Chance v. Board of Examiners

Press Release

July 14, 1971

Cite this item

-

Press Releases, Volume 6. Chance v. Board of Examiners, 1971. 4b88bfa0-ba92-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/61056535-8ae1-4748-9e5d-9a17e2d143fe/chance-v-board-of-examiners. Accessed February 22, 2026.

Copied!

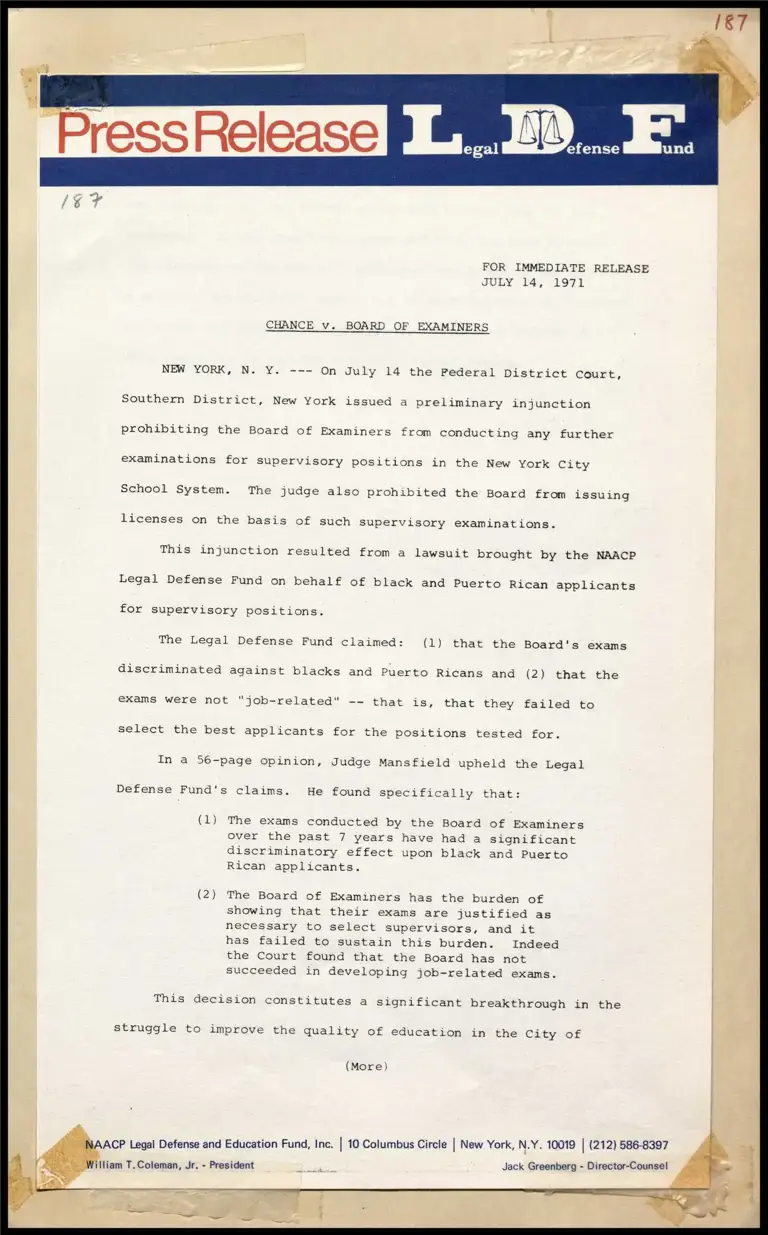

PressRelease B Sime ae Se

FOR IMMEDIATE RELEASE

JULY 14, 1971

CHANCE v. BOARD OF EXAMINERS

NEW YORK, N. Y. --- On July 14 the Federal District Court,

Southern District, New York issued a preliminary injunction

prohibiting the Board of Examiners from conducting any further

examinations for supervisory positions in the New York City

School System. The judge also prohibited the Board from issuing

licenses on the basis of such supervisory examinations.

This injunction resulted from a lawsuit brought by the NAACP

Legal Defense Fund on behalf of black and Puerto Rican applicants

for supervisory positions.

The Legal Defense Fund claimed: (1) that the Board's exams

discriminated against blacks and Puerto Ricans and (2) that the

exams were not "job-related" -- that is, that they failed to

select the best applicants for the positions tested for.

In a 56-page opinion, Judge Mansfield upheld the Legal

Defense Fund's claims. He found specifically that:

(1) The exams conducted by the Board of Examiners

over the past 7 years have had a significant

discriminatory effect upon black and Puerto

Rican applicants.

(23 The Board of Examiners has the burden of

showing that their exams are justified as

necessary to select supervisors, and it

has failed to sustain this burden. Indeed

the Court found that the Board has not

succeeded in developing job-related exams.

= This decision constitutes a significant breakthrough in the

struggle to improve the quality of education in the City of

(More)

ACP Legal Defense and Education Fund, Inc. | 10 Columbus Circle | New York, N.Y. 10019 | (212) 586-8397

ilNliam T. Coleman, Jr. - President Sos bake: Jack Greenberg - Director-Counsel

CHANCE v. BOARD OF EXAMINERS PAGE TWO

New York,not only for blacks and Puerto Ricans, but for all

students. It has long been recognized that the exam system

administered by the Board of Examiners has acted to perpetuate

a sterile, bureaucratic system and to keep out many of the most

qualified and imaginative applicants, both black and white,

from positions in the New York City School System.