failed to publicize its willingness to accept black students

(382 F. Supp. at 932-35).

Plaintiffs discovered that a number of schools, including

several specifically attacked in the earlier phase of this, the

Green litigation, were still enjoying federal tax-exempt status

although they had been found ineligible to receive textbook loans

from the State of Mississippi because of their racially discrim

inatory policies. The IRS had failed to act against schools

7/ Judge Ready's conclusion about this school was as follows:

T382 F. Supp. at 928):

Admittedly the factors for a prima facie

case are here present. The only question is

whether this school, sponsored by a close-knit

Christian membership, has successfully rebut

ted the inference of a racially discriminatory

admissions policy. The school's reluctance,

if not disdain, in presenting evidence to this

court has not facilitated our task. Neverthe

less, this court has undertaken to give this

school utmost, careful consideration in view

of its status as a church-sponsored school

emphasizing religion. Despite contrary claims,

however, we are driven to the conclusion that

the South Haven school exists as a haven for

perpetuating white, segregated education.

-9-

adiudicated discriminatory under the Norwood standards in both

_8/Mississippi and Louisiana, apparently because there were no

_9/

IRS announcements setting forth such standards. However, the

IRS had, on May 22, 1975, issued Revenue Ruling 75-231, 1975-1

Cum. Bull. 158, which proclaimed explicitly that organizations

"including churches, that conduct schools with a policy of re

fusing to accept children from certain racial and ethnic groups

10/

will not be recognized as tax-exempt."

In response to the plaintiffs' motion, the government orig

inally moved to dismiss the action (this request was denied by

Judge Waddy on May 25, 1977); subsequently, the IRS advised the

District Court, inter alia, that

Plaintiffs' 1976 motion reopening this lawsuit

prompted the Service to review its procedures

for determining whether private schools seeking

8/ See Brumfield v. Dodd, 405 F. Supp. 338 (E.D. La. 1975);

Td., 425 FT Supp. 528 (E.D. La. 1976).

9/ Thus, for example, Rev. Proc. 75-50, adopted November 6,

T9 75 , contained no reference to the relationship between a pri

vate school's establishment or expansion and public school deseg

regation .

10/ Rev. Rul. 75-231 was appended to the February 6, 1976 letter

from IRS Chief Counsel Meade Whitaker to Green plaintiffs' counsel

Frank Parker which is Exhibit 8 to the 1976 motion for further

relief (see note 5 supra). It appears in Appendix D to this

brief, pp. 40d- 41d infra. Subsequently, on November 6, 1975,

the IRS issued Rev. Proc. 75-50, 1975-2 Cum. Bull. 587, setting

forth the showing that had to be made to establish a school's

nondiscriminatory policy. (But see note 9 supra.) On March 19,

1976, the IRS issued Technical Information Release No. 1449, an

nouncing that the annual certification of nondiscrimination re

quired by Rev. Proc. 75—50 should be filed along with a school's

Form 990 information return; and that for schools which did not

file Form 990 [such as church schools, see 26 C.F.R. §1.6033-2(g)

(1979); 42 Fed. Reg. 767-68 (.Jan. 4 , 1977)], "a separate certifi

cation form is being developed . . . ."

-10-

or maintaining Section 501(c)(3) tax exemp

tion have racially nondiscriminatory admis

sions policies as to students. After review

ing the Service's existing guidelines and

the judicial authority in racial discrimina

tion cases, the Service concluded that its

existing procedures do not provide adequate

guidance with respect to certain schools

formed or substantially expanded at the time

of public school desegregation in the commu

nity. Defendants believe that the Service's

existing procedures are ineffective in iden

tifying such schools whose formation or ex

pansion raise substantial doubts concerning

their practices, even though the schools may

profess an open enrollment policy and comply

with the yearly publication requirement of

Rev. Proc. 75-50. 11/

It therefore published, for comment, a proposed Revenue Procedure

providing additional guidelines to be used in reviewing private

schools' eligibility for tax-exempt status. 43 Fed. Reg. 37296-

98 (August 22, 1978). These clearly applied to church-operated

schools. In hearings on the proposed Revenue Procedure held in

Washington on December 5-8, 1978, testimony was given by a num

ber of representatives of religious organizations, including

counsel for the Association of Christian Schools International,

asserting conflict with religious freedom. After receiving and

reviewing numerous comments, the Service made substantial revi

sions and reissued the guidelines for comment on February 9,

1979, 44 Fed. Reg. 9451-55. The proposed Procedure has never

12/

been implemented.

11/ Memorandum of Defendants in Response to Plaintiffs' Submis-

sTon on the Merits, filed November 27, 1979, at 20-21.

12/ In 1979 and 1980, the Congress approved riders to Treasury

Department appropriations measures prohibiting the use of funds

to carry out the guidelines.

- 11-

On cross-motions for summary judgment, the District Court

held that the IRS had not violated the order of June 30, 1971,

but that the order required supplementation and modification.

(A. 9.) Paragraph (1) of the 1980 ruling expanded the injunction

to prohibit the grant of tax-exempt status to Mississippi private

schools

which have been determined in adversary or

administrative proceedings to be racially

discriminatory; or [which] were established

or expanded at or about the time the public

school districts in which they are located

or which they serve were desegregating, and

which cannot demonstrate that they do not

racially discriminate in admissions, employ

ment, scholarships, loan programs, athletics,

and extra-curricular programs.

Paragraph (2) explained that the existence of the conditions set

forth in paragraph (1) raises an inference of discrimination

which can be overcome "by evidence which clearly and convincingly

reveals objective acts and declarations establishing that such is

not proximately caused by such school's policies and practices,"

and set forth non-exclusively the type of evidence which would

tend to establish nondiscrimination. (A. 10.)

The Court also modified the prior decree to require greater

regularity in the schools' publicizing of nondiscriminatory poli

cies and to require the IRS to collect additional information

with respect to the organization and status of the school.

(A. 11-12.) The IRS was directed to take all reasonable steps to

determine which, if any, church-related schools in Mississippi

would come under the definition of Paragraph (1), and with re

spect to such schools to collect the information required by the

-12-

permanent injunction. (A. 13.) Finally, the Service was ordered

to deny tax exemption unless the showing and information required

by the permanent injunction, as amended, was made within specific

times. (A. 12.) The order was amended on June 2, 1980, to make

clear that it was intended to apply only to schools which have

in the past been determined to be racially discriminatory, or

which were established or expanded at or about the time the pub

lic school districts in which they are located or serve were

desegregated. (A. 14-16.)

C. The Motion to Intervene

In June, 1980, after entry of the final decree in this

case, the Association of Christian Schools International, the

First Presbyterian Church of Jackson, Mississippi, and some of

its members moved to intervene in this action (A. 17-29). The

Association alleaed that it represented the interests of more

than 1400 Bible-oriented Christian elementary and secondary

schools in the United States (A. 17); the First Presbyterian

Church that it ran a school for children whose parents desire

instruction in the Biblical faith and who abide by the religious

and moral principles of the church (A. 18). The Church averred

that it enrolls children who reside in public school districts

in Mississippi which have been desegregated, and that none of

the students or teachers at the school are black (A. 21). The

proposed intervenors alleged that the order of May 5, 1980, as

amended, unduly burdened the right of a wholly religious enter

prise to conduct its religious ministry in education free from

government direction, supervision, investigation, and evaluation,

-13-

in violation of the First Amendment (A. 21). The application to

intervene also alleged that the motion was timely because no

church schools were implicated in the original complaint or in

the motion of the plaintiffs filed in July, 1976, to enforce the

original (June 10, 1971) decree (A. 28).

Annexed to the motion to intervene was a proposed answer to

the complaint in which the proposed intervenors challenged the

status of the plaintiffs to maintain this action and asserted

that the Internal Revenue Code of 1954 does not require that

religious schools adopt or publicize a policy of racial nondis

crimination as a condition of being accorded recognition of tax

exemption (A. 57). They also annexed a proposed response to the

July 1976 motion to modify the original decree in which they al

leged that, if the decree were extended to include churches and

other religious entities, it would violate the First Amendment

(A. 59). In a subsequent response to the contention of the plain

tiffs that the motion to intervene was untimely, proposed inter

venors offered the affidavit of their attorney that he was first

contacted by the First Presbyterian Church about this case on

May 21, 1980, after the district court order of May 5, 1980; that

he was unaware of the order prior to that time; and that he was

retained to seek intervention only on June 2, 1980. (A. 122—23.)

The District Court denied the motion to intervene on July 9,

1980. It ruled that the motion was untimely; that the movants

lacked any protectable interest; that to allow intervention would

delay and prejudice the rights of the original parties. It also

noted that the Association of Christian Schools International

-14-

sought to represent the interest of religious schools located

outside the State of Mississippi (A. 124-25).

This appeal followed.

-15-

ARGUMENT

THE DISTRICT COURT'S DENIAL OF THE

MOTION TO INTERVENE WAS PROPER

Although the Association of Christian Schools International

is a nominal appellant on this appeal, the Brief for Appellants,

by concentrating on the position of the First Presbyterian Church

Day School [hereinafter referred to as the "Day School"], virtu

ally concedes that the Association has no independent interest

that would give it standing to intervene in this case, which is

limited to schools in Mississippi. Aside from the fact that the

Day School is a member of the Association, the only other basis

for an independent interest which the Association suggests is

that it stands ready to represent other Mississippi schools

(App. Br. at 24). Since it does not even suggest that any other

school desires representation, this obviously does not give the

Association standing to intervene in this case.

As to the Day School and its patrons or employees, they

allege an interest affected by the decrees issued in this case,

since the school has an all-white enrollment and was started

after a desegregation order in its district. Our primary con

tention in this Court is that the denial of their motion to

intervene was nevertheless proper because the motion was untimely

(the school having slept on its rights after it knew or should

have been aware that it might be affected by the orders in this

case). The judgment below should also be sustained since the

interest which the school asserts may be fully litigated, if

-16-

exemption is denied (either because the school declines to fur

nish the IRS with the information it is required by the Green

decree to collect or because the IRS concludes, based upon ap

plication of the Green decree to the Day School, that it has

failed to establish nondiscrimination), in an action under

26 U.S.C. §7428. Such an action would concentrate on the partic

ular facts relating to this school's claims without the neces

sity of opening the final judgment in this long-standing action.

A. The motion to intervene was not timely.

It is well-established that, in accord with the language of

Rule 24 of the Federal Rules of Civil Procedure, before granting

a motion to intervene, the court "must first be satisfied as to

timeliness." NAACP v. New York, 413 U.S. 345, 365 (1973). See

also Moten v. Bricklayers, Masons and Plasterers International

Union, 177 U.S. App. D.C. 77, 81, 543 F.2d 224, 228 (1976). Timeli

ness is a flexible concept, to be determined from all the circum

stances of the case. Hodcrson v. United Mine Workers, 153 U.S.

---- ------------TV

App. D.C. 407, 473 F.2d 118 (1972). As a result, the question

of timeliness is largely committed to the discretion of the dis

trict court, whose determination will not be overturned on appeal

unless an abuse of discretion has been shown. NAACP v. New York,

supra, 413 U.S. at 366. While the point to which the suit has

progressed is not solely dispositive, it is an appropriate factor

13/ Accord, Brumfield v. Dodd, supra, 425 F. Supp. at 531 (post-

judgment motion of Grawood Christian School to intervene in Lou

isiana textbook-aid case denied as untimely).

-17-

to be considered. NAACP v. New York, supra, 413 U.S. at 366 .

Even more significant is the length of time during which the

would-be intervenor actually knew or reasonably should have known

of his interest in the case before he petitioned for leave to

intervene. Stallworth v. Monsanto Co., 558 F.2d 257, 264 (5th

Cir. 1977).

Appellants are disingenuous in their assertion that their

motion was timely because they moved to intervene immediately

after they realized they would be affected by the May 5, 1980

order of the District Court. Of course, appellants did not know

the exact terms of the order until it was entered. But if they

did not know -- long before that time -- that all-white, church-

related schools in Mississippi, established after desegregation

orders in their localities, could be affected by the Green liti

gation (at least to the extent of being asked to provide the IRS

with information), that could be only because they deliberately

chose to ignore what they had to know.

1. It is inconceivable that any white, private school in

Mississippi was unaware of the Green litigation. When t_he first

order for a temporary injunction in January, 1970 barred the

IRS from approving an application for tax exemption unless it

determined that the school was not part of a system of private

schools "operated on a racially segregated basis as an alterna

tive to white students seeking to avoid desegregated public

schools," the Day School had to be put on notice that, as a

racially segregated school established after a desegregation

order, it was potentially subject to being affected by an order

in the Green case.

-18-

Any possible doubt on that score would have had to be dis

sipated by the IRS press releases of July, 1970 making clear that

its "statement of position on racially nondiscriminatory admis

sions policies would be app?icable to all private schools, whether

church related or not." (See Statement, supra, at 5.) It

does not appear whether the Presbyterian Day School received the

kind of letter which the Commissioner said, in December 10, 1970,

he would send to church-owned private schools (see Statement,

supra, at 6), but, in view of the wide dissemination indicated by

the Commissioner, it is difficult to believe that any private

school interested in its tax-exempt status would not be aware of

the IRS rulings. When, therefore, the district court in this

case issued its first permanent injunction in June, 1971, prohib

iting the Internal Revenue Service from approving tax-exempt

status for any private school in Mississippi unless the school

had a racially nondiscriminatory policy and supplied information

concerning its organization and racial composition, the proposed

intervenors had to be aware that all-white religious schools in

Mississippi would fall within the orbit of that order.

Appellants stress that the initial opinion on the permanent

injunction reserved (as not before the Court then) the question

whether a school could be granted exemption if discrimination was

dictated by the religion itself (see 330 F. Supp. at 1169). The

point is a curious one, for it suggests that appellants not only

11/were aware of the Green litigation as early as 1971 but also

14/ Nowhere in their pleadings before the District Court nor in

their brief in this Court do appellants ever state that they had

[footnote continued on next page]

-19-

were aware that tax exemptions for religious schools could become

15/an issue in the case. Yet they chose to remain outside the

litigation, after it was reopened in 1976, until a final judgment

16/was entered. Even though appellants' reading of

17/the 1971 opinion is fundamentally in error, therefore, their

[continuation of footnote no. 14]

no knowledge of this litigation before May 5, 1980. They focus

only on the provisions of the May 5, 1980 judgment itself — but

if prescience as to the contents of a yet unwritten ruling were

the only basis for a finding of untimeliness, there would be lit

tle finality of judgments in American law. Cf. NAACP v. New York

supra.

15/ Appellants admit that the language of the 1971 District

Court opinion concerning the issue which the Court was pretermit-

ting can be interpreted in two different ways (App. Br. at 14-15)

See also A. 115 ("plainly susceptible of two possible meanings

. . . equally plausible . . . .")

16/ Had appellants not slept on their rights, by deliberately

seeking to ignore this litigation so long as no order had been

entered which they viewed as objectionable, they would have noted

the discussion of religious schools in the plaintiffs' 1976 mo

tion for further relief, in the cases cited by plaintiffs in that

motion, in the correspondence appended to the motion as exhibits,

and in the IRS Revenue Procedures attached to that document.

(See Appendix D infra.) These indications would have motivated

a responsible party to intervene on a timely basis.

17/ Appellants propose a tortured interpretation of the words,

""acts of racial restriction," from the 1971 opinion — which they

claim indicate that the District Court did not mean to include

within the ambit of its decree private sectarian schools, formed

in the wake of public school desegregation, which limited their

enrollment on a religious basis and had all-white enrollments.

(App. Br. at 14-15.) This construction of the opinion is plainly

inconsistent with the District Court's statement, in the same

part of its 1971 opinion, that the issue it pretermittea "may

never arise . . . ," a statement which obviously refers to the

expectedly unusual case in which there is a claim that racial

discrimination is a tenet of religious belief. Cf. Newman v.

Piggie Park Enterprises, Inc., 256 F. Supp. 941, 944, 945

(D.S.C. 1966), rev'd in part on other grounds, 377 F.2d 433

(4th Cir. 1967), modified on other grounds and aff'd, 390 U.S.

400 (1968) . Appellants1 reading of the opinion also contradicts

[footnote continued on next page]

-20-

heavy emphasis on that reading virtually compels the conclusion

that they knew of the potential reach of this lawsuit long before

they ultimately decided to intervene, and it supports the common-

sense notion that the widely publicized 1971 Green ruling put the

Day School on notice that it might be within the scope of the

litigation. This is particularly so in light of the IRS July,

1970, announcements, discussed above.

[continuation of footnote no. 17]

the IRS' consistent interpretation of its application to sectar

ian schools since 1970. See Statement, supra, at 5-6; n.10 and

accompanying text. It is hardly unreasonable to expect that, if

the District Court had intended its 1971 decree to bind the IRS

only with respect to private, nonsectarian schools in Mississippi,

it would have said so in its order or opinion.

Appellants also imply that they were entitled to ignore the

Green litigation because the 1971 opinion and decree "did not

constitute a ruling even with respect to whether a segregative

private secular school qualifies for tax exemption under Section

501(c)(3)." (App. Br. at 15 n.*.) This is a drastic misreading

of the Supreme Court's comment about this case in Bob Jones Uni-

versity v. Simon, 416 U.S. 725, 740 n.ll (1974) . All that the

Supreme Court indicated was that its own summary affirmance of

the 1971 Green ruling by the District Court (which is certainly

the law of the land as well as the law of this case until over

ruled) was not entitled to as much precedential weight in another

case as a decision reached with full written opinions after ple

nary consideration by the Supreme Court. Furthermore, since the

Bob Jones ruling was not announced until three years after Green,

it could have had nothing at all to do with the Day School's

decision not to seek post-judgment intervention in this case be

tween 1971 and 1974.

We maintain that the District Court in 1971 reserved only

the question whether a school claiming that racial discrimination

in its operations was required as a matter of religious principle

would be entitled to an exemption. This should have put the Day

School, which states that none of its religious principles "re

quires or implies exclusion on the basis of race" (A. 21 13;

see also App. Br. at 13), on notice of the potential impact of

this case upon its status.

-21-

2. Even assuming that, in 1971, there could have been some

doubt as to the inclusion of all-white church schools, founded

after desegregation orders in their locales, within the class of

schools which would be affected by a suit designed to prohibit

tax exemption for private schools serving as an alternative to

desegregated public schools, there could be absolutely no ques

tion as to such inclusion after the developments in Norwood v.

Harrison, supra, particularly on the remand in the trial court.

See Statement, supra, at 6-8. The opinion on remand made it

absolutely clear that church schools could come within a judicial

definition of a prima facie racially discriminatory school. As

noted in the Statement, the opinion of Judge Ready specifically

dealt with three church schools, including a Presbyterian Day

School in Cleveland, Mississippi. It is inconceivable that a

private church school in Mississippi could have been unaware of

the Norwood opinion. And since that opinion several times re

ferred to the opinion in Green v. Connally (see 382 F. Supp. at

929, 932, 934), the close relationship between the two cases in

defining what constitutes a prima facie racially segregated

school had to be apparent to school administrators, whether or

18/

not they are lawyers.

18/ Cases arising in states adjacent to Mississippi during this

time also subjected church-related and non-sectarian schools to

the same standards of racial nondiscrimination. In Gilmore v.

City of Montgomery, 417 U.S. 556, 569 (1974), the Supreme Court

unanimously upheld a district court injunction prohibiting city

authorities from allowing private schools (and affiliated groups)

to use public recreational facilities because

the city's actions significantly enhanced

the attractiveness of segregated private

schools, formed in reaction against the

[footnote continued on next page]

-2 2-

Moreover, the IRS had announced explicitly, in May, 1975 ,

that organizations, "including churches", which conduct schools

with a policy of refusing to accept children of certain racial

and ethnic groups would not be recognized as tax-exempt. As

noted in the Statement, this announcement was supplemented by

one which set forth the showing that had to be made to establish

a nondiscriminatory policy — a showing substantially in accord

with the terms of the Green injunction, if lacking its focus on

"badge of doubt" schools. If the Day School knew, as it had to

know, that the Green litigation involved tax exemption for pri

vate white schools in Mississippi, it had to know that a white

church school established after a desegregation order was poten

tially affected by that litigation.

[continuation of footnote no. 18]

federal court school order, by enabling

them to offer complete athletic programs.

That injunction applied to church-related as well as nonsectarian

schools in Montgomery, Alabama. Gilmore v. City of Montgomery,

337 F. Su p p . 22; 24 (M.D. Ala. 1972) (St. James School), rev d

in part on' other grounds, 473 F.2d 832 (5th Cir. 1973) , rev d in

part and remanded on other grounds, 417 U.S. 556 (1974).

In Brumfield v. Dodd, supra, 405 F. Supp. 338, the federal

district court in Louisiana established a certification procedure

similar to that developed in Norwood, to be administered by the

state Board of Elementary and Secondary Education in connection

with loaning state-owned textbooks to private schools. In that

case, as in^Norwood, religious as well as secular schools^ were

subjected to the same standards for determining whether they had

nondiscriminatory policies. See 405 F. Supp. at 346 [Del^a

Christian Academy); 425 F. Supp. at 534-35 (Grawooa Christian

School).

-23-

3. Proposed intervenors were under a duty to keep abreast

of developments in the Green case since they had to know that

tax-exempt church schools were potentially concerned. They thus

had to realize that, if they wanted to assert an interest in their

alleged right to be free of all inquiry as to their tax-exempt

status, they had to move to intervene, at the very latest, when

19/

plaintiffs made the motion for additional relief in 1976.

That obligation became even clearer in the face of the IRS Aug

ust 22, 1978 proposed guidelines for determining whether a school

should be deemed racially discriminatory. Those proposed guide

lines clearly concerned church schools. A number of religious

organizations, including the Association of Christian Schools

International, to which the Day School belongs, testified at the

December, 1978, hearings held by the IRS on the proposal. Since

the guidelines related to tax exemption, their relationship to

the Green case had to be self-evident to any interested person,

20/

layman or lawyer.

19/ Plaintiffs' motion, together with its attachments, is part

of the District Court record which was not transmitted to this

Court. It is reproduced in Appendix D, infra.

20/ The IRS itself consistently made clear that development of

the proposed guidelines was undertaken because of the Green case.

For example, in a January 9, 1978 address to the PLI Seventh

Biennial Conference on Tax Planning for Foundations (the text of

which was issued as News Release IR-1930 by the Service), Commis

sioner Kurtz stated (at 8-10) (emphasis supplied):

. . . As I will relate in a moment, the

Service has taken significant steps in

recent years to improve compliance with

its private school policy. We expect

further guidance from the court since

we are presently involved in litigation

[footnote continued on next page]

-24-

4. The Day School does not explain why it became aware of

the May 5, 1980 order in this case in time to contact counsel on

[continuation of footnote no. 20]

about our enforcement program.

. . . Service ruling policy is found in

Revenue Rulings 71-447 and 75-231. Guide

lines and procedures are found in Revenue

Procedure 75-50. Essentially, these three

documents deny tax exemption to private

schools that discriminate in their admis

sions policy on the basis of race or eth

nic origin. Church-related private schools

are covered within this policy as well as

the churches that operate and control them.

. . . One question is how we should evaluate

the bona fides of the admission policy of

schools located in communities subject to

desegregation orders that operate over a

long period of time without actually enroll

ing any minority students. Does that fact

create a presumption calling for more careful

scrutiny? Might a similar rule be applicable

even in the absence of local desegregation

orders? And, on the other side of that ques

tion, what steps can an exempt school take in

such a situation to establish that it, in

fact, has been open to children of all races

and ethnic groups?

Similarly, Commissioner Kurtz opened the December, 1978 hearings

on the proposed guidelines by stating:

The plaintiffs in the original Green case I

mentioned earlier have reopened the case and

at aoproximately the same time a nation-wide

class action was filed challenging the ade

quacy of the Service's enforcement in this

area. The Civil Rights Division in the

Department of Justice and the Commission on

Civil Rights also have been critical of the

Service's rules in this area. We have re

viewed our current rules and have concluded

that more objective rules may be necessary

to identify those schools which, while

[footnote continued on next page]

-25-

May 21, 1980 (see A. 122), but was unaware of the case before

that time. From the papers that are attached to appellants'

brief, it appears that the Internal Revenue Service did not con

tact the Day School until June 30 , 19 8 0 (see App. Br. at 45) . It

is a reasonable inference that the IRS, which seemed to have dif

ficulty in identifying tax-exempt church schools in Mississippi,

had not reached the Day School with any inquiry before the May 5,

1980 order, and it may be that the Day School was not interested

in making the IRS aware of its exempt status by moving to inter

vene in the action until it became clear from the May 5 order

that the school would be a subject of inquiry. Be that as it

may, it is abundantly clear, from the court opinions and the IRS

releases, that no minimally responsible Mississippi school admin

istrator could have been unaware, before 1976 at the very latest,

that the Green litigation potentially involved white church

schools established after desegregation orders in their areas.

The proposed intervenors, if they cared about their tax-exempt

status at all, had to know that such status could be implicated

[continuation of footnote no. 20]

claiming a nondiscriminatory policy, are

operated in a manner excluding minority

students. The Court has deferred any

action on the two cases at this time,

pending resolution of the Service's final

action with regard to the proposed revenue

procedure.

Internal Revenue Service, Hearing: Proposed Revenue Procedure

on Tax Exempt Private Schools (December 5, 1978) at 9-10 (empha

sis supplied). Excerpts from the hearings, including the remarks

of Commissioner Kurtz and ACSI Attorney Ball, are reproduced in

Appendix E, infra.

-26-

in the Green case. If they wanted to represent their interest,

vis-a-vis the controversy between the Green plaintiffs and the

IRS, they should have moved to intervene much earlier than they

did. At the very latest, they should have so moved at the time

of the motion to modify the injunction order in 1976. They could

not ignore the potential effect and wait for certainty in the

outcome before moving to intervene.

The burden is on the movants to show why they should be

allowed to come into this case at this late date. Nevilles v.

EEOC, 511 F.2d 303, 305 (8th Cir. 1975). The fact that the pro

posed intervenors did not know with certainty the terms that

would be imposed by the final order (although in view of the IRS

proposed guidelines, they could have fairly anticipated what the

ultimate ruling would be) does not excuse their delay since they

surely knew the risks. See Alaniz v. Tillie Lewis Foods,

572 F.2d 657, 659 (9th Cir.), cert, denied sub nom. Beaver v.

Alaniz, 439 U.S. 837 (1978).

The motion to intervene was thus properly denied as un-

21/

timely.

21/ The District Court also ruled (A. 124) that the morion to

Intervene should be denied because "The movants lack any protec-

tible interest under the modified permanent injunction entered

by this court on May 5, 1980 and clarified on June 2, 1980 be

cause they do not come within the description contained in Para

graph 1 of that order." Appellants also challenge this ruling,

but this Court need not consider the question since the alterna

tive ground of untimeliness is clearly adequate to sustain the

District Court's disposition of the motion to intervene.

-27-

B. The proposed intervenors' interests can be fully adjudi

cated in a separate action under 26 U.S.C.§7428, which

would develop the particular facts of appellants' particu

lar situation without the necessity of disturbing the final

judgment in this case.

While, as we discussed above, we believe that the motion to

intervene could properly be denied on the basis of untimeliness

alone, the denial of the motion in this case was particularly

appropriate because the School's interests can be protected and

the claims which it wishes to assert adjudicated in an individual

action under 26 U.S.C.§7428. It is thus unnecessary to reopen

the judgment in this long-pending case. Cf. Brumfield v. Dodd,

supra, 425 F. Supp. at 531 (post-judgment intervention in text

book aid case unnecessary since school will have opportunity for

judicial review of administrative determination of ineligibility).

All that the District Court order of May 5, 1980, requires

in relation to church schools is that the IRS obtain information

about the organization and status of the school (see Question

naire attached as an Appendix, App. Br. at 47). Appellants do

not and could not reasonably contend that the mere furnishing of

such neutral information would in any way impinge upon their

freedom of religion. See United States v. Freedom Church,

2 2?

613 F .2d 316, 320 (1st Cir. 1979). Their claimed objection to

the injunction in this case stems from the fact that the District

Court adopted the view that an all-white school established after

a desegregation order would be deemed presumptively discrimina

tory and required to show by objective means that it did not in

fact discriminate on the basis of race. Appellants assert that

22/ But see App. Br. at 38-39 1! (f) ; 40 «! (j) .

-28-

their religious mission precludes the kind of showing suggested

by the District Court. While the order of the District Court

suggests some of the types of evidence by which the presumption

could be overcome, it does not, however, direct that nondiscrim

ination can be shown only by these means. The order directs the

IRS to consider "any other similar evidence calculated to show

that the doors of the private school and all facilities and pro

grams therein are indeed open to students or teachers of both

the black and white races upon the same standard of admission or

employment" (A. 10). Appellants are therefore free to bring be

fore the IRS any and all evidence which they believe would tend

to show that the Day School does not discriminate on the basis

of race, despite the time of the school's foundation and its

23/

all-white enrollment.

Whether or not the school is racially discriminatory will

be determined by the IRS on the basis of all the facts before it.

If, because the school declines to answer certain questions which

it deems improper, or because its answers do not convince the IRS

that it is nondiscriminatory, and the IRS declines to accord tax-

exempt status, the school will have the opportunity, in an action

23/ The District Court's decree thus does not inexorably burden

the exercise of the Day School's religious mission even if one

accepts appellants' far-fetched interpretation of what the Dis

trict Court meant when it identified "active and vigorous recruit

ment programs to secure black students or teachers," "meaningful

public advertisements stressing the school's open admissions pol

icy," and "meaningful communication between the school and black

groups . . . " (A. 10) as evidence tending to rebut the inference

of discrimination which attaches to "Paragraph 1" schools. See

App. Br. at 36-38.

-29-

under 26 U.S.C. § 7428, to assert whatever claims it has, under

the First Amendment or otherwise, as to why it should be accorded

tax-exempt status without having to make the showing suggested by

24/

the District Court.

An action under 26 U.S.C. § 7428 will have the advantage of

focusing on the particular facts relating to this school's partic

ular situation. Such a concentration on the facts of an individ

ual case is, as the district court initially held in this case,

desirable when passing on religious claims. See 330 F. Supp. at

1169. In moving for an advanced hearing on this appeal, appel

lants have asserted that an action under 26 U.S.C. § 7428 would

not be as expeditious as intervention because, under the statute,

they must first exhaust administrative remedies. This merely

serves to emphasize that the District Court's order in this case

does not affect appellant's interest to the point of requiring

denial of exemption, and that appellants do have an opportunity

to present their claims: first administratively, and then, if

necessary, judicially.

The right to seek a declaratory judgment under 26 U.S.C. §

7428 to review an IRS denial of tax exemption to a church orga

nization existed before appellants made their motion to intervene

24/ While the merits of appellants' claims are not before the

Court in this proceeding, it should be noted that what is at is

sue here is, not the rxght of the school to conduct its affairs

and limit its students as it sees fit, but its right to receive

aid from the government in the form of tax exemptions even if

the school follows a policy of racial discrimination. See Green

v. Connally, supra, 330 F. Supp. at 1166; Goldsboro Christian

Schools, Inc. v. United States, 436 F. Supp. 1314, 1318-19 (E.D.

N.C. 1977) .

-30-

in this case. Intervention was thus not then, and is not now,

necessary to enable appellants to assert whatever claims they may

have that a decision to deny their tax exemption based upon the

IRS' application of the District Court's decree would violate

their First Amendment rights.

On the other hand, opening this case now would greatly de

lay the already long-deferred enforcement of plaintiffs' rights.

The proposed intervenors tried to come into this case only after

final judgment; they sought, not only to press their own particu

lar interest, but to open up the whole judgment, including the

25/

issue of plaintiffs' standing to bring suit. Manifestly, they

were not entitled to intervene to seek such broad relief. But

even if their application could be deemed limited to the narrower

question of whether the IRS should be directed to make a deter

mination as to the tax-exempt status of church schools, the in

tervention would go far beyond the Day School's particular inter

est and interfere with the ability of the IRS to make determina

tions as to other schools which might not contest the right of

the IRS to make a determination as to their status.

Since appellants have a full and complete remedy without

intervention, while intervention would prejudice the rights of

the plaintiffs, the motion to intervene was properly denied. The

existence of other means by which a late intervenor's rights can

be determined is an important factor, closely related to the con

cept of practical timeliness, by which the propriety of the

25/ The government moved to dismiss the action after the filing

of the plaintiffs' motion for further relief (see Statement,

supra, at 9), on the ground, inter alia, that plaintiffs lacked

standing. The motion to dismiss was denied May 25, 1977.

-31-

denial of a motion to intervene is to be judged. See Hodgson v.

United Mine Workers, supra, 153 U.S. App. D.C. at 418, 473 F.2d

at 129-30; Brumfield v. Dodd, supra, 425 F. Supp. at 531. Indeed,

in United States v. Marion County School Dist., 590 F.2d 146 (5th

Cir. 1979) , the court considered the relative prejudice to the

existing parties and the would-be intervenor to be a function of

timeliness. In NAACP v. New York, supra, 413 U.S. at 368, the

Supreme Court noted, as a factor supporting the denial of late

intervention, that proposed intervenors were free to attack, in

a separate suit, the redistricting plan, rejection of which was

the main object of their proposed intervention.

Here, the grant of intervention would hamper and delay the

implementation of an order already too lone delayed. Since the

proposed intervenors have a full and complete remedy if the IRS

decides that the Day School is not entitled to tax exemption, a

remedy which was in existence at the time it sought to intervene

2_6/

here, its late motion to intervene was properly denied.

CONCLUSION

The judgment of the District Court should be affirmed.

26/ Even if the Court should conclude that untimeliness is not

established on this record, the matter should be remanded to the

trial court for an evidentiary hearing on intervention, at which

the extent of the wide publicity given in Mississippi to the pro

ceedings in the Green case could be even more fully documented.

Respectfully submitted,

William L. Robinson

Norman J. Chachkin

Beatrice Rosenberg

Lester Goldner

Lawyers' Committee for

Civil Rights Under Law

733 15th Street, N.W.

Washinaton, D. C. 20005

(202) 628-6700

Frank R. Parker

Lawyers' Committee for

Civil Rights Under Law

720 Milner Building

210 South Lamar Street

Jackson, Mississippi 39201

(601) 948-5400

Attorneys for Plaintiffs-Appellees

CERTIFICATE OF SERVICE

I hereby certify that, on this 3th day of October, 1980,

I served two copies of the foregoing Brief for Plaintiffs-

Appellees upon counsel for the other parties to this appeal, by

depositing same in the United States mail, first-class postage

prepaid, addressed as follows:

Charles J. Steele, Esq.

Whiteford, Hart, Carmody

and Wilson

1828 L Street, N.W.

Washington, D. C. 20036

William Bentley Ball, Esq.

511 North 2nd Street

Post Office Box 1108

Harrisburg, Pennsylvania 17108

(1 copy)

(1 copy)

Michael L. Paup, Esq.

Chief, Appellate Section

Tax Division

U.S. Department of Justice

Washington, D. C. 20530

(2 copies)

APPENDIX A

APPENDIX A

Rule 24 of the Federal Rules of Civil Procedure provides,

in pertinent part:

(a) Intervention of Right. Upon timely

application anyone shall be permitted to inter

vene in an action: . . . (2) when the applicant

claims an interest relating to the property or

transaction which is the subject of the action

and he is so situated that the disposition of

the action may as a practical matter impair or

impede his ability to protect that interest,

unless the applicant's interest is adequately

represented by existing parties.

(b) Permissive Intervention. Upon timely

application anyone may be permitted to intervene

in an action: . . . (2) when an applicant's

claim or defense and the main action have a

question of law or fact in common. . . . In

exercising its discretion the court shall con

sider whether the intervention will unduly de

lay or prejudice the adjudication of the rights

of the original parties. . . .

Section 7428 of the Internal Revenue Code of 1954, as

amended in 1976 (90 Stat. 1717) and 1978 (92 Stat. 2924) pro

vides, in pertinent part:

(a) Creation of remedy. In a case of actual

controversy involving —

(1) a determination by the Secretary —

(A) with respect to the initial

qualification or continuing quali

fication of an organization as an

organization described in section

501(c)(3) which is exempt from tax

under section 501(a) . . . upon

the filing of an appropriate plead

ing, the United States Tax Court,

the United States Court of Claims,

or the district court of the United

States for the District of Columbia

may make a declaration with respect

to such initial qualification or

-la-

or continuing qualification . . . .

For purposes of this section, a

determination with respect to a con

tinuing qualification or continuing

classification includes any revoca

tion of or other change in a quali

fication or classification.

(b) Limitations.

(2) Exhaustion of administrative remedies.

A declaratory judgment or decree under this

section shall not be issued in any proceed

ing unless the Tax Court, the Court of Claims,

or the district court of the United States

for the District of Columbia determines that

the organization involved has exhausted ad

ministrative remedies available to it within

the Internal Revenue Service. . . .

-lb-

APPENDIX B

Attachment 1 to MS (ll)6G-58

News a

Internal R evenue S e rv ic e

For Release: U : 00 PM ,ED'5 Fri .

July 10, 1970

Tel. (202) WO 4-4021

IRS Announces Fosition on Private Schools

Washington, D.C. — The Internal Revenue Service announced today that

it has been concluded it can no longer legally justify allowing tax-exempt

status to private schools which practice racial discrimination nor can

it treat gift* to such schools as charitable deductions for income tax

purposes.

The Internal Revenue Service will proceed without delay to make

favorable rulings of exemption immediately available to private schools

announcing racially nondiscriminatory admissions policies and to deny

the benefit of tax-exempt status and deductibility of contributions to

racially discriminatory private schools.

The Service said that favorable rulings given to private schools in

the past will remain outstanding where the school is able to show that it

has racially nondiscriminatory admissions policies.

All private schools with favorable rulings outstanding will receive

a written inquiry from the District Director of Internal Revenue and it

is anticipated that in most instances evidence of a nondiscriminatory

policy can be supplied by reference to published statements of policy or

to the racial constituency of the student body.

Where a school fails to establish that it has a racially nondiscriminatory

admissions policy, an outstanding ruling of exemption will be withdrawn.

However, a school seeking to clarify or change its policies and practices

will be given a reasonable opportunity to do so in order to retain its

ruling of federal tax exemption. In any event, full opportunity to present

evidence and be heard will be provided in accordance with usual revenue

procedures and the right to appeal to the courts will be available. Similar

principles will be followed in acting upon requests made by new schools for

rulings.

# # #

U:00 PM, EDT

7/10/70

Manual Supplement O f f ic ia l U s e O n ly

Attachment 2 to MS (ll)6G-58

News

For RaieoMe SundayJuly 19, 1970

Internal Revenue Service

W®sODflra@S®mo g®gg4}

Tol. (202) WO 4-402X

IR-1052

Washington, D. G. — The Internal Revenue Service today announced it has

issued favorable rulings of exemption to six private schools that have an

nounced racially nondiscriminatory admissions policies. The schools are

located in five different southern states.

The rulings were the first to be issued under the statement of position

announced by the IRS on July 10 concerning the tax status of private schools.

Other applications for exempt ruling^ pending at the time of the announcement,

which meet the stated standards will be processed expeditiously, the IRS

said.

The IRS said the written inquiry on admissions policies to be sent to

all private schools that currently hold favorable tax exemption rulings is

now being developed. Inquiry letters are expected to be sent out by the 58

IRS district directors within a few weeks.

The six schools to which new favorable rulings of exemption were issued

had provided the IRS complete information that they had a racially nondiscri

minatory admissions policy announced within their respective communities.

The schools are:

Nathanael Green Academy, Inc.

Siloam, Georgia

The Heritage School, Inc.

Newnan, Georgia

The Gaffney Day School

Gaffney, South Carolina

Desoto School, Inc.

Helena, Arkansas

Southeast Education, Inc.

Dothan, Alabama

Pamlico Community School

Washington, North Carolina

(More)

Manual Supplement O f f ic ia l U s e O n ly

Attachment 2— Cont. to MS (ll)6G-58

In response to questions it has received, the IRS also issued a more

detailed explanation of its July 10 statement of position on the tax status

of private schools. In that statement the IRS said, in the future, favorable

rulings of tax exemption would be available where schools announced racially*

nendiscriminatory admissions policies.

The IRS said its July 10 statement does not affect a school's ordinary

admissions policies which have no relation to race. The IRS specifically

added that a school's ordinary academic standards will not be affected.

The IRS explained that its July 10 statement is applicable to all pri

vate schools throughout.the United States, except as limited by the order of

a three judge Federal District Court in the District of Columbia, in

Green v. Kennedy and Thrower. That court has ordered that rulings be issued

in .Mississippi only under terms and conditions approved by the court.

In its initial nationwide review of the present status of private schools,

the IRS said that where a school has adopted and publicly announced a racially

nor.discriminatory admissions policy, it will assume, in accord with normal

procedures in requests for rulings, that such policy has been adopted and will

be maintained in good faith. If subsequent examination by an IRS field office

indicates that a school has not administered such a policy in good faith,

the tax exempt status of the school will be challenged.

The IRS also said that, should an existing ruling of a private school be

revoked as the result of such a challenge, persons contributing to the school

will be allowed to deduct contributions made prior to the date of the public

announcement by the IRS of the revocation. This follows the usual IRS rules

and procedures cn contributions.

The IRS added that its statement of position on racially nondiscriminatory

admissions policies would be applicable to all private schools, whether

church related or not. Selectivity of students, as by a religious seminary,

having no relation to racial discrimination would not be inconsistent with

the IRS statement of position.

. *§?•'' # # #

7/19/70

- 2 -

Manual Supplement O f f ic ia l U s e O n ly

APPENDIX C

____J

IN IKE UNITED STATES DISTRICT COURT

FCR THE DISTRICT OF COLUMBIA

WILLIAM H. GREEN, et al.,

Plaintiffs

>ri°

v.

DAVID M. KENNEDY, Secretary of the

Treasury of the United States of Ameri

and RANDOLPH W. THROWER, Commissioner

of Internal Revenue,

Defendants

ca}

Civil

No. L.

Action

.355-69

AFFIDAVIT

Randolph W. Thrower, Commissioner of Internal Revenue, being

duly sworn deposes and says r

I. After receiving copies of affidavits filed by the

plaintiffs with, the Court on or about November 12, 1970, the

Internal Revenue Service conducted an inquiry with respect

to various allegations contained in such affidavits.

Representatives cf the schools referred to in the affidavits

were provided copies of such, affidavits and were given an

opportunity to respond. The sane opportunity was provided to

officials of Macon, Mississippi, referred to in one of

plaintiffs1 affidavits. Thera are attached hereto, marked

Exhibits A-l to 6, affidavits received from representatives

of che following schools:

A-l

A-2

A-3

Central Holmes Academy, Lexington

Affidavit dated December 7, 1970 of S. W. Hooker,

J. 3. Yates and Frank A. Jones

Copiah Educational Foundation, Hazelhurst

.Affidavit dated December 5, 1970 of Hardy W. Graves

Indianola Educational Foundation, Indianola

.Affidavits dated December 7, 1970 of Glenn A. Cain,

James C. Robertson and Henry Paris

Latter from Richard M. Allan dated December 7, 1970

A-4 Lula-Rich Educational Foundation, Clarksdale

Affidavit dated December 5, 1970 of Leon C. 3rasb!acc

A-5 Noxubee Educational Foundation (Central Academy), Macon

Affidavit •dated December 3, 1970 of Polk Farrar

Affidavit dated December 4, 1970 of John L. Barrett

Affidavit dated December 5, 1970 of Jesse ?. 3tennis

"A-6 Quitman County Educational Foundation, '.-larks

Affidavits dated Decemoer 4 and 5, 1970 of R. A. Carsot

-Ac*

i

.4

rh<= al1 e^ations contained in the ? In response to tne . 10 7 0__~ ._ - , Tnhn w Hunter dated Novemoer 3, 1970,aftidavat or ^ - ^ t ^ r s concerning a meeting held on svbmitced 07 the plaint , ves 0f t’ne black and white

January 13, 1970, between - ? the Internal Revenue Service

coranrunities -n , ' * nxs, co interview the Mayor and Chief

dispatched two “ niCf *fi3sipoi and the affiant, Rev. Hunter.

Attac.hed*hereto is’a memorandum dated Dece^er 4,^1970j y ^ ^

1* T “ ^7orV“ .d RicSLd Adaas, Chl.f

: f ? S S so°-%i=o;; «***« »-*«* »-* «.?«=-u™w •