Wheeler v. Montgomery Brief Amicus Curiae

Public Court Documents

September 30, 1969

Cite this item

-

Brief Collection, LDF Court Filings. Wheeler v. Montgomery Brief Amicus Curiae, 1969. 8d107ce6-c89a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/5b43782a-c88b-4f81-9c11-4b25f9bd02b2/wheeler-v-montgomery-brief-amicus-curiae. Accessed February 21, 2026.

Copied!

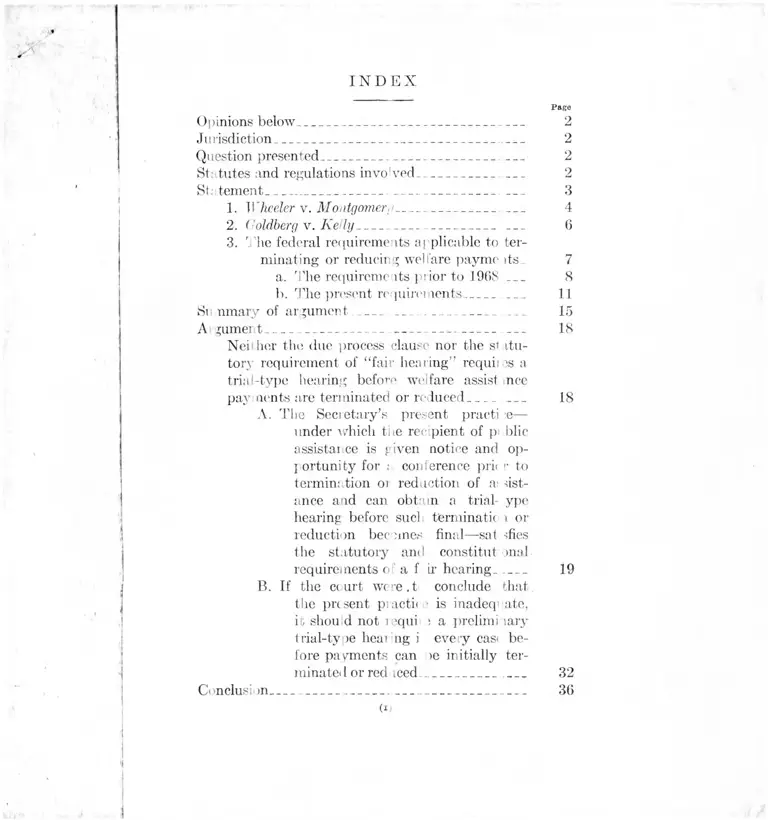

I N D E X

Pago

Opinions below_____________________________________ 2

Jurisdiction_______________________________________ 2

Question presented________________________________ 2

St: tutes and regulations invo'ved__________________ 2

St: tement___________________ 3

1. Wheeler v. Montgomery________________ 4

2 . Goldberg v. Kelly______________________ 6

3. The federal requirements :q plicable to ter

minating or reducing welfare payme its 7

a. The requirements prior to 190S__ 8

b. The present requirements____ _______ 11

St nmary of argument ______________ ______ __ 15

A ■ turner t_______________________________ IS

Neither the due process clause nor the s< itu-

tory requirement of “ fair hearing” requites a

trial-type hearing before welfare assist mce

pay nents are terminated or reduced___________ 18

A. The Secretary’s present practi e—

under ’which the rec pient of pi blic

assistance is given notice and op-

jortunity for : conference prk r to

termination ot reduction of a: sist-

ance and can obtain a trial ype

hearing before sucl terminate i or

reduction bee ones final—-sat sfies

the statutory and constitut onal

requirejnents of a f ir hearing_____ 19

B. If the court were.t conclude that.

the present practii is inadeq ate,

it should not lequi ; a prelimi lary

trial-type heai ng i every cas< be

fore payments can >e initially ter

minated or red iced__________ ____ 32

Conclusion______________________________________ 30

(i)

II

CITATIONS

Cases:

Bi-Metallic Investment Co. v. State Board of PatP

Equalization of Colorado, 239 IT.S. T! 1___ 35

Cafeteria Workers v. McElron, 307 U.S. 886 __ 20,

26, 30

C alley Electronics Coro. v. Federal Coi muni-

cations Commission, 394 F. 2d 620__ ____ 35

F dcral Power Commission v. Texan >, 377

U.S. 33___________________________________ 35

Flemming v. Xestor, 3(>3 U.S. 603______ 22

Hannah v. Bar die, 368 U.S. 420 _____ 15, 20, 29

Morgan v. United Stal s, 298 U.S. 468 __ 34

Phillips v. Commissioner, 283 U.S. 5S9 ______ 29

Shapiro v. Thompson, ■ 94 U.S. 618_ 20

Shcrbcrtv. Vernier, 374 U.S. 398 _____ __ __ 20

Sniadach v. Family Finance Carp., 3S5 U.S.

337____________ 28

United States v. Store • Broadcasting ( >., 351

U.S. 192__________________________________ 35

Constitution, and statutes:

United States Constit ition:

Fifth Amend men :

Due Process Clause__ ____ — 5,19,22

Fourteenth Amen Iment:

Due Process ( Clause_________ _. 4, 6, 19

Internal Revenue (Tide, 20 U.S.C. 0861-

6864______________ 29

Social Security Act, as amended, 42 U.S.C.

301 et seq.__ ....... ........... — — 2. 4

42 U.S.C. 302(a) ___ ____ ___ _ _ 3

42 U.S.C. 302(a) ( 1) ______________ _____ 3,4

42 U.S.C. 302(a)(5)____________ 8,23

42 U.S.C. 302(a)(8)_______ ... __ 23

42 U.S.C. 403(h) 3)___________ 29

42 U.S.C. 601 et ■ r/.____________________ 6

42 U.S.C. 602(a) 1)___________ 3

Til

C< institution and Statutes— Continued

Social Security Act, as amended— Continued

42 U.S.C. 602(a)(5)_____________________

42 U.S.C. 1202(a)(4)____________________

42 U.S.C. 1202(a)(4)____________________

42 U.S.C. 1252(a)(4)____________________

42 U.S.C. i:582(a) (4)_______________

42 U.S.C. 1396a(a)(3) (Supp. IV )._

Social Security Act, Public Law No. 27 , 49

Slat. 620 et sea.:

Section 2(a)(4)_____________________

Section 402(a) (4) __ _____________

Section 1002(a)(4)_________________

Social Security Amendments of 1951 64

Stat. 477, Sec. 321________________________

5 U.S.C. (Supp. IV) 558(c)____________

28 U.S.C. 2281 . ______ _____________________

47 U.S.C. 312(c)____________________________

A! iscellaneous:

34 F.R, 13595_____ ___________________

Handbook of Public Assistance Adininisti ition

of tin; Deparl metit ( f Health, Hduntion

and Welfare, Part I V _______________

§ 2200(b)(4)___________________________~

§ 2200(d )________________ ______________

§ 2300(d)(5)_______________________

§ 5514, item 2a___ ________________ ____

§ 5514, item 2b___________________

§ 5514, item 2c____________________ _____

§ 5514, item 2d____________________

§ 6201 i__________________________________

§ 6200(b).. ___________ ________

§ 6200 ( j )_______________________________

§ 6200(k) ______________________________

§ 6300__________________________________

§ 6400(a)_________________________

Page

8, 23

3

3

*)tj

3

3

8

P

8

8

29

5

29

3

10

11

12

11

11

13

13

9

34

13

14

9

p

IV

Miscellaneous— Continued

Handbook of Public Assistance Administra

tion o f the Department of Health, edu

cation and Welfare, Part IV — Continued page

§ 6500(a)__________________________________ 14

§ 6500(b)_________________________________ 14

Willcox, The Lawyer in the Administrate >i of

Non regulatory Programs, Public Adm ns-

tration Review, Vol. X III , No. 1, W iter

1953_________________________________________ 21

J i t i te S u p rem e dfmtrt oj the U n ite d S ta te s

October T erm 1969

Xo. M

M at. W heeler, et at. , aitellants

r.

-John Montgomkey, D irector oe rnii-: State I )epart-

men r oe Social W es.take, a > d R onald Horn, (Jen-

ERAI ]\ ANAiiLi; OE THE SAX FRANCISCO ClTY AND

Cot .;tv Department oe Social Services

No. 62

-J \C K v. (toLDRERO, COMMISSIONER OE SOCIAL S RVICEN

of 'i .ie C ity oe N ew Y ork, et al., viteli ants

v.

-J ohn K elly, et al .

OX API BAT/,Sf FROM THE E X IT ED STATE.S' D I S T R I C T COURTS

FOR HE X O R T I IE R X DIS TR IC T Oh' CAT IFOR XIA . 17 ) THE

SORT ERX D IS T R IC T OF X E W YORE

BE 3F FOE ?HE UNITEI STATE AS AMICUS CUT :AE

Thi brief is submitted in r< spouse to the < Court's

order >f Apr I 2 1 . 1969. inviting H e Solicitor Con-

9

cal. to express the views of the United States with

respect to these cases.

OPINIONS BELOV/

The opinion of the three-judge district court in

No. 14 (Wheeler App. (12') is reported at 299 F.

Sup]). 138. The opinion of the three-judge district

< ourt in No. 82 ( ( loldberg A]>p. 895a) is reported at

: 94 F. Supp. 893.

JURISDICTION

In No. 14, the district <■ uirt's judgment was entered

< u April 19. 1998, and the notice of appeal was filed

n June 14, 11)98. In Xo. 92, the judgment was entered

u December 13, 1998, and the notice of appeal was

led on January 9, 1999. In both cases, this Court

oted probable jurisdiction on April. 21, I960 (394

r.S. 970-971). Tile jurist ietion of this Court rests on

8 U.S.C. 1253.

QUESTION PRESENTED

Whether the Due Process Clause of the Fourteenth

amendment to the Constitution requires he States to

Ford recipients of welfare assistance a tidal-type

earing before suspending, terminating or reducing

heir benefit payments.

STATUTES AND REGULATIONS INVOLVED

The relevant provision of t ie Social Security Act,

; s amen led, 42 U.S.C. 301 cl scq., are as follows: 1

1‘‘Wheeler App.” citations are t;> the appendix iiv Xo. 14.

Goldber • App.” references a e to ihe appendix ia I to. 62.

3

§ 302(a). A. State plan for old-age assistance,

or for medical assistance for the aged, or for

old-age assistance and medical assi dance for

the aged must—

(4) provide for granting an opportunity for

a fair hearing before [lie State agency to any

individual whose claim for assistance under the

plan is denied or is not acted upon with reason

able promptness * * *.

§(>02(a ). A State plan for aid and services

to needy families with children must * * * (4 )

provide for granting an opportunity for a fair

bearing before the State agency to any individ

ual whose claim for aid to families with depend

ent children is denied >r is not acted upon with

reasonable promptness * * *.2

Id rtinent excerpts from Pa t 1 Y of the Handbook of

Puli'i< Assistance Administration o f the United States

Pep i nieni of 1b'altli Ifdlic; 1 ion, and Well are here-

aide Ilaudboolv” ) ai e set o d in \|>P<■ndi' ; 1 f to the

1 >ri< for A ipeil ants in No. 1 . Tin rele\•ant prov isions

of id • Calif. rnia Well' i re and 1 nsi tutions Code and of

Cab ornia. s ale regulations a re s( out in J ppen dices

1 1 I ml IV to 11 it1 I ii i • f for . p]>( ants in > o. 1 k The

appl cable .few York stale regu! itioi is set out in

App •II ant’s 1 »ri ■f iu Nro. 62, pp. 2-5.

ETATEMl NT

1? then tinm a tempi its ow i des •ripi ion o r the facts

of t e pendi ng t ases, the gov •mm nt s: is f nth below

- 1 to!lei pi ovisions :ij ) 1 y 1 < > he i tgrams of aid to the

blind it id to ito 1 crnuini illy an< tor: y <Ii ' title* aid to rte

iti ind, or distil led, an ' medic; 1 ass' ance. 12 r S.C. 1202

(a) ( ), 1352(a )(4) , 13S2( 0(4), aad 1 :6a (a) (8) Sup! r IV).

4

only a brief summary of the proceedings below. Like

1 he brief amicus curiae which the government tiled in

No. 62 below, the Statement is principally devoted to an

explanation in outline form, based on information sup

plied by the Department of Health, Education, and

Volf are, of certain Federal policies and procedures

pplicable to the Federal-State pro,a rams involved here.

1. WHEELER V. jMOXTCiOMERV

Jn No. 14, the appellant, Mae Ydheeler, brought an

iction for individual ai d class declaratory and in-

pmctive relief from C; lifornia welfare procedures

m emitting the termination or suspension of assist

ance— including assistance from Federal-State pro

grams under the Social Security Act— before the giv

ing of notice and an opportunity to he heard in a

trial-type proceeding. The State assistance program

specifically involved was Old Vge Security assistance,

which is eligible for federal funding under dnle I

of the Social Sec irity A % 42 U.S.C. 301 cf seq., sub

ject, inter alia, to a requirement that the participating

state agencies provide a “ la ir hearing, on request,

to any claimant to whom assistance is denied. 42

U.S.C. 302(a) (4 . Because the complaint sought to

enjoin the operation of California statutes and regu

lations of general appli -ation on grounds of conflict

with the Fourtei nth Amendment, a three-judge dis-

3 To avoid any c< illusion between the statutory requirement

of n. “fail- hearing" and a. hearing Hint is fair in the constitu

tional sense of moi ring tin reqnireine its ot the Hue Process

Clause, quotation n arks an used where the statutory hearing

is referred to.

5

ti-iet court was convened.4 28 U.S.O. 2281: Wheeler

App. 29-31.

California then amended its Public Social Services

Manual to provide for the termination procedures,

now in effect, which were ruled on by the district

court, fhese procedures require that whenever a de

cision is made to wit 1 hold welfai assistance from a

presi nt recipient, a n< (ice of the imposed action and

the M'asons for it must he given to him at least three

mai delivery days before the withheld assistance ordi-

nari / would he received. The recipient is then en

title to an informal conference with his caseworker

or a lotlier responsibh person in the county depart-

men before the withdrawal t dees effect, to “ learn the

natu e and extent of the information on which the

with olding action is based,’ to “ provide any expla-

nati< i or information” to the officials concerned, and

to “ < iscuss the entire matter informally for the pur

pose of clarification and, whore possil le, resolution.”

1 >rif for Appellants in No. 14, pp. 19a -20a.

T 1 i district court concluded, that this pre-termina

tion informal conference procedure, taken together

with the trial-type “ fair hear ng” required by statute

and egulations to he held soon after tennin ition, met

the . mauds of due pr< cess.

4 Ti convening I In tliroi' udge court, the ruling district judge

noted diat the pleat ings also raiset! by inference a further con-

stitut 'li il challengt—that if the California termination pro-

cedur s were not repugnant to the. Social Security Act, that

Act as repugnant to tin Due Process Clause ot the Fifth

Amoi ment. Wheeler App. 30.

1-515— 6fl------ 2

6

2. GOLDBERG V. KELLY

The action in Xo. 62 was brought by a number of

X"w York State wel fare recipients: some of‘ them were

recipients of goner; 1 assistance mu.or slate aw awl

the others wore recipients of Aid to Families with

I ) 'pendent Children ( ‘-A F IK D . a federally-funded

program under Title 1\ o! ihe Social Security -Act,

42 U.S.C. 601 et HCtf. Like Mrs. Wheeler, they sought,

ii lividual and class declaratory and injunctive relief

fi an the operation of Xew York statutes and regula-

ti ns which permitted the termination or suspension

o benefi s before tin; giving of notice and an oppor-

ti nity to lie beard in a triad-type proceeding, on

g ounds of conflict with the Due Process Clause of

tb . Fourteenth Amendment. A three-judge district

court was convened. Coldburg App. 131a-139a.

At the time the suit war brought. State regulations

provided for neither notice nor bearing before termi

nation of welfare assistance, but permitted recipients

under st; te as well as Federal-State programs to obtain

a trial-type bearing after termination. During the

p eideney of the action, the state regulations were

a aended— for both State a d Federal-Stale programs—

p require local program administrators to choose one

0 two mow procedures: ( >) an informal pre-termina

tion hearing procedure . imilar to tba adopted by

California; and (2 ) a review-on-tlm-m-ord procedure'

in which recipien s would be permitted to submit

written statements sliowii g why tl eir benefits should

1 ' conti nu'd. Doth option re([uire sevi'ii days ad\ance

written notice of t le reasons for a proposed termina

tion, and both continue C e provision for a post.-termi-

t

nation “ fair hearing.” Now York City chose to apply

the second of those procedures to all its aid programs.

Colt berg App. “ (18a “71a.

The district com! concl idod that this second pro-

cedr re violated tlie Due Process Clause. Coldberg

Api . 1180 38(>a. It held tint the first procedure— less

immediately involved since all the plaintiff-appellants

resided i . New York City and accordingly would be

processed under the second— would bo permissible if

eoi trued to require both eonfrontalion of persons

whose ert dihility was in qu *stion regarding the factual

basis for terminating benefits and that the reviewing

officer be a superior of the person proposing the ad

verse action. Coldberg App. 386a-389a. The court

noted that nothing in its opinion was “ meant to affect

the right to a post-te rmina tion hearing in accordance

witl the procedures already in existence,’ ’ Coldberg

App. 391a— i.c., the* “ fair bearing" procedures re

quired In federal law for programs under the Social

Security \rt and carried o' er by State law into State -

funded general welfare programs. Tims, as in

T17 I'clcr, the court appear'd te> reach its conclusions

in the context of an ass nr; nee th it a nil >ost.-termi-

natiein trial-type1 bearing would be bad.

3. TUB FKDKI’AIj EE.QU1RBMEXTS APP I TO A RLE TO

TERVI iNATIM i OR REIUJC1 \TG WET FART ’AYMF.NT T

D iring tlie past, few ye irs, eonsidei able attention

lias been ‘ocused on ihe op ration of f lerally funded

I rograms under the, Social Securi y A . Much of this

attention has beam directed to th que tien s of eligi

bility ane level of welfare assist; nee, and the proe-e-

8

dures for determining these issues. As a result, those

procedures have b-*en in considerable flux. V. e set out

iu'low, first, the procedures that have been generally

required until recent times of States participating in

federal programs: and second, the current require-

aents, the product of changes of which most became

effective duly 1 , 1 ! 08.

A. TUF. REQUIREMENTS I ’RIOR TO 11ICR

As originally enacted in 11135, the Social Seem it\

\(-t provided tha each State plan for public assist

ance must provide for granting to any individual,

vhose claim for aid or assistance is denied, an oppor-

unity for ; ‘ ‘fail hearing” before the State agency.

Sections 2 (a )(4 ). 402 (a)(4 ) and 1002(a)(4) of the

Social Security A -t, Public Law No. 271, 40 Stat. 020

I set/. The Social Security Act Amendments of 1950,

>4 Stat. 477. 549,; dded the requirement that such hear

ings be afforded ii cases whore claims for benefits were

not acted ui on wi h reasonable promptness; otherwise,

the provisions have continued without substantial

change to the present.

On the basis of t hose “ fair hearing” requirements and

the Secretary’s general authority to require that the

states provide for such methods of administration as

he finds necessary for proper and efficient operation,

42 TT.IS.O. 302 (a)(5 ), 002 (a)(5 ), the Secretary (like

his predecessors, the Federal Security Administrator

and the Social Security Hoard) has prescribed de

tailed procedure requirements for ‘ ‘ fair hearings.

Any claimant wl o is aggrieved by any agency action

affecti lg his rcc< ipt of assistance, including tormina-

9

tion, must be afforded a bearing i f be requests one.

T ie claimant must be informed of bis right to a bear

ing, how to obtain it, and that be may be rep -esented

by counsel; and any clear express.•• n o f a desire to

present bis cast' to higher authority must be treated

a an effective request, lea rings m to be conducted

by impartial officers, in accordant with published

procedures, at a time and place < nvcnient to the

elaima d and after reasonable noth.' to him. A t the

It aria s. the claimant must have ; opportunity to

c amii o all documents and roc >rds tst'd at tin' hear-

it g, re hte any testimony or evident present, bis own

e idem o, witnesses, and testimony, dvance all perti-

n nt arguments and secure conside tion o f any fac

tual or legal issue important, to his r dm. The decision

n ust be based exclusively on the e 'deuce and other

muteri d introduced at tl e hearng. ] iandbook §§ (1200,

ft 00; ilrie f for Appellants in \o. 14, pp. 3u-9a. In

si ort, while “ |'t.]lie hearing is co iduc >d in an informal

r: ther than formal court-type pro< lure in order to

serve the best interests of Hit1 clai ant. [, it] *

is to he subject to the requirement:- >f due process.”

LI. at y 6400(a), p. 10a.

A 1th >m b tliest' j roced ices an ■ foi >wed at the “ fair

la arin ,” until recent! \ the inly requirement for

a; enee pioeedures ]>rim to termini ion or reduction

ol pay in its 1o individi als already receiving aid or

assistance was that the paymei ts m ist be continued

until 1 lere bad been a formal agei y determination

that, t (' individual was no h.ngei eligible or was

ebgibb only for lesser amounts. ’ hat is, agencies

ci uld iot terminate or reduce issis nice jam ling in-

10

vcstigations or the evaluation of information it had

received. Handbook, § 2200( b) ( l). I Jut 1 hoy were not

required to inform recipients that an investigation or

evaluation was under way or to permit them to par

ticipate in the process leading to this initial decision.

Once the agency decided to terminate or reduce assist

ance, it could do so without advance notice or any

! wring procedures and then 1 otif'y the individual of

his right to a “ fair hearing.”

The rules governing Federal funding operated in a

way which probably encoorag l the Slates to make

tl ere determinations promptly, and did not encourage

i volvement of the recipient at this slagt. As a matter

( overall policy, there is a st ng inter‘st in paying

; sistance to all individuals w ho are eligible, and in

< nying assistance to ail indivi luah who are not eligi-

1 e. There is also a need, in a Fedoral-Siaie program,

:f r a fa ir sharing between the federal and State gov-

t muents o f the costs of those case.- in which, despite

tl e best efforts of the administrators to determine

( igibility, payments are made to persons Inter found

1 have been ineligible. Accordingly, Federal mateh-

i g funds are paid in cases where a Stale follows the

< rrect procedures hut err meo isly determines that an

i dividual is eligible. To inis extend, the Federal gov-

( nnlent shares in the payment of ineligible cases, in

tl e interests of orch rly aclministr iti >n.

As a condition of such p iym< nts l ndcr the previous

i gulations, however, the 1 'edera! government insisted

o speedy action, with r< ;pect to both the periodic

r pilar reevalnation of all reci ienis and the special

e ablations which tl e Stab s are - xp >cted to undertake

11

upon receipt of information suggesting the possible

ineligibility of particular recipients. Thus, if rede-

terminations of < iigibility were not made within pre

scribed time periods and the recipient turned out to

have become ineligible, Federal rinancial participation

was not av; ifable for payments in periods beyond the

dead'ine for Dial ing the re< eterminat: >n. Handbook

§ 22<H(di ; § of) 14 , item 2a. i imilarly, the State must

investigate within 30 d; vs any report of possible in

eligibility received during tin interim Ir ween regular

reiuwstig.i; ions. Handbook § of, 14, i 'in 2b. The

periods ■•wed did not ])m■mit i 01 lgtl : ]Vi .1 oeedures.

i a r('SI iif, wi ere assistauee \vas tm iiinated or ro

(I I ICC :! a., 11. i ;a “ fa'r hear: ]} oy was tlien osted, the

usual st;: i o pract ice was to 11 .•» V”/ > 1 <1 > V the t mu illation or

redu.i •t iOT\ h i effe<-t ] lending lie learin -if;.( cn;ues

eouk' co: ■4 ;; .me th ■ paymcuts if thay wi died, but Fed-

oral :inamcial as dstanv ■ was no■ pro idee1, and in

ju'ac ice the Stati ■s did not oi■dinarily i: ■if'C such pay

ment V,dthout .1'Vdora 1 m; i chi i:g. ! f the hearing

decis.l on vvas in favor iif ti: ■ im!i vidu 1, tiho. States

could •eins' ate t: ie pay item " P-'<iSTV'Ct i vely., or they

could pay for t! ie bad ]>e •iod. I f ti ey i'•hose the

latte COIll'se, flu y woi1 id n •eivi Fed. ral matching

fund

B. TUR PIlESRXT Ii ■’.Q Fill i HTCXTS

Tit * revent changes, i lost of w hich 1>ok effect on

•Inly I, 106S, considerably m< lifted the : xisting prac-

tice by requiring advance n< ice that adverse action

is pi ■ lined, and an opportuni y for an informal con-

fere ee before that acti< n tal >s effect, ; ad providing

an ilargei scope of fklera! funding participation

12

during the process of assistance reduction or termina-

1 ion.

Thus, it is now required for participation in feder

ally-funded programs that when a question arises

concerning change in a recipient’s circumstances, the

agency must give—-

advance notice of ques ions it h is about an

individual’s eligibility s that a rcc picnt has an

opportunity to discus his situ lion before

receiving formal writ! n notice' >f reduction

in payment or terminati n of assist mce. [Hand

book' § 2200(d ) (5 ) . ]

This irocedure is designed tc serve so' ral purposes

in the public' assistance prog 11ns. First it gives the

individual a chance1 to bring lew or additional facts

o the agency’s attention ; thus he may Ik able to show,

arior te> anv more lormal a< ion, that ids situation

ias not actually changed, or as cliany d to a lesser

legre e than the agency belie es. I f In can tliereby

avoid termination of assistai -e, it ben fits both the

individual, who does not h; e his usi al payments

inter upted and need ne>t sen a “ fair tearing,” and

the agency, which will be t Hired the expense and

staff time involved in an unn -essary I anal hearing.

More >ver, because this advan ■ notice ; ocedure must

be followed in all cases, ev n those' r cipients who

would not contest terminatioi of assist ice are given

some time to prepare for 10 effect vhich it will

have on their financial sit itions, e! minating the

el cm* nt of surprise.

I t soon became obvious the states w 1 information

of possible ineligibility could ot com pi with this new

requ rement within the 30 ay peri* allowed for

13

making a determination of ineligibility du ing which

Federal matching continued. Accordingly, the States

are now permitted an additional 30-day period of

federal matching during which to give the advance

notice, provide time for the recipient to obtain and

appear at a conference, eonsidei any new evidence or

oilier re levant matters he may raise, and determine

whether he is still eligible. Ham book § 5b 1, item 2c.

Tl e fact that the new period i this brie however,

sh \vs tl at the conference is con rived as a, i informal

an exj(editions proceeding bef -e local aft", not a

tri . 1-type “ fair hearing’ ' at the date agem y level. It

is nerely a method of providing lotice am screening

on thoi-e cases which can he vsolved h\ informal

pi 'Cedures.

iter the advance notice p ocedure, t le agency

m; kes its determination on the basis of all the infor

mal ion it then lias available. ssistance payments

nn st 1h continued as before 1 > this point. I f the

ag ncy < <-ternlines that assistant will be ter >limited or

re< need, it nur t communicate tl decision In writing

to he in lividual and advise him ' his right to request;

a • fair iearing” before the Sta e agency. i f a “ fair

lie; ring” is not requested, that the end < f the mat

tei I f a hearing is requested, t State must hold it

an tak ‘ final administrative a lion withi i (it) days

of the eqnesty' Handbook § (12 0 ( j ) , but is not ro-

s flic S'ate is allowed ail additional ( days of fe leral match

ing to carry out the mechanics of disco I inning or r during pay-

mo Is. Ifa ldboolc, §5514. item 2d..Tin a total of liree 30-dav

pei ods— tor investigation of ineligibi y, for the idvance no-

tic; and c inference, and for stopping • payment are allowed

foi continuation of Federal matching u State pa\ lents to in

ch; 'I>11‘ individuals and families.

302 09------ 3

14

quired to continue assistance pending tin> heaving and

decisi >n. I f the State does continue as istance, how

ever, [federal matching- funds now will hr paid, Hand-

hook § 6500(b), whether the lie a ring decision is in

.favor of the recipient or the agency. Two or three of

the S ales continue assistance pending liraring. In all

of tin other States, if the hea ring decisii 11 is in favor

of th recipient, the agency i repaired lo make cor

rect!' payments retroactive!;, to the date of the in-

corre t action terminating r reducing payments,

ITani look § 6200(k), and Fe< ral matcl ng funds are

•aid ir these corrected paynu its, TTandl ml; § 6500(a).

(a ).

In sum, under the cun- utly a]i]>1 icahle IIE W

equi ements, assistance pay: 'ids unde federal pro-

,'rani may not he terminated or redu -cd until the

ecipi 'lit has been given a dvr ice notice and an oppor

tunity for a conference, and lie agency lias made its

( eteri iination. I f the paymo ts are terminated, the

iudivi Inal may obtain a “ f r hearing" which com-

orts with the customary reqi irements o ‘ due process

efor< such termination bee< mes final. I f the hearing

< ecision is in favor of the recipient, corrective pay

ment must he made retroact; ely. Tho ; ate at its op

tion ay continue payments aiding th hearing and,

if it oes so, there will he fi ral shariu ;■ in the pay-

i icuts regardless of whethei he d<'<-isi . i is in favor

>>f t Ik recipient or the agency.'

“On August 20, 1 !)<>!), 11 ic Sec tary postp.. >d IVom O.to-

5m 1, lie.), to July 1. 1070, the c 'Ctivo date ■ a new regula-

i on r paring that, in cases in Iving <pu-- i >ns of fact or

j ulgm it relating to the partici, ir individual involved (as

< isting lishetl from cases involvii the application of a gen-

15

SUMMARY OF A GUMENT

No question lias been raised that the trial-type hear

ing t hat is held at the reqi est of tlie recipient of

welfare assistance before the erminatioi or reduction

<>f his benefits becomes final, satisfies 1 fill the statu

tory requirement of “ fair hearing” and the constitu

tional requirement of procedural due process. The

issue here is the narrower o: ‘ of the liming of such

bearing: whether it must be eld bcfop there is any

preliminary termination or p luction o benefits. We

subnet that the present a< ninistrati e practice—

under which the beneficiary p eives ad nee notice of

a proposed termination or r< luction o his benefits

lias tb(' opportunity for infoi nil confc mce with the

taff of tin' State welfare ag icy befoi • such action

is taken, and can obtain a “ f; r bearin', ’ before such

termination or reduction lie* ines final -satisfies the

statutory and constitutional requirenwilts o f fair

hearing.

A. Where questions of adm istrativc iroeeduve are

-oncerned, “ the re<iui rements due pro ss frequently

vary with the typo of proceei ng invol d ’ ’ {Ilannali

• La d ie , 3(13 l .S. -130, -110 ). n the co ext of public

velfare programs, these reqi •ements , > I so may vary

•nil policy to individual cases, see ifra, pp. ,-85), assistance

be continued until (here has been trial-type earing, 84 IMP

3595 (19(59). A press release of lie Departi cut of Health,

education, and Welfare explained taf the Si \s are slid pip

ing into effect the federal require nits whirl became effective

uly 1, 19(>S, and are working t attendai problems, and

hat some States have taken the j it ion that i lie effect of the

iew regulation will he to keep re pients on , u> rolls hevond

lie point of reasonahle question ah it their el hilily.

16

"'it'll tin; nature of the programs adopted. We discuss

oidy what procedures are required for tlx particular

program here involved.

The determinatio i of the appropriate procedures

here requires a balancing of competing social policy

considerations invoicing, on the one hand, he govern

ment’s interest in avoiding improper ex. uditure of

v dfarc funds and unduly burd< nsome pro. (hires, and

o i the other hand the interest of the -ipients of

Public assistance in fair treatment and p >er receipt

of the benefits Congi*ess intended them t( lave. Since

" are interpreting the statut try re<[uii incut that

th >re be a “ fair hearing,” snbst; ntial wei: t should be

gi' en to the expert judgment of the Secretary that,

on the basis of present experience with the opera

te n of public assist nice progr; ms, the p icedures he

ha-i adopted constiti te the most approp ate method

f« ’ accomplishing th > congressional direct ve. The cur-

r< it procedures bee; me effective' only on ' dy I. 19(JS

ai 1 it is still too soon to make an adeouate assess-

nn nt of their effectiveness. The changes they have

m de have required substantia! modifiewi ms bv the

St ites of their prior practice, and these i i ditications

ha Te not been completely achiev d. I f the . -esent pro-

cedures should prove inadequaie properl \ to accom

plish the Congressional purpose retlected n the fed-

ei'.d program here i lvolved, th< Secretary can make

fu flier changes. It is important, ho\ve\< ■, that his

thr ibility to do so should be preserved, and that fixed

procedures should no be required.

There is a strong public interest in av< iding con

tinuation of payments to persom who arc i ot entitled

17

thereto, both to avoid improper disbursement ol' gov-

ernment funds and to prevent prejuc ee to the inter

ests of eligible persons who would suffer i f substan

tial sums were paid to ineligible ones, i f benefits were

required to be continued whenever a trial-type bear

ing was requested, the inevitable res It would be the

disburse merit, of significant amounts to person ulti

mately found not entitled thereto.

15. I f contrary to our submission, the Court >re to

conclud ■ that the present procedures - re inadeq ite, it

should ot require a preliminary tri; type hea ng in

every case before' payments can be in . ially term nated

or rcdiK >d. Such a requirement, which he court below in

No. 62 came close to adopting, would - mse sub antial

and unnece'ssary delay in a large number of cases and

would i npose needless expense upon the welfar pro

grams. Moreover, the court below in Vo. 62 apn rent-

ly woul 1 require a trial-type hearin even wh" e the

only issue raised by the claimant is the validity of

settled principles of general applicability— as, for

exampli , a challenge to the general evel of In ictits.

Rcquiri ig a trial-type hearing in ev ry such ca te be

fore be; efits could be initially termii ited would mean

that pe. sons who had no hope of ulti itely pre\ tiling

becaust hey art'ineligible under the cl llenged) vctico

neverth less could continue to receive enefits u il the

hearing were held. A trial-type heat ng ordin; rily is

not ret, tired before a general prim pie is ro inely

applied o a particular individual.

18

ARGUMENT

NEITHER THE DUE PROCESS CLAUSE NOR THE STATUTORY

REQUIREMENT 01*' “ FAIR HEARING” REQUIRES A TRIAL-

TYPE HEARING BEFORE WELFARE ASSISTANCE PAYMENTS

ARE TERMINATED OR REDUCED

No question lias been raised in these eases that the

trial-type hearing, ae< mled 01 request, to the recip

ient of welfare assistance before the termination or

reduction of his benefits becomes final, satisfies both

the statutory requirement of “ lair bearing’7 and the

constitutional standard of procedural due process. The

issue, rather, involves the timing- of such hearing:

whether, as the recipients coi fund, it must be held

before there is any suspension, termination or reduc

tion of benefits, or whether, as the Secretary believes,

the constitutional and statutory requirements are sat

isfied as long as the recipient can obtain such “ fair

hearing” before there is a find determination as to

whether bis benefits are to be ended or reduced.

To state the issue another way, in the context of

public assistance programs involving millions of re

cipients and thousands of possible hearings every year,

do the essential elements of ir procedure require

anything more than the present practice? Ihider that

practice, ( 1 ) the beneficiary receives advance notice

that bis payments are to be terminated or reduced ; ( 2 )

he has the opportunity for a cm Perenco with the staff

of the wel fare agency before su< h termination or reduc

tion, at which the reasons I'm* the action will be

explained to him and he can present any facts or ex

planations showing why his assistance should be con

tinued at ts existing level; (3 ) if the state then termi

19

nates or reduces assistance, he can obtain a “ fair hear

ing” lx*fore llie state action becomes final; and (4 ) if

lie prevails at such hearing, lie receives back payments

for the interim period during which his benefits were

terminated or reduced.

Our submission is that the present procedures sat

isfy both the statutory and conditutional equirements

>f fair hearing, and that a t mil-type hearing is not

required before public assistance is susp tided, termi

nated or reduced. I t also follows, we bel we, that wel

fare recipients arc* not entitled to a continuation of

their previous benefits during the period between pre

liminary termination or reduction and tlie final deci

sion of the state agency that i rendered after a “ fair

hearing” in those relatively fe cases wl ere such more

formal proceeding is requestet

A. THE SECRETARY^ PRESENT PRACTICE-— UNDER WHICH THE RECIP

IENT OF PUBLIC ASSISTANCE IS CI\ V NOTICE 1) OPPORTUNITY

FOR A CONFERENCE PRIOR TO TERM \TION OR R! RUCTION OF AS

SISTANCE AN1) CAN OBTAIN A TRIAl 1'YPE HEAR! ,G BEFORE SUCH

TERMINATION OR REDUCTION IiKO IBS FIN AI -SATISFIES THE

STATUTORY AND CONSTITUTIONAL REQUIREMENTS OF A FAIR

HEARING

1 . Neither any of Hie partie. nor tin* Dinted Stales

disputes that the Due Proee. Clause of the Four-

teentl Amendment and, for 11 District if Columbia,

the F ifth Amendment to the tonstituth n, are appli-

cabli* to public welfare progi mis. Alt! ugh there is

no constitutional requiremei that sic li programs

exist- so that access to benefi payment could be de

scribed for some purpose's as a 'privileg ' rather than

a “ right”—the fact of their < \istenee carries with it

the guarantees against gove mental iprioiousness

20

and arbitrariness embodied in those clauses. /'>.//.,

Sherbcrt v. Vom er, 274 U.S. 208; Shapiro v. Thomp

son, 394 U.S. 618, 627 n. 6. bidiis observation, however,

serves only to frame the question of what procedures

are to be followed in benefit termination cases, not to

answer it. For where questions of administrative pro

cedure are concerned, as dislinct from the issues of

capriciousness and arbitrariness involved in the cited

cases, “ the requirements of due process frequently

vary with the type of proceeding involved.” Hannah v.

Larchc, 363 U.S. 420, 440. A r the Court, expl ained in

Cafeteria. Workers v. McElroi/, 367 U.S. 886, 895:

[Consideration of what procedures due process

may require under any given set, of c ircum

stances must begin with a determination of the

precise nature of the government function in

volved as well as of tin private interest that has

been affected by governmental act ion. * * *

There would bo significant differences, for example, in

the procedures necessary in a zoning case, a prosecu

tion for a capital crime, a garnishment, a suspension

of a government employee, or the termination or re

duction of public assistance.

2 . Tn the context of pubi e welfare programs, we

believe those requirements might also vary with the

nature and aims of the prog vms adopted. 1 f a State

wished to— and assuming it constitutionally could__

revert to programs for dispensing charitv to the

“ worthy poor,” it, might be permitted far different

procedures than would have h attend programs whose

purposes include promotion < f equity among all re

cipients and their freedom fi >m the private charity

21

giver’s traditional control. In view of these possible

variations, we address ourselves only to the question

what (hie process requires for the federal!) funded

programs lore at issue. For their purpose is <• ear.

When the Social Security Act was issed its

: public assistance titles were designed to bring

about, for the population groups to wi ieh they

app ied, important changes in the i .oner of

dis] ,nsing aid to the needy, flic pub!i almoner

had been prone to assume he prero fives of

the giver of private eliarih, to gran or with

hold according to his judgment o f the deserts

of 1 te applicant, and often to assunr a pater

nalistic control over the live s o f those lie aided.

Tin Social Security Act s night to itroduce

int< this field a govern 1 lent of laws, a:; 1 to that

end. among others, attached a series . f condi

tions to it s proffer of fedei al grant n-aid to

the states. One of the condh ions re' res that

the state grant a fair lieari g to any pplicant

who is denied assistance; otl rs look 1 uniform

application of the plan throughout tk state, to

equiiable treatment of pers< is in dil’i ing eco

nomic situations, and to 1 e safegu ding of

information about applicants, and r. -ipients;

while tin' definition of assistance as “ n uey pay

ments” calls for the givin ; o f casl with no

strings attached. [W illcox, he Lav r in the

Adiuinistritiou of Nonrec laiory 'ograms,

Public Administration Rev w, Yob t i l , No.

1, W inter 1953,12, 15-1G.]

In thus legislating to provide f >r the general wel

fare, the Congress authorized the i e of Fed al funds

to fi mis! part of the cost o f pa incuts m le under

Stall pub c assistance plans. lIow< er one nr r charac-

0 9

/

/

/

terize the interest of the benefieiaries of such pro

grams, it certainly is less tangible than that o f the

beneficiaries of the federal old-age, survivors’ and dis

ability insurance program. For under 1 he latter pro

gram the potential beneficiaries pay taxes therefor

that are placed in a trust fund so lhat, unlike the

public assistance benefits here involved, payments are

not dependent upon yearly Congress! ■ ial appropria

tions. Yet even under that program ihe “ right” to

bene its is not protected under the Fifth Amendment

in t ie manner of personal property ( Flcmminf/ v.

Neat or, 36b U.S. 603), and benefits are terminated,

redu jed or suspended without a prior t rial-type hear

ing.7

The statutory mandate that there ' a “ fair hear

ing” before public assistan-e payments are denied

helps to define the kind of protect ion lhat Congress

intended to give the be noth iaries of tch payments.

The statute does not distin uish bel\ en the initial

denial of applications for bei 'fits and "ir subsequent-

deni;'. I by termination. Whe t a State agency decides

initially that a new applica t for hem tits is not en

titled! thereto, it does so wit sout first >lding a < rial-

type hearing; such a liearim is held o y if tlic appli

cant requests it; and when uch a he. ing is sought,

7 While (.here are differences be>

the old ag.' survivors’ and disab

grams, a requirement that the S

sistance payments pending the <l

sistent with ‘lie practice aufhori

Act for the 0ASD1 program, \

by t! e Federal government and

whicl irdiv! buds have a stated

seen the pi

ity insur.an

;tes must <

u r hearing

d under I

aich is <I i •

lvolvos ii

■ “ right."

'ic assistance and

■ fO A S D ! ) pro-

itinuo public as-

would be incon-

Socia! Security

11 v .administered

ranee benefits to

. 11. hlfr:'-.

23

benefits are not ]>aicl in the interim.8 I t lias never been

suggre ted that this procedure denies tlie applicant a

"fa ir icaring.”

As we develop below, cogent policy considerations

support the Secretary’s judgment that the same prac

tice should be followed where following the informal

conference procedure, the Shite initia ly decides to

lermirate or reduce benefits, fids pra dice not only

records with the statutory re< uirement that there be

ucha hearing before a claim f< rassistan -e is “ denied,”

but is further supported by the statutory provisions

autlioi izing the Secretary to adopt such methods of

admin stration as he finds t< lie necessary for the

grope • and efficient operation o public a> distance plans.

-’2 U.S.C. 302 (a)(5 ), 602(a) ( f ) .

°. d o determination of wha procedu es and timing

are appropriate in an administrative proceeding of

inis h pe requires a balancing of competing social

] obey considerations. On the one hand, there is the

interest of the government in insuring that tiie pro-

tedures do not become either so unnecessarily expen

sive or so time-consuming and cumbers* me that their

i ltimate effect is to hinder rather th; n aid in the

( ffectu ition of the public policies the program re-

f ects. )n the other hand, there is the i derest of the

} ersons affected—-here the recipients of public assist

ance— in being fa irly treated and in pro] >rlv recefving

t le benefits they rightfully cai expect the program to

8I f t ,0 applicant prevails at sue hearing. ! .'iiefits are paid

ritroactively to the date of the in al (hut er oneous) denial.

accomplish. These two interests are complementary

lather than antithetical. For welfare recipients would

suffer in the long run if' the government were required

to follow inefficient and unnecessarily burdensome re

quirements, while the public interest would suffer if

the recipients were not treated fairly.

Moreover, since we are dealing with the interpre

tation o f the statutory command that there be a “ fa ir

hearing,” it is appropriate to give considerable weight

to the expert judgment of the Secretary that, on the

basis of our present experience with the operation o f

] ublic assistance programs, the procedures he has

< dopted constitute the most appropriate method for

accomplishing the congressional directive.

The current procedures have been in effect only

since -July il, 1968, and ii is still too soon to make an

adequate assessment of their effectiveness in properly

accommodating the competing policy considerations.

The introduction of the new informal conference pro

cedure and the establishment of the 60-dav period for

completing trial-type hearings wl eu requested came

at a time when an increasing mi nber o f public as

sistance recipients were challengir ? agency decisions,

were represented by counsel and wore requesting “ fa ir

hearings.” In order to handle this nereased workload,

the .States had to hire and train more hearing exami

ners and to appropriate funds for their employment.

Although the States have made substantial progress in

solving these problems, they have not been fully sur

mounted. Moreover, in some States a large number of

public assistance recipien s have r< quested “ fair hear-

i lgs” to challenge basic aspects of the particular wel

24

I

fare program involved—contending, for example,: that

the level of 1) 'nefits is inadequate.” Challenges of this

type inevitably lead to extensive delay in the hearing

and decision of all pending cases.

The nature of public assistance programs inevitably

requires consi lerable room for experiment and change

in determining, through trial and error, what are the

most effective methods for carrying out the programs.

It is therefor > important that flexibility in adjusting

the procedures to changing circumstances remain

available to tl e Secretary. Significant changes recently

have been lira le in the procedures, and i f they should

prove i lappi >priate in the light of experience in

working witl them, the way always is open for the

Secretary to nodify them still further. A t this stage

of their devei >pment, however, the procedures should

9 For examplt during the r eek' of January 29, 1!>( >, there

were approxim; ely 500 requests for hearings in the Miami,

Florida, area < udlenging the amount of assistance and the

method of its < imputation. In seven counties in Kentucky in

July 1969 there vore 417 requests for hearings challengii g deter

mination.- of ine gibility that had resulted from a change made by

the State >f Ke tueky in its delinition of um mployment In De-

cemher l! >8 and January I960 in Los Angeles County, California,

there wer ■ 222 inquests for hearings on the contention hat the

amount o' bene !i is was inadequate; in Hinds County, IMf hssippi,

in July )67 th re were 184 requests for hearings on the same

question. In October 1968 in Philadelphia, I’ennsylven a, there

were 275 requests for hearings on a claim that each child

should re eive $50.00 to have an American Christmas.

In add ion, theme have recent! v been several instances in which a

large nun her of requests have been made for a hearing on a single

issue. Foi instance, in New York City in November 1968 l ! we were

approxin ttely 1! >00 requests for hearings on whether the ■ upient

needed a eleplx le.

2(1

not be frozen into the fixed molds in'

]lc 'ssistanee recipients would push

( 4 Testf,(1 by these standards, we

Secretary's present procedures for

fa i“ Payments meet the statutory a

requirements of a. fa ir hearing.

1,1 view o f Congress' choice to requ

m - ' for aggrieved claimants of he

Hoc al Security Act and the implicath

for the nature o f the benefit progra

we lo not argue that it is -possibli

[the receipt of benefits under the Act |

loge subject to the Executive’s plen

that “ notice and iiearing are not co:

finir -d.” Cafeteria Workers, supra, :

Xon 'fheless, the privilege aspect o f r,

role s both the government unction

interest involved in a way which be

the 'prior hearing question.

Av a matter of government funetioi

in th '\ ri.-ht of the federal and state

p!a.c< budgetary limitations on the tot•

they will undertake for the e progr;

mati- ally than a simple desire for <:

rost, such limitations make ; i aceure

binds to eligible ])ersons imp. •ative; i

of ineligible persons are abb to enf.

receive benefits for substantia! period

■“frect will be to reduce the amounts

sharing by eligible recipient . ft see:

hut f payments are eontim d pend:-

ug” here will be more reqi -sts for

0 which the pub-

1 hem.

mb:.lit that the

'rimnafing wel-

I constitutional

' re a “ fa ir hear-

1 "'fits under the

os of t hat choice

u, supra, p. 22,

to ‘Anraw: rize

as a mere ju ivi-

1 ry power, ’ ’ so

<itutionallv re-

E.S. at 8.fib.

eipt of benefits

oid the private

ors directly on

. if. is reflected

ovfunments to

I expenditures

ms. More dra-

ieiency or low

• a i Vocation of

I urge nmnhcrs

ree a right to

of time, the

available foi

l s predictable

g “ fair hoar-

uch hearings,

and mcm payments will be made to ineligible

individual .

rl'be full effect of continuation o f payme its pend

ing hearing would be experienced only ovc a ])eriod

of years. \t present, information is scanty. Missis

sippi, however, in August 1968 put into effc: ‘ a policy

ef continr.ing assistance pending “ fa ir lie ring” in

eases of t< -urination o f assistance. For the ; ar ended

dune 30, il )69, the increase over ti e previoi s year in

the numb r of liearings requested was sul -tantially

greater in -ases involving terminat on o f ]> • fits than

for all we fare cases; the latter inn-eased r -uglily 40

pore; nt, fi an 773 to 1059, while th * former increased

appr iximaiely 200 percent, from )7 to 28 . O f the

288 inquests for hearings in 19(38- 9(i9 inv< sing tor

mina ion < ’ benefits, 46 wore witbd awn pro • to hear

ing, one e! limant died before lieai ing, 26 <• ises were

pend ng o- July 1 , 1969, and 215 < ecisions cere ren

dered. 50 < ecisions were in favor o the clai lant, and

165 decisions uphold the agency’s d terminal on. Thus,

on the basis of the “ fair hoari g ” deci-ions, the

claimant was ineligible in 77 pe cent of die cases

wher - assistance was continued, n the p ior year,

when benefits were not continued ] aiding h siring, 57

hearings were held in termination ases; tin claimant

prevailed n seven, and the State geney i 50.

Moreover, the cognizable priva ■ intorei- in con

tinued rec-’ ipt of welfare benefits ending 1 earing is

i lore tentai ive than a direct interest i proper .• as such.

The issue ;s not whether a present sset is t< be taken

away fron its owner, but whether he reel] nt shall

continue t- share in a limited reso ree altlu ugh (un-

28

like others) his eligibility is in serious doubt. There

could be no legitimate interest in a prior hearing

simply as a means by which ineligible persons could

proh ng the time during which they continue to receive

benefits at the expense of the general public and, pos

sibly. of eligible recipients. Tbe in teres arises because

some individuals in fact are or have a sound claim

that they are, eligible despil a prelii linary determi-

nati< n to the contrary, and herefore should not be

mad* to suffer such hardslii is as ar< set out in the

com] laints. Thus, as would lot be true of property

detei urinations, assessment o the indi\ idual’s stake in

a p ro r hearing depends on i nv often the individuals

reqm sting such hearings pro ail.

Th i present case is then lore unlike Sniadacli v.

Fam ly Finance Carp., 395 1 .S. 337, \ here the Court

inva dated, under the Thu Process Clause o f the

Poui eentli Amendment, a t ate pro<- dure by which

wag( s could be garnished ay bout pr >r notice to or

opp< 'tunity for hearing for le wage arner. The key

to t at decision was that “ [w ]e deal here with

wage — a specialized type of iroperty presenting dis

tinct problems in our econom - system' (p. 340). Potli

the i lajority opinion and tl - concuri ing opinion of

Mr. rustice Harlan made pi in that t ie State proce

dure was invalid because gar islnnent involves the im-

med be taking of a AArage e -ner’s “ property” ; and

the < ourt stated ( p. 339) th: althoug i “ [s]uch sum-

man procedure may well i -et the i -quirements of

29

due process in extraordinary sit tations,” 0 garnish

ment 1>y a wage earner’s creditor vas not such a situ

ation. In the present case, howe er— as in cases in

volving government employment, licenses, and other

benefits commonly dealt with thix ugh the ; dministra-

tive proc >ss-—the recipients have 10 prope -ty (in the

classic se ise) of which the gove unent is seeking to

deprive them. In cases involvin the question what

procedui 1 due process required in this • property

h'ss com *xt, this Court has sev ral time indicated

tliai the mswer permissibly vari s with tl e proceed

ing and private interests concert d.11 E.g., Hannah v.

10 The cl iss of “extraordinary situat ns-’ is large enough to

include sui unary actions to protect goc 'rrunent r< enues. Phil

lips v. Commissioner, 28“ TT.S. 589, 591 597. Thus even should

this Court conclude that this case does all within the teaching

of hniadach, it does not follow that h< rings prio to termina

tion or reduction are constitutionally required, ft would be

nece ssary to assess whether in the we are conic" t any threat

to gtvernn cut revenues posed by a requ cement cl >rior hearing

is so great. s to justify summary procedu e.

11 Statute ty solutions to the problem 1 ive not bet > uniform. A

licet se to use part, of the limited broa cast sped um may not

usu; lly be suspended before notice am hearing, ' TJ.S.C. 312

(c) and see, 5 U.S.C. (Supp. IV ) 1 -8(c) : but there is ex-

plic t statutory authority to suspend b< .efits unde the Federal

Old Age, Survivors, and Disability Ins ranee Ben tits Program

bef< re. hea •ing, 42 U.S.C. 403(h )(3 ), f it appeti 'S that there

is a dangei of overpayments being mac , and fede al employees

are regularly suspended from their en, >loyment i advance of

the hearings to which they are entitled under the Civil Service

Act. As in Phillipy supra, n. 10, the <1 ect involv ment of gov

ern! Lent revenues in the latter cases 5 iay justify a procedure

more summary than would be appropri te where ; benefit with

out cost t< the government, such as a roadcast I -ense, is con

cern id. Si lilarly, in case of “jeopard; federal axes may be

assessed a d collected without any op] ntunity f< r prior hear

ing. Inten il Revenue Code, 26 U.S.C. >1-68(14.

30

Larc'ne, 363 U.S. 420, 440; Cafeteria \

I'Jlror. 307 U.S. 886, 894-895.

Th>* present statistics show that sub-

ineligible tlian eligible individuals reqi

ings’ V 1' Moreover, it p la in tiff prevail,

her a id proportion of ineligible indO

mg f; ir hearings might increase. Such

retiec either a substantial degree of usi

iiig” requests as a means of proiongi;

ments for individuals who clearly are

hie, or, as the appellant in No. 62 suggv

pp. 14-17, tl'.e efficient fuuct oning ot

new | re-hearing notice-and-cu nferenee

eithe. case, the argument for -fa ir lie;

terrni nation or reduction of benefits

less s rung than it is now.

12 While a substantial proportion of ‘‘ fan-

lie past led to reversal or modi ieation <>j

leterminations, only a small propo tion of U

a reqi cst.s for such hearings. Tlui forms ■ i

fornia to the National Center for Social St a

nartmi nt of Health, Education an Welfare

leriod July 1, 1908. to March .'ill, 1 09— durim

‘‘or Appellants in No. 14 states tl; -re were

■oncer; ing termination of assist an e, p. lU,

i total of 163,035 terminations of r -sistance n

•ity Act programs. O f these, 98,98- represent

issistanca under the Aid for Famil -s with I )«

irogram, and the remainder, the a rious adu

Statistics collected in the annual -eports of

Nationwide Quality Control Svstei on Publi

V f o r t'w year April 1, 1907, > March

ocal a pencies in the nation as a w iole incorr

ermin i-ted benefits in 5.6 percent >f AFFK

if adi t program cases, and under] lid benefit

VFTX and 9 percent of adult p igram cas

hand, .0 percent of A F D C cases i id 1.7 per-

o r k e r s v. 31 c -

tantially more

est " fa ir hear-

both the num-

duals request-

chaugo might

of “ fair hear-

g benefit pay-

0 longer eligi-

is in bis brief,

the relatively

ieclmiques. fit

ring” prior to

could be even

earing-s’’ have in

adverse agency

1 niinal ions rc nit

hm if ted by ( ali-

istics of the De-

how that in the

which the- Uriel'

"fair hearings”

. 12— there wore

>der Social Secn-

d termination of

icndent Ohihlren

jirograms.

i he Department's

Assistance Case

. 1908, show that

-ct 1 v withheld or

and 4.0 percent

in II percent of

■s. On the other

-nt of adult pro-

31

The ewrently applicable Federal

strike the oalance fairly in the light of

ently known. The individual lias adv;

termination or reduction of: assistance

nity for conference. Such con Terence p

formal, expeditious procedure available

ents with respect to whom the agency

ing termination or reduction of paymei

is thus inform; 1 of the proposed agency

vance and can get an explanation; i f lie

the content plat d action is incorrect, it <

The emphasis is on notice, communicate

ing out those cases where the agency <

shown it is making a mistake, or the r<

given informal ion so that he understa

ineligible. The risk of incorrect St;

thereby reduced. I f tire State agency tl

that the term nation or reduction is

claimant s afforded opportunity foi

hearing, which is to be conducted exj

the minority o f cast's where the agenc

out to be incorrect, corrective payments-

The proct-du,-e tlms provides an expo<

for handling a large volume of cases

gives all welfare recipients the opportui

gram. c;ises involved incorrect determinations

were eligibh, and 10.4 percent of AFDO and

adult p.'ogr; m recipients were being overpaid

These (ignn ■> are compiled by State quality

the basis o! a controlled sampling of local

and are en irelj7 independent of “ fair hear

These latter figures, however, cover total tern

do not know in bow many instances hearing

requiren mts

what is pres-

ice noth of

tnd opportu-

ivides an in

to all reoipi-

contem >lat-

ts. Ever one

action i. ad-

an show that

n l)o ave fed.

i, and screen-

ii readil ' be

i])ient c;i i be

Is why i e is

e action; is

n dotern ines

justified, the

a trial- ype

ditiously 111

action 1 urns

are mad .

tious m< hod

i a way hat

ty to exi lain

that rocij ients

10.1 percc I of

iring this ime.

•ntrol uni ■; on

ency case files

g” prorr ires,

at ions, ;e: we

vere ra w ;ted.

32

to tlie State agency in advance why their payments

should not be termin; ted or curtailed, with the assur

ance o f a trial-type bearing I efore such State action

becomes final. I t satisfies both the statutory and con

stitutional command op fair hearing.

]’.. I P T H E COl'JtT WERE TO t ’ONOIAIDE I'll AT TH E 1’EENENT PRACTICE

IS INADEQUATE, i t s n o t I) NOT r e q u ir e A P R E L IM IN A R Y T R IA L -

T Y P E HEARING IN' EVERY \8E UEPOR PAYM EN TS (!A ' P,E IN IT IA L L Y

TERM INATED OR REDUCE

A principal inten t o f tin United States in this

case is to avoid a pi -.liberation of hearings and pro-

cedures which would substant ally burden the admin

istration of the Soci il Security Act without confer

ring material benefii on eligi >le recipients. The dis

trict court in No. 62, owever, failed to adopt this per

spective. I pon colic1 ding that due process requires

more substantial pro< edings ] rior to termination, the

court’s solution was o enlarge and expand the ad

vance notice and info mal conference procedure which

is required before tin agency edetermines eligibility.

By adding the vaiio s procot ural elements which it

concluded are requii 1 by du * process ai that early

stage, the court mad two sig lificant changes in the

overall procedure.

First, the conferen ; is no h ngor a conference; it is

something close to a ull-dres hearing at which wit

nesses must appear, ; id the it apient lias the right to

question them, etc. ideed, t ie court stated: “ W e

realize that these req rement- will duplicate the ‘fair

hearing’ post-termina ion ]iroc ‘dure to some extent.”

Goldberg App. 385a. ! bus, the e may be two bearings

in each case, the pre- erminat >n and the post-termi

nation hearing. This seems unnecessary and potential

ly expensive. Most likely, the 30-day time period now

provided for the advance notice and conference pro

cedure will be inadequate in many cases, so that addi

tional time will be needed before the agency can

determine whether the recipient has become im ligible.

Moreover, the procedure may often rove inadequate

to handle cases involving complex I dual sit ations.

Finally, it might so burden the agen y staff a; to add

further del; ys before these matters can be finally

resolved—a result; as detrimental to welfare re ipients

as to the agency. Such a procedure es not a] pear to

be conducive to the proper and effi< *nt oper; tion o f

the welfare program.

The second, and closely related, difficult;, arises

from the requirement that assistance be conti iued in

all cases until the agency’s initia determ nation,

which is made after the first confer nee hear ng and

which, because of the new procedure required for all

cases, necessarily will further dele; the adn nistra-

tive process at a point where it is ; ready o\ 'rburd-

ened and dilatory. The added expen e to the federal

am; State agencies could be consider; le.

The seriously adverse effect o f tin leeision ; clow in

No. 62 is compounded by ils applic; on even o cases

where ihe claimant challenges only le provisions of

law or settled agency policy. A t leas; me of th appel

lees in that case, Mrs. Altagraeia G man, ap tears to

present only' such an issue in her con daint. M \s. Guz

man's VFDG payments are alleged i be in it minent

danger of t rmuiation because she 'fuses t< assign

to New Yoi k welfare authorities In right o action

34

!

against her husband for non-support

once with an established policy,

threaten to terminate her benefits. She

the tacts nor the policy’s applicabili

simply asserts that the policy ‘ ‘has no

and indeed is contrary to th • statutes

State ” Goldberg App. 25a. ' lie court

exclu !o her from the relief g anted.1:1

I f ‘very individual subject d as am

to tin adverse impact of a ge oral adn

icy could require that his bet ‘fits be -

ing ; trial-type hearing on the law I'

policy, this could almost par lyzc the

of t l i1 Act and would add immeasural

The ( Ifect of requiring trial-1 vpe heari

eases would be that persons a ho could

no vindication from the pr cedures

33 Its failure to do so may luo ■ been ina

]>oint in its opinion tlie court note ! that "W>

with the issue whether procedural < ue process

to ora argument on a matter of i\v. See. ['

TT.S. 265, 276 * * *. ft. is true tin [ I forr/an

‘198 TT.S. T68, 481] contained the c ‘turn that

lie oral or written,’ * * * but w< do not fa

t hat in this case there is no const it itional rig

deuce, as opposed to argument, in ] Tson." Go

Hie t. ct that one of the plaintiffs i fact did

duce arguments, not evidence, appe: ‘S not to b

to in t ie proceedings below.

14 U der the existing H E W regi at ions, an

i ipienf of assistance can obtain a fair heari

grieves by * * * agency action affe ting bis r

lion oi assistance, or by agency pol y as it alii

Hand! aik, § 6200(b). We are info- led that i

this regulation is to provide “f; • hearing

which, like Mrs. Guzman's, raise o !y issues <

uid, in accord-

hey therefore

denies neither

y to her, but

mpport at l;tw

of New Y ork

below did ,ot

tier o f course

nistrative poi-

utiimed peud-

iluess o f that

'.dministratioii

!y to its costs,

igs in all such

dope to obtain

bus invoked 14

ivertent. At. one

do not. deal hero

' •quires the right,

v. W JR , .-‘17

. I ’nlt-rd States,

| ajrgmnent may

ke that to mean

1 to present, evi-

i'eerg App. 98La.

visli only to p-o-

ve been adverted

claimant or re-

ig” if lie is “ag-

eipt or termina

ls his s'ituat io.i."

.' practice under

on complaints

f general policy.

35

because they are ineligible under the policy el

could continue to receive benefits until the

was held. The cost of this delay would have to i

by the community as a whole and, i f total tun

able for benefit purposes were limited, by othe

cuts under the program in the form of redue<

levels. Indeed, i f prior “ fair hearings” were

for each individual adversely affected by a

P(fiicy change, they would be requh >d wher-

ciency of funds required across-the )oard re

in benefit levels.

V trial-type hearing is not requii d befor<

general rule is applied to a part -ular ind

unless there are demonstrable sp< -ial reas

different action in the individual ca e. Unite-

v. Stover Broadcasting Co., 3f>l T S. 192;

Power Commission v. Texaco, 377 LT.S. 33:

Electronics Corp. v. Fcdt a! Conn, /(nicotic,

mission, 39-! F. 2d (120, (!2(i (C.A. I( . “ When

of conduct applies to more than a few pe-n

impracticable that every one should 1 ve a di

in its adoption. * * * There1 must 1 a limit

vidual argument in such matters ' govern

to go on,” Bi-Metallic Investment ( . v. Sfai

of Equalization of Colorado, 239 U h 441, 4

Guzman does not allege any special -ireumst:

her case; she challenges only the neral rn

dlenged

nearing

;e borne

:s avaii-

' reel pi-

benefit

■quired

general

insuffi-

uctions

such a

i vidual,

ns for

States

federal

Conley

; Com

ix rule

!e it is

t voice

o indi-

lent is

Board

5. Mrs.

nces in

36

CONCLUSION

Tlie judgment of the district court in No. 14 should

be affirmed. The judgment of the district court in No.

62 should be modified to eliminate the conditions im

posed by the court as to the first procedure permitted

by the New York statute and as thus modified, should

be a firmed.

R ' 'spectfully subu fitted.

September 1969.

E rwin N Gris wo in,

Solii lor General.

W illiam D. R uck eshaus,

As sis mt Attn I iey General.

R obert A Zener,

Stephen l . F elso ,

A Homeys.

U.S. OOVERNMEN NTINS OFHCF :