Wheeler v. Montgomery Appendix

Public Court Documents

October 11, 1968 - April 21, 1969

Cite this item

-

Brief Collection, LDF Court Filings. Wheeler v. Montgomery Appendix, 1968. 976093ec-c89a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/7d9795d3-0cf0-43fc-831c-2b3868b42370/wheeler-v-montgomery-appendix. Accessed February 20, 2026.

Copied!

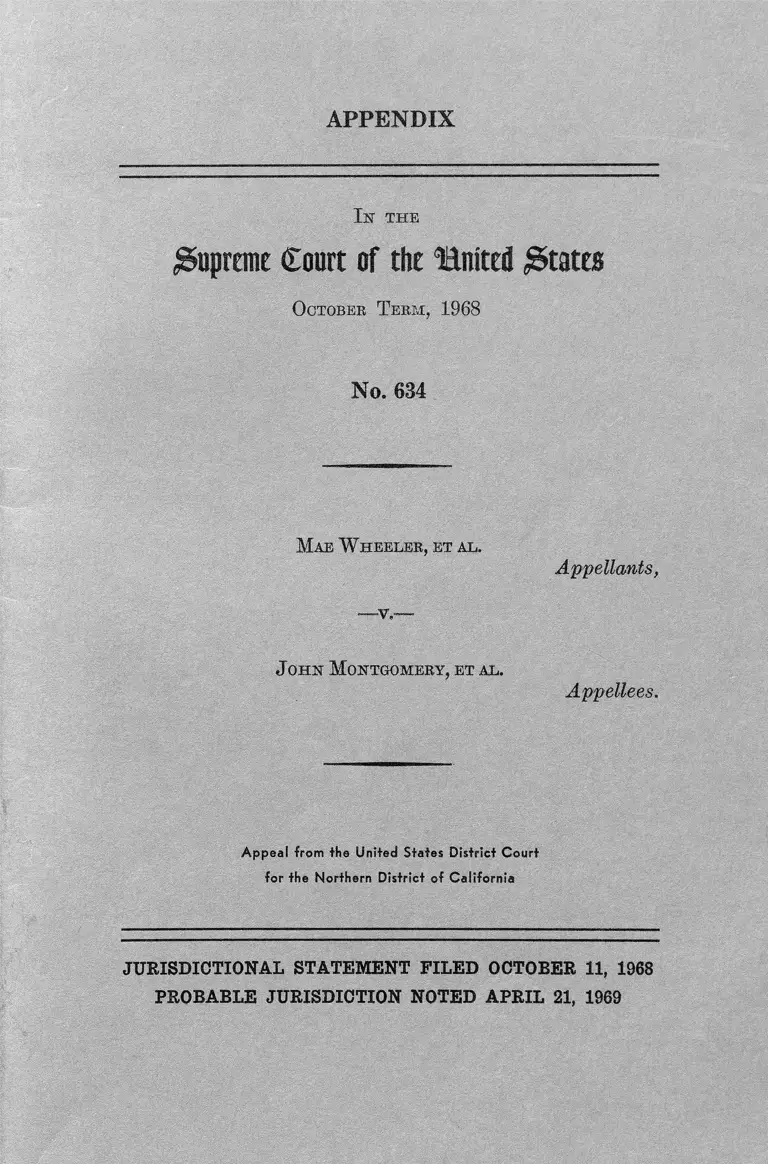

APPENDIX

In the

^Supreme Court of the United States

October Term, 1968

No. 634

Mae W heeler, et al.

Appellants,

J ohn Montgomery, et al.

Appellees.

Appeal from the United States District Court

for the Northern District of California

JURISDICTIONAL STATEMENT FILED OCTOBER 11, 1968

PROBABLE JURISDICTION NOTED APRIL 21, 1969

I n the

Supreme Court of the Suited States

October Term, 1968

N o. 634

Mae W heeler, et al.

Appellants,

John Montgomery, et al.

Appellees.

Appeal from the United States District Court

for the Northern District of California

JURISDICTIONAL STATEMENT FILED OCTOBER 11, 1968

PROBABLE JURISDICTION NOTED APRIL 21, 1969

I N D E X

Page

Record from the United States District Court for the Northern

District of California

Docket Entries ............................................................................. 1

Complaint .................................................................................... 5

Affidavit of Mae Wheeler.......................................................... 17

11 Index

Page

Supplemental Affidavit of Arthur C. Agnos in support of

Temporary Restraining Order and Preliminary Injunction 19

Temporary Restraining Order...................................................... 23

Memorandum Opinion Permitting Class Action and Certifying

Necessity of Convening Three Judge District Court............... 27

Answer Filed by Defendant Ronald Born................................. 34

Answer Filed by Defendant Montgomery and Exhibits Ap

pended Thereto.................................. ...................................... 36

Excerpt from Pre-Trial Order of Facts Admitted and at Issue 55

California State Department of Social Welfare, Regulation

PSS 44-325. 43 Effective April 1, 1968.................. .................. 60

Memorandum Opinion and Order Dismissing Action................ 62

IN THE UNITED STATES DISTRICT COURT

FOR THE NORTHERN DISTRICT OF CALIFORNIA

Case No. 48303

DATE

1967

Nov. 30

30

Dec. 1

1

1

1

1

1

1

6

7

Mae W heeler v . John Montgomery

DOCKET ENTRIES

FILINGS— PROCEEDINGS

1. Filed ord. permitting action to be filed in forma

pauperis. Zirpoli

2. Filed complaint. Issued summons.

3. Filed motion by pltff. for temp, restrain, order,

with supporting papers attached.

4. Filed motion by pltff. for prelim, injunc., with

supporting affidavits attached.

5. Filed brief by pltff. supporting mos. for a temp,

restrain, order and prelim, injunc.

6. Filed appli. by pltff. for convening of 3 Judge

Court.

7. Filed memo by deft. Ronald H. Bom opposing

mo. for a temp, restrain, order and prelim, injunc.

8. Filed declaration of Ronald H. Born on behalf of

City and Co. of S.F. opposing mos.

Ord., aft. hrg., Court granted in part the appli, for

a temp, restrain, order and prelim, injunc. and re

stored pltff. to Welfare assistance aid effective Dec. 1,

1967, as will more fully appear in findings and order

to be presented by counsel for pltff.; the Court de

ferred ruling for 30 days without prej. on pltff’s. mo.

for the convening of a 3 Judge Court. (Zirpoli)

9. 12:34 P.M., Filed temporary restraining order.

(Zirpoli)

10. Filed proof of service of summons & complt. on

deft. John Montgomery, etc., Nov. 30, 1967.

2 Appendix

DATE

1967 FILINGS— PROCEEDINGS

11 11. Filed notice & Motion by Joseph Granatier and

Albert Curry, to intervene as pltffs., Dec. 20, 1967, 9 :45

A.M., with supporting papers attached.

13 12. Filed notice & Motion by Virginia Hill to inter

vene as party pltff., Dec. 20, 1967, 9 :45, A.M., before

Judge Zirpoli, with supporting papers, attached.

15 13. Filed notice & Motion by pltff. for modification of

temp, restrain, order, Dec. 15, 1967, 9 :45 A.M. before

Judge Zirpoli, with supporting papers attached.

15 Ord. pltff’s. mos. to intervene, for a 3 judge court, for

a class action & to modify restraining order taken

under submission; motions noticed for hrg. o'n Dec.

20, & Jan. 2, 1968 ordered off calendar. (Zirpoli)

18 14. Filed motion by Lizzie Reeves for leave to inter

vene as a party pltff. and for a temp, restrain, order,

with supporting affidavit & memo.

18 Lodged temp, restrain, order.

18 Lodged intervenor’s complt. (See Sheet “ B ” )

20 15. Filed suppl. affidavit of Lizzie Reeves supporting

mo. for temp, restrain, order & mo. to intervene.

20 16. Filed affidavit of J. Gerald Mabey.

20 Ord., aft. hrg., Mo. of Lizzie Reeves to intervene as

pltff. and for temp, restrain, order, denied without

prej. (Zirpoli)

20 17. Filed Memorandum Opinion and order denying

continuance; partially vacating prior order; permitting

class action; denying motions to intervene; denying mo.

to modify temp, restrain, order; notification & certifi

cation of necessity of 3 Judge Court. (Zirpoli)

Copies mailed.

20 18. Filed notification and certificate to convene a

3 Judge Court. (Zirpoli)

Copies mailed to counsel & Judge Chambers, CCA.

26 19. Filed summons, on return.

Appendix 3

DATE

1967

26

29

DATE

1968

Jan. 4

5

5

8

15

17

19

25

29

29

Feb. 6

6

6

FILINGS— PROCEEDINGS

20. Filed answer of deft. Ronald Born, indiv. and as

Genl. Mgr. of San Francisco City & Co. Dept, of Social

Services.

21. Filed order convening 3 Judge Court and desig

nating Judges Oliver D. Hamlin, CJ; Albert C. Wol-

lenberg and Alfonso J. Zirpoli, DJ’s. (Chambers, CJ)

3 Judge copies made & distributed.

22. Filed notice by pltff. of taking deps. of Frank

Vasquez, Norman Clayton, & Wilbur L. Parker.

23. Filed notice by pltff. of taking dep. of Mary Jane

Rand and issued subp.

24. Filed dep. subp. d.t., exec. Jan. 8, 1968, as to

Mary Jane Rand.

25. Filed notice by pltff. of production of documents

pursuant to subp., of a copy of the proposed decision

in the Mae Wheeler Fair Hearing, etc. and issued subp.

26. Mailed notice of pre-trial conf. on Feb. 7, 1967,

11:00 A.M. before Judge Zirpoli for sched. a time table

for fur. pleadings, etc.; deft. John Montgomery is

given to & inch Jan. 22, 1968 to file his answer or other

pleadings. (Zirpoli)

Copies sent to Judge Hamlin & Judge Wollenberg.

27. Filed answer of John Montgomery, indiv. & as

Director of the Calif. State Dept, of Social Welfare,

with exh. attached.

28. Filed notice by pltff. of taking dep. of Dr. Scott

Brier, Professor, School of Social Welfare, Berkeley,

Calif. & iss. subp.

29. Filed stip. & order cont, pre-trial conf. to Feb. 14,

1967, at 11:00 A.M. (Zirpoli)

30. Filed dep. subp. d.t., exec. Jan. 29, 1968, as to

Scott Brier.

31. Filed deposition of Frank J. Vasquez.

32. Filed deposition of Wilbur L. Parker.

33. Filed deposition of Norman Clayton.

4 Appendix

DATE

1968

14

FILINGS— PROCEEDINGS

Ord., aft. pre-trial conf., a joint pre-trial order to be

presented. (Zirpoli)

14 34. Piled additional statistical material in regard to

the deposition of Wilbur L. Parker. (In brown envel

ope)

14 35. Piled deposition of Mary Jane Rand, with statisti

cal material in brown envelope attached.

23 36. Piled additional statistical material, as to the de

position of Prank J. Vasquez. (In brown envelope in

file)

Mar. 14 37. Piled notice of trial before 3 Judge Court, Apr.

12, 1968, 10 A.M. in Courtroom No. 2; pltff’s. brief to

be filed by Mar. 15, 1968; resps’ brief filed by Apr. 1,

1968 (Clerk)

19 38. Piled brief in support of motion for preliminary

injunction, etc.

20 39. Piled pre-trial order case will probably be set

during week of April 8, 1968. (Zirpoli)

Apr. 1

9

40. Piled defts’ reply trial brief.

41. Piled pltffs’ reply brief.

9 42., Piled pltffs’ Exhibit Number 1.

11 43. Piled list of documents described in pre-trial order,

dated March 19, 1968, marked for identification and

to be offered as pltffs’ exhibits in evidence.

11 44. Lodged order form. (Preliminary injunction)

12 Trial before 3 Judge Court, ordered case submitted.

(Hamlin, Wollenberg, Zirpoli)

19 45. Piled memorandum opinion and order that this

proceeding may, with propriety, now be dismissed.

(Hamlin, CJ, Wollenberg, Zirpoli)

June 14 46. Piled notice of appeal by pltff. to the Supreme

Court of the United States.

17 Mailed notice of filing notice of appeal.

July 15 Made, Mailed Record on Appeal Supreme Court of the

U.S.

Appendix 5

In the United States District Court for the

Northern District of California

No. 48303

Filed November 30, 1967, Clerk IT. S. District Court,

San Francisco

[TITLE OMITTED IN PRINTING]

COMPLAINT FOR THREE JUDGE COURT,

DECLARATORY JUDGMENT, AND

INJUNCTIVE RELIEF

I

This is an action for injunctive and declaratory relief

authorized by Title 42 U.S.C. 1983 to secure rights, privi

leges and immunities established by the Fourteenth Amend

ment to the Constitution of the United States and the

Social Security Act, 42 U.S.C. 301, et seq., and the regula

tions promulgated thereunder.

II

Jurisdiction is conferred on this Court by 28 U.S.C.

1343(3) and (4) providing for original jurisdiction of this

Court in suits authorized by 42 U.S.C. 1983; and jurisdic

tion is further conferred on this court by 28 U.S.C. 2201

and 2202 relating to declaratory judgments.

III

This is a proper case for determination by a three judge

Court pursuant to Title 28 U.S.C. 2281 and 2284, in that

it seeks an injunction to restrain the defendants from ap

plying, enforcing, executing and implementing Sections

6 Appendix

12200, 12201 and 10950 of the California Welfare and

Institutions Code (annexed hereto as Exhibit A ) and the

regulations promulgated thereunder, insofar as these stat

utes and regulations require termination, suspension or

reduction of financial aid in the form of Old Age Security

(OAS) prior to granting of notice and opportunity to be

heard, on the grounds of the invalidity of said statutes and

regulations under the Constitution and laws of the United

States.

IV

This action seeks an injunction and declaratory judgment

restraining the enforcement of and declaring unconstitu

tional the aforesaid state statutes and state-wide regula

tions, on their face and as applied and interpreted by

defendants, on the grounds that said statutes and regula

tions, and actions taken pursuant thereto, deny to plaintiffs

the due process of law guaranteed by the Fourteenth

Amendment to the United States Constitution and the

“ fair hearing” guaranteed by the Social Security Act, in

that said statutes and regulations deny to plaintiffs an

opportunity for a hearing prior to termination and with

drawal of financial aid under the OAS program.

V

Plaintiff Mae Wheeler is an adult citizen of the United

States and a resident of the City and County of San

Francisco, State of California.

VI

Plaintiff Wheeler brings this action pursuant to Rule

23 of the Federal Rules of Civil Procedure on behalf of

herself and all other recipients who are similarly situated.

All OAS recipients are similarly affected by the statutes

and regulations challenged herein in that all said recipients

Appendix 7

are by statute and regulation made subject to peremptory

ex parte termination of their aid. The persons in the class

are so numerous as to make joinder impractical; there are

common questions of law and fact; plaintiff’s claims are

typical of the claims of the class; and the representative

party will fairly and adequately protect the interests of

the class.

VII

Defendant John Montgomery is the Director of the Cali

fornia Department of Social Welfare and is charged with

statewide administration of the OAS program and with

establishing rules and regulations to carry out the statu

tory provisions of said program.

Defendant Ronald Born is General Manager of the San

Francisco City and County Department of Social Services

and is responsible for administration of the OAS program

in the City and County of San Francisco, State of Cali

fornia.

VIII

The OAS program created by Section 12000, et seq. of

the California Welfare and Institutions Code, provides

financial aid to persons over sixty-five years of age. Persons

who meet the statutory criteria receive financial aid as a

matter of statutory entitlement.

IX

At all times relevant hereto the State of California and

defendants, in order to receive federal funds for the OAS

program of the State of California, have been required by

the Social Security Act, 42 U.S.C. § 301, et seq., to have

formulated a “ state plan” for said program in conformity

with the provisions of the Act and the United States Con

stitution. The Social Security Act, 42 U.S.C. § 302(a) (4)

8 Appendix

as interpreted by regulations of the United States Depart

ment of Health, Education and Welfare require that a

“ state plan” provide for granting an opportunity for a

fair hearing before the State agency to any individual

aggrieved by an action of a County Department of Social

Welfare.

X

Plaintiff Mae Wheeler is a seventy-five year old widow

who had been receiving OAS continuously for thirteen

years until her aid was terminated.

X I

Defendants have established plaintiff’s total monthly

needs at $158.55. This figure includes plaintiff’s regular

allotment for food, rent, clothing, transportation, and other

necessities, plus added allowances for required telephone

service ($2.70), laundry ($3.00), household remedies ($4.00)

and a special medical diet ($11.35). Until September 1,

1967, defendants had granted plaintiff $113.95 monthly;

the remainder of plaintiff’s needs being met by monthly

OASDI (Social Security) payments of $44.60. In addition,

by virtue of her OAS eligibility, plaintiff was entitled to

complete free medical treatment and hospitalization under

the Medi-Cal program.

X II

Without prior notice defendants withheld plaintiff’s Sep

tember 1,1967 OAS check.

X III

On or about September 14, 1967, defendants informed

plaintiff that her OAS was being withheld because of plain

tiff’s alleged transfer of approximately $4,000.00 in insur

ance proceeds to her deceased son’s nephew in satisfaction

of a pre-existing debt owed by her deceased son to said

nephew.

Appendix 9

X IY

In September and October, 1967, plaintiff, assisted by a

social worker from the Public Health Authority, attempted

to have her OAS restored.

X V

By letter dated November 7, 1967, plaintiff was informed

that her OAS was discontinued effective August 31, 1967.

The basis of the discontinuance was ineligibility due to

transfer of personal property with the intent to reduce

plaintiff’s holdings to a sum within the maximum amount

permitted to be retained by an OAS recipient. It was not

and is not alleged that plaintiff had or has retained any

money for her own use or benefit as a result of her son’s

death.

X V I

On November 16, 1967, after seeking advice, plaintiff,

through her authorized representative, filed an appeal and

request for a hearing and a further request that her aid

be restored and continued until a decision after hearing.

(A copy of plaintiff’s representative’s letter requesting

restoration of aid is attached hereto as Exhibit B.) No

answer to said letter has been received to date; aid has not

been restored, nor has a hearing been scheduled.

X V II

At present, plaintiff has no assets to pay her December

rent. Her total income (met through Social Security and

the County General Assistance program) is projected at

$98.50 per month, although defendants have calculated

plaintiff’s minimum needs to be $158.55 monthly. To date,

plaintiff has only received a $15.60 emergency food order

under the General Assistance program.

10 Appendix

X V III

Plaintiff is in extremely poor health and was hospitalized

on or about November 26, 1967. No money for plaintiff’s

medical expenses or special medical needs is now being

granted.

X IX

Section 10950 of the California Welfare and Institutions

Code, prescribing the hearing procedure in the OAS pro

gram, and Sections 12200 and 12201 prescribing the manner

of termination or reduction of aid in the OAS program

on their face and as interpreted and applied to plaintiff

and members of her class, violate the rights of due process

of law guaranteed by the Fourteenth Amendment to the

United States Constitution and the “ fair hearing” guaran

teed by the Social Security Act in that said statutes and

the regulations adopted in enforcement thereof authorize

and require effective action terminating, suspending and

revoking financial aid prior to the granting of reasonable

notice and opportunity for a hearing. The termination and

withdrawal of financial aid may, under the regulations,

extend for a period of several months before a hearing is

held and a decision is rendered, even though plaintiff had

been receiving such aid and is in vital need of such aid for

food and shelter and medical care and even though plaintiff

is prepared to prove that she is and has been eligible.

X X

Plaintiff has no adequate remedy at law and defendants

will continue, to cause plaintiffs irreparable injury unless

enjoined by this Court.

Wherefore, plaintiff respectfully prays on behalf of her

self and others similarly situated, that this Court:

Appendix 11

1. Assume jurisdiction of this cause and convene a

three judge Court pursuant to Title 28 U.S.C. § 2281.

2. Enter a temporary restraining order and a prelimi

nary injunction ordering the defendants to grant plaintiff’s

request for restoration and continuation of aid until the

holding of a hearing and the issuance and implementation

of a decision by the State Department of Social Welfare,

or until the determination of this cause.

3. Enter a declaratory Judgment pursuant to Title 28

U.S.C. 2201, 2202 and Rule 57 of the Federal Rules of Civil

Procedure declaring that Sections 10950, 12200 and 12201

of the California Welfare and Institutions Code and the

regulations issued pursuant thereto violate the Fourteenth

Amendment to the United States Constitution and the So

cial Security Act on their face and as applied, insofar as

they authorize and require termination, suspension or revo

cation of aid prior to granting reasonable notice and oppor

tunity for a hearing.

4. Enter a preliminary and permanent injunction re

straining the defendants, their successors in office, agents

and employees from terminating, suspending or revoking

the aid of any OAS recipient prior to the granting of

reasonable and adequate notice and opportunity for a hear

ing which satisfies the standards of due process of law.

12 Appendix

5. Allow plaintiff her costs herein, grant her and all

others similarly situated such additional or alternative re

lief as the Court may deem to be just and appropriate.

Respectfully submitted,

P eter E. Sitkin

Stafford Smith '

ISIDOOR B oRNSTEIN

Gilbert Graham

1095 Market Street, Suite 312

San Francisco, California 94103

Telephone: (415 ) 626-3811

Attorneys for Plaintiffs

Steven A ntler

2701 Folsom Street

San Francisco, California 94110

B rian Glick

Henry F reedman

401 West 117th Street

New York, New York 10027

Of Counsel

STATUTES

California W elfare and Institutions Code:

Section 12200. Grounds; report of suspension; effect of

eligibility for medical assistance. The county may for

cause, and upon instructions so to do by the department,

shall cancel, suspend, or revoke aid. Upon request of the

department, an immediate report of every suspension shall

be made to the department stating the reason for the sus

pension and showing the action of the board of supervisors

in approving the suspension.

Eligibility for medical assistance for the aged does not

constitute cause for retroactive cancellation, suspension, or

revocation of aid.

Section 12201. Notice to recipient. I f the board of super

visors, in accordance with Section 12200, cancels, suspends,

or revokes aid, the recipient shall be immediately notified

in writing of the county’s action, the date thereof, and of

the reason therefor and the recipient’s right to appeal there

from.

Section 10950. Opportunity; recipient defined. I f any ap

plicant for or recipient of public social services is dissatis

fied with any action of the county department relating to

his application for or receipt of aid or services, or if

his application is not acted upon with reasonable prompt

ness, or if any person who desires to apply for such aid

or services is refused the opportunity to submit a signed

application therefor, and is dissatisfied with such refusal,

he shall, in person or through an authorized representative,

without the necessity of filing a claim with the board of

supervisors, upon filing a request with the department, be

accorded an opportunity for a fair hearing.

As used in this chapter, “ recipient” means an applicant

for or recipient of aid or services except aid or services

exclusively financed by county funds.

Appendix 13

E X H I B I T A (to com p la in t)

14 Appendix

E X H I B I T B (to com p la in t)

November 16, 1967

State Department of Social Welfare

Fair Hearing Section

1407 Market Street

San Francisco, California 94103

R e : Mrs. Mae Wheeler

1855 15th Street

San Francisco, California

OAS #38-10-56380

Gentlemen:

Mrs. Wheeler has authorized me to represent her in her

request for a Fair Hearing and in other proceedings neces

sary to have her Old Age Security payments immediately

re-instated.

Since September 1, 1967, Mrs. Wheeler has not received

any old age assistance because the local Social Services

Department ruled that she transferred some of her deceased

son’s property in order to qualify for aid. This decision is

contrary to the facts and a misapplication of the law and

regulations—I request an immediate fair hearing.

As you should be aware, Mrs. Wheeler is 75 years old, and

in extremely poor health. Her regular assistance budget

includes money for a special diet as well as other vital

additional items. At the present time, my client must live

on Social Security payments of $44.00 monthly. She has

no other income or assets. I hereby request that your de

partment grant Mrs. Wheeler continued full assistance

pending the decision of the fair hearing— she cannot sur

vive without this money.

By letter dated November 7, 1967, Mrs. Wheeler was in

formed that her grant was discontinued effective August

31,1967, because of “ ineligibility due to transfer of personal

property.” On November 1, 1967, she had been informed

by letter that “ Your September and October, 1967, warrants

which were withheld, will be decreased to zero because of

lump sum death benefits received by beneficiary which re

sulted in overpayments in August and September.” Mrs.

Wheeler had first discovered that her eligibility was ques

tioned when she inquired why she had not received her

regular September 1st check.

The San Francisco Department challenges Mrs. Wheeler’s

payment to her grandson, Bobby Lee Wheeler of the pro

ceeds of a Veterans Insurance Poliey left by her son, R. L.

Wheeler who died February 5, 1967. There is no question

that the policy was actually paid to Bobby Lee Wheeler,

and that Mrs. Wheeler no longer has any money remaining.

The Department relies on Section 41-321.321, PSS Manual

[Applicant or Recipient Unable to Account for Disposition

of Property], as the basis of its action. Assistance was dis

continued in spite of Mrs. Wheeler’s explanation that her

son while in the hospital following his heart attack made

her promise to pay the policy over to his nephew. Mrs.

Wheeler has supplied the Department with two affidavits

from her grandson explaining in detail the circumstances of

the original loan and the arrangements for its repayment

as well as her own four page affidavit on this subject.

Section 41-321.1 PSS Manual states:

Although only the person concerned can state what

his intent was in transferring property, his actions

can support or contradict such statement and his real

intent can he determined only by consideration of all

the facts, (emphasis added)

Appendix 15

16 Appendix

Here all the facts clearly substantiate Mrs. Wheeler’s claim

and rebute any possible presumption that she was attempt

ing to illegally remain eligible for assistance.

Additionally, the Department’s reduction to zero of Mrs.

Wheeler’s September and October grant is violative of the

law. Appellant also reserves her rights to present all rele

vant testimony and argument challenging every aspect of

the local department’s action of suspending, reducing and

discontinuing her grant.

Mrs. Wheeler stated in her October 18th letter (accompany

ing the material she submitted to her social worker), “my

situation has become desperate as I do not have enough

money to live on without my OAS grant.” As Mrs. Wheeler

has a constitutional right to a hearing prior to discontinuing

of her old age assistance, immediate resumption of assist

ance prior to the hearing is required.

If I do not hear from you within one week, I will be forced

to resort to court action.

Sincerely,

Marvin S. K ayne

Attorney at Law

B y ......................................................

Steven J. A ntler

SJA/aee

CC: Commissioner John Montgomery

A uthorization

I hereby authorize as my representatives in connection with

this welfare appeal: Marvin S. Kayne, Esq., Peter E. Sitkin,

Esq., and Mr. Steven J. Antler, 2701 Folsom Street, San

Francisco, California.

Dated: November 16, 1967.

, /s / Mrs. Mae W heeler

Mrs. Zulma Mae Wheeler

In the United States District Court for the

Northern District of California

[TITLE OMITTED IN PRINTING]

AFFIDAVIT IN SUPPORT OF MOTION

FOR TEMPORARY RESTRAINING ORDER

AND PRELIMINARY INJUNCTION

State of California

City and County of San Francisco—ss.

Mrs. Mae Wheeler, having been duly sworn, deposes

and says:

1. I am the plaintiff in the above-entitled action.

2. I am a 75 year old widow who regularly resides at

1855 - 15th Street, City and County of San Francisco, a

Public Housing Project for the elderly.

3. For approximately the last ten years my sole source

of support has been Old Age Security (OAS) and Social

Security (OASDI) payments.

4. My last OAS check came on about August 1, 1967,

and I haven’t received any money under the OAS program

since that date.

5. The reasons given for terminating my OAS are com

pletely untrue. I transferred my deceased son’s insurance

policy to his nephew to satisfy my son’s debt. I never in

tended to affect my OAS eligibility. Through my repre

sentative, I requested continued OAS assistance until I

could vindicate myself at a fair hearing.

6. I was living on my allowable reserve income and my

Social Security payments ($44.60 monthly) until about No

vember 10, 1967, when I ran completely out of funds.

Appendix 17

18 Appendix

7. On or about November 25, 1967, I finally received an

emergency food order for $15.60 and have been promised

$43.90 monthly from the County General Assistance

Program.

8. I have no money whatsoever on hand now. I can’t

pay my December rent of $49 or buy any household or other

items I need.

9. I am a diabetic who needs a special diet of foods such

as meats and sugar free fruits, which are much more ex

pensive than regular foods. I have difficulty buying these

items on my full OAS budget.

10. I also suffer from heart disease and high blood

pressure. I am currently confined to Hahnemann Hospital

on doctor’s orders as a result of my many ailments, but I

expect to be released from the hospital within the next few

days.

11. I am extremely worried and nervous because I don’t

know how I can possibly live without my full OAS grant.

/ s / M bs. Mae W heeler

Mrs. Mae Wheeler, Affiant

Appendix 19

In the United States District Court for the

Northern District of California

[TITLE OMITTED IN PRINTING]

SUPPLEMENTAL AFFIDAVIT IN SUPPORT

OF MOTION FOR TEMPORARY RESTRAINING

ORDER AND PRELIMINARY INJUNCTION

State of California

City and County of San Francisco—ss.

A rthur C. A gnos, being duly sworn, deposes and says:

I received a Master of Social Work Degree (MSW) in

April, 1966. I have been Assistant Director of Human Re

lations and Social Services with the San Francisco Public

Housing Authority since September, 1966.

Mrs. Mae Wheeler was referred to my office by one

of the Housing Authority’s Review Clerks. When she saw

the Review Clerk, she expressed concern about not receiving

her OAS check.

Mrs. Wheeler called my office on September 14, 1967,

claiming that she had not received her OAS check and her

situation was becoming more and more desperate. She

seemed extremely anxious and was crying. I reassured her

that I would help her and would call the Department of

Social Services.

On the same day, September 14, I called Mrs. Wheeler’s

welfare worker, Mrs. Geraldine Palmer, and asked for

clarification of the situation. She explained that Mrs. Wheel

er’s check had been suspended until an investigation could

be made. She told me that, since I was not Mrs. Wheeler’s

representative, she could not discuss the case with me. How-

20 Appendix

ever, she did tell me that the Department had received an

anonymous phone call telling them that Mrs. Wheeler had

received an inheritance and should not be receiving welfare

assistance. I asked why Mrs. Wheeler had not been told

this and she explained that she had been away on vacation

and had just returned to a pile of work. I stressed the fact

that Mrs. Wheeler was an emergency situation and merited

immediate attention. I strongly questioned the fact that the

OAS check had been cut off on the basis of an anonymous

phone call without any discussion with Mrs. Wheeler. I

demanded immediate action to correct the situation. The

welfare worker said that she would see what she could do.

Shortly after my telephone conversation with the welfare

worker, I received a call from her supervisor, Mrs. Ream,

who questioned my involvement in the case. I explained that

part of my job as a social worker with the Housing Author

ity often necessitated helping Housing Authority residents

with welfare problems. More specifically, Mrs. Wheeler had

requested that I act in her behalf as she was at a loss as

to what to do.

The supervisor refused to discuss the case with me stat

ing that the problem was between the Department and the

Recipient and the Department would take it up “ in our good

time.” I refused to accept the statement that the Department

would take the situation up “ in our good time” as I was

acutely aware of Mrs. Wheeler’s increasingly desperate con

dition. I again strongly disagreed with the way in which

Mrs. Wheeler had been treated on the basis of an anonymous

phone call. I insisted that something be done immediately to

correct the situation. The supervisor explained that the

assigned worker had been on vacation and could not see Mrs.

Wheeler. I questioned delaying action on a matter which in

volved the major part of a 75 year old ill woman’s income,

and that I was not satisfied with the situation.

Appendix 21

I immediately called Miss Trudy Kanner, Supervisor of

the Community Services Division, explained the situation

and requested an immediate opportunity to do something to

get Mrs. Wheeler’s aid restored. She agreed to look into the

matter immediately. Shortly thereafter Miss Kanner called

back to tell me that we would have the opportunity on Mon

day, September 18.

I arranged for Mrs. Wheeler to sign a “ release of informa

tion” in order that the Department would discuss the case

with me. On Friday, September 15, I was present during a

home visit by the welfare worker who told us what state

ments were needed. Over the weekend I helped Mrs. Wheel

er gather and prepare the required information.

On Monday, September 18,1 appeared with Mrs. Wheeler

and a relative at the Department of Social Services. We

were met by Mrs. Wheeler’s welfare worker and a man who

was introduced as a representative from the County Fail-

Hearings Section. I presented the prepared statements to

the welfare worker who briefly scanned them. Mrs. Wheeler

stated that she had not intended to deceive the Department,

but was only carrying out her late son’s dying wish. Mrs.

Wheeler asked when her aid would be restored. The wel

fare worker replied that at this meeting she could only re

ceive the prepared statements from us. In turn, she would

forward them to administrative superiors for a decision.

Mrs. Wheeler asked how long it would take for a decision.

The representative from Fair Hearing Section stated that

she would be notified about the decision. I asked the repre

sentative what his role was in today’s meeting. He answered

that he was only present as an “ observer.” This entire meet

ing lasted approximately ten minutes and absolutely no

decision was rendered. It was only to present the prepared

statements to the welfare worker,

22 Appendix

On September 22, I called the welfare worker to learn of

any decision. She informed me of additional information

which was required to amplify on the earlier statements. A.

letter was received outlining the additional information re

quired. I immediately set about compiling the considerable

amount of additional information. This involved writing to

Texas for a statement from another ill son, supplemental

statements from a nephew, driving to Milpitas with Mrs.

Wheeler to try to determine the disposition of a home pur

chased by her deceased son in 1962.

On October 16, 1967, Mrs. Wheeler presented the addi

tional information required to the welfare worker.

On October 19, 1967, the welfare worker telephoned Mrs.

Wheeler and me to inform us that her OAS grant had been

restored. She told me that there had been a transfer of funds

but it was not considered intentional, and the aid was to be

restored.

On October 23, 1967, another phone call from the welfare

worker informed Mrs. Wheeler and me that the aid was not

to be restored. The decision had been reversed by admin

istrative higher ups. She suggested that Mrs. Wheeler could

request a fair hearing.

At this point I felt I had exhausted all of my professional

resources. I recommended to Mrs. Wheeler that we apply

for legal assistance from the San Francisco Neighborhood

Legal Assistance Foundation.

/s / A rthur C. A gnos

Arthur C. Agnos

Appendix

TEMPORARY RESTRAINING ORDER

23

In the United States District Court

for the Northern District of California, Southern Division

Civil Action No. 48303

Mae W heeler, et al.,

v.

John Montgomery, et al.,

Plaintiffs,

Defendants,

TEMPORARY RESTRAINING- ORDER

The plaintiffs have filed this action to declare uncon

stitutional California Welfare & Institutions Code Sec

tions 12,200, 12,201 and 10,950, which authorizes the ter

mination, suspension or revocation of financial aid under

the Old Age (OAS) program prior to the granting of

reasonable and adequate notice and opportunity for a hear

ing. They have made application for the hearing of this

cause for a declaratory judgment, preliminary and per

manent injunction before a Three-Judge District Court

pursuant to Title 28, United States Code, Sections 2281

and 2284.

This action coming on to be heard on December 1, 1967,

on the motion of plaintiffs for a temporary restraining

order, and adequate notice having been given to defend

ants; and the Court having considered the affidavits and

memoranda presented and the arguments of counsel for

all parties, and being fully advised in the premises, it makes

the following findings of fact and conclusions of law:

,24 Appendix

FINDINGS OF FACT

1. Defendants withheld and thereafter terminated plain

tiff Mae Wheeler’s aid under the OAS program without

affording her reasonable notice and an opportunity for a

prior hearing.

2. Plaintiff Mae Wheeler’s minimum monthly need as

of August 31, 1967 was determined by defendants to be

$158.55 and was met through direct Social Security benefits

of $44.60 and an Old Age Security grant of $113.95. As a

consequence of the termination of Old Age Security, she

now has been promised County General Assistance in the

sum of $53.90 a month which, when added to her direct

Social Security payments totals $98.50 a month.

3. Defendants have refused plaintiff Mae Wheeler’s

request for restoration and continuation of aid under the

OAS program.

4. Defendants’ withdrawal and termination of aid and

their continued refusal to reinstate plaintiff Mae Wheeler’s

aid has caused and is causing plaintiff Mae Wheeler imme

diate and irreparable injury in that she will not have suffi

cient funds with which to subsist on a day-to-day basis

without her full OAS payment.

5. Irreparable injury has been shown only with respect

to plaintiff Mae Wheeler and no proof so far has been pre

sented of any others in the class who are likely to suffer

immediate and irreparable injury.

CONCLUSIONS OF LAW

Defendants’ termination of plaintiff Mae Wheeler’s aid

under the OAS program pursuant to California Welfare &

Institutions Code Sections 12,200 and 12,201 and the regu

lations promulgated thereunder without a prior hearing

Appendix 25

and reasonable notice raises a substantial question as to

whether the due process clause of the Fourteenth Amend

ment to the U.S. Constitution has been violated.

Upon the foregoing, it is, by the United States District

Court for the Northern District of California, Southern

Division, this 1st day of December, 1967

ORDERED:

1. That the defendants John Montgomery and Ronald

Born, their agents, servants, and employees be, and they

are hereby restrained effective December 1, 1967 from

enforcing against the plaintiff Mae Wheeler the provisions

of the California Welfare and Institutions Code Sections

12,200, 12,201, and 10,950, et seq., and implementing the

Rules and Regulations of the State Department of Social

Welfare, so that Old Age Assistance shall be restored to

plaintiff Mae Wheeler forthwith in the amount to which

she may be found eligible in order to meet her needs as

established under the Old Age Security program until such

time as a determination is made by this Court regarding

plaintiff’s application for convening a Three-Judge Court

pursuant to Title 28 U.S.C. 2281 and 2284.

26 Appendix

2. That action on plaintiff’s application for the conven

ing of a Three-Judge Court shall be deferred for 30 days

until January 2, 1968, at 5 p.m. without prejudice to any

of the parties herein.

A lfonso J. Zirpoli

District Court Judge

Signed on December 6,1967.

APPROVED AS TO FORM :

T homas C. Lynch

Attorney General

By E lizabeth P almer

Deputy Attorney General

Attorneys for Defendant

J ohn Montgomery

T homas M. O’Connor,

City Attorney

By......................................................

Raymond D. Williamson, Jr.

Deputy City Attorney

Attorneys for Defendant Ronald Born

Appendix 27

MEMORANDUM ©PINSON PERMITTING CLASS ACTION AND

CERTIFYING NECESSITY OF CONVENING THREE-JUDGE

DISTRICT COURT.

United States District Court

For the Northern District of California

No. 48303

Mae Wheeler, individually and on behalf

of all others similarity situated,

Plaintiffs,

vs.

John Montgomery, individually and in his

capacity as Director of the California

State Department of Public Welfare,

and Ronald Born, individually and in

his capacity as General Manager of the

San Francisco City and County Depart

ment of Social Services,

Defendants.

MEMORANDUM OPINION AND ORDER DENYING

CONTINUANCE, ORDER PARTIALLY VACAT

ING PRIOR ORDER, ORDER PERMITTING

CLASS ACTION, ORDER DENYING MOTIONS

TO INTER VENE, ORDER DENYING MOTION TO

MODIFY TEMPORARY RESTRAINING ORDER,

NOTIFICATION AND CERTIFICATION OF

NECESSITY OF THREE JUDGE COURT.

FACTS AND PROCEEDINGS TO DATE

Plaintiff has filed a complaint, in forma pauperis, seeking

injunctive and declaratory relief against a California wel

fare practice authorized by state statutes which permit the

termination of old age security benefits prior to affording

the recipient a hearing on his supposed ineligibility. The

28 Appendix

statutes which are involved are CAL. W ELF. & INST.

CODE §§ 12,200, 12,201. The complaint is in the form of

a class action.

The facts alleged pertaining to the named plaintiff are

as follows: As of August 30,1967, Mrs. Wheeler was receiv

ing old age benefits in the amount of $113.95. Defendants

received information that Mrs. Wheeler had received some

$6,000.00 in insurance proceeds and had transferred the

money to her grandson. Defendants determined that Mrs.

Wheeler’s alleged action rendered her ineligible for con

tinued benefits because she had had more money than the

maximum permitted while maintaining eligibility.

Mrs. Wheeler’s benefit cheeks had, at the time the suit

was filed, been withheld since September 1, 1967, although

she came to receive general assistance in the amount of

$53.90 until December 1, 1967, the date on which this court

heard argument on the propriety of a temporary restrain

ing order restoring old age benefits and on the need for a

three judge court.

On December 6, 1967, this court issued a temporary re

straining order to avoid irreparable injury to Mrs. Wheeler,

the court having been satisfied by plaintiff’s showing that

such injury was occurring. The court also stayed further

proceedings for thirty days to permit Mrs. Wheeler to

appeal to a state referee to adjudicate her dispute with the

County of San Francisco.

Prior orders in no way were a determination of the merits

of plaintiff’s claims, but merely endeavored to preserve

the status quo pending the court’s determination of the

questions involving a three judge court and a class action.

The court recognizes that the result of the appeal will in

no way affect the existence of a case or controversy be

tween the parties over the constitutionality of the statutes

Appendix 29

here challenged. No restraining order was issued applicable

to any other member of the alleged class because no show

ing was made of an imminent threat of irreparable harm.

The court expressly allowed appropriate showing to be

made as instances of threatened irreparable harm arose.

Since December 6, 1967, plaintiff’s counsel have made

motions for intervention and a motion for modification of

the temporary restraining order to include the entire alleged

class. The court deems the showings made with respect to

persons other than Mrs. Wheeler inadequate to warrant

further injunctive relief at this time.

Defendants’ counsel have requested a continuance of the

argument scheduled on some of the motions and on the

questions of the three judge court and class action. Having

heard further argument on December 15, 1967, the court

deems that no continuance is necessary, that the pleadings

constitute a more-than-adequate record on which to base

rulings on the matters now pending before the court, and

that the court’s duty is to determine certain of the questions

involved by referring to the complaint in this action. The

court is satisfied that any previous stay of these proceed

ings to permit further argument has been rendered unneces

sary by the court’s own examination of the issues involved

in this case and by further argument and documents filed

by the parties.

JURISDICTION: NEED FOR A THREE JUDOE

COURT

Plaintiff’s basic contention is that to terminate old age

benefits without first giving the recipient a hearing is to

deny a recipient due process of law. Plaintiff contends that

the right to a hearing prior to termination may be found

either in the due process clause, U.S. Const., amend. 14,

3G Appendix

or in portions of the Social Security Act, specifically 42

U.S.C. § 1382(a)(4) and certain regulations promulgated

pursuant thereto. Plaintiff’s attack is merely on the proce

dural method by which aid is terminated. She disclaims

any contention that under the facts as alleged by defend

ants to exist, aid may not be terminated. She merely says

that a hearing on the question of eligibility must be held

prior to the termination.

Actually, three potential constitutional challenges lurk

in the pleadings of this case: (1) California’s termination

statutes are repugnant to the due process clause of the

fourteenth amendment; (2) California’s termination stat

utes are repugnant to provisions of the Social Security

Act; (3) if California’s termination statutes are not repug

nant to the Act, the Act is repugnant to the due process

clause of the fifth amendment. While the second enumerated

contention does not require a three judge court, Swift &

Co., Inc. v. Wickham, 382 U.S. 111 (1965), the first and

third do, 28 U.S.C. §§ 2281, 2282.

The requirements of § 2281 are satisfied in this case:

a state statute is challenged as repugnant on its face to

the federal constitution; an injunction is sought; a state

officer is a defendant ; the statute has statewide application.

This court cannot say the federal question presented is

not substantial in the sense that term is used with reference

to the propriety of a three judge court. Just “ how much

due process” is required is a difficult question to decide when

administrative proceedings are involved. Also, the precise

question presented—whether a hearing prior to adminis

trative action is required—is a difficult question which has

engendered considerable debate and litigation. Though not

resolved, a situation strikingly similar to the one in this

ease has been presented to and reached the Supreme Court.

Thorpe v. Housing Authority of the City of Durham, 386

U.S. 670 (1967).

Appendix 31

Recent years have seen an increasing number of deci

sions dealing with the question of public entities attempting

to terminate “benefits” without hearings. E.g., Slochower v.

Board of Higher Education of New York City, 350 U.S.

551 (1956); Wasson v. Trowbridge, 382 F. 2d 807 (2d Cir.

1967); Dixon v. Alabama State Board of Education, 294

F. 2d 150 (5th Cir. 1961), cert, denied, 368 U.S. 930 (1961);

Teel v. Pitt County Board of Education, 272 F. Supp. 703

(E.D. N.C. 1967). But cf., e.g., Cafeteria & Restaurant

Workers Union v. McElroy, 367 U.S. 886 (1961); Vitarelli

v. Seaton, 359 U.S. 535 (1959). See also 1 Davis, Adminis

trative Law §§ 7.04-7.20; Silver, How to Handle a Welfare

Case, 4 Law in Trans. Q. 87, 100 n. 54 and accompanying

text (1967); Note, Federal Judicial Review of State Wel

fare Practices, 67 Colum. L. Rev. 84, 93 (1967). Based on

a review of the above and other authorities, this court must

conclude that the precise federal question presented by

this case is substantial and that a three judge court is

required to ultimately dispose of the issues.

CONSIDERATIONS PERTAINING TO A CLASS

ACTION

The prayer for declaratory and injunctive relief raises

common issues of law for each member of the class; namely,

whether a termination of benefits without a prior hearing

denies a recipient his rights under the United States Con

stitution. All members of the class are governed by the

same California procedures and statutes.

The court concludes that the prerequisites of Fed. R.

Civ. P. 23(a) are satisfied. Similarly, the requirement of

Fed. R. Civ. P. 23(b) (2) is satisfied.

The foregoing memorandum opinion and the orders

which follow dispose of the matters presently scheduled

32 Appendix

to be beard on January 2,1968, and of all other preliminary

matters now pending before this court. Hence, absent fur

ther pleadings by the parties, no further action or appear

ances will be required of the parties prior to the convening

of the three judge court.

ORDERS

1. The court being satisfied that a continuance would

serve no useful purpose in disposing of the merits of this

case, It Is Ordered that defendants’ motion for a contin

uance is denied.

2. The court being, satisfied that further delay in the

resolution of pending matters would not aid the court in

ruling on such matters, and the court having examined the

pleadings and authorities relevant to the rulings made this

day, It Is Ordered that any prior order of this court is

vacated to the extent such order stayed further proceedings

preliminary to the court’s ruling on any matter ruled upon

this day.

3. Pursuant to Fed. R. Civ. P. 23(a), (b )(2 ), (c)(1 ),

and (d )(2 ), It Is Ordered that a class aetion for declara

tory and injunctive relief may be maintained, the class to

consist of all recipients of old age benefits subject to Cali

fornia termination statutes, and that plaintiff shall forward

to the United States Attorney at San Francisco and to the

Secretary of the Department of Health, Education and

Welfare, notice of the pendency of this action, together

with a copy of the pleadings heretofore filed with the court

and with a copy of this memorandum opinion and these

orders.

4. The court being satisfied that the showings hereto

fore made on behalf of the putative intervenors are not

substantial enough to require intervention, and the court

Appendix 33

being satisfied that the rights of all members of the class

will be protected without the intervention, It Is Ordered

that all motions to intervene on, file on the date of this

order are denied.

5. The court being satisfied that the showings hereto

fore made in support of the motion to modify the tempo

rary restraining order are insufficient to justify further

injunctive relief at this time by this court, It Is Ordered

that the motion to modify the temporary restraining order

is denied without prejudice to such reconsideration as may

be appropriate of requests for interim relief.

6. The court will notify the chief judge of the ninth

circuit that in this court’s opinion a three judge court is

required to resolve the issues in this case.

Dated: December 20,1967

A lfonso J. Zirpoli

United States District Judge

Filed Feb. 20, 1967

■ In the United States District Court

for the Northern District of California

[TITLE OMITTED IN PRINTING]

ANSW ER TO COMPLAINT

Comes now the defendant RONALD BORN, individually

and in his capacity as General Manager of the San Fran

cisco City and County Department of Social Services, and

answering, the complaint of plaintiffs on file herein, admits,

denies and alleges as follows:

I

Denies each and every, all and singular, generally and

specifically, the allegations contained in paragraphs I, II,

III, IV, VI, X , XI, XII, X III, XV, XVI, XVII, XVIII,

X IX and X X of said complaint.

II

Answering the allegations of paragraph X IV of said

complaint this answering defendant states that he has no

information or belief upon the subject sufficient to enable

him to answer any of the said allegations, and placing his

denial on that ground, this defendant denies each and every,

all and singular, generally and specifically, said allegations.

III

Answering the allegations of paragraph V II of said com

plaint, Ronald Born states that he is the Director of the

Department of Social Services for the City and County

of San Francisco.

IV

Answering the allegations of paragraph IX of said

complaint, this defendant admits that, in accord with due

process, a “ fair hearing” is afforded any recipient who feels

34 Appendix

Appendix 35

aggrieved by a decision to terminate aid, and Mae Wheeler

received suck fair hearing, on December 22, 1967.

V

Further answering the allegations of paragraph X of

said complaint, this defendant states that plaintiff has been

a recipient of old age security for a period of about ten

(10) years.

VI

Further answering the allegations of paragraph X II of

said complaint, this defendant states, on information and

belief, that plaintiff was contacted by telephone on August

30, 1967, and, in that telephone conversation, admitted re

ceiving and subsequently transferring funds received due

to the death of her son; that plaintiff had not notified

the Department of Social Services of the existence or dis

position of these funds; and that no check was withheld

until after plaintiff had admitted receiving and disposing

of funds received due to the death of her son.

VII

Further answering the allegations of paragraph X V I

of said complaint, this defendant states that a fair hearing

was conducted on December 22, 1967, and plaintiff has

been mailed her December check for Old Age Security.

Wherefore, defendant prays that plaintiffs take nothing

by their complaint on file herein, that said defendant have

judgment for his costs of suit herein incurred and for such

other and further relief as to the court may seem proper.

Dated: December 26, 1967.

T homas M. 0 ’Connor

City Attorney

R aymond D. W illiamson, Jr.

Deputy City Attorney

In the United States District Court

for the Northern District of California

[TITLE OMITTED IN PRINTING]

Civil Action No. 48303

ANSW ER TO COMPLAINT

Comes now the defendant John Montgomery, individu

ally and in his capacity as Director of the California State

Department of Social Welfare and answering the complaint

of plaintiffs on file herein, admits, denies and alleges as

follows:

I

Denies each and every, all and singular, generally and

specifically the allegations contained in paragraphs I, II,

III, IV, VI, XI, XVII, X V III and X X of said complaint.

II

Admits the allegations contained in paragraphs V, VII,

VII, IX and X IV of said complaint.

III

Denies the allegations contained in paragraph X and

alleges that plaintiff is a 75 year old widow who had been

receiving Old Age Security continuously and in varying

amounts since December 1959 to supplement her social

security benefits which she currently receives in the amount

of $44.60 per month.

IV

Answering the allegations contained in paragraphs X II

and X III of the complaint, this defendant is informed and

believes and on the basis of such information and belief

alleges that plaintiff was contacted by defendant county

on August 30, 1967, and, in that telephone conversation

36 Appendix

Appendix 37

plaintiff admitted receiving and subsequently transferring

the proceeds of a check in the sum of $4,582.15 to her

grandson, Bobby Lee Wheeler. On the basis of such infor

mation and belief defendant further alleges that no Old

Age Security check was withheld until after plaintiff had

admitted receiving and disposing of said funds over six

months previously and without at any time having, notified

defendant county of her receipt or transfer of said funds.

Defendant further alleges that while withholding plain

tiff’s Old Age Security check defendant county granted

general assistance funds to plaintiff.

y

Denies the allegations contained in paragraphs X V and

alleges that on or about November 2, 1967, defendant

county took the following actions with respect to plaintiff:

1. Discontinued Old Age Security, effective August 31,

1967, and cancelled the subsequently withheld warrants,

and

2. Requested repayment of all Old Age Security paid

to the claimant for the period May 1 through August 31,

1967.

VI

Admits the allegations contained in paragraphs IX and

X V I and alleges that the hearing referred to in said para

graphs came on for hearing on December 22, 1967.

That thereafter on January 12,1968, the defendant John

Montgomery, Director of the Department of Social Wel

fare, adopted the proposed decision of the hearing officer.

A copy of said proposed decision of defendant John Mont

gomery is attached hereto as Exhibit 1. Said decision or

dered that the plaintiff’s claim be granted and that the

defendant County restore Old Age Security, effective Sep

tember 1, 1967, in the amount to which plaintiff-claimant

is otherwise eligible and to cancel any demand made by

38 Appendix

defendant county on plaintiff for repayment of Old Age

Security for the period of May through August 1967.

VII

Denies the allegations contained in paragraph X IX and

alleges that on January 19, 1968, defendant Director held

a public hearing pursuant to California Government Code

sections 11420 et seq. for the purpose of permitting indi

viduals and others to present and discuss their views in

regard to a proposed regulation amending sections 44-325.4,

44-235.44, 40-181.1, 40-181.32, and 40-1255 of the Public

Social Services Manual of the State Department of Social

Welfare. A copy of said proposed regulation is attached

hereto as Exhibit 2. The explanatory statement issued by

defendant Director (pursuant to Government Code section

11424) with respect to the proposed amendment of said

regulation is attached hereto as Exhibit 3.

Defendant will ask leave of court to amend this Answer

following defendant Director’s action with respect to said

proposed regulations.

Wherefore, defendant prays that plaintiffs take nothing

by their complaint on file herein, that said defendant have

judgment for his costs of suit herein incurred, and for such

other and further relief as to the court may seem proper.

Dated: January 18, 1968

T homas C. Lynch

Attorney General

R ichard L. Mayers

Deputy Attorney General

E lizabeth Palmer

Deputy Attorney General

Attorneys for State

Department of Social Welfare,

John C. Montgomery,

Director.

Appendix 39

Exhibit 1 to Montgomery Answer

CONFIDENTIAL

Information in this decision is protected by Section 10850,

Welfare & Institutions Code. Violation of this section is a

misdemeanor.

Before the Department of Social Welfare

of the State of California

Adopted by the Department of Social Welfare

State of California

Director

Jan. 15, 1968

John C. Montgomery

State No. 38-10-56380

In the Matter of the Hearing of

Mae W heeler

Claimant

PROPOSED DECISION

SUMMARY

Where it has not been established that the claimant trans

ferred personal property for the purpose of maintaining

eligibility to receive Old Age Security (OAS), she was

eligible to receive that aid without interruption (Public

Social Services Manual Section 41-321).

This matter, originally scheduled for hearing on Decem

ber 15, 1967, was postponed and then came on for hearing

40 Appendix

before Maurice Rosen, Referee for the State Department

of Social Welfare, at 9 a.m., December 22, 1967, in Room

400, 1407 Market Street, San Francisco, California. The

following persons were present:

Mrs. Mae Wheeler, claimant

Mr. Peter Sitkin, Attorney, Neighborhood Legal Assistance

Foundation, and authorized representative of the claim

ant

Mr. Steven Antler, Law Clerk, Neighborhood Legal Assist

ance Foundation

Mr. Bobby L. Wheeler, grandson of the claimant

Mr. Arthur Agnos, Assistant Director, Human Relations,

San Francisco Housing Authority, and witness for the

claimant

Mr. J. P. Dowdall, Director, Social Services Program, San

Francisco County Department of Social Services

Mrs. Jane Rand, Division Supervisor, Aged Program, San

Francisco County Department of Social Services

Mrs. Anita Yao, Senior Supervisor, Aged Division, San

Francisco County Department of Social Services

Mrs. Rosella Rheaume, Social Work Supervisor, Aged Di

vision, San Francisco County Department of Social

Services

Miss Geraldine Palmer, Social Worker, San Francisco

County Department of Social Services.

Based on the evidence presented at the hearing, the State

ment of Fact, Reason for Decision, and Order are as follows:

STATEMENT OF FACT

I

San Francisco County discontinued OAS, effective Aug

ust 31, 1967, and has requested repayment of OAS granted

Appendix 41

during the months of May through August 1967, on the

grounds that during April 1967 the claimant had transferred

personal property to her grandson in order to maintain

her eligibility to receive OAS, and. thereby rendered herself

ineligible for public assistance as of May 1, 1967.

II

The request for a fair hearing was filed on November 21,

1967.

The claimant maintains that:

1. She transferred the funds in question to her grand

son, Bobby Lee Wheeler, in order to carry out the

wishes of her dying son, R. L. Wheeler.*

2. She did not make the transfer in order to qualify

for aid or to remain eligible for aid.

3. She was and continues to be eligible to receive OAS.

III

The issues in this case are:

1. Whether the claimant transferred personal prop

erty in order to qualify for OAS.

2. Whether the claimant was eligible to receive. OAS

on the point of property during months subsequent

to April 1967.*

IV

The claimant, a 75-vear-old widow, had been receiving

OAS continuously and in varying amounts since December

.1959 to supplement her Social Security benefit, currently

in the amount of $44.60 per month.

Although suffering from a heart condition and diabetes,

she lives alone in a San Francisco Housing Authority

apartment.

V

On February 5, 1967, the claimant’s son, R. L. Wheeler,

an ex-serviceman, died. On or about April 3,1967, the claim-

*In December 1967, the county restored OAS pendente-lite pur

suant to order of the Federal Court.

42 Appendix

ant, as beneficiary of her son’s veteran’s insurance, received

from the Veterans Administration a check for $4,528.15 and,

on or about April 6, 1967, she turned this amount over to

her grandson, Bobby Lee Wheeler.

VI

During the ensuing five months, the claimant was, on

several occasions, in touch with her social worker regarding

fluctuating needs and annual redetermination of eligibility**

but it was not until August 30, 1967 that the county learned

from an anonymous caller of receipt by the claimant of the

proceeds of her late son’s veteran’s insurance and the trans

fer of these proceeds to her grandson.

VII

On or about August 30, 1967, the county placed a hold on

the claimant’s OAS warrants and, during the ensuing two

months, undertook an intensive investigation of the cir

cumstances surrounding the property transfer. There were

numerous conferences involving the claimant, as well as her

grandson and the assistant director for human relations at

the public housing project, for the purpose of evaluating the

disposition of the funds received by the claimant from her

son’s estate.* Although the claimant’s OAS warrants were

** July 25,1967.

*The County also learned that, on various dates during the

spring and summer of 1967, the claimant had received the follow

ing additional proceeds from her son’s estate:

1. Back Wages ..................................... $ 110.22

2. Printers Union benefits ................... 1,100.00

3. Social Security death benefits........... 255.00

4. Veterans death benefit ....................... 250.00

However, it was likewise established by the county that the

claimant had expended most of these funds for her son’s funeral

and for legal services in connection with the estate and that there

fore, these funds of themselves would presumably not have affected

her ongoing eligibility for OAS.

withheld during this period, the county granted some

amounts of county general assistance to supplement the

claimant’s small monthly Social Security benefit,

VIII

On November 2, 1967, the county, having carefully

weighed the evidence, including sworn statements of the

several parties, in support of the claimant’s allegation that

she had transferred the insurance proceeds to her grandson

because of her promise to her son, concluded that the trans

fer was in fact a transfer to maintain the claimant’s eligibil

ity to OAS and therefore, took the following actions:

1. Discontinued OAS, effective August 31, 1967 and

cancelled the subsequent withheld warrants.

2. Requested repayment of all OAS paid to the claim

ant for the period of May 1 through August 31,1967,

and

3. Determined that the transferred assets, less the

$1,200 allowable reserve, would have supported the

claimant at the rate of $200 a month for sixteen-

and-a-half months, or until September 1968, when

she would presumably again qualify for OAS.

IX

In sworn statements submitted prior to the hearing as

well as at the hearing, the claimant and her grandson,

Bobby Lee Wheeler, declared that:

1. In 1962, the now deceased R, L. WHieeler borrowed

from his nephew Bobby Lee Wheeler, $3,000 in

order to purchase a home at 447 Heath Street, in

Milpitas, California.

2. In 1964, R. L. Wheeler borrowed from Bobby Lee

Wheeler, $750 in order to purchase an automobile.

3. After 1964, R. L. Wheeler borrowed smaller sums

of money from Bobby Lee Wheeler and, although

he made occasional repayments to Bobby Lee

Appendix 43

Wheeler, the amount which the uncle owed the

nephew by January 1967 totalled $4,200.*

4. Late in January 1967, R. L. Wheeler suffered a

massive heart attack and lived for approximately

one week thereafter.. During the final week of his

life, R. L. Wheeler, in the presence of the claimant

and Bobby Lee Wheeler, asked the claimant to re

pay to Bobby Lee Wheeler from the insurance pol

icy he had taken out in the claimant’s name many

years before, this debt of $4,200.**

5. R. L. AVlieeler died on February 5, 1967 and, in

accordance with his deathbed request, the claimant

. repaid to Bobby Lee Wheeler the full proceeds of

the veteran’s benefits ($4,528.15) which she received

in April 1967. It was understood that Bobby Lee

Wheeler would then remit to R. L. Wheeler’s

brother, 0. L. Wheeler, of Texas, $300f to reimburse

him for expense incurred by him in connection with

attendance at R. L. Wheeler’s funeral.

6. O. L. Wheeler then insisted that he had spent an

additional $200 in connection with his trip to Cali

fornia at the time of his brother’s funeral and, upon

his insistence that he receive this additional money

and to keep the family peace, Bobby Lee Wheeler

remitted an additional $200f to O. L. AVheeler, even

though this cut into part of the money his uncle

R. L. Wheeler had owed to him.

44 Appendix

*AVritten records were not kept but uncle and nephew were

allegedly fully aware of the amounts involved.

**R. L. Wheeler and his nephew Bobby Lee Wheeler had an

especially close relationship and, although B. L. Wheeler reportedly

owed other persons some $25,000 at the time of his death, he chose

to have his nephew repaid from the proceeds of the insurance.

t'Money order receipts, in the amounts of $300 and $200 respec

tively, from Bobby Lee AVheeler to O. L. Wheeler have been viewed

by the county representative.

Appendix 45

X

The county, in finding that the transfer was a transfer to

maintain OAS eligibility, considered that:

1. The claimant, as beneficiary of her late son’s veter

an’s insurance policy, was entitled to receive the

proceeds of it to meet her own needs.

2. The claimant withheld information regarding re

ceipt of the insurance proceeds during the period

of April through August 1967, although she had

ample opportunity to report the facts to her worker.

3. The claimant has been unable to submit adequate

supportive documentary evidence to substantiate

either Bobby Lee Wheeler’s claim of R. L. Wheeler’s

indebtedness to him or R. L. Wheeler’s acknowl

edgement of any such debt.

X I

At the hearing, the claimant’s authorized representative

submitted a memorandum and points of law in support of

his argument that the claimant was bound by the terms

of an oral trust to turn over the proceeds of her son’s

veteran’s pension to her grandson, Bobby Lee Wheeler.

REASON FOR DECISION

I

Section 41-321 of the Public Social Services Manual pro

vides that transfer of property made to qualify for aid

results in ineligibility. Circumstances under which the in

eligibility is presumed to exist as the result of property

transfer includes a transfer of property to reduce the re

maining holdings within the statutory maximum.

II

The same section, under the heading of Interpretation

(guide material), includes the following:

The reason an applicant transferred property, i.e., Ms

actual intent in doing so, is the single most essential

element to be considered in determining the effect of

the transfer npon his eligibility. A transfer of prop

erty is, in itself, disqualifying only when the transfer

or’s reason for making the transfer was to qualify for

a id . . .

In determining the transferor’s intent, it is necessary

to evaluate his stated reason for the transfer and the

consistency of such statement with the known facts.

The consideration received for the property trans

ferred may not have been adequate; the transfer may

have been ill-advised and/or the transferor, in making

the transfer, may have exercised poor judgment. How

ever, these facts alone do not automatically establish

that a transfer was disqualifying. The motive of the

transfer must be carefully scrutinized, the important

determination being the transferor’s actual reason for

the transfer and the relationship of that reason to his

application for aid.

III

We find, on a preponderance of the evidence, that the

claimant did not transfer personal property for purposes

of qualifying for OAS.

IV

Our conclusion in this respect is based upon the follow

ing:

1. In the absence of any internal inconsistencies or

other evidence to the contrary, we have credited the

testimony of the claimant and Bobby Lee Wheeler

that R. L. Wheeler owed his nephew, Bobby Lee

Wheeler, $4,200 and that, just prior to his death,

he had asked the claimant to repay this debt from

the proceeds of his veteran’s insurance policy.

2. Because of this deathbed request, the claimant felt

that she had a moral, if not legal, duty to transfer

46 Appendix

the proceeds of the insurance policy to her grand

son.

3. Under these circumstances, it cannot be concluded

that the transfer was a transfer to qualify for aid

within the meaning of the cited regulation (al

though there was failure on the part of the claimant

to meet her reporting responsibilities).*

ORDER

The claim is granted:

1. San Francisco County shall restore OAS, effective

September 1,1967, in the amount to which the claim

ant is otherwise eligible.

2. San Francisco County shall cancel any demand for

repayment of OAS for the period of May through

August 1967.

I hereby submit the foregoing which con

stitutes my report of the proceedings and

proposed decision in the above-entitled

matter, and recommend its adoption as the

decision of the Director of the State De

partment of Social Welfare.

/s ,/ Maurice R osen

Appendix 47

Maurice Rosen

Referee

Dated: J anuary 12,1968

Exhibit 2 to Montgomery Answer

DETERMINATION OF ELIGIBILITY

40-173 COUNTY DEPARTMENT RESPONSIBILITY

FOR NOTIFYING APPLICANTS AND RECIP

IENTS (Continued)

*cf. Public Social Services Manual Section 40.105.

48 Appendix

.4 Notification When Application is Withdrawn

Use Form DP A 8, Notice to Applicant Who Withdraws

Application. I f the county elects to deny the applica

tion, use Form ABCD 239.

.5 Notice to Recipient of his Responsibility

Use Form 239 C, Important Notice to All Recipients,

as specified below: