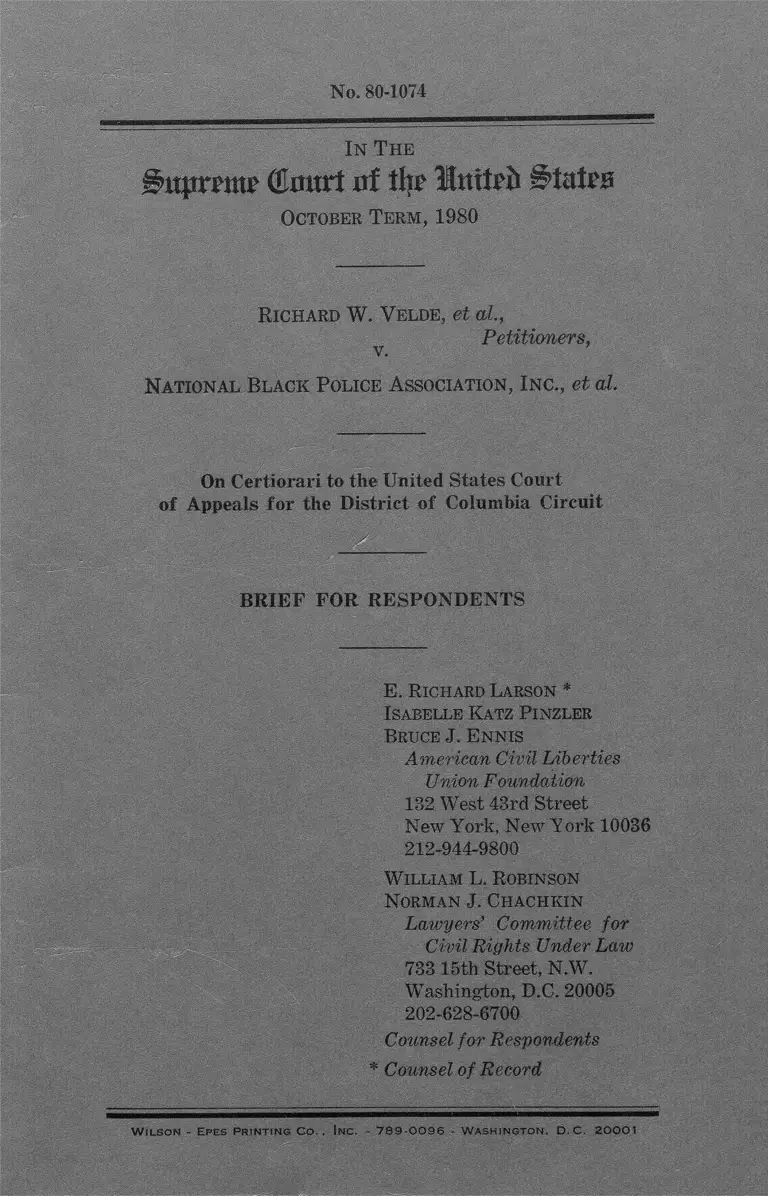

Velde v. National Black Police Association, Inc. Brief for Respondents

Public Court Documents

October 6, 1980

Cite this item

-

Brief Collection, LDF Court Filings. Velde v. National Black Police Association, Inc. Brief for Respondents, 1980. 2a404604-c89a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/8794926b-5be0-4f02-8042-47c406702d28/velde-v-national-black-police-association-inc-brief-for-respondents. Accessed February 21, 2026.

Copied!

N o. 80-1074

In The

(&mrt at tJfr Inltri Btutv#

October Term, 1980

Richard W. Velde, el al,

Petitioners,v.

National Black Police A ssociation, Inc., et al.

On Certiorari to the United States Court

of Appeals for the District of Columbia Circuit

: ; : A _ . •

BRIEF FOR RESPONDENTS

E. Richard Larson *

Isabelle Katz Pinzler

Bruce J. Ennis

American Civil Liberties

Union Foundation

132 West 43rd Street

New York, New York 10036

212-944-9800

W illiam L. Robinson

Norman J. Ciiachkin

Lawyers’ Committee for

Civil Rights Under Law

733 15th Street, N.W.

Washington, D.C. 20005

202-628-6700

Counsel for Respondents

* Counsel of Record

W il s o n - Ep e s P r in t in g Co . . In c . - 7 8 9 - 0 0 9 6 - W a s h in g t o n , D .C . 2 0 0 0 1

COUNTER-STATEMENT OF QUESTIONS PRESENTED

1. Are the administrators of federal grant-in-aid pro

grams, who must insure that funds are expended by

their grantees in accordance with applicable federal re

strictions, entitled to an absolute immunity from damages

liability for their allegedly willful, unconstitutional re

fusal to enforce federal civil rights requirements?

2. Do allegations that LEAA program administrators

willfully and maliciously refused to carry out any of their

civil rights enforcement obligations and continued to ex

pend federal funds to support the admittedly discrimina

tory practices of LEAA grantees state a cause of action

for damages under the Fifth Amendment?

3. Should the district court have granted petitioners’

motion for summary judgment, insulating them from any

liability to respondents on the theory that petitioners

acted “ in good faith” albeit unconstitutionally, where the

only admissible evidence submitted by the government

contained no assertions of “good faith,” and where re

spondents’ submissions— despite the denial of any dis

covery by the district court—would have supported a

finding on this record that petitioners deliberately vio

lated respondents’ constitutional rights?

(i)

TABLE OF CONTENTS

STATEMENT ........... 1

SUMMARY OF ARGUMENT.............. 10

ARGUMENT ........ 14

Page

TABLE OF AUTHORITIES ......... -..... .................... . iv

I. Administrators Of Grant Programs, Whose Re

sponsibilities Include The Enforcement Of Fed

eral Restrictions Upon The Use Of Funds By

Grantees, Are Not Prosecutors Protected By An

Absolute Immunity From Damages Liability

For Their Unconstitutional Actions ................... 14

II. Respondents Have A Cause Of Action For Dam

ages To Redress The Deprivation Of Their Fifth

Amendment Rights Based Upon Their Allega

tions Of Petitioners’ “Willful And Malicious”

Refusal To Enforce Restrictions Imposed By

The Fifth Amendment And By The Crime Con

trol Act Upon The Use Of Federal Funds To

Support Discriminatory Practices Of LEAA

Grantees ........ 30

III. Petitioners, On This Record, Cannot Demon

strate That They Should Be Accorded Qualified

Immunity As A Matter Of Law__ ________.... 42

CONCLUSION .............................................................. 50

APPENDIX—Relevant Portions Of The Legislative

History Of § 518(c) Of The Crime Con

trol Act As Enacted In 1973 And As

Amended In 1976...... . la

(iii)

Cases

TABLE OF AUTHORITIES

Page

Adams v. Richardson, 480 F.2d 1159 (D.C. Cir.

1973) (en banc) ........................... ................... „... 36, 41

Adi ekes v. S.H. Kress & Co., 398 U.S. 144 (1970).. 13, 45,

47, 48, 49, 50

Bane v. Spencer, 393 F.2d 108 (1st Cir. 1968)-... 47

Bivens v. Six Unknown Fed. Narcotics Agents, 403

U.S. 388 (1971)............ ................ ...............11,12, 30, 32

Bolling v. Sharpe, 347 U.S. 497 (1954) ............... 31

Briggs v. Goodwin, 569 F.2d 10 (D.C. Cir. 1977),

cert, denied, 437 U.S. 904 (1978) .......... ...... ..... 28

Butz v. Economou, 438 U.S. 478 (1978) ________ passim

Carey v. Piphus, 435 U.S. 247 (1978) ................... 32

Carlson v. Green, 446 U.S. 14 (1980) ___ _____30,31,32

Coit v. Green, 404 U.S. 997 (1971), aff’g Green v.

Connally, 330 F. Supp. 1150 (D.D.C. 1971) ....35, 40, 49

Committee for Full Employment v. Blumertthal,

606 F.2d 1062 (D.C. Cir. 1979) ....... .................. 36

Committee for Nuclear Responsibility, Inc. v. Sea-

borg, 463 F.2d 783 (D.C. Cir. 1971) ............. 47

Conley v. Gibson, 355 U.S. 41 (1957) _______ __ 46

Costlow v. United States, 552 F.2d 560 (3d Cir.

1977) _______ _____ ___ ______ ___ _______ _______ 47

Davis v. Passman, 442 U.S. 228 (1979)........30, 31, 32, 37

Dellums v. Powell, 50 U.S.L.W. 2101 (D.C. Cir.,

July 24, 1981) _____________ _______________ 20

Duke Power Co. v. Carolina Environmental Study

Group, Inc., 438 U.S. 59 (1978) .......... ..... ........ 38,42

Forsyth v. Kleindienst, 599 F.2d 1203 (3d Cir.

1979) ______________ __ ___ ___________ _______ 27

Francis-Sobel v. University of Maine, 597 F.2d 15

(1st Cir.), cert, denied, 444 U.S. 949 (1979).... 37

Gautreaux v. Romney, 448 F.2d 731 (7th Cir.

1971) _____ __________ ____ ______ _______ _____ 36

Gilmore v. City of Montgomery, 417 U.S. 556

(1974) ......_____ ______ _____________________ 35,40

Gladstone, Realtors v. Village of Bellwood, 441

U.S. 91 (1979) 38

V

TABLE OF AUTHORITIES— Continued

Page

Gomez v. Toledo, 446 U.S. 635 (1980) .......... ........ 33

Guerro v. Mulheam, 498 F.2d 1249 (1st Cir.

1974) ....—....... ........... .............. -........................ - 28

Halperin v. Kissinger, 606 F.2d 1192 (D.C. Cir.

1979), aff’d by equally divided court, 69 L. Ed.

2d 367 (1981) .............. -.........-............. -........ ----- 27

Hampton v. City of Chicago, 484 F.2d 602 (7th

Cir. 1973), cert, denied, 415 U.S. 917 (1974).... 28

Hampton v. Hanrahan, 600 F.2d 600 (7th Cir.

1979), cert, denied on relevant issue, 446 U.S.

754, 759 (1980) ......... ............... ........................... 27

Helstoski v. Goldstein, 552 F.2d 564 (3d Cir.

1977)....... .................... -....................-----....... -.... - - 28

Hunt v. Washington Apple Advertising Comm’n,

423 U.S. 333 (1977)..... ........ .......... .... ............... 39

Imbler v. Pachtman, 424 U.S, 409 (1976)..........20, 27, 43

Legal Aid Society of Alameda County v. Brennan,

608 F.2d 1319 (9th Cir. 1979), cert, denied, 447

U.S. 921 (1980) ......... ............... . ..-------- ------- 35-36

Mancini v. Lester, 630 F.2d 990 (3d Cir. 1980).... 27

Marrero v. Hialeah, 625 F.2d 499 (5th Cir. 1980).. 27

Marshall v. Jerrico, Inc., 446 U.S. 238 (1980) 21

Martinez v. California, 444 U.S. 277 (1980) — .... 37

Miller v. DeLaune, 602 F.2d 198 (9th Cir. 1979).. 27

Morrison Flying Serv. v. Denting Nat’l Bank, 340

F.2d 430 (10th Cir. 1965)....... .............. -....... . 47

NAACP v. Button, 371 U.S. 415 (1963)................ 39

NAACP, Western Region v. Brennan, 360 F. Supp.

1006 (D.D.C. 1973) ........ - ........ ------........— - 36

NLRB v. Sears, Roebuck & Co., 421 U.S. 132

(1975) ..... -----..... - - - - - ....... -------.... 42

Norwood v. Harrison, 413 U.S. 455 (1973) ...11-12, 31, 35,

36, 37, 39, 40, 49

O’Connor v. Donaldson, 422 U.S. 563 (1975)------ 45

Procunier v. Navarette, .434- U.S. 555 (1978) ....... 45

Quinn v. Syracuse Model Neighborhood Corp., 613

F.2d 438 (2d Cir. 1980).......... —- ........- ............. 47

Ramsey v. United Mine Workers, 401 U.S. 302

(1971) .......... .......... -...... -............ 42

Rizzo v. Goode, 423 U.S. 362 (1976)___ ____ ____ 37

Scheuer v. Rhodes, 416 U.S. 232 (1974) ...........11,13,14,

26, 29, 45

Sierra Club v. Morton, 405 U.S. 727 (1972)____ 39

Slavin v. Curry, 574 F.2d 1256 (5th Cir. 1978).... 27-28

United States v. City of Chicago, 549 F.2d 415

(7th Cir.), cert, denied, 434 U.S. 875 (1977).— 41-42

United States v. Diebold, Inc., 369 U.S. 654

(1962) ........ .......... ................................................. 45,50

Washington v. Cameron, 411 F.2d 705 (D.C. Cir.

1969) ................................ .................. ......... ....... . 47

Wood v. Strickland, 420 U.S. 308 (1975) .........13, 28, 45,

48-49

Zweibon v. Mitchell, 516 F.2d 594 (D.C. Cir. 1975),

cert, denied, 425 U.S. 944 (1976) ______ ____ ___ 28

Constitution and Statutes

U.S. Const., A rt. II, § 3 ............... ...................... . 16

U.S, Const., Art. I l l _________ ___ ____________ 38, 40

U.S. Const, Amend. V ___ ___________ 16, 30, 31, 37, 38

29 U.S.C. § 816(c)(1) (Supp. II 1978) ............... 19

29 U.S.C. § 818(d) (1976) ........... 19

29 U.S.C. § 991(b) (1976) ______ 19

42 U.S.C. § 2000d-l (1976) ...... 18

42 U.S.C. § 3766(c) (1976) ...................... 7,1a

42 U.S.C. § 3766(c) (Supp. V 1975).................... la

42 U.S.C. § 3766(c) (2) (Supp. V 1975) ___ 2

42 U.S.C. § 5309(b) (1976) ..................... 18

42 U.S.C. § 5311 (1976) ............... 18

49 U.S.C. § 1615(a) (3) (B) (1976) ......... 18-19

Crime Control Act of 1976, Pub. L. No. 94-503,

§ 122, 90 Stat. 2404, 2418 ______ __________ .....2, 7, la

Crime Control Act of 1973, Pub. L. No. 93-83, § 2,

87 Stat. 197 .... ...... ................ ....... ......... ..... ......passim

Rules

F.R. CIV. P. 5 6 ..................................... ....... ............. 13, 47

F.R. Civ. P. 56(c) ................. ...... ................ .45, 47, 50

F.R. CIV. P. 56(e) .................. .... ................. .47,48,49

F.R. Civ. P. 56(f) ...... ............... ............ .............. 46

vi

TABLE OF AUTHORITIES— Continued

Page

vii

TABLE OF AUTHORITIES— Continued

Regulations Page

28 C.F.R. § 42.206(a) (1973) .................................. 22

41 Fed. Reg. 28478 (June 12, 1976) ................... 23

40 Fed. Reg. 56454 (December 3, 1975)............. 23

37 Fed. Reg. 16671 (August 18, 1972) ....... 22

Legislative Materials

Reports

H.R. Rep. No. 94-1155, 94th Cong., 2d Sess.

(1976)............................................... ........ ....6, 22-23,12a

H.R. Rep. No. 93-249, 93rd Cong., 1st Sess.

(1973) ....................................................... la

Debates

119 Cong. Rec. (1973) ................1, 2, 3, 20, 23, 40, la, 4a

Hearings

LEAA Hearings Before the Subcommittee on

Crime of the House Committee on the Judiciary,

94th Cong., 2d Sess. (1976) ........... ....... 3, 6, 7, 23, 13a

LEAA Hearings Before Subcommittee No. 5 of

the House Committee on the Judiciary, 93rd

Cong., 1st Sess. (1973) ..... ............................ 2, 3, 40, 4a

Bills

H.R. 12364, 94th Cong., 2d Sess. (1976) ................. 12a

Other Authorities

6 Moore’s Federal Practice (2d ed. 1976)........ 47

U.S. Comm’n on Civil Rights, The Federal Civil

Rights Enforcement Effort— 1974 (Vol. VI,

To Extend Federal Financial Assistance)

(1975) ........... ..................... .. .....................5, 6, 40-41

C. Wright & A. Miller, Federal Practice and

Procedure (1 9 7 3 ).... ...................................... ........ 47

In The

g>ttpranp (tart at % Initris Ĵ tatr a

October Term , 1980

No. 80-1074

R ichard W. V elde, et al,

Petitioners, v. ’

National Black Police Association, Inc., et al.

On Certiorari to the United States Court

of Appeals for the District of Columbia Circuit

BRIEF FOR RESPONDENTS

STATEMENT

Respondents accept most of the petitioners’ description

of the factual circumstances which shape this case, sub

ject to the additions and clarifications below concerning

(1) petitioners’ statutory civil rights enforcement obliga

tions, (2) the scope of respondents’ complaint, and (3)

the posture of this case in the trial court.

1. Petitioners’ description of their statutory civil

rights enforcement responsibilities, Pet. Br. 4-5, fails to

note that § 518(c) (2) was added to the Omnibus Crime

Control and Safe Streets Act in 1973 (through an amend

ment introduced by Rep. Barbara Jordan) because of

the fact that LEAA theretofore had “had no civil rights

2

enforcement program.” 1 In fact, “ [i]t took over 2 years

. . . [after its establishment in 1968] before LEAA

recognized its responsibilities to prevent racial discrimi

nation in the use of its funds.” 2

Even after LEAA formally recognized in 1970 that it

had a civil rights enforcement “ obligation [which] stems

from the Fifth and Fourteenth Amendments and [which]

is reflected in the policy underlying Title VI of the Civil

Rights Act of 1964,” 3 its “ inaction of the previous two

years” continued to be defended at the highest levels of

its parent agency, the United States Department of Jus

tice,4 and LEAA officials continued to refuse “ to deal

1 H 9 CONG. Rec. 20071 (June 18, 1973) (Rep. Jordan). The

Crime Control Act of 1973, Pub. L. No. 93-83, § 2 (August 6,

1973), 87 Stat. 197, added Rep. Jordan’s amendment as § 518(c) (2)

of the Act. See 42 U.S.C. § 3766(c) (2) (Supp. V 1975). The

complete text of § 518(c) (2) as enacted in 1973 is set forth at

Pet. Br. 2-3.

Relevant portions of the legislative history pertaining to the

civil rights enforcement provisions of the Crime Control Act of

1973 and of the Crime Control Act of 1976 are set forth in the

appendix to this Brief, at la-24a infra.

2 119 Cong. Rec. 22059 (June 28, 1973) (Sen. Bayh).

3 LEAA Hearings Before Subcommittee No. 5 of the House Com

mittee on the Judiciary, 93rd Cong., 1st Sess. 621 (1973) (Rep.

Hawkins).

4 As Representative Hawkins explained, id. at 621-22 :

In July 1970, the Office of Legal Counsel of the Department

of Justice (then headed by William Rehnquist) issued a legal

position letter attempting to justify the inaction of the previ

ous two years by declaring that Title VI of the Civil Rights

Act of 1964 was not applicable to employment practices of

LEAA grantees and subgrantees. This position received scath

ing criticism from civil rights groups and from the Civil

Rights Commission. On October 23, 1970, an additional opin-

3

with complaints in an expeditious manner,” “ performed

[no] pre-award [civil rights compliance] reviews,” and

adopted “ regulations indicat [ing] a strong preference

that a judicial proceeding rather than the more logical

one of an administrative proceeding be used [to secure

com p lian ce]8

In enacting § 518(c) (2) in 1973, Congress not only

sought to “ reverse LEAA’s traditional reliance on court

proceedings to correct discrimination, rather than un

dertaking administrative enforcement of civil rights re

quirements,” * 5 6 but also “ imposed upon LEAA the most

stringent statutory civil rights mandate” governing any

federal agency.7

2. Respondents filed this lawsuit because, according to

the allegations of the complaint, petitioners had utterly

failed to carry out their constitutional and statutory civil

rights enforcement obligations and had knowingly con

tinued to distribute millions of dollars in federal

ion, from the Department of Justice’s Office of Title VI, ad

dressed to Jerris Leonard in his capacity as Assistant At

torney General for the Civil Rights Division, argued force

fully— and apparently convincingly— that LEAA programs

were indeed covered by Title VI. The LEAA acquiesced and

promulgated regulations implementing the law.

5 Id. at 622 (Rep. Hawkins).

6 119 Cong. Rec. 20071 (June 18, 1973) (Rep. Jordan). As Rep.

Jordan explained her amendment, which became § 518(c) (2 ), id.:

The effect of my amendment . . . is to require LEAA to first

use the same enforcement procedure which applies to any

other violation of LEAA regulations or statutes. That proce

dure of notification, hearings, and negotiations is spelled out

in Section 509, which provides the ultimate sanction of fund

ing cutoff if compliance is not obtained.

7 LEAA Hearings Before the Subcommittee on Crime of the

House Committee on the Judiciary, 94th Cong., 2d Sess. 606

(1976) (Rep. Rangel).

4

grants to state and local police departments practicing

discrimination.

Respondents’ lawsuit sought declaratory and injunc

tive relief (in the nature of mandamus) to compel pe

titioners and their successors in office to enforce the law,

and damages on account of petitioners’ prior conduct.

Respondents’ complaint did not merely attack a few un

related failures by petitioners to investigate individual

complaints or to take administrative enforcement actions

when investigations established civil rights noncompliance;

instead, respondents alleged a consistent policy and prac

tice that bore no relation to individualized decisionmaking

or to the exercise of discretion on a case-by-case basis.

For example, petitioners were charged with:

— systematically responding not at all or ineffectively

to all administrative complaints of discrimination

filed by aggrieved individuals, and taking no ef

fective enforcement action against any grantees

found to be in civil rights noncompliance, J.A. 21,

26-28, 30-32, 35-36, 40-41;

—maintaining “ a policy of not conducting any pre

award [civil rights] compliance reviews of law

enforcement agencies which applied for LEAA

funding,” undertaking very few post-award com

pliance reviews, and taking no administrative ac

tion when discrimination was found, J.A. 20, 34-

35, 36-38;

— refusing to take action against grantees which had

been adjudicated to be discriminatory or which

had been sued because of alleged discrimination,

J.A. 18-19, 28-30, 32-34, 38-40;

— refusing to take action against, but continuing to

fund, grantee law enforcement agencies which pe

titioners knew to maintain prima facie discrimina

tory policies and practices, J.A. 19-20, 22-41;

5

— asserting, contrary to LEAA’s own published reg

ulations, “ that the utilization of women in police

service is a ‘novel question’ ” and refusing to

“ terminate LEAA funding to any law enforce

ment agency which denies sworn police officer em

ployment to women,” J.A. 21, 26-28, 80-32, 34-38,

40-41;

— never having conducted an administrative hear

ing that could lead to terminating, and never hav

ing “ denied or terminated LEAA funding . . .

on the grounds that the law enforcement agency

was engaged in race or sex discrimination or was

' otherwise in civil rights noncompliance,” J.A. 21.

Petitioners’ refusals to respond effectively to the adminis

trative complaints and requests of the individual plain

tiffs were alleged, in detail, as examples of these broad

policies and practices. Petitioners’ actions were alleged

to be unconstitutional, in excess of their authority, will

ful, and malicious, J.A. 41-44.8

8 A report issued by the Civil Rights Commission two months

after this lawsuit was filed closely paralleled the allegations of the

complaint. U.S. Comm’n on Civil Rights, The Federal Civil

R ights Enforcement Effort— 1974 (Vol. VI, To Extend, Federal

Financial Assistance) 271-393, 773-77 (1975).

The Commission found, for example, that “LEAA was slow to

investigate its complaints,” a fact due in part “to LEAA’s re

luctance to' take enforcement action when the recipients are re

sistant to coming into compliance voluntarily.” Id. at 374-75,

reprinted in C.A. App. 599-600. “LEAA rarely conducts compli

ance reviews,” id. at 355, C.A. App. 580, and when it did, the

agency often found that discrimination had occurred but took no

action: “Despite the apparent frequency, diversity, and severity

of civil rights problems uncovered by LEAA in its compliance

reviews, none of these reviews resulted in LEAA’s finding re

cipients to be in noncompliance.” Id. at 364, C.A. App. 589. Al

though 26 of the 50 largest police departments in the nation had

been sued for alleged race or sex discrimination, “LEAA had not

examined these cases to ascertain if they show primei facie civil

rights violations.” Id. at 380, C.A. App. 605. The agency’s record

6

Respondents’ charges were virtually duplicated by the

findings of subsequent congressional investigation. Al

though “ LEAA has both a constitutional and a statutory

responsibility to enforce [its] civil rights law,” * 9 the

House Judiciary Committee concluded in 1976 that “ [t]he

response of LEAA to the 1973 civil rights amendments

has been less than minimal.” 10 The “ attempt by Con

gress [in 1973] to make clear to LEAA that it is to

utilize and give preference to its administrative enforce

ment powers rather than its traditional reliance on ju

dicial remedies has been blatantly disregarded.” 11 The

1973 amendment had “not been enforced,” 12 and “was

was especially poor with regard to sex discrimination, inasmuch

as “LEAA has indicated that its reason for not enforcing equal

employment opportunity of women is that it believes sex may be a

valid criterion for selecting persons for police work.” Id. at 366,

C.A. App. 591. Finally, the report observed, “LEAA staff states

that the agency has never terminated funding because of a civil

rights violation,” id. at 383, C.A. App. 607, and “LEAA continues

to fund jurisdictions in which there is prima facie evidence of

civil rights violations.” Id. at 378, 777, C.A. App. 603, 623.

The Commission’s report was filed with the district court as an

exhibit to respondents’ motion for preliminary injunction, and

relevant portions of the report were reprinted in the Appendix filed

in the court of appeals, C.A. App. 481-623.

9 LEAA Hearings Before the Subcommittee on Crime of the

House Committee on the Judiciary, 94th Cong., 2d Seas. 447

(1976) (Rep. Jordan).

10 H.R. Rep. N o. 94-1155, 94th Cong., 2d Sess. 11 (1976). The

Judiciary Committee also observed, id.: “LEAA has never termi

nated payment of funds to any recipient because of a civil rights

violation. Despite positive findings of discrimination by courts and

administrative agencies, LEAA has continued to fund violators of

the Act.”

11 LEAA Hearings Before the Subcommittee on Crime of the

House Committee on the Judiciary, 94th Cong., 2d Sess. 606 (1976)

(Rep. Rangel) (emphasis added).

12 Id. at 442 (Rep. Jordan).

7

ignored,” 13 “ in effect making the federal government a

party to the discrimination which pervades our criminal

justice system. Our taxpayers’ dollars cannot be tun

neled in this discriminatory manner.” 14

3. The district court did not reach the merits of re

spondents’ complaint. It dismissed the request for in

junctive relief as moot and held that petitioners as fed

eral officials were protected from any damage claims by

an absolute immunity. Cert. Pet, App. 28a-29a. Both

of these rulings were reversed by the court of appeals.

Cert. Pet. App. la-23a. Petitioners do not seek review

here of the court of appeals’ reinstatement of the injunc

tive claims, Pet. Br. 6 n.8, but they do argue that the

court of appeals incorrectly denied them absolute im

munity from damages liability, Pet. Br. 14-28. The

13 Id. at 443 (Rep. Conyers).

14 Id- at 606 (Rep. Rangel). The legislative response to LEAA’s

record of nonenforcement was the enactment in 1976 of yet another

§ 518(c) (2) amendment, again authored by Rep. Jordan, which

added additional triggers to the already existing mandatory fund

termination requirements governing LEAA officials. Crime: Con

trol Act of 1976, Pub. L. No. 94-503, § 122 (October 15, 1976), 90

Stat. 2404, 2418; see 42 U.S.C. § 8766(c) (1976).

Although Representative Jordan remarked at the time that

“something” had to be done “about civil rights enforcement in the

Law Enforcement Assistance Administration,” LEAA Heariyigs

Before the Subcommittee on Crime of the House Committee on

the Judiciary, 94th Cong., 2d Sess. 442 (1976), there was of course

no guarantee that the response of LEAA officials would be any

different from that which greeted the 1973 amendment. As Repre

sentative Conyers observed, id. at 443:

We all enacted a law; everyone understood what it meant; it

went on the books; the President signed it; and then it was

ignored.

Now, some of us— yourself included— are getting a little

tired of this. We can pass civil rights laws year in and year

out, and the agency charged with the enforcement ends up

being the prime noncompliant.

8

petitioners also make two arguments here which were

not addressed by either court below: that respondents

failed to allege or prove the requisite elements of a

constitutional cause of action, and that even if they had

only a qualified immunity petitioners were on this record

unquestionably entitled to summary judgment in their

favor. Pet. Br. 28-44. Because of these arguments, it

is important to describe accurately the posture of this

case in the trial court.

a. Respondents were allowed no discovery. Ten days

after the case was commenced, respondents filed four

sets of discovery demands upon petitioners, and later

noticed a deposition of one of the petitioners. J.A. 1-3,

341-45.13 The government obtained an order staying

all discovery which the trial court thereafter refused to

vacate. Id.

b. Nevertheless, in January, 1976 respondents filed

affidavits and documentary evidence, obtained prior to

the commencement of this litigation through requests

made to LEAA under the Freedom of Information Act,

supporting their complaint and motion for preliminary

injunction. J.A. 2, 46-233.

c. When the government three weeks later moved to

dismiss, or alternatively for summary judgment, J.A.

3, 234-35, it filed only cursory affidavits in which the

petitioners stated that they had acted as administrators

within the scope of their official duties, and in which

they made no assertions that they had acted in good faith,

J.A. 236-64. The government also submitted an unsworn,

uncertified, discursive document entitled “Statement of

Reasons and Appendix,” * 16 * 18 but it simply is wrong to say,

16 See note 47 at 46 infra.

16 Part of this document is reprinted in the Joint Appendix

before this Court. J.A. 265-303. The entire document appears in

the Appendix filed in the Court of Appeals. C.A. App. 624-720.

[Footnote continued on page 9]

as the government does, that the “ Statement” was “ in

corporated by reference in [petitioner] Velde’s affidavit,”

Pet. Br. 27. The Velde affidavit refers to, but neither

incorporates the document nor attests to its accuracy.

See, e.g., J.A. 243.* 17

d. In opposition to the government’s motion, respond

ents relied not only upon the materials submitted with

their motion for preliminary injunction but also filed

additional affidavits and documentary evidence. J.A. 340-

494. They also submitted a 38-page statement of gen

uinely disputed issues.18 It is thus untrue to say that

“ respondents have not disputed any of the factual repre

sentations made in the Statement of Reasons and its

Appendix,” Pet. Br. 43, and it is also incorrect for the

government to characterize its summary judgment ma

terials as “ uncontradicted” or “ undisputed,” and to refer

18 [Continued]

In addition to these documents and to petitioners’ affidavits, the

government also submitted a four-paragraph, one-and-one-half-page

statement of material facts, which stated no facts at all. C.A.

App. 188-89.

17 Petitioner Velde could not have done so. See note 48 at 47

infra.

18 The statement of genuine issues filed by respondents, J.A. 309-

39, points out that the government’s submissions were inadequate

to establish the policies which petitioners actually followed or the

motivations for their actions or inactions, see, e.g., J.A. 315-18.

And the affidavits of the respondents and their counsel, see J.A. 51-

233, 346-494, were more than adequate to call into question the

government’s assertion that “petitioners made extensive efforts to

enforce the Act’s antidiscrimination provisions . . . [and] the only

conclusion that can be supported by the record is that petitioners

acted reasonably and in good faith in attempting enforcement

measures before considering whether to resort to funding termina

tion,” Pet. Br. 43. Finally, respondents reminded the district court

that its stay of all discovery prevented them from submitting addi

tional “sworn, admissible evidence in opposition” to the assertions

of, the government. See J.A. 340-42. .

10

to the record as an “uncontradicted record,” Pet. Br. 11,

13, 25.

SUMMARY OF ARGUMENT

I

In Butz v. Ecommon, 438 U.S. 478 (1978), this Court

held that federal officials, like their state counterparts,

are entitled only to a qualified, “ good faith” immunity

from damages liability for misconduct while in office.

The Court recognized a very few, narrow exceptions to

this general rule for, inter alia, those officials who are

akin to prosecutors because they have “broad discretion

in deciding whether a [civil penalty] proceeding should

be brought and what sanctions should be sought,” id. at

515. Butz does not support the government’s claim of

absolute immunity here.

A. The Butz exception is inapplicable to this case

because the misconduct alleged by the respondents ex

tends far beyond any role which petitioners might have

played in connection with adjudicatory administrative

proceedings (had there been any). Petitioners were

charged with an across-the-board refusal to carry out

any of their constitutional and statutory civil rights en

forcement obligations. The exception cannot be stretched

to cover all of petitioners’ alleged misconduct, on the

premise that it was ultimately connected to petitioners’

failure to conduct administrative proceedings, without

swallowing up the Butz holding.

B. Even if this case concerned only petitioners’ re

fusal to initiate fund termination proceedings, the ex

ception in Butz still would not apply because petitioners

had no prosecutorial discretion.

1. Congress in the Crime Control Act mandated the

use of this enforcement tool against grantees not in

compliance with civil rights requirements— using lan

guage quite different from that in other statutes such

11

as Title VI of the Civil Rights Act of 1964. Hence pe

titioners lacked “ broad discretion in deciding whether a

proceeding should be brought.” 438 U.S. at 515. And

they had no discretion to decide “what sanctions should

be sought,” id., since the statute provides only for the

termination of “ federal payments.” This mandated sanc

tion also is entirely unlike the range of civil penalties

(such as license revocation, in Butz) available to Execu

tive Branch officials whom this Court has recognized as

“ prosecutors.”

2. The record here also bars the government’s claim

of prosecutorial immunity. The evidence establishes that

petitioners deprived themselves of any discretion by main

taining and rigidly following a policy against ever in

itiating fund termination proceedings. Significantly, no

where in their summary judgment affidavits did peti

tioners describe themselves as exercising prosecutorial

functions.

C. Even if petitioners were to be regarded as prosecu

tors, it would be inappropriate in this case for the Court

to accord them absolute immunity from liability for their

allegedly deliberate, unconstitutional maetion. The adver

sarial checks or other safeguards on prosecutorial mis

conduct upon which the Court relied in Butz are absent

when officials are alleged to have willfully failed to take

any action at all. Indeed, the policy of encouraging execu

tive actions and decisionmaking which underlies all im

munities— absolute or qualified, see Scheuer v. Rhodes,

416 U.S. 232, 242 (1974)— is inapplicable in this

situation.

II

The allegations of respondents’ complaint are more

than sufficient to state a Bivens cause of action under

the Fifth Amendment, see Butz v. Economou, supra, to

remedy violations of a government agency’s “ constitu

tional obligation . . . to steer clear . . . of giving signifi

12

cant aid to institutions that practice racial or other in

vidious discrimination,” Norwood v. Harrison, 418 U.S.

455, 467 (1973).

A. Not only did respondents extensively document

their allegations that petitioners funded grantees which

they knew to be discriminatory, but respondents also

specifically charged petitioners with “willful and mali

cious” refusals to carry out their civil rights enforcement

obligations, in violation of the principle applied in Nor

wood and similar cases. (In its argument on this point,

the government curiously does not cite Bivens, Butz, or

Norwood. )

B. Since these allegations concerned the behavior and

constitutional obligations of petitioners—-and not the dis

criminatory practices of their grantees— any uncertainty

about how those grantees might have responded had peti

tioners undertaken any civil rights enforcement efforts

does not affect respondents’ cause of action against peti

tioners. As the Chief Justice observed in Norwood v.

Harrison, supra, 413 U.S. at 465-66: “ We do not agree

with [the government’s] analysis of the legal conse

quence of this uncertainty, for the Constitution does not

permit [government] to aid discrimination even when

there is no precise causal connection between [govern

ment] financial aid to a [discriminator] and the con

tinued well-being of that [discriminator].”

C. Even if the government’s arguments are viewed as

questioning respondents’ Article III standing, they are

without merit, both for the reasons stated above and be

cause the allegations of the complaint were ample to

survive a motion to dismiss, as Judge Tamm, partially

dissenting below, recognized.

I ll

The government’s final submission— that this Court

should perform the functions of a trial court by ruling

on contested factual issues decided by neither court be

is

low, and by holding that petitioners on this record are

entitled to qualified immunity as a matter of law—mis

takes the role of this Court, misinterprets the law of

official immunity, and misconstrues the record in this

case.

According to the teaching of cases such as Scheuer v.

Rhodes, supra, and Wood v. Strickland., 420 U.S. 308

(1975), cited approvingly in Butz v. Economou, supra,

a determination of entitlement to qualified immunity re

quires an exploration into the facts, circumstances, and

motivations surrounding the actions or inactions of the

officials charged with constitutional violations. The trier

of fact must determine whether the officials behaved mali

ciously, or in a manner which they knew (or should have

known) would violate constitutional rights. As the gov

ernment itself pointed out in its Brief in Butz, these is

sues are not ordinarily susceptible of determination on

the basis of affidavits which might be filed in connection

with a summary judgment motion; testimony and cross-

examination are necessary.

Summary judgment for petitioners would have been

particularly inappropriate in this case, since the govern

ment’s motion was inadequately supported (for example,

petitioners nowhere claimed in their affidavits that they

had acted in good faith), since respondents were denied

any discovery by a protective order obtained by petition

ers, and since respondents’ own affidavits and documen

tary material submitted in opposition to the government’s

motion amply demonstrated the existence of genuine fact

issues. See F.R, Civ. P. 56; Adickes v. S.H. Kress & Co.,

398 U.S. 144, 157 (1970).

14

ARGUMENT

I. Administrators Of Grant Programs, Whose Responsi

bilities Include The Enforcement Of Federal Restric

tions Upon The Use Of Funds By Grantees, Are Not

Prosecutors Protected By An Absolute Immunity

From Damages Liability For Their Unconstitutional

Actions

In Butz v. Economou, supra, 438 U.S. at 507, this

Court applied the “Schemer principle of only qualified im

munity for constitutional violations . . . [to hold fil ederal

officials liable . . . [for damages if they] discharge their

duties in a way that is known to them to violate the

United States Constitution or in a manner that they

should know transgresses a clearly established constitu

tional rule.” In reaching this conclusion, the Court re

jected the government’s argument

that all of the federal officials sued in this case are

absolutely immune from any liability for damages

even if in the course of enforcing the relevant stat

utes they infringed respondent’s constitutional rights

and even if the violation was knowing and deliberate.

Id. at 485. Undeterred, the United States, on behalf of

the petitioners here, resurrects its Butz arguments in an

attempt to expand this Court’s narrow exception for

prosecutors, see id. at 509-11, 515-17, so as to swallow

up the ruling in Butz. The government seeks to ac

complish this by renaming all of the administrators with

in LEAA’s hierarchy who had any connection with its

civil rights enforcement activities as “prosecutors.”

The government’s immunity claim must be rebuffed.

Petitioners here were charged not just with refusing to

initiate administrative proceedings but with an across-

the-board refusal to perform any of their constitutional

and statutory civil rights enforcement obligations. Even

if this case concerned only the failure to initiate adminis

15

trative fund termination proceedings, petitioners still

could not be clothed with an absolute prosecutorial im

munity because the Crime Control Act allowed them no

discretion once a grantee was determined to be out of

compliance, and because the statute in any event does not

provide for the imposition of a civil penalty against

grantees. Further, the record in this case established

that petitioners exercised no discretion but uniformly

followed a policy against initiating administrative pro

ceedings, and in their own affidavits, petitioners nowhere

described their functions as prosecutorial. Finally, the

Court should not allow the government’s claim here be

cause the justifications for absolute immunity— official

acts subject to adversarial checks or similar safeguards

against prosecutorial misconduct— are not present when

federal officers refuse to act at all,

A. Contrary to petitioners’ characterization of this

case, see Pet. Br. 16-17, respondents did not challenge

only petitioners’ refusal to initiate administrative fund

termination proceedings upon finding civil rights non-

compliance. Instead, as is pointed out at 3-5, supra,

respondents claimed that they, and the class they seek

to represent, had been harmed by petitioners’ long

standing and consistent refusal to carry out any of their

constitutional and statutory civil rights enforcement ob

ligations, J.A. 18-41. In other words, the foundation of

this action is quite different in degree from that in Blitz.

This lawsuit was not brought by a single disgruntled

corporate official complaining that he had been unfairly

targeted and thereafter penalized in an individual ad

ministrative enforcement proceeding. And, it involves

much more than executive decisionmaking about one or

even numerous administrative proceedings, see Pet. Br.

25. Respondents here charged petitioners with a whole

sale refusal to exercise any of the meaningful enforce

ment tools available to them, resulting in continued un

constitutional government support for discriminatory

16

practices. As Justice White observed in his opinion for

the Court in Blitz, 438 U.S. at 506, “ [ejxtensive Gov

ernment operations offer opportunities for unconstitu

tional action on a massive scale. In situations of abuse,

an action for damages against the responsible official [s]

can be an important means of vindicating constitutional

guarantees.” This is such a case.

For petitioners to argue that all of their inactions and

refusals to act were carried out under the guise of

prosecutorial discretion is to say that the duty of all

Executive Branch officials, to take care that the laws

shall be faithfully executed, is a nullity. It also is to

say (quite apart from Art. II § 3 of the Constitution,

from the limitations imposed upon federal officials by

the Fifth Amendment, and from the specific limitations

imposed upon petitioners by Congress’ enactment of § 518

(c) (2) of the Crime Control Act) that this Court’s de

cision in Butz— holding that federal officials in general

are not protected from liability by an absolute immunity

— actually applies to no federal officials. All officials are

prosecutors, in the government’s submission. Pet. Br.

14-28. Even if there were any merit to the government’s

arguments with respect to LEAA’s policy and practice

of never initiating fund termination proceedings, those

contentions clearly fail of application so broad as to

shield all LEAA officials from liability for all of their

unconstitutional actions.

B. Even if this case were limited only to petitioners’

regulatory policy and practice of never initiating ad

ministrative fund termination proceedings, petitioners

here still could not, on this record, avail themselves of

the absolute immunity allowed by this Court in Butz to

the federal officials in that case who could demonstrate

on remand that they exercised prosecutorial functions.19

m We recognize that in Butz, this Court itself gave absolute

immunity to three of the twelve federal officials involved: the

17

In Butz, because of the impartiality built into, and the

opportunity for review of, the administrative proceed

ings, this Court recognized that an agency official’s “de

cision to initiate” administrative proceedings in which

a civil penalty may be imposed upon an individual or

corporation “ is very much like the prosecutor’s decision

to initiate or move forward with a criminal prosecution,”

and that such an official accordingly may have an abso

lute immunity with regard to that decision. Id. at 515.

As the Court emphasized, “ [a]n agency official, like a

prosecutor, may have broad discretion in deciding whether

a proceeding should be brought and what sanctions should

be sought.” Id. (emphasis added). Petitioners here meet

none of these criteria.

1. Under their governing statute, § 518(c) (2) of the

Crime Control Act, see Pet. Br. 2-3, petitioners enjoyed

no discretion once they determined that a grantee was

not in compliance with the nondiscrimination require

ment in § 518(c) (1) of the Act. Following that determi

nation, petitioners were required by § 518(c) (2) to in

itiate fund termination proceedings by requesting the

appropriate chief executive to secure compliance, and,

that failing, to terminate “ further payments” under

§ 509 of the Act. Concurrent with, but not before these

steps, petitioners also were authorized to refer the matter

to the Justice Department for it to decide whether to

initiate litigation.20

prosecuting attorney who was responsible for presenting the gov

ernment’s case at the administrative hearing, the Chief Hearing

Examiner who was responsible for hearing and deciding the case,

and the Judicial Officer who was responsible for reviewing the

ruling of the Chief Hearing Examiner. Butz v. Economou, supra,

438 U.S. at 508-18. Petitioners here do not purport to claim that

they or anyone else within LEAA performed these functions.

ao The mandatory nature of the requirement in § 518(c) (2) that

administrative fund termination proceedings be invoked either

prior to or concurrently with other steps (such as referral to the

18

a. This statutory scheme led the court of appeals be

low to conclude that petitioners “have virtually no dis-

Justice Department for the possible filing of a civil action) is not—

contrary to the government’s assertion, Pet. Br. 18 n,14, 19, 22—

at all “typical” of the discretionary options under Title VI and

other civil rights enforcement provisions. The significant difference

between § 518(c) (2 ), see Pet. Br. 2-3, and the other statutory

provisions is illuminated by the comparison suggested by the

government at Pet. Br. 18 n.14.

Title VI of the 1964 Civil Rights Act provides, at 42 U.S.C.

§ 2000d-l (1976) (emphasis added) :

Compliance with any requirement adopted pursuant to this

section may be effected (1) by the termination of or refusal

to grant or to continue assistance . . . or (2) by any other

means authorized by law.

The Housing and Community Development Act of 1974 contains

two relevant sections. 42 U.S.C. § 5309(b) (1976) states (emphasis

added) :

Whenever the Secretary determines that a State or unit . . .

has failed to comply . . . the Secretary is authorized to (1)

refer the matter to the Attorney General . . . ; (2) exercise

the powers and functions provided by Title VI . . . ; (3) exer

cise the powers and functions provided for in section 111(a)

of this Act; or (4) take such other action as may be provided

by law.

42 U.S.C. § 5311 (1976), §111 of the Act, provides (emphasis

added):

(a) If the Secretary finds . . . that a recipient of assistance

. . . has failed to comply . . . the Secretary . . . shall— (1)

terminate payments . . . , or (2) reduce payments . . . , or

(3) limit the availability of payments . . . .

( b ) (1) In lieu of, or in addition to, any action authorized

by subsection (a), the Secretary may . . . refer the matter to

the Attorney General . . . .

The Urban Mass Transit Act, 49 U.S.C. § 1615(a) (3) (B) (1976)

provides (emphasis added) :

[Footnote continued on page 19]

19

cretion under the relevant statute in deciding whether

to terminate LEA A funding of discriminatory recipi

ents,” Cert. Pet. App. 6a; and that since “ [t]he purpose

of shielding discretionary prosecutorial decisions from

fears of civil liability has no place where, as here, agency 30

30 [Continued]

If . . . such person fails or refuses to comply . . . the Secre

tary shall— (i) direct that no further Federal financial assist

ance . . . be provided . . . ; (ii) refer the matter to the At

torney General . . . ; (iii) exercise the powers and functions

provided by Title VI . . . ; or (iv) take such other actions as

may be provided by law.

Finally, as originally enacted, the Comprehensive Employment

and Training Act of 1973 stated, at 29 U.S.C. § 818(d) (1976)

(emphasis added) :

Whenever the Secretary determines . . . that any prime

sponsor . . . is— (1) maintaining a pattern or practice of

discrimination . . . the Secretary . . . to the extent necessary

and appropriate shall not make any further payments . . . .

Likewise, 29 U.S.C. § 991(b) (1976) provided, until 1978, that

(emphasis added) :

Whenever the Secretary determines that a prime sponsor

. . has failed to comply . . . the Secretary, in addition to

exercising the powers and functions provided for the termina

tion of financial assistance under this Act, is authorized (1)

to refer the matter to the Attorney General . . . ; (2) to

exercise the powers and functions provided by Title VI . . . ;

or (3) to take such other action as may be provided by law.

The statutory language in each of these- instances is markedly

different from the mandatory phrasing of the Crime Control Act.

See Pet. Br. 2-3. In light of the government’s broad statements

about similarities, however, it is interesting to note that in 1978

Congress amended the CETA statute in a manner similar to its

earlier amendment of the Crime Control Act, so as to provide for

mandatory fund termination. See 29 U.S.C. § 816(c) (1) (feupp. II

1978) ; compare id. at § 816(c) (2).

20

officials lack discretion,” id., these officials accordingly

cannot claim an absolute immunity.21

This view of § 518(c) (2) is entirely supported by the

law’s legislative history. Mandatory fund termination,

in fact, was the express purpose of § 518(c) (2). Rep.

Jordan, the author of the amendment which became

§ 518(c) (2), quite clearly described both its purpose and

its intended effect:

The effect of my amendment. . . is to require LEAA

to first use the same enforcement procedure which

applies to any other violation of LEAA regulations

or statutes. That procedure of notification, hearings,

and negotiations is spelled out in Section 509, which

provides the ultimate sanction of funding cutoff if

compliance is not obtained.

* * * * *

This amendment was necessary to reverse LEAA’s

traditional reliance on court proceedings to correct

discrimination, rather than undertaking administra

tive enforcement of civil rights requirements.22

Although the government makes no effort to harmonize

its peculiar view of the legislative history, see Pet. Br.

22-23 n.19, with the statements of Rep. Jordan, it none

theless asserts that § 518(c) (2) and its legislative his

tory “ do not negate the proposition that petitioners, pos

sessed broad discretion in their administration of the

Act’s antidiscrimination 'provision.” Pet. Br. 23 n.19

(emphasis added). This merely underscores the breadth

of the absolute immunity claim which the government is

making in this case— not limited, in accordance with

21 The court of appeals, it should be pointed out, has not at all

abandoned the concern for protecting the exercise of true prose

cutorial discretion which this Court expressed in Imbler v. Pacht-

man, 424 U.S. 409 (1976) and Butz v. Economou, supra. See, e.g.,

Dellums v. Powell, 50 U.S.L.W. 2101 (D.C. Cir., July 24, 1981).

22 119 Cong. Rec. 20071 (June 18, 1973).

21

Butz, to “prosecutors” but encompassing every federal

official connected in any way with the administration, of

the civil rights provisions of the law.

b. Petitioners also lack discretion to apply any sanc

tions other than fund termination to grantees who fail

to comply with the restrictions imposed on the use of

federal funds. Under § 509 of the Act, petitioners are

required simply to make no “ further payments” to non

complying grantees.

c. Apart from this lack of discretion, nowhere does the

Crime Control Act authorize the imposition of a civil

'penalty on grantees for their failure to comply with the

statutory restrictions on the use of funds under this

federal grant-in-aid program. Unlike the petitioners in

Butz who initiated prosecutorial proceedings, petitioners

here have neither the discretion nor the authority to seek

a license revocation or any other civil penalty. Cf. Mar

shall v. Jerrico, Inc., 446 U.S. 238 (1980) (imposition

of a monetary fine). Instead, the only sanction here—

which the government admits is “ coercive not punitive,”

J.A. 297— is one that denies to a noncomplying grantee

the federal aid for which it is not eligible.

Because of the nature of fund termination proceedings

in grant-in-aid programs, and particularly because of

§§ 518(c ) (2) and 509, petitioners do not fit within the

exception for prosecutors recognized in Butz. Petitioners

do not “have broad discretion in deciding whether a

proceeding should be brought and what sanctions should

be sought,” 438 U.S. at 515, and they in fact have no

authority whatsoever to seek the imposition of a civil

penalty on their grantees. The pursuit of their policy

against ever initiating administrative proceedings ac

cordingly has none of the characteristics of a “prosecu

tor’s decision to initiate or move forward with a crimi

nal prosecution.” Id.

22

2. Petitioners also cannot be accorded an absolute im

munity on the record in this case. Under their own reg

ulatory policy, petitioners denied themselves the decision

making power to initiate administrative proceedings.

Moreover, nowhere in the affidavits they filed in the trial

court did petitioners describe their functions in any way

resembling those of prosecutors.

a. At the time this litigation was commenced, peti

tioners still adhered to a regulation which stated an ex

press preference for referring matters of noncompliance

to the Civil Rights Division of the Department of Justice

in lieu of initiating administrative fund termination pro

ceedings. While that regulation, adopted prior to amend

ment of § 518 in 1973, stated:

Where the responsible Department official determines

that judicial proceedings . . . are as likely or more

likely to result in compliance than administrative

proceedings . . . , he shall invoke the judicial remedy

rather than the administrative remedy23

it was interpreted by petitioner Velde to “require LEAA

to pursue court action and not administrative action to

resolve matters of employment discrimination,” J.A. 90.24

The uniform pursuit of this policy is reflected by the con

clusion reached by the House Judiciary Committee in

1976: “ LEAA has never terminated payment of funds to

23 28 C.F.R. § 42.206(a) (1973) ; see 37 Fed. Reg. 16671 (August

18, 1972).

24 This statement by petitioner Velde was made in a letter sent

to Rep. Charles Rangel in an attempt to explain why LEAA had

not initiated administrative proceedings against the Philadelphia

Police Department, J.A. 90, a grantee which LEAA in 1974 had

formally determined to be in noncompliance, see J.A. 97.

The existence of this absolute policy was also confirmed by the

senior attorney in LEAA’s Office of Civil Rights Compliance, in a

1975 interview: “She reports that, when the agency discovers dis

crimination, its policy is to seek judicial relief rather than to stop

paying out the money.” C.A. App. 844 (emphasis in original).

23

any recipient because of a civil rights violation/’ 125 To be

sure, this regulatory policy contravened the statutory

mandate in § 518(c) (2) of the Crime Control Act.26 But

the point here is simply that, under LEAA’s own regu

lations as interpreted by Mr. Velde, none of the petition

ers had discretion— much less a broad “prosecutorial”

discretion—to do other than decline to initiate adminis

trative proceedings.

b. Even more compelling, none of the petitioners

claimed— in the affidavits filed by the government in the

trial court— either the authority or the responsibility for

refusing to initiate administrative fund termination pro

ceedings. See J.A. 236-64. Although the government here

cites to petitioners’ affidavits, see Pet. Br. 7 n.9, 25-28,

it conveniently does not quote from them. Nowhere in

25 H.R. Rep. No. 94-1155, 94th Cong., 2d Sees. 11 (1976). Addi

tional findings by the Judiciary Committee are set forth in n.10 at

6 supra. Similar findings were made in November, 1975 by the

United States Commission on Civil Rights, see n.8 at 5-6 supra.

2'* * 6 It is precisely this regulatory policy which Congress in 1973

sought “to reverse,” 119 CONG. Rec. 20071 (June 18, 1973) (Rep.

Jordan), when it enacted Rep. Jordan’s amendment as § 518(c) (2 ).

See generally the legislative history discussed at 1-3 supra, and

in the Appendix to this Brief at la-24a infra.

Contrary to the express action and intent of Congress in 1973,

petitioners neither reversed their practices nor even altered their

regulation. Instead, at the time this lawsuit was filed in September,

1975, petitioners still adhered to their regulation and policy against

initiating administrative fund termination proceedings. Finally,

three months after this lawsuit was filed, petitioners proposed

to eliminate the policy, 40 Fed. Reg. 56454 (December 3, 1975),

although they did not alter their practices. As Rep. Charles

Rangel observed in the spring of 1976: “LEAA’s unlawful regula

tory preference remains in effect today.” LEAA Hearings before

the Subcommittee on Crime of the House Committee on the Ju

diciary, 94th Cong., 2d Sess. 606 (1976). Rep. Jordan was a bit

more blunt: “Simply put, LEAA’s civil rights regulations contra

vene the law.” Id. at 446. Ultimately, ten months after this law

suit was filed, petitioners promulgated the proposed regulation as a

final rule. 41 Fed. Reg. 28478 (July 12, 1976).

24

those affidavits did petitioners describe their functions as

prosecutorial or their roles as involving prosecutorial dis

cretion. Instead, petitioners uniformly described them

selves as administrators and consistently asserted that

they had acted within the scope of their administrative

duties.27

27 Petitioner Richard W. Velde stated that he had held several

administrative positions at L E A A : first he was “Associate Ad

ministrator,” later he was “Deputy Administrator for Policy De

velopment,” and finally, on September 5, 1974, he became the “Ad

ministrator” of LEAA. J.A. . 236. He noted that in the latter

capacity, as Administrator, he had “delegated” to the “director

of the Office of Civil Rights Compliance” the “authority and

responsibility for insuring that recipients of LEAA funds com

ply with applicable civil rights laws, statutes, orders, rules and

regulations.” J.A. 237; see also J.A. 244-46. Petitioner Velde

also stated that he nonetheless remained “responsible for establish

ing the basic policy and direction that LEAA will pursue in meeting

its civil rights obligations.” Id. In carrying out this responsibility

among others, petitioner Velde was authorized only to “perform

predominantly executive rather than quasi-legislative or quasi

judicial functions.” C.A. App. 205 (Attachment 1 to the Affidavit of

Edward H. Levi). Petitioner Velde concluded that all of his actions

“were fully in the discharge of my official duties and responsibilities

as Administrator.” J.A. 243.

Petitioner Charles R. Work stated that from November 2, 1973,

until November 21, 1975, he had served as LEAA’s “Deputy Ad

ministrator for Administration.” J.A. 251. He claimed that in this

capacity he had been delegated authority which “involved taking

final action on internal LEAA administrative management mat

ters.” Id. ; see also J.A. 255-61. He stated that although he had

no “delegated authority in the day-to-day operations of LEAA’s

civil rights programs” and “had no regular direct contact with

the day-to-day operations of the Office of Civil Rights Compliance,”

he nonetheless was the supervisor of petitioner Herbert C. Rice,

who “reported to me periodically with respect to operations ques

tions.” J.A. 252-53.

Petitioner Herbert C. Rice stated that he had been the “Director

of the Office of Civil Rights Compliance . . . since May of 1971,”

and that his office had “the responsibility of establishing compre

hensive procedures and programs for effective enforcement of civil

rights responsibilities.” J.A. 262. These responsibilities, as dele-

25

Petitioners’ own affidavits thus fail even to raise a fac

tual issue about the existence or scope of any prosecu

torial responsibilities which they may have had. In view

of their policy, they had no such responsibilities. They

accordingly are not entitled to absolute immunity.

C. The absolute immunity recognized in Butz for fed

eral officials who initiate prosecutorial proceedings is

premised upon the adversarial checks and safeguards

which govern the decision to prosecute, see 438 U.S. at

512-17. Such checks and safeguards to protect respond

ents’ constitutional rights are not present here, since

respondents could not be parties to administrative actions

designed to enforce those rights which petitioners dele

gated by petitioner Velde, J.A. 244-46, included developing regu

lations, directives and guidelines; developing policy on technical

assistance; coordinating policies with other federal agencies; con

ducting audits, compliance reviews, and complaint investigations;

and conducting negotiations and recommending sanctions. In

carrying out those responsibilities, petitioner Rice alleged “that

a number of judgments must be made daily by me both in making

policy and in making decisions to carry out policy.” On these

policy matters, petitioner Rice noted that he sought advice and

counsel from various of his supervisors including “the Adminis

trator,” and he stated that he “reported directly” to petitioner

Work. J.A. 263.

Petitioner Edward H. Levi stated that he had been Attorney

General since February 6, 1975, and that he therefore had “certain

powers and duties” with regard to LEAA including “general policy

guidance, budgetary review and regulatory supervision.” J.A. 247.

These powers and duties were considerable. See generally C.A. App.

202-29 (Attachments 1 and 2 to the Affidavit of Edward H.

Levi). Petitioner Levi was authorized “to prescribe policies for

the guidance of the Administration in performing its functions,”

and “to review such of the day-to-day operations of the Adminis

tration as may be necessary to assure compliance with the pre

scribed policies.” Id. at 204-05. The policy and regulatory roles

were backed up by petitioner Levi’s “far-reaching budgetary powers

over the Administration.” Id. at 206. For example, petitioner

Levi’s “control over the budget” enabled him “to determine . . . the

relative emphasis which the Administration will place on various

functions.” Id.

erately never brought.28 29 Moreover, as Chief Justice Bur

ger explained for the unanimous Court in Scheuer v.

Rhodes, supra, the policy justification for a grant of im

munity— whether absolute or qualified— is to encourage

government officials to act. This justification disappears

when officials, such as petitioners here, are charged with

not acting at all.

1. In Butz, this Court held that the agency official

who decides to initiate a prosecutorial proceeding may be

entitled to an absolute immunity “ [b]ecause the legal

remedies already available to the defendant in such a

proceeding provide sufficient checks on agency zeal.” 438

U.S. at 516 (emphasis added). Two sets of remedies, in

fact, are available to a defendant as checks on agency

zeal in such a proceeding. Initially, the “ decision to pro

ceed with a case is subject to scrutiny in the proceeding

itself,” a proceeding in which “an impartial trier of

fact” can render “ an independent judgment as to whether

the prosecution is justified.” Id. Thereafter, because of

the provisions for “ judicial review” of agency proceed

ings, a defendant’s “ claims that the proceeding is uncon

stitutional may also be heard by the courts.” Id?9

28 In Butz, the Court granted prosecutors absolute immunity

from suits by the targets of prosecutorial proceedings because

“the defendant in an enforcement proceeding has ample oppor

tunity to challenge the legality of the proceeding.” 438 U.S. at

515. The Court, however, did not consider whether this rationale

would be applicable to suits by individuals in the position of the

respondents here, because it thought that “there is not likely to

be anyone willing and legally able to seek damages from the officials

if they do not authorize the administrative proceeding Id.

It is obvious, of course, that this lawsuit is respondents’ only

means of challenging the legality of petitioners’ failure to carry

out their constitutional and statutory obligations, a challenge

which would be completely frustrated if petitioners were accorded

an absolute immunity.

29 These administrative and judicial checks on agency zeal are

similar to “the safeguards built into the judicial process,” Butz v.

Economou, supra, 438 U.S. at 512. It is the existence of these ju-

26

27

These “ safeguards,” id. at 512, 514; these “ checks on

agency zeal,” id. at 516, are lost where there is no deci

sion to prosecute, particularly where there is an across-

dicial checks and safeguards which earlier led this Court in Imbler

v. Pachtman, supra, 424 U.S. at 431, to limit its decision to- “hold

only that in initiating a prosecution and in presenting the State’s

case, the prosecutor is immune from a civil suit for damages.” As

the Court in Imbler summarized, the checks and safeguards on

prosecutorial zealousness “include the remedial powers of the trial

judge, appellate review, and state and federal post-conviction col

lateral remedies. In all of these the attention of the reviewing

judge or tribunal is focused primarily on whether there was a fair

trial under law.” Id. at 427.

Because of the focus in Butz and Imbler on the checks and safe

guards that surround a prosecutor’s decision to prosecute and his

presentation of the case, and also because of the importance of a

prosecutor’s “quasi-judicial” functions to the immunity doctrine,

the courts of appeals subsequent to Butz have uniformly allowed

prosecutors an absolute immunity only for their “advocacy” func

tions of initiating and carrying out a prosecution, and not for

the actions taken by prosecutors in their administrative or investi

gative roles. Mancini v. Lester, 630 F.2d 990 (3d Cir. 1980) (county

prosecutor and deputy attorney general are not entitled to abso

lute immunity for actions taken in their administrative or in

vestigative roles) ; Marrero v. Hialeah, 625 F.2d 499 (5th Cir.

1980) (state prosecutors are not protected by absolute immunity

for actions taken in their administrative or investigative roles) ;

Hampton v. Hanrahan, 600 F.2d 600 (7th Cir. 1979), cert, denied

on relevant issue, 446 U.S. 754, 759 (1980) (state- prosecutors and

federal law enforcement officials are not protected by absolute

immunity for actions taken in their administrative or investigative

roles) ; Forsyth v. Kleindienst, 599 F.2d 1203 (3d Cir. 1979) (two

former U.S. Attorneys General are not protected by absolute im

munity for actions taken in their administrative roles); see also

Miller v. DeLaune, 602 F.2d 198 (9th Cir. 1979) (federal Internal

Revenue Service official is not protected by absolute immunity) ;

cf. Halperin v. Kissinger, 606 F.2d 1192 (D.C. Cir. 1979), aff’d by

equally divided court, 69 L. Ed. 2d 367 (1981) (the President

and his advisors are not protected by absolute immunity). Even

prior to this Court’s decision in Butz, the courts of appeals had

uniformly denied absolute immunity to federal and state prosecutors

who had been acting not in their “quasi-judicial,” prosecutorial

capacities but in their administrative or investigative roles. Slavin

28

the-board policy never to initiate enforcement proceed

ings. In this case, petitioners’ refusals to initiate admin

istrative proceedings were never able to be subjected to

scrutiny in any administrative proceeding, and thus were

never able to be subjected thereafter to judicial review

of an agency proceeding.

Since the remedial oversight premise for extending ab

solute immunity to the official who has the discretion to

initiate and who does initiate a proceeding is altogether

absent here, and since the only means of providing re

dress and of deterring official misconduct is an action

such as this, there is no absolute immunity in an action

such as this.* 30 Accordingly, even if petitioners here had

enjoyed broad discretion with respect to a prosecutorial

proceeding, they nonetheless would not be entitled to

absolute immunity from liability for following an uncon

stitutional and illegal policy of never enforcing the law.

2. The final legal roadblock barring petitioners from

entitlement to absolute immunity arises from the very

reason for the existence of the immunity doctrine. As

v. Curry, 574 F.2d 1256 (5th Cir. 1978) (state officials) ; Briggs v.

Goodwin, 569 F.2d 10 (D.C. Cir. 1977), cert, denied, 437 U.S. 904

(1978) (federal officials) ; Helstoski v. Goldstein, 552 F.2d 564

(3d Cir. 1977) (federal officials) ; Guerro v. Mulhearn, 498 F.2d

1249 (1st Cir. 1974) (state officials); Hampton v. Chicago, 484

F.2d 602 (7th Cir. 1973), cert, denied, 415 U.S. 917 (1974) (state

and federal officials) ; cf. Zweibon v. Mitchell, 516 F.2d 594 (D.C.

Cir. 1975), cert, denied, 425 U.S. 944 (1976) (federal officials).

30 The absence of any administrative or judicial checks and

safeguards also can be viewed as a sufficient reason to deny abso

lute immunity even to officials who decide to- prosecute and who

perform adjudicative functions. In Wood v. Strickland, supra, for

example, the school board members concededly were “adjudicators

in the school disciplinary process,” roles in which the school board

members “must judge whether there have been violations of school

regulations and, if so, the appropriate sanctions for the violations.”

420 U.S. at 319. Nonetheless, the school board members were de

nied absolute immunity for their allegedly unconstitutional de

cisions to prosecute and to punish.

29

Chief Justice Burger explained at some length for the

unanimous Court in Scheuer v. Rhodes, supra, the con

sistent legal justification for allowing any immunity—

absolute or qualified—is to encourage public officials to

act, not to encourage them not to decide or not to act at

all. “ Implicit in the idea that officials have some immu

nity— absolute or qualified—for their acts, is a recogni

tion they may err. The concept of immunity assumes

this and goes on to assume that it is better to risk some

error than not to decide or act at all.” 416 U.S. at 242.

In other words, the immunity doctrine is based on a

single “policy consideration [which] seems to pervade the

entire analysis: the public interest requires decision and

action to enforce laws.” Id. at 241. Officials “who fail

to make decisions when they are needed or who do not

act to implement decisions when they are made do not

fully and faithfully perform the duties of their offices.”

Id. at 241-42.

Although none of the petitioners here claimed respon

sibility for not initiating the administrative proceedings

required under their governing statute, J.A. 236-64, the

fact of the matter is that there were no administrative

proceedings despite formal determinations that their re

cipients were in civil rights noncompliance. When offi

cials such as petitioners here are responsible for acting

but do not act, or even refuse to act at all, the immunity

which they claim is drained of its justification. Accord

ingly, petitioners here should be barred from claiming

entitlement to any immunity whatsoever. At a minimum,

petitioners have no claim to absolute immunity.

30

II. Respondents Have A Cause Of Action For Damages

To Redress The Deprivation Of Their Fifth Amend

ment Rights Based Upon Their Allegations Of Peti

tioners’ “Willful And Malicious” Refusal To Enforce

Restrictions Imposed By The Fifth Amendment And

By The Crime Control Act Upon The Use Of Federal

Funds To Support Discriminatory Practices Of

LEA A Grantees

Petitioners’ second argument31 is nominally addressed

to the question whether this Court should accord to these

respondents the same right, to bring a constitutional cause

of action for damages for the violation of Fifth Amend

ment guarantees which they have alleged, as was recog

nized in Davis v. Passman, 442 U.S. 228 (1979) ; see also

Carlson v. Green, 446 U.S. 14 (1980) ; Bivens v. Six Un

known Fed. Narcotics Agents, 403 U.S. 388 (1971).

Their brief, however, fails to address the issue squarely 32

31 This issue was not decided below— in fact, it was never even

raised by the government in either the district court or the court

of appeals— and it should not be considered by this Court. See dis

cussion in n.44 at 42-43 infra.

32 Perhaps the clearest indication of the government’ s approach

is the fact that it neither cites nor discusses the seminal decision

of this Court recognizing an implied constitutional cause of action

for damages, Bivens v. Six Unknown Fed. Narcotics Agents, supra.

Although Davis v. Passman, supra, and Carlson v. Green, supra,

receive bare mention, nowhere in its brief does the government

contend that this Court erred in Butz v. Economou, supra, 438

U.S. at 504, when it stated that “the decision in Bivens, established

that a citizen suffering a compensable injury to a constitutionally

protected interest could invoke the general federal-question juris

diction of the district courts to obtain an award of monetary

damages against the responsible federal official.”

In any event, it is clear under the analysis of these cases that

respondents’ complaint adequately alleges injury resulting from

the deprivation of constitutional rights which justifies an implied

cause of action for damages. The constitutional protection which

respondents seek to enforce was succinctly recognized in Davis,

442 U.S. at 234 (citations omitted) : “the Due Process Clause of

the Fifth Amendment forbids the Federal Government from deny

ing equal protection of the laws.” Since the substantive content

31

but instead presents a curious array of arguments about