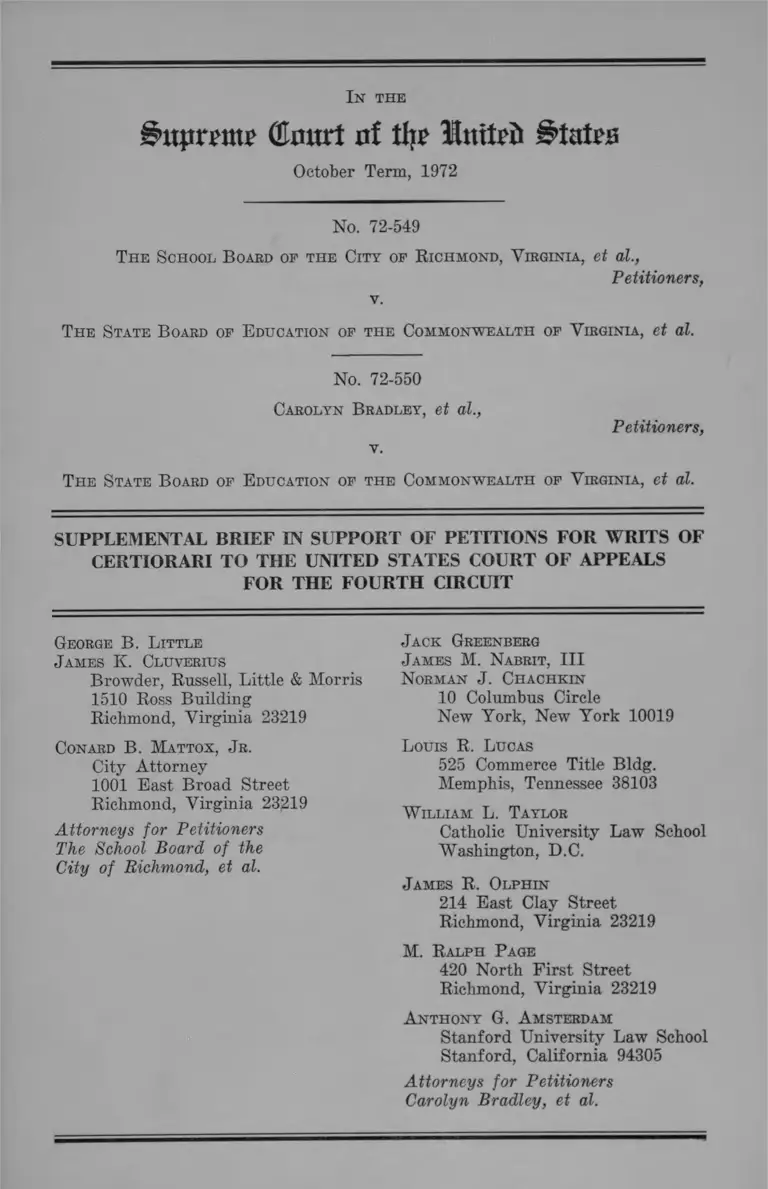

Richmond Virginia School Board v Virginia Board of Education Supplemental Brief in Support of Petitions for Writs of Certiorari

Public Court Documents

October 1, 1972

85 pages

Cite this item

-

Brief Collection, LDF Court Filings. Richmond Virginia School Board v Virginia Board of Education Supplemental Brief in Support of Petitions for Writs of Certiorari, 1972. 4272e65b-c29a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/f5360697-67ac-4c78-8b5b-7cf5eac93fef/richmond-virginia-school-board-v-virginia-board-of-education-supplemental-brief-in-support-of-petitions-for-writs-of-certiorari. Accessed February 22, 2026.

Copied!

iatpmtt? (tart of tfy? Htuteii States

October Term, 1972

No. 72-549

The School B oard of the City of R ichmond, Virginia, et al.,

Petitioners,

v.

The State B oard of E ducation of the Commonwealth of Virginia, et al.

No. 72-550

Carolyn B radley, et al.,

Petitioners,

v.

The State B oard of E ducation of the Commonwealth of Virginia, et al.

I n th e

SUPPLEMENTAL BRIEF IN SUPPORT OF PETITIONS FOR WRITS OF

CERTIORARI TO THE UNITED STATES COURT OF APPEALS

FOR THE FOURTH CIRCUIT

George B. L ittle

J ames K. Cluverius

Browder, Russell, Little & Morris

1510 Ross Building

Richmond, Virginia 23219

Conard B. Mattox, J r.

City Attorney

1001 East Broad Street

Richmond, Virginia 23219

Attorneys for Petitioners

The School Board of the

City of Richmond, et al.

J ack Greenberg

J ames M. Nabrit, I I I

Norman J . Chachkin

10 Columbus Circle

New York, New York 10019

Louis R. Lucas

525 Commerce Title Bldg.

Memphis, Tennessee 38103

W illiam L. Taylor

Catholic University Law School

Washington, D.C.

J ames R. Olphin

214 East Clay Street

Richmond, Virginia 23219

M. Ralph P age

420 North First Street

Richmond, Virginia 23219

Anthony G. Amsterdam

Stanford University Law School

Stanford, California 94305

Attorneys for Petitioners

Carolyn Bradley, et al.

1st the

$ttp:ran? (Enurt nf % Itttteii States

October Term, 1972

No. 72-549

T he S chool B oard of th e City of R ichmond,

V irginia, et al.,

P etition ers,

v.

T he S tate B oard of E ducation of the

Commonwealth of V irginia, et al.

No. 72-550

Carolyn B radley, et al.,

P etition ers,

v.

T he S tate B oard of E ducation of th e

Commonwealth of V irginia, et al.

SUPPLEMENTAL B R IEF

IN SUPPORT OF PETITIONS FOR WRITS OF

CERTIORARI TO THE UNITED STATES COURT

OF APPEALS FOR THE FOURTH CIRCUIT

Counsel for petitioners in each of these cases, presently-

pending upon petitions for writs of certiorari, file this

joint supplemental brief pursuant to Rule 24(5) of this

Court. A significant decision of another United States

Court of Appeals has been rendered since the filing of the

2

petitions for writs of certiorari, which conflicts with the

decision of which review is sought by the petitioners, and

which underscores the importance and desirability of

granting review.

On December 8, 1972, the United States Court of Ap

peals for the Sixth Circuit rendered a decision in B rad ley

v. M illiken, Nos. 72-1809, -1814, which affirmed the district

court’s decision to require a plan of desegregation for

Detroit not limited by school district boundary lines, and

upheld the power of the court to fashion such a remedy.

(The district court decision is referred to in note 36 at

page 53 of the Petition in No. 72-549 and in note 122,

page 64 of the Petition in No. 72-550.) The Court of Ap

peals’ opinion in the Detroit case, B rad ley v. M illiken, is

directly contrary to the decision below of which review

is sought. (See the Sixth Circuit’s comment at page 67

of the opinion, declining to follow the Fourth Circuit.)

The decision of the Court of Appeals for the Sixth Cir

cuit is appended hereto.

3

Respectfully submitted,

George B. L ittle

J ames K . Cltjvebius

Browder, Russell, Little

& Morris

1510 Ross Building

Richmond, Virginia 23219

Conard B. Mattox, J r .

City Attorney

1001 E ast Broad Street

Richmond, Virginia 23219

A ttorneys fo r P etition ers

T he School B oa rd o f the

City o f R ichm ond, et al.

J ack Greenberg

J ames M. Nabrit, I I I

Norman J . Chachkin

10 Columbus Circle

New York, New York 10019

Louis R. L ucas

525 Commerce Title Bldg.

Memphis, Tennessee 38103

W illiam L. T aylor

Catholic University Law School

Washington, D.C.

J ames R. Olph in

214 E ast Clay Street

Richmond, Virginia 23219

M. R alph P age

420 North F irs t Street

Richmond, Virginia 23219

A nthony G. A msterdam

Stanford University Law School

Stanford, California 94305

A ttorneys fo r P etition ers

C arolyn B rad ley , et al.

Nos. 72-1809 - 72-1814

UNITED STATES COURT OF APPEALS

FOR THE SIXTH CIRCUIT

Ronald Bradley, et al.,

Plaintiffs-Appellees,

v.

W illiam G. M illiken , Governor of

Michigan, etc.; Board of E duca

tion of the C ity of Detroit,

Defendants-Appellants,

and

Detroit F ederation of T eachers

L ocal 231, American F ederation

of T eachers, AFL-CIO,

Defendant-Intervenor-Appellee,

and

Allen Park Public Schools, et al.,

Defendants-Intervenors-Appellants,

and

Kerry Green, et al.,

Defendants-Intervenors-Appellees.

A p p e a l from the

United States District

Court for the Eastern

District of Michigan,

Southern Division.

Decided and Filed December 8, 1972.

Before Phillips, Chief Judge, E dwards and Peck, Circuit

Judges.

Phillips, Chief Judge. This is a school desegregation case

involving the metropolitan area of Detroit, Michigan.

The present appeal is the fourth time that the case has been

before tills court since the complaint was filed August 18,

2 Bradley, et al. v. Milliken, et al. Nos. 72-1809, 72-1814

1970. The earlier decisions of this court are reported at Brad

ley v. Milliken, 433 F.2d 897 (1970); Bradley v. Milliken, 438

F.2d 897 (1971); and Bradley v. M illiken,---- F .2 d ----- (1972),

cert, denied, — U.S. — , 41 U.S.L.W. 3175 (Oct. 10, 1972).

(On November 27, 1972 this Court dismissed for want of

jurisdiction an “emergency motion” by the Detroit Board of

Education that State officials be required to provide funds

to keep the Detroit public schools operating for 180 regular

days of instruction during the current school y e a r .---- F.

2 d ---- .)

No specific desegregation plan has been ordered by the

District Court. The procedural history of the litigation is set

forth below.

Before this court at the present time are four interlocutory

orders from which we have granted appeal pursuant to 28

U.S.C. § 1292(b) and one final order, viz:

1. Ruling on Issue of Segregation, dated September 27,

1971, reported at 338 F.Supp. 582;

2. Findings of fact and conclusions of law on “Detroit only”

plans of desegregation, dated March 28, 1972;

3. Ruling on Propriety of a Metropolitan Remedy to Ac

complish Desegregation of the Public Schools of the City of

Detroit, dated March 24, 1972;

4. Ruling on Desegregation Area and Development of

Plan, and Findings of Fact and Conclusions of Law in support

thereof, dated June 14, 1972; and

5. Order dated July 11, 1972, directing Michigan State

officials to purchase 295 school buses (which this court con

siders to be a final order).

On July 13,1972, following oral argument, this court granted

a motion for a temporary stay of the District Court’s order

of July 11, 1972, ordering the purchase of 295 school buses.

On July 17,1972, following oral argument, this court directed

that its stay order remain in effect until entry by the District

Court of a final desegregation order or until certification by the

Nos. 72-1809, 72-1814 Bradley, et al. v. MiUiken, et al. 3

District Court of an appealable question as provided by 28

U.S.C. § 1292(b).

Thereafter the District Court certified that the orders set

forth above involve controlling questions of law, as provided

by 28 U.S.C. § 1292(b), and made a determination of finality

under Rule 54(b ), Fed. R. Civ. P.

On July 20, 1972, this court entered an order granting the

interlocutory appeal concluding that:

“[A]mong the substantial questions presented there is at

least one difficult issue of first impression that never has

been decided by this court or the Supreme Court. In so

holding we imply nothing as to our view of the merits of

this appeal. We conclude that an immediate appeal may

materially advance the ultimate termination of the litiga

tion.”

The motion for leave to appeal was granted and the case

was advanced for oral arguments on the merits on August

24, 1972.

The July 20, 1972, order of this court included the following

stay order, which has remained in effect pending final disposi

tion of the appeal on its merits:

“The motion for stay pending appeal having been con

sidered, it is further ORDERED that the Order for Ac

quisition of Transportation, entered by the District Court

on July 11, 1972, and all orders of the District Court con

cerned with pupil and faculty reassignment within the

Metropolitan Area beyond the geographical jurisdiction

of the Detroit Board of Education, and all other proceed

ings in the District Court other than planning proceedings,

be stayed pending the hearing of this appeal on its merits

and the disposition of the appeal by this court, or until fur

ther order of this court. This stay order does not apply to

the studies and planning of the panel which has been ap

pointed by the District Court in its order of June 14,

1972, which panel was charged with the duty of pre

paring interim and final plans of desegregation. Said

4 Bradley, et al. v. Milliken, et al. Nos. 72-1809, 72-1814

panel is authorized to proceed with its studies’ and plann

ing during the disposition of this appeal, to the end that

there will be no unnecessary delay in the implementation

of the ultimate steps contemplated in the orders of the

District Court in event the decision of the District Court

is affirmed on appeal. Pending disposition of the appeal,

the defendants and the School Districts involved shall

supply administrative and staff assistance to the aforesaid

panel upon its request. Until further order of this court,

the reasonable costs incurred by the panel shall be paid

as provided by the District Court’s order of June 14, 1972.”

This court also has granted leave to appeal to various in

tervening parties and leave to file numerous amicus briefs.

Extensive oral arguments on the merits were heard August

24, 1972. The briefs and arguments of all the parties have

been considered in the disposition of this appeal.

We affirm two of the ridings of the District Court sum

marized above: (1) The Ruling on the Issue of Segregation

and (2) the Findings of Fact and Conclusions of Law on

“Detroit-only” plans of desegregation. We hold that the find

ings of fact of the District Court as set forth in these rulings

are not clearly erroneous, Rule 52(a), Fed. R. Civ. P., but to the

contrary are supported by substantial evidence.

As to the District Court’s third ruling pertaining to the pro

priety of a Metropolitan remedy, we affirm in part and re

verse in part. We vacate this and the two remaining orders

and remand to the District Court for further proceedings as

hereinafter set forth in detail in this opinion.

I. Chronology of Proceedings

On April 7, 1970, the Detroit Board of Education adopted

a plan to effect a more balanced distribution of black and

white students in the senior high schools through enactment

of changes in attendance zones involving some 12,000 pupils,

to become effective over a three year period. Three months

later this modest effort was thwarted by the legislature of

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. 5

the State of Michigan through enactment of Act 48 of the

Public Acts of 1970. Section 12 of the Act delayed implementa

tion of the plan. The four members of the Board who sup

ported the April 7 plan were removed from office through a

citizen initiated recall election. The new members of the

board and the incumbent members who had originally op

posed the April 7 plan thereafter rescinded it.

The complaint in this case was filed by individual black

and white school children and their parents, and the Detroit

branch of the NAACP against the Board of Education of the

City of Detroit, its members, and the then Superintendent

of Schools, as well as the Governor, the Attorney General,

the State Board of Education and the State Superintendent

of Public Instruction of the State of Michigan.

The complaint alleged that the Detroit public school system

was and is segregated on the basis of race as the result of

actions and policies of the Board of Education and of the

State of Michigan. The complaint specifically challenged the

constitutionality of Act 48 of the Public Acts of 1970 of the

State of Michigan, which in effect repealed the April 7, 1970,

high school desegregation plan formulated by the Detroit

Board.

The case was heard originally on plaintiffs’ motion for a

preliminary injunction to restrain the enforcement of Act

48. In response to this motion the District Judge denied a pre

liminary injunction, did not rule on the constitutionality of Act

48, but granted the motion of the Governor and Attorney Gen

eral of Michigan for dismissal of the cause as to them. On

appeal this court held that § 12 of Act 48 was an unconstitu

tional interference with the lawful protection of Fourteenth

Amendment rights, that there was no abuse of discretion in

denying a preliminary injunction, and that the Governor

and Attorney General should not have been dismissed as par

ties defendant at that stage of the proceeding. The case was

remanded to the District Court for an expedited trial on

the merits. 433 F.2d 897.

On remand plaintiffs moved for immediate implementation

of the April 7 plan. On December 3, 1970, following an

evidentiary hearing on that plan and two updated plans, the

District Court ordered implementation of the “Magnet” or

“McDonald” plan effective at the beginning of the next full

school year, pending ultimate disposition on the merits. Plain

tiffs appealed and filed a motion for summary reversal. This

court again held that the District Court had not abused its

discretion in refusing to adopt the April 7 plan prior to an

evidentiary hearing on the allegations of constitutional viola

tions in the complaint. We remanded the case with in

structions to proceed to trial expeditiously on the merits of

plaintiffs allegations concerning the Detroit public school

system. 438 F.2d 945. The trial of the case on the issue of

segregation began April 6, 1971, and continued until July

22, 1971, consuming 41 trial days. On September 27, 1971,

the District Court issued its ruling on the issue of segrega

tion, holding that the Detroit public school system was racially

segregated as a result of unconstitutional practices on the part

of the defendant Detroit Board of Education and the Michigan

State defendants. 338 F.Supp. 582.

A decision on a motion to join a large number of suburban

school districts as parties defendant was deferred on the

ground that the motion was premature, in that no reasonably

specific desegregation plan was before the court. The Detroit

Board of Education was ordered to submit desegregation plans

limited to the City, while State defendants were directed

to submit plans encompassing the three-county metropolitan

area. An effort was made to appeal these orders to this

court. On February 23, 1972, this court held the orders to be

non-appealable and dismissed the appeal. — F .2 d ---- , cert.

denied, — U.S. — , 41 U.S.L.W. 3175 (Oct. 10, 1972).

After further proceedings concerning proposals for a Detroit

only desegregation remedy and the presentation of two plans

therefor, the District Judge on March 24, 1972, issued a

ruling entitled “Ruling on Propriety of Considering a Metro

6 Bradley, et al. v. Milliken, et al. Nos. 72-1809, 72-1814

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. I

politan Remedy,” and on March 28, 1972, he issued “Findings

of Fact and Conclusions of Law on Detroit Only Plans of

Desegregation.” He rejected all Detroit only plans, saying

in part: “Relief of segregation in the public schools of the

City of Detroit cannot be accomplished within the corporate

geographical limits of the city.”

Subsequently, the District Court issued an order on June

14, 1972, entitled “Ruling on Desegregation Area and Order

for Development of Plan for Desegregation.” In this ruling

and order the District Court established tentative boundaries

for a metropolitan remedy and provided for a panel of nine

members to design plans for integration of the Detroit schools

and those of 53 metropolitan school districts within certain

guidelines.

The panel recommended preparatory purchases of school

buses prior to implementation of an interim plan in Septem

ber 1972. Following a hearing, the District Court on July

11 ordered State defendants to purchase or otherwise acquire

295 school buses.

In view of the intervening Congressional action by the en

actment of the “Broomfield Amendment,” certification was

made to the Attorney General of the United States that the

constitutionality of § 803 of the Education Amendments of

1972, Pub. L. No. 92-318, 86 Stat. 235, had been called into

question. The Department of Justice intervened, filed a brief

and participated in the oral arguments before this court.

II. The Issues

All of the parties to this litigation in one form or another

present three basic issues which we phrase as follows:

1. Are the District Court’s findings of fact pertaining to

constitutional violations resulting in system-wide racial segre

gation of the Detroit Public Schools supported by substan

tial evidence or are they clearly erroneous?

2. Based on the record in this case, can a constitutionally

8 Bradley, et al. v. Milliken, et ah Nos. 72-1809, 72-1814

adequate system of desegregated schools be established with

in the geographic limits of the Detroit school district?

3. On this record does the District Judge’s order requiring

preparation of a metropolitan plan for cross-district assign

ment and transportation of school children throughout the

Detroit metropolitan area represent a proper exercise of the

equity power of the District Court?

III. The Constitutional Violations

(A) Constitutional violations found to have been committed

by the Detroit Board of Education:

(1) Segregative zoning and assignment practices.

(a) The District Judge found that the Detroit

Board of Education formulated and modified

attendance zones to create or perpetuate racial

segregation. He also found that the feeder sys

tem for junior and senior high schools was de

signed to maintain rather than eliminate black

or white schools at the higher levels. Its prac

tice of shaping school attendance zones on a

north-south rather than an east-west orientation

resulted in attendance zone boundaries con

forming to racial dividing lines.

(b ) He further found that the Detroit Board of

Education’s policies involved a substantial

number of instances of transporting black chil

dren past white schools with available school

space.

(2) He also found that it was the policy of the Board

of Education to create optional attendance areas

which permitted white students to transfer to all

white or predominately white schools located nearer

the city limits.

Nos. 72-1809, 72-1814 Bradley,, et al. v. Milliken, et al. 9

(3) The District Judge also found that the policies of

the Detroit Board of Education (and State Board

of Education) concerning school construction in

some instances had the purpose of segregating stu

dents on a racial basis and in many others resulted

in maintaining or increasing segregation.

(1) Segregative Zoning and Assignment Practices.

(a) The District Judge’s findings of fact pertaining to al

teration of zones and feeder patterns are as follows:

“The Board has created and altered attendance zones,

maintained and altered grade structures and created and

altered feeder school patterns in a manner which has

had the natural, probable and actual effect of continuing

black and white pupils in racially segregated schools.

The Board admits at least one instance where it pur

posefully and intentionally built and maintained a school

and its attendance zone to contain black students.

Throughout the last decade (and presently) school at

tendance zones of opposite racial compositions have been

separated by north-south boundary lines, despite the

Board’s awareness (since at least 1962) that drawing

boundary lines in an east-west direction would result in

significant integration. The natural and actual effect of

these acts and failures to act; has been the creation and

perpetuation of school segregation. There has never been

a feeder pattern or zoning change which placed a pre

dominantly white residential area into a predominantly

black school zone or feeder pattern. Every school which

was 90% or more black in I960, and which is still in use

today, remains 907 or more black.” 338 F.Supp. at 588.

The legal conclusion of the District Judge is as follows:

“5. The Board’s practice of shaping school attendance

zones on a north-south rather than an east-west orienta

tion, with the result that zone boundaries conformed to

racial residential dividing lines, violated the Fourteenth

10 Bradley, et al. v. Milliken, et al. Nos. 72-1809, 72-1814

Amendment. Northcross v. Board of Ed. of Memphis,

6 Cir., 333 F.2d 661.” 338 F.Supp. at 592-93.

* « «

“9. The manner in which the Board formulated and

modified attendance zones for elementary schools had

the natural and predictable effect of perpetuating racial

segregation of students. Such conduct is an act of de

jure discrimination in violation of the Fourteenth Amend

ment. United States v. School District 151, D.C., 286 F.

Supp. 786; Brewer v. School Board of City of Norfolk, 4

Cir., 397 F.2d 37.” 338 F.Supp. at 593.

There is, of course, other legal support for the legal con

clusions set out above. Davis v. School District o f Pontiac,

443 F.2d 573, 576 (6th Cir.), cert, denied, 404 U.S. 913 (1971);

United States v. Board of Education, Ind. School District No.

1, 429 F.2d 1253, 1259 (10th Cir. 1970); United States v.

Jefferson County Board o f Education, 372 F.2d 836, 867-68

(5th Cir. 1965), aff’d in banc, 380 F.2d 385 (5th Cir. 1966),

cert, denied sub nom, Caddo Parish School Board v. United

States, 389 U.S. 840 (1970); Clemons v. Board o f Education,

228 F.2d 853, 858 (6th Cir.), cert, denied, 350 U.S. 1006

(1956); Spangler v. Pasadena Board of Education, 311 F.

Supp. 501, 522 (C.D. Cal. 1970).

Witness Charles Wells, defendant School Board’s assistant

superintendent in charge of the Office of Pupil Personnel

Services, read into the record and testified in support of the

minutes of a meeting of the Citizens Association for Better

Schools. Mr. Wells was the president of the Citizens As

sociation at the time the meeting was conducted. His testi

mony includes the following:

“Q. (By Mr. Lucas) Go ahead, sir.

“A. ‘November 3, 1960.

‘TO: Honorable Nathan Kaufman, Chairman

Committee on Equal Education Opportunity.

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. 11

‘We should like to begin our presentation by reviewing

with you briefly the development of our organization. We

feel it is significant as it represents an attempt on the

part of people who make up this organization to effective

ly deal with the frustrations historically inherent in at

tempting to provide for minority group children an ade

quate education within the Detroit Public School System.

A majority of the people of the Negro race moved into

the now Center District from other school districts with

in the limits of the City of Detroit. Although better

housing conditions were but one of the motives for such

a move, of equal importance was a desire to provide their

children with a more equitable and enriched educational

experience.

‘They were aware of the increased population within

their new geographical area, and accepted the counselling

of the then new administration of the Board of Edu

cation, to the effect that additional tax monies would

have to be made available if educational standards within

the City of Detroit were to be improved, or even main

tained. Consequently, each of them made a strong per

sonal investment in the millage campaign of Spring 1959.

In this campaign, initially, their efforts did not meet the

wholehearted approval of the Negro community, since

from past experience, particularly involving other millage

campaigns, members of the Negro community had ob

served that the results of the expenditures of monies

obtained from additional taxes, had little effect on the

facilities, the equipment, or the curriculum available to

their children.

‘Despite this resistance, they were aware that there

would be less justification for demanding adequate edu

cational opportunities for their children if they did not

accept their responsible share for the successful passing

of the millage program. As a consequence of their ef

forts, their respective schools voted overwhelmingly for

the millage program, and they logically expected that

positive results would follow their efforts.

12 Bradley, et al. v. Milliken, ct al. Nos. 72-1809, 72-1814

‘Their first disillusionment occurred only a few months,

but yet a few weeks after the passage of the millage —

they were rewarded with the creation of the present

Center District. In effect this District, with a few minor

exceptions, created a segregated school system. It ac

complished with a few marks of the crayon on the map,

the return of the Negro child from the few instances of

an integrated school exposure, to the traditional pre

dominantly uniracial school system to which he had for

merly been accustomed in the City of Detroit.

‘Their attempts to meet this threat to their children’s

educational experience through existing school organiza

tions met with little success. Their conferences with

District and City-Wide administrators including the super

intendent, Dr. Samuel Brownell, resulted in only ration

alizations concerning segregated housing patterns, and

denials of any attempts at segregation. When it was

pointed out that regardless of motivation, that segrega

tion was the result of their boundary changes, little com

promise was effected, except in one or two instances,

where opposition leadership was most vocal and ag

gressive.

Concurrent with boundary changes, it was alarming

ly noticeable that the school population within the Cen

ter District was rapidly increasing, and that the priority

building program would have little positive effect in

dealing with the problem. Attempts to discuss this prob

lem with school and district administration gave promise

of only minimal relief.

Finally, it had been earlier noted by new residents

moving into what is now the Center District that prior

to and during its change from a uniracial (predominant

ly white) to a biracial system and again to a uniracial

(predominantly Negro) school system that the quality

of their children’s previous educational experiences did

not eqiup them to compete on an equal basis with resi

dent children in the same grade and classifications.

“These experiences made them aware that no one or

ganization composed of one or several schools, could ef-

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. 13

fectively coordinate the mutual concern of the many

parents residing within the Center District. Thus out of

the several discussions of groups of people whose primary

concern was the adequate and equitable education of their

children, this organization was bom. It is felt that no

better description of its purpose, its objective, and its

reason for being can be found than in the preamble to

its Constitution, which is:

‘PREAMBLE: Our interest is in equal educational op

portunities for all persons within the City of Detroit.

‘We do not believe that such opportunities are possible

within a segregated school system.

‘We oppose a policy of containment of minority groups

within specified boundaries, an example of which is the

Center District. While the above is of utmost concern

to us we are also aware that there is need for improve

ment and enrichment of the standards within this district

in practice as well as in theory.

‘We believe that once standards have become reason

ably adequate, that such standards should be maintained.

It should be further recognized that future population

shifts brought about by urban redevelopment will ad

versely affect the above goals in the Center District, unless

there is anticipation of the impact of this population

growth upon this district.

‘Since the inception of our organization we have noted

the following:

‘The public school system of the City of Detroit is

divided into nine administrative districts, one of which

is the Center District.

‘Yet, every day, when the children in this city leave

their homes to go forth to public schools, approximately

one out of every four leaves a home in the Center District.

Of the 154,969 children enrolled in public elementary

schools as of September 30, 1960, 36,264 or 23.4 percent

of these children leave a home in the Center District.

‘There are 221 elementary school buildings in the De

troit Public School System. Of these 28 are in the Center

District. This means, then, that the 23.4 percent of the

total elementary school population is accommodated in

12.7 percent of the buildings.

Fifteen percent of these children sit in classes of 40 to

44 students per class. This is in comparison to:

14 Bradley, et al. v. Milliken, et al. Nos. 72-1809, 72-1814

Sixty-two and one-half percent of all the children in

the city’s elementary schools who sit in classes of 45 to

49 are children in the Center District. These schools in

the Center District find their capacities short by 6,352

pupil stations. In other words, their capacities are over

taxed to the extent of 16 percent; and the future build

ing program, as set forth by the superintendent’s report

of October 17, 1960, will make available only 11,189 ad

ditional pupil stations within the next ten-year period.

However, this will be insufficient to meet the demands of

the Center District. Therefore, it is apparent that a

school bussing program will have to become a permanent

part of the school housing program. Thus the manner

in which the bussing program is administered becomes a

matter of acute concern.

‘Presently, children are being bussed by grades. Under

this system a number of problems are created:

1) It makes necessary a reorganization of the

bussing school, as well as the school into which the

children are bussed.

2) They are not integrated into the school into

which they are bussed, except in minor instances.

East

North

.13 percent

.05 percent

.04 percent

.08 percent

.01 percent

.01 percent

.05 percent

Northeast

Northwest

South

Southeast

West

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. 15

3) There is a possibility of the separation of the

family unit.

4) Parents are unable to establish a good rapport

with the teachers and administrators in the new

school since there exists a time limit in which these

children will be members of that school.

‘It is recommended that a policy of bussing by geo

graphical areas instead of by grades be instituted so as

to eliminate the above problems.

‘The emphasis on curricula objective are not compara

ble in the various school districts of the Detroit School

System. There is a tendancy in the Center District to

stereotype the educational capacity of the children. This

means that children entering the schools in this district

whose background enables them to comprehend an en

riched educational program, are not challenged.

‘For example, one student in the Hutchins Intermediate

School who desired to prepare for entrance into an East

ern college found that Latin was not offered, and only

after considerable effort by members of the community,

along with his family, was Latin placed back in the school

curriculum. Many other instances can be cited upon

request.

‘Conversely, children whose initial capacity is retarded

by deprived socio-economic circumstances also go un

challenged. The District Administrator has admitted that

no program exists to take care of these children.

‘The curriculum and counselling as they now exist,

do not encourage students to achieve their maximum ca

pacities. We feel that the responsibility for any inequities

in the educational experience offered to any group of

children within a given school system must be assumed

by those persons charged with the overall responsibility

of administering that system.

‘Therefore, we recommend that strong policies be adopt

ed by the top administration to erase inequities of the

16 Bradley, et al. v. Milliken, et ah Nos. 72-1809, 72-1814

Detroit Public School System, and a policy of super

vision through all levels of administration be instituted

at all levels of administration to insure equal educational

opportunities to all children.

‘The Citizens’ Association for Better Schools.’

“Q. Do you join in that statement in submission to the

committee?

“A. Yes, I did.”

* O 9

Mr. Wells cited the example of the Center ( administrative)

District, where attendance boundaries were shaped in a gerry

mandered fashion to conform to the racial residential pattern.

“Q. With regard to that same situation, you were ex

pressing a problem which your committee had met in

attempting to discuss this. Can you tell me how you

came to be discussing this with the Board at that time?

“A. It was not with the Board of Education, I be

lieve it was with the administration of the school system.

“Q. The administrative staff?

“A. Including the superintendent.

“Q. All right.

“A. Our initial concern about the boundaries of the

center district grew out of the concern we had in 1960

about the changing of the attendance areas between the

Central High School and the Mackenzie High School.

“Q. Is that the optional attendance area also set up in

that?

“A. A part of that was optional. Well, let’s put it

that way, a part of it had been optional, the proposal was

to eliminate the option. In the process of eliminating the

option what it would mean would be that by and large

the few black children who had been attending Mackenzie

would have been pulled back into the Central area.

"Q. Mackenzie at that time was a majority white

school?

“A. Predominatly white.

“Q. Central by that time had become black?

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. 17

“A. Predominatly black.

“Q. So the cancellation of the optional area which

had been there had the effect of preventing black chil

dren choosing Mackenzie, is that correct?

“A. That is right.

“Q. Were there any other schools — there is a ref

erence made to the establishment of the center district

boundaries — were there any other schools which had

not previously been in certain feeder patterns that were

drawn back into the center district?

“A. I am trying to remember now as I said eleven

years.

“Q. I understand.

“A. If I remember correctly, the Sherrill School which

also had been a part of it, that portion north of Tireman

had been attending Mackenzie and they in turn, the total

school then would have been returned to the Chadsey

area.

“Q. What about Tappan and that area, are you fa

miliar at all with changes that took place?

“A. Tappan was the junior high school in which Win

terhalter, the elementary school in the area south of

Davison just west of Ewald Circle attended. At that

time the students from that area attended Tappan and

all students from Tappan attended Mackenzie.

“The new change would mean that the students from

Winterhalter, and I think McKerrow which is just below

Winterhalter would have attended Tappan through the

9th grade, but then had been pulled back into the center

district to attend Central High School.

“The other students in Tappan would have gone to

Mackenzie.

“Q. The other students in Tappan, were they pre

dominatly white students?

“A. Yes. Our concern about this region really at that

time was that we could draw a line which separated the

black residents from the white residents and almost to

the alley and that in effect was the boundary line of

the center district.”

There was evidence that school feeder patterns were changed

so as to make particular junior high schools or senior high

schools either generally white or generally black, as shown

in the following testimony:

“MR. CALDWELL: Your Honor, I have copies of

the Mumford High School district in 1959 which is taken

from Plaintiffs Exhibit 78-A, and this makes it easier to

see the schools.

Q. Let s get back to the 1962-’63 overlay.

“Prior to the 1962-’63 - first of all, will you point out

to the Court where the Vandenberg and Vemor Schools

are.

A. This triangle to the northwest corner of this area.

( indicating)

Q. Prior to 1962-63 where did the Vemor and Van-

derburg youngsters go to high school?

“A. Mumford High School.

“Q. A boundary change was made in 1962-63?

“A. That’s right.

Q. Where did those youngsters go to school in that

year?

“A. Ford High School.

Q. How long did that feeder pattern continue?

A. Until 1966-67 when they returned to Mumford.

“Q. All right.

MR. CALDWELL: Plaintiffs’ Exhibit 128-A, your

Honor, reflects that in 1960 Vandenburg and Vemor were

0 percent black. Mumford was 16.1 black, Ford was .1

percent black. With regard to Vandenburg and Vemor,

there was a gradual increase in the black population until

1966 when Vandenburg was 39.5 percent black and Ver-

nor was 39.8 percent black.

Then in 1967 the change was made taking Vandenburg

and Vemor back into Mumford. Vandenburg had be

come 70 percent black, Vernor had become 63.2 percent

black. That year the change was made and Mumford

was 78.1 percent black, Ford was 4.1 percent black.

18 Bradley, et al. v. Milliken, et al. Nos. 72-1809, 72-1814

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. 19

“Q. I believe that feeder pattern continued into the

current school year?

“A. That is right.

“Q. Those schools now feed back into Ford High

School this year?

“A. That is right.”

The effect of such a policy was attested to by Dr. Gordon

Foster of the University of Miami, director of the Florida

School Desegregation Consulting Center:

“Q. The effect, Doctor, then, of the removal of Van-

denberg and Vemor from the Ford feeder pattern into

the Mumford feeder pattern, what was the effect in terms

of race?

“A. The effect of this move in 1967-68 of the transfer

back of the two elementary schools was to increase the

segregation at Mumford, to take blacks from the Ford

High School and, therefore, increase the segregated pat

tern there, and, in my opinion, it reinforced inevitably

the perception that Ford would be kept white as a

matter of basic policy and that Mumford would be a

racially contained isolated high school attendance area.”

Similar testimony regarding the segregative effect of alter

ing school feeder patterns was given with respect to the

Jefferson and Hutchins Junior High Schools, Garfield and

Spain Junior High Schools, Burton and Irving Elementary

Schools, Higginbotham Elementary School, Jackson and Foch

Junior High Schools, Stellwagen, Keating and Clark Elemen

tary Schools, Cleveland and Nolan Junior High Schools, Cour-

ville Elementary School, Ford and Brooks Junior High Schools,

Osborne and Pershing High Schools, Parkman Elementary

School, the Ellis, Sills, Newberry and Sampson Elementary

Schools, and Northwestern and Chadsey High Schools.

(b ) The District Judge made the following findings of

fact pertaining to busing black children to black schools past

white schools:

20 Bradley, et al. v. Milliken, et al. Nos. 72-1809, 72-1814

“The Board, in the operation of its transportation to

relieve overcrowding policy, has admittedly bused black

pupils past or away from closer white schools with avail

able space to black schools. This practice has continued

in several instances in recent years despite the Board’s

avowed policy, adopted in 1967, to utilize transporta

tion to increase integration.

“With one exception (necessitated by the burning of

a white school), defendant Board has never bused white

children to predominantly black schools. The Board has

not bused white pupils to black schools despite the enor

mous amount of space available in inner-city schools.

There were 22,961 vacant seats in schools 90% or more

black.” 338 F.Supp. at 588.

The legal conclusion of the District Judge follows:

“8. The practice of the Board of transporting black

students from overcrowded black schools to other identi-

fiably black schools, while passing closer identifiably white

schools, which could have accepted these pupils,

amounted to an act of segregation by the school authori

ties. Spangler v. Pasadena City Bd. of Ed., D.C., 311

F.Supp. 501.” 338 F.Supp. at 593.

Additional support for the District Judge’s legal conclusion

includes: United States v. School District 151, 286 F.Supp. 786,

798 (N.D. 111. 1967), a f d , 404 F.2d 1125, 1131 (7th Cir.

1968), on remand, 301 F.Supp. 201, 211, 222 (N.D. 111. 1969),

aff’d, 432 F.2d 1147, 1150 (7th Cir. 1970), cert, denied, 402

U.S. 943 (1971); United States v. Board o f School Commis

sioners, Indianapolis, Ind., 332 F.Supp. 655, 669 (S.D. Ind.

1971).

The following testimony pertains to busing black children

from overcrowded black schools past white schools with

available pupil capacity to other black schools:

“Q. I am trying to anticipate, Mr. Ritchie’s question.

Have you noted some examples of the bussing of black

children from black schools to other black schools?

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. 21

“A. I have.

“Q. Could you give us a couple illustrations?

“MR. BUSHNELL: While Dr. Foster is looking

through his notes, might I make the request that we

made yesterday that on conclusion of his testimony we

have access to the notes made?

“MR. LUCAS: At the conclusion, yes. We have no

objection to that.

“A. In 1960-61, and we don’t have any record for

’61-62 so I am not certain as to that year, students were

transported from Angell to Greenfield Park. This has

already been part of our testimony, I believe, 186 students

and students from Angell to Higginbotham, 118 students.

In 1969 -

“Q. Excuse me, Doctor, let me ask you if the Angell-

Higginbotham — were there white schools available with

space, from your examination of the records?

“A. Yes, there were.

“Q. Between Angell and Higginbotham?

“A. Yes, sir, I believe I testified to that before.

“Q. All right.

“A. In 1969 the Ruthruff Elementary School which

was 99 percent black transported 143 children to Herman

Elementary, 55 percent black.

0 0 0

“Q. (By Mr. Lucas, continuing) Dr. Foster, would

you step to the map.

“I think we were talking about the Ruthruff-Herman

Schools.

“A. Yes. We were testifying at recess about trans

portation of blacks past white schools. In 1969 we stated

that Ruthruff Elementary which is here in the south

eastern portion of the Mackenzie High School zone on

the large 1970-71 attendance area map, in 1969 trans

ported 143 children to Herman Elementary School which

is just below the blue area on the undermap here —

Herman Elementary School (indicating). Herman in

1969 was 55.6 percent black. Ruthruff was 99.1 percent

black and I think it is important to note that the access

22 Bradley, et a l v. Milliken, et al. Nos. 72-1809, 72-1814

to Herman goes right past the Parkman Elementary

School which at that time had 136 spaces available and

according to their capacity figures —

“Q. Parkman was what percentage?

“A. Parkman I don’t have the figure for ’69 and ’70.

Parkman was 12.8 percent black.”

O 9 O

“A. Another example was the Parker Elementary

School which is in the general center of the Mackenzie

High School zone. Parker in 1970 was 79.4 black; 61

children were bussed from Parker again to the Herman

Elementary School which at that time was 58.5 percent

black and again past the Parkman Elementary which in

1970 was 12.8 percent black.

“Q. Did Parkman have capacity at that time, Doctor?

“A. Parkman in ’70, according to my data, had 121

spaces.

* © *

“Q. Excuse me, would you give us the A. L. Homes.

“MR. BUSHNELL: I thought the Court ruled on that?

“THE COURT: He says he is pursuing a non-cumula-

tive matter here. If that be true he may go ahead.

“A. A. L. Holmes School, children were bussed from

this school over to the McGraw School which is in the

south end of the Northwestern District in center city.

In 1970-71 the Post Junior High School, which is lo

cated —

“MR. BUSHNELL: If the Court please, Mr. Lucas

just pointed out the location of Post which the witness

obviously couldn’t find on the map.

“THE COURT: Well, he hasn’t moved it.

“A. I noted the west section of Cooley instead of the

east. The Post Junior High School and Clinton Schools,

which are in the east section of the Cooley High School

attendance zone transported 54 students to the Jefferson

School which is now in the Murray zone and it is lo

cated in the eastern section of the Murray High School

attendance area. I think it is important to note that

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. 23

these students who were bussed came from a consider

able distance north and there were several possibilities —

Q. Excuse me, were the Post children in a black

school or white school?

“A. The Post School this year, 1970-71 was 99.3 per

cent black. The Clinton School from which they also

came was 97 percent black.

“Q. What about Jefferson?

A. Jefferson was 87.6 percent black. There were two

or three other possibilities much closer to the Post-Clinton

area. One would have been in the western portion of the

Mackenzie district here (indicating).

“Q. What is the racial composition?

“A. At this time it had 35.4 percent black with a ca

pacity of 109 stations available. Another possibility would

have been the Vetal School in the Redford zone, the

southern portion of the Redford High School zone, which

at this time was 2 percent black with vacancies of 203

pupil stations and a third alternative could have been

the Coffey School to the east of the Ford attendance area

which at this time was 29 percent black with 69 pupil

stations available.

“Q. Did you say to the east was part of the Ford

attendance area or outside of that, Doctor?

“A. It’s in the Ford attendance area.

» * *

“THE COURT: Well, to save time why don’t we pro

ceed on the assumption that that was his testimony.

But if it proves otherwise we will strike it.

“MR. LUCAS: Thank you, sir.

“Q. (By Mr. Lucas) Doctor, I understand that the

policy of the district is that bussing to relieve overcrowd

ing would be done in such a manner as to improve in

tegration at the receiving school. From your examina

tion of the current bussing examples which you have

given, do you have an opinion as to whether or not that

policy has or has not been followed?

“A. Well, I think from the examples I have given so

far it would give an indication that integration could

24 Bradley, et al. v. Milliken, et ah Nos. 72-1809, 72-1814

have been effected in a much better way if the children,

instead of going to the schools would have been dropped

off at other schools where the racial balance was quite

different.

O » S

“Q. Are there any white schools from your examina

tion of data, Doctor Foster, between Angell and Higgin

botham which had capacity at that time?

“A. Yes, there were several which were a good deal

closer to Angell than Higginbotham. The effect of this

sort of zoning pattern was to provide segregated student

ratios at all three of the elementary schools, and in

terms of things that could be done or could have been

done at that particular time to correct the segregated

situation, it is my opinion that, first of all, the students

being bussed from Angell could have been dropped off

at any number of places on the way to Higginbotham,

schools which had the space and had a better racial

composition for this sort of input. This having been

done, zone lines could have been redrawn at these three

schools to have approached a racial balance situation

which, in my opinion, would have helped to stabilize the

situation at that time. This would have also assisted in

the overcrowding at Pasteur and a couple of classrooms

extra at Higginbotham.

“Q. Do you have an opinion, Doctor, as to the per

ception created by the maintenance of the Higginbotham

School under those circumstances, including the transpor

tation of black students from Angell into it?

“A. Well, it is obvious that if you transport black

children past white schools to an all black school that the

community is going to perceive this as a segregated in

tent, a segregated action. If you have a boundary situa

tion which isolates and enforces black students to a par

ticular area when the boundary lines could be changed

to effectuate a better pattern racially, then it seems to

me that community perception would also be that the

school is not doing what it could in terms of integration

and equal opportunity.

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. 25

“Q. Doctor, from your examination of the data in

1960 are there any administrative reasons, any administra

tive problems which would indicate to you a reason

why this boundary was maintained rather than drawn

in some other fashion?

“A. In terms of school capacity there are none, no.”

Defendant’s witness (Mr. Henrickson) admitted instances

of busing black students past closer white schools to black

schools:

“Q. We find on the under and over capacity map in

the Higginbotham area that there were three schools sur

rounding Higginbotham. Vernor, which is listed as be

ing 121 over capacity; MacDowell, 103, is it? Pasteur,

90. At the same time we find that Higginbotham was

489 under capacity. Is that what the exhibit shows, sir?

“A. Yes.

“Q. We also know, do we not, that Pasteur, Mac

Dowell and Vernor were white schools?

“A. Both Pasteur and MacDowell at that time, as I

recall, had some beginning of black students as a result

of the growth of the settlement of the Higginbotham

area.

“Q. They were predominatly white schools at that

time?

“A. Yes.

“Q. Higginbotham was all or virtually all black?

“A. Yes.

“Q. Indeed, it had been the same in 1950, had it not?

“A. Yes.

“Q. At the same time that we are talking about you

were transporting youngsters from Angell to Higgin

botham, is that correct?

“A. Yes.

“Q. Those were black kids being transported from

Angell to Higginbotham?

“A. Yes.

“Q. We also know on that exhibit that they were

transported past such schools as Fitzgerald and Clinton

which had more than enough capacity to handle them?

“A. We have made no denial of that.”

For some years it was a Board of Education policy to trans

port classrooms of black children intact to white schools where

they were educated in segregated classes.

Testimony as to the intact busing practice follows:

Q- (By Mr. Lucas, continuing) Will you go into the

Detroit system, Doctor, on transportation.

A. Answering it generally, counsellor, my answer

would be that the intact bussing is the practice of trans

porting classrooms of children intact from one school to

another and leaving them intact when they are educated

at the receiving school.

Q. Doctor, when such transportation occurs from a

school which is 90 percent or more black to a school which

is predominantly a white school, what effect, if any, does

this have in terms of racial segregation on those chil

dren?

A. This would lead to what we call classroom seg

regation or segregation within a particular school. It

could be sometimes resegregation, but essentially it is a

segregated situation within a school which could be seg

regated or not segregated generally.

“Q. Doctor, in your experience with school segregation

and school desegregation plans, is this a technique which

you have had to deal with in the past?

“A. On occasion, yes, sir.

“Q. Doctor, did you examine data or relevant informa

tion with respect to the transportation practices in the

Detroit school system in connection with this type of

bussing, intact bussing?

“A. Yes, sir.

“Q. What did your examination reveal, Doctor?

“A. It is my understanding from the data that there

was intact bussing generally in the late ’50’s, as I said,

and early ’60’s.

26 Bradley, et al. v. Milliken, et al. Nos. 72-1809, 72-1814

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. 27

“Q. How did that intact transportation operate, Doc

tor?

"A. It involved transporting classrooms in whole from

one school to another receiving school and at the receiv

ing school the classrooms were kept intact for instructional

purposes.

“Q. Was this policy changed at any time, Doctor, as

far as you know?

“A. It is my understanding it was changed in the

middle ’60s but I don’t remember the exact date.

“Q. What would the change be, Doctor? What type

of bussing would result in terms of relieving overcrowd

ing?

“A. You simply gather children up on a geographical

basis and transport them and assign them at random

to whatever grade they are in the receiving school rather

than keeping them in an intact classroom.”

Segregating children by race within schools has been held

repeatedly to be unconstitutional. Jackson v. Marvell School

District No. 22, 445 F.2d 211, 212 (8th Cir. 1970); Johnson

v. Jackson Parish School Board, 423 F.2d 1055 (5th Cir. 1970).

The record indicates that in at least one instance Detroit

served a suburban school district by contracting with it to

educate its black high school students in a Detroit high school

which was overwhelmingly black by transporting them away

from nearby suburban white high schools and past Detroit

high schools which were predominately white.

The District Judge found on this score that for years black

children in the Carver School District were assigned to black

schools in the inner city because no white suburban district

(or white school in the city) would take the children.

This finding is supported by the testimony of Detroit School

Superintendent Drachler, which follows:

“Q. When was the Carver District in existence as a

separate entity?

“A. The Carver District? The Carver is not in De

troit.

28 Bradley, et al. v. Milliken, et al. Nos. 72-1809, 72-1814

“Q. Is it a separate school district whose students at

tended some Detroit high schools, in particular Northern?

“A. Oh, I see what you’re referring to. I am told that

back in ’57, ’58, at that time I was not in Central Office,

there were some students from Carver District who did

not have a place for adequate high school facilities. An

arrangement was made with Detroit for the Carver stu

dents to come in on buses and go to Northern High

School. Now, the nearest school to Carver was Mum-

ford at the time. And they did go past Mumford towards

Northern.

“Q. Is Carver a black district?

“A. Yes, black and very poor.

“Q. Has Carver District subsequently merged with

Detroit?

“A. Oak Park.

“Q. With Oak Park?

“A. That’s right.

“Q. And at that time the transportation was termi

nated?

“A. That’s right. By the way, as a result of those

youngsters coming, there was a rumor spread that De

troit children were being bussed, say, from the Higgin

botham, which is north — Higginbotham area which is

north of Mumford High School area but in Detroit, that

they were being bussed to Northern, too, because they

were black students, people saw black students from the

Eight Mile area coming down. But to the best of my

knowledge these were outside students.

“Q. There were black children being bussed to Hig

ginbotham, weren’t they?

“A. There were black children being bussed to Hig

ginbotham.

“Q. From Angell?

“A. From Angell past some white schools. And when

the issue was brought to Doctor Brownell’s attention by

me in about ’59 or ’60 — there were a series of instances

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. 29

like that. There was the Angell, there was from the

military fort in the southwest, they were bussing their

own children up to the Noble, and Doctor Brownell, as

soon as it was brought to his attention, abolished that

as well as the optional areas.

“Q. Was this so-called intact bussing, that is a class

being brought as a unit?

“A. Generally speaking, yes. That policy of changing

to geographic bussing occurred about ’62-’63 as a result

of the Equal Education Opportunities Committee.

“Q. Was all of the bussing done in the City of De

troit of an intact nature until the Equal Opportunities

study?

“A. To the best of my knowledge it was. I know

when my children were being bussed, they were bussed

intact.”

(2 ) Optional Areas.

The record demonstrates that in many instances when

neighborhoods in Detroit began to experience some inmigra

tion of black families, it was Board of Education policy to

create optional attendance zones, thereby allowing white stu

dents to change schools to all white or predominately white

schools, generally located farther toward the city limits. For

many years the record indicates this practice to have been

pervasive. It continued in at least one instance up to the

1970-71 school year.

As to optional attendance zones, the District Judge found:

“During the decade beginning in 1950 the Board cre

ated and maintained optional attendance zones in neigh

borhoods undergoing racial transition and between high

school attendance areas of opposite predominant racial

compositions. In 1959 there were eight basic optional

attendance areas affecting 21 schools. Optional attendance

areas provided pupils living within certain elementary

areas a choice of attendance at one of two high schools.

In addition there was at least one optional area either

created or existing in 1960 between two junior high

30 Bradley, et al. v. Milliken, et al. Nos. 72-1809, 72-1814

schools of opposite predominant racial components. All

of the high school optional areas, except two, were in

neighborhoods undergoing racial transition (from white

to black) during the 1950s. The two exceptions were:

(1 ) the option between Southwestern (61.6% black in

1960) and Western (15.3% black); (2 ) the option be

tween Denby (0% black) and Southeastern (30.9% black).

With the exception of the Denby-Southeastem option

( just noted) all of the options were between high schools

of opposite predominant racial compositions. The South

western-Western and Denby-Southeastem optional areas

are all white on the 1950, 1960 and 1970 census maps.

Both Southwestern and Southeastern, however, had sub

stantial white pupil populations, and the option allowed

whites to escape integration. The natural, probable, fore

seeable and actual effect of these optional zones was to

allow white youngsters to escape identifiably ‘black’

schools. There had also been an optional zone (elimi

nated between 1956 and 1959) created in ‘an attempt

. . . to separate Jews and Gentiles within the system,’

the effect of which was that Jewish youngsters went to

Mumford High School and Gentile youngsters went to

Cooley. Although many of these optional areas had

served their purpose by 1960 due to the fact that most

of the areas had become predominantly black, one op

tional area (Southwestern-Western affecting Wilson Jun

ior High graduates) continued until the present school

year (and will continue to effect 11th and 12th grade

white youngsters who elected to escape from predominant

ly black Southwestern to predominantly white Western

High School). Mr. Henrickson, the Board’s general fact

witness, who was employed in 1959 to, inter alia, elimi

nate optional areas, noted in 1967 that: ‘In operation

Western appears to be still the school to which white

students escape from predominantly Negro surrounding

schools.’ The effect of eliminating this optional area

( which affected only 10th graders for the 1970-71 school

year) was to decrease Southwestern from 86.7% black in

1969 to 74.3% black in 1970.” 338 F.Supp. at 587-88.

Nos. 72-1809, 72-1814 Bradley, et al. v. MilUken, et al. 31

From these facts the District Judge arrived at the following

legal conclusion:

“7. The Board’s policy of selective optional attendance

zones, to the extent that it facilitated the separation of

pupils on the basis of race, was in violation of the Four

teenth Amendment. Hobson v. Hansen, D.C., 269 F.Supp.

401, aff’d sub nom., Smuck v. Hobson, 408 F.2d 175.

[(D.C. Cir. 1969)].” 338 F.Supp. at 593.

Additional support for the District Judge’s legal con

clusion includes: United States v. Texas Education

Agency, — F.2d — (5th Cir. 1972); Northcross v. Board

o f Education o f Memphis, 333 F.2d 661, 665-66 (6th

Cir. 1964) (different but analogous situation); United States

v. Board o f School Commissioners o f Indianapolis, 332 F.

Supp. 655, 668 (S.D. Ind. 1971); Spangler v. Pasadena City

Board o f Education, 311 F.Supp. 501, 502 (C.D. Cal. 1970).

The effect of use of optional zones was described in Dr.

Foster’s testimony:

“The first method or technique I might cite that is

used to maintain segregation would be the use of op

tional zones.

“Would it be possible for me to step to the board to

illustrate?

“Q. Please do.

(The witness proceeded to the blackboard.)

“A. Optional zones are sometimes also referred to as

dual zones or dual overlapping zones. I think it will

be easier for me to illustrate this briefly.

(The witness drew a sketch on the board.)

“A. If you have, let’s say, two high school districts,

District X and District Y, frequently when you set up

an optional zone you carve the zone out of one district,

occasionally two, but assume we carve it out of District

Y and the children in this optional zone are then per

mitted to go to either high school X or high school Y,

this becomes in a sense an overlapping zone because

32 Bradley, et al. v. Milliken, et aJ. Nos. 72-1809, 72-1814

if we refer to the boundaries of school District X at

this point it not only includes the previous boundary but

also takes in the optional zone.

“District Y in turn would include its previous bound

aries, also including the optional zone. I think this may

explain the origin of the connotation of the word ‘over

lapping’.

“Essentially optional zones are set up for two or three

reasons, one is to allow white students or black students

the option of attending one of the two attendance areas

which make up the boundaries of the zone and another

is for, occasionally for religious purposes to provide al

ternatives for persons of different religions. Sometimes

these are set up for socio-economic reasons and I have

on occasion seen them set up by boards of superin

tendents as political gimicks in order to help pass a bond

issue or one thing or another or a school board or super

intendent will set up temporary optional zones as a favor

to certain constituents in return for assistance in helping

the school board with one thing or another.

“I think in the frame work in which we operate they

are used primarily for maintaining segregated patterns.

* * *

“Q. Dr. Foster, have you made a study and analysis

of optional zones in the Detroit school system?

“A. Yes, I have.”

Dr. Fosters analysis of the purpose and effect of each op

tional zone in existence in the Detroit School District is

exemplified in his testimony on the Mackenzie-Central option.

“Q. Doctor Foster, do you have an opinion as to the

administrative use of the optional attendance zone in

1960 between and prior to that in Mackenzie-Central

area?

“A. Yes. I think it was used primarily — you mean

as to the purpose of it?

“Q. Well, as to whether or not it had any administra

tive value that you know of. Doctor, aside from race?

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. 33

“A. In terms of assignment I can see no advantage to

it.

* * O

“Q. Do you have an opinion as to its use in terms of

segregation or desegregation, Doctor Foster?

“A. In my opinion it was used as an optional zone

to allow whites during the period it was in existence in

the ’50’s and also until such time as it was done away

with in 1962 to be assigned to predominantly white Mac

kenzie High School.

“Q. Doctor Foster, from your examination of the 1950

census and in turn the 1960 census exhibits, do you have

an opinion as to the effect of such an optional zone on

the community, residence pattern in the community?

4 « 4

“A. Community people and residents in a situation

such as this generally have a perception that there is

something wrong with their school, that the whites need

an optional zone to get out into a less black situation and,

therefore, this increases their perception of racial isola

tion and, in fact, physical containment.

“Q. Does this have an effect, Doctor, in terms of the

residence pattern? I believe you testified in 1950 the

optional area was entirely white or zero to 4.9 per cent

white.

# # *

“A. In my opinion this tends to increase the instability

of the community because they generally feel this is an ad

hoc temporary interim situation and it increases white

flight in this sort of situation.

* # *

“Q. Doctor Foster, does the use of these techniques in

some areas have an effect in terms of the perception of

the community of schools besides the actual two schools

to which the option was involved?

4 4 4

“A. Thank you. Yes, I think the perception is not only

34 Bradley, et al. v. Milliken, et al. Nos. 72-1809, 72-1814

of rank and file community residents, but people of con

siderable influence in the community, along with School

Board administration people, School Board members,

School Board officials. In many cases they have sub

stantiated this perception that I have recounted; that the

optional zones did lead to greater pupil segregation

and a feeling of frustration that the school authorities

were not doing what was called for in terms of desegre

gation, and it had a generally debilitating effect on the

image of the schools as far as all of these groups were

concerned.”

Mr. Henrickson, defendant School Board’s principal wit

ness and divisional director of planning and building studies

in the School Housing Division, did not deny the discriminatory

effect of at least some of these optional zones.

Q- In 1959 optional areas frustrated integration, did

they not?

MB. BUSHNELL: Objection to the form of the ques

tion.

“THE COURT: He may answer.

“A. Some of these areas in 1959 had no effect what

ever with movement of black or white students. They

were either all black or all white. Some of them such

as the Western-Southwestern area can be said to have

frustrated integration and continued over the decade.”

(3 ) Building Construction.

The District Judge found and the record contains evidence

that the Detroit Board of Education practices in school con

struction generally tended to have segregative effect; the great

majority of schools were built in either overwhelming all

black or all white neighborhoods so that the new schools

opened as one race schools.

The District Judge’s school construction findings were as

follows:

Nos. 72-1809, 72-1814 Bradley, et al. v. Milliken, et al. 35

“In 1966 the defendant State Board of Education and

Michigan Civil Rights Commission issued a Joint Policy

Statement on Equality of Educational Opportunity, re

quiring that

‘Local school boards must consider the factor of racial

balance along with other educational considerations

in making decisions about selection of new school

sites, expansion of present facilities . . . . Each of

these situations presents an opportunity for inte

gration.’

Defendant State Board’s ‘School Plant Planning Hand

book’ requires that

‘Care in site locations must be taken if a serious

transportation problem exists or if housing patterns

in an area would result in a school largely segregated

on racial, ethnic, or socio-economic lines.’

The defendant City Board has paid little heed to these

statements and guidelines. The State defendants have

similarly failed to take any action to effectuate these

policies. Exhibit NN reflects construction (new or ad

ditional) at 14 schools which opened for use in 1970-71;

of these 14 schools, 11 opened over 90% black and one

opened less than 10% black. School construction costing

$9,222,000 is opening at Northwestern High School which

is 99.9% black, and new construction opens at Brooks

Junior High, which is 1.5% black, at a cost of $2,500,000.

The construction at Brooks Junior High plays a dual seg-

regatory role: not only is the construction segregated, it

will result in a feeder pattern change which will remove

the last majority white school from the already almost

all-black Mackenzie High School attendance area.

“Since 1959 the Board has constructed at least 13 small

primary schools with capacities of from 300 to 400 pupils.

This practice negates opportunities to integrate, ‘con

tains’ the black population and perpetuates and com

pounds school segregation.” 338 F.Supp. at 588-89.

36 Bradley, et al. v. Milliken, et al. Nos. 72-1809, 72-1814

Other cases in which such findings have been held to con

stitute a de jure act of segregation include: Swann v. Charlotte-

M ecklenburg Board o f Education, 402 U.S. 1, 21 (1971);

Cisneros v. Corpus Christi Independent School Dist., — F.2d

— (5th Cir. 1972), cert, applied for, 41 U.S.L.W. 3255 (Oct.

31, 1972); Kelly v. Guinn, 456 F.2d 100 (9th Cir. 1972),

petition for cert, filed, 41 U.S.L.W. 3114 (U.S. Aug. 28, 1972);

Davis v. School District o f Pontiac, 443 F.2d 573, 576 (6th

Cir.), cert, den ied 402 U.S. 913 (1971); Sloan v. Tenth School

District, 433 F.2d 587, 590 ( 6th Cir. 1970); United States

v. Board o f Education o f Tulsa, 429 F.2d 1253, 1259 (10th

Cir. 1970); Brewer v. School Board o f N orfolk, 397 F.2d

37, 42 ( 4th Cir. 1968); United States v. Board o f Public

Instruction, 395 F.2d 66, 69 (5th Cir. 1968); Kelley v. Alt-

heimer, Arkansas Public School Dist. No. 22, 378 F.2d 483,

496-97 (8th Cir. 1967); Johnson v. San Francisco Unified School

District, 339 F.Supp. 1315, 1326, 1341 (N.D. Cal. 1971);

United States v. Board of School Commissioners o f Indianapolis,

332 F.Supp. 655 ( S.D. Ind. 1971); Spangler v. Pasadena City

Board o f Education, 311 F.Supp. 501, 522 (C.D. Cal. 1970);

United States v. School District 151, 286 F.Supp. 786, 798

(N.D. 111.), a f d , 404 F.2d 1125 (7th Cir. 1968); L ee v. Macon

County Board o f Education, 267 F.Supp. 458, 472 (M.D. Ala.),

aff’d per curiam sub nom., W allace v. United States, 389 U.S.

215 (1967).

Record evidence pertaining to Detroit Board of Education

building construction practices and their results include:

“Q. Doctor Foster, I show you a document in evi

dence, Plaintiff’s Exhibit 70. I direct your attention to

page 15 of the exhibit. The exhibit is School Planning

Handbook, Bulletin 412, revised, January, 1970, Michigan

Department of Education. Directing your attention to

Chapter 2, the School Site, and the last full paragraph in

the left-hand column on page 15, Doctor, would you read

that paragraph?

“A. ‘Care in site location must be taken if a serious