Naimaster v. NAACP Brief for Appellee

Public Court Documents

February 6, 1970

Cite this item

-

Brief Collection, LDF Court Filings. Naimaster v. NAACP Brief for Appellee, 1970. 67069c03-bf9a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/74974065-e25f-4207-8ced-b81b48560085/naimaster-v-naacp-brief-for-appellee. Accessed February 19, 2026.

Copied!

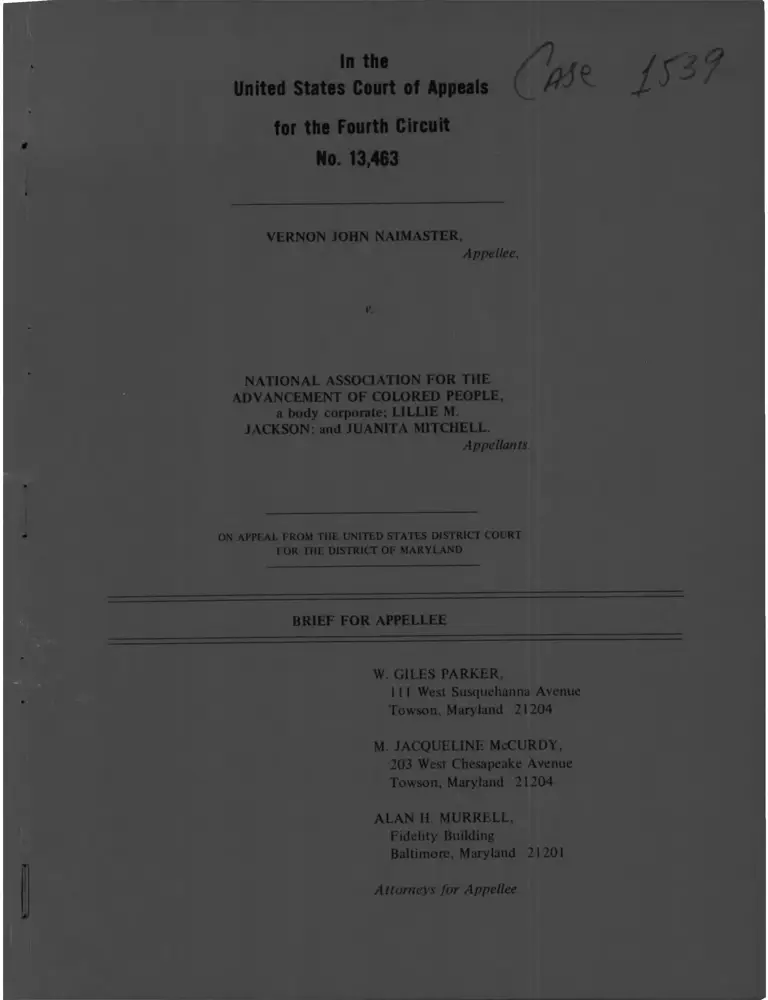

In the

United States Court of Appeals

for the Fourth Circuit

No. 13,463

(V i f i f

VERNON JOHN NAIMASTER,

Appellee,

v.

NATIONAL ASSOCIATION FOR THE

ADVANCEMENT OF COLORED PEOPLE,

a body corporate; LILLIE M.

JACKSON; and JUANITA MITCHELL.

Appellants.

ON APPEAL FROM THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF MARYLAND

BRIEF FOR APPELLEE

W. GILES PARKER,

11 1 West Susquehanna Avenue

Towson, Maryland 21204

M. JACQUELINE McCURDY,

203 West Chesapeake Avenue

Towson, Maryland 21204

ALAN H. MURRELL,

Fidelity Building

Baltimore, Maryland 21201

Attorneys for Appellee.

INDEX

Page

Issue Presented ............................................................................................................................... *

Statement of the C ase ...................................................................................................................... 1

Argument

Appellants Have No Sufficient Claim To Civil Rights Removal Jurisdiction

Pursuant To 28 U.S.C. 1443 (1) .............................................................................................. 2

Conclusion ........................................................................................................................................ 8

Table of Cases

Baines v. City of Danville, 357 F. 2nd 756 ................................................................................... 4,7

Georgia v. Rachel, 384 U.S. 780, 86 S. Ct. 1783 .......................................................................... 3

Greenwood v. Peacock, 384 U.S. 808, 86 S. Ct. 1800 .................................................................. 3,6

Jones v. Mayer, 392 U.S. 409, 88 S. Ct. 2 1 8 6 ............................................................................... 6

Maryland v. Brown, 295 F. Supp. 63 (Cert, denied by S. C t . ) ..................................................... 7

NAACP v. Overstreet, (384 U.S. 71,86 S. Ct. 1306 and 221 Ga. 16, 142 SE 2nd 816) ......... 3,7

Naimaster v. NAACP et al (296 F. Supp. 1277) ........................................................................... 7

New York v. Davis, 41 1 F. 2nd 750 ................................................................................................ 2

Schoen v. Sulton, 297 F. Supp. 538,411 F. 2nd 793, 90 S. Ct. 370 ....................................... 6

Shuttlesworth v. Birmingham, 399 F. 2nd 529; 382 U.S. 87, 86 S. Ct. 211 ............................... 5

S n y p p v. Ohio (CCA 9-1934) 70 F. 2nd 535, Cert, d e n ie d 293 U.S. 563 ................................. 3

In the

United States Court of Appeals

for the Fourth Circuit

No. 13,463

VERNON JOHN NAIMASTER,

Appellee,

v.

NATIONAL ASSOCIATION FOR THE

ADVANCEMENT OF COLORED PEOPLE,

a body corporate; LILLIE M.

JACKSON; and JUANITA MITCHELL.

Appellants.

ON APPEAL FROM THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF MARYLAND

BRIEF FOR APPELLEE

Issue Presented

Does appellants’ petition for removal state a claim for the exercise of civil rights removal

jurisdiction pursuant to 28 U. S. C. SI443(1)?

Statement of the Case

This is an appeal from an order of the United States District Court for the District of

Maryland remanding the case to the Circuit Court for Baltimore County, Maryland, from which

removal was attempted.

upon the claim that a fair trial could not be obtained in the State Courts. There is a recent case

which, in our mind, is very close on a factual basis to the allegations of the case at Bar; namely,

N.A.A.C.P., et al, v. Overstreet (384 U.S. 71, 86 S. Ct. 1306) in which the Court per Curiam

refused certiorari to the Georgia Courts; however, the facts are stated in a dissenting opinion by

Mr. Justice Douglas. (The reference to the Georgia case is 221 Ga. 16, 142 S.E. 2nd 816). This

was a suit for damages for unlawful and malicious interference with the Plaintiffs operation of

his business. Apparently no effort was made to remove this case for trial to the Federal Court

for the District of Georgia.

The cases cited by the Defendants both in this Court and below and every case which we

have been able to find involving removal of causes under the Civil Rights Laws concern criminal

prosecution; namely, a controversy between some branch of government and individual citizens,

almost all of whom alleged in their petitions for removal that they had been arrested or

prosecuted, primarily, because of their race or activities on behalf of voting rights, equal

accommodations, and other civil rights guaranteed them by law. With the general trend of these

cases we have no dispute, but it is our opinion that they are completely immaterial when applied

to the removal of a simple suit for damages which involves no attempt to deny any rights of the

Defendant of any nature. The line of cases determining this is exemplified pretty well in the case

of Snypp v. Ohio (1934 - CCA 9, 70 F. 2nd 535; certiarari denied, 293 US 563). This was a

case of prosecution under the State Blue Sky Laws in which the Defendant petitioned for

removal on the ground that he could not obtain justice in any court of the State of Ohio because

of prejudice and local influence. The Court held that removal was not in order and said “If

susceptible of proof, this allegation would not constitute a discrimination by the State Courts,

affecting the Civil Rights of the Appellant” (at P. 536). The most recent cases, and the most

important ones to our mind, are State o f Georgia v. Rachel (384 U.S. 780, 86 S. Ct. 1783) and

City o f Greenwood v. Peacock, et al. (384 U.S. 808, 86 S. Ct. 1800). In the Rachel case, it is

obvious that removal was allowed because the State of Georgia was prosecuting the Defendants

under a local statute, which was itself in direct conflict with the Equal Public Accommodations

section of the Civil Rights Law. It was obvious that any prosecution under the Georgia statute,

regardless of its outcome, would have been a violation of civil rights sufficient to warrant

removal to the Federal Courts. The Court was very careful in its opinion to point out that such

3

issued against picketing and the defendants were being prosecuted for, among other things, a

violation of the injunction. The State cases were removed to the U.S. District Court. The Circuit

Court of Appeals held (at P. 764) that there could be no basis for removal to the Federal Courts

on grounds involving the 1st and 14th Amendments which, of course, provide rights applicable

to all citizens and are not specifically civil rights provided by law for Negroes. At P. 765 the

Court points out that the right of removal cannot be predicated on a supposition that any of the

defendant’s Constitutional rights will be denied by the State Courts; and at P. 769 and 770 the

Court pointed out that the question of whether or not a fair trial could be had in the State

Courts would “ . . . require the Federal Judge to try the State Court.” This case is well worth

reading in toto, although too long to include here, as Judge Haynesworth in his Opinion goes

into quite a long dissertation on the history and background of the Civil Rights Legislation. The

opinion makes reference to the Cox, Rachel and Peacock cases, and specifically cites the older

case of Powers (201 U.S. 1, 26 S. Ct. 387). It is interesting that there was a dissent by Judge

Sobolof in which he cites the Peacock case, but only has reference to the Fifth Circuit’s decision

in that case; and was, of course, not aware of the Supreme Court’s decision in the Peacock case,

which was not handed down until June 20, 1966. (The Baines case was decided in January

1966). The Fifth Circuit’s decision was reversed by the Supreme Court in the Peacock case. (384

U.S. 808, 86 S. Ct. 1800).

Another case which illustrates the useless consumption of time in cases of this nature, if

nothing else, decided in August, 1968, by the Circuit Court of Appeals, is Shuttlesworth v. the

City o f Birmingham (399 F. 2nd, 529). Shuttlesworth has been to the Supreme Court of the

U.S. with this case five times, the latest time being reported in 382 U.S. 87, 86 S. Ct. 211, and

involves a charge by the municipality and the State of Alabama against the Defendant for

“ loitering.” In the previous Supreme Court decision (1965) which arrived in the Supreme Court

by certiorari from the Court of Appeals of Alabama, it was held that the conviction should have

been reversed and remanded for a new trial on the loitering charge. This opinion is worth reading

because it recites the facts of the case. The latest case (399 F. 2nd 529) which was determined

in August, 1968, points out the further facts that, having been remanded to the Courts of

Alabama for a new trial, the defendant one day before the trial date removed the case to the

5

243). The two latter opinions affirmed the decision of the District Court by “Per Curiam”

memorandum decisions affirming Judge Northrup’s order to remand the case after removal from

Prince George’s County, Maryland, to the District Court. This was a suit to enjoin an alleged

nuisance which held that even vexatious litigation is not, per se, removable to the Federal

Courts. The present case; i.e., Naimaster v. NAACP, was cited in a footnote to Judge Northrup’s

opinion in the Sulton case (supra), as were the cases of Baines v. Danville, 357 F. 2nd 756, and

Maryland v. Brown, 295 F. Supp. 63, (in which case certiorari has been denied by The Supreme

Court January 12, 1970). (Citation not available.)

In the words of Judge Northmp (at Page 541 of 297 F. Supp.), “In conclusion, the Court

notes that if the Defendant’s theory was accepted, Federal Court would have to hold, at the very

least, evidentiary hearings in every case brought in the State Court which the Defendant alleged

was motivated by racial prejudice. Such a result, aside from the immense administrative problems

it would pose, would sound the destruction of the independent State judiciary system and would

establish a Federal judiciary that was never intended by the Constitution or by Congress.”

The “Per Curiam” memorandum opinion of this Honorable Court, in addition to affirming

Judge Northrup’s decision, cited the case of N.Y. v. Davis (411 F. 2nd 750, 2nd Circuit, March

28, 1969, Friendly, Judge) to which this Court is respectfully referred. It is noteworthy that

having, in effect, conceded that the Sulton case (supra) certainly involved similar issues of

construction to the present case, if not conceding that the decision would be controlling in this

case, the appellants have not cited or referred to Sulton in the Appellant’s brief.

7

CERTIFICATE OF SERVICE

I hereby certify that on January I served two copies of the foregoing Brief for

Appellee upon the following attorneys of record for Appellants by United States Mail, postage

prepaid:

CLARENCE M. MITCHELL, Jr., Esq.

1239 Druid Hill Avenue

Baltimore, Maryland 21217

GERALD A. SMITH

Howard, Brown & Williams

1500 American Building

Baltimore, Maryland 21202

JACK GREENBERG

MELVYN ZARR

10 Columbus Circle

New York, New York 10019

Attorney for Appellee

9

/