Norwood v. Harrison Brief of Appellees

Public Court Documents

January 1, 1972

This item is featured in:

Cite this item

-

Brief Collection, LDF Court Filings. Norwood v. Harrison Brief of Appellees, 1972. 91c9c1fc-bf9a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/1cb0ea09-1318-4710-b0d8-f63e5bee725d/norwood-v-harrison-brief-of-appellees. Accessed February 04, 2026.

Copied!

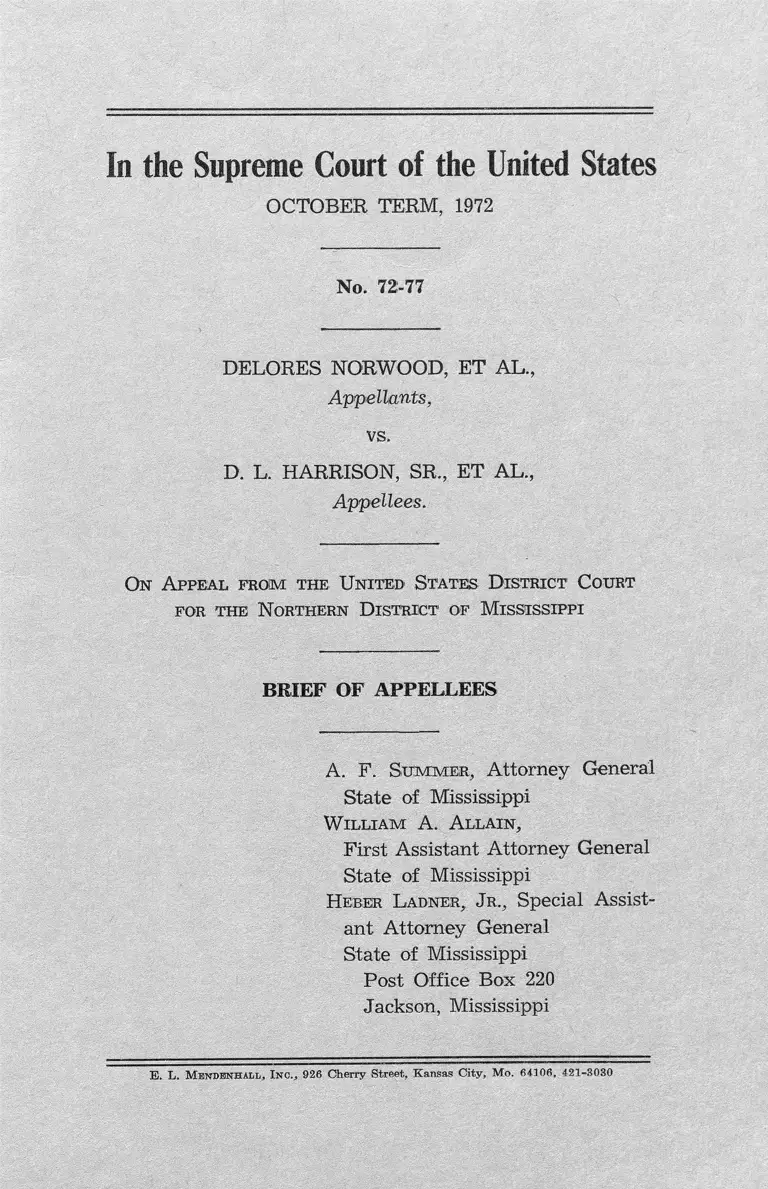

In the Supreme Court of the United States

OCTOBER TERM, 1972

No. 72-77

DELORES NORWOOD, ET AL.,

Appellants,

vs.

D. L. HARRISON, SR., ET AL.,

Appellees.

On A ppeal from the United' States D istrict1 C ourt

for the N orthern D istrict of M ississippi

BRIEF OF APPELLEES

A. F. Su m m e r , Attorney General

State of Mississippi

W il l ia m A. A llain ,

First Assistant Attorney General

State of Mississippi

H erer L adner, Jr ., Special Assist

ant Attorney General

State of Mississippi

Post Office Box 220

Jackson, Mississippi

E. L. M end en h all , In c ., 926 Cherry Street, Kansas City, Mo. 64106, 421-3030

TABLE OF CONTENTS

Question Presented .............................. 1

Statement of the Case .......................................................... 1

Summary of Argument ...................................................... 3

Argument—

Textbook Aid to Individual Students Is Not Sig

nificant Involvement with the Beliefs or Prac

tices of Private Schools ....................... .................. 4

Loaned Textbooks to All Educable Children Is Not

Significant State Aid to Racial Discrimination .... 9

Conclusion ............................................................................. 16

Table of Authorities

Cases

Abingdon School District v. Schempp, 374 U.S. 203, 83 S.

Ct. 1560, 10 L.Ed.2d 844 (1963) .................................. 4

Anderson v. Martin, 375 U.S, 399, 84 S.Ct. 454, 11 L.

Ed.2d 430 (1964) ............. .................. ................................ 14

Board of Education v. Allen, 392 U.S. 236, 88 S.Ct. 1923,

20 L.Ed.2d 1060 (1968) .............................. ....... ......... 4,6,8

Burton v. Wilmington Parking Authority, 365 U.S. 715,

81 S.Ct. 856, 6 L.Ed.2d 45 (1961) .................................. 12

Chance V. Mississippi State Textbook Rating and Pur

chasing Board, 190 Miss. 453, 200 So. 706 (1941) ..... 8

Cochran v. Louisiana State Board of Education, 281 U.S,

370, 50 S.Ct. 335, 74 L.Ed. 913 (1930) .......................... 7,16

Coffey v. State Educational Finance Commission, 296

F. Supp. 1389 (S.D. Miss. 1969) .................................... 2,10

II

Evans v. Abney, 396 U.S. 435, 90 S.Ct. 628, 24 L.Ed.2d

634 (1970) ..........-.............................................................. 13

Everson v. Board, of Education, 330 U.S. 1, 67 S.Ct. 504,

91 L.Ed. 711 (1947) ..................................................... ----- 4, 7

Follett v. Town of McCormick, 321 U.S. 573, 64 S.Ct.

717, 88 L.Ed. 938 (1944) ...........................................-...... 4

Green v. County School Board, 391 U.S. 430, 88 S.Ct.

1689, 20 L.Ed.2d 716 (1968) ............................................ 14

Griffin v. School Board of Prince Edward County, 377

U.S. 218, 84 S.Ct. 1226, 12 L.Ed.2d 256 (1964) ....... 10

Griffin v. State Board of Education, 296 F. Supp. 1178

(E.D. Va. 1969) .................- ........................................... - 10

Haas v. Independent School Dist., 69 S.D. 303, 9 N.W.2d

707 (1943) ......................................................... - - .......... 8

Hall v. St. Helena Parish School Board, 197 F. Supp. 649

(D.C. E.D. La. 1961), affd. 368 U.S. 515 (1962) ....... 10

Lemon v. Kurtzman, 403 U.S. 602, 91 S.Ct. 2105, 29 L.

Ed.2d 745 (1971) .............................................................. 6,7

Meyer v. Nebraska, 262 U.S. 390, 43 S.Ct. 625, 67 L.Ed.

1042 (1922) ..........................................................-............ 15

Moose Lodge No. 107 v. Irvis, ....... U.S. ------, 92 S.Ct.

....... , 32 L.Ed.2d 627 (1972) .............................................11-12

Norwood v. Harrison, 340 F. Supp. 1003 (S.D. Miss.

1972) ................................................................................... 11

Palmer v. Thompson, 403 U.S. 217, 91 S.Ct. 1960, 29 L.

Ed.2d 438 (1971) ...................~~~............ -....................... 12

Pierce v. Society of Sisters, 268 U.S. 510, 45 S.Ct. 571,

69 L.Ed. 1070 (1925) .................................... -................. 9,15

Poindexter v. Louisiana Financial Assistance Commis

sion, 275 F. Supp. 833 (E.D. La. 1967), affd. 389 U.S.

571 (1968) ....................................... 10

Reitman v. Mulkey, 387 U.S, 369, 87 S.Ct. 1627, 18 L.

Ed.2d 830 (1967) ............................................................12,13

Ill

Shelley v. Kraemer, -334 U.S. 1, 68 S.Ct. 836, 92 L.Ed.

1161 (1948) ........................ -.............. -............................12,13

Simkins v. Moses H. Cone Hospital, 4 Cir., 1963, 323 F.2d

959, cert, denied, 376 U.S. 938 (1963) ....................... - 5

Smith v. Donahue, 202 App. Div. 656, 195 N.Y.S. 715

(1922) ................................................................................. 8

Swann v. Charlotte-Mecklenburg Board of Education,

402 U.S. 1, 91 S.Ct. 1267, 28 L.Ed.2d 554 (1971) ....... 14

Tilton v. Richardson, 403 U.S. 672, 91 S.Ct. 2091, 29 L.

Ed.2d 790 (1971) .............................................................. 5

Walz v. Tax Commission, 397 U.S. 664, 90 S.Ct. 1409,

25 L.Ed.2d 697 (1970) ....................................-.............. - 7

Wright v. City of Brighton, 441 F.2d 447 (5 Cir., 1971) .. 14

Wright v. City of Emporia, ...... U.S.......... , 92 S.Ct.

....... , 33 L.Ed.2d 51 ........................ -................................. 14

C onstitutional P rovisions

and S tatutes

Constitution of the United States—

First Amendment........ ......................................3, 4, 5, 6,16

Fourteenth Amendment .......... ........ 1, 3, 4, 6, 9,12,14, 16

Section 6656, Mississippi Code of 1942 ............................ 1, 8

20 U.S.C. 711, 721................................................................. 5

O ther A uthorities

93 A.L.R.2d 986, 987 (1964) .............................................. 8

13 J. Pub. L. 76, 79 (1964) .................... ........................... 8

43 Miss. L.J. 737 (1972) .............................. -........ -.......... 8

In the Supreme Court of the United States

OCTOBER TERM, 1972

No. 72-77

DELORES NORWOOD, ET AL.,

Appellants,

vs.

D. L. HARRISON, SR., ET AL.,

Appellees.

On A ppeal from the United States D istrict C ourt

for the N orthern D istrict of M ississippi

BRIEF OF APPELLEES

QUESTION PRESENTED

Whether §6656, Miss. Code 1942, providing loans of

state owned textbooks to all educable children violates the

Equal Protection Clause of the Fourteenth Amendment.

STATEMENT OF THE CASE

Delores Norwood and other members of the appel

lant’s class are black public; school students of the Tunica

County, Mississippi School District. The appellees, D. L.

Harrison, et al., are members of the Mississippi State Text

book Purchasing Board. The appellants, in attendance at

2

the desegregated unitary Tunica County School System,

brought suit to enjoin the defendants from providing or

permitting the distribution or sale of state owned text

books to private racially segregated schools and acade

mies.

The impression created by appellant’s Statement of

Facts as it involves Tunica and Holmes Counties, as well

as cities like Canton, Jackson, and Indianola, is that there

was a sub rosa transmutation of public to private schools.

The use of target districts is not representative of the pace

or scope of the development of private schools in Mis

sissippi. Certainly, these extreme examples are not con

sistent with the lower court’s finding that 90% of the

educable children remain in public schools.

Two other points need to be made concerning the

nature of the private schools in Mississippi. All of the

depositions of superintendents of the private schools dis

close an “ open enrollment” policy, the main criterion be

ing ability to pay. Thus, the characterization of the

schools as “private segregationist academies” [Brief of

Appellants, p. 11] is not ideologically correct. The super

intendents uniformly testified that their schools were

formed to provide quality education. The textbook law,

in their view, had nothing to do with the formation or

continuation of these schools.

Second, the factual findings from. Coffey v. State Edu

cational Finance Commission, 296 F’. Supp. 1389, 1392

(S.D. Miss. 1969) that the new schools were opened on

the “ thinnest financial basis” are stale findings of little

use in resolving this present controversy. Many of the

academies operate in new facilities; virtually none use

former public school properties. Many of the schools were

started after Coffey and its findings have little relevance

to them.

3

SUMMARY OF ARGUMENT

State-furnished textbooks to all educable children in

Mississippi serve a racially neutral and benevolent pur

pose. The degree of aid, if any, which textbook program

renders private education is insignificant. Books are

loaned to students at a per capita annual expense of $6.00.

The First Amendment’s prohibition of “Establish

ment” and the Fourteenth Amendment’s similar ban on

discrimination are analogous limitations. State aid to pu

pils in sectarian schools is constitutional where that aid

is to the student and not to the school per se. By the

same token, the State may grant benefits without regard

to race by means of free textbooks without offense to the

Fourteenth Amendment.

The Court below found that the provision for text

books was not vital to the private schools and that public

integrated education was secure. These findings are not

clearly erroneous however the test is framed. For the

existence of a constitutional violation, there must be a

partnership between private discrimination and State ac

tion that is “ symbiotic.” Here, private discrimination

rests on private choice and not any perceptible moving

hand of the State.

4

ARGUMENT

TEXTBOOK AID TO' INDIVIDUAL STUDENTS IS NOT

SIGNIFICANT INVOLVEMENT WITH THE BELIEFS OS

PRACTICES OF PRIVATE SCHOOLS

For the purpose of constitutional adjudication, the

contours of forbidden action under the First Amendment’s

establishment of religion clause should be analogous to

but more stringent than standards applicable to forbid

den state action under the Fourteenth Amendment. Just

as a state may not foster an established religion, it may

not support racial discrimination. This Court’s prece

dents concerning state provision for assistance to pupils

in sectarian schools require affirmance in this case. Board,

of Education v. Allen, 392 U.S, 236, 88 S.Ct. 1923, 20 L.Ed.2d

1060 (1968); Everson v. Board of Education, 330 U.S. 1,

67 S.Ct. 504, 91 L.Ed. 711 (1947); Abingdon School Dis

trict v. Schempp, 374 U.S. 203, 83 S.Ct. 1560, 10 L.Ed.2d

844 (1963).

Just as there is a line between state neutrality to

religion and state support of it, there is a line drawing func

tion in the Fourteenth Amendment cases between neu

trality toward and support of discrimination. Whether

government support is “ institutional” aid which violates

the Establishment Clause is certainly not a sufficient Four

teenth Amendment test for state action. However, identi

fying “ institutional” support for religion or segregation

certainly would point the Court toward further inquiry

into the state’s involvement, with private discrimination.

The rights protected or secured from abridgment under the

First Amendment are said to occupy a preferred position. Follett

v. Town of McCormick, 321 U.S. 573, 64 S.Ct. 717, 88 L.Ed. 938

(1944).

5

The appellant’s distinctions of equal protection and

Establishment Clause standards prove too much. Appel

lant perceives (Brief of Appellants, p. 32) that a construc

tion grant to a religious hospital is not unconstitutional,

where discrimination by such a hospital would be uncon

stitutional. Considered as a hypothetical, appellant’s con

clusion might not follow if a pure construction grant were

involved with no other strings.

If the hypothetical is correct, we stress that “ insti

tutional” aid is the quality that lends truth to it, not a

greater constitutional mission to stamp out discrimina

tion. Further, it is not so much the presence of state or

federal money but the ambience of public control and

supervision that follows it. Tilton v. Richardson, 403 U.S.

672, 91 S.Ct. 2091, 29 L.Ed.2d 790 (1971), the construc

tion grant example, concerned a straight grant under the

Higher Education Facilities Act of 1963, 20 U.S.C. 711,

721, while Simkins v. Moses H. Cone Hospital, 4 Cir., 1963,

323 F.2d 959, cert, denied, 376 U.S. 938 (1963), involved

Hill-Burton funds. It was not the grant per se that

caused the court to find state action in Simkins, but rather,

the elaborate analysis of state regulation inherent in the

program, exercise of a state function through the alloca

tion of medical care, and the presence of public trustees

on the boards of the hospitals.

Appellants also stress (Brief of Appellants, p. 33) that

religious and secular aims of both the aid and recipient

institution may be clearly delineated in First Amendment

cases. They say education and segregation, on the other

hand, are inextricably interwoven. This analysis assumes

a compactness and neatness in the religious-secular pur

pose distinction that does not exist. All state aid which

fuels the secular purpose of an institution has some in

cremental effect on the institution’s ability to further re

6

ligious doctrine. There is simply no more furtherance of

segregation with textbook aid than there is of a given

religious doctrine in a parochial school receiving similar

aid.

The state believes that this case is squarely governed

by Board of Education v. Allen, 392 U.S. 236, 88 S.Ct. 1923,

20 L.Ed.2d 1060 (1968). There, a New York statute re

quiring school districts to purchase and lend textbooks to

students enrolled in parochial as well as in public and

private schools was under attack. This Court held the

law was not in conflict with the First or Fourteenth

Amendments to the Constitution of the United States. As

the Court stated:

The express purpose of §701 was stated by the New

York legislature to be furtherance of the educational

opportunities available to the young. Appellants have

shown us nothing about the necessary effects of the

statute that is contrary to its stated purpose. The

lav/ merely makes available to all children the bene

fits of a general program to lend school books free of

charge. Books are furnished at the request of the

pupil and ownership remains, at least technically, in

the state. Thus no funds or books are furnished to

parochial schools and the financial benefit is to par

ents and children, not to schools. Perhaps free books

make it more likely that some children choose to

attend a sectarian school, but that was true of the

state-paid bus fares in Everson and does not alone

demonstrate an unconstitutional degree of support for

a religious institution. Id. at 1065, 66.

It is likewise certain from Lemon v. Kurtzman, 403

U.S. 602, 91 S.Ct. 2105, 29 L.Ed.2d 745 (1971), that

state aid to religious institutions which offends the

7

First Amendment is direct institutional aid which re

sults in an intertwined relationship between the gov

ernment and the religious authority. Id. at 757, “Neu

tral or nonideological services, facilities or materials” may

be provided free of the Establishment Clause if they are

given in common to all students. In striking down Penn

sylvania’s aid to defray teachers’ salaries in church-re

lated schools, the Kurtzman Court found that the aid ran

afoul of the carefully preserved distinction that aid must

flow to the student and not to the church-related school

per se. Id. at 760. Nonstudent centered financial assist

ance has likewise been upheld for churches but only in

the context where the involvement of the state is not ex

cessive and where there is no continuing call for state

surveillance or entanglement. Walz v. Tax Commission,

397 U.S. 664, 90 S.Ct. 1409, 25 L.Ed.2d 697 (1970). While

the tax exemption was to benefit the institution directly,

it was saved by virtue of its application to all denomina

tions and by the harshness that might be worked by tax

ing church property.

This Court has unerringly considered whether a given

enactment has a “ secular legislative purpose and a pri

mary effect that neither advances nor inhibits religion.”

Everson, supra, at 838. The fact that aid may have as

sisted a given religious institution did not, in the cited

cases, deflect this Court from considering the recipient

of the aid and not the institutional by-product of that as

sistance. Specifically, the Allen Court reaffirmed Coch

ran V. Louisiana State Board of Education, 281 U.S. 370,

50 S.Ct. 335, 74 L.Ed. 913 (1930), holding that statewide

provision for free textbooks to all students was permissi

ble under the Fourteenth Amendment in that the state

may further secular education through private schools as

a proper public concern.

8

The theory that §6656 is a measure benefiting chil

dren rather than schools has strong basis in fact. The

measure was originally sustained as one to encourage “the

promotion of intellectual and moral improvement” of the

citizens of the state. Chance v. Mississippi State Textbook

Rating and Purchasing Board, 190 Miss. 453, 200 So. 706

(1941). Neutrality in matters of private benefit was clear

enough:

It [the state] cannot control what one child may think,

but it can and must do all it can to teach the child

how to think. The state . . . should not . . . proscribe

him from benefits common to all.” Id. at 710.

The accent of private benefit is consistently carried out

by §6656 which provides for loans of the textbooks which

the students are free to carry to their homes. In the ab

sence of these benefits it is doubtful that the cost of books

would be borne by the schools in the absence of this stat

ute. Note, 43 Miss. L.J. 737 (1972).

Under this “ child benefit theory” the state may ex

tend certain welfare aid to students attending church

related schools in situations where general aid to the

parochial schools themselves would be unconstitutional,

13 J. Pub. L. 76, 79 (1964). The theory pales, however,

before a finding that such aid accrues to the benefit of

the schools themselves. Annot. 93 A.L.R.2d 986, 987

(1964); Smith v. Donahue, 202 App. Div. 656, 195 N.Y.S.

715 (1922); Haas v. Independent School Dist., 69 S.D. 303,

9 N.W.2d 707 (1943). The doubt surrounding the validity

of the theory was dispelled in Board of Education v. A l

len, 392 U.S. 236, 88 S.Ct. 1923, 20 L.Ed.2d 1060 (1968). The

court revivified the child benefit theory by characterizing

the legislation as benefiting the parent and child.

9

LOANED TEXTBOOKS TO ALL EBUCABLE CHILDREN

IS NOT SIGNIFICANT STATE AID TO

RACIAL DISCRIMINATION

This case once again calls for a formulation of the

character and degree of state aid which must exist to

render private action subject to the Fourteenth Amend

ment. Various formulations in which private-choice-state

aid equation have been framed—“significant aid,” “ sym

biotic relationship” tend to obscure inquiry into the cause-

effect relationship between the state action and private

action. One may find private discrimination, look for

some ingredient of state action and subjectively label the

result encouragement. Or, one may identify the state

action, look for its actual impact on private discrimina

tion, and determine whether it is state action or private

ordering that is actually producing the result.

This case also involves an accommodation between

the place public education must enjoy—as an outgrowth

of the “ affirmative duty” rationale— and the doctrine of

private choice embodied in Pierce v. Society of Sisters,

268 U.S. 510, 45 S.Ct. 571, 69 L.Ed. 1070 (1925). Thus,

the question is broader than the constitutionality of §6656.

It is whether the State may function neutrally, treating

both races alike, or whether it must adopt sanctions against

private education in the realm of State provided services

not significant enough to motivate private discrimination.

What we mean here is that State services such as police

and fire protection, public health protection, driver train

ing, and practice teachers trained in public universities

may in the aggregate be a greater financial aid to private

schools than books, but they would certainly not be piv

otal in imposing a choice to discriminate.

10

This court originally broached the issue of impermis

sible state aid to education in Hall v. St. Helena Parish

School Board, 197 F. Supp. 649 [D.C.E.D. La. 1961], affd.

368 U.S. 515 (1962). There at issue was a tuition grant

scheme with a transparent design of recasting public

schools into “private” ones. There was no colorable con

stitutional justification in Hall for the closing of the schools

or the mystical substitution of “private” for “ public”

character in the funding arrangement. Both Hall and

Griffin v. School Board of Prince Edward County, 377

U.S. 218, 84 S.Ct. 1226, 12 L.Ed.2d 256 (1964) invalidated

a total partnership between State action and private seg

regation, the one unavoidably leading to the other.

The tuition grant cases, Coffey v. State Educational

Finance Commission, 296 F. Supp. 1389 (S.D. Miss. 1969);

Poindexter v. Louisiana Financial Assistance Commission,

275 F. Supp. 833 (E.D. La. 1967), affd. 389 U.S. 571 (1968);

Griffin v. State Board of Education, 296 F. Supp. 1178

(E.D. Va. 1969), all have in common the active fostering

of alternatives to public education. Direct institutional

aid variously adjudged to be “ critical” , “ substantial” , or

“pivotal” to the new schools was, on the evidence, found

to be underpinning an ever-growing network of private

schools. Since these nominally private institutions were

financed almost entirely from the public treasury the

natural and reasonable effect of the tuition legislation was

to underwrite and encourage private discrimination.

Illustrative of the approach to tuition grants is that

of the Fifth Circuit. Treating Louisiana tuition grant

statute Judge Wisdom articulated a two-pronged test:

“Any aid to public schools that is the product of the

State’s affirmative, purposeful policy of fostering seg

regated schools and has the effect of encouraging dis

crimination is significant state involvement in private

11

discrimination (we distinguish therefore, state aid

from tax benefits, free school books, and other prod

ucts of the State’s traditional policy of benevolence

toward charitable and educational institutions), Poin

dexter v. Louisiana Financial Assistance Commission,

275 F. Supp. 833.”

Both Judge Wisdom’s test and his disclaimer for school

books are significant in that his rationale would void “any

state aid” if the purpose and effect were suspect.

The three-judge court below applied these tests and

sustained the act, Norwood v. Harrison, 340 F. Supp. 1003

(S.D. Miss. 1972). It wrote that “the free textbook pro

gram began without racial motivation. . .” and had been

uniformly applied, Id. at 1013. It found that there had

been no real encouragement of discrimination in that 90%

of the state’s educable children remained in public schools.

Finally, it discounted any notion that deprivation of the

books would “ roll-back” private school enrollment, Id, at

1013. On the issue of encouragement the court wrote:

Plaintiffs say that furnishing the free textbooks to

pupils in private schools encourages attendance at

such schools. This, of course, is conjectural, as there

is no substantial proof on that score. It occurs to us,

however, that if encouragement alone is a sufficient

test and if impermissible encouragement necessarily

follows from the issuance of the books and subsequent

attendance at a particular school, then the books may

not be issued to those attending private sectarian

schools (something which the Supreme Court has thus

far declined to invalidate) Id. at 1013.

Appellees stress both that “ encouragement” of dis

crimination was not found here and in fact may no longer

be constitutionally sufficient. The court seems in Moose

12

Lodge No. 107 v. Irvis, ....... U.S.......... , 92 S.Ct......... . 32

L.Ed.2d 627 (1972) to have moved back to the affirma

tive enforcement of discrimination rationale of Shelley v.

Kraetmer, 334 U.S, 1, 68 S.Ct. 836, 92 L.Ed. 1161 (1948)

rather than the subjective notion of “ encouragement” of

discrimination found in Reitman V. Mulkey, 387 U.S. 369,

87 S.Ct. 1627, 18 L.Ed.2d 830 (1967). Indeed Moose Lodge

avoids citing Reitman for any “encouragement” theory,

preferring to stress the “ symbolic” or alter ego relation

ship between state action and private conduct as an

nounced in Burton v. Wilmington Parking Authority, 365

U.S. 715, 81 S.Ct. 856, 6 L.Ed.2d 45 (1961). The relation

ship necessary between states and private entities to in

voke the Fourteenth Amendment is one in which the State

has “ insinuated itself into a position of interdependence

[with otherwise ‘private persons’ ] . . . that they must

be recognized as a joint participant in the challenged ac

tivity” . Id. at 52.

Burton’s reliance on significant multiple examples of

state aid in the construction of the parking facility, on the

one hand, and Moose Lodge’s insistence that there must

be some demonstrable way in which state regulation or

state benefits fosters racial discrimination, Id. at 637, 639,

seems to confine the contours of the Fourteenth Amend

ment to private action only if there is a significant inter

facing effect between private acts and state action.

Other cases decided since Reitman emphasize that it

turned very heavily on state court findings of encourage

ment of discrimination. Palmer v. Thompson, 403 U.S.

217, 91 S.Ct. 1960, 29 L.Ed.2d 438 (1971) is one:

In the first place there are no findings here about any

state “ encouragement” of discrimination. We need

not speculate upon such a possibility for there is no

such finding here, and it does not appear from the

13

record that there was evidence to support such a find

ing. Reitman v. MvXkey was based on a theory that

the evidence was sufficient to show the State was

abetting a refusal to rent apartments on racial grounds.

Id. at 444.

Similarly, Reitman was distinguished in Evans v. Abney,

396 U.S. 435, 90 S,Ct. 628, 24 L.Ed.2d 634 (1970) where

the effect of a state court’s termination of a discrimina

tory trust was in issue. A Reitman based argument was

offered that Georgia’s trust statutes, permissive on racial

discrimination, induced the testator to discriminate. It

was rejected since there was no evidence of such a mo

tive. Here appellants argue from the parallelism of pub

lic to private changeovers in certain target districts. But

what of the fact that 8,000 pupils in 41 schools spurn the

publicly provided textbooks? Is not the fact that 25%

of the private school pupils (consisting of 10% of the total

of pupils) opt out of the program sufficient to support

the lower court’s: holding of no encouragement. Certainly

the fact is enough to show that textbooks are not the sine

qua non of private education.

There is also a question of whether a neutral public

policy on books works any injury on the plaintiffs. A

state’s neutrality toward discrimination was even sanc

tioned in dictum in Reitman v. Mulkey: “ a state is per

mitted a neutral position with respect to private racial

discrimination” . Id. at 834. A state’s abstention from action

which would result in private discrimination was also

sanctioned in Shelley v. Kraemer, 334 U.S. 1, 19, 68 S.Ct.

836, 92 L.Ed. 1161, 1183.

Does the affirmative duty doctrine have any bearing

on the constitutionality of §6656? Appellants say that the

constitutionality of state policy in the context of the dual

14

system is measured by “ whether it hinders or furthers the

process of school desegration.” Wright v. City of Emporia,

U.S. ....... , 92 S.Ct. ____ , 33 L.Ed.2d 51. Whether the

keystone is effective “ disestablishment,” Green v. County

School Board, 391 U.S. 430, 88 S.Ct. 1689, 20 L.Ed.2d 716

(1968) or “ unitary” , Swann v. Charlotte-Mecklenburg

Board of Education, 402 U.S. 1, 91 S.Ct. 1267, 28 L.Ed.2d

554, 571 (1971), we cannot assume from the decisions of

this court that state action which bears any relationship

whatever to the interaction between public and private

education must be judged by that standard. Once the

duties of Swann and Green are met in the sense that the

public school system is composed of just schools—neither

white nor black—the affirmative duties are discharged.2

All a state must do is maintain a preferred competitive

position for public education. It should be required to

steer clear of institutional aid, but should not be required

to take sanctions against private education. This court

should reaffirm that there is still a constitutionally viable

choice between public and private education. Only where

the state by its hand points toward private discrimination

should the Fourteenth Amendment come into play.

Neither can §6656 be said to be a law neutral on its

face but having primary impact on the minority. Anderson

v. Martin, 375 U.S. 399, 84 S.Ct. 454, 11 L.Ed.2d 430 (1964).

In the context where all sorts of schools receive equal

treatment, no right of the plaintiffs is being frustrated.

2. The affirmative duty extends to establishing a unitary

system of public education, Green v. County School Board, supra,

Swann, supra, but apparently does not extend to mandating cen

tralized public education. In short, a state must undo all it has

done to further a dual system in facilities, staff, etc., but must not

attempt to coerce attendance in public schools. The distinction is

not at variance with the school property cases, Wright v. City of

Brighton, 441 F.2d 447, 5 Cir. (1971), et al., since they involve

institutional aid which is a special burden on the racial minority.

Here the textbook law is neutral in origin and impact.

15

It is private choice and not school books that is luring

students from the public schools. Moreover, the plaintiff’s

constitutional right is one of attendance at schools, not at

tendance with pupils.

Assuming a constitutional right to opt out of the

system, Pierce v. Society of Sisters, 268 U.S. 510, 45 S.Ct.

571, 69 L.Ed. 1070 (1925); Meyer v. Nebraska, 262 U.S. 390,

43 S.Ct. 625, 67 L.Ed. 1042 (1922), the statutory provision

for books at every school, antedating the entire integra

tion controversy, would seem to work no injury on students

in one system by those in another. Appellants’ theory of

“ frustration” is simply too broad and too selective to be

viable. They exempt from the prohibition private schools

antedating the so-called white flight, parochial schools

said not to have provided a refuge to white students and

certain “ other” schools (Brief of Appellants, p. 7). If in

jury is wrought on the plaintiffs by erosion of white at

tendance why does not the principle have broader reach?

Considerations of the possible relief in this case make

clear the difficulty in ruling for the appellants. Deter

minations would have to be made as to the quantity of in

tegration necessary for a private school to avoid, a. ban

on textbooks. Since attendance is totally voluntary in

these schools, exclusion of black pupils cannot be assumed

from attendance in numbers that would be clearly in

sufficient in a public school. Moreover, stated “ open door”

policies would have to be looked into. Even though

Catholic schools are exempted from the requested relief,

there is a grave question whether their black enrollment

would be sufficient to come out from under the requested

ban. Finally, should not each school have its day in court

on its enrollment policies? These obstacles to consistent

and efficacious relief strongly counsel in favor of affirming

the judgment of the District Court.

16

CONCLUSION

State furnished textbooks avoid the Fourteenth

Amendment’s proscriptions because they (1) are provided

to children of all races, (2) serve a benevolent purpose and

(3) provide a benefit to the child and not his chosen in

stitution.

By analogy to the First Amendment Establishment

Clause cases, textbook aid serves a secular function which

the state may further. Based on the findings of fact that

the aid does not encourage discrimination or significantly

abet a private choice to discriminate, there is no Four

teenth Amendment violation. The holding of Cochran v.

Louisiana State Board of Education that textbook aid is a

proper public concern remains good law.

Respectfully submitted,

A. F. Su m m e r , Attorney General

State of Mississippi

W il l ia m A. A llain ,

First Assistant Attorney General

State of Mississippi

H eber L adner, Jr ., Special Assist

ant Attorney General

State of Mississippi

Post Office Box 220

Jackson, Mississippi