Bates v. Batte Brief for Appellants

Public Court Documents

June 1, 1950

Cite this item

-

Brief Collection, LDF Court Filings. Bates v. Batte Brief for Appellants, 1950. e51dd2f3-c29a-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/f6119bda-964e-4c82-aaac-c13700295c7c/bates-v-batte-brief-for-appellants. Accessed February 22, 2026.

Copied!

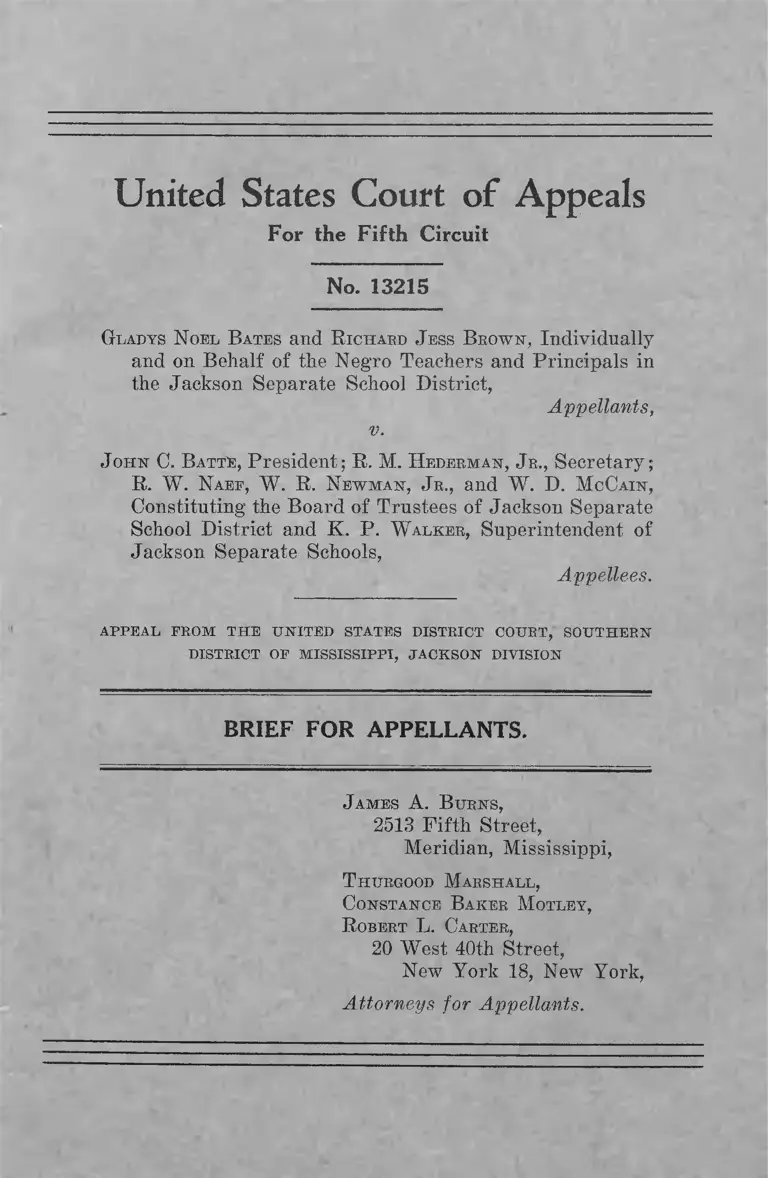

United States Court of Appeals

For the F ifth Circuit

No. 13215

G ladys N oel B ates and R ichard J ess B ro w n , Individually

and on Behalf of the Negro Teachers and Principals in

the Jackson Separate School District,

Appellants,

v.

J o h n C. B a tte , President; R. M . H ederm an , J r ., Secretary;

R. W. N a ef , W. R. N ew m a n , J r ., and W. D. M cCa in ,

Constituting the Board of Trustees of Jackson Separate

School District and K. P. W alker , Superintendent of

Jackson Separate Schools,

Appellees.

a p p e a l p r o m t h e u n i t e d s t a t e s d i s t r i c t c o u r t , s o u t h e r n

D ISTR IC T OP M IS S IS S IP P I, JA C K S O N D IV ISIO N

BRIEF FOR APPELLANTS.

J ames A. B u r n s ,

2513 Fifth Street,

Meridian, Mississippi,

T hubgood M arshall ,

C onstance B aker M otley ,

R obert L. Carter,

20 West 40th Street,

New York 18, New York,

Attorneys for Appellants.

TA BLE OF C O NTENTS

PAGE

Statement of the Case_________________________ 1

Statement of F acts____________________________ 4

Questions Presented___________________________ 5

Specification of Errors ________________________ 6

A rg u m en t :

I. Neither the County Superintendent nor the State

Board of Education has statutory authority to

grant appellants the relief herein sought ____ 6

The State Board of Education _____________ 7

The County Superintendent of Education ____ 9

The Administrative Appeals Provided Under

the Statutes __________________________ 10

This Is Not a Controversy Arising Under Mis

sissippi School Laws __________________ 12

II. Administrative remedies need not be exhausted

unless pursuit of remedy is found to be man

datory ________________________________ 13

III. Appeal to the County Superintendent and to the

State Board of Education would he a futile

gesture ___________________ 16

IV. The administrative remedies provided under

Mississippi statutes are not adequate to protect

appellants’ rights and therefore need not be

pursued prior to resort to the federal courts___ 19

V. The decision of this Court in the Cook case did

not justify the trial court in dismissing appel

lants’ complaint_________________________ 23

VI. This case is not moot as to the original plaintiff 26

Conclusion __________________________________ 29

Certificate of Service__________________________ 30

Appendix ___________________________________ 31

11

T ab le o f C ases

PAGE

Aircraft & Diesel Equipment Corp. v. Hirsch, 331 IT. S.

752 ______________________________________ 21

Alton v. School Board of Norfolk, 112 F. 2d 992 (C.

C. A. 4th 1940) cert, denied 311 U. S. 693 _______ 17

Ashley, et al. v. School Board of Gloucester Co., 82 F.

Supp. 167 (E. D. Va. 1948) __________________ 17

Bacon v. Rutland R . R. Co., 232 U. S. 134__________ 15

Banton v. Belt Line R. R., 268 U. S. 413____________ 15

Brown v. Owen, 75 Miss. 319, 23 So. 35____________ 14

City of Louisville v. Greer, 166 Miss. 554,148 So. 356 .... 14

Clark, et al. v. Board of Trustees of Loper Line Con

solidated School District, 117 Miss. 234, 78 So. 145.... 14

Cook v. Davis, 178 F. 2d 595 ________ 3, 5,11, 23, 24, 25, 26

Davis v. Cook, 80 F. Supp. 443 (N. D. Ga. 1948)_____ 17

Euclid v. Amber Realty, 272 IT. S. 365 ____________13,16

Federal Trade Comm. v. Goodyear, 304 IT. S. 257 ____ 28

Freeman v. County School Board of Chesterfield

County, 82 F. Supp. 167 (E. D. Va, 1948) _______ 17

Hobbs v. Germany, 94 Miss. 469, 49 So. 515________ 14

Hollis v. Kutz, 255 H. S. 452 _____________________ 15

Lander v. Tolbert, 121 Miss. 592, 83 So. 748 _______ 10

McDaniel v. Board of Public Instruction, 39 F. Supp.

638 (N. D. Fla. 1941) ______________________ 17

Mills v. Board of Education of Anne Arundel Countv,

30 F. Supp. 245 (D. Md. 1939) _______________ 17

Ill

PAGE

Mills v. Lowndes, 26 F. Supp. 792 (D. Md. 1939) ____ 17

Montana National Bank v. Yellowstone County, 276

U. S. 499_________________________________ 16,18

Moore v. Illinois Central Railway Co., 312 U. S. 630 __ 15

Moreau v. Grandich, 114 Miss. 560, 75 So. 434 ______ 14

Morgan v. United States, 304 U. S. 1 ______________ 22

Morgan v. United States, 289 U. S. 468_____________ 22

Morris v. Williams, 149 F. 2d 703 (C. C. A. 8th 1945)_ 17

National Labor Relations Board v. Penn (1. Lines, 303

U. S. 261 _________________________________ 28

Oklahoma Natural Gas Co. v. Russell, 261 U. S. 290___ 21

Pacific Telephone & Telegraph Co. v. Kuykendall, 265

U. S. 196 _________________________________ 21

Peterson Baking Co. v. Bryan, 290 U. S. 570 _______ 16

Porter v. Investors Syndicate, 286 U. S. 461________ 21

Rice v. Gong Lum, 139 Miss. 760, 104 So. 107_______ 14

St. Joseph Stockyard Co. v. United States, 298 U. S. 38„ 22

Slocum v. Delaware Lackawanna Western Railway

Company, October Term 1949, dec. April 10, 1950_ 15

Smith v. Illinois Bell Telephone Co., 270 U. S. 587____ 19

Smith v. Cahoon, 283 U. S. 553„_________________ 13,16

Smith, et al. v. School Board of King George County,

82 F. Supp. 167 (E. D. Va. 1948)_______________ 17

Smithmeyer v. United States, 147 U. S. 342_________ 15

State, ex rel. Baria v. Alexander, 158 Miss. 557, 130 So.

754 _____________________________________ 14

State, ex rel. Cowan v. Morgan, 141 Miss. 585, 106 So.

820 14

iv

PAGE

State, ex rel. Plunkett, et al. v. Miller, 162 Miss. 149,137

So. 737 ___________________________________ 14

Steele v. Louisville & N. R. Co., 323 U. S. 192_______13,16

Taylor v. State, 83 So. 810______________________ 14

Tunstall v. Brotherhood of Locomotive Firemen & En-

ginemen, 323 U. S. 210.______________________ 13

Turner v. Keefe, 50 F. Supp. 647 (S. D. Fla. 1943)___ 17

United States v. Abilene, 265 U. S. 274_____________ 21

United States v. Aluminum Co. of America, 148 Fed.

2d 416 (C. C. A. 2d 1945)......___________________ 27

United States v. Knox, 128 U. S. 230:_____________ 15

United States v. Masonite Corp., 316 U. S. 265_______ 28

United States v. Trans Missouri Freight Association,

106 U. S. 290_______________ ....______________ 28

United States v. Vehicular Parking, 52 F. Supp. 749

(D. Del. 1943)______________________________ 28

Vandalia R. Co. v. Public Service Commission, 242 U. S.

255 --------------------------------------------------------- 22

Vanzandt v. Braxton, 194 Miss. 863, 14 So. 2d 222____ 10

Walling v. Helmerich, 323 U. S. 37, 42______________ 28

Waite v. Macy, 246 U. S. 606________________ ...___ 16

Whitman v. Owen, 76 Miss. 783, 25 So. 669__________ 14

Yakus v. United States, 321 U. S. 414______________ 22

Statutory A u thorities

PAGE

Mississippi Code, 1942 and 1948 Supplement

Section 6217______________ 31

Section 6218 31

Section 6219 32

Section 6232.11 ___________ ________________ 33

Section 6232.12 ___________ _______ ________ 34

Section 6232.13 ________________ 35

Section 6232.14 ________________ 35

Section 6232.15 36

Section 6234 ___________________10,11,12,13, 21, 36

Section 6235 ________________ 36

Section 6236 37

Section 6237 ________________ 37

Section 6238 ______________________________ 37

Section 6245.01 ________________ 38

Section 6245.02 ______________ 38

Section 6245.03 _______ ____ 39

Section 6245.04 ______________ 39

Section 6245.05 39

Section 6245.07 ___________ _______ 10,11,12,18, 40

Section 6245.08 ______________ 43

Section 6258 _______________ 45

Section 6259 9.45

Section 6260 ________ 50

Section 6261 ________ ______ _______ 11,12,13, 21, 50

Section 6262 ______________ 51

VI

PAGE

Section 6263 ______________________________ 51

Section 6264.5______________ _______________10,51

Section 6281 ______________________________ 52

Section 6282 ______________________________ 53

Section 6283 _______________________________ 53

Section 6284 ______________________________ g? 55

Section 6290 ______________________________ 55

Section 6295 ______________________________ 7 ̂55

Section 6411_____________________________ j , 57

Section 6416____________________________ 7 57

Section 6418_________________ 7

Section 6422 ______________________________ 59

Section 6423 ________________________ _____ g 9

Section 6527 __________________________ 65

Section 6528 _______________________ 66

Section 6541 ______________________ 67

Section 6542 ______________________________ 68

Section 6543 _____________________________ 68

Section 6558 _______________________ 69

Section 6569 _______________________ 71

Section 6570 ______________________ 72

Section 6571 _____________________ 72

Section 6572 _______________________ 25 73

Section 6574 ___________________ ____ 74

Georgia Code Annotated

Section 32-613 ____ _________________ 24

U n i t e d S ta t e s C o u r t of A p p e a ls

For th e F ifth Circuit

N o. 13215

G ladys N oel B ates and R ichard J ess B row n , Individually

and on Behalf of the Negro Teachers and Principals in

the Jackson Separate School District,

Appellants,

v.

J o h n C. B atte , President; R . M . H ederm an , J r., Secretary;

R. W. N aee, W. R. N ew m a n , J r., and W. D. M cCa in ,

Constituting the Board of Trustees of Jackson Separate

School District and K. P. W a lk er , Superintendent of

Jackson Separate Schools,

Appellants.

BRIEF FOR APPELLANTS.

Statem ent of the Case.

On February 7, 1948, appellant, Gladys Noel Bates, the

original plaintiff in this action, filed a petition with appel

lees on behalf of herself and other Negro teachers and prin

cipals in the public school system of Jackson, Mississippi,

requesting appellees to cease discriminating against Negro

teachers and principals in the payment of salaries (R. 66-

67). Appellees, in reply, advised appellant that they had

no knowledge that any such discrimination existed (R. 89).

On March 4, 1948, appellant filed a complaint in the

court below on behalf of herself and other Negro teachers

and principals alleging that they were receiving less salary

2

than was paid to white teachers and principals, possessing

the same qualifications, certificates and experience and per

forming substantially the same duties—all in violation of

the equal protection clause of the Fourteenth A mea (1 itien!

to the Constitution of the United States (E. 3-15).

On Mamr5, 1948, appellees moved to dismiss, the prin

cipal basis of which was that appellant had failed to ex

haust administrative remedies provided under state stat

utes, and that, therefore, court action was premature (R.

16-17). This motion was denied on December 20, 1948 (E.

18). On February 15, 1949, appellees filed their answer

(R. 19-38) and moved for summary judgment (R. 19), which

motion was denied on July 15,1949 (E. 61).

In the meantime, appellees failed to renew their contract

with Mrs. Bates because of her participation in this suit

(R. 163, 244). On May 9, 1949, appellant, Richard Jess

Brown, filed a motion to intervene as a party-plaintiff to

remove the possibility of this suit being declared moot in

view of Mrs. Bates’ non-teacher status (R. 44). This mo

tion was granted on December 12, 1949 (R. 66).

The cause came to trial on December 12, 1949. Before

proceeding with the taking of testimony, the trial court

again ruled out as a defense the allegation by appellees that

appellants had failed to exhaust administrative remedies.

The court ruled that the administrative remedies provided

were inadequate and had reference to controversies arising

under the school laws of the State of Mississippi; that this

controversy arose not under school laws of Mississippi but

under the Constitution of the United States and that, there

fore, the statutory provisions which appellees contended

should have been pursued were not applicable. Hence, it

held that appellants were not barred from seeking immedi

ate relief in the federal courts (R. 63-64).

3

After trial, but before judgment, this Court decided

Cook v. Davis, 178 F. 2d 595. On February 22, 1950, the

court below entered final judgment dismissing the complaint

without prejudice on the grounds that the decision of this

Court in that case was conclusive (R. 257); and that even

though it was still of the opinion that the remedies provided

under Mississippi statutes were inadequate, in view of the

decision in the Cook case, it was forced to rule that the

failure of appellants to appeal to the County Superinten

dent and State Board of Education prior to bringing the

instant action made the cause unripe for judicial determina

tion (R. 253, 256).

The trial court entered findings of fact and conclusions

of law in order that this Court might have the whole case

before it on appeal (R. 253). It found that the wide differ

ential between the salaries paid to Negro teachers and prin

cipals and those paid to white teachers and principals in the

Jackson public schools could only have resulted from racial

discrimination in violation of the equal protection clause of

the Fourteenth Amendment (R. 248). It further found that

as to appellants, Gladys Noel Bates and Richard Jess

Brown, that they were being paid less salary than white

teachers of equal qualifications and experience and perform

ing substantially the same functions (R. 247). The Court

further held that the failure of appellees to renew the con

tract of Mrs. Bates was not illegal (R. 256-257), in spite of

the fact that evidence was produced at the trial to show that

Mrs. Bates had not been reemployed solely because of her

participation in the action (R. 136, 137, 159, 162, 163, 164).

~ V \/V ^ A -cA ~ '—

Notice of appeal was filed on February 20,1950 (R. 258),

and notice that the record was in final form was received on

May 5, 1950.

4

Statem ent of Facts.

We do not believe it necessary to go into a detailed

statement of the factual evidence which appellants pre

sented to show the existence of discrimination in the pay

ment of teachers’ salaries, in that the court below found

that the differential which existed could have resulted only

from racial discrimination and that question is not before

this Court. We will, however, briefly touch upon some of

the evidentiary facts presented in order to give this Court

a fuller picture of the case.

Appellees freely admitted that Negro teachers were paid

less salary than white teachers (E. 69, 79,106, 208, 210, 212),

and that as to character, professional qualifications and

academic training there was no difference between Negro

and white teachers (E. 113-114). It is a fair appraisal of

the testimony to state that appellees attempted to justify

the higher pay to white teachers on the grounds that they

were better able to use their training and organize their

work and were further advanced culturally than were Negro

teachers and principals. The Superintendent of Schools

was unable to name one Negro teacher or principal who

compared favorably with white teachers (E. 154).

Appellants had a highly qualified statistician make a

detailed analysis of all available records of the entire

teacher population of the public schools of Jackson. These

findings are contained in Exhibit #9, which was transmitted

to this Court in its original form as a part of this record

(E. 261). This study reveals that although Negro teachers

compared favorably with white teachers in experience,

training and types of certificates held, their rate of compen

sation was far below that of the white teacher in every

category and at every level in the public school system.

For example, as between white principals and Negro prin-

5

cipals at the senior high school level, there was a salary

differential of 110 percent (R. 187); at the junior high

school level, 111.54 percent (R. 187); at the elementary

school level, 81.32 percent (E. 187). As between white and

Negro teachers at the senior high school level, the differen

tial was 57.65 percent (E. 187); at the junior high school

level, 46.40 percent (E. 187); and at the elementary school

level, 53.30 percent (R. 187V These facts were not dis

puted by appellees. The trial court fuuuu that appeHarrts1

and other Negro teachers and principals were being dis

criminated against in the payment of salaries and, except

for the decision .ofAhis ©onrt in Cook v. Davis, would have

entered judgment for appellants. f < A-'. ! - ,

Questions Presented.

I.

W hether appellants were required to first appeal to

the County Superintendent and State Board of Educa

tion as a condition precedent to invoking federal equity

jurisdiction.

II.

W hether having found that appellants were entitled

to judgm ent on the merits, the trial court was correct

in holding on authority of Cook v. Davis that appellants

could not obtain federal relief until an appeal had been

taken to the County Superintendent and State Board

of Education.

III.

W hether this case is moot as to the original plaintiff,

Gladys Noel Bates.

6

Specification o f Errors.

1. The trial court erred in dism issing the com

plaint on the grounds that appellants should have first

appealed to the County Superintendent and State

Board of Education of M ississippi.

2. The trial court erred in holding that appellees

had the authority to dismiss appellant Gladys Noel

Bates w ithout cause and that her dism issal even though

resulting from her participation in this action was

therefore not illegal and rendered the case moot as

to her.

3. The trial court erred in refusing to follow its

original decision denying the motion to dismiss and the

motion for summary judgm ent on the ground that the

adm inistrative rem edies provided were inadequate to

grant com plete relief and inapplicable to appellants’

cause of action.

A R G U M E N T .

I.

Neither the County Superintendent nor the State

Board of Education has statutory authority to grant

appellants the relief herein sought.

A reading of the statutes defining the powers and duties

of the State Board of Education, State Superintendent of

Education, County Superintendents of Education and Boards

of Trustees of Separate School Districts compels the con

clusion, we submit, that appellees have exclusive authority

to fix and determine the salaries of teachers employed by

them and that no other state agency has any power to order

7

appellees to adopt a salary schedule different from that

which is presently being* enforced. [All statutes referred

to herein are set forth in Appendix.]

Except for Kirby Walker, Superintendent of Schools,

appellees herein constitute the Board of Trustees of a Sepa

rate School District as defined by the laws of the State of

Mississippi. Miss. Code, 1942, Section 6295(4) and Section

6411. They have been granted exclusive power to fix the

salaries of teachers elected by them to teach in the public

schools of Jackson, Mississippi. Miss. Code, 942, Section

6423. The funds with which to pay salaries and maintain

the public school system of Jackson are provided by vari

ous tax levies of the municipality and/or a territory of

which a separate school district may be composed, in addi

tion to the state common school fund which the state main

tains to support public schools. Miss. Code, 1942, Sections

6416, 6418, 6219.

The trial court found that the appellees had exclusive

authority to determine teachers’ salaries (R. 249, 250), and

that they could refuse to reelect a teacher without any rea

son whatsoever (R. 256). These findings alone, we submit,

properly compel the conclusion that neither the County

Superintendent nor the State Board of Education has the

power to order appellees to cease the practices upon which

the instant complaint is based.

T h e S ta te Board o f E ducation .

A reading of the Mississippi statutes indicates clearly

an intent on the part of the legislature to retain control of

public schools systems in the hands of local officials. Final

authority is vested not in the State Board of Education but

in County Superintendents and Boards of Trustees of Sepa

rate School Districts. The main function of the State Board

8

of Education is to insure a uniform public school system

throughout the state.

The Trustees of Separate School Districts have exclu

sive power with respect to all school matters concerning

the schools of their district except (1) the making and

enforcing of rules for the government of schools which are

inconsistent with law or those prescribed by the State Board

of Education; (2) contracting with unlicensed teachers;

(3) paying teachers when school is closed without the ap

proval of the State Board of Education; and (4) enforcing

a course of study and use of textbooks other than those

adopted by proper authority. Miss. Code, 1942, Section

6423. Nowhere is the State Board of Education given any

authority with respect to teachers’ salaries except under

Section 6572 of the Miss. Code of 1942 which authorizes the

State Board of Education to prescribe reasonable rules and

regulations for the fixing of teachers’ salaries in those

counties or districts whose schools are maintained in part

out of the state equalization funds. These are state appro

priations for the specific purpose of equalizing “ educational

advantages of the different counties by maintaining public

high schools, and for the extension of common free schools

beyond the four-month term”. Appellees have not alleged

at any point in this case that they participate in this fund,

and such participation is highly unlikely in view of the fact

that the purpose of this fund is to bring the educational

advantages of children in poorer counties up to those of

the wealthier counties. Jackson is the capital, the largest

and wealthiest municipality in the state. Its school system

ranks among the best in Mississippi. The State Board of

Education has no statutory authority, therefore, to control

or to review the action of appellees in determining the sal

aries of teachers employed in the public schools of Jackson

Separate School District.

9

T h e C ounty Superin ten d en t o f Education .

The County Superintendent is granted authority to em

ploy teachers recommended by local trustees and to contract

with them and fix their salaries except “ as otherwise

authorized by law”. Miss. Code, 1942, Section 6259. Sec

tion 6423, as we have shown, however, vests such authority

with respect to separate school districts in the Board of

Trustees. These two provisions are not in conflict but are

mutually exclusive and can only be interpreted to mean that

the legislature intended separate school districts to operate

independently of the authority of the County Superinten

dent. Pursuant to Miss. Code, 1942, Section 6284, the

County Superintendent, and pursuant to Miss. Code, 1942,

Section 6423, the Board of Trustees of Separate School

Districts, are required to “ take into consideration the

character, academic and professional training, executive

ability and teaching capacity of the teacher” in fixing the

salaries of teachers within their respective jurisdictions.

The only connection between the County Superintendent

and a Board of Trustees of a Separate School District with

respect to salaries provided by statute is that the latter

may write orders to the City Clerk or the County Superin

tendent to issue warrants or to pay certificates on any

available school funds for the use of the separate school

district. Miss. Code, 1942, Section 6423. In addition, sepa

rate school districts are required to make a report to the

County Superintendent of all expenses in the district for

educational purposes to conform to the financial report re

quired by the State Board of Education. Miss. Code, 1942,

Section 6423.

It seems clear, therefore, that it was the intent of the

legislature that Separate School Districts should operate

independently of the County Superintendent and the Su-

10

preme Court of Mississippi has so held.1 See Lander v.

Tolbert, 121 Miss. 592, 83 So. 748; Vanzamdt v. Braxton, 194

Miss. 863, 14 So. 2d 222.

T h e A d m in istrative A p p ea ls Provided

U nder th e Statutes.

The following statutory provisions relate to appeals to

County Superintendents, State Superintendent and State

Board of Education and it is upon these provisions that

appellees rely:

Miss. Code, 1942

“ Section 6234—To Decide Appeals. The Board

of Education shall decide all appeals from the de

cisions of the county superintendent or from the de

cisions of the state superintendent ; but all matters

relating to appeals shall be presented in writing;

and the decision of the board shall be final.

“ Section 6245-07— (Laws, 1946, Chapter 297).

(9) To advise the county superintendents upon all

matters involving the welfare of the schools, and at

the request of any county superintendent to give his

opinion upon a written statement of facts on all ques

tions and controversies arising out of the interpre

tation and construction of the school laws, in regard

to rights, powers and duties of school officers and

county superintendents, and to keep a record of all

such decisions. Before giving any opinion, the super

intendent may submit the statement of facts to the

1 Section 6264.5 requires the County Superintendent and the

Superintendent of Schools of Separate School Districts to file reports

with the State Board of Education showing for each school in the

county oy separate school district the name of the school, the name,

sex, training, experience, salary and any other information deemed

necessary by the state board of education, of each teacher in the

school. This provision is another indicia of the coequal status of

the Board of 1 rustees of Separate School Districts and the County

Superintendents of Education.

11

attorney general for his advice thereon, and it shall

be the duty of the attorney general forthwith to ex

amine such statement, and suggest the proper deci

sion to be made upon such facts.

“ Section 6261—To Settle Disputes in Schools.

In all controversies arising under the school law the

opinion and advice of the county superintendent shall

first be sought. From his decision an appeal may be

taken to the state board of education upon a written

statement of facts, certified by the county superin

tendent or by the secretary of the board of trustees. ’ ’

Section 6245-07 is not pertinent in that it may be in

voked by the County Superintendent only and is not avail

able to a teacher unless the County Superintendent decides

to act under its provisions. Hence in considering the ques

tion of exhaustion of administrative remedies, this section

is not pertinent. See Cook v. Davis„ supra.

Section 6261 provides that the opinion and advice of the

County Superintendent must first be sought in all contro

versies arising under the school law, but that provision can

not be read out of context. It must necessarily relate to con

troversies over which the County Superintendent has au

thority to act, that is, controversies in schools and districts

under his control and supervision.

An appeal to the State Board of Education is provided

under Section 6234 from the decision of the County Super

intendent and the State Superintendent of Education. This

provision does not provide for an appeal from the decision

of the Board of Trustees of Separate School Districts and

must, therefore, relate to -such matters that are properly

handled under Section 6245-07 and Section 6261. We submit

that these two sections relate to controversies between

a County Superintendent and Trustees of School Dis

tricts within his jurisdiction and controversies among the

12

school districts over which the County Superintendent has

supervisory control. The statutes specifically permit and

empower separate school districts to operate as independent

and autonomous units outside of the control and jurisdic

tion of the County Superintendent.

The omission of reference to the Board of Trustees of

Separate School Districts from Section 6234 is, we submit,

fatal to appellees ’ contentions. It is clear that the legisla

ture of the State of Mississippi intended to vest full control

of the public school system within local school agencies.

Sections 6234, 6245-07 and 6261 were intended to provide for

an orderly disposition of disputes among various local

school districts over which the County Superintendent has

control and to enable such local boards to contest the deci

sion of the County Superintendent without the necessity of

a law suit. And these provisions relate solely to contro

versies arising in local school boards under the control and

jurisdiction of the County Superintendent. No such appeal

is provided from decisions of Boards of Trustees of Sep

arate School Districts, and their action is final.

In our view, therefore, these provisions have no relation

whatsoever to the Board of Trustees of Separate School

Districts, and the court below was in error in applying them

to appellants’ case. Thus we contend the County Superin

tendent and the State Board of Education have no statu

tory authority or jurisdiction to grant the relief herein

sought, and that no appeal from the decision of appellees is

provided under Mississippi statutes.

T his Is N ot a C ontroversy A risin g

U nder M ississippi School Laws.

These statutes have no relation to this cause of action

for an additional reason. Appellants allege merely that ap

pellees have discriminated against them in fixing salaries

13

solely because of race and color and have thereby violated

rights guaranteed under the Fourteenth Amendment to the

Federal Constitution. This case involves no controversy

or dispute under school laws since these laws could not em

power appellees to do the acts herein complained of. The

only way in which this could be considered a controversy

arising under the school laws would be (1) if the statutes

were construed as granting the appellees power to do the

acts herein complained of, or (2) if there was question as to

whether the statute attempted to empower appellees to dis

criminate because of race. In either case appellants by so

asserting would be directly attacking the constitutionality

of the statute under which appellees were operating and

therefore would not be required to pursue any administra

tive remedy provided thereunder. Cf. Smith v. Cahoon,

283 U. S. 553; Euclid v. Amber Realty, 272 U. S. 365; Steele

v. L. ■& N. R. R., 323 U. S. 192; Tunstall v. Brotherhood, of

Locomotive Firemen and Enginemen, 323 U. S. 210. Inter

pretation of the Constitution of the United States rather

than of the school laws of Mississippi is in issue in this case.

Therefore, we submit, the court below was in error in hold

ing that appellants were required to pursue administrative

remedies provided under the statutes.

II.

Adm inistrative rem edies need not be exhausted

unless pursuit of remedy is found to be mandatory.

Even if we are incorrect in our interpretation of the

import of Sections 6234 and 6261, and these provisions may

properly be construed as affording an administrative

remedy which is applicable here, still the trial court was

incorrect in holding that pursuit of the remedy provided

was a condition precedent to court action. This remedy is,

at most, a remedy which may be used as an alternative to

14

filing suit and has been so construed by the highest court

of the state. Moreau v. Grandich, 114 Miss. 560, 75 So. 434;

Hobbs v. Germany, 94 Miss. 469, 49 So. 515; Clark, et al. v.

Board of Trustees of Loper Line Consolidated School Dist.,

117 Miss. 234, 78 So. 145; State, ex rel. Plunkett, et al. v.

Miller, 162 Miss. 149, 137 So. 737; Brown v. Owen, 75 Miss.

319, 23 So. 35; State, ex rel. Cowan v. Morgan, 141 Miss.

585,106 So. 820; State, ex rel. Baria v. Alexander, 158 Miss.

557,130 So. 754; Whitman v. Owen, 76 Miss. 783, 25 So. 669;

Taylor v. State, 83 So. 810; Rice v. Gong Lum, 139 Miss. 760,

104 So. 107; City of Louisville v. Greer, 166 Miss. 554, 148

So. 356.

Thus the highest court of the state has held that the

remedy provided by the Mississippi Code for appeal to the

County Superintendent and then to the State Board of

Education with respect to all school matters is not an exclu

sive remedy and need not in any case be exhausted before

resort to the courts. In addition, the Supreme Court of

Mississippi has made clear that a claimant raising a sub

stantial question has a constitutionally protected right to

have his claim determined by a court of law rather than by

an administrative agency. The Mississippi Supreme Court

said in the Clark case, supra:

“ The courts are not closed to anyone aggrieved

because there may perchance be other tribunals or

other constituted authority, legislative or executive,

to which or to whom recourse may first be had. If

a man be wronged, if he be deprived of any right

conferred by law, however slight the wrong or dep

rivation may seem, he has his right of action in the

courts. Whether he has been the prey of unscrupu

lous private individuals, or the victim of misguided

public officials, there is no distinction or difference.

He may seek redress in a court of justice in either

event. In the latter case he is not compelled to ex-

15

haust Ms remedies by appeal to administrative au

thority before bringing his cause into court. He may

bring it in the first instance and there submit the

matter for adjudication. This is a right proceeding

from constitutional guarantees, and all efforts that

have ever been unwisely put forth to impair or cur

tail those guaranties have unfailingly shot their

mark before the formidable walls raised by that great

foundational instrument that preserves them for a

free people.”

One is not required under Mississippi law to follow statu

tory procedures providing for appeal to the County Super

intendent of Education and to the State Board of Educa

tion prior to seeking judicial intervention.

In Moore v. Illinois Central Railway Company, 312 U. S.

630, the Supreme Court of the United States held that use

of the administrative machinery was not a necessary pre

requisite to court action where the administrative remedy

provided was not mandatory but permissive. To the same

effect see Smithmeyer v. United States, 147 U. S. 342; Bacon

v. Rutland R. R. Co., 232 U. S. 134; United States v. Knox,

128 U. S. 230; Hollis v. Kutg, 255 U. S. 452; Ban-ton v. Belt

Line R. R., 268 U. S. 413. But see Slocum v. Delaware

Lackawanna Western Railway Company, October Term,

1949, decided April 10, 1950. Under Mississippi law the

statutory provisions providing for appeal to the County

Superintendent and the State Board of Education have

been similarly construed. Even if the trial court is correct

therefore in concluding that administrative machinery is

available to redress the wrongs of which appellants com

plain, since utilization of this machinery is not a necessary

prerequisite to court action, appellants were entitled to

federal relief without being first required to exhaust ad

ministrative remedies. We submit, therefore, that the judg

ment of the trial court was incorrect in dismissing this

16

complaint on the grounds that appellants had failed to ex

haust state administrative remedies since these remedies

were not mandatory in nature.

III.

A ppeal to the County Superintendent and to the

State Board o f Education would be a futile gesture.

Where utilization of the administrative process would

be futile or useless, one is not required to exhaust admin

istrative remedies prior to being entitled to seek relief in

the federal courts. Cf. Montana National Bank v. Yellow

stone County, 276 U. S. 499; Waite v. Macy, 246 U. S. 606;

Smith v. Cahoon, 283 U. S. 553; Euclid v. Amber Realty Co.,

272 U. S. 365; Steele v. Louisville & N. R. Co., 323 U. S. 192;

see also Peterson Baking Co. v. Bryan, 290 U. S. 570. Even

assuming arguendo, that the statutes providing an appeal

to the County Superintendent and State Board of Educa

tion govern this case, appellants would not be required to

pursue such remedies in that to do so would have been use

less and futile for the following reasons:

1. As we have stated, supra, under the statutory appeal

provisions upon which appellees rely, the jurisdiction of the

County Superintendent and State Board of Education is

confined to questions arising under the school laws of the

State of Mississippi. No such question is raised in this

case. Appellants do not contest the authority of appellees

to fix teachers’ salaries. Nor do they bring in issue the

validity of any provision of the school laws of Mississippi

or any question concerning their construction or interpreta

tion. They seek to correct a violation of their constitutional

rights which appellees have committed in paying to them

and the class they represent less salary than is paid to

17

white teachers solely because of race and color. The issues

here raised involve the interpretation and construction of

the Constitution of the United States. Mills v. Lowndes, 26

F. Supp. 792 (D. Md. 1939); Mills v. Board of Education of

Anne Arundel County, 30 F. Supp. 245 (D. Md. 1939);

Alton v. School Board of Norfolk, 112 F. 2d 992 (C. C. A.

4th 1940), cert, denied 311 U. S. 693; McDaniel v. Board of

Public Instruction, 39 F. Supp. 638 (N. D. Fla. 1941);

Turner v. Keefe, 50 F. Supp. 647 (S. D. Fla. 1943); Morris

v. Williams, 149 F. 2d 703 (C. C. A. 8th 1945); Davis v.

Cook, 80 F. Supp. 443 (N. D. G-a. 1948); Freeman v. County

School Board of Chesterfield County, 82 F. Supp. 167 (E. D.

Va. 1948); Cf. Smith, et al. v. School Board of King George

County, 82 F. Supp. 167 (E. D. Ya. 1948); Ashley, et al. v.

School Board of Gloucester County, 82 F. Supp. 167 (E. D.

Va. 1948).

As to these questions neither the County Superintendent

nor the State Board of Education has been granted any jur

isdiction or authority. For this reason an appeal to either

or both agencies would have been useless and futile in this

case.

2. As pointed out above, exclusive power to fix salaries

of teachers employed in the public schools of Jackson has

been delegated to appellees, the Board of Trustees of Jack-

son Separate School District. Neither the County Super

intendent nor the State Board of Education has any au

thority to tell appellees what rate of compensation it may

set for teachers employed in the public schools of Jackson.

Nor has the legislature granted to either agency authority

to review or correct the action of appellees in deciding what

salary a teacher may receive. The County Superintendent

and State Board of Education further have no enforce

ment power with respect to any action taken by appellees.

18

Therefore, as to the questions herein raised the agencies

to which appellees urge an appeal should have been first

made are without authority and wholly incompetent to act,

and an appeal to them would serve no useful purpose.

3. Appeal to these agencies would have been futile for

an additional reason. The State of Mississippi, by its At

torney General, without being named as a defendant in this

ease appeared specially and alleged by way of special an

swer (E. 39-41), among other things, that the appellees in

fixing appellants’ salaries “ did not fix their salary on race

and color, and such consideration did not affect the con

tracts” (E. 40). Such an allegation could have been made

only after investigation by state officials with respect to ap

pellants ’ complaint and obviously represents the legal opin

ion of the state since made by the Attorney General. The

State Superintendent of Schools is authorized to consult the

Attorney General on any question arising under the school

laws on which his opinion and advice is sought. Miss. Code,

1942, Section 6245-07, Laws, 1946. The opinion of the state’s

Attorney General in this case is now clear and on the record,

and is certainly binding upon the State Board of Education

and the County Superintendent. On appeal they must hold

that no discrimination has been practiced. Of. Montana

National Bank v. Yellowstone County, supra.

It would be futile, therefore, to now require appellants

to appeal to county or state officials before being entitled

to seek redress in the federal courts. The trial court, we

submit, was in error in refusing to grant appellants relief

to which he found them entitled because of their failure to

appeal to the County Superintendent and State Board of

Education.

19

IV.

The adm inistrative rem edies provided under Mis

sissippi statutes are not adequate to protect appellants’

rights and therefore need not be pursued prior to resort

to the federal courts.

The administrative remedies which the court below held

appellants had to pursue prior to instituting action in the

federal courts are patently inadequate to protect their

rights.

1. The provisions relied on do not provide any time

limit within which a decision must be rendered by the vari

ous administrative agencies. The injury to appellants is

immediate and continuing and has existed for a long period

of time. Neither the State Board of Education, nor the

County Superintendent is required to render a decision on

a matter appealed to them within any specified period, and

there is no protection against an unconscionable delay in

reaching decision. Almost two years elapsed between the

filing of this complaint in March, 1948 and judgment of the

court below in February, 1950. If appellants are now re

quired to appeal to the County Superintendent and then to

the State Board of Education many more years must be

consumed in an attempt to secure equal treatment to which

they are clearly entitled under the Constitution of the

United States. This is particularly true in view of the fact

that neither of the appellate agencies is required to render

a speedy decision. We believe that fact alone would entitle

appellants to by-pass the administrative process. See

Smith v. Illinois Bell Telephone Company, 270 U. S. 587.

2. The original plaintiff in this case filed her complaint

in March, 1948. Appellees failed and refused to renew her

20

contract for the ensuing 1948-1949 school year because of

her participation in this action. It thus became necessary

for another member of the class to intervene as party-

plaintiff. The trial court has ruled that appellees had au

thority to refuse to reelect appellant, Gladys Bates, without

cause and that because of their failure to renew her contract

her cause of action was moot. If appellees have this au

thority, it is to be expected that the contract of appellant,

Bichard Brown, who intervened as party-plaintiff will not

be renewed and that it will then be necessary for a third

member of the class to intervene to prevent the action from

being declared moot, and so on ad infinitum. Only a court

of equity could restrain the appellees from thus defeating

its jurisdiction. We submit, therefore, that the trial court

was in error in refusing to grant appellants relief sought

in this action.

3. Appellants are suffering irreparable injury. Until

appellees are required to cease discriminating against

Negro teachers in the payment of salaries, appellants and

the class they represent will continue to sustain serious

financial loss.

The total annual differential between the salaries paid

to Negro and white teachers based on the arithmetic mean

of all salaries is $106,905.46 at the present time (B. 185).

If this is multiplied by the number of years it may take

appellants to obtain relief, it is clear that the injury to

them and the class they represent, in monetary terms,

would be well over half a million dollars. If multiplied

further by the number of years appellants and the members

of their class have been suffering this injury, that is, the

total number of years of employment in the public schools

of Jackson, it is clear that their monetary damages will

exceed several millions of dollars. Such a sum, obviously

could not be recovered without serious financial dislocation,

21

if not complete financial ruin, to the public school system in

Jackson. Appellants are obliged therefore to forego any

such recovery and are constrained to seek the most expe

ditious means of redress, injunctive relief. Such relief will

not remedy past injury but will operate only to restrain

future conduct. Thus the longer the delay in obtaining

injunctive relief, the greater becomes appellants irrepara

ble damages.

The United States Supreme Court has consistently held

that the requirement that administrative remedies be ex

hausted prior to resort to federal courts would be dispensed

with where there was present a constitutional question, a

showing of the inadequacy of the prescribed administrative

remedy and a threat of irreparable injury flowing from the

delay incident to pursuit of the administrative process.

Aircraft & Diesel Equipment Corp. v. Hirsch, 331 U. S. 752;

Oklahoma Natural Gas Company v. Russell, 261 U. S. 290;

United States v. Abilene, 265 U. S. 274; Pacific Telephone &

Telegraph Company v. Kuykendall, 265 U. S. 196; Porter v.

Investors Syndicate, 286 U. S. 461. This rule has been most

frequently applied with respect to state administrative ac

tion, Aircraft & Diesel Equipment Corp. v. Hirsch, supra,

note 38 at page 773, and is properly applicable to this case.

4. If the County Superintendent and State Board of

Education were to review the action of the appellee board,

all the former could do is give “ opinion and advice”, and

all the latter can do is to decide appeals from decisions of

the former. Miss. Code, 1942, Sections 6234 and 6261.

Neither is expressly nor impliedly empowered to order ap

pellees to desist their discriminatory practices. Neither can

compel adherence to its decision by threat of withholding

funds, because no such authority has been granted and be

cause of the independence and autonomy of separate school

22

districts. Neither can remove recalcitrant school officials

from office.2 In short, no enforcement powers have been

delegated to either the County Superintendent or the State

Board. They could act simply in an advisory capacity with

respect to the questions here presented. An appeal to them,

therefore, could not possibly be an effective means for ap

pellants to obtain redress.

5. The guarantees of due process are completely lacking

in these sections. There is no provision for a hearing be

fore any person or body. No provision is made for the

calling of witnesses, cross examination, representation by

counsel, presentation of evidence or filing of objections to

findings made by any officer. There is lacking in the ad

ministrative remedies provided any guarantee of the mini

mum requirements of due process. This is fatal and clearly

entitles appellants to forego pursuing the administrative

remedy and seek immediate relief in the federal courts.

Cf. Morgan v. United States, 289 U. S. 468; Morgan v.

United States, 304 U. S. 1; Yakus v. United States, 321 U. 8 .

414; St. Joseph Stockyard v. United States, 298 U. 8 . 38;

Vandalia R. Co. v. Public Service Commission, 242 U. S. 255.

For these reasons, we submit the administrative rem

edies provided under Mississippi statutes, even assuming

the court below was correct in construing them as appli

cable to appellants ’ cause of action, are inadequate to grant

the relief herein sought. Appellants, therefore, are entitled

to seek the intervention of the federal courts without first

appealing to the County Superintendent and State Board

of Education.

2 Under Section 306, for example, of the Education Law of New

York (McKinney’s) the Commisioner of Education has power to

remove school officers and withhold state funds when his orders on

appeal are not followed. The Mississippi State Board of Education

has no such authority.

23

V.

The decision of this Court in the Cook case did not

justify the trial court in dism issing appellants’ com

plaint.

We believe the court below was in error in basing the

dismissal of this action on Cook v. Davis, supra. That de

cision did not extend or expand the situations in which ex

haustion of administrative remedies are required. This

Court merely held there that administrative remedies were

available under Georgia law which, if invoked, might have

afforded complete relief. That is not true in this case. We

do not have here any problem as to whether appellant

should have appealed to the local Board of Education as

was true in the Cook case.

In that case after the institution of the action in the

federal courts, the Atlanta Board of Education adopted a

new salary schedule and instituted a procedure whereby a

dissatisfied teacher could appeal her placement on the

schedule and her salary to the Atlanta Board of Educa

tion. This Court felt that under this procedure the Super

intendent of Schools made the initial placement on the

schedule independently of the Atlanta Board of Trustees,

and that any mistake which the Superintendent initially

made could be corrected by the Atlanta Board of Education.

There is no such procedure in this case. Here there is no

question but that the Board of Trustees of Jackson Sepa

rate School District has exclusive and final authority to

fix salaries. Prior to the institution of this action, appellant

petitioned the Superintendent of Schools and the Board of

Trustees of the Jackson Separate System to cease dis

criminating against Negro teachers in the payment of sal

aries. Appellees met, discussed the petition and denied

that any such discrimination existed. Therefore, insofar

24

as the Board of Trustees is concerned, the plaintiff has

done all that she could possibly do to get the Board to cor

rect the wrong herein complained of prior to the institution

of court action. Thus, the only question is whether appel

lants should have appealed to the County Superintendent

and State Board of Education as this Court felt should

have been done in Cook v. Davis, supra, prior to bringing

the action in the federal courts.

In Cook v. Davis, the State Board of Education not only

has general supervisory power over the public school sys

tem of the State of Georgia as the State Board of Educa

tion has in Mississippi, but it also has additional authority

with respect to the payment of teachers ’ salaries which, we

submit, is far different from the authority wdiich the State

Board of Education holds in Mississippi. Under Section

32-613 of the Georgia Code Ann., the State Board of Edu

cation is authorized to fix a schedule of minimum salaries

to be paid to teachers out of public school funds of the

state, and although local boards may supplement this salary,

they are bound to pay every teacher employed at least the

minimum salary which the State Board establishes. Further,

the State Board of Education is authorized to pay out to

every appropriate School Board state funds for the pay

ment of teachers’ salaries based upon the various classifi

cations which it establishes. Thus, in Georgia the State

Board of Education must decide the minimum number of

teachers which each local Board may employ, and the mini

mum salary rates which it must pay to each teacher. It

disburses public funds to the various local Boards on the

basis of this minimum standard, and in so doing it has

established dual minimum salary schedules for the payment

of Negro and white teachers with Negro teachers receiving

less salary than paid to whites.

25

This Court found that the Atlanta Board of Education,

which previously had paid salaries under a dual schedule

with a lower salary schedule for Negroes of equal qualifica

tions and experience, had abandoned this dual system and

had adopted a single salary schedule under which the sala

ries of the Negro teachers were raised approximately $10 per

month and that of the white teachers approximately $2 per

month. These raises had, apparently, remedied the initial

discrimination resulting from the salary schedule of the

State Board of Education. The Atlanta Board of Educa

tion contended that any differential which existed was the

fault of the State Board of Education. This Court felt that

the Atlanta Board was required to pay out the state funds

on the basis of the discriminatory state salary schedule, and

that, therefore, the discrimination complained of was not

totally the result of the action of the local Board but was due

to the State Board of Education. It was felt, therefore, that

a request should have been made of the State Board of Edu

cation that it cease setting discriminatory salary schedules

in the disbursement of state funds before federal action was

commenced. If this had been done the wrong complained

of might have been corrected and resort to federal courts

might have been rendered unnecessary. Cook v. Davis,

supra, pages 600, 601.

There is no such problem in this case. The State Board

of Education of Mississippi has no power to determine

teachers’ salaries.3 It distributes the state common school

fund on a per capita basis and has no authority to tell a

school board using this fund what rate of pay it must pay its

teachers. Unlike Georgia’s State Board of Education, it may

not even determine, under the statute, what part of these

8 It is empowered under Section 6572 to make reasonable rules

and regulations for the fixing of teachers’ salaries in those areas where

the schools are supported out of the state’s equalization fund. As we

had stated previously this is not applicable to appellees.

26

funds may be used for teachers’ salaries and what part may

be used for the maintenance of various other school activi

ties and school facilities. Nor has it adopted a discrimina

tory salary schedule, since it has no power to adopt any

schedule whatsoever.

We do not, therefore, have the problem of the State

Board of Education in Mississippi being guilty of causing

discrimination in payment of salaries by distributing state

funds for payment of salaries under a salary schedule estab

lishing a lower rate of pay for Negro than for white teach

ers. Here there is no question but that state funds which

are received pass into the exclusive control of the local

board. No limitations or restrictions are placed on the use

of these funds except that they must be used for main

tenance of public schools.

We submit, therefore, that this case is vastly different

from the Cook case. The State Board of Education here is

not the root of the trouble, which this Court found to be true

of the State Board of Education in the Cook case, in that it

has no power with respect to teachers’ salaries. Hence, the

reasons for requiring an appeal to the State Board of Edu

cation in the Cook case are not now present, and the court

below was in error in not entering judgment in appellants ’

favor.

VI.

This case is not m oot as to the original plaintiff.

The original plaintiff in this case brought this action on

behalf of a class as well as on behalf of herself. This class

is composed of qualified Negro public school teachers and

principals in Jackson, Mississippi who are being paid less

salary than is paid to white teachers of equal qualifications

27

and experience and performing substantially the same func

tions, solely because of race and color. All of the members

of the class were and still are subject to the discriminatory

policy, custom and usage of appellees in paying Negro

teachers less salary than is paid white teachers. Appellant

had a valid cause of action when she filed this complaint.

Appellees sought to defeat her cause of action and the jur

isdiction of the courts by refusing and failing to renew her

contract for the 1948-49 school year. Jurisdiction of federal

courts cannot be deliberately flouted in this manner by a

party to the action, and the court below was in error in de

claring that appellees refusal to reelect Mrs. Bates to teach

in the public schools was not wrongful and that their failure

to rehire her rendered her cause of action moot. As a re

sult of the decision of the court below, appellees may at

tempt to defeat the appeal by refusing to reelect Richard

Brown, the intervening plaintiff in the court below. This,

we submit, appellees should not be permitted to do.

This case is not moot as to the original plaintiff for the

further reason that the controversy had not been resolved

before judgment. In order to render a case moot, it is neces

sary that the controversy be resolved before judgment, or

as in cases where an injunction is sought, the act sought to

be enjoined must have been completely abandoned and its

likelihood of renewal completely precluded. In United

States v. Aluminum Co. of America, 148 Fed. 2d 416 at

448 (C. C. A. 2d 1945), the court said: “ To disarm the

court it must appear that there is no reasonable expecta

tion that the wrong will be repeated. ’ ’

The alleged mootness of the controversy as to the orig

inal plaintiff results from the wilful, malicious and delib

erate attempt on the part of appellees to render it so by

failing and refusing to renew appellant’s contract without

cause. It does not result from any resolution of the con-

28

troversy or any abandonment of the act sought to be en

joined. It is possible, of course, for the defendants in any

action to render the same moot by action on their part which

results in a resolution of the controversy. See United States

v. Trans Missouri Freight Association, 106 U. S. 290. See

also United States v. Vehicular Parking, 52 F. Supp. 749

(D. Del. 1943). But the actions of appellees in this case

in refusing to renew appellants’ contract did not resolve

this controversy. Discrimination against the original plain

tiff and the class which she represents is still a fact which

was established at the trial of this case.

There was conclusive evidence adduced at the trial not

only to establish that the controversy has not been resolved,

but that the discriminatory acts of appellees continue and

will continue in the future as to appellants and the class

they represent unless enjoined by the court. Such a situa

tion is sufficient to give a federal equity court jurisdiction

although the original plaintiff' is not presently employed

by the appellees. Walling v. Helmerich, 323 IT. S. 37, 42;

United States v. Masonite Corp., 316 U. S. 265, 282; Fed

eral Trade Comm. v. Goodyear, 304 U. S. 257, 260; National

Labor Relations Board v. Penn G. Lines, 303 U. S. 261, 271;

United States v. Trans Missouri Freight, supra, at page

308.

Therefore, since the wilful and malicious action on the

part of the appellees in failing and refusing to renew the

original plaintiff’s contract is not an attempt to resolve the

controversy in the case but is rather an attempt to defeat

the action and to oust the court of jurisdiction, the case

should not be declared moot as to her. Appellant is en

titled to seek redress in courts without being penalized by

appellees for so doing. We submit that the court below was

wrong in declaring the case moot as to Mrs. Bates. Rather

the court should have enjoined appellees from refusing to

29

reelect appellant to teach in Jackson public schools because

she sought relief in the courts from the discriminatory-

treatment of appellees.

Conclusion.

W h er efo r e , f o r th e re a s o n s h e re in ab o v e s ta te d , i t is

r e s p e c tfu lly su b m itte d th a t th e ju d g m e n t o f th e c o u r t be low

sh o u ld be re v e rs e d .

J am es A. B u r n s ,

2513 Fifth Street,

Meridian, Mississippi,

T hurgood M arshall,

C onstance B aker M otley ,

B obert L. Carter,

20 West 40th Street,

New York 18, New York,

Attorneys for Appellants.

Dated: June 1, 1950.

30

Certificate of Service.

It is hereby certified that a copy of this brief has been

mailed to Rufus Creekmore, 821 Standard Life Building,

Jackson, Mississippi, attorney for Appellees.

R obert L. Carter,

Attorney for Appellants.

Dated: June 1, 1950.

31

APPENDIX

M ississippi C ode, 1942

and

1948 Supplem ent

§ 6217. Curriculum.—(a) The common free schools shall

consist of a grammar school of eight grades, viz: First to

eighth grades inclusive. The curriculum of the common free

school shall consist of: Spelling, reading, arithmetic,

geography, English grammar, composition, literature,

United States history, history of Mississippi, elements of

agriculture, civil government with special reference to local

and State government, physiology and hygiene with special

reference to the effect of alcohol and narcotics on the human

system, home and community sanitation, general science and

elementary algebra, and such other subjects as may be

added by the State Board of Education.

(b) The public high school shall consist of a high school

of four grades, viz: Ninth to twelfth grades, inclusive. The

curriculum of the public high schools shall consist of: Math

ematics, English, history and social science, pure and ap

plied science, including agriculture, home economics and

manual arts, safety on the highways, and such other sub

jects as may be added by the State Board of Education.

S o u r c es : Laws, 1930, ch. 278; 1936, 2nd Ex. ch. 2; 1938,

eh. 238.

§ 6218. Scholastic year.—The scholastic year shall be the

same as the State fiscal year as is fixed by the amendment

to Section 115 of the Constitution of 1890, and shall begin

on the first day of July and end on the thirtieth day of June

of each year.

32

Appendix

S o u r c es : Laws, 1930, eh. 278; 1936, 2nd Ex. eh. 2;

1938, ch. 238.

§ 6219. Common school fund.—(a) It shall be the im

perative duty of the legislature to appropriate a State com

mon school fund to be taken from the general fund in the

State Treasury, which, together with the poll tax collected

by and retained in each county, and an ad valorem tax levied

by each county or separate school district, shall be sufficient

to maintain the common free schools as defined herein for

a term of not less than four months in each scholastic year.

The common school fund so appropriated shall be dis

tributed among the several counties and separate school dis

tricts in proportion to the number of educable children in

each, to be determined as is now or may hereafter be pro

vided by law.

(b) The legislature shall appropriate from the general

funds in the State Treasury additional funds to be known

as “ an equalizing fund,” and such fund shall be used for

equalizing the educational advantages of the different coun

ties by maintaining public high schools, and for the exten

sion of common free schools beyond the four months’ term

hereinbefore provided for, said funds to be distributed to

the various counties and school districts as is now or may

hereafter be provided for by law.

(c) The counties outside the separate school district, the

separate school districts, and other school districts, may

levy a tax as is now or may hereafter be provided for by

law, for the purpose of maintaining the public high schools,

for extending the term of the common free schools beyond

the four months herein provided for, and for other school

expenses not provided for by State appropriations.

33

Appendix

§ 6232-11. State aid for construction of school buildings

—application to state building commission.—Any county

consolidated school district, special consolidated school dis

trict, municipal separate school district, rural separate

school district, or other school districts, desiring to obtain

state aid for the construction of school buildings out of

funds appropriated therefor by the legislature, shall file

written application with the state building commission for

an allocation of grant of state funds to be used in helping to

defray the cost of constructing such school buildings. Such

application shall be made upon forms approved by the state

building commission, and shall contain accurate information

concerning the needs for such additional buildings or facili

ties, the type of building or buildings to be constructed, the

school area to be served by such new buildings, the location

of the school house or school houses in the area to be served,

and adjoining areas, the uses to be made of the buildings to

be erected and the total cost of the buildings to be erected,

and the amount of local funds to be provided for the con

struction of such building or buildings. Upon the filing of

such application, it shall be the duty of the state building

commission to refer the same to the state department of

education for examination and investigation of the need for

the construction of such building or buildings. The state

department of education shall thereupon cause a survey to

be made of the school building facilities in the area to be

served by such new building or buildings, for the purpose

of determining whether such building program should be

carried out. Such survey shall include a careful study of

the school district organization in the area to be served, the

location of the school house or school houses, the need for

the additional building facilities, and the utilitarian value

of such additional building facilities in reducing the cost

34

Appendix

and improving the efficiency of the public school system in

the area to be affected. And the state department of educa

tion shall file its written report with the state building com

mission, with recommendations as to the need for the con

struction of such new building or buildings, the type of

building or buildings which should be provided and the esti

mated cost of same. [Amends Laws 1946, cli. 250, § 1.]

S oitbces : Laws, 1946, ch. 250, § 1; 1948, ch. 301, § 1.

§ 6232-12. Grant of funds.—The state building commis

sion, after receiving the report from the state department

of education as to the need for the construction of such

school building or buildings, may require such additional

information as the commission may desire as to the long

term need for such additional school buildings and facilities,

and as to the manner in which the county’s or district’s

part of the construction funds is to be provided. If it shall

then appear to the state building commission that the pro

posed new buildings are needed, and that said buildings will

be useful in serving the long-term needs of the county, or

school district, as the case may be, the state building com

mission shall be authorized to grant funds to such county

or district, to aid in the construction of such school building

or buildings. The amount of such state aid shall in no case

exceed the sum of two thousand dollars for each class room

to be provided in such new building or buildings; and in no

event shall the amount of such state aid exceed fifty per

cent of the total cost of such school building or buildings.

The state building commission shall be authorized to

grant funds under the provisions of this act to aid in the

construction of new buildings or for the construction of ad

ditions to buildings which have already been constructed.

S oitbces : Laws, 1946, eh. 250, § 2.

35

Appendix

§ 6232-13. Allocation and disbursement of funds.—The

funds thus allocated by the state building commission to

any county or school district shall be paid in to the county

depository, and shall he used and expended by the county

school board of the county, in case such funds are allocated

to the county, or by the board of trustees of the school dis

trict, in case such funds are allocated to a school district,

and shall be paid out upon certificates issued by the county

superintendent of education, upon orders of the county

school board, or the board of trustees of such school district,

as the case may be. In case such grant be made to a munic

ipal separate school district such fund shall be paid into the

municipal separate school district depository, and shall be

paid out upon the order of the board of trustees of such

municipal separate school district.

Sources : Laws, 1946, ch. 250, § 3.

§ 6232-14. Regulation of expenditures—approval of

plans and specifications.—The state building commission

is hereby authorized to prescribe such reasonable rules and

regulations as the state building commission may deem

proper to safeguard the expenditure of funds granted to

counties and school districts for the construction of school

buildings under the provisions of this act. The state build

ing commission shall be authorized, if the commission shall

deem the same necessary, to require that the county’s part

or the district’s part of the construction funds required to

complete the construction of such school buildings be made

actually available before ordering the payment of the state’s

part of such funds into the county or district depository.

And the state building commission shall be authorized to

require that plans and specifications for the construction

of any such school building shall be submitted to and ap-

36

Appendix

proved by the state building commission before contracts

are let for the construction of same.

S ources : Laws, 1946, ch. 250, § 4.

§ 6232-15. Purpose of Act.—It is hereby declared to be

the purpose and intention of this act to provide a program

of state aid for the construction of school buildings in areas

where the existing school facilities are inadequate to meet

the needs of the school children, and to promote the con

solidation of high school facilities, so that better educa

tional opportunities may be provided for high school chil

dren at reasonable expense.

S ources : Laws, 1946, ch. 250, § 5.

§ 6234. To decide appeals.—The board of education

shall decide all appeals from the decisions of the county

superintendents, or from the decisions of the state superin

tendent; but all matters relating to appeals shall be pre

sented in writing, and the decision of the board shall be

final.

S ources : Codes, 1930, § 6549; Laws, 1924, eh. 283; 1930,

ch. 278.

§ 6235. To remove county superintendents in certain

cases.—For continued neglect of duty, drunkenness, incom

petency or official misconduct, the state board of education

may remove a county superintendent; but before the re

moval, the officer shall have ten days’ notice of the charge,

and be allowed opportunity to make defense. The members

of the board are authorized to administer oaths and to take

or cause depositions to be taken, and have the powers of a

court to compel witnesses to attend and testify in all mat

ters of investigation by the board.

S ources : Codes, 1930, § 6550; Laws, 1924, ch. 283; 1930,

ch. 278.

37

Appendix

§6236. Disburse equalizing fund.—In addition to the

regular per capita appropriation for common schools the

legislature shall provide an equalizing fund, which shall be

disbursed by the state board of education in such manner

as may be provided by the legislature of the state of Missis

sippi.

S ources : Codes, 1930, § 6551; Laws, 1924, ch. 283; 1930,

ch. 278.

§ 6237. To audit claims.—The board of education shall

audit all claims against the common school fund, and allow

so much as may be justly due, not to exceed the amount al

lowed by law. The board shall have authority, and it shall

be their duty, to hear and pass upon all appeals by trustees

of public schools from the decision of the county superin

tendent of education, as to the amount of money that shall

be allowed for the payment of teachers’ salaries and other

expenses allowed by law to any county public school, not a

separate school district, from the funds received by the

county from the county school fund, from the state common

school fund and from county levies for the public schools.

All appeals shall be made in writing and the decision of the

board shall be final.

S o u r c es : Codes, 1930, § 6552; Laws, 1924, ch. 283; 1930,

ch. 278.