LDF Files Suit to Protect Consumers from Unfair Deals in City Ghettoes

Press Release

March 1, 1968

Cite this item

-

Press Releases, Volume 5. LDF Files Suit to Protect Consumers from Unfair Deals in City Ghettoes, 1968. 8dd0587c-b892-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/9f49df68-cd2a-4126-a857-304134c77b1a/ldf-files-suit-to-protect-consumers-from-unfair-deals-in-city-ghettoes. Accessed February 21, 2026.

Copied!

a: ~

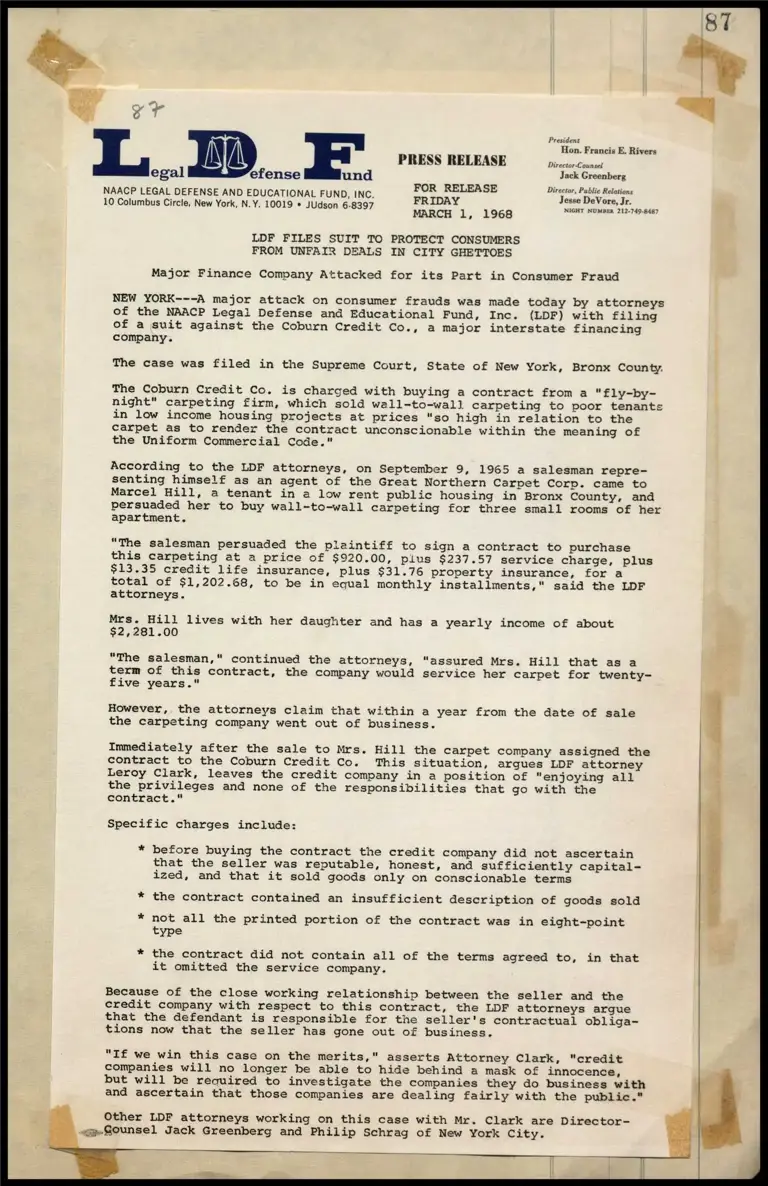

President

Hon. Francis E. Rivers

PRESS RELEASE Director Counsel

egal ‘efense und tare Creenberk

NAACP LEGAL DEFENSE AND EDUCATIONAL FUND, INC. teas = e laatavaste 10 Columbus Circle, New York, N.Y. 10019 * JUdson 6-8397 MARCH 1, 1968 NiGiT NuMBER 212-749-8487 ’

LDF FILES SUIT TO PROTECT CONSUMERS

FROM UNFAIR DEALS IN CITY GHETTOES

Major Finance Company Attacked for its Part in Consumer Fraud

NEW YORK---A major attack on consumer frauds was made today by attorneys

of the NAACP Legal Defense and Educational Fund, Inc. (LDF) with filing

of a suit against the Coburn Credit Co., a major interstate financing

company.

The case was filed in the Supreme Court, State of New York, Bronx County,

The Coburn Credit Co. is charged with buying a contract from a "“fly-by-

night" carpeting firm, which sold wall-to-wall carpeting to poor tenants

in low income housing projects at prices "so high in relation to the

carpet as to render the contract unconscionable within the meaning of

the Uniform Commercial Code."

According to the LDF attorneys, on September 9, 1965 a salesman repre-

senting himself as an agent of the Great Northern Carpet Corp. came to

Marcel Hill, a tenant in a low rent public housing in Bronx County, and

persuaded her to buy wall-to-wall carpeting for three small rooms of her

apartment.

“The salesman persuaded the plaintiff to sign a contract to purchase

this carpeting at a price of $920.00, pius $237.57 service charge, plus

$13.35 credit life insurance, plus $31.76 property insurance, for a

total of $1,202.68, to be in equal monthly installments," said the LDF

attorneys.

Mrs. Hill lives with her daughter and has a yearly income of about

$2,281.00

"The salesman," continued the attorneys, “assured Mrs. Hill that as a

term of this contract, the company would service her carpet for twenty-

five years."

However, the attorneys claim that within a year from the date of sale

the carpeting company went out of business.

Immediately after the sale to Mrs. Hill the carpet company assigned the

contract to the Coburn Credit Co. This situation, argues LDF attorney

Leroy Clark, leaves the credit company in a position of "enjoying all

the privileges and none of the responsibilities that go with the

contract." S

i

p

an

p

e

c

=

Specific charges include:

* before buying the contract the credit company did not ascertain

that the seller was reputable, honest, and sufficiently capital-

ized, and that it sold goods only on conscionable terms

* the contract contained an insufficient description of goods sold q

* not all the printed portion of the contract was in eight-point

type

* the contract did not contain all of the terms agreed to, in that

it omitted the service company.

Because of the close working relationship between the seller and the

credit company with respect to this contract, the LDF attorneys argue

that the defendant is responsible for the seller's contractual obliga-

tions now that the seller has gone out of business.

"If we win this case on the merits," asserts Attorney Clark, "credit

companies will no longer be able to hide behind a mask of innocence,

but will be required to investigate the companies they do business with

and ascertain that those companies are dealing fairly with the public."

Other LDF attorneys working on this case with Mr. Clark are Director-

~~ §ounsel Jack Greenberg and Philip Schrag of New York City.