Goldsboro Christian Schools, Inc. v. United States Supplemental Memorandum for the United States

Public Court Documents

February 1, 1982

Cite this item

-

Brief Collection, LDF Court Filings. Goldsboro Christian Schools, Inc. v. United States Supplemental Memorandum for the United States, 1982. fdcc538f-b39a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/241039c1-a285-47d2-8fbe-9dcc1568627c/goldsboro-christian-schools-inc-v-united-states-supplemental-memorandum-for-the-united-states. Accessed February 26, 2026.

Copied!

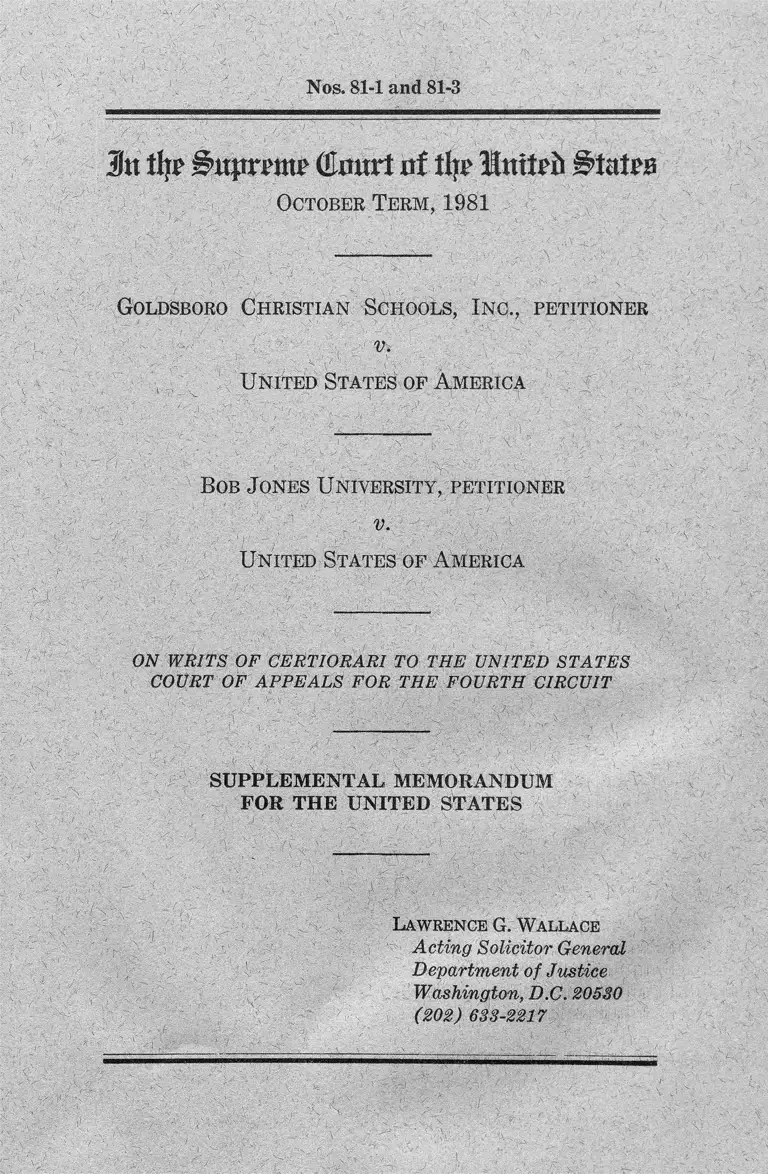

Nos. 81-1 and 81-3

October Term, 1981

Goldsboro Christian Schools, Inc., petitioner

v.

United States of America

Bob J ones U niversity, petitioner

v.

United States of America

ON WRITS OF CERTIORARI TO THE UNITED STATES

COURT OF APPEALS FOR THE FOURTH CIRCUIT

SUPPLEMENTAL MEMORANDUM

FOR THE UNITED STATES

Lawrence G. Wallace

Acting Solicitor General

Department of Justice

Washington, D.C. 20530

(202) 633-2217

In tip (tart nf % HHnitvb BMm

October Term, 1981

No. 81-1

Goldsboro Christian Schools, Inc., petitioner

v.

United States of America

No. 81-3

Bob J ones University, petitioner

v.

U nited States of America

ON WRITS OF CERTIORARI TO THE UNITED STATES

COURT OF APPEALS FOR THE FOURTH CIRCUIT

SUPPLEMENTAL MEMORANDUM

FOR THE UNITED STATES

We wish to inform the Court that on January 25,

1982, the government filed a response to the Plain

tiffs’ Motion to Vacate Stay of Proceedings, etc., in

(1)

2

the related litigation styled Green v. Regan, Civ.

Action No. 1355-69 (D.D.C.).

For the convenience of the Court, we have re

printed that response in the Appendix, infra. At

tached to that response is a copy of proposed legisla

tion submitted by the President on January 18, 1982,

which would give the Secretary of the Treasury and

the Internal Revenue Service express authority to

deny tax-exempt status to private non-profit educa

tional organizations with racially discriminatory

policies. Copies of the statement by the White House

press secretary, the proposed bill, the text of Presi

dent Reagan’s letter to the President of the Senate

and the Speaker of the House, the Press Release of

the Department of the Treasury dated January 18,

1982, and an affidavit of the Assistant Commissioner

of the Internal Revenue for Employee Plans and

Exempt Organizations, were attached to the govern

ment’s response in Green and are likewise reproduced

for the information of the Court. We are advised

that both the House Ways and Means Committee and

the Senate Finance Committee have scheduled hear

ings on the President’s proposal in early February,

1982.

Respectfully submitted.

Lawrence G. Wallace

Acting Solicitor General *

February 1982

* The Solicitor General is disqualified in these cases.

l a

APPENDIX

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF COLUMBIA

Civil Action No. 1355-69

W illiam H. Gkeen, et al,, plaintiffs

v.

Donald T. Regan, et al., defendants

DEFENDANTS’ RESPONSE TO PLAINTIFFS’

MOTION TO VACATE STAY OF PROCEED

INGS, TO SHORTEN TIME FOR RESPONSE

HERETO, AND FOR FURTHER INJUNCTIVE

RELIEF TO ENFORCE DECLARATORY JUDG

MENT AND PRESERVE THE STATUS QUO

Defendants submit that this Court’s Order of Jan

uary 6, 1982, staying all proceedings herein should

be continued in effect until the United States Su

preme Court enters its decisions in the consolidated

cases of Bob Jones University v. United States (No.

81-3) and Goldsboro Christian Schools, Inc. v. United

States (No. 81-1). Until the final status of these

two Supreme Court actions becomes clear, defendants

believe it would be premature to vacate the Janu

ary 6,1982 stay order in this case.1

A significant development since the filing of plain

tiffs’ motion is that on January 18, 1982 the Presi

dent submitted proposed legislation to Congress to

amend Code Section 501 to state expressly that effec

tive after July 9, 1970, tax-exempt status may not

1 Defendants’ counsel was advised today, January 25, 1982,

by the Clerk’s Office of the United States Supreme Court that

no final action has been taken in the Bob Jones and Goldsboro

cases, and that the Supreme Court will be in recess until

February 22, 1982.

be accorded to private, non-profit educational organi

zations with racially discriminatory policies. At the

same time the legislation was proposed, the Treasury

Department announced that the Internal Revenue

Service has been instructed “not to act on any appli

cations for tax exemptions filed in response to the

Internal Revenue Service’s policy announced on Fri

day, January 8, 1982, until Congress has acted on

the proposed legislation (except as required by the

memorandum in support of the motion to vacate as

filed in the Supreme Court on January 8, 1982).” 2

With respect to the subject matter of the instant

case, as set forth in the Affidavit of S. Allen Win-

borne (Assistant Commissioner Employee Plans and

Exempt Organizations), attached as Exhibit B, de

fendants have continued to comply with the outstand

ing injunction orders of this Court. Defendants have

not taken any action to restore tax-exempt status to

private schools in Mississippi which had their exist

ing tax exemptions revoked or their applications for

tax exemptions denied because of the injunction

orders in this case.

Insofar as the revenue rulings and revenue proce

dures referred to in plaintiffs’ motion are concerned,

defendants believe that plaintiffs are erroneous in

broadly interpreting the prior decisions in this case

as limiting or prohibiting future administrative ac

tions by defendants that affect private schools out

side the State of Mississippi. These plaintiffs clearly

2 A copy of this proposed legislation and the related Treas

ury Department News Releases are attached as Exhibit A.

The exception noted in the parenthesis portion of the above

quotation from the January 18 Treasury Press Release con

cerns the petitioners in the two Supreme Court cases, neither

of which operate a school in Mississippi covered by the out

standing orders in this case.

2a

3a

lack standing to complain about IRS administra

tive actions which have not resulted in defendants

acting inconsistent with the extant injunction orders

in this case. Nowhere in the outstanding declaratory

judgment or injunction orders is there any directive

concerning the adoption, modification or revocation

of specific, national IRS revenue rulings or revenue

procedures. Accordingly, since as indicated in the

Winborne Affidavit, the defendants have continued

to comply with the injunction orders of this Court

with respect to Mississippi private schools, it is sub

mitted there is no standing or other jurisdictional

basis for plaintiffs’ claim to the further injunctive

relief requested in paragraph d of their motion as

to the referenced IRS administrative rulings.

Moreover, as the pleadings and prior decisions in

this case make clear, the purpose of this suit was

and is to prohibit defendants “from according tax-

exempt status and deductibility of contributions to

private schools in Mississippi discriminating against

Negro students.” Green v. Connolly, 330 F. Supp.

1140, 1151 [sie] (D. D.C. 1971), aff’d sub nom., Coit

v. Green, 404 U.S. 997 (1971). It is also apparent

that the scope of the injunction orders entered in 1971,

as modified in 1980, pertain solely to “Mississippi

private schools or the organizations that operate

them.” 8 The inappropriateness of plaintiffs’ current

request for injunctive relief affecting IRS adminis

trative policy with respect to private schools outside

of Mississippi is clearly illustrated by the fact that

counsel for plaintiffs brought a separate nationwide

class action in order to accomplish relief of the type

plaintiffs now claim there is a basis for granting in

a See this Court’s Order and Permanent Injunction of

May 5, 1980 at page 2.

4a

the Green case. See Wright v. Miller, 480 F. Supp.

790 (D. D.C. 1979), rev’d 656 F. 2d 820 (D.C. Cir.

1981), petition for certiorari filed November 23, 1981

Regan v. Wright (S. Ct. 81-970). In effect, the

bringing of the Wright action shows a recognition

that the scope of this suit properly should be limited

to IRS actions affecting tax-exempt status of private

schools in the State of Mississippi, and as stated

above, defendants have complied with the outstand

ing injunction orders entered in this case. Accord

ingly, defendants submit there is no jurisdictional

basis in this suit for granting the broader injunctive

relief plaintiffs now request.

Finally, defendants note that since every effort will

be made by defendants to obtain prompt considera

tion of the recent legislation proposed to Congress,

and since Congress presumably will have an oppor

tunity to consider the complex issues now pending

before this Court, this legislative development pre

sents an additional basis for continuing the stay

order now in effect.

CONCLUSION

For the foregoing reasons, defendants respectfully

submit that plaintiffs’ motion to vacate this Court’s

Order of January 6, 1982 should be denied.

Dated: January25, 1982

Respectfully submitted,

/ s / Glenn L. Archer, Jr.

Glenn L. Archer, J r.

Assistant Attorney General

Tax Division

U. S. Department of Justice

5a

/&/ John F. Murray

J ohn F. Murray

Deputy Assistant Attorney General

Tax Division

U. S. Department of Justice

/ s / Donald J. Gavin

E dward J. Snyder

Donald J. Gavin

Michael J. Kearns

Attorneys, Tax Division

U. S. Department of Justice

Washington, D.C. 20530

Telephone: (202) 724-6346

Of Counsel:

Charles F. C. Ruff

United States Attorney for

the District of Columbia

THE WHITE HOUSE

Office of the Press Secretary

For Immediate Release January 18, 1982

FACT SHEET

Tax Exemption Bill Summary

The proposed legislation being submitted by the

President to the Congress will, for the first time,

give the Secretary of the Treasury and the Internal

Revenue Service express authority to deny tax-exempt

status to private, non-profit educational organiza

tions with racially discriminatory policies. The legis

lation recognizes and is sensitive to the legitimate

special needs of private religious schools.

Section 1 of the bill adds to section 501 of the Internal

Revenue Code a new subsection that expressly pro

hibits granting tax exemptions to private schools

with racially discriminatory policies, notwithstand

ing that such schools otherwise meet the tests for

exemption presently listed in section 501(c) (3).

Religious schools of all faiths are permitted to limit,

or give preferences and priorities, to members of a

particular religious organization or belief in their

admissions policies or religious training and worship

programs. However, the bill expressly provides that

a tax exemption will not be granted if any such

policy, program, preference or priority is based upon

race or a belief that requires discrimination on the

basis of race.

Section 2 of the bill amends several sections of the

Internal Revenue Code dealing with deductions to

provide, consistent with the exemption provisions of

the new law, that no deductions will be allowed for

contributions to a school with a racially discrimina

tory policy.

6a

7a

A BILL

To amend the Internal Revenue Code of 1954 to pro

hibit the granting of tax-exempt status to organiza

tions maintaining schools with racially discrimina

tory policies.

Be it enacted by the Senate and House of Repre

sentatives of the United States of America in Con

gress assembled,

Section 1. Denial of Tax E xemptions to Orga

nizations Maintaining Schools W ith

Racially Discriminatory P olicies.

Section 501 of the Internal Revenue Code of 1954

(relating to exemption from tax) is amended by

redesignating subsection (j) as subsection (k) and

inserting a new subsection (j) reading as follows:

“ (j) Organizations Maintaining Schools W ith

Racially Discriminatory P olicies.—

“ (1) IN GENERAL.—An organization that

normally maintains a regular faculty and curric

ulum (other than an exclusively religious cur

riculum) and normally has a regularly enrolled

body of students in attendance at the place where

its educational activities are regularly carried

on shall not be deemed to be described in subsec

tion (c) (3), and shall not be exempt from tax

under subsection (a), if such organization has a

racially discriminatory policy.

“ (2) Definitions.—For the purposes of this sub

section—

“ (i) An organization has a ‘racially discrimi

natory policy’ if it refuses to admit students of

all races to the rights, privileges, programs, and

8a

activities generally accorded or made available

to students by that organization, or if the or

ganization refuses to administer its educational

policies, admissions policies, scholarship and loan

programs, athletic programs, or other programs

administered by such organization in a manner

that does not discriminate on the basis of race.

The term ‘racially discriminatory policy’ does

not include an admissions policy of a school, or

a program of religious training or workshop of

a school, that is limited, or grants preferences or

priorities, to members of a particular religious

organization or belief, provided, that no such

policy, program, preference, or priority is based

upon race or upon a belief that requires dis

crimination on the basis of race.

“ (ii) The term ‘race’ shall include color or

national origin.”

Sec. 2. Denial of Deductions for Contributions

to Organizations Maintaining Schools

W ith Racially Discriminatory P ol

icies.

(a) Section 170 of the Internal Revenue Code of

1954 (relating to allowance of deductions for certain

charitable, etc., contributions and gifts) is amended

by adding at the end of subsection (f) a new para

graph (7) reading as follows:

“ (7) Denial of Deductions for Contribu

tions to Organizations Maintaining Schools

W ith Racially Discriminatory Policies.—No

deduction shall be allowed under this section for

any contribution to or for the use of an or

ganization described in section 501 (j ) (1) that

has a racially discriminatory policy as defined

in section 501 (j) (2).”

9a

(b) Section 642 of such Code (relating to special

rules for credits and deductions) is amended by add

ing at the end of subsection (c) a new paragraph

(7) reading as follows:

“ (7) Denial of Deductions for Contribu

tions to Organizations Maintaining Schools

W ith Racially Discriminatory Policies.—No

deduction shall be allowed under this section for

any contribution to or for the use of an organiza

tion described in section 501 (j) (1) that has a

racially discriminatory policy as defined in sec

tion 501 (j) (2).”

(c) Section 2055 of such Code (relating to the

allowance of estate tax deductions for transfers for

public, charitable, and religious uses) is amended

by adding at the end of subsection (e) a new para

graph (4) reading as follows:

“ (4) No deduction shall be allowed under

this section for any transfer to or for the use

of an organization described in section 501 (j) (1)

that has a racially discriminatory policy as

defined in section 501 (j) (2).”

(d) Section 2522 of such Code (relating to chari

table and similar gifts) is amended by adding at the

end of subsection (c) a new paragraph (3) reading

as follows:

“ (3) No deduction shall be allowed under

this section for any gift to or for the use or an

organization described in section 501 (j) (1) that

has a racially discriminatory policy as defined in

section 501 (j) (2).”

Sec. 4. E ffective Date.

The amendments made by this Act shall apply

after July 9, 1970.

10a

THE WHITE HOUSE

Office of the Secretary

For Immediate Release January 18, 1982

TEXT OF LETTER SENT TO

THE PRESIDENT OF THE SENATE AND

THE SPEAKER OF THE HOUSE

Dear Mr. President/Mr. Speaker:

As you are aware, the Department of the Treasury

announced on January 8 that the Internal Revenue

Service would no longer deny tax-exempt status to

private, non-profit educational organizations that

engage in racially discriminatory practices but other

wise qualify for such status under the present In

ternal Revenue Code. That decision reflects my

belief that agencies such as the IRS should not be

permitted, even with the best of intentions and to

further goals that I strongly endorse, to govern by

administrative fiat by exercising powers that the

Constitution assigns to the Congress.

I share with you and your colleagues an unalterable

opposition to racial discrimination in any form. Such

practices are repugnant to all that our Nation and

its citizens hold dear, and I believe this repugnance

should be plainly reflected in our laws. To that end,

I am herewith submitting to the Congress proposed

legislation that would prohibit tax exemptions for

any schools that discriminate on the basis of race.

This proposed legislation is sensitive to the legitimate

special needs of private religious schools.

I pledge my fullest cooperation in working with you

to enact such legislation as rapidly as possible, and

11a

urge that you give this matter the very highest

priority.

I have been advised by the Secretary of the Treasury

that he will not act on any applications for tax

exemptions filed in response to the IRS policy an

nounced on January 8, until the Congress has acted

on this proposed legislation.

I believe the course I have outlined is the one most

consistent both with our mutual determination to

eradicate all vestiges of racial discrimination in

American society, and with a proper view of the

powers vested in the Congress under our constitu

tional system.

I feel this legislative action is important to and de

sired by all citizens of this great Nation; I am

confident that you will give the issue the prompt

attention it deserves.

Sincerely,

/ s / Ronald Reagan

Ronald Reagan

12a

TREASURY NEWS

Department of the Treasury

Washington, D.C.

Telephone: 566-2041

FOR IMMEDIATE RELEASE

Monday, January 18, 1982

Contract: Marlin Fitzwater

(202) 566-5252

TREASURY—IRS TO HOLD ACTION ON

TAX EXEMPTIONS

Recognizing the President’s desire to have legisla

tion introduced to prohibit the granting of tax ex

emptions to certain educational institutions that en

gage in racially discriminatory practices, the Secre

tary of Treasury has instructed the Commissioner

of Internal Revenue not to act on any applications

for tax exemptions filed in response to the Internal

Revenue Service’s policy announced on Friday, Janu

ary 8, 1982, until Congress has acted on the proposed

legislation (except as required by the memorandum

in support of the motion to vacate as filed in the

Supreme Court on January 8, 1982).

13a

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF COLUMBIA

Civil Action No. 1355-69

W illiam H. Green, et al., plaintiffs

v.

Donald T. Regan, et al., defendants

AFFIDAVIT

City of Washington )

) ss

District of Columbia)

S. ALLEN WINBORNE, being first duly sworn,

deposes and says upon information and belief:

1. I am the Assistant Commissioner (Employee

Plans and Exempt Organizations) and I am familiar

with the steps taken by the Internal Revenue Service

to implement the Orders of this Court dated May 5

and June 2, 1980.

2. This affidavit is being submitted in connection

with plaintiffs’ Motion to Vacate Stay of Proceed

ings to Shorten Time for Response Hereto, and for

Further Injunctive Relief to Enforce Declaratory

Judgment and to Preserve Status Quo filed with the

Court on January 13, 1982.

3. As set forth in detail in the affidavits I have

previously filed in this case, the Internal Revenue

Service has complied with the revised injunctive

orders entered by this Court. The Internal Revenue

Service is taking no actions to restore the tax exempt

status of any organization operating a private school

in Mississippi which had exempt status revoked as

a result of failure to comply with the criteria of the

orders entered in this case. Any requests for recogni

tion of exempt status made by organizations operat

ing a private school in Mississippi are being con

sidered in accordance with the criteria of the orders

entered in this case.

/ s / S. Allen Winbome

S. Allen W inborne

Subscribed and Sworn to before me this 21st day

of January, 1982.

Judith 0. Hinson

Notary Public

My commission expires January 31, 1986.

15a

CERTIFICATE OF SERVICE

IT IS HEREBY CERTIFIED that service of the

foregoing Defendants’ Response to Plaintiffs’ Motion

to Vacate Stay of Proceedings, to Shorten Time for

Response Hereto, and for Further Injunctive Relief

to Enforce Declaratory Judgment and Preserve the

Status Quo has been made this 25th day of Janu

ary, 1982, by mailing a copy thereof to counsel for

intervenors at the following addresses:

William Bentley Ball, Esquire

Philip J. Murren, Esquire

Ball & Skelly

511 North Second Street

P.O. Box 1108

Harrisburg, Pennsylvania 17108

Charles J. Steele, Esquire

James Edward Ablard, Esquire

Whiteford, Hart, Carmody & Wilson

1828 L Street, NW.

Washington, D.C. 20036

By mailing a copy thereof to counsel for the plain

tiffs at the following address:

William L. Robinson, Esquire

Norman J. Chachkin, Esquire

Frank P. Parker, Esquire

Lawyer’s Committee for Civil

Rights Under Law

733 15th Street, N.W.

Suite 520

Washington, D.C. 20005

16a

And by mailing a copy thereof to the other counsel

of record at the f ollowing address:

George S. Leonard, Esquire

206 N. Washington Street

Room 328

Alexandria, Virginia 22313

/ s / Donald J. Gavin

Donald J. Gavin

☆ U . S . GOVERNMENT PRINTING OFFICE; 1 9 8 2 3 6 5 8 0 7 7 8 6