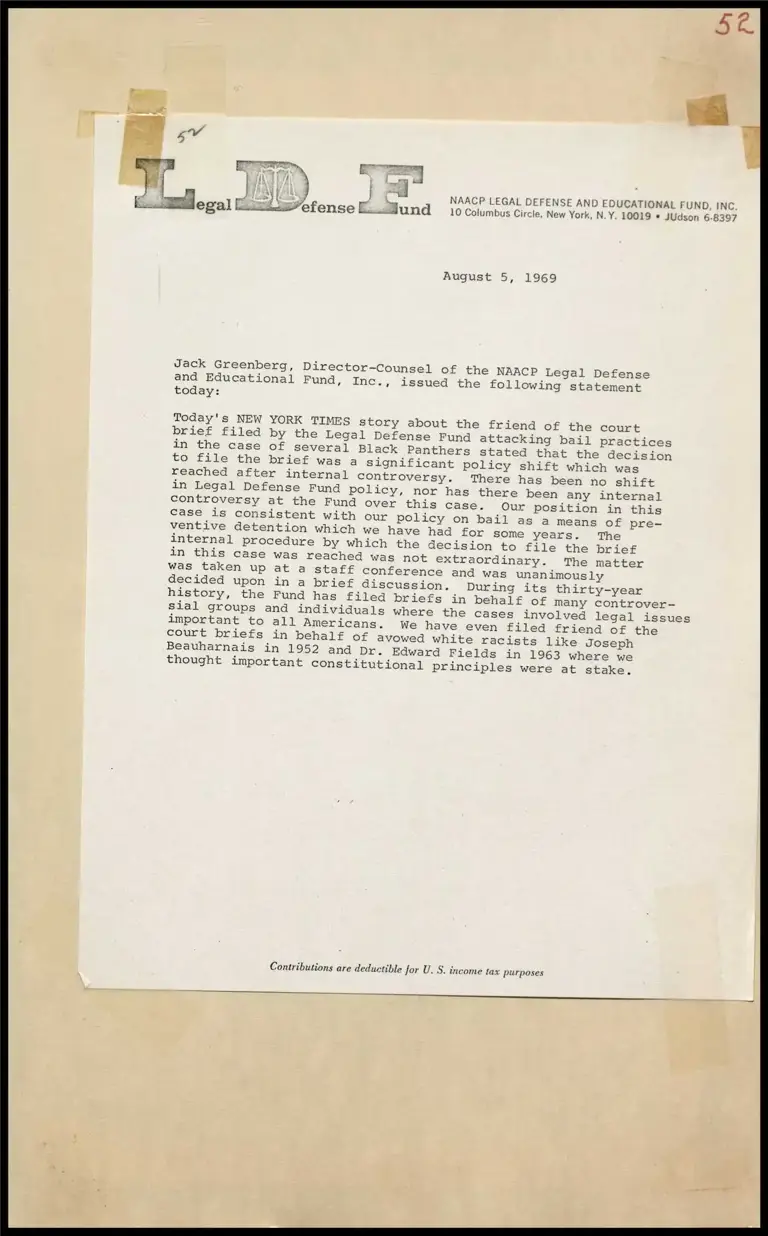

Greenberg Statement on New York Times Story and Internal Policies Re: Brief on Behalf of Black Panthers

Press Release

August 5, 1969

Cite this item

-

Press Releases, Volume 6. Greenberg Statement on New York Times Story and Internal Policies Re: Brief on Behalf of Black Panthers, 1969. e74501a8-b992-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/4864a28d-110f-4673-ad9b-8ad073f18c86/greenberg-statement-on-new-york-times-story-and-internal-policies-re-brief-on-behalf-of-black-panthers. Accessed February 21, 2026.

Copied!

}

ee

hee ae egal

Jack Greenberg, Director-couw

and Educational Fund, Inc.,

today:

AVP i

JnnaiPefense Lund

Se

NAACP LEGAL DEFENSE AND E DUCATIONAL FUND, INC

10 Columbus Circle, New York, N.Y. 10019 « JUdson 6-8397

August 5, 1969

msel of the NAACP Legal Defense

issued the following statement

Today's NEW YORK TIMES

brief filed by the Lega

story about the friend of the court

an D

efense Fund attacking bail practices in the case of several Bla ck P.

to file the brief was a signif

reached after internal controv

in Legal Defense Fund policy,

controversy at the Fund over t

case is consistent with our po

ventive detention which we hav.

internal procedure by which th

in this case was reached was n

was taken up at a staff confer

anthers stated that the decision

icant policy shift which was

ersy. There has been no shift

nor has there been any internal

his case. Our position in this

licy on bail as a means of pre-

e had for some years. The

€ decision to file the brief

ot extraordinary. The matter

ence and was unanimously

During its thirty-year

decided upon in a brief discussion.

history, the Fund has filed briefs in

sial groups and individuals where the

behalf of many controver-

cases involved legal issues

We h ave even filed friend of the

important to all Americans.

court briefs in behalf of av

Beauharnais in 1952 and pr.

thought important constituti

Contributions are deductible for U.

owed white racists like Joseph

Edward Fields in 1963 where we

onal principles were at stake.

S. income tax purposes