Miles College Honor Graduate to Teach Two Law Courses Here

Press Release

September 22, 1968

Cite this item

-

Press Releases, Volume 5. Miles College Honor Graduate to Teach Two Law Courses Here, 1968. 3596e2f6-b892-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/5f7eebb5-508f-467c-8687-52599799fbc1/miles-college-honor-graduate-to-teach-two-law-courses-here. Accessed February 21, 2026.

Copied!

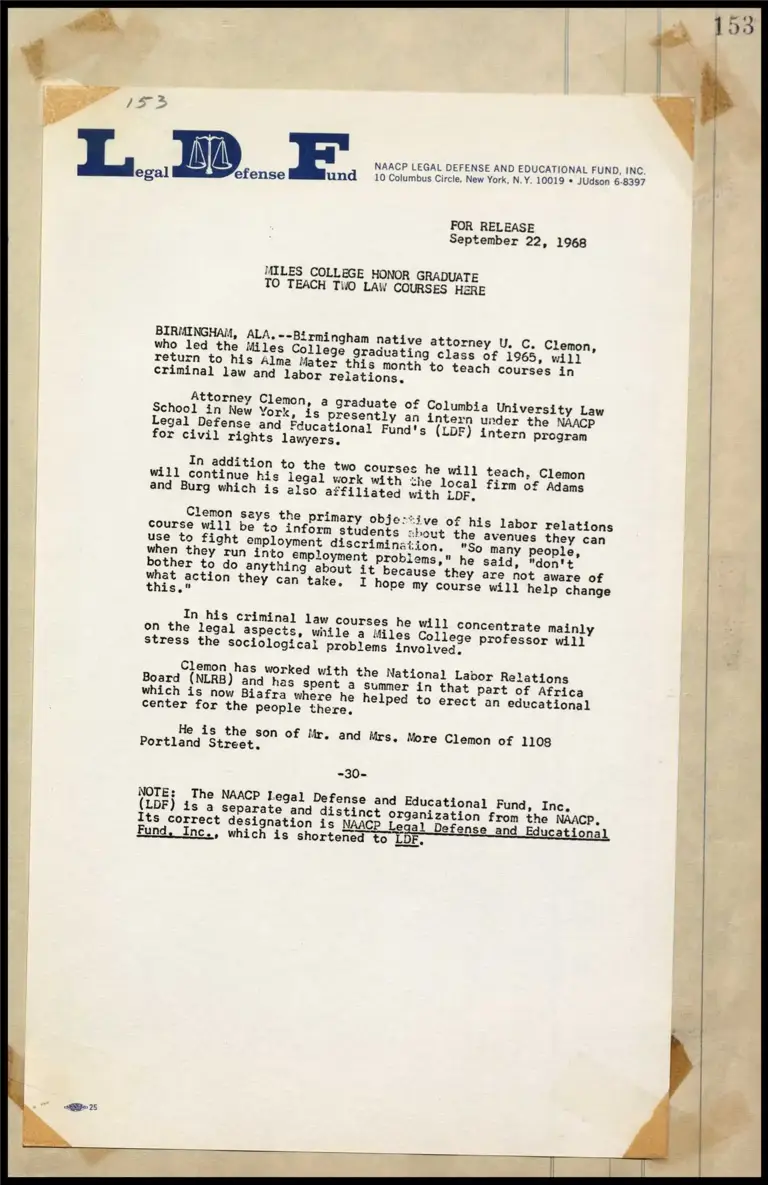

NAACP LEGAL DEFENSE AND EDUCATIONAL FUND, INC. egal ‘efense FE. 10 Columbus Circle, New York, N.Y. 10019 * JUdson 6.8397

FOR RELEASE

September 22, 1968

MILES COLLEGE HONOR GRADUATE TO TEACH TWO LAW COURSES HERE

BIRMINGHAM, ALA, --Birmingham native attorney U. C, Clemon, who led the Miles College graduating class of 1965, will return to his Alma Mater this month to teach courses in criminal law and labor relations,

Attorney Clemon, a graduate of Columbia University Law School in New York, is presently an intern under the NAACP Legal Defense and Fducational Fund's (LDF) intern program for civil rights lawyers,

In addition to the two courses he will teach, Clemon will continue his legal work with the local firm of Adams and Burg which is also affiliated with LDF,

ive of his labor relations ut the avenues they can

n. "So many people, when they run into employment probiems," he said, "don't bother to do anything about it because they are not aware of what action they can take, I hope my course will help change this,"

In his criminal law courses he will concentrate mainly on the legal aspects, while a Miles College professor will stress the sociological problems involved.

Clemon has worked with the National Labor Relations Board (NLRB) and has spent a summer in that part of Africa which is now Biafra where he helped to erect an educational

s the son of Mr. and Mrs. More Clemon of 1108

He i

Portland Street.

=30=

NOTE: The NAACP Legal Defense (LDF) is a Separate and distinct organization from the NAACP,