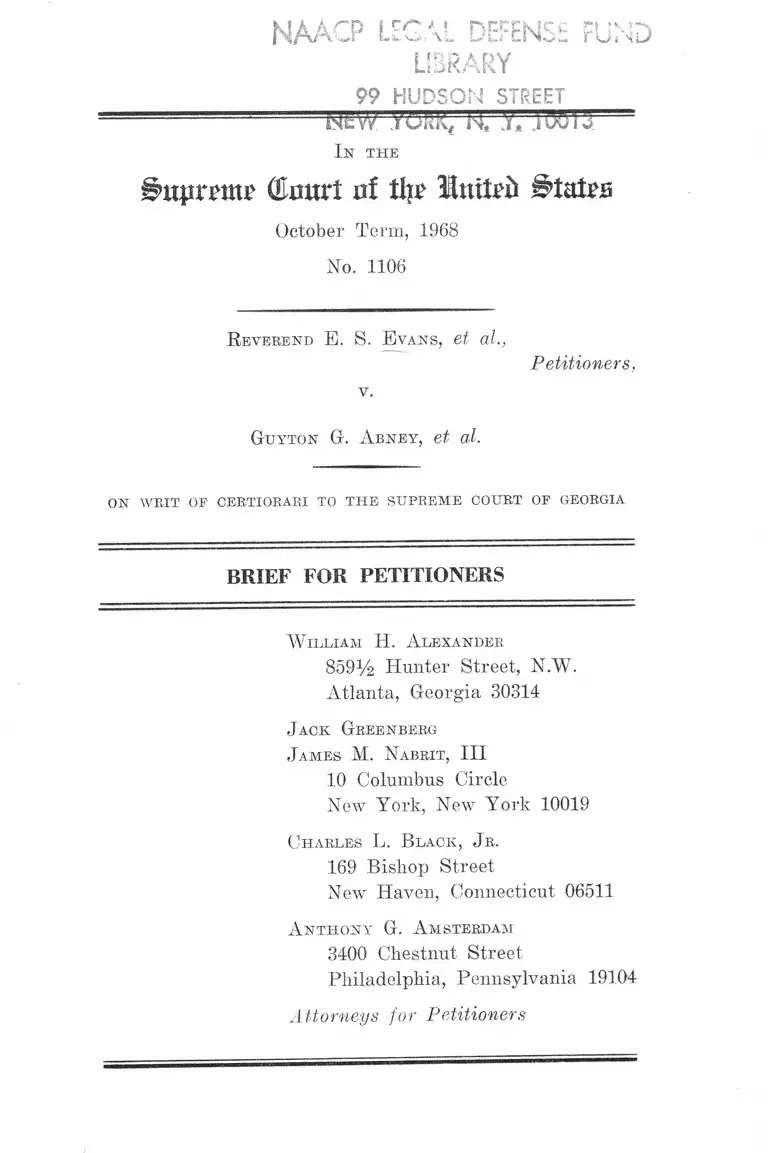

Evans v. Abney Brief for Petitioners

Public Court Documents

January 1, 1968

Cite this item

-

Brief Collection, LDF Court Filings. Evans v. Abney Brief for Petitioners, 1968. 5f7ed42f-b19a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/55237103-bef1-426f-a181-1e39c09d0a34/evans-v-abney-brief-for-petitioners. Accessed February 21, 2026.

Copied!

N M C P LEGAL DEFENSE FUND

LIBRARY

99 HUDSON STREET

Isr t h e

fpupreuu' (Enurt 0! tip HtutTft States

October Term, 1968

No. 1106

R everen d E. S. E v a n s , et al.,

Petitioners,

v.

G u y t o n G . A b n e y , et al.

ON WRIT OF CERTIORARI TO THE SUPREME COURT OF GEORGIA

BRIEF FOR PETITIONERS

W il l ia m H. A le x a n d e r

859% Hunter Street, N.W.

Atlanta, Georgia 30314

J a c k G reen berg

J am e s M. N a b r it , III

10 Columbus Circle

New York, New York 10019

C h a r le s L. B l a c k , Jr.

169 Bishop Street

New Haven, Connecticut 06511

A n t h o n y G . A m sterdam

3400 Chestnut Street

Philadelphia, Pennsylvania 19104

Attorneys for Petitioners

I N D E X

Opinions Below ..........................-.......................... .......... - 1

Jurisdiction ..................................................... 2

Questions Presented ............................................—-......... 2

Statutes Involved ........................................... —.............. 3

Statement of the Case ...................................................... 5

The Will ...................................... -........ -...................... 9

The City of Macon Acquires Baeonsfield—1920 .... 11

City Administration and Financial Aid to the

Park and Federal Government Aid ..................... 14

Baeonsfield Clubhouse—Built by Federal Govern

ment ...... ................................-....................................

Public Roads in the P a rk .................... -.................... 21

City-Built Swimming Pool and Bathhouses at

Baeonsfield .................................... 21

City Operated Zoo ........................................ - ------ 24

Public School Playground .......................................... 24

City Leased Building .............................. 25

City-Aided Recreation Facilities ................... 25

Sale of Portion of Trust Property to State........... 26

Tax Exemption .................. -..... ................................... 26

Income Property........................................................... 27

Assets of the Estate .................................. -.............. 27

PAGE

11

How the Federal Questions Were Raised and De

PAGE

cided .............................. ........................................... 28

Summary of Argum ent...................................................... 33

A egumestt—

I. Introductory: State and National Law ....... ..... 36

II. The Decree of the Court Below Violates the

Fourteenth Amendment, in That It Is Hostile

to and Infringes Petitioners’ Right to Continue

to Enjoy Public Facilities Without Racial Dis

crimination ........ ..... ........ ..... _......... ........ ............. 40

A. The Decree of the Georgia Court Imposes

the Drastic Sanction of Reverter on Compli

ance With the Fourteenth Amendment, and

in so Doing Infringes upon a Federal Inter

est Declared and Created by the Constitu

tion, at the Same Time and by the Same Act

Inflicting Detriment on the Petitioners and

Encouraging Racial Discrimination ......... . 40

B. The Judgment That This Trust Has

“Failed,” Though Its Intended Beneficiaries

May Still Enjoy Its Benefits Just as Before,

Can Rest Logically Only on the Proposition

That, as a Matter of Law, the Presence of

Negroes Spoils a Park for Whites, an Im

permissible Ground Under the Fourteenth

Amendment. The Rejection of the Cy Pres

Alternative Must Rest on Substantially Sim

ilar Grounds 50

Ill

PAGE

C. Confronted with the Unavoidable Necessity

of Choosing Between Senator Bacon’s Two

Contradictory Wishes, the Georgia Court

Impermissibly Chose to Give Effect to That

Part of His Will Which Was Incurably

Tainted by Its Having Been Drawn Under

Georgia Code §69-504. This Choice Consti

tuted a Preference of the Unconstitutional

Over the Constitutionally Unobjectionable

Alternative ....................................... -.......... -..... 60

D. At Least Under the Highly Special Circum

stances of This Case, the Provision for Ra

cial Discrimination in Baconsfield Ought, as

a Matter of Federal Law, Under the Four

teenth Amendment, to Be Treated as Abso

lutely Void. If This Is Correct, Then Fed

eral Law Commands That This Trust Be

Continued and That the City Continue as

Trustee, for It Is Clear That Without the Ra

cially Discriminatory Language Georgia Law

Compels That Result. Similarly, Federal

Law Commands That a Public Park “Dedi

cated” to the White Public Be “Dedicated”

to the Negro Public as Well ..... .................... 71

C o n clu sio n 80

IV

T able of A uthorities

Cases: page

Adams v. Bass, 18 Ga. 130 .............. .... ........................... 56, 57

Anderson v. Martin, 375 U.S. 399 (1964) — ............. - 68

Barrows v. Jackson, 346 U.S. 249 (1953) ............. 34,41,48

Brown v. Board of Education, 347 U.S. 483 (1954)....48, 73,

77

Brown v. Gunn, 75 Ga. 441 (1885) ............................... . 65

Burton v. Wilmington Parking Authority, 365 U.S. 715

(1961) .......... 34,50,67

Charlotte Park and Recreation Commission v. Bar

ringer, 242 N.C. 311, 88 S.E.2d 114 (1955), cert.

denied, 350 U.S. 983 (1956) .......... ...... ........... ......... 47,53

Commonwealth of Pennsylvania v. Brown, 392 F.2d

120 (3rd Cir. 1968), cert. den. 391 U.S. 921 (1968)..._34, 75

County of Gordon v. Mayor of Calhoun, 128 Ga. 781

(1907) ....... 65

Crandall v. Nevada, 73 U.S. (6 Wall.) 35 (1867)—.33,41, 43

East Atlanta Land Co. v. Mowrer, 138 Ga. 380 (1912).... 65

Erie R.R. v. Tompkins, 304 U.S. 69 (1938) .................. 46

Evans v. Newton, 382 U.S. 296 (1966) _____5, 35, 43, 48, 49,

60, 76

Evans v. Newton, 221 Ga. 870, 148 S.E.2d 329 (1966).... 7

Evans v. Newton, 220 Ga. 280, 138 S.E.2d 573 (1964),

reversed, 382 U.S. 296 (1966), on remand, 221 Ga.

870, 148 S.E.2d 329 (1966) ................... ...................... . 1

Ford v. Harris, 95 Ga. 97 (1894) ..................... .............. 65

Ford v. Thomas, 111 Ga. 493 ...... .......... ....... ..... ........... 56

Griffin v. County School Board, 377 U.S. 218 (1964).... 73

Holmes v. Atlanta, 350 U.S. 879 (1955) .......................35, 77

V

Indiana ex rel. Anderson v. Brand, 303 U.S. 95 (1938).. 37

Lyeth v. Hoey, 305 U.S. 188 (1938) .............—...... -........ 37

Mapp v. Ohio, 367 U.S. 643 (1961) .............................. 35,70

Marsh v. Albania, 326 U.S. 501 (1946) ........................... 74

Martin v. Hunters’ Lessee, 1 Wheat. 304 (1816) ------33, 37

Mayor and City Council of Baltimore v. Dawson, 350

U.S. 877 (1955) ...........- ............. -.................................... 77

Mayor and Council of the City of Macon v. Franklin,

12 Ga. 239 (1852) .................................................... 64, 65, 76

McCulloch v. Maryland, 4 Wheat. 316 (1819) ....... 33,41,43

New York Times v. Sullivan, 376 U.S. 254 (1964).....33, 39,

47

PAGE

Pennsylvania v. Board of Directors of City Trusts, 353

U.S. 230 (1957) ........................................................34,74,77

Peterson v. City of Greenville, 373 U.S. 244 (1963)....... 69

Pettit v. Mayor and Council of Macon, 95 Ga. 645

(1894) ...........................- ........ ........................................ 65

Pettway v. American Cast Iron Pipe Company, ——

F .2 d ------ (5th Cir., No. 25826, May 22, 1969)......... 38

Plessy v. Ferguson, 163 U.S. 537 (1896) ..... .............. .73,77

Presbyterian Church in the United States v. Mary

Elizabeth Blue Hull Memorial Presbyterian Church,

____U .S .------- , 37 U.S.L.W. 4107 (1969) .................33, 38

Reitman v. Mulkey, 387 U.S. 369 (1967) .....................41, 68

Robinson v. Florida, 378 U.S. 153 (1964) .................... . 42

Shelley v. Kraemer, 334 U.S. 1 (1948) ........................ 34,41

Strauder v. West Virginia, 100 U.S. 303 (1880).....34, 50, 60

VI

Sweet Briar Institute v. Button, 280 F. Supp. 312

(W.D. Ya. 1967), rev’d per curiam, 387 U.S. 423,

decision on the merits, 280 F. Supp. 312 (1967)....... 75

PAGE

Tyler v. United States, 281 U.S. 497 (1930) .... ............ 37

Western Union Telegraph Co. v. Georgia Railroad and

Banking Co., 227 F. 276 (S.D. Ga. 1915) ................ . 65

Statutes:

28 U.S.C. §1257(3) ....... .......... .......................................... 2

U. S. Constitution, Art. VI ............................................ 37

Civil Rights Act of 1964 ............ ............... ................... . 38

Georgia Code, §69-504 (1933) (Acts, 1905) ..... 2,3,30,34,

60, 61, 63, 66, 67, 68,

69, 71, 73, 76, 77, 79

Georgia Code, §69-505 (1933) (Acts, 1905) ...... .4,30,34,35,

62, 72, 73, 74

Georgia Code, §108-106(4) ........ ........ ............... 34,50,52,54

Georgia Code, §108-202 ............ ......................... ...4, 55, 56, 60

Georgia Code, §108-203 ....... ...................... ..................... . 62

Georgia Code, §108-212 (Acts, 1952) ........... ......... ....... 8

Georgia Code, §113-815 ........... ............................4,55,56,60

Georgia Code of 1895, §4008 ........ .................... .......... . 62

I n th e

(Emtrt rtf % Inttrfc

October Term, 1968

No. 1106

R everend E . S. E vans , et ah,

v.

Petitioners,

Guyton G. A bn ey , et ah

ON WRIT OF CERTIORARI TO THE SUPREME COURT OF GEORGIA

BRIEF FOR PETITIONERS

Opinions Below

The letter opinion of the Judge of the Superior Court of

Bibb County dated December 1, 1967, and filed May 14,

1968 (A. 525)* is unreported. The opinion of the Supreme

Court of Georgia filed December 5, 1968, is reported at 165

S.E.2d 160 (A. 537). Earlier proceedings in this same case

are reported sub nom, Evans v. Newton, 220 Ga. 280, 138

S.E.2d 573 (1964), reversed 382 U .S . 296 (1966), on remand,

221 Ga. 870, 148 S.E.2d 329 (1966).

* Citations herein are to Appendix (A .), except where indicated

as citations to original record (R.).

2

Jurisdiction

The judgment of the Supreme Court of the State of

Georgia was entered on December 5, 1968 (A. 546). The

Petition for Certiorari was filed March 3, 1969 and wTas

granted May 5, 1969 (A. 548). The jurisdiction of this

Court is invoked under 28 U.S.C. §1257(3), the petitioners

having claimed the violation of their rights under the Con

stitution of the United States.

Questions Presented

1. Whether, in the absence of any reversionary clause in

the will leaving property in trust as a park, the imposition

by the Georgia court of a reversion to the heirs on a show

ing that Negroes have used, and must be allowed to use the

park, constitutes an infringement by state power on a

federal interest declared and created by the Constitution,

both by its immediate penalization of compliance with the

Fourteenth Amendment, and by its operation to discourage

desegregation.

2. Whether the holdings by the state court that this

trust has “failed” and that cy pres, cannot apply, rest on a

ground impermissible under the Fourteenth Amendment—

the ground that the presence of Negroes frustrates the en

joyment of the park by whites, even though the latter, the

intended beneficiaries, may use the park as freely as ever.

3. Whether the racially exclusionary provision in Bacon’s

will must as a matter of federal law be treated as null and

void, first, because it is “ incurably tainted” for all pur

poses by its connection with Georgia Code §69-504; sec

ondly, because it was meant to form and did actually form

a part of the public law by which the City conducted its

3

park; and thirdly, because federal law, commanding equal

ity between the races, commanded and by operation of law

brought it about that this park, “ dedicated in perpetuity”

to whites, must also be taken to be “dedicated in perpetuity”

to Negroes.

Statutes Involved

1. This case involves the Fourteenth Amendment to the

Constitution of the United States.

2. This case involves the following Georgia statutes:

a. Georgia Code Section 69-504:

Ga. Code §69-504 (1933) (Acts, 1905, p. 117):

Gifts for public parks or pleasure grounds.—Any

person may, by appropriate conveyance, devise, give,

or grant to any municipal corporation of this State, in

fee simple or in trust, or to other persons as trustees,

lands by said conveyance dedicated in perpetuity to

the public use as a park, pleasure ground, or for other

public purpose, and in said conveyance, by appropriate

limitations and conditions, provide that the use of

said park, pleasure ground, or other property so

conveyed to said municipality shall be limited to the

white race only, or to white women and children only,

or to the colored race only, or to colored women and

children only, or to any other race, or to the women

and children of any other race only, that may be

designated by said devisor or grantor; and any person

may also, by such conveyance, devise, give, or grant

in perpetuity to such corporations or persons other

property, real or personal, for the development, im

provement, and maintenance of said property.

4

b. Georgia Code Section 69-505:

Ga. Code §69-505 (1933) (Acts, 1905, pp. 117, 118):

Municipality authorized to accept.—Any municipal

corporation, or other persons natural or artificial, as

trustees, to whom such devise, gift, or grant is made,

may accept the same in behalf of and for the benefit

of the class of persons named in the conveyance, and

for their exclusive use and enjoyment; with the right

to the municipality or trustees to improve, embellish,

and ornament the land so granted as a public park,

or for other public use as herein specified, and every

municipal corporation to which such conveyance shall

be made shall have power, by appropriate police

provision, to protect the class of persons for whose

benefit the devise or grant is made, in the exclusive

used (sic) and enjoyment thereof.

c. Georgia Code Section 108-202:

Cy pres.—When a valid charitable bequest is in

capable for some reason of execution in the exact man

ner provided by the testator, donor, or founder, a

court of equity will carry it into effect in such a way

as will as nearly as possible effectuate his intention.

d. Georgia Code Section 113-815:

Charitable devise or bequest. Cy pres doctrine, ap

plication of.—A devise or bequest to a charitable use

will be sustained and carried out in this State; and in

all cases where there is a general intention manifested

by the testator to effect a certain purpose, and the

particular mode in which he directs it to be done shall

fail from any cause, a court of chancery may, by ap

proximation, effectuate the purpose in a manner most

similar to that indicated by the testator.

Statement of the Case

Petitioners are Negro citizens in Macon, Georgia who

have sought in this extended litigation to desegregate

Baconsfield Park, a previously all-white municipal park

left to the City of Macon by the will of the late United

States Senator Augustus Octavius Bacon. The case was

reviewed by this Court once before in Evans v. Newton,

382 U.S. 296 (1966). Petitioners now seek a reversal of a

ruling by the Georgia courts that as a consequence of this

Court’s holding that the Fourteenth Amendment forbids

the exclusion of Negro citizens from the park, Bacon’s trust

fails and the park and other trust property is forfeited by

the City and reverts to the heirs of Senator Bacon.

The early course of the lawsuit, which was begun in the

Superior Court of Bibb County, Georgia on May 4, 1963,

is briefly summarized in the following excerpt from the

opinion by Mr. Justice Douglas for the Court, Evans v.

Newton, 382 U.S. 296, 297-298:

In 1911 United States Senator Augustus 0. Bacon

executed a will that devised to the Mayor and Council

of the City of Macon, Georgia, a tract of land which,

after the death of the Senator’s wife and daughters, was

to be used as “a park and pleasure ground” for white

people only, the Senator stating in the will that while

he had only the kindest feeling for the Negroes he was

of the opinion that “in their social relations the two

races (white and negro) should be forever separate.”

The will provided that the park should be under the con

trol of a Board of Managers of seven persons, all of

whom were to be white. The city kept the park segre

gated for some years but in time let Negroes use it,

taking the position that the park was a public facility

which it could not constitutionally manage and maintain

on a segregated basis.

6

Thereupon, individual members of the Board of Man

agers of the Park brought this suit in a state court

against the City of Macon and the trustees of certain

residuary beneficiaries of Senator Bacon’s estate, ask

ing that the city be removed as trustee and that the

court appoint new trustees, to whom title to the park

would be transferred. The city answered, alleging it

could not legally enforce racial segregation in the park.

The other defendants admitted the allegation and re

quested that the city be removed as trustee.

Several Negro citizens of Macon intervened, alleging

that the racial limitation was contrary to the laws and

public policy of the United States, and asking that the

court refuse to appoint private trustees. Thereafter

the city resigned as trustee and amended its answer

accordingly. Moreover, other heirs of Senator Bacon

intervened and they and the defendants other than the

city asked for reversion of the trust property to the

Bacon estate in the event that the prayer of the peti

tion were denied.

The Georgia court accepted the resignation of the

city as trustee and appointed three individuals as new

trustees, finding it unnecessary to pass on the other

claims of the heirs. On appeal by the Negro inter-

venors, the Supreme Court of Georgia affirmed, hold

ing that Senator Bacon had the right to give and be

queath his property to a limited class, that charitable

trusts are subject to supervision of a court of equity,

and that the power to appoint new trustees so that the

purpose of the trust would not fail was clear. 220 Ga.

280, 138 S. E. 2d 573.

This Court, in reversing the judgment of the Georgia

Supreme Court, ruled that the park was “a public institu

tion subject to the command of the Fourteenth Amendment,

7

regardless of who now has title under state law” (382 TT.S.

at 302).

Immediately after this Court’s decision, the Supreme

Court of Georgia delivered a second opinion setting forth

the view that the purpose for which the Baeonsfield Trust

was created had become impossible to accomplish and had

terminated. Evans v. Newton, 221 Ga. 870, 148 S.E.2d 329

(1966). However, the judgment did not direct that the

Superior Court on remand enter any particular order, but

merely ruled that the court should pass on contentions of

the parties not previously decided, and said that the “ judg

ment of the Supreme Court of the United States is made

the judgment of this Court” (148 S.E.2d at 331).

On remand in the Superior Court of Bibb County, a

Motion for Summary Judgment (A. 98) (which was sub

sequently amended and supplemented by three additional

pleadings (A. 360, 462, 468) was filed by Guyton G. Abney,

et al. as Successor Trustees under the Last Will and Tes

tament of Senator Augustus Octavius Bacon. The motion

asked that the court rule that Senator Bacon’s trust had

become unenforceable, and that the Baeonsfield property

had reverted to movants as successor trustees under Item

6th of Bacon’s will, and to certain named heirs of Senator

Bacon (A. 103). The motion was opposed by petitioners,

Rev. E. S. Evans, et al., the Negro citizens of Macon who

had earlier intervened seeking the racially nondiscrimina-

tory operation of Baeonsfield Park, by the filing of a re

sponse (A. 119) and four supplemental responses to the

summary judgment motion (A. 242, 393, 454; R. 971). Peti

tioners filed numerous exhibits, as well as depositions,

affidavits, answers to interrogatories and stipulations set

ting forth additional facts. Petitioners objected on federal

constitutional grounds based on the due process and equal

protection clauses of the Fourteenth Amendment, as well

8

as on state law grounds, to the relief sought by the suc

cessor trustees and heirs. The heirs also filed several affi

davits and exhibits supplementing the factual record. None

of the other parties to the case, including the City of Macon,

the Trustees of Baeonsfield named by the court’s order of

March 10, 1964, or the members of the Board of Managers

of Baeonsfield (who initiated this lawsuit) either opposed

the granting of the relief requested in the Motion for Sum

mary Judgment, or offered any evidence. The court heard

oral arguments on June 29, 1967, and granted the parties

time to file further documentary evidence, which was filed.

At the hearing the petitioners, Evans, et al., suggested

that the Attorney General of Georgia should be made a

party to the case. By order dated July 21, 1967, the Attor

ney General was made a party pursuant to Georgia Code

Section 108-212 (Acts 1952, pp. 121, 122; 1962, p. 527). The

Attorney General of Georgia filed a “Response” opposing

the relief requested by the heirs and supporting the posi

tion of the intervenors E. S. Evans, et al. that the doctrine

of cy pres should be applied to save the trust (R. 975-988).

The Superior Court, granted the relief requested in the

successor trustees’ and heirs’ Motion for Summary Judg

ment, ruling that the trust established by Senator Bacon

failed immediately upon this Court’s ruling in January

1966, that the City of Macon was dismissed from the case,

and that the trust assets reverted to the successor trustees

and heirs (A. 517-524). In addition, the court ruled that

the doctrine of cy pres was not applicable, that there was

no dedication to the public, that the heirs were not estopped

and that no federal constitutional rights of intervenors

were violated by the reversion of the trust assets (id.). The

Superior Court order and decree was entered May 14 1968

(id.).

9

Petitioners duly appealed to the Supreme Court of

Georgia, which filed an opinion December 5, 1968, affirming

the decree of the Bibb Superior Court, and rejected peti

tioners’ federal constitutional claims (A. 537-545). The

court below stayed its remittitur and further proceedings

pending the disposition of a timely petition for certiorari

in this Court (A. 547).

While the record filed with this case includes the entire

record of proceedings before this Court on the prior peti

tion, it also includes a good deal of additional factual data

and evidence presented to the Superior Court on remand.

The evidence develops the history of Baconsfield Park, and

shows in great detail the substantial governmental invest

ment, including the expenditure of both city and federal

government funds, in establishing, improving and main

taining Baconsfield Park.

The Will

Senator A. 0. Bacon provided in Item 9th of his Will

(A. 10-31), signed in 1911 and probated in 1914, for the

disposition of his farm called Baconsfield. He left the prop

erty in trust for the use of his wife and daughters during

their lives (A. 118) and provided that after their deaths:

. . . it is my will that all right, title and interest in

and to said property hereinbefore described and

bounded, both legal and equitable, including all re

mainders and reversions and every estate in the same

of whatsoever kind, shall thereupon vest in and belong

to the Mayor and Council of the City of Macon, and to

their successors forever, in trust for the sole, perpetual

and unending, use, benefit and enjoyment of the white

women, white girls, white boys and white children of

the City of Macon to be by them forever used and

10

enjoyed as a park and pleasure ground, subject to

the restrictions, government, management, rules and

control of the Board of Managers hereinafter provided

for: the said property under no circumstances, or by

any authority whatsoever, to be sold or alienated or

disposed of, or at any time for any reason devoted to

any other purpose or use excepting so far as herein

specifically authorized. (A. 19)

The will provided for a seven member all-white Board of

Managers to be chosen by the Mayor and Council of Macon

(A. 19) and for the Board to have power to regulate the

park, including discretion to admit men (A. 20). Senator

Bacon directed that a portion of the property be used to

gain income for the upkeep of the park (A. 20). He directed

that “ in no event and under no circumstances” should either

the park property or the income-producing area be sold or

otherwise alienated, and specified that except for the desig

nated income-producing area the property “ shall forever,

and in perpetuity be held for the sole uses, benefits and

enjoyments as herein directed and specified” (A. 20). The

will stated Senator Bacon’s belief that Negroes and whites

should have separate recreation grounds (A. 21). It also

stated his wish that the property be “ preserved forever for

the uses and purposes” indicated in the will, and that it be

perpetually known as “Baconsfield” (A. 21). It provided

that the trustees had no power to sell or dispose of the

property “under any circumstances and upon any account

whatsoever, and all such power to make such sale or alien

ation is hereby expressly denied to them, and to all others”

(A. 22).

Item 10th of Senator Bacon’s will bequeathed bonds,

valued at $10,000, to the City of Macon with directions that

the income be used for the preservation, maintenance and

11

improvement of Baconsfield (A. 22). The will said that if

the City was without legal power under the city charter to

hold the funds in trust, the City should select a successor

trustee (A. 24). Bacon gave a similar direction for the

City to select a successor trustee “if for any reason it

should be held that the Mayor and Council of the City of

Macon have not the legal power under their charter to hold

in trust for the purposes specified the property designated

for said park and pleasure ground . . .” (A. 24).

In a 1913 codicil, Senator Bacon noted that one of his

daughters, Mrs. Augusta Curry, had predeceased him, and

provided that her children should stand in her place in the

disposition of the property, except that with respect to

Baconsfield their interest would cease upon the death of

his wife and his other daughter (A. 29-30). Item 3rd of

the codicil provided, inter alia:

To prevent possibility of misconstruction I hereby pre

scribe and declare that all interest of the said children

of my said daughter Augusta in the property specified

in Item 9 of my said Will and in the rents, issues and

profits thereof, shall cease, end and determine upon

the death of my wife Virginia Lamar Bacon and of

my daughter Mary Louise Bacon Sparks (A. 30).

In Item 4th of the codicil, it was provided that Custis

Nottingham, one of the trustees and executors under the

will, and his family, could occupy a house on Baconsfield

rent-free until the full expiration of the trust for which he

was appointed (A. 30).

The City of Macon Acquires Baconsfield— 1920

The City of Macon obtained possession of Baconsfield in

February 1920, many years before the death of Senator

Bacon’s surviving daughter, by virtue of an agreement

12

between the City and the trustees under the will, which was

entered into with the written assent of all of Senator

Bacon’s heirs. The agreement is set forth in the Macon

City Council Minutes of February 3, 1920 (Intervenors’

Exhibit 0 ; A. 405-407). Under the agreement between the

City and the trustees, which recites that it was executed

with the signed assent of all legatees and beneficiaries of

the Bacon estate, the trustees conveyed Baconsfield to the

City by deed, and also conveyed to the City to be covered

into the City treasury the bonds and accumulated interest

bequeathed by Item 10th of the will (Id.). The deed of

Baconsfield to the City appears in the record as Intervenors’

Exhibit P ; it was executed February 4, 1920, and recorded

February 10, 1920 (A. 353). In the agreement the City

agreed to pay the trustees the sum of $1,665 annually dur

ing the life of Senator Bacon’s daughter, Mrs. Sparks

(A. 405-407). The City also agreed that it would appro

priate 5% of the sum of the value of the bonds and ac

cumulated interest each year, or $650 annually, for the

improvement of Baconsfield Park (Id.). The City agreed

not to charge any taxes or other assessments of any kind

against the property (Id.). At the same time the City

agreed with Custis Nottingham that he would terminate

his occupancy of a house in Baconsfield in consideration

of a cash payment of $5,100 from the City of Macon (Ex

hibit O; A. 405). Nottingham’s Quit Claim Deed to the

City is Intervenors’ Exhibit G- (A. 357).

The City of Macon paid $5,100 to Custis Nottingham in

consideration of his deed of his interest in Baconsfield

(A. 405). The City of Macon paid the trustees under the

will an annuity each year during the life of Mrs. Mary

Louise Bacon Sparks. The Baconsfield annuity payments of

$1,665 per year were regularly included in the Macon City

budgets. (See, for example, budgets for the years 1939 and

13

1940, Interveners’ Exhibits T and U ; A. 416, 417). Mrs.

Sparks lived until May 31, 1944 (Intervenors’ Exhibit W ;

A. 456). Accordingly, there were 25 payments of $1,665

from February 1920 through February 1944, and the City

of Macon thus paid a total of $41,625 to the trustees under

Bacon’s will in order to acquire Baconsfreld during Mrs.

Sparks’ life.

The Macon City Council Minutes of February 17, 1920

(Intervenors’ Exhibit P ; A. 408), reflect the fact that

the City had taken over Baconsfield Park; that the council

elected the first Board of Managers; that the Mayor of

Macon, G. Glenn Toole, was elected to the Board of Mana

gers; and that this election of the Mayor was requested

by the trustees under Bacon’s will, Messrs. Jordan and

Nottingham, who wrote a letter to the Mayor stating:

In turning over to the City of Macon the park devised

to it by Senator Bacon, permit us to express the hope

that this Park will mean all to the white citizens of

Macon that Senator Bacon wished it to mean.

The place is one of great natural beauty, but it could

easily be marred by haphazard work. We are sure

that before anything material is done to this property

that you, the City Council, and the Commission ap

pointed by it will have a well defined and permanent

plan of improvement in view.

We believe that it is of the utmost importance that

you be a member of this Commision, and wish here

to voice the hope that you will not decline such service

from any false modesty. It will greatly expedite the

people’s enjoyment of this property if the Commission

is headed hy the head of our City Government. Dif

ferences in opinion and change of plans will be thus

avoided, and the money essential to the improvement

of this property will be expended by the one charged

with raising it. (A. 408-409; emphasis added).

14

Mr. Toole who was Mayor of Macon from 1918-1921 and

from 1929-1933 (Heirs and Trustees Exhibit E ; A. 463),

remained a member of the Board of Managers until 1945.

(Intervenors’ Exhibit B, Baeonsfield Minutes of May 30,

1945, and November 1, 1945; A. 268, 271, 273-274).

City Administration and Financial Aid to the Park

and Federal Government Aid

Mr. T. Cleveland James was Superintendent of Parks of

the City of Macon from 1915 to the time of his Deposition

in April 1967 (A. 206). He developed most of Macon’s

parks, including Baeonsfield and exercised “general super

vision” over Baeonsfield for many years. (A. 205). He

testified that Baeonsfield was a “wilderness” with “under

growth everywhere” and no facilities at the time the

Mayor directed him to take charge of the park (A. 199-200;

202; 218). Supt. James initially developed Baeonsfield

Park using workmen who were paid by the federal Works

Progress Administration, an agency of the United States

(A. 203-205). The W.P.A. men were working at Bacons-

field under his supervision for a period he estimated as

a year or more (A. 203-205; 218). The federally paid

workmen cleared the underbrush, cleared foot paths, built

footbridges, dug ponds, built benches, planted trees and

flowers and generally performed landscaping work in

Baeonsfield Park (A. 201-207). The W.P.A. workers did

similar work in other city parks under the supervision

of the City Park Superintendent (A. 213). Mr. James’

testimony is supplemented and corroborated by W.P.A. rec

ords from the archives of the United States (Intervenors’

Exhibit E ; excerpts at A. 347-352) which reflect that Works

Progress Administration Work Project No. 244 involved

landscaping city parks in Macon, Georgia under the su

pervision of the City Park Superintendent. The W.P.A.

records indicate that W.P.A. Project No. 244 was ap

15

proved August 7, 1935; that the federal government paid

$120,032.35 for 469,079 man hours of work; and that the

sponsor (City of Macon) paid $17,923.43 for work on the

project (A. 349). The W.P.A. records do not indicate how

much of the labor was at Baconsfield and how much was

at other city parks. But, Mr. James’ testimony indicates

that W.P.A. work at Baconsfield was very extensive (A.

218):

Q. Will you describe for us very briefly what you

meant when you said Baconsfield Park was a wilder

ness when you first went out there? A. Well, there

wasn’t nothing there but just undergrowth every

where, one road through there and that’s all, one

paved road.

Q. And no facilities out there; is that correct! A.

No.

Q. And how long did it take you to turn it into a

usable park? A. Oh, about 6 or 8 months, probably

a year.

Q. I see, and you used employees fairly regularly

during all of that year? A. Yes.

Q. Every day? A. Well, we had the PW A labor,

trying to get me to give them something to do, you

know, and I worked them over there.

Q. You say you used the PWA employees for maybe

a year? A. I expect I did, yes, that is what I did

my work with.

The minutes of the Baconsfield Board of Managers meet

ing held March 30, 1936 (Intervenors’ Exhibit B ; A. 248),

indicate that considerable development, landscaping and

planting had been done in the park during the preceding

12 months. No earlier minutes of the Board are avail

able (A. 247). However, the Board minutes indicate an

extensive pattern of governmental involvement in the

16

maintenance of the park from 1936 until the City resigned

as trustee of the park in 1964. (The minutes from 1936-

1945 are Exhibit B, R. 506-565; see excerpts at A. 246-

275. The minutes from 1945-1967 are Exhibit A, R. 376-

505; see excerpts at A. 276-346). The City’s involvement in

the operation of the park was manifested in a great number

of ways. For example, for a twelve year period from 1936

to 1948, all but one of twenty-one meetings of the Board of

Managers of Baconsfield took place in the Mayor’s office or

elsewhere in Macon’s City Hall. During the same period

the Mayor of Macon attended 16 of the 21 meetings. (See,

generally, Intervenors’ Exhibits A and B supra; A. 246-

346). The minutes reflect that over an extended period of

years the Board of Managers frequently requested and

obtained assistance from the City of Macon in developing

and improving the park. The minutes of the Board of

Managers refer to Baconsfield as “ one of the outstanding

municipal parks in the Southeast” (A. 294), and to “Ba

consfield and the other public parks of the City of Macon”

(A. 274).

The deposition of Park Superintendent James and the

Board of Managers’ minutes indicate positively and con

clusively that Baconsfield Park was maintained and oper

ated as an integral part of the City park system from the

time the park was first developed until the City resigned

as trustee in 1964. Park department employees under Mr.

James’ supervision maintained Baconsfield just as they did

all of the other city parks (A. 200-201; 208; 217-218). Mr.

James estimated that the City spent about $5,000 for

flowers and plants in Baconsfield during the years he

worked there, and additional amounts were spent by the

Board of Managers for gardening supplies (A. 211). In

1938, the United States government gave to the park 144

bamboo plants representing six different varieties of bam

boo (A. 252). Mr. James regularly assigned men from the

17

city Park Department to work in Baconsfield as the need

arose (A, 200-201). City workers did all the general main

tenance work in the park until 1964 (A. 200-201). For a

period of years, Mr. James, the City Superintendent of

Parks, lived in Baconsfield Park, occupying a home rent

free (A. 290). The substantial value of the city’s contri

bution of labor for upkeep of the park is demonstrated

bv the increase in the board’s maintenance expenditures

after the City resigned as trustee of the park in 1964 (A.

235). The amounts spent by the Board of Managers for

maintenance in the years 1960-1966 were as follows:

1960--$1,307.20

1961 — $1,645.72

1962 — $1,995.57

1963 — $1,465.20

1964 — $6,545.78

1965 — $7,073.80

1966 — $6,675.89

(Computed from Answer to Interrogatory No. 9; A. 135-

136.) The Chairman of the Board of Managers agreed that

the cost increase in 1964 and thereafter was attributable to

the fact that the City withdrew its services, and it became

necessary for the board to pay for services which had pre

viously been furnished by the City Parks Department (A.

235). The Mayor of Macon ordered all city employees to

stop working at Baconsfield after the City resigned as

trustee in 1964 (A. 176-177).

Baconsfield Clubhouse— Built by Federal Government

There is a two story brick building known as the Bacons

field Clubhouse located in the park. The clubhouse was built

in 1939 by the Works Progress Administration (W.P.A.),

an agency of the United States (Intervenors’ Exhibits J

(A. 403-404). Iv (R. 724-841; excerpts at A. 419-442), L

18

(R. 842-846), M (R. 847-910; excerpts at A. 443-453), N

(R. 911-913) and R (A. 413-414)). The clubhouse con

struction project was sponsored by the City of Macon

acting in conjunction with a private group known as the

Women’s Clubhouse Commission. In its application for

federal funds for this project, the City of Macon, by its

Mayor and Treasurer, executed numerous documents con

stituting agreements, assurances, certificates, representa

tions and contracts which are contained within the W.P.A.

records (Intervenors’ Exhibits K (A. 419-442) and M (A.

443-453)). The City in several documents represented to

the United States that the City was the sole owner of the

Baconsfield Park property (R. 774, 788-789), that the City’s

ownership was “perpetual,” (A. 449), that there were no re

versionary or revocation clauses in the ownership docu

ments (R. 789; A. 449), that the property was not private

property (id.), and certified that proposed clubhouse proj

ect was “ for the use or benefit of the public” (R. 796, 808;

A. 434, 451). Federal funds totaling $16,512.80 were ex

pended to construct the clubhouse (see Intervenors’ Ex

hibits L (R. 842-846) and N (R. 911-913)). The city officials

signed documents indicating that the sponsor’s (City’s)

share of construction costs would be financed out of the

“ regular tax fund with the assistance of the Women’s Club

of Macon” (Intervenors’ Exhibit K ; R. 774). The Women’s

Club had agreed to contribute $3,000 (Intervenors’ Ex

hibit R ; A. 413). The sponsor’s (City’s) share of the con

struction costs finally amounted to $8,376.91 (R. 846, 913).

The total costs of the clubhouse, including the federal

contributions ($16,512.80; R. 845, 912) was $24,889.71 (In

tervenors’ Exhibits L and N).

In a sworn certificate executed under oath by the Mayor

and Treasurer of the City of Macon on October 14, 1938,

quoted in full below, the City promised that there would be

19

no discrimination against any group or individual in the

use of the clubhouse or the property upon which it was

located, and that the City did not intend to lease, sell,

donate or otherwise convey title or release jurisdiction of

the property during the useful life of the improvements

built with federal funds. The certificate contained in Inter

veners’ Exhibit K, reads as follows (A. 440-441):

With reference to Works Progress Administration

Project Application State Serial No. 6586, this is to

certify that the proposed building referred to in plans,

specifications and other data submitted to support the

project applications, as “Baconsfield Club House” will,

upon completion, be used as a community club house

for the general use and benefit of the public at large,

without discrimination against any individual, group

of individuals, association, organization, club or other-

party or parties who may desire the use of the build

ing and the property upon which the building is

located.

It is further certified that the City of Macon, as project

sponsor and owner of the property upon which the

building is to be constructed, does not intend to lease,

sell, donate or otherwise convey title or release juris

diction of the property together with improvements

made thereon, during the useful life of the improve

ments placed thereon through the aid of W. P. A.

funds.

It is further certified that the City of Macon, as project

sponsor, will be responsible to see that the property

together with the improvements made thereon will be

maintained for the general use and benefit of the public,

and will not be used for the profit or benefit of any

one individual or specific group or organization; and

20

the management of the property, together with im

provements made thereon, will at all times be subject

to the approval of the designated city official or officials

of the City of Macon, who will be responsible to see

that the foregoing certification is adhered to.

/ s / Chables L. B owden

Mayor, City of Macon,

Georgia

/ s / F ran k B ranan

Treasurer, City of Macon,

Georgia

Another similar certificate or agreement containing as

surances that the property “will not be leased, sold, donated

or otherwise disposed of to any private individual or cor

poration, or to a quasi-public organization during the oper

ation of the project” and would be “maintained by the

Women’s Club and operated for the benefit of the general

public,” was executed September 7, 1938, by the Mayor

and Treasurer of the City of Macon and by the President

and Treasurer of the Women’s Club House Commission

(Intervenors’ Exhibit M at A. 453).

The Women’s Club continues to occupy the clubhouse in

Baeonsfield Park, using the building free of charge and

without paying rent either to the City or to the Board of

Managers. The Women’s Club charges fees for various

organizations which use the building for meetings, but none

of these funds go to the City or to the Board of Managers

(A. 159-164; 221-222; 232-234). Mayor Merritt of Macon

testified that he has attended meetings at the Clubhouse of

such organizations as the Georgia Legal Secretaries Asso

ciation, the Georgia Milk Dealers Association, and several

other local associations of various types (A. 161-163).

21

The minutes of the Board of Managers of Baeonsfield in

dicate that the Board permitted the Highland Hill Baptist

Church to use the Baeonsfield Clubhouse as the temporary

meeting place for the church during the construction of

the church. The Board voted this permission for the church

to use the Clubhouse at its meeting of June 25, 1953, not

withstanding its attorney’s advice that this use was not

permitted by Senator Bacon’s will (Exhibit A, Minutes

of 6/25/53; A. 296-298). A letter from the Chairman of

the Board of Deacons of Highland Hill Baptist Church

thanking the Board for the use of the Clubhouse as a

meeting place for the church was read at the Baeonsfield

Board meeting of May 17, 1955 (Exhibit A, Minutes of

5/17/55; A. 311).

Public Roads in the Park

Certain roads running through Baeonsfield Park were

paved and developed by the City (A. 167-169; 202-203; see

also Intervenors’ Exhibit A, Minutes of 5/17/55 (A. 312-

313). On several occasions the Board of Managers resolved

to seek federal funds for the paving of roadways in the

park, but the record does not indicate whether any federal

highway funds were actually obtained (see Intervenors’

Exhibit B, Minutes of 3/30/36 (A. 247-248); 6/28/38 (A.

253); and 10/12/38 (A. 247-248)). On one occasion the City

paid the Board of Managers the sum of $1,000 as “ partial

reimbursement from City of Macon for paving in Bacons-

field.” (Intervenors’ Exhibit A, financial statement follow

ing Minutes of 10/16/47; A. 393).

City-Built Swimming Pool and Bathhouses at Baeonsfield

As early as 1936, the Board of Managers of Baeonsfield

began discussing the desirability of constructing a swim

ming pool in the park, and the discussion of government

22

aid for a pool continued for years (Interveners’ Exhibit

B, Minutes of 6/29/36 (A. 249), 7/30/36 (A. 251), 12/7/36

(B. 517), 12/14/44 (A. 260), 5/30/45 (A. 262-268)). Fi

nally, on June 3, 1947, the Chairman of the Board of

Managers met with the Mayor and several aldermen of

Macon and “ strongly urged” that the City appropriate

$100,000 to build a pool in Baconsfield. (See Intervenors’

Exhibit A, Minues of 6/3/47; A. 281-282). The City agreed

to this suggestion and on July 22, 1947, resolved to deliver

the sum of One Hundred Thousand Dollars to the Board

of Managers of Baconsfield to be used by the Board for

the construction of a swimming pool. (Intervenors’ Ex

hibit I ; A. 389; see also, Intervenors’ Exhibit V ; A. 418.)

Subsequently, the City appropriated an additional Forty

Thousand Dollars on December 23, 1947 to the Becreation

Department to construct bathhouses at Baconsfield pool

(Intervenors’ Exhibit I ; A. 389). The Baconsfield minutes

indicate that the Board of Managers accepted the $100,000

grant and designated the Chairman and Secretary of the

Board of Managers and the Chairmen of the City Council’s

Finance and Becreation committees to act as agents to con

struct the pool and disburse the funds from a special swim

ming pool account. (Intervenors’ Exhibit A, Minutes of

8/4/47; A. 285-287.) A large community swimming pool

and adjacent buildings were constructed in 1948 on a por

tion of the Baconsfield land designated in Bacon’s will as

income-producing property. After the pool was constructed

the Board of Managers and the City entered into a contract

by which the pool was leased by the Board to the City for

a two year term, to be automatically renewed for successive

two year terms unless either party terminated the lease

or the City breached its covenants (Heirs’ Exhibit D ; A.

384-388). The City agreed to operate the pool:

. . . as a part of the pleasure and recreational facil

ities of Baconsfield, for the enjoyment and benefit of

23

the beneficiaries of the trust for Baconsfield, as set

up and established in the said last will and testament

of the said A. 0. Bacon, deceased, and also for other

persons who are or may be admitted to Baconsfield

(A. 385).

The City agreed to bear any losses in connection with the

pool operation, and to share any profits with the Board.

No payments to the Board were made under this provision

(Heirs’ Exhibit H and attached letter; A. 470-474). The

City made additional capital expenditures at the pool and

related facilities over the years for improvements, includ

ing the following amounts (Heirs’ Exhibit I I ; A. 473):

1948 $ 4,999.57

1960 6,079.21

1962 6,360.55

$17,439.33

The sum of $1,084.93, which remained in the old swim

ming pool account was transferred to the regular account

of the Board of Managers in 1959. (Intervenors’ Exhibit

A, Minutes of 5/8/59; A. 326, and financial statement fol

lowing Minutes of 10/29/59; R. 456.)

The pool was finally closed and the lease cancelled in

1964 in order to avoid racial desegregation as required

by the Fourteenth Amendment. In April 1963, following

attempts by Negro groups to integrate the park, the Board

resolved to cancel its contract with the City relating to the

pool and to attempt to negotiate a contract with a private

party for operation of the pool (Minutes of 4/9/63; A.

334-335). At the same time, the Board directed its attor

neys to commence this lawsuit to remove the City as trustee

(Id.). The swimming pool contract was finally cancelled

24

in May 1964. The Board’s attorney wrote a letter to

Mayor Merritt dated May 22, 1964 (Intervenors’ Exhibit

X ; A. 458-460) stating that it was cancelling the pool lease

because of the City’s inability to enforce racial segrega

tion at the pool. The Mayor replied by letter dated May 28,

1964 (Intervenors’ Exhibit Y ; A. 461), acquiescing in the

termination and relinquishing control of the pool to the

Board of Managers. The swimming pool has remained

closed since that time, and has not been maintained or

kept in repair since 1964. Nearby highway construction

which interfered with the pool area during a period of time

has now been completed, but the pool remains closed.

City Operated Zoo

The City established a zoo in Baconsfield Park, with

caged animals, including monkeys, a bear, ducks, rabbits,

a raccoon, a few deer, and a few peafowl and pheasants.

(Answer to Interrogatory No. 2; A. 133.) Mayor Merritt

stated that the zoo included 40 or 50 monkeys (A. 154).

The zoo was closed and all the animals and cages removed

after the City resigned as trustee in 1964. While the zoo

was in operation the City employed a full-time employee

at Baconsfield to take care of the animals (A. 155-156; 201,

208). The Public Works Department of Macon dismantled

the zoo (R. 208).

Public School Playground

A playground in the Baconsfield Park is regularly used

as the school playground for a nearby public school oper

ated by the Bibb County Public School System (A. 173-

174). The school is Alexander School Number 3, a pre

viously all white elementary school, which it was anticipated

would be attended by a small number of Negro pupils living

in the neighborhood under the school district’s desegrega-

OK

t j O

tion plan. (Intervenors’ Exhibit W, Stipulation No. 2;

A. 456-457.) The school personnel supervise the children

in using the playground in Baconsfield (A. 173-174; 178-

179). The Bibb County Board of Education was respon

sible for having the playground installed, including bas

ketball courts (A. 180, 192). Prior to 1964, the City

Recreation Department had an employee assigned to the

playground at Baconsfield to supervise the children. The

City spent an average of $1,180.70 per year to employ

someone at the playground prior to February 1964 (A.

175-179).

City Leased Building

From 1954 until the present time, the City has leased a

building referred to as the Open Air School from the

Board of Managers and paid the Board a rental of $300

per annum. (Exhibit A, Minutes of 6/24/54; A. 301; A.

181-184.) This is a one story brick building located in

the portion of the Baconsfield property set aside for rais

ing revenue (Id.). The City in turn makes the building

available, free of charge, to the Macon Young* Women’s

Civic Club for the activities of the “Happy Hour Club,” an

organization of elderly people (Id.). The building was

previously occupied by the Board of Education rent free

(Intervenors’ Exhibit B, Minutes of 7/10/41; R. 541).

City-Aided Recreation Facilities

A Little League baseball field located in the park was

constructed in part with the aid of the City which dumped

100 to 200 truck loads of dirt in a low area of Baconsfield

where the field is now located (A. 164-165). The financial

records of the Board indicated that it made a “part pay

ment” to the City for filling in the play area in the amount

of $3,500. (Exhibit A, financial statement following Min-

26

utes of 12/18/56; E. 437.) The minutes do not indicate

any subsequent payments.

Several tennis courts are maintained in the park. The

City of Macon assisted in installing lights at the tennis

courts to permit play at night. (A. 169-170; Minutes of

7/24/62; A. 330.) In 1964, the Board of Managers granted

to the Macon Tennis Club, a private club, permission for

the club to regulate play at the Baconsfield Tennis Courts

according to the rules of the club, and permission to main

tain the tennis courts. (Intervenors’ Exhibit A, Minutes of

4/10/64; E. 492.)

Sale of Portion of Trust Property to State

During World War II, when informed that the War De

partment wanted a strip of land to open a roadway, the

Board and the City sold a strip of land from the area of

Baconsfield devised by Senator Bacon as income-producing

property to the State Highway Board of Georgia. (See

the deed and attached resolutions, Intervenors’ Exhibit H ;

E. 655-660.) The Board of Managers received a check in

the amount of $1,500 from the City of Macon in this trans

action. (Intervenors’ Exhibit B, Minutes of 3/3/42; E. 542-

543, and financial statement following Minutes of 12/15/44;

A. 261.)

Tax Exemption

The Board of Managers has never paid any taxes, fed

eral, state, or local, on the Baconsfield property or on any

of the income they have received. The property has always

been treated as exempt from taxes under Georgia laws.

(See Financial Statements in Intervenors’ Exhibits A and

B, passim-, see also A. 184, 196.)

27

Income Property

The income-producing area of the trust property now

includes a shopping center with several business, includ

ing a filling station, pharmacy, ice cream store, etc. The

rental income of the Board of Managers during calendar

year 1966 was $7,058.37. (Computed from Intervenors’ Ex

hibit C; R. 569-592.) The rental income received during

the period April 1, 1963, to March 31, 1964, was $5,225.04

(R. 346). During the years the Board also has received

payment for various types of utility easements on the

property. In 1958, the Board received $3,500 from the City

Board of Water Commissioners for a sewer easement. (In

tervenors’ Exhibit A, financial statement following Minutes

of 5/8/58; A. 324.) The State Highway Department ac

quired 26.932 acres of land in Baeonsfield by condemnation

proceedings in 1964 to construct a portion of Interstate

Highway 16. (Heirs’ Exhibit I ; A. 476.) The Board of

Managers was awarded the sum of $131,000 in the con

demnation, and the Court ordered that sum paid to the

Chairman of the Board of Managers to be invested in short

term government bonds and to be held subject to the fur

ther order of the court pending the outcome of proceedings

in the instant case {ibid.).

Assets of the Estate

The assets as of April 17, 1967, held by the First Na

tional Bank & Trust Company in Macon, as agent for the

Board of Managers of Baeonsfield, were stated by the

Bank as follows (Intervenors’ Exhibit D ; R. 594):

28

“ A ssets :

Cash:

Principal Cash Overdraft $ 266.44

Income Cash Balance 9,443.67

$ 9,177.23

Property:

Real Estate 255,000.00

U. S. Treasury Bonds 136,434.98

Savings Account First

National Bank 7,795.05

399,230.03

Total Assets $408,407.26

Less:

Real Estate 255,000.00

Highway Right of Way Fund 143,766.92

398,766.92

Rent Accumulation $ 9,640.34”

The original trust fund of $10,000 in bonds left by Sen

ator Bacon, was long ago “depleted” according to the

City (City’s Answer to Interrogatory No. 13; A. 116).

An accounting filed by the successor trustees with the

court below on June 3, 1968, showed the total trust assets

to be $404,810.77, including a book value for the real estate

of $255,000 (R. 1055).

How the Federal Questions Were Raised

and Decided

The petitioners’ federal constitutional objections to the

order of the court below ruling that the Baconsfield Park

property had reverted to the heirs were stated in their

Response to the motion for summary judgment (A. 119-

122) and in their several supplemental responses (A. 242,

29

393, 454; E. 971). The federal constitutional objections

were repeatedly and elaborately articulated. The follow

ing excerpts from the Supplemental Kesponse and the

Second Supplemental Eesponse represent the general

thrust of petitioners’ argument as stated to the Superior

Court:

The entry of a judgment to the effect that the trust

properties should revert to the heirs of Senator Bacon

would violate the intervenors’ rights under the Due

Process and Equal Protection clauses of the Four

teenth Amendment to the United States Constitution,

in that:

(a) A Judicial decree of reversion would not im

plement the intent of Senator Bacon’s will, which ex

pressed the legally incompatible intentions that (1)

Negroes be excluded from Baconsfield Park, and (2)

that Baconsfield Park be kept as a municipal park for

ever. A judicial choice between these incompatible

terms must be made in conformity with the said

Fourteenth Amendment. The affirmative purpose of

the trust, to have a park for white people, will not fail

if the park is opened for all, and for the court to rule

that the mere admission of Negroes to the park is such

a detriment to white persons’ use of the park as to

frustrate the trust and cause it to fail, would be a vio

lation of the said Fourteenth Amendment. (A. 242-243)

# # *

An application of the reverter doctrine or other doc

trine finding a failure of the trust on the facts of this

case would amount to a judicial sanction which imposed

a penalty because the agencies managing Baconsfield

Park fulfilled their Fourteenth Amendment obligation

to operate the park on a racially non-diseriminatory

basis. The use of such a judicial sanction in these cir

30

cumstances would violate the intervenors’ rights under

the due process and equal protection clauses of the

Fourteenth Amendment to the Constitution of the

United States. (A. 399)

— 6 —

The due process and equal protection clauses of the

Fourteenth Amendment to the Constitution of the

United States require that the racially exclusionary

words of Senator A. 0. Bacon’s will relating to Bacons-

field Park he treated by the courts as pro non scripto

as though they were never written. This is required,

firstly, because the racially exclusionary terms were

written in the will to conform to racially exclusionary

suggestions and requirements of Georgia Code Section

69-504 (Georgia Acts 1905, p. 117). The racial portions

of Section 69-504 are void under the Fourteenth

Amendment, and indeed were void ab initio even under

the “ separate but equal” doctrine, by authorizing the

total exclusion of Negroes from public parks, and thus

must be regarded as pro non scripto. Secondly, it is

required because by the City’s acceptance of the park,

pursuant to Georgia Code Section 69-505 (Georgia

Acts 1905, pp. 117-118), and its operation of the park

in accordance with Bacon’s will, the will was made a

part of the City’s own laws governing the operation

and use of the park, and is to be treated in the same

manner as if the racially exclusionary words appeared

in a city ordinance. (A. 399-400)

— 9 —

By virtue of all the facts and circumstances pre

sented on the record of this case the City of Macon

has so invested the Baeonsfield Park with a public

31

character, and the City .has become involved to such

an inextricable extent, that it would be a violation of

the intervenors’ rights under the due process and

equal protection clauses of the Fourteenth Amend

ment for the state courts to apply any state law doc

trines (whether relating to trust law, the law of dedica

tion, real property law, or other principles), so as to

defeat the rights of the intervenors to racially non-

discriminatory use and access to the park as a public

park (E. 401-402)

Before the Superior Court the constitutional claims were

argued orally and were presented in full written briefs.

The ruling of the trial court on petitioners’ constitutional

arguments was brief and general. The court stated in its

order of May 14, 1967 (A. 519-520):

It is my opinion that Shelley vs. Kraemer, 334 U.S.

1, 68 S.Ct. 836, 92 L.ed. 1161 (1948), does not sup

port the position of the intervenors. It is further my

opinion that no federal question is presented in regard

to the reversion of Baconsfield, but rather this prop

erty has reverted by operation of law in accordance

with well settled principles of Georgia property law.

The federal questions were preserved on appeal by ap

propriate enumerations of error and again fully briefed

before the Supreme Court of Georgia. The Supreme Court

of Georgia also rejected petitioners’ constitutional argu

ments on the merits. The court stated at the conclusion

of its opinion (A. 545) :

6. The intervenors urge that they have been denied

designated constitutional rights by the judgment of

the Supreme Court of Bibb County holding that the

trust has failed and the property has reverted to Sen-

32

ator Bacon’s estate by operation of law. We recognize

the rule announced in Shelley v. Kraemer, 334 U.S. 1

(68 SC 836, 92 LE1161, 3ALR2d 441), that it is a viola

tion of the equal protection clause of the Fourteenth

Amendment of the United States Constitution for a

state court to enforce a private agreement to exclude

persons of a designated race or color from the use or

occupancy of real estate for residential purposes. That

case has no application to the facts of the present

case.

Senator Bacon by his will selected a group of people,

the white women and children of the City of Macon,

to be the objects of his bounty in providing them

with a recreational area. The intervenors were never

objects of his bounty, and they never acquired any

rights in the recreational area. They have not been

deprived of their right to inherit, because they were

given no inheritance.

The action of the trial court in declaring that the

trust has failed, and that, under the laws of Georgia,

the property has reverted to Senator Bacon’s heirs, is

not action by a state court enforcing racially discrimi

natory provisions. The original action by the Board

of Managers of Baconsfield seeking to have the trust

executed in accordance with the purpose of the testator

has been defeated. It then was incumbent on the trial

court to determine what disposition should be made of

the property. The court correctly held that the prop

erty reverted to the heirs at law of Senator Bacon.

33

Summary of Argument

Federal law entirely governs the crucial issues in this

case. As both venerable and recent decisions of this Court

established beyond doubt, no area of state law and no

action of any state agency, whether in the field of trusts

or anywhere else, is immune from total control by the

Constitution. Petitioners contend that the Fourteenth

Amendment has been violated in this case, thus tender

ing a purely federal question. Martin v. Hunters’ Lessee,

1 Wheat. 304 (1816); New York Times v, Sullivan, 376 U.S.

254 (1964); Presbyterian Church in the United States v.

Mary Elisabeth Blue Hull Memorial Presbyterian Church,

ITS , 37 U.S.L. Week 4107 (1969).

The action of the court below violates the Constitution

in that it imposes a drastic forfeiture on the mere fact of

the City’s compliance with federal law. The only possible

excuse for this (an excuse whose extreme doubtfulness

need not be argued in this case) would be the testator’s

definite command, but the record unequivocally shows, and

the court below admits, that the contingency now dealt with

in this way never entered the testator’s mind and that he

made no provision, definite or indefinite, for action such

as that taken by the court below. Thus, it is the choice of

the Georgia court, that this reversion is to occur on a

showing that Negroes must be allowed to use the park.

Aside from its naked character as a penalty on municipal

compliance with federal law, this action constitutes a

strong potential encouragement of racial discrimination.

Petitioners, as Negroes in whose favor the constitutional

guarantees primarily run, and as citizens of Macon who

will lose a public park if this reverter is enforced, have

standing to rely on this ground. McCulloch v. Maryland,

4 Wheat. 316 (1819); Crandall v. Nevade, 73 U.S. (6

34

Wall.) 35 (1867); cf. Shelley v. Kraemer, 334 U.S. 1

(1948); Barrows v. Jackson, 346 U.S. 249 (1953).

Secondly, since the intended white beneficiaries of Ba

con’s trust may still use the park as freely as ever the

judgment that the “ uses of the trust” have “ failed” (Geor

gia Code §108-106(4)) must logically rest on the premise

that for Negroes to use it as well so impairs white enjoy

ment as to produce “ failure.” The record is absolutely

silent on this impairment, so that the premise is one of

pure law. Cf. Mr. Justice Stewart’s concurring opinion in

Burton v. Wilmington Parking Authority, 365 U.S. 715,

726 (1961). This is beyond question a proposition on which

no state court judgment can be allowed to rest, under the

Fourteenth Amendment, for it goes even further than an

“ assertion” of Negro “ inferiority.” Strauder v. West Vir

ginia, 100 U.S. 303, 308 (1880). It is immaterial that this

proposition doubtless was not consciously present in the

Georgia court’s mind; it is a proposition logically neces

sary to the conclusion that the “uses” of this trust—en

joyment by whites—have “failed” (Georgia Code §108-106

(4)) when all that has changed is that Negroes in uncertain

numbers may be present. Having, under Georgia law, an

easy alternative to this decreeing of “failure,” in the

Georgia cy pres statutes, the Georgia court refused to

use it, a decision which logically must rest on a proposi

tion very similar to the one just identified. See Pennsyl

vania v. Board of Directors of City Trusts, 353 U.S. 230

(1957); Pennsylvania v. Brown, 392 F.2d 120 (3rd Cir.

1968), cert, denied, 391 U.S. 921 (1968).

Thirdly, the discriminatory provision in Bacon’s m il

was incurably tainted by its evident connection with §69-

504 of the Georgia Code authroizing racial discrimination

and only racial discrimination in trusts for public parks.

A provision so tainted ought to be unusable, not merely

35

affirmatively, but for any practical purpose. Mapp v. Ohio,

367 U.S. 643 (1961); see Mr. Justice White’s concurring

opinion in Evans v. Newton, 382 U.S. 296 (1966).

Fourthly, the racially discriminatory term in Bacon’s

will should be treated as a nullity, pro non scripto, for two

reasons. The first reason is that it was intended to be

come and did actually become a part of the public law

material of the city of Macon; its character as such (evi

dent enough in any case) is incontestably established by

Georgia Code §69-505. Having this character, it should

simply be stricken, as a city ordinance commanding racial

discrimination would be stricken. Holmes v. City of A t

lanta, 350 U.S. 879 (1955). The second reason is that this

park, which by Georgia law was beyond any doubt “dedi

cated in perpetuity” to the whites, must by virtue of the

federal command of racial equality be “dedicated in per

petuity” to the blacks. The park, by virtue of this federally

commanded addition to Georgia law, then stands “ dedi

cated in perpetuity” to all.

All of the above arguments are greatly strengthened and

reinforced by the impressive showing in this record of long-

continued and heavy public involvement in the park’s main

tenance and control.

36

ARGUMENT

I.

Introductory: State and National Law.

One overriding point must initially be made. Respon

dents have introduced into this case, in their Brief in

Opposition to Petition for Certiorari, at p. 15 and passim,

an idea that seems to govern strategically the view of the

case which they would have this Court take:

Respondents submit that the petition for a writ of

certiorari should be denied because the decision of the

Supreme Court of Georgia involved nothing more than

the application of well-settled principles of Georgia

law to a Georgia will. No rights guaranteed petitioners

by the Fourteenth Amendment have been denied; nor

is the decision of the Georgia court in any way incon

sistent with the decision of this court in Evans v.

Newton, 382 U.S. 296 (1966).

This Court has scrupulously adhered to the rule that

the highest court of a state may administer its statu

tory and common law according to its own under

standing and interpretation (see, e.g., American Rail

way Express Co. v. Commonwealth of Kentucky, 273

U.S. 269 (1927)), and especially where the law which

is being administered by the state tribunal is property

law (see Tyler v. U. S., 281 U.S. 497 (1930)), or where

the case involves the construction of a will. As this

Court stated in Lyeth v. Hoey, 305 U.S. 180, 59 S.Ct.

155 (1938):

“ The local law determines the right to make a

testamentary disposition . . . and the condition es

sential to the validity of wills, and the state courts

37

settle their construction.” 59 S.Ct. at 158. (Empha

sis supplied.)

At the very beginning, in application to each and every

argument that is to follow, petitioners deem it necessary to

confront this idea (surely valid as far as it goes) with its

obvious and beyond all doubt equally valid limitation—that

no state law and no state act, in any field, from automobile

traffic to contingent remainders, can prevail in the face of

federal law, and that no state court holding can stand in

the way of a federal court’s examining the fact and truth

of any transaction, for determining whether, in practice

and not only in theory, the Constitution has been violated.

The Constitution protects against actions, and not only

against maladroit or erroneous classifications and con

cepts. This has been clear at least since Martin v. Hunters’

Lessee, 1 Wheat 304, 357-360 (1816); Indiana ex rel. Ander

son v. Brand, 303 U.S. 95 (1938). Petitioners have no inter

est in questioning the general right of the Georgia court to

deal with trust questions. But when it is claimed, as

petitioners here claim, that the particular dealing at bar

violates, in multiple ways, the Fourteenth Amendment, it

is entirely unresponsive to set up the general proposition

that state courts ordinarily deal with these matters, where

federal law is not implicated. U. S. Constitution Article

VI.

Respondents’ own cases, cited in the just-quoted pas

sage from their Brief in Opposition, in fact illustrate not

only the general proposition, but also the exception. In

both Tyler and Lyeth, having paid due respect to state

law and state courts, this Court went on to say and to

hold that these cannot control the incidence of federal

taxation. See Tyler v. United States, 281 U.S. 497, 503

(1930); Lyeth v. Hoey, 305 U.S. 188, 193 (1938). Unless

the Fourteenth Amendment is of lesser dignity than a

tax statute, the very same thing is true in this case.

38

The Georgia court has the general power to say when,

under Georgia law, a trust has terminated. But that only

opens, and does not by any means close, the question

whether the Georgia court’s holding, in all its bearings

and on all the facts, results in a violation of the Fourteenth

Amendment.

It is very striking that no longer ago than last Term

the Georgia court’s decree declaring a trust to be termi

nated was in this Court reexamined, in the light of a claim

that the action violated the First Amendment, and un

animously reversed—Mr. Justice Harlan concurring spe

cially not because of any belief that Georgia controls her