Parklane Hosiery Company v. Shore Court Opinion

Unannotated Secondary Research

January 9, 1979

Cite this item

-

Case Files, Thornburg v. Gingles Working Files - Guinier. Parklane Hosiery Company v. Shore Court Opinion, 1979. f06448fe-e192-ee11-be37-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/8d666645-56f7-4c4b-8c02-e7d6a0409da8/parklane-hosiery-company-v-shore-court-opinion. Accessed February 05, 2026.

Copied!

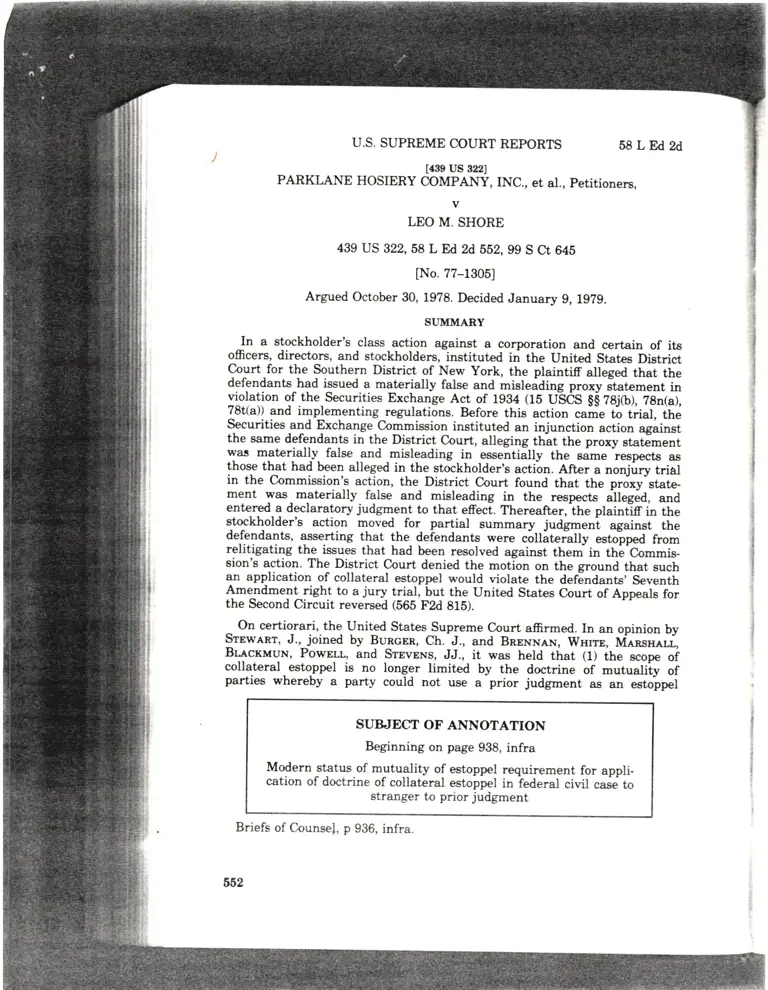

pARKLANE HosrERy dffir$Xiffi, rNc., et al., petitioners,

v

LEO M. SHORE

439 US 322,58 L Ed 2d 552,99 S Ct 645

[No.77-1305]

Argued October 30, lgZB. Decided January g, 1g?9.

SI'MII{ARY

In a stockholder's class action against a corporation and certain of its

officers, directors, and stockholders, instituted in ttre United States Districi

C,ourt for the Southern District of New York, the plaintiff alleged thai the

defendants had issued. a materially false and misleiding proxy Jtatement in

violation of the securities Exchange Act of 1994 (15 u-scs $$ zajful, zgn(a),

78t(a)) pd iryp_l"eenting_regulations. Before this action ca-e ti, taat, trre

Securities and Exchange Commission instituted an injunction action against

the same defendants in the District Court, alleging thlt the proxy statement

1as m-ater-ially false -and -misleading in eesentially the same

-respects

as

those that had been alleged in the stockholder's action. After a nonjury trial

in the commission's action, the District court found that the proxy-etate-

ment was materially false and misleading in the respects alleged, and

entered a declaratory judgment to that effect. Thereafter,ihe plaintlf in the

etockholder's action moved_ for partial 8ummary judgmenl against the

defendants, asserting that the deiendants *e"e couatei[y esto-pped from

relitigating the issues that had been resolved against them in thi'Commis-

Bion's action. The District Court denied the motion on the ground that such

an application of collateral estoppel would violate the deflndants, Seventh

Amendment_nght to a jury trial, but the united States court of Appeals for

the Second Circuit reversed (565 F2d 8f5).

_ on certiorari, the 9"iEd states_supreme court afirmed. In an opinion by

Srrwanr, J., joined by Burcen, Ch. J., and BnpNN.e.N, Wnrm, I\,I^xgH r;,

BlacruuN, PowEr.r, and SrnvnNs, JJ., it was held that (1) [he ,";p";i

collateral

_

estoppel is no longer limited by the doctrine of mutuali'ty of

parties whereby a party could not uae a prior judgment aa an esto-ppel

U.S. SUPREME COUBT REPORTS 68L&t2d

SU&IECT OF ANNOTATION

Beginning on page 988, infra

Modern status of mutr',ality of estoppel requirement for appli-

cation of doctrine of collateral estoppel in federar civil case to

stranger to prior judgment

Briefs of Counse|, p 936, infra.

i

I

I

662

58L&t2d

?etitioners, against the o,

**f'Til'TuT9*tlyrr3;ST.?*t

tr["]""""i;X,:',f ?i""*"#"Pj].lartiql.werebounc

::i,thl,:tlr,#lf HJ.,,*lt,,r:g;"tTdir",li*H"#,:i

ursi**#iu,*ilsru,r-*;,t*[9"':*,ff, {l;twould be unfair

i#rffi#li$i[F#&]]i*;H#tqjli,rtr*_qffi

,:ilH"#',i:"dilfldff

{jfi t}*r#,it,,*tj3*:gm,"*:,,H:

fi iffi :ras,#,,i'"'rfl gl{:q,*1:;g","trf6;fffi ,,?frTfff

fiiHffHT,T", typi.,riy -i"r1rii,i

#itrs:r#di:il,"rffiHiii*gnqfi}tr*,11ifu+",*U

#f *t;*u+,qf+ffill,gg*;1g1li;liruru'F,}r

;6,$-**=ffiHr;,$i*utrffiments_;r"ri#Jl,illll"_,:ffi4:*pr;F;##T.,f;:tlH{tf

fr i*'i"i*f, *m:n,,{tx;lgi;:}T*"r,,=:t,T,,[i:s,an,,o,he

RunNqursr, J., d.

irfr lrf, :x;*,ffi":*ittliff:q{ill*H}"-$Hi#::t

9r Jury trial obtair

l.#*rl$n[**r,rJfnr-fl*,i,',ffi

,"r."ffi '#:dgt#*t"*r"ffi*xi;i-##jlli$lt"1-l

jury trials, ana sincl;t ;:::.::f-: p the.strong federaJ

$$;;*fl $';"{[ti,,*rf iJffi +*".,#fti",{li-"r,*ffi ,-:if

1979.

nd certain of its.

tcl _States District

alleged that the

Tif,,ff}?Xij;

rme b trial, the

n action against

proxy statement

rme respecrts a.6

'-a nonjury trial

,he proxy etate_

Ls alleged, and

plaintitr in thert against the

estopped from

n the Commis_

rund that such

lants' Seventh

of Appeals for

an opinion bvt, MensHed.

the ecope of

mutuality of

r an estoppel

J:! I

U.S. SUPREME COURT REPORTS 68LEd2d

HEADNOTES

Classified to U. S. Supreme Court Digest' [,awyera'Edition

Evidence $S 396, 396; Securitiee RegU- action in a Federal District Court

lation $ 16 - violation of proxy against a corporation and certain of its

lawe - private remedy - p_rogf ofrcer€, directors, and gtockholders for

1a, 1b' In an action-I]_ "lt:q*:i"J:' alleged vioration of the proxy provisions

tion o!!he proxy provirsio.l.,,of,ll",Xt or trr" Securities Exchange ici of lg3a

rities Exchange Act of 1934 (fb USGS ;.

$$ ?8j(b), 78n(a), 78t{"ii jii=r,lir"ilii (15 UScs $$ 78j(b)' 78n(a)', 78(a)) and

ing regutatio*, "

priritJ;i"il'ifr;; implementing regulations, the defen-

""iitf"}-t"

retilf iimply-bfi;;;;;i- dants are precluded, under the plaintifs

i"g i-rirt it "

pro*i

"oficitation

was mate ofensive uee of the collateral estoppel

iiitti i"t"" aira misteaaing; the plaintiff doctrine, from relitigating the issue of

m,re[ abo ehow that he was injured and the material falsity and misleading na-

prove damages.

Judgment $ 168 - collatcral eetoppel

- judguent in SBC action - ef'

fect in private action

2a. 2b, 2c. ln a stockholder'e class

ture of the proxy atatement, which issue

had been resolved adversely to the defen-

dants at an earlier trial, without a jury,

in the District Court in i4junction

proceedings against the defendants

i

I

I

I

TOTAL CLIENT€ERVICE LIBRARYO REFERENCF,S

47 Am Jur 2d, Judgrnents $$ 52G523; 47 Am Jur 2d, Jury

$$ 29 et seq.

14 Federal Procedural Forms L Ed, Securities and Commodi-

ties Regulation $$ 59:1 et seq.

22 Am Jur Pl & Pr Forms (Rev), Securities Regulation, Form

4

USCS, Constitution, 7th Amendment

US L Ed Digest, Judgment $ 158; Jury $ 22

ALR Digests, Judgment $ 128; JurY $ 45

L &l Index to Annos, C,ollateral Estoppel Doctrine; Judgment;

Jury; Securities Regulation

ALR Quick Index, Collateral Estoppel Doctrine; Jury

Jury Trial; Securities Regulation

Federal Quick Index, Collateral Estoppel; Jury and

Trial; Securities Regulation

and

Jury

ANNOTATION REFERENCES

Supreme Court'g construction of Seventh Amendment's guaranty of right to trial

by jury. 40 L Ed 2d 846.

Proxiee provision of $ 14 of Federal securitiee Exchange Act (15 USCS S 78n). 12

LM Zd 1235; 56 ALR2d 1126.

Mutuality of eetoppel as prerequisite of availability of doctrine of collateral

eatoppel to a stranger to the judgment' 3l ALRSd 1044.

civit action by private pereon under $ 10G) of securities Exchange Act of 1934

(15 USCS $ 78j(b)t. 37 ALR2d 649.

5U

58LEd2d

District Court

nd certain of its

gtockholders for

proxy provisions

nge Act of l9B4

r(a), 78(a)) and

rrrsr the defen-

ler the plaintifs

llateral estoppel

ng the issue of

misleading na-

ent, which issue

ely to the defen-

without a jury,

in injunction

he defendants

;t

., Jury I

nmodi- |

Form I

I

ment; I

rand I

Jurv I

,, .:,", I

s zenr rz I

,ott"t".O I

r or rgsa I

PARKLANE HOSIERY CO. v SHORE

439 US 322,58 L Ed 2d 552,99 S Ct 645

brought by the Securities and Exchange doctrine of res judicata, has the dualcommission based on eesentiartT; purpose of protecting ritigants from thesame atlegations as to the proxv'state ilu";;;;:;irE;il, an identicar is'uement, where 0) the plaintitr probablv with th.e samei;; or his privy and ofcould not have ioined' in the a;;#- promoting :uaiciai-L"orro.y by prevenr_eion's action "*,, ir t"-iiJ'L-aJi"li, ,r,, needless ritigation.

1n! tZ) there was no unfairness-; th;

defendants in applying ,fl;;il ""I"t- Judgment $ z? - couaterar eetoppereral eetoppel, since tat in tight ;i il" _ mutualitv

serious allesations made in tr," cornrni"l . ? Th;;;[ Jf coilateral estoppel bysion's complaint against th" d;f;;a;;, j_rac*"ri;;r"i;ser rimited by theas well as the foreseeability or ,ruro "dd;i"";f;rt".'tity

or parties wherebyquent private suits that tvpi;ary foii;; a partv could not uL " prio, judgmenta euccessfur government juagm"nt, ilre as."n gsqpper against the other partydefendants had every i""""tl""- to ud ynJ"." b",f ;;il were bound by thegate the Commissiont lawsuit fufiy ani judgment.

vig. orously, (b) the judgment i; iil"co;: -

/see annotation p 9J8, infralmuslon'E action was not inconsistent

with anv previous dpcision,

";e G[h;;; constitutionat [,aw $ zsr _ due proc-would not be availabre to ttre deienJanG e'a - efiect of judguentin the stockholder's, action ;y ;;; - 0",6t rfi=;';;i;tion of due processdural opporrunities that were rin";;ii;- r* i jya*}i;; binding on a riti-ble to them in the com-Gilnt;;;; gant who-w* ,rot a party nor a privyand that would be of a .find that ;dil irrd the.efor" n"" ,rJr". had an opporru-be.likely to cause a different ;;ilEi; nity to be heard.being immateriat that til i;i""d;;

would have been entitled to a iury-triJ Judgnent $ g0

- collateral estoppel

in tlre stockholder's action on irre"i"";;; ro"tri"" - arrJ*rr",.".bearing on whether the proiy ilt"*;;; z. Derensire ui- of' cottateral eetoppelwas materially false. and m-isreading if -whereby ,-pr"i"tfi rs estopped fromthe Commission's action naa ne""iuLi asserting-" crii_ irr"t the plaintiff hasbrought, eince^the preeence or absence oi previousiy riiig"t"i'""a loet againet an-I jury ae factfinder is basicaily ""rti.t, 6tr,". a"r"ni.'l1rpi""ruaes a praintiffunlike, for exampre. the necee;ilt; d* ffi. ,"rft!ii", ",0"""r,*r issue' byfending the firet'raws"it in an-i"";;; merery switching adversaries.

i#*t,ffil:iailf;h"0'i"t, J,

-d-i;;* - &" *ioLlii p esa, inrra]

[*e annotation p gJ8, infral JulilS4ent g E0 - eetoppel efiect

Judguent $$ z-e, 8r,

.s2, .8e --res judi-

",:il;il; ?l1trff"ftffi ,oi;"tlffi

cata - collateral estoppel -?y sometimes justify not allowing a3a, 3b. under the doctrine of res j,rri- prior judgm;;#;; estopper effect incata, a judgment on the.pe.rits in a irioi i s"u'seq"ue";- ,"iioi'L""n between theeuit bars a second suit

.

invoivi"g- tt " same parties, or where defensive co[at_same parties or their privies bas;d on erar. estoppet't"-#;t by a defendantthe eame cauee of action;.r"d;;th; d;: against

" iri.irrtin *il rr"" litigated andtrine of collaterar eetoppel, o" trr" otrr"i i_;1 i" *

""iii"i-""iiJn ug"ir,rt anotherhand, the e€cond action'is uporr. aiii"i- iefendant.e-nt cause of action and the juagme"i i"

ll_"_ ldoT euit .preclud"r ""iiiii"iion Li Judgment g 80 - collatcrar estopperrssues actually litigated and nec-easary to doctrini _ otrerrsive usethe outcome of the first action. g. with

""c.Jt"

.tI"

offeneive uee of

rudgment- $76 - ree judicata _ cor. *,fl*i1ffIrj;*::fiJ";":iffi:,Ilateral estoppel - pur?ose ing the issues which the defendant has4' collateral eatoppel, like the related freviously litigated and lost in an action

555

with another party-in the federal

courts, the trial courts have broad dis-

cretion to determine when it should be

applied; the general rule should be that

a trial judge should not allow the use of

ofensive collateral estoppel where a

plaintif could easily have joined in the

earlier action, or where the application

of offensive estoppel would be unfair to a

defendant, such as where (1) the defen-

dant was sued for small or nominal dam'

ages in the first action and thus had

little incentive to defend vigorously (par-

ticularly if future euits were not foresee'

able), (2) the judgment relied uPon as a

basis for the estoppel was itself inconsist-

ent with one or more previous judgments

in favor of the defendant, or (3) the

second action aforded the defendant pre

cedural opportunitiee unavailable in the

first action that could readily cause a

different result.

[fu annotation P 938, infra]

Jury $ 22 - collatcrd eetoPPel -judgment in SEC action - effect

in private action

10a, 10b. In a stockholder's class ac-

tion in a Federal District Court against a

corporation and certain of its omcers,

directors, and stockholders for alleged

violation of the proxy provisions of the

Securities Exchange Act of 1934 (15

USCS $S 78jG), 78n(a), 78(a)) and imple

menting regulations, the defendants'

Seventh Amendment right to a jury trial

is not violated by the plaintifs ofensive

use of the collateral estoppel doctrine to

preclude the defendants from relitigat-

ing before a jury the issue of the mate'

Respondent brought this stockholder's

class action in the District Court for

damages and other relief against pe.

titioners, a corporation, its ofEcers, direc'

tors, and stockholders, who allegedly had

issued a materially false and mieleading

proxy statement in violation of the fed-

eral securities laws and Securities and

Exchange Commission (SEC) regrrlations'

Before the action came to trial the SEC

sued the same defendants in the District

556

U.S. SUPREME COURT REPORTS 58LEd2d

rial falsity and misleading nature of the

proxy statement, which iesue had been

reeolved adversely to the defendants at

an earlier trial, without a jury, in the

District Court in injunction proceedings

against the defendants brought by the

Securities and Exchange C,ommission

based on essentially the same allegations

as to the proxy statement; even though

under the common law as it existed in

1791 collateral estoppel was permitted

only where there was mutuality of par-

tiea, nevertheless the subsequent devel-

opments in the law of collateral estoppel,

like the law in other procedural areas

defining the scope of the jury'a function,

are not repugnant to the Seventh

Amendment simply because they did not

exist in 1791. (Rehnquist, J., disgent€d

from this holding.)

Jury 52 purporc of Seventh

Amendment

11. The thrust of the Seventh Amend-

ment is to preserve the right to jury

trial as it existed in 1791.

Jurl' $$ 1.3, 14 - falee prorY state

ment - action by SEC - advie'

ory jury

l2a, L2b. In an equitable injunctive

action brought by the Securities and

Exchange Commission against a corpora-

tion and certain of its officers, directora,

and stockholders for alleged violation of

the proxy provisions of federal laws, the

defendants do not have a right to a jury

trial; an advisory jury in such an action

does not constitute a Seventh Amend-

ment jury.

SYLLABUS BY REPORTER OF DECISIONS

Court alleging that the proxy stat€ment

was materially falee and misleading in

eesentially the eame respects a8 respon-

dent had claimed. The District Court

after a nonjury trial entered a declara-

tory judgpent for the SEC, and the

Court of Appeals affirmed. Respondent

in this case then moved for partial eum-

mary judgment against petitioners as'

serting that they were collaterally estop

ped from relitigating the issues that

68'L &t 2d

nature of the

sue had been

defendants atjury, in the

r proceedings

rught by the

Commisgion

te allegations

even though

it exieted in

rs permitted

nlity of par-

quent devel-

lral estoppel,

rdural areas

y's function,

he Seventh

they did not

I., dissented

f Seventh

rth Amend-

;ht to jury

ory etate

) - advi+

ir{unctive

rities and

a corpora-

, directons,

.iolation of

I laws, the

ttoajury

an action

h Amend-

statement

eading in

la nespon-

ict Crurt

r declara-

and the

spondent

tial eum-

)ners a8-

lly estop

ues that

PARKLANE HOSIERY CO. v SHORE

439 US 522,68LEdtut 552,99 S Ct 645

!$_ been reeolved against them in the

SEC euit. The District Court aeniJ iiie

motion on the ground that such * ,oplication of collateral estoppel *r"ia

deny petitioners their Severith A;;;a:

ment right to a jury trial. The CouJ of

Appeals reversed. .Efeld.

- 1.-Petitionens, who had a ,,full andfair" opportunity to litigate th"i, ;l"i;;

in the SEC action, are cbilaterally estop

ngd jrom- relitigating tte queeiio"

-6f

In-qth9r the proxy etatement was maternlly false and misleading.

-(a) The mutuality doctrine, under

which neither party could use'" il;;

;udgment against the other unlees bothpartiea were bound by the same iuas-

ment, no -longer applies. See gtonaei_

r-ongue L,aboratories, Inc. v University of

19l9rs fbundation, 402 US gfg, 28 L Ed

%1788,91 S Ct 1434.

(b) The offensive uee of collateral e+

top-pel (when, as here, the plaintiff seeL

to foreclooe the defendant fiom litis;i;

an _iesue that the defendant has

-p.e"il

91uly lit-iSated uneuccessfully in e,n ac-

lbl $tf another party) does

"oi pi*

mote judicial economy in the same man-

ne-r that is promoted by defensive use(when a defendant eeeks to p""u"ni"

plaintitr from asserting a clai- ttrai itreplaiatiff has previousty litigated ;"d il;;

ag_ainst another defendant), and suchofensive uae may also be ;"f; t -;

d€tendant in various ways. Therefore.

the general rule should be that il;;

yhe-re a plaintitr could easily fr."" ioi"Jin the earlier action or ,rt,i." tfr" "rppfl-

cation of offensive eetoppel *o,la-'U"

unfair to a defendant, a tad i"ag" i"the exercise of his discretion shouiE-noJ

allow the use of offensive

"ott"t"r"t

-"r-

toppel.

(c) In this case, however, the applica-

tion of offensive collateral estoppel will

not reward a privatc plaintiff who could

have joined- in the previou,

"ction,

eirrc!the respondent probably could not have

Jolned in the injunctive action brousht

by the SEC. Nor is there any unfairn"ess

to petitioners in euch application herl.since petitioners had 6uery i"ce"-iiue

tully and vigorously to litig;t€ rh" SiiC

suit;.the judgment in the SEC action was

not inconsistent with any prior decision

and in the respondent's ac[ion th";;;i

be no procedural opportunities available

io the petitioners that were unavailable

.- _tl,u SEC action of a kind it

"t -[hibe likely to cause a different r"r,rlt.----'"-

2. The use of collat€ral estoppei in this

case would not violate petitioners, Sev-

enth Amendment right to a jury trial.

-'

. (a) An equitable determination san

have collateral estoppel efect in;;rt;

quent legal action without violating the

Seventh Amendment. Katchen-v il.;;;

382 US 323, rb LFa A Bgt, 86 S Ct;6i:

- G) Petitioners' contention thaf sin;ethe scope of the Seventh e-""arr""i

must be determined by reference to th;

common law as it exist€d in 1291, atwhich time collateral estoppel ** p"i-

qrtt d only where there was mutuaiityof parties, is without merit, for maniprocdural devices develo@ eince figithat have diminished the civil iurv,s

historic domain have been fou"i ,ioi"t"

violate the Seventh Amendment S.", ;.g.-Galloway v United Statee, g1g IJS

372, 38L393, 87 L Ed 1458, 63 S Cr

1077.

565 F2d 815, affirmed.

. Stewart, J., delivered the opinion ofthe Court, in which Burger, C. "1., ."jBrennan, Whit€, Marshall, Sfack;;".

Powell, and Stevens, JJ., joined. R"ill

quist, J., filed a dissenting opinion

APPEARANCES OF COUNSEL

Jack B- Ifyrtt argued the cause for petitioners.

Samuel K. Rosen argued the cause fii respondent.

Briefs of Counsel, p g56, infra.

OPIMON OF THE COURT

[{39 US S%]

"r*;,i:;tffi *,X-"deriveredthe*ff ;:.'f ;'fi,"',iilf n*i"1"iiil"":

657

of fact adjudicated advereely to it in

an equitable action may be collater-

ally estopped from relitigating the

eame iseues before a jury in a subse.

quent legal action brought against it

by a new party.

The respondent brought this stock-

holder's class action against the pe.

titioners in a Federal District C,ourt.

The complaint alleged that the pe-

titioner^s, Parklane Hosiery Co., Inc.

(Parklane), and 13 of its officers,

directorr, and stockholders, had is-

sued a materially false and mislead-

ing proxy statement in connection

with a merger.t The proxy state.

ment, according to the complaint,

had violated $$ 14(a), 10(b), and 20(a)

of the Securities Exchange Act of

1934, 48 Stat 895, 891, 899, as

amended, f5 USC $$ 78n(a), 78j(U),

and 78t(a) [l5.USCS $$ 78n(a), 78j(b),

and 78t(a)], as well as various rules

and regulations promulgated by the

Securities and Exchange C,ommis-

eion (SEC). The complaint sought

damages, rescission of the merger,

and recovery of costs.

Before this action came to trial,

the SEC filed suit against the same

defendants in the Federal District

Court, alleging that the proxy state.

ment that had been issued by Park-

lane was materially false and mis-

leading in essentially the same re

spects as those that had been alleged

U.S. SUPREME COURT REPORTS 58LEd2d

in the respondent's complaint. In-

junctive relief wae requested. After a

fourday

[,l80 US 826]

trial, the Dietrict Court

found that the proxy statement was

materially false and misleading in

the respects alleged, and entered a

declaratory judgment to that effect.

SEC v Parklane Hosiery C-o. 422 F

Supp 477. The Court of Appeals for

the Second Circuit afrrmed this

judgment. 558 F2d 1083.

[1a] The respondent in the present

case then moved for partial sum-

mary judgment against the petition-

ers, asserting that the petitioners

were collaterally estopped from reli-

tigating the issues that had been

resolved against them in the actiqn

brought by the SEC.' The District

Court denied the motion on the

ground that such an application of

collateral estoppel would deny the

petitioners their Seventh Amend-

ment right to a jury trial. The Court

of Appeals for the Second Circuit

reversed, holding that a party who

has had issues of fact determined

against him after a full and fair

opportunity to litigate in a nonjury

trial is collaterally estopped from

obtaining a subsequent jury trial of

these same issues of fact. 565 F2d

815. The appellate court concluded

that "the Seventh Amendment pre.

l. The amended complaint alleged that the

proxy statement that had been issued to the

etockholders was false and misleading because

it failed to discloee: (1) that the president of

Parklane would financially benefit as a result

of the company's going private; (2) certain

ongoing negotiations that could have resulted

in financial benefit to Parklane; and (3) that

the appraisal of the fair value of Parklane

etock was based on insufrcient information to

be accurate.

2. [1b] A private plaintiff in an action

under the proxy rules is not entitled to relief

658

simply by demonatrating that the proxy solici-

tation was materially falee and misleading.

The plaintitr must alao ahow that he was

injured and prove damagee. Mills v Electric

Autolite Cr. 396 US 375, 386-390, 24 L Dd

2d 593, 90 S Ct 616. Since the SEC action was

limited to a determination of whether the

proxy Btatement contained materially false

and misleading information, the reapondent

conceded that he would etill have to prove

theae other elements of his prima facie case

in the private action. The petitioners' right to

a jury trial on those remaining issues iB not

contest€d.

68LEd2d

mplaint. In-

sted. After a

tistrict Court

rtement was

isleading in

d entered a

that effect.

Y er.. 422 F

Appeals for

Ermed thig

the present

artial sum-

he petition-

petitioners

cl from reli-

had been

the actiqn

he District

)n on the

rlication of

l deny the

h Amend-

The Court

nd Circuit

party who

letermined

l and fair

a noqjury

rped from

ry trial of

. 565 Fzd

concluded

ment pre.

proxy aolici.

mioleading.

hat he was

b v Electric

w,24 L Ed

) action wa8

vhetller the

trially false

reapondent

re to prove

a facie case

ers'right to

rgues is not

PARKLANE HOSIEBY @. v SHORE

439 US 322,fi L &t 2d 662,99 S Ct 645

Ber:ves the right to jury trial only

with respect to issues of fact, 1and1

once those issues have been iully

and fairly adjudicated in a prioi

proceeding, nothing remains for

trial, either with or without a jury.',

Id., at 819. Because of an interdir-

cuit conflict,r we granted certiorari.

135 US 1006,56 L Ed 2d 387, 98 S

ct 1875.

[4]E US 8261

I

[2a] The threshold question to be

considered is whether, quite apart

from the right to a jury iriat under

the Seventh Amendmbnt, the pe

titioners can be precluded from reli-

tigating facts reeolved adversely to

them in a-prior equitable p"ocoedi.rg

with -another party undei the genl

eral law of collateral estoppel. Spe-

cifically, we must determini-whetlier

a litigant who was not a party to a

prior judgment may nevertheless use

that judgment "offensively,, to pre.

vent a defendant from relitiga[ing

issues resolved in the earliei prJ

ceeding.i

A

[3a{a] Collateral estoppel, like

the related doctrine of reJjudicata,6

has the dual purpose of protecting

litigants from the burden of reliti-

gating an identical issue with the

same party or his privy and of pro

moting judicial economy by prevent-

ing needless litigation. Blonder-

Tongue Laboratories, Inc. v Univer-

sity of Illinois Foundation, 402 US

313, 329-329,29 L &l 2d 7gg, 91 s

Ct 1434. Until relatively recently,

however, the scope of collateral es-

toppel was limited by the doctrine of

mutuality of parties. Under this mu-

tuality doctrine, neither party could

use a prior judgment

[48e us 327]

against the other r.rr"ffitn";T1*

were bound by the judgment.6 Based

on the premise that it is somehow

unfair to allow a party to use a prior

judgment when he himself would

not be so bound,T the mutuality re-

- 3. The pooition of the Court of Appeals forthe Second Circuit is in conflict ilth th.t

q{.en by the Court of Appeals for the Fifth

Circuit in Bachal v Hill, rlilB FZd 89.

{. In this context, ofensive use of collateral

eatoppel occurg when the plaintitr seeks to

forecloee the defendant from litigating an

issue the defendant has previousli titii.t"a

unsucceaafully in an action with another

party. Defensive use occurs when a defendant

.:".k" to. prevent lRlaintitr from asserting a

claim the plaintiff has previously litiga-t€d

and loet against another defendant.-

9. -t3bl Under the doctrine of res judicata,

a judgment on the merits in a prior iuit bare

a. eecond auit involving the aame parties or

their priviee based on the eame cause of ac-

tion. Under the doctrine ofcollateral estoppel,

on_the other hand, the second action is upo; a

different cause of action and the judgment in

the prior suit precludes relitgation if i""ro

actually litigated and necessary to the out_

come of the firgt action.'18 J. Moore. Feaerat

hTtiq l10.405[r], pp 622-$24 (2tJ d 1974t; e.

g., l,awlor v National Screen Serv. Corp. :ilSus 322, 326, 99 L EA LL22,76 S C{ 865;

C.ommisgioner v Sunnen, gBB US 5gl, 5g7, gi

I H^99-9,^S_S Ct 718; Cromwelt v 6unty oi

Sac, 94 US 35r, 352.3Sg, 24 L Ed tgl.

^-9. _9.^g, Bigelow v Old Dominion Copper Co.

225 US trr, 127,56 L Ed 1009, 32 S'ct ear

CIt iB a princi-ple of general elementary law

that eatopael of a judgment must be mutuat"t;

Buckeye Powder Co. v E. L Dupont de Nem-

ours Powder e-o. 248 US SS, 69, 6g L Ed 129,

39 S Ct 38; Restatement of Judgments g 9C(J94D.

. 7. [6b] It is a violation of due process for ajudgment to be binding on a litigant who was

not a party or a privy and therefore has

never had an opportunity to be heard. Blon-

der-Tongue l,aboratories, Inc. v Univereitv of

Illinois Foundation, 402 US gl3, BZg, At t Ed

!-?-ry, 91 S Cr 1434; Hansberry v Lee, Blius 32, 40, 85 L Ed 22. 6l S ct fis, 132 ALR

741.

559

U.S. SUPREME COURT REPORTS 58L&l 2d

quirement provided a party who had

titigated and lost in a previous ac-

tion an opportunitY to relitigate

identical issues with new parties.

By failing to recognize the obvious

di-fference in position between a

party who has never litigated an

issue and one who has fully litigated

and lost, the mutuality requirement

was criticized almost from its incep

tion.E Recognizing the validity of this

criticism, the Court in Blonder-

Tongpe Laboratories, Inc. v Univer-

sity of Illinois Foundation, supra'

abandoned the mutualitY require'

ment, at least in cases where a Pat-

entee seeks to relitigate the validity

of a patent after a federal court in a

previous lawsuit has alreadY de'

clared it invalid.e The

[43e us'tJb"o"du"

n.r"r-

tion" before the Court, however, was

"whether it is any longer tenable to

aford a litigant more than one full

and fair opportunity for judicial res-

olution of the same issue." 402 US,

at328,28 L Ed 2d788,91 s Ct 1434.

The Court strongly suggested a nega-

tive answer to that question:

"In any lawsuit where a defen-

dant, because of the mutualitY

principle, is forced to Present a

complete defense on the merits to

a claim which the Plaintiff has

fully litigated and lost in a Prior

action, there is an arguable misal-

Iocation of reeources. To the ex-

tent the defendant in the second

suit may not win bY asserting,

without contradiction, that the

plaintif had fully and fairlY, but

unsuccessfully, litigated the same

claim in the prior suit, the defen-

dant's time and money are di-

verted from alternative usee-Pre

ductive or otherwis*to relitiga-

tion of a decided issue. And, still

assuming that the issue was re'

solved correctly in the first suit,

there is reason to be concerned

about the plaintiffs allocation of

resouroes. Permitting repeated liti-

gation of the same issue as long as

the supply of unrelated defendants

holds out reflects either the aura

of the gaming table or 'a lack of

discipline and of disinterestedneds

on the part of the lower courts,

hardly a worthy or wise basis for

fashioning rules of Procedure.'

Kerotest Mfg. Co. v COTwo Co.

342 US 180, 185, [96 L Ed 2@,72

S Ct 2191 (1952). Although neither

judges, the parties, nor the adver-

sary system performs PerfectlY in

all cases, the requirement of deter'

mining whether the PartY against

whom an estoppel is asserted had

a full and fair opportunity to liti-

gate is a most significant eafe'

guard." Id., at 3n,28 L Fd 2d 788'

91 S Ct 1434.'0

t

I

I

!

I

I

F

i

I

i

I

8. ThiB criticism was eummarized in the

Court'e opinion in Blonder-Tongue l,aborator-

ies, Inc. v Univeraity of Illinoie Foundation,

Bupra, at 32?,327,28 L Ed %).78f,91 S Ct

1434. The opinion of Justice Traynor for a

unanimous California Supreme Court in Bern-

hard v Bank of America Nat. Ttugt & Savings

As8n. 19 Cal 2d 807, 812, L22 P2d 892' 895,

made the point succinctly:

"No satisfactory rationalization has been ad-

vanced for the requirement of mutuality. Just

why a party who was not bound by a previous

action ehould be precluded from asserting it

as ree judicata against a party who was bound

by it is difficult to comPrehend."

560

9. In T?iplett v lowell, 29? US 638' 80 L Ed

949, 56 S Ct 645, the C.ourt had held that a

determination of patent invalidity in a prior

action did not bar a plaintitr from relitigating

the validity of a patent in a subeequent dction

against a iifferent defendant. This holding of

tfie Triplett cas€ was erplicitly overmled in

the Blonder-Tongue ca8e.

10. The Court alao emphasized that relitiga'

tion of issuea previously adjudicated is partic-

ularly wasteful in patent cases becouse of

theii ataggering expense and typical len-glh'

402 US, at S34, 348, 28 L M %l 78€, 91 S Ct

1434. Under the doctrine of mutuality of par-

ties an alleged infringer might find it cheaper

58L&t2d

Fable misal-

To the ex-

r the eecond

y aeserting,

r, that the

I fairly, but

ld the same

t, the defen-

ney are di-

e Uses-prG

-to relitiga-

e. And, still

3Ue waa re-

,e 6rst suit,

l concerned

rllocation of

'epeated liti-

re as long as

I defendants

er the aura

r 'a lack of

berestedne6s

,wer Courts,

se basis for

procedure.'

)O-1\ro Co.

EA 200,72

ugh neither

' the adver-

perfectly in

rnt of deter-

rty against

sserted had

nity to liti-

frcant safs.

, Ed 2d 7gg,

;638, 80 L Ed

d held that a

ity in a prior

m relitigating

equent action

his holding of

overnrled in

that relitiga-

rted is partic-

s because of

ryical length.

788, 9t S Ct

ualit-v of par.

nd it cheaper

PARKLANE HOSIERY CO. v SHORE

439 US 322,58LFH% 552,99 S Ct eai

[lE0 us 320]

- Th" Blonder-Tongue caae involved

defensive use of cofateral ot"pp"l--

a plaintiff was estopped f"om ,Jse"t-ing a claim that lhe ptainiif;;;

previously litrg"t"a and lost against

_another defendant. The presen;;;;

by--contrast, involves of""ri*

"r" Jicollateral estoppel-a plaintitr- is

see*rng to estop a defendant from

relrtrgating the issues which the de-

fendant previously titigatea anJ foJt

agarnst another plaintitr In both the

oftensive and defensive use situa_

tioas, the party against whom ;;t ;pel rs asserted has litigated and lostin an earlier action. w"""rtfr"flr",

several reasong have been adrrarrcei

why the two situations shouia--be

treated differently.u

[7] First, ofensive use of collateral

estrippel does not promote judiciai

economy in the same manner as

defensive use does. Defe"si"e-use rI

ggJtlterat estoppel precludes . pl.i"_

trfi tiom relitigating identical issuesby merely "switching adversaries.'i

Bernhard v Bank oiarn".i."-Nut.

T*r,- 9. S:yrnss Assn. 19 Cal 2d, ;a8!3, 12-? P2d, at 898.12 Thus ili";:

sive collateral estoppel gives

"

pi;;_tu a strong incentive to join

[43e US 3S0]

potential defendants in the fi*t ;:ltion if possible. Offensive

"r" oi.ot_

lateral estoppel, on the other hanJ.glerq precisely the opposite incen_

trve. since a plaintif will be able to

rely

^on _a previous judgrnent

"c;i";;a defendant but wili nol be brfid L;

that judgment if the defenda"t;;i

the plaintiff has every incentive 6

aSop! a "wait and se6" attitude, inthe hope that the first action' [v

another plaintitr will result in a iJ-

vorable judgment. E. g., Neva"ou- u

Ualdweil, 161 Cal App 2d 762,267_

7.68, 327 p2d 111, iiS; n"u"i*'u

Allen, 88 NJ Super S@, 571_572,

213- A2d 2G, gZ. Thus offensiu" ,.L'oi

collateral estoppel will titetv--ii_

crease rather than decrease the total

apgun! of litigation, since potential

plaintiffs will have eu""ythirrg to

gain and nothing to lose [y ,roI irr_

tervening in the first action.rs

[8a] A second argument against

offensive use of collateral estop-pet is

that it may be unfair to a defendant.

If a defendant in the first action is

sued for small or nominal damages,

he may have little incentive to ?J

fend vigorously, particularly if fu_

ture suits are not foreseeable. The

t-o pay royaltiee than to_challenge a patent

that had been declared invalid in; o;";;il:since the holder of the pateni il ;fiffi ;';

:Flrpry preaumption of validity. Id., at 838,28 L FA 2d ?8,91 S ct 1434.

ll. Various commentatorg have expressedreeervations regarding the applicati,ori

"-i-oflrenslv.e _collateral eatoppel. Mutuality of Ee-toppet: Limits of the Bernhard Doctrine, 9Stan L Rev 281 ttSEZf; Semmel Aili'rai

$11nr"_t, Y"tt4ig ""d

J"-;;;;i p;ff fiL9llT L.ttev l4b7 (1968); Note, The Impacts

oI uetenBive and Offensive Assertion ofCollat_eral Estoppel by a Nonparty, gS Geo Was; i

Rev 1010 (1967). profeesor Currie later tem-pered his reeervations. Civil procedu;, ,iil;

Tempest Brewe, EB Catif L R;r-itii96b;' ""

.12. Under the mutuality rcquirement. aplaintitr iould accompti"t, tt i" r*"fi rii""' f,"would not have been bound by the judgment

had the original defendant won.

- _13._frg Restatement (Second) of Judgments

$ 88(3t Clent Draft No. Z, Apr. t5,'ib;;;

provides

-that application of coff ateJ-.gtop;i

may be denied if the party asserting it;;"ilfC

nave enected joinder in the firsi action between himself and his present adversary 'i --

I

I

i

56r

Evergreens v Nunan, L4L Fzd 927,

929 GAD cf. Berner v British Com-

monwealth Pac. Airlines, 346 F2d

532 (CA2) (application of offensive

collateral estoppel denied where de.

fendant did not appeal an adverse

judgment awarding damages of $35,-

000 and defendant was later sued for

over $7 million). Allowing offensive

collateral estoppel may also be un-

fair to a defendant if the judgment

relied upon as a basis for the estop

pel i6 itself inconsistent with ohe or

more previous judgments in favor of

the defendant.ta Still another situa-

tion where it might be

[48e US 33r]

unfair to apply offensive

estoppel is where the second action

afords the defendant procedural op

portunities unavailable in the first

action that. could readily cause a

diferent result.,o

C

[9] We have concluded that the

preferable approach for dealing with

U.S. SUPREME COURT REPORTS 58LEd2d

these problems in the federal courts

is not to preclude the use of offen-

sive collateral estoppel, but to grant

trial courts broad discretion to deter-

mine when it should be applied.r.

The general rule should be that in

cases where a plaintitr could easily

have joined in the earlier action or

where, either for the reasons dis-

cussed above or for other reasons,

the application of offensive estoppel

would be unfair to a defendant, a

trial judge should not allow the use

of offensive collateral estoppel.

[2b] In the present case, however,

none of the circumstances that

might justify reluctance to allow the

offensive use of collateral estoppel is

present. The application of offensive

collateral

[489 US 3i}2]

estoppel will not here rtr.

ward a private plaintiff who could

have joined in the previous action,

since the respondent probably could

not have joined in the injunctive

action brought by the SEC even had

he so desired.t? Similarly, there is no

t

i

{

I

14. In Professor Currie's familiar example,

a railroad collision injurea 50 passengers all

of whom bring separate actions against the

railroad. After the railroad wins the first 25

suits, a plaintiff wins in euit 26. Professor

Currie argues that ofensive uee of collateral

eetoppel should not be applied so aB to allow

plaintiffa 27 through 5O automatically to re,

cover. Currie, supra, 9 Stan L Rev, at 3O4. See

Restatcment (Second) of Judgments g 88(4),

8Upra.

16. [8bl If, for example, the defendant in

the 6rgt action was forced to defend in an

inconvenient forum and therefore was unable

to engage in full acale diecovery or call wit-

neeses, application of offensive collateral es-

toppel may be unwarranted. Indeed, diferen-

ces in available procedures may eometimes

justify not allowing a prior judgment to have

eetoppel efect in a subeequent action even

between the eame parties, or where defensive

eetoppel is aeserted against a plaintifl who

has litigated and loet. The problem of unfair-

ness is particularly acute in cases of offensive

562

eetoppel, however, becauee the defendant

against whom eatoppel is asserted typically

will not have choeen the forum in the firgt

action. See, id., at $ 88(2) and Comment d.

f6. This is essentially the approach of id., at

$ 88, which recognizee that "the distinct tr€nd

if not the clear weight of recent authority is

to the effect that there is no intrinsic difier-

ence between 'ofensive' as distinct frrom 'de

fensive' issue preclusion, although a atronger

ahowing that the prior opportunity to litigatc

was adequate may be required in the former

situation than the latter." Id., Reporter'e

Note, at 99.

17. SEC v Evereet Management Corp. ,176

F2d 1236, l24O (€,IA\ ('[T[re complicating

effect of the additional is8ue6 and the addi-

tional partiee outweighs any advantage of a

single dispoeition of the common issues").

Moreover, coneolidation of a private action

with one brought by the SF,C without its

consent is prohibited by atatute. 15 USC

$ 78u(s) [15 USCS $ 78uG)].

i

I

I

I

PABKLANE HOSIERY CO. v SHORE

439 US 822,58 L Ed 2d 652,99 S Ct 645

I

I

:

I

I

I

I

unfairness to the petitioners in ap

plyrng offensive collateral estoppel

in this case. First, in light of the

serious allegations made in the

SEC's complaint against the Pe-

titioners, as well as the foreseeabil-

ity of subsequent private suits that

typically follow a successful Govern-

ment judgrnent, the petitioners had

every incentive to litigate the SEC

lawsuit fully and vigorously.tt Sec-

ond, the judgment in the SEC action

was not inconsistent with any previ-

ous decision. Finally, there will in

the respondent's action be no proce-

dural opportunities available to the

petitioners that were unavailable in

the first action of a kind that might

be likely to cause a different result.re

We conclude, therefore, that none

of the considerations that would jus-

tify a refusal to allow the use of

offensive collateral estoppel is pres-

ent in this case. Since the petition-

ers received a "full and fair" oppor-

tunity to litigate their claims in the

[4Se us 333]

SEC action, the contemporary law of

collateral estoppel leads inescapably

to the conclusion that the petitioners

are collaterally estopped from reliti-

gating the question of whether the

proxy statement v/as materiallY

false and misleading.

II

[10a] The question that remains is

whether, notwithstanding the law of

collateral estoppel, the use of offen-

sive collateral estoppel in this case

would violate the petitioners' Sev-

enth Amendment right to a jury

trial.D

A

[11] "[T]he thrust of the [Seventh]

Amendment was to preserve the

right to jury trial as it existed in

L791." Curtis v Loether, 415 US 189,

193, 39 L Ed 2d 260,94 s Ct 1005.

At common law, a litigant was not

entitled to have a jury determine

issues that had been previously adju-

dicated by a chancellor in equitY.

Hopkins v Lee, 6 Wheat 109; 5 L Ed

218; Smith v Kernochen, 7 How 198,

217-2L8,12 L Ed 666; Brady v Daly,

175 US 148, 158-159, 44 L Ed 109,

20 S Ct 62; Shapiro & Coquillette,

The. Fetish of Jury Trial in Civil

Cases: A Comment on Rachal v Hill,

85 Harv L Rev 442,44U58 (1971)."

18. After a fourday trial in which the

petitioners had every opportunity to present

evidence and caII witnesses, the District Court

held for the SEC. The petitioners then ap

pealed to the Court of Appeals for the Second

Circuit, which affirmed the judgment against

them. Moreover, the petitioners $/ere already

aware of the action brought by the respon-

dent, since it had commenced before the fiIing

of the SEC action.

19. [2c] It is true, of course, that the

petitioners in the present action would be

entitled to a jury trial of the issues bearing on

whether the proxy statement was materially

false and misleading had the SEC action

never been brought-a matter to be discussed

in Part II of this opinion. But the presence or

absence of a jury as factfinder is basically

neutral, quite unlike, for example, the neces-

sity of defending the first lawsuit in an incon-

venient forum.

20. The Seventh Amendment provides: "In

Suils at common law, where the value in

controversy shall exceed twenty dollars, the

right to jury trial shall be preserved. . ."

21. The authors of this article conclude that

the historical aources "indicates that in the

late eighteenth and early nineteenth centu-

ries, determinations in equity were thought to

have as much force as determinatione at law,

and that the possible impact on jury trial

rights was not viewed with concern. . . If

collateral estoppel is otherwise warranted, the

jury trial question should not stand in the

way." 85 Harv L Rev, at 455456. This com-

mon-law rule is adopted in the Restatement of

Judgments $ 68. Comment i (1942).

66il

U.S. SUPREME COURT BEPORTS 58LEd2d

Recognition that an equitable de-

termination could have collateral-es-

toppel effect in a subsequent legal

action was the major premise of this

Court's decision in Beacon Theatres,

Inc. v Westover, 3Sg US b00, B L Ed

2d 988, 79 S Ct 948. In that case the

plaintiff sought a declaratory judg-

ment that certain arrangemenLs be-

tween it

[4r9 US 834]

and the defendant were notin violation of the antitrust laws,

and asked for an injunction to pre.

vent the defendant from instituting

an antitrust action to challenge the

arrangements. The defendant denied

the allegations and counterclaimed

for treble damages under the anti-

trust laws, requesting a trial by jury

of the issues common to both

-

the

legal and equitable claims. The

Court of Appeals upheld denial of

the request, but this Court reversed,

stating:

"[f]he effect of the action of the

District Court could be, as the

Court of Appeals believed, ,to limit

the petitioner's opportunity fully

to try to a jury every issue which

has a bearing upon it treble dam-

age suit,' for determination of the

issue of clearances by the judge

might 'operate either by way of

res judicata or collateral estoppel

so as to conclude both parties with

respect thereto at the subsequent

trial of the treble damage claim.,',

Id., at 504, 3 L Ed 2d 988, Z9 S Ct

948.

It is thus clear that the Court in

the Beacon Theatres case thought

that if an issue common to Uoth

legal and equitable claims was fir8t

dete-rmined by a judge, relitigation

of the issue before a jury might be

foreclosed by res judicata or collat

e-ral estoppel. To avoid this result,

the Court held that when legal and

equitable claims are joined in the

same action, the trial judge has only

limited discretion in deteimining thl

sequence of trial and ,,that discre.

tion . . . must, wherever possible, be

exe_rcised to preserve jury trial.,, Id.,

at 510, 3 L Ed 2d 988, ?9 S Ct g4g.n

Both the premise of Beacon Thea-

tres, and the fact that it enunciated

no more than a general prudential

rule were confirmed by this Court,s

decision in Katchen v Landy, 392 US

323, t5 L Ed 2d 391, 86 S Ct 467. In

that case the Court held that a

bankruptcy court, sitting as a statu-

tory court of equity, is empowered to

adjudicate

[43e us 8s5]

equitable claims prior to

legal claims, even though the factual

issues decided in the equity action

would have been triable by a jury

under the Seventh Amendmenl if

the Iegal claims had been a{iudi-

cated first. The Court stated:

"Both Beacon Theatres and Dairy

Queen recognize that there mighl

be situations in which the Court

could proceed to resolve the equi-

table claim first even though lhe

results mrght be dispositive of the

issues involved in the legal claim.,,

Id., at 339, 15 L Frl 2d 891, 86 S Ct

467.

Thus the Court in Katchen v tandy

recognized that an equitable deter-

mination can have collateral-estop

--,22.. S^imil.ar_ly, in both Dairy eueen, Inc. v

w99q,-369 Us 46s, 8 L Ed 2d 44,-sz s ct Cga,

and Meeker v Ambassador Oil Corp. B7E US

160, 11 L &l 2d 26t,84 S Ct 2?9, ihe Co,."t

w

hgld that legal cleimr should ordinarily be

tried before equitable claims to p.eeerve the

right to a jury trial.

68LEd2d

dms was first

e, relitigation

iury might be

nta or collat-

d this result,

hen legal and

joined in the

udge has only

:termining the

"that discre-

er possible, be

ury trial." Id.,

79 S Ct 948."

Beacon Thea-

it enunciated

ral prudential

)y this Court's

Landy, 382 US

16 S Ct 467. In

held that a

ing as a statu-

empowered to

rl

claime prior to

rgh the factual

equity action

rble by a jury

S,mendment if

I been adjudi-

ststed:

tres and Dairy

at there might

rich the Court

solve the equi-

en though the

rpositive of the

re legal claim."

2d 391, 86 S Ct

rtchen v Landy

quitable deter-

:ollateralcstop

ruld ordinarily be

ns to preeerve the

B

Despite the strong support to be

found both in history and in the

recent decisional law of this Court

for the proposition that an equitable

determination can have collateral-es-

toppel effect in a subsequent legal

action, the petitioners argue that

application of collateral estoppel in

this case would nevertheless violate

their Seventh Amendment right to a

jury trial. The petitioners contend

that since the scope of the Amend-

ment must be determined by refer-

ence to the common law as it existed

in 1791, and since the common law

permitted collateral estoppel only

where there was mutuality of par-

ties, collateral estoppel cannot con-

stitutionally be applied when such

mutuality is absent.

The petitioners have advanced no

persuasive reasion, however, why the

meaning of the Seventh Amendment

should depend on whether or not

mutuality of parties is present. A

litigant who has lost because of ad-

verse factual findings in an equity

action is equally deprived of a jury

trial whether he is estopped from

relitigating the factual issues

against the same party or a new

party. In either case, the party

against whom estoppel is asserted

has litigated questions of fact, and

PARKLANE HOSIERY CO. v SHORE

439 US 322,ffi L Ed 2d 552,99 S Ct 645

pel effect in a subsequent legal ac- has had the facts determined against

tion and that this estoppel does not him in an earlier proceeding.

violate the Seventh Amendment. [439 US 836]

In ei-

ther case there is no further fact-

finding function for the jury to per-

form, since the common factual is-

sues have been resolved in the previ-

ous action. Cf. Ex parte Peterson,

253 US 300, 310, 64 L Ed 919, 40 S

Ct 543 ("No one is entitled in a civil

case to trial by jury unless and ex-

cept so far as there are issues of fact

to be determined").

The Seventh Amendment has

never been interpreted in the rigid

manner advocated by the petition-

ers. On the contrary, many proce.

dural devices developed since 1791

that have diminished the civil jury's

historic domain have been found not

to be inconsistent with the Seventh

Amendment. See Galloway v United

States, 319 US 372, 38&393, 87 L Ed

1458, 63 S Ct 1077 (directed verdict

does not violate the Seventh Amend-

ment); Gasoline Products Co. v

Champlin Refining Co. 283 US 494,

497498,75 L Ed 1188, 51 S Ct 513

(retrial limited to question of dam-

agies does not violate the Seventh

Amendment even though there was

no practice at common law for eet-

ting aside a verdict in part); Fidelity

& Deposit Co. v United States, 187

us 315, 319-321, 47 L EA 194, 23 S

Ct 120 (summary judgment does not

violate the Seventh Amendment).8

The Galloway case is particularly

instructive. There the party against

whom a directed verdict had been

23. The petitioners' reliance on Dimick v

Schiedt, 293 US 474, 79 L Ed 603, 55 S Ct

296, 95 ALR 1150, is misplaced. In the Dimick

case the C,ourt held that an increase by the

trial judge of the amount of money damages

awarded by the jury violated the second

clause of the Seventh Amendment, which

provides that "no fact tried by a jury, sha[ be

otherwise re-examlned in anv Court of the

United States, than according to the rules of

the common law." C-ollateral eotoppel does not

involve the "re-examination" of any fact de

cided by a jury. On the contrary, the whole

premise of collateral eetoppel is that once an

issue has been resolved in a prior proceeding,

there is no further factfinding function to be

performed.

565

entered argued that the procedt're

*"" ,rt.on.litutional under the Sev-

"rrth

A^"t dment. In rejecting this

claim, the Court said:

"The Amendment did not bind

the federal courts to the exact-

oioc"a,rrut incidents or details of

iurv trial according

[439 US 337]

to the common law

,in 1791, any more than it tied'tt"*

to the iommon-law sYstem of

pf"uai"g or the sPecific- rules.of

i"ia"".-" then Prevailing' Nor

were 'the rules of the common

law' then Prevalent, including

lhose relating to the Procedure bY

*t i"f, the judge regulated the ju-

rv's role on questions of fact, crys'

iiili*J in a fixed and immutable

system' .

"The more logical conclusion' we

tfti"t, and t[e one which both

history and the previous decisions

here iuPPort, is that the Amend-

*""t *"" designed to Preserve the

basic institution of jury trial in

U.S. SUPREME COURT REPORTS

SEPARATE OPINTON

only its most fundamental ele'

-"tttt, not the great mass of Pro

c"a"t.t forms and details, varYing

even then so widelY among -com-

mon-Iaw jurisdictions'" 319 US' at

bgo, ggz, 8? L Ed 1458, 63 s ct

1077 (footnote omitted)'

[10b, 12a] The law of collateral

esioppel, Iike the law in other proce'

il;;i areas defining the scoPe of the

ir*'t function, has evolved since

lfLgt. Under the rationale of the

Galloway case, these develoPments

"." "ot"

rePugnant to the Seventh

Amendment simPlY for the reason

lfrJ tft"y did not-exist in 1791' Thus

ii.

""

*" ttuve held, the law of collat'

Liui

"ttopp"l

forecloses the petition-

"r.

fto*'retitigating the factual is-

sues determined against them in the

SPC uctio", nothing in the Seventh

Amendment dictates a different re

;;ii; ;;;" though because of lack of

mutualitY there would have been no

collateral estoPPel in 1791's

The judgment of the Court of AP

peals is affirmed.

58LEd2d

Mr. Justice Rehnquist, dissent-

ing.

ers' demand for a jury trial in thil

i"*."it. outrage is an emotion all

but

t43e us SltEl

imPossible to generate with re

It is admittedtY difficult to be out-

racJaUout the treatment accorded

ffif,"-i"aeral judiciatl to ryl't'o1

24. ln reaching this concluaion, the Court of

Appeals went on to Etate:

"\Vere there any doubt about the [queation

*i"ift". the pelitioners were entitled to I

i,rri- t a"t"t.ination of the issues otherwise

'r,"fil*t to collateral estoppell it should in any

erent be reeolved against the defendants rn

;his-case for the reaeon that, although they

*L" f"fry aware of the pendency of.tfe p1s;

ent suit throughout the non-jury- tnal ot.lne

SEC;". they"made no effort to protect -their

IIi,-* "

jurv trial of the damage claims

;;t "d

by' plaintiffs. either b1' seeking .to

;;t" iti"i or the Present action or bY

rJ"*ti"* Jufue Dutry- in the exerciee of hrs

iiiJ"r"pr*-rant to Rule 39(br' (o' FR Civ

566

P. to order that the issues in the SEC c48e k

ii# "ur-

" i; ; before an advisory jurY'"

rH-Ffi . it'ezi -szz. (Footnote omittcd')

"Tr26'i rio"-co"* of Appeals was mislaken

in'the# suggeations' The petitionen drd lol

ii;;';-r[hTto a jurv trdl in the qpitable

iri""ii""-"ition u.o,igr't bv the SEC' More'

oJ"t, * advisory jury, which miSht have oruy

ili;il -anJ ct,irpric"ted that proceeding'

wouid not in any event have been a xveDrn

el""a-""t jury. end the Petitioners.were

;;-; "

posiilon to ex@ite the private ac'

ffi';;; il.; th" SEC action' The Securitiee

i;;;;;;" A;, :l_le* H:"ttfi lTr*f,Henforcement actlons Dy

;;';;l"l pttrtt ".liot"

15 Usc ! 78u@)

lr5 USCS $ 78utg)l'

58LEd2d

fundamental ele

great mass of pro

nd details, varying

ridely among com-

etions." 319 US, at

Ed 1458, 63 S ct

mitted).

law of collateral

law in other proc+

ng the scope of the

has evolved since

rationale of the

lrese developments

rt to the Seventh

rly for the reason

exist in 1791. Thus

l, the law of collaL

:lose6 the petition-

ing the factual is-

gainst them in the

ng in the Seventh

tes a different re-

becauee of lack of

'ould have been no

in 1791.u

f the Court of Ap

'

jury trial in this

is an emotion all

rs it88l

o generate with re

ruea in the SEC case be

lore an advisory jury."

'ootnote omitted.)

Appeals w6s mistekgn

lhe petitionera did not

r trial in the equitable

ght by the SEC. More

which might have only

ated that proding,

rt have been a Seventh

i the petitioners were

xpeditc the private ac-

i action. The Securities

{ provides for prompt

y the SEC unhindered

tions. 15 USC 5 78u€)

PARKLANE HOSIEBY CO. v SHORE

439 US 322, 58 L Ed tut 552, 99 S Ct 645

spect to a corporate defendant in a

securities fraud action, and this case

is no exception. But the naggrng

Bense of unfairness as to the way

petitioners have been treated, engen-

dered by the imprimatur placed by

the Court of Appeals on respondentb

"heads I win, tails you lose,, theory

of this litigation, is not dispelled by

this Court's antiseptic analysis of

the issues in the case. It may be that

if this Nation were to adopt a new

Constitution today, the Seventh

Amendment guaranteeing the right

ofjury trial in civil cases in federal

courts would not be included among

its provisions. But any present senti--

ment to that effect cannot obscure or

dilutc our obligation to enforce the

Seventh Amendment, which was in-

cluded in the Bill of Rights in t7gl

and which has not since been re-

pealed in the only manner provided

by the Constitution for repeal of its

provisions.

The right of trial by jury in civil

cases at common law is fundamental

to -our history and jurisprudence.

Today, however, the Cou* reduces

this valued right, which Blackstone

praised as "the glory of the English

law," to a mere "neutral"

[489 US :]tgl

factor andin the name of procedural reform

denies the right of jury trial to de.

fendants in a vast number of casesin which defendants, heretofore,

have enjoyed jury trials. Over Bd

years ago, Mr. Justice Black la-

mented the "gradual process of judi-

cial erosion which in one.hundred-

fifty years has slowly worn away a

major portion of the essential giar_

antee of the Seventh Amendment.,,

Galloway v United States, glg US

372,397,87 L Ed 145g,63 S Ct 107?

(1943) (dissenting opinion). Regrett-

ably, the erosive process cortlrrues

apace with today's decision.t

The

vides:

I

Seventh Amendment pro-

t

t

I

I

!

I

I

t

"In Suits at common law, where

the value in controversy shall ex-

ceed twenty dollars, the right oftrial by-jury shall be preserved,

and no fact tried by a jury, shali

be otherwise reexamined in an"

Court of the United States, thai

according to the rules of the com-

mon law."

The history of the Seventh Amend-

ment has been amply documented

by this Court and by iegal scholars,2

and it would serve no ueefd purpose

to attempt here to repeat all that

has been written on the subject.

Nonetheless, the decision of this Lase

turns on the scope and effect of the

Seventh Amendment, which, per-

haps more than with any other pre

vision of the Constitution, are de-tcr-

mined by reference to the historical

[439 US:t40]

setting in which the Amendment

yT _{opted. See Colgrove v Battin,

1lq US 149, L52,37 L Ed %J.522, 93

S Ct 2448 (f973). It therefore is ap

propriate to pause to review, albeit

l. Becaus€ I believe that the use ofoffensive

collateral estoppel in this particular case wa.6

improper, it is not neceasa-ry for me to decide

whether I would approve its ,rse in

"ircu--Btances where the defendant's right to a jury

trial was not impaired.

^-2: Qge,!..s., Qlrroye v Batrin, 4lB US 149,

37 L Ed tul 522. 9g S Ct 2448 l1973t; Capitai

Traction Co. v H9l tZ4 US t, 43 L E; AZ5, r9

q Ct 580 (1899); Paraons v Bedford, B pet 433,7 L Ed 732 (7830); Henderson, The Back-

ground of the Seventh Amendment, g0 Harv

! R"u 289 (1966) (hereinafter Henderson);

Wolfram, The Constitutional History of the

Seventh Amendmenr, 5? Minn L ilev 6:i9

(1973) (hereinafter Wolfram). See alEo Unitcd

States v Woneon, 28 F Cae ?48 (No. f6,ZEO]

(@ Mass 1812) (Story, C. J.).

briefly, the circumstances preceding

and attending the adoption of the

Seventh Amendment as a guide in

ascertaining its application to the

case at hand.

A

It is perhape easy to forget, now

more than 200 years removed from

the events, that the right of trial by

jury was held in such esteem by the

colonists that its deprivation at the

hands of the English was one of the

important grievances leading to the

break with England. See Sources

and Documents Illustrating the

American Revolution 1764-1788 and

the Formation of the Federal Consti-

tution 94 (S. Morison 2d ed 1929); R.

Pound, The Development of Consti-

tutional Guarantees of Liberty 69-72

(1957); C. Ubbelohde, The ViceAd-

miralty Courts and the American

Revolution 2O&2Ll (1960). The ex-

tensive use of vice.admiralty courts

by colonial administrators to elimi-

nate the colonists' right of jury trial

U.S. SUPREME COURT REPORTS 58L&l%

was ligted among the specific offen-

sive English acts denounced in the

Declaration of Independence.E And

after

[480 US 84r]

war had broken out all ofthe

13 newly formed States restored the

institution of civil jury trial to its

prior prominence; 10 expressly guar-

anteed the right in their state con-

etitutions and the 3 others recog-

nized it by statute or by common

practice.'Indeed, "[t]he right to trial

by jury was probably the only one

universally secured by the firet

American etate constitutione . . . ."

L. kry, Legacy of Suppreesion:

Freedom of Speech and Press in

Early American History 281 (1960).!

One might justly wonder then why

no mention of the right of jury trial

in civil cases should have found its

way into the Constitution that

emerged from the Philadelphia Con-

vention in 1787. Article III, $ 2, cl 3,

merely provides that "The Trial of

all Crimes, except in Cases of Im-

peachment, shall be by Jury." The

8. The Declaration of Independence etates:

"For depriving ua in many cases, of the bene

fits of Trial by Jury." Just two years earlier,

in the Declaration of Rights adopted October

14, 1774, the 6rat Continental Congreas had

unanimously reeolved that "the reapective

colonies are entitled to the common law of

England, and more eapecially to the great and

ineatimable privilegp of being tried by their

peers of the vicinage, according to the couree

of that law." I Joumals of the C,ontinental

Congrees (1904 ed) 69.

Holdsworth has written that of all the new

methods adopted to atrengthen the adminis-

tration of the British Lawa, "the most effec-

tive, and therefore the moet disliked, was the

exteneion given to the jurisdiction of the reor-

ganized courts of admiralty and viceadmi-

ralty. It was the moet effective, because it

deprived the defendant ofthe right to be tried

by a jury which was almoet certain to acquit

him." l1 W. Holdgworth, I History of English

Law 110 (1966). While the vice-admiralt;-

courts dealt chiefly with criminal offenges,

668

their jurisdiction also was extended to many

areas of the civil law. Wolfram &{ n 47.

4. Ga Const, Art IJ(I (L777), i^ 2 fire Fed-

eral and Stat€ Constitutione Colonial Char-

ters, and Other Organic [,aws 786 (F Thorpe

d 1900) (hereinafter Thorpe); Md Conet, Art

III (1776), in 3 Thorpe 168&-1687; MaaB Const,

Art XV (1780), in 3 Thorpe 1891-1892; NH

Const, Art XX (1784), in 4 Thorpe 24O6; NJ

Conat, Art XXII (1776), in 6 thorpe 2598; NY

Const, Art XI.J. (1777), in 5 Thorpe 2637; NC

Const, Declaration of Rights, Art XIV (1776),

in 5 Thorpe 7188; Pa @nst, Declaration of

Rights, Art XI (1776), in 6 Thorpe 30811; SC

Const, Art XLI (1778), in 6 Thorpe 8267; Ya

Const, Bill of Righte, $ 1r (1776), in 7 Thorpe

3814. Se€ Wolfram 655.

6. When Congress in 1787 adopted the

Northweet Ordinance for governance of the

territoriee west of the Appalachians, it in-

cluded a g'uarantae of trial by jury in civil

caee6. 2 Thorpe 960-961.

58LEd2d

specific ofen-

ounced in the

rndence.! And

l

r out aII ofthe

s restored they trial to its

xpressly guar-

eir state con-

others recog-' by common

right to trial

the only one

)y the frst

rtions...."

Suppression:

nd Press in

281 1195p;.0

ler then whv

ofjury trial

rve found its

tution that

delphia Con-

IU, g 2, cl B.

the Trial oi

lases of Im-

Jury." the

:nded to manv

64 n 47.

in 2 The Fed-

blouial Char-

785 (F Thoroe

Md Const, Art

7; Mase Const,

891-1802; NH

rrpe 2456; NJ

trpe 2698; Ny

rrpe 2&37; NC

rt XfV (UZ6),

)reclaration of

'rpe 308i1; SC

,rp. 3i267; Ya

, in 7 I'horpe

adopted the

rance of the

hians, it in-

jury in civil

PARKLANE HOSIERY CO. v SHORE

439 US 322,58 L Ed 2d 552, 99 S ct 64;

omission of a clause protective of the

civil jury right was not for lack oitrying, however. Messrs. pincknev

and Gerry proposed to provide--l

clause securing the right of iurvtrial in civil cases, but their "d;:failed.t Several reaslons

[llile us 342]

advanced for this faiture. ,[XS:lrlry!. argued that the p""cti"" ofcivil juries among the several S;t".

vaned so much that it was too diffi-cult to draft constitutional fr"er""Lto accommodate the ditrerent-etaL

practicgt,See C;olgrove v Battin, 4i5

US, at 159, gZ L Ed 2d 522, 9A'S Ct

2448.1 Whatever the reason for the

omission, however, it is clear thai

even before the delegates had left

Philadelphia, plans were under wavto attack the proposed Constitutioi

on the ground that it failed to con_

tain a guarantee of civil jury t;iai-;

the -new federal courts. iS.J n. nui-

l^and, $nrSe Mason 9l (1961)! W;i-

fram, The Constitutio""f Hi"6ry;f

the Seventh Amendment, EZ Minn il

Rev 639, 662 (fgZB).

T.he vjrtually complete absence ofa blll.of rights in the proposed con_stitution was the principat f;;-;f

the Anti-Federalists' attack on the

Constjtution, and the lack ;i;;r;;i:

sion.,for civil juries featured p;;;i-

nently in their arguments. SeL par-

lols_ v_ Bedford, 3 pet 4gg, 445, 7 LEd 732 (1880). Their pf"". ,-t*"f

"responsive chord in the populace,

grd the price exacted i.'*;;;

States for approval of the A;;#_

tion was the appending of " fi*

-of

recommended amendments, chief

among them a clause securing the

lght of jury trial in civil .L;;.;

tbsponding to the pressures for acivil jury

[439 US 34S]

quarantee generated dur-

qr8 the ratification de6ates,-th" n*t

Congress under the new Constitution

at ik first eession in 17g9 p"opos;;

to amend the Constitution by

"iaingthe following language: ,,In-suits ai

cgmmon law, between man and man,the trial by jury, as one of the besi

securities to the rights of the p"opf",

ought to remain inviolate.', 1 innals

of. elg. 435 (U89). tt at p"ouisior,,

{ter9d in language to what U"crrn"the Seventh Amendment, was pro

po.."{ by the Congress in i7gg to-the

Iegrslatures of the several States and

became effective with its "rtifi;il;;by Virginia on Decembe" tS, t-Zgf i"

. 8. The propoeal was to add the followino

l"nguage to Art ltr: ..And a trial by ju.v shJjbe preaerved as usual i" ci"il J"&.;i ;'fi.

I*.ld, Ihe Records of tfre feaffiC";;-

tion oJ.l78?, p 6iA (191I). ffr" aeUat" ,ecaii.

iq..rt* propoeal is quoted ; -C;L#;;

Dattrrn,8upra, at lE3_15S, n g, 87 L Aa2d SZZ,93 S Ct 2448.

-,

7. Tlt" objection of Mr. Gorhem of Massa-

lnl31r" was. that-.[tJhe constitution of JuriesrR oulerent in different States and the triJ

itself is uaua.l in diferent caee6 in aife.e"tS*tP " 2 M. Farand, supra, at 62g. Com-mentators have sugrgested

-eeveral

"aaiti"i"tIeTolB for the failure of tt"

"o"u"niil"--f

il?:#,: i:ililJ?#,i*tr *" #tftr:similar provision for,cjr.il 5u.i" *."

"i-f;'""i

in part that the convention members simolvwanted to go home"); Wolfram 666556.--'-'',

.,t. See. Hendereon 29g; Wolfram 66?_Z0g.vrrglnla's recommended jury trial a-end-

ment. ie typical: ..That, in ci"t"orl"aG'[

8p9:tmg property, and in suits between manano man, the ancient trial by jury is one ofthe greateet eecuritiee to tfr! "*frt"

"i tfre

fr'"h,s,i!"H,'i3'B"f; HT,-:ii"f;Hi

C,onstitution 668 (2d ed 1886).

,9. The Judiciary Act of September 24. llilg.wnrch. was passed within six months of theorganization of the new government and onthe day -before the first tO e-u"a."n;';#

proposed to the legislatures of the S;G 1;th.e.FiTt Consessl provided i";; ;i;il";trial right. t Stat Z?

-

689

The foregoing sketch is meant to

suggest what many of those who

oppose the use ofjuries in civil trials

seem to ignore. The founders of our

Nation coneidered the right of trial

by jury in civil cases an important

bulwark against tyranny and corrup

tion, a safeguard too precious to be

Ieft to the whim of the sovereign, or,

it might be added, to that of the

judiciary.r0 Those who passionately

advocated the right to a civil jury

trial did not do so because they con-

sidered the jury a familiar proce'

dural device that should be contin-

ued; the concerns for the institution

ofjury trial that led to the passages

of the Declaration of Independence

and to the Seventh Amendment

were not animated by a belief that

use of juries would lead to more

efficient judicial administration.

Trial by a jury of laymen rather

than by the sovereign's judges

[439 US 3{4]

waa

important to the founders because

juries represent the layman'B com-

mon sense, the "passional elements

in our nature," and thus keep the

administration of law in accord with

the wishes and feelings of the com-

munity. O. Holmes, Collected Legal

Papers 237 (1920). Those who fa-

vored juries believed that a jury

would reach a result that a judge

either could not or would not

reach.rr It is with these values that

U.S. SUPREME COURT REPORTS 58LEd2d

underlie the Seventh Amendment in

mind that the Court should, but ob-

viously does not, approach the deci-

sion of this case.

B

The Seventh Amendment requires

that the right of trial by jury be

"preserved." Elecauee the Seventh

Amendment demands preservation

of the jury trial right, our cases have

uniformly held that the content of

the right must be judged by histori

cal standards. E. 9., Curtis v

Ioether, 415 US 189, 193, 39 L Ed

2d260,94 S Ct 1005 (1974); Colgrove

v Battin, supra, at 15L156, 37 L Ed

2d, 522,93 S Ct 2448; Ross v Bern-

hard, 396 US 531, 533,24 L Ed 2d

729,90 S Ct 733 (1970); Capital Trac-

tion Co. v Hof, 174 US 1, 8-9, 43 L

Ed 873, 19 S Ct 580 (1899); Parsons v

Bedford, supra, aL 446,7 L Fa 732