LDF Files Suit to Protect Consumers from Unfair Deals in City Ghettoes

Press Release

January 11, 1968

Cite this item

-

Press Releases, Volume 5. LDF Files Suit to Protect Consumers from Unfair Deals in City Ghettoes, 1968. c9ae426a-b892-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/3a7a6d2c-7113-4886-a9af-922172474ea8/ldf-files-suit-to-protect-consumers-from-unfair-deals-in-city-ghettoes. Accessed February 21, 2026.

Copied!

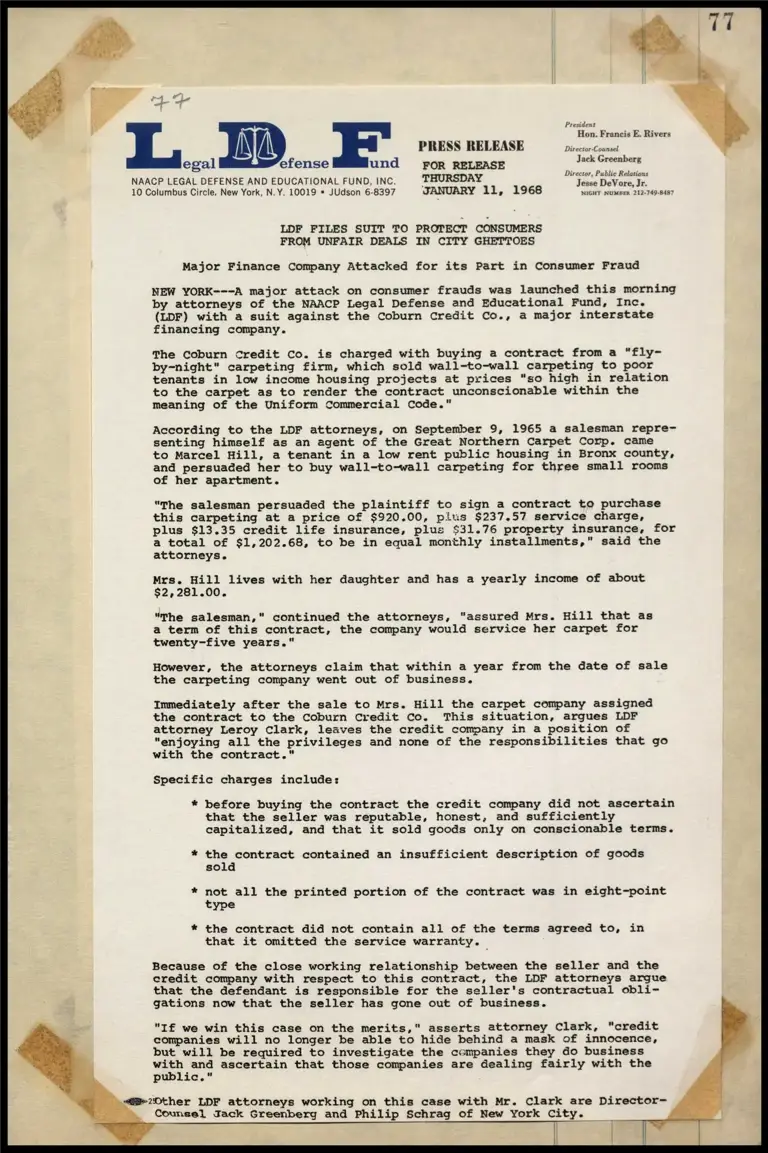

Presiden

Hon. Francis E. Rivers

PRESS RELEASE Director Counsel

egal efense und = FoR RELEASE dack Croeabers

Di , Public Relations

NAACP LEGAL DEFENSE AND EDUCATIONAL FUND, INC. | THURSDAY Ses Devons, 3e

10 Columbus Circle, New York, N.Y. 10019 * JUdson 6-8397 JANUARY 11, 1968 NIGHT NUMBER 212-749-8487

LDF FILES SUIT TO PROTECT CONSUMERS

FROM UNFAIR DEALS IN CITY GHETTOES

Major Finance Company Attacked for its Part in Consumer Fraud

NEW YORK---A major attack on consumer frauds was launched this morning

by attorneys of the NAACP Legal Defense and Educational Fund, Inc.

(LDF) with a suit against the Coburn Credit Co., a major interstate

financing company.

The Coburn Credit Co. is charged with buying a contract froma "“fly-

by-night" carpeting firm, which sold wall-to-wall carpeting to poor

tenants in low income housing projects at prices "so high in relation

to the carpet as to render the contract unconscionable within the

meaning of the Uniform Commercial Code."

According to the LDF attorneys, on September 9, 1965 a salesman repre-

senting himself as an agent of the Great Northern Carpet Corp. came

to Marcel Hill, a tenant in a low rent public housing in Bronx county,

and persuaded her to buy wall-to-wall carpeting for three small rooms

of her apartment.

"Phe salesman persuaded the plaintiff to sign a contract to purchase

this carpeting at a price of $920.00, pius $237.57 service charge,

plus $13.35 credit life insurance, plus $31.76 property insurance, for

a total of $1,202.68, to be in equal monthly installments," said the

attorneys.

Mrs. Hill lives with her daughter and has a yearly income of about

$2,281.00.

“The salesman," continued the attorneys, “assured Mrs. Hill that as

a term of this contract, the company would service her carpet for

twenty-five years."

However, the attorneys claim that within a year from the date of sale

the carpeting company went out of business.

Immediately after the sale to Mrs. Hill the carpet company assigned

the contract to the Coburn Credit Co. This situation, argues LDF

attorney Leroy Clark, leaves the credit company in a position of

"enjoying all the privileges and none of the responsibilities that go

with the contract."

Specific charges include:

* before buying the contract the credit company did not ascertain

that the seller was reputable, honest, and sufficiently

capitalized, and that it sold goods only on conscionable terms.

the contract contained an insufficient description of goods

sold

* not all the printed portion of the contract was in eight-point

type

* the contract did not contain all of the terms agreed to, in

that it omitted the service warranty. :

Because of the close working relationship between the seller and the

credit company with respect to this contract, the LDF attorneys argue

that the defendant is responsible for the seller's contractual obli-

gations now that the seller has gone out of business.

"If we win this case on the merits," asserts attorney Clark, "credit

companies will no longer be able to hide behind a mask of innocence,

but will be required to investigate the companies they do business

Bee and ascertain that those companies are dealing fairly with the

public."

<@20ther LDF attorneys working on this case with Mr. Clark are Director-

Counsel Jack Greenberg and Philip Schrag of New York City.

|