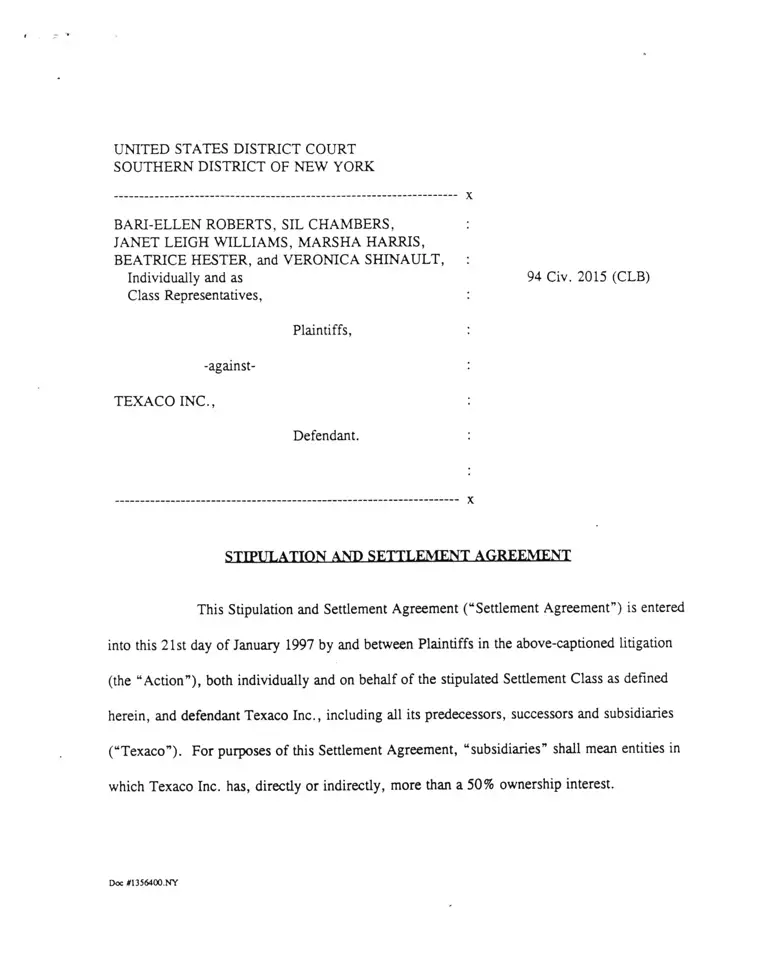

Roberts v Texaco Stipulation and Settlement Agreement

Public Court Documents

January 21, 1997

82 pages

Cite this item

-

Brief Collection, LDF Court Filings. Roberts v Texaco Stipulation and Settlement Agreement, 1997. 8e66059f-c29a-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/3716ec2f-1b5e-4359-b140-39d4ca454466/roberts-v-texaco-stipulation-and-settlement-agreement. Accessed February 23, 2026.

Copied!

UNITED STATES DISTRICT COURT

SOUTHERN DISTRICT OF NEW YORK

x

BARI-ELLEN ROBERTS, SIL CHAMBERS, :

JANET LEIGH WILLIAMS, MARSHA HARRIS,

BEATRICE HESTER, and VERONICA SHINAULT, :

Individually and as 94 Civ. 2015 (CLB)

Class Representatives, :

Plaintiffs, :

-against- :

TEXACO INC., :

Defendant. :

x

STIPULATION AND SETTLEMENT AGREEMENT

This Stipulation and Settlement Agreement (“Settlement Agreement”) is entered

into this 21st day of January 1997 by and between Plaintiffs in the above-captioned litigation

(the “Action”), both individually and on behalf of the stipulated Settlement Class as defined

herein, and defendant Texaco Inc., including all its predecessors, successors and subsidiaries

(“Texaco”). For purposes of this Settlement Agreement, “subsidiaries” shall mean entities in

which Texaco Inc. has, directly or indirectly, more than a 50% ownership interest.

Doc #1356400.NY

WHEREAS, Plaintiffs are prosecuting the Action on behalf of a purported class

of present and former salaried African-American employees of Texaco;

WHEREAS, Plaintiffs, through their counsel, have alleged in the Action that

certain Texaco employment policies and practices had a disparate impact on the individual

plaintiffs and the class alleged in the complaint in violation of Section 1981 of the Civil Rights

Act of 1871, Title VII of the Civil Rights Act of 1964, and Section 296 of the New York

Human Rights Law;

WHEREAS, Plaintiffs, through their counsel, have conducted an extensive

investigation into the facts of this case and have conducted substantial class action discovery in

the Action;

WHEREAS, Plaintiffs, through their counsel, moved for class certification in

the Action and the court had scheduled a hearing on that motion for December 6, 1996,

WHEREAS, Texaco has denied Plaintiffs’ allegations in the Action, and

specifically the claims of discrimination against Plaintiffs and the members of the class they

purport to represent;

WHEREAS, Texaco opposed Plaintiffs’ motion for class certification

contending, among other things, that individual questions raised by the purported class

members’ claims of discrimination predominate over any common questions among the

purported class;

WHEREAS, on November 15, 1996, Texaco and Plaintiffs, through their

counsel, entered into an Agreement in Principle to Settle (the Agreement in Principle ) the

individual and class claims (hereafter the “claims”) asserted in the Action,

Doc #1356400.NY 2

WHEREAS, in the Agreement in Principle, the parties, solely for purposes of

settlement, agreed to stipulate, subject to Court approval, to certification of a settlement class

consisting of all African-Americans employed in a salaried position subject to the Texaco

Merit Salary Program in the United States by Texaco or its subsidiaries at any time from

March 23, 1991 through and including November 15, 1996;

WHEREAS, on November 22, 1996, pursuant to the Agreement in Principle,

Texaco deposited with Citizens Bank of Maryland (the “Escrow Agent”) the sum of

$115,000,000 in cash (the “Settlement Fund”), upon which interest is accruing, in partial

resolution of this Action, pursuant to the terms of the Escrow Agreement attached hereto as

Exhibit A;

WHEREAS, Plaintiffs, through their counsel, have concluded, after carefully

considering the facts and applicable law, that it would be in the best interest of the Settlement

Class to enter into this Settlement Agreement to avoid the uncertainties of continued litigation

and ensure a benefit to Plaintiffs and the members of the Settlement Class;

WHEREAS, this Settlement Agreement is the result of arm’s length negotiations

between counsel for Plaintiffs and Texaco, and counsel for Plaindffs have concluded that this

Settlement Agreement is fair, reasonable and adequate and in the best interests of Plaintiffs and

the Settlement Class they represent;

WHEREAS, Texaco has concluded that it is in its best interests to enter into this

Settlement Agreement to eliminate the expense, inconvenience, burden and uncertainties of

continued litigation and to avoid any further distractions and controversies related to the Action

and the allegations therein; and

Doc #1356400.NY 3

WHEREAS, this Settlement Agreement shall not be deemed or construed as an

admission or evidence of any violation of law or any liability or wrongdoing by Texaco or the

existence of a class satisfying the requirements of Fed. R. Civ. P. 23;

NOW, THEREFORE, IT IS AGREED by and among the undersigned counsel,

on behalf of their respective clients, that, subject to Court approval as provided herein, all

claims against Texaco in the Action shall be settled, compromised and dismissed on the merits

and with prejudice on the following terms and conditions:

1. Finality of Spttlement. This Settlement Agreement shall become Final

on the occurrence of all the following events: (a) entry of an Order by the Court certifying the

action as a class action on behalf of the Settlement Class; (b) entry of the Dismissal Order

(subject to the Court’s ongoing jurisdiction during the Monitoring Period), including dismissal

of all claims in the Action against Texaco by members of the Settlement Class who do not opt

out, with prejudice, incorporating the Release on behalf of all members of the Settlement

Class; and (c) the time for appeal of the Dismissal Order and final judgment has expired or, if

an appeal is noticed, it has been dismissed or the final judgment has been affirmed in its

entirety and the affirmance has become no longer subject to further appeal or review (the

“Finality Date” or “Effective Date”).

2. Spftlpmpnt C lass. Solely for purposes of this Settlement Agreement and

subject to Court approval, Plaintiffs and Texaco agree that this Action may be maintained as a

class action on behalf of a settlement class consisting of all African-Americans employed in a

salaried position subject to the Texaco Merit Salary Program in the United States by Texaco or

its subsidiaries at any time from March 23, 1991 through and including November 15, 1996

Doc #1356400.NY 4

(the “Settlement Class”). Employees whose salaried position was not subject to the Texaco

Merit Salary Program are not within the Settlement Class. For purposes of this Settlement

Agreement, African-Americans shall mean persons who, pursuant to the EEOC’s Race/Ethnic

Identification form, designated themselves to Texaco as “Black”, including those who signed a

release of claims in exchange for an enhanced severance package.

3. Release. When this Settlement Agreement becomes Final, each member

of the Settlement Class who does not opt out will have released Texaco from, and have

covenanted not to sue it on, any and all claims under federal or state law that have been, or

could have been, asserted against Texaco arising out of or relating to any employment

discrimination (including retaliation) or disparate treatment or impact in their employment by

Texaco prior to November 16, 1996 (the “Release”), including any claim for discrimination

on the basis of age, disability, gender, national origin, race, religion or any other factor or

protected classification.

4. Texaco stipulates for purposes of this Settlement Agreement that,

pursuant to Rules 23(b)(2) and (b)(3), plaintiffs Sil Chambers, Janet Leigh Williams, Marsha

Harris, Beatrice Hester, and Veronica Shinault (the “Class Representatives”) are adequate

representatives of the Settlement Class and that their claims are typical of the claims of Class

members, and that the following counsel adequately represent the Settlement Class: Michael

D. Hausfeld and Cyrus Mehri of Cohen, Milstein, Hausfeld & Toll, P.L.L.C.; and Daniel L.

Berger and Steven B. Singer of Bernstein Litowitz Berger & Grossmann LLP.

5. With respect to equitable and injunctive relief to be provided to the

Settlement Class, including the creation of the Equality and Tolerance Task Force described

Doc #1356400.NY 5

herein, Plaintiffs and Texaco agree that the Settlement Class should be certified pursuant to

Rule 23(b)(2) of the Federal Rules of Civil Procedure and, upon the Effective Date, all such

relief will be binding on all Class members, whether or not they opt-out. With respect to the

monetary relief to be provided to the Settlement Class, including both the distribution from the

Settlement Fund and the Salary Increase described herein, Plaintiffs and Texaco agree that the

Settlement Class should be certified pursuant to Rule 23(b)(3) of the Federal Rules of Civil

Procedure, and Class members will have the right to opt-out of such relief and pursue their

individual claims.

Settlement Consideration

6. In full and complete settlement and satisfaction of all claims asserted

against it and any other obligations Texaco has or might have to pay for class notice, the cost

of administering the payment of claims, costs of suit, and reasonable attorneys’ fees and

expenses, under 42 U.S.C. §§ 1981, 1988 and 2000e-(5)(k), and in consideration for the

Release and the other benefits of this Settlement Agreement, Texaco agrees to the following:

Monetary Relief

7. On November 22, 1996, Texaco deposited with Citizens Bank of

Maryland the sum of $115,000,000 in cash, upon which interest has been accruing since that

date, in partial resolution of this Action. No portion of this Settlement Fund was attributed in

negotiations to any back pay claim. The Settlement Fund shall be used to satisfy: (i) monetary

claims; (ii) the cost of class notice; (iii) the cost of suit, including reasonable attorneys’ fees

and expenses, including expert (both consulting and witness) fees and expenses, as approved

by the Court under Fed. R. Civ. P. 23; (iv) the cost of administration of the Plan of Allocation

Doc #1356400.NY 6

described herein; (v) any obligation Texaco might otherwise have in connection with payments

or distributions from the Settlement Fund; and (vi) any other purpose the Court may order.

Class Counsel may draw on or seek reimbursement from the Settlement Fund to pay the costs

of notice to the Settlement Class, plus taxes, if any, which may be due on interest earned from

the Settlement Fund. Class Counsel may obtain the services of an appropriate organization to

assist in the administration of the Settlement and the distribution of the Settlement Fund. If

this Settlement Agreement is not approved by the Court in whole or part, either preliminarily

or finally, or if this Settlement Agreement is terminated under paragraph 37 hereof, the

Settlement Fund (including accrued interest), but excluding the cost of administration already

expended, shall promptly revert to Texaco.

8. When this Settlement becomes Final, payment of Class members’ claims

shall be made out of the Settlement Fund in accordance with a Court-approved plan of

allocation (the “Plan of Allocation”). The proposed Plan of Allocation is annexed as Exhibit

B. Texaco will have no responsibility for, standing, or involvement with the development or

administration of the Plan of Allocation. The cost of such administration shall be paid solely

from the Settlement Fund. All federal, state and local income taxes will be withheld and paid

from the Net Settlement Fund to the appropriate tax authorities, as appropriate. Tax counsel

will be retained to seek a private letter ruling from the Internal Revenue Service regarding the

amount, if any, of the distribution from the Net Settlement Fund subject to employment

(including employer’s share) taxes. A portion of the Net Settlement Fund will be retained

pending receipt of the private letter ruling. Upon receipt Class Counsel will abide by the IRS

Doc #1356400.NY 7

ruling. Any indicated employment taxes will be paid from the Net Settlement Fund. If

necessary, a second distribution to class members will be made.

9. When this Settlement becomes Final, each Class member then employed

by Texaco who was so employed on November 15, 1996, will receive an 11.34% increase

over such employee’s November 15, 1996 base annual salary retroactive to January 1, 1997

(such percentage representing, as of November 15, 1996, an aggregate annual salary increase

of $4 million) (the “Salary Increase”). This increase is in addition to and not in lieu or

replacement of any other pay increase any member of the Class would receive in 1997 in the

ordinary, customary or usual course of employment. Within 30 days after the Settlement

becomes Final, the portion of the Salary Increase accrued from January 1, 1997 to the date of

payment will be paid to each such employee. Any Class member employed at Texaco on

January 1, 1997 who did not voluntarily leave Texaco but whose employment was terminated

by Texaco prior to such date of payment, will be paid on such date the portion of the Salary

Increase applicable to that employee’s actual period of employment after January 1, 1997.

Programmatic Relief

10. Texaco affirms the following “Statement of Equality and Tolerance

Objectives”:

Texaco Inc. is affirmatively committed to the fullest extent to an

environment of inclusion; to eradicate all forms of prejudice

within the company; to promote and foster complete equality of

job opportunities within the company to all applicants and

employees regardless of race, gender, religion, age, national

origin and disability; and to ensure tolerance, respect and dignity

for all people.

Doc #1356400.NY 8

This paragraph does not create any contractual causes of action or other rights of action that

would not otherwise exist.

11. Immediately upon the Settlement becoming Final, Texaco and Plaintiffs

will activate an independent Equality and Tolerance Task Force (“Task Force”) to determine

revisions and additions to Texaco’s current human resource programs and to oversee, in

conjunction with the President of Texaco’s Human Resources Division, the implementation by

Texaco of the human resource program changes agreed to or resulting from the terms of this

Settlement Agreement including, but not limited to, the specific programmatic changes

described below.

12. The Task Force will have authority for a period of five years, under

Court supervision, to determine the policies and practices that should be developed,

restructured or implemented to meet the programmatic relief objectives of this Settlement

Agreement. The Task Force will have reasonable access to all relevant books, data,1

documents and other sources of information, in whatever form they are maintained in the

ordinary course of business, necessary or appropriate to the exercise of their authority. Given

the need of the Task Force to review confidential business information of Texaco, each Task

Force member will sign a Confidentiality Agreement.

13. Texaco will be responsible for implementation of all programmatic relief

under the terms of this Settlement Agreement, except as otherwise provided in this Settlement

Agreement. Texaco is not precluded from developing and implementing its own inclusion

1 If there is a disagreement between the Task Force and Texaco as to the accuracy and/or

completeness of any Texaco data, an independent accounting firm (selected by the Task

Force from among the six nationally recognized accounting firms) will be appointed to

certify its accuracy and/or completeness at Texaco’s expense.

Doc #1356400.NY 9

programs as it may find appropriate. In formulating its determinations, the Task Force will

take such programs into account.

14. The Task Force will consist of three Texaco appointees, three Plaintiffs’

appointees, and one independent appointee agreed to by the parties who serves as Chairperson.

The nominees to the Task Force, including the Chairperson, shall be individuals the Court

finds responsible and appropriate. They will come from diverse backgrounds, including racial

and gender diversity. They will come from the following fields:

a. former government officials in the labor/civil rights area;

b. professors/academics specializing in labor/employment

issues;

c. current or former Texaco executives with experience and

knowledge of the Company and its workforce needs for

running its operations;

d. professional employment/diversity consultants;

e. legal profession, including judiciary, knowledgeable in

employment/diversity matters; and/or

f. business, with practical experience in managing a diverse workforce.

Names and backgrounds of the nominees are to be submitted to the Court. Should the Court

disapprove of any nominee, an appropriate replacement is to be submitted. In the event a Task

Force member is unable or unwilling to continue to serve as a member of the Task Force, the

party who selected the Task Force member shall have the authority to replace that member,

subject to the Court approving that nominee. If the Chairperson is unwilling or unable to

Doc #1356400.NY 10

continue to serve as Chairperson the parties shall jointly select a new Chairperson, subject to

the Court approving the nominee. Texaco shall compensate all Task Force members,

including the Chairperson, at customary market rates or other terms acceptable to Texaco and

the Task Force members.

15. The Task Force will evaluate all existing employment policies and

practices and develop and design, in conjunction with the President of the Human Resources

Division, procedures, practices and methodologies to achieve the programmatic relief

objectives of this Settlement Agreement as well as to measure and demonstrate program

progress and results. The determinations of the Task Force will apply to all salaried non

officer job positions at all grade levels, in all departments, divisions and subsidiaries

nationwide. Texaco will provide all funding necessary to fulfill the work of the Task Force,

including the reasonable compensation of the Task Force members, and the cost of reasonable

staff, consultants, statisticians, and other appropriate experts.

16. Within the first six months after the Finality Date or at such other

reasonable time as is agreed upon by the Task Force, Texaco will:

a. Adopt and implement a company-wide diversity and sensitivity

training program.

b. Adopt and implement a company-wide mentoring program.

c. Insure that Equal Employment Opportunity (“EEO”) and

Diversity Performance is included in management objectives and

in determining management compensation.

d. Develop and implement an ombudsperson program.

e. Implement national job posting through at least pay grade 18, and

commence evaluation of posting at higher grade level positions.

Doc #1356400.NY 11

f. Develop recommendations for the creation and implementation of

a mechanism to minimize feax of retaliation in connection with

complaints of employment discrimination.

The Task Force will review the effectiveness of these programs.

17. During this period, the Task Force will, and the President of Human

Resources Division may also begin to:

a. Evaluate and revise or replace the Performance Management

Program (“PMP”), including the PMP Appeal Process, to ensure

that the PMP accurately measures employee performance and,

among other things, that the standards for performance objectives

are specific, measurable, achievable, relevant, time bound and

documented.

b. Evaluate and revise or replace methods for determining the

appropriate competencies needed for a job position or positions.

Once accepted, Texaco will begin implementation of the changed

methods within sixty days. Such implementation will include, if

appropriate, job analyses to identify, but not be necessarily

limited to, critical job tasks, knowledge, skills and abilities. The

Task Force will monitor implementation.

c. Review Affirmative Action Plans (“AAPs”) developed under

Executive Order (“EO”) 11246 to ensure they are properly

constructed. The Task Force, the Chairman of the Texaco Inc.

Board of Directors (the “Chairman”) and the Texaco Inc. Board

of Directors (the “Board of Directors”) shall be informed of the

compliance performance of each establishment covered by these

plans. The Task Force may recommend appropriate action where

deemed necessary.

d. Evaluate and revise or replace the promotion and employee

development process, including High Potential List procedure,

and making known to all employees objective Promotability

Criteria.

e. Establish an Employment Selection and Performance

Management Oversight/Monitoring System.

f. Evaluate and revise job posting procedures.

Doc #1356400 NY 12

g. Develop and implement centralized monitoring of employee

compensation to ensure no disparate treatment or impact based on

race which is not job related and/or consistent with business

necessity. Review appropriate data to ensure against unfairness

which is not job related and/or consistent with business necessity.

Data may be furnished in such a form as to protect the identity of

individuals.

18. The Task Force will, and the President of the Human Resources

Division may review and revise, as appropriate, the Company’s policies and practices for:

a. Recruitment;

b. Hiring;

c. Training;

d. Special Opportunities;

e. Assignments; and

f. Promotion.

19. The Task Force will, within one year of the Effective Date, complete its

own review and evaluation of all current employment policies and practices, through, among

other means, the use of surveys and employee interviews conducted through Texaco. Subject

to the terms of the Agreement, Texaco will implement such changes or additions as the Task

Force deems necessary and appropriate to achieve the Equality and Tolerance Objectives and

the terms of this Settlement Agreement.

20. The Task Force will, within one year or less of the Effective Date,

complete its initial determinations in all of the areas set forth. Thereafter, for the duration of

the Task Force, it will be responsible for continuing the review and evaluation of all ongoing

employment policies and practices of the Company, as well as monitoring the impact and

Doc #1356400.NY 13

effectiveness of the implementation of its determinations. The Task Force will continue during

this time to determine revisions or modifications to ongoing employment policies and practices

in order to achieve the Equality and Tolerance Objectives and the terms of this Settlement

Agreement.

21. The Task Force will establish the timetable for the implementation and

completion of compliance with any of its determinations, subject to the terms of this

Settlement Agreement.

22. The President of the Human Resources Division will implement each

final determination of the Task Force unless within seven business days after receiving a

determination, Texaco files an objection with the Court that the Task Force’s determination, in

whole or in part, involves the application of unsound business judgment or is technically not

feasible.

23. In the event Texaco files an objection with the Court to a determination

of the Task Force, Plaintiffs’ counsel will participate in the proceedings with the Court in

support of the Task Force determination objected to by Texaco. All reasonable fees and

expenses of Plaintiffs’ counsel, including reasonable expert fees and expenses, in so doing will

be paid by Texaco.

Monitoring

24. Every six months, beginning on the Effective Date and continuing

though the fifth anniversary (“the Monitoring Period”), the Task Force will provide to the

Court, the Chairman, the Board of Directors, and Plaintiffs’ counsel, information which

reflects the impact of this Settlement Agreement.

Doc #1356400.NY 14

Reporting

25. At the end of each year, the Task Force will submit a detailed report to

the Court and Plaintiffs’ counsel, reviewing and evaluating Texaco’s employment policies and

practices, the determinations made by the Task Force, and the impact of the actions taken in

achieving the Equality and Tolerance Objectives and the terms of this Settlement Agreement.

The report will also identify what remains to be done by the Task Force and by the Company,

why it needs to be done, and a timetable for accomplishing it.

26. The work of the Task Force and the supervision of the Court will

continue for the full Monitoring Period, five years, unless, upon good cause shown by either

party, the period is shortened or extended by the Court.

General Provisions

27. This Settlement Agreement and any proceedings taken hereunder shall

not in any event be construed nor be deemed to be a concession or admission by or on the part

of Texaco of any liability or wrongdoing or evidence of the truth of any allegation made

against Texaco in any court or legal proceeding.

28. The parties hereto agree to undertake their best efforts, including all

steps contemplated by this Settlement Agreement, to effectuate this Settlement Agreement. In

this connection, counsel for the Plaintiffs and Texaco will use their best efforts to effectuate

this Settlement Agreement.

29. The parties shall have the authority to enforce any aspect, term or

provision of this Settlement Agreement and can take appropriate measures to effectuate

enforcement of this Settlement Agreement and any of its terms or provisions.

Doc #1356400.NY 15

30. The parties agree that notice of this Settlement Agreement shall be

provided to members of the Class in the form agreed upon and annexed hereto as Exhibit C

(the “Notice”). Notice shall consist of mailing the Notice to the last known address of the

Class members. Plaintiffs’ counsel will make reasonable efforts to obtain current addresses for

individuals whose Notices are returned undeliverable and to re-send such Notices.

31. The parties will seek entry of an order satisfactory to the parties

dismissing all claims in the Action with prejudice and without costs to any party except as

expressly provided herein, and incorporating the Release on behalf of all members of the Class

and directing the entry of a final judgment (the “Dismissal Order”). Neither Plaintiffs nor

their counsel nor any Settlement Class member shall be liable to Texaco for any court costs or

attorneys’ fees incurred by Texaco in connection with this action.

32. At or following the hearing to approve the Settlement, Class Counsel

shall apply to the Court for an award of attorneys’ fees and reimbursement of expenses, which

award shall be contingent upon approval of the Settlement by the Court. The attorneys fees

and reimbursement of expenses, as awarded by the Court, shall be paid out of the Settlement

Fund.

33. Texaco shall have no obligation under this Settlement Agreement to pay

any money except only as expressly set forth in this Settlement Agreement. Texaco shall not

be liable for any of Plaintiffs’ or the Settlement Class’ costs or attorneys’ fees. In the event

this proposed settlement is not approved by the Court, the costs incurred in notifying members

of the Settlement Class and any other costs approved by the Court shall be paid from the

Settlement Fund. Texaco further shall not be liable for any of the expenses of notice to the

Doc #1356400.NY 16

Settlement Class or administration of the Settlement Fund. Such expenses, as approved by the

Court, shall be paid out of the Settlement Fund. Since Texaco’s creation of the Settlement

Fund will fully discharge any obligation it might otherwise have for attorneys’ fees, costs, and

expenses, the named plaintiffs waive any and all rights to payment of attorneys’ fees and costs

directly by Texaco. Texaco agrees not to oppose the fee and expense application of Plaintiffs’

counsel or incentive awards for the named Plaintiffs.

34. Texaco will not object to or participate in the allocation or distribution of

the Settlement Fund. Texaco will not oppose the application of counsel for the Settlement

Class to serve as disbursing agent for the Settlement Fund.

35. If requested, Texaco promptly shall provide such consents as may be

necessary to release funds from the,Settlement Fund to meet administrative expenses, as such

releases may be approved by the Court.

36. In the event this Settlement Agreement does not become Final, this

entire Settlement Agreement shall become null and void and of no force and effect and all

funds in the Settlement Fund shall be returned to Texaco within ten (10) business days after

demand upon Class Counsel therefor, less any expenses related to the cost of notice to the

Settlement Class or other administrative costs that have been paid out of the Settlement Fund

pursuant to this Settlement Agreement and pursuant to procedures which have been approved

by the Court.

Doc #1356400.NY 17

Texaco’s Right To Withdraw

37. Texaco will have a right to withdraw from the Settlement if, in its

discretion, it deems the number of class members who opt out of the Settlement to pursue their

own claims to be substantial. Such right shall be exercised within seven calendar days

following the date established by the Court for final receipt of written opt-out requests from

class members.

38. The Plaintiffs and their counsel agree that, except as otherwise required

by law, within twenty (20) days after this Settlement Agreement becomes Final, or at such

other date agreed to by the parties, all materials produced by or discovered of Texaco or any

of its present or former directors, officers or employees, including all copies thereof

(collectively the “Texaco Materials”), in the possession or control of the Plaintiffs or their

counsel, experts, consultants or agents shall be returned to Texaco. However, plaintiffs

counsel may retain one copy of each deposition transcript. Upon Texaco s request, counsel for

the Plaintiffs shall provide a written declaration certifying that all Texaco Materials have been

returned.

39. Texaco will not defame any Class Representative and no Class

Representative will defame Texaco. Nor will any Class Representative disclose confidential

information relating to the claims and proceedings in the Action. Each Class Representative

agrees to abide by the terms and conditions of the Protective Order entered in this Action and

the Mediation Groundrules. Each Class Representative will use her or his best efforts to avoid

further controversy concerning the Action.

Doc #1356400.NY 18

40. This Settlement Agreement may not be modified or amended except in

writing executed by counsel on behalf of Plaintiffs and Texaco and approved by the Court.

Doc #1356400.NY 19

41. This Settlement Agreement shall become effective upon its execution by

the undersigned counsel and may be signed in counterparts.

Dated this 21st day of January, 1997.

Michael D. Hausfeld '

Cyrus Mehri

COHEN, MILSTEIN, HAUSFELD

& TOLL, P.L.L.C

1100 New York Avenue, N.W.

West Tower, Suite 500

O I C V C U £>. O l l l g C l

BERNSTEIN LITOWITZ BERGER

& GROSSMANN LLP

1285 Avenue of the Americas

New York, NY 10019

(212) 554-1400

Richard T. Sampson

SEMMES, BOWEN & SEMMES, P.C.

250 West Pratt Street

Baltimore, MD 21201

(410) 539-5040

ATTORNEYS FOR PLAINTIFFS

KAYE, SCHOLER, FIERMAN,

HAYS & HANDLER, LLP

425 Park Avenue

New York, NY 10022

(212) 836-8000

ATTORNEYS FOR TEXACO INC.

Doc #1356400.NY 20

UNITED STATES DISTRICT COURT

SOUTHERN DISTRICT OF NEW YORK

___________________________ — ------------------X

BARI-ELLEN ROBERTS, SH CHAMBERS,

JANET LEIGH WILLIAMS, MARSHA HARRIS,

BEATRICE HESTER .AND VERONICA SHINAULT,

Lndlvidujtlly and as 54 Civ, 2015 (CLB)

Class Representatives,

Plaintiff,

•against*

TEXACO INC.,

Defendant.

----- X

ESCROW AGREEMENT

This Agreement is made and entered into this 21st day of November, 1996, by and

between Cohen, Milstein, Hausfeld & Toll, P.L.L.C. (as counsel for plaintiffs and the settlement

class), Kaye, Scholer, Fierman, Hays & Handler, LLP (as counsel for defendant Texaco Inc,) and

Citizens Bank of Maryland, a corporation organized under the laws of the State of Maryland

(“Escrow Agent”). Escrow Agent is a State Chartered Banking Institution.

WITNESSETH

WHEREAS plaintiffs and Texaco Inc. (“Texaco") have entered into an agreement in

principle dated November 15, 1996, to settle all claims of plaintiffs and the settlement class

against Texaco, and

WHEREAS the agreement in principle provides, among other things, for the deposit in

escrow of SI 15,GC0,CC0 in cash by November 22, 1996;

WHEREAS plaintiffs and Texaco will seek a Final Order (as hereinafter defined) from the

Court approving the settlement o f this action,

WHEREAS plaintiffs and Texaco intend for both Cohen, Miljtein, Hausfeld <fe Toll,

P LX.C. (“CMH&T”) and Kaye, Scholer, Fierman, Hays & Handler, LL? (“KSFH&H”) to be

principals under this Agreement until the entry of a Final Order by the Court, and thereafter, for

CMH&T alone to be the principal under this Agreement; and

WHEREAS Counsel (as hereinafter defined) have entered into this Agreement to facilitate

the consummation of the settlement of this action;

NOW, THEREFORE, in consideration of the premises and for other good and valuable

consideration, receipt of which is hereby acknowledged, the parties agree as follows:

t • As used herein, “Final Order" shall mean the order of the Court giving final

approval to the settlement of this action, from which no timely appeals have been taken or as to

which all appeals have been exhausted.

2. From the date of this Agreement until the Escrow Agent receives joint written

instructions from CMH&T and KSFH&H that the order of the Court giving final approval to the

settlement of this action has become a Final Order, “Counsel,” as used herein, shall mean both

CMH&T and KSFHAH; thereafter, “Counsel” shall mean solely CMH&T. When “Counsel”

means both firms, instructions, confirmations and authorizations to or from the Escrow Agent

must be received from or by both firms.

3. Counsel do hereby appoint, constitute and designate Citizens Bank of Maryland as

their Escrow Agent for the purposes set forth herein, and the Bank accepts the agency created

2

under this Agreement and agrees to p e rfo rm the ob liga tions im posed .

4 O n or b e fo re N o v e m b e r 22, 1996, T exaco will d ep o sit w ith E sc ro w A g en t by w ire

tra n sfe r SI 1 5 ,0 0 0 ,0 0 0 in cash ( th e "E sc ro w F und").

5 Escrow Agent shad invest the Escrow Funds in marketable direct obligations

issued by the Federai Government of the United States of .America or issued by any agency

thereof and backed by the frill faith and credit of the United States.

6. .Ail income earned by the Escrow Fund shall be reinvested by Escrow Agent in

accordance with the above-referenced written instructions of Counsel and shall become a part of

the Escrow Fund.

7 Escrow Agent is hereby authorized to transfer snd distribute fUnds from the

Citizens Bank Trust account established for this escrow by check, wire, electronic, or internal

process, upon receiving prior written authorization from Counsel. Such authorization may be by

facsimile transmission or other written communication. Wire transfers shad be followed by a

return call to Counsel for confirmation. Escrow Agent shall disburse no funds from' the Escrow

Fund without the prior 'written authorization of Counsel. All transfers and distributions made by

this authorization shall be governed by the Maryland Uniform Commercial Code - Funds

Transfers (1991, ch. 548).

8. In the event of disagreement between Counsel (before joint instructions that the

order o f approval has become a Final Order) with respect to the disbursement of funds from the

Escrow Fund, Escrow Agent shall hold the disputed flunds until the disagreement is resolved.

9. Escrow Agent shall not be concerned with or have any responsibility for collection

o f the Escrow Fund from Texaco, and Escrow Agent shall have no responsibility concerning

3

compliance by Counsel (before joint instructions that the order of approval has become a Final

Order) with their duties to each other under any agreement.

1 & Any Federal, State, Municipal or local taxes due as a resuit of income earned by,

or assets in, the Escrow Fund are to be pud from the Escrow Fund by the Escrow Agent or the

settlement claims administrator. The Escrow Agent or the settlement claims administrator shall

also make or file any returns or reports relative thereto, upon such confirmations from Counsel as

it may request.

11. All signatories to this Agreement warrant that they have full and complete

authority to enter into this Agreement and to sign said Agreement on behalf of themselves and/or

the entity or persons they represent.

12. The annual fee for Escrow Agent for its sendees shall be four (4) basis points, with

no annual minimum. One quarter o f the fee shall be paid at the end of each calendar quarter from

the Escrow Fund. The fee shall be determined based upon the market value of the assets in the

Escrow Fund at the end of the calendar quarter. Any necessary out-of-pocket expenses of

Escrow Agent shall be paid from the Escrow Fund after ten (10) business days notice to Counsel.

13. Pursuant to national banking regulations which establish uniform standards for

bank record keeping, trade confirmation, and other procedures with respect to securities

transaction* made for trust departments, Counsel have the option of receiving a written

confirmation each time a trade is executed on the Escrow Fund’s behalf within five (3) business

days o f its execution. In the alternative, Counsel may forego receipt of individual trade

confirmations and agree to accept a transaction statement that itemizes each trade as sufficient

notice of trades. Escrow Agent meets the alternate confirmation requirement by providing its

4

clients with :ase statements, at least monthly, that itemize each trade effected for the client’s

account, giving ail pertinent information relating to the transaction. Time of execution is not

furnished, but can be provided within a reasonable time, upon 'written request. Counsel may

waive receipt of individual trade confirmations by so indicating at the end of this Escrow

Agreement.

14. Escrow Agent shall be entitled to rely upon the most recent instructions from

Counsel as to the names of the persona authorized to instruct Escrow Agent. Counsel shall

provide a list of the signamres of such authorized persons to Escrow Agent from time to time.

15. Escrow Agent shall be protected in acting upon written notice, request, waiver,

consent, receipt or other paper document furnished to it by Counsel, not only as to its due

execution and the validity and effectiveness of its provisions, but also as to the truth and

acceptability o f any information contained therein, which it in good faith believes to be genuine

and what it purports to be.

16. Escrow Agent shall have no duties except those which are expressly set forth

herein and those imposed by law, and it shall not be bound by any notice of claim, or demand with

respect thereto, or any waiver, modification, amendment, termination or recisioo of this

Agreement, unless in writing received by it, and if its duties herein are affected, unless it shall have

given prior written consent thereto.

17. Escrow Agent may resign at any time by giving a minimum of 30 business days

prior written notice o f resignation to the parties hereto, such resignation to be effective on the

date specified in such notice. Any assets held by Escrow Agent under the terms of this

Agreement as of the effective date o f the resignation shall be delivered to a successor escrow

5

agent designated in writing by Counsel. If* no successor escrow agent Has been appointed as of

the effective date of the resignation, all obligations of Escrow Agent hereunder shall nevertheless

:ease and terminate, except that Escrow Agent’s sole responsibility thereafter shall be to keep

safely all Escrow funds held by it and to deliver the same to a person designated by Counsel or in

accordance with the direction of a final order or judgment of a court of competent jurisdiction.

18. This Agreement shall be binding upon and inure to the benefit of the respective

heirs, legal representatives, successors and assigns of the parties hereto.

19. This Agreement will be governed by and construed in accordance with the laws of

State of Maryland.

20. For purposes of notices, correspondence and mailing of checks, or wiring o f fluids,

the parties’ addresses shall be:

Cohen, MUstein, Hausfeld & Toll, PL.L.C.

Attention: Michael D. Hausfeld

1100 New York Avenue, N.W.

West Tower, Suite 500

Washington, D.C, 20005-3964

Telephone: (202) 408-4600

Facsimile: (202) 408-4699

Kaye, Scholer, Fierman, Hays & Handler, LLP

Attention: Milton J. Schubin

425 Park Avenue

New York, New York 10022-3598

Telephone: (212) 836-8000

Facsimile: (212) 836-8689

Citizens Bank o f Maryland

Attention: Donald F. Yetter

14401 Sweitzer Lane, MS 728

Laurel, Maryland 20707

Telephone: (301) 206-6243

Facsimile: (301) 206-6374

6

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date

first sat forth above.

Michaei D. Hausfeidrlisq.

Counsel for the Plaintiff!

KA YE, SCHOLER, FIERMAN, HA YS

A HANDLER, LLP

Milton J. Schubin, Esq.

Counsel for Defendant,

Texaco Inc.

CITIZENS BANK OF MARYLAND

EscrpHUgtnt

By:

BCttaJd F. Yetter

Assistant Vice Pr

7

E

xh

ib

it

B

UNITED STATES DISTRICT COURT

SOUTHERN DISTRICT OF NEW YORK

- - - - - - - - - - - - - - - - - - - - X

BARI-ELLEN ROBERTS, SIL CHAMBERS, :

JANET LEIGH WILLIAMS, MARSHA HARRIS,

3EATRICE HESTER and VERONICA SHINAULT, :

Individually and as

Class Representatives, : 94 Civ. 2015 (CLB)

Plaintiffs,

- against -

TEXACO INC.,

Defendant.

- - - - - - - - X

PLAN OF ALLOCATION

1. After deduction of attorneys' fees, costs and

reimbursement of expenses, including expert fees and expenses,

awards to the Class representatives and other administrative

expenses, as approved by the Court, the balance of the Settlement

Fund (the "Net Settlement Fund") shall be distributed to Class

members in the manner and subject to the conditions set forth

below.

2. After consultation with various experts who advised

Class Counsel as to a fair, equitable, uniform and efficient plan

of allocation, Class Counsel has determined that the distribution

of the Net Settlement Fund will be based on the following four

factors: (1) Existence -- employment by Texaco at any time during

the Class Period1 (which assures that every Class member will

receive compensation from the Net Settlement Fund); (2) Earnings 1

1 The Class Period is defined as the period from March

23, 1991 through November 15, 1996, inclusive.

-- the total earnings of the Class member from Texaco during the

Class Period; (3) Disparity -- the difference between the actual

earnings from Texaco and estimated expected earnings of the Class

member had race not been a factor during the Class Period, as

calculated by plaintiffs' expert; and (4) Time -- the length of

salaried employment by Texaco of the Class member during the

Class Period. For purposes of the Plan of Allocation, only

salaried employment at Texaco will be considered in calculating

each of the above factors.

3. Each of Time, Earnings and Disparity will be

implemented in a proportionate manner. Earnings and Disparity

will be obtained for each Class member for each year and summed

over years to obtain a total disparity2 and total earnings for

each Class member.

4. Existence: Each Class member will receive $2,000 from

the Net Settlement Fund for the Existence factor. This will

account for approximately $2,700,000 of the Net Settlement Fund.

5. Earnings and Disparity: Approximately $23,000,000 of

the Net Settlement Fund will be distributed on the basis of

Earnings and Disparity. In order to accomplish this, a Disparity

Proportion will be computed for each Class member3 as the ratio

2 Negative disparities will be treated as such except

that negative total disparities will be treated as zero (over the

entire Class Period).

3 If information appropriate to ascertain a disparity

for a Class member for a particular year is not available, then

that individual will be considered to have a disparity for that

year equal to the mean of the negative disparities, and zero

disparities for those with positive disparities.

2

of the Class member's total Disparity during ■d tohe Class Peri

the sum of the total Disparities of all'Class members during the

Class Period. Similarly, an Earnings Proportion will be computed

for each Class member as the ratio of the Class member's total

Earnings during the Class Period to the sum of the total Earnings

of all Class members during the Class Period. A Weighted Average

of the Disparity Proportion and the Earnings Proportion will be

computed for each Class member as 3/4ths of the Disparity

Proportion added to l/4th of the Earnings Proportion. Each Class

member will receive a payment from the $23,000,000 portion of the

Net Settlement Fund equal to his or her Weighted Average

multiplied by $23,000,000.

6. Time: The remainder of the Net Settlement Fund will be

distributed in a proportionate manner according to the Time

factor. To accomplish this, each Class member will be considered

as starting employment at Texaco either on the date of their hire

or on March 23, 1991 (the first day of the Class Period),

whichever is later. Each Class member will be considered to have

ended employment at Texaco either on their last day of employment

or November 15, 1996 (the last day of the Class Period),

whichever is earlier. This amount of time (in total days) will

be divided by the corresponding total time employed, in days, for

all Class members to arrive at a Time Proportion for each

individual. Each Class member will receive a payment equal to

his or her Time Proportion multiplied by the remainder of the Net

Settlement Fund.

3

7. Within two weeks after the Court enters an order

approving the Settlement, Class Counsel will send each Class

member by first-class mail, postage prepaid, written notification

of the Class member's individual factors (the "Individual

Factors") that will be used to determine the distribution that

the Class member will receive from the Settlement Fund, including

the Class member's (1) length of service at Texaco during the

Class Period according to records provided to Class Counsel by

Texaco and (2) total earnings at Texaco during the Class Period

according to Texaco records provided to Class Counsel by Texaco.

Each member of the Settlement Class will then have two weeks from

the date of mailing to notify Class Counsel in writing about any

disagreement with Texaco's records and to provide any available

supporting documentation (the "Notification Date"). Class

Counsel will attempt to resolve any such disputes through

consultation with Texaco's Human Resources Department. _ However,

to the extent that any disputes cannot be resolved through such

consultation, all outstanding disputes will be collectively

submitted to the United States Magistrate Judge within ten days

of the Notification Date. The Magistrate Judge's determination

as to the Individual Factors will be final and binding on all

parties.

4

E

xh

ib

it

C

UNITED STATES DISTRICT COURT

SOUTHERN DISTRICT OF NEW YORK

BARI-ELLEN ROBERTS, SIL CHAMBERS,

JANET LEIGH WILLIAMS, MARSHA HARRIS,

BEATRICE HESTER and VERONICA SHINAULT,

Individually and as

Class Representatives,

Plaintiffs,

94 Civ. 2015 (CLB)

- against -

TEXACO INC.,

Defendant.

- - - - - - - - - - - - - - - - - - - - X

NOTICE OF PENDENCY OF CLASS ACTION,

PROPOSED SETTLEMENT AND FAIRNESS HEARING

TO: ALL AFRICAN-AMERICANS EMPLOYED IN A SALARIED POSITION

SUBJECT TO THE TEXACO MERIT SALARY PROGRAM IN THE UNITED

STATES BY TEXACO INC. ("TEXACO") OR ITS SUBSIDIARIES AT ANY

TIME FROM MARCH 23, 1991 THROUGH NOVEMBER 15, 1996,

INCLUSIVE (THE "SETTLEMENT CLASS").

PLEASE READ THIS NOTICE CAREFULLY AND IN ITS ENTIRETY. YOUR

RIGHTS WILL BE AFFECTED BY PROCEEDINGS IN THIS LITIGATION.

1. NOTICE IS HEREBY GIVEN, pursuant to Rule 23 of the

Federal Rules of Civil Procedure and an Order of the United

States District Court for the Southern District of New York,

dated January 22, 1997, that a hearing will be held before the

Honorable Charles L. Brieant in a Courtroom of the United States

District Court for the Southern District of New York, 300

Quarropas Street, White Plains, New York, at 9:00 a.m. on

Tuesday, March 18, 1997 (the "Fairness Hearing") to determine

(1) whether a proposed settlement (the "Settlement") of the

above-entitled litigation, (the "Action") as set forth in the

Stipulation and Settlement Agreement dated January __, 1997 (the

"Settlement Agreement"), is fair, reasonable, adequate, and

should be approved; (2) whether a final judgment should be

entered dismissing the Action on the merits, with prejudice and

without costs; (3) whether the plan proposed for allocating and

distributing the Net Settlement Fund is fair and reasonable and

should be approved; (4) whether an award of attorneys' fees,

costs and reimbursement of disbursements should be made to Class

Counsel; and (5) whether Incentive Awards should be made to the

named plaintiffs. You may but are not required to attend the

Fairness Hearing in order to receive your share of the

Settlement.

I.

BACKGROUND OF THE ACTION

2. On March 23, 1994, a class action complaint was filed

in the United States District Court for the Southern District of

New York (the "Court") by plaintiffs Bari-Ellen Roberts and Sil

Chambers against defendant Texaco, which alleged that certain

Texaco employment policies and practices had a disparate impact

on the individual plaintiffs and the Class alleged in the

Complaint in violation of Section 1981 of the Civil Rights Act of

1971, as amended in 1991, 42 U.S.C. § 1981 ("Section 1981"), and

Section 296 of the New York Human Rights Law, N.Y. Exec. Law. §

296 ("Section 296"). On June 30, 1994, plaintiffs filed a First

Amended Complaint (the "Amended Complaint"), which, among other

2

things, added claims on behalf of individual plaintiffs Janet

Williams, Marsha Harris, Beatrice Hester and Veronica Shinault

and the Class alleged in the Complaint and asserted claims

arising under Title VII of the Civil Rights Act of 1964, as

amended in 1991, 42 U.S.C. §§ 2000e, et seg ("Title VII").

3. The Amended Complaint alleges that, beginning no later

than March 23, 1991, certain Texaco employment policies and

practices had a disparate impact on salaried African-American

employees in promotions, compensation and the terms and

conditions of their employment, including training and job

assignments. On July 15, 1994, Texaco answered the Amended

Complaint, denying any and all alleged wrongdoing or liability.

4. On May 15, 1995,' plaintiffs moved for class

certification under Section 1981 and Section 296. In connection

with discovery related to class certification issues, plaintiffs

reviewed thousands of documents, including Texaco's Affirmative

Action Plans, performed detailed statistical analyses of the

promotion and compensation rates of Texaco's African-American and

Caucasian employees, and obtained, in addition to the testimony

of the six named plaintiffs, declarations from thirty individuals

regarding alleged racial discrimination at Texaco. During class

discovery more than forty fact and expert witnesses were deposed.

Further, plaintiffs obtained expert reports from three

independent experts in support of class certification. In August

1996, plaintiffs moved to add Title VII claims to the class

3

motion. The Court granted this motion and set the entire class

motion to be heard on December 6, 1996.

5. Texaco denies any and all fault, wrongdoing or

liability whatsoever, and maintains that there is no substance to

any of the allegations made against it in the Action, and

desires, by settlement of all controversies between it and

plaintiffs and the Settlement Class, to avoid the expense,

inconvenience, distraction and delay of further litigation.

II. SETTLEMENT CLASS

6. For purposes of the proposed Settlement, the parties

have stipulated to and the Court has, by Order dated January 22,

1997, certified the following Settlement Class:

All African-Americans employed in a salaried

position subject to the Texaco Merit Salary

Program in the United States by Texaco or its

subsidiaries at any time from March 23, 1991

through and including November 15, 1996.

For purposes of this Settlement, African-Americans means persons

who, pursuant to the EEOC's Race/Ethnic Identification form,

designated themselves to Texaco as "Black". Also for purposes of

this Settlement, "subsidiaries" shall mean entities in which

Texaco Inc. has, directly or indirectly, more than a 50%

ownership interest. Employees whose salaried position was not

subject to the Texaco Merit Salary Program are not within the

Settlement Class. Please note: even if you signed a release of

4

claims in exchange for receiving an enhanced severance package

from Texaco, you are still entitled to participate in’ this

Settlement.

7. For purposes of this Settlement, the Court has

certified plaintiffs Chambers, Williams, Harris, Hester and

Shinault as Class representatives and has appointed Michael D.

Hausfeld and Cyrus Mehri of Cohen, Milstein, Hausfeld & Toll,

P.L.L.C. and Daniel L. Berger and Steven B. Singer of Bernstein

Litowitz Berger & Grossmann LLP as Class Counsel.

8. The Court has certified the Settlement Class under both

Fed. R. Civ. P. 23 (b)(2) and 23 (b)(3). With respect to

equitable and injunctive relief to be provided by this Settlement

to the Settlement Class, including the creation of the Equality

and Tolerance Task Force described below, the Court certified the

Settlement Class under Fed. R. Civ. P. 23(b)(2) and, if the

Settlement is approved by the Court, all such relief will be

binding on all Class members, whether or not they opt-out. With

respect to the monetary consideration to be provided the

Settlement Class, including both the distribution from the Net

Settlement Fund and the Salary Increase described below, the

Court certified the Settlement Class under Fed. R. Civ. P.

23(b)(3), and Class members have the right to opt-out of the

monetary aspects of the Settlement and pursue their individual

claims.

5

III.

FACTORS LEADING TO THE PROPOSED SETTLEMENT

9. Plaintiffs, through their counsel, have made a thorough

investigation into the facts and circumstances relevant to the

claims alleged in the First Amended Complaint (the "Class

Claims"). In connection with that investigation, they have

conducted substantial discovery, including inspecting thousands

of pages of documents produced by Texaco, interviewing dozens of

witnesses, and taking numerous depositions. Plaintiffs retained

and consulted with various experts, including an expert in the

statistical analysis of the impact of employment practices; an

industrial psychologist; and a former director of the Office Of

Federal Contract Compliance Programs, an expert in employment

practices. Each expert prepared a report in support of

plaintiffs' motion for class certification and was deposed by

Texaco's counsel. Class Counsel also deposed Texaco's experts.

Class Counsel have considered the expense and length of time

necessary to complete an extensive, multi-track deposition and

expert discovery program and to prosecute this action through

trial; the uncertainties of the outcome of this complex

litigation; the likely appeal after trial of any judgment,

resulting in many years of additional litigation; and the

substantial benefit provided by the proposed Settlement to the

Settlement Class. Plaintiffs have also considered that the

Settlement was arrived at only after extensive negotiations, in

which plaintiffs Roberts and Chambers directly participated.

6

Based upon these considerations, Class Counsel have concluded

that it is in the best interests of the Settlement Class to

settle this Action on the terms set forth herein.

10. Texaco, while denying all wrongdoing of any kind

whatsoever and denying any liability to plaintiffs or the

Settlement Class, and relying on the provisions of the Settlement

Agreement that the Settlement shall in no event be construed or

deemed to be evidence, or an admission, or a concession on the

part of Texaco, of any fault or liability whatsoever, and without

conceding any infirmity in the defenses it has asserted or

intended to assert against the Class Claims, considers it

desirable that this Action be dismissed on the terms set forth

herein in order to avoid further expense, to dispose of

burdensome and protracted litigation and undue distractions and

to terminate all controversy concerning the Action.

IV.

SUMMARY OF THE TERMS OF THE PROPQ8ED SETTLEMENT

11. The Settlement provides for monetary and programmatic

relief which Class Counsel estimate is worth approximately $176

million. Class Counsel believe the Settlement is the largest in

the history of employment race discrimination litigation.

12. The Settlement comprises the following monetary relief

under Fed. R. Civ. P. 23(b)(3):

A. A payment by Texaco of $115,000,000 in cash, which

was deposited on November 22, 1996 with a Settlement Escrow

7

agent, plus the interest on that sum which has been accruing

since November 22, 1996 (collectively, the "Settlement Fund").

Class Counsel may draw on or seek reimbursement from the

Settlement Fund to pay the costs of notice to the Settlement

Class, plus income taxes, if any, which may be due on income

earned or other applicable taxes. The Settlement Fund will be

used to pay (1) all Class members' claims for compensation and

damages; (2) all costs of Notice of the Settlement; (3) all

administrative costs of the Settlement; (4) all amounts awarded

by the Court for attorneys' fees, costs and expenses of the

litigation; and (5) any Incentive Awards to the named plaintiffs.

B. When this Settlement becomes Final, each Class

member then employed by Texaco who was so employed on November

15, 1996, will receive an 11.34% increase over such employee's

November 15, 1996 base annual salary retroactive to January 1,

1997 (the "Salary Increase"). This percentage represents, as of

November 15, 1996, an aggregate annual salary increase of

$4,000,000. Class Counsel expect the Salary Increase to

approximate $26 million over 5 years. The Salary Increase shall

be in addition to, and not in lieu or replacement of, any other

pay increase any member of the Settlement Class would receive in

1997 in the ordinary, customary or usual course of employment.

Within 30 days after the Settlement becomes Final, the portion of

the Salary Increase accrued from January 1, 1997 to the date of

payment will be paid to each such employee. Any Class member

employed at Texaco on January 1, 1997, who did not voluntarily

8

leave Texaco but whose employment was terminated by Texaco prior

to such date of payment, will be paid on such date the portion of

the Salary Increase applicable to that employee's actual period

of employment after January 1, 1997.

13. The Settlement is comprised of the following equitable

and injunctive relief under Fed. R. Civ. P. 23(b)(2):

A. Texaco affirms the following "Statement of

Equality and Tolerance Objectives":

Texaco Inc. is affirmatively committed to the

fullest extent to an environment of

inclusion: to eradicate all forms of

prejudice within the company; to promote and

foster complete equality of job opportunities

within the company to all applicants and

employees regardless of race, gender,

religion, age, national origin and

disability, and to ensure tolerance, respect

and dignity for all people.

B. Plaintiffs and Texaco will create an independent

Equality and Tolerance Task Force (the "Task Force") to determine

revisions and additions to Texaco's current human resources

programs and to oversee, in conjunction with Texaco's President

of the Human Resources Division, the implementation by Texaco of

the human resources program changes agreed to or resulting from

the terms of the Settlement. Class Counsel estimate that the

Task Force and the changes it will implement will cost

approximately $35 million over 5 years. The Task Force will

consist of three Texaco appointees, three plaintiffs' appointees,

and one independent appointee agreed to by the parties who serves

as Chairperson. The Court will approve the nominees to the Task

Force. When vacancies occur, the parties shall have the

9

authority to replace the Task Force members they selected and to

jointly select a new Chairperson, subject to Court approval.

Texaco will provide all funding necessary to fulfill the work of

the Task Force, including the reasonable compensation of the Task

Force members, and the cost of reasonable staff, consultants,

statisticians, and other appropriate experts.

C. Within the first six months after final approval of

the Settlement, Texaco will:

o Adopt and implement a company-wide diversity and

sensitivity training program;

o Adopt and implement a company-wide mentoring

program;

o Insure that Equal Employment Opportunity ("EEO")

and Diversity Performance is included in

management objectives and in determining

management compensation;

o Develop and implement an ombudsperson program;

o Implement national job posting through at least

pay grade 18, and commence evaluation of posting

at higher grade level positions; and

o Develop recommendations for the creation and

implementation of a mechanism to minimize the fear

of retaliation in connection with complaints of

employment discrimination.

The Task Force will review all of these initiatives.

D. During this first six month period, the Task Force

will, among other things:

o Evaluate and revise or replace the Performance

Management Program ("PMP") including the PMP

Appeal Process to ensure that the Program

accurately measures employee performance and,

among other things, that the standards for

performance objectives are specific, measurable,

achievable, relevant, time-bound and documented.

10

o Evaluate and revise or replace the promotion and

employee development process, including High

Potential List procedures, including making known

to all employees objective Promotability Criteria;

o Develop and implement centralized monitoring of

employee compensation to ensure no disparate

treatment or impact based on race which is not

job-related and/or consistent with business

necessity. Review appropriate data to ensure

against unfairness which is not job-related and/or

consistent with business necessity. Data may be

furnished in such a form as to protect the

identity of individuals.

E. The Task Force will review and revise, as appropriate,

Texaco's policies and practices for recruitment, hiring,

training, opportunities, assignments, and promotion.

F. The Task Force will establish the timetable for the

implementation and completion of compliance with any of its

determinations, subject to the terms of the Settlement Agreement.

The President of Texaco's Human Resources Division will implement

each final determination of the Task Force, unless Texaco files

an objection to the Court and the Court determines that such

final determination constitutes in whole or in part unsound

business judgment or is technically not feasible. In the event

Texaco files an objection with the Court to a determination of

the Task Force, Class Counsel will participate in the

proceedings. All reasonable fees and expenses in so doing,

including reasonable expert fees and expenses, will be paid by

Texaco.

G. Every six months for five years ("the Monitoring

Period"), the Task Force will provide to the Court, the Texaco

Chairman and Board of Directors, and Class Counsel, information

11

which it considers to reflect the impact of the Settlement. In

addition, the Task Force will submit a detailed annual report

("Annual Report") during the Monitoring Period to the Court, the

Texaco Chairman and Board of Directors, and Class Counsel, on the

impact of its actions in achieving the Equality and Tolerance

Objectives and the terms of the Settlement.

14. All proceedings with respect to the Settlement

described by this Notice and the determination of all

controversies relating thereto, including disputed guestions of

law and fact with respect to the validity of claims, will be

subject to the jurisdiction of the Court.

V.

THE PLAN OF ALLOCATION

15. After deduction of attorneys' fees, costs and

disbursements including expert fees and expenses, awards to the

Class representatives and other administrative expenses, as

approved by the Court, the balance of the Settlement Fund (the

"Net Settlement Fund") shall be paid to Class members in the

manner and subject to the conditions set forth below.

16. After consultation with various experts who advised

Class Counsel as to a fair, equitable, uniform and efficient plan

of allocation (the "Allocation Plan" or "Plan of Allocation"),

Class Counsel have determined that the distribution of the Net

Settlement Fund will be based on the following four factors: (1)

Existence — employment by Texaco at any time during the period

12

from March 23, 1991 through November 15, 1996, inclusive (the

"Class Period"); (2) Earnings — the total earnings of the Class

member from Texaco during the Class Period; 3) Disparity -- the

difference between the actual earnings from Texaco and the

estimated expected earnings of the Class member had race not been

a factor during the Class Period, as calculated by plaintiffs'

expert; and (4) Time — the length of service of the Class member

during the Class Period.

17. Existence: This factor ensures that every Class member

will receive compensation from the Net Settlement Fund. Each

Class member will receive $2,000 from the Net Settlement Fund for

the Existence factor. This will account for approximately

$2,700,000 of the Net Settlement Fund.

18. Earnings and Disparity: Approximately $23,000,000 of

the Net Settlement Fund will be distributed on the basis of

Disparity and Earnings. In order to accomplish this, a Disparity

Proportion will be computed for each Class member as the ratio of

the Class member's total Disparity during the Class Period to the

sum of the total Disparities of all Class members during the

Class Period. Similarly, an Earnings Proportion will be computed

for each Class member as the ratio of the Class member's total

Earnings during the Class Period to the sum of the total Earnings

of all Class members during the Class Period. A Weighted Average

of the Disparity Proportion and the Earnings Proportion will be

computed for each Class member as 3/4ths of the Disparity

Proportion added to l/4th of the Earnings Proportion. Each Class

13

member will receive a payment from the $23,000,000 portion of the

Net Settlement Fund equal to the Class member's Weighted Average

multiplied by $23,000,000.

19. Time: The remainder of the Net Settlement Fund will be

distributed in a proportionate manner according to the Time

factor. To accomplish this, each Class member will be considered

as starting employment at Texaco either on the date of his or her

hire or on March 23, 1991 (the first day of the Class Period),

whichever is later. Each Class member will be considered to have

ended employment at Texaco either on his or her last day of

employment or November 15, 1996 (the last day of the Class

Period), whichever is earlier. This amount of time (in total

days) will be divided by the corresponding total time employed

(in days) for all Class members to arrive at a Time Proportion

for each individual. Each Class member will receive a payment

equal to the Class member's Time Proportion multiplied by the

remainder of the Net Settlement Fund.

20. Within two weeks after the Court enters an order

approving the Settlement, Class Counsel will send each Class

member by first-class mail, postage prepaid, written notification

of his or her individual factors that will be used to determine

the distribution that he or she will receive from the Settlement

Fund, including his or her (1) length of service at Texaco during

the Class Period according to records provided to Class Counsel

by Texaco and (2) total earnings at Texaco during the Class

Period according to records provided to Class Counsel by Texaco

14

(the "Individual Factors"). Each member of the Settlement Class

will then have two weeks from the date of mailing to notify Class

Counsel in writing (the "Notification Date") about any

disagreement with Texaco's records of his or her Individual

Factors and to provide supporting documentation. Class Counsel

will attempt to resolve any such disputes through consultation

with Texaco's Human Resources Department. However, to the extent

that any disputes cannot be resolved through such consultation,

all outstanding disputes will be collectively submitted to the

United States Magistrate Judge within ten days of the

Notification Date. The Magistrate Judge's determination as to

the Individual Factors will be final and binding on all parties.

21. If you have any questions concerning the Plan of

Allocation, you may call toll-free at 1-800-914-4722.

VI.

TAX CON8EOPENCE8

EACH CLASS MEMBER IS ADVISED TO CONSULT HIS OR HER OWN TAX

ADVISOR REGARDING THE TAX CONSEQUENCES OF RECEIVING A CASH

BENEFIT FROM THIS SETTLEMENT.

22. Class Counsel have retained experienced tax counsel who

have advised that, as a result of a recent amendment to the

Internal Revenue Code, all distributions from the Net Settlement

Fund to the Class members may be subject to federal income

taxation and may also be subject to applicable state and/or local

taxation.

15

23. It is presently contemplated that tax counsel retained

by Class Counsel on behalf of the Settlement Class will seek a

private letter ruling from the Internal Revenue Service on behalf

of Class members regarding the issue of whether distributions

from the Net Settlement Fund or a portion thereof constitutes

"wages” for purposes of the Federal Insurance Contributions Act

("FICA"), the Federal Unemployment Tax Act ("FUTA") and federal

income tax rules regarding the withholding of tax at the source

of payment. To the extent a portion of the distributions from

the Net Settlement Fund is deemed by the IRS to constitute

"wages," some portion of the Net Settlement Fund will be used to

pay the applicable FICA tax and FUTA tax. Consequently, it is

contemplated that a portion of the Net Settlement Fund will be

withheld pending receipt from the Internal Revenue Service of

this letter ruling to pay the applicable FICA taxes and FUTA

taxes. In such event, a second distribution may be made of any

previously withheld funds that, consistent with the Internal

Revenue Service's ruling, is not needed to pay the applicable

FICA tax and FUTA tax.

VII.

EEOC

24. Texaco reached a settlement agreement with the Equal

Employment Opportunity Commission ("EEOC") on January 3, 1997,

which is contingent upon final approval of this Settlement. The

settlement agreement between Texaco and the EEOC provides, among

other things, that the EEOC will have certain rights to receive

16

information, to monitor this Settlement, and to participate in

court proceedings related to this Settlement after the Settlement

becomes effective. The settlement agreement between Texaco and

the EEOC has been filed with the other papers in the Action and

may be inspected at the Office of the Clerk of the United States

District Court, United States Courthouse, 300 Quarropas Street,

White Plains, New York, during business hours of each business

day.

VIII.

CLASS MEMBER RIGHTS AND OBLIGATIONS

25. TO RECEIVE ANY PAYMENTS FROM THE NET SETTLEMENT FUND OR

TO BENEFIT FROM THE SALARY INCREASE, YOU DO NOT NEED TO TAKE ANY

ACTION.

26. YOU MAY, IF YOU CHOOSE, EXCLUDE YOURSELF ("OPT-OUT")

FROM THE MONETARY RELIEF PORTION OF THE SETTLEMENT, WHICH

INCLUDES YOUR SHARE OF THE NET SETTLEMENT FUND AND SALARY

INCREASE. THIS WILL LEAVE YOU FREE TO PURSUE ANY CLAIM(S) YOU

MAY HAVE UNDER APPLICABLE LAW FOR INDIVIDUAL MONETARY RELIEF OR

DAMAGES RESULTING FROM YOUR EMPLOYMENT AT TEXACO. IF YOU WISH TO

OPT-OUT, YOUR REQUEST, MADE IN WRITING, MUST BE SENT OR DELIVERED

SO THAT IT IS RECEIVED AT THE FOLLOWING ADDRESS BY NO LATER THAN

MARCH 4, 1997:

TEXACO CLASS ACTION DISCRIMINATION LITIGATION

c/o Bernstein Litowitz Berger & Grossmann LLP

P.O. Box 5141

New York, NY 10185-5141

17

Any Class member who opts-out shall not be bound by the monetary

portion of this settlement, and will not receive any distribution

from the Net Settlement Fund and will not receive any Salary