Clinton v. Jeffers Jurisdictional Statement

Public Court Documents

January 21, 1992

Cite this item

-

Brief Collection, LDF Court Filings. Clinton v. Jeffers Jurisdictional Statement, 1992. f7b439d5-ad9a-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/7101aff9-ef6b-4168-afb7-7ee60b4b7b99/clinton-v-jeffers-jurisdictional-statement. Accessed February 21, 2026.

Copied!

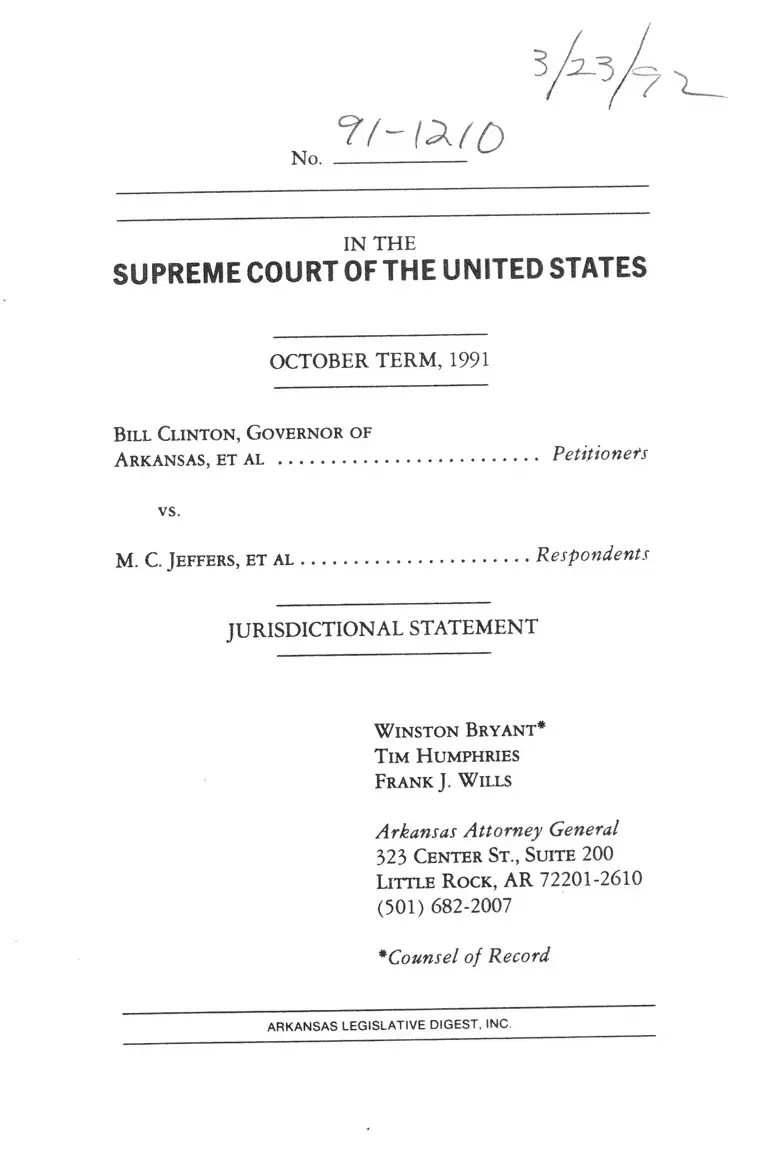

No.

IN THE

SUPREME COURT OF THE UNITED STATES

OCTOBER TERM, 1991

Bill Clinton, Governor of

Arkansas, ET AL ...................................................... Petitioners

vs.

M. C. Jeffers, et al ........................... ................... Respondents

JURISDICTIONAL STATEMENT

W inston Bryant*

Tim Humphries

Frank J. W ills

Arkansas Attorney General

323 Center St ., Suite 200

Little Rock, AR 72201-2610

(501) 682-2007

* Counsel o f Record

ARKANSAS LEG ISLA TIVE D IG EST, INC,

1

QUESTIONS PRESENTED

This appeal presents two related questions concerning

the propriety of a district court’s levying a fifty per cent,

''enhancement” of a $653,687.00 lodestar fee award made

pursuant to civil rights fee shifting statutes and based solely

upon the risk of loss faced by respondents’ attorneys,

specifically:

I.

W HETHER TH E M AJORITY’S DECISION TO G RA N T A

FIFTY PER CENT. ENHANCEM ENT OF THE LODE

STA R FEE A W A RD SO LELY TO C O M P E N SA T E

RESPONDENTS’ ATTORNEYS FOR RISK OF LOSS WAS

CONTRARY TO LAW BECAUSE IT PRODUCED NOT

A REASONABLE FEE, BUT RATHER AN ILLEGAL

WINDFALL.

II.

IF A RISK OF LOSS ENHANCEM ENT TO A LODESTAR

FEE AWARD IS PERMISSIBLE, DID THE M AJORITY

ERR WHEN IT MADE THE AWARD W ITHOUT A N Y

FINDING TH AT THIS CASE PRESENTED TH E RARE

A N D E X C E P T IO N A L C IR C U M ST A N C E S T H A T

WOULD JU STIFY SUCH AN ENHANCEMENT.

11

The Petitioners, who were defendants in the action

below, are Bill Clinton, the Governor of Arkansas, W. J.

McCuen, the Arkansas Secretary of State, and Winston

Bryant, the Arkansas Attorney General, all in their official

capacities and as members of the Arkansas Board of

Apportionment. The Respondents, who were plaintiffs in the

action below, are M. C. Jeffers, A1 Porter, Evangeline Brown,

Clyde Collins, O. C. Duffey, Earl Foster, The Reverend Ellihue

Gaylord, Shirley M. Harvell, Linda Shelby, J. C. Jeffries,

Lavester McDonald, Joseph Perry, Clinton Richardson,

T. E. Patterson, Ernest Simpson, Bryan Smith, and Charlie

Statewright.

LIST OF PARTIES

Ill

Page

TABLE OF CONTENTS

QUESTIONS PR ESEN TED ...................................................... i

LIST OF PARTIES.................................................................... ii

TABLE OF CO N TEN TS.......................................................... iii

TABLE OF AUTHORITIES .................................................... iv

OPINIONS BELOW ................................................................... I

JURISDICTION ............................................................................1

STATUTES AND RULES INVOLVED.................................2

STATEMENT OF THE C A SE .................................................3

THE QUESTIONS PRESENTED ARE

SUBSTAN TIAL.................................................................. 4

I. W HETHER THE MAJORITY’S DECISION

TO GRANT A FIFTY PER CENT. EN

HANCEMENT OF THE LODESTAR FEE

AW ARD SOLELY TO CO M PEN SA TE

RESPONDENTS’ ATTORNEYS FOR RISK

OF LOSS WAS CO N TRA RY TO LAW

BECAUSE IT PRODUCED NOT A REA

SONABLE FEE, BUT RA TH ER AN IL

LEGAL W IN D FA LL........................... '.’V .tW ............... 5

II. IF A RISK OF LOSS ENHANCEMENT TO A

LODESTAR FEE AWARD IS PERMISSIBLE,

DID TH E M AJORITY ER R WHEN IT

MADE THE AWARD W ITH O U T ANY

FINDING THAT THIS CASE PRESENTED

THE RARE AND EXCEPTIONAL CIR

CUMSTANCES THAT WOULD JUSTIFY

SUCH AN ENHANCEMENT....................................... 8

CONCLUSION............................................................................11

A P P E N D IX .............................................................A -l—A-24

IV

CASES: Page

Blanchard v. Bergeron, 489 U.S. 87 (1989) ............................4

Blum v, Stenson, 465 U.S. 886 (1984) ........................... 6, 8, 9

Coalition to Preserve Houston v. Interim Bd. o f

Trustees o f W estheimer bid. School Dist.

494 F.Supp. 738, 742 .................... 4

Hensley v. Eckerhart, 461 U.S. 424 (1983) ............................ 7

Hendrickson v. Branstad, 934 F.2d 158

(8th Cir. 1 9 9 1 ) .................................................................. 8 ,9

Jeffers v. Clinton, 730 F.Supp. 196 (E.D. Ark. 1989)

a f f ’d mem. ..... U .S ................................................................ 6

TABLE OF AUTH ORITIES

Jeffers v. Clinton, 776 F. Supp. 465 (E.D. Ark. 1 9 9 1 )......... 1

Laffey v. Northwest Airlines, Inc.,

' 746 F.2d 4 (D.C. Cir. 1 9 8 4 ) ...................................... 5, 8, 9

Lewis v. Coughlin, 801 F.2d 570 (2nd Cir. 1986).................. 9

McKinnon v. City o f Berwyn, 750 F.2d 1383

(7th Cir. 1 9 8 5 ) ..................................................................5 ,8

Morris v. American N at’l. Can C orp.,-----F .2d------,

1991 W.L. 271737 (8th Cir. 1991) .......................5, 8, 10

Pennsylvania v. Del. Valley Citizens Council fo r

Clean Air, 483 U.S. 711 (1 9 8 7 )........................... 4, 7, 8, 9

Smith v. Clinton, 687 F.Supp. 1310 (E.D. Ark. 1988),

a f f ’d m em .___U .S ................................................................ 6

V

CASES: Pa8e

Venegas v. Mitchell, 495 U.S. 82 (1990) .................................4

Wildman v. Lerner Stores Corp., 771 F.2d 605

(1st Cir. 1985) ........................ * - 5

STATUTES AND RULES:

28 U.S.C. §1253 ..............................................................................2

42 U.S.C. § 1 9 7 3 b .................................... 3

42 U.S.C. §19731(e) .............................................................2> 5

TABLE OF A UTH O RITIES

No.

IN THE

SUPREME COURT OF THE UNITED STATES

OCTOBER TERM, 1991

Bill Clinton, Governor of

Arkansas, et al ...................................................... Petitioners

vs.

M. C. Jeffers, et a l ............................................... Respondents

JURISDICTIONAL STATEMENT

Governor Bill Clinton of Arkansas, together with the

other two members of the Arkansas Board of Apportionment,

respectfully submit that this jurisdictional statement presents

questions so substantial as to require plenary consideration,

with briefs on the merits and oral argument, for their

resolution.

OPINIONS BELOW

The opinion and dissent of the district court (J.S. App. 1)

are reported at 776 F.Supp. 465 (ED . Ark. 1991).

JURISDICTION

The district court entered its final order awarding fees

under the fee shifting provisions of the Voting Rights Act, 42

U.S.C. §19731 (e), on October 24,1991. J.S. App. 1. Petitioners

?

filed their notice of appeal on November 20, 1991. J.S. App.

21. This Court has jurisdiction under 28 U.S.C. §1253.

STATUTE INVOLVED

42 U.S.C. §19731(e) provides:

Attorney’s fees

(e) In any action or proceeding to enforce the

voting guarantees of the fourteenth or fifteenth amend

ment, the court, in its discretion, may allow the prevail

ing party, other than the United States, a reasonable

attorney’s fee as part of the costs.

3

Respondents prevailed in their 1989 challenge to

Arkansas’ 1981 State Legislative Apportionment Plan, which

was brought pursuant to §2 of the Voting Rights Act, 42

U.S.C. §1973b. Following respondents’ application under 42

U.S.C. §19731 (e) for an award of fees and costs, a majority of

the district court three-judge panel awarded respondents’

counsel fees and costs totaling $1,034,492.00. J.S. App. 20.

The fee and cost award was comprised of three elements:

a "lodestar” fee award, based partially upon market rates

outside the relevant community (J.S. App. 5), of $653,687.00;

a cost and expense award of $72,060,00; and a fifty per cent,

"contingency” enhancement of $308,745.00, which was made

solely to compensate respondents’ attorneys for the "risk of

loss.” J.S. App. 14. That enhancement was awarded over

petitioners’ objection and one panel member’s dissent. J.S.

App. 13, 16. The majority made no finding that this case

presented rare and exceptional circumstances which would

justify the contingency enhancement.

Petitioners have paid respondents’ counsel all of the fee

and cost award except the $308,745.00 risk-of-loss enhance

ment. A unanimous district court granted petitioners’ request

to stay payment of the enhancement pending resolution of

this appeal. J.S. App. 23-24.

STATEM ENT OF TH E CASE

4

THE QUESTIONS PRESENTED ARE SUBSTANTIAL

Introduction. This appeal raises the question of when

it is proper, if ever, to enhance a fee award, calculated under

the "lodestar” method, solely to compensate prevailing

party’s counsel for the "risk of loss” they faced in bringing

civil rights actions. Although the propriety of such "con

tingency” enhancements has been before the Court recently,

see Pennsylvania v. Delaware Valley Citizens Council fo r

Clean Air, 483 U.S. 711 (1987) (hereinafter "Delaware Valley

II”), no clear answer has emerged.1 In Delaware Valley II, four

members of the Court were "unconvinced that Congress

intended the risk of losing a lawsuit to be an independent basis

for increasing the amount of any otherwise reasonable fee.

. . .” Id. at 725. Of the four justices who unqualifiedly endorsed

contingency enhancements, only two remain. Although there

is no clear concensus on the issue, it appears that a majority of

the Court has eschewed the contingent-fee analysis that the

district court used to justify its risk-of-loss enhancement

award. J.S. App. 12-13; see Venegas v. Mitchell, 495 U.S. 82,

___ (1990) ("[In] construing §1988, we have generally turned

away from the contingent-fee model to the lodestar model of

hours reasonably expended compensated at reasonable

rates”); Cf. Blanchardv. Bergeron, 489 U.S. 87,96 (1989) ("It

should also be noted that we have not accepted the contention

that fee awards in §1983 damages cases should be modeled

'Although Delaware Valley II addressed the propriety of contingency

enhancements in the context of 42 U.S.C. 7604(d), the same standards

appear to govern fee awards made pursuant to other civil rights statutes,

including the Voting Rights Act. See Pennsylvania v. Del. Valley Citizens

Council for Clean Air, 483 U.S. 711,713, n.l (1987); Coalition to Preserve

Houston v. Interim Board of Trustees of Westheimer Independent School

Dist., 494 F.Supp. 738, 742 (S.D. Tex. 1980), aff'd mem., 450 U.S. 901

(1981).

5

upon the contingent-fee arrangements used in personal injury

litigation.”).

Plenary review of the questions presented in this appeal

is required to provide guidance to the lower courts, which are

split on the issue of contingency enhancements. Compare

M cKinnon v. City o f Berwyn, 750 F.2d 1383, 1392 (7th Cir.

1985) (risk of loss, alone, does not justify enhancement) and

Laffey v. N orthw est Airlines, Inc., 746 F.2d 4,28-29 (D.C. Cir.

1984) (risk of loss only justifies enhancement in "rare

and exceptional circumstances”) with Morris v. American

National Can C orporation,___ F.2d------, 1991 W.L. 271737

(8th Cir. 1991) and Wildman v. Lerner Stores Corp., I l l F.2d

605,611,613 (1st Cir. 1985) (disagreeing with M cKinnon and

noting the split among circuits). This appeal presents the

issues clearly and cleanly, for not only did the district court

improperly enhance the lodestar fee award solely to "compen

sate the plaintiffs’ attorneys for the risk of loss,” J.S. App. 14,

but also made its risk-of-loss enhancement without a finding

that this case presented rare and exceptional circumstances.

J.S. App. 11-13, 14.

I.

W HETHER THE MAJORITY'S DECISION TO GRAN T

A FIFTY PER CENT. ENHANCEM ENT OF THE LODE

STA R FEE A W A R D SO LELY TO C O M PEN SA TE

RESPONDENTS’ ATTORNEYS FOR RISK OF LOSS WAS

CONTRARY TO LAW BECAUSE IT PRODUCED NOT

A REASONABLE FEE, BU T RATHER A N ILLEGAL

WINDFALL.

The prevailing party in a Voting Rights Act case is

entitled to recover a "reasonable attorneys fee.” 42 U.S.C.

§19731 (e). However, it is only a reasonable fee; civil rights

6

fee shifting statutes were not designed nor intended to

produce financial windfalls for lawyers. See, Blum v. Stenson,

465 U.S. 886,897 (1984).

In calculating respondents’ attorneys fees according to

the lodestar method, the district court arrived at a figure of

$653,687.00, which is presumed to be a "reasonable fee” for

purposes of the civil rights fee shifting statutes. Blum , 465

U.S. 897. Although petitioners urged the district court to use

market rates prevailing in the local community to calculate

the lodestar, J.S. App. 3, see Id. at 895, the majority concluded

that "it (was) reasonable to pay at least some of plaintiffs

out-of-town lawyers at out-of-town rates.” J.S. App. 5. It then

calculated the lodestar for at least one of respondents’ lawyers

at a rate that "may slightly exceed the local market rate from

most top-notch lawyers.”2 * * J.S. App. 5. As a result, the district

court arrived at a lodestar fee figure that not only was

presumptively reasonable, but also was higher than a fee

would have been if calculated according to prevailing market

rates in the relevant community.

The district court then enhanced the lodestar, based

solely upon "the risk of loss.”5 J.S. App. 14. Notwithstanding

their making a fee award in excess of that which would have

been made if calculated according to prevailing local market

rates, the majority then determined that civil rights plaintiffs

2Aithough the district court's methodology of calculating the lodestar

is not a subject of this appeal, it is detailed to illustrate the generous nature

of the fee award made.

Ît could be argued that there was very little risk of loss involved for

respondents in this case. Compare. Jeffers v. Clinton. 730 F.Supp. 196

(E.D. Ark. 1989) (Arnold, J.) with Smith v. Clinton. 687 F.Supp. 1310

(E.D. Ark. 1988) (Arnold, J .); see Laffey. 746 F.2d 29.

7

in general, not the plaintiffs in this particular action,4 would

face substantial difficulty in retaining counsel absent "the

prospect of enhancement.” J.S. App. 12. Such post hoc

justification freed the district court from having to assess the

need for risk enhancement in this particular case and allowed

it to award respondents a windfall based upon its perception

"that the civil rights market in Arkansas has changed” in the

last nine years; presumably for the worse for civil rights

plaintiffs’ attorneys. J.S. App. 13. Not only does such

reasoning ignore the requirement that civil rights fee awards

"must be determined on the facts of each case,” Hensley v.

Eckerhart, 461 U.S. 424,429 (1983), but also flies in the face of

the Delaware Valley 11 plurality’s observation that "any

further increase in (the lodestar) sum based on the risk of not

prevailing would result not in a 'reasonable’ attorneys fee, but

in a windfall for an attorney who prevailed in a difficult case.”

Delaware Valley II, 483 U.S. 727. Having liberated itself from

the constraint that a fee award in a given case be dependent

upon the facts of that case, the majority was then free to

improperly enhance the fee award in this case in an apparent

attempt to stimulate the sagging local "civil rights market.

See J.S. App. 13.

A plurality of the Court has concluded "that multipliers

or other enhancements of a reasonable lodestar fee to

compensate for assuming the risk of loss is impermissible

under the usual fee-shifting statutes.” Delaware Valley II, 483

U.S. 727. A split in the circuits over this conclusion exists.

tin this action, plaintiffs actually were represented simultaneously by

eleven lawyers. J.S. App. 19. Five of those lawyers live and practice in

Arkansas. Regardless of the assertions made in respondents fee

applications, it appeared that there was no dearth of lawyers willing to

represent them.

8

Compare McKinnon, 750 F.2d 1392 with Morris, ___ F.2d

-----, 1991 W.L. 271737. Therefore, the question whether it is

ever proper to enhance a lodestar fee award solely to

compensate respondents’ attorneys for risk of loss is a

substantial question requiring plenary consideration by the

Court.

II.

IF A RISK OF LOSS ENHANCEM ENT TO A LODESTAR

FEE AWARD IS PERMISSIBLE, DID THE M AJORITY

ERR WHEN IT MADE THE AWARD W ITHOUT A N Y

FINDING THAT THIS CASE PRESENTED THE RARE

A N D E X C E P T IO N A L C IR C U M ST A N C E S T H A T

WOULD JU STIFY SUCH AN ENHANCEM ENT

If risk of loss, alone, can ever justify enhancing a

presumptively reasonable lodestar fee award, then the district

court erred when it acceded to respondents’ enhancement

request without finding that this case presented rare and

exceptional circumstances. The Court has made it clear that

only in cases of "exceptional success” does the possibility of

enhancement exist. Blum, 465 U.S. 901. That language has

been interpreted to mean that only rare and exceptional

circumstances can ever justify an upward adjustment of the

lodestar to reflect the contingency of payment due to the risk

of loss. Laffey, 1AG F.2d 28-29; Hendrickson v. Branstad,

934 F.2d 158, 162 (8th Cir. 1991). The purpose of requiring

"rare and exceptional circumstances” before a contingency

enhancement may be allowed appears to be to prevent

arbitrary or unjust fee awards, cf. Delaware Valley II, 483 U.S.

732 (a risk noted by Justice O’Connor).

What is meant by the term "rare and exceptional” has

9

been the subject of debate among the circuits. See Laffey, 746

F.2d 28-29; Lewis v. Coughlin, 801 F.2d 570, 574-75 (2nd Cir.

1986); Hendrickson, 934 F.2d 162, 163. According to this

Court, the term appears to apply "only in the rare case where

the fee applicant offers specific evidence to show that the

quality of service rendered was superior to that one reasonably

should expect in light of the hourly rates charged and that the

success was exceptional." Blum, 465 U.S. 899 (emphasis

supplied). Regardless of what the Court meant by the term

"exceptional” there has been fairly clear guidance as to what

the term does not mean. It does not mean that the issues

presented were novel or difficult. Delaware Valley II, 483 U.S.

731. It does not mean that the danger of protracted litigation

existed. Id.

In this case, the district court made no finding that

circumstances qualifying as "rare and exceptional” existed in

granting the enhancement. Although the majority found that

plaintiffs’ attorneys "did a splendid job” and provided "efforts

(that) were superb,” it rewarded them by allowing higher

than local market rates. J.S. App. 5. It made no finding that the

quality of services rendered was superior in light of the hourly

rates charged. See Blum, 465 U.S. 899.

The majority also noted that "over 5,000 billable hours

does seem like an extraordinary amount of time to spend

on one case.” J.S. App. 6. Flowever, noting respondents’

"Flerculean” efforts, it found that "the plaintiffs’ lawyers and

paralegals reasonably expended 5,060.88 hours in this case.”

J.S. App. 7. That total included compensation for work

performed in connection with respondents’ unsuccessful

efforts to intervene in an earlier Voting Rights Act case. J.S.

App. 10.

In refusing to be confined to awarding the risk of loss

10

enhancement in the ''rare and exceptional case,” the district

court was free to provide a windfall to respondents’ already

generously compensated attorneys. Unmoored to the stand

ard of the rare and exceptional case, the majority has injected

the possibility of arbitrary fee awards into the jurisprudence

governing fee awards in civil rights actions. Rather than being

reserved for the "rare and exceptional” case, enhancement

of fee awards appears becoming the rule rather than the

exception. See M orris,___ F.2d___ , 1991 W.L. 271737. The

Court should note probable jurisdiction over this appeal

because the question whether a risk of loss enhancement

is appropriate absent a finding of rare and exceptional

circumstances is a substantial question requiring plenary

consideration by the Court.

1 1

CONCLUSION

Jurisdiction should be noted. The questions presented

within this jurisdictional statement are so substantial as to

require plenary consideration, with briefs on the merits and

oral argument, for their resolution.

Respectfully submitted,

By: WINSTON BRYANT

Attorney General

TIM HUMPHRIES

Assistant Attorney G eneral

FRANK J. WILLS

Assistant Attorney General

323 Center St., Suite 200

Little Rock, AR 72201-2610

Attorneys fo r Petitioners

CERTIFICATE OF SERVICE

I, Frank J. Wills, Assistant Attorney General, do hereby

certify that I have served the foregoing by mailing a copy of

same, U.S. Mail, postage prepaid, to P. A. Hollingsworth, 415

Main Place, Little Rock, AR 72201, on this 21st day of January,

1992.

/s/ Frank J. Wills

A P P E N D I X

A -l

In THE UNITED STATES DISTRICT COURT

EASTERN DISTRICT OF ARKANSAS

EASTERN DIVISION

M. C. Jeffers, Al Porter,

Evangeline Brown, Clyde Collins,

O. C. Duffy, Earl Foster,

The Rev. Ellihue Gaylord, Shirley

M. Harvell, Linda Shelby,

J. C. Jeffries, Lavester McDonald,

Joseph Perry, Clinton Richardson,

T. E. Patterson, Earnest Simpson,

Brian Smith, and Charlie Statewright,

on behalf of themselves and all

others similarly situated, .................. ........................ Plaintiffs,

v. No. H-C-89-004

Bill Clinton, in his official

capacity as Governor of Arkansas and

Chairman of the Arkansas Board of

Apportionment; W. J. McCuen, in his

official capacity as Secretary of

State of Arkansas and member of the

Arkansas Board of Apportionment; and

Steve Clark, in his official capacity

as Attorney General of Arkansas and

member of the Arkansas Board of

Apportionment, .........................................................Defendants.

Submitted: June 11, 1991

Filed:__________

Before ARNOLD, Circuit Judge, EISELE, Senior District

Judge, and HOWARD, District Judge.*

ARNOLD, Circuit Judge.

*It has apparently been customary in three-judge-court cases for the

originating district judge to decide fee matters for himself or herself. E.G.,

Smith v. Clinton, No. LR-C-88-29 (E.D. Ark. July 26, 1990). The statute

permits this practice, but it does not require it. In this case, the entire Court

chooses to consider and decide the motion for fees.

A-2

We have before us plaintiffs’ final motion for attorneys’

fees and expenses. Over two years ago the plaintiffs filed this

lawsuit challenging the apportionment of the General

Assembly of Arkansas. They argued that the redrawing of

legislative districts after the 1980 census violated the Voting

Rights Act, 42 U.S.C. §1973 et seq., and the Fourteenth and

Fifteenth Amendments. After a twelve-day trial, the Court

found that the plaintiffs had proved that the 1981 re

apportionment decreased the opportunity for meaningful

minority participation in state politics. Jeffers v. Clinton, 730

F. Supp. 196 (E.D. Ark. 1989). We enjoined the State from

holding elections under the discriminatory apportionment,

and ordered it to submit a new plan. It did so, and with

modifications suggested by the plaintiffs, this Court approved

the new plan in time for the 1990 elections. 756 F. Supp. 1195

(E.D. Ark. 1990). In due course, we filed another opinion on

the plaintiffs’ constitutional claims. Rejecting the bulk of the

plaintiffs’ contentions that the State acted with discrim

inatory intent, we agreed that the enactment of general-

election run-off statutes for municipal offices violated the

Fifteenth Amendment. 740 F. Supp. 585 (E.D. Ark. 1990).

The State appealed that decision, as well as our earlier holding

that the 1981 apportionment violated the Voting Rights Act,

to the Supreme Court of the United States. On January 7,

1991, the Supreme Court summarily affirmed our decision on

the plaintiffs’ voting-rights claim. I l l S. Ct. 662 (1991).

Several months later, the State withdrew its appeal on the

constitutional claim. I l l S. Ct. 1096 (1991). Those decisions

concluded the merits of the case.

The plaintiffs’ victory has brought this request for

reasonable attorneys’ fees and other expenses of the lawsuit.

The plaintiffs have asked for a total of $758,352 (after

rounding individual requests to the nearest dollar) in fees for

the eleven lawyers and seven paralegals who worked on the

case. They have also asked that we double that amount to

A-3

reflect the contingent nature of the case. In addition, the

plaintiffs have asked for $166,831' in other expenses. The

particulars of their request are set out in Appendix A.

The State objects. It argues that most of the hourly rates

requested by the plaintiffs are too high by Arkansas standards,

that the plaintiffs’ lawyers spent too much time on the case,

that there is no need to enhance the attorneys’ fee, and that

many of the expenses plaintiffs claim are unreasonable or

poorly documented. The State, however, has not opposed all

of the plaintiffs’ request. On two occasions, we have, on the

plaintiffs’ motions, ordered the State to pay undisputed

amounts of the plaintiffs’ request. The State has done so. Our

final award will be decreased by those amounts, totalling

$231,969.

In the main, we believe that plaintiffs’ requests are

reasonable. Their petition is thorough and well documented.

We award attorneys’ fees at rates ranging from $175 an hour

for Ms. Hair and Mr. Hollingsworth, who jointly captained

this case, to $90 an hour for Mr. Glover. With some

adjustments, we award fees for the bulk of the time claimed by

plaintiffs. The total fee award is $962,432. This figure

represents a lodestar fee of $653,687 enhanced by a

contingency multiplier of 50 per cent. Finally, again with

reductions, this time substantial ones, we award various

expenses of the litigation. The total expense award is $72,060.

The details of our award of both attorneys’ fees and expenses

‘In plaintiffs’ final motion for attorneys’ fees and costs, they request

$167,741 in expenses. Our calculations reveal a total of $167,481 in

expenses. Despite our efforts, we cannot account for the additional $260.

Plaintiffs’ motion also contains two requests for reimbursement of travel

for J. Wilson on October 6, 1989, in the amount of $649-98. We have

deducted this amount from their final request to avoid duplication,

resulting in a final figure of $166,831.

can be found in Appendix B to this opinion. We reason to

these conclusions as follows.

I.

Setting hourly rates for plaintiffs’ lawyers and paralegals

is our first task. The plaintiffs request a spectrum of rates for

their lawyers, ranging from $195 an hour for co-lead counsel

Hollingsworth to $90 an hour for attorney Glover. The

plaintiffs support their request with numerous affidavits,

attesting to the reasonableness of these hourly rates. The

State, relying primarily on the fee order in Smith v. Clinton,

No. LR-C-88-29 (E.D. Ark. July 26, 1990), urges us to cap the

lawyers’ fees at $130 an hour, and work down from there

based on experience. The plaintiffs request between $60 and

$40 for their paralegals. Again, relying on Smith, the State

argues that $30 or $35 an hour is the going local rate, and

therefore the reasonable rate.

The first legal question is whether all the out-of-town

lawyers associated with the Legal Defense Fund should be

held to local hourly rates. "[T]he prevailing market rates in

the relevant community!)]” are presumptively reasonable,

1Slum v. Stenson, 465 U.S. 886,895 (1984). Smith, supra, holds

that Little Rock, Arkansas is the relevant community for a

voting-rights case such as this. The guiding principle here is

the availability of qualified and willing local counsel. If it is

reasonable for civil-rights plaintiffs to look beyond Arkansas

to find such lawyers, then the Court may look beyond

Arkansas in setting a reasonable hourly rate for their services.

Avalon Cinema Corp. v. Thompson, 689 F.2d 137 (8th Cir.

1982) (en banc). We do not read Avalon Cinema, however,

to determine conclusively that no prospective civil-rights

plaintiff will ever need to seek a lawyer who is not an

Arkansan. Avalon Cinema requires, rather, a case-by-case

determination of the need for outside counsel. 689 F.2d at

A-5

140-41. This mammoth case could not have been undertaken

without the Legal Defense Fund’s lawyers and resources.

Indeed, it was not launched until local counsel could be certain

of that partnership. See, e.g., O. Neal Supplemental State

ment at paragraphs 9, 10; P. Hollingsworth Supplemental

Statement at paragraph 4. The expertise, energy, and

resources to challenge numerous legislative districts, covering

approximately one-third of Arkansas, are simply not cur

rently available in this State. We conclude, accordingly, that it

is reasonable to pay at least some of plaintiffs’ out-of-town

lawyers at out-of-town rates.

We believe the following schedule of hourly rates is

reasonable. Ms. Hair, of the Legal Defense Fund, directed this

case. She was the guiding force both before and at trial. She

was first among equals as co-lead counsel, spending nearly

twice as much time on this case as any other lawyer. And she

did a splendid job. A reasonable hourly rate for her efforts,

given her unique expertise in voting-rights cases, is the rate

she requests: $175. Ms. Hair’s rate may slightly exceed the

local market rate for most top-notch lawyers. Since her

services were essential, however, it is reasonable to pay the

non-local hourly rate she requests. Justice Hollingsworth,

co-lead counsel and the individual who diligently coordinated

the plaintiffs’ efforts in Arkansas, has requested $195 an hour.

Though his efforts were superb, we think $175, the same rate

allowed for Ms. Hair, is reasonable for Mr. Hollingsworth as

well. See, e.g., Little Rock School District v. Pulaski County

Special School District No. 1, No. LR-C-82-866, Order at

Schedule B (E.D. Ark. Feb. 6, 1991) (awarding Justice

Hollingsworth $165 an hour for work done in 1988);

G reenwood v. Ross, No. LR-C-79-406, Order at 7-8 (E.D. Ark.

Feb. 2, 1989) (Howard, J.) (awarding Hollingsworth an

average hourly rate of $ 135 for work during 1986-1988, while

noting that $165 was his current hourly rate).

The rest of the plaintiffs’ legal team will be paid at the

A-6

following hourly rates, which we find are reasonable:

Ms. Karlan — $125; Ms. Cunningham, Ms. Dennis, and

Mr. Bird — $110; Ms. Thomas, Ms. Bell, Mr. Neal, and

Mr. Simes — $ 100; Mr. Glover — $90. We believe these rates

reflect the relative experience and efforts in this case of the

various lawyers. We agree with the State that at least some of

the plaintiffs’ paralegals should also be limited to the hourly

rate currently paid in Arkansas. An hourly rate of $40 is

reasonable for plaintiffs’ local support staff. See Little Rock

School District, supra at Schedule B. The paralegals helping

non-local counsel, however, are entitled to the slightly higher

non-local rate of $50 an hour.

II.

Having decided how much per hour to pay the plaintiffs’

lawyers, we must now decide how many hours they should be

paid for. The State points out that not all time spent on a case

is billable time. The plaintiffs agree. The final fee request

mentions several instances of time spent, but not charged.

These were not insignificant efforts: they total, by the

plaintiffs’ estimation, some 900 hours of work. Even so, the

plaintiffs seek fees for a large amount of time — 4,739.05

hours of lawyers’ time and 671.1 hours of paralegals’ time.

The State argues forcefully that the request is excessive. First,

the State sees many projects that supposedly took too long, for

example, the two Supreme Court appeals. While only two

motions and supporting briefs were produced, the plaintiffs

seek pay for almost 400 hours of work. Moreover, the State

points to what it considers duplicative efforts. For example,

both Ms. Hair and Ms. Cunningham worked on the post-trial

papers. Finally, the State argues that some of the claimed time

is simply not properly considered billable time. A prominent

example is the travel time claimed by non-local counsel. On its

face, the State’s general point has weight. Over 5,000 billable

hours does seem like an extraordinary amount of time to

spend on one case.

A-7

On reflection, however, we are persuaded that most of

the plaintiffs’ lawyers’ and paralegals’ time was necessary and

well spent. This was a Herculean effort. We tried the case for

twelve days. It involved a cloud of witnesses and a mountain of

exhibits. Extensive expert testimony was required. It took this

Court three opinions to consider and decide the many issues

raised. As the plaintiffs remind us, the State has recognized

the magnitude of the case. It noted that the remedy, for

example, ”involve[d] twenty-three of one hundred House

districts and eight of thirty-five Senate districts [and]

affect[ed] hundreds of thousands of voters in east and south

Arkansas.” Defendants’ Motion for Stay of Judgment Pending

Appeal at 6, No. 89-2008 (U.S., filed March 12, 1990). The

plaintiffs’ lawyers’ time records are in the main thorough and

credible. Indeed, one aspect of the plaintiffs’ final request

deserves commendation. Responding to the State’s initial

concerns, almost every lawyer’s claim was revised by omitting

some challenged time. There are exceptions, of course, and

the State has done a good job of bringing them to the Court’s

attention. We consider them in detail below. Any remaining

excessiveness or duplication is negligible. Accordingly, we

find that the plaintiffs’ lawyers and paralegals reasonably

expended 5,060.88 hours in this case. The particulars of this

finding are set out in Appendix B.

The State first contends that almost every lawyer spent

too much time working on the case. It suggests across-the-

board cuts in most of the lawyers’ time requests. The State’s

blanket assertions are not persuasive. It attacks, for example,

the 89 hours Ms. Hair spent on the post-trial brief. That

document was invaluable to the Court in preparing its

opinion. We see excellence here, not excessiveness. The State

also points to Ms. Hair’s and Ms. Cunningham’s efforts on

appeal. It calculates the cost of plaintiffs’ motions to dismiss

in the Supreme Court at $ 1,300 a page for the first motion and

$890 a page for the second one. Those figures alarm. But like

A-8

most statistics, they do not teli the whole story. Divided into

legal research, strategy conferences, review of the record, and

actual drafting and editing, plaintiffs’ efforts on appeal come

into focus. Beyond the statistics lie diligence and craftsman

ship, not excess. Further, not all of this time was devoted to

the documents themselves: the lawyers also spent time

helping the Justice Department through the extensive record

on appeal. Moreover, the State’s cost estimates do not account

for our reduction in Ms. Cunningham’s hourly rates. In

general, then, we find the amount of time plaintiffs spent

both justifiable and justified.

The State is correct, however, in its general assertion

regarding attorney Glover’s records. Their indefiniteness is

troubling. The plaintiffs’ response — that Glover did valuable

work gathering evidence — is probably true, but it is

insufficient to meet the State’s objection. The infirmity lies in

the lack of thorough documentation. The bulk of plaintiffs’ fee

request sets a high standard on this score, one that Glover’s

request does not meet. Our uncertainty leads us to award

Glover one-half of the hours claimed for his work outside of

trial.

The State next contends that the plaintiffs’ lawyers

duplicated each other’s work. The fee award, the State

continues, should be reduced accordingly. We agree that it is

unreasonable to pay for the same work twice. It is not

unreasonable, however, to divide responsibilities among

many lawyers in a large case such as this. To remedy any

duplication caused by the shuffling of lawyers, the plaintiffs

have not claimed any time for lawyer Ifill of the Legal Defense

Fund. That amounts to 118 hours. This is a reasonable

adjustment. Except for the specific instances discussed below,

we reject the State’s duplication objections.

While this case needed a team of lawyers and legal

A-9

assistants to prepare and try, we are nevertheless convinced

that fewer people could have done the job at trial. There were

always five, and sometimes as many as eight, lawyers at the

plaintiffs’ table. That is duplicative. We believe three lawyers,

or at most four, could have tried this case effectively. All of the

co-lead counsels’ time at trial is reasonable: Ms. Hair and

Justice Hollingsworth needed to be in the courtroom to run

their case. Each of the other lawyers’ trial-time requests,

however, must be reduced. A rotation of effort would have

been the better course. To effect that rotation — in pay, if not

in time — we award each of the other lawyers one-half of the

trial time they claim. The same problem arises with respect to

paralegals. One was surely a necessity. The three legal

assistants that worked the trial, often in pairs, were not. We

award each of them one-half of the trial time they claim.

The State also sees duplication during the remedy phase

of the case. Often two, and sometimes three, lawyers attended

each meeting of the Board of Apportionment. One lawyer

could have adequately represented the plaintiffs’ views at each

meeting. Justice Hollingsworth was the only plaintiffs’ lawyer

to attend all of the meetings. He was their logical repre

sentative, and we award all of his time. Lawyers Neal and

Simes, on the other hand, though helpful, were not necessary

participants on every occasion. We award half of the

approximately thirty-nine hours they claim for attending

Board meetings.

We come finally to the third aspect of the State’s

excessiveness argument: improper time. The plaintiffs

supposedly seek payment for time that it is not appropriate to

bill. The State first contends that it is unreasonable to bill for

time the out-of-town lawyers spent travelling to and from

Arkansas. Here again, the State relies on the order awarding

fees in the Smith case. As plaintiffs point out, much of the

contested time was spent travelling in Arkansas interviewing

A-10

witnesses and gathering evidence. This is clearly appropriate.

Further, we have found, distinguishing Smith , that this case

could not have been prosecuted without a partnership of local

and non-local counsel. It follows, therefore, that it is

reasonable for those out-of-town lawyers to expect pay for the

time spent getting to and from their client. Rose Confections,

Inc. v. Ambrosia Chocolate Co., 816 F.2d 381, 396 (8th Cir.

1987); Craik v. M innesota State University Board, 738 F.2d

348, 349-50 (8th Cir. 1984) (per curiam). Moreover, though it

is not required, at least some of the plaintiffs’ lawyers often

worked in transit. See, e.g., Statement of D. Cunningham

at paragraph 4; Supplemental Declaration of P. Hair at

paragraph 18.

The State also contends that chunks of Ms. Hair’s,

Ms. Karlan’s, and Mr. Simes's claims are not related to this

case at all. The challenged time involves the unsuccessful

intervention in Smith v. Clinton. The plaintiffs acknowledge

the State’s point, but claim that the failed intervention formed

the foundation of the Jeffers complaint. The Smith time,

plaintiffs say, is thus also Jeffers time, and as such is properly

claimed now. We are persuaded by the plaintiffs’ explanation.

The State finally points to a miscellaneous list of claimed

time it says is improper. Much of what it objected to along

these lines has been withdrawn in the plaintiffs’ final request.

Two remaining items need to be adjusted. Ms. Hair claims the

7.3 hours she spent getting an apartment in Little Rock. Since

she is not from here, she needed a place to stay during the trial.

It is not reasonable, however, to pay Ms. Hair $175 an hour to

do what another (a local paralegal, for example) could have

done for far less. We do not believe a private client would pay a

lawyer for an apartment search or getting the utilities hooked

up. This part of Ms. Hair’s request is denied. Mr. Neal claims

fourteen hours for monitoring elections in the new districts

created by this case. The State does not see the relevance of

A -ll

this time. Neither do we.2 We reject the rest of the State's

objections to the time claimed by plaintiffs’ lawyers and

paralegals.

III.

Multiplying the adjusted hourly rates by the adjusted

amounts of time worked by each lawyer and paralegal yields

an attorneys’ fee of $653,895. That is what the cases call the

"lodestar” figure. As the name suggests, it is a guide. The

lodestar "is presum ed to be the reasonable fee to which

counsel is entitled.” Pennsylvania v. Delaware Valley Citizens’

Council, 478 U.S. 546, 564 (1986) (emphasis in original,

quotation omitted). Plaintiffs, however, seek more. They

request that we enhance their attorneys’ fee by 100 per cent. In

other words, they ask us to double it.

The Supreme Court has held that in certain circum

stances enhancing the lodestar to account for the possibility of

loss is proper. Pennsylvania v. Delaware Valley Citizens’

Council, 483 U.S. 711, 731, 733-34 (1987) (Delaware Valley

II) (O’Connor, J., concurring in part and concurring in the

judgment). The animating principle — of both the underlying

fee statutes and the cases interpreting them — is the need to

attract competent counsel for meritorious cases. If a con

tingency enhancement is necessary to meet this need, then it

is reasonable to award one. See, e.g., Hendrickson v. Branstad,

934 F.2d 158,162-63 (8th Cir. 1991). Useful facts in analyzing

this issue are how the "particular market compensates for

’In their final motion for attorneys’ fees, plaintiffs state they do not

claim 30.5 hours billed by Mr. Neal. Since the plaintiffs do not indicate

which 30.5 hours they are not claiming, we err on the side of assuming

(since plaintiffs have the burden of establishing the right to the fees) the

hours they do not claim are not the hours Mr. Neal billed for monitoring

elections.

A-12

contingency” cases as a class, and whether, "without an

adjustment for risk[,j the prevailing party would have faced

substantial difficulties in finding counsel in the local or other

relevant market,” Delaware Valley II, 483 U.S. at 733

(quotation and citation omitted).

We conclude the plaintiffs here have met their burden

under Delaware Valley II to justify enhancement of their

attorneys’ fees. Under Morris v. American National Can

Corp., 941 F.2d 710,715 (8th Cir. 1991)/ the plaintiffs are not

required to show that they "actually faced substantial difficulty

in retaining counself.]” Rather, the inquiry is whether the

plaintiffs would have faced such difficulty in the absence of the

prospect of an enhancement.

Plaintiffs here have made that showing. Justice Hol

lingsworth states "that without compensation for risk, no law

firm [his] size can regularly accept [civil-rights] cases.”

P. Hollingsworth Supplemental Statement at paragraph 1.

Another of the plaintiffs’ attorneys, L. T. Simes, asserts that

”[p]rior to contacting [the Legal Defense Fund], I approached

w o other organizations for assistance in this case — Eastern

Arkansas Legal Services and the Lawyers’ Committee for Civil

Rights. Each of these organizations refused to handle the case

because of its difficulty and broad scope.” L. T. Simes

Supplemental Statement at paragraph 5. Absent a con

tingency enhancement, he doubts plaintiffs could have

retained competent attorneys.

We find the affidavit of Jim Guy Tucker particularly

persuasive on this issue. He has no financial stake in the

outcome of this case in particular or civil-rights cases as a

class. In his affidavit, Lieutenant Governor Tucker expresses

'A petition for rehearing with suggestion for rehearing en banc is

pending before the Court of Appeals in Morris.

A-13

the opinion that without an enhanced hourly rate, attorneys

have no incentive to accept voting-rights cases.

Similarly, plaintiffs have adequately demonstrated that

the relevant market, Little Rock, Arkansas, compensates

contingency cases as a class by enhancing attorneys’ fees.

Again, Justice Hollingsworth avers via affidavit, that he

regularly receives four or five times his hourly rates in

successful contingency cases. P. A. Hollingsworth Declaration

at paragraph 9. Other attorneys provide a similar figure.

R. Quiggle Statement at paragraph 4; O. Neal Supplemental

Statement at paragraphs 6,7 (four or five times hourly rate in

personal injury cases; 1.75 times hourly rate in social-security

cases). In a more conservative estimate, John Walker states

that the Little Rock market tends to compensate attorneys in

contingency cases "in the neighborhood of two to four times

as much as their normal hourly billing rates.” J. W. Walker

Statement at paragraph 17.

Although the State disagrees with the plaintiffs' request

for an enhancement of the lodestar, it has not presented any

affidavits of its own which contradict those presented by the

plaintiffs. Instead, it cites dicta in Venegas v. Mitchell, 110

S. Ct. 1679, 1682 (1990), for the proposition that enhance

ments are disfavored. It also relies on the Court of Appeals’

observation in Avalon Cinema, 689 F.2d at 141, that "the day

has not yet come when a civil-rights plaintiff must go out of

[Arkansas] to get representation.” In the face of the specific

evidence presented by plaintiffs, we decline to rely on the

State’s general opposition to the plaintiffs’ request. Moreover,

we note that Avalon Cinema was decided nine years ago.

Plaintiffs’ uncontradicted affidavits indicate that the civil-

rights market in Arkansas has changed since then. No such

proof was before the Avalon Cinema court, and the issue in

that case — the validity of a zoning ordinance under the First

Amendment — was considerably less complex and specialized

A-14

than the multifarious questions presented in the present case.

Plaintiffs have established that they are entitled to an

enhancement of their attorneys’ fees. We cannot agree,

however, that plaintiffs are entitled to a 100 per cent

enhancement of these fees. Such an enhancement, we think,

would result in a windfall to attorneys some of whom might

have taken the case without the possibility of an enhance

ment. We find that an enhancement of 50 per cent will

adequately compensate the plaintiffs’ attorneys for the risk of

loss without affording them a windfall. After eliminating

those hours not entitled to enhancement (i.e., hours spent on

the fee petition itself), our calculations reveal that the

plaintiffs are entitled to an enhancement of $308,745,

resulting in a total attorneys’ fee award of $962,432.

IV.

The plaintiffs also seek reimbursement for other

expenses of the litigation. These include expert witness fees,

court costs, travel, photocopying, regular postage, telephone

calls, and overnight mail. These expenses total approximately

$170,000. The State raises both factual and legal objections.

The primary argument about what the law requires

concerns the plaintiffs’ expert witnesses. By statute, most

witnesses are limited to $40 a day, plus reasonable expenses in

some circumstances, in compensation for their time. 28 U.S.C.

§1821. The State urges that we adopt that ceiling for all the

witnesses in this case, including the experts. Many courts, see,

e.g., Friedrich v. City o f Chicago, 888 F.2d 511 (7th Cir. 1989),

vacated, 111 S. Ct. 1383 (1991), have allowed successful civil-

rights plaintiffs to recover actual expert witness fees and

expenses. In a recent case, however, the Supreme Court

squarely rejected this special treatment of experts. West

Virginia University Hospitals, Inc. v. Casey, 111 S. Ct. 1138

(1991). The plaintiffs point out that this may not be the end of

A-15

the story. The proposed Civil Rights Act of 1991, which has

been passed by the House of Representatives and is pending

in the Senate, would overrule West Virginia University

Hospitals. The plaintiffs urge us to withhold a ruling on this

part of their fee petition until the Congress acts. We are not

inclined to wait. It is true that we have retained jurisdiction in

this case. By way of a legal argument, however, the most the

plaintiffs can offer is the possibility that the law will change.

That is not enough. Plaintiffs may recover only $40 per day of

testimony plus travel expenses for each of their experts. West

Virginia University Hospitals, 111 S. Ct. at 1148. Likewise,

the fees not paid by plaintiffs but submitted directly to this

Court by one of their experts, Jerry Wilson, cannot be

recovered. We award the statutory fee plus allowable

expenses, which amounts to a total award of $2,236 for

plaintiffs’ expert-witness costs.

The State also challenges the plaintiffs’ expense claims

in several other respects. While conceding the bulk of the

court costs, it argues that four depositions not used at trial

should be excluded. We disagree. The plaintiffs are correct in

responding that these were reasonable discovery expenses.

The State also challenges the approximately $10,000 plain

tiffs seek in mail and telephone expenses. We agree that

regular postage is not billed separately in this jurisdiction.

Smith, supra, at 9. That part of plaintiffs’ claim is denied. We

find approximately $900 in regular postage in the various

expense reports. That amount will be subtracted from the

expenses we award to the lawyers who claimed the postage.

The State relies on the fee order in the Smith case for its

contention that overnight mail and most of the long-distance

telephone expenses should likewise be rejected. This part of

plaintiffs’ request relates to the reasonableness of hiring non

local counsel. Having concluded it was reasonable to hire

out-of-town lawyers, we will not impair their communica

tions with their clients and with local counsel. These expenses

are reasonable.

A-16

Finally, the plaintiffs have requested several thousand

dollars for "miscellaneous expenses.” The State objected. We

too were troubled initially by the thinness of the plaintiffs’

explanation of these expenses in their interim fee petition. In

their final request, however, the plaintiffs responded by

offering the State the opportunity to review the receipts

beneath this request. In light of that offer, and the State’s

failure to elaborate any specific objection in its response to

plaintiffs’ final request, we conclude that most of these

expenses should also be allowed. An exception is the

additional $9,288 in miscellaneous expenses that relates to

plaintiffs’ expert-witness costs. For the reasons elaborated

above, plaintiffs’ experts are limited to their statutory fees.

The State has conceded that the rest of the plaintiffs’ expenses

request — for such things as photocopies and exhibit

preparation — is reasonable. It is accordingly allowed.

« 9 •

We have considered the plaintiffs’ fee request, and the

State’s objections to it, with care. Our decision involves a lot of

money. We do not award it lightly. Rather, we are convinced

that these fees and expenses fairly compensate these lawyers

for their efforts, while not providing them a windfall. The

State will have thirty days from the date of this opinion to pay

the award. The plaintiffs’ request for interest on this award

from the date their fee petition was filed is denied.

It is so ordered.

/s/ Richard S. Arnold

United States Circuit Judge

/s/ George Howard, Jr.

United States District Judge

This document entered on docket sheet 10/25/91.

EISELE, Senior District Judge, dissenting.

Although I agree with the majority that Plaintiffs’ lead

A-17

attorneys did a first rate professional job in the representation

of their clients in this voting rights case, I, nevertheless,

dissent from the fee award because I find it clearly excessive.

In my view too many lawyers and too many paralegals were

used; the hourly rates awarded are too high and the number of

hours allowed excessive. Furthermore, I do not believe, under

the facts and circumstances of this case, that any contingency

enhancement is called for. I recognize we are dealing here

with matters of judgment so I see little benefit in setting forth

my specific objections.

Without going into details, the award which I would have

approved would be somewhat less than one-half of the award

actually made by the Court to the Plaintiffs as the prevailing

parties.

A-18

APPENDIX A

PLAINTIFFS’ REQUEST*

I. TIME

A, Attorneys

1. P. Hollingsworth 738.20 hrs x $195/hr = $143,949

2. P. Hair 1458.00 hrs x $175/hr = $255,150

3. P. Karlan 130.10 hrs x $150/hr = $ 19,515

4. D. Cunningham 871.00 hrs x $ 135/hr = $117,585

5. D. Dennis 394.00 hrs x $ 135/hr = S 53,190

6. P. Bird 92.00 hrs x S135/hr = $ 12,420

7. S. Thomas 428.60 hrs x $125/hr = $ 53,575

8. 0 . Neal 220.75 hrs x $125/hr = $ 27,594

9. K. Bell 12.90 hrs x S125/hr - S 1,613

10. L. Simes 261.75 hrs x 5100/hr’= S 26,175

11. D. Glover 131.75 hrs x S 90/hr = $ 11,858

Paralegals

1. T. Hollingsworth 216.00 hrs x $ 60/hr = $ 12,960

2. V. Thompson 30.00 hrs x $ 60/hr = $ 1,800

3. S. Mortman 121.30 hrs x S 60/hr = $ 7,278

4. C. Birnhak 82.00 hrs x $ 50/hr = $ 4,100

5. S. Bradford 51.00 hrs x $ 50/hr = $ 2,550

6. T. Aldrich 20.80 hrs x $ 50/hr = $ 1,040

7. O. Hampton 150.00 hrs x S 40/hr = $ 6,000

TOTAL = S758,352

'All dollar amounts are rounded to the nearest dollar.

‘’Plaintiffs' petition does not speak with one voice on Mr. Simes’s

requested hourly rate. At some points, it is $100 per hour for all his time.

At other points, it is S100 per hour for his time in court and $85 per hour

for his time out of court. Since the State concedes, and we agree, that $ 100

an hour is a reasonable rate for all his time, the discrepancy is not material.

A-19

II. EXPENSES

A. Paid by the Legal Defense Fund

1. telephone, postage, and copying

2. court costs

3. expert witness fees and costs

4. travel

5. miscellaneous

6. various expenses since June 1990

B. Paid by Individuals

1. P. Hollingsworth

2. O. Neal

3. K. Bell

4. L. Simes

5. J. Wilson

$ 15,031

$ 9,296

$ 82,882

$ 26,068

$ 16,099

$ 1,776

S 9,891

$ 1,235

$ 131

$ 484

$ 3,938

TOTAL = $166,831

APPENDIX B

ATTORNEYS’ FEES AND EXPENSES AWARDED

I. TIME

A. Attorneys

1 . P. Hollingsworth 738.20 hrs x $175/hr = Sl29,185

2. P. Hair 1450.70 hrs x $175/hr = $253,873

3. P. Karlan 130.10 hrs x $125/hr = $ 16,263

4. D. Cunningham 835.00 hrs x $ 110/hr = $ 91,850

5. D. Dennis 359.00 hrs x $110/hr = $ 39,490

6. P. Bird 92.00 hrs x $110/hr = $ 10,120

7. S. Thomas 405.60 hrs x $100/hr = $ 40,560

8. O. Neal 149.25 hrs x $100/hr = $ 14,925

9. K. Bell 12.90 hrs x $100/hr = $ 1,290

10. L. Simes 214.15 hrs x $100/hr’ = $ 21,416

11. D. Glover 59.87 hrs x $ 90/hr = $ 5,388

A-2Q

B. Paralegals

1. T. Hollingsworth 205.00 hrs x $ 50/hr

2. V. Thompson

3. S. Mortman

4. C. Birnhak

5. S. Bradford

6. T. Aldrich

7. O. Hampton

30.00 hrs x S 50/hr = $

108.30 hrs x S 50/hr = $

82.00 hrs x S 50/hr = $

51.00 hrs x 5 50/hr = S

20.80 hrs x S 40/hr = S

117.00 hrs x S 40/hr77 = S

10,250

1,500

5,415

4,100

2,550

832

4,680

TOTAL = 5653,687

II. EXPENSES

A. Paid by the Legal Defense Fund

1. telephone, postage, and copying S 14,689

2. court costs S 9,296

3. expert witness fees and costs s 2,236

4. travel s 26,068

5. miscellaneous s 6,811

6. various expenses since June 1990 s 1,634

Paid by Individuals

1. P. Hollingsworth s 9,541

2. O. Neal s 1,181

3. K. Bell s 120

4. L. Simes s 484

5. J. Wilson s 0

TOTAL = s 72,060

III. FINAL ATTORNEYS’ FEES AND EXPENSES

AWARD

A. Total Time S 653,687

+ Enhancement S 308,745

+ Total Expenses S 72,060

= Total Award 51,034,492

- Interim Awards S 231,969

= Balance Due S 802,523

A-21

IN THE UNITED STATES DISTRICT COURT

EASTERN DISTRICT OF ARKANSAS

EASTERN DIVISION

M. C. Jeffers, et al. ...........................................................Plaintiff

v. No. H-C-89-004

Bill Clinton, et al................................ ........................ Defendants

NOTICE OF APPEAL TO THE

UNITED STATES SUPREME COURT

Notice is hereby given that the defendants, Bill Clinton,

W. J. McCuen, Winston Bryant and the Arkansas Board of

Apportionment, hereby appeal to the Supreme Court of the

United States from that portion of the final order awarding

attorneys fees and costs which "enhanced” the fee award by

fifty per cent, due to the possibility that the appellees might

have lost the case. That order was entered on October 25,

1991.

This appeal is taken pursuant to Title 28, U.S. Code

Section 1253.

Respectfully submitted,

WINSTON BRYANT

Attorney General

BY: /s/Frank J. Wills

FRANK j. WILLS, III, #80162

TIM HUMPHRIES, #84080

Assistant Attorneys General

323 Center, Suite 200

Little Rock, AR 72201-2610

(501) 682-2007

Attorneys for Defendants

A-22

CERTIFICATE OF SERVICE

I, Frank J. Wills, III, Assistant Attorney General, do

hereby certify that I have served the foregoing by mailing a

copy of same, U.S. Mail, postage prepaid, to Les Hollings

worth, Lead Attorney for Plaintiffs, Hollingsworth Law Firm,

P.A., Main Place Building, 415 Main Street, Little Rock, AR

72201, on this 20th day of November, 1991.

/s/ Frank J. Wills

A-23

In THE UNITED STATES DISTRICT COURT

EASTERN DISTRICT OF ARKANSAS

EASTERN DIVISION

M. C. Jeffers, A1 Porter,

Evangeline Brown, Clyde Collins,

O. C. Duffy, Earl Foster,

The Rev. Ellihue Gaylord, Shirley

M. Harvell, Linda Shelby,

J. C. Jeffries, Lavester McDonald,

Joseph Perry, Clinton Richardson,

T. E. Patterson, Earnest Simpson,

Brian Smith, and Charlie Statewright,

on behalf of themselves and all

others similarly situated,........................................... Plaintiffs,

v. No. H-C-89-004

Bill Clinton, in his official

capacity as Governor of Arkansas and

Chairman of the Arkansas Board of

Apportionment; W. J. McCuen, in his

official capacity as Secretary of

State of Arkansas and member of the

Arkansas Board of Apportionment; and

Steve Clark, in his official capacity

as Attorney General of Arkansas and

member of the Arkansas Board of

Apportionment,........................................................Defendants.

Submitted: December 3, 1991

Filed:---------------

Before ARNOLD, Circuit Judge, EISELE, Senior District

Judge, and HOWARD, District Judge.

ORDER

The motion of defendants for partial stay of the order

entered October 24, 1991, is granted. That portion of the

A-24

order which directs defendants to pay to plaintiffs’ counsel

5308,745.00 as enhancement is hereby stayed pending final

disposition of the appeal. The unpaid amount, however, will

bear interest from and after November 24, 1991, at the rate

provided by law for judgments of United States district courts.

The motion of plaintiffs to hold defendants in contempt

is denied.

It is so ordered.

/s/ Richard S. Arnold

United States Circuit Judge

/s/ G. Thomas Eisele

Senior United States District Judge

/s/ George Howard, Jr.

United States District Judge

This document entered on docket sheet on 12/6/91.