Chemical Bank Found in Violation of '68 Consumer Act

Press Release

June 21, 1971

Cite this item

-

Press Releases, Loose Pages. Chemical Bank Found in Violation of '68 Consumer Act, 1971. 2ac228cc-bd92-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/6fd34168-0d1b-491c-90cc-62166a567a9c/chemical-bank-found-in-violation-of-68-consumer-act. Accessed February 27, 2026.

Copied!

PressHeleaseB See

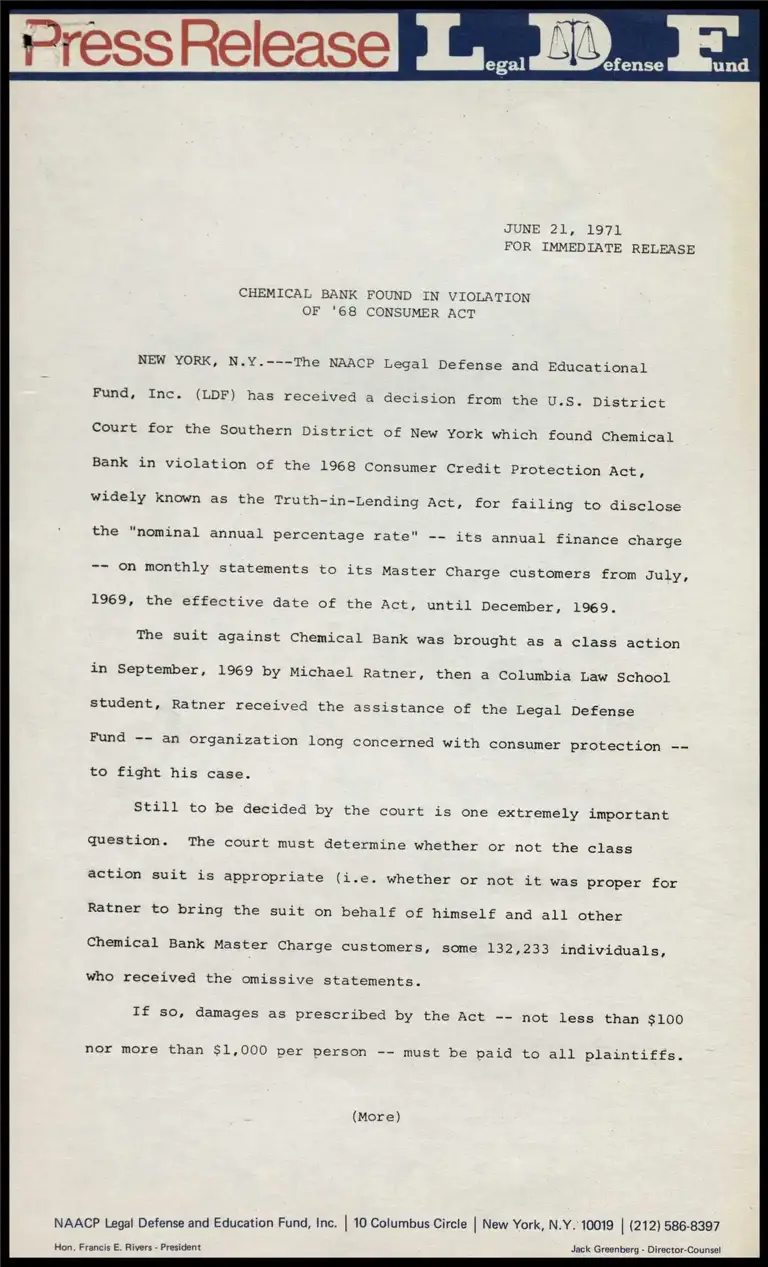

JUNE 21, 1971

FOR IMMEDIATE RELEASE

CHEMICAL BANK FOUND IN VIOLATION

OF '68 CONSUMER ACT

NEW YORK, N.Y.---The NAACP Legal Defense and Educational

Fund, Inc. (LDF) has received a decision from the U.S. District

Court for the Southern District of New York which found Chemical

Bank in violation of the 1968 Consumer Credit Protection Act,

widely known as the Truth-in-Lending Act, for failing to disclose

the “nominal annual percentage rate" -- its annual finance charge

-- on monthly statements to its Master Charge customers from July,

1969, the effective date of the Act, until December, 1969.

The suit against Chemical Bank was brought as a class action

in September, 1969 by Michael Ratner, then a Columbia Law School

student, Ratner received the assistance of the Legal Defense

Fund -- an organization long concerned with consumer protection --

to fight his case.

Still to be decided by the court is one extremely important

question. The court must determine whether or not the class

action suit is appropriate (i.e. whether or not it was proper for

Ratner to bring the suit on behalf of himself and all other

Chemical Bank Master Charge customers, some 132,233 individuals,

who received the omissive statements.

If so, damages as prescribed by the Act -- not less than $100

nor more than $1,000 per person -- must be paid to all plaintiffs.

(More)

NAACP Legal Defense and Education Fund, Inc. | 10 Columbus Circle | New York, N.Y. 10019 | (212) 586-8397

Hon. Francis E. Rivers - President Jack Greenberg - Director-Counsel

CHEMICAL BANK FOUND

IN VIOLATION OF '68

CONSUMER ACT

PAGE TWO

If this decision goes against Chemical Bank, the institution

could be forced to pay out some $13,223,000 in damages, assuming

the minimum fine is imposed.

In his summary decision, dated June 16, Judge M. E. Frankel

gave great weight to the intent of the Act which was designed to

give consumers an opportunity to "shop around” and compare the

various prices of credit before deciding to use any. The Act

stipulates that both the "periodic" finance charge -- in this

case monthly charge -- as well as the annual charge be shown on

all statements to credit customers.

One of the bank's principal arguments was that no interest

had accrued in Ratner's account and that, since no annual interest

charge was "applicable" at the time he filed suit, the bank's

failure to divulge its annual rate (18%) was not in violation of

the Act. However, were this the case, no Chemical Bank Master

Charge card customer would be advised of the bank's annual rate

until after he had accepted credit.

Chemical Bank also put forth.a "good faith defense," claiming

that it relied upon the advice of its counsel in interpreting the

Act and in deciding not to disclose its annual rates.

On this matter the court said "It is undisputed that

defendant carefully, deliberately - intentionally - omitted

the disclosure in question. That defendant, in this court's view,

mistook the law does not make its action any less intentional."

According to attorney Eric Schnapper of the Legal Defense

Fund, the case will be continued on June 28 to decide the remaining

issue.

2305

For further information: Eric Schnapper or Sandy O'Gorman

586-8397