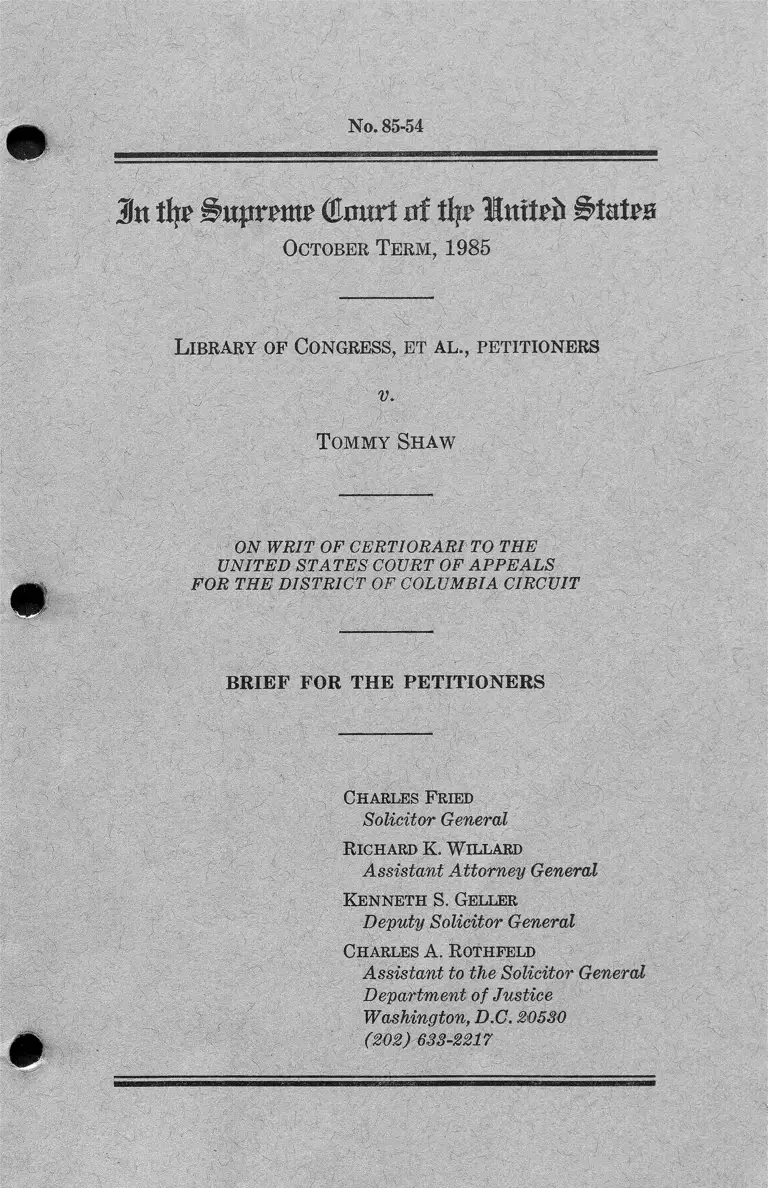

Library of Congress v. Shaw Brief for the Petitioners

Public Court Documents

November 29, 1985

Cite this item

-

Brief Collection, LDF Court Filings. Library of Congress v. Shaw Brief for the Petitioners, 1985. 85c0dd42-bb9a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/f21659c4-7502-418d-a975-2e70545f08da/library-of-congress-v-shaw-brief-for-the-petitioners. Accessed February 21, 2026.

Copied!

Jn % (tnnxt at % Mrnteh l̂ tatea

October Te rm , 1985

L ibrary of Congress, et a l ., petitioners

v.

T om m y Sh a w

ON WRIT OF CERTIORARI TO THE

UNITED STATES COURT OF APPEALS

FOR THE DISTRICT OF COLUMBIA CIRCUIT

BRIEF FOR THE PETITIONERS

Charles Fried

Solicitor General

Richard K. W illard

Assistant Attorney General

Kenneth S. Geller

Deputy Solicitor General

Charles A. Rgthfeld

Assistant to the Solicitor General

Department of Justice

Washington, D.C. 20530

(202) 633-2217

QUESTION PRESENTED

Whether Section 706 (k) of the Civil Rights Act

of 1964, 42 U.S.C. 2000e-5(k), which makes the fed

eral government liable to prevailing Title VII plain

tiffs for attorneys’ fees, waives sovereign immunity

so as to permit the recovery of interest on attorneys’

fee awards.

(i)

II

PARTIES TO THE PROCEEDING

In addition to the parties named in the caption,

petitioners include Daniel J. Boorstin, Librarian of

Congress; Donald C. Curran, Associate Librarian of

Congress; and John J. Kominsky, General Counsel,

Library of Congress.

TABLE OF CONTENTS

Page

Opinions below ...................... ......................... ................. .. 1

Jurisdiction .................... .............................................. .......... 1

Statutes involved ......................... ............... ........................ 2

Statement ............................ ............. ..................... .............. 2

Summary of argument............................................... .......... 7

Argument :i

Congress has not waived the government’s sov

ereign immunity from interest on awards of at

torneys’ fees under Title VII of the Civil Rights

Act of 1964 ..... ........ ..................................................... 10

A. Interest may be recovered from the government

only when such interest awards have been af

firmatively and expressly authorized by Con

gress ........... - ............................ ..................... - ........ 11

B. 42 U.S.C. 2000e-5 (k) does not waive the “ no-

interest rule” ............................ .............................. 17

C. 42 U.S.C. 2000e-5(k) may not be read to au

thorize delay adjustments of any sort to fee

awards ............. ................................... .................... 26

Conclusion .......... ................. ................... .............. ............ . 29

TABLE OF AUTHORITIES

Cases:

Albrecht V. United States, 329 U.S. 599 .................... 13,14

Arvin V. United States, 742 F.2d 1301 ........... .......16, 22, 25

Blake V. Califwho, 626 F.2d 891..... 14, 15,18,19, 20, 21, 27

Boston Sand Co. V. United States, 278 U.S. 41..... 11, 14,16

Canadian Aviator Ltd. V. United States, 324 U.S.

215 __________ _________ _______ ____ _______ -..... 17

Christiansburg Garment Co. V. EEOC, 434 U.S.

412 .... ....................... ......... ................ ............. .......... 19,20

Cherokee Nation V. United States, 270 U.S. 476....... 14

(III)

Cases— Continued:

IV

Page

Copeland V. Marshall, 841 F.2d 880:....................3, 4, 25, 28

Copper Liquor, Inc. v. Adolph Coors Co., 701 F.2d

542 ................. ................................................ ............ 23

deWeever v. United States, 618 F.2d 685 __________ 21

District of Columbia V. Johnson, 165 U.S. 330 ........ 14

Fischer V. Adams, 572 F.2d 406 .................. .............. 21

General Motors Corp. v. Devex Corp. 461 U.S. 648.. 23

Gordon v. United States, 74 U.S. (7 Wall.) 188....... 14

Holly V. Chasen, 639 F.2d 795, cert, denied, 454

U.S. 822 .... .......... ................ ..................................13,15, 22

Indian Towing Co. v. United States, 350 U.S. 61..... 17

Johnson V. University College of the University of

Alabama, 706 F.2d 1205, cert, denied, 464 U.S.

994 ....... ........... ........................................ .................. 28

Knights of the Ku Klux Klan v. East Baton Rouge

Parish School Board, 735 F.2d 895 ___ .________ 16, 25

Lehmany. Nakshian, 453 U.S. 156..... ......11, 15, 20, 22, 23

McMahon V. United States, 342 U.S. 25_____ ____ 11

Murray V. Weinberger, 741 F.2d 1423 ............ .......... 6, 28

National Ass’n of Concerned Veterans V. Secretary

of Defense, 675 F.2d 1319______ _____________ 28

Peoria Tribe V. United States, 390 U.S. 468 ........... 13-14

Perkins V. Standard Oil, 487 F.2d 672 _______ ____ 23

Ramos v. Lamm, 713 F.2d 546 .......... ............. ........... 28

Richerson V. Jones, 551 F.2d 918 ........... ................... 21

Rodgers v. United States, 332 U.S. 371 ................... 23

Rosenman V. United States, 323 U.S. 658 ....... ........ 14

Ruckelshaus V. Sierra Club, 463 U.S. 680 ..... . 23

Saunders V. Claytor, 629 F.2d 596, cert, denied, 450

U.S. 980 ............................................ ............ ........ 21, 27

Segary. Smith, 738 F.2d 1249, cert, denied, No. 84-

1200 (May 20, 1985) ................. .............................. 21

Sheckels V. District of Columbia, 246 U.S. 338 ____ 14

Sherman v. United States, 98 U.S. 565 ................10,12, 14

Smyth V. United States, 302 U.S. 329 ..................... 7,13

Soriano V. United States, 352, U.S. 270 ...... ............... 11

Standard Oil Co. V. United States, 267 U.S. 76.... . 17

The Scotland, 118 U.S. 507 ______ _________ _____ 16

Tillson V. United States, 100 U.S. 4 3 ..... ............ ..12,14,15

United States V. Alcea Band of Tillamooks, 341 U.S.

48 ............................................. ................... .....12,13,14,15

United States V. Commonwealth & Dominion Line,

Ltd., 278 U.S, 427 ........................... ........._........._..... 14

United States v. Delaware Tribe of Indians, 427

F.2d 1218______ __ ______ ____ ______ ____ .____ .... 27

United States V. Goltra, 312 U.S. 203 ___ ___ _____ 14,15

United States V. King, 395 U.S. 1 .............................. 15

United States V. Louisiana, 446 U.S. 253 ..... ......7,13,15

United States v. Mescalero Apache Tribe, 518 F.2d

1309, cert, denied, 425 U.S. 911 ........ ................ . 18, 27

United States V. North Carolina, 136 U.S. 2 11 ....... 14

United States V. North American Co., 253 U.S. 330.. 14,15,

18, 27

United States v. N.Y. Rayon Importing Co., 329

U.S. 654 ........ ...................... ...................... ......... ...... 13, 14

United States V. Rogers, 255 U.S. 163____________ 14

United States V. Sherwood, 312 U.S. 584_________ 11

United States V. Testan, 424 U.S, 392 ....... .......... 11

United States v. Thayer-West Point Hotel Co., 329

U.S. 585 __________ ___ ____ ________ __________ _ 14

United States v. Verdier, 164 U.S. 213 ............ 15

United States V. Worley, 281 U.S. 339 ..... ............ . 14,17

United States v. Yellow Cab Co., 340 U.S. 543 ...... ’ 17

United States ex rel. Angarica v. Bayard, 127 U S

251 ....... ..................... ............ ....................... ........... 13

Constitution, statutes and regulations :

U.S. Const. Amend. V (Just Compensation Clause).. 13

Act of May 15, 1922, ch. 192, 42 Stat. 1590 .......... 16

Age Discrimination in Employment Act, 29 U.S.C.

633a ..... .................................................... ................. 45 ̂23

Civil Rights Act of 1964, 42 U.S.C. 2000e et seq. ’ 3

42 U.S.C. 2000e-5 (g) ......................... ................. 21

42 U.S.C. 2000e-5(k) ..... ....................................passim

42 U.S.C. 2000e-16 (d) ........................................2, 3, 20

Court o f Claims Act of 1863, ch. 92, § 7, 12 Stat.

766 ------------- --------_______________ 7,13

Equal Access to Justice Act:

28 U.S.C. 2412 (b) ....... ................... ........ 9,16, 24

28 U.S.C. 2412(d) ........ .............. ................... 24

V

Cases— Continued: Page

VI

Constitution, statutes and regulations— Continued: Page

Equal Employment Opportunity Act of 1972, Pub.

L. No. 92-261, 86 Stat. 103 et seq______ ________ 19

War Risk Insurance Act of 1914, eh. 293, 38 Stat.

711 et seq............ ............... .......— ---------- ------------ 17

15 U.S.C. 15 _______________ ___________ __ ______ 23

26 U.S.C. 7426 (g) _____________________. . . - ......... . 22

28 U.S.C. 1961 (c) (2) _______ ___ ______________ ___ 22

28 U.S.C. 2411 ........... ............................................... ..... 22

28 U.S.C. 2516 (a) .................... ................. ...........7,13, 14, 22

28 U.S.C. 2516 (b) _____ ___________ _____________ 22

31 U.S.C. 1304(b) (1) (A ) ______ 22,24

31 U.S.C. 1304(b) (1) (B) ............ 22

31 U.S.C. 3728(c) ____ __ ____ ___ __ ________ ____ 22

40 U.S.C. 258a_______________ ____ ___ _______ __ - 22

Pub. L. No. 88-352, § 706 (k ) , 78 Stat. 261 ............... . 19

Pub. L. No. 99-80, 99 Stat. 183 et seq.:

§ 2 (e ), 99 Stat. 185-186 .................. ......„ „ ........ 24

§ 6, 99 Stat. 186 ________________ ________ ____ 24

Miscellaneous:

H.R. Rep. 98-992, 98th Cong., 2d Sess. (1984) ....... 24

H.R. Rep. 99-120, 99th Cong., 1st Sess. (1985) ____ 24

Letter from the Comptroller General to Senator

Thurmond, B-40342.4 (Oct. 5, 1984) ___________ 24

1 Op. Atty. Gen.:

p. 268 (1819) _____________ _________ ___ ___ 7,12

p. 722 (1825) ____________ __________ _ ___ 12

2 Op. Atty. Gen.:

p. 390 (1830) _______________ ________ ______ 12

p. 463 (1831) .......... ................................... ...... 12

3 Op. Atty. Gen. 635 (1841) .... .................................. 12

4 Op. Atty. Gen.:

p. 14 (1842) ..................................................... 12

p. 136 (1842) ______________ _______________ 12, 25

p. 286 (1843) ............................ .............. ............ 12

5 Op. Atty. Gen.:

p. 138 (1849) ....... ....... .................... ..................... 12

p. 227 (1850) ...... ............................................... 12

7 Op. Atty. Gen. 523 (1855) _________ _______ ___ 12

VII

Miscellaneous—Continued: Page

Staff of the Subcomm. on Labor of the Senate

Comm, on Labor and Public Welfare, 92d Cong.,

1st Sess., Legislative History of the Equal Em

ployment Opportunity Act of 1972 (Comm. Print

1972) ..................................................................... 19

20 Weekly Comp. Pres. Doc. 1814 (Nov. 8, 1984).... 24

Kn % Bupmm (tort uf % Initrii ^tatrs

October T erm , 1985

No. 85-54

L ibrary of Congress, et a l ., petitioners

v.

T om m y Sh a w

ON WRIT OF CERTIORARI TO THE

UNITED STATES COURT OF APPEALS

FOR THE DISTRICT OF COLUMBIA CIRCUIT

BRIEF FOR THE PETITIONERS

OPINIONS BELOW

The opinion of the court of appeals (Pet. App. la-

56a) is reported at 747 F.2d 1469. The opinion of

the district court (Pet. App. 57a-70a) is unreported.

JURISDICTION

The judgment of the court of appeals (Pet. App.

71a,-72a) was entered on November 6, 1984; an order

denying rehearing (Pet. App. 73a-75a) was entered

on February 20, 1985. On May 8, 1985, the Chief

(1)

2

Justice extended the time within which to file a peti

tion for a writ of certiorari to June 27, 1985. On

June 21, 1985, the Chief Justice further extended the

time for filing the petition to July 12, 1985. The peti

tion was filed on that date and was granted on Oc

tober 7, 1985. The jurisdiction of this Court is in

voked under 28 U.S.C. 1254(1).

STATUTES INVOLVED

42 U.S.C. 2000e-5(k) provides :

In any action or proceeding under this sub-

chapter the court, in its discretion, may allow

the prevailing party, other than the [Equal Em

ployment Opportunity] Commission or the United

States, a reasonable attorney’s fee as part of the

costs, and the Commission and the United States

shall be liable for costs the same as a private

person.

42 U.S.C. 2000e-16(d) provides:

The provisions of section 2000e-5(f) through

(k) of this title, as applicable, shall govern civil

actions brought hereunder.

STATEMENT

1. In 1976 and 1977 respondent filed administra

tive complaints charging his employer, the Library of

Congress (Library), with racial discrimination.

These complaints were settled in August 1978, when

the Library agreed tô award respondent back pay and

to take certain other remedial measures. Pet. App.

2a-3a. Shortly afterwards, however, upon the advice

of the Comptroller General, the Library informed re

spondent that it lacked the authority to provide such

3

relief absent a specific finding of racial discrimina

tion (id. at 3a & n.7). Respondent then brought suit,

arguing that Title VII of the Civil Rights Act of

1964, as amended by the Equal Employment Oppor

tunity Act of 1972 , Tit. VII, 42 U.S.C. 2000e et seq.

(Title V II), authorized the Library to accord the

relief specified in the settlement agreement (Pet.

App. 3a-4a).

On September 14, 1979, the United States District

Court for the District of Columbia ruled in respon

dent’s favor on the merits (see Pet. App. 4a). The

court accordingly held (see ibid.) that respondent’s

attorney1 was entitled to an award of fees under the

Title VII attorneys’ fees provision, which states that

“ the court, in its discretion, may allow the prevailing

party * * * a reasonable attorney’s fee as part of the

costs, and * * * the United States shall be liable for

costs the same as a private person.” 42 U.S.C.

2000e-5(k).2 But the district court declined to set

the fee award pending a decision by the en banc Dis

trict of Columbia Circuit in Copeland v. Marshall,

641 F.2d 880 (1980), which the district court antici

pated would provide guidance on the standards ap

plicable in the computation of attorneys’ fees. See

1 The attorney whose fee is at issue here, Shalon Ralph,

represented respondent in 1978, while the case was in its

administrative phase; he also provided some assistance during

the district court proceedings (Pet. App. 4a n.13). The fee

claims of respondent’s other counsel have been settled (ibid.).

References to “ respondent’s attorney” in this brief therefore

are directed only at Ralph.

2 Section 2000e-5 (k) is made applicable to federal agency

defendants by 42 U.S.C. 2000e-16(d), which provides that

“ [t]he provisions of section 2000e-5(f) through (k) of this

title, as applicable, shall govern civil actions brought” against

government employers under Title VII. See pages 19-20, infra.

4

Pet. App. 4a, 60a. The court of appeals’ decision in

Copeland ultimately issued almost one year later, on

September 2, 1980.

Over one additional year passed before the district

court, on November 4, 1981, issued an order setting

fees and awarding them to respondent’s attorney.

The court began by fixing the so-called “ lodestar”

(see Pet. App. 2a n.2) based on the number of hours

worked and the attorney’s 1978 hourly rate (id. at

5a, 62a-66a). After making a variety of adjustments

to the lodestar that are not relevant here (see id. at

5a, 66a-68a), the district court declared that “ [t]his

case should have ended in August 1978, or at the

latest in November of that year. If [respondent’s at

torney] had been compensated at about that time, he

could have invested the money at an average yield of

not less than 10% per year. It is the fault of neither

[respondent] nor [his attorney] that payment was

not made sooner.” Id. at 68a (footnote omitted). Be

cause three years had passed since late 1978, the

court accordingly ordered “an upward adjustment [of

the fee] of 30% for delay” (ibid.).

2. On appeal, a divided panel of the court of ap

peals rejected the Library’s contention that Congress

in Section 2000e-5(k) had not authorized the award

of interest against the United States, and that the

30% delay adjustment accordingly was improper.

The panel majority acknowledged that the delay ad

justment was interest because it “was designed to

reimburse [respondent’s] counsel for the decrease in

value of his uncollected legal fee between the date on

which he concluded his legal services and the court’s

estimated date of likely actual receipt” (Pet. App.

11a (footnote om itted)); see id. at 12a~13a & n. 11).

And the court acknowledged the force of the so-called

5

“no-interest rule”— that the United States may not

be held liable for interest in the absence of an ex

press waiver of its sovereign immunity (id. at 13a).

The court of appeals held, however, that Section

2000e-5 (k) is such a waiver. The court noted that

private parties generally may be held liable for in

terest on fee awards under Title VII, and that Title

VII makes the United States liable for costs “ the

same as a private person.” This, the court concluded,

is an “ express” statutory waiver as to interest, the

range of which “ is defined in unmistakable lan

guage.” Pet. App. 15a. The court also based its hold

ing on what it termed an alternative ground: that

“ the traditional rigor of the sovereign-immunity doc

trine [is relaxed] when a statute measures the lia

bility of the United States by that of private persons”

(id. at 24a).8

s Although the court of appeals thus held that attorneys may

be awarded interest under Section 2000e-5 (k ) , it nonetheless

remanded the case to the district court for further proceed

ings. In the majority’s view, “ a delay-in-payment adjustment

[is] appropriate only where the lodestar is the per-hour

charge to clients who pay when billed” (Pet. App. 8a, n.28).

The court suggested, however, that a lodestar may “ repre

sent [] a higher rate charged clients who sue under fee-shifting

statutes,” in which case the figure might already “ ha[ve]

* * * * taken into account the pecuniary disadvantage resulting

from the lengthy wait for payment ordinarily encountered un

der such statutes” (ibid.). In such circumstances, the panel con

cluded, “ an upward adjustment for delay would * * * result in

the attorney being paid twice for the delay” (ibid.). The court

of appeals therefore instructed the district court, on remand,

to determine whether the lodestar had been based on a rate

that “ has already taken into account the pecuniary disadvan

tage resulting from the lengthy wait for payment” (id. at 37a).

If so, the district court was to vacate its 30% delay adjustment

(ibid.). The court of appeals also noted that, following oral

6

Judge Ginsburg dissented. She agreed that the

30% adjustment is interest, but concluded that noth

ing in either Section 2000e-5 (k) or its legislative his

tory so much as adverts to an intent to overcome the

“no-interest rule” (Pet. App. 41a). Judge Ginsburg

also noted that sovereign immunity prevents Title

VII 'plaintiffs from recovering interest on back pay

awards entered against the government, and found it

unlikely that Congress would have given Title VII

attorneys more favorable treatment than their clients

(id. at 42a-44a). She therefore concluded that Con

gress could not “ ‘plainly’ [have] resolved an im

munity waiver issue never even framed in the course

of its deliberations” (id. at 41a) .* 4

argument in the case, it had ordered the government to pay

the undisputed portion of the attorney’s fee (id. at 6a n.24) ;

that payment has since been made.

4 Although Judge Ginsburg thus found no justification in

the statute for an award of interest against the United States,

she suggested that Murray v. Weinberger, 741 F.2d 1423 (D.C.

Cir. 1984), compelled the conclusion that there is a meaningful

distinction between “ interest” and an “ adjustment for delay

in receipt of payment” (Pet. App. 38a). She explained:

“ [j] ust as an attorney setting an hourly rate in a contingent

fee case may factor in the risk that the cause may not prevail,

so too an attorney embarking on services for which he or she

anticipates payment ultimately, but not promptly, may factor

in the expected delay” (id. at 38a-39a). Judge Ginsburg

therefore would require a district court to determine whether

an attorney’s historic rates (those that he charged at the

time that he did the work at issue) were enhanced by such a

delay factor. If so, the attorney would be entitled to reim

bursement at that enhanced rate—but not to any additional

recovery because of actual delay in receiving fees. If the

historic rate did not contain a component for anticipated

delay in the receipt of fees, however, Judge Ginsburg in an

“ appropriate” case would permit the district court to use

The Library’s petition for rehearing en banc was

denied, with Judges Ginsburg, Bork, Scalia, and Starr

dissenting (Pet. App. 73a-75a).

SUMMARY OF ARGUMENT

1. From the earliest reported treatment of the

issue, it has been the law that interest may not be

awarded on claims against the United States unless

Congress affirmatively considered the interest ques

tion and unambiguously expressed its intention that

interest should be available. That principle already

was well-established in the executive agencies in 1819

(see 1 Op. Atty. Gen. 268 (1819)), and it was ac

knowledged by Congress itself at the time of the crea

tion of the Court of Claims. See Court of Claims Act

o f 1863, ch. 92, § 7, 12 Stat. 766 (current version at

28 U.S.C. 2516(a )). Since that time, the “no-interest

rule” has been repeatedly propounded by this Court:

“ in the absence of specific provision by contract or

statute, or ‘express consent . . . by Congress,’ in

terest does not run on a claim against the United

States.” United States v. Louisiana, 446 U.S. 253,

264-265 (1980), quoting Smyth v. United States, 302

U.S. 329, 353 (1937).

This rule has been applied with essentially unmiti

gated rigor. This and other courts, for example, have

held interest unavailable against the United States

under statutory language that regularly is used to

make private defendants liable for interest. Simi

larly, the United States cannot be ordered to pay

interest under the authority of statutory provisions

current market rates rather than historic rates in computing

the lodestar, if doing so would not generate a windfall for

the attorney. Id. at 50a-53a.

8

awarding “ just compensation”— even though “ just

compensation” for constitutional purposes has long

been understood to include an interest component.

And the courts have held that statutes basing the

liability of the government upon that of private par

ties may not be read to authorize interest awards.

2. The court of appeals’ analysis cannot be squared

with this settled law. 42 U.S.C. 2000e-5(k) makes no

reference to interest, express or otherwise. And an

examination of the provision’s legislative history in

dicates that the availability of interest never even

was framed in the course of Congress’s deliberations,

let alone addressed and resolved. Indeed, the specific

language relied upon by the court of appeals— the

“ same as, a private person” proviso*— was placed in

Section 2000e-5 (k) in 1964, before the government

was subject to Title VII as a defendant, presumably

to make the United States liable as a plaintiff for the

fees of prevailing defendants. In that context, the

language was intended simply to waive the sovereign

immunity of the government so as to make it liable

for fees to certain prevailing parties, just as private

plaintiffs are in some instances liable for the fees of

prevailing defendants.

In fact, Title VII contains considerable evidence

that the congressional scheme should not be intepreted

to permit attorneys to obtain interest on their fees in

cases against the government. While Title VII plain

tiffs may be awarded interest on back pay awards

against private employers, it is settled law that inter

est does not run on back pay recovered from a govern

ment employer. Had Congress given any attention to

the interest question— and an award of interest could

have been affirmatively authorized only if Congress

did so— it is difficult to imagine that, in a single legis

9

lative package, it would have chosen to accord plain

tiffs’ lawyers more favorable treatment than that ac

corded plaintiffs themselves.

The court of appeals’ analysis, moreover, disre

gards the entire body of legislation in which Congress

has permitted interest to run on substantive recover

ies against the United States. When it has chosen to

make interest available Congress has done so ex

plicitly, and has spelled out the conditions upon, and

the rate governing, such awards. This is, in fact,

precisely the approach that Congress recently took

in amending the Equal Access to Justice Act, 28

U.S.C. 2412(b)— a statute that is virtually identical

to Section 2000e-5(k)— to provide expressly for

awards of interest. There is no reason to believe that

Congress intended Section 200Qe-5(k) to signal a

strikingly backhanded and understated departure

from its usual practice in this area. In failing to

acknowledge the usual congressional approach to the

availability of interest, the ruling below frustrates

the purposes of the “no-interest rule” by making the

government liable for unexpected liabilities arising at

unanticipated times, while infringing in a direct way

on the congressional prerogative to waive the govern

ment’s sovereign immunity.

3. A final question here concerns the appropriate

disposition of this case. Dissenting below, Judge

Ginsburg suggested that, under District of Columbia

Circuit precedent, the case should be returned to the

district court for a determination whether the his

toric rates charged by respondent’s attorney con

tained a component for anticipated delay in payment;

if they did not, an upward adjustment of the lodestar

to add such a component would be permissible. As

the court below itself recognized, however, there is

10

no difference for purposes of the “no-interest rule”

between such delay adjustments and interest. Be

cause the rule is based on the proposition that delay

cannot be attributed to the government ( United States

v. Sherman, 98 U.S, 565, 568 (1978)), it uniformly

has been applied to prevent plaintiffs from holding

the United States liable, absent its explicit consent,

for all claims grounded on the belated receipt of

funds. Any adjustment for delay to the fee awarded

respondent’s attorney, then, would run afoul of the

“noninterest rule.”

ARGUMENT

CONGRESS HAS NOT WAIVED THE GOVERN

MENT’S SOVEREIGN IMMUNITY FROM INTEREST

ON AWARDS OF ATTORNEYS’ FEES UNDER TITLE

VII OF THE CIVIL RIGHTS ACT OF 1964

The decision below announces an expansive refor

mulation of the sovereign immunity doctrine. For

well over a century, this Court, executive agencies,

and Congress itself consistently have explained that

federal statutes should not be deemed to allow inter

est to run on recoveries against the United States

unless Congress affirmatively desired that result and

announced its intentions in unambiguous terms. The

court of appeals’ contrary conclusion— that 42 U.S.C.

20Q0e-5(k) effected a waiver of sovereign immunity

as to interest despite the absence of anything in the

statute or its legislative history indicating an affirma

tive intention on the part of Congress to do so— can

not be reconciled with this settled law.

By departing from the controlling principle in this

area, the court below has opened the federal treasury

to a potentially wide range of monetary awards that

were unanticipated, and not consciously authorized,

11

by Congress. And it has effectively substituted the

judgment of the courts for that of Congress in deter

mining when the federal government’s sovereign im

munity should be deemed waived. The court of ap

peals thus disregarded this Court’s repeated admoni

tion that the disposition of claims against the United

States for interest must “ start with the rule that the

United States is not liable to interest except where

it assumes liability by - contract or by the express

words of a statute.” Boston Sand Co. v. United

States, 278 U.S. 41, 47 (1928).

A. Interest May Be Recovered From The Government

Only When Such Interest Awards Have Been Affirma

tively And Expressly Authorized By Congress

It is common ground that an award of interest

against the government is permissible only if Con

gress waives the government’s sovereign immunity as

to such an award. In determining whether Congress

has done so, this Court has indicated that analysis

should begin with the principle that “ [w] aivers of

immunity must be ‘construed strictly in favor of the

sovereign,’ McMahon v. United States, 342 U.S. 25,

27 (1951), and not ‘enlarge [d] . . . beyond what the

language requires,’ Eastern Transportation Co. v.

United States, 272 U.S. 675, 686 (1927).” Ruckels-

haus v. Sierra Club, 463 U.S. 680, 685-686 (1983) :5

This case involves a principle related to but dis

tinct from the government’s basic immunity from

suit: as the court below acknowledged (Pet. App.

13a), even when Congress has expressly permitted

6 Accord Lehman, v. Nakshian, 453 U.S. 156, 161 (1981) ;

United States v. Testan, 424 U.S. 392, 400-401 (1976) ; Soriano

V. United States, 352: U.S. 270, 276 (1957) ; United States v.

Sherwood, 312 U.S. 584, 586-587, 590 (1941).

12

collection on substantive claims against the United

States, the “ ‘traditional rule’ [is] that interest on

[such claims] cannot be recovered” unless the award

ing of interest was affirmatively and separately con

templated by Congress, United States v. Alcea Band

of TiUamooks, 341 U.S. 48, 49 (1951). Grounded on

the proposition that “ delay or default cannot be at

tributed to the government” ( United States v. Sher

man, 98 U.S. 565, 568 (1878); see 5 Op. Atty.

Gen. 138 (1849); 2 Op. Atty. Gen. 463, 464 (1831)),

this “no-interest rule” has been consistently applied

from the earliest reported treatment of claims against

the United States.

As early as 1819, the “usual practice of the Treas

ury Department” was to decline to pay interest un

less Congress in terms directed its payment or af

firmatively intended it to be allowed (1 Op. Atty.

Gen. 268); it was “ confidently believed, that in all

the numerous acts of Congress for the liquidation

and settlement of claims against the government,

there is no instance in which interest has been al

lowed, except only where those acts have expressly

directed or authorized its allowance.” 3 Op. Atty.

Gen. 635, 639 (1841). While the “ equitable principle

that interest is an incident to the debt” was recog

nized at the time, “ [t] he exception in favor of the

government [was] established by the policy of so

ciety, and for the protection of the public.” 4 Op.

Atty. 136, 137 (1842). Accord Tillson v. United

States, 100 U.S. 43, 47 (1879); 7 Op. Atty. Gen. 523,

524-527 (1855); 5 Op. Atty. Gen. 227, 231 (1850);

4 Op. Atty. Gen. 286, 293 (1843); 4 Op. Atty. Gen.

14, 16 (1842); 2 Op. Atty. Gen. 390, 392 (1830);

1 Op. Atty Gen. 722, 731 (1825). Congress in terms

recognized this traditional rule in 1863, when it pro

13

vided that the Court of Claims could award interest

against the government only if expressly authorized

to do so by statute or contract. Court of Claims Act

of 1863, ch. 92, § 7, 12 Stat. 766 (current version at

28 U.S.C. 2516(a )).

Against this background, some 100 years ago this

Court routinely was relying on the already “ well-

settled principle, that the United States are not liable

to pay interest on claims against them, in the absence

of express statutory provision to that effect.” United

States ex rel. Angarica v. Bayard, 127 U.S. 251, 260

(1888). And since that time, the Court repeatedly

has reaffirmed the notion that, “ [a]part from con

stitutional requirements, in the absence of specific

provision by contract or statute, or ‘express consent

. . . by Congress,’ interest does not run on a claim

against the United States.” United States v. Louisi

ana, 446 U.S. 253, 264-265 (1980), quoting Smyth

v. United States, 302 U.S. 329, 353 (1937).6 Thus,

a waiver of immunity is effective only “where inter

est is given expressly by an act of Congress, either

by the name of interest or by that of damages.”

Bayard, 127 U.S. at 260. “ The waiver cannot be by

implication or by use of ambiguous language” (Holly

v. Chosen, 639 F.2d 795, 797 (D.C. Cir.), cert, de

nied, 454 U.S. 822 (1 981 )); the “ consent necessary

to waive the traditional immunity must be express,

and it must be strictly construed.” United States v.

N.Y. Rayon Importing Co., 329 U.S. 654, 659 (1947).

Accord Peoria Tribe v. United States, 390 U.S. 468,

6 The “ constitutional requirements” arise in takings under

the Just Compensation Clause; the Court has held that just

compensation must include a payment for interest. See, e.g.,

Tillamooks, 341 U.S. at 49; Albrecht v. United States, 329

U.S. 599, 605 (1947) ; Smyth, 302 U.S. at 353-354.

14

470 (1968) (dictum ); Tillamooks, 341 U.S. at 49;

Albrecht v. United States, 329 U.S. 599, 605 (1947);

United States v. Thayer-West Point Hotel Co., 329

U.S. 585, 590 (1947); Rosenman v. United States,

323 U.S. 658, 663 (1945) (dictum ); United States v.

Goltra, 312 U.S. 203, 207 (1941); United States v.

Commonwealth >& Dominion Line, Ltd., 278 U.S. 427,

428-429 (1929); United States v. Worley, 281 U.S.

339, 341 (1930); Boston Sand Co. v. United States,

278 U.S. 41, 46 (1928); Cherokee Nation v. United

States, 270 U.S. 476, 487, 490 (1926); United States

v. Rogers, 255 U.S. 163, 169 (1921) (dictum );

United States v. North American Co., 253 U.S. 330,

336 (1920); Sheckels v. District of Columbia, 246

U.S. 338, 340 (1918); District of Columbia v. John

son, 165 U.S, 330, 338 (1897); United States v.

North Carolina, 136 U.S. 211, 216 (1890); Tillson,

100 U.S. at 46; United States v. Sherman, 98 U.S.

565,567-568 (1878). See generally Gordon v. United

States, 74 U.S. (7 Wall.) 188, 193 (1868).'7

This principle has been applied with unmitigated

rigor: the courts have held virtually without excep

tion that the government’s immunity to awards of

interest can be found to have been waived only -when

Congress affirmatively considered the interest ques

7 Several of these cases involved the construction of prede

cessors to 28 U.S.C. 2516(a), which permits an award of

interest on judgments against the United States in the Claims

Court “ only under a contract or Act of Congress expressly

providing for payment thereof.” The Court repeatedly has

emphasized, however, that the statute simply “ codifies the

traditional rule” (N.Y. Rayon, 329 U.S. at 658) that the

government is immune “ from the burden of interest unless

it is specifically agreed upon by contract or imposed by legisla

tion.” Goltra, 312 U.S. at 207 (footnote omitted). See Thayer,

329 U.S. at 588; Blake V. Califano, 626 F.2d 891, 894 n.6

(1980).

15

tion and unambiguously expressed its intention that

interest should be available. See Holly, 639 F.2d at

797; Pet. App. 43a (Ginsburg, J., dissenting). Cf.

Nakshicm, 453 U.S. at 168; United States v. King,

395 U.S. 1, 4 (1969). This and other courts there

fore have held, for example, that interest could not

be awarded when the United States was required to

disgorge funds under an agreement that had per

mitted it to collect and use revenues from disputed

lands pending a determination of ownership ( United

States v. Louisiana, 446 U.S. at 261-264), or when,

“ in the adjustment of mutual claims” with a private

party, the government was awarded interest on its

claims. North American Co., 253 U.S. at 336; United

States v. Verdier, 164 U.S. 213, 218-219 (1896). See

Pet. App. 45a (Ginsburg., J., dissenting).

Similarly, interest has been ruled unavailable un

der statutes or contracts directing the United States

to pay the “ amount equitably due” ( Tillson, 100 U.S.

at 46), or “any * * * equitable relief * * * the court

deems appropriate” (Blake v. California, 626 F.2d 891,

893 (1980)), although identical language is regularly

held to make private defendants liable for interest.

See Blake, 626 F.2d at 893 & n.3. Cf. Nakshian, 453

U.S. at 163 (language in the Age Discrimination in

Employment Act of 1967 (A D E A ), 29 U.S.C. 633a,

that had been held to make jury trials available to

private sector plaintiffs did not waive the govern

ment’s sovereign immunity to the extent of permit

ting jury trials in ADEA suits against the United

States). And the United States cannot be ordered to

pay interest under the authority of statutory provi

sions awarding “ just compensation” (e.g., Tillamooks,

341 U.S. at 49; Goltra, 312 U.S. at 207-211), even

though “ just compensation” for constitutional pur

16

poses has long been understood to require payment of

interest (seenote 6, supra).

Indeed, the Court has indicated that even statu

tory language basing federal liability “ ‘upon the

same principle and measure * * * as in like cases

* * * between private parties’ ” generally “ ha[s]

been understood * * * not to carry interest.” Boston

Sand, 278 U.S. at 46, 47 (quoting Act of May 15,

1922, ch. 192, 42 Stat. 1590). While the Court in

Bostofi Sand also pointed to the legislative history of

the Act of May 15 in holding interest unavailable in

an award under that statute (see 278 U.S. at 47), the

Court concluded that “ the usage of Congress simply

shows that it has spoken with careful precision, that

its words mark the exact spot at which it stops, and

that it distinguishes between the damages * * * and

the later loss caused by delay in paying for [the dam

ages],— between damages and ‘the allowance of in

terest on damages.’ ” 278 U.S. at 48, quoting The

Scotland, 118 U.S. 507, 518 (1886). Recognizing

that “Congress has been accustomed” to this use of

language, two courts of appeals also have held that

awards of interest against the government are not

authorized by the Equal Access to Justice Act

(EAJA) (28 U.S.C. 2412(b)) (making the United

States liable for fees “ to the same extent that any

other party would be liable under the common law or

under the terms of any statute which specifically pro

vides for such an award” ), which in relevant part is

virtually identical to Section 20Q0e-5(k). Arvin v.

United States, 742 F.2d 1301, 1304 (11th Cir. 1984);

Knights of the Ku Klux Klan v. East Baton Rouge

Parish School Board, 735 F.2d 895, 902 (5th Cir.

1984).

17

There is thus no merit to the court of appeals’ sug

gestion that the traditional “no-interest rule” is in

applicable when the statute at issue “measures the

liability of the United States by that of private per

sons” (Pet, App. 24a-36a). None of the decisions

cited by the court of appeals on this point involved

an award of interest, as to which a discrete, express

waiver of the government’s immunity must be found.

Instead, those decisions stand only for the unexcep

tional proposition that the usual substantive rules

apply to shape the government’s liability once it has

waived its basic immunity from suit. See, e.g., Cana

dian Aviator, Ltd. v. United States, 324 U.S. 215, 222

(1945) (cited at Pet. App. 29a); Indian Towing

Co. v. United States, 350 U.S. 61, 69 (1955) (cited

at Pet. App. 2 7 a ); United States v. Yellow Cab Co.,

340 U.S. 543, 548 (1951) (cited at Pet. App. 28a).8

B. 42 U.S.C. 2000e-5(k) Does Not Waive The “No-Interest

Rule”

1. Against this background, the court of appeals

found that Section 20Q0e-5(k) evidences an express

congressional authorization of interest awards be

cause private employers may be held liable for inter

8 Nor does Standard Oil Co. v. United States, 267 U.S. 76

(1925) (cited at Pet. App. 33a-34a) provide support for the

court of appeals’ conclusion. That decision held the United

States liable for interest on insurance policies issued under

the War Risk Insurance Act of 1914, ch. 293, 38 Stat. 711

et seq., only because that insurance program was a for-profit

venture making use of standard commercial insurance con

tracts, so that the United States in administering the program

had placed itself in the position of a nongovernmental entity.

See United States V. Worley, 281 U.S. 339, 342 (1930). The

Court has declined to apply Standard Oil outside of its specific

commercial and contractual context. Worley, 281 U.S. at

343-344.

18

est on attorneys’ fees under Title VII, and the stat

ute appears to measure the liability of the United

States against that of private defendants (Pet. App.

14a-16a). But Section 2000e-5 (k) makes no refer

ence to interest, express or otherwise, and in light of

the settled law in this area it is hardly “ logomaehic”

(Pet. App. 20a) to conclude that the provision does

not explicitly waive the “no-interest rule.” 9 To the

contrary, as Judge Ginsburg observed below, “ [ i ] f

the statutory waiver here is ‘express’ and ‘unmistak

able’ * * * it is remarkable that [respondent], repre

sented by able, experienced counsel, never argued

that position” before the court of appeals (Pet. App.

47a n.6).10

Moreover, an examination of the legislative history

of Title VII indicates that the interest issue “ never

9 The court of appeals suggested that it would have been

unnecessary for Congress to have spoken of interest explicitly

in a provision such as Section 2000e-5 (k) (Pet. App. 16a-17a

& n.49). In fact, however, that is precisely the course that

Congress has taken when providing for the award of interest

in analogous statutes. See pages 21-25, supra.

10 Instead, respondent “ attempted to distinguish between

‘an award of interest and the adjustment of a fee to ensure

that it is reasonable when there is delay in its payment’ ”

(Pet, App. 47a n.6, quoting Appellee C.A. Br. 10; see Pet.

App. 10a). This proposed distinction, however, was re

jected by both the majority and the dissent in the court of

appeals; both opinions correctly recognized that the 30%

upward adjustment—which explicitly was intended to com

pensate respondent’s attorney for delay in the receipt of pay

ment (see id. at lla -12a)— was “ interest.” See generally

North American Co., 253 U.S. at 338; Blake, 626 F.2d at 895;

United States V. Mescalero Apache Tribe, 518 F.2d 1309, 1322

(Ct. Cl. 1975), cert, denied, 425 U.S. 911 (1976).

19

even [was] framed in the course of [Congress’s] de

liberations” on Section 2000e-5(k) (Pet. App. 41a

(Ginsburg, J., dissenting)), let alone addressed and

resolved. See Blake, 626 F.2d at 894. Section 2000e-

5(k) was enacted in its current form as Section

706 (k) of the Civil Rights Act of 1964, Pub. L.

No. 88-352, 78 Stat. 261. The legislative history

of the provision is “ sparse” ( Chnstiansburg Gar

ment Co. v. EEOC, 434 U.S. 412, 420 (1978)), and

so far as we have been able to determine it contains

not a single reference to the availability of interest.

Similarly, we have been unable to uncover anything

bearing on the interest question in the legislative his

tory of the Equal Employment Opportunity Act of

1972, Pub. L. No. 92-261, 86 Stat. 103 et seq., which

made Title VII applicable to federal employees. See

generally Staff of the Subcomm. on Labor of the

Senate Comm, on Labor and Public Welfare, 92d

Cong., 1st Sess., Legislative History of the Equal

Employment Opportunity Act of 1972 (Comm. Print

1972).

The absence of any evidence in the statute or its

legislative history that Congress intended to make

interest available should be dispositive here. Even

beyond that, however, the development of Section

2000e-5(k) makes it plain that the court of appeals

placed undue weight on the specific language of the

provision. The court relied exclusively on the “ same

as a private person” proviso; it was in that phrase,

the court explained, that Congress “ spoke clearly

enough” to waive the “no-interest rule” (Pet. App.

23a-24a, see id. at 16a). But the court of appeals

failed to recognize that the proviso was placed in the

statute many years before federal employees were

permitted to sue under Title VII, presumably to make

20

the United States or the Equal Employment Oppor

tunity Commission (EEOC) liable as plaintiffs for

the fees of certain prevailing defendants. See Chris-

tiansburg Garment Co. v. EEOC, supra. In that con

text, the language relied upon by the court of appeals

can most naturally be read simply as a basic waiver

of the government’s immunity, intended to establish

that the United States is liable for the fees of pre

vailing defendants in the same circumstances as are

private plaintiffs. Yet the very purpose of the “ no-

interest rule” is to establish that interest is not made

available by such threshold and undifferentiated waiv

ers of immunity. Cf. Nakshian, 453 U.S. at 160-161,

168.

The government was made liable as a defendant by

42 U.S.C. 2000e-16(d), which provides that many of

the substantive provisions of Title VII, including

Section 2000e-5(k), are applicable in civil actions

against government employers. It is thus Section

200Qe-16(d), in combination with Section 2000e-

5 (k ) , that Congress understood to waive the sover

eign immunity of an agency defendant and make it

liable for the plaintiff’s “ reasonable attorney’s fee.”

That Section 2000e-5 (k) already contained language

equating the liability of the United States for attor

neys’ fees to that of a private person is a fortuity

that plainly does not represent an affirmative decision

to waive the “no-interest rule.”

In fact, Title VII contains considerable evidence

suggesting that the congressional scheme should not

be interpreted to permit attorneys to obtain interest

on their fees in cases against the government. While

Title VII plaintiffs may be awarded interest on back

pay awards against private employers (see, e.g.,

Blake, 626 F.2d at 893 & n.3 and cases cited), it is

21

settled law that interest does not run on back pay

recovered from the federal government. Segar v.

Smith, 738 F.2d 1249, 1296 (D.C. Cir. 1984), cert,

denied, No. 84-1200 (May 20, 1985); Saunders v.

Claytor, 629 F.2d 596, 598 (9th Cir. 1980), cert, de

nied, 450 U.S. 980 (1981); Blake, 626 F.2d at 894;

deWeever V. United States, 618 F.2d 685, 686 (10th

Cir. 1980); Fischer v. Adams, 572 F.2d 406, 411 (1st

Cir. 1978); Richerson v. Jones, 551 F.2d 918, 925

(3d Cir. 1977). Had Congress given any attention

to the interest question— and an award of interest

could have been affirmatively authorized only if Con

gress did so— it is difficult to imagine that, in a sin

gle legislative package, it would have chosen to ac

cord plaintiffs’ lawyers more favorable treatment

than that accorded plaintiffs themselves. See Pet.

App. 43a-44a (Ginsburg, J., dissenting).11

2. The court of appeals’ analysis in this case dis

regards not only the structure of Title VII, but also

the entire body of legislation in which Congress has

permitted interest to run on substantive recoveries

against the federal government. When it has chosen

to make interest available, Congress— which of course

legislates against the background of the “no-interest

rule”— has in terms provided for awards of interest,

and has spelled out the “procedures which a plaintiff

11 The court of appeals explained away this anomaly by

pointing to the specific language of Section 2000e-5 (k) and

noting that it differs from that of Title VII’s back pay provi

sion (42 U.S.C. 2000e-5 ( g ) ). See Pet. App. 9a-10a n.32, 18a

n.54, 36a n.120. As we explain above, however, the “ same as

a private person” proviso certainly was not placed in the stat

ute in a conscious effort to distinguish the attorneys’ fee

from the back pay provision.

22

must follow to perfect his entitlement to interest,

the rate of interest which the United States will pay

on each type of judgment, and the time when inter

est will start to run and the time it will stop.” Ar-

vin, 742 F.2d at 1303. See Holly, 639 F.2d at 797-

798.12 Yet nothing in Title VII so must as adverts

to interest, let alone addresses the circumstances in

which it should be available or the terms on which it

should be paid. And there is no reason to believe

that Congress intended Section 2000e-5(k) to signal

a strikingly backhanded and understated “ depart-

[ure] from its usual practice in this area.” Nak-

12 See 26 U.S.C. 7426(g) (providing for interest in cases of

wrongful levy by the Internal Revenue Service running from

the date of the levy) ; 28 U.S.C. 1961 (c) (2) (providing for

interest on final judgments of the United States Court of

Appeals for the Federal Circuit in claims against the United

States) ; 28 U.S.C. 2411 (providing for interest on overpay

ments of federal tax running from the date of overpayment) ;

31 U.S.C. 1304(b) (1) (A ) (appropriating funds for interest

on certain district court judgments after an unsuccessful

appeal by the United States “ and then only from the date of

filing of the transcript of the judgment with the Comp

troller General through the day before the date of the mandate

of affirmance” ) ; 31 U.S.C. 1304(b) (1) (B) (appropriating

funds in similar circumstances for interest on decisions of the

Federal Circuit and the Claims Court after affirmance by the

Supreme Court (see 28 U.S.C. 2516(b)). Cf. 31 U.S.C.

3728(c) (providing for the payment of interest on debts

wrongfully withheld by the Comptroller General in certain

set-off situations) ; 40 U.S.C. 258a (providing for the pay

ment of interest as part of the compensation in proceedings

for the taking of property by the United States). Congress

also has provided that “ [ijnterest on a claim against the

United States shall be allowed in a judgment of the United

States Claims Court only under a contract or Act of Congress

expressly providing for payment thereof.” 28 U.S.C. 2516 (a ) .

23

shian, 453 U.S. at 162.18 See id. at 161, 168-169

(holding trial by jury impermissible in suits against

the United States under the Age Discrimination in

Employment Act, 29 U.S.C. 633a, because Congress

“has almost always conditioned [waiver of sovereign

immunity] upon a plaintiff’s relinquishing any claim

to a jury trial” and has not “affirmatively and un

ambiguously” provided that right in the AD EA).

Cf. Ruckelshaus v. Sierra Club, 463 U.S. 680, 685

(1983) (footnote omitted) (when Congress is alleged

to have departed from traditional fee shifting rules

“a clear showing that this result was intended is re

quired” ).

A notable example of Congress’s usual treatment

of interest questions is offered by the EAJA. As

noted above, that statute provides in part that the

United States is liable for fees “ to the same extent

that any other party would be liable.” 28 U.S.C. 13

13 This is particularly true where, as here, it is claimed that

Congress implicitly allowed an award of prejudgment interest.

In the absence of exceptional circumstances or a statutory

provision to the contrary, the usual rule is that such interest

may be awarded only from the date on which the damages

were liquidated or readily calculable. See generally General

Motors Corp. v. Devex Corp., 461 U.S. 648, 651-652 & n.5

(1983), and cases cited; Rodgers V. United States, 332

U.S. 371, 373 (1947). Cf. Perkins V. Standard Oil Co.,

487 F.2d 672, 675 (9th Cir. 1973) (under 15 U.S.C. 15, “ claims

for ‘reasonable’ attorneys’ fees, being unliquidated until they

are determined by a court, are not entitled to pre-judgment

interest as would be certain liquidated claims” ) ; Copper

Liquor, Inc. V. Adolph Coors Co., 701 F.2d 542, 544 & n.3

(5th Cir. 1983) (affirming an award of interest on attorneys’

fees under 15 U.S.C. 15 only from the time of the “ judgment

establishing the right to fees or costs” ). Had Congress in

tended to depart from that traditional rule, it presumably

“ would have used explicit language to [that] effect.” Sierra

Club, 463 U.S. at 685 n.7.

24

2412(b). Congress nevertheless recently amended

the EAJA to make interest expressly available at

specified rates on fees awarded under the statute 14—

although only if the government appeals unsuccess

fully from an award of fees, and then only from the

date of the award through the day before the date

of the mandate of affirmance. Pub. L. No. 99-80,

§ 2(e) , 99 Stat. 185-186.15 In doing so, Congress ex

plained that interest was being made available to

“give the United States an incentive to meet its obli

gations promptly and to reimburse the recipient of

the award for the lost use of the money involved.”

H.R. Rep. 98-992, 98th Cong., 2d Sess. 12 (1984).

14 The amendment also applies to fees awarded under 28

U.S.'C. 2412(d); that subsection had expired on October 1,

1984, and was reenacted as part of the recent amendment.

Pub. L. No. 99-80, § 6, 99 Stat. 186.

15 As originally passed by Congress, the EAJA amendment

made interest available from 61 days after the date of judg

ment through the date of payment. See H.R. Rep. 98-992, 98th

Cong., 2d Sess. 12 (1984). The Comptroller General objected

to this provision, however, noting that interest generally is

available only after an unsuccessful appeal by the government

(see 31 U.S.C. 1304(b) (1) ( A ) ) and that the proposed amend

ment therefore accorded EAJA awards uniquely favorable

treatment. Letter from the Comptroller General to Senator

Thurmond, B-40342.4 (Oct. 5, 1984). The President subse

quently vetoed the amendment, citing the Comptroller Gen

eral’s objections. See 20 Weekly Comp. Pres. Doc. 1814, 1815

(Nov. 8, 1984). Congress then modified the amendment to

meet the objections. See H.R. Rep. 99-120, 99th Cong., 1st

Sess. (1985). The decision below thus presumes that Congress

— without making any explicit statement— intended to give

Title VII fee awards uniquely favorable treatment of the sort

that Congress deliberately avoided in the 1985 EAJA amend

ment.

25

This recent congressional recognition that interest

is unavailable on attorneys’ fee awards in the absence

of an express provision to the contrary— and that

statutes providing for interest generally should do so

only in narrow, established circumstances— plainly

makes the court of appeals’ ruling untenable. Indeed,

if the court of appeals’ analysis of the parallel lan

guage in Section 2000e-(5) (k) were correct, the 1985

EAJA amendment not only would have been unnec

essary, but also would have flown in the face of the

congressional intent by narrowing the circumstances

in which interest may be awarded under the stat

ute.16

3. By thus disregarding the sharp contrast be

tween Section 2000e-5(k) and the other statutes in

which Congress has permitted interest to run on sub

stantive recoveries against the United States, the

court of appeals frustrated the purpose long served

by the “no-interest rule”— the “protection of the pub

lic” (4 Op. Atty. Gen. 136, 137 (1842)) from unex

pected liabilities arising at unanticipated times.

That effect is particularly noticeable where, as here,

an award of pre judgment interest is concerned, for

such liability may be found to have attached years

after the fact for reasons that were wholly beyond

the government’s control. In this case, for example,

the district court withheld judgment for one year

pending the decision in Copeland and for a second

year while the fee issue was under submission, and

then ordered the government to pay interest on a fee

generated three years earlier. See pages 3-4, supra.

16 Congress made no suggestion that the pre-amendment

EAJA should have been read to authorize awards of interest,

and gave no indication that it was aware of Arvin and East

Baton Rouge.

26

More basically, the court of appeals’ conclusion

that courts may infer waivers of immunity from am

biguous statutory language infringes in a direct way

on the congressional prerogative to waive the govern

ment’s sovereign immunity. For well over 100 years,

as the legislation cited above demonstrates, Congress

has been acting against the background of— and pre

sumably relying upon— the “ no-interest rule” that

consistently has been propounded by this Court. If

legislation enacted in that setting is to be interpreted

in light of a new controlling principle, such a

“change, in view of the long-prevailing, rigorously-

applied rule, lies within the province of Congress”

(Pet. App. 42a (Ginsburg, J., dissenting)).

C. 42 U.S.C. 2000e-5(k) May Not Be Read To Authorize

Delay Adjustments Of Any Sort To Fee Awards

A final question concerns the appropriate disposi

tion of this case. Dissenting below, Judge Ginsburg

felt constrained by District of Columbia Circuit prec

edent (see Pet. App. 40a-41a) to advocate a remand.

See note 4, supra. That precedent, she suggested,

recognized a distinction between impermissible “ in

terest” and other, permissible types of “adjustment

for delay in receipt of payment” that “ figure [s] as a

contingency adjustment, applied prospectively to the

lodestar” (Pet. App. 38a). This line of analysis is

grounded on the assumption that “ an attorney em

barking on services for which he or she anticipates

payment ultimately, but not promptly, may factor in

the expected delay” in setting an hourly rate (id. at

38a-39a). Here, Judge Ginsburg would have re

turned the case to the district court for a determina

tion whether the historic rates charged by respon

dent’s attorney contained such a component for antici

27

pated delay in receipt of payment; if they did not,

circuit precedent would permit an adjustment to the

lodestar to add such a component (through the use of

the attorney’s current rates) (id. at 53a-56a). See

also note 3, supra.

As the court below itself recognized (Pet. App. 12a

n.41), however, this analysis cannot be squared with

the “no-interest rule.” That rule is not directed solely

at monetary awards expressly denominated as in

terest; because the doctrine is based on the proposi

tion that delay cannot be attributed to the govern

ment (see page 12, supra), it uniformly has been

applied to prevent plaintiffs from holding the United

States liable, absent its explicit consent, for all claims

grounded on “ the belated receipt” of funds.” Saun

ders, 629 F.2d at 598. The courts accordingly have

barred claims of every kind arising out of the delayed

payment of substantive recoveries by the United

States, whether termed “'inflation adjustments”

(Blake, 626 F.2d at 895; Saunders, 629 F.2d at 598),

“ compensation for use” (North American Co., 253

U.S. at 337-338), or something equally euphemistic.

See generally United States v. Mescalero Apache

Tribe, 518 F.2d 1309, 1322 (Ct. CL 1975), cert, de

nied, 425 U.S. 911 (1976); United States v. Dela

ware Tribe of Indians, 427 F.2d 1218, 1222-1224

(Ct. Cl. 1970). See note 10, supra. And while there

are technical differences between interest and an ad

justment of the lodestar through the. use of current

rates,17 the latter type of payment is expressly de

17 In contrast to a flat interest rate applied retrospectively,

for example, current rates may more clearly take account of

inflationary changes that occurred while payment was pend

ing. Cf. Blake, 626 F.2d at 895 & n.9. At the same time,

however, a law firm’s or practitioner’s rates may be affected

2 8

signed to adjust the fee award for “ inflation and in

terest.” Ramos v. Lamm, 713 F.2d 546, 555 (10th

Cir. 1983). See Murray v. Weinberger, 741 F.2d

1423, 1433 (D.C. Cir. 1984); Johnson v. University

College of the University of Alabama, 706 F.2d 1205,

1210-1211 (11th Cir.), cert, denied, 464 U.S. 994

(1983); National Ass’n of Concerned Veterans v.

Secretary of Defense, 675 F.2d 1319, 1328 (D.C. Cir.

1982); Copeland v. Marshall, 641 F.2d 880, 893 (D.C.

Cir. 1980) (en banc). Use o f current rates, in other

words, is nothing more than an “ adjustment[I] for

delay in payment.” Murray, 741 F.2d at 1433.

Furthermore, the suggestion that current rates

may realistically be distinguished from interest on

the ground that the former substitute for what should

have been a prospectively applied delay factor (see

Pet. App. 38a (Ginsburg, J., dissenting)) is based

on a fiction. As the court of appeals acknowledged,

“ an award under a fee-shifting statute benefiting

only a party prevailing in litigation can never be

made prospectively” (id. at 12a n.41). Because the

rate used in calculation of the lodestar is chosen at

the completion of the litigation, allowing the addition

of a delay factor (or the use of current rates) simply

amounts to a decision that the attorney is entitled

to obtain compensation for delay attributed to the

federal government. That remedy is foreclosed by the

“no-interest rule.”

by a wide range of factors wholly unrelated to the passage of

time, such as changes in the firm’s reputation, experience, or

expenses. Even if Congress in Section 2000e-5 (k) has waived

sovereign immunity as to awards of interest, then, it is far

from clear that use of a current rate adjustment ever would

be an appropriate substitute for interest.

29

CONCLUSION

The judgment of the court of appeals should be

reversed.

Respectfully submitted.

November 1985

Charles Fried

Solicitor General

Richard K. W illard

Assistant Attorney General

Kenneth S. Geller

Deputy Solicitor General

Charles A. Rothfeld

Assistant to the Solicitor General

☆ U . S . GOVERNMENT PRINTING OFFICE; 1 9 8 5 491507 2 0 0 5 4