Albemarle Paper Company and Halifax Local No. 245, United Papermakers and Paperworkers, AFL-CIO v. Moody Brief for the United States and the Equal Employment Opportunity Commission as Amici Curiae 2

Public Court Documents

April 1, 1975

Cite this item

-

Brief Collection, LDF Court Filings. Albemarle Paper Company and Halifax Local No. 245, United Papermakers and Paperworkers, AFL-CIO v. Moody Brief for the United States and the Equal Employment Opportunity Commission as Amici Curiae 2, 1975. cc9a6461-b79a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/118e551f-6be3-4b8d-af1a-d95a935d639a/albemarle-paper-company-and-halifax-local-no-245-united-papermakers-and-paperworkers-afl-cio-v-moody-brief-for-the-united-states-and-the-equal-employment-opportunity-commission-as-amici-curiae-2. Accessed February 21, 2026.

Copied!

. . titilwe

!V> ci ( L -€. r* (■ c y-w jo op yiy

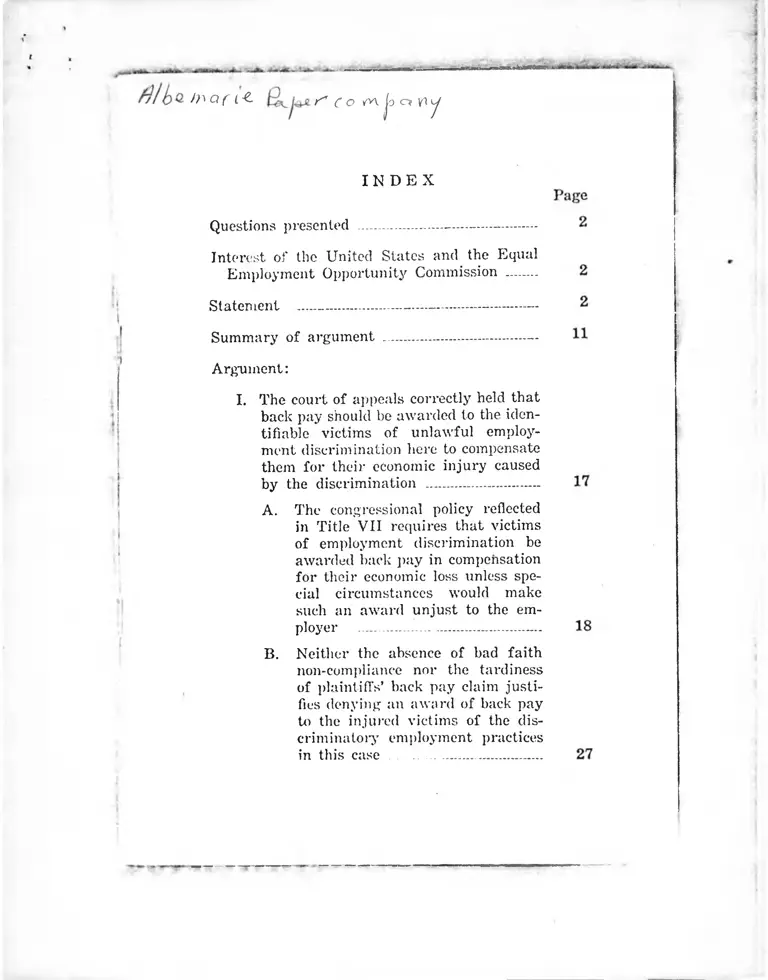

I N D E X

Questions presented ...................... ........................

Interest of the United States and the Equal

Employment Opportunity Commission ........

Statement ........................... ........ ............- ......... —

Summary of argument ......................................—

Argument:

I. The court of appeals correctly held that

back pay should be awarded to the iden

tifiable victims of unlawful employ

ment discrimination here to compensate

them for their economic injury caused

by the discrimination ..............................

A. The congressional policy reflected

in Title VII requires that victims

of employment discrimination be

awarded back pay in compensation

for their economic loss unless spe

cial circumstances would make

such an award unjust to the em

ployer .......................................... ......

B. Neither the absence of bad faith

non-compliance nor the tardiness

of plaintiffs’ back pay claim justi

fies denying an award of back pay

to the injured victims of the dis-

criminatory employment practices

in this case ..... ............................. .....

II

Argument-—Continued Page

C. Back pay claims should be deter

mined for all class members who

have sustained economic loss,

whether or not they filed individ

ual charges with the Equal Em

ployment Opportunity Commis

sion _________________

i

i

i

31

II. Albemarle’s testing program is unlaw-

ful because its tests operate to exclude

blacks and have not been shown to bear

a demonstrable relationship to success

ful performance of the jobs for which

they are used .............. .. . CO

A. Albemarle’s tests have a dispropor

tionate adverse impact on blacks ... 35

B. The company’s testing program

was not shown to be job-related

1. The court of appeals correctly

oCO

looked to the EEOC Guidelines

for guidance in assessing the

adequacy of Albemarle’s vali

dation study .......................

1

38

2. Albemarle’s validation study !

was not conducted in accord- [

ance with professionally accept

ed standards ............ ............. 41

3. The study does not, in any

event, demonstrate that the (

i

tests are related to the jobs for

which they are used

f

46

Conclusion 49

III

CITATIONS

Cases: Page

Baxter v. Savannah Sugar Refining Corp.,

495 F. 2d 437 ............................-........... - 27

Bou'c v. Colgate-Palmolive Co., 416 F. 2d

711 ................................... -----......-........20 ,21 ,31

Carey v. Greyhound Bus Co., 500 F. 2d

1372 ____ .................................- ............-..... 27

Duhon v. Goodyear Tire & Rubber Co.,

494 F. 2d 817 ........ .......... - ....................... 42

Franks v. Bowman Transportation Co.,

495 F. 2d 39S, certiorari granted on

other issues, March 24, 175, No. 74-

728 ...................... .................. -.................... - 31,42

Griggs v. Duke Power Co., 401 U.S. 4 2 4 .1 1 , 14,

28, 34, 36,

39, 42, 48

Head v. Timken Roller Bearing Co., 486

F. 2d 870 .............. 21, 27, 31

Hccht Co. v. Boivlcs, 321 U.S. 3 2 1 .......12, 19,20

J. I. Case Co. v. Bo rale, 377 U.S. 426 .... 24

Johnson v. Goodyear Tire it Rubber Co.,

491 F. 2d 1364 .......................... . 21, 27, 32, 42

Kober v. Westinghouse Electric Corp.,

480 F. 2d 210 ' .............. ......................... 26

Lawn v. United States, 355 U.S. 339__ 36

LcBlanc v. Southern Bell Telephone &

Telegraph Co., 460 F. 2d 1228, certio

rari denied, 409 U.S. 990 ..................... 26

Louisiana v. United States, 3,80 U.S. 145 24

Maiming v. International Union, 466 F.

2d 812, certiorari denied sub nom.

Manning v. General Motors Corp., 410

U.S. 946 ............................ ........................ 26

Miller v. international Paper Co., 408 F.

2d 283 ............... ..............—___ ________ 31

rfy, VirtHi

IV

Cases—Continued Page

Mitchell v. Robert DcMcirio Jewelry, Inc.,

301 U.S. 2SS .... ........................................... 12, 19

National Labor Relations Board v. J. II.

Ruttcr-ltcx Mfg. Co., 396 U.S. 258 .... 22, 27

Newman x. Piggie Park Enterprises, Inc.,

390 U.S. 400 .................... ............. 13, 24, 25, 28

Oatis v. Crown Zcllcrbach Corp., 398 F.

2d 496 .......................................................... 31

Pettway v. American Cast Iron Pipe Co.,

494 F. 2d 211 ......................... ........ 21 ,27 ,32

Phelps Dodge Co)~p. v. National Labor

Relations Board, 313 U.S. 177 ............. 12,22

Porter v. Warner Holding Co., 328 U.S.

395 19

Robinson v. Lori Hard Corp., 444 F. 2d

791 ......................................................10, 21, 27, 30

Rogers v. International Paper Co., 9

j CCIIJ EP1) H 9865 ................ .............. 42

Rosen v. Public Service Electric and Gas

Co., 409 F. 2d 775 ...................v....... ...... 30

Rosen v. Public Service Electric and Gas

Co., 477 F. 2d 90 ............................ .. 21 ,27

Rowe v. General Motors Corp., 457 F. 2d

348 ............... .............................. ...... .......... 43

Schaeffer v. San Diego Yellow Cabs, Inc.,

462 F. 2d 1002 ‘...................................... 26

Sprogis v. United Air Lines, Inc., 444 F.

2d 1194, certiorari denied, 404 U.S.

991 ............................................... . .2 1 ,2 7

United States v. Burr, 25 Fed. Cas. 30 20

United States v. Georgia Power Co., 474

F. 2d 906 ........................................... 21, 40, 41

United States v. Hayes International

Corp., 456 F. 2d 112 ................................ 30

i

■ .... . ■=... MOST.

V

Cases— Continued Page

United States v. N.L. Industries, Inc.,

479 F. 2d 354 .. ................................. 23,27

United States v. St. Louis-San Francisco

Ry. Co., 404 F. 2d 301 .....-..................... 27

Vulcan Socich/ v. Civil Service Commis

sion, 490 F. 2d 387 ...................... - .......... 15, 4a

Waters v. Wisconsin Steel Works, 502 F.

2d 1309 .............................- .......... - ............ 27

Young v. Edgeomb Steel Co., 499 F. 2d

97 ‘............................................. 42

Statutes:

Civil Rights Act of 1964, 78 Stat. 253, as

amended, 42 U.S.C. 2000e, et seq........... 2, 3

Section 70G, 42 U.S.C. 2000e-5 ........ 31

Section 706(g), 42 U.S.C. (Supp.

I l l ) 2000e-5(g) ................ 11, 17, 19, 20,

21,22, 23

Section 713(b), 42 U.S.C. 2000e-12 .

(b) ....................................................... 26

Equal Employment Opportunity Act of

1972, 86 Stat. 103 21

National Labor Relations Act, Section 10

(c), 29 U.S.C. 160(c) 22

Miscellaneous:

A PA, Standards for Educational and Psy

chological 'Pests and Manuals (1966) 39,42,

44

Civil Service Commission Regulations (37

Fed. Reg. 21557-21559) ..................... 40 ,42 ,45

------------- --------------- U. .. ■ ------ »..-.■

VI

Miscellaneous—Continued Page

MS Cong. Rec.:

7166-7169 ....................... 21

7168 ................................. ...... 12, 21, 30, 33

7563-7567 21

7565 .................................... 12, 21, 30; 33

Department of Labor Order:

41 C.F.R. Part 60-3 .......................... 40

41 C.F.R. 60-3.6 . 42

30 Fed. Reg. 14927 ........................... 26

34 Fed. Reg. 13368 ................... 26

Federal Rules of Civil Procedure:

Rule 53 ................... 32

Rule 54(c) 30

Guidelines on Employee Selection Proce

dures:

29 C.F.R. Part 1607 - 34, 36

29 C.F.R. 1607.4(c) ____ 42

29 C.F.R. 1607.4(c)(1) .............. 45

29 C.F.R. 1607 .4(c)(2) .............. 37, 44, 47

29 C.F.R. 1607.5(b)(3) ................. 36, 42

29 C.F.R. 1607.5(b)(4) ..................... 37

S. Rep. No. 415, 92d Cong., 1st Sess. 33

Un tltr ^uprrmr GJmtrt nf tlir llmtr h ^tatrii

O c t o b e r T e r m , 1974

No. 74-389

A l b e m a r l e P a p e r C o m p a n y , e t a l ., p e t i t i o n e r s

v.

J o s e p h P . M o o d y , e t a l .

No. 74-428

H a l i f a x L o c a l N o . 4 2 5 , U n i t e d P a p e r m a k e r s

a n d P a p e r w o r k e r s , AFL-ClO, p e t i t i o n e r

V.

J o s e p h P . M o o d y , e t a l .

OX 117.777? or CERTIORARI TO T1IK EXITED STATES

COURT o r ARREARS EOR THE FOURTH CIRCUIT

B R IE F FOII T H E U N IT E D STA TES AND T H E

EQUAL EM PLOYM ENT O PPO R TU N IT Y COMMISSION

AS AMICI CURIAE

( 1 )

—‘•'..I*".1 «»« .,, ■■. rf„„

EQUAL EM PLOYM ENT O PPORTUN ITY CO.MMISSION

I

Pursuant to Title VII of the Civil Rights Act of

10(1-1 and Executive Order 1124G, the Equal Employ-

ment Opportunity Commission, the Attorney Gen

eral, and other branches of the federal government

have responsibility for enforcement of federal laws

providing for equal employment opportunities. Al

though this case was brought by private plaintiffs,

the issues concerning back pay and testing raised

here are similar to issues that arise in suits brought

by the government. The resolution of the issues

presented in this case will directly affect the govern

ment’s enforcement responsibilities.

2

Q U ESTION S PR E S E N T E D

1. Whether a district court, in determining

whether to award hack pay to members of an iden

tifiable class of persons who have suffered economic

injury because of racially discriminatory employment

practices in violation of Title VII of the Civil Rights

Act of 1961, must exercise its discretion in a manner

consistent with the remedial purposes of the Act.

2. Whether petitioner Albemarle’s employment

selection tests are unlawful because they have a dis

proportionate adverse impact on blacks and have not

been shown to be substantially job-related.

ST A T E M E N T

1. On August 25, 19GG, respondents, after they

had received a right-to-sue letter from the Equal

. . . - ■--..-...~

Employment Opportunity Commission, filed a class

action1 against their employer, Albemarle Paper

Company (petitioner in No. 71-389), and their union,

Halifax Local No. 425 (petitioner in No. 74-428),y

alleging that the defendants were engaged in racially

discriminatory employment practices in violation of

Title VII of the Civil Rights Act of 1964, as amended,

42 U.S.C. 2000e, et scq. The complaint sought a

permanent injunction against those practices and

prayed for “such other additional relief as may ap

pear to the Court to be equitable and just” (A. 10).

The alleged discriminatory employment practices

took place at Albemarle’s paper mill in Roanoke

Rapids, North Carolina. The principal business of

the paper mill is the production of kraft paper, pulp,

1 The district court defined the classes represented by re

spondents as “ (1) all Negroes employed a t the Iloanokc

Rapids plant of Albemarle Paper Company as of June 30,

19G7; (2) all Negroes employed a t said plant a f te r June 30,

19G7, except those whose initial perm anent positions were not

job classifications limited to or predominantly staffed by

Negroes; and (3) all Negroes who may hereafte r apply for or

be cmplovod a t said Roanoke Rapids plant who may be affected

by the alleged racially discrim inatory employment practices

of the defendants” (A. 47-1).

3 The original three defendants were Albemarle P ape r Com

pany (V irg in ia), the United Paperm akers and Paperw orkers,

and Paperm akers Halifax-Local 42r>. The international union

was subsequently dismissed as a defendant (A. 1G-20). In

1968, the company’s assets were sold and t ran sfe rred in a

series of transactions. As a result. Albemarle Paper Company

(Delaw are), Hoerner W aldorf Corporation, Lthyl Coipoia-

tion, and F irs t Alpaco Corporation were joined as defendants

(A. 30-39).

MtMMkMuta a t ...ii-------——

i

I

|

4

and allied products (A. SS). The mill has 11 func

tionally discrete departments (A. 477, 511), and each

department has one or more functionally related lines

of progression consisting of several job categories (A.

88, 477). The mill has 17 lines of progression and

more than 100 job classifications (A. 477, 514). In

all but exceptional circumstances, employees enter

a line of progression at the lowest paying job, and

vacancies are filled by promotions from within each

line of progression on the basis of seniority and

ability (A. 477).

In addition to the lines of progression, the mill,

prior to 19G8, had two “extra boards”— reservoirs

of employees who were available to staff the lowest-

level jobs in the lines of progression. The General

Extra Board supplemented the skilled lines of pro

gression; the Utility Extra Board supplemented the

unskilled lines of progression (A. 485). The extra

boards were staffed by new employees and employees

who had been laid off from other jobs and were await

ing recall (ibid.). In 19G8, the two extra boards

were merged (A. 48G).

Promotions and demotions in the plant are gov

erned by job seniority. When a vacancy occurs, the

first opportunity to fill it is ordinarily given to the

employee in the next lowest job category within the

line of progression who has the greatest seniority in

that job, if he possesses the necessary ability, ex

perience, and training (A. 477-478).

Albemarle uses personnel tests in selecting appli

cants for employment in certain jobs. Since 19G3,

i

i

i-•A

iri

1

i

• *■*

*,*•

■■

- 4

on *** > ffirtitiiivagBSw* -

j i

I

applicants for 13 lines of progression in eight depart

ments ' have generally been required to have a high

school education and to score successfully on the

Revised Beta Examination—a nonverbal test devel

oped during World War I to measure the intelli

gence of illiterate and non-English-speaking persons

— and the Wonderlic A or B Series examinations—

short, verbal tests used to measure general mental

ability (A. 100-101, 487-48S, 514).

2. After a trial, the district court found that

“ [pjrior to January 1, 1964, Albemarle’s lines of

progression were strictly segregated on the basis of

race” (A. 480). Approximately 86 of the 100 jobs

at the plant were “traditionally reserved for white

persons” (A. 477). The court found that “ [tjhose

lines of progression to which black employees were

traditionally assigned were lower paying than the

‘white’ lines of progression” and that “ [tjhe racial

identifiability of jobs and departments in lines of

progression were maintained subsequent to the effec

tive date of Title VII (July 2, 1965)” (A. 480). The

extra boards were also segregated on the basis of

race. As of June 1967, there were 62 white and two

* These figures were derived by the d istr ic t court and the

court of appeals from a stipulation filed on July 25, 1971 (A.

86-106). A Hough the court of appeals stated th a t examinations

a re required for employment in U lines of progression (A.

5 1 4 ), both the stipulation and the d istrict court’s opinion

indicate th a t 13 is the correct number. Albemarle s ta tes (Hr.

13) that , as a result of changes in mill operations, the tests

w ere administered, by the time of trial, to applicants for only

e ight lines of progression in four departments.

1

-S '*

lAkUU

• riia.,

black employees assigned to the General Extra Board;

no whites and 50 blacks were assigned to the Utility

Extra Board (A. 484-485).

Although a 196S collective bargaining agreement

effected some “changes in the lines of progression

[that] had the effect of eliminating, to some extent,

their strictly segregated composition,” “black em

ployees were still ‘locked’ in the lower paying job

classifications” (A. 485). Similarly, while the two

extra boards were merged in 1968, “[ejmployees on

the merged board still retain recall rights to jobs

and lines of progression which they held prior to

being reduced to the call board,” so that “black-

employees are recalled to black jobs and white em

ployees are recalled to white jobs” (A. 486).

The court concluded that “Albemarle practiced

racially discriminatory employment practice] s | prior

to July 2, 1965,” and that “the effects of this dis

ci imination has [«v/c] been perpetuated” (A. 495-

496). The court stated (A. 496):

Although o\ ert racial discrimination ceased sub

sequent to the effective date of Title VII, the

eflects of this racial discrimination have not been

eradicated. The job seniority system has re

sulted in blacks occupying the lower paying

positions \\ ithin an integrated line of progres

sion. Other lines of progression remain essen

tially segregated because of the inability of

black employees to meet the educational 'and

testing requirements to transfer into other, high

er paying lines of progression.

****»«>*»*►___ ------------- ---------

The court ordered the defendants “to abolish the ex

isting seniority system based substantially on job

seniority” and “to implement and permanently con

tinue a system of plant seniority * * * so that * * *

when employees of the affected class are competing

with employees not of the affected class, and the

qualifications of the competitors are relatively equal,

plant seniority rather than job seniority shall gov

ern” (A. 499-500).

The district court declined to award back pay to

members of the class who had suffered economic in

jury as a result of the discriminatory employment

practices that locked them into the lower paying

jobs to which they had l>een assigned on the basis

of race. The court rested its denial of back pay on

two considerations. First, “there was no evidence

of bad faith non-compliance with the Act” (A. 498).4

Second, the plaintiffs did not specifically seek back

pay in their complaint5 and did not assert a back

pay claim until “nearly five years after the institu

tion of this action” ( ib id ) . “ |T]he defendants

* The court stated th a t Albemarle hud bepun in 1964 to re

cru it blacks for its Maintenance Apprentice Propram , th a t it

merped some lines of propression on its o\\ n initiative and

took certain steps to correct abuses in accordance with de-

velopinp judicial in terpreta tions of the Act, and th a t it paid

higher wapes for all levels of employment than did o ther in

dustries in the a rea (A. 498).

' In their memorandum in opposition to a motion for sum

m ary judpmont, plaintilTs stated that ” [n ]o money damapes

a re soupht for any member of the chuss not before the court”

(A. 13-14).

;-f Hi ■•Hi mil. ------ • * - ,

8

would ho substantially prejudiced by the granting of

such allinnative relief,” the court stated, because they

_ m^ ' t have chosen to exercise unusual zeal in hav

ing this court determine their rights at an earlier

date had they known that back pay would be at issue”

(ibid.).

Ihe court also rejected respondents’ contention

that Albemarle’s testing reciuirements are unlawful

because they have a disproportionate adverse impact

on blacks and were not shown to be related to job

performance. It concluded that “ftjhe personnel tests

administered at the plant have undergone validation

studies and have been proven to be job related” (A

497).

The \ alidation study conducted by Albemarle cov

ered 10 job groups in 8 of the 18 lines of progression

for which the tests are required (A. 511). Albe

marle’s expert conducted no job analysis of the jobs

co\eied by the study. 1 Ih e sample of employees

tested for the study were selected from the top. and

middle ranges of the lines of progression (A. 490).

Their scores on each of the three tests use by Albe

marle— Beta, Wonderlic A, and Wonderlie B— were

compared with job performance ratings assigned to

them by two supervisors, who rated them according

t° this standard: “Excluding a man’s attitude, just

how well the guy can do the job when he’s feeling

right” (A. 19o, 511-515). The study found “ [s|ig-

"T he expert spent only about a half day at the p lant (A.

171). lie had no written job descriptions (ihitf.) and did not

speak with any supervisors while he was a t the mill (A. 175).

...... . .u.i&l^ i*?***”*********"

9

nificant correlations * * * for at least, one of the three

tests investigated for nine of the ten groups of jobs

(A. 431). The use of all three tests was found valid

only for one of the 10 job groups, and the use of the

Beta together with either Wonderlic A or Wonderlic

B— the use made of the tests by Albemarle was

found valid only for two of the 10 job groups (A.

432).

On the basis of that validation study, the district

court found that “ [tjhe defendants have carried the

burden of proof” in demonstrating the job-related

ness of the company’s testing program (A. 497). The

court found, however, that “the high school education

requirement used in conjunction with the testing re

quirements is unlawful in that the personnel tests

alone arc adequate to measure the mental ability and

reading skills required for the job classifications”

(A. 497). It accordingly enjoined Albemarle from

“requiring a high school education as a prerequisite

for employment, promotion or transfer” (A. 502).

3. The court of appeals reversed with respect to

the back pay and testing issues (A. 512-537).*

On the back pay issue, the court held that neither

plaintiffs’ delay in making a claim for back pay nor

the lack of evidence of bad faith noncompliance with

’ All applicants a rc given the Net a examination and both

series of the Wonderlic test. They are required to score

satisfactorily both on the be ta and on either the Wonderlic

A or the Wonderlic H (A. 220).

* Petitioners did not appeal any aspect of the d istrict

court’s order.

10

the Act “is sufficient to justify the district court’s

refusal to award back pay” (A. 520). Relying on

its 1 eject ion of similiar contentions in Robinson v.

Lorillard Corp., 4-14 F. 2d 701, the court of appeals

reasoned that Albemarle was not substantially preju

diced by the plaintiffs delay in seeking back pay and

that a showing of bad faith is not required for an

aw aid of back pay, because the award is designed

not to penalize the employer but to compensate the

victims of the discrimination for their tangible eco

nomic loss.

The court rejected the contention that the denial

of back pay should nevertheless be sustained as

within the discretion of the district court. “Where

a district court fails to exercise discretion with an

eye to the purposes of the Act. it must be reversed”

(A. 52.3). The court stated that, in view of “the

compensatory nature of a back pay award and the

strong congressional policy embodied in Title VII”__

which favors making the victims of the unlawful

discrimination economically whole so far as possible__

“a plaintiff or a complaining class who is successful

in obtaining an injunction under Title VII of the

Act should ordinarily be awarded back pay unless

special circumstances would render such an award

unjust” (A. 52.3-521). It held that “there are no such

special circumstances here” (A. 524).

With respect to testing, the court stated: “The

effect of the district court’s approval of Albemarle’s

testing procedure is to approve a validation study

done without job analysis, to allow Albemarle to

11

require tests for 6 lines of progression where there

has been no validation study at all, and to allow

Albemarle to require a person to pass two tests for

entrance into 7 lines of progression when only one

of those tests was validated for that line of progres

sion. We think this was error” (A. 515). The court

concluded that the tests were not shown to have

“a manifest relationship” to the jobs for which they

are used by Albemarle (A. 516). Since “ [t]he plain

tiffs made a sufficient showing below that Albemarle’s

testing procedures have a racial impact (A. o lo ) ,

and since Albemarle failed to showr that the tests are

substantially job related, it followed under Grifjgs v.

Duke Power Co., 401 U.S. 424, that the testing pro

cedure is unlawful.®

SUMMARY OF ARGUM ENT

I

A. When a district court finds that an employer

or a labor union has intentionally engaged in unlaw

ful employment practices, it may enjoin those prac

tices and may “order such affirmative action as may

be appropriate, which may include * reinstate

ment or hiring of employees, with or without back

pay” (42 U.S.C. (Supp. I l l) 2000e-5(g)). The

court’s discretion with respect to back pay awards

must, however, be exercised in accordance with the

• Judjre Foreman dissented on the testing issue (A. 524-

532), and Ju d se Bryan dissented on the back pay issue (A.

532-527).

12

large objectives of the Act” ( JI edit Co. v. Bowles,

321 U.S. 321, 331), for it is the duty of a court of

equity “to provide complete relief in light of the

statutory purposes” {Mitchell v. Robert DcMario

Jewelry, Inc., 361 U.S. 288, 292).

The objectives of Title VII are to eliminate dis

criminatory employment practices and, so far as pos

sible, to compensate the victims of employment dis

crimination for their economic loss caused by the

discrimination. The district court’s duty “to fashion

the most complete relief possible” (see 118 Cong. Rec.

7108, 7505) upon a finding of employment discrim

ination ordinarily means that it must both enjoin

the unlawful practices and award back pay to the

injured victims. “Only thus can there be a restora

tion of the situation, as nearly as possible, to that

which would have obtained but for the illegal discrim

ination” {Phelps Dodge Corp. v. National Labor Re

lations Board, 313 U.S. 177, 194). Moreover, the

reasonably certain prospect that back pay will be

awarded provides an important economic incentive

for employers and unions to comply voluntarily with

the provisions of Title VII and thereby to bring a

prompt end to employment discrimination.

It follows that the Act’s policies of making the

victims whole and deterring future discrimination re

quire back pay to be awarded to the injured em

ployees unless, for substantial reasons that are con

sistent with the Act’s purposes, awarding back pay

would be unjust to the employer or the union. That is

the standard that the court of appeals applied here

13

and that this Court applied with respect to awards

of counsel fees under Title II of the Act in Newman

v. Pi;,fiic Pari: Enterprises, hie., 300 U.S. -100, 402.

B. The district court’s reasons for denying back

pay in this case do not satisfy that standard. Since

the remedial purpose of Title VII is to compensate

the injured victims of employment discrimination and

not to punish the employer, the absence of “bad faith

non-compliance” (A. 408) does not justify denying

back pay. A requirement that injured employees

prove malice or deliberate recalcitrance would be

an unwarranted obstacle to effective relief and would

weaken the incentive for voluntary compliance by

making back pay awards depend upon the applica

tion of an uncertain, subjective standard. This Court

rejected a similar standard for the award of counsel

fees in Newman v. Pif/fji.e Park Enterprises, Inc.,

supra, and it should reject it here as well.

Nor was the plaintiffs’ delay in asserting a back

pay claim on behalf of the entire class of injured

employees a proper basis for denying back pay. The

defendants were aware of that claim at least one

year prior to trial, and their defenses to the claim

were identical to their defenses with respect to in

junctive relief. There is no foundation foi the dis

trict court’s speculation that the defendants “might

have chosen to exercise unusual zeal” (A. 498) in

expediting a trial if they had known of the back pay

claim earlier, nor is there any support for petitioners’

assertion that discovery was made more difficult by

plaintiffs’ delay. In the absence of a showing of sub-

14

stantial prejudice, that delay did not affect the dis

trict court’s duty to award complete relief.

C. Back pay relief is not limited to those mem

bers of the class who have filed individual charges

with EEOC. The filing of a single charge alleging

unlawful employment practices fully satisfies the pur

poses of Title VII’s filing requirement by putting

the employer on notice of the charge and invoking

EEOC s conciliation functions. There is no reason

to require the filing of numerous identical claims.

Congress considered and rejected precisely such a

requirement when it enacted the 1972 amendments

to Title VII.

I I

A. That Albemarle’s tests operate disproportion

ately to exclude blacks was implicit in the district

court’s lengthy discussion concerning the job-related-

ness of the tests and was the subject of an explicit

finding by the court of appeals (A. 515). Albemarle

aigues that the plaintiffs failed to make an adequate

show ing that the tests have a racially disparate im

pact, but that issue was not presented in the pe-

tition for a writ of certiorari and is not properly

bcfoie this Court. In any event, the record supports

the court of appeals’ finding.

B. I he court of appeals correctly concluded that

Albemaile did not carry its burden of showing that

its present use of the tests “have a manifest rela

tionship to the employment in question” (Griggs v.

Duke Power Co., 401 U.S. 424, 432). In making

__ _

15

that determination, the court of appeals properly

looked to the EEOC Guidelines as “a helpful sum

mary of professional testing standards” (Vulcan So-

cieltj v. Ciril Service Commission, '190 F. 2d 287,

394, n. 8 (C.A. 2 )) and made proper use of the

Guidelines in assessing the adequacy of Albemarle’s

test validation study.

In a Title VII case within the scope of EEOC’s

enforcement jurisdiction, it is particularly appropri

ate for a court to rely upon the professional ex

pertise reflected in the Guidelines. And where, as

here, the pertinent sections of the Guidelines ac

curately summarize the professionally accepted stand

ards for test validation and no showing is made that

there are significant deferences of opinion within the

profession, an employer whose validation study de

parts from the Guidelines should bear the heavy bur

den of showing that the departure was justified and

that the study was nevertheless adequate to prove

that the tests are job-related.

Albemarle’s study was not conducted in accord

ance with the Guidelines, and the company neither

justified the departure nor demonstrated that the

study was otherwise adequate. Albemarle’s expert

failed to conduct a job analysis to determine the skills

and abilities required for successful performance of

the jobs he studied; under generally recognized pro

fessional standards, a job analysis is an essential

first step in a proper employment test validation

study. Its absence in Alliemarlc’s study made it nec-

16

essaiy to rely on a vague, subjective standard for

supervisory ratings of employees and made it impos

sible to tell whether the abilities rated by the super

visors and measured by the tests are the ones that

are necessary to perform the jobs at the mill.

The study also departed lrom professional stand

ards because Albemarle’s expert did not take precau

tions to ensure that the tests were administered under

controlled and standardized conditions and that the

raters were kept unaware of the employees’ test

scores. Moreover, the jobs studied were at the higher

le\els in the plant, although applicants for employ

ment naturally begin work at the lower levels. Al

bemarle did not show that it was reasonable to

validate the tests for the jobs studied rather than

those that a new employee would perform.

Even if the study had been conducted properly,

however, its results do not show that the tests are

related to the jobs for which they are used. The

study covered only eight of the 13 lines of progres

sion for which tests are required, and it found cor

relations supporting Albemarle’s present use of the

tests for only two of the 10 job groups studied. Al

bemarle s claim that it is ncccssaiy to ensure that

all applicants are qualified for each line of progres

sion in the plant is not supported by the record.

ARGUM ENT

■I

T H E COURT OF A P PE A L S CORRECTLY IIELI)

T H A T RACK PAY SHOULD RE AW ARDED TO

T H E 1D E N TIFIA R L E VICTIMS OF U N LA W FU L

EM PLO YM EN T D ISCRIM IN ATION H E R E TO COM

PE N S A T E TH EM FOR T H E IR ECONOMIC IN JU R Y

CAUSED 15Y T H E DISCRIM IN ATION

The district court found that petitioners engaged

in unlawful discriminatory employment practices that

confined the black employees at Albemarle’s paper

mill to the lower paying, less desirable jobs to which

they had been assigned on the basis of their race (A.

480-486, 496). The court was therefore authorized

under Section 706(g) of the Act, 42 U.S.C. (Supp.

I l l) 2000e-5(g), to enjoin the unlawful practices

and to “order such affirmative action as may be ap

propriate, which may include * * * reinstatement or

hiring of employees, with or without back pay * *

Although the victims of petitioners’ racially discrim

inatory practices suffered tangible economic loss as

a result of the discrimination, the district court re

fused to award them compensatory back pay because

it found “no evidence of bad faith non-compliance

with the Act” and because respondents’ initial fail

ure specifically to request back pay on behalf of the

class they represent may have induced petitioners not

to exercise “unusual zeal in having this court deter

mine their rights at an earlier date” (A. 49S).

The court of appeals held that the district court’s

denial of back pay for those reasons was not a proper

t

18

exercise of its discretion under the Act. That discre

tion, the court stated, must be exercised “with an eye

to the purposes of the Act” (A. 523) and in a way

that gives the fullest possible effect, consistent with

fairness, to the congressional policy of making whole

the victims of employment discrimination.

Petitioners contend (Albemarle Br. 50-61; Halifax

Br. 21-33) that the court of appeals unduly restricted

the scope of the district court’s statutory discretion

in determining whether to award back pay and that

the district court’s refusal to award back pay in this

case should have been sustained under “traditional

equitable principles” (Albemarle Br. 53). Albemarle

also argues (Br. 01-66) that back pay may not, in

any event, be awarded to individual members of the

affected class of injured employees who have not

themselves fded charges with the Equal Employment

Opportunity Commission. In our view, petitioners are

wrong on both counts.

A. The Congressional Policy Reflected In Title VII

Requires That Victims Of Employment Discrimina

tion l>e Awarded Rack Ray In Compensation For

Their Economic Loss Unless Special Circumstances

Would Make Such An Award U n jus t To The Em

ployer

The issue here is not whether the district courts

have discretion to award or withhold back pay, for

the Act clearly commits that decision to the sound

discretion of the trial judge. Nor is the issue wheth

er that discretion “is governed by traditional equi

table principles” (Albemarle Br. 53); Congress in-

__:.....aafcasa l...

10

tended in Section 706(g) to invest the courts with

full, traditional equity jurisdiction to fashion effec

tive relief upon a finding of unlawful employment

practices. Cf. Porter v. ir«r«cr Holding Co., 328

U.S. 395, 398, 400; Mitchell v. Robert DeMario

Jewelry, Inc., 361 U.S. 2SS, 291-292.

The issue, rather, is the extent to which the district

courts’ exercise of discretion under the Act is cir

cumscribed by, and must be responsive to, the legis

lative objectives of Title VII. It is settled, of course,

that traditional equity jurisdiction does not empower

a court to take whatever action it wishes. Discre

tion must be exercised according to appropriate

standards. In the enforcement of a statutory scheme,

the courts must exercise their discretion “in light of

the large objectives of the Act” ; their discretionary

remedial determinations must “reflect an acute

awareness” of the congressional policy (Hccht Co. v.

Bowles, 321 U.S. 321, 331). It is “the historic power

of equity to provide complete relief in light of the

statutory pui*poses” (Mitchell v. Robert DeMario

Jewelry, Inc., supra, 361 U.S. at 292).

Albemarle thus properly concedes that a district

court’s discretion under Section 706(g) of the Civil

Rights Act of 1961 “must be exercised consistently

with legislative objectives” (Br. 53). It seeks to avoid

the thrust of that principle, however, by arguing

that the legislative objective was “to leave resolution

of complex remedial problems to the traditional, dis

cretionary powers of the federal courts of equity”

(Br. 54).

.—MM.

20

But that argument begs the question. It merely

restates a proposition that no one disputes— that the

district courts have discretion in determining whether

to award back pay. As Chief Justice Marshall stated

long ago, to say that the matter is within a court’s

discretion means that it is addressed not to the

courts ‘inclination, but to its judgment; and its

judgment is to be guided by sound legal principles”

{United Stales v. Burr, 25 Fed. Cas. 30, 35). The

proper inquiry is this: what are “the large objec

tives of the Act” (IIecht Co. v. Bowles, supra, 321

U.S. at 331) in accordance with which that discre

tion must be exercised?

The large objectives of Title VII are to eliminate

discriminatory employment practices and, as far as

possible, to restore the victims of employment dis

crimination to the situation they would have been

in but for the discrimination. “The clear purpose of

Title VII is to bring an end to the proscribed dis

criminatory practices and to make whole, in a pecu

niary fashion, those who have suffered by it” (Bowc

v. Colgate-Palmolive Co., 41G F. 2d 711, 720 (C.A.

• ) ) •

Albemarle’s contention that “the Congressional em

phasis was on the prospective elimination of discrim

inatory practices and not on reparations” (Br. 54)

rests on its inference from the word “may” in the

statutory phrase “may include * * * reinstatement

or hiring of employees, with or without back pay”

(Section 7 0 0 (g )). But that inference is unjustified.

The same word is used in connection with injunctive

21

relief: ‘‘the court may enjoin the respondent from

engaging in such unlawful practice” (emphasis add

ed). Every court of appeals that has considered the

question has correctly concluded that the Act’s pur

poses are both to eliminate employment discrimina

tion and to compensate the victims.’"

The “make whole” purpose of Title VII is con

firmed by the legislative history of the Equal Em

ployment Opportunity Act of 19/2, 86 Stat. 10o,

which reenacted Section 706(g) with changes not

relevant here. The Scction-by-Section Analysis of the

1972 Act, presented to the House and the Senate at

the time the Conference Report on the Act was sub

mitted to each body (11.8 Cong. Rec. 7166-7169, 7563-

7567), states with respect to Section 706(g) (id. at

7168, 7565; emphasis added):

The provisions of this subsection are intended

to give the courts wide discretion exercising

their equitable powers to fashion the most com

plete relief possible. In dealing with the present

section 706(g) the courts have stressed that the

scope of relief under that section of the Act is

intended to make the victims of unlawful dis-

io gee, e.fi., Rosen V. Public Service Electric and Gits Co.,

A l l F. 2d 00, 00 (C.A. :’*): Robinson V. Lurilhtrd Corji., AAA

F. 2d 701, 801 (C.A. -1); P ct tw an V. American Cast Iron Pii>c

Co 401 F. 2d 211, 272 (C.A. r>); Johnson V. Good near Tire

tC- Rubber Co., 101 F. 2d i:i«4, 1:17.". (C.A. .7); United States

V. Geori/ia Power Co.. 47 1 F. 2d 000, 021 (C.A. 5 ); Head V.

Timken Roller Rcarinp Co., 480 F. 2d 870, 870 (C.A. 0);

H our V. Colfintc-Palmolicc Co., supra, 110 F. 2d at (20:

S prop is V. United A i r R ims , Inc., 141 F. 2d 1101, 1202 (C.A.

7 ), certiorari denied, 404 U.S. 001.

22

crimination whole, and that the attainment of

this objective rests not only upon the elimination

of the particular unlawful employment practice

complained of, but also requires that, persons

aggrieved by the consequences and effects of the

unlawful employment practice be, so far as pos

sible, restored to a position where they would

have been were it not for the unlawful discrimi

nation.

Injunctive relief serves the purpose of eliminating

the discriminatory practices prospectively. An award

of back pay serves the purpose of making the victims

financially whole. In view of the Act’s objectives, the

district court’s duty “to fashion the most complete

relief possible” (ibid.) ordinarily means that it must

both enjoin the unlawful practices and award back

pay to those who have sulfered financial injury as

a consequence of the discrimination. As this Court

said with respect to back pay awards under Section

10(c) of the National Labor Relations Act, which

was the model for Section 706(g) of the Civil Rights

Act of 1064, “compensation for the loss of wages”

is “generally require[dj” to effectuate the policies of

that Act, because “ [o]nly thus can there be a restora

tion of the situation, as nearly as possible, to that

which would have obtained but for the illegal dis

crimination” (Phelps Dodge Carp. v. National Labor

Delations Hoard, 3.13 U.S. 177, 101). See also Na

tional Labor Relations Hoard v. J. H. Rutter-Rex

Mfg. Co., 306 U.S. 258, 263.

Moreover, compelling practical considerations sup

port the view that back pay should normally be

awarded to redress proven injuries. The reasonably

certain prospect that back pay will be awarded pro

vides the only substantial economic incentive to en

courage voluntary compliance with Title VII and

therefore a sw ift end to unlawful employment dis

crimination. Back pay awards “provide the spur or

catalyst which causes employers and unions to self-

| | examine and to self-evaluate their employment prac

tices and to endeavor to eliminate, so far as possible,

' the last vestiges of an unfortunate and ignominious

page in this country’s history” ( United States v.

N.L. Industries, Inc., 479 F. 2d 354, 379 (C.A. S )) .

An employer or union is less likely to make a seri

ous attempt to eliminate discriminatory practices or

practices that perpetuate the effects of past discrimi

nation if it can reasonably anticipate a court order

after lengthy litigation that merely requires it to do

what it should have done in the first place. Indeed,

with respect to changes in practices that would re

quire the expenditure of money, the absence of back

pay as a usual element of relief under Section 706

(g) could provide a financial incentive to an employer

or union to maintain the unlawful status quo as long

' as possible.

It follows that, in the exercise of their discretion

to effectuate the Act’s purposes and to encourage

prompt, voluntary compliance with its terms, the dis

trict courts should ordinarily award back pay to the

identifiable victims of unlawful employment discrim

ination. unless there are substantial countervailing

considerations that make such an award unnecessary

or inappropriate. In the court of appeals’ words, the

injured victims of the discrimination “should ordi

narily be awarded back pay unless special circum

stances would render such an award unjust” (A. 523-

524).

That standard neither forecloses nor unduly re

stricts a district court’s exercise of discretion. Courts

of equity always have “the duty * * * to be alert to

provide such remedies as are necessary to make ef

fective the congressional purpose” (J.I. Case Co. v.

Borah, 377 U.S. 426, 433). And in the enforcement

of the civil rights statutes, “the court has not merely

the power but the duty to render a decree which will

so far as possible eliminate the discriminatory effects

of the past as well as bar like discrimination in the

future” (Louisiana v. United States, 380 U.S. 145,

154).

The standard adopted by the court of appeals here

is identical to the one that this Court applied to the

exercise of a district court’s discretion to award at

torney’s fees under Title II of the Act. Newman v.

Pifj(/ic Bark Enterprises, Ine., 390 U.S. 400. The

court of appeals there had ruled that counsel foes

should be awarded only to the extent that a party

advances defenses in bad faith and for purposes of

delay. This Court held that that standard would not

adequately effectuate the purposes of the counsel-fee

provision of Title II. That provision was enacted

“not simply to penalize litigants who deliberately

advance arguments they know to be untenable but,

more broadly, to encourage individuals injured by

-...--------------- •----ii.iir

26

racial discrimination to seek judicial relief under

Title II” (390 U.S. at 402). Since private litiga

tion is an essential “means of securing broad com

pliance with [Title 11J” (-id. at 401), and since a

plaintiff suing as a “private attorney general” can

not recover damages, awards of counsel fees are im

portant to “vind icate] a policy that Congress con

sidered of the highest priority” (id. at 402).

The situation here is analogous. While this case

involves Title VII rather than Title II and back pay

awards rather than attorney’s fees, the effect of

awarding back pay in the absence of special circum

stances similarly vindicates the broad congressional

policy reflected in the Act and similarly ensures com

pliance with the law. The “special circumstances”

standard is no less an appropriate guide for the exer

cise of discretion in awarding back pay under Title

VII than it is for the exercise of discretion in award

ing counsel fees under Title II.

We do not suggest, nor did the court of appeals

hold, that back pay is mechanically compelled where

violations of the Act are found. Nor do we suggest

that courts of appeals should lightly overturn the

informed exercise of a district court’s discretion.

Where unlawful employment practices result in eco

nomic loss to identifiable persons, however, the “make

whole” purpose of Title VII, and the important policy

of encouraging voluntary compliance with the law,

should normally call for compensation, in the absence

of substantial countervailing considerations. The dis

trict court must articulate its reasons for denying

26

Dack pay, and those reasons should be carefully

scrutinized by the appellate courts to ensure that the

district court has fashioned the fullest possible re

lief consistent with fairness.

_ As 've understand the application of the “special

circumstances” standard to the question of back pay,

the Act’s policies of making the victims whole and

deterring future discrimination require back pay to

be awarded unless, for substantial reasons that are

consistent with the purposes of the Act, awarding

back pay would be unjust to the employer. One such

special circumstance, in the context of employment

practices that discriminate on the basis of sex, might

be the employer’s reasonable and good-faith reliance

upon state female “protective” statutes. See LeBlanc

v. Soul/tern Bell Telephone S: Telegraph Co., 4G0 F.

2d 3228 (C.A. 5 ), certiorari denied, 409 U.S. 990;

Manning v. International Union, 466 F. 2d 812 (C.A.

G), certiorari denied sub nom. Manning v. General

Motors Carp., 410 U.S. 946; Kobcr v. Westing house

Electric Corp., 480 F. 2d 240 (C.A. 3 ); but see

Schaeffer v. San Diego Yellow Cabs, Inc., 462 F. 2d

1002 (C.A. 9)." As we shall now show, no such spe

cial circumstance justified the district court’s denial

of back pay in the present case.

” Fnclcr LhOC. interpretive guidelines in effect from 10do

through August 1000, such state protective laws were con-

sidei ed consistent with I itle \ II. Compare 00 Fed. Peg 1 10°7

with III fed . Keg. lk.'IOS. Reliance on a published EEOC

guideline is a defense to liability under Title VII Cl*> TI r

2000c-12(b)). ' v - u .o .^ .

_ _ . „ _____ •■iiMfwitaiifiiiMwiiiMteS.aai

27

R. N either The Absence Of Rad F aith Non-Com pliance

N or The T ard iness Of P la in tiffs’ Rack P ay Claim

Justifies Denying An Award Of Rack P ay To 'lh e

In ju red Victims Of The D iscrim inatory Em ploy

m ent P ractices In T h is Case

Since the purpose of a back pay award is to com

pensate the injured persons and not to punish the

employer, the absence of bad faith should not or

dinarily justify denying back pay. As between the

innocent victim of an unlawful employment practice

and the employer or union that has violated the law,

the economic loss should normally fall on the wrong

doer. Cf. National Labor Relations Hoard v. J. H.

Rnttcr-Rc.v Mf<j. Co., supra, 206 U.S. at 26-1-265.

Accordingly, the courts of appeals have uniformly

rejected general claims of good faith as a reason to

deny back pay under Title VII.1'

To make back pay awards dependent upon proof

of malice or deliberate recalcitrance would place an

unwarranted obstacle in the path, of those seeking

compensation for economic injury resulting from un-

12 See, e.g., P ettw ay V. Am erican Cast Iron Pipe Co., supra,

401 F. 2d a t 253; Head V. Tim ken Roller Bearing Co., supra,

•180 F. 2d at 877; Sgrogis V. United A irlines, Inc., supra, 444

F. 2d a t 1201; lFrrfrr.s v. W isconsin Steel W orks, 002 F. 2d

1000, 1021 (C.A. 7 ) ; B axter V. Savannah Sugar Refining

C.orp., 405 F. 2d 437, 442-443 (C.A. 5 ); Robinson V. Lorillard

Carp.', supra, 444 F. 2d at. 804; Rosen V. Public Service Electric

and Gas Co., supra. M l V. 2d at 05-00; Carey V. Grey

hound Bus Co., 500 F. 2d 1372, 1378-1370 (C.A. 5 ) ; Johnson

V. Good year Tire S: Rubber (■<>., supra, -101 I'. 2d a t 13G.>-1.»G7.

Com pare United S to tts V. S t. Louis-San Francisco R y. Co.,

4G1 F. 2d 301, 311 (C.A. 8 ) , with flic same court’s subsequent

decision in United S ta tes V. S’.L. Industries, Inc., supra, 470

F. 2d a t 378-379.

28

lawful employment discrimination. As in Newman

v. Piggic Parle Enterprises, Inc., supra, where the

Court rejected a similar “had faith” test for the

award of attorney's fees, requiring a showing of bad

motive would not adequately effectuate the purpose of

the Act.

The subjective good faith of an employer or a labor

union does not diminish the economic harm suffered

by the victims of discrimination and should not

exempt the violator from the obligation to make those

victims whole. Moreover, good faith is an inherently

vague standard, the application of which would re

duce the predictability of back pay awards and thus

weaken the incentive for voluntary compliance with

Title VII.

This Court stilted in Griggs v. Duke Power Co.,

■101 U.S. 121, 482, that “good intent or absence of

discriminatory intent does not redeem” an other

wise unlawful employment practice. For similar rea

sons, good intent should not, at least in the absence

of extraordinary circumstances not present here, im

munize an employer or a labor union from the ob

ligation to compensate the innocent victims of em

ployment discrimination.

Nor should the plaintiffs* initial disclaimer of an

intention to seek back pay on behalf of members of

the class not before the court justify denying an

award in this case. Since petitioners knew of the

back pay claim for all members of the class at least

as early as June 4, 1970 (A. 28-29), they were on full

notice of the claim more than a year prior to trial.

The district court itself stated in an opinion filed 10

>-*■«*

29

months prior to trial that “[tjhe possibility of an

award of money damages upon a determination of

liability is still with us” despite the plaintiffs’ earlier

disclaimer (A. MS). The court reiterated several

weeks before trial that the claim for back pay would

be considered on its merits and that “damages may be

recovered in this action if the plaintiffs prevail” (A.

51). This advance notice gave petitioners ample op

portunity to address the matter completely in the

district court.

Moreover, as the court of appeals correctly held,

the defenses available to petitioners with respect to

the back pay issue were identical to their defenses

with respect to injunctive relief. Petitioners were thus

no less able to defend against the back pay claim

than they would have been had it been asserted at

the time the complaint was tiled. The district court’s

speculation that petitioners “might have chosen to ex

ercise unusual zeal” in expediting the trial if they

had known that back pay was in issue (A. -198) is

contradicted by the absence of any indication that

they exercised any such “unusual zeal” after learning

that the plaintiffs were seeking back pay. Albemarle

makes no representation in its brief that it would

have sought an earlier trial.

Albemarle contends that “fdjiscovery relating to

individual claims was clearly rendered much more

difficult, if not impossible, by the passage of time”

(Br. 58). But the record reflects that the district

court ordered the plaintiffs to answer Albemarle’s

interrogatories concerning individual back pay claims

30

and to submit “a statement as to each such member

of the class as to how he was personally and specifi

cally discriminated against; and the amount of dam

ages being claimed” (A. 46). Albemarle does not

indicate why those discovery procedures were inade

quate.'3

In the absence of substantial prejudice to pe

titioners, the delay in claiming back pay should not

altei the district court’s duty “to fashion the most

complete relief possible” (Section-by-Section Analysis

of 1972 Act, supra, 118 Cong. Rec. 7168, 7565).

Ri.de 54(c) of the federal Rules of Civil Procedure

provides that the district court “shall grant the relief

to which the party in whose favor it is rendered is

entitled, even if the party has not demanded such

relief in his pleadings.” Accordingly, other courts of

appeals have correctly held that Title VII back pay

claims asserted even after trial are entitled to full

adjudication in the absence of prejudice. See Rosen

v. Public Service Electric and Gas Co., 409 F. 2d 775,

780, n. 20 (C.A. 3 ); Robinson v. Lorillard Corp.,

supra, 444 F. 2d 802-803; United States v. Ilayes

International Corp., 456 F. 2d 112, 121 (C.A. 5).

15 N or should back pay be foreclosed because A lbem arle’s

assets w ere sold by E thyl Corporation to I lo em er W aldorf

Corporation in 1908. If H oerncr W aldorf tru ly acted “ in

the belief th a t in th is su it plaintiffs were not s e e k i n g dam

ages” (A lbem arle J»r. .r>8), th a t consideration poes only to

the allocation of liability as am ong the various defendants.

31

C. Hack P ay C laim s Should He D eterm ined F o r All

C lass M embers \ \ ho Have S ustained Economic Loss,

W hether O r N ot They Filed Indiv idual CharRes

W ith The E qual Em ploym ent O pportun ity Com

mission

Albemarle concedes (Br. 62) that membership in a

Title VII class action for injunctive relief need not

be limited to persons who have filed charges with the

Equal Employment Opportunity Commission. Miller

v. International Paper Co., 408 F. 2d 283, 284-285

(C.A. 5) ; Oat is v. Cro wn Zellcrbach Corp., 398 F. 2d

496, 499 (C.A. 5). It contends, however, that back

pay should be denied to those members of the class

who did not individually file charges with EEOC.

The purpose of the provision of Title VII (Sec

tion 706, 42 U.S.C. 2000c-5) requiring the filing of

charges with EEOC is to provide notice to the charged

party of the alleged violation of the Act and to bring

to bear the voluntary conciliatory functions of EEOC.

The filing of a single charge alleging unlawful em

ployment practices gives the employer notice of the

complaint and an opportunity to correct the unlaw

ful practices. It would serve no useful purpose to

re(iuire scores of substantially identical claims to be

processed through EEOC when a single charge is

sufficient to satisfy the requirements of Title VII.

Bowc v. Colgate-Palmolive Co., supra, 416 F. 2d at

720; Miller v. International Paper Co., supra, 408

F. 2d at 285; see also Franks v. Boiuman Transporta

tion Co., 495 F. 2d 398, 421-422 (C.A. 5 ), certiorari

granted on other issues, March 21, 1975, No. 74-72S;

Head v. Timken Roller Bearing Co., supra, 486 F. 2d

at 876.

M

32

Just as with injunctive relief, once it has been de

termined that the defendant has engaged in unlawful

employment practices that have caused the class mem

bers financial loss, the defendant’s liability for back

pay arises from conduct applicable to all aftected

members of the class. That the particular way in

which that common conduct has affected indi\ idual

class members may differ in degree, so that the

amount of back pay owing to each affected class

member may vary, docs not change the essential class

characteristics of the discriminatory practices.

“Once class-wide discrimination has been demon

strated to result in disproportional earnings, a class

wide decision that back pay is appropriate can be

discerned without deciding which members of the

class are entitled to what amounts (Pettway v.

American Cact Ivon Pipe Co., supva, 494 I'. 2d at

257). Thereafter, the district court” can proceed

to determine how much back pay is owed to which

class members."

As respondents’ brief demonstrates (pp. 37-41),

the legislative history of the Equal Employment Op-

14 In appropria te cases, the court may re fe r the m atte r to a

special m aster. See Fed. It. Civ. 1\ 53. The d is tr ic t court in

the p resen t case stated in a p re tria l o rder th a t “ if [hack pay]

claims become too num erous o r complicated, th is phase of the

case may be referred to a special m aste r’’ (A. 51 ). The record

reflects th a t approxim ately 80 persons filed claim s fo r back

pay in the d istric t cou rt (A. 70-8.>, 11G-117).

F o r a com prehensive discussion of m ethods fo r de ter

m ining back pay aw ards, see P ettw ay V. Am erican Cast Iron

Pipe Co., supra, A91 F. 2d a t 251-203, and Johnson V. Goodyear

Tire & Rubber Co., tnijiru, 101 F. 2d a t 1371-1375, 1379-1380.

j

[

■

{

i

33

portunity Act of 1972 shows that Congress considered

and rejected a provision, originally included in the

bill that passed the House, that would have fore

closed an award of back pay to any member of a

class who had not filed an individual charge with

EEOC. The report accompanying the Senate bill,

which omitted the provision contained in the House

bill stated that “any restriction on [class] actions

would greatly undermine the effectiveness of title

VII” (S. Rep. No. 415, 92d Cong., 1st Sess., p. 27).

The Section-by-Section Analysis of the bill that

emerged from the Conference Committee and that

was passed by both houses stated: “ |T ]he leading

cases in this area to date have recognized that many

Title VII claims are necessarily class complaints and

that, accordingly, it is not necessary that each indi

vidual entitled to relief be named m the original

charge or in the claim for relief. A provision lim it

ing class actions was contained in the House bill and

specifically rejected by the Conference Committee’

(118 Cong. Rec. 71G8, 7565). .

Congress thus explicitly rejected the precise limi

tation on class action relief that Albemarle now asks

this Court to accept.

34

II

A LBEM A R LE’S TE ST IN G PROGRAM IS UNLAW

FU L BECA U SE IT S T E S T S O PE R A T E TO E X

CLUDE BLACKS AND HAVE NOT B E E N SHOW N

TO BEAR A DEM O NSTRA BLE R E L A T IO N SH IP TO

SU C C E SSFU L PER FO R M A N CE OF T H E JO B S FOR

W H ICH T H E Y ARE USED

In Griggs v. Duke Power Co., 401 U.S. 424, this

Court hold that Title VII prohibits the use of tests

or other employee selection procedures that operate

to exclude members of minority groups, unless the

employer demonstrates that the procedures are sub

stantially related to job performance— i.c., that they

reliably measure capability for, or accurately predict

successful performance of* the jobs for which they are

used. The district court in the present case ruled

that Albemarle carried its burden of demonstrating

that its tests are job-related. The court of appeals,

however, relying on the principles established by this

Court’s decision in Griggs and looking to EEOC’s

Guidelines on ‘Employee Selection- Procedures (29

C.F.R. Part 1007) for guidance in determining the

adequacy of Albemarle’s proof, held that the com

pany’s test validation study was methodologically de

ficient and did not, in any event, demonstrate that the

tests provide a reasonable measure of the applicant’s

ability to perform successfully the jobs for which the

tests are used. That holding is correct.

35

A. A lbem arle’s T es ts Have A D isproportionate A dverse

Im pact On lllacks

Under Title VII, as construed by this Court in

Grifffjs, the plaintiffs bear the threshold burden of

showing that a challenged testing procedure disquali

fies from employment opportunities a disproportion

ately high percentage of minority group candidates.

If that showing is made, the burden shifts to the de

fendant to demonstrate that the tests are job-related.

Although the district court did not specifically state

that Albemarle’s tests disproportionately exclude

blacks, it did find that the higher paying lines of pro

gression “remain essentially segregated because of

the inability of black employees to meet the educa

tional and testing requirements” (A. 49G). More

over, the adverse racial impact of the tests was an

implicit premise of the court’s lengthy discussion con

cerning the job-relatedness of those tests, in which

it concluded that “ [t]he defendants have carried the

burden of proof” by demonstrating that the tests aic

job-related (A. 497). The court of appeals was more

explicit. It stated that “ [t]he plaintiffs made a suffi

cient showing below that Albemarle’s testing proce

dures have a racial impact” (A. 515).

Albemarle argues (Br. 28-31) that the plaintiffs’

showing was not sufficient and that the company

therefore was not required to prove that the tests aie

job-related. That issue, however, was neither pre

sented in Albemarle’s petition for a writ of ceitio ia ii

nor fairly comprehended within any issue that was

presented. It is, therefore, not properly before this

Xm-V-aMHii M4 k-ViV

36

Court. Lawn v. United States, 3o5 U.S. 339, 362-363,

n. 16.

Jn any event, we believe, substantially for the rea

sons stated by respondents (Br. 19-21), that the court

of appeals was justified in concluding that the plain

tiffs carried their threshold burden of showing a dis

proportionate racial impact.

B. The Com pany’s T esting P rogram W as N ot Shown

To Be Job-B elated

Albemarle attempted to meet its burden of showing

that its tests are related to the jobs for which they

are used by submitting the results of a test validation

study conducted in 1971 by Dr. Joseph Tiffin (A.

431-438). The court of appeals correctly concluded

that the study failed to demonstrate that Albemarle’s

tests “have a manifest relationship to the employ

ment in question” (Griggs v. Duke Power Co., supra,

401 U.S. at 432).

In reaching that conclusion, the court of appeals

drew upon the testing expertise reflected in several

sections of EEOC’s Guidelines mi Employee Selection

Procedures, 29 C.F.R. Part 1607. One of those sec

tions emphasizes the importance of a careful job

analysis to identify “ [t]he work behaviors or other

criteria of employee adequacy which the test is in

tended to predict” (29 C.F.R. 1 6 0 7 .5 (b )(3 )). An

other highlights the danger of relying upon the “sub

jective evaluations” of supervisors in measuring the

job performance of the subjects of a validation study,

because of “the possibility of bias inherent in” such

»<ufiihn __.... .. i, «--aartW«¥ii M. M..I —

37

evaluations (29 C.F.R. 160 7 .5 (b )(4 )). A third sec

tion states that the validity of a test with respect to

a particular job may be demonstrated by evidence

of validity with respect to a related job, if “no sig

nificant differences exist” between the jobs (29

C.F.R. 1 6 0 7 .4 (c )(2 )).

The court of appeals held that Albemarle’s valida

tion procedure was deficient because the expert who

conducted the study performed no job analysis but

relied exclusively upon the “possibly subjective rat

ing of supervisors who were given a vague standaid

by which to judge job performance” (A. 517). Re

ferring to the Guidelines, the court stated. \Vc

agree that some form of job analysis resulting in

specific and objective criteria for supervisory rat

ings is crucial to a proper concurrent validation

study” (A. 518).

The court also held that, “ [e]ven if the validation

procedure had been proper, it was error to approve

the testing procedures for lines of progression wheie

there had been no validation study” (ibid.). The

court recognized that “a test need not always be vali

dated for each job for which it is required” (ibid.),

but it held that the absence of any job analysis for

the lines of progression involved in the study and those

for which the tests are required “prevents concluding

that no significant differences exist in the jobs in

question” (A. 519).

Finally, the court held that “it was also error to

approve requiring applicants to pass two tests for

positions where only one test was validated (ibid.).

38

Although Albemarle argued that the requirement is

appropriate because the company hires employees in

to a pool from which they may move into any one

of several lines of progression, the court stated that

“Albemarle has not shown that hiring all employees

into a pool is necessary to the safe and efficient oper

ation of its business, nor has it shown that hiring em

ployees for specific lines of progression is not an ac

ceptable alternative” (A. 519-520).

In our view, each of these holdings is correct. Al

bemarle’s validation study was not conducted in ac

cordance with professionally accepted standards, and

it failed, in any event, to show that the tests are

substantially related to performance of the jobs for

which they are used.

1. T he court o f appeals correctlp looked to th e

EEO C G uidelines fo r guidance in assessing the

adequacy o f A lbem arle’s validation s tu d y

Albemarle’s threshold contention is that the court of

appeals erroneously “equat[ed] EEOC suggested tech

nical methodology with acceptable standards of judi

cial proof of job relatedness” (Br. 34). That is not

the way we read the court of appeals’ opinion.

The court did not state or imply that the Guidelines

have the force of law or that the adequacy of a vali

dation study depends upon rigid compliance with each

provision of the Guidelines. It merely looked to the

Guidelines as a source of professionally accepted

standards for the validation of employee selection

procedures, giving them the “deference” to which they

* * *are entitled as an “interpretation of the Act

by the enforcing agency” (A. 51G). See Griggs v.

Duke Power Co., supra, 401 U.S. at 433-434.

The determination whether a testing device has

been adequately validated as a reasonable measure

of job performance is complex and technical. Since

most district judges are not experts in industrial psy

chology or psychometrics and arc not professionally

equipped to evaluate the adequacy of a test valida

tion study, it is appropriate for them to defer to the

experts in those fields for guidance.

There are several accessible sources of such exper

tise in the field of employee test validation, lh e

American Psychological Association’s Standards for

Educational and Psychological Tests and Manuals

(hereinafter APA Standards) are generally regarded

as stating in a comprehensive fashion the accepted

standards of the psychological profession.’'1 The gov

ernment agencies with responsibilities in the area of

equal employment opportunities—including EEOC,

the Department of Labor, and the Civil Service Com-

io The 100(5 edition of the APA Standards is p a r t of the

record in th is case and is se t fo rth a t A. 415-426. The S tand

ards w ere revised in 1074. b u t the revisions do not substan

tially affect the provisions rela ting to the m atte rs a t issue

here. A lbem arle’s expert. Dr. Tiffin, testified th a t the Stand-

ards a re “a classic” in the psychological profession, th a t he

generally agrees w ith the principles fo r validating tests th a t

a re contained in the Standards, and th a t he a ttem pted in us

study to follow those principles “ [a] hundred percent (A.

172,209).

40

m inion—publish guidelines or regulations dealing in

a more concise fashion with test validation.”

These standards, guidelines, and regulations are not

in every respect identical, but each can provide use

ful guidance to a court in evaluating an employer’s

test validation study. In a case such as the present

one, involving a private employer subject to the provi

sions of Title VII and within the scope of EEOC s

enforcement responsibilities, it is particularly appio-

priate for the court to look to the EEOC Guidelines

for “a helpful summary of professional testing stand

ards” (Vulcan Society v. Civil Service Commission,

490 F. 2d 387, 394, n. 8 (C.A. 2 ) ) , since these

guidelines undeniably provide .a valid framework for

determining whether a validation study manifests

that a particular test predicts reasonable job suita

bility” ( United States v. Gcoryia Power Co., 474 F.

2d 90G, 913 (C.A. 5 ) ) .

If there arc substantial, legitimate differences with

in the profession, the court should of course apply

the Guidelines with appropriate caution in light of

those differences. But where, as here, the Guidelines

accurately reflect the standards and expertise of the

psychological profession and no showing is made that

» The form er Labor D epartm ent o rder governing the vali

dation of employm ent tests by contractors and ^ ^ n o d o r s

subject to the provisions of Lxecutive O r d e r 11-H> nppi a s

t \ not ‘v>8 The cu rren t version, which is substantially

GO'1 The Civil Service Commission’s regulations governing

te s t validation appear a t 37 Fed. Reg. 21557-21559.

41

there are significant differences of professional opin

ion with respect to the relevant portions of the Guide

lines, an employer whose validation study departs

from those provisions should bear the heavy burden of

showing that the departure was warranted and that

the validation study was nevertheless adequate to de

monstrate that the tests are job-related. In these

circumstances, the Guidelines 1 should be followed ab

sent a showing that some cogent reason exists for non-

compliance” {United Slates v. Georgia Power Co.,

supra, 474 F. 2d at 913).

The court of appeals in the present case did not

rigidly and uncritically apply the Guidelines to Al