Jenkins v. Missouri Motion for Award of Post-Judgement Interest

Public Court Documents

December 5, 1989

Cite this item

-

Brief Collection, LDF Court Filings. Jenkins v. Missouri Motion for Award of Post-Judgement Interest, 1989. e37915ea-b59a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/bf92e8bc-4479-4a4f-920e-3aa64bf0bc84/jenkins-v-missouri-motion-for-award-of-post-judgement-interest. Accessed February 21, 2026.

Copied!

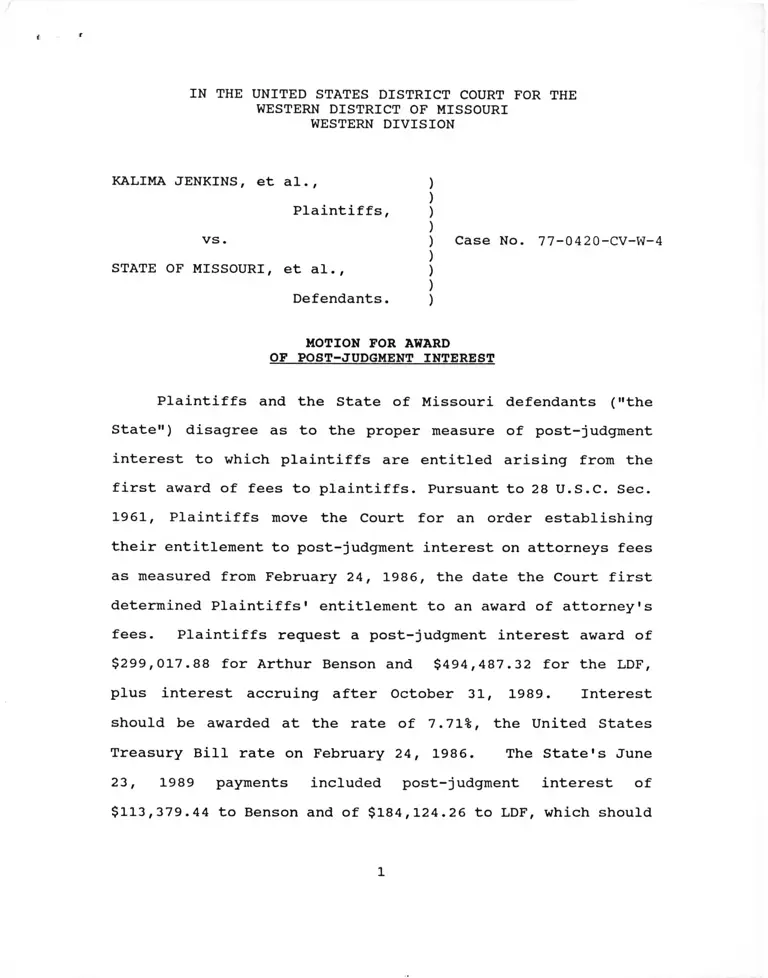

IN THE UNITED STATES DISTRICT COURT FOR THE

WESTERN DISTRICT OF MISSOURI

WESTERN DIVISION

KALIMA JENKINS, et al.,

Plaintiffs,

vs.

STATE OF MISSOURI, et al.,

Defendants.

)

)

)

)

) Case No. 77-0420-CV-W-4

)

)

)

)

MOTION FOR AWARD

OF POST-JUDGMENT INTEREST

Plaintiffs and the State of Missouri defendants ("the

State") disagree as to the proper measure of post-judgment

interest to which plaintiffs are entitled arising from the

first award of fees to plaintiffs. Pursuant to 28 U.S.C. Sec.

1961, Plaintiffs move the Court for an order establishing

their entitlement to post-judgment interest on attorneys fees

as measured from February 24, 1986, the date the Court first

determined Plaintiffs' entitlement to an award of attorney's

fees. Plaintiffs request a post-judgment interest award of

$299,017.88 for Arthur Benson and $494,487.32 for the LDF,

plus interest accruing after October 31, 1989. Interest

should be awarded at the rate of 7.71%, the United States

Treasury Bill rate on February 24, 1986. The State's June

23, 1989 payments included post-judgment interest of

$113,379.44 to Benson and of $184,124.26 to LDF, which should

1

be offset against the post-judgment interest awarded.

Plaintiffs, therefore, request the Court to order the State

to pay the balance of post-judgment interest owed, $185,638.44

to Benson and $310,363.06 to LDF.

In the alternative, plaintiffs move the Court for an

order awarding Arthur Benson prejudgment interest in the

amount of $178,859.18. The requested prejudgment interest

includes: (a) $121,131.62, the extraordinary interest

payments he paid from September 17, 1984 to May 11, 1987 and

(b) $57,727.56, the differential between the interest Benson

paid and the 6.3% statutory interest earned (between May 11,

1987 and June 30, 1989 when Benson's loans were finally paid)

on that portion of the fees judgment that could have been used

immediately to repay his $471,000 indebtedness had the State

promptly paid the judgment, to compensate Benson for the

extraordinary debt service burden he incurred as a result of

the extraordinary and protracted nature of this litigation.

SUGGESTIONS IN SUPPORT OF MOTION

Although the fee award ordered by this Court on May 11,

1987 has been affirmed on appeal by the Eighth Circuit and

the Supreme Court, there remains a dispute between the parties

as to the proper amount of interest on that award that is due

plaintiffs. By this motion plaintiffs request this Court to

determine the appropriate amount of that interest.

2

The calculations of the post—judgment interest award for

Benson and the LDF, including appropriate credit for interim

payments made by the State during the course of the fees

litigation, are set forth in attachments to this motion. see

affidavit of Randall Hickman. The calculation of the

plaintiffs' alternative request of an award of prejudgment

interest for Benson is set forth in the attached affidavit of

Benson XX; the calculation of the interest

differential paid by Benson from May 11, 1987 to June 30,

1989, is also set forth in Benson's affidavit.

Post-judgment interest per Sec. 1961 on attorney's fees

awards commences to run no later than the date of the judgment

awarding fees. This is the minimum post-judgment interest to

which plaintiffs are entitled. The caselaw and the views of

the leading commentators indicate that post-judgment interest

should run from the date that plaintiffs' entitlement to fees

is recognized by the district court (in some instances as

early as the date of the judgment on the merits).

Plaintiffs have asked this Court to award them post

judgment interest from February 24, 1986, the date this Court

first declared plaintiffs' entitlement to fees. They submit

that the caselaw and policy underlying Sec. 1961 and powerful

equitable considerations mandate that post-judgment interest

run from that date rather than the May 11, 1987 judgment which

quantified the amount of plaintiffs' fee award.

3

The Eighth Circuit Decision in Dalton Mandates Post-Judgment

Interest on Attorney's Fees Awards; Although Dalton Fails to

Instruct as to the Event Which Triggers the Running of Such

Interest, Dalton's Approving Citation of the Fifth Circuit's

Decision in Copper Licruor Suggests Incorporation of the Copper

Liquor Standard

In R.W.T. v- Dalton. 712 F . 2d 1225 (8th Cir.)/ cert.

denied. 464 U. S. 1009 (1983), the court of appeals reversed

the district court which had declined to allow post-judgment

interest on fees awarded pursuant to Sec. 1988. Quoting from

Perkins v. Standard Oil Co. , 487 F.2d 672, 675 (9th Cir.

1973), the court held that post-judgment interest was

mandatory under Sec. 1961 for fees awards as well as damages,

noting that a contrary rule would dilute fees awards and would

work as an undesirable incentive for defendants to appeal.

712 F .2d at 1234-1235.

Having reversed the district court's denial of post

judgment interest on the fees award, the court of appeals in

Dalton. in a single sentence and without explanation,

instructed the district court to "allow interest from and

after March 30, 1982, until payment." Id. at 1235. Although

the district court had entered summary judgment for plaintiffs

on October 14, 1980, its final judgment, including costs and

attorney's fees, had been entered on March 30, 1982.

The failure of the court of appeals in Dalton to explain

its rationale for measuring post-judgment interest on the fees

award from March 30, 1982, leaves ambiguity. It is quite

I

4

possible that March 30, 1982 was the date selected by

plaintiffs, and that plaintiffs did not request that interest

run from an earlier date. This explanation is quite plausible

due to the reality that 28 U.S.C. Sec. 1961 "became effective

on October 1, 1982, after the award of fees in this case".

Id. at 1235. It is also possible the court of appeals

intended post-judgment interest on fees to run from the date

of the district court's judgment of liability, as both the

final merits and fees decision were merged in the March 30,

1982 judgment.

Dalton clearly does not hold that post-judgment interest

on a fees award cannot run from the date of liability on the

merits or from the date of an earlier order establishing

plaintiffs' entitlement to fees. Indeed, the Eighth Circuit's

approving citation in Dalton. at 1234, of the Fifth Circuit's

opinion in Copper Liquor. Inc, v. Adolph Coors Co., 701 F.2d

542 (5th Cir. 1983) (en banc) is a strong indication that

post—judgment interest ordinarily should be measured from one

of these two dates which precede the actual order awarding

fees.

The Fifth Circuit in Copper Liquor recognized that, in

certain circumstances, post-judgment interest on a fees award

can run from the date of the judgment on the merits rather

than the date of a subsequent judgment on fees:

If a judgment is rendered that does not mention the

right to attorneys' fees, and the prevailing party is

unconditionally entitled to such fees by statutory

right, interest will accrue from the date of the

5

m e n S ^ f a t i o r n e y ^ J s ^ f t h " ered “^ o u tit? wi-t-v.!*-. 4-1̂ j - . rees/ ^nd the allowance of fep?s^ S n rS S ^ sss

Copper Liquor, 701 F.2 d at 5 4 5 .

In CgBper Liquor plaintiffs first obtained a judgment on

liability at least as early as 1975. Following appeal to the

Fifth Circuit the case was remanded for reconsideration of

damages and fees. 506 F.2d 934 (5th Cir. 1975). The case was

retried, and the district court entered a judgment for damages

and fees on July 31, 1978. Following appeal the case was

again remanded for reconsideration of fees. 6 2 4 F.2 d 5 7 5 (5th

Cir. 1980). The district court's amended judgment awarded

fees on June 29, 1981.

m Copper Liquor the "plaintiffs urge only that interest

on attorneys' fees for work performed before July 31, 1978 be

allowed from that date, because the original judgment awarding

attorneys' fees was then rendered, and that interest on

attorneys' fees for subsequent work be allowed from June 29,

1981, the date of the district court's amended judgment." 7 0 1

F*2d at 545‘ The Fifth Circuit approved this request. It

should be noted that plaintiffs did not seek post-judgment

interest from the date liability was first established on the

merits, but conservatively sought post-judgment interest only

from the date their entitlement to fees was first established

in the district court.

6

Although Judge Collinson of this Court cited Dalton in

an order awarding post-judgment interest from the date of the

fees judgment (in a case where the fees judgment was entered

separately and subsequent to the judgment of liability), Judge

Collinson did not discuss whether the interest could have been

assessed from the date of liability or from the date of an

earlier order establishing entitlement to fees. Griffin v.

Ozark County, Mo.. 688 F. Supp. 1372, 1377 (W.D.Mo. 1988).

Dalton does not stand as a barrier to an award of post

judgment interest measured from the date of the judgment on

the merits or, as plaintiffs propose here, the date the

district court first determined plaintiffs' entitlement to a

fee award, as the issue was not addressed in Dalton.

II

Post-Judgment Interest Should Be Allowed At Least From

the Date the Court Determines that the Fee

Applicant Is Eligible for Fees

The better view, one in keeping with the compensatory

purposes of Sec. 1961 and the Fees Act, is that post-judgment

interest should run from the date that plaintiffs establish

entitlement to fees, based on either the judgment of liability

establishing plaintiffs as prevailing parties or a

determination by the district court that plaintiffs are

entitled to fees but prior to quantification of the amount of

fees. Post-judgment interest is intended to "compensate the

wronged person for being deprived of the monetary value of the

loss from the time of the loss to the payment of the money

7

judgment." Buck v. Burton. 768 F.2d 285, 286 (8th Cir. 1985),

citing Turner v. Japan Airlines. Ltd.. 702 F.2d 752, 756 (9th

Cir. 1985).

The leading case, Copper Liquor, has been discussed

above. The Federal Circuit expressly followed Copper Liquor

in Mathis v. Spears. 857 F.2d 749, 760 (Fed. Cir. 1988).

Mathis held: "Interest on an attorney fee award thus runs

from the date of the judgment establishing the right to the

award, not the date of the judgment establishing its quantum."

In Mathis the district court awarded Sec. 1961 interest on

its fees award measured from the date of the judgment on the

merits, March 21, 1986, rather than the date of its subsequent

judgment on fees, June 27, 1986. The Federal Circuit upheld

the award of post-judgment interest from the date of the

judgment on the merits because that judgment established

plaintiffs' entitlement to fees.

The United States District Court for the Southern

District of New York awards post-judgment interest as measured

from the date it determines plaintiffs' entitlement to fees,

rather than the date it enters the fees judgment. In

Williamsburg Fair Housing Comm, v. Ross-Rodnev Housing. 599

F. Supp. 509 (S.D.N.Y.1984), judgment on the merits was

entered January 22, 1981; judgment granting plaintiffs'

request for fees was entered on August 23, 1983; judgment

quantifying plaintiffs' fees award was entered on October 26,

1984. The court ruled that post-judgment interest per Sec.

8

1961 ran from August 23, 1983.

The leading commentators agree:

The better view would allow interest at least from the

date a court (trial or appellate) determines that the

fee applicant is eligible for fees. * * *

And certainly the fee opponent should not be able to

benefit by simply taking an appeal either on the merits

or on the fee award. A fee opponent's appeal could

effectively postpone for a substantial period of time

the day when a fee judgment was finally entered or

executed. Allowing interest dating back to the merits

judgment (or at least to the date eligibility is

presumptively determined, which may be the same date

as the merits judgment) may be the only way to prevent

fee opponents from undermining the remedial and

deterrent purposes of fee awards.

Derfner & Wolf, Court Awarded Attorney Fees. para. 18.07,

at 18-90.

In the instant case, plaintiffs' entitlement to fees was

clearly established on September 17, 1984, when this Court

found liability on the part of the State and the KCMSD.

Although this Court's opinion of that date was silent as to

defendants' liability for fees, plaintiffs unquestionably

attained "prevailing party" status entitling them to a fully

compensatory fee on that date. The Supreme Court this past

Term, in Texas State Teachers Association v. Garland

Independent School District. 109 S.Ct. 1486 (1989), confirmed

again Sec. 1988's very generous prevailing party test.

Quoting from Nadeau v. Helqemoe. 581 F.2d 275, 278-279 (1st

Cir. 1978), the Court held: "If the party has succeeded on

'any significant issue in litigation which achieve[d] some of

the benefit the parties sought in bringing suit' the plaintiff

9

has crossed the threshold to a fee award of some kind." 109

S. Ct. at 1493.

Because of the extensive and immediate work necessitated

by the remedy proceedings and the appeals by both parties,

plaintiffs did not file their fee applications until February

1986. On February 24, 1986 this Court entered its order

confirming plaintiffs' entitlement to fees: "Clearly under

the law, counsel for plaintiffs are entitled to an award for

attorney's fees." (Page 1). Once this Court made this

finding, post-judgment interest unquestionably began to accrue

under the second part of the Copper Liquor test, Mathis, and

Williamsburg Fair Housing.

Plaintiffs anticipate that the State will argue that this

Court's award of current market rates and an additional

enhancement of Benson's rate for delay in payment precludes

award of post-judgment interest prior to May 11, 1987.

Although this Court's May 11, 1987 Opinion awarded fees based

on "current market rates," it did not identify its time frame.

Although the May 11, 1987 Opinion did not state that the

"current" rates were those of February 24, 1986, the date this

Court first determined plaintiffs' entitlement to fees, such

a reading would be consistent with plaintiffs' evidence. The

extensive Altman & Weil Survey which established billing

rates, P. Ex. 4, was based on "hourly rates as of December 31,

1985." (Page 47). Weil's testimony and chart as to the

effect of not receiving fees at the time the work was done

10

went only through December 31, 1986. P. Ex. 5; T. at 114.

The affidavits and charts as to Kansas City market rates were

primarily based on billing rates in early 1986.

Award of post-judgment interest from February 24, 1986

would be consistent with the delay in payment enhancement

awarded plaintiffs on their lodestar fee and would fulfill

the compensatory purpose of Sec. 1961. Such an award is also

supported by powerful equitable considerations. Benson's

interest payments on the $ 633,000 debt incurred during this

litigation continued unabated, with Benson paying $121,131.62

in interest from September 17, 1984, the date of the Court's

decision on liability, through May 11, 1987.

Ill

The District Court Possesses

Inherent Authority to Award Prejudgment interest

from September 17, 1984 through May 11, 1987

to Compensate Benson for $121,131 in Extraordinary

Interest Paid and for the Interest Differential

of $57,727 (Between Sec. 1961's 6.3%

Post-Judgment Interest and the 11%+ Interest)

Imposed Upon Benson Because the State Delayed

Final Payment Until June 23, 1989

Plaintiffs' alternative request for prejudgment interest

is a conservative one. Plaintiffs do not request that

prejudgment interest be awarded on their entire $4.1 million

fees judgment. Rather, they request only that Benson be

compensated in full, in the form of prejudgment interest, for

the entire interest he paid (on the extraordinary debts he

incurred to successfully litigate this case to conclusion).

11

They request compensation, in the form of prejudgment

interest, for Benson for all interest which he paid from the

date this Court entered its judgment on liability, September

17, 1984, until his debts were fully paid on June 30, 1989

(less an offset described below for certain post-judgment

interest earned).

Arthur Benson's extraordinary debt service burden did

not conclude of course upon entry of this Court's fees

judgment on May 11, 1987. Although not insignificant partial

payments were made by the State, Benson was unable to repay

his enormous loans in full and continued to pay the high

interest rates for more than two years after the fees

judgment— until the State's June 1989 payment enabled Benson

to finally pay off his loans. Benson paid $121,107.31 in

interest after this Court's May 11, 1987 fees judgment.

Although Benson earned post-judgment interest at 6.3%

following this Court's May 11, 1987 fees judgment (while that

judgment was appealed), the interest rates paid by Benson

throughout the fees appeals were nearly double the 6.3%

Treasury Bill rate paid him in post-judgment interest. These

continuing and substantial interest obligations were

necessitated solely due to the extraordinary debts this

litigation imposed on Benson and the State's decision to delay

payment of the judgment. The interest penalty thus imposed

was, most certainly, not compensated in the May 11, 1987

j udgment.

12

The award Plaintiffs request, thus, includes not only

the $121,131.621 in interest payments Benson paid from

September 17, 1984 to May 11, 1987, the date of the fees

judgment, but also includes the additional interest costs that

resulted from the failure of the State to pay Benson's $1.7

million judgment on May 11, 1987. These additional interest

costs, and they were substantial, were the direct result of

the extraordinary debts Benson incurred earlier and his

continuing obligation to pay interest on that indebtedness at

rates substantially higher (generally 11% and higher) than the

6.3% statutory post-judgment interest Benson's judgment would

earn pursuant to Sec. 1961.2 The interest differential or

In order to avoid any possible confusion, plaintiffs observe

that the amount of interest Benson paid prior to May 11, 1987

($121,107.31) is nearly identical to the amount of interest he paid

subsequent to May 11, 1987 ($121,131.62). The similarity is, of

course, coincidental.

2Benson was entitled to payment in full on May 11, 1987.

Benson had been paid approximately $347,000 prior to May 11, 1987,

leaving a balance of $1,382,000. At that time Benson's litigation-

related indebtedness was approximately $471,000. See affidavit of

Benson and Benson Aff., Jan. 16, 1987, Tab III; T. at 131-132. The

interest penalty incurred by Benson due to the State's delay in

payment of the May 11, 1987 judgment can be appreciated by the

following comparison of Benson's position on June 30, 1989.

Had Benson been paid in full on May 11, 1987, he could have paid

his $471,000 indebtedness and thereby eliminated his obligation to

pay interest at times in excess of 15%. The balance, $910,702,

Benson could have invested and earned at least the 6.3% interest

then paid on T-bills. Through June 30, 1989 Benson would have

earned $50,000. See affidavit of Benson. This figure of $50,000

would also represent Benson's net return from his fees judgment,

since his immediate repayment of the $471,000 indebtedness would

have eliminated any further interest payouts.

Since the State did not pay Benson's judgment on May 11, 1987,

but made only partial payments until June 23, 1989, Benson was

13

penalty is $57,727.56 and represents the difference between

the interest Benson paid on the $471,000 indebtedness through

June 23, 1989 - at rates of approximately 11% - and the

statutory interest earned on that same amount - at rates of

6.3% - which was ultimately paid Benson by the State on June

23, 1989.

This Court should exercise its equitable discretion and

order prejudgment interest paid Benson in the amount of

$121,131.62, the interest actually paid by him on his

litigation-related indebtedness between September 17, 1984

and May 11, 1987. It should further order prejudgment

interest paid Benson in the amount of $57,727.56, the interest

differential or penalty which resulted from the State's delay

in payment of the judgment. In total, plaintiffs request

forced to continue to pay higher interest on the $471,000

indebtedness through June 23, 1989. The total interest paid by

Benson from May 12, 1987 to June 30, 1989 totals $121,107.31. The

portion of the outstanding $1.3 million fees judgment which Benson

would have used to repay his indebtedness - $471,000 - of course

did earn statutory post-judgment interest while the State delayed

payment, but this interest was only at 6.3%. The statutory post-

judment interest which could have been earned on the entire

outstanding fees judgment through June 30, 1989 is $113,379.

See Benson affidavit. Subtraction of the $121,107.31 in interest

Benson paid (after May 11, 1987) from the $113,379, the total post

judgment interest earned, produces a net return of a negative

$7,727.87 on Benson's fee judgment.

The State's decision to delay payment of Benson's fees judgment

resulted in a net return of a negative $7,727.87; in contrast,

immediate payment of Benson's fee judgment by the State would have

resulted in a net return of $49,999.69. The difference of

$57,727.56 can be fairly characterized as a continuing interest

penalty for Benson - a penalty directly tied to his litigation-

related indebtedness.

14

prejudgment interest of $178,859.18 for Benson.

The Eighth Circuit has recognized that a district court

has equitable discretion to award interest on fees awards per

Sec. 1988, beyond the post-judgment interest statutorily

mandated by Sec. 1961, in order to ensure that plaintiffs are

fully compensated for any delay in payment of the fees

judgment. Association for Retarded citizens nf worth n.voe.

i^Olnon, 713 F. 2d 1384 (8th Cir. 1983). See also Mathis y

Spears f supra.3 * *

In ARC V . Olson, 561 F.Supp. 495 (D.N.D. 1982) the

district court recognized that delay in payment of a fee award

may impose substantial damages on plaintiffs. The degree of

hardship that would result from delay in payment would be

significantly less for plaintiffs' counsel in Olson where

plaintiffs were represented by a legal services program, than

m the instant case where plaintiffs were represented by a

private practitioner. still, the district court in Olson

^warded__plaintiffs interest that explicitly compensate for

both inflation and out-of-pocket interest paid hv

counsel to maintain the litigation. Plaintiffs urge that this

Court fashion similar relief for Benson.

In ARC v. Olson, the district court made an interim fee

c o u r t ^ H ^ ? ^ V; SpPars' -Simra, plaintiffs appealed the district

the"federal"circuit"affirmed" "I*6"63" the awardthe district court to awaST H' e r6c°gnlzed an inherent power in

has acteS in bad faith or T * erest “hen the defendant

F.2d at 761. ° other exceptional circumstances." 8 5 7

15

award on December 16, 1981, which the state apparently did

not appeal. When the state did not pay, plaintiffs moved that

defendants be found in contempt. The court instead exercised

its equitable discretion to ensure that plaintiffs' counsel

would "be made whole if payment is delayed" pending appeal on

the final fees judgment. 561 F.Supp. 495, 511 (D.N.D. 1982).

The district court found that the original fees judgment would

have to be supplemented by 11% to compensate for loss due to

inflation, by an additional 3% for reasonable interest income,

and by an additional 17 1/2% to 18 1/2% for all lawful

interest paid to loaning agencies on operational loans owed

by plaintiffs' counsel during such time as this debt is not

paid. 561 F.Supp. at 511. The Eighth Circuit upheld the

above interest award, stating the district court may "take

any reasonable action to secure compliance with its orders,

and only when the district court's response is so

inappropriate as to amount to an abuse of discretion will the

Court of Appeals intervene." 713 F.2d at 1396.

The debt load imposed on Arthur Benson as a result of

this litigation constitutes the extraordinary circumstances

which permit exercise of this Court's inherent authority to

award prejudgment interest. Benson paid interest at rates at

times exceeding 15% on loans exceeding $633,000. From

September 17, 1984, the date this Court entered judgment on

liability, until Benson was finally able to repay his loans

following the State's June 1989 payment, Benson paid a total

16

of $242,238.93 in interest on loans incurred directly as a

result of this litigation. Plaintiffs are unaware of any case

in which the demands of the litigation forced individual

counsel to incur such extraordinary personal financial

obligations in order to maintain himself and his law firm

through the conclusion of the litigation.

The Seventh Circuit has recognized an equitable

discretion in the district court to award prejudgment interest

on an attorney's fees award from the date of the judgment on

the merits to the date of the fees judgment. In re Burlington

Northern Employment Practices Litigation. 810 F.2d 601, 608-

609 (7th Cir. 1986), cert, denied. 108 S.Ct. 82. Although it

held the district court had not abused its discretion in

denying plaintiffs prejudgment interest on their fees award

in Burlington Northern, the court of appeals held:

While [28 U.S.C. Sec. 1961(a)] does not preclude

prejudgment interest, the award of such interest is

committed to the discretion of the district court and

is to be based on equitable considerations. See, e .g..

Michaels v. Michaels. 767 F.2d 1185, 1204 (7th Cir.

1985).

Id. at 609.

In Burlington Northern (BN) a settlement was reached as

to the merits which included a substantial agreement as to

attorney's fees. The consent decree was approved on April 2,

1984, plaintiffs' filed their fee application in June 1984,

and the district court entered its judgment on fees on

September 20, 1985. The BN defendants conceded the

17

reasonableness of the 12,228 attorney hours and the 5,157

paralegal hours claimed by plaintiffs. BN objected to the

hourly rates sought, a requested multiplier, and prejudgment

interest. The district court awarded fees of $ 2,184,165,

the total lodestar sought. The court awarded the hourly rates

sought by plaintiffs, but denied a multiplier and denied

prejudgment interest.

On appeal the Seventh Circuit declined to overturn the

district court's denial of prejudgment interest. In

examining the Seventh Circuit's rationale it is important to

appreciate that the district court's denial of prejudgment

interest was reviewed under the very deferential abuse of

discretion standard. Under the abuse of discretion standard

a rationale that has any plausibility whatsoever is sufficient

to sustain the district court's decision.

The court of appeals noted two such plausible reasons

existed to sustain the district court. First, the delay in

the fees judgment was "occasioned by a legitimate dispute over

several issues, notably the question of fee multipliers" and,

therefore, the award of prejudgment interest would unfairly

penalize BN for asserting a successful defense. Second, the

court of appeals also observed:

In the absence of evidence, we have no basis on which to

conclude that payment based on [top] 1984 rates

compensated lead counsel only for the delay in payment

up to that time; in fact, it may also have ameliorated

the delay from June 1984 to September 1985."

Id. at 609.

18

Although this Court's denial of a risk enhancement to

the Jenkins plaintiffs provides a parallel to Burlington

Northern, there are several key distinguishing equitable

considerations that strongly commend exercise of this Court's

discretion in favor of plaintiffs' lead counsel Benson.

First, unlike in Burlington Northern. plaintiffs'

alternative prayer does not seek prejudgment interest on the

ultimate fees judgment of nearly $ 4.1 million. Rather,

plaintiffs' alternative prayer seeks compensation only for

the extraordinary interest paid by their lead counsel Benson

on the $ 633,000 debt he incurred as a result of this case.

Plaintiffs are unaware of any civil rights case in which a

solo practitioner had to incur such an enormous debt. The

hardship was compounded because Benson paid interest at rates

in excess of fifteen percent. Benson merely asks that the

State be required to compensate him for the interest he paid

following this Court's decision establishing liability. Had

Benson been paid his fees award in September 1984, he could

have paid his indebtedness and avoided over $242,238.93 in

interest payments.

Second, plaintiffs acknowledge that denial of prejudgment

interest may be appropriate when a plaintiff has engaged in

dilatory tactics during the course of the litigation. See

Michaels, supra. This rationale underlay Burlington Northern,

where it is apparent the only major fees issue in dispute was

plaintiffs' entitlement to a multiplier and the district court

19

found that issue, which was resolved against plaintiffs,

delayed the fees award. Recall that in Burlington Northern

the defendants did not dispute any of the plaintiffs' 12,000-

plus hours. In contrast the State disputed almost every

aspect of the Jenkins plaintiffs' fees claims, from the number

of hours that should be cut because of Hensley v. Eckerhart.

461 U.S. 424 (1983), or alleged duplication, to hourly rates,

to delay in payment, to a myriad of expenses and disbursements

issues, to risk enhancement. All but the risk enhancement

issue was resolved in plaintiffs' favor, and plaintiffs'

unsuccessful request for a risk enhancement in no way delayed

this Court's adjudication of plaintiffs' fees.

Third, the period of time from entry of the consent

decree in Burlington Northern to entry of the fees award was

slightly over seventeen months, from April 1984 to September

1985. In the instant case the period of time from entry of

the judgment on liability in September 1984 to entry of the

fees award in May 1987 is thirty-two months. Although

offered in a different context, Justice Cardozo's perceptive

observation provides a helpful touchstone here: "The law is

not indifferent to considerations of degree." Carter v.

Carter Coal Co. . 298 U.S. 238 (Cardozo, J. , diss.). The

delay in Jenkins extended nearly a year and a half longer than

that in Burlington Northern. Burlington Northern is silent

as to any special financial burdens imposed on plaintiffs'

counsel as a result of the litigation.

20

In Burlington Northern the consent decree not only

resolved the liability issues, it resolved the remedies issues

as well— and eliminated all appeals. The bifurcated nature

of the liability and remedy issues in the instant case, and

the appeals from both, did not permit immediate resolution of

plaintiffs' fees immediately following the September 1984

judgment. Following the remedies rulings in June 1985, and

while both liability and remedy were pending on appeal, the

Jenkins plaintiffs filed their fee applications in February

1986. The plaintiffs can in no way be faulted for waiting

to file their fee application. Because the resolution of the

appeals and cross-appeals would impact dramatically the fees

decision due to the Hensley principles, this Court delayed its

fees decision until the Eighth Circuit en banc affirmed its

rulings on December 5, 1986. Had plaintiffs filed their fee

applications earlier it would not have resulted in an earlier

disposition of their fees claim.

In Burlington Northern, although the district court had

made no such finding, the Seventh Circuit speculated that the

award of top 1984 market rates may have effectively

compensated plaintiffs for the delay to the September 1985

fees judgment. The leap of faith evident in the court of

appeals' reasoning underscores the cursory nature of the abuse

of discretion standard of appellate review.

This Court has the equitable power to award Arthur Benson

the comparatively modest prejudgment interest and post

21

judgment interest differential requested. The issue before

this Court is whether the delay in payment enhancement awarded

Arthur Benson compensated him for the extraordinary interest

expenses he incurred to litigate this case. Unquestionably,

the enhancement did not compensate Benson for the $121,107.31

interest he was to pay during the two—plus years following the

district court's fees judgment until June 23, 1989, when the

State made its "final" payment following the Supreme Court's

ruling. At a minimum, this Court should award Benson this

amount in prejudgment interest (offset by the statutory 6.3%

interest), or $57,727.56. Plaintiffs respectfully submit the

enhancement likewise did not compensate Benson for the

$121,131.62 interest he paid from September 17, 1984 to May

11, 1987.

Plaintiffs anticipate the State will argue that the $200

hourly rate awarded Benson necessarily included compensation

for the extraordinary interest he paid. This Court, after

finding that an appropriate hourly rate for Benson would

normally be at the higher end of the $125 to $175 range,

awarded Benson $200 per hour due to the additional factor of

delay in payment. Plaintiffs' evidence showed that, during

the period from 1979 to 1986, Kansas City "hourly rates have

not gone nearly as high as the compounding effect of use on

interest rates." T. at 116 (Testimony of Robert Weil).

Plaintiffs would first observe that this Court's Opinion

never mentioned that it in any way took into account the

22

$113,706.56 in interest Benson paid through 1986. Plaintiffs

would next observe that the $200 hourly rate awarded Benson

parallels one of Robert Weil's illustrative, but exceedingly

conservative calculations. Using only the midwest average of

$72.50 per hour in 1979, Weil showed that counsel would have

to be paid $203 per hour on December 31, 1986, based on the

prime rate plus 1%, to be compensated for the delay in payment

for work done in 1979. T. at 113-114; P.Ex. 5 at p. 10.

Although a generally very instructive calculation, due to the

conservative 1979 hourly rate and the conservative prime rate

plus one assumptions, Weil's sample calculation understated

a fully compensatory fee for Benson. This is evident in that

a fair market rate for Benson in 1979 clearly exceeded $72 and

Benson's financial situation was sufficiently precarious that

he was unable to borrow money at rates as low as the prime

rate plus one percent.

Whatever the facts may have shown in Burlington Northern,

this Court's award of current market rates, whether those of

February 1986 or May 1987, even when adjusted for the delay

in payment enhancement awarded Arthur Benson, did not

compensate Arthur Benson for the extraordinary interest

expense he incurred and paid from September 17, 1984 to June

23, 1989. This Court should exercise its equitable discretion

and award Benson the requested prejudgment interest, and

should make express findings that the delay in payment

enhancement included in its May 11, 1987 fees award did not

23

ameliorate the unique injury suffered by Benson as a result

of the extraordinary litigation-indebtedness he incurred.

This Court should award Benson prejudgment interest of (a)

$121,131.62, the extraordinary interest payments he paid from

September 1984 to May 1987 and (b) $57,727.56, the

differential between the interest Benson paid and the 6.3%

statutory interest earned between May 11, 1987 and June 23,

1989 when Benson was finally able to discharge all debts.

IV

Conclusion

In sum, plaintiffs submit that, pursuant to Sec. 1961,

they are entitled to an award of post-judgment interest for

Benson and the LDF from February 24, 1986 at 7.71%. In the

alternative, pursuant to the Court's equitable discretion,

plaintiffs submit that Benson is entitled to an award of

prejudgment interest in the amount of (a) $121,131.62, the

extraordinary interest payments he paid from September 1984

to May 1987 and (b) $57,727.56, the differential between the

interest Benson paid and the 6.3% statutory interest earned

(between May 11, 1987 and June 30, 1989 when Benson's loans

were finally paid) on that portion of the fees judgment that

could have been used to immediately repay Benson's $471,000

indebtedness had the State promptly paid the judgment.

24

Respectfully submitted,

i 1 > 'fejtl (t.LabJHRUSSELL E. 'LOVELL

3111 40th Place

Des Moines, IA 50310

1000 Walnut, Suite 1125

Kansas City, MO 64106

Attorneys for Plaintiffs

I hereby certify that a copy of the

above and foregoing was mailed,

postage prepaid, this *5^day of

December, 1989 to:

Michael Fields

221 W. High St., 8th FI.

Jefferson City, MO 65102

Allen Snyder

Hogan & Hartson

555 Thirteenth Street, N. W.

Washington, D. C. 20004

Bartow Farr

Onek, Klein & Farr

2550 M Street, N. W. #350

Washington, D. C. 20037

Michael Gordon

204 W. Linwood Blvd.

Kansas City, MO 64111

25

AFFIDAVIT

STATE OF MISSOURI )

) ss

COUNTY OF JACKSON )

I, Randall D. Hickman, Tax Manager for the Accounting

firm of Deloitte, Haskins & Sells, based interest calculations on

schedules provided to us by the Law Offices of Benson & McKay

reflecting fee awards to the Legal Defense Fund and Arthur A.

Benson II in the case of Jenkins v. State of_Missouri and on

payments made by the State of Missouri to Arthur Benson and the

Legal Defense Fund. Interest was calculated at 7.71% beginning

February 24, 1986 and compounded annually through October 31, 1989.

Randall D. Hickman

DELOITTE, HASKINS & SELLS

Sworn and subscribed to before me this day o f v

1989.

My Commission Expires:

7 7 7 7

Notary Public

NANCY L. ELDER

Notary Public • Stats of Missouri

Commissioned In Clay County

My Commission Expires Feb. 1 5 ,1S82

nuo jN I

1 N i L R L j 1 1 n v c L n 1 1 D N

ON J U D u i" .E i(T T h R O U c .-.

i v ; w 1 / B 7

DATE DESCRIPTION

OUTSTANDING 4 uF unij

BALANCE OUTSTANDING

INTEStST ACCRUED

r a t e i n t e r e s t

02/ 24 ■' CO F JO C nhn: 1 , 0 4 ,457 .4 D 1. tl4,457 .43 9 T. 71% 7D >0c9. 20

C i'05;1 dO P n f M t N i i 200, OCO. 00 j 1,,4i4, 937. 43 90 7. I 1 -o 2b, 389..81

U D/ 03JI Sc r A iCIlNT (ICC, 000. 00 J 1,,314, 437 .46 - ■ 7- 7P© 7, 49d .61

7 Q ' 00 FEE HWn! i o*T A j090. 45 1,556, 527 .85 i j , . 1 0 2o,,o48,

i C!■ :*i.' jO PAYMENT i 1' 4 ; ,333. 00) 1 ,,309, 1V4 .86 14c 7, 71* 40,, j / d .

C "7. J ,

_ i •• d / INTEREST i 04 ,4 79..72 i,913,,674. 60 ■‘■j 1 ,. . i o 2 L ., 0 7 4 , ' ' i

i i fEE r,h-

7 *, 70";, 49 1 ,966, „ 7 , ,08 2 7 ,, : i s .

C •. v t

C u,'Co / 87 PrtrhENT (300 ,000 .00) 1 , 136 ,577 .09 202 7 .71-o 50 >o2i .57

02;'24 / d d ANNUhL INTEREST 100 , o 3 1 ,.82 1 ,267 ,008 .91 o6 7 .7 Pi 18 ,456 . 3d

d 5,f 02 1 w c PAYMENT (500 ,000 .00) 787 ,008 .91 298 i .71$ 4 7,540 . 16

c J.0/ «. n/89 m HNUAl INTEREST 68 ,026 c c 853 ,035 .46 119 7 .714 21 ,492 .78

•n r/ C 7 ?nthENT ! 0 7 5 ,376 .511 159 lio, / J U .65 Iod ’ .71C 7 0 71 J 6 1 . 0 L

10. wf i/3S ACCRUE! i n t e r e s t _ D ,579 .60 185 f 7C, U J U .44

Z 1 N - w li j il C K .1 ;

I H T E f t E w i v , n L u U L n T 1 ON

ci j u d g m e n t t h r o u g h

i O / 51 / 3 "i

w/nTE D E S C R I P T O R h i ^ O D f i l

•jU I j I HiiO I fib

BnLhll v t

H OF DAYS

uUT j i AUDIHo

INTEREST

RATE

ACCRUED

INTEREST

AO '04 /

•J - i til So FEE AkARE1 0 70?fc , J* w ,,730,.6 0 2 ,323,,730 .6 0 3c 5 7,, 7 U 179,,159,.63

02/24/ 37 ANNUAL INTEREST 179,,139,.o3 0

L , 502 ,890 . 2 j It *7. 7 U 40 , lCu,. C j

u 5/ 1 1 /67 r t l A A nRD *t u .,145., 14 L ,,545,,035,,37 87 7,. 7ii 4fc,,770. •>:, / u

03/Oo/ 87 PAYMENT 1550,, OuO,,0 0 ) 1 ,695 ,035 .37 2 0 2 7,. 71% 72:,325., 3 j

02;'24/ 85 ANNUAL i n t e r e s t 159,,276.,96 * 1,654, 7 1 '), jl. ,.35 66 7 7ii 2 6 ,, c 3 5., v 4

• 5, 0 2 /55 rAlnlNl SOv.,,0 0 2 ,0 0 ) i , 444,,.i. . u u 295 ,:n u - ,i - .44

02/24/69 ANNUAL In t e r e s t ill.,885. 47 1 ,,466,,197., 80 119 7. 71* 36,,655. 39

06/23/ 39 PAYMENT 1 i ,^ 0 0 .,0 0 0 .,0 0 ) 2 6 o ,197 ,80 130 7,,7U 7,,309.,8c

10/31/69 ACCRUED INTEREST 44,,165. 2o 310,, u6 o ..06

AFFIDAVIT

STATE OF MISSOURI )

) ss

COUNTY OF JACKSON )

1. Arthur A. Benson II, of lawful age and being first duly

sworn state that:

1* In the course of the Jenkins litigation I found it

necessary to borrow substantial sums of money. After I had

exhausted my limited personal resources I borrowed on my own

signature until I could obtain no further credit. I then borrowed

with the assistance of others who co-signed or guaranteed my loans.

2. The loans were necessary because, after devoting

increasing amounts of time to the litigation from 1979 through

1982, in January, 1983 with the commencement of depositions, I

devoted full-time, often in excess of 75 to 80 hours a week to the

Jenkins case. This committment continued through mid-June, 1984.

Thereafter substantial, and often virtually full-time, work on the

case was required in each of the succeeding years.

3. With little or no income from practicing law, the loans

were necessary to pay salaries and other overhead for associates

and nonlawyers working on the case and to meet my personal

obligations for house payments, food, and normal living expenses.

These loans were mostly written at rates that varied from day to

day with interest generally costing me the prime rate plus one or

two percent. it was not unusual for unforeseen needs to require

loans more quickly than could be arranged with co-signors. On

those occasions I used credit cards for cash advances and later

paid down the balances on the credit cards when loans were secured.

4. Interest rates at time exceeded twenty percent (20%) on

some loans and for much of the time even the bank loans were at

thirteen percent (13%) to fifteen percent (15%) when the prime rate

was between eleven percent (11%) and thirteen percent (13%).

5. A substantial amount of my time, and that of my office

manager, was required to find willing co-signors, obtain the loan,

secure the co-signature, obtain borrower's insurance, keep track

of due dates, pay-off, re-finance, or roll-over the loans, and keep

records of payments of principal and interest.

6. At my direction, under my supervision, and in the normal

course of the record-keeping practices of this office, data was

maintained on payments of interest and principal and those records

have been summarized and appear as attachments to this affidavit.

The information contained there, as well as the factual statements

in the accompanying motion and suggestions are true and correct to

the best of knowledge and belief.

Sworn and subscribed to before me this 5th day of December,

1989.

My Commission Expires: October 26, 1992.

CHRONOLOGY OF INTEREST PAID

1984

September through December $ 8,625.93

1985 43,395.37

1986 51,506.70

1987

Through May 11 17.603.62

Subtotal of interest paid 9/84-5/11/87: $ 121,131.62

1987

May 12 through December 31 38,029.73

1988 50,834.02

1989

Through June 30 (all debts paid off when

payment received from State) 32.243.56

Subtotal of interest paid 5/12/87-6/30/89: $ 121,107.31

Total Interest Paid: $ 242,238.93

Total Interest received from State: $ 113,379.44

CALCULATIONS OF INTEREST DUE

$1,614,437.43

- 200 , 000.00

- 100,000.00

+ 42,090.45

47,333.00

+ 72.702.49

$1,381,897.37

- 471.195.36

$ 910,702.01 (could have been

invested to earn

6.3% interest)

I. Net Return Had State Paid Fees Judgment on 5/11/87.

A. Interest that could have been earned (offset by

payments that the State did make from 5/11/87 to

6/23/89)

$910,702.01 x 6.3% per annum = $157.19 per day x 87

(87 days until 8/6/87 payment) = $ 13,675.53

-300,000.oo payment received from State on 8/6/87

$610,702.01 x 6.3% per annum = $105.41 per day x 269

(days until 5/2/88 payment) = 28,355.29

-500,000.oo payment received from State on 5/2/88

$110,702.01 x 6.3% per annum = $19.11 per day x 417

(days until 6/23/89 payment) = 7.968.87

Interest Benson could have earned (giving credit

by offsetting payments made by State) $ 49,999.69

02/24/86 Fee Award:

03/05/86 Payment:

06/03/86 Payment:

06/30/86 Fee Award:

10/01/86 Payment:

05/11/87 Fee Award

Balance due 5/11/87:

Debt owed by Arthur Benson

Profit to Benson if State

had paid judgment 5/11/87

Net Return Had State Paid Fees Judgment on 5/11/87 $ 49,999.69

II. Net Return Because of Benson's Extraordinary

Debts and State's Delay in Payment to 6/23/89

A. Interest earned by payment from State of

6.3% interest from 5/11/87 to 6/23/89 $113,379.44

B. Interest Benson paid from 5/11/87 to

6/23/89: -121.107.31

Net Return Because Judgment paid 6/23/89: -$ 7,727.87

III. Interest Penalty Incurred by Benson: $ 57,727.56