Joseph F. Hughes & Co. v. United Plumbing & Heating Court Opinion

Unannotated Secondary Research

March 18, 1968

2 pages

Cite this item

-

Case Files, Milliken Working Files. Joseph F. Hughes & Co. v. United Plumbing & Heating Court Opinion, 1968. db7e51b8-54e9-ef11-a730-7c1e5247dfc0. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/24c17f7e-4281-4cd7-b5ef-2c2d8e8c294b/joseph-f-hughes-co-v-united-plumbing-heating-court-opinion. Accessed February 21, 2026.

Copied!

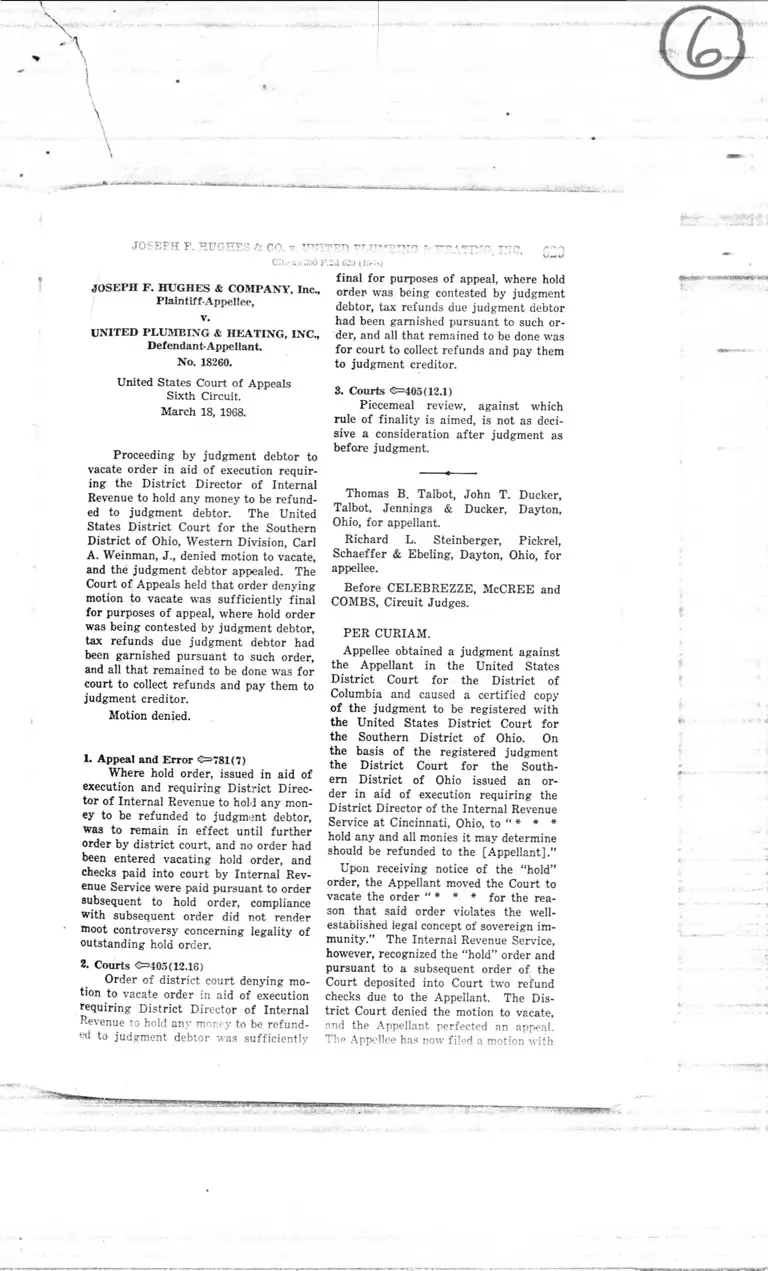

JOSEPH F. HUGHES ft CO, v ’rr*TYrFY,T) t«ta

Cite us oC/0 F.2d 020 ( UX>S)

i ^ r r r % ? r * y * r r i

JOSEPH F. HUGHES & COMPANY, Inc.,

Plaintiff-Appellee,

v.

UNITED PLUMBING & HEATING, INC.,

Def endan t-Appellan t.

No. 18260.

United States Court of Appeals

Sixth Circuit.

March 18, 1968.

Proceeding by judgment debtor to

vacate order in aid of execution requir

ing the District Director of Internal

Revenue to hold any money to be refund

ed to judgment debtor. The United

States District Court for the Southern

District of Ohio, Western Division, Carl

A. Weinman, J., denied motion to vacate,

and the judgment debtor appealed. The

Court of Appeals held that order denying

motion to vacate was sufficiently final

for purposes of appeal, where hold order

was being contested by judgment debtor,

tax refunds due judgment debtor had

been garnished pursuant to such order,

and all that remained to be done was for

court to collect refunds and pay them to

judgment creditor.

Motion denied.

1. Appeal and Error C=781(7)

Where hold order, issued in aid of

execution and requiring District Direc

tor of Internal Revenue to hold any mon

ey to be refunded to judgment debtor,

was to remain in effect until further

order by district court, and no order had

been entered vacating hold order, and

checks paid into court by Internal Rev

enue Service were paid pursuant to order

subsequent to hold order, compliance

with subsequent order did not render

moot controversy concerning legality of

outstanding hold order.

2. Courts 0=405(12.16)

Order of district court denying mo

tion to vacate order in aid of execution

requiring District Director of Internal

Revenue to hold any money to be refund

ed to judgment debtor was sufficiently

final for purposes of appeal, where hold

order was being contested by judgment

debtor, tax refunds due judgment debtor

had been garnished pursuant to such or

der, and all that remained to be done was

for court to collect refunds and pay them

to judgment creditor.

3. Courts e=405(12.1)

Piecemeal review, against which

rule of finality is aimed, is not as deci

sive a consideration after judgment as

before judgment.

Thomas B. Talbot, John T. Ducker,

Talbot, Jennings & Ducker, Dayton,

Ohio, for appellant.

Richard L. Steinberger, Pickrel,

Schaeffer & Ebeling, Dayton, Ohio, for

appellee.

Before CELEBREZZE, McCREE and

COMBS, Circuit Judges.

PER CURIAM.

Appellee obtained a judgment against

the Appellant in the United States

District Court for the District of

Columbia and caused a certified copy

of the judgment to be registered with

the United States District Court for

the Southern District of Ohio. On

the basis of the registered judgment

the District Court for the South

ern District of Ohio issued an or

der in aid of execution requiring the

District Director of the Internal Revenue

Service at Cincinnati, Ohio, to “ * * *

hold any and all monies it may determine

should be refunded to the [Appellant].”

Upon receiving notice of the “ hold”

order, the Appellant moved the Court to

vacate the order “ * * * for the rea

son that said order violates the well-

established legal concept of sovereign im

munity.” The Internal Revenue Service,

however, recognized the “ hold” order and

pursuant to a subsequent order o f the

Court deposited into Court two refund

checks due to the Appellant. The Dis

trict Court denied the motion to vacate,

and the Appellant perfected an appeal.

The Appellee has now filed a motion with

l

- 4

630 390 FEDERAL REPORTER, 2d SERIES

this Court to dismiss the appeal on any

one of three grounds: (1) that the case

is moot since the Internal Revenue Serv

ice has paid the refund checks into

Court, (2) that the judgment of the Dis

trict Court is not final, and (3) that the

Appellant has no standing to raise the

defense of sovereign immunity. We

deny the motion so far as it is based upon

the mootness and lack of finality of the

District Court’s order; the question of

standing is passed to be briefed and ar

gued on appeal.

[1] The “ hold” order in question is

to remain in effect “ until further order

[by the District Court] * * No

order has been entered vacating the

“ hold” order; and the cheeks paid into

Court by the Internal Revenue Service

were paid pursuant to an order subse

quent to the “ hold” order. Compliance

with the subsequent order does not ren

der moot this controversy concerning the

legality of the still outstanding “ hold”

order.

[2] We also find that the order of

the District Court denying the motion

to vacate is sufficiently final for appeal.

In Sabadash v. Schavo, 128 F.2d 923 (6th

Cir. 1942), this Court held that an or

der denying a petition to recall and per

petually stay execution upon a judgment

was not appealable. The petition in that

case was based on the claim that the

judgment had been discharged by virtue

of the petitioner’s subsequent discharge

in bankruptcy. No property of the peti

tioner had been levied upon; so in es

sence the petitioner was seeking an ad

visory opinion. Here specific property,

tax refunds due or to be due to the

judgment debtor, has been garnisheed;

and the judgment debtor is contesting

the Court’s power to levy upon the spe

cific property in question. In a like

circumstance this Court has entertained

an appeal from a denial of a motion to

vacate a levy and sale. Whiteleather v.

United States, 264 F.2d 861 (6th Cir.

1959).

[3J rcover, since the C7,, 7 , . . , , •,

case the United States Supreme Court

has noted'tKarthrTccitrireinent of final-

liv' sEo'dia BFM W TTaifactical rather

than a technical construction. Gillespie

w United States Steel Corp., 379 U.S.

“ 148, 85 S.Ct. 308, 13 L.Ed.2d 199 (1964)

affirming 321 F.2d 518 (6th Cir. 1963).

Piecemeal review, against which the rule

judgment. g. Plymouth Mutual

Life Ins. Co. v. Illinois Mid-Continent

Life Ins. Co., 378 F.2d 389 (3rd Cir.

1967); McDonnell v. Birrell, 321 F.2d

946 (2d Cir. 1963). In the instant case

all that remains to be d'OTte' is for the

District Court to collect any refunds due

the judgment debtor and pay them over

t<r^fi(f’judgment cred ito r^ ji would be

difficult to conceive of a time when this

the judgment debtor must wait and sue

for return of his property wrongfully

-garnisheed. Such a requirement would

seem to promote the piecemeal litigation

that the rule of finality was designed to

avtrtth---- -------

©JfTEe question of standing to raise

the defense of sovereign immunity, we

have found a surprising lack of author

ity on the capacity of a judgment debtor

to contest a proceeding in aid of execu

tion, and an even more surprising lack of

authority on the nature of the defense

of sovereign immunity and its affect up

on the jurisdiction of a federal District

Court. Compare Williams v. United

States, 289 U.S. 553, 571-577, 53 S.Ct.

751, 77 L.Ed. 1372 (1933); with United

States v. Sherwood, 312 U.S. 584, 61

S.Ct. 767, 85 L.Ed. 1058 (1941). It

would be inappropriate, therefore, to dis

pose of the close question of standing or,

a motion to dismiss. A determination of

that question and a final determination

on the motion to dismiss will be passed

to the argument on appeal. Counsel an

requested to further brief the question

of standing for the convenience of the

Court.