Parker v. Lewis Brief for Appellant

Public Court Documents

January 1, 1981

Cite this item

-

Brief Collection, LDF Court Filings. Parker v. Lewis Brief for Appellant, 1981. 5249f17b-c09a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/fc18d60d-2ed2-46b5-bd60-881affa3586b/parker-v-lewis-brief-for-appellant. Accessed February 22, 2026.

Copied!

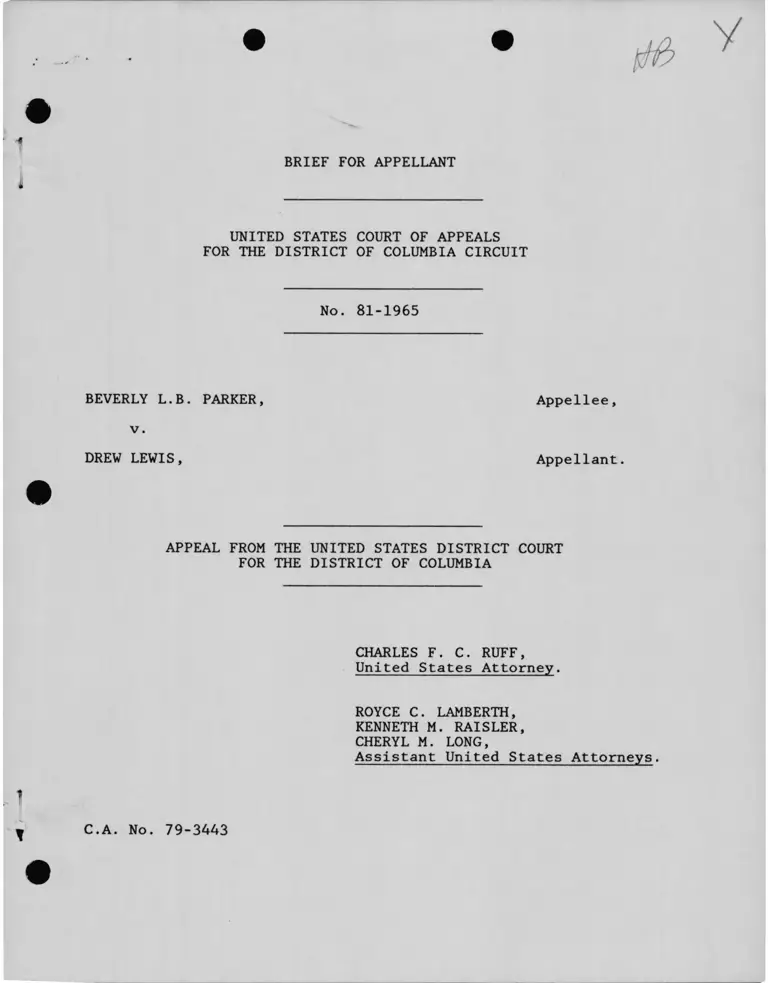

BRIEF FOR APPELLANT

UNITED STATES COURT OF APPEALS

FOR THE DISTRICT OF COLUMBIA CIRCUIT

No. 81-1965

BEVERLY L.B. PARKER, Appellee,

v.

DREW LEWIS, Appellant.

APPEAL FROM THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF COLUMBIA

CHARLES F. C. RUFF,

United States Attorney.

ROYCE C. LAMBERTH,

KENNETH M. RAISLER,

CHERYL M. LONG,

Assistant United States Attorneys.

C .A. No. 79-3443

I N D E X

Page

0 REFERENCES TO PARTIES AND RULINGS....................1

STATEMENT OF THE CASE................................. 1

ARGUMENT............................................... 3

The District Court abused its discre

tion when it denied discovery and award

ed $14,200.95 in attorney's fees in a

conclusory manner with no basis in the

record.

A. The District Court's

failure to permit

discovery and a hering

is an abuse of discre

tion...................................4

B. The District Court's con

clusion that all of the

hours claimed by counsel

for appellees were rea

sonably expended is an

abuse of discretion................. 6

C. The District Court

abused its discretion

when it awarded counsel

for appellees compensa

tion at the hourly rates

that they sought................... 7

CONCLUSION. . ........................................ 12

T

11

TABLE OF CASES

Page

* Copeland v. Marshall, 641 F.2d 880

(D.C. Cir. 1980)..................................... 3, Passim

Crowley v. Haig, No. 74-0494 (D.D.

C. 1 9 8 1 ) ................................................9

Detroit v. Grinnel Corp., 495

F . 2d 488 (2d Cir. 1974) .............................. 5

Lindy Brothers Builders, Inc., v.

American Radiator & Standard Corp., 487

F . 2d 161 (3rd Cir. 1973)............................ 5

Grumin v. International House

of Pancakes, 513 F. 2d 114 (8th Cir. 1975)............. 5

Johnson v. Georgia Highway Express,

Inc., 488 F . 2d 714 (5th Cir. 1974)......................7

Naismith v. Professional Golf

Association, 85 F.R.D.................................... 4

Stastny v. Southern Bell Telephone

and Telegraph Co., 77 R.D. 662 (W.D.N.C . 1978)........ 4

Wolf v. Frank, 555 F. 2d 1213 (5th Cir. 1977)......... 4

TABLE OF AUTHORITIES

42 U.S.C. §2000e-16..................................... 1

Equal Access to Justice Act,

Public Law 96-481 §201 et seq........................... 10

asterisks.

ISSUES PRESENTED -/

In the opinion of appellant, the following issue is presented

Whether the District Court abused its discretion, when it

denied discovery and a hearing, when it awarded $14,200.95 in

attorneys' fees in a Title VII discrimination case, and when it

awarded the fees in a conclusory manner with no basis in the

record.

*/ This case has not previously been before this Court.

UNITED STATES COURT OF APPEALS

FOR THE DISTRICT OF COLUMBIA CIRCUIT

No. 81-1965

BEVERLY L.B. PARKER, Appellee,

v .

DREW LEWIS, Appellant.

APPEAL FROM THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF COLUMBIA

BRIEF FOR APPELLANT

REFERENCES TO PARTIES AND RULINGS

Appellant is the Secretary of Transportation. Appellee is

Beverly L.B. Parker, an employee at the Department of Transportation.

The subject of this appeal is the Order filed by the Honorable

Aubrey E. Robinson, Jr. on June 30, 1981, awarding appellee

$17,200.95 in attorneys' fees and $140.79 in costs.

STATEMENT OF THE CASE

Appellee brought this action pursuant to Title VII of the

Civil Rights Act of 1964, 42 U.S.C. § 2000e-16, against the

Secretary of Transportation requesting a retroactive promotion,

2

back pay and attorney's fees. Specifically, appellee alleged

that sex discrimination had caused a denial of a promotion at the

GS-9 level to the position of attorney-advisor in the Federal

Highway Administration. The case was settled on February 13,

1981, resulting in an agreement to provide a retroactive promotion,

the sum of $4,254.76 in back pay and reasonable attorneys fees

which would be litigated separately.

On April 15, 1981, appellee filed a motion requesting an award

of attorneys' fees and costs totaling $24,442.22. The request

included a lodestar amount $14,200.95 for retained counsel;

$3,000 for appellee's own pro se representation; and $140.79 in

costs. Appellant has appealed only the first of the three compo

nents of the award.

The total "lodestar" fee demanded for appellee's retained

counsel was outlined as follows:

ATTORNEY CLASS YEAR HOURS HOURLY ]RATE FEES

Valerie V. Ambler Partner 1979 5.6 $102.00 $ 571.201980 0.6 123.00 73.801981 1.0 138.00 138.00

Elizabeth L. Newman Partner 1980 31.85 123.00 3 ,917.551981 18.80 138.00 2 ,594.40

Alan M. Sandals Associate 1981 49.35 60.00 2 ,961.00

Paula Carmody Associate 1980 78.90 50.00 3 ,945.00

TOTAL $14 ,200.95

1/ In addition, appellee sought a contingency adjustment to the

lodestar of 50% bringing the total amount demanded for retained

counsel to $21,301.43.

3

Appellant filed an opposition to appellee's motion on May 15, 1981,

and requested the opportunity to take discovery and have a hearing

regarding appellee's request.

The District Court issued an Order on June 30, 1981, in which

it awarded appellee her requested lodestar amount of $14,200 in

attorneys' fees, $3,000 in pro se fees and $140.79 in costs. No

separate contingency adjustment was awarded.

ARGUMENT

The District Court abused its discretion when

it denied discovery and awarded $14,200.95 in

attorneys' fees in a conclusory manner with no basis in the record.____________

In Copeland v. Marshall, 641 F.2d 880 (D.C. Cir. 1980) (en

( Copeland III ) , this Court established that the determina

tion of a fee award is to begin with the fixing of a "lodestar"

amount by multiplying the number of hours reasonably expended

times the reasonable hourly rate (or rates). Id. at 891. The

District Court correctly cited to Copeland III for its analysis

and determination of the award amount. However, we submit that

the District Court's analysis and its attorneys' fee award repre

sents an abuse of discretion in three respects: (1) the Court

denied appellant's request for discovery and a hearing; (2) the

Court held that all of the hours claimed by counsel for appellees

were reasonably expended; and (3) the Court established what it

defined as the reasonable hourly rate in the Washington, D.C.

area for similar Title VII work without any basis. In each

respect in which the District Court abused its discretion, it

4

failed to adequately articulate its reasons or based its decision

on improper factors. See Copeland III, supra at 901 n.39. As a

result, the District Court's fee award should be reversed and this

action should be remanded with instructions to grant appellant's

request for discovery and a hearing and thereafter to recalculate

the fee award using the appropriate factors.

A. The District Court's failure to

permit discovery and a hearing is

an abuse of discretion.

This Circuit in Copeland III recognized the appropriateness

of discovery and a hearing in contested attorneys' fees claims.

Icl. at 905. We submit that the denial of discovery and a request

ed hearing in the context of this case was an abuse of discretion.

Discovery is necessary on the issues of the number of hours

reasonably expended and the hourly rate counsel for appellees are

entitled to receive. Counsel for appellee failed to submit

any documentation that specifically addressed the rate "prevailing

in the community for similar work." Copeland III at 975. Instead

of allowing discovery, or even compelling counsel for appellees

-•£•» Stastny v. Southern Bell Telephone and Telegraph Co.,

^ F.R.D. 662 (W.D.N.C. 1978) (discovery relevant and production

ordered of original time records of counsel along with documenta

tion of fees received by same attorneys in other related cases);

Naismith v. Professional Golf Association. 85 F.R.D. 552, 562-565

(N.D. Ga. 1979) (discovery relevant and production ordered of

a^ ° rneys ' hours, rates and total fees as well as their knowledge

of fee awards obtained in community (Atlanta) by same attorneys

’ — also Volf v - Frank, 555 F.2d 1213 (5th Cir.19/7) (after a challenge to attorneys fee supporting affidavits

as inadequate, Court permitted deposition of the attorney seeking the fee and others).

5

to produce more evidence of the hourly rates paid by their paying

clients or of the hourly rates prevailing in the community for

similar work, Judge Robinson simply adopted counsel for appellees'

proposed hourly rates.

For essentially the same reasons, we submit that the District

Court abused its discretion in denying our request for a hearing.

This Court in Copeland III recognized the usefulness of con

ducting a hearing on the issue of the fee when such a hearing is

requested and when the amount of the fee is contested. Id. at

905. Courts of Appeals in other Circuits have recognized that a

hearing is required where the amount of the fee is contested and

the failure to hold a hearing under such circumstances is an

abuse of discretion. See Detroit v. Grinnel Corp.. 495 F.2d 448,

468 (2d Cir. 1974); Lindy Brothers Builders, Inc, v. American Radi-

ator & Standard Sanitary Corp.. 487 F.2d 161, 169-170 (3rd Cir.

1973) (Lindy I); Grumin v. International House of Pancakes, 513

F.2d 114, 127 (8th Cir. 1975). As the Third Circuit Court of

appeals stated:

[0]pposing interests should be afforded a

hearing to provide an evidentiary basis for

resolution of disputed factual matters and to

allow the parties to supplement possibly

incomplete statements of opposing parties.

Lindy— I, 487 F.2d at 169. In this case both the hours reasonably

expended and the reasonable hourly rate were contested; the

District Court's refusal to grant discovery and a hearing is

reversible error.

6

B. The District Court's conclusion

that all of the hours claimed by

counsel for appellees were reasonably

expended is an abuse of discretion.

The District Court correctly recognized, citing Copeland III,

that the first issue in any fee setting inquiry is to determine

the reasonable number of hours spent by the attorneys requesting

the fee. However, the District Court then clearly erred in

awarding compensation to appellees' attorneys for every hour of

time that they requested.

It is incumbent upon the party seeking fees to present the

Court with sufficient documentation to allow the kind of searching

analysis that Copeland III requires. In this case, appellant's

challenge to the reasonableness of the hours was severely limited

by the District Court's refusal to allow discovery and a hearing.

Nonetheless, appellant did identify certain points that required

a reduction in the hours which the District Court rejected. For

example, counsel for appellee claimed compensation for hours

spent by partners and associates talking with each other in their

law office. Just as Copeland III, supra at 891, provided that

where three attorneys are at a hearing where one would suffice,

billing judgment requires that compensation should be denied for

the excess time, we believe billing judgment requires that compen

sation for more than one counsel should be denied when counsel

discuss the case among themselves. It is not uncommon for attorneys

in private practice to review each others work or to discuss a

case among themselves. However such time is duplicative and

7

should be reduced in the exercise of "billing judgment." This is

especially true when partners discuss a case or review each

others work. To do otherwise results in the government being

billed at the maximum rate of $276 per hour every time counsel

choose to discuss this case among themselves. The Distrct Court's

wholesale acceptance of counsel for appellee's hours while denying

appellant discovery and a hearing was an abuse of discretion.

C. The District Court abused its

discretion when it awarded counsel

for appellees compensation at the

hourly rates that they sought.

After determing the reasonable hours expended, the remaining

element in fixing the lodestar is determining the reasonable

hourly rate. We submit that the District Court clearly erred

when it accepted wholesale counsel for appellee's statement of

the hourly rate they believed that they were entitled to receive.

It is clear that "plaintiff has the burden of proving his

entitlement to an award of attorney's fees just as he would bear

the burden of proving a claim for any other money judgment."

Johnson v. Georgia Highway Express, Inc., 488 F.2d 714, 720 (5th

Cir. 1974). accord, Copeland III at 891-892. ^ Counsel for

appellee simply have not met their burden of proof in providing

that the hourly rates sought are reasonable.

Remain specifically recognized that the Johnson analysisremain!s] central to any fee award." Copeland III, supra at 889.

)

8

At this juncture, it is helpful to summarize the method by

which counsel for appellee attempted to establish their reasonable

hourly rate. Essentially, counsel for appellee's started calcula

tion of their hourly rate by using a base figure of $75.00 per

hour which one of the counsel had obtained in a 1977 settlement.

Next, counsel added $5.00 per hour since 1977 for each succeeding

year to account for their alleged "increased expertise in employment

discrimination cases." Then, each year's hourly rate was also

adjusted, "to compensate for the effects of inflation on that

base rate, using the consumer price index as a key to the average

annual inflation factor." (App. 14-16). Counsel for appellee cal

culation of their hourly rate is totally artificial and gives no

clue as to what rates were actually paid to counsel for appellee

or what fees were actually paid to other local Title VII lawyers

for similar services. Counsel for appellee's method of calcula

tion of their present hourly rate is even more artificial than the

"cost plus" hourly rate expressly rejected by the Court in Cope

land III. Id. at 896-900. In rejecting that artificial approach,

the Court stated that it would rely upon the "market mechanism"

or law of supply and demand to determine a reasonable hourly

rate. The Court in Copeland III envisioned that the pressure of

the market would keep attorneys' hourly rates at a reasonable

level. Thus while counsel for appellee may hypothesize that they

acquired $5.00 per hour more experience per year, the real relevant

question under Copeland III is whether clients in the marketplace

paid such fees to counsel or to similarly situated Title VII

counsel. Moreover, while counsel for appellee may hope that

their hourly rate kept pace with inflation, the relevant question

again is whether counsel for appellee or similarly situated

counsel have been successful in passing on the costs of inflation

to their clients. If the market has not allowed counsel to pass

on inflation costs to their clients, then counsel in this action

should not be allowed to pass such costs on in this action simply

because the government is paying the attorneys' fees.

Counsel for appellee's determination of the hourly rate

chargable by associates, $50 and $60 per hour, is no more realistic.

Both associates only graduated from law school in 1980. There

was absolutely no evidence that either had experience in Title

VII law or that paying clients paid the firm at the high rates

sought from the government. Additionally, there was no evidence

that paying clients paid other recent law school graduates at

those high rates for similar work.

Review of counsel for appellee's affidavits describing their

experience does not justify the hourly rate of $138 per hour.

Both lead partners were only admitted to the Bar in 1973. Neither

appears to have tried a case at the time compensation was paid.

It appears that the firm of Ambler and Newman was only established

in 1980. None of these factors would seem to justify what was at

the thime the highest hourly rate awarded against the government

by a Court in this Circuit. Counsel for appellee did not

4/ We are only aware of one case, which was decided subsequent

to the decision at bar with an hourly rate above the $138 rate

awarded in this case. Crowley v. Haig No 74-0494 (D.D.C. 1981)

(FOOTNOTE CONTINUED ON NEXT PAGE)

9

10

provide supporting facts about rates actually being paid to

themselves or to attorneys of similar skill performing similar

work. There was no such evidence presented to the District Court

in this action, except for a conclusory claim that there have

been instances of clients paying $150.00 per hour to counsel for

appellee (App. 32). Without explanatory detail and discovery,

even this assertion seems to be an aberation that is clearly

insufficient to support the Court's award.

The Equal Access to Justice Act, Public Law 96-481 § 201 et

seq., October 1, 1980, which became effective for actions pending

or commenced on or after October 1, 1981, authorizes the payment

of attorney's fees to a prevailing private person in administra

tive or judicial proceedings against the United States unless it

is determined that the position of the United States was substan

tially justified or special circumstances make an award unjust.

The Act provides that attorneys' fees which are to be based on

prevailing market rates shall not be awarded in excess of $75 per

hour unless the Court determines that an increase in the cost of

living or a special factor, such as limited availability of

qualified attorneys available for the proceedings involved,

justifies a higher fee. Although this Act's hourly rate specifi

cally does not apply to actions brought under Title VII, the $75

(FOOTNOTE CONTINUED FROM PREVIOUS PAGE)

($148.28). That case, which was also decided by Judge Robinson,

xs pending appeal. No. 81-2213. All other attorneys' fees

awards against the government in this Circuit by Judges other

than Judge Robinson are at levels considerably lower than $138 per hour. See Appendix A to our brief.

11

per hour is the amount that Congress has determined generally is

the outside limit on market rates in 1981 when attorney's fees

are to be paid by the government. The outside limit of $75 per

hour by definition includes any adjustments which may be sought

such as for a delay contingency adjustment, and incentive adjustment.

Presumably the rates would have lower for work performed prior to

1981.

As reflected in Appendix A to this brief, the rates awarded

in this case, at the time of decision, included the highest

hourly rates ever awarded against the government by any court in

this District. Thus, the government is seriously concerned that

these rates may set the new "floor" for rates "prevailing in this

community," within the meaning of Copeland III. Id. at 892.

Since these rates are so out of line with other recent awards,

and since the district court committed several errors in setting

them, we submit that a reversal is required.

Appellee submitted as an exhibit to her motion for fees a

list of twelve cases that purport to show a wide range of attorney's

fees awarded since 1972. This submission certainly could not

form a basis for determining that $138.00 per hour is a reasonable,

prevailing rate for a case such as this one. Seven of the cases

cited are labelled as being antitrust or securities-related

cases. Five others are broadly labelled Title VII, Title VI or

desegregation cases. There is nothing stated or argued about how

this second group of cases compare in difficulty or range of

issues to the instant action. Moreover, any pre-Copeland III

12

case is subject to further scrutiny to determine how, if at all,

the particular court confronted the same analysis of factors to

establish an award.

CONCLUSION

WHEREFORE, appellant respectfully submits that the judgment

of the District Court be reversed and the case be remanded to the

District Court with directions to permit discovery and a hearing

and to reconsider the fee award using the appropriate Copeland III

factors.

CHARLES F. C. RUFF,

United States Attorney.

ROYCE C. LAMBERTH,

KENNETH M. RAISLER,

CHERYL M. LONG,

Assistant United States Attorneys.

9

A P P E N D I X A

ATTORNEYS' FEE AWARDS

DISTRICT OF COLUMBIA

►

CASE TITLE HOURLY RATE CASE TYPE

Vaughn v. Rosen, No. 73-1039

(D.C. Cir. 1973)

$85 FOIA

Smith v. Kleindiest, 8 FEP

753 (D.D.C. 1974)

$40-$75 Title VII

Communist Party of the United

States v. Department ot Justice,

No. 75-1770 (D.D.C. 19/b; “

,$45 FOIA

Parker v. Matthews, 411 F. Supp.

1059 (1976J~

$30-$60 Title VII

Pealo v. Farmers Home Adm., 412

F. Supp. 561 (D.D.C. 1976)

$50-60 Housing

Rucker v. Matthews, No. 75-0531

(TTD.C. 1976) “

$58.05

(average) Title VII

Weahkee v. Perry, 16 FEP 755

^(D.D.'C. 1976)~

Walden v. Boorstin, 16 FEP 1739

(D.D.C. 1976)“

$60 Title VII

$50 Title VII

Williams v. Saxbe, 17 FEP 1657

(D.D.C. 1976)

$30-$65 Title VII

Zeldin v. Hoffman, No. 75-1913

(D.D.C. 1976)“

$40 FOIA

Anderson v. Treasury, et al.,

— No. "76-1404 (D.D.C. 19/ T)

Not based on hourly

rate (awarded $2,000)

Privacy Act

Founding Church of Scientology

of Washington, D.U., Inc. v.

Marshall, 439 F. Supp. 1267

(D.D.C. ”1977)

$60 FOIA

Copeland v. Usery, 14 FEP 1677

(D.D.C. 1977)

$57.17

(average)

Title VII

Pace v. Califano, No. 76-99

t d .d .c . T<nrr

$52-$54 Title VII

R p Amnicillin Antitrust

Litigation, MDL. No. 3U,

Rise. No~45-70 (D.D.C. 1978)

$40-$200 Antitrust

(non

government)

.)

13

CASE TITLE HOURLY RATE CASE TYPE

Cayce v. Adams, 18 FEP 465

(D.D.C." 1978)

Tpeland v. Marshall, No. 77-1351

t (D.D.C. 19781

Kinsey v. Legg Mason Wood Walker,

* No. 71-1338 (D.D.C. 1978)

Parker v. Califano, 443 F. Su d d .

789 (D.D.C. 1978)

Postow v. Oriental Bldg. Ass'n,

455 F. Supp. 781 (D.D.C. 1978)

American Broadcasting Companies

Inc., et al. v. Department of

Labor, et al.. No. 78-1711

TTT.C.c. 1979)

Crooker v. Department of Justice,

No. 78-1820 (D.D.C. 1979)

iB»es. v. United States Secret

^service, et al., No. 78-0891

"(D.D.C. 1979)

Marimont v. Califano, No. 1992-73

“ (D.D.C. 19791

Public Citizen Health Research

Group v. Department of Labor,

No. 76-88/ (D.D.C. 1979)

Sonnenberg v. Adams, 18 Emp.

Prac. Dec. IT 8875 (D.D.C. 1979)

Ward v. Postal Rate Commission,

No. 77-0145 (D.D.C. 1979)

Williams v. Boorstin, No. 78-2408

(D.D.C. 19791

Wolfson v. Dept, of Justice,

No. 75-1714 (D.D.C. 1979)

Jones v. Trailways Corporation,

No. 78-TT27- (D.D.C. 19S01---

$40-$75

$51.65

$20-$65

$35-$72

$60-$75

$55-$75

$5

(Pro se

Prisoner)

$10

(Pro se

Prisoner)

$50-85

$55

$50

$50-75

$75

$60-$75

$75

Title VII

Title VII

Title VII

(non

government)

Title VII

Truth-in

Lending

(non

government)

FOIA

FOIA

FOIA

Title VII

FOIA

Title VII

FOIA

PA

Title VII

FOIA

Title VII

(non

government)

CASE TITLE A HOURLY RATE ^ CASE TYPE

V7illiams v. Civiletti,

No. 74-0186 (D.D.C7 1980)

$30-$85 Title VII

ffchman v. Pertschuk,

i No. 76-0079TD.D.C. 1981)

$70-$100 Title VII

Blake v. Hoston, 513 F. Supp.

* 6^3 (D.D.C. 1981)

$40-$75 Title VII

Caton v. Barry, No. 80-1584

[D. D. C . _T913l)

$50-100 Housing

(non

government)

Donnell v. United States of

America, No. 78-0392 (D.D.C.

1981)

$40-60 Voting

Rights

Fells v. Brooks, No. 80-2981

T dTD.C. 1981)

$75 Vocational

Rehabili

tation

Act (non

government)

G a m e s v. Brown, No. 76-0974

(D.D.C. 1981)

$60-$100 Title VII

Green v. Department of Commerce,

^ N o . 77-0363 (D.D.C. 19FT)

Indian Lav; Resource Center v.

U.S. Department of the

Interior, No. 79-0540

(D.D.C. 1981)

$45-95 FOIA

$70

(average)

FOIA

In Re Swine Flu Immunization

Products Liability Litigation,

MDL No. 330, Misc. No. /8-Ou40

(D.D.C. 1981)

$40-$75

and

$100 (lawyer-

physician)

Swine Flu

Kemp v. Williams, No. 77-2014

“ID.D.C. 1981)

$45-$60 Title VII

Lawrence v. Franklin Investment

Co., Inc., et al., No. 78-0919

TDTD.C. 1981)

$75 Truth-in

Lending

(non

government)

Mangiapane v. Secretary of

Transportation, No. 75-1239

(D.D.C. 193IT~

$70 Title VII

1 National Ass'n. of Concerned $85 FOIA

Veterans v. Secretary of

Defense, No. 79-0212 (D.D .C .TTOTT- 15

CASE TITLE HOURLY RATE CASE TYPE

North Slope Borough v. Andrus,

̂ 515 F.Supp. 961 (D.D.C. 1981)

Metropolitan Washington

* Coalition for Clean Air,

et al. v. District of Columbia,

NosT- 73-1424, 73-F844 (D.D.C.-

^981)

Parker v. Lewis, No. 79-3443

(D7D.C. 1981)

Quinto v. Legal Times of

Washington, Inc., 511 F.

Supp. 579 (D.D.C. 1981)

Smith v. Schweiker, No. 76-2311

(D.D.C. 1981)

Sneed v. Harris, No. 77-2191

(D.D.C. 1981)

Veterans Education Project

v. Secretary of the Air Force,

et al., No. 79-210 (D.D.C. 1981)

Whelchel v. Lewis, No. 78-0514

--(D.D.C. 198T)

Crowley v. Hai£, No. 74-0494

(D.D.C. 1981)

Breen v. Tucker, No. 78-2222

(DTD.C. 1981)

$45-$125 ESA/OCSLA

$40-$175 Clean Air

$50-$138 Title VII

$5 - law student

(Pro se)

Copyright

(non

government)

$55-$65 Title VII

$80 Title VII

$35-$110 FOIA

$65-$85 Title VII/

Equal Pay

Act

$40-$l48.28 Personnel

Action -

Back Pay Ac

$90 Title VII

(non

government)

I

16

p