Associated Press Article on LDF Campaign Against Installment Contracts and Loan Agreements

Press Release

July 8, 1969

Cite this item

-

Press Releases, Volume 6. Associated Press Article on LDF Campaign Against Installment Contracts and Loan Agreements, 1969. ba4b9e9b-b992-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/a7a3bd59-3d70-4e76-883f-5ca9c0c23585/associated-press-article-on-ldf-campaign-against-installment-contracts-and-loan-agreements. Accessed February 24, 2026.

Copied!

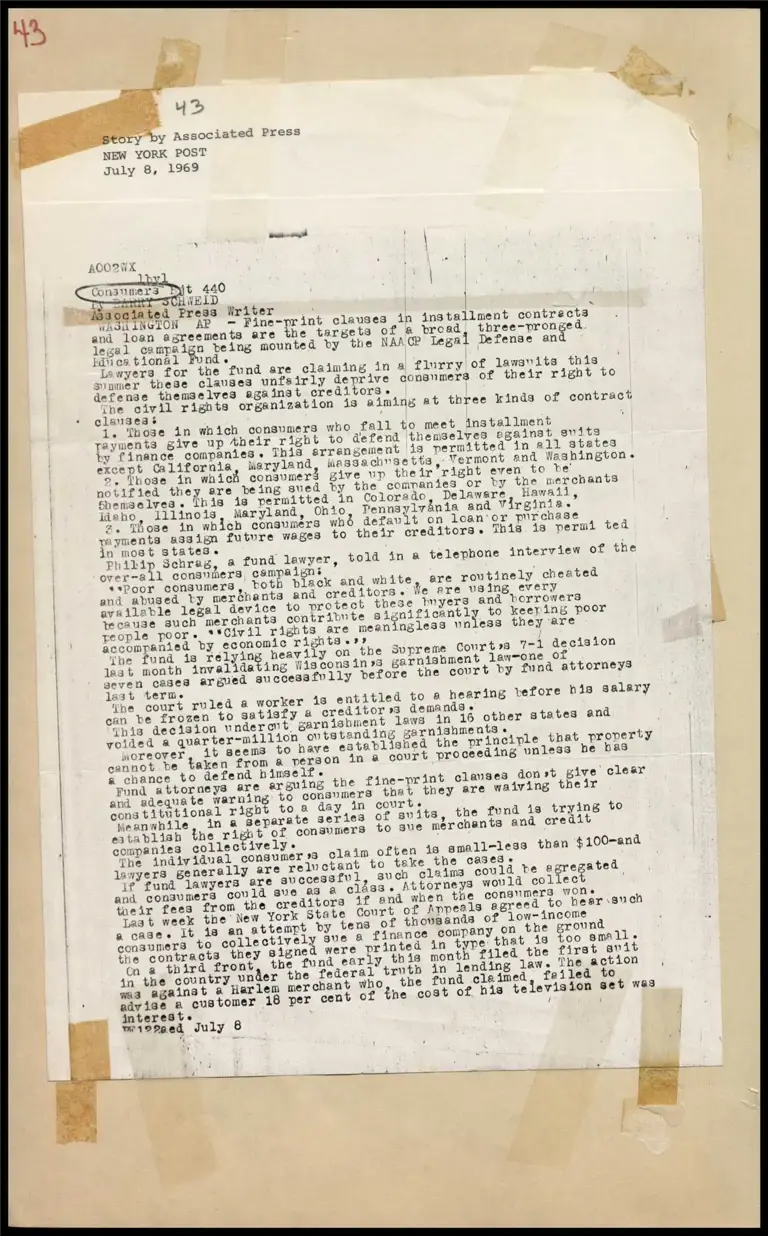

y by Associated Press

NEW YORK POST

July 8, 1969

owen mig

tallment contra ots

and loan agreements are the targets of a broad three-pronged

legal campaign yeing mounted by the NAA Leg

fan ca. Aenea und « ~ Sea: e gat Pet aehlbaes

lawyers for the fund are claiming in a flurry of lawsvits th is

syumer these clauses unfairly deprive consumers of their right to

defense themselves against creditors.

clauses s

1. Those in which consumers who fall to meet installment

jayments give up Aheir right to defend themselves against svi

by finance companies. This errangement is permitted in all st

20 Mpose in woich consumers give vp their right even to be

notified they are peing sued by the companies or by the merch

Shemselves. this is permitted in Colorado, Delaware, Hawaii

idaho, Illinois, Maryland, Ohio Pennsylvania and virginia.’

2, Those in which consumers whé default on loan'or purchase

yayments assign futvre wages to their creditors. This is perm

jn most statese

:

phshee Schrag, a fund lawyer, told in a telephone interview

ver-all consumers campaigns

ihe civil rights organization is aiming at three kinds of contract

ts

ates

except California, Maryland Massachrsetts, Yermont and Washington.

ants

4 ted

of the

**Poor consumers, both black and white, are routinely cheated

and abused ty merchants and creditors + We are vsing every

available legal device to protect these tvyers and borrowers

| tecause such merchants contribyte significantly to keeping poor

people poore *sCivil rights are meaningless uniess they are

| accompanied by economic rights .»?

]

| Ybe fund is relying heavily on the Supreme Gourtes 7-1 decis

| Jast month jnvalidating Wis cons in 3 garnishment law-one of

ion

seven cases argued succesafvlly before the covrt by fund attorneys

last terme.

can be frozen to satisfy a creditor »3 demands + fhe court ruled a worker is entitled to a hearing vefore his salary

| {his decision vnderont garnishment laws in 16 other states and

voided @ quarter-million ontstanding garnishment

not be taken from & person in @ court proceeding unless he

nance to defend himself.

| Tund attorneys are arguing the fine-print clavses don st give

and adequate warning to consumers tbat they are waiving their

constitutional right toa day in court.

Neanwhile, in @ separate series of suits, the fund is trying

| establish the right of consumers to sue merchants and credit

companies collectively+

3

moreover, it seems to have established the principle that property

as

clear

to

| The individual consumer »3 claim often is small-less than $100-and

| lawyers generally are reluctant to take the cases +

ie fund lawyers are svecessfvl, such claims could be agregated

| and consumers could sve ag a class. Attorneys would collec

| their fees from the creditors 4f and when the consumers wone

| Laat week the New York State Court of Anpeals agreed to hear

a cages It is an attempt by tens of thousands of low-income

consumers to collectively sue a finance company on the ground

interest.

miopaed July 8

t

advise a customer 18 per cent of the cost of his television 8

such

were printed in type that 4g too small.

aT

aa

a

ea

e

|