Goldsboro Christian Schools, Inc. v. United States Motion for Leave to File and Supplemental Brief Amici Curiae

Public Court Documents

January 1, 1981

Cite this item

-

Brief Collection, LDF Court Filings. Goldsboro Christian Schools, Inc. v. United States Motion for Leave to File and Supplemental Brief Amici Curiae, 1981. 82305f95-b39a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/e17c8566-ae6e-4263-b652-217b9632106e/goldsboro-christian-schools-inc-v-united-states-motion-for-leave-to-file-and-supplemental-brief-amici-curiae. Accessed February 23, 2026.

Copied!

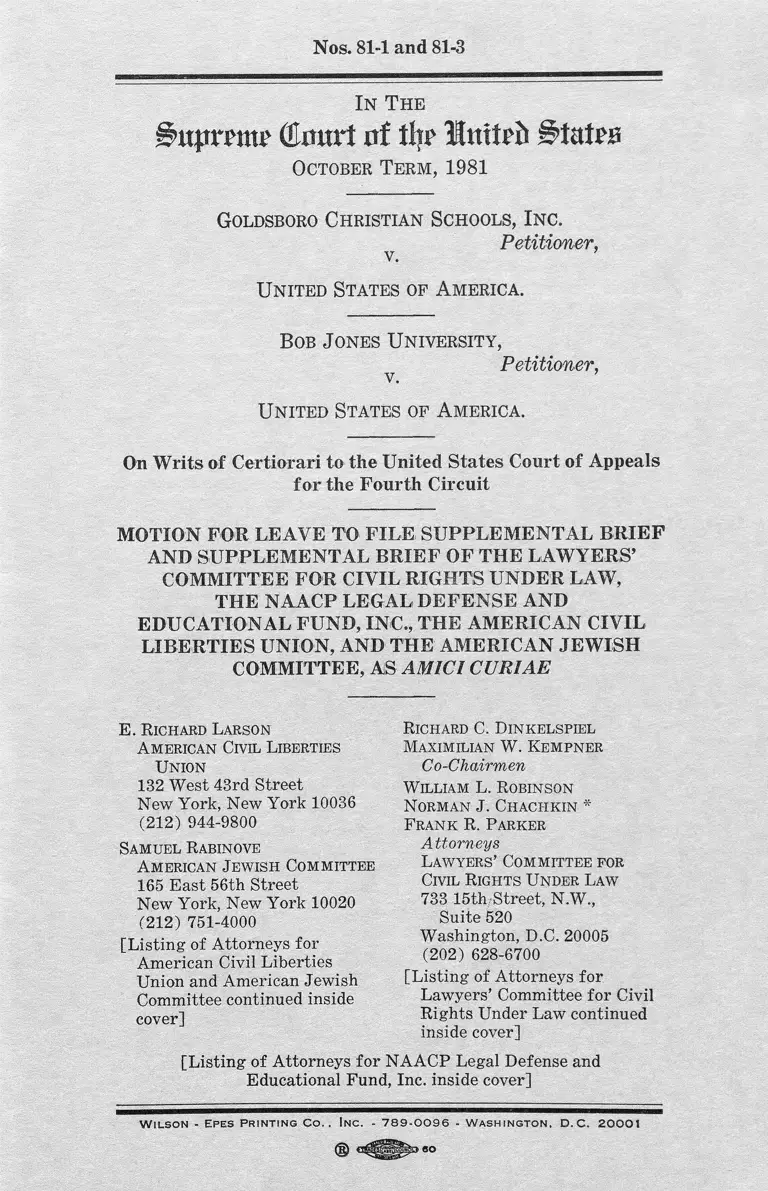

Nos. 81-1 and 81-3

I n T h e

§>ttproxt? ( ta r t uf tl|p Imtrb States

October T e r m , 1981

Goldsboro C h r istia n S chools, I n c .

Petitioner,v.

U n it ed States of A m erica .

Bob J ones U n iv ersity ,

Petitioner, v. ’

U n it ed States of A m erica .

On Writs of Certiorari to the United States Court of Appeals

for the Fourth Circuit

MOTION FOR LEAVE TO FILE; SUPPLEMENTAL BRIEF

AND SUPPLEMENTAL BRIEF OF THE LAWYERS’

COMMITTEE FOR CIVIL RIGHTS UNDER LAW,

THE NAACP LEGAL DEFENSE AND

EDUCATIONAL FUND, INC., THE AMERICAN CIVIL

LIBERTIES UNION, AND' THE' AMERICAN JEWISH

COMMITTEE, AS AMICI CURIAE

E. Richard Larson

American Civil Liberties

Union

132 West 43rd Street

New York, New York 10036

(212) 944-9800

Samuel Rabinove

American J ewish Committee

165 East 56th Street

New York, New York 10020

(212) 751-4000

[Listing of Attorneys for

American Civil Liberties

Union and American Jewish

Committee continued inside

cover]

Richard C. Dinkelspiel

Maximilian W. Kempner

Co-Chairmen

William L. Robinson

Norman J. Chaciikin *

Frank R. Parker

Attorneys

Lawyers’ Committee for

Civil Rights Under Law

733 15th Street, N.W.,

Suite 520

Washington, D.C. 20005

(202) 628-6700

[Listing of Attorneys for

Lawyers’ Committee for Civil

Rights Under Law continued

inside cover]

[Listing of Attorneys for NAACP Legal Defense and

Educational Fund, Inc. inside cover]

W il s o n - E p e s P r in t in g C o . . In c . - 789-0096 - W a s h in g t o n , D.C. 20001

eo

Nadine Strossen *

Deborah J. Stavile

H. Stow Lovejoy

125 Broad Street

New York, New York 10004

(212) 558-4000

Attorneys for American Civil

Liberties Union and American

Jewish Committee

Robert H. Kapp

J oseph M. Hassett

Sara-Ann Determan

David S. Tatel

Walter A. Smith, J r.

Nancy G. Yates

Sylvia Schwarz

Hogan & Hartson

815 Connecticut Avenue, N.W.

Washington, D.C. 20006

(202) 331-4500

Attorneys for Lawyers’

Committee for Civil Rights

Under Law

(* Counsel of Record)

J ack Greenberg

Beth J. Lief

NAACP Legal Defense and

E ducational F und, I nc.

10 Columbus Circle

New York, New York 10019

(212) 586-8397

Leon Silverman, P.C.*

Robert H. Preiskel, P.C.

Linda R. Blumkin

Ann F. Thomas

Marla G. Simpson

Fried, Frank, Harris,

Shriver & J acobson

(A partnership which includes

professional corporations)

One New York Plaza

New York, New York 10004

(212) 820-8000

Attorneys for NAACP Legal

Defense and Educational

Fund, Inc.

(* Counsel of Record)

Attorneys for Amici Curiae

I n T h e

î ujjrpmp GImtrt uf % WmUb

October T e r m , 1981

Nos. 81-1 and 81-3

Goldsboro Ch r istia n Schools, I n c .

Petitioner, v. ’

U n it ed States of A m erica .

B ob J ones U n iv ersity ,

Petitioner, v. ’

U n ited States of A m erica .

On Writs of Certiorari to the United States Court of Appeals

for the Fourth Circuit

MOTION FOR LEAVE TO FILE SUPPLEMENTAL BRIEF

OF THE LAWYERS’ COMMITTEE FOR CIVIL RIGHTS

UNDER LAW, THE NAACP LEGAL DEFENSE AND

EDUCATIONAL FUND, INC., THE AMERIC AN CIVIL

LIBERTIES UNION, AND THE AMERICAN JEWISH

COMMITTEE, AS AMICI CURIAE

Pursuant to Rules 36 and 42 of the Rules of this

Court, the Lawyers’ Committee for Civil Rights Under

Law, NAACP Legal Defense and Educational Fund, Inc.,

American Civil Liberties Union, and American Jewish

Committee (“amici”) move for leave to file the attached

supplemental brief. In support of this motion, amici

state as follows:

2

Each of the movants has already filed with this Court

briefs on the merits of this litigation, all of which sup

port the decisions of the court of appeals. Subsequent

to the filing of these amicus briefs, the United States,

on January 8, 1982, filed a Memorandum informing the

Court that

the Department of the Treasury has initiated the

necessary steps to grant petitioner Goldsboro Chris

tian Schools tax-exempt status under Section 501 (c)

(3) of the Code, and to refund to it federal social

security and employment taxes in dispute. Similarly,

the Treasury Department has initiated the necessary

steps to reinstate tax-exempt status under Section

501(c) (3) of the Code to petitioner Bob Jones Uni

versity, and will refund to it federal social security

and unemployment taxes in dispute. Finally, the

Treasury Department has commenced the process

necessary to revoke forthwith the pertinent Revenue

Ruluings that were relied upon to deny petitioners

tax exempt status under the Code. [footnote

omitted]

The Memorandum for the United States requested that

the judgments of the court of appeals be dismissed as

moot.

The question of mootness raised by the government’s

actions and Memorandum had not previously arisen in

this litigation, throughout which the United States had

consistently opposed tax-exempt status for the two

schools. Amici therefore could not have foreseen the

existence of this question at the time they filed their

briefs, since that question arises from a government

decision announced without prior notice and which over

turned the long-established practice of the Internal Reve

nue Service.

Although supplemental briefs from amici are not usu

ally entertained by the Court, this is an appropriate

occasion for doing so. Despite the fact that the issue of

mootness is of central importance to the disposition of

this litigation, and to the timely resolution of the under

lying issues, none of the parties has yet analyzed it in

their submissions to this Court.

3

Because of the pressing national importance of the

issues presented in the pending cases, and the necessity

that the mootness determination sought by the United

States receive the most thorough consideration, we re

spectfully suggest that the filing of the annexed brief

arguing that the cases are not moot will help to provide

the essential adversarial arguments “upon which the

Court so largely depends for illumination of difficult

constitutional questions.” Baker v. Carr, 369 U.S. 186,

204 (1962).

Accordingly, amid respectfully request that their mo

tion for leave to file the attached supplemental brief be

granted.

E. Richard Larson

American Civil Liberties

Union

132 West 43rd Street

New York, New York 10036

(212) 944-9800

Samuel Rabinove

American J ewish Committee

165 East 56th Street

New York, New York 10020

(212) 751-4000

Nadine Strossen *

Deborah J. Stavile

H. Stow Lovejoy

125 Broad Street

New York, New York 10004

(212) 558-4000

Attorneys for American Civil

Liberties Union and American

Jewish Committee

(* Counsel of Record)

Respectfully submitted,

Richard C. Dinkelspiel

Maximilian W. Kempner

Co-Chairmen

William L. Robinson

Norman J. Chachkin *

F rank R. P arker

A ttorneys

Lawyers’ Committee for

Civil Rights Under Law

733 15th Street, N.W.,

Suite 520

Washington, D.C. 20005

(202) 628-6700

Robert H. Kapp

J oseph M. Hassett

Sara-Ann Determan

David S. Tatel

Walter A. Smith, J r.

Nancy G. Yates

Sylvia Schwarz

H ogan & Hartson

815 Connecticut Avenue, N.W.

Washington, D.C. 20006

(202) 331-4500

Attorneys for Lawyers’

Committee for Civil Rights

Under Law

(* Counsel of Record)

4

J ack Greenberg

Beth J. Lief

NAACP Legal Defense and

E ducational F und, Inc.

10 Columbus Circle

New York, New York 10019

(212) 586-8397

Leon Silverman, P.C.*

Robert H. Preiskel, P.C.

Linda R. Blumkin

Ann F. Thomas

Marla G. Simpson

F ried, F rank, Harris,

Shriver & J acobson

(A partnership which includes

professional corporations)

One New York Plaza

New York, New York 10004

(212) 820-8000

Attorneys for NAACP Legal

Defense and Educational

Fund, Inc.

(* Counsel of Record)

Attorneys for Amici Curiae

TABLE OF AUTHORITIES

Cases: Page

Bob Jones University v. Simon, 416 U.S. 72:5

(1974) .......................... .......................... ...... ........ 1-2

Bob Jones University v. United States, 639 F.2d

147 (4th Cir. 1980) _______________ _______ 6n-7n

Brown v. Hartlage (No. 80-1285), 50 U.S.L.W.

3300 (U.S., Oct. 19, 1981) ____ ____ ___ _____ 8

Cheng Fan Kwok v. INS, 392 U.S. 206 (1969)....... 8

Church of Scientology v. United States, 485 F.2d

313 (9th Cir. 1973) ............................................. . 4, 5

County of Los Angeles v. Davis, 440 U.S. 625

(1979) ............... ...................... ................. .......... . 7n

DeFunis v. Odegaard, 416 U.S. 312 (1974) _____ 3, 5n

FTC v. Goodyear Tire & Rubber Co., 304 U.S.

257 (1938) ........ ................... ............... ............. .... 3n

Flast v. Cohen, 392 U.S. 83 (1968) .... ......... ..... . 9

Franks v. Bowman Transp. Co., 424 U.S. 747

(1976) _________ ____ _______ __________ __ 9

Granville-Smith v. Granville-Smith, 349 U.S. 1

(1955) ....... -........... ......... ...... .............. ........... ...... 8

Gray v. Sanders, 372 U.S. 368 (1963) .................... 3n

Green v. Connally, 330 F. Supp. 1150 (D.D.C.),

aff’d mem. sub nom.Coit v. Green, 404 U.S. 997

(1971) ---------------------------- ----------------------- 5,6

Green v. Kennedy, 309 F. Supp. 1127 (D.D.C.),

appeal dismissed sub nom. Cannon v. Green, 398

U.S. 956 (1970) ......................... ............ ......... ..... 5

Moore v. Ogilvie, 394 U.S. 814 (1969) ................... 5n

Powell v. McCormack, 395 U.S. 486 (1969) __ __ 8-9

Quern v. Mandley, 436 U.S. 725 (1978) ................. 5n

Richardson v. Ramirez, 418 U.S. 24 (1974) ........... 8n

Roe v. Wade, 110 U.S. 113 (1973) ................ ....... . 5n

Sibron v. New York, 392 U.S. 40 (1968) ...... ........ 8

Sosna v. Iowa, 419 U.S. 393 (1.975) ....... .......... ...... 8n

South Spring Hill Gold Mining Co, v. Amador

Medean Gold Mining Co., 145 U.S. 300 (1892).. 8n

Southern Pacific Terminal Co. v. ICC, 219 U.S.

498 (1911) .......................... ............ .......... ...... . 5n

Super Tire Engineering Co. v. McCorkle, 416 U.S,

155 (1974) ___ _________ _____ _____ _______ 5n

ii

TABLE OF AUTHORITIES—Continued

Page

Swift & Co. v. Hocking Valley R.R., 243 U.S. 281

(1917) ...... .................................................. ... 8n

United States v. Concentrated Phosphate Export

Ass’n, 393 U.S. 199 (1968)_____ ___ _______ 3, 7

United States v. Lovett, 328 U.S. 303 (1946)......... 8

United States v. Munsingwear, Inc., 340 U.S. 36

(1950) ...... ............ ......................................... . 7n

United States v. Trans-Missouri Freight Ass’n, 166

U.S. 290 (1897) ............ ... .................. .... .......... 3n

United States v. W.T, Grant Co., 345 U.S. 629

(1953)............................ ...... ............. ....... ........ 3, 7

Utah Public Serv. Comm’n v. El Paso Natural Gas

Co., 395 U.S. 464 (1969) .......................... ......... 8

Vermont Yankee Nuclear Power Corp. v. Nat

ural Resources Defense Council, Inc., 435 U.S.

519 (1978) .......... ....................................... . 5n

Vitek v. Jones, 445 U.S. 480 (1980) ..................... 3n

Walling v. Helmerich & Payne, Inc., 323 U.S. 37

(1944).................................................. .......... . 3n

Young v. United States, 315 U.S. 257 (1942)......... 8

Other Authorities:

N.Y. Times, Feb. 4, 1982 (city ed.) ................... 4n

In The

Bnpmnt ( ta rt of % Inttrti Stairs

October Term, 1981

Nos. 81-1 and 81-3

Goldsboro Christian Schools, Inc.

Petitioner, v. ’

United States of America.

Bob J ones University,

Petitioner, v. ’

United States of America.

On Writs of Certiorari to the United States Court of Appeals

for the Fourth Circuit

SUPPLEMENTAL BRIEF OF THE LAWYERS’

COMMITTEE FOR CIVIL RIGHTS UNDER LAW, THE

NAACP LEGAL DEFENSE AND EDUCATIONAL FUND,

INC., THE AMERICAN CIVIL LIBERTIES UNION, AND

THE AMERICAN JEWISH COMMITTEE,

AS AMICI CURIAE

These cases raise important statutory and constitu

tional questions relating to the granting of tax-exempt

status to racially discriminatory private schools. Although

the cases arose as suits by petitioners for the return of

certain disputed tax payments, these suits were simply

a means, expressly suggested by this Court, for raising

the underlying statutory and constitutional issues. Bob

2

Jones University v. Simon, 416 U.S. 725, 746 (1974).

The fund-raising advantages resulting from the deducti

bility of contributions made to schools with tax-exempt

status are far more important to petitioners than the

particular sums for which they brought suit.

On January 8, 1982, the United States announced in

a Memorandum filed with this Court that it would re

fund the disputed tax payments, had begun the process

of granting or restoring petitioners’ tax-exempt status,

and was revoking the Revenue Rulings and Revenue

Procedures pursuant to which that status had been

withheld. Thus, as of January 8 it appeared that the

United States intended to confirm to petitioners the tax-

exempt status which these cases were commenced to

obtain.

However, only 10 days later, the President announced

that the government actually opposes granting tax-exempt

status to petitioners and other racially discriminatory

private schools and was submitting legislation to Congress

to prevent this result. See Appendix to February 3, 1982

Supplemental Memorandum for the United States (“U.S.

Supp. Mem. App.” ) in these cases, at 10a. The proposed

legislation specifically provides that tax-exempt status

will not be granted to any organization maintaining a

school with racially discriminatory policies, even if those

policies are religiously based {id. at 7a-8a) and would

have an effective date of July 9, 1970, thus assuring that

the specific taxes in dispute in these cases would have

to be paid by petitioners {id. at 9a).

Moreover, at the same time the President declared

that, pending Congressional action on the legislative

proposal, the Internal Revenue Service would “not act

on any applications for tax exemptions filed in response

to the IRS policy announced on January 8” {id. at 11a).

A Treasury Department release on the same date clarified

this newest policy by making a special exception for the

petitioners in these cases, who would be granted tax-

3

exempt status “as required by the memorandum in

support of the motion to vacate as filed in the Supreme

Court on January 8, 1982” {id. at 12a) (emphasis added).

Finally, the government has indicated that it is con

tinuing to comply with injunctive decrees barring tax

exemptions for racially discriminatory private schools

located in Mississippi {id. at 2a, 3a, 13a-14a).

In these circumstances, the pending cases are not

moot. It is well settled that “a voluntary cessation of

the [tax] practices complained of could make this case

moot only if it could be said with assurance ‘that “there

is no reasonable expectation that the wrong [denial of

tax exemption] will be repeated.” ’ United States v.

W.T. Grant Co., [345 U.S. 629,] 633 [(1953)]. Other

wise, ‘[t]he defendant is free to return to his old ways,’

id., at 632 . . . .” DeFunis v. Odegaard, 416 U.S. 312,

318 (1974). The heavy burden upon parties arguing

for dismissal as moot was summarized in United States

v. Concentrated Phosphate Export Ass’n, 393 U.S. 199,

203 (1968) :

The test for mootness in cases such as this is a strin

gent one. Mere voluntary cessation of allegedly il

legal conduct does not moot a ease; if it did, courts

would be compelled to leave “ [t]he defendant . . .

free to return to his old ways.” . . . A case might

become moot if subsequent events made it absolutely

clear that the allegedly wrongful behavior could not

reasonably be expected to recur.

Failure to satisfy this heavy burden will “prevent moot

ness because of the ‘public interest in having the legality

of the practices settled.’ ” DeFunis v. Odegaard, supra,

416 U.S. at 318, quoting United States v. W.T. Grant Co.,

supra.1

1 Accord, Vitek v. Jones, 445 U.S. 480, 487 (1980); Gray v.

Sanders, 372 U.S. 368, 375-76 (1963); Walling v. Helmerich &

Payne, Inc., 323 U.S. 37, 42-43 (1944); FTC v. Goodyear Tire &

Rubber Co., 304 U.S. 257, 260 (1938); United States v. Trans-

Missouri Freight Ass’n, 166 U.S. 290, 308-10 (1897).

4

This heavy burden has not been met in these cases.

It is anything but “absolutely clear” that the disputed

withholding of tax-exempt status “could not reasonably

be expected to recur.” Indeed, the United States quite

clearly intends to revert to its “old ways” by denying

petitioners tax-exempt status in the future, and to that

end is actively seeking to “prohibit tax exemptions for

any schools that discriminate on the basis of race” (U.S.

Supp. Mem. App. at 10a). Were the President’s proposed

legislation enacted, petitioners would have any newly

restored or granted tax-exempt status revoked retro

actively and would again be in the posture of having

to sue the United States based upon the same constitu

tional challenges advanced in these proceedings.2 3 Even

if the legislation were not enacted, there is reason to

believe that upon some other signal of agreement from

the Congress, the government might resume its pre-

January 8, 1982 stance with regard to the eligibility of

racially discriminatory private schools for exemption.8

In that event, petitioners again would lose their tax-

exempt status and would again be suing the United

States on the constitutional and statutory theories ad

vanced in their briefs in these cases. Thus, the requisite

showing that the controversy between the parties has

quite clearly come to an end, and is highly unlikely to

recur, simply has not been made.

The posture of these cases bears a striking resemblance

to Church of Scientology v. United States, 485 F.2d 313

(9th Cir. 1973), where the government’s offer to refund

the Church’s assessed tax deficiencies was held not to

moot the Church’s challenge to the government’s denial

to it of tax-exempt status. Noting that “the status of

2 The only change in petitioners’ cases would presumably be that

they would not be attacking the revocation of their tax-exempt

status on statutory-interpretation grounds.

3 See, e.g., N.Y. Times, Feb. 4, 1982, at 1 col. 1 (city ed.) (ad

ministration “may accept” sense-of-Congress resolution in lieu of

legislation).

5

[the Church] as an exempt organization is a continuing

one . . . [which] recurs each year” (id. at 317) and that

the government had indicated that it might dispute the

Church’s tax-exempt status in later years, the Court of

Appeals relied upon the W.T. Grant Co., supra, line of

cases as well as the decisions of this Court rejecting

mootness claims where the controversy is “capable of

repetition, yet evading review” 4 and ruled that the

Church of Scientology case was not moot.

The mootness claim in these cases also approximates

that made by the government in Green v. Connolly,

330 F. Supp. 1150 (D.D.C.), aff’d mem. sub nom. Coit v.

Green, 404 U.S. 997 (1971). There, the plaintiffs at

tacked the policy of granting tax exemptions to racially

discriminatory private schools on both constitutional and

statutory grounds. After a preliminary injunction was

issued, Green v. Kennedy, 309 F. Supp. 1127 (D.D.C.),

appeal dismissed sub nom. Cannon v. Green, 398 U.S. 956

(1970), the government voluntarily announced the policy

which it has now sought in these cases to repudiate. On

the basis of its voluntary announcement, it then asked

that the lawsuit be declared moot. See Green v. Con

nolly, supra, 330 F. Supp. at 1170. The three-judge

district court correctly foresaw the possibility that a later

national administration might not wish to adhere to the

voluntarily adopted policy, thus depriving the plaintiffs

of their rights. Is therefore rejected the claim of moot-

ness:

We think plaintiffs are entitled to a declaration of

relief on an enduring, permanent basis, not on a basis

that could be withdrawn with a shift in the tides of

4 Southern Pacific Terminal Co. v. ICC, 219 U.S. 498, 515 (1911);

accord, Super Tire Engineering Co. v. McCorkle, 416 U.S. 155, 122

(1974) ; Roe v. Wade, 410 U.S. 113, 125 (1973); Moore v. Ogilvie,

394 U.S. 814, 816 (1969) ; see DeFunis v. Odegaard, supra, 416 U.S.

at 318-19; see also Quern v. Mandley, 436 U.S. 725, 733 n.7 (1978);

Vermont Yankee Nuclear Power Corp. v. Natural Resources Defense

Council, Inc., 435 U.S. 519, 535 n.14 (1978).

6

administration, or changing perceptions of sound dis

cretion.

Id. at 1170-71. The soundness of this approach is demon

strated, eleven years later, by the government’s unilateral

abandonment of the very policy upon which its earlier

claim of mootness had been based.

Green bears upon the present issue in another impor

tant sense. The declaratory judgment in that case, see

330 F. Supp. at 1179, aff’d mem. sub nom. Coit v. Green,

404 U.S. 997 (1971), interprets the Internal Revenue

Code to bar federal tax exemptions for racially discrimi

natory private schools. The government concedes that it

must continue to enforce that interpretation at least with

respect to private schools in Mississippi (U.S. Supp. Mem.

App. at 2a, 3a, 13a-14a) ; and renewed litigation in the

Green case is now pending in the U.S. Court of Appeals

for the District of Columbia Circuit on the question

whether the declaratory judgment also binds the govern

ment as to private discriminatory schools outside Mis

sissippi.5 It is thus far from “absolutely clear” that

the government is legally free to make refunds and to

grant exemptions to the petitioners in these cases. In

deed, it would appear that the government cannot

consummate the restoration of petitioners’ tax exemptions

and the refund of amounts previously paid under protest

unless and until the judgments of the court- of appeals are

vacated.6 Much the less may it be said that the United

5 The Green plaintiffs on January 13, 1982 sought injunctive

relief from the district court to enforce the declaratory judgment

on a nationwide basis. (The pleading reprinted in the United States’

Supplemental Memorandum (U.S. Supp. Mem. App. at la-16a) was

filed in response to the plaintiffs’ motion.) On February 4 the dis

trict court ruled that the Green case was limited to Mississippi

schools. Plaintiffs in Green have noticed an appeal and filed a

request for emergency injunctive relief with the Court of Appeals,

which is presently pending.

6 See Bob Jones University v. United States, 639 F.2d 147, 155

(4th Cir. 1980) (“ [t]he judgment of the district court is reversed

7

States has carried its “heavy burden” of showing that it

“could not reasonably be expected to” reassert petitioners’

tax liabilities. See United States v. W.T. Garni Co.,

supra; United States v. Concentrated Phosphate Export

Ass’n, supra.

The government has in fact made no attempt whatever

to justify its request that the judgments below be vacated

on the basis of mootness. It has filed no document in

this Court explaining its January 1982 shifts in position.

And, although some government officials have recently

indicated in testimony before Congressional Committees

that they disagree with the construction of the Internal

Revenue Code underlying the court of appeals’ decisions

in the present cases (the same construction of the Code

mandated by the Green declaratory judgment), the gov

ernment has not sought to obtain from this Court a

definitive interpretation of the Code.

Yet there is ample precedent under which the govern

ment could have proceeded in an orderly fashion rather

than by seeking to moot these cases and avoid an au

thoritative judicial ruling. It could, for example, have

“confessed error” on the statutory interpretation issue,7

in which case this Court would have made an independent

with instructions to dismiss the University’s claim, for refund of

1975 FUTA taxes, and to reinstate the government’s claim for the

years 1971 to 1975 and enter appropriate judgment thereon for

defendant”) (emphasis supplied). Cf. United States v. Munsing-

wear, Inc., 340 U.S. 36 (1950) (res judicata effect of unvaeated

judgment in case mooted prior to review by this Court). For this

reason, the second part of the test for mootness applied by this

Court in County of Los Angeles v. Davis, 440 U.S. 625, 631 (1979)

(“complet[e] and irrevocabl[e] eradicat[ion of] the effects of the”

challenged practice) has not been satisfied.

7 There is no indication that the United States agrees with peti

tioners’ position on the First Amendment questions in these cases;

to the contrary, the proposed legislation (U.S. Supp. Mem. App. at

8a) indicates that the government rejects petitioners’ First Amend

ment claims.

8

examination of the record before reaching a disposition.

See, e.g., Sibron v. New York, 392 U.S. 40, 58-59 (1968) ;

Young v. United States, 315 U.S. 257, 258-59 (1942) ;

see also Utah Public Service Commission v. El Paso

Natural Gas Co., 395 U.S. 464 (1969). Even if it had

not “confessed error,” the government was not obliged

to defend the pre-1982 policy, but it could have argued

with petitioners that the rulings below incorrectly con

strued the Code.8 9 Had it done so, this Court could have

appointed an amicus curiae to argue in support of the

judgments below. E.g., Brown v. Hartlage (No. 80-1285),

50 U.S.L.W. 3300 (U.S., Oct. 19, 1981) ; Cheng Fan Kowk

v. Immigration & Naturalization Service, 392 U.S. 206,

210 n.9 (1968) ; Granville-Smith v. Granville-Smith, 349

U.S. 1, 4 (1955) ; cf. United States v. Lovett, 328 U.S.

303 (1946). This avenue is still open in the instant

cases and amici stand ready to assist the Court.

The fact that all of the parties appear to agree that

these cases should be treated as moot is, of course, not

controlling. It is the responsibility of the Court, and not

the parties, to determine its jurisdiction,® and the Court

should avoid even the appearance that its jurisdiction,

once invoked, can be manipulated by parties seeking to

avoid possibly unfavorable adjudication of fundamentally

important issues such as are involved in these cases.10

As amici have demonstrated above, these cases involve

a dispute still “live” in which each of the parties retains

a “legally cognizable interest in the outcome.” Powell v.

8 See note 7 supra.

9 See Sosna v. Iowa, 419 U.S. 393, 398 (1975); Richardson v.

Ramirez, 418 U.S. 24 (1974) ; Swift & Co. v. Hocking Valley R.R.,

243 U.S. 281 (1917); South Spring Hill Gold Mining Co. v. Amador

Medean Gold Mining Co., 145 U.S. 300 (1892).

10 See Utah Public Serv. Comm’n v. El Paso Natural Gas Co.,

395 U.S. 464 (1969) (refusing to grant Rule 60 motion to dismiss

appeal and holding that remand order of lower court failed to carry

out prior mandate of this Court).

9

McCormack, 395 U.S. 486, 496 (1969). They involve

issues of compelling national importance which will in

evitably find their way to this Court and which ulti

mately must be decided by the Court. See Franks v.

Bowman Transportation Co., 424 U.S. 747, 757 n.9

(1976). The questions have been framed with “the nec

essary specificity” and can be “contested with the neces

sary adverseness and . . . vigor,” Flast v. Cohen, 392

U.S. 83, 106 (1968). The cases are, therefore, not moot

and the government’s suggestion to the contrary should

be rejected. At the very least, in recognition of the post-

January 8 modifications in the position of the United

States and the substantial likelihood of significant further

developments in the near future, resolution of the moot

ness question should be deferred until after the Court

has heard oral argument on the merits.

CONCLUSION

For the foregoing reasons, amici respectfully urge that

the judgments of the court of appeals not be vacated as

moot and that these cases be set down for oral argument

on their merits. The Court may wish to request that

the United States submit a brief and to invite an amicus

of its choosing to file a brief in support of the judgments

below and present oral argument.

E. Richard Larson

American Civil Liberties

Union

132 West 43rd Street

New York, New York 10036

(212) 944-9800

Samuel Rabinove

American J ewish Committee

165 East 56th Street

New York, New York 10020

(212) 751-4000

Respectfully submitted,

Richard C. Dinkelspiel

Maximilian W. Kempner

Co-Chairmen

William L. Robinson

Norman J. Chachkin *

Frank R. P arker

Attorneys

Lawyers’ Committee for

Civil Rights Under Law

733 15th Street, N.W.,

Suite 520

Washington, D.C. 20005

(202) 628-6700

10

Nadine Strossen *

Deborah J. Stavile

H. Stow Lovejoy

125 Broad Street

New York, New York 10004

(212) 558-4000

Attorneys for American Civil

Liberties Union and American

Jewish Committee

(* Counsel of Record)

Robert H. Kapp

J oseph M. Hassett

Sara-Ann Determan

David S. Tatel

Walter A. Smith, J r.

Nancy G. Yates

Sylvia Schwarz

Hogan & Hartson

815 Connecticut Avenue, N.W.

Washington, D.C. 20006

(202) 331-4500

Attorneys for Lawyers’

Committee for Civil Rights

Under Law

(* Counsel of Record)

J ack Greenberg

Beth J. Lief

NAACP Legal Defense and

Educational F und, Inc.

10 Columbus Circle

New York, New York 10019

(212) 586-8397

Leon Silverman, P.C.*

Robert H. Preiskel, P.C.

Linda R. Blumkin

Ann F. Thomas

Marla G. Simpson

Fried, F rank, Harris,

Shriver & J acobson

(A partnership which includes

professional corporations)

One New York Plaza

New York, New York 10004

(212) 820-8000

Attorneys for NAACP Legal

Defense and Educational

Fund, Inc.

(* Counsel of Record)

Attorneys for Amici Curiae