Wilder v. Lambert Brief for Appellee

Public Court Documents

February 1, 1985

Cite this item

-

Case Files, Bozeman & Wilder Working Files. Wilder v. Lambert Brief for Appellee, 1985. 7ca8c9fb-f092-ee11-be37-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/3843b11f-aec2-40af-a163-b87bcbca2687/wilder-v-lambert-brief-for-appellee. Accessed February 05, 2026.

Copied!

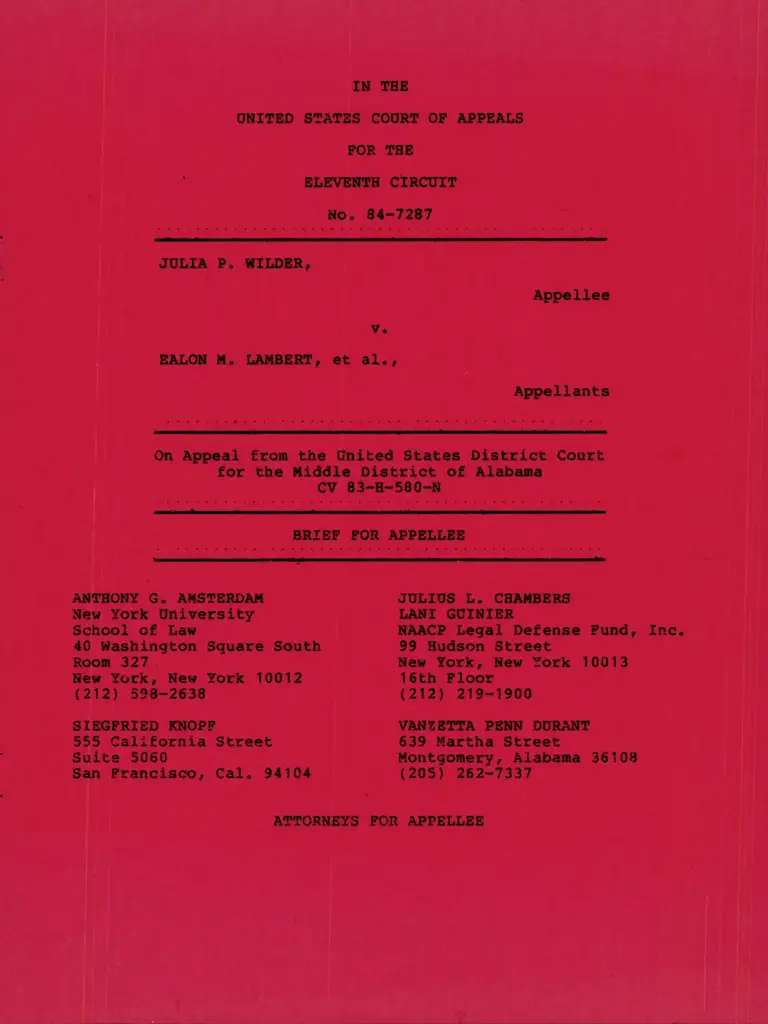

IN THE

UNITED STATES COTIRT OF APPEALS

FOR TEE

ELE1IENTE CIRCUTT

No. 84-7287

JULrA P. WTLDER,

Appellee

V.

EALON ll. LAIIBERT r €t dl. 7

Appellants

On Appea1 from the United States District Court

for the l{iddle District of Alabana

cv 83-E-580-N

BRIEF FOR APPELLEE

A}ITEONY G. AI{STERDAI{ JULIUS L. CEAITIBERS

New York University LANI GUINIER

Schoo1 of Law NAACP Legal Defense Fund, Inc.

40 Washington Square South 99 Eudson Street

Room 327 New York, New York 10013

New York, New York 10012 15th Floor

(212) s98-2638 (212) 219-1 900

SIEGFRIED KNOPF VANZETTA PENN DURANT

555 California Street 639 lttartha Street

Suite 5060 llontgom€ry, Alabama 36108

San Francisco, CaI. 94104 (2051 262-7337

ATTORNEYS FOR APPELLEE

SIATE}ISXT REGANDING PBEPBREHCE

fhig appeal ls entitled to preference as an appeal from a

grant of habeas corpus under 28 U.S.C. 52254.

tt

STAIELEN'I REqTBDUq qRAt ARGUITENT

Appellee respectfully reguests oral argument. The legal

issues are comprex and the consequences for appelree are ergnifi-

cant.

iil

TABLE OF CONTENTS

STATEITTENT REGARDING PREFERENCE .................... o...

.SIATEMENT

REGARDING ORAL ARGUMENT ................ O " "

TABLE oF CoNTENTS . o...... o........ o...................

TABLE OF CASES .. . . o . . . . . . . . o .. . . . . . . . . . . . . . . . . . . . . . . . .

STATE!4ENT OF THE ISSUES ..........................o....

STATEMENT oF THE CASE o..o.o...........................

I. PRoCEEDINGS BELoW ..................o........

II. STATEIT{ENT OF TIIE FACTS .............o........

III. STATEIT'TENT OF THE STANDARD OF REVIEW .O"""'

SUlllrtARY OF THE ARGUITIENT .. o.........o.................o

STATEMENT oF JURISDICTION ..... o... o.............. o....

ARGUI'IENT .....................o. ' ' ' ' ' '' ' o ' ' ' ' ' t '' ' t ' '' '

THE INDICTMENT AGAINST I'{S. WILDER WAS

FATALLY DEFECTIVE IN TIIAT IT FAILED TO

INFORM HER OF THE NATURE AND CAUSE OF

THE ACCUSATION .......'. " " " " " " "" " ..'

A. The Indictment Was Constitutionally

Defective In That, It Failed To Pro-

vide Fair Notice Of All Of The

Charges On Which The JurY Was Per-

mitted To Return A Verdict Of Guilt ....

B. The Indictment Was Fatally Defec-

tive In That It Failed To Include

Constitutionally Suff icient A1Ie-

gations Concerning The Charges Of

Fraud . . . . . . . . .. . . . . . . . . . . . . .. . t ' ' t ' ' t t '

( 1 ) The factual allegations in

each count were constitu-

tionally insufficient to Pro-

vide notice of the nature and

cause of the allegedlY fraudu-

lgnt conduct ......oo...o..........

Page

ii

iii

iv

vi

x

1

1

4

10

11

12

12

12

13

25

1V

27

Paqe

(2t Counts I and II l{ere constl-

tutlonallY insufficient for

failure to allege the crucial

mental element of t,he offense

of fraudulent vot,ing under

517-23-1 ...t....o i......tt""""

coNcLusloN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

CERTIFICATE OF SERVICE ................o...............

31

33

35

-V-

TABLE OF CASES

-

Case

Andrews v. State , 344 So.2d 533 (Crim. APp. ),

cert. denied, 344 So.2d 538 (Ala. 1977) ...'."""'

Bachellar v. Maryland, 397 U.S. 554 (1970) ........""

Barbee v. state, 417 So.2d 611 (AIa. Crim.

APP. 1982) ..... o............. " " ' o ' o "" " "" o " '

Boykin v. Alabama, 395 u.S. 238 ('l 969) .......... o.....

CafafaS V. La Va}Iee, 391 U.S. 234 ( 1968) ...... o... o..

Carter v. State, 382 So.2d 510 (Ala. Crim.

App. 1980), cert. denied, 382 So.2d

614 ('l 980 ) ...... . o.. ... . ... ........ o. ... .. ...... . . .

Cole v. Arkansas, 333 U.S. 196, 201 ( 1948) .......... "

County Court of Ulster County v. Allen, 442

U.S. 140 (1979 ) . . . . . . .. . . .. ' ' ' ' ' ' ' ' ' " ' ' ' ' " o ' ' ' ' ' '

DeJonge v. oregon, 299 u.S. 353 ( 1937) .............. o.

Dunn v. united States , 442 U.s. 100 ( 1979) ............

Goodloe v. Parratt, 605 F.2d 1041 (8th Cir.

1959 ) . . . . . o . . . . . . . o . . o o . ' ' ' t ' ' o t o ' t ' ' ' ' ' ' t ' ' ' t ' ' t ' '

Gordon v. State, 52 Ala. 308 (1875) ..................'

Gray v. Rains, 662 ?.2d 589 (10t'h Cir. 1981) ..........

In fe GaUIt, 387 U.S. 1 ( i967) ....... o................

Jackson v. Virginia, 443 U.S. 307 (1979) ..............

Keck v. United States, 172 U.S. 434 (1899) ......o.."'

Malloy v. Purvis, 68.t F.2d 736 (11th Cir. 1982)

Nelson v. State , 278 So.2d 734 (Ala. Crim.

APP. I973) ........ o.........o. " o " " " " " " " t "'

Plunkett v. Estelle, 709 F.2d 1004 (5th Cir.

1983), cert. denied, 104 S.Ct. 1000.........o......

Presnell v. Georgia, 439 U.S. 14 (1978) ...............

Page

20

26

20

12,19

25

19

19

21 ,22 r23

24

23

19

3, 19,33

21

4

20

23 r24

19

20

25

4

-vl

Case

Russell v. United States, 369 U.S. 749 (1962) ".{""'

Shut,tlesworth v. Birmingham, 382 U.S. 87 ( 1965 ) " " " '

smith v. otGrady, 31 1 u.S. 329 ( 1941 ) .......... o......

Street v. New York, 394 U.S. 576 (1969) "..oo"""t"

Stromberg v. California, 283 U.S. 359 (1931) """""

Tarpley v. Estelle, '703 F.2d 157 (5th Cir'

igg3), cert. dgnied, 104 s.ct. 508 ......o......o...

Terrniniello v. Chicago, 337 U.S. 1 (1949) ""o"'o""

United States V. AugUrS, 427 U.S. 97 (1976) ...........

United StaLes v. Berlin, 472 F.2d 1003 (2nd

Cir. 1973) ..........."""""'o..""""..t""'

United States v. Carl1, 105 U.S. 611 (1882) "'o"""'

united States v. Clark, 546 F.2d 1130 (5t'h

Cir. 1977 ) ......... " " " " " " " " " " " " t " t " "

United States v. Cruikshankr 92 U.S. 542

(1875) ..........t"""o"t""""o"'ot"""""

United States v. Curtis, 506 F.2d 985 (1Oth

Cif . 197 4 ) . . .. . . .. o . . . . .. . . .. . . . . . . . . . . .. . . . o .. . . . .

united States v. Diecidue, 603 E.2d 535 (5Eh

Cir. 1979) ............""""'o"""..t""" ""

United States v. Dorfman, 532 F. SuPP. 1118

(N.D. I11. 1981) ...'oo""'o""""""""o"""

United States v. Dreyfus, 528 F.2d 1064 (5th

Cir. 1975) ...o......"""..o""o"t" "'' """'o

United States v. Haas, 583 F.2d 216t reh.

denied, 588 F.2d 829 (5th Cir. 19781 |

Ceft. denied, 440 U.S. 981 (1979) ................o.

United States v. Hess, 124 U.S. 483 (1888) ....""""

United States v. Huff, 512 F.2d 66 (5th

Cir. 1975) ..........""""".."""""' """t'

Page

19 ,21

27 ,32

24

12

26

24 t25 126

23

24 t25 t26

25

32

32

28

21 ,22 r27

29

32,33

20,31

27

32

29

28

-v1r-

Case

United

477 ,

United

C ir.

950

States v. Nance, 144 U.S. APP. D.C.

533 F.2d 699 (1976) ............

States v. Outler, 559 F.2d 1306 (5th

Unit B 1981 ), cert. denied, 445 U.S.

( 1982 ) . . . . . . . . . . . o . . o . . o . ' ' o ' ' ' ' ' ' ' t ' ' ' ' ' ' ' ' ' t '

Page

29

20 r27

28 t31

19 ,27 ,31

20 r31

11,

7,8r18

26

18 r24

25

25

12

ii

United States v. Ramos, 666 F.2d 469 (11th

Cir. 1982) ............o."""""o"' "'o""""'

United SLates v. St,rauss, 283 F.2d 1955

(5th Cir. 1950) ........oo"..""''o""..'"'ooo''

von Atkinson v. smith, 575 F.2d 819 (1oth

Cir. 1978 ) . ... . . . . . . . . . ' ' ' ' ' " t " ' ' ' ' ' ' ' ' ' t ' ' " ' ' ' '

Wainwright v. Sykes t 433 U.S. 72 (1977 ) .....o."'oo'o'

watson v. Jingo, 558 F.2d 330 (6t,h Cir. 1977 ) ...'."oo

Westbrook v. zant, 704 F.2d 1487 (1lth Cir.

1983 ) . . . . . . . . . . . . . . . o . ' ' ' t ' ' ' ' t ' ' ' t ' ' o ' ' ' ' ' ' ' ' ' ' ' ' '

Wilder v. State, 401 So.2d 151 (AIa. Crim.

App.)r cert. denied, 401 So.2d 167 (Ata'

tgbtl, cert. denied, 454 U.S. 1057 (1982) ...."""

williams v. North Carolina, 317 U.S. 287 (1942)

wilson v. stater 52 Ala. 299 (1875) -.-..-...--........

United States Constitution and Statutes

r'

SiXth Amgndment oo..........o..........................

FOUf tegnth Amendment .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28 U.S.C. 52241 (C) (3) . ...................... o...... o..

28 U.S.C. 52254 . ...... . .. .... ....... . ....... .. .... .. ..

Fgd. R. Civ. P. 54(b) ..............o.'o"""""""'

RUIeS GOVefning SeCtiOn 2254 CaSeS ........... o........

23

25

23

25

12

34

- v111

Alabama Statutes

AIa. Acts 1980, No. 80-732, P. 1478, SS3, 4 ..o........

Ala. COdg S13-5-'115 ('1975) o..................o........

Page

6

11 ,14

15 | 16 ,17

11t14r15

11 ,14 ,15

6r11r14

pass im

Ala. Code S 1 7-1 O-3 ( 1 975 )

Ala. Code S17-10-5 ( 1975)

A1a. Code S17-10-7 (1975)

A1a. Code S17-23-1 (1975)

a a a a a a aa a a a a a a a a a a a a a aa a a a a a o

a a a a a o a a a t a a . a a a a a a a a a a a a a a a a6,

aaaoaaaaaaaaaaaaaaaoaaaaaa"'

a a. a aaa a aa a aa a aa a a a aa aa aa a aa a

Other Authorities

75 Am. JUf.2d Tfial 5885 ............ o............. o... o

75 Am. JUf.2d Tfial 51 1 1 1 ..............................

26

26

IX

. srArEuENr 9I' TBB TSSUES

Whether an lndictment, which fails to inforn a

defendant of the nature and cause of the

accusation against, her violates the Sixth and

Fourteenth Anendments?

-I

IN THE

UNITED STATES COURT OF APPEALS

FOR THE

ETEVENTH CIRCUIT

No. 84-7287

JULIA P. WTLDER,

Appellee

V.

EATON U. I"AIIBERTT €t il.r

Appellants

On Appeal from the United States District Court

for the t{iddle District of Alabama

cv 83-E-580-N

STATET{ENT OP THE CASE

I. PROCEEDINGS BELOW

This is an appeal by Ealon M. Lambert et a1. (hereinafter

"the state" or "appeIlants") from an order of the District Court

for the Dliddle District of Alabama, the Honorable Truman Hobbs,

1

grant,ing the motion for summary judgment of Julia P. Wilder.

1,1s. Wilder agrees with the recital of prior proceedings in

Appellants I Brief except that it is incomplete.

I rh" following abbreviations will also be used: "Tr. " for Circuit

Court trial t,ranscriptl "Hrg. Tr." for Hearing before Judge

Hobbsi "R.n for Record on Appeal.

After judgment, of conviction by the trial court but prior to

the f iling of ghe present federal habeas petition, in addition to

the proceedings set fort,h on Page 4 of eppellants' brief :

d. A motion for a new trial was made to the trial court

(the Circuit Court of Pickens County), and was denied on

September 27, 1979.

b. The Court of Criminal Appeals of Alabama denied Ms.

Wilder's motion for rehearing on April 21, 1981.

In the federal habeas case, in addition to the proceedings

set forth at Pages 5-6 of Appellants' brief:

1. Concurrently with t.he f iling of her petition on June 8,

1983, Ms. Wilder filed a motion requesting that the district

court order the stat.e Eo produce Lhe full transcript of certain

out-of-courE Statements which, MS. Wilder alleges, were used

against her in violation of her const,itutional rights.

2. On June 28, 1983, the district court ordered the state

to show cause why the relief requested by Ms. Wilder should not

be granted.

3. On July 18, 1983, the st,ate f iled a motion to dismiss

t.he petition contending that Ms. Wilder had f ailed to exhaust

state remedies.

4. On August 10, 1983, !1s. Wilder f iled a reply brief to

the state's motion t,o dismiss.

5. On September 1, 1983, the district court denied t.he

staters mot,ion to dismiss.

2

6. On September 22, 1983, the stat,e f iled an answer to the

pet it ion.

7. On October 7, 1983, the state filed an amended answer.

8. On December 2, 1983, the district court issued an order

denying llls. Wilderts motion refered to in paragraph t ibove, and

ordering both parties to file a brief or other documents sett,ing

out their positions on the issues in the case.

9. On December 19, 1983, Dls. Wilder f iled her response to

the district courtrs order of December 2.

10. On January 10, 1984, the state filed its response.

1 1. on January 20 , 1984, !1S. wilder f iled a motion f or

summary judgment, amended February 23, 1984, challenging, on

three grounds, the constitutional sufficiency of her indictment.

12. On April 13 . 1984 the district court ruled for l{s.

g{ilder on the due process issues raised by her motion for summary

judgment, and ordered the writ of habeas corpus to issue unless,

within ninety days, the st,ate retried her. The district court

also discussed and decided against Ms. Wilder an issue under

-Jacfson ". virgin+, 443 U.S. 307 (1979) which her motion for

2

summary judgment had not, raised.

13. The April 13 judgment was certified pursuant to Fed. R.

Civ. P. 54(b), and on May 1t 1984 the district court granted

appellants a stay of judgment pending appeal.

See note 15, below.

3

II. STATEMENT OF FACTS

Appellee Julia P. Wilder was convicted of violating Alabama

Code S17-23-1 and was sentenced to five years' imprisonment.

because of her alleged participation in an effort to assist,

elderly and illiterate black voters in Pickens County, Alabama to

vote by absentee ballot in the Democratic Primary Run-Off

3

Election held on September 26, 1978 (hereinafter the "run-off" ).

A vaguely worded statute which, prior to [1s. Wilder's appeal, had

last been authoritatively construed in a published opinion in

1875r s€ction 17-23-1 prohibit.s inter alia "any kind of illegal

or fraudulent voting."

I{s. Wilder charged t,hat she:The indictment against

COT'NT ONE

did vote more than oncer oE did deposit more

than one ballot for the same office as her

vote t ot did vote illegally or fraudulently,

in t,he Democratic Primary Run-off Election of

September 26, L978,

3 at th. tine her federal habeas petition was filed, tls. wilder was

on parole in the custody of appellant members of the State Board

of pardons and Parole. Appellants have stat,ed that !1s. Wilder

was subsequently released from parole. t{S. Wilder, of course,

has and Jtifl suffers irreparable damage due to collateral

consequences arising from this felony conviction-including the

loss of various civil liberties, including the franchise. See

Carafas v. La Vallee, 391 U.S. 234 (1968); ptillov v. Purvis, 6:6'T

th Cir. 1 982 ) .

4-

couNT Two

did vote more than once as an absentee voter,

or did deposit more than one absentee ballot

for the same office or offices as her vote t Qt

did cast illegaI or fraudulent absentee

ballots, in the Democratic Primary Run-off

Election of September 26, 1978,

COUNT TEREE

did cast i11ega1 or fraudulent absentee

ballots in the Democratic Primary Run-off

Election of September 26, 1978, in that she

did deposit with the Pickens County Circuit

Clerk, absentee ballots which were fraudulent

and which she knew to be fraudulent, against

the peace and dignity of the State of

AIabama.

Tr. 305.

The evidence at trial indicated Ehat on October 10, 1978,

two weeks af ter the run-of f , the Sherif f of Pickens County, ljlr.

Louie Coleman, along with the District At.torney of the County,

t'lr. P.ltll. Johnstonr drr investigator named Mr. Cha.rlie Tate and [{r.

Johnstonrs secretary, Ms. Kit,ty Cooper, opened the county

absentee ballot box, and began searching for ballots which could

be connected to tts. Wilder and t,o the general effort, in which,

as had come to

was involved,

the at.tent ion of the such of f icials, Ms. Wilder

to aid elderly blacks in Pickens Count,y to vot,e by

absentee ba1Iot. Tr. 69-70. They isolated thirty-nine absentee

ballots out of t,he many cast. These ballots vrere isolated by the

following method. Mr. Tate was able to get the names of certain

voters whose application f or an absentee ballot lvls. Wilder had

5

4

turned into the Pickens County Circuit Clerk. Tr. 70-71, 74-76i

Egg 4gg Tr. 45-45. Since at Ehat time Alabama law required that

the absentee ballot contain the name of the vot,er, A1a. Code

SS 17-10-6, 17-10-7 (19751 , SS3,4, Mr. Tate r^,as thus able to

identify t,he ballots of each of these voters, and when it, eras

noticed that each of these ballots 'had been notarized by the same

man (a black notary from outside of Pickens County named Mr. PauI

Rollins ), dIl of the absentee ballots not.arized by Mr. Rollins,

amounting t,o a t,otal of 39, $rere isolated. Tr. 58, 75-76.

The names on each of these 39 absentee ballots indicated

that each was the vote of a different black, elderly, and

infirmed resident of Pickens County. The state claimed that Ms.

Wilder, who is 72 years o1d, Participated in Lhe casting of these

ballots in violation of S17-23-1.

Test.imony was given by 14 of the 39 voters whose ballots

were introduced into evidence. Of t,hese 14 witnesses, the Court

of Criminal Appeals cited t,he testimony of five as having been

incriminatory of I{S. Wilder t,o some degree: Mr. Charles

ffiofIr1s.Wi1der|stria1acomp1icatedmu1ti-step

process for voting by absentee balIot was prescribed by Alabama

lavr. In order to receive an absentee baIlot, one had first to

pick up an application for an absentee ballot. The application

had to be filled out and witnessed and mailed in to the appro-

priate county office. An absentee bal1ot could Lhen be procured,

but only by having it mailed to the address indicated on the

application. The absentee ballot once completed had to be

notarized. Alabama Code SS 1 7-1 0-6, 17-10-7 ( 1975). These

statutes were amended within a year after trts. Wilderrs trial to

no longer require notarization of the absentee baIlot, Acts 1980,

No. 80-732, p. 1478, SS3r4.

6

Cunningham, I'ts. Lucille Harris, Ils. Sophia Spann, Ms. Eula

Deloach, and Mr. Robert' Goines, Wilder v. St,ate, 401 So.2d 151

5

161-152 (AIa. Crim. APP. ) , cert,. denied 401 So.2d 167 ( 1981 ) .

ffi.courtacceptedascorrecttheA1abamacourt|sreview

of the evidence. R. 15-9. According to that court, the testimony

of yr. Cunningham was incriminatory because he testified that Ms.

Wilder aidel him in voting by absentee ballot in a "wet-dry"

election. Tr. 189, 193. titr. Cunningham never testif ied that Ms.

Wilder did not aid him to vote by absentee ballot in t,he run-off.

In fact, he stated that tis. Wilder read him the names of the

candidates appearing on the absentee ballot when she aided him to

Vote. Tr. -i91. The testimony of Ms. Harris, I1S. Spann, lils.

Deloach, and tlr. Goines was said by the Court of Criminal Appeals

to have inculpated 1.1s. Wilder in that each claimed never to have

received or rrbted an absentee ballot in the run-off . 401 So.2d

at 161-62. In fact, only two of the voters were able to testify

with a reasonable degree of certainty that they never received an

absentee ba1}ot, tl". IIarris, Tr. 145-46, and lls. Spann, Tr.

10G-107. No connection was drawn between Fls. Wilder and the

asserted failure of either of these witnesses to receive an

absentee ba1}ot. According to }ls. Harris' ballot aPPlication,

Ehe absentee ballot was sent to her home. Tr. 147-148. According

to Ms. Spann's ballot applicat,ion, her absentee ballot was sent

to the home of Ms. Ufiinie Dunner HilI. See Tr. 224i State I s

exhibit *5'l .

Of the nine remaining witnesses who had voted absentee

ballots, three Ms. t{atlie Gipson , Tt. 99-105, MS. Clemie

Wells, Tr. 170-179, and Ivls. Maudine Latham (whose testimony was

entered in summary form by stipulation), Tr. 193 -- drew no

connection between [ls. Wilaer and their respective voting

activities in the run-off.

The remaining six voter-wltnesses -- lls. Annie Billups, Mf.

Nat DanCy, MS. -ttlamie Lavendar, l{r. Lewis I"linOr, FlS. Bessie

BilluPSr-and Pls. Fronnie Rice varied in their ability t'o

recaII the underlying events surrounding their vote in the

runrcff, but no one 6f the six gave testimony from which it could

be conciuded that Ms. Wilder employed fraud in order to vote more

than once. Each voter recalled that i\41s. Wilder had aided that

voter in voting absentee, with that voterrs knowledge and

consent. Tr. gA-g5 (A. Billups); Tr. 126 (N. Oancy); Tr.

134-135, 137-138 (lvl. Lavender) ; Tr. 140-144 (L. t'{inor); Tr. 154,

150-'t61 (8. BilluPs); Tr. 163-164t 168-169 (F. Rice) '

7-

tluch of the testimony of the voters "was both confusing and

conflicti^g, and, depending on who was examining then, ...

favorable to both t.he prosecution and the defense." 401 So.2d at

162. Whether caused by the manifest unreliability of the memory

of cert.ain of the voters, their lack of exPerience with the

voting process, or the susceptibility of many to coercive and

Ieading questions from the prosecution, the confusing and

conflicting nature of t,he testimony makes characterizing the

evidence d i f f icult . The test imony of t'lr. Goines, cited by the

Court, of Criminal Appeals'as incriminating and presumably

characterized in the same \{ay by the district court, is illustra-

tive. Mr. Goinesr ST years old at the time of trial, TE.87, in

poor health, i9., and illiterate, Tr.85, began his testimony by

stating that he had voted in the run-off , Tt. 81. He remembered

also that trts. Wilder had aided him in filling out an applicat,ion

for an absentee ba11ot, TE, 82. ME. Goines was then asked

whether he had ever seen the absentee baltot voted in his name to

which he answered, "Yes, sir, I believe Sor' Tr. 83. But the

prosecutor was subsequently able to elicit on direct examination

a contrary answer from [r{r. Goines through the following line of

questioning:

Did you tell anybody t,hey could vote for

you on Sept,ember the 26th , 1978?

tObjection from defense counsel, over-

ruled l

o.

I

A.

o.

A.

Tell anybody that I could get

vote f or me? You have t,o

voting.

That is what I thoughtr too.

e

you?

[Defense counsel objects]

I didn't do that. [objection

I have t.o go straight.

You go by the rulee?

I got t,o go straight. I didn I t

All right, sir. You did not

ballot, did you?

No sir. I don't know a thing

ba1Iot.

Prosecution Russell: Your witness,

t'lr. Goines: I didn't do it.

somebody to

do you own

You did not

for you, did

overruledl.

do that.

vote this

about this

counsel.

offered against I'ts. Wilder,

to the prosecution, were that

o.

A.

Q.

A.

Tr. 84-85 (emPhasis added).

The other sorts of evidence

viewed in the light most favorable

she:

(i)

(ii)

picked up a number of aPPlicationq for absentee

ballots fiom the Circuit Clerkrs Office during the

week prior to the run-off, Tr. 44i subsequellIy,

returned some completed absentee ballot apPlica-

tions, Tr'. 45; and on the day before the run-off,

deposited a number of absentee ballots, !!.; and

vras present with two or three young women, who did

not include the voters, dt the notarizing of the

absentee balIots, Tt. 15-17 | and was permitted by

the notary, ME. RoIIins, to represent whether the

signatures were genuine, Tr. 22, 25-27-

9-

fhe prosecution advanced various grounds on which it

contended that Ms. Wilder should be held culpable, asserting

principally t,he f ollowing: ( i ) that lrls. Wilder did not ade-

quately explain absentee vot,ing to the voters, TE.268, (ii) that

many of the absentee ballot apPlications were signed with an 'Xr'

wh i 1e t.he correspond ing absentee baI lot had been signed in

script,, and that many of the witnesses denied having signed the

absentee ballot voted in their name, TE. 269-270, 299; ( iii ) that

the notary did not have the voters before him when he notarized

the ballots, TE. 269-270i and (iv) that some of the wienesses

testified that they had never b€fore seen the absentee ballots

voted in their names, Tr. 270t 299.'The court below summarized

the evidence against Ms. Witder. 'Wilder picked uP numerous

applications, she took them to persons whose votes were Pur-

portedly "stolenr' she had access to many of the ballots, and she

was in the grouP that took them to Rollins to be notarized." R.

at 165.

III. STATEUENT OF TBE STA}IDARD OF REVIEW

The st,andard of review is whether the district court

disregarded applicable legaI principles in its adjudication of

the const,itutional merits of the case.

10

SUUUARY OF ARGT'UENT

-

Irls. WiIder was indicted f or violations of Alabama Code

S17-23-1 (1975). The court. below found that. the trial judge

instructed the jury on four statutes, AIa. Code 517-10-3 (1975)

[miscited by the trial judge as 517-23-3], Tr. 308-09; A1a. Code

S17-10-5 (1975) [miscited by the trial judge as 517-10'7), Tr.

309-310; A1a. Code S17-10-7 (I975), Tr. 310-31 1; and AIa. Code

513-5-115 (1975), Tr. 311, and further instructed the jury that

proof of lls. Wilder's commission of any act'not authorized by

... Or ... contrary to" any law wOuld conStitute an "iIIegal' act

warranting her conviction under SlT-23-1. Tr. 308. The effect of

these instructions was to make a violation of each of the other

statutes a separate ground for liability under 517-23-1. Yet the

indictment contained no allegations that, FIs. Wilder had violat,ed

Ehe other statutes or had engaged in acts which would constitute

violations of them.

For these reasons the district court correctly held that the

indictment failed to provide notice of the offenses for which t'ls.

Wilder's conviction was actually sought, and that her conviction

was obtained in violation of due process. The failure of noLice

was a defect of the indictment which }ls. Wilder challenged in the

state courts aqd which the state courts upheld against her

challenge. appellants' Wainwright v. Sykes argument is therefore

totally wide of the mark.

11

STATEI{ENT OF JURISDICTION

The district, court had jurisdiction under 28 u.s.c.

52241(c)(3). The district court's final judgment was certified

pursuant to Fed. R. Civ. P. 54(b).

ARGUMENT

TEE INDICTI{ENT AGAINST lis. WILDER WAS FATALLY DEFECTIVE IN TEAT

IT FAILED TO INFORU EER OP TEE NATUFA A}ID CAUSE OF TEE ACCUSATION

The indictment filed against tls. Wilder failed in numerous

respects to provide the level of not,ice required by the Sixth

Amendment's guarantee that in all criminal cases the accused

shall receive "notice of the naEure and cause of the accusation"

against her. Each of these failures, standing aIone, amounts to

a denial of constitutionally required notice; together, they add

up to a stunningly harsh and egregious denial of notice, a right

which the Supreme Court has deemed "the first and most universal-

ly recognized requirement of due process. " Smith v. O'Gradv | 312

U.S. 329 | 334 11941); see also Co-le v. Arkansas, 333 U-S. 196,

201 (1948).

The district court found that the indictment failed to

provide any notice of a number of charges which were submitted t,o

the jury. tls. Wilder was tried, "to Put it simply -.. uPon

charges t.hat r^rere never made and of which Ishe was] ... never

12

notified." R. 177. She did not discover the precise charges

against her, "unti1 [she] had rest,ed Iher] case.' R. 176. The

district court held that she was thereby denied due process.

The Indictment Was Constitutionally Defective In That

It Failed To Provide Fair Notice Of AII Of The Charges

On Which The Jury Iitas Permitted To Return A Verdict Of

Guilt

The district court not,ed t.hat various statutes and theories

of liability as to which the indictment provided no notice

whatsoever were incorporat,ed into the charges submitted to the

jury as the basis for a finding that Ms. Wilder had violated

s17-23-1 by "any kind of illegal ... voting.n The indictrnent is

set forth at pp. 4-5 sqpra. In each of its three counts, it

ostensibJ-y tracked various provisions of S17-23-1. rt alleged

disjunctively with other charges in Count I that Ms. Wilder had

"votIed] iI1egally or fraudulentlyr" and in Counts II and III

that she had "cast illega1 or fraudulent absentee ballots.tr Only

in Coune III was any factual specification provided; and there it.

was alleged that Ms. Wilder had deposited fraudulent absentee

ballots which she knew to be fraudulent. fn none of the counts

was any elaboratlon given to t,hat portion of the charge which

accused lts. wilder of having "vot[ed] illega11y" or having "cast

i11ega1 ... absentee ba1Iots."

A.

l3

In the instructions to the jury, the trial judge did frame

elaborate charges under which Ms. Wilder could be convicted of

illegal voting. After reading S17-23-1 to the jury, he explained

the statuters provision against'any kind of illega} or fraudu-

lent voting" by defining the terms "il1egaI" and "frauduient."

Tr.308. Concerning t,he term "illegalr'he instructed the:uty

that, "illegal, of course, means an act that is not authorized by

Iaw or is contrary to the lavr." Tr. 308. He then instructed the

jury on f our stat,utes: Ala. Code S 17-10-3 ( 1975 ) [miscited as

S17-23-3), Tr. 308-309; AIa. Code S17-10-5 (1975) lmiscited as

s17-10-71, Tr. 309-310; AIa, Code S17-10-7 (1975',) t Tr. 310-311;

and Ala. Code S13-5-115 ( 1975), Tr. 311. None of t,hese sLatutes

or their elements was charged against lls. Wilder in the indict-

ment. Their terms provided numerous new grounds on which to

convict. The jury was thus author,ized to f ind lls. Wilder guilty

under 517-23-1 if she had acted irr''" manner 'not authorized by or

... contrary totr any one Of the provisiOns Of a number Of

statutes not, specified or even hinted at in the indictment.

For example, the jury was first instructed on S17-10-3,

miscited by the trial judge as S17-23-3, which sets forth certain

qualifications as to who may vote by absentee ba11ot. The trial

judge instructed that under S17-10-3 a person is eligible to vote

absentee if he will be absent from the county on election day or

is afflicted with "any physical illness or infirmity which

prevents his attendance at, the polls." Tr. 309. Thus a finding

14

by the jury that one of the absentee voters had not been physi-

cally "preventIed]" from going to the pol1s to vote in the

run-of f would have constit,uted the f inding of an 'act not

authorized by ... Or . .. cOntrary to" S17-10-3, necessit,ating It{S.

Wilder's conviction under S17-23-1 even though she was given no

notice in the indictment t,hat such proof could be grounds for

I iabi I ity.

The trial judge then instructed the jury that s17-10-6,

miscited as S17-10-7, reguires, s!35 a1ia, that all absentee

ballots "shaII be sworn to... before a notary public" except in

cases where t,he voter is conf ined in a hospital or a similar

institution, or is in the armed forces. Tr. 309-10. Further,

under S17-10-7, the trial judge stat,ed t,hat the notary must'swear

that the voter "personally appearedn before him. Tr. 310.

Accordinglyr €vidence that the voters were not present at t,he

notar LzLng, see Tr. 19-30 , 269-270, sufficed to establish g se

culpability under S17-23-1 although, again, the indictment gave

Ms. Wilder no warning whatsoever of any such basis for culpabi-

I ity.

The trial judge then instructed the jury that S13-5-115

provides:

"'Any person who sha11 falsely and incorrectly

make any sworn statement or affidavit as to

any matters of fact required or authorized to

be made under the election laws, general,

primaryr special or local of this state sha11

Ue guilty of perjury.' This section makes it

illegal to make a sworn stat.ement, oathr oE

15

af f idavit as t,o any matters of f act required

or authorized to be made under the election

laws of this state. "

Tr. 311. Both sent,ences of this instruction contain egregious

misstatements concerning S 1 3-5- 1 1 5. The first sentence repre-

sents a verbatim reading of S13-5-115 with one crucial error. The

trial judge instructed that S13-5-115 proscribes "faIseIy and

incorrectly" making the sworn stat,ements described in the

St,atute, whereas in fact the staLute Proscribes the making of

such statements nf alseIy and corruptly" -- i€., with criminal

6

intent,. The second sentence of the instruction, which aPPare-

ntly represents the trial j udge 's int,erpret,ation of S 13-5-1 15,

has the absurd result of making illegal every s$rorn statement

duly made under the election laws.

-

o The district court wrote that "the judge charged the jury t,hat,

under Ala. Code 513-5-115, any Person who falsely and g53g1!y,

makes a s$rorn statement, in connection with an election is guilty

of perjury. n R. 171 . While t,his is a f air characterization of

the terms of S13-5-115, the trial judge actually instructed the

jury that the statute penalized "fa1se1y and incorre_c_tlv" making

such a statement. Tr. 311 (emphasis added). The trial judge

thus rendered the addition of S13-5-115 as a new charge against

Ms. Wilder even more damaging than it ot,herwise would have been

by misreading it to remove the only word in the stat,ute embodying

ciiminal intent o.. "corruptly" and replacing it with a word

"incorrectlyrr -- embodying no leve1 of mens E.

t6

Irrespect ive of these misst,atements, the charging of

S 13-5-1 15 deprived t'ls. Wilder of constitutionally required

notice. The misstatements of the terms of a statute which IUs.

Wilder had no reason to suspect she was confronting in the first

7

place only aggravated t,his denial of due process.

Thus, t.hree of the four statutes not charged in t,he indict-

ment had the ef f ect of making any evidence of it{s. Wilder's

participation in the notarizing into evidence of ESI se culpabi-

Iity under S 17-23-1. The district court f ound t,hat the trial

judge's charge, by explicitly permitting the jury to convict l'ls.

Wilder of casting an improperly noEarized baIlot, was Prejudicial

because the jury could have convicted her on that basis alone.

R. 175-77. As the district court said: "There is a world of

difference between forging a person's ballot and failing to

follow the proper procedure in getting that, person's ballot

notarized." R. 177. The indictment contained no allegations

which could have put I{s. Wilder on notice t,hat. her participation

in the notarizing process was violative of S17-23-1 or in any way

The trial judge also misread 517-23-1 in a way which expanded the

charges against tls. Wilder. He instructed the jury that 517-23-1

penalizes one who "deposits more than one baIlot for the same

office.'r Tr. 307. In fact S 17-23-1 penalizes one who "deposits

more than one ba11ot for t,he same office as his vote" (emphasis

added). This omission by the trial judge-?adTEafTfrchanged the

meaning of the statute so that the mere physical act of deposit-

ing two or more ballots at the same election even ballots

deposited on behalf of other voters violates 517-23-1. It

thus produced a new charge against l4s. Wilder of which the

indictment provided no notice.

17

criminal. Yet, dt Erial a large Part of the prosecution's case

was spent attempting to Prove t,hrough the test,imony of lrlr.

Rollins, and through quest.ions posed to virtually all of the

testifying voters, t,hat the notarizing took place outside of the

presence of the voters, and that Ms. Wilder had participated in

t,hat notariz ing. The district court f ound that the unindicted

charges rrrere signif icant because they enabled t'he jury t,o convict

even if the jury believed that Ms. Wilder aided people to vote

absentee only with their knowledge and consent. R. 175. The

details of !4s. Wilder's dealings with the voters, beyond her

testimony that these were relationships of trust and consent, are

largely obscured in t,he testimony by the voters' poor memory,

their inability to read and write, their d9€, their lack of

understanding of the voting process, and their susceptibility to

the leading and coercive questions of the prosecutor. Ms. Wilder

contended that, to the extent any alleged deficiencies in voting

procedures erere connected to her, they failed to establish that

8

she employed fraud to vote more than once. Hence, the charges

made for the first, time in the instructions provided new grounds

for culpability which were crucial to her conviction.

ffiftheso1eoffensechargedagainstMs.Wi1derwere

that she employed fraud to vot,e more than once. Wilson v. State,

52 A1a. Z6g,'303 11875); Wilder v. State, 4om

(Ara. crim. App.), cert. aeni@z (A1a. 1981), cert.

1!g!g!, 454 U.S. 1057 (1982).

18

The court below held that the failure to al1ege these

grounds for culpability in the indictment violated Ms. Wilder's

Fourteent,h Amendment rights. The only relevant allegations in

the indictment vrere that Ms. Wilder had "vote Id] illegalIy"

(Count I ) or had "cast i11ega} ... absentee ballots" (Counts II

and III) in the run-off. These allegations in no way informed

ilts. Wi1der with particularity that she could be prosecuted under

the rubric of illegaI voting for acts trnot authorized by... or

o.. contrary to' the four unalleged statutes charged in the

instructions. But " [n]otice, to comply with due process require-

ments, must be given sufficient,ly in advance of the scheduled

court proceedings so t,hat reasonable opportunity to prepare will

be afforded, and it must 'set forth the alleged misconduct with

particularity. '' In re GaulE, 387 U.S. 1, 33 (1967). "Convic-

tion upon a charge not made would be a sheer denial of due

procesS. n De..Ionge v. Oregon | 299 U.S. 353, 362 (1937) i see also

Dunnv.UnitedStates,442U.S.100,105(1979)i@

Virginia, 443 U.S. 307, 314 (1979 ); Presnell v. Georgia, 439 U.S.

14r 15 11978); Cole v. Arkansasr 333 U.S. 196r 201 (1948)'

ys. Wilder was plainly subjected to an egregious violation

of the rule that, in order to satisfy the Notice Clause of t'he

Sixth Amendment, an indictment must allege each of the essential

elements of every statute charged against t,he accused. Egg

RusseIl v. United States, 369 U.S. 749, 761-766 (1962)i United

States v. Ramos, 566 F.2d 469t 474 (11th Cir. 1982)i United

19

States v. Out,ler, 659 F.2d 1305, 1310 (5t.h Cir. Unit B 1981),

S. {S4"d, 455 U.S. 950 1 19.Q2 ) ; Unitsd, States v. Haas, 583

F.2d 216 , 219 re[. 9SI1g|, 588 F.2d 829 ( 5th Cir. 1978) | gS.

{S , 440 U.S. 981 11979);^United SLates v. Strauss, 283 F.2d

9

155, 158-59 (5th Cir. 1960). Here, the indictment failed even

remotely to identify the critical elements uPon which her guilt

was made to depend at t,rial.

9 This rule is followed by the Alabama courts as a proposition of

both Alabama 1aw and f ederal constitutional 1aw. EE, €.9. r

Andrews v. State, 344 So.2d 533, 534-535 (Ala. Crim. App.), cert.

ffia 538 (A1a.1977). rn fact, under Alabama Iaw,

?EiTGle to include an essential element of the offense in the

indictment is regarded as such a fundamental error that it

renders the indictment void, and objection to such an indictmenE

cannot be waived. See ej3r Barbee v; SEate | 417 So.2d 611 (A1a.

crim. App. 19ez)-;-cEffir@o.2d 510 (Ara. crim.

App.), "6ft.

denied gffiO); In Nelson v. Stater 278

s-o.za-13:mAIEffiTm. App. 19731 , the court@asis

for the rule as follows:

"When rules of state practice and procedure

conflict with the due Process clause of the

Fourteenth Amendment, they must yield to the

commandments of that, AmendmeDt. . . .

'An intelligent and fuIl understanding by the

accused of the charge against him is a first

requirement of due Process. ***r [citation

onit.tedl .

The conviction in this case cannot, stand as it

offends the first requirements of constitutional

due process. The failure to charge an offense

and ihe obvious harm to the defendant resulting

therefrom, is the kind of defect involved in due

process of law and it cannot be waived."

Ig. at 737.

20

The indictment also violated the

Cruikshank, 92 U.S. 542 ( 1875) r that:

rule of United States v.

"where the definition of an offence, whether

it. be at common law or by st,atute, includes

generic terms, it is not sufficient that the

indictment sha1l charge the offence in the

same generic terms as in the definit,ion; but

it, must st,ate the species it must descend

to the particulars."

Id. at 558 (citation omitted). The Cruikshank rule is fundamen-

tal to the notice component of due process. See Ussell--v.-

United Statesr 35g U.S. 749r 755 (1962). It is apposite to this

case because "illegal" is unquestionably a "generic term." &.*.

v. United States, 172 U.S. 434, 437 (1899); @

605 F.d 1 041 , 1 0 45-46 ( 8th Cir. 1979). An indictment which

charges unspecified illegalities as did I'ts. Wilder's in

charging her with 'votIing] i1legalIyr or "castIing] illegal ...

absentee ballotsn must, under Cruiksha4k, ndescend to the

particulars' and identify the acts and underlying laws which

alleged1y constituted t.he illegalities. Id. In Ms. Wilder's

situation, Cruikshank required that t,he indictment allege that

she violated 517-23-1 by failing t,o comply with each of the four

statutes as they were charged against her in the instructions,

and contain specific factual allegations giving her fair notice

of the acts which were aIlegedly criminal under those charges.

21

Such $ras the conclusion which the court below derived from

Goodloe v. Parratt, 505 F.2d 1041 (8th Cir. 1979)t where habeas

petitioner Goodloe had been convicted in a state court of

operating a motor vehicle to avoid arrest. Under Nebraska Iaw

the crime a1legedly committed by the defendant for which he was

subject t.o arrest, and because of which he was resisting, had to

be proven as an element of the offense of resisting arrest. 19.

at 1045. The ggodloe court found that during trial the prosecu-

tion changed the offense it was relying on as the crime for which

Goodloe was allegedIy resisting arrest. .L9. at 1044-1045. This

change denied Goodloe constitutionally required notice. .L9.. In

addition, irrespective of the change in underlying offenses at

trial, the Eighth Circuit held under Cruikshank that Goodloe was

denied constitutionally required notice because the initial

charge against him had failed to include notice of the underlying

offense which Goodloe had allegedly commit,ted and because of

which he vras allegedIy resisting arrest. The indictment there-

fore failed to "allege an essent,ial substantive element. " Id. at

10

1 046.

1o The court reasoned:

'rThe indictment. upon which Goodloe was tried

charged that he did, 1n the words of the sLatute,

'un1lwfully oPerate a mot,or vehicle to f lee in

such vehicle in an effort to avoid arrest for

violating any Iaw of this State.' There is no

indication from this statutory language t,hatr 8s

the trial court held and instructed the juryr dD

additional element must be proven for conviction:

actual commission of the violation of state law

22

The f acts of Goodloe are analogous to !1S. Wilder I s case,

since the four statutes invoked against her which the stat.e

failed to charge in the indictment were incorporated as substan-

tive elements of S17-23-1's prohibition against illegaI voting.

Accord, @, 558 F.2d 330 (5t,h Cir. 1977). See alsg

Plunkett v. Estelle , 709 F.2d 1004 ( 5t,h Cir. 1983 ) , cert. deniqQ

104 S.Ct. 1000; Tarplev v. Este1ler 7O3 F.2d 157 (5th Cir. 1983),

cert. denied 104 S.Ct. 508; Gray v. Rains, 562 F.2d 589 (1Oth

Cir. 1981); Von Atkinson v; Smith, 5'75 F.2d 819 (1oth Cir. 1978).

The district court followed the basic approach of these cases in

deEermining that t,he jury could reasonably have convicted ltls.

Wilder of a crime not, charged in the indicEment. The courtrs

determinat,ion was based on its examination of the trial as a

whole, including the charge, the arguments of counsel, the t'heory

of the prosecution and [he evidence. R. 173-74. The court

rejected appellantsr argument t,hat DIs. Wilder was challenging the

jury charge rather Lhan Ehe indictment's failure to provide fair

notice of the charge. As appellants' now realize, "Judge Hobbs

considered the instruction on st,atutes not contained in the

for which the defendant fled arrest. Once prior

violation of a specific state statute became an

element of the offense by virtue of the trial

court ruling, Goodloe was ent'it,led not only to

notice of that general fact, but also to specific

not i ce o f wh at l aw h e was al leged t'o have

violated. "

Id. at 1045.

23

ind ictment

instrumenE

un ind i ct ed

Cir. 1983).

to amount to a constructive amendment to t,he charging

, dllowing the jury to convict the defendant for an

crime. See, Plunkett v. Estql1e, 709 F.2d 1004 (5th

" AppellantsI Brief, Bozeman v; Lambert, No. 84-7285|

at 22.

This was entirely correct. It was the challenged indictment.

which created the substantial potential for abuse eventually

11

realized by the oral charge. ESg Qtrombarg v. Californi,a, 283

U.S. 359, 364-65 (1931); Telmin-iel1o v. Chicago, 337 U.S. 1r 5

( 1949 ) . AS Judge llobbs explained, MS. WiIder 'went into court

facing charges that Ishe] ... had 'Stolen'votes and ended up

being tried on the alternative theory that Ishe] had commit,ted

one or more statutory wrongs in the notarization of balIots." R.

176-77. Because t.he indictment f ailed to give t'ls. Wilder fair

ffiuethattheabsenceofcase1awconstruings17-23-1

aC the time of us. Wilder's trial is an excuse for the trial

judge's "understandable' recourse to four uncharged statutes to

define the offense. Brief at 13. The Alabama Supreme Court had

construed S17-23-1 in Wilson v. State, 52 Ala. 299, 303 (1875),

to prohibii trvoting moffind in GordoqJl *g99, 52

Ar;. 308, 309-to (1875), to require proffi aut

however unclear the law construing Stz-zg:t may havffiefr-in the

wake of these decisions, that is no justificaLion for adding new

charges without notice. Compare Shuttlesworth v. Birmingham, 382

u.s.- g7 (1955). WE€:ffi s in

Shuttlesworth, is that the uncertain state of state law at the

ffiesu1tedint{s.wi1der'sconvictionuponsweeping

charges spun limitlessly out of the indictmentrs unspecified

allegations of illegal voting. It is these unspecified accusa-

tions, which were not confined by the definition subsequently

placed upon the charged offense by the Alabama Court of Criminal

Appeals in affirming the conviction, which form the basis for Ms.

Wilder's constitutional complaint against the indictment.

24

"notice of the nature and cause of the accusation" against her as

required by the Sixth and Fourt,eenth Amendments, the district

12

court properly overturned her conviction.

The Indictment Was Fatally Defective In That It Failed

To Include Constitutionally Sufficient Allegat'ions

Concerning The Charges Of Fraud

Additional grounds support the district court's judgment

invalidating the indictment. Each count alleged at least in the

alternat ive t,haE MS. Wilder had in some way committed f raud

through her voting activities in the run-off. For the reasons

set, forth in the following subsection ( 1 ), these allegations of

1 2 Stromberg and Terminiello demonstrate the fallacy of appellants'

f6Ti1TE on @, 433 u.s. 72 (1977) (Brief at

l5-1G). gotm that an objection to the jury

instructions is immaterial where the instructions merely reflect

constitutional inadequacies in the charges initialty made.

United States v. Augurs | 427 U.S. 97, 112 n.28 (1976) ('rt'he

ocess refers to the charge" ). Since

the constitutional fault lay in the indictment, no objections to

t.he jury instructions were required to preserve Ms. Wilder's

challenge to it. gytgq is inapposite because Ms. Wilder Pre-

sented itre claim tffi Alabama courts. She challenged her

indict,ment on due process and notice grounds at tria1, R. 46,

Exhibit, A, and on direct appeal her claim was rejected by the

Alabama Court of Criminal Appeals. 401 So.2d at 160-161. At

trial, counsel objected specifically to charging the jury on

perjury, Tr.315-16, and to the fact nthat the charge goes to the

laws relating to fraudulent notary seals which is beyond the

purview of t,his.' Id. gybes is inapposite because there is no

Lpplicable st,ate flroceEffiT rule Uirring Ms. wilder's claims.

See, €.9.r County Court of Ulster v. A1len, 442 U.S. 140, 150-57

E-il.E:fit 14a7, 1491 n.6 (r1rh

Cir. 1983). rffing that Dls. wilder's claim is

barred, the Alabama courts consider the right to notice to be so

fundamental that objections t,o indictments on the ground of lack

of proper not.ice cannot be waived. Note 9 suPra. Seer 39-.

Boviin -v. Alabama, 395 U.S. 238, 241-42 (196f

B.

25

fraud failed to provide the quantum of notice required by the

S ixth Amendment . l'loreover, as noted in subsect ion (2) be1ow,

Counts I and II failed to alIege fraudulent intent or knowledge

as a necessary element of the offense charged'. Counts I and II

failed to allege any nenP rea whatsoever. Only in Count III was

lls. Wilder accused of having acted with fraudulent intent.

The prejudice caused by these const,itutionally defective

counts is incalculable since }ls. Wilder was convicted under what

can only be described as an 'extra-general verdict.' In a

general verdict, the jury gives its verdict for eacL cognt

without elaboration as to the findings of fact,. E generalIy 75

Am. Jur.2d Trial 5885i 76 Am. Jur. 2d Trial S111.|. But in Ms.

Wilder's case, despite a three-count indictment, there was merely

a one-line verdict pronouncing her "guilty as charged" of a

single undifferentiated violation of S17-23-1. Tr. 332. Since

there is no way of determining under which count or counts the

jury convicted her, prejudice owing to even one defective count

requires the invalidation of her conviction- gE, *-

Stromberg v. California, 283 U.S. 359 11931); Williams v. Ngrth

QgIo-l_fICr 317 U.S. 287 (1942)i Terminiello v,, Chicagor 33T U.S. 1

(1949)t Street v. New York, 394 U.S. 576 (1969); Bachellar v.

I{arv1and, 397 U.S. 564 (1970).

26

(1)

None of the three counts charging fraud stated the asserted-

1y fraudulent conduct with particularity. The counts alleged

nothing more than that Ms. Wilder vot,ed fraudulently (Count I),

or cast fraudulent absentee ballots (Counts II and III) in the

run-off. In Count III only was this latter allegation elaborated

albeit insufficiently to satisfy the constitutional require-

ment of fair notice by accusing !1s. Wilder of depositing the

fraudulent. absentee ballots with t,he Pickens Count'y Circuit

Clerk, knowing that the ballots were fraudulent.

In order to pass constitutional musterr do indictment 'rmust

be accompanied with such a st,atement of the f acts and circum-

stances as will inform the accused of the specific offence,

coming under the general description, with which he is charged. | "

Russell v. United States, 359 U. S. 7 49 | 7 65 ( 1962 ) (quoting

United St,ates v. Hess , 124 U.S. 483, 487 1 t 888 ) ) ; see also United

States v. Ramos, 666 F.2d 469, 474 (1lth Cir. 1982)i United

States v. Out1err 659 F.2d 1305, 1310 n.5 (5th Cir. Unit B,

1981). Fraud is a "generic term" which is insufficient to

provide the constitutionally required notice unless detailed

factual allegations are included in the indictment. See United

States v. C.ruikshank, 92 U.S. 542, 558 (1875) (discussed at pP.

21-22, su353.). The indictment "must descend to t,he particulars"

The factual

const itutionallY

the nature and

conduct

al legat ions

insuff icient

cause of the

in each count were

to provide notice of

allegedly fraudulgnt

27

of the acts

also United

of the accused which were aIlegedly fraudulent. See

F. 2d 535, 547 ( 5th Cir.S t,ates v. D iec idue , 6 0 3

1979) .

I t was inadequate f or the s t,ate t.o aIlege ( as it did in

Count II I only ) lhat t'ls. Wilder had deposited f raudulent

absentee ballots in the run-off. Such an accusation failed to

inf orm "the def endant . .. of which transaction t ot f act.s give

rise to the alleged offense.'

13

United Stateg_:. iutler, gg.,

559 F.2d at 1310 n.5. In order to satisfy the rule of

Cruikshank, the indictment in its charging of fraud was required

to set forth the transaction alleged to have been fraudulent, and

to inform t,he accused of what representations h,ere alleged to

14

have been used t,o carry out the fraud.

Rulings on indictment,s in federal cases are also premised on the

Fif th Amendment requirement of indict.ment by grand jury, the

Federal Rules of Criminal Procedure, and federal common law.

See, e.q., United States V. Outler, supra. However the Cases

EiEed hFein es now invoked are mandated

coextensively by the Sixth Amendment Notice Clause.

For example in United Stat.es v. Clark, 546 F.2d 1130 (5th Cir.

1977'), thL court charging t,he accused with

making fraudulent, representations in a loan application to a

Unit,ed States agenqf. The court established that its scrutiny was

based inter alia on t,he Sixth Amendmentrs Notice Clause, id. at

1133 nlfr-nd-E5'en proceeded to determine whether E,he indiEment

adequately identified the alleged fraudulent statements. Since

the indictment, specified the apProximate date on which the

allegedly fraudulent representations were made, the precise forms

on which such representations i{ere made, the Purpose for which

such representations were made, and the entries on the forms

which were not accurate, the court held that the indictment, had

sufficiently put the defendant on not,ice as to the substance of

the alleged fraudulent statements. Ig. at 1 1 33-1 1 34.

By contrast if the indictment fails reasonably to identify

13

14

28

This indictment. did not even begin to descend to the

particulars of the alleged fraud. In Count I, t'here is only a

bare disjunctive allegation of fraudulent vot,ing, with no

elaboration whatsoever. In CountS II and III, the absentee

ballots are alleged to have been fraudulent; and in Count IfI,

tts. Wilder is accused of having knowingly deposited fraudulent

absentee ballots. But how those ballots became fraudulent, and

what Ms. Wilder a1legedly did to effect lhat unexplained result

is unsaid.

the acts or statements through which the alleged fraud was

perpetrated, it is constitutionally deficient under the Notice

Clause. See €.9., United States v. Nance, 144 U.S. ApP. D.C.

477, 533 r'.zd-s9ffis , 505 F.2d 985

( l Oth Cir. 197 4) . ln Cur Lment alleged:

it I that Curtis' busiilffiurported to be a computer matching

service for single people; (2) that Curtis sent out "compatibi-

lity Questionnaires" which he rePresented would be fed into the

computer, (3) that Curtis took money for this service and placed

ads soliciting customersi (4) that he sent out purported invoices

for computer service work for the purpose of convincing customers

that he was providing c-omputer services; and ( 5 ) that in fact he

contracted for services he did not Provide. Id. at 987-89. The

indictment was held defective because, while iFst,ated in detail

the acts used to implement the scheme, it did not staEe what the

actual false promise was. I4. at 987, 989. Quite plainly,

however, it came much closer to-p'inpointing for Curtis the nature

of the alleged fraudulent statements, and the vehicle used to

perpetrate the fraud, than did the indictment f iled against lvls.

Wilder. See also United States v. Dorfman, 532 F. SupP. 1'l 18,

124 (N.D. Tff.-TfEt t which stat.ed only

that defendants engaged in a "scheme or artifice ... [t]o obtain

money" through fraud, '[s] canding alone clearly would not meet

the constitutional requirement, of fair not,ice of t,he facts

underlying the charge". Ig. at 1125).

29

Certainly the mere depositing of more than one absentee

bal1ot, each purporting to be the ballot of a different voter,

would not in itself have constit.uted fraud. The alleged fraud

had to have occurred during the preparation of those ballots for

casting. The state was required to charger €lt least in general

terms, the event,s or transactions during which the fraud al-

legedly was committed, and the naEure of the acts by t'ls. Wilder

which allegedly constituted that fraud. Because t,he indictment

failed in this regard, l{s. Wilder had no advance warning of which

of her activities on behalf of the effort to bring out, the black

vot,e among the elderly in Piclcens County was being seized uPon by

the stat,e as suPposedly fraudulent. This failure to provide

constitutionally required not,ice was extremely Prejudicial to her

abilit,y to defend herself especially in view of the expansive

array of grounds and theories of liability which were spun out of

the indictment in the judge's charge to the jury. And if even

one or two of the three counts $ras insufficient in its factual

allegations, tls. Wilder's conviction must be set aside because

the potential prejudice inhering in the defective count or count.s

necessarily infects the jury's extra-general verdict finding her

guilty of a single undifferentiated violation of S17-23-1.

30

(21 Counts I and II were constitutionally insufficient,

for fallure to allege the crucial mental elemenE

of the offense of fraudulent' voting under

s 1 7-23-l

In order to sat,isfy the Sixth and Fourteenth Amendments, the

indictment rras required to notify Ms. Wilder of every element of

the offense charged. See United Statgs v. Ram9s, 666 F.2d 469,

474 (lIth Cir. 1982)i tJnited States v. Ou!Ier, 659 F.2d 1306,

1310 (5th Cir. Unit B 1981), cert. deniedr 455 U.S.950 (1982)i

United States vo Haas, 583 F.2d 2.16, reh. denied, 588 F.2d 829

(5th cir. 1978), cert. denied , 440 u.s. 981 ( 1978); [nited

St,ates v. Strauss | 283 F.2d 155, 158-159 (5th Cir. 1960). Since

fraud was a necessary element of that offense see Not,e I supra

(discussion of the elements of S17-23-1), each count of the

indictment was required to allege that she had acted with

fraudulent knowledge or intent.

Both Count. I and Count II failed to alleged any fraudulent,

knowledge or intent, and were therefore constit,utionally insuffi-

cient. The fact that they were cast in the precise language of

S17-23-1 -- whose mental element is implicit rather than explicit

does not save them. 'rln an indictment uPon a Statute, it is

not sufficient to set forth the offence in the words of the

statute, unless those words of themselves fully, directly, and

expressly, without any uncertainty or ambiguity, set forth all

31

the elements necessary to constitute the offence intended to be

punished. '' Russell v. Unite.d States, 369 U.S 749, 765 (1962)

(quoting Unit,ed SEates v. Car1l, 105 U.S. 611, 612 ( 1882)) -

Ordinarily, of course, because each count of an indictment

is meant to charge a separate offense and is t,herefore to be

treated in effect as a separate indicEment, the finding of a

fatal defect in one count would not impair the other counts of

the indicEment or any guilt,y verdict announced as to those

counts. See United States v. Huf f | 512 F.2d 66, 69 ( st,h Cir.

1975). But t'ls. Wilder's case is removed f rom t,he operation of

that rule by the extra-general verdict under which she $ras

convicted. That form of verdict renders it impossible to

determine on which count or counEs the conviction rests. Under

these circumstances, the constitutionally defective counts are

inextricable from anything else. This is not a case such as

United States v. Berlin, 472 F.2d 1002, 1008 (2nd Cir. 1973)l

where it was apparent on the record that the "jury very carefully

considered t,he evidence on each count and reached its verdict on

the evidence relative thereto." Rather, Ms. Wilder's situation

is comparable to United SEates v.. Dreyf us , 528 F.2d 1064 ( 5th

Cir. 1976), where the court overturned the conviction on a

twenty-two count indictment because of a single defective count

since, under the circumstances Present in that case, the court

felt that there was a significant probability that the submission

of one def ective count to Ehe jury prejudiced t,he deliberations

32

a

as a who1e. Ig. at 1071-1072. Ivls. Wilderrs conviction by a

single verdict of "guilty as charged" upon al} three counts of

her indictment without differentiation suggests even more

strongly than in 951.;!5. a signif icant,.possibility of prejudice;

and the judgment of conviction must therefore fall because of the

unconstitutional failure of Counts I and II to allege each

necessary mental element of S17-23-1.

CONCLUSION

For the reasons stat,ed, the judgment of the district court

that the indictment was constitutionally defective should be

15

aff irmed.

ffi.n"judgment,theCourtneednotreachthesuffi.

ciency of the evidence under Jackson v. Virginia, 443 U.S. 307

(1g7gi. !!s. Wilder orginially the district

courtrs sul qPqn]gs. decision of that issue in dictum, but has

6i;;isseci-Tt ffi?s-appeal because f urther coffiiE?ation led

counsel to conclude that it is unnecessary to burden this court

with it. In the event that there are further proceedings in the

district court, Ms. Wilder can move t,here for reconsideration of

the Jackson issue in conjunction with other related factual

issuet-

The district court considered the Jackson issue although it

$ras not presented in tls. Wilderrs motiolf,i-ffi summary judgment.

us. Wilder had reserved the Jackson issue because of its intimate

connection to factual issueffilving (a) her challenge under

the Sixth Amendment to the use, as substantive evidence, of prior

inconsistent statements from out-of-court interrogations at which

no counsel was Present for the witness or herself, and (b) her

challenge to prosecution for her federally protected constitu-

tional activity. 1,1s. Wilder stated in the district court that

she was not moving for summary judgment on her Jackson claim "in

rhar certain of the f acts-unaeilying this cEllfi-E?e also the

subject of tthel claim [raised in paragraph 26 of the Petition].

Since her trial record is, as noted by the Alabama Court of

33

a

Respectfully submitted,

LANI GUINIER

NAACP Legal Defense Fund, Inc.

99 Eudson Street

New York, New York 10013

16th Ploor

1212) 2r9-1900

A}ITEONY G. AMSTERDAI,T

New York UniversitY

School of Law

40 Washington Square South

Roou 327

New York, New York 10012

(212) s98-2638

VAIIZETTA PENN DURANT

639 Martha Street

tltontgom€Ey r Alabama 36108

(20s1 262-7337

SIEGFRIED KNOPF

555 Californla Street

Suite 5060

San Francisco, California 94104

Attorneys for APPellee

Criminal Appeals, particularly confused, Petitioner requests that

consideri[ion of both these claims be held in abeyance until

after an evidentiary hearing. Consistent with Rule 8(a) of the

Ru1es Governing Section 2254 Cases, PeEitioner believes it is

appropriate first to dispose of those issues. lot which an

eviaentiary hearing is not necessary and for which petitioner

believes she is entitled t,o prevail aS a matter of law.tr R. 82.

34

CBRSIEICATE OI SERVICE

I hereby certify t.hat I have this lst, day of February 1985

served a copy of the foregoing on the attorney for appellants by

placing 6ame in the United States mail7 postage prepaid and

. addressed as follows:

".

P.!i. Johnston

P.O. Box 442

Aliceville, ALabama 35442

t AI{I GUftrIER

A$SONNEY FOR TPPBLI.EE

-35