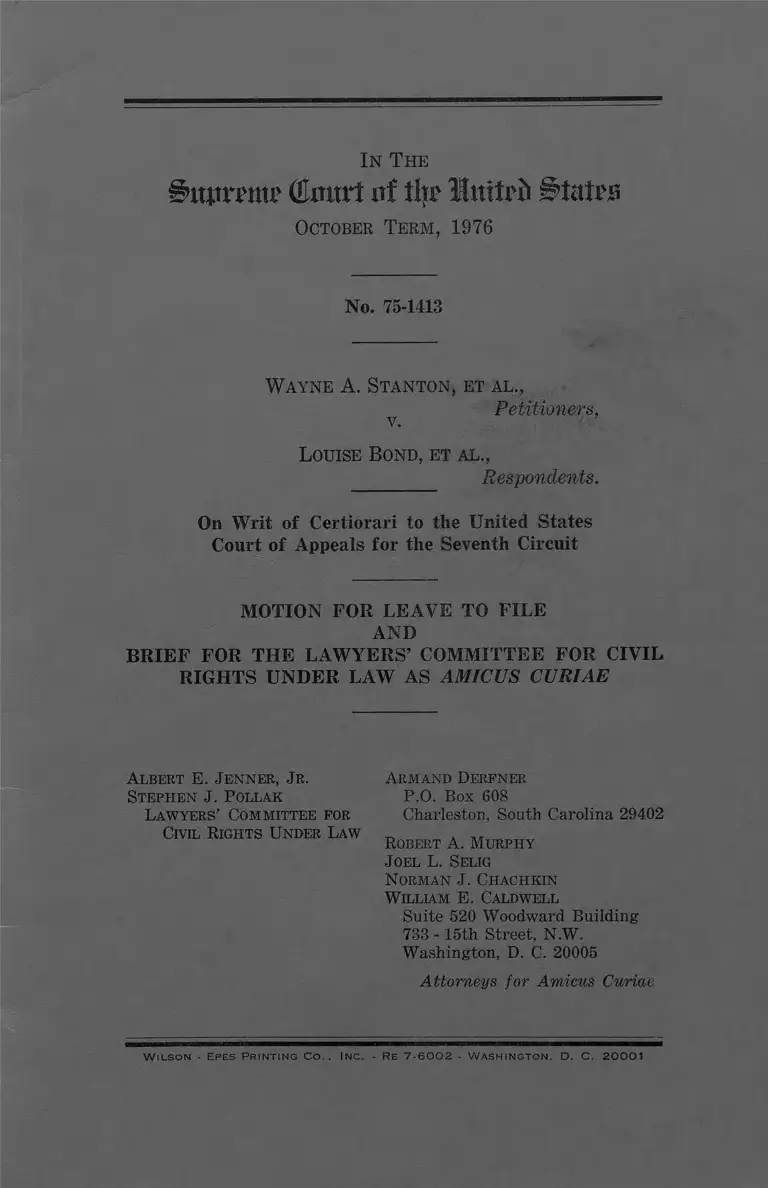

Stanton v. Bond Motion for Leave to File and Brief Amicus Curiae

Public Court Documents

October 4, 1976

Cite this item

-

Brief Collection, LDF Court Filings. Stanton v. Bond Motion for Leave to File and Brief Amicus Curiae, 1976. ae64a1fe-c49a-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/1ec80a1b-1a7d-4e2c-a6a7-1e43bb47cb91/stanton-v-bond-motion-for-leave-to-file-and-brief-amicus-curiae. Accessed February 22, 2026.

Copied!

I n T h e

i>tutn>mr Glmttl itf tljj? Imtrft

October Term, 1976

No. 75-1413

Wayne A. Stanton, et al.,

Petitioners,v.

Louise Bond, et al.,

_________ Respondents.

On Writ of Certiorari to the United States

Court of Appeals for the Seventh Circuit

MOTION FOR LEAVE TO FILE

AND

BRIEF FOR THE LAW YERS’ COMMITTEE FOR CIVIL

RIGHTS UNDER LAW AS AMICUS CURIAE

A lbert E. Jenner, Jr.

Stephen J. Pollak

Lawyers’ Committee for

Civil Rights Under Law

Armand Derfner

P.O. Box 608

Charleston, South Carolina 29402

Robert A. Murphy

Joel L. Selig

Norman J. Chachkin

William E. Caldwell

Suite 520 Woodward Building

733 - 15th Street, N.W.

Washington, D. C. 20005

Attorneys for Amicus Curiae

W i l s o n - Ep e s Pr i n t i n g C o . . In c . - R e 7 - 6 0 0 2 - W a s h i n g t o n . D. C. 2 0 0 0 1

In The

Bupvmm (to rt itf % Imtrft S>tut?s

October Term, 1976

No. 75-1413

Wayne A. Stanton, et al.,

Petitioners,

v.

Louise Bond, et al.,

Respondents.

MOTION FOR LEAVE TO FILE BRIEF AMICUS CURIAE

Amiens curiae Lawyers’ Committee for Civil Rights

Under Law respectfully seeks leave to file the attached

Brief in order to assist the Court in resolving an issue

of critical importance— the power of a federal court to

award attorneys’ fees against state officials. The Law

yers’ Committee’s interest in this case stems from its

longstanding" concern with the problem of devising reme

dies that will secure the effective enforcement of federal

civil rights laws, as more fully described in the “ Interest

of Amicus Curiae” section of the attached Brief. In this

connection, the Lawyers’ Committee has been especially

concerned for a number of years with issues relating to

the award of attorneys’ fees in civil rights cases, and

has filed briefs as amicus curiae in this Court in such

cases as Bradley v. School Bd. of Richmond, 416 U.S. 696

(1974); Alyeska Pipeline Service Co. v. Wilderness So

ciety, 421 U.S. 240 (1975) ; and Fitzpatrick v. Bitzer,

44 U.S.L.W. 5120 (U.S. June 28, 1976), as well as in

various federal Courts of Appeals and state courts.

As of the time at which this Brief must be printed,

amicus has received consent from the Respondents but

has not yet been notified whether the Petitioner will con

sent to the filing of this Brief. (A copy of the Respond

ents’ letter of consent has been filed with the Clerk of

this Court).

WHEREFORE, amicus Lawyers’ Committee for Civil

Rights Under Law respectfully moves that its Brief be

filed in this case.

Respectfully submitted,

Armand Derfner

P.O. Box 608

Charleston, South Carolina 29402

Robert A. Murphy

Joel L. Selig

Norman J. Chachkin

W illiam E. Caldwell

Lawyers’ Committee for

Civil Rights Under Law

Suite 520 Woodward Building

733 - 15th Street, N.W.

Washington, D. C. 20005

Attorneys for Amicus Curiae

TABLE OF CONTENTS

Table of Authorities .........

Interest of Amicus Curiae

Argument .............................

Conclusion .............................

TABLE OF AUTHORITIES

Cases

Allen v. Illinois, 397 U.S. 337 (1970) .......................

Allen V. State Board of Elections, 393 U.S. 544

(1969) ..............................................-.............................

Alyeska Pipeline Service Co. v. Wilderness Society,

421 U.S. 240 (1975) ............ -.....................................2

Amos v. Sims, 409 U.S. 942 (1972) aff’g 340 F.

Supp. 691 (M.D. Ala. 1972) -----------------------------

Bond V. Stanton, 528 F.2d 688 (7th Cir. 1976) ......

Boston Chapter NAACP, Inc. V. Beecher, 504 F.2d

1017 (1st Cir. 1974), cert, denied, 421 U.S. 910

(1975) .................. ..........................................................

Bradley V. School Board of Richmond, 416 U.S.

696 (1974) ................................ .....................................

Chapman v. Meier, 420 U.S. 1 (1975)........................

Cherokee Nation V. Oklahoma, 397 U.S. 620

(1970) ............................................................................

Class V. Norton, 505 F.2d 123 (2d Cir. 1974) ........

Connor V. Williams, 401 U.S. 549 (1972) .................

Edelman V. Jordan, 415 U.S. 662 (1974) ...............-5

Epperson V. Arkansas, 393 U.S. 97 (1968) ............

Ex parte Young, 290 U.S. 123 (1908) .................3,4

Fairmont Creamery Co. V. Minnesota, 275 U.S. 70

(1927) - ......... -................................................- ......... 3,

Fitzpatrick v. Bitzer, 44 U.S.L.W. 5120 (U.S. June

28, 1976) ....................................................................... 2

General Oil Co. v. Crain, 209 U.S. 211 (1908) ........

Goldfarb V. Virginia State Bar, 421 U.S. 773

(1975) ............................................. ..............................

Hans v. Louisiana, 134 U.S. 1 (1890) .......................

Page

I

1

3

11

9

6

, 8,10

10

10

7

2

6

7

7,10

6

, 7,10

6

, 5,11

6, 7,8

:, 8,10

4

7

7

II

TABLE OF AUTHORITIES— Continued

Page

Jenkins V. Georgia, 418 U.S. 153 (1974) _________ 6

Jordan V. Gilligan, 500 F.2d 701 (6th Cir. 1974),

cert, denied, 421 U.S. 991 (1975) ______________ 10

Keyes V. School District No. 1, 413 U.S. 189

(1973) ._....................... ............................... ...... ............ 7

McClanahan V. State Tax Commission of Arizona,

411 U.S. 164 (1973) _____________________________ 6-7

McCrary V. Runyon, 44 U.S.L.W. 5034 (U.S. June

25, 1976) ............................................... 9

Milliken V. Bradley, 418 U.S. 717 (1974) _________ 7

National Hockey League V. Metropolitan Hockey

Club, Inc., 44 U.S.L.W. 3754 (U.S. June 30,

1976) _____________ 10

Skehan V. Board of Trustees, 501 F.2d 31 (3d Cir.

1974), vacated, 421 U.S. 983 (1975) ____ _______ 10

Souza V. Travisono, 512 F.2d 1137 (1st Cir.), va

cated, 423 U.S. 809 (1975) ___________ ___ ______ 10

Spence V. Washington, 418 U.S. 405 (1974) ....... . 6

Thonen V. Jenkins, 517 F.2d 3 (4th Cir. 1975) ___ 10

Constitution and Statutes

United States Constitution:

Article III .............. ....................... .......................... 6, 7

Eleventh Amendment ........................................... 4, 5

United States Code:

5 Stat. 518 ............. ................ ....... ..... .......... ........ 8

10 Stat. 161 ............................................................. 8

28 U.S.C. 1920 ........................................................ 8

28 U.S.C. 1923 ........................................................ 8

Federal Rules of Appellate Procedure

Rule 38 ......... 9

Federal Rules of Civil Procedure

Rule 37(a) (4) ........................................................ 9

Rule 37 (c) ............................................................... 9

Ill

TABLE OF AUTHORITIES— Continued

Other Authorities Page

C. Wright, Handbook of the Law of Federal Courts

(2d Ed. 1970) ............................................. 4

Note, Attorneys’ Fees and the Eleventh Amend

ment, 88 HARV.L.REV. 1875 (1975) ..................... 7

In The

itpronr (tort of t!?r llntlpb Btntxn

October Term, 1976

No. 75-1413

Wayne A. Stanton, et al.,

Petitioners,

v.

Louise Bond, et al.,

Respondents.

On Writ of Certiorari to the United States

Court of Appeals for the Seventh Circuit

BRIEF FOR THE LAW YERS’ COMMITTEE FOR CIVIL

RIGHTS UNDER LAW AS AMICUS CURIAE

Interest of Amicus Curiae

The Lawyers’ Committee for Civil Rights Under Law

was organized in 1963 at the request of the President

of the United States, John F. Kennedy, to involve private

attorneys throughout the country in the national effort

to assure civil rights to all Americans. The Committee’s

membership today includes two former Attorneys Gen

eral, fourteen past Presidents of the American Bar As

sociation, two former Solicitors General, a number of law

2

school deans, and many of the nation’s leading lawyers.

Through its national office in Washington, D.C. and its

offices in Jackson, Mississippi and eleven other cities,

the Lawyers’ Committee over the past thirteen years

has enlisted the services of over a thousand members of

the private Bar in addressing the legal problems of

minorities and the poor in voting, education, employ

ment, housing, municipal services, and the administra

tion of justice.

The primary objective of the Lawyers’ Committee is

to help develop the legal resources necessary to enforce

fully the civil rights of minorities and the poor. Through

the efforts of the Lawyers’ Committee and similar groups,

a great deal of high-quality legal service has been pro

vided by the volunteer activities of the private Bar.

However, the experience of the Lawyers’ Committee over

the past decade compels the conclusion that these valu

able but limited legal resources are inadequate by them

selves to effectuate fully the basic civil rights created

by Congress and embodied in the Constitution.

Accordingly, we have participated as amicus curiae in

recent cases in this Court concerning awards of counsel

fees in civil rights litigation, Bradley v. School Bd. of

Richmond, 416 U.S. 696 (1974) ; Alyeska Pipeline Service

Co. V. Wilderness Society, 421 U.S. 240 (1975) ; Fitz

patrick V. Bitzer, 44 U.S.L.W. 5120 (U.S. June 28, 1976),

because we have concluded that such awards are essential

elements of the relief appropriate for those who have

vindicated federal rights which depend in large measure

upon private enforcement. Such awards also serve other

essential functions in cases such as the one at bar, for

they make available to federal judges an appropriate

sanction in controlling the conduct of litigants and they

provide an effective deterrent to others who would litigate

in an unacceptable manner.

3

In the instant case the petitioners, who are state

officials, do not challenge (and do not raise any question

concerning) the finding that they acted in bad faith and

that the attorneys’ fees awarded by the courts below are

therefore appropriate under established equitable prin

ciples. In these circumstances the only question is

whether state officials who have in fact litigated in bad

faith are nonetheless immune to an award of attorneys’

fees which would concededly be proper against any other

litigant.

The Lawyers’ Committee litigates a variety of civil

rights cases against state governments and their officials.

To permit state officials who litigate in bad faith to

clothe themselves with this kind of immunity will have

a pernicious effect on our efforts to require state govern

ments to live up to their legal and Constitutional obliga

tions. Amicus therefore has a vital interest in this

matter and in urging this Court to affirm the award of

attorneys’ fees.

ARGUMENT

Petitioners do not argue that federal courts lack power

to grant attorneys’ fees as costs against parties in gen

eral who are guilty of litigating in bad faith. Rather,

petitioners’ sole challenge is that, as state officials, they

alone are not subject to such costs. That argument is

foreclosed by this Court’s decisions' in Ex parte Young,

290 U.S. 123 (1908), and Fairmont Creamery Co. v.

Minnesota, 275 U.S. 70 (1927), two cases not cited by

the petitioners.

Analysis of the petitioners’ defenses here must begin

with Ex parte Young, for it is that case which gives

rise to the respondents’ right to bring this suit against

state officials. The doctrine that state officers are suable,

established by Ex parte Young, has been called “ indis

pensable to the establishment of constitutional govern

4

ment and the rule of law.” C. Wright, Handbook of the

Law of Federal Courts 186 (2d ed. 1970). That doc

trine is a fundamental mechanism for enforcing federal

rights and protecting citizens from violations of their

federal rights committed in the name of their state gov

ernment. As this Court said in General Oil Co. v. Crain,

209 U.S. 211, 226 (1908), decided the same day as Ex

parte Young:

Necessarily to give adequate protection to constitu

tional rights a distinction must be made between

valid and invalid state laws, as determining the

character of the suit against state officers. And the

suit at bar illustrates the necessity. I f a suit against

state officers is precluded in the national courts by

the 11th Amendment to the Constitution, and may

be forbidden by a state to its courts, as it is con

tended in the case at bar that it may be, without

power to review by this court, it must be evident

that an easy way is open to prevent the enforcement

of many provisions of the Constitution; . . .

The doctrine of Ex parte Young, and the remedies

available once state officials are properly before the fed

eral courts, are not unlimited. Two years ago this Court

defined a major boundary when it held that back pay

ments of welfare benefits could not be required of the

states—no matter whether such payments were called

1 Nor did the Court regard this as a fanciful possibility, for it

was fully aware that government officials may misuse their power

even where they do not deliberately set out to interfere with con

stitutional rights:

Zeal for policies, estimable, it may be, of themselves, may over

look or underestimate private rights. The swift execution of

the law may seem the only good, and the rights and interests

which obstruct it be regarded as a kind of outlawry. See Ex

parte Young, where this subject is fully discussed and the cases

reviewed.

209 U.S. at 227.

5

damages or equitable restitution. Edelman v. Jordan, 415

U.S. 662 (1974).

Edelman acknowledges that the difference between re

lief barred by the Eleventh Amendment and that per

mitted under Ex parte Young is often subtle, 415 U.S.

at 667. While characterizing the Eleventh Amendment as

a protection of the state treasury from potentially ruin

ous money awards, Edelman recognizes that many forms

of equitable relief have great fiscal impact on state

treasuries ; but such an “ ancillary effect” is a “permissible

consequence” of Ex parte Young. 415 U.S. at 668. Edel

man essentially draws the line between “ a monetary loss

resulting from a past breach of legal duty on the part

of the defendant state officials” (direct effect), and pay

ments which are a necessary consequence of the suit

itself (ancillary effect). 415 U.S. at 668.

The distinction is decisive in this case. The normal

incidents and consequences of a federal court action—

e.g., filing costs, witness fees, and properly awarded at

torneys’ fees— are ancillary in nature. Such incidents

of litigation are not in the nature of actions on pre

existing state debts; they are not “ a monetary loss re

sulting from a past breach of legal duty.” They do not

derive from the prior conduct of the state or its officials

which gave rise to the underlying cause of action. They

are not designed to compensate, nor to provide repara

tions for, the victims of unlawful conduct. Except for the

fact that such costs of litigating also involve dollars,

there is no resemblance to the “ award of damages against

the State” which is forbidden by Edelman. 415 U.S. at

668.

Rather, the attorneys’ fees at issue here are an inci

dental expense of the litigation itself and, as such, are

within a court’s inherent power to control the litigation

before it. That power was affirmed a half century ago

6

in Fairmont Creamery Co. v. Minnesota, 275 U.S. 70

(1927). In that case, Minnesota made the explicit claim

that, as a sovereign state, it could not be taxed with the

prevailing party’s costs of suit. This Court held that

a state can be made to bear the expenses of proceedings

in federal court:

But is the state to be regarded as the sovereign here?

This court is not a court created by the state of

Minnesota. The case is brought by a writ of error

issued under the authority of the United States by

virtue of the Constitution of the United States. It

is not here by the state’s consent but by virtue of a

law, to which it is subject. Though a sovereign, in

many respects, the state when a party to litigation

in this court loses some of its character as such.

275 U.S. at 74. The practice of taxing costs against

states in the same way as against other litigants has been

invariable and has continued to this day.2

2 Amicus State of California (though not the petitioners) at

tempts to limit Fairmont Creamery on the ground that the case

began as a criminal prosecution brought by the State of Minnesota.

But this Court made it clear that no such limitation was intended,

and that the power to tax costs against any litigant attaches in all

eases properly within the Article III jurisdiction of a court of the

United States. Thus, the Court “ treat[ed] the state just as any

other litigant, and imposfed] costs on it as such,” 275 U.S. at 77;

and it referred to 129 cases, dating back to 1860, which show that

“ the invariable practice has been when the judgment has been

against a state in both civil and criminal cases to adjudge costs

against it.” Id.

The Court has continued to apply the Fairmont Creamery rule,

without distinction, to tax costs against states, state agencies, and

state officials; in cases coming up from the federal courts and from

the state courts; and in cases where the states are plaintiffs and in

cases where the states are defendants. See, e.g., the judgments in

Jenkins V. Georgia, 418 U.S. 153 (1974); Spence V. Washington,

418 U.S. 405 (1974) ; Epperson V. Arkansas, 393 U.S. 97 (1968);

Allen V. State Board of Elections, 393 U.S. 544 (1969); Connor v.

Williams, 401 U.S. 549 (1972) ; Chapman V. Meier, 420 U.S. 1

(1975) ; McClanahan V. State Tax Commission of Arizona, 411

7

The attorneys’ fee issue in this case is settled by the

decision in Fairmont Creamery because such fees are

costs of litigation. They are “ incidents of the hearing,”

which “ attach to the regular jurisdiction” of a court of

the United States under Article III of the Constitution.

275 U.S. at 77.

The equivalence of costs and fees is established by

function and tradition. Both are closely related to a

court’s power and obligation to manage the litigation

before it. And their amount varies with the nature,

length and complexity of the litigation itself.3

In keeping with their functional equivalence, fees have

traditionally been regarded by Congress as in the nature

U.S. 164 (1973); Goldfarb V. Virginia State Bar, 421 U.S. 773

(1975); Cherokee Nation V. Oklahoma, 397 U.S. 620 (1970).

The question has been raised again recently, and the rule of

Fairmont Creamery reiterated by two courts of appeals. Boston

Chapter NAACP, Inc. V. Beecher, 504 F.2d 1017, 1028 (1st Cir.

1974), cert, denied, 421 U.S. 910 (1975); Class v. Norton, 505 F.2d

123 (2d Cir. 1974).

3 A recurring theme of the state immunity cases has been concern

about the potentially ruinous effect unregulated monetary awards

might have upon state treasuries. This concern was most acute in

cases like Hans v. Louisiana, 134 U.S. 1 (1890), involving the size

of the state’s debt, but it was also alluded to in Edelman V. Jordan,

415 U.S. 662, 665-66 (1974). In this respect, while an attorneys’

fee award will ordinarily be larger than the other costs taxed in

a given case, both are invariably so limited that neither could dis

rupt a state treasury. Indeed, most attorneys’ fee awards are

miniscule compared with the dollar expense of complying with an

injunction. Moreover, many cases involve other taxable costs which

are larger than most attorneys’ fee awards. Compare the $2,366

attorneys’ fee granted in this case with the costs awarded in this

Court alone in such cases as Milliken V. Bradley, 418 U.S. 717

(1974) ($20,329.60) ; Keyes v. School District No. 1, 413 U.S. 189

(1973) ($28,905.48). See also the listing of attorneys’ fees in

volved in other cases involving state officials in Note, Attorneys’

Fees and the Eleventh Amendment, 88 TIarv. L. Rev. 1875, 1896

n.126 (1975).

8

of costs.4 For example, attorneys’ fees have been in

cluded among those costs regulated by general cost

statutes, such as the Act of August 23, 1842, which gave

this Court power (5 Stat. 518) :

to make and prescribe a table of the various items

of costs which shall be taxable and allowed in ail

suits, to the parties, their attorneys, solicitors, and

proctors, to the clerk of the court, to the marshal

of the district, and his deputies, and other persons

serving processes, to witnesses, and to all other per

sons whose services are usually taxable in bills of

costs.

The same pattern was followed in 1853 when Congress

itself undertook to set attorneys’ fees (10 Stat. 161),

and has continued to the present in the form of 28

U.S.C. §§ 1920 and 1923. Under these provisions, attor

neys’ fees are retained as taxable costs.

The virtual identity of fees and other items of costs

was recognized in an amicus brief filed by Indiana (pe

titioners here) and 19 other states in Fitzpatrick v.

Bitzer, 44 U.S.L.W. 5120 (U.S. June 28, 1976) : “ Costs

taxed against the state, however minimal, nevertheless

are paid from the state treasury, as are attorneys’ fees

awarded against the state.” Brief of the Commonwealths

of Pennsylvania and Virginia, et al., as amici curiae in

No. 75-283, at p. 25. From this, these state amici con

cluded flatly that “Fairmont Creamery should be explicitly

overruled.” Id. We agree with these state amici (in Fitz

patrick) that the attorneys’ fee award cannot be re

versed unless this Court is to overrule Fairmont Cream

ery and leave states and state officials— unlike any other

4 It is true that the general American rule treats attorneys’ fees as

a cost which is not ordinarily taxable, but as this Court only re

cently reiterated, that is a matter of statute or equitable discretion,

not a matter of constitutional power. Alyeska Pipeline Service Co.

v. Wilderness Society, 421 U.S. 240, 270-71 (1975).

9

party— immune from such routine litigation expenses as

the costs of filing, service of process, court transcripts,

discovery sanctions, appeal bonds, and proceedings be

fore special masters. Nothing in the Constitution, our

federal system, or an unbroken century of judicial prac

tice commands such an anomalous result.

In no situation are the foregoing principles more apt

than where parties— in this case state officials represented

by state lawyers— have been guilty of bad faith litiga

tion. Courts have traditionally exercised their “ inherent

power” to control litigation by awarding attorneys’ fees

against those who have “acted in bad faith, vexatiously,

wantonly, or for oppressive reasons.” McCrary v. Run

yon, 44 U.S.L.W. 5034, 5041 (U.S. June 25, 1976). With

out the power to control such behavior, the courts are

degraded and their constitutional function is severely

eroded. Cf. Allen v. Illinois, 397 U.S. 337, 347 (1970).

The State of California, amicus herein, recognizes the

anomaly of depriving federal courts of the power to regu

late litigants’ behavior, and advances the startling pro

posal that in injunctive suits the courts’ only regulatory

device is the contempt power. Amicus Brief, pp. 10-11.

A more intrusive remedy could hardly be imagined, yet

California is correct in saying that contempt citations

are the only alternative. While we agree that courts do

have the power to issue contempt citations to those, even

state officials, who litigate in “bad faith, vexatiously,

wantonly, or for oppressive reasons,” we also believe that

the range of sanctions and deterrents available to federal

judges should not be limited to the one which they, un

derstandably, are most reluctant to invoke against state

officials.5 Having the contempt power, it follows a fortiori

5 If petitioners’ position is accepted, then of course it would be

unconstitutional to apply to state officials the provisions of Rules

37(a)(4) and 37(c), Fed. R. Civ. P., or Rule 38, F.R. App. P.,

i.e., no attorneys’ fees could be imposed for willful failure to make

10

that federal courts have the lesser power to award at

torneys’ fees in cases, like this, of undisputed bad faith

litigation.

The availability of fees against state officials who liti

gate in bad faith has been affirmed by this Court as

recently as four years ago. Amos v. Sims, 409 U.S. 942

(1972), aff’g 340 F. Supp. 691 (M.D. Ala. 1972). In

that case, the district court, having found bad faith in

the long failure to reapportion, awarded attorneys’ fees

against state officials who included the Governor, At

torney General and Secretary of State. On appeal to this

Court, those officials argued that such an award was

“ tantamount to the award of a money judgment against

the State of Alabama in direct violation of the doctrine

of sovereign immunity.” Jurisdictional Statement, p. 17.

This Court summarily affirmed, in a decision to which it

referred in Alyeska Pipeline Service Co. v. Wilderness

Society, 421 U.S. 240, 270 n.46 (1975).6

discovery or willful failure to admit, nor could damages and single

or double costs be taxed for taking a frivolous appeal. This Court,

however, has only recently emphasized the need for a broad range

of sanctions, “not merely to penalize those whose conduct may be

deemed to warrant such a sanction, but to deter those who might

be tempted to such conduct in the absence of such a deterrent.”

National Hockey League V. Metropolitan Hockey Club, Inc., 44

U.S.L.W. 3754, 3755 (U.S. June 30, 1976).

6 Since Edelman, four circuits have upheld awards of attorneys’

fees against state officials. Class V. Norton, 505 F.2d 123 (2d Cir.

1975); Souza V. Travisono, 512 F.2d 1137 (1st Cir. 1975), vacated,

423 U.S. 809 (1975); Thonen V. Jenkins, 517 F.2d 3 (4th Cir.

1975) ; Bond v. Stanton, 528 F.2d 688 (7th Cir. 1976) (the instant

case). See also Fitzpatrick v. Bitzer, supra.

Two circuits, however, have found such fee awards indistinguish

able from the retroactive welfare payments condemned in Edelman.

Skehan V. Board of Trustees, 501 F.2d 31 (3d Cir. 1974), vacated,

421 U.S. 983 (1975); Jordon V. Gilligan, 500 F.2d 701 (6th Cir.

1974), cert, denied, 421 U.S. 991 (1975). The two courts which have

denied attorneys’ fees against state officials in reliance on Edelman

have focused only on the fact that money is to be paid from the state

treasury, and have ignored the distinction between direct and

ancillary effects on state treasuries.

11

The petitioners, here approach this Court, after entry

of judgment against them and after undisputed findings

that they litigated in bad faith, and assert that the most

fundamental rules, applicable in their nature to all liti

gants, cannot touch them. Acceptance of their argument

would destroy the meaning of Ex parte Young, hasten

the erosion of the rights of the people of this Nation, and

deprive the federal courts of a relatively mild but effec

tive deterrent against bad faith litigation.

The lower courts’ orders awarding attorneys’ fees

should be affirmed.

Respectfully submitted,

CONCLUSION

A lbert E. Jenner, Jr.

Stephen J. Pollak

Lawyers’ Committee for

Armand Derfner

P.O. Box 608

Charleston, South Carolina 29402

Civil Rights Under Law Robert A. Murphy

Joel L. Selig

Norman J. Chachkin

W illiam E. Caldwell

Suite 520 Woodward Building

733 - 15th Street, N.W.

Washington, D. C. 20005

Attorneys for Amicus Curiae