Baker v. Jefferson County Brief for Appellants

Public Court Documents

May 26, 1982

Cite this item

-

Brief Collection, LDF Court Filings. Baker v. Jefferson County Brief for Appellants, 1982. 6b7a1e9e-ba9a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/a3f058d5-29ae-4b57-9698-a58669490faa/baker-v-jefferson-county-brief-for-appellants. Accessed February 17, 2026.

Copied!

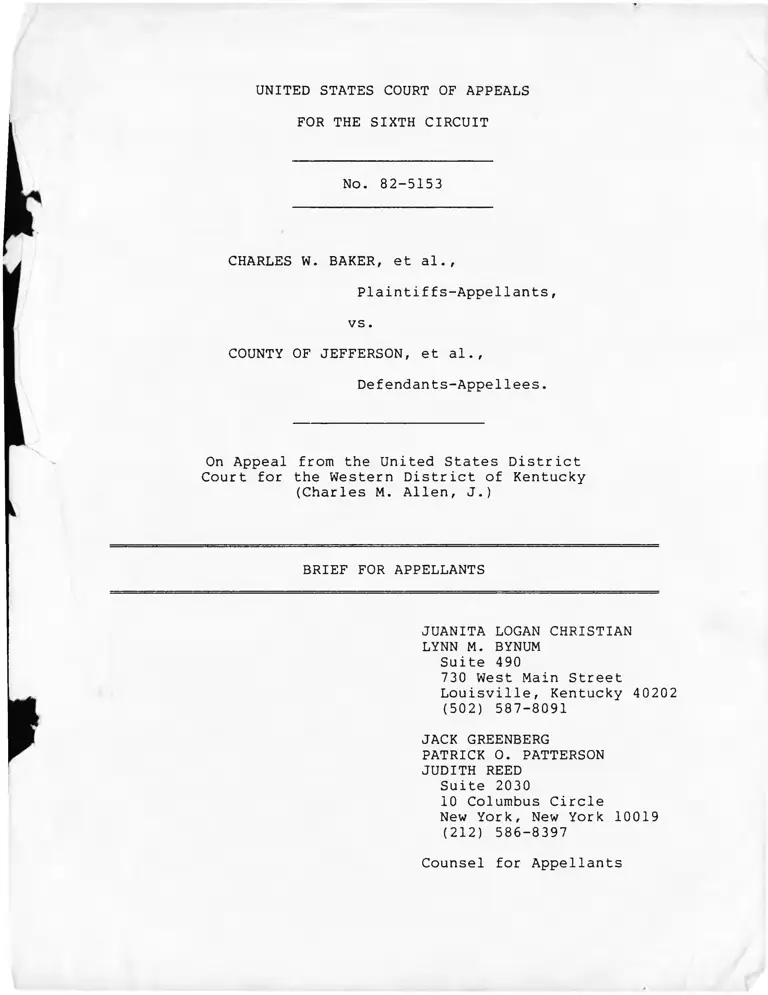

UNITED STATES COURT OF APPEALS

FOR THE SIXTH CIRCUIT

No. 82-5153

CHARLES W. BAKER, et al. ,

Plaintiffs-Appellants,

vs.

COUNTY OF JEFFERSON, et al.,

Defendants-Appellees.

On Appeal from the United States District

Court for the Western District of Kentucky

(Charles M. Allen, J.)

BRIEF FOR APPELLANTS

JUANITA LOGAN CHRISTIAN

LYNN M. BYNUM

Suite 490

730 West Main Street

Louisville, Kentucky 40202

(502) 587-8091

JACK GREENBERG

PATRICK 0. PATTERSON

JUDITH REED

Suite 2030

10 Columbus Circle

New York, New York 10019

(212) 586-8397

Counsel for Appellants

Table of Contents

Page

Table of Authorities ............................. iii

Fact Sheet for Title VII Appeals ................. vi

Questions Presented .............................. 1

Statement of the Case ............................ 2

Argument .......................................... 11

I. In making an award of fees which did not

compensate plaintiffs' counsel for the

fair market value of their services in

this civil rights case, the District

Court abused its discretion and failed

to comply with the requirements of the

applicable federal fee award statutes .... H

II. The fees awarded to plaintiffs’ Louis

ville attorneys were based on hourly

rates far below the fair market value

of their services ........................ 17

A. The rates set by the District Court

were contrary to all the evidence

in the record establishing reason

able hourly rates .................... 17

B. The rates set by the District Court

for services performed in this case

in 1979-1981 were inherently un

reasonable because they were based

on rates’ previously awarded in a

different case for services per

formed in 1974-1979 .................. 19

C. The rates set by the District Court

were contrary to the requirements

of the federal fee award statutes .... 24

D. The District Court failed to com

pensate plaintiffs' Louisville

counsel at a higher rate for all

documented in-court services ........ 27

Page

III. The fees awarded to the Legal Defense

Fund were based on hourly rates far

below the fair market value of the

services it provided in this case ....... 28

IV. The fees awarded to plaintiffs'

attorneys were unreasonable because

they did not account for the fact

that compensation was contingent upon

success in the case ........................ 38

A. Plaintiffs' counsel were entitled

to a contingency adjustment for

time spent on the class aspects of

the case ............................. 41

B. Plaintiffs' counsel were entitled

to a contingency adjustment for

time spent on the plaintiffs'

individual claims .................... 44

1. The Louisville Attorneys ......... 44

2. The Legal Defense Fund ........... 46

V. The District Court erred in failing to

direct payment of interest on the judg

ment awarding attorneys' fees, costs,

and expenses ............................. 48

Conclusion ........ 49

Addendum: Statutes Involved

- ii -

Table of Authorities

Page

Cases

Anderson v. Morris, 658 F .2d 246 (4th Cir.

1981) 15

Bradford v. Blum, 501 F. Supp. 526 (S.D.N.Y.

1981) ......................................... 37

Chrapliwy v. Uniroyal, Inc., 670 F .2d 760 (7th

Cir. 1982) 32,35,36

City of Detroit v. Grinnell Corp., 560 F .2d

1093 (2d Cir. 1977) 15

City of Detroit v. Grinnell Corp., 575 F .2d 1009

(2d Cir. 1977) 48

Copeland v. Marshall, 641 F.2d 880 (D.C. Cir.

1980) (en banc) ........................ 15,31,42,47

Davis v. County of Los Angeles, 8 EPD

IT 9444 (C.D. Cal. 1974) ............. 24,31,32,47

Deposit Guaranty National Bank v. Roper, 445

U.S. 326 (1980) ............................. 13

Fairley v. Patterson, 493 F.2d 598 (5th Cir.

1974) ......................................... 31

Furtado v. Bishop, 635 F .2d 915 (1st Cir. 1980) ... 15

Gates v. Collier, 616 F .2d 1268 (5th Cir. 1980) ... 15

Gulf Oil Co. v. Bernard, 101 S.Ct. 2193 (1981) .... 29

Hedrick v. Hercules, Inc., 658 F .2d 1088 (5th

Cir. 1981) .................................... 32

Incarcerated Men of Allen County Jail v. Fair,

507 F . 2d 281 (6th Cir. 1974) 31,47

Jones v. Armstrong Cork Co., 630 F .2d 324 (5th

Cir. 1980) .................................... 37

Jones v. Diamond, 636 F.2d 1364 (5th Cir.

1981) (en banc) .............................. 44

Jones v. Federated Department Stores, Inc., 527

F. Supp. 912 (S.D. Ohio 1981) 18,19

- iii -

Page

Johnson v. Georgia Highway Express, Inc.,

488 F . 2d 714 (5th Cir. 1974) ................. 31

Lindy Brothers Builders, Inc. v. American

Radiator & Standard Sanitary Corp.,

487 F . 2d 161 (3rd Cir. 1973) ................. 15

Lindy Brothers Builders, Inc. v. American

Radiator & Standard Sanitary Corp.,

540 F .2d 102 (3rd Cir. 1976) (en banc) ...... 42

Maher v. Gagne, 448 U.S. 122 (1980) ............... 16

NAACP v. Button, 371 U.S. 415 (1963) .............. 8,29

Newman v. Piggie Park Enterprises, Inc.,

390 U.S. 400 (1968) 13

New York Gaslight Club, Inc. v. Carey, 447

U.S. 54 (1980) 13,31,46

Northcross v. Board of Education, Memphis

City Schools, 611 F .2d 624 (6th Cir.

1979) , cert, denied, 447 U.S. 911

(1980 )......................................... passim

Oldham v. Erlich, 617 F .2d 163 (8th Cir. 1980) .... 47

Palmigiano v. Garrahy, 616 F .2d 598 (1st Cir.

1980) . 47

Seals v. Quarterly County Court, 562 F .2d 390

(6th Cir. 1977) 15

Stanford Daily v. Zurcher, 64 F.R.D. 680 24,30,31,32,

(N.D. Cal. 1974) ....................... 42,44,45

Swann v. Charlotte-Mecklenburg Board of

Education, 66 F.R.D. 483 (W.D.N.C.

1975) 24,31,47

Torres v. Sachs, 69 F.R.D. 343 (S.D.N.Y.

1975), aff'd, 538 F .2d 10 (2d Cir. 1976) .... 31

Statutes

28 U.S.C. § 1961 .................................. 48

Civil Rights Attorney's Fees Award Act of 1976,

42 U.S.C. § 1988 .............................. passim

IV

Page

Title VII of the Civil Rights Act of 1964-,

42 U.S.C. §§ 2000e et seq................... passim

Legislative History

H.R. Rep. No. 94-1558, 94th Cong.,

2d Sess. (1976) 13,14,25,31,46

S. Rep. No. 94-1011, 94th Cong., 2d 12,13,24,25,30,31,

Sess. (1976) 33,42,43,46

Other Authorities

A. Miller, Attorneys' Fees in Class Actions

(Federal Judicial Center 1980) 15,34,35

Attorney Fee Awards in Antitrust and Securities

Class Actions, 6 Class Action Reports

82 (1980) .................................... 10

U.S..Department of Commerce, Bureau of the Census,

Census Tracts, Louisville, Ky.-Ind.

Standard Metropolitan Statistical Area,

Table P-1 (General Characteristics of

the Population: 1970) 5

U.S. Department of Labor, Bureau of Labor

Statistics, 105 Monthly Labor Report

(May 1982) 23,24

v

UNITED STATES COURT OF APPEALS

FOR THE SIXTH CIRCUIT

FACT SHEET FOR TITLE VII APPEALS

Case Name and Number: Charles W. Baker, et al. v. County of

Jefferson, et al., No. 82-5153

Person Reporting: Patrick 0. Patterson

Counsel for Plaintiffs-Appellants

1. Dates EEOC charges filed: April 27, 1979; May 9, 1979;

January 22, 1980.

2. Was any compromise or settlement reached by the state civil

rights agency? No. By EEOC? No.

3. Date EEOC right to sue letters issued: January 25, 1980.

4. Date present action filed: January 24, 1980.

5. Have all filings been timely? (X) Yes. ( ) No. If not,

are any "tolling" arguments available? ( ) Yes. ( ) No.

If so, describe briefly.

6. Nature of claims of discrimination and date(s) of occurrence:

(a) Discrimination in hiring, training, assignment,

promotion, and discipline of black police officers and

applicants since prior to March 1972 and continuing;

(b) Retaliatory demotion of two police officers for

filing EEOC charges and opposing defendants' racial dis

crimination, on or about January 17, 1980.

7. Disposition below: Consent decree approved December 18, 1980;

judgment awarding fees, costs and expenses to plaintiffs'

counsel entered March 5, 1982.

vi

UNITED STATES COURT OF APPEALS

FOR THE SIXTH CIRCUIT

No. 82-5153

CHARLES W. BAKER, et al.,

Plaintiffs-Appellants,

vs.

COUNTY OF JEFFERSON, et al.,

Defendants-Appellees.

On Appeal from the United States District

Court for the Western District of Kentucky

(Charles M. Allen, J.)

BRIEF FOR APPELLANTS

QUESTIONS PRESENTED

1. Whether the District Court erred in setting rates of

$35 and $55 an hour for the services performed by plaintiffs'

Louisville counsel where those rates are substantially lower

than the reasonable market value of the services provided by

those attorneys, as measured by either their normal hourly

rates or the prevailing rates customarily charged by com

parable attorneys in the Louisville area for similar services.

2. Whether the District Court erred in failing to compen

sate plaintiffs' Louisville counsel at a higher rate for all

documented in-court services.

3. Whether the District Court erred in setting a rate

of $70 an hour for services performed by an experienced staff

attorney of the New York-based NAACP Legal Defense and Educational

Fund, where that rate is substantially lower than the reasonable

market value of those services as measured by (a) the individual

attorney's background and experience as a specialist in employ

ment discrimination cases, (b) the Legal Defense Fund's insti

tutional resources and expertise, and (c) the prevailing rates

customarily charged by comparable attorneys and national law

firms for similar services.

4. Whether the District Court erred in failing to make

any contingency adjustment in the fees awarded to plaintiffs'

counsel.

5. Whether the District Court erred in failing to direct

payment of interest on the judgment awarding fees, costs and

expenses to plaintiffs' counsel.

STATEMENT OF THE CASE

This * is an appeal by plaintiffs' counsel from an inadequate

award of counsel fees under the Civil Rights Attorney's Fees

Awards Act of 1976, 42 U.S.C. § 1988, and Title VII of the

Civil Rights Act of 1964 , as amended, 42 U.S.C. § 2000e e_t seq.

- 2 -

The present appeal involves the same District Judge, most of

the same attorneys for the plaintiffs, and some of the same

issues as the appeal in Louisville Black Police Officers Organi

zation, Inc., et al. v. City of Louisville, et al., Civil

Action No. C-74-106 L(A) (W.D. Ky., March 17, 1981), appeal

docketed, Nos. 81-5466/5491 (6th Cir., June 30, 1981). The

plaintiffs in the Louisville Black Police case obtained

substantial classwide and individual relief for racially dis

criminatory employment practices of the City of Louisville

Police Department, and the plaintiffs in the present case

obtained similar relief with respect to the Jefferson County,

Kentucky, Police Department. Counsel for the plaintiffs in

both cases have appealed from fee awards entered by the District

Court.

On January 24, 1980, plaintiffs' counsel instituted this

action in the District Court pursuant to Titles VI and VII of

the Civil Rights Act of 1964, as amended, 42 U.S.C. §§ 2000d

and 2000e et seq; 42 U.S.C. §§ 1981 and 1983; and the Thirteenth

and Fourteenth Amendments. The complaint charged the defendants

with unlawful employment discrimination against the plaintiffs

individually and as representatives of a class of black officers

and applicants for employment. The complaint also charged the

defendants with unlawful retaliation against plaintiff Charles

Baker, a black officer, for filing a charge of discrimination

and for opposing the defendants' racial discrimination, and

against plaintiff John Arnold, a white officer, for supporting

and assisting plaintiff Baker in opposing that discrimination.

-3-

The defendants subsequently informed the Court and

plaintiffs' counsel that they wished to negotiate a settlement

of the class claims of discrimination in hiring and promotion,

but that they would vigorously resist the individual claims of

plaintiffs Baker and Arnold. (Memorandum Opinion on Plaintiffs'

Application for an Award of Attorneys' Fees, Costs, and Ex

penses, March 5, 1982, at 1) (hereinafter "Counsel Fee Opinion").

Accordingly, while the parties prepared for a contested hearing

on the individual retaliation claims, they also proceeded with

a substantial amount of informal, voluntary discovery concerning

the claims of discrimination against blacks as a class. On

March 4, 1980, following a four day hearing on the individual

retaliation claims, the District Court dissolved the temporary

restraining order it had previously granted and denied plain

tiffs' motion for a preliminary injunction. Plaintiffs appealed.

See Brief for Appellants in Baker and Arnold v. County of

Jefferson, No. 80-3205 (filed Nov. 14, 1980).

While that appeal was pending in the Sixth Circuit, the

parties continued their efforts to negotiate a settlement of the

case as a whole. Those efforts culminated in a consent decree

which the Court approved on December 18, 1980. That decree

remains in effect. It provides substantial classwide relief

for black police officers and applicants as well as individual

relief for the plaintiffs. In addition to prohibiting unlawful

discrimination and retaliation, the decree requires the defendant

to take the following affirmative actions: implement a minority

4-

recruitment program; hire one black officer for each white

1/officer hired until at least 13.8%— of the officers on the

force are black; provide assistance to police recruits in

recruit school; assure adequate representation of black officers

in assignments and units throughout the Department; and promote

black officers to higher ranks in specified ratios until at

least 13.8% of the officers in each rank are black. (Consent

Decree, M 1-39). The decree also requires the defendants to

pay a total of $18,500 to the named plaintiffs in satisfaction

of their individual claims for monetary relief. (Id./

40) y

The only issues not resolved by the consent decree con

cerned attorneys' fees, costs, and expenses. (Consent Decree,

1[ 56). Following the District Court's approval of the decree,

counsel for the parties attempted to settle these issues but

were unable to reach a negotiated settlement. Therefore, in

November 1981, counsel for plaintiffs filed their application

for attorneys' fees, costs, and expenses. The application

1/ According to the 1970 census, blacks accounted for 13.8%

of the population in Jefferson County and 12.2% of the popula

tion in the Louisville SMSA. U.S. Bureau of the Census, Census

Tracts, Louisville, Ky.-Ind. Standard Metropolitan Statistical

Area, Table P-1 (General Characteristics of the Population:

1970). The Court had found that "only 3% of the persons on the

Police Force are black, and that only one sergeant is black, and

that he was just promoted to that status within the last few

weeks." (Findings of Fact, Conclusions of Law and Memorandum

Opinion, March 4, 1980, at 4).

2/ Plaintiffs' appeal was subsequently dismissed at the request

of the parties. (Order Dismissing Appeal, No. 80-3205, Feb. 18,

1981) .

-5-

requested compensation for all attorney time expended on the case

through December 31, 1980, and also for all subsequent time

devoted to implementation of the consent decree and to negotia

tion and litigation of the claim for counsel fees. Plaintiffs'

counsel reserved the right to file a supplemental application

requesting other fees, costs, and expenses.

In support of their fee application, counsel for plaintiffs

filed detailed time logs and affidavits showing their experience,

qualifications, and hourly billing rates. The application and

supporting affidavits show that Juanita Logan Christian, a

Louisville attorney who was admitted to practice in 1977,

began working on this case in January 1979. (Christian Affidavit,

11 2 and Ex. A, p. 1). Ms. Christian, who has some experience in

civil rights litigation {id., 1M( 3-5), drafted the plaintiffs'

EEOC charges and served as the plaintiffs' principal attorney in

most of the ensuing litigation and negotiation. (Id. 1(1( 2, 8-9).

She was assisted by her associate, Lynn M. Bynum, who was

admitted to practice in 1978. (Bynum Affidavit, 1| 2). Ms.

Christian received a total of approximately $7,600 from various

sources as advances on fees, costs, and expenses, with the

express understanding that she would refund any part of such

advances subsequently awarded by the Court. (Christian Supp.

Affidavit, 1M| 2-19) .

Ms. Christian and Ms. Bynum requested base rates of $85

and $75 an hour, respectively. —^ These rates were well within

3/ Ms. Christian requested an increased hourly rate of $105 for

36.25 hours of "in-court" time, defined as time spent in depo

sitions and in court proceedings. Ms. Bynum requested an hourly

rate of $90 for 0.75 hour of in-court time. (Counsel Fee Appli

cation, at 4 and Attachment 1).

- 6-

the range of their normal hourly billing rates. (Christian

Affidavit, 1( 6; Bynum Affidavit, 1[ 4) . The requested rates

were also consistent with all the evidence of record regarding

4/the hourly rates of Louisville attorneys generally, — in

cluding the customary hourly rates charged by counsel for

defendants. —^

4/ Counsel for plaintiffs filed the affidavits of six local

attorneys establishing the rates customarily charged by

Louisville attorneys in 1981 for complex federal litigation.

Defendants did not file any affidavits or present any other

evidence contradicting those affidavits. The affidavits may

be summarized as follows:

Affiant Attorney

and Law School

Class

Rate for

Attorney with

Less than 3

Years Ex

perience

Rate for

Attorney with

More than 3

Years Ex

perience

Aff iant

Attorney's

Rate

0. Barber, 1968 $60-75 $75-100 $ 90-100

F. Haddad, 1952 $60 $80-100 $100-125

G. Helman, 1968 $60-80 $80-100 $ 75 (cases

not involving

complex federal

litigation)

J. Hickey, 1965 - $70-110 $ 80-100

T. Hogan, 1969 $60 $80-100 $ 75-100

S. Manly, 1971 $60 $75-150 $100

5/ In the only affidavit filed by defendants bearing on the issue

of hourly rates, William L. Hoge, III, an attorney for the defendants

who was admitted to practice in approximately 1971, stated that his

"customary hourly fee ranges between $75 and $100 per hour in his

private practice." (Hoge Affidavit in Support of Defendants' Appli

cation for Attorney's Fees, 11 7). He also stated that, "since the

time expended by Affiant in the instant matter was due to his

position as an Assistant Jefferson County Attorney, Affiant believes

that a fair and reasonable hourly rate [for his services in this

case] would be $60 per hour." (Id.)

-7-

Before filing this action in the District Court, Ms.

Christian requested the assistance of the NAACP Legal Defense

and Educational Fund, Inc. (hereinafter "Legal Defense Fund" or

"LDF"). She made that request because of the Legal Defense

Fund's institutional expertise and resources, and because of

the specialized training and experience of its staff attor

neys in civil rights litigation and employment discrimination

law. (Christian Affidavit, 11 8). The Legal Defense Fund is

a New York-based, tax-exempt charitable organization which

provides specialized legal assistance in civil rights cases.

It has been cited by the Supreme Court for its "corporate

reputation for expertness in presenting and arguing the

difficult questions of law that frequently arise in civil

rights litigation." NAACP v. Button, 371 U.S. 415, 422 (1963).

The Legal Defense Fund is generally recognized as one of the

foremost civil rights law firms in the United States; its staff

attorneys have served as counsel in many landmark employment

discrimination cases and other civil rights cases decided by

the Supreme Court and other courts. (Patterson Affidavit,

111! 2-4) .

Legal Defense Fund attorneys began working with Ms. Christian

on this case in January 1980. (Patterson Affidavit, App. D, at

1). Patrick 0. Patterson, the principal LDF staff attorney on

the case, is a 1972 honors graduate of Columbia Law School. He

has litigated many employment discrimination class actions, has

lectured at numerous conferences and training programs on

employment litigation and related topics, and has taught a law

- 8-

school course in employment discrimination law. Since joining

the staff of the Legal Defense Fund in 1976, he has continued

to specialize in employment discrimination litigation. (Id.,

111! 12-15 and App. A) .

The Legal Defense Fund requested a base rate of $120 an

hour for Mr. Patterson's services. The record shows that this

rate was reasonable and comparable to the hourly rates charged

for complex federal litigation by attorneys of comparable

experience and ability in first-class New York firms. (Frankel

Affidavit, KK 4-5).—/ The record also shows that courts in

various parts of the country have awarded base rates of $125 to

$135 an hour for services performed by other LDF staff attorneys

and by comparable specialists in civil rights litigation.

(Patterson Affidavit, 11 17 and App. B) . The record further

shows that the rate requested by LDF in the present case was

conservative in comparison to the rates typically awarded in

6/ The affidavit of Marvin E. Frankel, who served for 13

years as a United States District Judge for the Southern

District of New York and is now a member and managing partner

of the New York City law firm of Proskauer Rose Goetz &

Mendelsohn, demonstrates that, for services performed in

complex federal litigation where payment of counsel fees is

not contingent upon success in the case, the rates charged

by New York City law firms in 1981 ranged from $70 to $275

(or more) per hour. His affidavit also establishes that,

based on the facts of record concerning Mr. Patterson's

experience and ability, a current base rate of $120 per hour

for his services is reasonable and comparable to the rates

charged by attorneys of comparable experience and ability in

first-class New York firms.

-9-

antitrust and securities cases. (Id., 11 18 and App. C) ^

The defendants did not dispute any of these facts.

Counsel for plaintiffs requested compensation for a total

of 836.45 documented hours. (Counsel Fee Application,

Attachment 1). Their total fee request, including a contin

gency adjustment of 25%, amounted to $98,431, plus post

judgment interest. (Id., Proposed Order and Judgment, at

2). On March 5, 1982, the District Court issued its memo

randum opinion and entered a judgment awarding less than

half that amount.—^

The Court held that the plaintiffs were the prevailing

parties and that their attorneys were therefore entitled to

an award of fees for all time reasonably expended on the

case. (Counsel Fee Opinion, at 2-3). The Court also held

that, with the exception of 3 specific hours of one attorney's

time, all of the 836.45 hours documented by plaintiffs'

counsel were appropriate and should be compensated. (Id.

9 /at 4-5, 7). — The Court concluded, however, that

7/ Counsel for plaintiffs filed a copy of a recent survey

of fee awards in antitrust and securities cases which shows

that, in awards made from approximately 1974 through early

1980 for which all necessary information is available, the

average base rate (with no adjustment for inflation) was

approximately $92.50 per hour, and the average actual rate

(with no adjustment for inflation) was approximately $165

per hour. When adjusted for inflation to February 1980, the

average actual hourly rate was over $200 per hour. Attorney

Fee Awards in Antitrust and Securities Class Actions, 6

Class Action Reports 82, 121 (1980). (Patterson Affidavit,

App. C).

8/ The Court awarded a total of $45,603.79 in fees, without

interest. (Judgment entered March 5, 1982). The Court

awarded the full amount of costs and expenses requested by

plaintiffs' counsel, also without interest. (Id.)

9_/ The Court reduced these hours by 5% to account for dupli

cation of effort. (Counsel Fee Opinion, at 7).

- 10-

Ms. Christian's rate should be set at only $55 an hour and

Ms. Bynum's at only $35 an hour. (Id. at 7). — / The Court set

a rate of only $70 an hour for Mr. Patterson's services.

(Id.) — / Furthermore, the Court concluded that plaintiffs'

counsel were not entitled to any contingency adjustment in the

fees. (Id. at 7-8). Finally the Court failed to direct

payment of interest on the judgment. (Judgment entered March

5, 1982). Plaintiffs' counsel filed their notice of appeal on

March 12, 1982.

ARGUMENT

I. IN MAKING AN AWARD OF FEES WHICH DID NOT COMPENSATE

PLAINTIFFS' COUNSEL FOR THE FAIR MARKET VALUE OF

THEIR SERVICES IN THIS CIVIL RIGHTS CASE, THE

DISTRICT COURT ABUSED ITS DISCRETION AND FAILED TO

COMPLY WITH THE REQUIREMENTS OF THE APPLICABLE

FEDERAL FEE AWARD STATUTES.

Both Title VII of the Civil Rights Act of 1964 and the

Civil Rights Attorney's Fees Awards Acts of 1976 provide for an

award to prevailing plaintiffs of "a reasonable attorney's fee as

part of the costs." 42 U.S.C. § 2000e-5(k); 42 U.S.C. § 1988. ' As

this Court held in its controlling decision in Northcross v. Board

of Education, Memphis City Schools, 611 F.2d 624, 632 (6th Cir.

10/ The Court set a rate of $75 an hour for Ms. Christian's

in-court services but compensated only 15.5 hours of her time

at this rate. (Counsel Fee Opinion at 4, 7-8).

11/ The Court compensated 16.3 hours of Mr. Patterson's time

at an in-court rate of $95 an hour. (Counsel Fee Opinion, at

5, 7) .

- 11-

1979, cert, denied, 447 U.S. 911 (1980), ... in making fee awards

in civil rights cases today, courts are no longer applying their

historical equitable powers to devise an adequate remedy." Instead,

they are awarding fees pursuant to the express direction of

Congress:

[R]ather than being an equitable remedy, flexibly

applied in those circumstances which the court

considers appropriate, it is now a statutory

remedy, and the courts are obligated to apply

the standards and guidelines provided by the

legislature in making an award of fees. There

fore, a close examination both of the statute

itself and its legislative history is necessary.

Id. at 632 (emphasis in original).

In Northcross, this Court undertook such an examination and

concluded that Congress has "commande[d] the courts to use the

broadest and most effective remedies available to them to achieve

the goals of the civil rights laws," id̂ . at 633, and that Congress

accordingly has mandated fee awards representing "the fair market

value of the services provided." _Id. at 638. The fundamental

purpose of the fee award statutes is to provide for effective

enforcement of the Constitution and civil rights laws by assuring

reasonable compensation for the lawyers who represent victims of

civil rights violations. As the Senate Judiciary Committee stated

in its report on the Civil Rights Attorney's Fees Awards Act of

1976 (hereinafter "Fees Act"):

[T]he civil rights laws depend heavily upon

private enforcement, and fee awards have proved an

essential remedy if private citizens are to have a

meaningful opportunity to vindicate the important

Congressional policies which these laws contain.

- 12 -

In many cases arising under our civil rights

laws, the citizen who must sue to enforce the law

has little or no money with which to hire a lawyer.

If private citizens are to be able to assert their

civil rights, and if those who violate the

Nation's fundamental laws are not to proceed with

impunity, then citizens must have the opportunity

to recover what it costs them to vindicate these

rights in court.

... "Congress therefore enacted the pro

vision^] for counsel fees ... to encourage

individuals injured by racial discrimination to

seek judicial relief...."

S. Rep. No. 94-1011, 94th Cong., 2d Sess. 2-3 (1976), quoting

Newman v. Piggie Park Enterprises, Inc., 390 U.S. 400, 402

(1968) . Accord, New York Gaslight Club, Inc, v. Carey, 447

U.S. 54, 60-66 (1980) .

Congress enacted these fee-shifting statutes to insure

"vigorous enforcement of ... civil rights legislation, while

at the same time limiting the growth of the enforcement

bureaucracy." S. Rep. No. 94-1011, at 4. As the House

Judiciary Committee stated in its report on, the Fees Act:

The effective enforcement of Federal civil

rights statutes depends largely on the efforts of

private citizens. Although some agencies of the

United States have civil rights responsibilities,

their authority and resources are limited. In

many instances where these laws are violated, it

is necesssary for the citizen to initiate court

action to correct the illegality. Unless the

judicial remedy is full and complete, it will

remain a meaningless right. Because a vast

majority of the victims of civil rights violations

cannot afford legal counsel, they are unable to

present their cases to the courts___ [The Fees

Act] is designed to give such persons effective

access to the judicial process where their grievances

can be resolved according to law.

H.R. Rep. No. 94-1558, 94th Cong., 2d Sess. 1 (1976). See also

Deposit Guaranty National Bank v. Roper, 445 U.S. 326, 338-39

-13-

(1980) . 12/

Congress was aware that the victims of civil rights

violations often could not vindicate their rights in court

because they were unable to obtain counsel. Citing evidence

that "private lawyers were refusing to take certain types of

civil rights cases because the civil rights bar, already

short of resources, could not afford to do so," the House

Committee found a "compelling need" for the Fees Act. H.R.

Rep. No. 94-1558, at 3. Congress thus concluded that the

Act was necessary to "insure that reasonable fees are awarded

to attract competent counsel in cases involving civil and

constitutional rights, while avoiding windfalls to attorneys."

Id. at 9. As this Court recognized in Northcross, "[t]he

entire purpose of the statutes was to ensure that the repre

sentation of important national concerns would not depend upon

the charitable instincts of a few generous attorneys." 611

F .2d at 638.

The legislative history of the fee award statutes requires

that they be construed "[i]n accordance with the[ir] broad

12/ In the present case it is clear that the plaintiffs'

Tnjuries were not remedied by the regulatory action of govern

ment, and that those injuries would have continued if plaintiffs'

counsel had not filed this private enforcement action. Be

ginning in April 1979, the plaintiffs filed a series of

administrative charges of discrimination with the Equal Employ

ment Opportunity Commission. (Complaint, 11 13 and Ex. A-C) . But

no corrective action was taken until after this lawsuit was filed

in January 1980. As the District Court found, "Jefferson County

had not changed its policies with regard to blacks until this

lawsuit was filed and, therefore, it cannot validly complain that

the suit was not necessary in order to effectuate the settlement

which resulted." (Counsel Fee Opinion, at 3-4).

-14-

See alsoremedial purpose." Northcross, 611 F.2d at 633.

Seals v. Quarterly County Court. 562 F.2d 390, 393 (6th Cir.

1977); Gates v. Collier, 616 F.2d 1268, 1275 (5th Cir.

1980). Following the mandate of Congress, this Court in

N°rthcross adopted "a logical, analytical framework which

should largely eliminate arbitrary awards based solely on a

judge's predispositions or instincts." 611 F.2d at 643.

This analytical approach is designed to insure that attorneys

are compensated for the fair market value of their services,

by requiring district courts to make reviewable determinations

of: (1) the hours of service provided; (2) reasonable

hourly rates for the services provided by particular attorneys;

and (3) appropriate adjustments to insure that the fee is

reasonable in view of special circumstances, including the

fact that receipt of an award is contingent upon success in

the case. Id. at 636-39. As the Court concluded, "[f]ocusing

on the fair market value of the attorney's services will

best fulfill the purposes of the Fees Awards Act, by providing

adequate compensation to attract qualified and competent

attorneys without affording any windfall to those who undertake

such representation." Id. at 638. — /

In some respects, the District Court in the present case

properly applied the statutory requirements imposed by Congress

That Court held, for example, that in obtaining a consent

13/ Other Circuits have adopted substantially similar approaches

to the calculation of counsel fees under federal fee award

statutes. See Lindy Bros. Builders, Inc, v. American Radiator &

City ofStandard Sanitary Corp., 487 F.2d 161 (3d Cir. 1973)

Detroit v. Grinnell Corp.. 560 F.2d 1093 (2d Cir. 1977)

~ _BishoP ' 635 F.2d 915 (1st Cir. 1980); Copeland v. MarsKlll.

(en banc); Anderson v. Morris,

, 635 F .2d 915

(D.C. Cir. 1980

(4th Cir. 1981).

at

Furtado

F.2d 880

F.2d 246

Fees in Class Actions,

"641

658

See generally a . Miller, Attorneys'

60-184 (Federal Judicial Center 1980)

-15-

decree providing substantial classwide and individual relief,

the plaintiffs became the prevailing parties and were

therefore entitled to an award of fees. (Counsel Fee Opinion,

at 2-3). See Maher v. Gagne, 448 U.S. 122, 129 (1980).

Moreover, since the plaintiffs were the prevailing parties

in the case as a whole, the District Court correctly held

that they were entitled to an award of fees for all time rea

sonably expended on the case, and that the defendants were

not entitled to any award of fees. (Counsel Fee Opinion,

at 2-3). See Northcross, 611 F .2d at 635-36. The Court

further held that, with the exception of 3 specific hours of

one attorney's time, all of the 836.45 hours documented by

plaintiffs' counsel were appropriate and should be compensated.

14/(Counsel Fee Opinion, at 4-5,7). See Northcross, 611

F.2d at 636-37. Finally, the Court awarded the full amount

of plaintiffs' costs and expenses. (Counsel Fee Opinion, at

8). See Northcross, 611 F.2d at 639-40.

In other respects, however, the District Court failed

to comply with the standards and guidelines established by

Congress. The Court set hourly rates which were far below

the market value of the services provided by plaintiffs' Louisville

attorneys, as measured by either their normal hourly rates or the

prevailing rates customarily charged by comparable Louisville

attorneys for similar services. See Section II, infra.

Additionally, although the Court set higher rates for in

court than for out-of-court services, it failed to compensate

14/ The District Court reduced these hours by 5% to account for

duplication of effort. (Counsel Fee Opinion, at 7). This

reduction was permissible under Northcross, 611 F.2d at 636-37.

-16-

plaintiffs' Louisville counsel at the higher rate for all

documented in-court services. Id. The Court also substantially

undervalued the services performed by plaintiffs' Legal Defense

Fund counsel, setting rates which were unreasonably low in view

of (a) the individual LDF staff attorney's background and

experience as a specialist in employment discrimination cases,

(b)ithe Legal Defense Fund's institutional resources and expertise,

and (c) the prevailing rates customarily charged by comparable

attorneys and national law firms for similar services. See

Section III, infra. Furthermore, the Court failed to make any

adjustment in the fees to account for the fact that recovery

of fees was contingent upon success in the case. See Section IV,

infra. Finally, the Court failed to direct payment of post

judgment interest on any of the fees, costs and expenses awarded

to plaintiffs' counsel. See Section V, infra. As a result of

these errors by the District Court, plaintiffs' counsel have

been deprived of the fair market value of the services they

provided in this case.

II. THE FEES AWARDED TO PLAINTIFFS' LOUISVILLE ATTORNEYS

WERE BASED ON HOURLY RATES FAR BELOW THE FAIR MARKET

VALUE OF THEIR SERVICES.

A. The Rates Set by the District Court Were Contrary

to All the Evidence in the Record Establishing

Reasonable Hourly Rates.

In Northcross, this Court held that hourly rates should

reflect

the fair market value of the services provided.

In most communities, the marketplace has set a

value for the services of attorneys, and the

hourly rate charged by an attorney for his or her

services will normally reflect the training,

background, experience and skill of the individual

attorney. For those attorneys who have no private

practice, the rates customarily charged in the

community for similar services can be looked to

for guidance.

-17-

611 F .2d at 638.

In accordance with the guidance provided by Northcross,

plaintiffs' Louisville attorneys, Juanita Logan Christian

and Lynn M. Bynum, submitted evidence in the present case

establishing both the hourly rates they normally charged

paying clients in their private practice and the rates com

parable Louisville attorneys customarily charged clients for

similar services. The base rates they requested in this case

— $85 an hour for Ms. Christian and $75 an hour for Ms.

Bynum — were well within the range of their normal hourly

rates, and were also consistent with all the evidence of

record regarding the hourly rates charged by Louisville

attorneys generally, including the customary rates charged

by counsel for the defendants in this case. See pp. 6-7,

supra. The defendants did not offer any evidence disputing

the reasonableness of the requested rates. Yet the District

Court refused to award the rates supported by the record,

and instead set rates of only $55 an hour for Ms. Christian

and only $35 an hour for Ms. Bynum. (Counsel Fee Opinion, at

7) .

Another court in this Circuit was recently confronted

with essentially the same situation. In Jones v.Federated

Department Stores, Inc., 527 F. Supp. 912 (S.D. Ohio 1981),

attorneys for the prevailing plaintiffs in a Title VII case

had submitted a fee application to the magistrate to whom

the case had been referred. In support of their application,

plaintiff's attorneys in that case filed affidavits regarding

their hourly rates. In addition, another attorney testified

that the rates requested by plaintiff's counsel were in line

-18-

with the rates generally charged by other Dayton attorneys

with comparable experience. 527 F. Supp. at 919. The de

fendants did not offer any evidence regarding hourly rates.

The magistrate in Jones, like the District Court in the

present case, did not accept the rates established by the

record, opting instead for lower hourly rates. The court in

Jones reversed this determination as clearly erroneous.

Like the District Court here, the magistrate in Jones

"committed error when he failed to rely on, or at least

distinguish, the only evidence in the record ... indicating

the 'fair market value of the services provided.'" 527 F.

Supp. at 919 (emphasis in original), quoting Northcross, 611

F.2d at 638. As in the present case, the magistrate in Jones

not only "failfed] to discuss, rely upon or distinguish [the

evidence establishing prevailing rates in the community]

..., but he failed to discuss and distinguish the figures

proferred by the attorneys themselves." Id. Like the rates

set by the magistrate in Jones, the rates set by the District

Court in the present case are not supported by any evidence

in the record and must therefore be reversed.

B . The Rates Set by the District Court for Services

Performed in this Case in 1979-1981 Were

Inherently Unreasonable Because They Were Based on

Rates Previously Awarded in a Different Case for

Services Performed in 1974-1979.

Rather than relying on the uncontroverted evidence in the

case at bar to determine reasonable current hourly rates, the

District Court turned instead for guidance to its prior decision

awarding fees for a different period of time in the Louisville

Black Police case. (Counsel Fee Opinion, at 5-6). That decision,

as noted above, is presently before this Court on appeal.

-19-

In the Louisville Black Police case, plaintiffs' counsel

requested fees for services performed from 1974 to 1979. In its

initial counsel fee opinion in that case, the District Court set

hourly rates for attorneys in three different categories: (1)

"inexperienced," zero to two years of experience; (2) "intermediate,"

two to seven years; and (3) "fully experienced," more than seven

years. (Appendix in Nos. 81-5466/5491, at 333). The Court further

held that, for the period 1974 to 1979, the "inexperienced" attorney

rates were $40 an hour for office work and $56 an hour for in-court

work; the "intermediate" rates were $50 an hour for office work and

$70 an hour for in-court work; and the "fully experienced" rates

were $65 an hour for office work and $90 an hour for in-court work.

(Id. at 333-34) /

Plaintiffs' counsel contended in Louisville Black Police that,

due to the effects of inflation in the intervening years, an award

of fees in 1981 based on these 1974-1979 rates would not compensate

them for the fair market,, value of their services. They argued that

the District Court was required under Northcross either to adjust

these historical rates directly to reflect the annual increase in

the Consumer Price Index, or in the alternative to award fees for

past services at the attorneys' present hourly rates. (See Brief

for Plaintiffs-Appellants in Nos. 81-5466/5491, at 22-34). The/

District Court rejected both approaches, holding as follows:

We find no indication that Nor thcross gives

the District Court the "either-or" alternative of

adding an inflation factor into attorney fee

awards, or granting fees based on the present value of

15/ The Court held that Deborah M. Greenberg, a Legal Defense Fund

attorney who graduated from law school in 1957, did not fall within

any of these categories. She was awarded $75 an hour for office

work and $106 an hour for in-court work. (Appendix in Nos. 81-

5466/5491, at 332-33).

- 20-

comparable work by the same attorneys. ... [W]e

found in our memorandum opinion of February 12,

1981 that the Louisville Black Police attorneys

have been fairly and adequately compensated without

the addition of an inflation factor or the use of

a present-value based calculation....

(Appendix in Nos. 81-5466/5491, at 432). Thus, in its

Louisville Black Police opinions the Court made it very clear that

it was awarding fees on the basis of rates that it found to be

reasonable for the period 1974-1979.

In its opinion in the present case, however, the District

Court described its Louisville Black Police decision as follows:

This Court held in Louisville Black Police

Officers' Organization v. City of Louisville,

supra, that $40 per hour represents a reasonable

figure to use for attorneys who are in their

first two years of practice. We then went on to

hold that persons with two to seven years might

be considered as having intermediate experience

and being entitled to fees of $65 per hour

for out-of-court work, and $90 per hour for

in-court work. For those persons who had

more than seven years of experience, we

regarded them as being fully experienced, and

entitled to, and in the case of Deborah Greenberg

who met that qualification, an award of $75 for

out-of-court work and $106 per hour for in-court

work was appropriate [sic].

(Counsel Fee Opinion, at 5-6). Stating that the Louisville Black

Police case "had lasted for almost six years and ... had been

bitterly contested," the Court then found that the "[r]epresen-

tation afforded by counsel, in that case, in effect made it much easier

for counsel in the case at bar, and basically narrowed their

representation to the objective of obtaining a fair settlement

based on the settlement that had been reached in Louisville

Black Police ... and in [sic] attempting to secure for Baker and

Arnold more favorable treatment than they had been accorded by

the Jefferson County Police Department." (Id. at 6). Contrary

- 2 1 -

to the Court's statement, however, no settlement had been

reached in the Louisville Black Police case at the time the

present action was filed in January 1980; in fact, the parties

did not submit their proposed consent decree in Louisville

Black Police until May 1980, and the Court did not approve

that decree until September 1980. (Appendix in Nos. 81-

5466/5491, at 23-24). The District Court's finding in this

regard is clearly erroneous.

In setting hourly rates in the present case, the District

Court stated that it was following the three-category approach

it had adopted in the Louisville Black Police case. The Court

found that Ms. Christian passed from "inexperienced" to

"intermediate" in May 1979, that Ms. Bynum made this transition

in October 1980, and that Mr. Patterson became "fully experienced"

in 1979. (Counsel Fee Opinion, at 6-7). The Court then held

that, "[b]ecause of the difference in the amount of difficul

ties incurred" in the present case as compared to the Louisville

16/Pol ice case, — ' the following rates were appropriate: $35

an hour for work done by Ms. Bynum, $55 an hour for out-of-

court work and $75 an hour for in-court work done by Ms. Christian,

and $70 an hour for out-of-court work and $95 an hour for in-court

work done by Mr. Patterson. (Id̂ .) — ^ The Court failed to note

that in the present case it was awarding fees for services performed

in 1979-1981, whereas in Louisville Black Police it had awarded

16/ The Court stated that it had also considered the affidavits

of record in the present case. (Counsel Fee Opinion, at 7).

However, the rates it awarded were far below the rates

established by those uncontroverted affidavits.

17/ The Legal Defense Fund had requested a rate of $120 an

hour for Mr. Patterson's services. See Section III, infra.

- 2 2 -

fees at substantially the same rates for services performed

in 1974-1979.— ^ As set forth above, the Court in Louisville Black

Pol ice had held that those rates were appropriate for work done in

that period, and had explicitly refused either to directly adjust

those rates for inflation or to award current rates. (Appendix in

Nos. 81-5466/5491, at 432).

Thus, for services performed from 1979 to 1981 in the present

case, plaintiffs' counsel were not compensated on the basis of the

reasonable current hourly rates established by the uncontroverted

evidence in the record. Instead, they were compensated on the

basis of rates which the District Court had previously found to be

reasonable in a different case for the period 1974-1979. Nothing in

the present record — or in the Louisville Black Police record, for

that matter -- justifies the use of those rates in this case.

Indeed, due to inflation, the use of 1974 rates to compensate

plaintiffs' counsel for work they did in 1979-1981 is inherently

u n r e asonable^

18/ The hourly rate set for Ms. Bynum work in the present case was

$15 an hour less than the "intermediate" rate and $5 an hour less

than the minimum "inexperienced" rate set for the period 1974-1979

in the Louisville Black Police case. The rates awarded for Ms.

Christian's and Mr. Patterson's work in the present case were each

$5 above the corresponding rates set for "intermediate" and "fully

experienced" attorneys, respectively, in the Louisville Black Police

case. See p. 20, supra.

19/ The Consumer Price Index, based on a scale of 100 in 1967,

increased from 147.7 in 1974 to 272.3 in 1981. U.S. Department of

Labor, Bureau of Labor Statistics, 105 Monthly Labor Report at 85,

Table 19 (May 1982). Thus, the 1967-based consumer dollar was

worth 67.8 cents in 1974; by 1981, its value had declined to 36.7

cents. Conversely, a 1981 dollar would buy only as many goods and

services as 54 cents bought in 1974. Accordingly, as of 1981, the

hourly rate awarded to Ms. Christian in the present case ($55) was

equivalent to a rate of $29.70 awarded in 1974, and the hourly rate

awarded to Ms. Bynum ($35) was equivalent to a rate of $18.90

awarded in 1974.

-23-

c. The Rates Set by the District Court Were Contrary

to the Requirements of the Federal Fee Award Statutes.

The legislative history of the Fees Act demonstrates that

the overriding purpose of the fee award statutes is to encourage

private enforcement of the civil rights laws "by providing

adequate compensation to attract qualified and competent attorneys

without affording any windfall to those who undertake such

representation." Northcross, 611 F.2d at 638. See Section I,

supra. As Congress recognized, reasonable hourly rates are an

essential element of adequate compensation.

The Senate Judiciary Committee's report on the Fees Act

cited three cases as illustrative of the proper application of

the standards governing the amount of fees: Stanford Daily v.

Zurcher, 64 F.R.D. 680 (N.D. Cal. 1974); Davis v. County of Los

Angeles, 8 EPD 1[ 9444 (C.D. Cal. 1974) ; and Swann v. Charlotte-

Mecklenburg Board of Education, 66 F.R.D. 483 (W.D.N.C. 1975).

S. Rep. No. 94-1011, at 6. In Stanford Daily, the court held

in 1974 that $50 was a reasonable hourly rate for work performed

from 1971 to 1974. 64 F.R.D. at 685. In Davis, the court

held in 1974 that rates ranging from $35 to $60 an hour were

reasonable for work performed in 1973 and 1974. 8 EPD at p.

5048. In Swann, the Court awarded fees in 1975 at an effective

rate of $65 an hour for work done from 1968 through 1974. 66

F.R.D. at 486. These rates translate into the following amounts

in 1981 dollars: Stanford Daily, $92 an hour; Davis, $65-$lll

an hour; Swann, $110 an hour. — 7 Congress determined that

20/ Between 1974 (the year the awards were made in Stanford

Daily and Davis) and 1981, the Consumer Price Index increased

by a factor of 1.844, from 147.7 to 272.3. Between 1975 (the

year the award was made in Swann) and 1981, the Index increased

by a factor of 1.689, from 161.2 to 272.3. U.S. Department

of Labor, Bureau of Labor Statistics, 105 Monthly Labor Report

at 85, Table 19 (May 1982). The rates awarded in 1974 and

1975 are multiplied by the applicable factor to convert them

to 1981-dollar equivalents. -24-

the fees awarded in these cases were "adequate to attract

competent counsel, but ... do not produce windfalls to attorneys."

S. Rep. No. 94- 1011, at 6.

Congress also determined that "the amount of fees awarded

under [the Fees Act should] be governed by the same standards

which prevail in other types of equally complex Federal litigation,

such as antitrust cases ...," S. Rep. No. 94-1011, at 6, and

that "civil rights plaintiffs should not be singled out for

different and less favorable treatment." H.R. Rep. No. 94-1558,

at 9. See Northcross, 611 F.2d at 633. As the survey submitted

by plaintiffs demonstrates, the rates requested in the present

case were modest in comparison to the average actual rate of

over $200 an hour awarded in antitrust and securities litigation.

See p. 10, supra. The defendants did not offer any evidence

contradicting the findings of this survey. Nevertheless, the

District Court made no reference to it — or to any of the

other record evidence — when it set the hourly rates in this

case.

Finally, Congress determined that attorneys for prevailing

civil rights plaintiffs should be paid in the same manner as

attorneys compensated by fee-paying clients. See S. Rep. No.

94-1011, at 6. As a rule, attorneys who win major cases are

able to command higher hourly rates when they represent fee

paying clients in subsequent cases involving similar issues.

Their clients recognize that, as a result of their experience

in earlier cases, their familiarity with the issues involved,

and the precedential value of their previous victories, such

attorneys are able to use their time more productively and to

-25-

achieve favorable results without expending as many hours as

might otherwise be required. Cf. Northcross, 611 F.2d at

637.

The District Court recognized that its prior decision

in Louisville Black Police had that effect in the present

case. The defendants here were aware of that decision, and

" [w]ith this knowledge at hand, defendants not only indicated

their willingness to settle the case very early on, but also

made unnecessary the taking of extensive discovery ...."

(Counsel Fee Opinion, at 3). Thus, in part because plaintiffs'

counsel had prevailed after six years of "bitterly contested"

litigation in the Louisville Black Police case, the present

case was resolved in a relatively short period of time, with

21/a comparatively small number of attorney hours. — (Id. at

6 ) .

However, instead of recognizing that the market value

of the services provided by plaintiffs' attorneys had, if

anything, increased as a result of their success in the

Louisville Black Police case, the District Court held that

their hourly rates should be reduced "[b]ecause of the

difference in the amount of difficulties" in that case as

compared to this one. (Counsel Fee Opinion, at 6). Thus,

plaintiffs' counsel were penalized because they had prevailed

in the earlier case, and defendants received a windfall:

21/ In the present case, plaintiffs' counsel requested

compensation for a total of 836.45 hours. In their first fee

application in the Louisville Black Police case, they requested

compensation for 4,511.25 hours. (Appendix in Nos. 81-5466/5491,

at 66). In a second application now pending before the District

Court in that case, they have requested compensation for an

additional 3,693.2 hours.(Second Application for Award of

Interim Attorneys' Fees, Costs and Expenses in Civil Action

No. C 74-106L(A), dated March 19, 1982).

-26-

not only did they pay for far fewer attorney hours as a result

of the prior litigation, but they paid for those hours at

less than full market value.

In sum, the rates set by the District Court did not

reflect the fair market value of the services provided by

plaintiffs' Louisville attorneys. Ignoring all the relevant

evidence in the record and disregarding the intent of Congress,

the District Court entered an "arbitrary award ... based solely

on a judge's predispositions or instincts." Northcross, 611

F.2d at 643. This is precisely what the federal fee award

statutes and this Court's decision in Northcross were designed

to prevent.

D. The District Court Failed to Compensate

Plaintiffs' Louisville Counsel at a Higher

Rate for All Documented In-Court Services.

Ms. Christian requested a higher "in-court" hourly

rate for 36.25 documented hours she had spent in court and in

depositions. The District Court awarded a rate of $75 an

hour for Ms. Christian's in-court time, as compared to $55 an

hour for her other time (Counsel Fee Opinion, at 7), but com

pensated only 15.5 hours of her time at the higher hourly rate.

(Id. at 4, 8) .

While the District Court described only 15.5 hours of her

time as being "spent in court at trial" (id. at 4), the record

shows that Ms. Christian spent a total of 22.5 hours in court

at trial between February 4 and February 8, 1980. (Christian

Affidavit, Ex. A (1980), at 2). The remainder of the time for

-27-

which she claimed an in-court rate was also fully documented. —

The District Court did not explain why it had refused to award

the full number of documented hours at the in-court rate, nor

did it identify the hours it had disallowed. This arbitrary

reduction in fees was not permissible under Northcross. See

611 F .2d at 637.

III. THE FEES AWARDED TO THE LEGAL DEFENSE FUND WERE

BASED ON HOURLY RATES FAR BELOW THE FAIR MARKET

VALUE OF THE SERVICES IT PROVIDED IN THIS CASE.

The Legal Defense Fund requested a base rate of $120 an

hour for the work done in this case by one of its staff attorneys,

Patrick 0. Patterson. In support of that request, the applicants

submitted the following: (1) Mr. Patterson's affidavit des

cribing his qualifications and experience as a specialist in

employment discrimination litigation; (2) the affidavit of former

District Judge Marvin E. Frankel, establishing that the requested

rate was reasonable and comparable to the hourly rates charged by

attorneys of comparable experience and ability in first-class New

York law firms; (3) recent decisions from various parts of the

country awarding base rates of $125 to $135 an hour for services

performed by LDF staff attorneys and by comparable specialists in

civil rights litigation; and (4) a survey demonstrating that the

rate requested by the Legal Defense Fund was conservative in

comparison to the rates typically awarded in antitrust and

securities cases. See pp. 8-10, supra. Although the defendants

22/ This remaining time consisted of the following: a hearing

on plaintiffs' motion for a temporary restraining order (Jan.

25); five depositions (Jan. 31); two conferences with the Court

(Feb. 8, Dec. 18); and an oral argument on plaintiffs' motion

for a preliminary injunction (Feb. 20). (Christian Affidavit,

Ex. A (1980), at 1-7; Ex. A (1980-81), at 1).

-28-

did not dispute any of these facts, the District Court refused to

award the rate supported by the record. Instead, it compensated

Mr. Patterson's time at a rate of $70 an hour. (Counsel Fee

Opinion, at 7). — ^

For the reasons set forth in section II of this brief,

supra, the District Court erred with respect to all of

plaintiffs' attorneys in setting hourly rates which were not

supported by the record in this case and were inconsistent with

the intent of Congress. In compensating the Legal Defense Fund

for its services at a rate of only $70 an hour, the District

Court compounded these errors by failing to recognize that the

services of LDF specialists in civil rights cases have a higher

market value than the services of most other lawyers in such cases.

The Legal Defense Fund is a "nonprofit organization

dedicated to the vindication of the legal rights of blacks and

other citizens." Gulf Oil Co. v. Bernard, 101 S.Ct. 2193, 2199

n.ll (1981). The Supreme Court and other courts have long

recognized the Fund's "corporate reputation for expertness in

presenting and arguing the difficult questions of law that

frequently arise in civil rights litigation." NAACP v. Button,

371 U.S. 415, 422 (1963). As a result of the Fund's long

involvement in civil rights cases and the specialization of its

staff attorneys, the Fund has acquired an institutional expertise

that makes its time more valuable than the time of most private

attorneys in such cases. As this Court stated in Northcross;

23/ The Court compensated 16.3 of Mr. Patterson's hours at an

in-court rate of $95 an hour. (Counsel Fee Opinion, at 7).

-29-

The services provided by the Legal

Defense Fund clearly had to be provided by

someone, and in fact, the attorneys'

intimate familiarity with the issues in

volved in desegregation litigation

undoubtedly meant that their time was far

more productive in this area than would

be that of a local attorney with less

expertise.

611 F .2d at 637.

The Legal Defense Fund has the same intimate familiarity

with the issues involved in employment discrimination litigation.

Indeed, Ms. Christian asked the Fund for assistance in the present

case precisely because of its institutional expertise and resources,

and because of the specialized training and experience of its

staff attorneys in civil rights litigation and employment dis

crimination law. (Christian Affidavit, 1[ 8). The record shows

that the Fund played a crucial role in this case. (See Patterson

Affidavit, 1[ 20). The District Court characterized Mr. Patterson's

role as that of "lead counsel" in the case. (Counsel Fee

Opinion, at 5).

In enacting the Fees Act in 1976, Congress intended to

insure that, when public interest organizations provide legal

services such as those provided by the Legal Defense Fund in the

present case, they will receive fee awards representing the full

market value of their services. As noted above, the Senate Report

listed three decisions as examples of the proper application of

standards governing the amount of fees. S. Rep. No. 94- 1011, at

6. Each of these decisions expressly held that fees should not

be denied or reduced because the plaintiffs were represented by

public interest attorneys. Stanford Daily v. Zurcher, supra,64

-30-

F.R.D. at 681; Davis v. County of Los Angeles, supra, 8 EPD at

pp. 5048-49; Swann v. Charlotte-Mecklenburg Board of Education,

supra, 66 F.R.D. at 486. The House Report also cited three such

cases with approval, H.R. Rep. No. 94-1558, at 8 n.16, including

this Court's decision in Incarcerated Men of Allen County Jail v.

Fair, 507 F.2d 281, 286 (6th Cir. 1974) (a full award of fees

"serves its purpose— to prevent worthy claimants from being

silenced or stifled because of a lack of legal resources--whether

it goes to private or 'public' counsel"). See also Fairley v.

Patterson, 493 F.2d 598, 607 (5th Cir. 1974); Torres v. Sachs, 69

F.R.D. 343 (S.D.N.Y. 1975), aff'a, 538 F.2d 10 (2d Cir. 1976).

As the Supreme Court has concluded, "Congress endorsed such

decisions allowing fees to public interest groups when it was

considering, and passed, the [Fees Act], which is legislation

similar in purpose and design to Title VII's fee provision."

New York Gaslight Club, Inc, v. Carey, 447 U.S. 54, 70-71 n.9

(1980). See also Copeland v. Marshall, supra, 641 F.2d at

899-900.

The legislative history of the Fees Act further demon

strates that the Legal Defense Fund should be compensated at rates

which recognize the individual and institutional expertise of its

attorneys. The Senate Report cited Johnson v. Georgia Highway

Express, Inc., 488 F .2d 714 (5th Cir. 1974), as providing appro

priate standards for fee awards. S. Rep. No. 94-1011, at 6.

Johnson, in which the plaintiffs were represented by LDF attorneys,

states that "[a]n attorney specializing in civil rights cases may

enjoy a higher rate for his expertise than others, providing his

-31-

ability corresponds with his experience." See also Stanford

Daily v. Zurcher, supra, 64 F.R.D. at 684 (attorneys should be

compensated for "specialized knowledge of civil rights

litigation")? Davis v. County of Los Angeles, supra, 8 EPD at p.

5048 (awarding a higher hourly rate to "an able and experienced

litigator in employment discrimination cases").

The District Court in the present case failed to follow

the instructions of Congress. The record here shows that plain

tiffs’ LDF counsel was a highly qualified and experienced

specialist in employment discrimination litigation, and that he

played a leading role in this case. As other courts have recog

nized, these facts justify a higher hourly rate than would

otherwise be appropriate. See, e.g., Chrapliwy v. Uniroyal, Inc.,

670 F.2d 760, 764, 769 (7th Cir. 1982) (New York City and

Washington, D.C., attorneys specializing in employment discrimination

litigation entitled to hourly rates of $200 and $175, respectively);

Hedrick y. Hercules, Inc., 658 F.2d 1088, 1097 (5th Cir. 1981)

(Gadsden, Alabama, attorney with special expertise and experience

in employment discrimination cases entitled to rate of $120 an

hour) .

Moreover, as a staff attorney at the Legal Defense

Fund, plaintiffs' LDF counsel brought with him the institutional

expertise and experience of the Fund as a whole. Mr. Patterson

was able to draw on the Fund's institutional expertise and

-32-

24/resources throughout his involvement in this case, — and

therefore his time was "far more productive in this area than

would be that of a local attorney with less expertise."

Northcross, 611 F.2d at 637. Thus, the fair market value of Mr.

Patterson's services cannot properly be determined without

considering both his individual qualifications and experience and

the institutional expertise and resources of the Legal Defense

Fund itself.

The District Court further erred in limiting its focus

to the local Louisville market rather than determining the value

of the Legal Defense Fund's services in the context of the

national market in which its attorneys practice. As this Court

recognized in Northcross, Congress mandated that the amount of

fees to be awarded under the Fees Act should be governed "by the

same standards which prevail in other types of equally complex

Federal litigation, such as antitrust cases," and should not be

reduced because the rights involved may be nonpecuniary in

nature. 611 F.2d at 633, quoting S. Rep. No. 94-1011, at 6.

Thus, plaintiffs in civil rights cases, like plaintiffs in

antitrust cases, cannot be limited to their local area in

obtaining legal representation, but are entitled to be repre

sented by the civil-rights equivalent of national law firms with

special expertise in such cases. In order to effectuate the

intent of Congress, the attorneys and organizations that provide

such specialized services must be compensated at rates which take

24/ Other LDF attorneys reviewed documents and conferred with

Mr. Patterson on the case, but no compensation was claimed for

their services. (Patterson Affidavit, 1[ 21).

-33-

into account not only their reputation and expertise, but also

the nature and location of their practice and the prevailing

rates charged by comparable firms for comparable services.

A recent study of counsel fee awards in class actions,

commissioned by the Federal Judicial Center, includes detailed

consideration of the problems raised by the existence of varying

rates for legal services throughout the country. The study found

in part that,

. . . if the schedule for the community

where the litigation takes place is

chosen, some attorneys may be compensated

at rates much higher or lower than they

normally would command. This system

might contribute to inequities in the

availability of high quality legal

services. For example, an experienced

and successful attorney from a major

urban area might be unwilling to take a

case in a rural community if he or she

knew the rate of compensation would be

much lower than what could be earned at

home . . . .

A. Miller, Attorneys' Fees in Class Actions, at 365-66 (Federal

Judicial Center 1980) (footnote omitted).

This is precisely what happened in the present case:

the services of a specialized staff attorney from the Legal Defense

Fund's New York City office were compensated at far lower rates

than the Fund could obtain for the services of that same attorney

in New York and many other parts of the country. If the Legal

Defense Fund and other civil rights law firms are not permitted

to recover the fair market value of their services, their ability

to provide effective legal assistance to vindicate federally

protected rights will be significantly impaired. The purposes of

-34-

the federal fee award statutes will not be served by reducing

counsel fee awards and thereby limiting the activities of such

organizations. To the contrary, those purposes are advanced by

the involvement of the Legal Defense Fund and similar

organizations in as many cases as possible. The low rates

awarded to the Fund in the present case therefore frustrate

25/the intent of Congress. —

The Federal Judicial Center study concluded that the

problem of geographic variations in rates could be solved, to

some extent,

... by interpreting the concept of community

standard as including both geography and the

substantive law character of the case. Rates

within areas of specialization of legal

practice do not vary as much among regions of

the country as do fee rates in general. Fo

cusing on the rates within the specialization

reduces the problem of varying community

rates.

Attorneys' Fees in Class Actions, supra, at 366. See also, id.

at 9, 364.

The Seventh Circuit recently adopted this solution in

Chrapliwy v. Uniroyal, Inc., supra. There the attorneys for the

prevailing plaintiffs in a Title VII case litigated in South

Bend, Indiana, included employment discrimination specialists

from New York and Washington, D.C., as well as local counsel.

They requested rates ranging from $175-$200 an hour for the

25/ The Legal Defense Fund is a private, nonprofit organiza

tion funded primarily by tax-deductible contributions from private

individuals. In recent years, following the enactment of the Fees

Act of 1976, counsel fee awards and settlements in cases litigated

by LDF staff attorneys have also provided a significant source of

funds for LDF's program, comprising approximately 12 percent of

its income in 1978 and 1979, and over 20 percent of its income in

1980. (Patterson Affidavit, 11 6). If this important source of

income were curtailed, LDF would have to devote more of its efforts

to raising funds and less to litigating civil rights cases.

-35-

specialists down to $50-$70 an hour for the local attorneys.

670 F.2d at 764. The district court held that the New York

and Washington attorneys were limited to recovering local

rates, and awarded them $50-$75 an hour. Id. at 768.

The Seventh Circuit reversed, holding that the district

court had "erred as a matter of law in limiting the hourly

rates to local rates charged in the South Bend area." 670

F.2d at 768. The court held that Congress did not intend to

limit civil rights plaintiffs to their local area in obtaining

representation; to the contrary, Congress intended to encourage

plaintiffs to go elsewhere if it was necessary to do so in

order to find attorneys with the requisite degree of skill and

expertise. I_d. at 768-69. As the court stated:

. Attorneys with specialized skills in a narrow

area of law, such as admiralty law, patent law, or

antitrust and other complex litigation, tend to be

found in large cities, where an attorney may have

a greater opportunity to focus on a narrow area of

law. As a specialist, the attorney will usually

charge more for performing services in his area of

expertise than a general practitioner will charge

for performing-similar services. Furthermore, the

costs of practicing law will vary from city to city,

and such costs will be reflected in the rates of

the attorneys.

Id. at 769. In Chrapliwy, as in the present case, the skills

and expertise of plaintiffs' out-of-town specialists in

employment discrimination law were not available in the local

area, and the plaintiffs acted reasonably in going beyond their

local area to find such specialists. The Seventh Circuit there

fore held that plaintiffs' New York and Washington attorneys

were entitled as a matter of law to be compensated on the basis

-36-

of their billing rates of $175-$200 an hour. Id.

In a case involving Legal Defense Fund lawyers, the

Fifth Circuit as well has recognized that reasonable fees

for New York attorneys may not be the same as reasonable

fees for attorneys located elsewhere. In Jones v. Armstrong

Cork Co., 630 F.2d 324, 325 (5th Cir. 1980), the court held

that, " [a]lthough involved in the same [Georgia] case, the

fees awarded to lawyers from the LDF's New York City office

would not necessarily be reasonable fees for .. a Macon,

Georgia private practitioner." Cf. Bradford v. Blum, 507

F .2d 526 (S.D.N.Y 1981) (reasonable hourly rates for New

York attorneys in 1981 were $75 for attorneys with less than

two years of experience, $90 for those with more than two

years, and $125 for those with as much as 12 years).

In the present case, plaintiffs' counsel submitted ample

evidence that a base rate of $120 an hour reflected the fair

market value of the services provided by the Legal Defense

Fund. See pp. 9-10. supra. None of this evidence was

challenged by the defendants, but all of it was ignored by

the District Court, which compensated the Legal Defense Fund

for Mr. Patterson's services at a rate of only $70 an hour —

even less than the market value of the services of Louisville

26/attorneys with equivalent years of experience. The