Dept. of Health and Human Services v. Florida Brief of Amicus Curiae

Public Court Documents

January 13, 2012

Cite this item

-

Brief Collection, LDF Court Filings. Dept. of Health and Human Services v. Florida Brief of Amicus Curiae, 2012. eae932a2-af9a-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/7f1e889e-c039-4e66-8672-5bbcdf537c13/dept-of-health-and-human-services-v-florida-brief-of-amicus-curiae. Accessed February 21, 2026.

Copied!

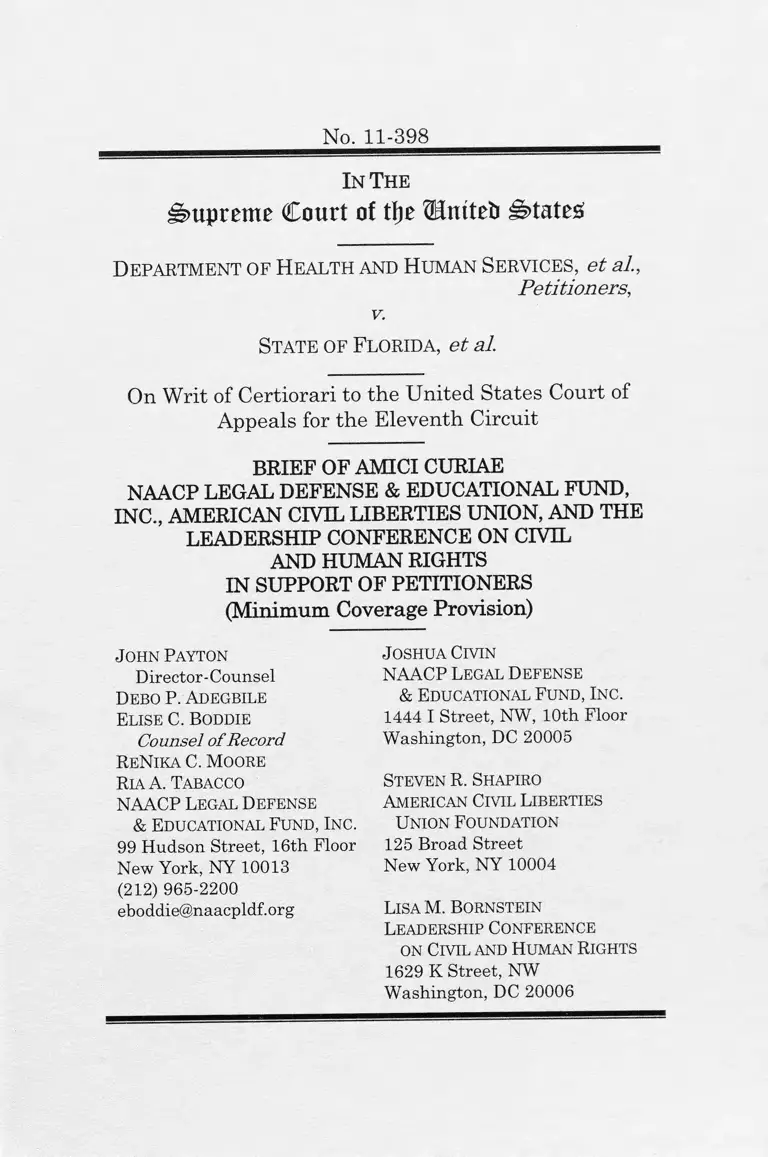

No. 11-398

In The

Supreme Court of tfje ii>tate£

Department of Health and Human Services, et al.,

Petitioners,

v.

State of Florida, et al.

On Writ of Certiorari to the United States Court of

Appeals for the Eleventh Circuit

BRIEF OF AMICI CURIAE

NAACP LEGAL DEFENSE & EDUCATIONAL FUND,

INC., AMERICAN CIVIL LIBERTIES UNION, AND THE

LEADERSHIP CONFERENCE ON CIVIL

AND HUMAN RIGHTS

IN SUPPORT OF PETITIONERS

(Minimum Coverage Provision)

Joshua Civin

NAACP Legal Defense

& Educational Fund, Inc.

1444 I Street, NW, 10th Floor

Washington, DC 20005

Steven R. Shapiro

American Civil Liberties

Union Foundation

125 Broad Street

New York, NY 10004

LisaM. Bornstein

Leadership Conference

on Civil and Human Rights

1629 K Street, NW

Washington, DC 20006

John Payton

Director-Counsel

Debo P. Adegbile

Elise C. Boddie

Counsel o f Record

ReNika C. Moore

Ria A. Tabacco

NAACP Legal Defense

& Educational Fund, Inc.

99 Hudson Street, 16th Floor

New York, NY 10013

(212) 965-2200

eboddie@naacpldf.org

mailto:eboddie@naacpldf.org

1

TABLE OF CONTENTS

TABLE OF CONTENTS........................................... i

TABLE OF AUTHORITIES................................... iii

INTERESTS OF AMICI...........................................1

SUMMARY OF THE ARGUMENT..........................3

ARGUMENT.............................................................5

I. The minimum coverage provision enhances

the ability of individuals to participate in

the economic, social, and civic life of our na

tion, thereby advancing equal opportunity

and personal liberty.............................................5

A. The uninsured are more likely to

experience conditions that inhibit the

quality of life.......................... 6

B. The minimum coverage provision

promotes equal opportunity....................... 9

C. The ability to self-insure is not analo

gous to any liberty interests recog

nized by this Court...................................12

1. The provision imposes minimal

burdens on liberty............................ 14

2. Under the Court’s Commerce

Clause jurisprudence, individuals

must sometimes yield economic

liberty to advance the collective

good.....................................................16

II. The Necessary and Proper Clause further

supports the constitutionality of the

minimum coverage provision.......................... 21

CONCLUSION

I l l

TABLE OF AUTHORITIES

Cases

Bond u. United States, 131 S. Ct. 2355 (2011)..... 13

Bryan v. Koch, 627 F.2d 612 (2d Cir, 1980)...........1

Cruzan v. Director, Missouri Department of

Health, 497 U.S. 261 (1990)......................... 14-15

Delaware v. Prouse, 440 U.S. 648 (1979)........ 15-16

Employment Division v. Smith, 494 U.S. 872

(1990)...................................................................20

Garcia v. Vanguard Car Rental USA, Inc., 540

F.3d 1242 (11th Cir. 2008)................................ 16

Gonzales v. Raich, 545 U.S. 1 (2005)........ . 18-19, 22

Griswold v. Connecticut, 381 U.S. 479 (1965)...... 15

Heart of Atlanta Motel, Inc. v. United States,

379 U.S. 241 (1964)....................................... 11

Hosanna-Tabor Evangelical Lutheran Church

& School v. EEOC, No. 10-553, 556 U.S. _ _

(2012)................................................................. 20

Jacobson v. Massachusetts, 197 U.S. 11 (1905).... 15

Katzenbach v. McClung, 379 U.S. 294 (1964)...... 11

Lawrence v. Texas, 539 U.S. 558 (2003)......... 11, 15

Linton v. Commissioner of Health &

Environment, 65 F.3d 508 (6th Cir. 1995)........... 1

Lochner v. New York, 198 U.S. 45 (1905)............. 13

McCulloch v. Maryland, 4 Wheat. 316 (1819).....21

Moore v. City of East Cleveland, 431 U.S. 494

(1977)................................................................ 15

IV

Mussington v. St. Luke’s-Roosevelt Hospital

Center, 824 F. Supp. 427 (S.D.N.Y. 1993).........

NLRB v. Jones & Laughlin Steel Corp., 301

U.S. 1 (1937)................................................. 14,

Ophthalmic Mutual Insurance Co. v. Musser,

143 F.3d 1062 (7th Cir. 1998)...........................

Parents Involved in Community Schools v.

Seattle School District No. 1, 551 U.S. 701

(2007)..................................................................

Planned Parenthood of Southeastern

Pennsylvania v. Casey, 505 U.S. 833 (1992).....

Rackley v. Board of Trustees of Orangeburg

Regional Hospital, 238 F. Supp. 512

(E.D.S.C. 1965)....................................................

Rochin v. California, 342 U.S. 165 (1952)............

Sabri v. United States, 541 U.S. 600 (2004).........

Seven-Sky v. Holder, 661 F.3d 1 (D.C. Cir.

2011) .................................................................................

Simkins v. Moses H. Cone Memorial Hospital,

323 F.2d 959 (4th Cir. 1963)..............................

Thomas More Law Center v. Obama, 651 F.3d

529 (6th Cir. 2011)....................................... 16,

United States v. Comstock, 130 S. Ct. 1949

(2010)...................................................... 21, 23-

United States v. Darby, 312 U.S. 100 (1941)........

United States v. Lee, 455 U.S. 252 (1982)....... 19-

United States v. Lopez, 514 U.S. 549 (1995)........

United States v. Wrightwood Dairy Co., 315

. 1

19

16

11

15

.. 1

15

23

22

,. 1

18

■24

19

■20

23

V

U.S. 110 (1942).................................................. 23

Washington v. Glucksberg, 521 U.S. 702

(1997)............................................................ 14-15

West Coast Hotel Co. v. Parrish, 300 U.S. 379

(1937)............................................................ 13-14

Wickard v. Filburn, 317 U.S. I l l (1942)......... 16-19

Federal Statutes

Health Care and Education Reconciliation Act

of 2010, Pub. L. No. 111-152, 124 Stat. 1029

(2010).....................................................................3

Patient Protection and Affordable Care Act,

Pub. L. No. 111-148, 124 Stat. 119 (2010).......... 3

26 U.S.C. § 5000A...................................................4

26 U.S.C. § 5000A(f)(l).........................................14

42 U.S.C. § 300gg..................................................21

42 U.S.C. § 300gg-l.................................................9

42 U.S.C. § 300gg-l(a)...........................................21

42 U.S.C. § 300gg-3(a)...........................................21

42 U.S.C. § 18091(a)(2)(A).................................. 4

42 U.S.C. § 18091(a)(2)(E)......................................8

42 U.S.C. § 18091(a)(2)(F).............................8-9, 22

42 U.S.C. § 18091(a)(2)(G)........................................7

42 U.S.C. § 18091(a)(2)(I)................................. 9, 22

V I

Court Filings

Consent Decree, Terry v. Methodist Hospital

of Gary, Nos. H-76-373, H-77-154 (N.D. Ind.

June 8, 1979)....................................................... 1

Other Authorities

James A. Baker III Institute for Public Policy

of Rice University, The Economic Impact of

Uninsured Children on America (Houston,

Tex.), June 2009................................................ 7-8

Robin A. Cohen et al., Health Insurance Cov

erage: Early Release of Estimates from the

National Health Interview Survey, 2010

(National Center for Health Statistics),

June 2011............................................................... 7

Jack Hadley, Sicker and Poorer: The Conse

quences of Being Uninsured (Kaiser Family

Foundation, Wash., D.C.), May 10, 2002.............7

Catherine Hoffman & Julia Paradise, Health

Insurance and Access to Health in the

United States, 1136 Annals N.Y. Acad. Sci.

149 (2008)..............................................................8

Institute of Medicine, Committee on the Con

sequences of Uninsurance, Coverage Mat

ters: Insurance and Health Care (2001)...... 10-11

Institute of Medicine, Committee on the Con

sequences of Uninsurance, Health Insur

ance Is a Family Matter (2002)......................... 6-8

Kaiser Commission on Medicaid and the Un

insured, The Uninsured: A Primer, Key

Facts About Americans Without Health In-

surance (Kaiser Family Foundation, Wash.,

D.C.), Oct. 2007..... ......................................6-7, 10

Neil S. Siegel, Four Constitutional Limits that

the Minimum Coverage Provision Respects,

27 Const. Comment. 591 (2011)............... ...........4

Kristen Suthers, Evaluating the Economic

Causes and Consequences of Racial and

Ethnic Health Disparities (American Public

Health Association, Wash., D.C.), Nov.

2008.............................................................. 8, 10

U.N. Committee on the Elimination of Racial

Discrimination, Consideration of Reports

Submitted by States Parties under Article 9

of the Convention, Concluding Observa

tions of the Committee on the Elimination

of Racial Discrimination, United States of

America (May 2, 2008), available at

http:// www. state, gov/ documents/or ganizatio

n/107361.pdf (last visited Jan. 10, 2012)

vii

10

1

INTERESTS OF AMICI1

The NAACP Legal Defense & Educational Fund,

Inc. (LDF) is a non-profit legal organization that for

more than seven decades has helped African Ameri

cans secure their civil and constitutional rights.

Throughout its history, LDF has worked to support

and provide equal treatment and high-quality medi

cal services, care, and opportunities to African

Americans. E.g., Linton v. Comm’r of Health &

Env’t, 65 F.3d 508 (6th Cir. 1995) (preservation of

Medicaid-certified hospital and nursing home beds to

prevent eviction of patients in favor of admitting

more remunerative private-pay individuals); Bryan

v. Koch, 627 F.2d 612 (2d Cir. 1980) (challenge to

closure of municipal hospital serving inner-city resi

dents); Simkins v. Moses H. Cone Mem’l Hosp., 323

F.2d 959 (4th Cir. 1963) (admission of African-

American physician to hospital staff); Mussington v,

St. Luke’s-Roosevelt Hosp. Ctr., 824 F. Supp. 427

(S.D.N.Y. 1993) (relocation of services from inner-

city branch of merged hospital entity); Rackley v. Bd.

of Trs. of Orangeburg Reg’l Hosp., 238 F. Supp. 512

(E.D.S.C. 1965) (desegregation of hospital wards);

Consent Decree, Terry v. Methodist Hosp. of Gary,

Nos. H-76-373, H-77-154 (N.D. Ind. June 8, 1979)

(planned relocation of urban hospital services from

inner-city community). LDF has a substantial inter

1 Pursuant to Supreme Court Rule 37.6, counsel for amici

state that no counsel for a party authored this brief in whole or

in part, and that no person other than amici, their members, or

their counsel made a monetary contribution to the preparation

or submission of this brief. The parties have filed blanket con

sent letters with the Clerk of the Court pursuant to Supreme

Court Rule 37.3.

2

est in this case because of its continuing commit

ment to promoting opportunity for African Ameri

cans, including access to affordable health insurance

and health care.

The American Civil Liberties Union (ACLU) is a

nationwide, nonpartisan, nonprofit organization

with more than 500,000 members dedicated to the

principles of liberty and equality embodied in the

Constitution and this nation’s civil rights laws.

Since it was founded in 1920, the ACLU has

appeared before this Court in numerous cases, both

as direct counsel and as amicus curiae. The ACLU

has a substantial interest in the proper resolution of

this case because of its potential impact on the abil

ity of millions of uninsured Americans to participate

more fully in the economic, political, and social life of

the Nation.

The Leadership Conference on Civil and Human

Rights is a diverse coalition of more than 200

national organizations charged with promoting and

protecting the rights of all persons in the United

States. The Leadership Conference was founded in

1950 by A. Philip Randolph, head of the Brotherhood

of Sleeping Car Porters; Roy Wilkins of the NAACP;

and Arnold Aronson, a leader of the National Jewish

Community Relations Advisory Council. The Lead

ership Conference works to build an America that is

as good as its ideals, and toward this end, supports

the authority of Congress to enact legislation, such

as the Patient Protection and Affordable Care Act,

which provides for the general welfare of the nation.

Access to quality health care is a fundamental civil

and human right, but the current system of health

care in the United States denies this right to the

3

most vulnerable segments of society, including low-

income families, people of color, women, seniors, and

people with disabilities. By addressing the huge dis

parities in both access to and quality of care, the

Patient Protection and Affordable Care Act takes a

momentous step toward ensuring that all Americans

can benefit from affordable, high-quality health care.

SUMMARY OF THE ARGUMENT

In our modern, integrated, and dynamic health

care system, personal choices have consequences

that extend far beyond the individual. The economic

decision to forego health insurance, therefore, is not

neutral. Rather, such a decision, when aggregated

across our national population, both limits the per

sonal liberty of others to choose health insurance

and has the effect of reinforcing harsh economic and

social disparities that threaten our country’s democ

ratic foundation and the cohesion of our society.

The minimum essential coverage provision of the

Patient Protection and Affordable Care Act (“ACA”

or “the Affordable Care Act”), Pub. L. No. 111-148,

124 Stat. 119 (2010),2 promotes opportunity for mil

lions of uninsured persons to participate in the life of

our nation. It achieves this objective by making

health insurance and, ultimately, health care itself

more affordable. This, in turn, alleviates the severe

financial burdens that fall on the uninsured, which

have a disproportionate negative impact on disad

vantaged populations. By reducing the exclusionary,

harmful effects of the current system, the minimum

2 As amended by the Health Care and Education Recon

ciliation Act of 2010, Pub. L. No. 111-152, 124 Stat. 1029

(2010).

4

coverage provision, 26 U.S.C. § 5000A - the corner

stone of ACA - enables covered persons to lead

healthier, freer, and more productive lives, thereby

advancing the twin goals of liberty and equal oppor

tunity. Respondents, therefore, go too far in suggest

ing that the provision trenches on individual liberty

in ways that require this Court to curtail federal

power.

Amici support the position of the United States

that the Eleventh Circuit erred in its analysis of

Congress’s power to enact the minimum coverage

provision under both the Commerce and Necessary

and Proper Clauses. Pet. Br. 17-20. Congress acted

well within its constitutional authority in seeking to

regulate “‘economic and financial decisions about

how and when health care is paid for, and when

health insurance is purchased”3 in order to prevent

the severe economic and social upheaval that occurs

when significant portions of the national population

are uninsured.4 See 42 U.S.C. § 18091(a)(2)(A).

Amici write separately to address the Eleventh

Circuit’s mischaracterization of the liberty interests

that are at stake in this case and to emphasize the

positive role the minimum coverage provision plays

in advancing equal opportunity. Amici additionally

demonstrate that the Necessary and Proper Clause

3 See Neil S. Siegel, Four Constitutional Limits that the

Minimum Coverage Provision Respects, 27 Const. Comment.

591, 596-99 (2011) (describing economic nature of decision to

self-insure).

4 In 2009, the number of uninsured persons totaled ap

proximately 50 million. Pet. Br. 7.

5

supports Congress’s authority to enact the minimum

coverage provision.

ARGUMENT

I. The minimum coverage provision enhances

the ability of individuals to participate in

the economic, social, and civic life of our

nation, thereby advancing equal opportu

nity and personal liberty.

Across our country, uninsured persons experience

significant hardship that has a profound cumulative

impact on our nation. Because they are less likely to

obtain adequate, stable health care, the uninsured

suffer many lost opportunities, which depresses both

the quality and the longevity of their lives. These

burdens are disproportionately borne by racial and

ethnic minorities, lower-income persons, and other

disadvantaged persons. For many individuals, being

uninsured is not a choice, but rather is a consequence

that is imposed on them due to circumstances

largely beyond their control. See Pet. Br. 6 (“The

coverage gaps [the uninsured] experience result for

the most part from the high cost of insurance and

employment changes - not a belief that coverage is

unnecessary.”).

Yet, although they lack steady access to health

care, uninsured persons are not completely pre

cluded from using medical services. Id. at 7. Un

foreseen crises can lead to costly emergency room

visits and hospitalizations that, while not covered by

the uninsured, are still paid for by the health care

system as a whole, eventually leading to higher

insurance premiums for everyone. Id. at 7-8. By re

quiring non-exempt individuals to bear some of the

6

cost of their otherwise uncompensated5 care, the

minimum coverage provision has the effect of lower

ing the cost of health insurance and making health

care more affordable and accessible. It is an essen

tial component of the Affordable Care Act’s compre

hensive regulatory framework, id. at 24-32, that

ultimately helps to protect and to improve the lives

of uninsured persons and to reduce the severe ineq

uities of our current system.

A. The uninsured are more likely to experi

ence conditions that inhibit the quality

of life.

From cradle to grave, lack of insurance can (and

often does) result in life-inhibiting and personally

catastrophic conditions that threaten the very core of

a person’s ability to function. Because of the high

cost of health care under our current system, the un

insured must often choose between paying directly

for health care services and other, basic life necessi

ties. Kaiser Comm’n on Medicaid and the Unin

sured, The Uninsured: A Primer, Key Facts About

Americans Without Health Insurance (hereinafter

Primer on Uninsured) (Kaiser Family Found.,

Wash., D.C.), Oct. 2007, at 9. Faced with these diffi

cult tradeoffs, the uninsured are far more likely to

accumulate significant debt and to experience the

life-altering effects of severe financial hardship. See

Inst, of Med., Comm, on the Consequences of Unin

surance, Health Insurance Is a Family Matter (here

inafter Family Matter) 77 (2002). Those who cannot

5 “Uncompensated care” refers to “care received by unin

sured patients but not paid for by them or by a third party on

their behalf.” Pet. Br. 8.

7

endure the financial burdens of non-covered health

care services may simply decide to forego them.

It is unsurprising, therefore, that the uninsured

have higher rates of illness, see Primer on Uninsured

at 7-8, and suffer the effects of lost educational, em

ployment, and other social and civic opportunities.

Over time, this lost human capital degrades their

lives and isolates them from the rest of the popula

tion. As multiple studies show, those without insur

ance often lead chaotic lives. They are less likely to

receive preventative care for treatable illnesses,

resulting in serious and even life-threatening condi

tions. See Family Matter at 87-88; Jack Hadley,

Sicker and Poorer: The Consequences of Being Unin

sured (hereinafter Sicker and Poorer) (Kaiser Family

Found., Wash., D.C.), May 10, 2002, at 5-9. Children

with untreated health problems are less likely to at

tend and to perform well in school. Family Matter at

122-24; Sicker and Poorer at 15. Being uninsured

also correlates with other poor educational outcomes,

such as failing to graduate from high school or to

enroll in college. See Robin A. Cohen et al., Health

Insurance Coverage: Early Release of Estimates from

the National Health Interview Survey, 2010 (herein

after Health Insurance Coverage) (Nat’l Ctr. for

Health Statistics), June 2011, at 4; Primer on Unin

sured at 5. The uninsured often amass significant

debt as a result of unforeseen medical expenses,

leading to a downward, destabilizing financial spiral,

including poor credit, Primer on Uninsured at 9;

bankruptcy, 42 U.S.C. § 18091(a)(2)(G); lost wages;

lower annual earnings, Sicker and Poorer at 13-14;

and unemployment, James A. Baker III Inst, for

Public Policy of Rice Univ., The Economic Impact of

8

Uninsured Children on America (Houston, Tex.),

June 2009, at 5-6. These consequences are often

cumulative and self-perpetuating and can create a

vicious cycle of poor health and reduced opportunity

that further diminishes the quality of life. See Fam

ily Matter at 76; see also 42 U.S.C. § 18091(a)(2)(E);

Catherine Hoffman & Julia Paradise, Health Insur

ance and Access to Health in the United States, 1136

Annals N.Y. Acad. Sci. 149, 150-51 (2008); Kristen

Suthers, Evaluating the Economic Causes and Con

sequences of Racial and Ethnic Health Disparities

(hereinafter Racial and Ethnic Disparities) (Am.

Pub. Health Ass’n, Wash., D.C.), Nov. 2008, at 2.

Congress reasonably concluded that lowering the

cost of health insurance was vital to the strength

and stability of our nation. Pet. App. 216a (Marcus,

J., dissenting) (“Congress has wide regulatory lati

tude to address the extent of financial risk-taking in

the health care services market, which in its view is

a threat to a national market.” (citations and inter

nal quotation marks omitted)). The minimum cover

age provision is the cornerstone of Congress’s efforts

to reduce health insurance costs. It accomplishes

this objective by regulating “how health care con

sumption is financed,” Pet. Br. 17, in order to disrupt

the cost-shifting that occurs when uninsured indi

viduals use uncompensated care. As noted above,

because many uninsured are unable to pay in full for

the services they receive, medical providers shift the

cost of their uncompensated services - totaling $43

billion in 2008 - to insurers in the form of higher

charges. Pet. App. 11a. Insurers then shift these

costs to insured persons in the form of higher premi

ums. Id. at lla-12a; see also 42 U.S.C.

9

§ 18091(a)(2)(F) (congressional finding that average

premium increases for insured families by more than

$1000 annually). By requiring individuals to pur

chase insurance (or risk incurring a financial pen

alty), the minimum coverage provision eliminates

this cost-shifting problem, thereby lowering insur

ance premiums for all. Pet. App. 11a- 12a (citing 42

U.S.C. § 18091(a)(2)(F)).

The minimum coverage provision also helps to ef

fectuate the guaranteed issue provision of the Act,

42 U.S.C. § 300gg-l, which requires insurers to

enroll all applicants. In the absence of a minimum

coverage requirement, the guaranteed issue provi

sion would reinforce the incentive for healthy people

to wait until they were sick to obtain health insur

ance. This would increase the underwriting and

administrative costs that have historically contrib

uted to high premiums. Congress rationally con

cluded that such a result would frustrate its reform

effort and included the minimum coverage provision

to help ensure that insurance would be affordable.

See id. § 18091(a)(2)(I). It did so based on the rec

ognition that steady access to health care enables

individuals to lead ordered, stable, and productive

lives — the effects of which benefit our entire country.

The provision enhances individual liberty to partici

pate in and contribute to the life of our nation,

alongside those who already have insurance.

B. The minimum coverage provision

promotes equal opportunity.

The burdens of costly health care are not distrib

uted evenly. Rather, they fall disproportionately on

disadvantaged populations which are more likely to

10

experience higher rates of unemployment, to have

jobs that do not offer health insurance, and to have

lower incomes that put higher insurance premiums

out of their financial reach. See Primer on Unin

sured at 4-5.

Although more than half of all uninsured persons

are non-Hispanic whites, Inst, of Med., Comm, on

the Consequences of Uninsurance, Coverage Matters:

Insurance and Health Care (hereinafter Coverage

Matters) 12 (2001), racial minorities are “much more

likely to be uninsured than whites.”6 Primer on Un

insured at 5. Latinos are the most likely to be unin

sured, followed by African Americans. Coverage

Matters at 12. These racial and ethnic disparities

predictably lead to higher mortality rates compared

to the insured population. See Racial and Ethnic

Disparities at 2. Other associated effects of being

uninsured — including the prolonged duration of oth

erwise treatable illnesses, depressed educational

outcomes, and fewer employment opportunities — are

more likely to affect racial minorities. Id. at 2-4.7

6 In a recent periodic review, the United Nations Commit

tee on the Elimination of Racial Discrimination noted its con

cern “that a large number of persons belonging to racial, ethnic

and national minorities still remain without health insurance

and face numerous obstacles to access to adequate health care

and services.” U.N. Comm, on the Elimination of Racial Dis

crimination, Consideration of Reports Submitted by States Par

ties under Art. 9 of the Convention, Concluding Observations of

the Comm, on the Elimination of Racial Discrimination, United

States of America H 32 (May 2, 2008), available at

http://www.state.gov/documents/organization/107361.pdf (last

visited Jan. 10, 2012).

7 Gender is also correlated with less stable forms of insur

ance. Although men in general are more likely to be uninsured,

http://www.state.gov/documents/organization/107361.pdf

11

By facilitating affordable health care, the mini

mum coverage provision integrates the uninsured

more fully into the life of our nation and helps them

to participate on a more equal footing with the rest

of society. The provision therefore promotes equal

opportunity, in addition to personal liberty. See

Lawrence v. Texas, 539 U.S. 558, 575 (2003) (observ

ing that equal protection and “substantive guarantee

of liberty are linked in important respects”).

Congress’s desire to promote equal opportunity, of

course, is not dispositive of the question presented in

this case. But in exercising its Commerce Clause

powers, Congress certainly may consider the impact

such legislation will have on those who are otherwise

disadvantaged by market distortions beyond their

control. See, e.g., Parents Involved in Cmty. Schs. v.

Seattle Sch. Dist. No. 1, 551 U.S. 701, 787-88 (2007)

(Kennedy, J., concurring in part and concurring in

judgment) (noting “the legitimate interest govern

ment has in ensuring all people have equal opportu

nity regardless of their race”); Katzenbach v.

McClung, 379 U.S. 294, 299-300 (1964); Heart of At

lanta Motel, Inc. v. United States, 379 U.S. 241, 257

(1964).

“women are more likely to obtain coverage through individual

policies and public programs” and, therefore, are more likely to

experience gaps in coverage. Coverage Matters at 12. For a

fuller discussion of the difficulties women have in obtaining

and maintaining health insurance, see Amici Br. of National

Women’s Law Center et al.

12

C. The ability to self-insure is not analogous

to any liberty interests recognized by

this Court.

In rejecting Congress’s authority to enact the

minimum coverage provision, the court of appeals

suggested that individual preferences to self-insure

should override Congress’s decision to require near-

universal8 insurance coverage. The Eleventh Circuit

emphasized the liberty of individuals to forego

health insurance. But it disregarded the counter

vailing liberty interests of individuals whose access

to health insurance will be constrained in the

absence of such a provision due to cost-shifting from

the uninsured to the insured. This dynamic has the

effect of placing affordable, stable health care out of

financial reach for many people. Pet. App. 11a (de

scribing inability of some uninsured to purchase cov

erage “because of higher premiums”).

Respondents abandoned their substantive due

process claim on appeal below. Id. at 112a n.93.

Therefore, the question whether the minimum cov

erage provision unconstitutionally infringes their

liberty interests was not squarely before the court of

appeals. See id. Nonetheless, the Eleventh Circuit’s

concerns about the provision’s effects on liberty

8 The statute contains several exemptions to the m i n i m u m

coverage provision. These include exemptions on the basis of

religion; for persons not lawfully present in the country; for in

carcerated persons; for those who fail to meet certain threshold

income requirements; for those who have short-term gaps in

their coverage; for “hardship” cases, as determined by the

Department of Health and Human Services; and for members

of Native American tribes. Pet. App. 43a.

13

plainly animated its conclusion that Congress

“departed] from commerce power norms.” Id. at

112a. The court of appeals objected that the provi

sion leaves persons “no choice” but “to purchase in

surance,” which “strikes at the heart of whether

Congress has acted within its enumerated power.”

Id. It further concluded that Congress may only

regulate individuals once they “actually enter the

stream of commerce and consume health care.” Id.

at 118a.

As this Court has recognized, structural limita

tions on Congress’s authority can serve the impor

tant function of protecting individuals against abuse

of government power. See Bond u. United States,

131 S. Ct. 2355, 2364 (2011) (“[Fjederalism protects

the liberty of the individual from arbitrary power.”).

The Eleventh Circuit, however, misconceived the

liberty interests at stake in this case. While it is

true that those who do not purchase insurance are

subject to a tax penalty beginning in 2014, Pet. Br.

11, this Court long ago repudiated the notion that

private economic decisions are beyond government

regulations designed to serve the larger good.

At bottom, the challenge to the minimum cover

age provision echoes arguments made during the

Lochner era about laws that purported to interfere

with the right to contract. See Lochner v. New York,

198 U.S. 45 (1905) (striking down state labor law es

tablishing maximum number of hours for bakers).

The Court has long since abandoned such a notion.

In West Coast Hotel Co. v. Parrish, for example, the

Court rejected a challenge to a state minimum wage

law on substantive due process grounds. 300 U.S.

379, 392-93 (1937) (collecting cases). The Court

14

observed the now familiar principle that the gov

ernment may reasonably regulate private economic

decisions to advance the public interest. Id. at 392;

see also Washington v. Glucksberg, 521 U.S. 702, 761

(1997) (Souter, J., concurring) (describing repudiated

economic due process cases); NLRB v. Jones &

Laughlin Steel Corp., 301 U.S. 1, 46 (1937) (uphold

ing federal law, enacted under Congress’s Commerce

power, that prohibited discharging employees based

on union membership).

1. The provision imposes minimal burdens on

liberty.

Although the minimum coverage provision is

commonly described as a “mandate,” it is worth clari

fying first that the provision does not require indi

viduals to purchase any particular insurance product

or service. See Pet. App. 25a-26a (citing 26 U.S.C.

§ 5000A(f)(l)). Instead, covered persons may elect to

pay a financial penalty that is enforced by an “offset

[of] any tax refund owed the uninsured taxpayer.”

Id. at 45a. Thus, the practical compulsory effect on

an individual’s personal choice whether to buy

insurance is minimal. For these reasons, the ability

to self-insure is not analogous to any liberty inter

ests that the Court has determined are constitution

ally cognizable.

A few examples illustrate this point. Cf. Glucks

berg, 521 U.S. at 722 (observing utility of “concrete

examples” for determining outlines of protected

liberty interests). The provision does not infringe on

bodily integrity; as already mentioned, it does not

require individuals to undergo any form of treatment

or to use any form of health care. See Cruzan v. Dir.,

15

Mo. Dep’t of Health, 497 U.S. 261, 269-79 (1990) (dis

cussing right of competent individual to refuse un

wanted medical treatment); see also Rochin v. Cali

fornia, 342 U.S. 165 (1952).9 Nor does the provision

intrude on “personal decisions relating to marriage,

procreation, contraception, family relationships,

child rearing, and education,” Lawrence, 539 U.S. at

574; involve the regulation of intimate, private rela

tionships inside the home, id. at 567; affect marital

privacy, Griswold v. Connecticut, 381 U.S. 479

(1965); or implicate the right to decide whether to

carry a pregnancy to term, Planned Parenthood of

Se. Pa. v. Casey, 505 U.S. 833 (1992).

Finally, the provision comfortably falls within the

ambit of other kinds of regulations imposed by

States that require persons, under penalty of law, to

purchase insurance. Therefore, the provision does

not implicate the kind of liberty interest that is “ob

jectively, ‘deeply rooted in this Nation’s history and

tradition.’” Glucksberg, 521 U.S. at 720-21 (quoting

Moore u. City of East Cleveland, 431 U.S. 494, 503

(1977) (plurality opinion)). Most States, for example,

require individuals to purchase car insurance as a

condition of vehicle registration (presumably even if

they never drive their car). See, e.g., Delaware v.

9 Notably, in Jacobson v. Massachusetts, 197 U.S. 11 (1905),

the Court repudiated the assertion that a compulsory smallpox

vaccination was “hostile to the inherent right of every freeman

to care for his own body and health in such way as to him

seems best.” Id. at 26. Observing “the fundamental principle

that persons and property are subjected to all kinds of re

straints and burdens in order to secure the general comfort,

health, and prosperity of the state,” id. (internal quotation

marks omitted), the Court upheld the law on the grounds that

it promoted public health and safety, id. at 31.

16

Prouse, 440 U.S. 648, 658-59 (1979); Garcia v. Van

guard Car Rental USA, Inc., 540 F.3d 1242, 1247-48

(11th Cir. 2008). Similarly, States may condition a

professional license on obtaining malpractice insur

ance. See, e.g., Ophthalmic Mut. Ins. Co. v. Musser,

143 F.3d 1062 (7th Cir. 1998). Thus, as Judge Sut

ton observed in his opinion in Thomas More Law

Center u. Obama, the provision does little more than

is required by States in analogous contexts. See 651

F.3d 529, 565 (6th Cir. 2011) (Sutton, J., concurring)

(describing State laws that require individuals to

buy medical insurance and car insurance).

2. Under the Court’s Commerce Clause

jurisprudence, individuals must sometimes

yield economic liberty to advance the collec

tive good.

The Court’s Commerce Clause cases acknowledge

that government’s economic regulation may limit in

dividual liberty to serve the common good. Wickard

v. Filburn, 317 U.S. I l l (1942), is a clear example.

Contrary to the conclusion of the Eleventh Circuit,

Wickard supports the authority of Congress to enact

the minimum coverage provision under its Com

merce Clause power. In light of the court of

appeals’s extensive treatment of Wickard, Pet. App.

65a-68a, 11 la-115a, and its close relationship to the

liberty interest suggested in this case, it deserves

close scrutiny.

In Wickard, this Court considered the constitu

tionality of a penalty imposed on a small commercial

farmer who produced wheat in excess of his allotted

acreage under the federal Agricultural Adjustment

Act. The purpose of the law was to regulate the sup

17

ply and demand for wheat in order to prevent price

fluctuations and to stabilize the interstate market.

317 U.S. at 115. Wickard is significant because the

farmer (Filburn) grew more than his quota not for

the purpose of selling it on the interstate market,

but for his own private consumption at home. Id. at

114. This fact did not matter under the law, how

ever. Any wheat grown in excess of the prescribed

allotment was subject to penalty and did “not depend

upon whether any part of the wheat either within or

without the quota [was] sold or intended to be sold.”

Id. at 119.

The court of appeals distinguished the liberty in

terests implicated by Congress’s wheat regulation in

Wickard on two grounds. First, Filburn was a com

mercial farmer and, therefore, had already chosen to

place himself “in commerce” as opposed to individu

als here who are - under Respondents’ view — “com

pelled]” to enter commerce to purchase individual

health insurance. Pet. App. 98a. Second, the court

observed that the Agricultural Adjustment Act “did

not require him to purchase more wheat.” Id. at

111a. Rather, Filburn retained a number of other

options: “He could have decided to make do with the

amount of wheat he was allowed to grow. He could

have redirected his efforts to agricultural endeavors

that required less wheat. He could have even ceased

part of his farming operations.” Id. at 11 la- 112a. In

other words, Filburn was still free to exercise some

choice, an option that the court of appeals concluded

is lost as a result of the minimum coverage provi

sion. Id. at 112a.

The Eleventh Circuit’s analysis overstates the

significance of Filburn’s farming operation and rests

1 8

on a false characterization of the nature of the choice

that was at issue in Wickard. Although Filburn

technically was a commercial farmer, this Court did

not treat the activity in question - “cultivation of

wheat for home consumption” — “as part of his com

mercial farming operation.” Gonzales v. Raich, 545

U.S. 1, 20 (2005). More important, there is no ques

tion that Filburn could not choose to grow wheat —

even for his own private consumption - beyond the

amount allotted to him under the Agricultural Ad

justment Act. If he wanted to sell all of his pre

scribed share, he would be required to purchase any

additional wheat for his personal use. As with indi

viduals who prefer to self-insure, Filburn preferred

to grow more wheat precisely so that he could avoid

having to buy it. Yet, as the Court expressly ac

knowledged, the law “forc[ed] some farmers into the

market to buy what they could provide for them

selves.” Wickard, 317 U.S. at 129. Filburn, in other

words, was “compelled” to enter the stream of com

merce to purchase a product that he would have oth

erwise chosen to cultivate himself. See Thomas More

Law Ctr., 651 F.3d at 560-61 (Sutton, J., concurring).

To meet its objective of stabilizing the wheat

market, Congress needed to regulate Filburn, just as

it now needs to regulate the willfully uninsured to

stabilize the market for health insurance and health

care. As the Wickard Court noted, it is simply the

nature of regulation “that it lays a restraining hand

on the self-interest of the regulated and that advan

tages from the regulation commonly fall to others.”

317 U.S. at 129.10 This is a common theme of the

10 The Court further observed that these legislative choices

“are wisely left under our system to resolution by the Congress

19

Court’s commerce cases. See United States v. Darby,

312 U.S. 100, 114-15 (1941); Jones & Laughlin Steel,

301 U.S. at 31-32; see also Raich, 545 U.S. 1 (con

cluding that application of federal law that criminal

ized possession and use of marijuana for medical

purposes to intrastate growers and users did not vio

late Commerce Clause).

Like the law challenged in Wickard, and as with

other federal programs that depend on individual

participation to be viable, the minimum coverage

provision requires nearly all persons, subject to

important exceptions,11 to make a financial contribu

tion. In United States v. Lee, 455 U.S. 252 (1982),

the Court upheld a similar financial “mandate” in

the context of social security after factoring in the

size and importance of the government program.

The Court rejected an as-applied challenge to the

constitutionality of a social security tax12 under the

Free Exercise Clause. A member of the Old Order

Amish challenged the mandate on the grounds that

both contributions to the social security system and

receipt of any benefits constitutionally infringed his

religious beliefs. Id. at 255. Accepting the conten

tions that “both payment and receipt of social secu

rity benefits is forbidden by the Amish faith” and

that “compulsory participation in the social security

under its more flexible and responsible legislative process,”

particularly where such flexibility is needed to adapt legislation

to the changing practical realities of our modern, integrated

economy. 317 U.S. at 129.

11 See supra note 8.

12 Amici do not take any position on whether the minimum

coverage provision’s financial penalty is a “tax.”

20

system interfere[d] with their free exercise rights,”

id. at 257, the Court nonetheless concluded that the

government’s interest “in assuring mandatory and

continuous participation in and contribution to the

social security system [was] very high.” Id. at 258-

59.13 While not a case about the scope of Congress s

Commerce power, Lee raises analogous concerns

about the balance between individual liberty and

government regulations designed to advance the

common good. This Court rested its Lee decision in

part on the role that social security played in

“serving] the public interest by providing a compre

hensive insurance system with a variety of benefits

available to all participants, with costs shared by

employers and employees.” Id. at 258. As with the

provision challenged here, which is an essential part

of ACA’s regulatory framework, Congress directed

individuals to contribute financial resources on the

ground that “mandatory participation is indispensa

ble to the fiscal vitality of the . . . system.” Id.

These cases demonstrate that the Court need not

privilege the economic choice of a subset of individu

als to self-insure, while disregarding the effect such

decisions have on the ability of persons who want

insurance to choose it. The minimum coverage pro

13 The Court reached this conclusion in Lee even though it

applied heightened scrutiny. 455 U.S. at 257-60. The Court

subsequently ruled, in Employment Division v. Smith, 494 U.S.

872 (1990), that heightened scrutiny does not apply to claims of

religious exemption from a neutral and generally applicable

law. Cf. Hosanna-Tabor Evangelical Lutheran Church & Sch.

v. EEOC, No. 10-553, 556 U .S .___(2012), slip op. at 15 (Jan.

11, 2012) (discussing Smith).

21

vision’s limitations on individual liberty are fully

consistent with the Constitution.

II. The Necessary and Proper Clause further

supports the constitutionality of the mini

mum coverage provision.

The principle that Congress may enact laws “nec

essary and proper” to the execution of its enumer

ated powers has been firmly established for nearly

200 years, McCulloch v. Maryland, 4 Wheat. 316

(1819), and repeatedly reaffirmed by this Court as

an essential ingredient of our constitutional system,

including most recently in United States v. Com

stock, 130 S. Ct. 1949 (2010). The minimum cover

age provision easily satisfies the constitutional stan

dards set forth in this Court’s cases interpreting the

Necessary and Proper Clause and should be upheld

for that reason, as well.

The minimum coverage provision does not exist

in legislative isolation. It is part of a comprehensive

legislative scheme and its validity under the

Necessary and Proper Clause must be evaluated in

light of that scheme. In particular, the minimum

coverage provision is closely tied to two other provi

sions of the health care law: one prohibits insurance

companies from denying health care coverage to in

dividuals based on pre-existing conditions or medical

history, 42 U.S.C. §§ 300gg-l(a), 300gg-3(a), the

other prohibits insurance companies from charging

such individuals a higher premium, id. § 300gg. To

gether, these provisions are designed to address a

free rider problem that currently distorts the na

tional health care market, increasing the cost of

insurance and decreasing the numbers insured.

22

The authority of Congress to enact the latter two

provisions under the Commerce Clause has not been

seriously questioned, see Seven-Sky v. Holder, 661

F.3d 1, 14 (D.C. Cir. 2011), and for good reason. In

surance companies are indisputably engaged in eco

nomic activity and that economic activity undeniably

has a substantial effect on interstate commerce. As

the legislative findings that were incorporated in

ACA specifically note:

The cost of providing uncompensated care to

the uninsured was $43,000,000,000 in 2008.

To pay for this cost, health care providers

pass on the cost to private insurers, which

pass on the cost to families. This cost-

shifting increases family premiums by on av

erage over $1,000 a year.

42 U.S.C. § 18091(a)(2)(F).

Congress further found that the minimum cover

age provision was “essential to creating effective

health insurance markets in which improved health

insurance products that are guaranteed issue and do

not exclude coverage of pre-existing conditions can

be sold.” Id. § 18091(a)(2)(I). The provision

“broaden[s] the health insurance risk pool to include

healthy individuals” who might otherwise choose to

remain uninsured or defer insurance coverage. Id.

This expanded pool, in turn, enables insurance com

panies to provide insurance coverage to everyone at

lower premiums. Id. § 18091(a)(2)(F).

“[WJhere Congress has the authority to enact a

regulation of interstate commerce, ‘it possesses every

power needed to make the regulation effective.’”

Raich, 545 U.S. at 36 (Scalia, J., dissenting) (quoting

23

United States v. Wrightwood Dairy Co., 315 U.S.

110, 118-19 (1942)). That is precisely what the

minimum coverage provision does in this case.

Moreover, Congress is generally granted broad dis

cretion in determining what legislation is necessary

and proper to effectuate its enumerated powers. See

Sabri v. United States, 541 U.S. 600, 605 (2004).

To be sure, the Necessary and Proper Clause is

not an unlimited license for Congress to enact any

legislation it chooses. In Comstock, Justice Kennedy

and the majority debated about whether the link to

an enumerated power must be one that is rationally

conceivable or empirically rooted. But that debate

has no relevance here. Even accepting Justice

Kennedy’s view that “[tjhe rational basis referred to

in the Commerce Clause context is a demonstrated

link in fact,” 130 S. Ct. at 1967 (Kennedy J.4 concur

ring), that “link in fact” is amply “demonstrated” by

the legislative findings supporting enactment of the

Affordable Care Act.

Nor does it matter for purposes of the Necessary

and Proper Clause whether the minimum coverage

provision is independently supported by the Com

merce Clause, although amici believe that it is for

the reasons stated above. See supra Part I. It is

enough, as this Court has noted, that the provision is

“an essential part of a larger regulation of economic

activity, in which the regulatory scheme could be

undercut unless the . . . activity [at issue] were regu

lated.” United States v. Lopez, 514 U.S. 549, 561

(1995).

Finally, in exercising its powers under the Neces

sary and Proper Clause, Congress cannot abridge

24

fundamental rights any more than it may in the ex

ercise of its enumerated powers. See Comstock, 130

S. Ct. at 1957. As noted, supra Part I.C, however,

the economic liberty interests suggested here in op

position to the minimum coverage provision do not

rise to that level.

CONCLUSION

For the foregoing reasons, the Court should re

verse the judgment of the Eleventh Circuit striking

down the minimum coverage provision.

Respectfully submitted,

John Payton

Director-Counsel

Debo P. Adegbile

Elise C. Boddie

Counsel of Record

ReNika C. Moore

Ria A. Tabacco

NAACP Legal Defense &

Educational Fund, Inc.

99 Hudson St., 16th Floor

New York, NY 10013

(212) 965-2200

eboddie@naacpldf.org

Joshua Civin

NAACP Legal Defense &

Educational Fund, Inc.

1444 I St., NW, 10th Floor

Washington, DC 20005

mailto:eboddie@naacpldf.org

25

Steven R. Shapiro

American Civil Liberties

Union Foundation

125 Broad Street

New York, NY 10004

LisaM. Bornstein

Leadership Conference

on Civil and Human

Rights

1629 K Street, NW

Washington, DC 20006

Counsel for Amici Curiae

January 13, 2012