Westberry v. Fisher Plaintiffs' Brief

Public Court Documents

January 1, 1969

Cite this item

-

Brief Collection, LDF Court Filings. Westberry v. Fisher Plaintiffs' Brief, 1969. 348848da-c89a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/16f7c477-1fca-4f48-97cb-1e8ccac1caa9/westberry-v-fisher-plaintiffs-brief. Accessed February 21, 2026.

Copied!

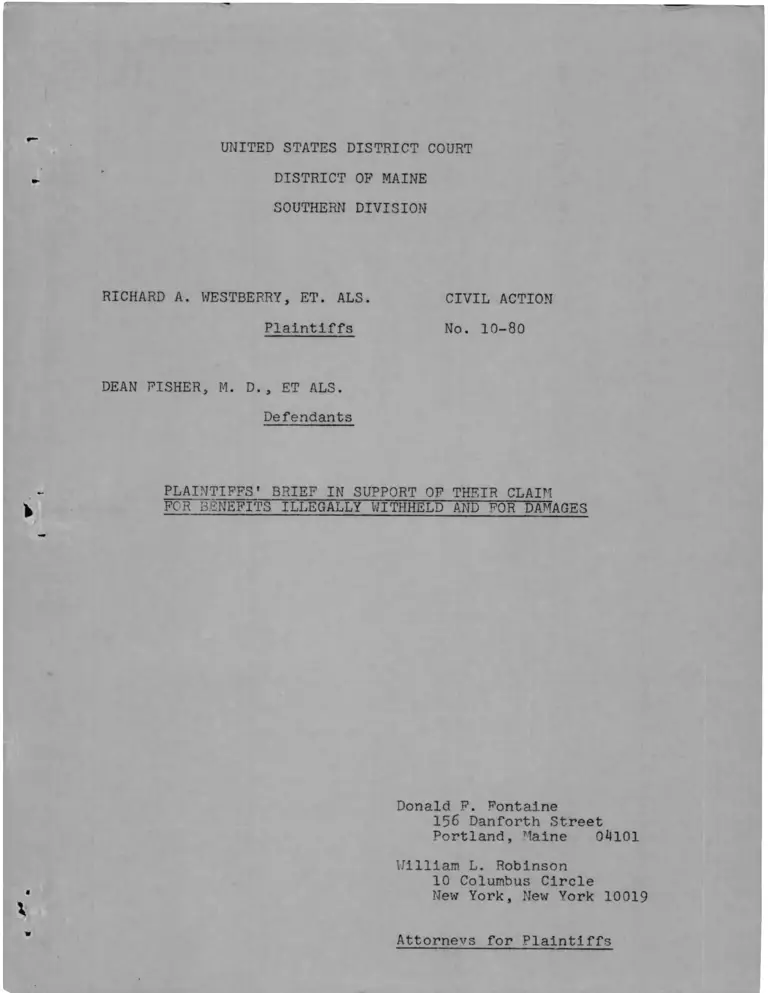

UNITED STATES DISTRICT COURT

DISTRICT OP MAINE

SOUTHERN DIVISION

RICHARD A. WESTBERRY, ET. ALS.

Plaintiffs

CIVIL ACTION

No. 10-80

DEAN FISHER, M. D . , ET ALS.

Defendants

PLAINTIFFS' BRIEF IN SUPPORT OF THEIR CLAIM

FOR"BENEFITS' ILLEGALLY WITHHELD AND FOR DAMAGES

Donald F. Fontaine

156 Danforth Street

Portland, Maine 0*1101

William L. Robinson

10 Columbus Circle

New York, New York 10019

Attornevs for Plaintiffs

UNITED STATES DISTRICT COURT

DISTRICT OP MAINE

SOUTHERN DIVISION

RICHARD A. WESTBERRY, ET. ALS.

Plaintiffs

CIVIL ACTION

No. 10-80

DEAN FISHER, M. D . , ET ALS.

Defendants

PLAINTIFFS' BRIEF IN SUPPORT OF THEIR CLAIM

FOR BENEFITS ILLEGALLY WITHHELD AND FOR DAMAGES

Donald F. Fontaine

156 Danforth Street

Portland, Maine 0*1101

William L. Robinson

10 Columbus Circle

New York, New York 10019

Attorneys for Plaintiffs

TABLE OF CONTENTS

Page

TABLE OF AUTHORITIES...................................... ill

ARGUMENT....................................................... 1

I INTRODUCTION ................................... 1

II DEFENDANTS MUST RELEASE BENEFITS

WRONGFULLY WITHHELD............... 2

a) Federal and State Administrative

Regulations Require payment of

benefits wrongfully withheld.............2

b) Federal and State Decisions support

plaintiff’s claim to benefits

wrongfully withheld....................... 6

III 4 U.S.C. §1983 REQUIRES DEFENDANTS TO

RECOMPENSE PLAINTIFFS FOR INCOME LOST

C O M P LICATION AND THREATENED APPLICATION

OF T H E ~ I X I M U M BUDGET REGULATIONS.......... .9

IV PERSONAL LIABILITY OF THE DEFENDANTS.......11

V CONCLUSION .....................................16

ii

T A B L E O F A U T H O R I T I E S

CASES Page

Board of Social Welfare v. Los Angeles County,

27 Cal. 2d 90, 162 P. 2d 630 (1945). ,. . . . . ,............ 7- 8

Board of Trustees of Arkansas A & M College v.

Davis, 396 FT 2d 730 (3th Cir. 1968)....................1 2 , 13

Chambers v. Henderson County Board of Education,

364 F. 2d 139 (4th Cir. 1966)............................ 10

Department of Employment v. United States,

385 U.S. 355 (1966)... ........... . ....................... 7

Ex parte Young, 209 U.S. 123 (1907).................... 12

Ferguson v. N o e , 364 S.W. 2d 650 (Xy. 1963)............ 7

Gregoire v. Biddle, 177 F. 2d 579 (2nd Cir.

1949), cert, d e n . , 339 U.S. 949 (1550)..................11

Hill v. Franklin Countv Board of Education,

Nos. 17647 , 17640 ■ and“17649 (6th Cir. decided

February 20 , 1968)................. . ...................10

Hogue v. Commissioner of Economic Security,

407 S.U. 2d 437 (Ky. 1366)............... ................ 7

Johnson v. Branch, 364 F. 2d 177 (4th Cir. 1966)...... 9, 10

Lane v. Wilson, 307 U. S. 268 (1939)...................15

Michaud v. City of Bangor, 159 Me. 491, 196

A. 2d 1C6 (1963) ... ...................... ................. 15

Monroe v . Pape, 365 U.S. 107 (1960)..................... 11

Norton v. .IcShane, 332 F. 2d 855 (5th Cir. 1964),

Cert, den. ̂ 330 U.S. 981 (1965)..........................11

Pierson v. Ray, 386 U.S. 550 (1967)..................... 13, 14

Public Utilities Commission of Ohio v. United

States Fuel Gas Co.' 317 U.S. 456 (1943)............... 4

Rolfe v. County Board of Education, No. 17498

(6th Cir. decided February 19, 1968) . ................. ..10

iii

Sherbert v . Verner, 374 U.S. 390 (1963).................. 7

Smith v. Board of Education of Horrilton

County^ 365 F . 23 77 0 (8th cir . 1966) . . ........ -........ 10

Thompson v . Shapiro, 270 F. Supp 331 (D.C. Conn.

1967), prob. juris. Noted, 19 L.Ed. 820 (1968).......... 6 , 9

Thorpe v. Housing Authority, ___ U.S.___ , 37 U.S.L.W.

4068 (1969) . .......................... -........ ......... * • • 4 f 5

United States v. Alabama, 362 U.S. 602 (1959)........... 4

United States v. Jefferson, 372 F „ 2d 836 (5th

Cir. 1966), aff'd en banc, 380 F. 2d. 385 (5th Cir.

1967) .............. .......................... 6

United States v. Obermeier, 186 F. 2d 243 (2nd

C i r . 1950) , cert. d e n .~ 3T0 U.S. 951 (1951)............. 6

('?all v. Stanley County Board of Education,

378 F . 2d 275 (4th Cir. 1967)... .......................... 9, 10

UNITED STATES CONSTITUTION

Eleventh Amendment ...... ...................... 12

STATUTES

42 U.S.C. § 1983 ......................... ................... 2, 9

11, 13

ME. R E V . STAT. ANN., tit.. 22, § 3351 (1964).............14

FEDERAL HANDBOOK OF PUBLIC ASSISTANCE

§ 6200 (a) (k) ,

§ 6500 (a)............................ ........... ......... 3 ' 4

MAINE PUBLIC ASSISTANCE PAYMENTS MANUAL

ChaDter II, Section C, pace 5 ....... ...................... 3, 4

15

TEXTS AND TREATISES

Emerson, Haber and Dorsen, Political and Civil

Rights in the United States (3rd ed. 196?) Vol. II.... 9

iv

Jennings, Tort Liability of Administrative

Officers, 21 Minn. L"I Rev „ 263 (1937).......................15

Prosser, Torts (2nd ed . 1555)................ ............... 15

v

UNITED STATES DISTRICT COURT

DISTRICT OF MAINE

SOUTHERN DIVISION

RICHARD A. TTESTBEP.RY, ET ALS . ) CIVIL ACTION

)

Plaintiffs ) No. 10-30

)

V o )

)

DEAN FISHER. M. D „, ET AMS. )

)

Defendants )

PLAINTIFFS' BRIEF IN SUPPORT OF THEIR CLAIM

FOP BENEFITS"'!:LLEGALLY VITIiHELr AND FOR DAMAGES

ARGUMENT

I . Introduction

This is a class action pursuant to F. R. Civ. P.

23 (b) (2 ) for a declaratory judgement that the maximum

grant' and maximum budget regulations contained in the

Maine Public Assistance Policy Manua l • Chapter III, Sec

tion A, pages 2, 4 and 5 as more particularly described

in the amended complaint, violate the Eoual Protection,

Due Process and Privileges and Immunities Clauses of the

Fourteenth Amendment to the United States Constitution,

certain provisions of Federal Civil Rights and Social Se-

-2-

curity Acts,, and certain provisions of the Maine welfare

statutes. Plaintiffs also seek injunctive relief. These

issues have been fully briefed and were araued before this

court on October 25, 1963.

This brief considers the question of damages. Cer

tain federal and state regulations and certain cases re

quire the defendant Department of Health and Welfare to

release moneys unconstitutionally withheld. (Point II).

A federal statute, 42 U.S.C. S 1903, in addition, requires

the individual defendants to compensate plaintiffs in the

same amount and for the damages sustained as a result of

the illegal action. (Point III). Neither the Eleventh

Amendment to the United States Constitution, nor the doc

trine of sovereign immunity, bars this relief against the

defendants. ITor are the individual defendants personally

immune u.naer re : nt case law. (Point IV) . The conclusion

is that this court may order the defendants to compute

damages with each member of the class in his individual

circumstances.

II. Defendants Must Release Benefits T’ronafullv withheld — ------------------------------ ——-——— ------------- - -

a) Tederal and State administrative regulations reauire

paymentcof benefits wrongfully withheld.

During the pendency of this action, administrative

regulations by the. United States Department of Health, E d u

cation and Welfare and the Maine Department of Welfare

-3

have become effective. These regulations provide for

fair hearinas ana retroactive payments of benefits

wrongfully denied. The HEW regulation is contained in

the Federal Handbook of Public Assistance and is attached

as Appendix A. It provides

f 6200 Requirements for State Plans

A state plan for . . . AFDC . . .

must provide that

(a) The State aaency will be r e

sponsible for fulfillment of fair

hearinas provisions, and shall

specify the hearing authority.

(k) Then the hearing decision is

favorable to the claimant, or when

the agency decides in favor of the

claimant prior to the hearing, the

aaency will make the correct pay

ments retroactively to the date

the incorrect action was taken.

§ 6500 Fed e r a l Financial Participation

Federal financial participation is

available in

(a) Payments made to carry out h e a r

ing decisions,- or to take corrective

action prior to the hearing, includ

ing corrected payments retroactively

to the date the incorrect administra

tive action was taken.

Handbook Transmittal Mo. 140, February

2, I960. (Effective date.- July 1, 1968)

The Maine Department of Welfare Administrative reau-

lations providing for fair hearings and retroactive pay

ments of benefits wrongfully witheId nrovide

-4-

If the agency's original action is

reversed or in any other way nodified’

causing a decision favorable to the

claimant, the agency will take im

mediate steps to insure that within

the CO day period that corrected pay

ments are made retroactively to the

date the incorrect action was taken

or to the date of application, which

ever was later. J. -aine Public As

sistance Payments Manual C h „ I ,

Section C, p. 5 fp.ev. 7/1/63) .

Numerous decisions of the United States Supreme Court

hold that a court must apply the law in effect at the

tine it renders decision. Thorpe v. Housing Authority,

Ho. 20, decided January 13, I960 United States v. Ala

bama , 362 U.S. 602 (1959) Public Utilities Commission

of Ohio v. United States Fuel has C o ., 317 U.S. 456 (1943)

In Thorpe the court held that the Housing Authority for

the City of Durham was obligated to follow eviction pro

cedures contained in a regulation enacted by the Depart

ment of Housing and Urban Development while the case was

on appeal. The court wrote

Chief Justice Marshall explained the

rule over 150 years ago as follows:

[I]f subsequent to the judge

ment and before the decision

of the appellate court, a lav;

intervenes and positively

changes the rule which gov

erns, the law must be obeyed

or its obligation denied.

If the lav; be constitution

al, . . .1 know of no court

which can contest its obli

gation. It is true that in

mere private cases between

-5-

inclivicluals, a court will and

ought to struggle hard against

a construction which will, by

a retrospective operation, af

fect the rights of parties,

but in great national con

cerns . . . the court must d e

cide according to existing

lavs, and if it be necessary

to set aside a judgement,

rightful when rendered but

which cannot be affirmed but

in violation of law, the

judgement must be set aside.

This same reasoning has been applied

where the change was constitutional,

statutory, and judicial. Surely it ap

plies with equal force where the change

is made by an administrative acrencv act

ing pursuant to legislative authorization.

L v7. 406S (1965), footnotes omitted.

This court- which has not yet rendered a decision

in the instant case is a fortior required to give effect

to the HE '/7 and state regulations and order defendants to

grant plaintiffs corrected payments to the date the in

correct administrative action vas taken.

Even if the court rejects plaintiffs argument that

it is bound to give effect to the federal and state regula

tions, the regulations lend strong persuasive support for

the position that the court should award plaintiffs retro

active payments of benefits wrongfully withheld back to

the date the incorrect action was taken. In these rerrula

tionsf the state and federal agencies responsible for ad

ministering the AFDC program recognize the recipient's

-G-

right to receive benefits wrongfully withheld retroac

tively to the date the incorrect action was taken. Ad

ministrative reaulations are presumed valid and the court

should give areat weight to the regulations of the

agencies responsible for administering the program, in

question. United States v. Obermeier, 13 6 F . 2d. 243 (2nd

Cir. 1950) cert. den. 340 U.S. 951 (1951) United States

v. Jefferson, 372 F.2d. 336 (5th Cir. 1966) , a f f ‘d en banc,

330 F.2d. 395 (5th Cir. 1967). cert. den. sub. n o n .,

Caddo Parish School Board v. United States, 339 U.S. 340

(1967). Plaintiffs submit that the court should adopt

the rationale of the federal and state regulations and or

der retroactive payment of benefits wrongfully withheld

back to the date the incorrect actions were taken pursuant

to the maximum budget and maximum grant regulations.

(b) Federal and State decisions support plaintiffs' claim

to benefits vronafully withheld.

Decisions of federal courts support plaintiffs'

claim to retroactive payments for benefits wrongfully with

held .

In Thonpson v. Uhap i r o , 27 0 F. Supp 331 (D.C. Conn.)

prob. juris, noted, 19 L.ed 2d 320 (1963). the case most

similar to the case at bar, a three-judge district court

declared unconstitutional the Connecticut statutes reguir-

-7~

ing a fartilv to reside in the state for one full year

prior to receipt of ADC payments. Significantly, the

court also awarded plaintiff retroactive payment of moneys

unconstitutionally withheld because of the unconstitutional

statutes. See Sherbert v . V e r n e r • 374 U.S. 398 (1S63) c f .

Department of Emplovr.ent v. United States, 38 5 U.S. 3 55X 7 7

(1966) .

Decisions by the highest courts in several states

also support plaintiffs ; prayer for retroactive payments

back to the date the incorrect action was taken. board of

Social T7elfara v. L03 Angeles County, 20 Cal. 2d 90, 162

p „ 2d 630 (1945) Perguson v. doe 3C4 S.T’. 2d 650 (Kv. 1963)

Hogue v. Commissioner of Economic Security, 407 S.I7. 2d 437

(Ky. 1965).

In Board of Social welfare v. Los Angeles County,

supra, the Supreme Court of California considered several

cases involving a claim for retroactive payments and issued

a peremptory writ of mandate ordering the county board to

make assistance payments retroactive to the date the reci

pients were erroneously denied public assistance. In ana

lysing one of the cases the court wrote

1./ Liability to make payment of moneys unconstitutionally

withheld may also be based on 42 U.E.C. § 1983. See Point

III of this Brief.

-8

In the case now before us we are of

the view that the provisions for appeal .

to the State Social Welfare Board and

for the payments, if awarded, to com

mence from the date the applicant was

first entitled thereto' likewise sub

serve a clear public purpose by se

curing to those entitled to aid the

full payment thereof from the date

*** [they were] first entitled there

to regardless of errors or delays

by local authorities. It was the

mandatory duty of the county to fur

nish aid according to the plan there

for which is laid down bv the ap

plicable provisions of the v’elfare

and Institutions Code [citations

omitted]. The obligation to may

became a debt due from the county!to

the applicant as of the date the lat

ter was first entitled to receive

the aid [citations omitted]. The

bare fact that an applicant has by

one means or another managed to ward

off starvation pending receipt of the

pavments to which he was previously

entitled provides no sufficient ex

cuse for a county to refuse to make

such payments. To hold otherv/ise

wou l d , as suggested by petitioner

herin, pro/ide a money-saving device

for tiie counties at the expense of

these of our citizenry least able to

bear the burden thereof.

165 p. 2d at 633.

T h u s , federal and state decisional lav; supports

plaintiffs' claim for benefits wrongfully denied.

Plaintiffs submit that this court should adopt the

rationale of’ other federal courts and of the Supreme Courts

of California and Kentucky and exercise its broad equity

powers to order the Commissioner of Welfare to award retro

active payment of the benefits wrongfully withheld pursuant

to the maximum grant and maximum budgeted requirements regu

lations .

-9-

III. 42 U.S.C. § 1933 Requires Defendants to Recompense

Plaintiffs for Income Lost by Application and

Threatened Application of the Ilaximun Budget P.egu-

latxons.

The purpose of § 1983 is to put the injured party

in the position they would have held but for the constitu

tional action of persons acting under color of state lav;.

§ 1983 provides that:

Every person , who, under color of any

statute, ordinance, custom or usage of

any State subjects, or causes to be

subjected, any citizen of the United

States or other person within the

jurisdiction thereof to the depriva

tion of any privileges or immunities

secured by the Constitution or lav;,

shall be liable to the party .injured

in an action at law, suit in equity, < :

or other proper proceeding for re

dress. (R.S. 1979 Force Act of 1871,

17 Stat. 13.) Emphasis added

Federal courts have frequently awarded money damages

to oersons deprived of thier privilecres and immunities in

£_• /

violation of § 1933. In Johnson v. Branch, 364 F. 2d 177

(4th Cir, 1966), the court, finding that the school board

had refused to renew the contract of a Negro teacher because

of her civil rights activities, remanded the case directing

the district court to order the board to renev; her contract

and determine her damages. In Uall v. Stanley County Board

2./ Thompson v . Shapiro, surra.: See generally, Emerson,

Haber and Dorsen, Political and Civil Eights in the United

States, (3rd Ed. 1367, Little, Brown and"Co., Poston)

Vol. II, pp. 1447-1454.

“10-

of Education,, 378 F.2cl 275 (4tii C i r . 1557), the court found

that Mrs. Mali, a Negro teacher, was refused employment by

the Stanley County Board of Education because of her race.

The court ordered the board to put her bach on the roster

of teaching applicants and that she be given objective con

sideration for employment and further ordered the board to

pay her damages for her loss of earnings;

Mrs. Nall managed to secure employ

ment elsewhere for the school year

1965-66. Proper damage elements

will include salary differences, if

any, and moving expenses to her new

residence. If she should be re-em--

ployed in the Stanley Countv system

for the school year 1967-60, she

should also be awarded the reasonable

expense of moving back to Stanley

County. 37 8 F2d at 27 3 3_./.

In the instant case, plaintiff, June Martin, qualified for

and willing to accept work as a nurse's aide which was a •

vailable in the community, was prevented from continuing

her employment by virtue of the enforcement of the maximum

budgeted requirements regulation just as the Negro teachers

in Johnson v. Branch, supra. and Wall v, Stanley, supra,

were prevented from working by the actions of the school

board. (Defendants5 Answer, Para. 12). Plaintiffs --Submit

that the court should similarly require the Commissioner of

Welfare to recompense her for her lost earnings.

3 / Additional cases awarding damages under £ 1583 to Negro

teachers refused employment because of their race a r c • Hill v.

Franklin County Board of Education Nos. 17647, 1764 3 and

1764 9 (6th Cir. decided Feb. 20. 1968) Folfe- v . Countv Board

of Education, No. 17456 (6th Cir. decided "Feb"." 19, i960) •“ —

Smith v. Board of Education of Morrilton County, 3G5 F.2d. 770

(8th Cir.. 1966)° Chambers v. Henderson County Board of E d u

cation, 364 F. 2d 1C? (4th C i r . 1966) .

11

Other members of the class have also suffered in

jury as a result of the challenged regulations. For ex

ample, some persons, precluded from receiving AFDC

assistance solely because of the maximum budget regulation?

are unable to receive medicaid and must obtain loans or for

go other necessities to obtain medicare and meciical car^.

These injuries and the resulting damages will, o£ course?

vary for each individual member of the class, however,

the defendants are personally liable for such damages under

§ 1933 . See PointjV of this brief.

IV. Personal Liability of the Defendants:

Once a cause of action has been proved under 4 2 U.S.C.

§ 1933 - Congress has plainly authorized damages against the

defendants as well as injunctive relief. Persons are

liable to the partv injured in an action at law. 42 U.S.C.

c 1983„ This section does not include federal offices.

Gregoire v. Biddle? 177 F„ 2d 579 (2nd Cir. 1949)... cert. d e n .

339 u.S. 942 (1350) Horton v. lie Shan e ,, 332 U.S. 931 (1365) .

But it does include the actions of the state officers whether

or not their acts are authorized by state lav7. Monroe v .

Pape, 365 U.S. 107, 184-137 (1960). It is sufficient that

the allegedly illegal act was made possible only because

the wrong.doer was clothed with the authority of state law.

The acts of the defendants in the instant case are

not immunized from liabilities because tney were exercising

-12-

the sovereign power of the state, since the state cannot

afford one immunity to violate the United States Consti

tution, Ex parte Young , 20? U.S. 123 (1907). Board of

Trustees of Arkansas A £ ?■ College v. Davis, 396 F. 2d 730

(3th Cir. 1963). The latter case was an action by a former

faculty member against a beard of trustees of a state college

for damages following the termination of plaintiff;s status

as a faculty member. A three-circuit judge court held that

the suit was not barred by the Eleventh Amendment. It

wrote 1

Plaintiff does not dispute that Arkan

sas A €i ] 1 College is a state agency.

He- stands on the proposition, how

ever, with which we agree, that sov

ereign immunity does not extend to

state or federal officials who act

beyond their authority or in viola

tion of the United States Constitu

tion .

The foundation case is Ex parte

Young, 209 U.S. 123, S. Ct. 441, 52

D.Ed. 714 (1903), where the Supremo

Court held that a suit against the

Attorney General of Minnesota to en

join the enforcement of an unconsti

tutional state statute did not violate

the prohibition of the Eleventh Amend

ment. In rejecting the claim of

state immunity the court announced

this basic principle,

The act to be enforced is alleged

to be unconstitutional, and if it

be so, the use of the name of the

state to enforce an unconstitution

al act to the injury of complain

ants is a proceeding without the

authority of and one which does

not affect the state in its

-13-

sovereign or governmental

capacity. It is simply an i l

legal act upon the part of a

state official in attempting,

by the use of the name of the

state, to enforce a legislative

enactment which is void be

cause it is unconstitutional.

If the act which the state at

torney general seeks to en

force be a violation of the

Federal Constitution, the of

ficer, in proceeding under such

enactment, comes into conflict

with the superior authority of

that Constitution, and he is

in that case stripped of his

official or representative

character and is subjected in

his person to the consequencas

of his individual conduct. The

state has no power to impart to

him any immunity from respon

sibility to the supreme

authority of the United States.

396 F. 2d 730, 732 (8th Cir.

1S68), footnotes omitted.

The general rule, therefore, of 42 U.S.C. § 1983 is

personal liability. The exception is immunity. Recently,

the United States Supreme Court in Pierson v. R a y , 386 U.S.

550 (1867) ha3.d a Mississippi police officer immune from

personal tort liability for false arrest where he has acted

with probable cause and good faith under an act he reason

ably believed to be constitutional. The court w r ote:

A policeman's lot is not so unhappy

that he must choose between being

charged with dereliction of duty if

he does not arrest when he has pro

bable cause, and being mulcted in

damages if he d o e s . Although the

-14-

matter is not entirely free from doubt

the same consideration would seen to

require excusing him from liability

for acting under a statute that he

reasonably believed to be valid but

that was later held unconstitutional,

on its face or as applied. 386 U.S.

at 555. (Footnote omitted).

Defendant Fisher, Commissioner of the Depart-ent of

Health and Welfare, however, is in an entirely different

position that was officer Fay. Fisher was not required by

state statute to deprive plaintiffs of moneys, whereas officer

Ray was required to make an arrest. On the contrary, de

fendant Fisher promulgated and approved the very regulations

that were used as the basis of depriving plaintiffs herein,

although he had the power and the duty to make . . . neces

sary rules and regulations for the administration of this aid.

that were legal and constitutional. ME. REV. STAT. ANN.

tit. 22, § 3351 (1964). Accordingly, the commissioner should

not be given the benefit of the Pierson doctrine. Even if

he receives benefit of the Pierson doctrine, the commissioner

should be held to a higher standard of reasonableness.

Plaintiffs concede that the spirit of Pierson v. R a y ,

supra., would seem to immunize defendant social workers

Tierney, Jenny, Holloway, and Smith, who were faced with the

possible choice of following the Department's regulations or

dereliction of duty. However, it is far from clear that at

common law such lower echelon administrators would be immune

-15-

from liability. Lane v. Wilson, 307 U.S. 268 (1939) Proeser.

Torts 732-733 (2d. ed_._1955) _ Jennings, Tore Liability of A d

ministrative Officers, 21 WINN. L. REV. 263 (1937). It is

clear that the liability of both Commissioner Fisher and the

other defendants will turn upon the reasonableness of their

action as revealed by all the facts. Defendants have pleaded

no facts that entitle them to immunity, except that the state

is entitled to spend its welfare money the way it chooses.

See Brief of Defendants. July 10, 1968, pp. 3-6. If this

were the basis of defendant's action, it is as a matter of

law unreasonable and lends no immunity to them.

Not only are the individual defendants not immune as

agents of the sovereign, but to the extent of moneys wrongfully

withheld, the State of Maine has waived its sovereign immunity

and consented to suit. It has adopted regulations allowing

retroactive corrected payments and authorized judicial review

of fair hearing decisions. See Point II of this Brief and

Maine Public Assistance Payments Manual, Ch. I, Section C n. 5.

Maine law itself permits recovery against the sovereicn for

torts which high administrative officials direct. Michaud v .

City of Bangor, 159 Me. 491, 196 A. 2d 106 (1963).

- 16-

V. Conclusion:

For the reasons stated in the foregoing memorandum,

the court should rule that the defendants are liable to

return moneys illegally withheld and to comnensate plaintiffs

for damages sustained. Further, the court should order

defendants (1 ) to notify all members of the class of the

courts' decision in this case; (2 ) to invite said persons

to confer with the department: (3 ) and to compute with each

such person a just and reasonable amount of compensation

for said damage.

Respectfully submitted,

Donald F. Fontaine

William L. Robinson

Handbook of Public Assistance Administration

Part IV Eligibility, Assistance,, and Services

------------------- “ 2/0/00Table of Contents - IV-6000

Fair Hearings

Provisions of the Act

Requirements for State Plans

Criteria for the Administration of the Plans

Interpretation

(a) Opportunity for a Fair Hearing

(b) Publication of Hearing Procedures

(c) Informing the Claimant of His Right

to a Hearing

(d) Convenience of the Claimant Considered

(e) Impartiality of Official Conducting the Hearing

(f) Impartiality of the Hearing Authority

(g) Prompt, Definitive, and Final Action

(h) Opportunity to Examine the Official Record

(i) Judicial Review

6000

6100

6200

6300

6 ^ 0

Federal Financial Participation 6500

Handbook of Public Assistance Administration

Part IV

6000-6999

Eligibility, Assistance,

Fair Hearings_______________

and Services

______2/ f i M

6000. Fair Hearings ;

6100. Provisions of the Act

(a) Sections 2(a)(4), 402(a)(4), 1002(a)(4), 1402(a)(4), and

1602(a)(4) read as follows;

"A State plan . . . must . . .

"provide for granting an opportunity for a fair hearing

before the State agency to any individual whose claim

for . . . ^aid or assistance under the plan7 is denied

or is not acted upon with reasonable promptness."

(b) Sections 6(a)(5), 4o6(b)(2)(E), 1006(5), 1405(5), and

1605(a)(E) authorize Federal financial participation in

protective payments "but only with respect to a State

whose State plan . . . includes provision for . . .

"opportunity for a fair hearing before the State agency on

the determination . . . Jot need for protective payment^

for any individual with respect to whom it is made."

6200. Requirements for State Plans

A State plan for OAA, AFDC, AB, APTD, or AABD must provide that:

(a) The State agency will be responsible for fulfillment of

fair hearings provisions, and shall specify the hearing

authority.

(b) An opportunity for a fair hearing before the State agency

will be granted to any individual requesting a hearing

because his claim for assistance is denied, is not acted

upon with reasonable promptness, or because he is aggrieved

i by any other agency action affecting his receipt or

termination of assistance, or by agency policy as it affects

his situation.

(c) Decisions by the hearing authority, rendered in the name of

the State agency, will be binding on the State and local

I agency. The State agency will establish and maintain a

6200-p .2

3

1

»

-

#>

&

V*1PM

X

V;

Handbook of Public Assistance Administration

Part IV

6000-6999

______Eligibility, Assistance, and Services

Fair Hearings 2/6/68

6200. Requirements for State Plans ((c) Continued)

method for informing, at least in summary form, all logfel

agencies of all fair hearing decisions by the hearing

authority, and the decisions will be accessible to the claiman ,

their representatives, and the public (subject to provisions

relating to safeguarding public assistance irjformation).

(a)

(e)

( f )

The hearings will be conducted by an impartial official

(or officials) of the State agency.

Hearing procedures will be issued and publicized by the

State agency for the guidance of all concerned.

Every claimant will be informed in writing at the time of

application and at the time of any agency action affecting

his claim

( 1)

(2)

(3)

of his right to a fair hearing;

of the method by which he may obtain a hearing;

that he may be represented by others including legal

counsel; and

( k ) of any provision for payment of legal fees by the agency.

(g) The hearing will be conducted at a time, date, and place

convenient to the claimant, and adequate preliminary written

notice will be given.

(*) When the hearing involves medical issues, a medical assess

ment other than that of the person o<r persons involved in

making the original decision will be obtained and made a

part of the record if the hearing officer or the appellant

considers it necessary.

(i) The claimant or his representative will have the opportunity

(l) to examine all documents and records used at the hearing;

(2) at his option, to present his case himself or with the

aid of others, including legal counsel;

H.T. No. lUO

if

i

&

1

1

'r‘A-

'

n

Part IV________________________ Eligibility, Assistance, and Services

6OOO-6999 Fair Hearings p/8/68*

6200-p.3

Handbook of Public Assistance Administration

\

r>

6200. Requirements for State Plans ((i) Continued) ^

(3) to bring witnesses;

(U) to establish all pertinent facts and circumstances;

(5) to advance any arguments without undue interference;

and

(6) to question or refute any testimony or evidence.

(j) Prompt, definitive, and final administrative action will

be taken within 60 days from the date of the request for

a fair hearing. The claimant will be notified of the

decision, in writing, in the name of the State agency and,

to the extent it is available to him, of his right to

judicial review.

(k) When the hearing decision is favorable to the claimant, or

when the agency decides in favor of the claimant prior to

the hearing, the agency will make the corrected payments

retroactively to the date the incorrect action was taken.

| (l) The hearing officer's (or panel's) recommendations shall

be based exclusively on evidence and other material

introduced at the hearing. The verbatim transcript of

testimony and exhibits, or an official report containing

the substance of what transpired at the hearing, together

with all papers and requests filed in the proceeding, and

the hearing officer's or panel's recommendations, will

( constitute the exclusive record for decision by the hearing

f , authority and will be available to the claimant at a place

V accessible to him or his representative at any reasonable

time.

6300. Criteria for the Administration of the Plans

(a) The State agency establishes policies and procedures that

carry out the purpose and provisions of this policy and

that assure equity of treatment in relation to the laws and

standards pertaining to assistance.

The State agency takes the necessary steps to see that there

is uniformity in the application of agency policy in similar

situations.

(f

I

fthK

»

« H.T. No. lUO

Part IV ______________Eligibility, Assistance, and Services

6006-69^9 _____________ Fair Hearings_______________________ 2/8/68.

6300. Criteria for the Administration of the Plans (Continued)

y(b) A request for a hearing is considered as any clear

expression (oral or written) by the claimant (or person

acting for him, such as his legal representative, relative,

or friend) to the effect that he wants an opportunity to

present his case to higher authority. The freedom to make

* such a request is not limited or interfered with in any way,

and agency emphasis will be on helping the claimant in sub

mitting and processing his request, and in preparing his

case, if needed .

(c) Opportunity for a fair hearing includes:

(1) Consideration of any action, or failure to act with

reasonable promptness, on a claim for assistance

which includes undue delay in reaching a decision on

eligibility or in making a payment, refusal to con

sider a request for or undue delay in making an

adjustment in payment, and suspension or discontinuance

of assistance in whole or in part:

(2) Consideration of the agency's interpretation of the

law, and the reasonableness and equitableness of the

policies promulgated under the law, if the claimant

is aggrieved by their application to his situation;

(3) Consideration of agency decisions regarding;

(i) Eligibility for assistance in both initial and

subsequent determinations,

(ii) Amount of assistance or change in payments,

(iii) The manner or form of payments, including restricted

or protective payments, even though no Federal

financial participation is claimed, and

(iv) Conditions of payments, including work require

ments .

(d) Provision is made for reasonable time in which to appeal

agency action.

Handbook of Public Assistance Administration

6300-p.3

Part IV

&OOO-6999

_________________Eligibility, Assistance,

Fair Hearings

Handbook of Public Assistance Administration

and Services

2/ 8/68

6300. Criteria for the Administration of the Plans (Continued^

(e) Final administrative action is taken within the 60-day

limit (IV-62OO, item j), except that where the claimant

requests a delay in the hearing in order to prepare his

case or for other essential reasons, reasonable time is

given and such extra time may be added to the 60 days.

(f) The agency does not deny or dismiss a request for a

hearing except where it has been withdrawn by the clainant

in writing or abandoned.

A request for a hearing is considered abandoned only if

neither the-claimant nor his representative appears at the

time and place agreed upon for the hearing, and if within

a reasonable time after the mailing of an inquiry as to

whether he wishes any further action on his request for a

hearing, no reply is received by either the local or State agency.

(g) The hearing authority may be the highest executive officer

of the State agency, a panel of agency officials or a

hearing officer appointed for that purpose, but no person

who participated in the local decision being appealed will

participate in a final administrative decision on such

case. The hearing authority is responsible for a final

administrative decision in the name of the State agency on

all issues that have been the subject of a hearing. The

decision of the hearing authority is binding on the State

and local agency. The State agency is^responsible for

seeing that the decision is carried out promptly.

Insofar as may be applicable, a decision in favor of the

claimant applies retroactively to the date the incorrect

action was taken, and also applies prospectively.

(h) The impartial official (or officials) of the State agency

who is responsible for conducting the hearing has not been

involved in any way with the action in question.

(i) The issuance of hearing procedures is in the form of rules

and regulations, or in some other form in which they will be publicized.

H.T. No. 1^0

6300- p. 14-

Part IV ____________________ Eligibility. Assistance, and Services

6000-6999 Fair Hearings 2/8/68

Handbook of Public Assistance Administration

6300. Criteria for the Administration of the Plans (Continue^)

(j) Written notification and, to the extent possible, oral

explanation of the right to and procedure for requesting

a fair hearing are given at the time of application.

Written notice, and oral explanation as necessary, are

1 given at the time of any agency action affecting the claim

for assistance, including change in or termination of

assistance.

(k) Individuals are informed of their right to be represented

at fair hearings by others. At his option, the claimant

may be represented by legal counsel or by a relative,

friend or .other spokesman, or may represent himself.

(l) The convenience of the claimant is considered in setting

the date, time, and place for the hearing. Notice is

given in writing with adequate preliminary information

about the hearing procedure necessary for his preparation

for the hearing and effective presentation of his case. He

is advised as to the use of witnesses and legal counsel or

other representative, as well as any procedure or financial

provisions for obtaining legal representation, including

availability of fees for legal counsel from the agency.

(m) When an assessment by a medical authority, other than the

one involved in the decision -under question, is. requested

by the claimant, it is obtained, at agency expense, from

a medical source satisfactory to the claimant. The hearing

officer can also consider the physician's report in the

record for can request additional evidence. The assessment

of such medical authorities will be reported in writing or

by: personal testimony as an expert witness for the hearing

record.

(n) The claimant or his representative has adequate opportunity

to examine material that will be introduced as evidence

prior to the hearing as well as during the hearing, to give

all the evidence on points at issue he believes necessary

without undue interference, to ask for substantiation of any

statements made by others, and to present evidence in re

buttal .

H.T. No. lUO

Handbook of Public Assistance Administration

6300-p.5

Part IV

5000-6999

______Eligibility, Assistance,

Fair Hearings_________________ and Services

______2/S/6 8.

^300. Criteria for the Administration of the Plans (Continued)

(o) Non-record or confidential information which the claimant

does not have an opportunity to hear or see is not made a

part of the hearing record or used in a decision on the

appeal. The hearing officer does not review the case

record, or other material prior to the hearing unless such

material is made available to the claimant or his

representative.

6^0 0. Interpretation

(a) Opportunity for a Fair Hearing

Fair hearing procedures, including the conduct of the

hearing, are designed to assure the right of every claimant

to demand and obtain a fair hearing. The claimant’s

freedom to request a hearing, whenever he believes that

proper consideration has not been given to al] the circum

stances surrounding his claim, is a fundamental right and

is not to be limited or interfered with in any way.

Since, under the Federal act and the State plan, every

^-SS^i^ved claimant is entitled to the opportunity for a

hearing, only the claimant may withdraw his request for a

hearing and this is to be in the form of a written withdrawal .

Effective complaint and adjustment procedures, whereby

corrective action may be easily requested and readily taken

without the need for a hearing, are necessary, when indicated.

Advance opportunity afforded the recipient to respond to

questions which could result in change of grant or termi

nation is a significant part of such procedures. So is

written, and whenever practical, oral information of the

reasons for change, denial, or termination. This is

particularly important where the agency decision is based

on judgmental factors or eligibility requirements that

entail evaluative decisions on the part of workers, as com

pared to decisions based on non-debatable facts (such as

receipt of OASI, death, etc.). However, the State and

locaL agency adjustment procedures cannot be allowed to

.interfere with the hearing process .

H.T. No. 1 I4O

6 U 0 0 -p .2

Part IV__________________________Eligibility, Assistance, and Services

6000-6999 Fair Hearings 2/8/68

6̂ -00. Interpretation ((a) Continued) y

The claimant's right to a hearing includes the privilege of

presenting his case in any way he desires. Some will wish

to tell their story in their own way, some will desire to

have a relative or friend present the evidence for them,

I and still others will want to be represented by legal counsel.

In many instances the recipient's position can best be

presented by an attorney. In order for the claimant to

I obtain an attorney, legal fees may need to be provided by

the State. Federal financial participation is available

in meeting the cost of these fees . States are urged to

provide payment for the services of an attorney, or refer

recipients to attorneys otherwise available in the comm

unity, because of the skill and knowledge of the legal,

profession in these matters. Furthermore, the claimant

may bring any witnesses he desires to help him establish

pertinent facts and to explain his circumstances.

The hearing is conducted in an informal rather than formal

court-type procedure in order to serve the best interests

of the claimant; however, the hearing is to be subject to

the requirements of due process .

(b) Publication of Hearing Procedures

The publication of hearing procedures in the form of rules

and regulations or a clearly stated pamphlet hfclpc to

emphasize the importance of the procedure. This material

is useful to applicants and recipients or to others interested

in their behalf. It contributes to the fairness of the

hearing procedure, and emphasizes that there is "due process"

( in program administration affecting the right to public

assistance.

(c) Informing the Claimant of His Right to a Hearing

Written notification of the right to a hearing may be on

the application form and other forms routinely used by the

agency which go to applicants and recipients, as well as an

explanatory pamphlet distributed by the agency. Oral

explanations should also be given regarding the policy on

hearings at intake and at time of a change in eligibility.

Handbook of Public Assistance Administration

H.T. No. lUO

Handbook of Public Assistance Administration

6400-P-3

Part IV_________________________ Eligibility, Assistance, and Services

6000-6999 Fair Hearings 2/8/68

6400. Interpretation ((c) Continued) ,

The purpose of informing the claimant of his right to a

hearing, in writing, and whenever practicable orally, is

to assure that the claimant fully understands this right.

This right is further assured by the agency explaining the

right to a hearing in understandable terms and in being

helpful as needed in the preparation for and conduct of

the hearing.

(d) Convenience of the Claimant Considered

The agency has not discharged its responsibility for a

hearing.unless it has taken all steps necessary to enable

a claimant who requested a hearing to attend the hearing

in person or to be represented by a person of his own

choosing. If the hearing is to be held at a considerable

distance from the locality of the claimant's residence, it

may be necessary to provide for the transportation and

other costs of the claimant, his representative, and his

witnesses.

Notice to claimant as to the hearing being scheduled in his

behalf includes information about the fair hearing as an

informal administrative procedure, in which a dissatisfied

claimant or his representative m y present his grievance

with the help of witnesses or legal representation to show

why action or inaction in his case should be corrected by

the State agency.

(•) Impartiality of Official Conducting the Hearing

The person conducting the hearing shall not have been

connected in any way with previous actions or decisions

on which the appeal is made. For example, a field super

visor who has advised the local agency in the handling of

a case would be disqualified from acting as the hearing

officer.

(f) Impartiality of the Hearing Authority

The hearing authority shall not have been directly connected

with the agency action about which the claimant is appealing.

H.T. No. i!+o

6kOO-p.b

Part IV__________________________Eligibility;, Assistance, and Services

6060-6999 Fair Hearings 2 / & / 6 Q

6U00. Interpre tat ion ((f) Continued) «

For example, a State board member who has participated as

a county board member or in another capacity in the local

action on a case would disqualify himself from rendering

a final decision on the particular case. This does not

* preclude the State director or administrative board from

signing the decision in the name of the State agency,

even though previously involved in the case.

(g) Prompt, Definitive, and Final Action

The hearing authority is responsible for rendering a con

clusive decision. When the hearing authority is different

from the hearing officer, such authority may adopt the

recommendations of the hearing officer, or reject them and

reach different conclusions on the basis of the evidence

at hand, or refer the matter back to the hearing officer

for a continuation of the hearing, because the materials

submitted are insufficient to serve as the basis for a

decision.

The State agency is responsible for assuring that the

decision is carried out. Various methods, such as a report

by the local unit to the State agency of action taken to

carry out the hearing decision or follow-up by the State

office staff, may be used. Remanding the case to the local

unit for further consideration is not a substitute for

"definitive and final administrative action."

The requirement for prompt, definitive, and final adminis

trative actfbn means that all requests for a hearing are

to receive immediate attention and will be carried through

all the steps necessary to completion. The requirement is

not met if the State agency dismisses such requests for any

reason other than withdrawal or abandonment of the request

by the claimant.

I The over-all time limit of 60 days between the date of the

request for the hearing and the date of the final adminis

trative action, will serve as one of the safeguards of

prompt, administrative action. Detailed controls of individ

ual steps in the hearing process , such as: time limits for

accepting, forwarding, and acknowledging a request for a

hearing, notice to the claimant, and date of the hearing will

facilitate proper administration of the hearing process.

Handbook of Public Assistance Administration

H.T. No. ilqo

Handbook of Public Assistance Administration

6400-p.5

Part IV

6000-6999 Eligibility, Assistance, and Services

Fair Hearings 9/30/68

6400. Interpretation (continued) f

(h) Opportunity to Examine the Official Record

The record of the proceedings at the hearing, which

constitutes the official record, is to be made available

to the claimant or his representative to examine, if he

desires. If any additional material is made a part of the

hearing record, this, too, would be made available.

(i) Judicial Review

In seme States, the right of judicial review may be

prescribed by statute specifically authorizing review of

the agency decision on the basis of the record of adminis

trative proceedings. In other States, even in the absence

of statutory provisions, a claimant may be able to invoke

the remedy of judicial review on the showing that the agency

action was "unreasonable, arbitrary, or capricious." The

content of the notice of decision, as regards judicial

review, would depend upon the kind of remedy available in

the State.

6500. Federal Financial Participation

Federal financial participation is available in:

(a) Payments made to carry out hearing decisions, or to take

corrective action prior to the hearing, including corrected

payments retroactively to the date the incorrect adminis

trative action was taken.

(b) Payments of assistance continued pending a hearing decision.

(c) Payments of assistance within the scope of the federally aided

public assistance programs made in accordance with a court

order.

H.T. No.147