Manego v. Orleans Board of Trade Brief for Plaintiff-Appellant

Public Court Documents

January 1, 1984

Cite this item

-

Brief Collection, LDF Court Filings. Manego v. Orleans Board of Trade Brief for Plaintiff-Appellant, 1984. c2f878de-bc9a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/16b5050f-cfc7-481f-8059-1c3ea4dbc648/manego-v-orleans-board-of-trade-brief-for-plaintiff-appellant. Accessed February 21, 2026.

Copied!

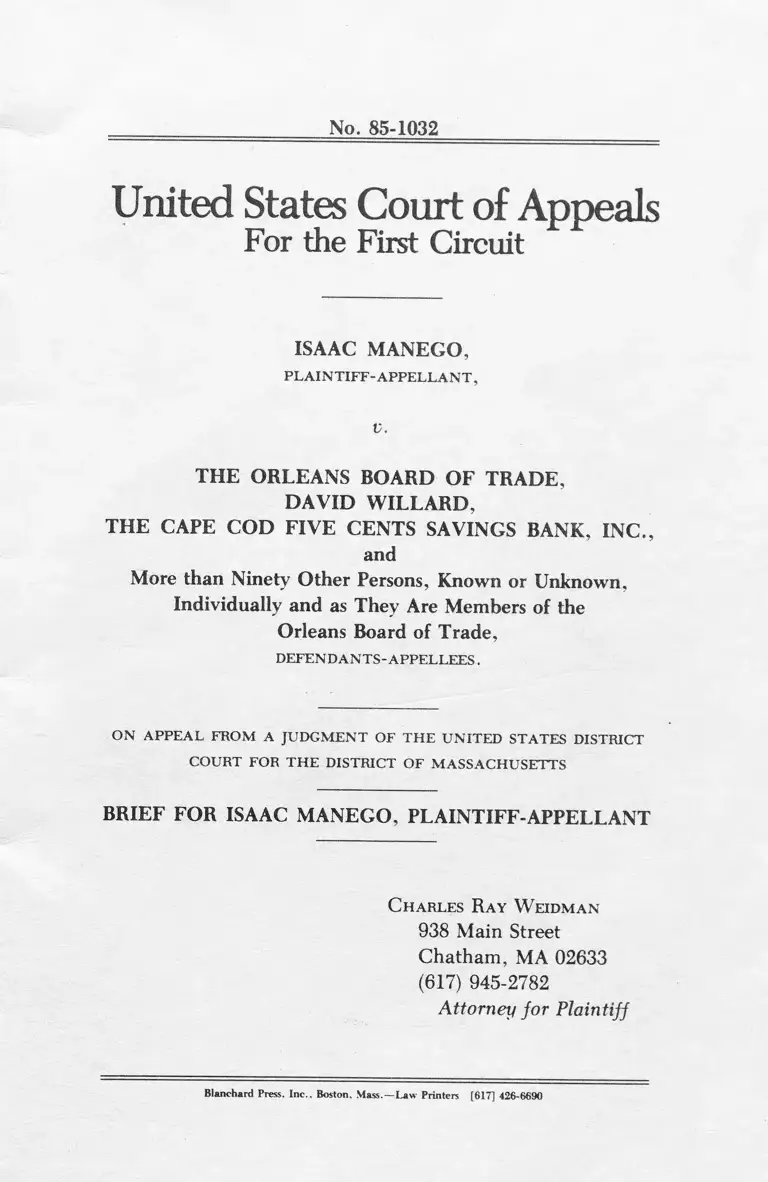

No. 85-1032

United States Court of Appeals

For the First Circuit

ISAAC MANEGO,

PLAINTIFF-APPELLANT,

V.

THE ORLEANS BOARD OF TRADE,

DAVID WILLARD,

THE CAPE COD FIVE CENTS SAVINGS BANK, INC.,

and

More than Ninety Other Persons, Known or Unknown,

Individually and as They Are Members of the

Orleans Board of Trade,

DEFENDANTS-APPELLEES.

ON APPEAL FROM A JUDGMENT OF THE UNITED STATES DISTRICT

COURT FOR THE DISTRICT OF MASSACHUSETTS

BRIEF FOR ISAAC MANEGO, PLAINTIFF-APPELLANT

C h a r l e s R a y W eid m a n

938 Main Street

Chatham, MA 02633

(617) 945-2782

Attorney fo r Plaintiff

Blanchard Press. Inc.. Boston, Mass. —Law Printers [617] 426-6690

TABLE OF CONTENTS

Page

Table of Authorities................................................................ i

Statement of the Issues to be Presented................................ 1

Statement of the Case.............................................................. 2

Argument................................................................................... 5

I. Res Judicata............................................................ 5

II. Application of Rule 56 ........................................... 14

III. Co-conspirators Liability for Sham Actions. . . 21

IV. Application of the Noerr-Pennington Doctrine. 27

Conclusion.................................................................................. 32

T a b l e o f C it a t io n s

Cases

A dickesv. S. H. Kress and Co., 398 U.S. 144, 176, (1970)

90 S.Ct. 1598.................................................................. 14,28

Alexander v. National Farmers Organization, 687 F.2d

1173 (8th Cir., 1982)..................... ....................................... 24

American Tobacco Co. v. U.S. 328 U.S. 781, 810 (1946)

66 S.Ct. 1125......................................................................... 25

Bradford v. Richards II Mass. App. 595; 417 N.E. 2d

1234, (1981)........................................................................... 10

Clipper Express v. Rocky Mountain Motor Tariff Bureau,

690 F.2d 1240 (9th Cir., 1982).................................... 21,26

Coastal States Marketing, Inc., v. Hunt, 694 F.2d 1358,

1369 (5th Cir., 1983)............................................................ 23

Commercial Box & Lum ber Co., Inc, v. UniRoyal, Inc. 623

F.2d 371, 374 (5th Cir., 1980)........................................... 8, 11

Cromwell v. County o f Sac, 94 U.S. 351, 352 (1876)...............5

11 Table of Contents

E.J. Delaney Corporation v. Bonne Bell, Inc., 525 F,2d

296 (10th Cir., 1975).............................................................. 9

E.G. Duke ir Co., v. Foerster, 521 F.2d 1277 (3d Cir.,

1975)........................................................................................ 28

Dyer v. MacDougall, 201 F.2d 265 (2d Cir., 1952)........... 18

Eastern States Retail Lum ber Dealers Association v. U.S.,

234 U.S. 600 (1914); 34 S.Ct. 951.................................... 8

Energy Conservation, Inc. v. Heliodyne, Inc., 698 F.2d,

386 (9th Cir., 1983).............................................................. 21

Federal Prescription Service v. American Pharmaceutical

Assn., 663 F.2d 255 (D.C. Cir., 1981) Cert. Denied,

455 U.S. 928 (1982) 102 S.Ct. 1293..................... 29, 30, 32

Ferguson v. Omnimedia, Inc., 469 F.2d 194 (1st Cir.,

1972)................................................................................... 8, 28

First National Bank o f Arizona v. Cities Service Co., 391

U.S. 253, 88 S.Ct. 1575 (1968)........................................... 20

Isaacs'. Schwartz, 706F .2d 15, 17 (1st Cir., 1983). . . 5, 7, 8

Kellerman v. Askew, 541 F.2d 1089 (5th Cir., 1976)........ 17

Kilgoar v. Colbert County Board o f Education, 578 F.2d

1033, 1035 (9th Cir., 1978)................................................. 11

Lovely v. Laliberte, 498 F.2d 1261, 1262, (1st Cir.,

1974)...................................................................................... 5 ,6

Manego v. Cape Cod Five Cents Savings Bank et al, 692

F,2d 174 (1st Cir., 1982)................................................. 5,11

Manego v. Orleans Board o f Trade et al, § 83-0045 (D.C.

Mass., Jan. 7, 1983).................................. 6 , 7 , 8 , 1 1 , 1 4 , 1 7

Manpower, Inc. v. Foley, 212 U.S.P.Q. 445 (D Mass. CA

No. 78-2713 N.A.), Dec. 5, 1980...................................... 23

Ness v. Marshall, 660 F.2d 517, 519 (3d Cir., 1981) . . . . . 17

Pennington v. United Mine Workers o f America, 325 F.2d

804, 811 (6th Cir., 1963) 381 U.S. 657 (1956) quoted in

Von Kalinowski, Anti-Trust Laws & Regulations, Vol 2,

Sec. 9, 14, [4]........................................... 17

Poller v. Columbia Broadcasting System, 368 U.S. 464 82

S.Ct. 486 (1962)............................................... 14 , 19 , 28 , 29

Page

Table of Contents iii

Page

Phelps Dodge Refining Corp. v. FTC, 139 F.2d 393 (2d

Cir.. 1943)............................................................................. 30

Sartor v. Arkansas Construction Corp., 321 U.S. 620

(1944) 64 S.Ct. 724, 729....................................................... 18

Scooper Dooper, Inc. v. Kraftco Corp., 494 F.2d 840 (3d

Cir., 1974)............................................................................. 6

Trucking Unlimited v. California Motor Transport Co.,

432 F.2d 755 (9th Cir., 1970) aff. 404 U.S. 506, 92

S.Ct. 609............................................................................... 21

U.S. v. The Haytian Republic, 154 U.S. 118, 129;

14 S.Ct. 992 (1894).............................................................. 10

U.S. v. U.S. Gypsum Co., 438 U.S. 422 (1978) 98 S.Ct.

2864 ........................................................................................ 25

Zell v. American Seating Co., 138 F.2d 641 (2d Cir.,

Statutes

15 USC §1 (Sherman Anti-Trust Act).................................... 3

Federal Rules of Civil Procedure:

Rule 56 ...................................................................... 14,18,21

Rule 56(e)...................................................................... 14, 15

Miscellaneous

Bauman, “A Rationale fo r Summary Judgm ent,” 33 Ind.

L .J. 467 (1958) 481, 484............................................... 19,20

31 Frd 648, Advisory Committee Note to Rule 56(e)........ 18

18 J. Moore’s, Federal Practice, 0.410 [1]................... 7, 10

Von Kalinowski, Anti-Trust Laws and Regulations, (1983)

Vol. 1, S.3.02(l)(3)a. Vol. 2, §9, 14 [4]..................... 17, 25

18 J. Wright, Miller & Cooper Federal Practice and Pro

cedure, § § 4406-4407 at 52, 63-64 ............................ 7 , 8 , 9

J. Wright, Miller, Kane, Federal Practice and Procedure,

Vol. 10A, Sec. 2727, § 2732........................................ 14, 17

Restatement (Second) of Judgments § 24, Comment “a” 5, 9

United States Court of Appeals

For the First Circuit

No. 85-1032

ISAAC MANEGO,

PLAINTIFF-APPELLANT,

V.

THE ORLEANS BOARD OF TRADE,

DAVID WILLARD,

THE CAPE COD FIVE CENTS SAVINGS BANK, INC.,

AND

M o re t h a n N in e t y O t h e r P er so n s , K n o w n or U n k n o w n ,

I n d iv id u a l l y a n d as T h e y A r e M e m b er s o f t h e

O r l e a n s B oard o f T r a d e ,

d e fe n d a n t s - a p p e l l e e s .

o n a p p e a l fr o m a ju d g m e n t o f t h e u n it e d st a t es d istrict

COURT FOR THE DISTRICT OF MASSACHUSETTS

BRIEF FOR ISAAC MANEGO, PLAINTIFF-APPELLANT

STATEMENT OF ISSUES

PRESENTED FOR REVIEW

1. Did the court err in barring action against David

Willard and the Cape Cod Five Cents Savings Bank on the

grounds of res judicata, if they engaged in a different con

spiracy with different parties to violate the Sherman Act, than

in the conspiracy alleged in the prior Civil Rights suit?

2

2. Did the court err in its application of Rule 56 of the

FRCP (Summary Judgment) in shifting the burden to Plain

tiff, where questions of conspiracy and state of mind are

involved?

3. Did the court err in concluding the Board of Trade is

not chargeable with the “sham” actions of its alleged co-

conspirator Cape Cod Five Cents Savings Bank?

4. Did the court err in concluding that the actions of the

Board of Trade are protected activities under the Noerr-

Pennington Doctrine (First Amendment right of free speech

and petition): especially in view of the presence and participa

tion of a majority of the town selectmen (Board of Trade

members Norgeot and Nickerson) at meetings of the Board of

Trade at which the Board of Trade’s opposition to plaintiffs

license application was discussed and unanimously voted,

prior to the selectmen’s hearing on the matter?

STATEMENT OF THE CASE

Plaintiff-Appellant has brought a series of independent

actions against various defendants, some of whom are defen

dants in this action, arising out of the participation of these

defendants in several allegedly unlawful and concerted activi

ties, which had the purpose to prevent plaintiff from

establishing and operating a disco business in the Town of

Orleans, Massachusetts.

The first action sought a writ in the nature of mandamus

from the Superior Court in Barnstable alleging that an Orleans

Selectmen’s decision to deny plaintiff an entertainment license

was arbitrary and capricious, because it was based on racial

hostility evident in the community against Plaintiff, a black

man. (R. 157). Summary judgment for defendants was

granted without memorandum on August 18, 1979. (R. 170,

374).

The second action was a civil rights complaint brought July

1, 1980, (R, 10) in the U.S. District Court for the District of

3

Massachusetts under Federal Civil rights laws; namely, 42

USC § 1981; 42 USC § 1983; 28 USC § 1331; 42 USC § 1985,

§ 1986 and § 1988. The suit named as defendants, the Cape

Cod Five Cents Savings Bank, Inc.; George P. Marble, David

B. Willard; T-Bears, Inc., d/b/a Lower Cape Sports Area,

Paul M. Thibert; and Gaston L. Norgeot, Herbert F. Wilcox,

Thomas B. Nickerson, individually and as they are members of

the Board of Selectmen of the Town of Orleans on April 13,

1982. Summary judgment was granted to all defendants,

which judgment was taken on appeal by plaintiff to the First

Circuit on October 28, 1982. (R. 142). The First Circuit

affirmed the District Court’s judgment, Manego v. Cape Cod

Five Cents Savings Bank, Inc.. 692 F .2d 174 (IstCir. 1982). In

the memorandum accompanying this judgment the First Cir

cuit Court stated, “had petitioner in this case provided suffi

cient facts to create a material issue as to whether the denial of

this license was because of his race, we w ould, as did the Court

in Adickes, look unfavorably on a refusal by the Lower Court

to allow him to pursue his claim that the denial w as the result

of conspiracy.”

Thereupon, plaintiff filed on January 7, 1983, the case at

bar in the U.S. District Court for the District of

Massachusetts, (R. 177) pursuant to the Sherman Antitrust

Act, 15 U.S.C. § 1 alleging that the Orleans Board of Trade

unlawfully conspired with the Cape Cod Five Cents Savings

Bank and David Willard, in restraint of trade to prevent plain

tiff from establishing and operating a disco business in the

Town of Orleans. On November 27, 1984, the U.S. District

Court again granted summary judgment to defendant, from

which this appeal is taken. (R. 557, 558).

In the case at bar, plaintiff furnished to the Court below,

depositions, answers to interrogatories, affidavits, and other

documents purporting to show that the Board of Trade did

meet on January 9, 1979, and under the direction of its Presi

dent, David Willard, thoroughly discussed and voted unani

4

mously to oppose plaintiffs application for an entertainment

license (R. 129); that the interests of the Bank, the Lower

Cape Sports Center, and the Board of Trade were interlocked

through the status of David Willard, who at the time was

simultaneously Manager of the Bank, General Manager of the

Sports Center, and President of the Orleans Board of Trade

(R. 12); that Selectmen Gaston Norgeot and Thomas Nicker

son who were also members of the Board of Trade (R. 434)

were actually present at the Board of Trade Meeting held on

January 9, 1979; that Selectman Thomas Nickerson was again

present at the Board of Trade meeting held on February 13,

1979 (R. 461), and reported on the scheduled hearing of the

Board of Selectmen to be held on the following night,

February 14, 1979, on Plaintiffs application for an entertain

ment license (R. 464, 465); that plaintiffs application was

denied at that hearing (R. 168); that the Lower Cape Sports

Center subsequently sought and obtained from the Board of

Selectmen a new entertainment license in order to expand its

program into live music and dancing, and roller disco (R. 171,

172); and that in May 1979, the bank brought and then

withdrew on July 3, 1979, a sham lawsuit it had brought

against plaintiff and the Orleans Board of Appeals to enjoin

plaintiff from proceeding with the completion of his building

and to revoke his Building Permit. (R. 20).

5

ARGUMENT

I. RES JUDICATA

D id t h e c o u r t err in ba rr in g a c t io n a g a in s t D avid

W illa r d a n d C a p e C od F iv e C e n t s Sa vin gs B a n k o n grounds

OF RES JUDICATA, IF THEY ENGAGED IN A DIFFERENT CONSPIRACY

WITH DIFFERENT PARTIES TO VIOLATE THE SHERMAN ACT, THAN

THE CONSPIRACY ALLEGED IN THE PRIOR ClVIL RIGHTS SUIT?

The court erred in barring the instant action against David

Willard and the Cape Cod Five Cents Savings Bank on the

ground o f res judicata where the causes o f action were not the

same.

The District court in the decision below found that the

actions against David Willard (“Willard ) and the Cape Cod

Five Cents Savings Bank (“The Bank”) were barred on the

ground of res judicata. That finding was based on the inter

pretation of the case at bar and Manego v. Cape Cod Five

Cents Savings Bank et al., 692 F.2d 174 (1st Cir. 1982) as set

ting forth the same cause of action. That interpretation is not

only factually questionable, but based on a legal standard

which results in injustice for cases such as the one at the bar.

It has been long undisputed that for the doctrine of res

judicata to apply, the subsequent case must be based on the

same cause of action as in the original case, e.g., Cromwell v.

County o f Sac, 94 U.S. 351, 352 (1876). The District Court’s

decision with regard to res judicata relies heavily on a broad

definition of “cause of action which it names the trans

actional” approach.

The transactional approach to a cause of action, or claim, is

to view the claim as coinciding with the factual transaction.

Restatement (Second) § 24, Comment “a,” or “series of trans

actions”, Isaac v. Schwartz, 706 F.2d 15, 17 (1st Cir., 1983)

from which it sprang, regardless of the number or variety of

legal theories which might arise from it. The Appeals Court in

Lovely v. LaLiberte, 498 F.2d 126 (1st Cir., 1974) uses the

6

phrase “operative nucleus of fact” to mean transaction in this

sense. The District Court below, utilizing this standard, found

that the instant action against Willard and the Bank was

barred.

First of all, if one were to accept the “transactional

approach” without question, it is doubtful whether it applies

so as to bar the instant action. In support of its application to

the case at bar, the District Court states:

“The present complaint differs only in that it names addi

tional defendants (The Board of Trade), and alleges that

the Bank planned to offer entertainment of (sic) its

facility similar to that which Plaintiff Manego would

have provided at his disco.”

Manego v. Orleans Board o f Trade et al., No. 83-0045

(D.C. Mass., Jan. 7, 1983) (R. 537). Not only are the above

differences in the “operative nucleus of fact” discrepancies

between the instant and prior action, but they are hardly in

substantial.

By adding the Board of Trade and all of its members as

defendants, the Plaintiff/Appellant identifies a new and dif

ferent conspiracy from the one alleged in the prior action.

(R. 96). With the description of the intent of the Bank to pro

vide an entertainment facility comparable to Manego’s pro

posed disco in his complaint in the instant action, Manego pro

vides evidence for an entirely distinct, factual basis for that

second, and different conspiracy—a conspiracy to restrain

trade.

The Court dismisses the above as insignificant, i.e., it con

siders the two cases as deriving from the same “operative

nucleus of fact.” Actually, the additions and changes to

Manego’s allegations from the prior action to the present one

are among the most important facts supporting his case. As

they are “controlling” facts, it is not appropriate that res

judicata apply to bar the instant action. Scooper-Dooper, Inc.

v. Kraftco Corporation , 494 F.2d 840 (3rd Cir., 1974).

7

It is important to note that the two cases from the First Cir

cuit cited bv the District Court to support its use of the trans

actional approach, Lovely v. LaLiherte, 498 F.2d 1262,

supra, and Isaac v. Schwartz, 706 F.2d 15, supra, are both

distinguishable on their facts from the instant matter. Both

cases involve a first and second suit in which the parties are

identical. That is not so here. Further, the first and second

suits of both cases concern the identical fact situations: an

eviction from a mobile home park and a failure to readmit a

law student, respectively. In Lovely and in Isaac only the

theories of recovery changed. Here, although many of the

facts are the same, the “operative nucleus of fact” has

undergone a marked alteration.

Thus, it can be seen that, if the transactional approach is

accepted as the appropriate standard by which to judge the

case at bar, it offers, at most, doubtful justification for the

application of the doctrine of res judicata.

The question which must be addressed at this point is

whether the broad “transactional approach” ought to be

applied to the instant claim. It is acknowledged by the District

Court that “(t)he exact contours of claim preclusion (res

judicata) are a subject of much discussion and disagreement.”

Manego v. The Orleans Board o f Trade et al. See 18 J. Wright,

Miller & Cooper, Federal Practice and Procedure

§§ 4406-4407 at 52, 63, 64 and 18 J. Moore’s Federal Practice,

H 0.410(1).

In other words, the transactional approach is simply one

approach among many in an area of ongoing conceptual

development. What constitutes a “claim” or “cause of action”

is not easily definable and has yet to be carved in stone by any

court or legal scholar.

The transactional definition of a claim is expansive; it in

cludes within one cause of action what formerly, or under a

different approach, would be two or more causes of action.

8

When it errs, it errs on the side of over-inclusiveness. Thus, it

might bar an action which deserved to be heard.

The weakness of the transactional approach is that it fails to

account for the uniqueness of cases. For example, a plaintiff

may have a valid reason for filing separate suits from the same

or similar factual background. Compelling maximum joinder

of claims to prevent res judicata would be unfair to such plain

tiffs. 18 J. Wright, Miller & Cooper, supra §§ 4407 at 52. The

court in Commercial Box ir Lum ber Co., Inc. v. Uniroyal,

Inc., 623 F.2d 371 (5th Cir., 1980) acknowledged just such a

valid reason. It noted that the Plaintiff could have combined

its two actions, both based on the same purchase contract, but

was not required to.

Another aspect of the unfairness of the transactional

approach is illustrated by the instant action, where the case

concerns a conspiracy. It is common knowledge that more

often than otherwise, direct evidence of a conspiracy is not

readily available. Eastern States Retail Lum ber Dealers

Association v. U.S., 234 U.S. 600; 34 S.Ct. 951 (1914),

Ferguson v. Omnimedia, Inc.. 469 F.2d 194 (1st Cir., 1972).

However, under the transactional approach, a court will look

at the first lawsuit filed, see a common “nucleus of fact”—

absent a few essential details—with the second lawsuit—and

declare the underlying claims to be the same. That is,

whatever claims were not litigated in the first action, both

could have and should have been litigated at that stage. See

Manego v. Orleans Board o f Trade et ah, supra at (R. 539,

542) and Isaac Schwartz, supra at 17:

“The issue is not whether the plaintiff in fact argued his

claims in the (first) proceedings, but whether he could

have.”

The transactional approach does not take into account the

special problems of conspiracy. To wit, much of the time the

Plaintiff could not have brought the second claim any sooner

9

than he did. Except for hearsay, the evidence, “those few

essential details,” simply was not there. The approach the

District Court has taken with the instant case has focused on

and found similar discrete parts of the alleged conspiracy

rather than the phenomenon as a whole. This does the Plain

tiff/Appellant’s case an injustice for:

“The character and effect of a conspiracy is not to be

judged by viewing its separate parts, but only by looking

at it as a whole.”

E. ]. Delaney Corp. v. Bonne Bell, Inc.. 525 F.2d 296 (10th

Cir., 1975).

The unfairness and inappropriateness of the transactional

approach to the case at bar, as a conspiracy case, is w'ell articu

lated in 18 J. Wright, Miller & Cooper, supra, §§ 4407, at

63-64. While discussing the possibilities for defining “claim” or

“cause of action,” the authors write:

“Each area of substantive law' has its own distinctive

implications for expectations, reliance and repose. Each

area generates its own special problems of practice in

pretrial and trial settings. These differences of the real

world and the lawyer’s wmrld must be sought out and

accounted for in the process of prescribing the dimensions

of the claims or causes of action spawned by the substan

tive principles.”

The transactional definition of “cause of action” does not

take into account the special problems of a conspiracy case. It

is, therefore, not appropriate for such an action, such as the

case at bar.

Although the Restatement (Second) of Judgments § 24,

Comment “a” asserts that the transactional definition is the

“present trend,” and it is followed in certain First Circuit deci

sions, it is not the only approach available. The alternative is

to decide on a case by case basis whether the claims are the

10

same. This would alleviate the unfairness of the transactional

definition in unusual cases. For if the transactional definition

were applied universally,

• then a judgment upon one cause of action would be

conclusive as to every other cause of action at the time,

although not embraced in a suit, and although the parties

were not obliged to join it therein. This would destroy the

right of parties to sue separately upon distinct causes of

action and would be subversive of the entire theory of the

thing judged.”

U.S. v. The Haitian Republic, 154 U.S. 118, 129, 14 S.Ct. 992

(1894).

Other courts have applied narrower definitions to “cause of

action” in the interests of fairness, and this has served to point

out the as yet unresolved nature of the debate.

“There are many cases that hold that a number of separate

claims or causes of action can arise from essentially the

same set of facts. The cases that adumbrate the distinc

tion between a single claim based on different theories,

and separate claims arising from the same nucleus of

operative act are not easy to reconcile.” 18 Moore’s

Federal Practice, Par. 0.410(1).

The Masachusetts Appeals Court indicated that a common

transaction alone might not be sufficient to unify two claims in

Bradford v. Richards, 11 Mass. App. 595; 417 N.E.2d 1234

(1981). There, although the court found common facts under

lying the two actions, it declined to find that the causes of

action were the same. In a thorough discussion of the doctrine

of Res Judicata in Massachusetts, the Appeals Court offered a

lengthy list of example cases where that doctrine applied. Not

one of the cases listed was a conspiracy case.

11

Commercial Box, supra, cited Kilgoar v. Colbert County

Board o j Education, 578 F.2d 1033 (5th Cir., 1978) for the

proposition:

“Plaintiffs are not barred from presenting any ground for

relief arising out of conduct not complained of in the

prior lawsuits.”

Id. at 1035.

However, in Kilgoar the conduct complained of occurred

subsequent to the first lawsuit, whereas in Commercial Box,

the wrongful conduct occurred both prior to and during the

first action. Thus, it can be seen that the case-by-case

approach to the definition of a single “cause of action” is also

in the process of developing.

It is this clear that the District Court determination that the

two actions, Manego v. Cape Cod Five Cents Savings Bank,

supra, and Manego v. The Orleans Board o j Trade et al.-,

supra, were based on the same cause of action is founded on a

legal standard that is both factually inapplicable and legally

unjust to the case at bar. Res Judicata does not apply to the

instant action against Willard and the Bank.

The Fifth Circuit has also indicated a willingness to examine

each case carefully rather than apply the broad transactional

definition regardless of circumstance. In Commercial Box ir

Lum ber Co., Inc. v. Uniroyal, Inc., 623 F.2d 371 (5th Cir.,

1980), the Appeals Court refused to apply res judicata, despite

the fact that the two actions were based on the same purchase

contract. The first section was for loss caused by Uniroyal’s

change in destination of its order, the second for Uniroyal’s

wrongful deduction of discounts from the same contract. The

court recognized that the Plaintiff had a valid reason for

bringing two separate actions. Id. at 374, fn. 2, supra:

12

“and Not only were these issues not raised, but they are

in no way germane or related to the challenge made in

the first suit. The issue in the present case is based upon a

different cause of action than that alleged in the first

lawsuit. Likewise, the matter involved in the present case

is not one that could have been established in the first

case in light of that case’s legal and factual bases.”

(Emphasis added).

Id. at 394.

This is clearly the case here: given the legal and factual

bases for the second legal or instant action, the matter could

not be established in the first case. Thus, res judicata should

not apply.

The court below also misreads Plaintiffs reasons for his

delay in filing his antitrust action (R. 542).

Plaintiff does not claim that the delay was the result of his

lack of knowledge of the Bank’s plans to develop its Sports

Center’s entertainment facilities, but, rather because of the

Plaintiffs lack of probative evidence about the alleged con

spiratorial meeting of the Board of Trade under the direction

of Bank Manager cum Sports Center’ General Manager cum

Board of Trade President David Willard, at which meeting

two Orleans Selectmen / Board of Trade members were

present.

Prior to the admission of facts concerning said meeting, as

set forth in David Willard’s affidavit served on Plaintiff only

one business day before the dispositive hearing on Plaintiffs

civil rights case on April 12, 1982 (R. 237, 243), Plaintiff had

only hearsay knowledge of such a meeting (R. 82, 83, 84).

Even so, the court below points out that under the liberal

federal rules of discovery and amendment, Plaintiff might

have amended his civil rights complaint to add an anti-trust

count prior to judgment of appeal, if only he had done more

discovery (R. 542).

13

Plaintiffs response is that where newly discovered facts give

rise to allegations of a new and independent cause of action re

quiring new parties to be added, such as a violation of Sec

tion 1 of the Sherman Act, and upon which event the Plaintiff

is deemed to have the right and standing to amend his com

plaint, then Plaintiff also has acquired the right and standing

to file a new independent action. That, indeed, was the choice

made by the Plaintiff in this case.

Plaintiff argues that the court below is in error when it

attempts to extend the res judicata doctrine beyond issues

which “were raised” or “could have been raised to issues

which “might have been raised” if more discovery had been

pursued, the right questions asked and answered and pro

bative documents sought and produced.

Finally, the Board of Trade and its members are necessary

defendants in Plaintiffs antitrust action. Its members repre

sent the very co-conspirators who were essential to Plaintiff s

allegations of conspiracy among businessmen to restrain trade

and thus constitute far more than a “mere addition of new

defendants in a subsequent action.” (R. 542). Plaintiff neither

raised nor could have successfully raised the antitrust issue in

his prior civil rights complaint, because he had no probative

evidence to support such an allegation, but only hearsay

knowledge.

The attempt by the court below to expand the application of

res judicata doctrine to issues which might have been raised if

more evidence had been produced, constructs an unfairly long

and slippery slope for Plaintiff to climb, especially in a con

spiracy case such as found here.

14

II. APPLICATION OF RULE 56

D id t h e c o u r t err in its a p p l ic a t io n o f R u l e 5 6 o f t h e

FRCP (s u m m a r y ju d g m e n t ) in s h if t in g t h e bu r d en to P l a i n

t i f f WHERE QUESTIONS OF CONSPIRACY AND STATE OF MIND ARE

INVOLVED?

The lower court erred in its application o f FRCP 56 by fin

ding its own facts and shifting the burden to plaintiff, ichere

questions o f conspiracy and credibility were involved.

In the District Court decision below, the court concedes

that conspiracy and antitrust claims are generally inappro

priate for summary judgment. Adickes v. S. H. Kress and C o.,

398 U.S. 144, 176 (1970) 90 S.Ct. 1598, Poller v. Columbia

Broadcasting System, 368 U.S. 464 (1962), 82 S.Ct. 486. It

then goes on to state that the case at bar falls within an excep

tion to that rule. That is: “(W)here a moving party in an anti

trust conspiracy case has shown that the facts relied upon in

the opposing party’s allegations are not susceptible to the inter

pretation which he sought to give them, Rule 56 (e) puts the

burden on the opposing party to produce evidence in support

of his allegations.” Manego v. Orleans Board o f Trade et al,

|83-0045 (R, 552). While the court accurately described Rule

56 (e), its application to the instant case was clearly erroneous.

The burden should never have shifted to the Plaintiff.

In order to reach Rule 56 (e), the District Court had to find

that the moving party had met its burden under the rule. It is

well settled that the party moving for summary judgment has

the burden of demonstrating that the Rule 56 test: “there is no

genuine issue as to any material fact” is satisfied. J. Wright,

Miller & Kane, Federal Practice and Procedure, Civil 2d,

§ 2727; Adickes v. S. H. Kress and Co., supra at 1608. The

court found that this burden was met by relying on the affi

davits of the moving party.

15

Ordinarily a court’s reliance on affidavits is enough to shift

the burden between parties under Rule 56 (e). However,

where the case concerns state of mind and credibility, as it

does in an antitrust action, and the affidavits are strictly self-

serving when provided and sworn to only by movants

themselves, then reliance becomes highly questionable.

Indeed such affidavits exhibit many of the same earmarks of

probative weakness as would the sworn denials of the prover

bial inhabitants of the henhouse that “there ain’t nobody in

here but us chickens.”

The Board of Selectmen stated that they voted to deny

Plaintiffs entertainment license due to traffic and noise prob

lems. (R. 168,228). Plaintiff argues that the circumstantial

evidence does not support their version of events. (R. 500,

501).

Plaintiff s proposed site was situated right next to the town

dump in a sparsely settled area, 1000 ft. from the nearest

residential home, and was going to be soundproofed. The

Traffic Study prepared by Sherman Reed, also a member of

the Board of Trade, which had already voted to unanimously

oppose Plaintiff’s disco, based his Committee’s estimation of a

traffic problem on the fact that young people, who would

patronize a disco, are prone to use drugs and alcohol. (R. 173).

This finding had no basis in fact, since Plaintiff’s liquor license

had already been denied and abandoned and Plaintiff indi

cated to the Selectmen that he was willing to operate without

it. (R. 153, 499). The Traffic Study Committee also found that

problems could be created by the increased traffic due to the

Plaintiff s operation of the disco. (R. 173, 175). Their findings

were made notwithstanding the fact that 25 new businesses

have been licensed and developed in close proximity to Plain

tiffs site, after the denial of Plaintiff’s entertainment license.

These businesses include a plastics company, two dog kennels,

two landscaping businesses, a car wash, a printing company, a

fish processing company, a boat manufacturer, and 15 storage

garages. (R. 500, 501).

16

In addition, the roller disco and ballroom dancing offered

by the Center would have produced noise (music) at night in

much the same way Mr. Manego’s disco would have.

The characterization of the grant of the entertainment

license to the Center, a few months after Plaintiff’s application

had been denied, as a renewal of an existing license is specious

to say the least. The new license was not a mere renewal. In

addition to ice skating, it was for roller skating, music and

dancing, neither of which activities had ever been before

offered at the Center. (R. 171, 172). The Center had to com

pletely renovate the floor in order to make music, dancing and

roller skating possible, (R. 353, 513), despite the obvious con

tradictions in the affidavit of Selectman Wilcox, who states

that he voted to “reissue” an amusement license to the new

owner of an “existing business,” the Lower Cape Sports

Center. This, he says, was not a license to open a disco, but

only to maintain an ice skating business. (R. 228, 334).

The Center had just been sold and the license had expired

three months before. Rather than maintain an existing failing

business, a new expanded business was proposed, a great sum

of money was invested; all of that energy and money was ex

pended to make the floor compatible to dancing and roller

skating. (R. 513). This would have placed Mr. Manego and

the Center in a highly competitive position. The fact that no

alcohol was served or that the ballroom-dancing program, and

for that matter the roller-disco program, failed to draw

customers and was discontinued, is irrelevant.

Mr. Manego’s disco was also going to be alcohol-free which

would have allowed him to cater to the same groups that the

Bank catered to at the Center. (R. 499). As Plaintiff remarked

in his first deposition: “Dancing is dancing. (R. 95). We may

disco in one place and roller-disco in the next, but it is all one

and the same.”

The District Court held that Plaintiff failed to contradict

Defendant’s assertion that the subsequent grant of the license

17

to the Sports Center was a legitimate exercise of the

Selectmen’s licensing authority. Plaintiff argues that the cir

cumstantial evidence gives credence to his allegation that the

grant was a subsequent act in furtherance of the conspiratorial

scheme in restraint of trade.

Here, there are obvious questions of credibility and intent.

It is well-settled law that where intent is an element of the

cause of action—generally to be inferred from the facts and

conduct of the parties: “courts should not draw factual in

ferences in favor of the moving party and should not resolve

any genuine issue of credibility.” Ness v. Marshall, 660 F.2d

517, 519 (3rd Cir. 1981).

The existence of conspiracy may be sufficiently strong, to

raise a factual question for the jury even though there is no

direct evidence that a conspiracy existed. Pennington v.

United Mine Workers o f America, 325 F.2d 804, 811 (6th Cir.

1963) reviewed on other grounds: 381, U.S. 657 (1956), cited

in Von Kalinowski, Antitrust Laws and Trade Regulations,

Vol. 2. § 9, 14, [4], In antitrust cases questions of motive or in

tent, credibility and conspiracy frequently prevent Summary

Judgment from being entered, since these issues involve sub

jective questions regarding state of mind that can only be

decided after a full trial. J. Wright, Miller, Kane, Federal

Practice and Procedure, Vol. 10A, § 2732.

In any event, upon reviewing all the evidence before it, the

court below found the “facts” of the case by summarizing the

affidavits of the movants. Manego v. Orleans Board o f Trade

et al. (R. 546). The factual allegations of the movants which

differ from those of the Plaintiff amount to no more than mere

denials of the latter. Id ., that is, they all state that they never

engaged in those acts which would have created a conspiracy

to prevent the Plaintiff from establishing a business in their

town. A party moving for Summary Judgment cannot sustain

his burden by denying the allegations in his opponent’s

pleadings. Kellerman v. Askew, 541 F.2d 1089 (5th Cir.,

18

1976). By choosing to believe the account of the movants

rather than that of the Plaintiff, the Court overstepped its

authority under FRCP 56.

In a motion for Summary Judgment, “if a fact asserted by

the plaintiff is contradicted by the defendant, the facts as

stated by the plaintiff are to be taken as true.” Zell v.

American Seating Co., 138 F.2d 641 (2nd Cir,, 1943). The

lower court here did the opposite. Further, “if defendant’s

evidence creates issues of credibility, the case must go to trial

and not be resolved at the Summary Judgment level.” Sartor v.

Arkansas Construction Corp., (1944) 44 S.Ct. 724, 729; 321

U.S. 620; D yerv. MacDougall, 201 F.2d 265 (2nd Cir., 1952).

The District Court’s treatment of the credibility of the

parties deserves close scrutiny. First of all, after citing the

“facts” as set forth in the movants’ affidavits, the Court states:

“These are denials of conspiracy from a Selectman, the Presi

dent of the Board of Trade, and an Officer and an employee of

the Bank.” (R. 547). The Court here seems to imply that these

denials are therefore credible because of the social rank of the

affiants, all defendants in the suit.

Because the Court is basing its findings on the denials of the

movants, the credibility of the respective parties becomes the

paramount question. A defendant’s rank within a community

or place of employment is hardly an adequate basis on which

to judge credibility. Instead, a court generally needs to ex

amine the individual’s demeanor and/or performance under

cross examination at trial. This is confirmed in the Advisory

Committee Note to the 1962 Amendment to Rule 56 (e), 31

F.R.D. 648:

“Where an issue as to a material fact cannot be resolved

without observation of the demeanor of witnesses in

order to evaluate their credibility, summary judgment is

not appropriate.”

19

Whether the movants engaged in activities which amounted to

a conspiracy against the Plaintiff, which they deny is, of

course, a “material fact.”

Secondly the Court appears to demean the Plaintiffs version

of the facts, due to the Plaintiffs ignorance of what transpired

among the various alleged co-conspirators. (R. 548). This

ignorance is, rather than a reason to disbelieve the Plaintiff,

the reason to deny the motion for summary judgment and

move the case to trial.

As so unequivocally held in Poller v. CBS 368 U.S. 464

(1962), 82 S.Ct. 468, summary judgment should be used

“sparingly” in antitrust actions where “the proof is largely in

the hands of the alleged conspirators.” It is inherent in a con

spiracy case that the plaintiff is not going to have access to

many of the facts he needs to prove; the conspirators

themselves have exclusive control over that information.

Because of this difficulty of proof, plaintiffs in conspiracy

actions often must rely, at least initially, on circumstantial

evidence.

Admittedly, plaintiff in the case at bar is relying primarily

on circumstantial evidence. The District Court reviewed both

this evidence and the evidence presented by the defendants,

the alleged conspirators, and chose to believe the latter. It can

not be doubted that the Court found the movants’ materials

more probative because of their first-hand knowledge. This

however, is the nature of the conspiracy: those charged have

the best knowledge of the facts of their alleged wrongdoing.

It is the court’s role then to regard the movants’ evidence

with a healthy suspicion. Bauman, “A Rationale fo r Summary

Ju dgm en t/’ 33 Ind. L.J, 467 (1958) at 481.

“Moreover, if the moving party’s proof is less convincing,

as in cases where he relies on his own testimony or has

exclusive knowledge of the transaction, the burden of

providing evidence may not shift to the opponent.”

20

Thus, it appears that the District Court declined to consider

the credibility of the movants to be a serious issue, despite the

fact that they were and still are in exclusive control of the facts

needed to prove Plaintiffs case. They are motivated by self-

interest in seeking to have the suit against them dropped, and

the court does not have the ability to observe them in an adver

sarial trial setting. None of the usual protections are in place

for the administration of justice, and all of the reasons arise to

be wary of the truth of the movants’ allegations. Nonetheless,

the District Court believed them sufficiently to deprive the

Plaintiff of his day in Court.

The lower court cited First National Bank o f Arizona v.

Cities Service Co. 391 U.S. 253, 88 S.Ct. 1575 (1968) in sup

port of its shifting the burden to Plaintiff. In that case, the

court found an “absence of any significant probative evidence

tending to support the complaint.” Id. at 1593. Such a situa

tion is clearly distinguishable from the instant matter. Here

the Plaintiff has shown a series of facts which not only “tend

to” but, in fact, directly support the allegations in his com

plaint.

By shifting the burden to Plaintiff in the case at bar, the

District Court is setting a dangerous precedent for future anti

trust and conspiracy actions. Its decision could in effect

guarantee failure at the summary judgment level whenever a

plaintiff brings such a case supported only or primarily by cir

cumstantial evidence. Yet, by its very nature, the plaintiffs

knowledge of the matter may be limited to the circumstantial,

and the movants’ evidence may be incapable of being con

troverted at summary judgment.

The motion for summary judgment presents a great tempta

tion for judges to usurp the role of the jury. Such is the reason

why, in its origins, motions for summary judgment were

limited to cases involving bills of exchange, promissory notes

and checks. Bauman, supra, at 473. In these cases, only incon

trovertible documentary evidence could be used in support of

21

the motion. It would be unfortunate indeed if the lower

court’s decision in the instant action initiated a trend towards

a looser application of a procedure with such great potential to

harm plaintiffs in our justice system.

The District Court exceeded its authority under FRCP 56 in

shifting the burden to plaintiff where the movants’ evidence

consisted of self-serving statements of questionable credibility.

III. CO-CONSPIRATORS LIABILITY

FOR SHAM ACTIONS

D id t h e C o u r t err in c o n c lu d in g t h e B oard o f T rad e is

NOT CHARGEABLE WITH THE ‘SHAM’ ACTIONS OF ITS ALLEGED CO

CONSPIRATOR C a p e C od F iv e C e n t s Sa vin g s B a n k ?

THE SHAM EXCEPTION ; BASELESS SUITS

The District Court failed to examine and to apply to the

Defendant Orleans Board of Trade the baseless suit exception

to the Moerr-Pennington Doctrine first enunciated in Truck

ing Unlimited v. California Motor Transport Company, 432

F.2d 755 (9th Cir., 1970) off. 404 U.S. 506, 92 S.Ct. 609

which prohibits “baseless repetitive claims” designed to

discourage and ultimately to prevent the plaintiffs from invok

ing the processes of the administrative agencies and courts. Id.

at 1512. The court, however, agreed with the plaintiff that

subsequent developments have held that a single unit is suffi

cient to invoke the sham exception, e.g., Clipper Express v.

Rocky Mountain Motor Tariff Board, 690 F.2d 1240 (9th Cir.,

1982), Energy Conservation, Inc. v. Heliodyne, Inc.. 698 F.2d

386 (9th Cir., 1983).

Basing its reasoning on Clipper Express, the Energy Court

found that the baseless claim was used for an unlawful pur

pose, i.e., to “competitively harm the plaintiff.” Id. at 389.

The Court stated that “these allegations may be sufficient to

state a claim of abuse of judicial process on the grounds that

the lawsuit was initiated for an unlawful purpose and the

22

defendants committed specific acts outside the judicial process

in furtherance of that purpose.” Id.

As the Plaintiff argued below, the lawsuit brought by the

Defendant Bank to revoke Manego’s legitimately issued

building permit was “clearly instituted for an unlawful pur

pose.” On March 8, 1979 the Orleans Building Inspector issued

a building permit to Plaintiff for construction of his proposed

disco. Shortly thereafter, Plaintiff hired a building contractor,

Roger Hulick, and began construction of a building on his

land. At about the same time Mr. Hulick was advised by an

agent for Nickerson Lumber Company, Charles Darling, that

the Cape Cod Five Cents Savings Bank had requested the firm

to cease delivery of materials to Mr. Manego. (R. 125). Mr.

Hulick also began to receive warnings from Defendant Cape

Cod Five Cents Savings Bank concerning arrears on his per

sonal loan at the Bank. (R. 125). (The fact that Mr. Darling

now denies he ever made such a statement to Mr. Hulick does

not diminish the importance of the allegation. It raises a

matter of credibility which in keeping with tradition of our

judicial system becomes the province of the trier of fact).

In April 1979, reacting to the issuance of the building per

mit to Plaintiff, the Bank appealed the Building Inspector’s

action to the Orleans Zoning Board of Appeals. (R. 201). The

Board, on May 23, 1979, confirmed the granting of the Plain

tiffs building permit. Defendant Bank then caused to be filed

in Barnstable Superior Court a suit to enjoin the Plaintiff from

proceeding with the construction of his building and to revoke

the action of the Orleans Board of Appeals in granting the

Plaintiffs building permit. (R. 201). This baseless action was

withdrawn on July 3, 1979 when the Bank transferred owner

ship of the Sports Center to the former employee, Paul

Thibert. (R. 201).

The Court went on to state the fact that the suit was subse

quently dropped after the Bank’s sale of the Sports Center did

not support an inference that the object of the suit was

23

unlawful. Moreover, the Court noted that the “sham” was

allegedly perpetuated by the Bank, not the Board of Trade.

(R. 550). Therefore, the Court reasoned, absent evidence that

the Board of Trade conspired with the Bank concerning the

suit, it was irrelevant to the issue of the Board’s immunity

under Noerr and its progeny. The Court then ruled that the

Plaintiff neither offered much evidence nor alleged that a con

spiracy existed with regard to the suit.

What is at issue is the Bank’s sham administrative and

judicial actions to revoke Plaintiff’s duly-issued building per

mit and enjoin construction of his competitive enterprise. In

Manpower, Inc. v. Foley, 212 U.S.P.Q. 445 (D. Mass. C.A.

No. 78-2713-MA Dec. 5, 1980) the court found that:

“the fact that (plaintiff) has prevailed on its claims in this

action, at a minimum, created a presumption that the

action was brought in a good faith effort to vindicate

(plaintiffs) legal rights.”

Id. at 449.

Here the Defendant Bank failed in its administrative actions

and is therefore, not entitled to the presumption that the

actions were bona fide. Conversely, the presumption then

becomes that their actions, as a result of this failure, were

motivated by bad faith, as it was stated in Coastal States

Market, Inc. v. Hunt, 694 F.2d 1358, 1369 (5th Cir., 1983),

“The number of lawsuits filed without success is itself cir

cumstantial evidence of sham.”

The Bank’s withdrawal from the suit in Barnstable Superior

Court after they had divested themselves of a direct economic

interest in the Sports Center, the application for and receipt of

an entertainment license authorizing music and dancing, in

addition to skating, does support an inference of sham.

(R. 201). In Coastal States the Fifth Circuit held that where

24

the Hunt Brothers, who were engaged in a dispute with Libya

over rights to exploit an oilfield, were engaged in litigation,

parties who were accepting delivery of said oil and who subse

quently dropped the suits after settlement with Libya, then

the fact that the suits were dropped was circumstantial

evidence of sham. The presumption was rebutted, however,

when this Court adjudicated that there was a bona fide legal

question of ownership, the existence of which was illuminated

by other evidence. Id. at 1369.

In Alexander v. National Farmers Organization, 687 F.2d

1173 (8th Cir. 1982), certain milk cooperatives attempted to

drive out of business a new arrival which they viewed as a

competitor. The Coops threatened litigation and in some cases

sued others who had consented to buy National Farmers

Organization (NFO) milk. Beatrice, when served with a com

plaint by the Coops which alleged that Beatrice was a co

conspirator with NFO in an antitrust conspiracy to eliminate

“responsible cooperatives” like Mid-Am, terminated its agree

ment to purchase NFO milk. The Court stated the fact that:

“Mid-Am voluntarily dismissed Beatrice as a defendant

after Beatrice had stopped purchasing NFO milk speaks

volumes.”

The Defendant Bank’s withdrawal of the suit after it had ex

changed its direct economic interest for a security interest and

later, through the procurement of a “renewed” license, en

abling its former employee to endeavor to get the arena out of

the red, is analogous.

In all three instances, litigation, administrative action or the

threat of litigation was voluntarily dismissed after liquidation

of the Defendant’s economic issue of interest. (In Alexander

and Coastal States this type of activity, unexplained, was

prima facie circumstantial evidence of predatory sham).

The sham actions of the Defendant Bank are clearly im

putable to the Defendant Board of Trade. Contrary to the

25

District Court’s finding, Plaintiff had alleged a conspiracy be

tween the Bank and the Board of Trade Members (including

two members who also constituted a majority of the Board of

Selectmen).

Plaintiff has alleged that at a meeting of the Board of Trade,

the Defendants entered into a conspiracy to block Plaintiff

from building and operating his proposed disco. A conspiracy

is defined as an agreement by two or more persons, evidenced

by either word or conduct to do an unlawful act, or to use

unlawful means to do an unlawful act: Von Kalinowski, Anti

trust Laws and Trade Regulations, Vol. 1, Sec. 3.02[1] (1983):

“where the circumstances are such as to warrant a jury in

finding that the conspirators had a unity of purpose or a

common design and understanding, or a meeting of

minds in an unlawful arrangement, the conclusion that a

conspiracy is established is justified.’’

American Tobacco Company v. U.S., 328 U.S. 781, 810

(1946).

It is well-settled law that the action of one conspirator is im

puted to all of the members of the conspiracy who fail to

timely disassociate themselves from the conspiracy. Antitrust

defendants may rebut proof of concerted action by demon

strating that the alleged combination or conspiracy was aban

doned. Von Kalinowski, supra, at Sec. 3.02(3)[a] in U.S. v.

Gypsum Company, 438 U.S. 422 (1978). The Supreme Court

has articulated a standard for establishing abandonment or

withdrawal from a conspiracy. The defendants may prove

withdrawal by showing “affirmative acts inconsistent with the

object of the conspiracy and communicated in a manner

reasonably calculated to reach co-conspirators.” Id. at 464.

The Defendants are otherwise liable jointly and severally

for the actions taken in furtherance of the objective of the con

spiracy by their co-conspirators, the Bank. There is no

26

evidence that the Board of Trade withdrew from the con

spiracy, either before or after the Bank initiated the sham—

administrative and legislative suits against the issuance of

Manego’s building permit. The fact that Defendant Willard

acted in his capacity as President of the Board and Agent and

Orleans Branch Manager for the Bank further thickens the

plot. (R. 199). The District Court, therefore, was incorrect in

finding that the sham actions of the Bank did not affect Defen

dant Board of Trade’s ability to rely on Noerr-Pennington as a

defense.

THE SHAM EXCEPTION: MEANINGFUL ACCESS

The District Court held that Plaintiff failed to prove his

argument that he was deprived of meaningful access to the

licensing process because the activities of the Defendants made

the Selectmen’s hearing a sham, or that Defendants’ actions

were anything other than a genuine attempt to influence

governmental action. (R. 551).

In Clipper Express the Court found a valid “sham ’ excep

tion when the alleged conspirators deprive the “competitor of

meaningful access” to the agencies and the Courts:

“Such a purpose or intent if shown, would be to

discourage and ultimately prevent the respondents for in

voking the processes of the administrative agencies and

courts and thus fall within the exception to Noerr. ”

Id. at 1259.

The Plaintiff has argued above that the Board of Trade

Meeting and the Defendants subsequent behavior is probative

of conspiracy as a matter of law; that the law is clear on the

matter of the baseless suits filed by the Defendant Bank and

that unless a conspirator withdraws from the conspiracy, all

action taken in furtherance of the conspiratorial objective are

27

imputable to all conspirators. Furthermore, the Board of

Selectmen, members of the alleged conspiracy, by attending

and participating in the Board of Trade meeting, sat in pre

judgment on the merits of an entertainment license they were

already compromised to defeat. Later, the Board of Trade

went through the motions of transmitting a letter to the Select

men voicing opposition to the disco, which opposition had

already been made known to them privately when they

formed the conspiracy. Another Board of Trade member,

Sherman Reed, Head of the Selectmen’s own appointed traffic

study committee, also opposed the operation of Plaintiffs

disco because of the “traffic hazard” it would create. It was on

his report the Selectmen claim to rely as grounds for their

denial of Plaintiffs entertainment license. (R. 173).

For all of these reasons, the Court below erred in concluding

that the Board of Trade is not chargeable with the sham

actions of its co-conspirator, Cape Cod Five Cents Savings

Bank.

IV. APPLICATION OF THE

NOERR-PENNINGTON DOCTRINE

D id t h e C o u r t err in c o n c lu d in g t h a t t h e a c t io n s o f t h e

B oard o f T ra d e a r e pr o t ec t ed a c t iv it ie s u n d er t h e Noerr-

Pennington Doctrine. ( F irst A m e n d m e n t rig h t o f fr e e

s p e e c h a n d p e t it io n ) , ESPECIALLY IN VIEW' OF t h e p r e s e n c e a n d

PARTICIPATION OF A MAJORITY OF THE TOWN SELECTMEN (BOARD

o f T rad e m e m b e r s N org eo t a n d N ic k er so n ) a t m eet in g s o f

t h e B oard o f T rad e a t w h ic h t h e B oard o f T ra d e’s o p p o s i

t io n to P l a i n t if f ’s l ic e n s e a p p l ic a t io n w a s d iscussed a n d

u n a n im o u s l y v o t ed , prio r to t h e Se l e c t m e n ’s H ea r in g on

t h e m a t t e r ?

The District Court erred in applying the Noerr-Pennington

exception in Plaintiffs anti-trust action. It is the Plaintiffs

contention that the public officials’ status of co-conspirators,

28

and Defendants’ sham law-suits as applied from the facts of

this case, take the Defendants’ actions out from under Noerr’s

protection. The District Court below acknowledges the public

official co-conspirator exception issue:

“Alternatively, the plaintiff invokes the “conspiracy” ex

ception of Noerr-Pennington which applies where

government officials participate with private individuals

in a scheme to restrain trade.” E. G. Duke v. Foerster,

521 F.2d 1277 (3rd Cir., 1975).

In support of this contention, the Plaintiff relies upon the fact

that two of the three members of the Board of Trade were

present at the meeting when Mr. Manego’s proposal was dis

cussed, and that other businesses were subsequently licensed in

the same area. (R. 552).

But contrary to the evidence and the case law, the Court

below refused to apply the exception and granted Summary

Judgment to the Defendant Orleans Board of Trade due to the

“lack” of a genuine issue for trial. (R. 552). The Court con

ceded that Summary Judgment is inappropriate in cases in

volving conspiracy claims because the existence or non

existence of a conspiracy is essentially a factual issue to be

decided by the jury. Adickes v. S.H. Kress, supra at 176. As

the Plaintiff stated in the District Court, conspiracy is very dif

ficult to prove. Those who could provide the best evidence are

those who generally will not “talk” because of their own in

volvement. Ferguson v. Omnimedia, Inc. 469 F.2d 194 (1st

C ir., 1972). In a small town of interlocking business and social

relationships, the above difficulty is aggravated.

The court also acknowledges Plaintiff s argument that Sum

mary Judgment may be inappropriate in antitrust cases where

“motive and intent” play leading roles. Poller v. Columbia

Broadcasting System 368 U.S. 464, 82 S.Ct. 486 (1962).

29

The court in Poller went on to say:

1. “ . . . the proof is largely in the hands of the alleged

conspirators, and hostile witnesses thicken the plot. It is

only when the witnesses are present and subject to cross

examination that their credibility lend the weight to be

given their testimony. Trial by affidavit is no substitute

for trial by jury which so long has been the hallmark of

‘even-handed justice.’ ”

The court, however, cited exception to the general rule,

stating that:

“Where a moving party in an anti-trust conspiracy case

has shown that the facts relied upon in the opposing

party’s allegations are not susceptible to the interpre

tation which he sought to give them, Rule 3b (e) puts the

burden on the opposing party to produce evidence in sup

port of his allegation.”

The Court below went on to say that, without express

evidence of a conspiracy involving the Orleans Selectmen, the

Plaintiff would be precluded from advancing the inference of

conspiracy based on their presence at the Board of Trade

Meeting, as a result of the ruling in Federal Prescription

Service v. American Pharmaceutical Ass’n 663 F.2d 255 (D.C.

Cir., 1981) cert, denied, 455 U.S. 928 (1982) 102 S.Ct. 1293,

that “mere membership” is not sufficient to prove conspiracy;

nor would Plaintiff be allowed to buttress his conspiracy

allegation by citing the fact of a subsequent grant of an enter

tainment license to the Sports Center, which was explained

away by the Selectmen as an exercise of “legitimate licensing

authority.” The facts of the case and controlling law could not

disagree more. More than “mere membership” was involved

here.

30

The District Court erred in applying Federal Prescription to

this case as controlling precedent. The District Court and the

Defendant’s reliance on this case, which is distinguishable on

the facts, created a miscarriage of justice by way of the fallacy

of argument by false analog}'.

The pertinent facts in Federal Prescription were as follows:

The regulatory officials were members of state pharmacy

boards, and also members of a national pharmacists associa

tion which was engaged in a program of lobbying before the

state boards to oppose licensing of mail-order pharmacies. The

court held that evidence of overlapping membership is not

probative of conspiracy. The court went on to hold that “mere

membership” (names on a roster) in associations, are not

enough to establish participation in a conspiracy with other

members of those associations and yet another association. The

fact that the case concerned mere membership and nothing

more can be deduced by noting that the plaintiff mail-order

pharmacies were forced to advance the tenuous argument of

“membership notification,” claiming that the national associa

tion was responsible for the actions to the state boards. The

court noted, relying on the membership notification case,

Phelps-Dodge Refining Corp. v. FTC, 139 F.2d 393 (2d Cir.,

1943) that liability is imposed upon members of an association

who knowingly acquiesce in unlawful conduct. The court then

declined to apply the membership notification theory, holding

the National Association liable for the conduct of the

individual state branch. The court stated that:

“absent evidence that the state branch was apparently

authorized by the national association, there could be no

finding of conspiracy. . ”

The court could find no evidence of this apparent authority to

be gleaned from mere membership but stated that it would be

a different matter if, among other possibilities, the national

31

association officers met in an unlawful fashion with state

board members. Id. at 264-265. The court did not expand on

what would be the indicia of a “meeting in unlawful fashion.”

It requires no quantum leap in logic, however, to assume that

a meeting with the regulatory officials/members with the

express purpose of restraining trade would be an unlawful

meeting and a clear violation of Section 1 of the Sherman Anti-

Trust Act.

In the present action we have neither a mere “membership

problem,” nor a case of overlapping membership. We do not

have a situation wherein “membership notification” is even

remotely applicable, except as it may impact upon those

members of the Board of Trade who were not present at the

conspiratorial meeting with the Bank in the person of its

agent, Defendant Branch Manager/Board of Trade, President

Willard and Board of Trade members, including two Orleans

Selectmen.

This is not a “mere membership” case. The “membership”

was coupled with knowledge, notification, presence and par

ticipation of the members of the Board of Selectmen who were

at the meeting. Contrary to the Court’s statement that “they

may have attended,” (R. 548), or Mr. Willard’s statement that

he did not “recall” if they attended, the record is clear.

According to the Board of Trade’s own minutes of its meeting,

the Selectmen Norgeot and Nickerson were there. (R. 461).

They were there even though they had yet to hold their own

official public hearing on the matter. They were there when a

vote was taken after Mr. Willard introduced the subject of Mr.

Manego’s disco. They were there when the subject was dis

cussed in a “wide ranging and thorough manner.” (R. 237).

They were there when the decision to “unanimously” oppose

the Plaintiff’s disco was taken.

There is also nothing in the record to justify granting the

Selectmen the benefit of a doubt as to whether they actually

participated in the vote. There were no abstentions of record

32

during the voting. One of the Selectmen returned one month

later to report to his fellow members on the Board of Trade the

status of the Manego case and informed them of the next

public hearing to be held the following evening. (R-464,465)

The District Court erred when it stated there was no

remaining genuine issue of fact to infer conspiracy primarily as

a result of its unwillingness to give probative weight to the

Selectmen’s membership in the Board of Trade and their

presence at the Board of Trade meeting. As argued above,

Federal Prescription does not apply. If Federal Prescription

does not apply then self-serving statements by Defendants

merely represent their preferred alternative interpretation of a

set of circumstances which Plaintiff alleges actually added up

to a probative inference of conspiracy, unprotected by the

Noerr-Pennington Doctrine.

CONCLUSION

For all of the reasons stated hereinabove, Plaintiff respect

fully submits that the judgment of the court below granting

summary judgment to the Defendants, should be reversed.

C h a r l e s R a y W eid m a n

938 Main Street

Chatham, MA 02633

(617) 945-2782

Attorney fo r Plaintiff