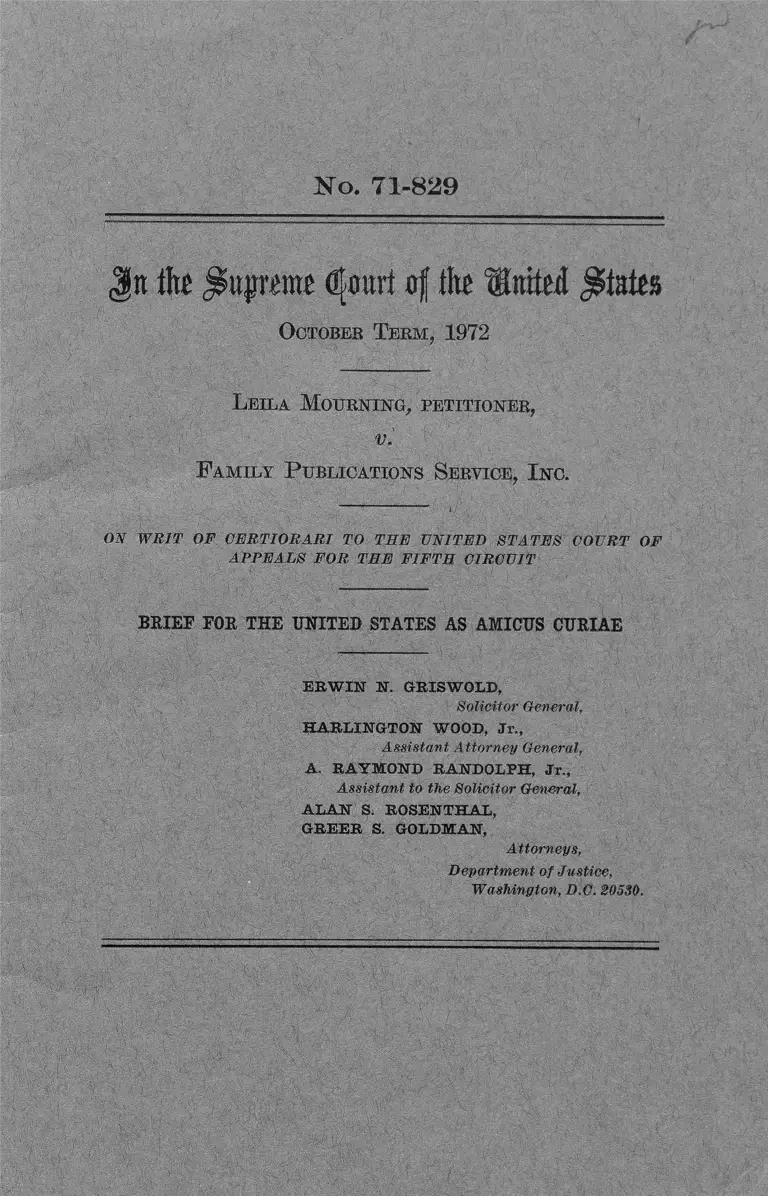

Mourning v. Family Publications Service, Inc. Brief Amicus Curiae

Public Court Documents

July 1, 1972

Cite this item

-

Brief Collection, LDF Court Filings. Mourning v. Family Publications Service, Inc. Brief Amicus Curiae, 1972. 0bc016e5-be9a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/6b904c04-b984-46dd-97b6-b36f33fa3cd2/mourning-v-family-publications-service-inc-brief-amicus-curiae. Accessed February 21, 2026.

Copied!

No. 71-829

J it t o dfottrt o f t o H t t i t d S ta te s

October Teem, 1972

Leila Mourning,, petitioner,

v.

F amily P ublications Service, I nc.

ON WRIT OF CERTIORARI TO THE UNITED STATES COURT OF

APPEALS FOR THE FIFTH CIRCUIT

BRIEF FOR THE UNITED STATES AS AMICUS CURIAE

E R W IN N. GRISWOLD,

Solicitor General.

HARLINGTON WOOD, Jr.,

Assistant A ttorney General,

A, RAYM OND RANDOLPH, Jr.,

Assistant to the Solicitor General,

A L A N S. ROSENTHAL,

GREER S. GOLDMAN,

Attorneys,

Departmen t of Justice,

Washington, D.C. 20580.

I N D E X

Page

Opinions below________________________________ 1

Jurisdiction___________________________________ 1

Questions presented____________________________ 2

Constitutional provision, statutes and regulations

involved________________

Statement_________________

Interest of the United States___________________ 5

Summary of Argument_________________________ 6

Argument_____________________________________ 12

I. The four installment rule is a valid exercise

of the Federal Reserve Board’s rule-

making authority under the Truth in

Lending Act_________________________ 12

A. The legislative history of the Act

suggests that Congress intended

that, even if sellers were not

required to disclose finance

charges hidden in the selling

price, they nevertheless had to

comply with the Act’s other

disclosure requirements_______ 13

B. The Board’s four installment rule,

which clarifies the scope of the

Act, effectuates its purpose and

is therefore valid under Section

1604________________________ 17

C. The Board also validly exercised

its rulemaking authority under

Section 1604 because the four

installment rule is necessary to

prevent evasion of the Act____ 22

a)

472 - 022— 72------------1

to

t

o

II

Argument— Continued Page

D. The Board’s regulation also is valid

because it facilitates compliance

with the A ct—another basis for

rulemaking under Section 1604, _ 24

II. The four installment rule does not violate

due process__________________________ 28

Conclusion____________________________________ 33

Appendix_____________________________________ 35

CITATIONS

Cases:

Adkins v. Children’s Hospital, 261 U.S. 525__ 29

American Telephone & Telegraph Co. v. United

States, 299 U.S. 232_____________________ 27

American Trucking Association, Inc. v. United

States, 344 U.S. 298_____________________ 27

City of New Port Richey v. Fidelity & Deposit

Co., 105 F. 2d 348_______________________ 31

Edward’s Lessee v. Darby, 12 wheat 206_____ 28

Ferguson v. Skrupa, 372 U.S. 726___________ 11, 29

Ferry v. Ramsey, 277 U.S. 88______________ 31

Gemsco, Inc. v. Walling, 324 U.S. 244_______ 24

Gratz v. Claughton, 187 F. 2d 46____________ 31

Hawkins v. Bleaky, 243 U.S. 210___________ 31

Heiner v. Donnan, 285 U.S. 312____________29, 31

Helvering v. City Bank Farmers Trust, 296 U.S.

85_____________________________________ 31

Jensen v. United States, 326 F. 2d 891________ 31

Jones v. Brim,, 165 U.S. 180________________ 30, 31

Lametta v. New Jersey, 306 U.S. 451________ 28

Lochner v. New York, 198 U.S. 45__________ 29

Martin v. City of Struthers, 319 U.S. 141____ 30

McBoyle v. United States, 283 U.S. 25_______ 28

I ll

Cases—Continued

Page

Metropolis Theatre Co. v. City of Chicago, 228

U.S. 61 — --------------------------------------------- 30

National Broadcasting Co. v. United States,

319 U.S. 190____________________________ 27

North American Co. v. Securities and Ex

change Commission, 327 U.S. 686________ 24

Norwegian Nitrogen Products Co. v. United

States, 288 U.S. 294_____________________ 27

Power Reactor Development Co. v. International

Electricians, 367 U.S. 396________________ 28

Schlesinger v. Wisconsin, 270 U.S. 230______ 31

Securities and Exchange Commission v. Joiner

Corp., 320 U.S. 344_____________________ 28

Shanahan v. United States, 447 F. 2d 1082__ 31

Stanley v. Illinois, No. 70-5014, decided

April 3, 1972____________________________ 32

Strompolos v. Premium Readers Service, 326 F.

Supp. 1100_____________________________ 23

Thorpe v. Housing Authority, 393 U.S. 268___ 10, 27

Udall v. Tollman, 380 U.S. 1_______________ 10, 28

United States v. Jones, 176 F. 2d 278________ 31

West Coast Hotel Co. v. Parrish, 300 U.S. 379_ 11;

29, 32

Westfall v. United States, 274 U.S. 256_____ 24

Constitution, statutes and regulations:

United States Constitution:

Fifth Amendment_________ 2, 11, 29, 30, 32, 35

Truth in Lending Act, 15 U.S.C. 1601-1665:

15 U.S.C. 1601^.

15 U.S.C. 1602.

15 U.S.C. 1602(e)

15 U.S.C. 1602(f).

15 U.S.C. 1602(g)

15 U.S.C. 1602(h)

15 U.S.C. 1604__

---------------------6,19,21

-------------------- 4,7,36

---------------------- 13,36

___ 2,9,13,19,22,36

--------------------- 17,36

--------------------- 13,36

3, 5, 8, 10, 12, 21,24, 36

IV

Constitution, statutes and regulations—Con

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

15 U.S.C.

1605(a)_________________ 7,13,20,37

1607(a)_____________________ 5

1607(c)_____________________ 5

1609_______________________ 18

1611_______________________ 28

1631_____________ 7,9,13,20,22,37

1631(a)____________________ 2-3,37

1635________________________ 22

1638_____________ 4,9,21,22,26,38

1638(a)_____________________ 3,38

1640________________________ 40

1640(a)-------------------------------- 4,40

1640(a)(1)-------------------------- 4,21,40

1640(e)_____________________ 6

1662_______________________ 22

1663 ______________________ 25

1664 ______________________ 25

Internal Revenue Code, 26 U.S.C. 483______ 31

12 C.F.R, 226.2(k)__________________3, 4, 8,18, 41

12 C.F.R. 226.2(m)_____________________ 8,18,41

12 C.F.R. 226.8__________________________3, 4, 41

Miscellaneous:

Caplovitz, The Poor Pay More 12-48 (1963)

34 Fed. Reg. 2002 (1969)________________ 18

114 Cong. Rec. 1611 (1968)________________ 22

Federal Reserve Board letter, No. 86,

August 26, 1969, from J. L. Robertson,

Vice-Chairman, Board of Governors,

Federal Reserve Board, summarized 1

C.C.H. Consumer Credit Guide f 30,457_-_ 3

Federal Reserve Board letter, July 24, 1969,

1 C.C.H. Consumer Credit Guide t1f 30,113,

30,114______________. __________________ 3

Hearings on Consumer Credit Regulations before

the Subcommittee on Consumer Affairs of the

House Committee on Banking and Currency,

91st Cong., 1st Sess. (1969)______________ 18, 19

V

Miscellaneous—Continued Page

Hearings on H.R. 11601 before the Subcommittee

on Consumer Affairs of the House Committee

on Banking and Currency, 90th Cong., 1st

Sess. (1967)__________________________ 15,16,22

Hearings on S. 6 before the Subcommittee on

Financial Institutions of the Senate Com

mittee on Banking and Currency, 90th Cong.

1st Sess. (1967)_________________________ 15

Hearings on S. 750 before a Subcommittee of the

Senate Committee on Banking and Currency,

88th Cong., 1st & 2d Sess. (1963-1964)___ 15

Hearings on S. 1740 before a Subcommittee of the

Senate Committee on Banking and Currency,

87th Cong., 1st Sess. (1961)_______ 14, 15, 16, 21

Hearings on S. 1740 before a Subcommittee of the

Senate Committee on Banking and Currency,

87th Cong., 2d Sess. (1962)______________ 15

H. Rep. No. 1040, 90th Cong., 1st Sess. (1967)_ 20, 24

Jackson, The Struggle for Judicial Supremacy,

(1941)__________________________________ 29

S. Rep. No. 392, 90th Cong., 1st Sess. (1967) __ 19,

20, 24

S. Rep. No. 750, 92d Cong., 2d Sess. (1972) __ 6

J it to j&qjrcm* djtort af to Winlid States

October Term, 1972

ISTo. 71-829

L eila M ourning, petitioner,

v.

F amily P ublications Service, I nc.

ON WRIT OF CERTIORARI TO THE UNITED STATES COURT OF

APPEALS FOR THE FIFTH CIRCUIT

BRIEF FOR THE UNITED STATES AS AMICUS CURIAE

O PIN IO N S B E L O W

The opinion of the court of appeals (Pet. App. 6a-

23a) is reported at 449 F.2d 235. The opinion of the

district court (Pet. App. la-5a) is unreported.

JU R IS D IC T IO N

The judgment of the court of appeals was entered

on September 27, 1971. The petition for a writ of

certiorari was filed on December 23, 1971, and granted

on March 20, 1972 (405 IT. S. 987). The jurisdiction

of the Court rests on 28 U.S.C. 1254(1).

(i)

2

QUESTIONS PR E SE N TE D

The United States will discuss the following ques

tions :

1. Whether the Federal Reserve Board acted beyond

its rulemaking authority under the Truth in Lending

Act in promulgating the “ four installment rule” o f

Regulation Z, which provides that any credit trans

action payable in more than four installments is sub

ject to the disclosure rules of the Act regardless of

whether there is an identified finance charge involved

in the transaction.

2. Whether the four installment rule creates a “ con

clusive presumption” regarding the imposition of

finance charges that violates the due process clause

of the Fifth Amendment to the Constitution.

C O N ST ITU T IO N A L P R O V IS IO N , ST A T U T E S A N D R E G U L A T IO N S

IN V O L V E D

The Fifth Amendment to the United States Consti

tution, the relevant provisions of the Truth In Lend

ing Act, 15 U.S.C. 1601-1665, and the pertinent regu

lations of the Federal Reserve Board, 12 C.F.R. 226,

are set forth in an Appendix to this brief, infra.

ST A T E M E N T

Under the Truth in Lending Act, 15 U.S.C. 1601—

1665, creditors who regularly extend “ credit” involv

ing finance charges 1 must disclose “ to each person to

whom consumer credit is extended and upon whom a

finance charge is or may be imposed,” 15 U.S.C. 1631

115 U.S.C. 1602(f).

3

(a ), information such as the cash price, the amount of

the down payment, the total amount to be financed, the

amount of the finance charge, and the number and

amount of payments required. 15 TJ.S.C. 1638(a); 12

C.F.R. 226.8. Since creditors could easily evade the

Act’s requirements by ceasing to identify the finance

charge while inflating the “ purchase” price,2 and since

the Federal Reserve Board has the duty of prescrib

ing rules and regulations “ to prevent circumvention

or evasion” of the Act, 15 U.S.C. 1604, the Board’s

Regulation Z includes within the class of covered

creditors any creditor who extends credit in a trans

action where repayment, pursuant to an agreement, is

or may be made in more than four installments. 12

C.F.R. 226.2 (k).

Petitioner Leila Mourning brought this action in

the United States District Court under the Act, 15

U.S.C. 1640, alleging that on August 19, 1969, she

entered into a written contract with Family Publica

tions Service, Inc. (“ F P S ” ) for the purchase of mag

azines; that in addition to her downpayment of $3.95

the contract obligated her to make thirty monthly

payments of $3.95 each in return for a sixty months’

subscription to four magazines; and that FPS failed

to disclose the total purchase price of the magazines,

the unpaid balance and other matters, as required by

2 Federal Reserve Board letter, No. 86, August 26, 1969,

from J. L, Robertson, Vice-Chairman, Board of Governors,

Federal Reserve Board, summarized 1 C.C.H. Consumer Credit

Guide 1f 30,457. See also Federal Reserve Board letter, July 24,

1969, 1 C.C.H. Consumer Credit Guide, 1^30,113, 30,114; and

note 22, infra.

472—022— 72---------- 2

4

Regulation Z, 12 C.F.R. 226.8 and the Act, 15 U.S.C.

1638.

On cross-motions for summary judgment the dis

trict court held that EPS had violated the Truth in

Lending Act and Regulation Z by extending credit in

a transaction involving more than four installment

payments without making the required disclosures

(Pet. App. 3a-5a). The court found that FPS had

extended “ consumer credit” within the meaning of

the Act, 15 IT.S.C. 1602; see 12 C.F.R. 226.2(k) : FPS

had given petitioner a sixty-month subscription in ex

change for a promise to pay a specified sum in thirty

monthly installments; the contract provided that it

could not be cancelled and that failure to make

monthly payments would render the entire balance

due; and FPS itself considered the transaction to be

a credit transaction (Pet. App. 4a). Pursuant to the

A ct’s civil penalty provision, 15 U.S.C. 1640(a), the

court awarded petitioner $100 together with attorney’s

fees of $1,500 (Pet. App. 5a).3 The district court did not

question the validity of the four installment rule in

Regulation Z.

The court of appeals reversed, holding that the

Board had exceeded its statutory authority in promul

gating the four installment rule (Pet. App. 6a-23a).4

In the court’s view, the Act “requires that a finance

charge must be found present, directly or indirectly,”

3 The civil penalty in actions brought by consumers is set by

the Act at “ twice the amount o f the finance charge * * * ex

cept that the liability * * * shall not be less than $100 nor

greater than $1,000.” 15 U.S.C. 1640(a) (1).

4 The court o f appeals did not pass on the question whether

FPS had extended credit as the district court found.

5

in a transaction before the creditor is subject to the

disclosure rules (Pet. App. 19a). But under the

Board’s four installment rule, disclosure is required

“whether or not there is found in such transactions

the imposition of a finance charge as an incident to

the extension of credit” (ibid.). The court therefore

held that the Act did not authorize the Board’s

regulation.

The court of appeals also held that the four in

stallment rule created a “ conclusive presumption” that

a finance charge had been imposed, that such a conclu

sive presumption violates the due process clause of the

Fifth Amendment, and that Congress itself thus could

not have validly enacted the four installment rule.

The court accordingly held the Board’s rule void (Pet.

Api>. 21a-23a).

IN T E R E S T OE T H E U N IT E D ST A TE S

The court of appeals has invalidated a significant

regulation designed to prevent evasion and circum

vention by creditors of their obligations under the

Truth in Lending Act. The Federal Reserve Board

has the duty of promulgating rules and regulations,

such as that involved in this case, in order to secure

compliance with the Act, 15 U.S.C. 1604, and the

Federal Trade Commission has general enforcement

responsibilities under that Act,3 15 TJ.S.C. 1607(c).5 6

Both agencies believe that the decision below will im

5 A violation o f the Truth in Lending Act is a violation of

the Federal Trade Commission Act, 15 TJ.S.C. 1607(c).

6 Other federal agencies have specific enforcement responsi

bilities in limited areas. 15 TJ.S.C. 1607(a).

6

pair public and private enforcement of the Act,7

and will significantly impede full realization of the

Act’s goal of assuring “ a meaningful disclosure of

credit terms so that the consumer will be able to com

pare more readily the various credit terms available

to him and avoid the uninformed use of credit.” 15

U.S.C. 1601.8

S U M M A R Y OF A R G U M E N T

» I

A.

Under the Truth in Lending Act, creditors who

regularly extend credit involving a finance charge

must disclose pertinent information to consumers in

credit transactions where a finance charge is or may

7 Under 15 U.S.C. 1640, consumers may sue creditors for vio

lations of the Act in any court of competent jurisdiction.

8 On April 27, 1972, the Senate passed the Fair Credit

Billing Act, S. 652, in which the four installment rule is in

cluded as an amendment to the Truth in Lending Act. The

accompanying report, S. Rep. No. 750, 92d Cong., 2d Sess. 18

(1972), explains the provision’s purpose as follows:

This section applies the disclosure provisions o f the T IL A

to creditors who levy no charge but who permit payment

in four or more installments. The Board administratively

promulgated the more-than-four installment rule to pre

vent any potential circumvention by creditors who might in-

include a finance charge in their cash price. One court de

cision held the Board’s rule exceeded its authority while

another decision affirmed the Board’s authority. The amend

ment thus clarifies the Board’s power to issue such a

regulation.

S. 652 is currently before the Consumer Affairs Subcommittee of

the House Banking and Currency Committee.

7

be imposed. 15 TT.S.C. 1602, 1631. There would be no

difficulty in applying this provision to installment sales

if creditors always differentiated the cost of credit

from the price of the goods. However, some creditors

simply pack credit costs into the selling price, thereby

hiding the finance charge, which includes all charges

incident to the extension of credit in addition to inter

est. 15 TT.S.C. 1605(a).

This practice was often mentioned during the seven

years of congressional hearings on the Act. Congress

assumed that whenever credit had been extended “ free

of charge” this simply meant that the creditor had

buried the finance charge in the price of the goods.

Although Congress did not perceive any way of pre

venting this practice, it believed that the Act would

nevertheless benefit consumers in “ no-charge-for-

credit” sales since creditors would still have to disclose

information other than the finance charge, such as the

cash price, the amount of downpayment, the number

of payments, and the amount to be financed. This

would enable consumers to shop on the basis of price

even when they could not shop by comparing finance

charges.

B.

It is against this background that the Board promul

gated the “ four installment rule” in its Regulation Z,

which provides that where consumer credit is extended

and where, pursuant to an agreement, the purchase

price is payable in more than four installments, the

creditor is subject to the Act’s disclosure requirements.

8

12 C.F.R. 226.2 (k).9 The Board exercised its rule-

making authority pursuant to Section 1604 of the Act,

15 U.S.C. 1604, after considering the recommendations

of a representative advisory board and after receiv

ing hundreds of comments and suggestions from in

dustry and consumer groups and government agencies.

Under Section 1604, the Board’s regulation is valid

if the resulting classifications or adjustments in the

class transactions are, in the Board’s judgment, neces

sary or proper to effectuate the purposes of the Act,

to prevent evasion or circumvention of the Act, or to

facilitate compliance with the Act.

As to the first of these independent grounds for

rulemaking, the four installment rule effectuates the

purposes of the Act by assuring that consumers will

have the benefit of meaningful information, from cred

itors even when finance charges are not identified.

This fulfills the Act’s goal of providing consumers

with full information so they can better decide whether

to enter into credit transactions. By making disclo

sure turn on whether more than four installments are

involved, rather than on whether the creditor has in

fact differentiated the cost of credit from the price of

the goods, the Board’s regulation ensures the Act will

reach “no-charge-for-credit ” vendors, which is consis

tent with Congress’ assumption in this regard.

9 The regulations define creditors subject to the Act as those

who regularly extend “ consumer credit,” which includes trans

actions where the purchase price is payable in more than four

installments. 12 C.F.R. 226.2 (m ).

9

c.

Moreover, the four installment rule is necessary

and proper to prevent evasion of the Act. Without it,

creditors could easily attempt to circumvent all of

their disclosure obligations by hiding the finance

charge in the selling price, thereby exempting them

selves from coverage. 15 TJ.S.C. 1602(f), 1631, 1638.

And this would mean that the less creditors tell their

customers, the easier it would be for them to avoid

compliance with provisions designed to give consumers

full information.

Even if the four installment rule reaches credit

transactions that the provisions of the Act themselves

might not cover because there are in fact no finance

charges involved directly or indirectly,10 the Board

validly promulgated the rule under Section 1604.

When Congress authorized the Board to make adjust

ments in any class of transactions to prevent evasion,

it must have intended to allow the Board to include

transactions the provisions of the Act itself might, on

their face, not reach.

D.

In addition, the Board’s regulation is valid under

Section 1604 because it facilitates compliance with

the Act. Private civil actions are one of the p r i m a r y

methods of enforcing the Act. But if the actual exist

ence of finance charges had to be shown before no

10 Congress, however, assumed that whenever credit is ex

tended the costs necessarily incurred by the creditor are in fact-

passed on to the consumer despite the absence o f an identified

finance charge.

10

charge-for-credit vendors were required to disclose

information, there would be endless legal disputes

after the fact over bookkeeping practices and other

matters foreign to the central purpose of providing

the consumer with full information. Yet the Act is

designed to relieve consumers of the burden of discov

ering undisclosed information; and disclosure is to

be made before the transaction is consummated.

The four installment rule is intended to. meet these

problems. It provides consumers and creditors with

an easily understandable rule to rely upon in no-

eharge-for-credit transactions. It ensures uniform ap

plication of the Act with respect to such transactions

and facilitates compliance.

Since the Board’s four installment rule is author

ized under Section 1604, it should be upheld. We deal

here with remedial legislation and with a regulation

that is reasonably related to the purposes of the Act.

Thorpe v. Housing Authority, 393 U.S. 268, 280^281.

Furthermore, the regulation in question represents

the Board’s interpretation of the provisions and pur

poses of the Act, and that interpretation is entitled

to grant weight, especially since this is a new statute

that the Board must set in motion through regula

tions. Udall v. Tollman, 380 U.S. 1, 16. The court be

low erred in holding that the Board had exceeded its

authority.

11

II.

The court of appeals also erred in holding that the

Board’s regulation deprives creditors of due process

in violation of the Fifth Amendment. The constitu

tionality of the four installment rule depends not on

whether it establishes a “ conclusive presumption” re

garding the existence of finance charges, as the court

below found, but rather on whether there is a rational

basis for the regulation and whether it is reasonable

in relation to the end sought to be achieved. West

Coast Hotel Co. v. Parrish, 300 U.S. 379, 391; Fergu

son v. Skrupa, 372 U.S. 726, 730-733. Under that

standard, the regulation should be sustained. Even if

some creditors in fact give “ free” credit, the burden

of requiring them to disclose is far outweighed by the

benefits of the Board’s prophylactic rule, which we

have discussed above.

Thus, characterizing the Board’s regulation as a

“ conclusive presumption” does not answer the question

whether the substantive rule of law it represents is

constitutionally valid. This Court, as well as the courts

of appeals, have often upheld conclusive presump

tions, which are simply a method of classifying. As

we have stated above, with respect to economic regula

tion of business activity, due process requires only

that the provisions at issue have a rational basis and

be reasonable in view of the policies served. The four

installment rule meets that test and the court below

erred in holding otherwise.

472- 022— 72- 3

12

A R G U M E N T

I.

T H E FO U R IN S T A L L M E N T R U L E IS A V A L ID E X E R C ISE OF

T H E FED ER AL RESERVE BO A R D ’S R U L E -M A K IN G A U T H O R

IT Y U N D E R T H E T R U T H IN L E N D IN G ACT

Aside from constitutional questions, which we dis

cuss separately below, this case turns upon whether

the Board, in promulgating the disputed regulation,

acted within its authority under 15 U.S.C. 1604, which

provides that:

The Board shall prescribe regulations to carry

out the purposes of this subchapter. These reg

ulations may contain such classifications, dif

ferentiations, or other provisions, and may pro

vide for such adjustments and exceptions for

any class of transactions, as in the judgment

of the Board are necessary or proper to effec

tuate the purposes of this subchapter, to pre

vent circumvention or evasion thereof, or to

facilitate compliance therewith.

In our view, the four installment rule is a proper

exercise of the Board’s Section 1604 rulemaking au

thority and validly serves not simply one, but all three

of the enumerated functions of rulemaking under

that provision: it effectuates the purposes of the Act,

it prevents evasion of the Act, and it facilitates com

pliance with the Act. Prior to dealing with these

specific points, however, we shall discuss briefly the

legislative history of the Act, to put the issues in

proper perspective.

13

A .

THE LEGISLATIVE HISTORY OF THE ACT SUGGESTS THAT CONGRESS

INTENDED THAT, EVEN IF SELLERS WERE NOT REQUIRED TO DIS

CLOSE FINANCE CHARGES HIDDEN IN THE SELLING PRICE, THEY

NEVERTHELESS HAD TO COMPLY WITH THE ACT’S OTHER DISCLO

SURE REQUIREMENTS

The Act itself requires a “ creditor” to disclose

pertinent information in a “ consumer credit” transac

tion where a “ finance charge” is or may be imposed.

15 U.S.C. 1631. To understand the applicability of

this requirement, one must refer to the Act’s defini

tions of the quoted words and phrases. “ Creditor”

means someone who regularly extends credit “ for

which the payment of a finance charge is required.”

15 U.S.C. 1602(f). “ Credit” is the right granted

by a creditor to a debtor “ to incur debt and defer

its payment,” 15 U.S.C. 1602(e), and the adjective

“ consumer” refers to transactions where the debtor

is a natural person and the subjects of the transac

tions are primarily for personal, family, household

or agricultural purposes. 15 U.S.C. 1602(h). “Finance

charge” is not simply interest, but “ the sum of all

charges, payable directly or indirectly by the person

to whom the credit is extended, and imposed directly

or indirectly by the creditor as an incident to the

extension of credit * * *.” 15 U.S.C. 1605(a).

These statutory provisions thus contemplate that

the Act’s disclosure requirements apply to credit

transactions involving finance charges and there would

be no difficulty with respect to installment purchases

if, in all such transactions, the charges for allowing

14

the consumer to pay over a period of time were identi

fiable or if the sum of the payments totalled more

than the stated cash price of the goods purchased,

which would indicate the presence of a finance charge.

But what if the finance charge is buried in the install

ment price? (That is, the seller does not differentiate

the cost of credit from the total selling price.) Of

course, if the creditor then gives a “ discount” for cash

purchases this would be tantamount to charging a

higher price for credit sales, or, in other words, a

finance charge.11 But suppose the creditor does not

state a cash price or does little or no cash business so

that such a comparison is not readily available. Should

such creditors be able to escape all of the Act’s dis

closure requirements by merely refusing to identify

finance charges and quoting to their customers only

the amount of the monthly payment ?

These questions highlight one of the major problem

areas considered by Congress in the seven years of

hearings on the Truth In Lending Act: the existing

practice of burying finance charges in the selling

price 12 and the possibility that this practice not only

11 See Hearings on S. T/Ifi before a Subcommittee o f the Sen

ate Committee on Banking caul Currency, 87th Cong., 1st Sess.

57 (1961) (.lames Tobin, Member of Council o f Economic A d

visers: “ [W jhere the store says to a potential time customer,

‘Tliis is my price and there are no credit charges or the credit

charges are very low’ ” and “he is at the same time saying to a

potential cash customer, ‘My price is really much lower than the

one I am quoting for time customers,’ then I think he is in

violation of the bill.” )

12 Senator Proxmire, one o f the co-sponsors o f this legisla

tion, estimated that in 1961 more than 50 percent of all retail

merchants “ concealed” their credit charges in the price of the

15

would continue but also would become more wide

spread if legislation required creditors to disclose in

formation such as the cost of credit, the cash price for

the goods sold, and the total installment price.13 Dur

ing the hearings, everyone assumed that “ no charge

for credit” simply meant that the creditor had

“ buried,” “ concealed” or “packed” finance charges in

the price of the goods sold.14 And there are indications

in the hearings that the provisions of the pending-

legislation might not, in themselves, forbid creditors

from doing this.15 16

goods. Hearings on S. 171fi before a .Subcommittee o f the Sen-

ate Committee on Banking and Currency, 87th Cong., 1st Sess.

389-390 (1961).

13 See, e.g., Hearings on S. 17iO before a Subcommittee o f the

Senate Committee on Banking and Currency, 87th Cong., 1st

Sess., 49, 57, 127, 389-390, 447-448, 563, 999-1000 (1961); H ear

ings on S. 171fi before a Subcommittee o f the, Senate Com

mittee on Banking and Currency, 87th Cong., 2d Sess. 16, 45,

360-361, 366 (1962); Hearings on S. 750 before a Subcommittee

o f the Senate Committee on Banking and Currency, 88th Cong.,

1st & 2d Sess. 500-501, 97S (1963-1964); Hearings on S. 5 be

fore the Subcommittee on Financial Institutions o f the Senate

Conimittee on Banking and Currency, 90th Cong., 1st Sess.

377-378, 513, 699 (1967); Hearing on H.R. 11601 before the

Subcommittee on Consumer Affairs o f the House Conimittee on

Banking and Currency, 90th Cong., 1st Sess. 590-591, 596, 802,

825-826 (1967).

14 See, e.g ., note 13 supra; the following statement by Senator

Proxmire in Senate Hearings on S. 5, supra note 13, at 513 (“ I

see, then what you are saying is that at Foyes you don’t pay

a carrying charge of any kind. Foj'es offers free payment ac

counts without interest. Obviously what Foyes is doing is bury

ing the charge and [sic] [in] the cost of the merchandise.” ) ;

and House Hearings on H .R. 11601, supra note 13, at 538 (Kep.

Williams: “ credit isn’t free under any circumstances” ).

16 See, e.g., Senate Hearings on S. 174,0, 87th Cong., 1st Sess.,

supra note 13, at 381 (Senator Proxmire).

16

However, although a creditor might not he required

to disclose finance charges if these were concealed in

increased prices, this did not mean the creditor would

have no obligation to disclose other relevant informa

tion, such as the cash price and the total amount to

be financed. Senator Douglas, who had been the prin

cipal proponent of the Act, replied as follows to Sen

ator Bennett’s claim that it would be impossible to

prevent the burying of finance charges: 16 * 18

Senator Douglas. I would like to call to your

attention, Senator, for purposes of the rec

ord, that this bill does not provide for judg

ment solely on the basis of the two, annual in

terest rate or the total finance charges. It also

provides that there shall be a statement of the

cash price or delivery price of the property or

service to be acquired. Both things are to be

stated, price and finance charges, and the judg

ment of the consumer can be on the basis of

both of these factors, not merely on one alone;

16 Senate Hearings on S. 1740, 87th Cong., 1st Sess., supra

note 13, at 447-448.

Others made the same point with respect to buried finance

charges. See, e.g., id., at 563 (R. C. Morgan, President, Credit

Union National Association: “ And if there is a separate charge

for credit, a price for that charge. In any event, the customer,

the buyer, can find out and tell exactly what the total cost,

including the credit, be it concealed or otherwise, is going to

be. This I think, is what is good about this legislation»” )

(emphasis added); House Hearings on II.R . 11601, supra

note 13, at 825-826 (Rep. Sullivan: I f the merchant conceals

the cost o f credit by raising the purchase price and the con

sumer nevertheless buys “ at least he knows what he is doing

and he is doing it with his eyes open. This is what we are try

ing to accomplish in this legislation.” ).

17

and if a merchant tries to have a low finance

charge and bury it in a high cash price or de

livered price, then the purchaser can shop on

price just as much as on the finance charges.

In sum, it was generally assumed that whenever

a merchant extended credit and purported to impose

no finance charges it simply meant that the cost of

credit had been absorbed in the price of the goods or

services. But this did not relieve the creditor o f his

duty to disclose; although he might not have to revise

his pricing scheme in order to differentiate the cost

of credit from the price of the goods, he nevertheless

had to tell the consumer the other information set

forth in the Act."

B.

THE BOARD’S FOUR INSTALLMENT RULE, WHICH CLARIFIES THE

SCOPE OF THE ACT, EFFECTUATES ITS PURPOSE AND IS THEREFORE

VALID UNDER SECTION 1604

It is against this background of legislative history

and the provisions of this Act that the Federal Re

serve Board promulgated the “ four installment rule.”

Under the Board’s Regulation Z, a “ creditor” subject

to the disclosure rules is anyone who regularly ex- 17

17 That identifiable finance charges are not the sine qua non

o f the obligation to disclose is further indicated by the fact

that the disclosure requirements are specifically applicable to

certain types o f leases and bailments where the bailee or lessee

is given an option to buy—transactions which, by their very

nature, do not involve identified finance charges. 15 U.S.C.,

1602(g). As with “no-charge-for-credit” installment sales, Con

gress believed that this was simply another way o f deferring

payment and that finance charges would therefore be present,

although imposed indirectly and not stated.

18

tends “ consumer credit,” 12 C.F.R. 226.2(m ), and

“ consumer credit” means the extension of credit

where a finance charge is imposed or where, pursuant

to an agreement, the purchase price “ is or may be

payable in more than four installments.” 12 C.F.R.

226.2 (k). Thus, “ no-charge-for-credit” vendors must

disclose other pertinent information when payment is

made in more than four installments, even if finance

charges are not identifiable.

Before so exercising its rulemaking authority, the

Board established, pursuant to Section 1609 of the

Act, 15 U.S.C. 1609, an advisory board of 20 members,

representing “ retailer, lender, and consumer groups in

all sections of the country. ” 18 In September 1968,

after careful study with the advisory board’s assist

ance, the Board issued a draft of proposed regulations

and later received more than 1200 comments and sug

gestions about the draft from industry and consumer

groups, and others, including state and federal agen

cies.19 In light of these comments, the Board published

and later promulgated Regulation Z with the “ four

installment rule.” 20

The reasons for the Board’s action are clear. The

Board knew, as the hearings on the Act had revealed,

that vendors could easily evade their disclosure obli

gations by including finance charges in the price of

18Hearings on Consumer Credit Regulations before the Sub

committee on Consumer Affairs o f the House Committee on

Banking and Currency, 91st C.ong., 1st Sess. 378 (1969) (state

ment of J. L. Robertson, Vice Chairman, Board of Governors

o f the Federal Reserve System).

19 Id. at 379.

20 34 Fed. Reg. 2002 (1969).

19

the goods or services. The Board's answer to the prob

lem—the four installment rule—effectuates the “ cen

tral objective [of the Act] of providing full informa

tion to consumers” 21 22 and clarifies the scope of the Act

with respect to “ no-charge-for-eredit” practices. 23

The Committee Reports indicate that Congress de

fined creditors as those who extend credit and require

a finance charge, 15 U.S.C. 1602(f), in order to ex

clude from coverage only deferred-payment sales that

are essentially cash transactions. Thus, “ the disclosure

21 S. Rep. No. 392, 90th Cong., 1st Sess. 2 (1967); see also 15

U.S.C. 1601.

22 See statement of ,1. L. Robertson, Vice Chairman o f the

Board o f Governors, Federal Reserve System, Hearings on Con

sumer Credit Regulations, supra, note 18, at 380-381:

Another less troublesome problem involves credit ex

tended “ without charge.” The act defines creditors as per

sons who “ regularly extend or arrange for the extension

o f credit for which the payment of a finance charge is re

quired.” In many cases creditors claim to make no finance

charge, although in every other respect they regularly ex

tend consumer credit. Take, for example, the merchant who

advertises watches for a dollar down, and a dollar a week,

with no indication of how many dollars are required to pay

for the watch. There is little doubt that lie is in fact, col

lecting a finance charge, included but not identifiable in the

cash price. And it seems clear that Congress intended to

reach advertising o f this kind.

Accordingly, the regulation defines “consumer credit” to

include credit payable in more than four installments even

though no finance charge is expressly imposed. Thus, the

advertising and disclosure provisions apply to this type of

credit except for those provisions that cannot be complied

with because the finance charge cannot be identified. In the

example given above, the merchant would have to state the

price o f the watch and give particulars as to the payment

schedule, even though he could not give the amount o f the

finance charge expressed as an annual percentage rate.

20

requirement would not apply to transactions which

are not commonly thought of as credit transactions,

including trade credit, open-account credit, 30-, 60-, or

90-day credit, etc., for which a charge is not made.” 23

Beyond this, however, Congress believed that finance

charges—identified or not—would be present in longer

term installment sales 24 since the costs of money, the

costs of collecting overdue amounts, the costs of credit

investigations, and so forth would be involved.

Thus, “ finance charge” is defined in the Act as “ the

sum of all charges, payable directly or indirectly by

the person to whom the credit is extended and imposed

directly or indirectly by the creditor as an incident

to the extension of credit.” 15 TJ.S.C. 1605(a) (em

phasis added) .20 And the general disclosure require

ments of the Act are for the benefit of “ each person

to whom consumer credit is extended and upon whom

a finance charge is or may be imposed,” 15 TJ.S.C. 1631

(emphasis added)—which indicates that it is sufficient

that the nature of the transaction renders the presence

of such a charge likely.

The Board’s four installment rule thus makes clear

what is implicit, if not explicit, in the Act itself: that

23 S. Rep. No. 392, 90th Cong., 1st Sess. 14 (1967); H.R. Rep.

No. 1040, 90th Cong., 1st Sess. 25 (1967). In light o f these

comments and since most installment purchases involve monthly

payments, the Board limited its rule to credit transactions pay

able in more than four installments.

24 See pp. 15-16 supra.

23 See S. Rep. No. 392, 90th Cong., 1st Sess. 8 (1967) (the

annual rate o f finance charge is “ a composite rate which in

cludes all charges incident to credit including interest” ).

21

even if they do not identify a finance charge, creditors

are still subject to the other disclosure requirements.26

In the language of Section 1604, it “ effectuate[s] the

purposes o f” the Act by making a reality the A ct’s

promise “ to assure a meaningful disclosure of credit

terms so that the consumer will lie able to compare

more readily the various credit terms available to him

and avoid the uninformed use of credit.” 15 U.S.C.

1601. It assures all credit customers that they will at

least be informed of such important credit informa

tion as the cash price, the number and amount of pay

ments, default or delinquency charges, any security

interest held by the creditor, and the amount to be

financed.2715 U.S.C. 1638.

26 On the basis o f the legislative history, the Board's position

is that if the cost o f extending credit is not identifiable, the

amount of any “ finance charge” need not be disclosed. See note

22 supra. In such situations, a creditor’s violation o f the other

applicable disclosure requirements would make him liable for

the minimum statutory penalty of $100. 15 U.S.C. 1640(a)(1).

27 That Congress knew the importance o f informing the con

sumer of the total installment price is shown by the specific

requirement in 15 U.S.C. 1638 that the creditor disclose this.

See Senate Hearings on S. l l l f i , 87th Cong., 1st Sess., supra,

note 13, at 117, which contains the following colloquy:

Mr. B lack . Another point that should be made here, too,

is that when people buy on time, what they frequently will

ask is: What is it going to cost me a month?

Senator B ennett . That is right.

Mr. B lack . In many instances, I gather they do not

bother to add it all up and find out what the total cost

would be. Vei'y often, they do, but that is the main con

cern o f people, in many instances: What is it going to cost

me a month?

Senator B ennett1. That is right.

Mr. B lack . When you think about it that way, this

monthly charge, sometimes it adds up to more than the

( 22

c.

THE BOARD ALSO VALIDLY EXERCISED ITS RULEMAKING AUTHORITY

UNDER SECTION 16 04 BECAUSE THE FOUR INSTALLMENT RULE IS

NECESSARY TO PREVENT EVASION OF THE ACT

The four installment rule is “ in the judgment of the

Board * * * necessary or proper * * * to prevent

circumvention or evasion” of the A ct28—another,

separate basis for the Board’s exercise of rulemaking

authority under Section 1604. Without the rule, cred

itors could avoid their obligation to disclose by simply

raising their selling price and ostensibly discontinuing

charging for credit, thereby exempting themselves

from coverage because they do not impose finance

charges. See 15 XJ.S.C. 1602(f), 1631, 1638.29 This

buyer can afford. I think, unfortunately, situations arise

as a result o f that.

See also House Hearings on H .R. 11601, supra note 13 at 1176,

where Senator Robert F. Kennedy pointed out that “ The most

shocking cases o f overreaching are generally o f poor people,

who cannot afford a down payment, are attracted by low

monthly payments, and are unsophisticated about the total cost

they will end up paying.”

28 See note 22 supra.

29 In addition to the disclosure requirements o f the Act,

Section 1635 grants the consumer a three-day right o f rescission

when he enters into a credit transaction involving a security

interest in his residence. This provision was inserted in the

Act partially as a result o f overreaching by some home improve

ment contractors. 114 Cong. Rec. 1611 (1968). Should the more

than four installment rule be held invalid, such creditors could,

conceivably, bury their finance charges to avoid giving consumers

these rescission rights, as well as the Truth in Lending disclo

sures. Moreover, it could be argued that the prohibitions against

“ bait” advertising in Section 1662 of the Act would then not be

applicable.

23

would bring about the ironic consequence that the less

the creditor tells his customers the more easily he

can evade his duty under an Act passed for the pur

pose of providing consumers with full information.

Although competition from other sellers with lower

cash prices might deter this practice in middle class

neighborhoods, where a large segment of consumers

buy on a cash basis, there would be no such deterrence

in poorer areas where the vast majority of consumers

buy on credit; 30 indeed, during the hearings Congress

heard evidence that this practice already was prev

alent.31 As the court held in Strompolos v. Premium

Readers Service, 326 F. Supp. 1100, 1103 (h.D. 111.),

the Board’s four installment rule is authorized by the

Act and is “not only sensible but also necessary to

prevent the Truth in Lending Act from becoming a

hoax and delusion upon the American public.”

Respondent has contended that despite the need to

prevent circumvention of the Act, the Board had no

authority to promulgate the rule because it covers

some transactions that the Act itself might not reach—

that is, credit transactions payable in more than four

installments where the consumer does not in fact pay

a finance charge directly or indirectly. Even assuming

that such transactions are theoretically possible, al

though Congress assumed otherwise as a practical

matter,32 this is not a basis for striking down the rule.

As Mr. Justice Holmes stated for the Court in West

30 See, e.g., Caplovitz, The Poar Pay More, 12-18, 88, 117-150

(1963), and note 27 su-pra.

31 See note 12 supra.

32 See p. 15 supra.

24

fall v. United States, 274 U.S. 256, 259, “ when it is

necessary in order to prevent an evil to make the law

embrace more than the precise thing to be prevented

it may do so.” See also North American Co. v. Securi

ties and Exchange Commission, 327 U.S. 686, 710-711.

Congress recognized this in Section 1604, when it au

thorized the Board to make “ adjustments and excep

tions for any class of transactions” in order to prevent

evasion of the Act. See Gemsco, Inc. v. Walling, 324

U.S. 244. This must mean that for credit transactions

with no identified finance charges the Board had au

thority to promulgate a general rule to prevent cir

cumvention even if the rule embraces some trans

actions that the provisions of the Act might not, on their

face, reach.

D.

THE BOARD’S REGULATION ALSO IS VALID BECAUSE IT FACILITATES

COMPLIANCE WITH THE ACT— ANOTHER BASIS FOR RULEMAKING

UNDER SECTION 1604

The Board also reasonably concluded that the four

installment rule was necessary and proper “ to facili

tate compliance” with the Act—still another indepen

dent basis for rulemaking under Section 1604. As the

Committee Reports state, one of the main methods of

enforcing the Act is through private civil actions.33

However, if in “ no-charge-for-credit” transactions the

creditor’s duty to disclose turned on whether the con

sumer could show the actual existence of buried finance

33 See S. Rep. No. 392, 90th Cong., 1st Sess. 9 (1967) (“ The

enforcement o f the bill would be accomplished largely through

the institution of civil actions authorized under section 7 of

the bill.” ) ; H.R. Rep. No. 1040, 90th Cong., 1st Sess. 19 (1967).

25

charges as a component of the price of the goods, there

would be great difficulties in securing compliance.

Disclosure of all required information is to be made

at the outset, when the presence of a finance charge

may not be apparent; the creditor is not to await the

consumer’s discovery of hidden charges before ful

filling his disclosure obligations. The very purpose of

the Act is to relieve consumers of the substantial

burden of discovering such things so that they will be

assured of having sufficient information to decide

whether to enter into the credit transaction.

In addition, if each transaction had to be dissected

after the fact in order to determine the existence of

buried finance charges, there would be endless legal

disputes over bookkeeping practices and other matters

far-removed from the central purposes of the Act, The

Board justifiably rejected any such approach in light

of the great difficulties in administration and the lack

of uniformity that would be bound to arise, which

would not only frustrate the A ct’s goal of informing

consumers, but also would leave creditors without any

clear and easily understandable rule to follow in “ no-

charge-for-credit ’ ’ transactions.34

34 Sections 1663 and 1664, 15 U.S.C. 1663, 1664, generally pro

vide that i f a specific credit term is advertised, for example,

“ ten dollars down,” the creditor must give additional credit

terms in his advertisement to inform fully prospective custom

ers of his credit plan. In the absence of the four installment

rule, creditors who extend long term credit that nominally did

not involve a finance charge might, advertise such specific terms

without complying- with the more complete advertising require

ments applicable to covered creditors. Since the advertisement

would not, itself, indicate either to enforcement agencies or to

competitors why a particular creditor’s advertising did not com-

26

This case itself, illustrates the wisdom of the

Board’s rule. I f BPS had complied with the Act and

the regulations thereunder, it would have informed

Mrs. Mourning of, among other things, the “ cash

price” of the magazine subscriptions. See 15 U.S.C.

1638. But PPS did not do this, claiming that the Act

did not apply to it because it imposed no finance

charges. \ret in its brief in opposition to the petition

for a writ of certiorari, at p. 9, note **, PPS ad

mitted for the first time that it gave a discount to

cash customers, which is simply another way of saying

that persons who buy on time are charged for some

thing more. And that something is at least part of

what Congress defined as a finance charge, imposed

“ indirectly.” 35

Of course, Mrs. Mourning could not have known of

this difference in price for cash and time purchases

at the time she signed her contract. And perhaps PPS

actually thought it had not imposed any finance

charges, although all indications now are that it did.

But one of the major reasons for the four installment

rule is that creditors, as v̂ ell as consumers, will clear

ly know what is required with respect to disclosure * 33

ply with the Act’s requirements, the Board and the Federal

Trade Commission foresee substantial administrative problems

in policing credit advertising and encouraging voluntary com

pliance should the rule be invalidated.

33 See note 11, supra, indicating that giving a discount to cash

customers while claiming to time customers that no finance

charges are being imposed would be a violation of the Act.

2 7

before the transaction is consummated and that com

pliance with the Act will thereby be facilitated.

O

In sum, we believe that the hoard’s action in pro

mulgating the regulation in question is an example

of the administrative process working at its best.

After thorough study and consideration, the Board

dealt with the problem of buried finance charges and

the potential for evasion of the Act by setting down a

clear and consise rule upon which both consumers and

creditors can confidently rely in determining their

rights and obligations under that Act, Where, as here,

Congress has enacted remedial legislation and con

ferred broad rulemaking authority upon an expert

agency, the agency’s regulation should be upheld if

it is “ reasonably related to the purposes of the en

abling legislation” 36 and “ within the bounds of [its]

administrative powers.” 37 And to the extent that the

Board’s rule represents its interpretation of the pro

visions and purposes of the Act, this construction is

entitled to great weight,38 particularly since we deal

here with a new statute and with rules promulgated

by the agency charged with the duty of setting it in

36 Thorpe v. Housing Authority, 393 U.S. 268, 280-281; see

American Trucking Associations, Inc. v. United States, 344 U.S.

298, 308-313.

37 American Telephone & Telegraph Go. v. United States, 299

U.S. 232, 236.

38 See National Broadcasting Co. v. United States, 319 U.S.

190; Norwegian Nitrogen Products Co. v. United States, 288

U.S. 294, 315.

28

motion.39 40 Under these standards, the court below erred

in holding that the Board had exceeded its authority.49

II.

T H E FO U R IN S T A L L M E N T R U L E DOES N O T V IO L A T E DUE

PROCESS

The court of appeals also held that the four install

ment rule establishes a “ conclusive presumption” that

39 See Vdall v. Tollman, 880 U.S. 1, 16; Power Reactor De

velopment Go. v. International Electricians, 361 U.S. 396.

The rule that the contemporaneous construction of a statute

by the administering agency is entitled to great weight has a

long history. See Edward''s Lessee v. Darby, 12 Wheat. 206,

210: “ In the construction of a doubtful and ambiguous law,

the contemporaneous construction of those who were called

upon to act under the law, and were appointed to carry its pro

visions into effect, is entitled to very great respect.” The rule

is based on the idea that contemporaneous constructions in

regulations often reflect the general understanding of law at

the time it was enacted by those who took part in the en

acting process and thus is evidence o f legislative intent. More

over, the rule allows persons affected by the regulation to rely

upon it with the knowledge that the courts will probably up

hold the agency’s action if, in the future, the regulation is

challenged in a lawsuit; thus, certainty and predictability of

the law are promoted.

40 The court below ignored the important remedial aspect

o f Truth in Lending and instead characterized the Act as

penal because there are penal sanctions for willful and know

ing violations, 15 U.S.C. 1611. (Pet. App. 17a). For this rea

son, it interpreted the statute narrowly. However, the penal

provisions are not involved in this case, and more important,

the Truth in Lending Act and the four installment rule do

not involve the problem of lack of notice that dictates narrow

construction of penal statutes. See Lametta v. New Jersey, 306

U.S. 451, 453; McBoyle v. United States, 283 U.S. 25, 27 (Mr.

Justice Holmes). In any event, when a remedial statute is sought

to be enforced in a civil proceeding, it is to be interpreted broadly

to effectuate its purpose, not narrowly because it also has criminal

sanctions. Securities and, Exchange Commission v. Joiner Gorp.,

.820 U.S. 344, 353-355.

29

all creditors impose finance charges in consumer credit

transactions payable, pursuant to an agreement, in

more than four installments. After so characterizing

the regulation, the court invoked the due process

clause of the Fifth Amendment to strike it down

(Pet. App. 21a to 23a).

But whether the substantive rule of law embodied

in the Board’s regulation deprives FPS and other

creditors of due process does not depend on labels; 41

the days of Lochner v. New York, 198 U.S. 45, and

Adkins v. Children’s Hospital, 261 U.S. 525, and

other similar decisions are long passed.42 Instead, when

economic regulation of business is in question, the

standard of review is that stated by this Court in

West Coast Hotel Co. v. Parrish, 300 U.S. 379, 391:

“ regulation which is reasonable in relation to its sub

ject and is adopted in the interests of the community

is due process.” See also Ferguson v. Sl§u,p/a, 372 U.S.

726, 730-733.

The four installment rule meets that test. There is

a rational basis for the classification established by the

regulation and the regulation is reasonable in light of

the relative benefits and burdens it creates. The Board,

as well as Congress, knew that finance charges are

41 See Mr. Justice Holmes, joined by Mr. Justice Brandeis

and Mr. Justice Stone, dissenting in Schlesinger v. Wisconsin,

270 U.S. 230, 241; and Mr. Justice Stone, joined by Mr. Jus

tice Brandeis (Mr. Justice Cardozo did not participate in the

case), dissenting in Heiner v. Dorman, 285 U.S. 312, 332, 349

(“ Unless the line [the regulation] draws is so wide of the

mark as palpably to have no relation to the end sought, it is

not for the judicial power to reject it and substitute another,

or to say that no line may be drawn.” ).

42 See Jackson, The Struggle for Judicial Supremacy 197-

285 (1941).

30

typically invol ved in consumer credit transactions 4°

because, when payment is deferred, the seller incurs

costs and those costs are passed on to the consumer.

Even if some creditors in fact give “ free” credit, the

burden of disclosure is minimal while the benefits of

the Board’s prophylactic rule are considerable.

As we discussed above, see pp 22 to 27, without

the four installment rule there would be substantial

danger that the Act could be easily circumvented or

evaded; moreover, transaction-by-transaction deter

minations regarding the existence of unidentified fi

nance charges would frustrate the purposes of the

Act and, in the Board’s viewT, would be unworkable.

In short, the important policy considerations under

lying the Board’s regulations far outweigh whatever

inconvenience it may cause creditors. Since the regula

tion has a rational basis and is reasonable, it satisfies

the substantive requirements of due process.43 44

Thus, even if the four installment rule is properly

characterized as a “ conclusive presumption,” it is

nevertheless constitutional under the Fifth Amend

ment. “ [T]he creation by law of such presumptions is

after all but an illustration of the power to classify. ’ ’

Jones v. Brim , 165U.S. 180,183. See also Martin v. City

of Struthers, 819 U.S. 141, 154 (Frankfurter, J. con

curring). And this Court, as well as the courts of

appeals, including the Fifth. Circuit, have often up

held the validity of “ conclusive presumptions.” See,

43 See pp. 5, supra.

44 Cf. Metropolis Theatre Co. v. City of Chicago. 228 U.S.

61, 69-70.

31

eg., Jones v. Brim, 165 U.S. 180; Hawkins v. Bleakly,

243 U.S 210; Ferry v. Ramsey, 277 US. 88; City of

New Port Richey v. Fidelity & Deposit Co., 105 P.

2d 348' (C.A. 5) ; United States v. Jones, 176 P. 2d

278 (C.A. 9) ; Gratz v. Claughton, 187 F. 2d 46 (C.A.

2) ; Jensen v. United States, 326 P. 2d 891 (C.A. 9) ;

Shanahan v. United States, 447 P. 2d 1082 (C.A. 10).

The Shanahan case, supra, is particularly apposite.

There, the question was whether Section 483 of the

Internal Revenue Code (26 U.S.C. 483) violated due

process because it created, in effect, a conclusive pre

sumption that when goods are purchased on an install

ment basis, a portion of the purchase price is interest.

The court upheld the statute because it was anchored

in the “ incontrovertible fact” that “ fujnlesis clearly

intended as a gift, a seller will not sacrifice interest

on deferred installment purchase payments” and be

cause it was “ a reasonable method of preventing

avoidance of ordinary income tax represented by

interest payments on installment sales contracts.” 447

P. 2d at 1084. Similar factual considerations obtain

here.

Schlesinger v. State of Wisconsin, 270 U.S. 230, and

Heiner v. Donnan, 285 U.S. 312, relied upon by the

court below, are distinguishable. As this Court pointed

out in Helvering v. City Bank Farmers Trust, 296

U.S. 85, and as the Tenth Circuit noted in Shanahan,

the presumptions involved in Schlesinger and Heiner

were invalidated because, in the Court’s view, they

created unreasonable classifications. In those cases, the

Court saw no rational basis for rules that all gifts

32

given within two years (Heiner) or six years

(ScJilesinger) of the donor’s death were made in con

templation of death. Moreover, the tax burden on the

individual as a result of the rule could have been con

siderable. Presumably, the result would have been the

same even if the rules had been written without the

presumptions, merely requiring that the gifts given

within the prescribed period prior to the donor’s

death must be taxed as part of the donor’s estate.43

However, to the extent that Heiner and Schilesinger

stand for the proposition that “ conclusive presump

tions” perforce violate the Fifth Amendment, these

cases are contrary to West Coast Hotel, supra, and

the other cases we have cited, pj3. 29-31 supra, and

should be overruled.4*

In sum, whether the four installment rule is viewed

as a conclusive presumption or as simply a substan

tive rule of law, it is rationally founded pursuant to

the Act and is reasonable in light of the important

policies it serves. The Fifth Amendment requires no

more and the court below erred in holding the regu

lation unconstitutional.

45 Stanley v. Illinois,, No. 70-5014, decided April 3, 1972, in

which this Court struck down a state dependency statute con

clusively presuming parental unfitness of unwed fathers and

depriving them of custody o f their children without a hearing,

is similarly distinguishable. In that case, the private interest of

a man in the children he sired and raised was considerable and

the state offered no countervailing governmental interest sup

porting the statute. Moreover, unlike Stanley, which involved

essential family relationships, this case deals with regulation

of business activity.

46 See also note 41 supra.

33

CONCLUSION

For the foregoing reasons, the judgment of the

court of appeals should he reversed.

Respectful] y submitted.

E rwin N. Griswold,

Solicitor General.

H arlington W ood, J r.,

Assistant Attorney General.

A. R aymond R andolph, J r.,

Assistant to the Solicitor General.

J u l y 1972.

A lan S. R osenthal,

Greer S. Goldman,

Attorneys.

A PPE N D IX

The Fifth Amendment to the United States Consti

tution provides:

No person shall be held to answer for a capi

tal, or otherwise infamous crime, unless on a

presentment or indictment of a Grand Jury,

except in cases arising in the land or naval

forces, or in the Militia, when in actual service

in time of War or public danger; nor shall

any person be subject for the same offence to

be twice put in jeopardy of life or limb; nor

shall be compelled in any criminal case to be

a witness against himself, nor be deprived of

life, liberty, or property, without due process

of law; nor shall private property be taken for

public use, without just compensation.

The Truth In Lending Act, 15 U.S.C. 1601-1665,

provides in relevant part:

§ 1601. Congressional findings and declaration

of purpose.

The Congress finds that economic stabiliza

tion would be enhanced and the competition

among the various financial institutions and

other firms engaged in the extension o f con

sumer credit would be strengthened by the in

formed use of credit. The informed use o f

credit results from an awareness o f the cost

thereof by consumers. It is the purpose of this

subchapter to assure a meaningful disclosure of

credit terms so that the consumer will be able

to compare more readily the various credit

terms available to him and avoid the unin

formed use of credit.

( 3 5 )

36

§ 1602. Definitions and rules of construction.

* * * * *

(e) The term “ credit” means the right grant

ed by a creditor to a debtor to defer payment

of debt or to incur debt and defer its payment.

(f ) The term “ creditor” refers only to credit

ors who regularly extend, or arrange for the

extension of, credit for which the payment of a

finance charge is required, whether in connec

tion with loans, sales of property or services,

or otherwise. Tire provisions of this subchapter

apply to any such creditor, irrespective of his

or its status as a natural person or any type of

organization.

(g) The term “ credit sale” refers to any sale

with respect to which credit is extended or ar

ranged by the seller. The term includes any

contract in the form of a bailment or lease if

the bailee or lessee contracts to pay as compen

sation for use a sum substantially equivalent

to or in excess of the aggregate value of the

property and services involved and it is agreed

that the bailee or lessee will become, or for no

other or a nominal consideration has the option

to become, the owner of the property upon full

compliance with his obligations under the con

tract.

(h) The adjective “ consumer”, used with

reference to a credit transaction, characterizes

the transaction as one in which the party to

whom credit is offered or extended is a natural

person, and the money, property, or services

which are the subject of the transaction are pri

marily for personal, family, household, or agri

cultural purposes.

* * * * *

§ 1604. Buies and regulations.

The Board shall prescribe regulations to

carry out the purposes of this subchapter. These

regulations may contain such classifications,

37

differentiations, or other provisions, and may

provide for such adjustments and exceptions

for any class of transactions, as in the judg

ment of the Board are necessary or proper to

effectuate the purposes of this subchapter, to

prevent circumvention or evasion thereof, or

to facilitate compliance therewith.

§ 1605. Determination of finance charge.

(a) Definition.

Except as otherwise provided in this section,

the amount of the finance charge in connection

with any consumer credit transaction shall be

determined as the sum of all charges, payable

directly or indirectly by the person to whom the

credit is extended, and imposed directly or in

directly by the creditor as an incident to the

extension of credit, including any of the follow

ing types of charges which are applicable:

(1) Interest, time price differential, and

any amount payable under a point, dis

count, or other system or additional

charges.

(2) Service or carrying charge.

(3) Loan fee, finder’s fee, or similar

charge.

(4) Fee for an investigation or credit

report.

(5) Premium or other charge for any

guarantee or insurance protecting the cred

itor against the obligator’s default or other

credit loss.

* * * * *

§ 1631. General requirement of disclosure.

(a)_ Each creditor shall disclose clearly and

conspicuously, in accordance with the regula

tions of the Board, to each person to whom

consumer credit is extended and upon whom

a finance charge is or may be imposed, the

information required under this part.

38

(b) I f there is more than one obligor, a

creditor need not furnish a statement of infor

mation required under this part to more than

one of them.

§ 1638. Sales not under open end credit plans.

(а) Required disclosures by creditor.

In connection with each consumer credit sale

not under an open end credit plan, the creditor

shall disclose each of the following items which

is applicable:

(1) The cash price of the property or

service purchased.

(2) The sum of any amounts credited as

downpayment (including any trade-in).

(3) The difference between the amount

referred to in paragraph (1) and the

amount referred to in paragraph (2).

(4) All other charges, individually item

ized, which are included in the amount of

the credit extended but which are not part

of the finance charge.

(5) The total amount to be financed (the

sum of the amount described in paragraph

(3) plus the amount described in para

graph (4 )).

(б) Except in the case of a sale of a

dwelling, the amount of the finance charge,

which may in whole or in part be desig

nated as a time-price differential or any

similar term to the extent applicable.

(7) The finance charge expressed as an

annual percentage rate except in the case

of a finance charge

(A ) which does not exceed $5 and is

applicable to an amount financed not ex

ceeding $75, or

(B ) which does not exceed $7.50 and is

applicable to an amount financed exceed

ing $75.

A creditor may not divide a consumer

credit sale into two or more sales to avoid

39

the disclosure of an annual percentage rate

pursuant to this paragraph.

(8) The number, amount, and due dates

or periods of payments scheduled to repay

the indebtedness.

(9) The default, delinquency, or similar

charges payable in the event of late pay

ments.

(10) A description of any security inter

est held or to be retained or acquired by the

creditor in connection with the extension of

credit, and a clear identification of the

property to which the security interest

relates.

(b) Form and timing of disclosure.

Except as otherwise provided in this part,

the disclosures required under subsection (a)

of this section shall be made before the credit

is extended, and may be made by disclosing the

information in the contract or other evidence

of indebtedness to be signed by the purchaser.

(c) Timing of disclosure on mailed or

telephoned orders.

I f a creditor receives a purchase order by

mail or telephone without personal solicitation,

and the cash price and the deferred payment

price and the terms of financing, including the

annual percentage rate, are set forth in the

creditor’s catalog or other printed material dis

tributed to the public, then the disclosures re

quired under subsection (a) of this section may

be made at any time not later than the date the

first payment is due.

(d) Timing of disclosure in .cases of an

addition of a deferred, payment

price to an existing outstanding

balance.

I f a consumer credit sale is one of a series of

consumer credit sales transactions made pur

suant to an agreement providing for the addi-

40

tion of the deferred payment price of that sale

to an existing outstanding balance, and the per

son to whom the credit is extended has approved

in writing both the annual percentage rate or

rates and the method of computing the finance

charge or charges, and the creditor retains no

security interest in any property as to which

he has received payments aggregating the

amount of the sales price including any finance

charges attributable thereto, then the disclosure

required under subsection (a) of this section

for the particular sale may be made at any time

not later than the date the first payment for

that sale is due. For the purposes of this sub

section, in the ease of items purchased on dif

ferent dates, the first purchased shall be deemed

first paid for, and in the case of items purchased

on the same date, the lowest price shall be

deemed first paid for.

§ 1640. Civil liability.

(a) Failure to disclose.

Except as otherwise provided in this section,

any creditor who fails in connection with any

consumer credit transaction to disclose to any

person any information required under this part

to be disclosed to that person is liable to that

person in an amount equal to the sum of

(1) twice the amount of the finance charge in

connection with, the transaction, except that the

liability under this paragraph shall not be less

than $100 nor greater than $1,000; and

(2) in the case of any successful action to en

force the foregoing liability, the costs of the ac

tion together with a reasonable attorney’s fee

as determined by the court.

* * * * *

The regulations of the Federal Reserve Board un