REA Holding Corporation v. Sowerwine Opinion

Public Court Documents

April 14, 1977 - July 27, 1977

Cite this item

-

Brief Collection, LDF Court Filings. REA Holding Corporation v. Sowerwine Opinion, 1977. b2c3afdc-c19a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/658d1c6d-86f4-471a-8be4-bd4dfe32f1fc/rea-holding-corporation-v-sowerwine-opinion. Accessed February 21, 2026.

Copied!

fflARCP Legal Defense Fund

10 C-.l.itnb’ is Civr-le

New YC;:\ ; l-Soi9

' ■ ■ . . ‘ i Y

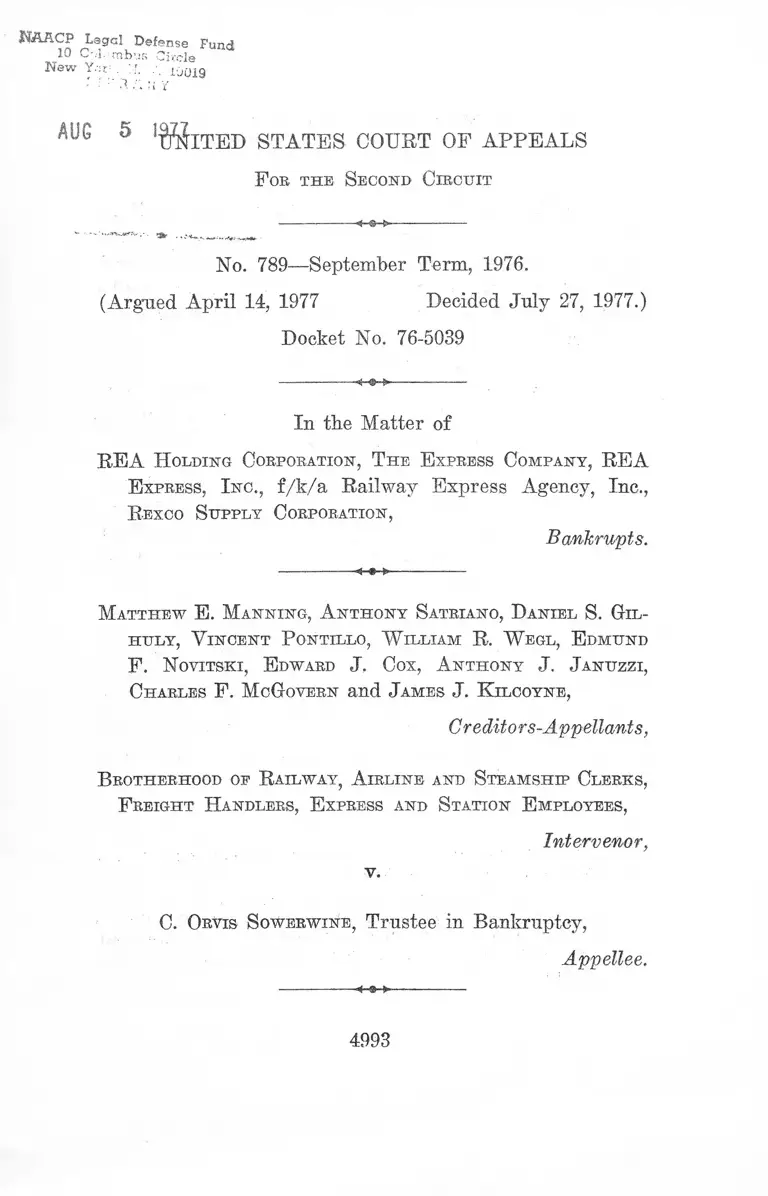

AUG 5 ^ ITED STATES COURT OF APPEALS

F ob th e S econd C iboxjit

*• ------■ ».xw^*r?v.- . Hjjc . _<9l

No. 789—September Term, 1976.

(Argued April 14, 1977 Decided July 27, 1977.)

Docket No. 76-5039

In the Matter of

REA H olding C orporation, T h e E xpress C o m pan y , REA

E xpress, I n c ., f/k /a Railway Express Agency, Inc.,

R exco S u p pl y C orporation,

Bankrupts.

M atth e w E. M a n n in g , A n t h o n y S atriano , D an iel S. G il -

h u l y , V in ce n t P ontillo , W illiam R. W egl, E dm und

F. N ovitski, E dward J. C ox, A n t h o n y J. J a n u z z i,

C harles F. M cG overn and J am es J. K ilco yn e ,

C r editor s-Appellants,

B rotherhood oe R ailw a y , A ir lin e and S team ship Clerks ,

F reight H andlers, E xpress and S tation E m ployees,

Intervenor,

v.

C. O rvis S o w erw in e , Trustee in Bankruptcy,

Appellee.

4993

Cl ark , Associate Justice,* and

M oore and M u lligan , Circuit Judges.

Appeal from order of the United States District Court

for the Southern District of New York, Lloyd F. Mac-

Mahon, Judge, dismissing the petition of a group of cred

itors for reorganization of a debtor corporation under

Chapter X of the Bankruptcy Act, 11 U.S.C, §501 et seq.

Affirmed.

A r t h u r M. W iseh art , Esq., New York, N.Y.

(Wisehart, Friou & Koch, of counsel), for

Creditors-Appellants.

W illiam M. K a h n , Esq., and J oshua J. A ngel ,

Esq., New York, N.Y. (Whitman & Eanson,

Marcus & Angel, co-counsel, Donald L. Wal

lace, Jeffrey A. Oppenheim, of counsel), for

Appellee.

J o h n O’B. Clarke , J r ., Esq., Washington, D. C.

(Reilly, Fleming, & Reilly and Highsaw,

Mahoney & Friedman, on the brief; David

J. Fleming, James L. Highsaw, William J.

Donlon, General Counsel for Brotherhood

of Railway and Airline Clerks, Rosemont,

Illinois, of counsel), for Intervenor.

Honorable Tom 0. Clark, Associate Justice, United States Supreme

Court, Retired, sitting by designation.

Mr. Justice Clark died on June 13, 1977, before this case could be

decided. Pursuant to $0.14 of the Rules of this Court, this petition is

being determined by Judges Moore and Mulligan, who are in agreement.

Prior to his untimely death, Mr. Justice Clark had voted to affirm the

petition.

4994

M o o re , Circuit Judge:

Four companies, REA Holding Corporation, The Ex

press Company, Inc., REA Express, Inc., f/k /a Railway

Express Agency, Inc. and Rexco Supply Corporation (col

lectively referred to as “REA” ), have been adjudicated as

bankrupts. Out of the welter of charges and countercharges

a few salient facts emerge. For many years prior to 1975

REA had been engaged in the express shipping business

in the United States by land and by air, and to some ex

tent internationally. Its Railway Express Agency trucks

were a common sight to the American public. It operated

under both Interstate Commerce Commission (ICC) and

Civil Aeronautics Board (CAB) authority.

Unlike the Biblical seven fat years alternating with seven

lean years,1 for some 30 years REA’s were all lean with a

modest exception in 1974. The natural consequence of such

financial debility was the filing of a petition for an arrange

ment under Chapter XI of the Bankruptcy Act, 11 U.S.C.

§701 et seq., which occurred on February 18, 1975. Honor

able John J. Gralgay, the Bankruptcy Judge in charge of

these proceedings, by order permitted the Bankrupts to

continue to operate their business as Debtors-In-Possession.

A Creditors Committee (confirmed April, 1975), in co

operation with the Bankrupts, endeavored by operating

economies to restore REA to a profitable operation. One

of the economy measures was a motion to reject a contract

with the Brotherhood of Railway and Airline Clerks

(BRAC), a union of which most employees were members.

From the time of the motion until ultimate rejection of the

contract, the BRAC employees were paid only 90% of their

then going wage and no vacation or holiday pay. These

deficits constitute the bulk of the large claims which the

1 Genesis, Chap. 41.

4995

BEAC employees assert and are the source of the claims

of the ten petitioning creditors in this proceeding.

Despite high hopes and substantial economies, REA con

tinued to suffer losses which during the Chapter XI pro

ceeding—February 18, 1975 through September 28, 1975—-

amounted to some $15,790,000, with a discouraging prog

nostication of additional losses of some $5,681,000 for the

next three months (October through December).

Unable to meet their payrolls, the bankrupts on Novem

ber 6, 1975 requested that they be adjudicated bankrupt.

Then ensued rapid developments. On November 6,1975 the

bankruptcy order was signed and entered. The next day,

C. Orvis Sowerwine, Esq. was appointed and qualified as

Trustee. The Trustee straightaway proceeded to collect

claims and to liquidate the bankrupts’ assets—including

terminals and rolling stock—so that REA had no operat

ing facilities. There remains, however, REA’s “operating-

authorities”—rights obtained through the ICC and CAB

to operate various routes.

In the liquidation process, these operating authorities

were put up for sale. Six hearings were held before the

Bankruptcy Judge during the period from June 23, 1976

to July 9, 1976. Judge Calgay, in an opinion and order-

dated July 16, 1976, held that of the four2 proposals sub

mitted for the acquisition of REA’s operating authorities,

customer lists and trade names and marks, the Alltrans

Express—U.S.A. proposal was the “best offer” : that it

represented “a fair and reasonable value for the Prop

erty” ; that “acceptance of the Alltrans offer is in the best

interests of the bankrupt estate” ; and that it “provides

2 Alltrans Express-—U.S.A. ("Alltrans” ), BEAEMCO, Ine., All Truck

Express, Inc. ("A ll Truck” ) and ABC Freight Forwarding Corpora

tion ("ABC” ).

4996

the probability of the greatest realization to the bankrupt

estate from the sale of the property” .

The Bankruptcy Judge had eliminated All Truck and

ABC as submitting either partial or contingent offers, so

that the choice was between Alltrans and BEAEMCO. In

the July 16, 1976 order, the Judge found in favor of All

trans and directed the Trustee to accept the Alltrans offer

and to prepare a contract for submission to, and approval

by, the Judge. An appeal from this order is pending

before Judge Werker.

Although not particularly material to the narrow issue

before us, a word about Alltrans and BEAEMCO may not

be amiss.

Alltrans is represented to be a subsidiary of Thomas

Nationwide Transport, Ltd., with consolidated assets of

$190,000,000. Pursuant to its proposal, Alltrans was to

pay the bankrupts $2,500,000 in cash upon ICC approval

of a temporary transfer to it of the operating authorities.

Additionally, pending decision on a permanent transfer,

Alltrans would make interim payments of certain percent

ages of gross revenues over a ten year period. If such

approval of a permanent transfer were obtained, Alltrans

and Thomas together guaranteed payments of at least

some $9,500,000.

BEAEMCO was organized in the interest of BEA’s em

ployees who desired to continue to operate BEA. It was

without funds and without operating facilities. Its chief

asset was “hope” and a hypothetical plan portrayed in

minute detail during 3% days of testimony by an acknowl

edged expert in the transportation field, Mr. F. Balph

Nogg. It was Mr. Nogg’s opinion that $3,000,000 would

be needed at the outset; that equipment could be rented

or purchased by the employees; that employees could con

tribute 10% of their salaries; and that large anticipated

4997

profits might enable substantial payments to be made to

creditors. However, no part of the REAEMCO plan called

for the production and presentation of new money because

there was none.

Thereafter, a group of ten former REA employees, as

creditors (claims aggregating $22,000) filed a petition for

reorganization under Chapter X of the Bankruptcy Act, 11

U.S.C. §501 et seq. That petition, assigned to District

Judge Lloyd F. MacMahon, was referred to Bankruptcy

Judge Galgay who since February 18, 1975 had been

thoroughly familiar with all the facts and proceedings in

connection with the bankrupt estate. Judge Galgay held a

hearing on the petition on September 27,1976. It is on that

occasion that appellants claim that they were deprived of

a fair hearing. The deprivation, however, is that Mr.

Nogg was not permitted to repeat his contention that “ the

reorganization of REA would be feasible” . (Appellants’

Brief, p. 13a). But the Bankruptcy Judge considered all

of the testimony and exhibits from November 5, 1975 to

September 27, 1976, including all of the Nogg testimony

in support of feasibility. The only issue before the Judge

and before us is whether the Chapter X petition was filed

in good faith.

The Bankruptcy Act provides:

“Without limiting the generality of the meaning of

the term ‘good faith’, a petition shall be deemed not

to be filed in good faith if * * *

(3) It is unreasonable to expect that a plan of re

organization can be effected . . . .” 11 U.S.C. §546.

Thus the Bankruptcy Judge did not have to look behind

the petition to discover an improper or unethical purpose.

He only had to look at the petition against the background

4998

of all the facts known to Mm and decide whether it was

“ reasonable to expect that a plan of reorganization can be

effected.” To this end, he not only had opinion testimony

before him, but the actual experience of a debtor using

substantial economy measures and accumulating a $15,-

790,000 deficit in seven and a half months and a further

estimated deficit of $5,681,000 in three additional months.

He knew that there were no terminals, no operating equip

ment and no operating personnel; even the operating au

thorities were in jeopardy. The period taken for decision

was short, but he -was entitled to rely on a non-legal con

cept—“deja vu” .

The Bankruptcy Judge’s Report of September 28, 1976

was submitted to Judge MacMahon who, on September 30,

1976, after oral argument from the parties on September

29, 1976, found the bankruptcy Judge’s findings supported

by substantial evidence and adopted them in all respects.

Judge MacMahon was mindful that “more time might im

prove the fullness of this [his] memorandum” , but wisely

refrained from adding to the volumes which already over

tax the space of our law libraries and held that the petition

was not filed in good faith. This holding is clearly correct

on the facts and the law, 11 TT.S.C. §546(3), and we there

fore affirm.

Appellant argues in extenso (it may be said—in exten-

sissimo) that the bankruptcy proceedings have been tainted

by a conflict of interest on the part of the Trustee. This is

no occasion to do more than touch upon the subject which

seems to be an obsession of the appellants. In the first

place, it is completely irrelevant to the issue of the likeli

hood of a feasible reorganization. This decision is solely

for the Bankruptcy Judge and the court. The recom

mendation by the Trustees that the Alltrans offer should

be accepted was quite in accord with the facts—Alltrans

4999

offered realty; EEAEMCO offered unfulfilled, speculative

hopes. Nor did the Bankruptcy Judge follow the Trustee’s

recommendation blindly, as his report clearly shows. Con

flict of interest did not create the u n fortu n ate financia l

situation in which EEA found itself. Conflict of interest

did not create the facts which after full and fair explora

tion proved the Alltrans. offer to be superior.

The appeal from the July 16, 1976 order (acceptance of

Alltrans offer) is pending. Proceedings before the ICC

are unfinished. There are still problems for the Bank

ruptcy Judge and on the facts, there is no n eed f o r a re

ceiver. Appellants are still free to raise the issue of con

flict of interest in appropriate proceedings in which facts,

if any, may be adduced in support thereof. Conflict of

interest is a conclusion and conclusions should rest upon

a solid foundation of fact. The order dismissing the Chap

ter X petition and vacating the stay was proper and ac

cordingly we affirm.

5000

480-7-29-77 . U8CA—4221

M E IIE N PRESS IN C ., 4 4 5 G R E E N W IC H ST., N E W YO R K, N . Y. 1 0 0 1 3 , (2 12 ) 9 6 6 -4 1 7 7