Adarand Constructors, Inc. v. Pena Brief for the Respondents

Public Court Documents

December 1, 1994

Cite this item

-

Brief Collection, LDF Court Filings. Adarand Constructors, Inc. v. Pena Brief for the Respondents, 1994. 11af56ea-ab9a-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/b6bde202-cedf-4328-957c-2108f0789ec5/adarand-constructors-inc-v-pena-brief-for-the-respondents. Accessed February 22, 2026.

Copied!

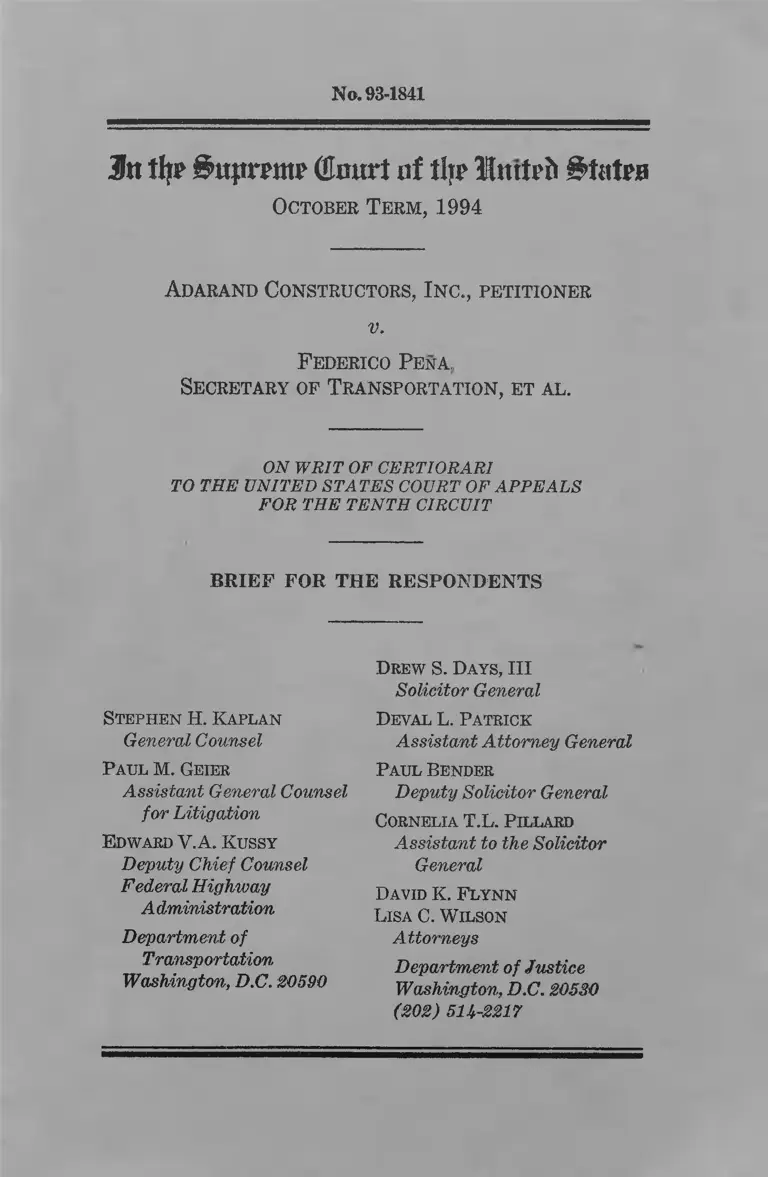

No. 93-1841

3fri tlyp #n;tmnp (tart nf Hyp Hmtrft g>tatPB

Adarand Constructors, Inc., petitioner

Secretary of Transportation, et al.

ON WRIT OF CERTIORARI

TO THE UNITED STATES COURT OF APPEALS

FOR THE TENTH CIRCUIT

BRIEF FOR THE RESPONDENTS

October Term, 1994

v.

F ederico Pena.

Drew S. Days, III

Solicitor General

Stephen H. Kaplan

General Counsel

Deval L. Patrick

Assistant Attorney General

Paul M. Geier

Assistant General Counsel

Paul Bender

Deputy Solicitor General

for Litigation Cornelia T.L. P illard

Assistant to the SolicitorEdward V.A. Kussy

Deputy Chief Counsel

Federal Highway David K. Flynn

General

A dministration

Department of

Lisa C. Wilson

Attorneys

Department of Justice

Washington, D.C. 20530

(202) 515-2217

Transportation

Washington, D.C. 20590

QUESTIONS PRESENTED

1. Whether the equal protection component of the

Fifth Amendment prohibits Congress from enacting

a rebuttable presumption that minority-owned and

-controlled businesses are disadvantaged business en

terprises under the Small Business Act.

2. Whether the equal protection component of the

Fifth Amendment prohibits the Department of

Transportation, pursuant to the Small Business Act,

from offering added compensation to federal govern

ment prime contractors who choose to subcontract

10% or more of their contract work to disadvan

taged business enterprises in order to cover the costs

of assisting the disadvantaged businesses.

(i)

TABLE OF CONTENTS

Page

Opinions below..................................... 1

Jurisdiction.......................................... 1

Constitutional and statutory provisions involved......... 2

Statement............................................................................ 2

1. Statutory background .......................... -............ - 4

2. Regulatory background ........................................ 12

3. The Subcontracting Compensation Clause......... 17

4. Proceedings below ................................................ 19

Summary of argument................................................... 22

Argument:

I. The Subcontracting Compensation Clause is

constitutional...... ................................................... 25

A. The Clause is based on social and economic

disadvantage; minority racial status plays

only a procedural role through a rebuttable

presumption of such disadvantage ......-....... 25

B. Petitioner lacks standing to challenge the use

of the race-based rebuttable presumption..... 27

C. The Clause does not constitute a preference

for disadvantaged subcontractors ................. 31

D. The rebuttable presumption of disadvantage

is based on congressional findings of racial

discrimination and serves the compelling

governmental objective of remedying past

discrimination.................................................. 33

1. Race-based remedial action by Congress

is subject to intermediate scrutiny......... 34

2. Intermediate scrutiny applies here ...... 38

3. Congress had a firm and compelling basis

to act ......................................................... 41

E. The Clause is narrowly tailored to achieve

Congress’s constitutional objectives ............. 43

(III)

IV

Argument—Continued: Page

1. The Clause is not underinclusive............. 43

2. The Clause is not overinclusive ____ 44

3. The Clause does not involve a fixed quota

or set-aside ........... ........ ............................ 47

4. The rebuttable presumption is of limited

duration.... ...... 48

II. Principles of stare decisis support the continuing

vitality of Fullilove v. Klutznick............... ......... 49

Conclusion ......................... 50

Appendix A ..... la

Appendix B ..... 18a

Appendix C ............. ............. .......... ............ ...... ....... . 37a

TABLE OF AUTHORITIES

Cases:

Allen V. Wright, 468 U.S. 737 (1984) ................... 30

Autek Systems Corp. V. United States, 835 F. Supp.

13 (D.D.C. 1993), aff’d, No. 93-5399 (D.C. Cir.

May 13, 1994) ................................ 14

City of Richmond V. J.A. Croson Co., 488 U.S. 469

(1989)....- .............. passim

Dandridge V. Williams, 397 U.S. 471 (1970) ......... 26

Doe V. Heatherly, 671 F. Supp. 1081 (D. Md.

1987), aff’d, 854 F.2d 1316 (4th Cir. 1988)....... 13

EEOC V. Wyoming, 460 U.S. 226 (1983) ............... 35

Ellis V. Skinner, 961 F.2d 912 (10th Cir.), cert.

denied, 113 S. Ct. 374 (1992) ................... ......... 50

Fullilove V. Klutznick, 448 U.S. 448 (1980).........passim

Harrison & Burrowes Bridge Constructors, Inc. V.

Cuomo, 981 F.2d 50 (2d Cir. 1992) _____ ____ 50

Heart of Atlanta Motel, Inc. V. United States, 379

U.S. 241 (1964) .................................................... 35

Hodel V. Indiana, 452 U.S. 314 (1981) ................ 35

Johnson V. Transportation Agency, Santa Clara

County, 480 U.S. 616 (1987) ............................ 48

Jones V. Alfred H. Mayer Co., 392 U.S. 409 (1968).. 38

Katzenbach V. McClung, 379 U.S. 294 (1964)..... . 35

Katzenbach V. Morgan, 384 U.S. 641 (1966) .......... 37

V

Cases—Continued: Page

Lujan V. Defenders of Wildlife, 112 S. Ct. 2130

(1992)...................................................................... 29

McDonald V. Sante Fe Trail Tramp. Co., 427 U.S.

273 (1976) ........................................................... 25

Metro Broadcasting, Inc. V. FCC, 497 U.S. 547

(1990) ................................................................... passim

Milwaukee County Pavers Ass’n V. Fielder, 922

F.2d 419 (7th Cir.), cert, denied, 500 U.S. 954

(1991) ..................................................................... 37, 50

Mobile, J. & K.C.R.R. V. Tumispeed, 219 U.S. 35

(1910) ..................................................................... 46

NLRB V. Baptist Hospital, Inc., 442 U.S. 773

(1979) .................................................................... 46

Northeastern Florida Chapter of Associated Gen

eral Contractors V. City of Jacksonville, 113

S. Ct. 2297 (1993) .............................................. 30

Norwood V. Harrison, 413 U.S. 455 (1973) ............. 35

O’Donnell Construction Co. V. District of Colum

bia, 963 F.2d 420 (D.C. Cir. 1992)....................... 50

Planned Parenthood V. Casey, 112 S. Ct. 2791

(1992) ..................................................................... 50

Regents of the University of California V. Bakke,

438 U.S. 265 (1978) .......... 42

Reno V. Flores, 113 S. Ct. 1439 (1993) __ ____ __ 33

Runyon V. McCrary, 427 U.S. 160 (1976) ---------- 38

Slaughter-House Cases, 83 U.S. (16 Wall.) 36

(1873)... ......................................................... -..... - 36

St. Mary’s Honor Center V. Hicks, 113 S. Ct. 2742

(1993) ................................................................... 45

Tennessee Asphalt Co. V. Farris, 942 F.2d 969 (6th

Cir. 1991) .............. 50

United States V. Gainey, 380 U.S. 63 (1965).......... 46

United States V. Salerno, 481 U.S. 739 (1987)---- 33

Useru v. Turner Elkhorn Mining Co., 428 U.S. 1

(1976) ............... 46

Wygant V. Jackson Board of Education, 476 U.S.

267 (1986) ........................... 42

Constitution, statutes and regulations:

U.S. Const.:

Art. I, § 8, Cl. 1 (Spending Clause) ............2—2, 35, la

Art. I, § 8, Cl. 3 (Commerce Clause) ...............2, 35, la

VI

Constitution, statutes and regulations—Continued: Page

Amend. I .............................................................. 41

Amend, V ................. ................ ........................... 20

Amend. X III....................................2, 35, 36, 37, 38, la

Amend. XIV ............................... 2, 20, 35, 36, 37, 38, la

Section 5 .................................................. 37, 38, 2a

Act of Oct. 24, 1978, Pub. L. No. 95-507, 92 Stat.

1757:

§ 201, 92 Stat. 1760............................................. 8

§ 211, 92 Stat. 1767............................................. 8

Act of July 2, 1980, Pub. L. No. 96-302, § 118, 94

Stat. 840 ......................................... ............ ........... io

Business Opportunity Development Reform Act of

1988, Pub. L. No. 100-656, 102 Stat. 3853:

§ 101,102 Stat. 3855.... ........ ............................. 10

§ 207,102 Stat. 3861-3862........ ...... ................... 10

Civil Rights Act of 1964, Tit. VI, 42 U.S.C. 2000d.. 20

Consolidated Omnibus Budget Reconciliation Act

of 1985, Pub. L. No. 99-272, § 18015, 100 Stat.

370 (1986) ................... ....................................... . io

Intermodal Surface Transportation Efficiency Act

of 1991, Pub. L. No. 102-240, § 1003 (b), 105

Stat. 1919-1921 ........ ................................ ............ 5

Public Works Employment Act of 1977, Pub. L.

No. 95-28, Tit. I, 91 Stat. 116 ......................... 41

Small Business Act, 15 U.S.C. 631 et seq. (1988 &

Supp. V 1993) ...................... .............................. 2,3,2a

15 U.S.C. 631 (f) (1) (B) ..................................7, 39, 2a

15 U.S.C. 631(f)(1)(C) ..................................7,39,2a

15 U.S.C. 631b (1988 & Supp. V 1993) ........ . 48, 4a

15 U.S.C. 632(a) (1)-(3) (Supp. V 1993)....... 6

15 U.S.C. 636(j) (10) (F) (1988 & Supp. V

1993) ............................................................... 15

15 U.S.C. 636(j) (10) (H) (1988 & Supp. V

1993)................................... 15

15 U.S.C. 637 (a) ................................................. 8,6a

15 U.S.C. 637(a) (5) ........................................ 6 ,13,7a

15 U.S.C. 637 (a) (6) (A) ................................. 6,14,7a

15 U.S.C. 637 (a ) (6 ) (B ) ................... 15,8a

vn-

Statutes and regulations—Continued: Page

15 U.S.C. 637 (a) (6) (C) (Supp. V 1993)......... 15, 8a

15 U.S.C. 637(a) (6) (C) (i) (Supp. V 1993).... 15, 8a

15 U.S.C. 637(d) (Supp. Y 1993) .............. ........ 7,9a

15 U.S.C. 637(d) (1) (Supp. V 1993)................ 4,9a

15 U.S.C. 637 (d) (3) (C) (Supp. Y 1993) ..6, 7, 39,11a

15 U.S.C. 644(g) (1) .................................... ..... 5,12a

15 U.S.C. 644(h) (1988 & Supp. V 1993)....... 48,14a

15 U.S.C. 644(h) (1) ........................................... 5,14a

15 U.S.C. 645(d) ................................................ 47

Surface Transportation and Uniform Relocation

Assistance Act of 1987, Pub. L. No. 100-17, 101

Stat. 132 ........ 3

§ 106,101 Stat. 144-146............................ .... 2 ,15a-16a

§ 106 (c) (1), 101 Stat. 145........................... ....5, 7 ,16a

§ 106(c) (2) (B ), 101 Stat. 146.................. ....... 7 ,17a

§ 106(c) (4), 101 Stat. 146.......................... ..... .34,17a

42 U.S.C. 1983........ 20

13 C.F.R.:

Pt. 121:

Section 121.601.......................................... 6

PI. 124................................................................ 12

Subpt. A:

Section 124.5................................................ 47

Section 124.6 ................................................ 47

Section 124.101 (c) (2 ) ....... 15

Section 124.103............................... 47

Section 124.104.... 47

Section 124.105 (b )...................................... 13

Section 124.105(b) (1) ....................... 16

Section 124.105 (c) (1) ( i ) ........................ 14

Section 124.105(c) (1) (v) ................... 14

Section 124.105(c) (1) (v) (A )-(C )............ 14

Sections 124.105-124.106...................... ..... 13, 39

Section 124.106(a) (1) (ii) ........................ 14

Section 124.106(a) (2 )............................. 14

Section 124.106 (b).................. 14

Section 124.108..... ......... ............... .— *...... 47

Section 124.109 ............................................ 47

VIII

Regulations—Continued: Page

Section 124.111(c)...................................... 15

Section 124.208......................................... 15

Subpt. B ...... ....... ........ ................................... 15, 29, 39

Section 124.603 (b ) ...................................... 15

Section 124.605(b) ( 2 ) ........................ 15

Section 124.607 (a ) ...................................... 15

Section 124.608......................................... 15

Sections 124.608-124.609............................ 29

Section 124.609..... 15

Section 124.609(d) (3 ) ............................... 15

48 C.F.R.:

Section 19.703 ................................ 44

Section 52.219-8.................................................. 7

Section 52.219-13................................................ 7,17

49 C.F.R. Pt. 23 ........................................................... 13

Subpt. C:

Sections 23.51-23.53............ 47

Subpt. D ................................................... 15

Section 23.62......................... ..................15,16,17

Section 23.62 (a )-(e )__ 16

Section 23.64(e)............... 5

Section 23.65.......................... 5

Section 23.69 ...................................... 29,39

Section 23.69 (b) (1 ) ............................... 16

App.A ................................................16,17, 26, 44

App. C .......................................... 16, 29, 39,44, 47

Subpt. E .............................................................. 16

Miscellaneous: Page

Barriers to Full Minority Participation in Fed

erally Funded Highway Construction Projects:

Hearing Before a Subcomm. of the House Comm,

on Government Operations, 100th Cong., 2d Sess.

(1988) ........................................... ......................... 10, 38

124 Cong. Ree. (1978):

p. 29,641....... 9

p. 29,644 ............................ ....... . 9

IX

Miscellaneous—Continued: Page

p. 34,097............................................................... 8

p. 35,408............................................................... 8

133 Cong. Rec. 33,314-33,315 (1987)...................... 10-11

Disadvantaged Business Set-Asides in Transporta

tion Construction Projects: Hearings Before the

Subcomm. on Procurement, Innovation, and

Minority Enterprise Development of the House

Comm, on Small Business, 100th, Cong., 2d Sess.

(1988)...................................................................... 10

Federal Contracting Opportunities for Minority

and Women-Owned Businesses—An Examina

tion of the 8(d) Subcontracting Program: Hear

ings Before the Senate Comm, on Small Busi

ness, 98th Cong., 1st Sess. (1983).......— ........... 9

Federal Highway Administration, U.S. Dep’t of

Transportation, Disadvantaged Business Enter

prise (DBE) Program Administration Partici

pant’s Manual (Apr. 1990) ............ 34

H.R. 1807,100th Cong., 1st Sess. (1987).................. 11

H.R. 5612, To Amend the Small Business Act to

Extend the Current SB A 8(a) Pilot Program:

Hearing on H.R. 5612 Before the Senate Select

Comm, on Small Business, 96th Cong., 2d Sess.

(1980)................... .................................................. 9

H.R. Rep. No. 468, 94th Cong., 1st Sess, (1975)..... 9

H.R. Rep. No. 1714, 95th Cong., 2d Sess. (1978).... 8, 26

H.R. Rep. No. 460, 100th Cong., 1st Sess. (1978).... 11

Minority Business and Its Contribution to the U.S.

Economy: Hearing Before the Senate Comm, on

Small Business, 97th Cong., 2d Sess. (1982)....... 9

Minority Business Participation in Department of

Transportation Project: Hearing Before a Sub

comm. of the House Comm, on Government Op

erations, 99th Cong., 1st Sess. (1985)................ 38

Minority Enterprise and General Small Business

Problems: Hearing Before the Subcomm. on

SBA and SBIC Authority, Minority Enterprise,

and General Small Business Problems of the

House Comm, on Small Business, 99th Cong., 1st

Sess. (1985) 10

X

Miscellaneous—Continued: Page

S, Rep. No. 1070, 95th Cong., 2d Sess. (1978)....... 8

S. Rep. No. 4, 100th Cong., 1st Sess. (1987) ......... 12

S. Rep. No. 394, 100th Cong., 2d Sess. (1988)....... 48

Small ancl Minority Business in the Decade of the

1980’s (Part 1): Hearings Before the House

Comm, on Small Business, 97th Cong., 1st Sess.

(1981)...................................................................... 9

Small Business Problems: Hearings Before the

House Comm, on Small Business, 100th Cong.,

1st Sess. (1987) .................................................... 10

State of Hispanic Small Business in America:

Hearing Before the Subcomm. on SB A and SBIC

Authority, Minority Enterprise, and General

Small Business Problems of the Home Comm, on

Small Business, 99th Cong., 1st Sess. (1985)..... 9-10

Surety Bonds and Minority Contractors: Hearing

Before the Subcomm. on Commerce, Consumer

Protection, and Competitiveness of the Home

Comm, on Energy and Commerce, 100th Cong.,

2d Sess. (1988) ..................................................... 10

The Disadvantaged Business Enterprise Program

of the Federal-Aid Highway Act: Hearing Be

fore the Subcomm. on Transportation of the

Senate Comm, on Environment and Public

Works, 99th Cong., 1st Sess, (1985)................. 19

Women Entrepreneurs— Their Success and Prob

lems: Hearing Before the Senate Comm, on

Small Business, 98th Cong., 2d Sess, (1984)....... 9

Htt tip? I&tprrnu? (Emtrt at tip? litttrh Staton

October Term , 1994

No. 93-1841

A darand Constructors, I n c ., petitioner

v.

F ederico P ena,

Secretary of T ransportation , et al.

ON WRIT OF CERTIORARI

TO THE UNITED STA TE S COURT OF APPEALS

FOR THE TENTH CIRCUIT

BRIEF FOR THE RESPONDENTS

OPINIONS BELOW

The opinion of the court of appeals (Pet. App.

1-24) is reported at 16 F.3d 1537. The opinion and

order of the district court (Pet. App. 27-37) are re

ported at 790 F. Supp. 240.

JURISDICTION

The judgment of the court of appeals was entered

on February 16, 1994. The petition for a writ of cer

tiorari was filed on May 17, 1994, and granted on

( 1 )

2

September 26, 1994. The jurisdiction of this Court

rests on 28 U.S.C. 1254(1).

CONSTITUTIONAL AND

STATUTORY PROVISIONS INVOLVED

The Spending Clause, the Commerce Clause, and

the Thirteenth and Fourteenth Amendments to the

Constitution are reprinted at App., infra, la-2 a. Per

tinent provisions of the Small Business Act, 15

U.S.C. 631 et seq. (1988 & Supp. V 1993), and of

Section 106 of the Surface Transportation and Uni

form Relocation Assistance Act of 1987, Pub. L. No.

100-17, 101 Stat. 144-146, are reprinted at App.,

infra, 2 a-17 a.

STATEMENT

This case concerns the constitutionality of a stand

ard contract clause, the Subcontracting Compensa

tion Clause (Clause or SCC), included in highway

construction contracts let by the Central Federal

Lands Highway Division (CFLHD) of the Federal

Highway Administration (FHWA) of the United

States Department of Transportation (DOT). The

Clause encourages, but does not require, prime con

tractors to hire small disadvantaged business enter

prises (DBEs) as subcontractors on federal highway

construction subcontracts by offering them financial

compensation for the added expenses of their employ

ing and assisting such subcontractors. Petitioner, a

losing bidder on a federal highway guardrail con

struction subcontract, challenges the constitutionality

of the Clause, asserting that it caused the prime con

tractor to reject its bid and to award the subcontract

to Gonzales Construction Company, a small disad

vantaged business.

3

The Federal Lands Highway Program (FLHP)1 in

cludes the Compensation Clause in its prime contracts

as one means to implement its statutory responsibilities

under the Small Business Act (SBA), 15 U.S.C. 631

et seq. (1988 & Supp. V 1993), which applies to all

federal agencies’ contracts for goods and services.

The Clause also helps the FLHP meet the require

ments of the Surface Transportation and Uniform

Relocation Assistance Act of 1987 (STURAA), Pub.

L. No. 100-17, 101 Stat. 132, which provided the

funding for the highway project in this case. The

SBA establishes a 5% government-wide minimum

goal for participation by small disadvantaged busi

nesses in government contracting and subcontract

ing, and requires each federal agency to implement

that government-wide goal through subsidiary

agency goals. STURAA, which applies only to DOT,

establishes a goal at not less than 10% for use of

small disadvantaged businesses in federally funded

transportation programs.

Under both statutes, “disadvantage” requires a

showing of both social and economic disadvantage. A

presumption of disadvantage operates where mem

bers of specified minority groups seek to have their

firms certified as disadvantaged. That presumption

is rebuttable if disadvantage does not in fact exist.

1 The CFLHD is one of three regional divisions of the

FLHP, a component of the FHWA. Each of the divisions is

responsible for the design and construction of roads on fed

eral lands, including national parks and forests. C.A. App.

320. The CFLHD includes within its jurisdiction roads on

federal lands within Arizona, California, Colorado, Hawaii,

Kansas, Nebraska, Nevada, New Mexico, North Dakota,

South Dakota, Texas, Utah, and Wyoming. Pet. App. 9 n.7.

4

Under STURAA, small businesses owned by women

are also presumed to be disadvantaged; expenditures

with businesses owned by women thus constitute

expenditures with disadvantaged subcontractors

under the Clause, and are counted toward both the

STURAA and SBA goals. In addition, businesses

owned by men who are not members of minority

groups are treated as disadvantaged under both stat

utes if the persons who own and control the firms

are socially and economically disadvantaged. Peti

tioner, which did not claim that it was itself disad

vantaged, did not challenge the fact that Gonzales

Construction Company was disadvantaged, nor did

it seek to rebut any presumption of disadvantage

that may have applied to Gonzales. Petitioner in

stead makes a facial challenge to the Clause.

1. Statutory background. A. Both the SBA and

STURAA establish a federal policy of doing business

with small disadvantaged business enterprises.2 The

statutes seek to foster nationwide economic develop

ment by permitting small disadvantaged businesses

to share in the economic benefit of the government’s

vast purchasing activity. The statutes also reflect

Congress’s belief that, by contracting with small dis

advantaged business enterprises, and by working with

them through a variety of business development pro-

2 Section 8(d) (1) of the SBA, 15 U.S.C. 637(d) (1) (Supp.

V 1993), provides:

It is the policy of the United States that small business

concerns, and small business concerns owned and con

trolled by socially and economically disadvantaged in

dividuals, shall have the maximum practicable oppor

tunity to participate in the performance of contracts let

by any Federal agency, including contracts and sub

contracts.

5

grams, the government can strengthen such businesses

and thereby enhance market competition for the goods

and services the government buys.

The SBA requires annual, government-wide goals

to be set for contracting for supplies and services

from small businesses, and also from small disadvan

taged businesses. The Act sets a 5% floor for the

latter goal. 15 U.S.C. 644(g)(1). The President is

required to adjust that government-wide goal an

nually, and each executive agency is required to de

velop a goal appropriate to its own contracting needs

and the markets from which it purchases goods and

services.3 The goals at every level may be waived

where not practicable,4 and no penalty attaches to

failure to meet them.

In STURAA, enacted in 1987, Congress comple

mented the SBA’s provisions by setting a disadvan

taged business enterprise goal specific to STURAA

transportation construction. Section 106(c)(1) of

STURAA contained a goal of not less than 10% for

disadvantaged business expenditure of federal funds

appropriated under STURAA for fiscal years 1987

through 1992. Pub. L. No. 100-17, 101 Stat. 145.5

Expenditures through disadvantaged businesses are

counted toward both STURAA and SBA goals.

3 The subsidiary disadvantaged business contracting goal

DOT assigned to the CFLHD for 1989 was approximately

12-15%. Pet. App. 9 n.7.

4 See 15 U.S.C. 644(h) (1) (requiring justification for fail

ure to meet goals) ; 49 C.F.R. 23.64(e), 23.65 (setting forth

waiver criteria for DOT).

5 The disadvantaged business enterprise goals are now

being implemented under the successor to STURAA, the

Intermodal Surface Transportation Efficiency Act of" 1991,

Pub. L. No. 102-240, § 1003 (b), 105 Stat. 1919-1921.

6

B. The definition of small disadvantaged business

that applies under both statutes is set out in the

SBA. A small business is one that is independently

owned and operated, is not dominant in its field of

operation, and has annual gross receipts not in ex

cess of the level set by regulation for the industry in

which the business operates. 15 U.S.C. 632(a)(1)-

(3) (Supp. V 1993)."8 A small business is disadvan

taged if it is at least 51% owned and controlled by

persons who are both socially and economically dis

advantaged. 15 U.S.C. 637(d)(3)(C) (Supp. V

1993). A “socially disadvantaged” person is one who

has been subjected to “racial or ethnic prejudice or

cultural bias because of [his or her] identity as a

member of a group without regard to [his or her]

individual qualities.” 15 U.S.C. 637(a)(5). An

“economically disadvantaged” person is a socially

disadvantaged person who also demonstrates that his

or her “ability to compete in the free enterprise sys

tem has been impaired due to diminished capital and

credit opportunities as compared to others in the

same business area who are not socially disadvan

taged.” 15 U.S.C. 637(a) (6) (A).

The goals of both the SBA and STURAA are thus

directed at the employment of disadvantaged business

enterprises. That category is not limited to members

of racial minority groups, nor are all members of

such groups included in the disadvantaged category.

Congress, however, expressly recognized in both stat

utes that racial discrimination in the United States

6 A small business, in the case of highway construction

specialty subcontractors such as Gonzales and petitioner, is one

whose average annual gross receipts do not exceed $7,000,000.

13 C.F.R. 121.601 (Major Group 17, SIC Code 1799).

7

has been a principal cause of current disadvantaged

status. Congress found in the SB A that “many

[socially and economically disadvantaged] persons

are socially disadvantaged because of their identifica

tion as members of certain groups that have suffered

the effects of discriminatory practices or similar in

vidious circumstances over which they have no con

trol,” and that “such groups include, but are not

limited to, Black Americans, Hispanic Americans,

Native Americans, Indian tribes, Asian Pacific Amer

icans, Native Hawaiian Organizations, and other mi

norities.” 15 U.S.C. 631(f)(1)(B ) and (C). The

SBA’s subcontracting provision, Section 8(d), thus

authorizes prime contractors to “presume that socially

and economically disadvantaged individuals include

Black Americans, Hispanic Americans, Native Ameri

cans, Asian Pacific Americans, and other minorities, or

any other individual found to be disadvantaged by

the [Small Business] Administration pursuant to

section 8(a) of the [SBA].” 15 U.S.C, 637(d) (3) (C)

(Supp. V 1993). STURAA utilizes the SBA’s defini

tion of disadvantaged business, see Pub. L. No. 100-

17, § 106(c) (1), 101 Stat. 145, except that STURAA

also provides that, in the context of highway

construction, “women shall be presumed to be

socially and economically disadvantaged individuals,”

§ 106(c)(2)(B), 101 Stat. 1467

C. Congress’s findings that disadvantage is highly

correlated with race were based on extensive evidence

of racial discrimination affecting government con-

7 The Federal Acquisition Regulations, 48 C.F.R. 52.219-8

and 52.219-13, referred to in the Subcontracting Compensa

tion Clause, J.A. 24, define disadvantaged business consist

ently with the SBA, and include women-owned businesses.

8

tracting. The SBA first made express reference to

race in the 1978 Amendments to the statute. Act of

Oct. 24, 1978, Pub. L. No. 95-507, §§ 201, 211, 92

Stat. 1760, 1767. Congress there recognized “ [t]he

fact that minority small businesses have had an espe

cially difficult time in fully participating in the

economic system,” and decided that the SBA’s small

business development program “should be used only

for developing minority and other socially and eco

nomically disadvantaged businesses.” S. Rep. No.

1070, 95th Cong., 2d Sess. 16 (1978); see also H.R.

Rep. No. 1714, 95th Cong., 2d Sess. 22 (1978):8

8 Representative Addabbo, the floor manager of the bill

in the House, stated that “ [o] ur findings clearly state that

groups such as black Americans, Hispanic Americans, and

Native Americans, have been and continue to be discrim

inated against and that this discrimination has led to the

social disadvantagement of persons identified by society as

members of those groups.” 124 Cong. Rec. 34,097 (1978).

Senator Nunn, who managed the bill in the Senate, also

emphasized that “ [bjecause of present and past discrimina

tion many minorities have suffered social disadvantagement.”

Id. at 35,408.

See S. Rep. No. 1070, supra, at 14 (analyzing the 1978

Amendments to SBA Section 8(a) that “establish [ed] the

policy goal of developing businesses owned by socially and

economically disadvantaged persons” as “also recogniz [ing]

the pattern of social and economic discrimination that con

tinues to deprive racial and ethnic minorities, and others,

of the opportunity to participate fully in the free enterprise

system”) ; id. at 20 (“many individuals are socially and

economically disadvantaged as a result of being identified

as members of certain groups, including but not limited

to, black Americans and Hispanic Americans”) ; id. at 22

(directing the Small Business Administration to “recognize

the historic past discrimination of minorities in their efforts

to participate in the free enterprise system”).

9

At the time of the 1978 Amendments, minority

businesses constituted only 4% of the total number

of firms in the United States and accounted for less

than 1% of total nationwide business receipts. 124

Cong. Rec. 29,641 (1978) (remarks of Sen. Glenn);

id. at 29,644 (statement by Sen. Heinz). A 1975

report of the Subcommittee on SBA Oversight and

Minority Enterprise of the House Committee on

Small Business set forth statistics showing that,

“ [w]hile minority persons comprise[d] about 16 per

cent of the Nation’s population,” only 3% of busi

nesses in the United States were minority-owned.

H.R. Rep. No. 468, 94th Cong., 1st Sess. 2. The re

port determined that those statistics were “not the

result of random chance,” but resulted from “past

discriminatory systems [that] have resulted in pres

ent economic inequities.” Ibid.

Since 1978, Congress has repeatedly revisited the

issue of disadvantage in federal contracting caused

by racial discrimination,® and has found that those

0 See, e.g., H.R. 5612, To Amend the Small Business Act

to Extend the Current SBA 8(a) Pilot Program: Hearing

on H.R. 5612 Before the Senate Select Comm, on Small Busi

ness, 96th Cong., 2d Sess. (1980) ; Small and Minority Busi

ness in the Decade of the 1980’s (Part 1).: Hearings Before

the House Comm, on Small Business, 97th Cong., 1st Sess.

(1981) ; Minority Business and Its Contribution to the U.S.

Economy: Hearing Before the Senate Comm, on Small Busi

ness, 97th Cong., 2d Sess. (1982) ; Federal Contracting Op

portunities for Minority and Women-Owned Businesses—

An Examination of the 8(d) Subcontracting Program: Hear

ings Before the Senate Comm, on Small Business, 98th Cong.,

1st Sess. (1983) ; Women Entrepreneurs— Their Success and

Problems: Hearing Before the Senate Comm, on Small Busi

ness, 98th Cong., 2d Sess.. (1984) ; State of Hispanic Small

Business in America: Hearing Before the Subcomm. on SBA

10

disadvantages continue. Consequently, each time the

SBA has been amended, Congress has retained or ex

panded upon the findings of social disadvantage based

on race.10 When Congress amended the SBA in 1988

to add the disadvantaged business enterprise goals,

it reaffirmed that the SBA’s disadvantaged business

contracting program is “the most significant effort

of the Federal Government to reduce the effects of

discrimination on entrepreneurial endeavors.” 133

and SBIC Authority, Minority Enterprise, and General Small

Business Problems of the House Comm, on Small Business,

99th Cong., 1st Sess. (1985) ; Minority Enterprise and Gen

eral Small Business Problems: Hearing Before the Subcomm.

on SBA and SBIC Authority, Minority Enterprise, and Gen

eral Small Business Problems of the House Comm, on Small

Business, 99th Cong., 1st Sess. (1985) ; Disadvantaged Busi

ness Set-Asides in Transportation Construction Projects:

Hearings Before the Subcomm. on Procurement, Innovation,

and Minority Enterprise Development of the House Comm,

on Small Business, 100th Cong., 2d Sess. (1988) ; Barriers

to Full Minority Participation in Federally Funded Highway

Construction Projects: Hearing Before a Subcomm. of the

House Comm, on Government Operations, 100th Cong., 2d

Sess. (1988) [hereinafter 1988 Barriers Hearing] ; Surety

Bonds and Minority Contractors: Hearing Before the Sub

comm. on Commerce, Consumer Protection, and Competitive

ness of the House Comm, on Energy and Commerce, 100th

Cong., 2d Sess. (1988); Small Business Problems: Hearings

Before the House Comm, on Small Business, 100th Cong., 1st

Sess, (1987).

10 See Act of July 2, 1980, Pub. L. No. 96-302, §118, 94

Stat. 840; Consolidated Omnibus Budget Reconciliation Act

of 1985, Pub. L. No, 99-272, § 18015, 100 Stat. 370 (1986);

Business Opportunity Development Reform Act of 1988, Pub.

L. No, 100-656, §§ 101, 207, 102 Stat. 3855, 3861-3862.

11

Cong. Ree. 33,314-33,315 (1987) (remarks of Rep.

LaFalce upon introduction of H.R. 1807). The House

Committee on Small Business specifically found that

“discrimination and the present effects of past dis

crimination” continue to hinder minority business

development, H.R. Rep. No. 460, 100th Cong., 1st

Sess. 18 (1987), and that an increase in the effective

ness of the SB A was necessary “to redress the effects

of discrimination on entrepreneurial endeavors,” id.

at 16.

Evidence before Congress in 1988 showed that the

disadvantaged business program had thus far made

unsatisfactory progress in removing discriminatory

barriers to minority business success: “ [0]nly six

percent of all firms are owned by minorities; less

than two percent of minorities own businesses while

the comparable percent for nonminorities is over six

percent; and the average receipts per minority firm

is less than 10 percent the average receipts of all

businesses.” H.R. Rep. No. 460, supra, at 18. Federal

procurement data revealed a similar pattern: In

1986, “total prime contracts approached $185 billion,

yet minority business received only $5 billion in prime

contracts, or about 2.7 percent of the prime contract

dollar.” Ibid. Repeating the observations that had

been made a decade earlier, the Committee Report

concluded that the disparity between minority and

nonminority businesses’ participation in the economy

and in federal procurement was “not the result of

random chance,” but that “discrimination and the

present effects of past discrimination have hurt

socially and economically disadvantaged individuals

in their entrepreneurial endeavors.” Ibid.

The enactment of STURAA in 1987 was also sup

ported by additional evidence and findings of racial

and gender discrimination specific to the highway

12

construction industry. The Senate Committee on En

vironment and Public Works reported on STURAA:

The Committee has considered extensive testi

mony and evidence on the bill’s DBE provision,

and has concluded that this provision is necessary

to remedy the discrimination faced by socially

and economically disadvantaged persons attempt

ing to compete in the highway and mass transit

construction industry. * * *

* * * [B]arriers still remain, preventing mi

norities and women from successfully competing

in the industry. Moreover, the Committee has

concluded that the findings adopted by Congress

in 1978 when enacting legislation covering proj

ects under the Small Business Act, 15 U.S.C.

§ 631(e), apply equally to the federally-funded

highway and mass transit construction projects

covered by this bill.

S. Rep. No. 4, 100th Cong., 1st Sess. 11 (1987). We

have collected in Appendix B, infra, 18a-36a, more

examples of hearings, floor debates and committee re

ports in which Congress’s choice of a limited, race-

based remedy was repeatedly debated and reaffirmed.

2. Regulatory background. Under the Subcon

tracting Compensation Clause that is challenged in

this case, a small business concern will be considered

disadvantaged if it has been certified as such by the

Small Business Administration (Administration) or

any state highway agency. J.A. 24.11 In certifying

11 The Administration certifies disadvantaged businesses

pursuant to the Small Business Act and its implementing

regulations, 13 C.F.R. Pt. 124. State highway and transporta

tion agencies certify disadvantaged businesses for partici-

13

businesses as disadvantaged, the Administration de

termines on a case-by-case basis (a) whether a firm

claiming disadvantage is actually owned and con

trolled by the person claiming disadvantage, (b)

whether that person is socially disadvantaged, and

(c) whether that person is economically disadvan

taged. In making those determinations, the Admin

istration employs a rebuttable presumption that,

“ [i]n the absence of evidence to the contrary,” Black

Americans, Hispanic Americans, Native Americans,

Asian Pacific Americans, and Subcontinent Asian

Americans are socially disadvantaged. 13 C.F.R.

124.105(b). Minority status is, however, neither a

sufficient nor a necessary basis for certification. Be

cause the presumption of social disadvantage is re

buttable, members of the specified groups may none

theless be considered not to be socially disadvantaged.

In addition, people who are not members of the speci

fied minority groups may also be treated as disad

vantaged under the Clause. 15 U.S.C. 637(a)(5);

13 C.F.R. 124.105-124.106. For example, persons

who have suffered ethnic or cultural bias on account

of their ancestry, physical handicap,112 or “long-term

residence in an environment isolated from the main-

pation in DOT programs pursuant to 49 C.F.R. Pt. 23. The

FLHP also accepts certification by other government agen

cies, provided the Contracting Officer has determined that

comparable procedures are followed. J.A. 24.

12 See, e.g., Doe v. Heatherly, 671 F. Supp. 1081 (D. Md.

1987) (applying nonracial inquiry into “cultural bias” to

evaluate disadvantage claim by person with calligraphic dys-

graphia and dyslexia), afFd, 854 F.2d 1316 (4th Cir. 1988)

(Table).

14

stream of American society” may be deemed socially

disadvantaged. 13 C.F.R. 124.105(c) (1) (i).1:3

Small business owners who establish their social

disadvantage must also demonstrate to the Adminis

tration that they are economically disadvantaged “as

compared to others in the same business area who are

not socially disadvantaged.” 15 U.S.C. 637(a)(6)

(A); 13 C.F.R. 124.106(b). The separate showing

of economic disadvantage ensures that certification

does not “assist concerns owned and controlled by

socially disadvantaged individuals who have accumu

lated substantial wealth, who have unlimited growth

potential or who have not experienced or have over

come impediments to obtaining access to financing,

markets and resources.” 13 C.F.R. 124.106(a)(1)

(ii). In evaluating whether a business owner is in

fact economically disadvantaged, the Administration

considers the personal financial condition, business

financial condition, and access to credit and capital

of the individual claiming disadvantaged status. 13

C.F.R. 124.106(a)(2).14

Where a competitor, such as petitioner, believes

that a certification of a subcontractor as disadvan

taged is unwarranted, it may submit information to

33 The Administration “will entertain any relevant evi

dence in assessing [the social disadvantage] element of an

applicant’s case,” 13 C.F.R. 124.105(c) (1) (v), and the reg

ulations set forth factors to be taken into account, 13 C.F.R.

124.105(c) (1) (v) (A)-(C) (education, employment, business

history).

34 See, e.g., Autek Systems Corp. v. United States, 835

F. Supp. 13 (D.D.C. 1993) (upholding Administration’s de

termination that minority business owner’s personal income

disqualified him from participation), aff’d, No. 93-5399 (D.C.

Cir. May 13, 1994).

15

the contracting officer and seek initiation of a protest.

13 C.F.R. 124.603(b); see generally 13 C.F.R. Pt.

124, Subpt. B. “No specific form is required” for a

protest to disadvantaged status, 13 C.F.R. 124.607

(а ) , and it may be filed at any time before the

work under the subcontract is completed, 13 C.F.R.

124.605(b) (2). When such a protest is filed, the Ad

ministration must investigate, 13 C.F.R. 124.608, and

make a prompt determination as to disadvantage, 13

C.F.R. 124.609. In making that determination, the

Administration is required to review “ownership and

control of each protested firm as well as social and

economic disadvantage regardless of the grounds

specified in the protest.” 13 C.F.R. 124.609(d) ( 8 ) “

States that certify disadvantaged businesses apply

standards that generally mirror those promulgated

under the SBA. 49 C.F.R. Pt. 23, Subpt. D ; see Pet.

App. 8. Under STURAA’s implementing regulations,

as under the SBA’s, members of certain minority

groups are rebuttably presumed to be disadvantaged.

49 C.F.R. 23.62.16 However, state certification of dis-

115 The Administration has independent review responsibil

ities even in the absence of a protest. The SBA provides that

businesses that are not in fact both socially and economically

disadvantaged must be decertified or “graduated.” 15 U.S.C.

636(j) (10) (F) and (H) (1988 & Supp. V 1993), 637(a)

(б) (C) (Supp. V 1993) ; 13 C.F.R. 124.208. The financial

information that disadvantaged businesses must file annually,

15 U.S.C. 637(a)(6)(B ), or credible evidence coming to

the attention of the Administration from any other source,

13 C.F.R. 124.101(c) (2), 124.111(c), may trigger a review,

and the Administration is required to investigate and to

satisfy itself that the criteria have been met, 15 U.S.C.

637(a) (6) (C) (i) (Supp. V 1993).

18 The groups as to which the rebuttable presumption ap

plies are virtually the same under both statutes. Both include

16

advantage under STURAA, like certification by the

Small Business Administration, is also available to

nonminorities.17 Thus, persons such as “disabled

Vietnam veterans, Appalachian white males, Hasidic

Jews, or any other individuals who are able to demon

strate to the [State] that they are socially and eco

nomically disadvantaged may be treated as eligible to

own and control a disadvantaged business, on the

same basis as a member of one of the presumptive

Black Americans, Hispanic Americans, Native Americans,

and Asian-Pacific Americans. The STURAA regulations,

however, specify “Asian-Indian Americans” in place of the

SBA regulations’ “Subcontinent Asian Americans.” Compare

49 C.F.R. 23.62 (a)-(e) (“socially and economically disadvan

taged individuals”) (defining precise contours of listed

groups) with 13 C.F.R. 124.105(b) (1) (same).

The rebuttable presumption under DOT’S STURAA regula

tions provides that “members of the named [minority] groups

* * * are presumed to be both socially and economically dis

advantaged,” 49 C.F.R. Pt. 23, Subpt. D, App. C If 2, while the

parallel presumption in the SBA regulations applies only to

social disadvantage. Under both sets of regulations, the cer

tifying agency is entitled to consider all relevant evidence in

order to ensure that the statutory disadvantage criteria are

met as to each subcontractor. With respect to the rebuttal

of the presumption, see 49 C.F.R. 23.62, the STURAA regula

tions provide that “ [a]ny third party” may bring a chal

lenge, 49 C.F.R. 23.69(b) (1); see 49 C.F.R. Pt. 23, Subpt. E,

and may “present evidence that the firm’s owners are not

truly socially and/or economically disadvantaged, even though

they are members of one of the presumptive groups,” 49

C.F.R. Pt. 23, Subpt. D, App. C If 2.

17 The state agencies “may determine, on a case-by-case

basis, that individuals who are not a member [sic] of one of

the [minority] groups are socially and economically disad

vantaged.” 49 C.F.R. 23.62 (defining “socially and economi

cally disadvantaged individuals”) ; see 49 C.F.R. Pt. 23,

Subpt. D, App. A T[ 10 (analysis of Section 23.62).

17

groups.” 49 C.F.R. Pt. 23, Subpt. D, App. A f 10

(analysis of Section 23.62). Women are also pre

sumed to be socially and economically disadvantaged.

49 C.F.R. 23.62; see also 48 C.F.R. 52.219-13 (cited

in Subcontracting Compensation Clause, J.A. 24).

3. The Subcontracting Compensation Clause. The

Subcontracting Compensation Clause is a standard

clause developed by FHWA’s Federal Lands Highway

Program and is used in most of the Program’s sealed-

bid contracts. The Clause is one of several means

employed to aid DOT in implementing its statutory

responsibilities to make efforts to expend contract

and subcontract funds through disadvantaged small

businesses. As its name suggests, the Clause is de

signed to offset the financial disincentives that would

otherwise exist to employing and assisting disadvan

taged businesses as subcontractors by covering the

additional expenses associated with such employment.

J.A. 24-26; Pet. App. 10; C.A. Supp. App. 33-34, 54,

108-109. In return for compensation under the

Clause, the prime contractor thus must agree to

locate, train, utilize, assist, and develop [disad

vantaged businesses] to become fully qualified

contractors in the transportation facilities con

struction field. The Contractor shall also provide

direct assistance to disadvantaged subcontractors

in acquiring the necessary bonding, obtaining

price quotations, analyzing plans and specifica

tions, and planning and management of the work.

J.A. 25.

Compensation Is available to a prime contractor

under the Clause when at least 10% of the prime

contract amount is expended with one or more dis-

18

advantaged subcontractors. J.A. 25.18 The Clause

limits compensation to 10% of the amount actually

subcontracted to disadvantaged subcontractors. In

this case, the subcontract amount was $104,800;

the prime contractor was thus entitled to compensa

tion of approximately $10,000. Pet. App. 11. In

addition, total compensation under the Clause may

not exceed 1.5% of the prime contract amount if the

prime contractor employs one disadvantaged subcon

tractor, or 2% of the prime contract amount if the

prime contractor employs more than one disadvan

taged subcontractor. J.A. 26. Thus, if Mountain

Gravel and Construction Company (Mountain Gravel),

the prime contractor on the project involved in this

case, had subcontracted 40% of the work on a

$1,000,000 project, its compensation would not be the

full $40,000 representing 10% of the subcontracted

amount; rather, if one disadvantaged subcontractor

performed the entire 40% portion, compensation

would be capped at $15,000 (i.e., 1.5% of the prime

contract amount), and if more than one disadvan

taged firm were involved, compensation could not ex

ceed $20,000 (i.e., 2% of the prime contract amount).

The compensation amount is deemed to be “full com

pensation for locating, selecting, training, and assist

ing DBE subcontractors; for maintaining supporting

records; and for supplying all facilities and services

to complete this DBE subcontracting provision.” Ibid.

The Clause does not impose any requirement that

prime contractors subcontract with any disadvantaged

subcontractors; a prime contractor remains fully eli

gible to be awarded a contract whether or not it does

18 This 10% threshold can be modified “based on the avail

ability of eligible subcontractors.” C.A. Supp. App. 39-40,

52-53, 103.

19

so. See Pet. App. 7; J.A. 25 (eligibility for compen

sation) ; C.A. Supp. App. 96.18

4. Proceedings below. A. In September 1989, the

CFLHD awarded Mountain Gravel a prime contract

for a federally funded highway construction project

in the San Juan National Forest known as the West

Dolores project. Pet. App. 9. The contract included

the Subcontracting Compensation Clause. Id. at 10.

Mountain Gravel solicited bids to subcontract the

guardrail installation portion of the contract. In

subcontracting, Mountain Gravel was not required

to accept the lowest bid. Although petitioner sub

mitted a slightly lower bid, Mountain Gravel awarded

the guardrail subcontract to Gonzales, a certified

small disadvantaged business, and thus received com

pensation under the Clause. Id. at 10-11. Petitioner

did not seek disadvantaged status for itself, did not

19 The mechanism of prime contractors assisting disadvan

taged businesses in a mentor-like relationship was proposed

to Congress by the American Association of State Highway

and Transportation Officials (AASHTO) in a hearing that

preceded the passage of STURAA. See The Disadvantaged

Business Enterprise Program of the Federal-Aid Highway

Act: Hearing Before the Subcomm. on Transportation of the

Senate Comm, on Environment and Public Works, 99th

Cong., 1st Sess. 101 (1985) (“The management of a high

way contracting organization requires many skills, including

knowledge of estimating and bidding, the employment and

administration of managers, technicians and laborers, and

the overall financial management of the business. These

skills are not easily learned [,] * * * In time, it can be ex

pected that as expertise is acquired, many of today’s subcon

tractors will become prime or general contractors if they so

desire. To help this process along, we believe in AASHTO

that wider usage of the mentor-protege concept, the forma

tion of partnerships between new DRE and WBE firms and

established contracting organizations, holds great promise.” ).

20

question Gonzales’s actual disadvantaged status, and

did not seek to rebut any presumption that might

have been applied to Gonzales in the certification

process.

On August 10, 1990, petitioner filed suit for declar

atory and injunctive relief against officials of DOT,

alleging that the use of the Clause violates 42 U.S.C.

1983, Title VI of the Civil Rights Act of 1964, 42

U.S.C. 2000d, and the Fifth and Fourteenth Amend

ments to the Constitution. On cross-motions for sum

mary judgment, the district court granted summary

judgment for respondents. Pet. App. 27-37. The

court rejected petitioner’s argument that the chal

lenged federal program must be subjected to strict

judicial scrutiny under City of Richmond v. J.A.

Croson Co., 488 U.S. 469 (1989), holding instead that

Fullilove v. Klutznick, 448 U.S. 448 (1980), and

Metro Broadcasting, Inc. v. FCC, 497 U.S. 547 (1990),

establish the relevant standard. The district court

was satisfied that here, as in Fullilove, Congress had

an “abundant historical basis” to support the chal

lenged program. Pet. App. 35 (quoting Fullilove, 448

U.S. at 478 (opinion of Burger, C.J.)). “ [T]he mere

fact that CFLHD implements a federal program

within Colorado does not convert it into a state pro

gram requiring Crosomtype analysis.” Pet. App. 34.

The district court held that the Clause is narrowly

tailored to serve Congress’s important objectives. Pet.

App. 35-36. The court found that the Clause is not

“overinclusive,” because the annual certification proc

ess ensures that only legitimately disadvantaged sub

contractors participate in the program. Ibid. It is

also not “underinclusive,” because disadvantaged

21

firms that are not presumptively disadvantaged may

apply for certification and become qualified to partici

pate. Id. at 36. The court further noted that the

waiver mechanism properly relieves federal agencies

of their disadvantaged business obligations when there

are not enough qualified disadvantaged businesses

available to achieve the agency’s goal. Ibid.

B. The court of appeals affirmed. Pet. App. 1-24.

In an undivided opinion, the court held, as had the

district court, that Fullilove, not Croson, controls. Id.

at 15. “Under Fullilove, if Congress has expressly

mandated a race-conscious program, a court must

apply a lenient standard, resembling intermediate

scrutiny, in assessing the program’s constitutional

ity.” Ibid. “Indeed,” the court observed, “the Metro

Broadcasting majority held that even non-remedial

race-conscious measures mandated by Congress are

constitutionally permissible if they satisfy intermedi

ate scrutiny.” Id. at 19.

The court rejected petitioner’s argument that, be

cause the challenged program was also “fashioned

and specified by an agency and not by Congress,” Pet.

App. 17, particularized findings of past discrimina

tion were required to justify the program under

Croson. The court stated that “ [petitioner] cites no

authority, nor do we know of any, to support the

proposition that a federal agency must make inde

pendent findings to justify the use of a benign race

conscious program implemented in accordance with

federal requirements.” Id. at 18. The court of ap

peals found that the particular aspects of the pro

gram petitioner challenges were specifically author

ized by Congress. In including the Subcontracting

Compensation Clause in prime contracts, the CFLHD

thus “did exactly what Congress explicitly directed

it to do” under the SBA. Id. at 20.

22

Finally, the court of appeals held that the Clause

is constitutional because it is narrowly tailored to

achieve the important governmental objective of pro

viding opportunities for minority subcontractors.

“The qualifying criteria of the SCC program [are]

not limited to members of racial minority groups,”

and “minority businesses that do not satisfy that

economic criteria cannot qualify for DBE status.”

Pet. App. 23. The court also pointed out that the

10% threshold for using disadvantaged subcontrac

tors in the Clause “is an optional goal, not a set-aside,”

because “it is entirely at the discretion of the prime

contractor whether to exercise its option under the

Subcontracting Compensation Clause.” Id. at 12 n.9.

The SCC program was “ ‘appropriately limited in

* * * duration’ because federal procurement and

construction contracting practices are subject to regu

lar ‘reassessment and reevaluation by Congress.’ ” Id.

at 23 (quoting Fullilove, 448 U.S. at 489 (opinion of

Burger, C.J.)).

SUMMARY OF ARGUMENT

I. A. Petitioner has brought a facial constitutional

challenge to the use of the Subcontracting Compensa

tion Clause on the ground that it incorporates race-

based classifications. The Clause, however, is sub

stantively based on disadvantaged status; race plays

a role in the operation of the Clause only through a

rebuttable presumption that small businesses owned

and controlled by members of racial minority groups

are disadvantaged. That presumption may be set

aside or rebutted if a minority subcontractor is not

actually disadvantaged. In addition, the compensa

tion program challenged by petitioner applies to en

courage the utilization of disadvantaged subcontrac

tors who are not members of minority groups.

23

Petitioner also mischaracterizes goals set under

the Small Business Act as “race-based set-asides.”

Those goals, however, are neither based on race nor

are they used to set aside funds exclusively for minori

ties. The goals do not apply to all minority businesses,

but only to those owned by disadvantaged minorities.

The goals also apply to government contracting with

women and members of other disadvantaged groups.

Because the percentage levels of the goals are not tied

to race, they are not subject to heightened constitu

tional scrutiny.

B. Petitioner lacks standing to challenge the use

of the rebuttable presumption associated with the Sub

contracting Compensation Clause. Petitioner failed

to show that the presumption was applied to the

successful bidder in this case, or that, if it was

applied, it led to an incorrect determination of dis

advantage. Nor did petitioner show that it was itself

disadvantaged. Petitioner, moreover, seeks only fu

ture relief, to which it is not entitled on a record

that demonstrates, at best, only remote and specula

tive future harm.

C. Nor is the challenged Clause correctly viewed

as conferring a racial preference. The Clause does

not create an artificial incentive to subcontract with

disadvantaged businesses. It seeks instead to remove

disincentives to using such businesses by compensat

ing prime contractors for the additional expenses and

time associated with that use. Specifically, the Clause

requests that prime contractors train and assist dis

advantaged subcontractors, and, where they agree to

do so, it offers them compensation to offset the cost

to them of such additional effort.

D. Because the challenged presumption was en

acted by Congress as a remedial measure based on

legislative findings of racial discrimination affecting

minority business opportunity, intermediate scrutiny

24

is the appropriate standard of constitutional review.

The presumption is, however, constitutional under

any degree of scrutiny. It serves a compelling re

medial objective, and, because rebuttable and non

exclusive, is closely tailored to serve that objective.

Congress determined that a remedy was necessary

based on its findings that racial discrimination con

tinues to impair minority access to subcontracting

opportunities in federal procurement generally, and in

road construction specifically.

E. The presumption challenged in this case is more

narrowly tailored than any race-based remedial meas

ure this Court has yet considered. It is not under-

inclusive, because it provides the same compensation

for contracting with nonminority-owned as with

minority-owned disadvantaged small businesses. It is

not overinclusive, because it is accompanied by proce

dures to exclude minorities who are not in fact dis

advantaged. The Clause imposes no fixed requirement

of subcontracting with disadvantaged businesses and

is neither a set-a,side nor a quota. The presumption

employed under the Clause is also appropriately lim

ited in duration, because it is subject to active and

ongoing congressional assessment of its continuing-

necessity.

II. Finally, this Court should reaffirm its decision

in Fullilove. As clarified by this Court’s subsequent

decisions in Croson and Metro Broadcasting, Fulli

love has provided a workable standard of constitu

tional review of race-conscious measures adopted by

Congress after extensive factfinding and delibera

tion. There is no conflict in the Circuits regarding

the proper application of Fullilove. The decision in

that case reflects appropriate judicial respect for

congressional determinations on matters of race that

touch federal spending programs.

25

ARGUMENT

I. THE s u b c o n t r a c t in g c o m p e n s a t io n

CLAUSE IS CONSTITUTIONAL

A. The Clause Is Based On Social And Economic Dis

advantage; Minority Racial Status Plays Only A

Procedural Role Through A Rebuttable Presump

tion Of Such Disadvantage

Petitioner challenges the Subcontracting Compen

sation Clause on its face. Although that Clause em

ploys a presumption of disadvantage that is based on

racial group membership, the presumption is rebutt

able and nonconclusive. The presumption therefore

plays a procedural rather than a substantive role in

the contracting program that employs the Clause.

The program is, at the same time, open to subcon

tractors who have been the targets of ethnic prejudice

or cultural bias, as well as to those subcontractors

who have been victims of racial prejudice.30 All sub

contractors covered by the Clause also must, in addi

tion to having suffered social disadvantage caused by

group prejudice or bias, have suffered economic dis

advantage.

A member of a racial minority group who has not

himself or herself been the victim of racial prejudice

is thus not to be treated as disadvantaged under the

challenged program. Nor is such a minority group

member to be treated as disadvantaged, even if he

or she has been the victim of racial prejudice, if that

prejudice has not resulted in economic disadvantage

to him or her. On the other hand, subcontractors

who are not racial minorities are to be included in

the program if they are both economically and so-

20 The program also broadly covers all disadvantage caused

by racial prejudice—not only racial prejudice directed against

racial minorities. Cf. McDonald V. Santa Fe Trail Tramp*

Co., 427 U.S, 273 (1976).

26

daily disadvantaged. Women subcontractors consti

tute the largest category of nonminorities who are

included. Members of ethnic minorities are also cov

ered. In addition, the Conference Report on the 1978

SBA Amendments refers to the potential disadvan

taged status of “a poor Appalachian white person,”

see H.R. Rep. No. 1714, supra, at 22, and the regu

lations under STURAA give disabled Vietnam vet

erans and members of Hasidic Jewish sects as other

illustrations of the program’s reach beyond racial

minorities, see 49 C.F.R. Ft. 23, Subpt. D, App. A

Hi o .

The Subcontracting Compensation Clause program

is thus a program based on disadvantage, not on

race. There is no constitutional impediment to legis

lative action based on such disadvantage beyond the

requirement that the means be nonarbitrary and ra

tionally related to the objective. Government regula

tion “in the social and economic field” requires only

the most relaxed judicial scrutiny. See Dandridge v.

Williams, 397 U.S. 471, 484 (1970). Congress’s

decision to foster the economic development of

small disadvantaged businesses clearly serves legiti

mate objectives—improving the disadvantaged busi

nesses’ stability and business competence, and en

hancing competition in the marketplace for govern

ment contracts—and the means chosen by Congress to

achieve those objectives are just as clearly rationally

related to the legislative ends.

Petitioner’s facial challenge to the CFLHD’s goals

depends entirely on its inaccurate assertion that they

are race-based. Petitioner erroneously equates dis

advantaged businesses with minority businesses, as

serting that, “ [wjhile Congress may have had a basis

for the adoption of a program authorizing the set-

aside of 5 percent of government contracts on the

basis of race, * * * the decision by the CFLHD to

27

adopt a program in which 12 to 15 percent of its

contracting funds are apportioned on the basis of

race is without the factual basis required by this

Court.” Pet. Br. 20 (emphasis added); see id. at

47-49. However, all percentages that petitioner re

fers to—including the 5% SB A goal, the 10%

STURAA goal, the 12-15% CFLHD goal, and the

10% subcontracting threshold in the SCC—reflect

expenditures with disadvantaged businesses of all

types, nonminority-owned as well as minority-owned.

Petitioner’s incorrect characterization of the goals as

race-based leads it to focus on the level of the goals,

and on how and by whom they are set. If petitioner

seeks to challenge the Clause as race-conscious, the

proper focus of that challenge is on the only aspect

of the program that is race-based: the race-based re

buttable presumption used in some certification de

terminations under the Subcontracting Compensation

Clause.

B. Petitioner Lacks Standing To Challenge The Use

Of The Race-Based Rebuttable Presumption

The Subcontracting Compensation Clause employs

a race-based criterion in the limited form of a re

buttable presumption of disadvantage flowing from

minority group membership. As we explain below,

that presumption, although calling for intermediate

scrutiny under the Court’s equal protection prece

dents, easily passes constitutional muster. As a pre

liminary matter, however, we believe that petitioner

has failed to demonstrate, as it must, that it has

standing to challenge the limited procedural use of

that racial criterion in the Compensation Clause pro

gram. Petitioner has completely failed to show that

the presumption affected the award of the subcon

tract in this case to another bidder, and petitioner

has also failed to allege or prove that the future

28

relief it seeks would affect its business opportunities.

Petitioner challenges its loss of a subcontract that

was awarded to a certified disadvantaged business

enterprise, arguing that the contract award was the

result of a racial preference, but has failed to estab

lish that race played any role whatever in the chal

lenged award. First, petitioner never alleged or

proved that the basis of Gonzales Construction Com

pany’s certification as a disadvantaged business was

its ownership and control by a member of a racial

minority group. Petitioner submitted no evidence

regarding the criteria actually used in that certifica

tion.21 So far as the record reveals, Gonzales may

have been certified as a disadvantaged business be

cause of ownership and control by a woman, by an

ethnic minority, or by a physically disabled person,

or on some other ground.22 There has thus been no

showing that the race-based rebuttable presumption,

which is the only racial component of the challenged

program, was actually applied so as to affect the

award of the subcontract in this case.

Second, petitioner failed to establish that, even

assuming that Gonzales’s ownership by a racial mi

nority group member was the basis of the certifica

tion, the owner was not socially and economically

disadvantaged. Although the SBA and STURAA

regulations provide a procedure through which any

interested person may challenge whether a certified

21 Petitioner did not depose or otherwise seek discovery

from the owner of the Gonzales firm, nor from any of the

state or SBA officials involved in disadvantaged business

certifications.

22 Petitioner simply refers repeatedly and consistently to

Gonzales as a disadvantaged business enterprise, or “DBE,”

without indicating the basis of the finding of disadvantage.

See, e.g., J.A. 18 (Complaint); Pis. Answers to Defs. Interrog.

16; Pet. 5; Pet. Br. 11; see J.A. 80.

29

disadvantaged subcontractor is actually disadvan

taged, 13 C.F.R. Pt. 124, Subpt. B; 49 C.F.R. 23.69,

petitioner chose chose not to take advantage of that

procedure. A challenge by petitioner to Gonzales’s

certification would have required the certifying

agency not simply to confirm the race of those who

own and control the company, but to review and

verify the company’s actual disadvantaged status.

See 13 C.F.R. 124.608-124.609; 49 C.F.R. Pt. 23,

Subpt. D, App. C. If Gonzales is actually disadvan

taged and if petitioner, as appears, see Pet. Br. 24

n.21, had a fair opportunity to challenge that status

but chose not to do so, petitioner can hardly claim

now that any rebuttable presumption used to deter

mine that Gonzales was disadvantaged was uncon

stitutional.

Nor has petitioner ever claimed or established that

it is itself disadvantaged. Thus, petitioner cannot

challenge the rebuttable presumption on the ground

that it unconstitutionally prefers minorities by mak

ing it easier for them than for nonminorities to be

certified as disadvantaged.

The abstract nature of petitioner’s claim is further

underscored by its failure to show that the relief it

seeks would actually affect its business. Petitioner

does not seek retrospective relief for Mountain Gra

vel’s failure to award it the subcontract. Rather, pe

titioner seeks only to enjoin and declare unlawful the

future use of the Clause by the FHLP. J.A. 22-23.

Petitioner thus has standing only if it faces “ ‘actual

or imminent’ injury.” Lujan v. Defenders of Wild

life, 112 S. Ct. 2130, 2138 (1992). The asserted

future harm upon which petitioner’s claim is based

is, however, both remote and highly contingent. In

the 18 years that petitioner has been in the guard

rail construction business, the subcontract on the

West Dolores project is the only subcontract that

3G

petitioner has allegedly lost due to the Subcontract

ing Compensation Clause. Pis. Answers to Defs.

Interrog., Attachs. 1, 3. In Colorado, where peti

tioner bids, the only agency using the Clause is the

CFLHD, which has on average less than one guard

rail subcontract per year in each State. Defs. An

swers to Pis. Interrog. 13. Petitioner has not always

bid on government subcontracts, and when it did it

most often failed to make the lowest bid. Pis. An

swers to Defs, Interrog. 9, Attach. 1. In addition,

most highway construction projects on which peti

tioner bids are not administered by the CFLHD, but

by the State, and therefore do not include the Sub

contracting Compensation Clause. Finally, if peti

tioner lost future contracts under the Clause to dis

advantaged businesses owned by nonminorities, an

injunction against use of the racial presumption in

the Clause would provide it no relief. All these fac

tors make the “links in the chain of causation be

tween the challenged Government conduct and the

asserted injury * * * far too weak for the chain as

a whole to sustain [petitioner’s] standing.” Allen v.

Wright, 468 U.S. 737, 759 (1984).23

Petitioner, in sum, has not established—nor does

it appear to have—any factual basis for challenging

23 Northeastern Florida Chapter of Associated General Con

tractors V. City of Jacksonville, 113 S. Ct. 2297 (1993), is

not to the contrary. That case was brought by an association

of 240 contractors and subcontractors that regularly bid on

contracts affected by the challenged set-aside, in contrast to

petitioner here, which faces only the most speculative chance

that it will be affected by the challenged program. The pro

gram in City of Jacksonville was also fundamentally different

from the one at issue here, because it was an exclusively

minority program, whereas the Clause here neither prevents

petitioner from obtaining certification as a disadvantaged

business nor, even if not so certified, from bidding on and ob

taining subcontracts on prime contracts including the Clause.

31

the constitutionality of the only factor of any kind

in the Compensation Clause program that is based

on minority racial status. As we show below, the

rebuttable presumption, in the context of a program

that seeks not to give a preference, but to alleviate

discriminatory barriers that would otherwise imperil

disadvantaged subcontractors, is unquestionably con

stitutional. On the present record, however, the only

aspect of the Compensation Clause open to challenge

is its implementation of Congress’s decision to in

crease the share of federal procurement business al

located to disadvantaged subcontractors, whether