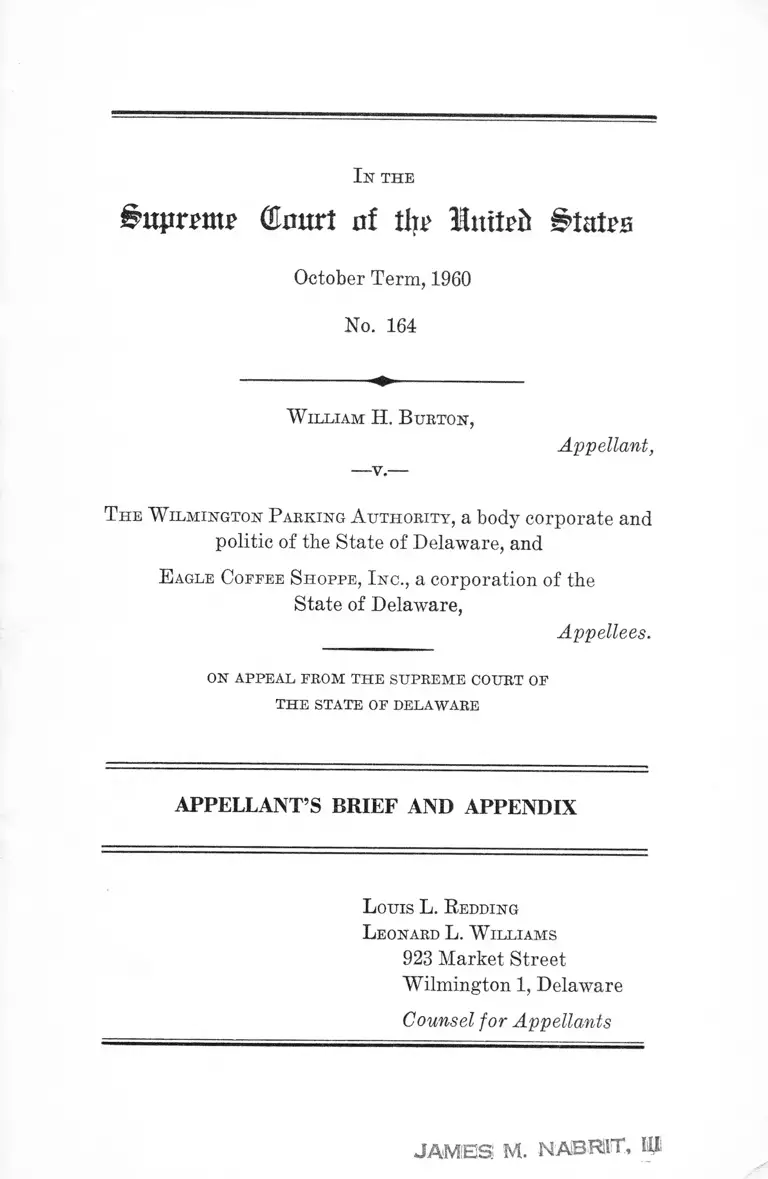

Burton v The Wilmington Parking Authority Appellants Brief and Appendix

Public Court Documents

December 27, 1960

50 pages

Cite this item

-

Brief Collection, LDF Court Filings. Burton v The Wilmington Parking Authority Appellants Brief and Appendix, 1960. 03ae1a2b-b79a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/cf2eb22f-0714-4efb-a72d-35eb653651e9/burton-v-the-wilmington-parking-authority-appellants-brief-and-appendix. Accessed February 24, 2026.

Copied!

I n t h e

infirm ? ( ta r t nf thT Hutted

October Term, 1960

No. 164

W illiam II. B urton,

—v.—

Appellant,

T he W ilmington P arking A uthority, a body corporate and

politic of the State of Delaware, and

E agle Coffee Shoppe, Inc., a corporation of the

State of Delaware,

Appellees.

on appeal from the supreme court of

THE STATE OF DELAWARE

APPELLANT’S BRIEF AND APPENDIX

Louis L. R edding

Leonard L. W illiams

923 Market Street

Wilmington 1, Delaware

Counsel for Appellants

JA M E S M. NASRiiT, M

I N D E X

PAGE

Opinions B elow .................................................................... 1

Jurisdiction .......................................................................... 1

Questions Presented .......................................................... 2

Statutes Involved .............................................................. 3

Statement .............................................................................. 3

Summary of Argum ent...................................................... 8

A rgument............................................................................ -..... 9

I— This Court Has Jurisdiction of the A ppeal.... 9

II— The Judicial Construction Below of the Stat

ute as Sanctioning Racial Discrimination Is

State Action Repugnant to the Fourteenth

Amendment ........................................................ 11

III— The Court Below Improperly Absolves an

Agency of State Government from Responsi

bility for Denial of Equal Protection of the

Laws to Appellant............................................... 13

a. The Court Below Reasons from Assump

tions of Fact Not in the Record hut

Imported from an Earlier Case to Which

Appellant Was Not a P a rty ................... 14

b. The Court Below Departs from Prac

tically Unanimous Authority as to the

Responsibility to Preserve Equal Pro

tection in the Leasing of Places of Public

Accommodation in Government-Owned

R ealty ........................................................ - 15

Conclusion 18

11

Table of Cases

page

American Federation of Labor v. Swing, 312 U. S. 321

(1941) ........................................................................ - ..... 13

Bridges v. California, 314 U. S. 252 (1941) — ........ .... 13

Brown v. Board of Education of Topeka, 347 U. S.

483 .................................-..... -........... -................................9,13

City of Greensboro v. Simkins, 246 F. 2d 425 (4th Cir.

1957) ......... ....... ..................... ........... ~ ............-.....-.... 15

Coke v. City of Atlanta,------ F. Supp. —— (N. D. Ga.,

Jan. 6, 1960) ............................................ ......................... 16

Cooper v. Aaron, 358 U. S. 1 (1958) ...... ..................... . 15

Culver v. City of Warren, 84 Ohio App. 373, 83 N. E.

2d 82 ............................................................. .. ...... - - ...... 18

Derrington v. Plummer, 240 F. 2d 922 (5th Cir. 1956) 17

Gayle v. Browder, 352 U. S. 903 ........ ............. ................ 9

Jones v. Marva Theatres Inc., 180 F. Supp. 49 (D. C.

Md. 1960) ............. ....................... -........... -....................... 15

Kern v. City Commissioners, 151 Kans. 565, 100 P. 2d

709 (1940) ............. ....... ............... ............................... - 16

Lawrence v. Hancock, 77 F. Supp. 1004 ------------ ------- 18

Marsh v. Alabama, 326 U. S. 501 (1946) .......... .......... . 16

Muir v. Louisville Park Theatrical Ass’n, 347 U. S. 971 15

Nash v. Air Terminal Services, Inc., 85 F. Supp. 554

(E. D. Va., 1949) 16

I ll

PAGE

Pennsylvania v. Board of Directors of City Trusts,

353 U. S. 230 (1957) ............................................... .......11,15

Rice v. Elmore, 165 F. 2d 387 (4th Cir. 1947), cert. den.

333 XL S. 875 ............................................................... ...... 17

Shelley v. Kraemer, 312 U. S. 321 (1941) ........._...... ...... 12

Smith v. Allwright, 321 IT. S. 649 ..... ........................... ..... 18

Strauder v. West Virginia, 100 U. S. 303 (1880) ___ __ 11

Tate v. Department of Conservation, 133 F. Supp. 53

(E. D. Va. 1955), aff’d 231 F. 2d 615 (4th Cir. 1956),

cert. den. 352 U. S. 838 ................................................ _. 15

Terry v. Adams, 345 IT. S. 461 ........ ....... ....... ................ 18

Wilmington Parking Authority v. Ranken, 34 Del. Ch.

339, 105 A. 2d 614......... ............ ..... ......... ............. ...4,14,17

Statutes:

22 Delaware Code Ch. 5 ........ ............. .......................... ..... 3,17

24 Delaware Code §1501 ..........................................3, 5, 6, 7, 9

28 U. S. C. §1257(2) ............. ...............................................2,10

Other Authority.

Crawford, The Construction of Statutes ...................... 11

1st th e

(Em trl u f tin* lu ttp fr S ta t e s

October Term, 1960

No. 164

W illiam H. B urton,

Appellant,

T he W ilmington P arking A uthority, a body corporate and

politic of the State of Delaware, and

E agle Coffee Shoppe, I nc., a corporation of the

State of Delaware,

Appellees.

ON APPEAL FROM THE SUPREME COURT OF

THE STATE OF DELAWARE

APPELLANT S BRIEF

Opinions Below

The opinion of the Supreme Court of Delaware is re

ported at 157 A. 2d 894 (1960) (R. 42-54). The opinion of

the Court of Chancery of the State of Delaware, in and

for New Castle County, is reported at 150 A. 2d 197 (1959)

(R. 36-39).

Jurisdiction

Appellant brought a class action in the Court of Chan

cery of the State of Delaware for a declaratory judgment

and injunctive relief against Wilmington Parking Au

2

thority, a public agency of the State of Delaware, and its

lessee, Eagle Coffee Shoppe, Inc., a Delaware corporation,

to restrain, as a denial of equal protection of the laws

secured by the Fourteenth Amendment, the racially dis

criminatory refusal of food service to him in a restaurant

operated in a public parking facility maintained by the

Authority in downtown Wilmington.

The judgment of the Supreme Court of Delaware, re

versing the declaratory judgment and injunction granted

by the Court of Chancery, was entered on January 12, 1960,

and on February 4, 1960, without opinion, the Supreme

Court of Delaware denied reargument. Notice of appeal

to this Court was filed in the Supreme Court of Delaware

on April 28, 1960, and the jurisdictional statement of

appellant was filed in this Court on June 22, 1960. On

October 10, 1960, this Court postponed further considera

tion of the question of jurisdiction to the hearing of the

case on the merits. The jurisdiction of this Court is in

voked under 28 U. S. C. §1257(2).

Questions Presented

1. Whether this Court has jurisdiction of the appeal.

2. Whether the court below is involved in state action

repugnant to the Fourteenth Amendment when it construes

a state statute, which on its face imposes no racial test,

as authorizing racial discrimination in a state-owned public

facility.

3. Whether the court below, by assuming facts outside

the record of the case and failing to recognize the inter

relationship of a public lessor of a state-owned public

facility with its lessee, improperly absolves the lessor of

the duty to accord equal protection of the laws.

3

Statutes Involved

This case involves the validity of Title 24, Delaware Code

of 1953, §1501, as construed and applied in this case by

the Supreme Court of Delaware to authorize racial dis

crimination. The text of the statute is as follows:

§1501. Exclusion of customers; definition

No keeper of an inn, tavern, hotel, or restaurant, or

other place of public entertainment or refreshment of

travelers, guests, or customers shall be obliged, by law,

to furnish entertainment or refreshment to persons

whose reception or entertainment by him would be

offensive to the major part of his customers, and would

injure his business.

As used in this section, “ customers” includes all

who have occasion for entertainment or refreshment.

Title 22, Delaware Code of 1953, Chapter 5, also per

tinent, but the validity of which is not involved, is reprinted

in the Appendix, infra, pp. 19-45.

Statement

Appellant, a Negro, resident in Wilmington, Delaware,

on August 14, 1958, parked his automobile in the public

parking structure of appellee Wilmington Parking Au

thority (Authority) and then proceeded into a restaurant

operated in the parking facility, or building. There he

sought food service and was refused, solely because of

his race (R. 1-3, 28-29, 37, 43).

The Authority is a public body corporate and politic,

established by the City of Wilmington, pursuant to 22

Delaware Code, Ch. 5 (Appendix), to construct and oper

4

ate a facility for off-street parking of automobiles. The

statute declares that the purposes for which a parking

authority shall exist and operate are “ public” uses. The

Authority has the power of eminent domain. The land on

which the facility is erected, however, was acquired through

negotiated purchases, the purchase money coming from

three sources: revenue bonds issued on the credit of the

Authority, cash donated by the City of Wilmington, and

a bank loan to the Authority (R. 12). Later the City of

Wilmington gave the Authority $1,822,827.69, which was

applied to redemption of revenue bonds and to repayment

of the bank loan (R. 12). The structure itself was erected

solely from the proceeds of the Authority’s revenue bonds

(R. 1-2, 5, 7, 11-13).

Section 504(a) (Appendix, p. 23) of the act under which

the Authority is established provides that the Authority

may lease portions of the first floor of the facility for com

mercial use where such leasing is necessary and feasible

for the financing and operation of such a facility. The

Authority is required to be financially self-sustaining. See

Wilmington Parking Authority v. Banken, 34 Del. Ch. 339,

105 A. 2d 614, 622 (1954). The Authority determined that

it would be feasible to erect and operate the structure only

if, in addition to fees from parking, there was income from

commercial leasing of space in the structure (R. 2, 5, 7,

12).

Appellee Eagle Coffee Shoppe, Inc. (Eagle) leased from

the Authority certain space in the building in April, 1957,

for twenty years, with an option to renew for an additional

ten years (R. 2, 5, 7, 14, 26). This lease required Eagle

to operate a restaurant, dining room, banquet hall, cocktail

lounge and bar and to engage in no other business (R. 21).

Eagle covenanted to “ occupy and use the leased premises

in accordance with all applicable laws . . . of any federal,

5

state or municipal authority” (R. 19). The Authority has

the right, under the lease, to enforce its provisions in

strict accordance with its terms (It. 25).

Appellant, on August 20, 1958, filed in the Court of

Chancery his complaint against the Authority and Eagle,

alleging that the Authority, “ acting through the instru

mentality of its lessee,” Eagle, “ using and occupying a

portion of said public facility,” had refused food service

to appellant, solely because of his race, color and ancestry.

The complaint alleged this refusal to be conduct of an

agency of the State of Delaware depriving appellant of the

equal protection of the laws, in violation of the Fourteenth

Amendment (R. 1-4).

When the Vice Chancellor rendered the decision of the

Court of Chancery, there had been filed in that court the

complaint, answers by both appellees, including an admis

sion by Eagle that appellant was refused service in the

restaurant only because of his race (R. 28-29), motions for

summary judgment by the Authority and Eagle, a counter-

motion for summary judgment by appellant, and affidavits

in support of the motions. Appellees’ motions set forth, in

essence, two grounds as the basis for summary judgment:

(1) that operation of the restaurant in the parking facility

was the private business of Eagle and independent of con

trol by the Authority; (2) that under 24 Delaware Code

§1501, supra, Eagle was permitted to refuse service to

appellant (R. 9-11).

The Vice Chancellor denied appellees’ motions and

granted appellant’s. He concluded that because rental in

come was a substantial and integral part of the means of

financing this “vital public facility,” the Authority was ob

ligated to enter into leases which would require the tenant

to carry out the Authority’s duty under the equal protec

tion clause. He deemed the Fourteenth Amendment to ap

6

ply to the operation of all aspects of the structure and to

forbid racial discrimination in the restaurant. Having thus

decided, the Vice Chancellor stated it was not necessary to

consider appellees’ reliance on 24 Delaware Code §1501 (R.

39).

The Supreme Court of Delaware, on appeal by the Au

thority and Eagle, was of the opinion (R. 42-54) that the

only concern the Authority had with Eagle was the receipt

of rent, “without which it [the Authority] would be unable

to afford the public the service of off-street parking.” It

concluded that Eagle’s discriminatory act was not that of

the Authority; it deemed Eagle to be acting in a “ purely

private capacity.” The record contained no evidence of ap

pellant’s offensiveness to other customers or of injury to

business, requisites under the terms of the statute to bring

it into operation, but the record did contain appellees’ ad

mission that service was refused appellant only because of

his race. Conjoined with this was appellees’ briefed argu

ment that, dispensing with proof, judicial notice could be

taken of the offensiveness of members of the class to which

appellant belongs. In this state of the record, the court

below held that 24 Delaware Code §1501 applied and au

thorized Eagle to refuse to serve appellant; and the court

reversed the Vice Chancellor.

As the gravamen of the complaint, appellant sets up, or

claims, a federal right, in that he alleges that the Authority,

a public agency of the State of Delaware, acting through the

instrumentality of its lessee, Eagle, in refusing appellant

food service in the restaurant located in the governmentally-

owned public facility, solely because of race, violated ap

pellant’s right to constitutional equal protection of the laws.

Secondly, a federal question was raised by appellant in

the trial court on appellees’ motions for summary judgment

claiming that the statute permits refusal of service to ap

7

pellant, a Negro, on the ground of race1 (E. 9, 10). Appel

lant’s brief, in reply, which was the mode appropriate under

Delaware practice to raise the issue, argued that:

“ [ I ] f the statute . . . be regarded as giving carte

blanche authorization to the keeper of an inn or other

place of public entertainment mentioned in the section

to make discriminatory regulations based on race or

color alone, this would not be private action, immune

from the Fourteenth Amendment, but discriminatory

state action which is barred by that Amendment.”

In the Supreme Court of Delaware, the constitutional

validity of the statute was again drawn into question by this

appellant on appeal by the Authority and Eagle from the

Vice Chancellor’s decision. On that appeal, the Authority’s

brief2 made a contention based on the statute and identical

with that advanced in the trial court in appellees’ joint brief.

Again, in the Supreme Court, appellant’s brief insisted that

if the statute be construed as authorizing a restaurateur

to discriminate because of race, the legislation would be

discriminatory state action which the Fourteenth Amend

ment prohibits. However, the Supreme Court of Delaware

1 In accordance with Delaware practice, appellees’ motions were

briefed and orally argued. The joint brief of the Authority and

Eagle made the point, stated verbatim, that: “A Delaware inn

keeper may refuse service to Negroes by reason of the provisions

of 24 Delaware Code of 1953 Section 1501.” This was developed

to support one of the two grounds on which the Authority’s motion

for summary judgment was based.

2 The Authority’s brief gave recognition of the necessity under

the statute of establishment of operative terms of the statute, viz.,

“ offensive to the major part of his customers” and injury to busi

ness and argued that “no issue of fact is raised by application of

Section 1501 because this Court can take judicial notice whether

a member of a class is offensive to a ‘major part’ of Eagle’s cus

tomers. The rule of judicial notice is a judicial short cut which

dispenses with proof of a notorious and self-evident fact.”

8

held the Authority not answerable for the admitted racial

discrimination; and it construed and enforced the statute as

authorizing exclusion of appellant because of race.

Summary of Argument

A statute of the State of Delaware relieves the proprietor

of a place of public refreshment, specifically a restaurant,

of obligation to receive in his place any person whose re

ception would be offensive to the majority of the persons

having occasion to use the restaurant and would injure the

business. The statute is construed by the Supreme Court

of Delaware to authorize exclusion of appellant because he

is a Negro without any evidence of his offensiveness to

other customers or of injury to business. Appellant chal

lenges the statute as thus construed and applied to exclude

him from a restaurant operated in a state-owned public

garage and the court below sustains the statute in the face

of appellant’s challenge. This Court has jurisdiction be

cause the appeal draws in question the validity of the stat

ute, the decision below being in favor of validity.

Inasmuch as the application of the statute to authorize

appellant’s exclusion because of race from the restaurant

in the government-owned facility derives solely from the

construction and enforcement given the statute by the state

court below, such discriminatory construction and enforce

ment is state judicial action repugnant to the equal pro

tection clause of the Fourteenth Amendment.

The court below indulged in erroneous assumptions of

facts outside the record before it and from these assump

tions drew the legal conclusion that there was an absence

of state action in the leasing of a restaurant in a state-

owned public facility. The court below also improperly

9

assessed the relationship between the state-agency lessor

and its lessee and the responsibilities flowing from this rela

tionship. These errors by the court below have invalidly

deprived appellant of the equal protection of the laws.

ARGUMENT

I

This Court has jurisdiction of the appeal.

This case involves the question of the validity, under

the Fourteenth Amendment, of a Delaware statute, Title 24,

Delaware Code §1501, which, as construed and applied by

the Supreme Court of Delaware to the facts of this case,

authorizes the operator of a restaurant located in a public

structure, conceived as a public facility by the Delaware

General Assembly and constructed and maintained by a

public agency of that state as a public facility, to deny

service to appellant solely because he is a Negro. It is now

established beyond meaningful dispute that a statute which

requires or permits racial distinctions patently violates the

Fourteenth Amendment. Brown v. Board of Education of

Topeka, 347 U. S. 483, Gayle v. Browder, 352 U. S. 903.

That the constitutional validity of this statute was drawn

in question in this case and that the statute was sustained

by the court below is inescapable in the aggregate context

of the case: a suit to enjoin refusal of service to appellant

because of his race; the admission of such refusal in the

pleadings (R. 28-29) ; appellees’ motions for summary judg

ment, pleading the statute as giving the right to refuse

service to appellant (R. 9-11); the total absence in the rec

ord of facts to evidence the existence of requisites of the

statute, viz., offensiveness of appellant to other customers

and injury to business; appellees’ briefs in support of their

10

motions urging judicial notice of the “notorious and self-

evident fact” that appellant’s being a Negro dispensed

with proof of the statutory grounds for refusal of service

(See fn. 2, supra) ; appellees’ further contention, definitively

arguing that “ a Delaware innkeeper may refuse service to

Negroes by reason of the provisions of” this statute (See

fn. 1, supra) ; appellant’s attack under the Fourteenth

Amendment on the validity of the statute, given the con

struction and application appellees advanced; the ruling

of the court below that on the basis of the statute, restau

rant service to appellant could be refused.

As initiated, appellant’s action was not framed in terms

of a challenge to the statute, for the statute does not spe

cifically or by implication authorize racial discrimination.

Moreover, in the 83 years of its existence prior to the filing

of appellant’s action, there are no reported cases dealing

with the statute and no discoverable record of its applica

tion. When, however, it was advanced to justify the racial

discrimination of which appellant complained, his attack on

its constitutional validity was clear and in a mode appro

priate in the context of the case. That challenge, or attack,

is the basis of this Court’s jurisdiction under 28 U. S. C.

§1257(2).

In the face of that challenge the court below has sus

tained the statute. Its ruling should not be suffered to

escape review merely because it does not contain language

explicitly declaring the statute impervious to constitutional

attack. The reference in the opinion below to erosion of

“ our local law” by Federal decisions and the holding that

the statute “ does not compel the operator of a restaurant

to give service,” under the facts presented in this case,

amply demonstrate the decision of the court below to uphold

the statute against the attack made upon it. The issue

therefore is an appropriate one for consideration under

11

28 U. S. C. 1257(2), because the court below has construed

the state statute to authorize discrimination against ap

pellant on the ground of his race and has upheld the stat

ute against his constitutional attack.

In the event that this Court should determine that an

appeal will not lie under 28 IT. S. C. 1257(2), it is respect

fully submitted that the case should be treated as an appro

priate one for certiorari. Pennsylvania v. Board of Di

rectors of City Trusts, 353 U. S. 230 (1957).

II

The judicial construction below of the statute as sanc

tioning racial discrimination is state action repugnant

to the Fourteenth Amendment.

The statute invoked by appellees to exclude appellant,

as enacted by the Delaware General Assembly, contains no

racial test or standard, as clearly it could not. Strauder

v. West Virginia, 100 U. S. 303 (1880).

It may be that the statute is so vague, indefinite and un

certain in its terms that it cannot be given intelligible mean

ing and therefore would be inoperative. See Crawford,

The Construction of .Statutes, §198. No guidance is given

by the statute as to when or how the offensiveness of a

prospective patron “ to the major part of his [the restau

rateur’s] customers” is to be ascertained. It is not indicated

whether the ascertainment is to be made by a poll of, in

the language of the statute, “ all who have occasion for

entertainment or refreshment,” irrespective of whether that

occasion was simultaneous with the appearance of the sus-

pectedly offensive character or prior thereto or at some

indefinite future time when the suspect is not presenting

himself for service.

12

However, assuming that the statute as enacted is valid,

appellees have not shown that they have exercised the tests

it does contain.3 With these tests unavailed of and no

showing whatever made with respect to appellant’s effect

on the customers in the restaurant at the time of his ap

pearance, the court below, presumably acceding to the Au

thority’s entreaty that it take judicial notice that members

of the class of persons to which appellant belongs, i.e.,

Negroes, are offensive, determined that the statute au

thorized his exclusion.

It has been held constitutionally impermissible for a

court, an agency of state government, to enforce wholly

private agreements plainly discriminatory on their face

against Negroes, or more accurately and inclusively, all

non-Caucasians, with respect to their right to acquire and

occupy real property. “ [Jjudicial action . . . bears the

clear and unmistakable imprimatur of the State,” this

Court said; and when by such action the state undertakes

to enforce private racially discriminatory pacts preventing

acquisition of real estate, Fourteenth Amendment equal

protection is transgressed. Shelley v. Kraemer, 334 U. S.

1 (1948). It would seem certainly not less transgressive of

that constitutional guaranty when the court below construes

and enforces a statute, which on its face has no racially

discriminatory provisions, to deprive appellant, because he

is a Negro, of the use of real property owned and main

tained by a state governmental agency.

Even if one agrees with the court below that the statute

is merely a restatement of the common law (R. 54), and

3 In its brief in the court below, the Authority sought to excuse

its failure to employ the tests thus: They “would involve the

appearance of an arbitrary number of witnesses to be compelled

to state their personal predilections upon a delicate and incitatory

question.”

13

we are not prepared so to agree, this Court has condemned

state judicial enforcement of common law policy which

nullifies constitutional freedoms. American Federation of

Labor v. Swing, 312 U. S. 321 (1941), Bridges v. California,

314 U. S. 252 (1941).

Ill

The court below improperly absolves an agency of

state government from responsibility for denial of equal

protection of the laws to appellant.

That a state, in operating its facilities on a racially segre

gated basis, violates the constitutional guaranty of equal

protection of the laws is now definitely established. Brown

v. Board of Education of Topeka, supra. The court below

early in its written opinion refers to this decision but in

a curiously oblique understatement of the principle of the

Brown case presignifies the departure it is to make from it.

Says the opinion:

“ [T]he states and their instrumentalities have been

required to act within the scope of state action in a

racially non-segregated manner” (E. 44). (Italics sup

plied. )

The opinion then proceeds ultimately to the conclusion,

that the Authority, a state agency, in its leasing of space

for a restaurant in what the trial court called a “vital

public facility,” is not involved in state action and that its

lessee acts in a “ purely private capacity” and the constitu

tional inhibition against racial discrimination does not

apply. In arriving at this conclusion, the court below not

only relies on factual information outside the record but

departs from practically undeviating authority on the sub

ject of state-owned leased real estate.

14

a. The court below reasons from assumptions of fact

not in the record but imported from an earlier case

to which this appellant was not a party.

From Wilmington Parking Authority v. Ranken, supra,

p. 4, brought by the Authority against a taxpayer, not

this appellant, to test the constitutionality of the Parking

Authority Act, the court below imported facts upon which

it relied for support of its determination that state action

was absent in the instant case. Because the parking struc

ture had not actually been erected, many of the cost figures

used in that case were only the estimates projected by the

Authority’s consultants. Id. 105 A. 2d at 618. On the basis

of that case the court below concluded that the only “ public

money” used in the construction of the parking structure

was “ $934,000 ‘advanced’ by the City of Wilmington and

used in the purchase of a portion of the land required”

(E. 50). This sum the court stated was only “ approximately

15% of the total cost” ; and it held that a “ slight contribu

tion is insufficient” to denote state action (E. 53).

The figure used by the court below conflicts with undis

puted acknowledgment by the chairman of appellee Au

thority, in the record before the court below, that:

“ Subsequently the City of Wilmington gave the Au

thority $1,822,827.69, which sum the Authority applied

to the redemption of the Eevenue Bonds delivered to

Diamond Ice & Coal Co. and to the repayment of the

Equitable Security Trust Company loan” (E. 12).

Appellant’s petition for reargument undertook to point

out that the error resulting from this venturing beyond

the record caused the court below to minimize what it con

sidered the percentage of “ public money” in the project.

As indicated above, the petition was denied without opinion.

15

Whether the figure be $934,000 or $1,822,000 or, as seems

more probable from the record, at least the aggregate of

these sums (R. 12), what the court below regarded as the

“ public money,” is substantial.

Moreover, it is difficult to understand that any of the

funds shown by the affidavit of the Authority’s chairman

as coming to it (R. 12), whether cash donated by the City of

Wilmington, proceeds from the sale of the Authority’s

revenue bonds, parking revenues or leasehold rental in

come, once in the treasury of this public governmental

agency, are other than public funds. If public property,

it cannot be used to maintain racial discrimination. Cooper

v. Aaron, 358 U. S. 1 (1958). If funds constituting a trust

created by an individual out of his own private fortune, in

the custody of public trustees whose official position makes

them agents of the state, cannot be administered in a racially

discriminatory manner, Pennsylvania v. Board of Directors

of City Trusts, supra, p. 11, then, a fortiori, the funds

controlled by the Authority, however derived, cannot be

used by it to work discrimination against appellant because

he is a Negro.

b. The court below departs from practically unanimous

authority as to the responsibility to preserve equal

protection in the leasing of places of public accommo

dation in government-owned realty.

That a public lessor and its lessee of government-owned

realty are so related as to be mutually involved in state

action is the clear rationale and result of the decided cases.4

4 Muir v. Louisville Paris Theatrical Ass’n, 347 U. S. 971, va

cating and remanding 202 F.2d 275 (6th Cir. 1953) (leased open

air theatre) ; Tate v. Department of Conservation, 133 F. Supp.

53 (E. D. Va. 1955), aff’d 231 F.2d 615 (4th Cir. 1956), cert. den.

352 U. S. 838 (leased beach) ; City of Greensboro v. Simkins, 246

F.2d 425 (4th Cir. 1957), affirming 149 F. Supp. 562 (M. D. N. C.

1957) (leased golf course); Jones v. Marva Theatres Inc., 180

16

Although, the court below seeks to distinguish some of these

cases, they present situations closely corresponding to the

instant ease. In Nash v. Air Terminal Services, Inc., 85 F.

Supp. 545 (E. D. Va., 1949), a corporate restaurant con

cessionaire in an airport in Virginia owned by the national

government, when sued for damages for refusing to serve

a Negro, defended on the ground that under Virginia law,

it was entitled to refuse service to the plaintiff. This con

tention was rejected. The court identified the private con

cessionaire with the “ public government” owning the prop

erty on which the concession was operated, declared that

the concessionaire was conducting the facility “ in the place

and stead of the Federal Government” and was “ too close,

in origin and purpose, to the functions of the public govern

ment” to be free of the inhibitions placed on government.

Close identity between the governmental lessor and the

private lessee exists also in the instant case and is, in fact,

so close that the government facility can function only by

virtue of its lessees. The power to lease portions of the

first floor of the structure in the instant case is permitted

to the Authority by the Parking Authority Act only if the

Authority determines such leasing desirable to assist in de

fraying the expenses of the Authority, and here it was so

determined (R. 12). The leasing was necessary to make

economically feasible the operation of the parking facility

as a self-sustaining governmental unit. This is admitted by

the answers of both appellees (R. 5, 7). Private ownership

itself has been held a mere technicality and constitutional

liberties are protected on privately-owned property, if that

property is operated as a municipality, i.e., a governmental

entity. See Marsh v. Alabama, 326 U. S. 501 (1946).

F. Supp. 49 (D. C. Md. 1960) (leased motion pieture theatre) ;

Coke y. City of Atlanta, ------ F. Supp. ------ (N. D. Ga., Jan. 6,

1960) (leased restaurant) ; Kern v. City Commissioners, 151 Kans.

565, 100 P.2d 709 (1940) (leased swimming pool).

17

The decision of the court below on the question of “ state

action” is in conflict with the opinion in Derrington v.

Plummer, 240 F. 2d 922 (5th Cir. 1956). There a cafeteria

in a county courthouse was held constitutionally prohibited

from discriminating on the basis of race. The court held

the building had been erected “ with public funds for the

use of the citizens generally” and that “diversion of the

property to purely private use” could not be countenanced.

In effect, the court coalesces the lessee with the county.

Discrimination by the latter would violate the Fourteenth

Amendment and the court held the “ same result inevitably

follows when the service is rendered through the instru

mentality of a lessee.” Id. at p. 925.

The court below absolved appellee Eagle from the re

sponsibility not to discriminate on the theory that the

public government did not control the restaurant. While

22 Delaware Code Ch. 5 authorizes leasing of space in a

portion of the Authority’s building, the General Assembly

conceived that such leasing was to enable the Authority

to serve a public purpose, not to divest itself of control.

Indeed the court below, in the Ranhen case, supra, sus

tained the leasing of a portion of the building only as inci

dental to the public uses. Its holding in the instant case

that the lessee acts in a purely private capacity is cer

tainly not consistent with a leasing incidental to public

uses. Having total control, that is ownership of the fee,

the Authority should have found a lessee who would have

agreed to operate the restaurant consistently with the con

stitutional duty which the Vice Chancellor, in conformity

with all of the cases, recognized was imposed on the Au

thority itself “not to deny to Delawareans the equal pro

tection of the laws” (R. 39). Previous attempts by state

governments at divesting themselves of the power to insist

on nondiscrimination have been exposed and state responsi

bility enforced. See Rice v. Elmore, 165 F. 2d 387 (4th

Cir. 1947), cert, denied 333 U. S. 875 (discrimination in

18

South Carolina primary unconstitutional although state

had repealed statutory references to primary); Terry v.

Adams, 345 U. S. 461; Smith v. Allwright, 321 U. S. 649.

See also Culver v. City of Warren, 84 Ohio App. 373, 83

N. E. 2d 82 and Lawrence v. Hancock, 77 F. Supp. 1004,

which pointedly hold that a governmental agency may not

in leasing a public facility relieve itself of the obligation

to cause the public property to be operated without racial

discrimination.

CONCLUSION

The court below has made the observation that appellant

was not “ discriminated against by the Authority in the

operation of the public parking portion of the facility.” In

a single building, erected and maintained with public funds

by an agency of state government to serve a public pur

pose, this appellant in one portion of the building serving

the public can be a Delawarean whose rights are undif

ferentiated from other citizens and in another portion of

the building, also ostensibly serving the public, is a demi-

citizen without rights. This confusing irony now derives

palpably from the error of the court below in construing

a statute as permitting discrimination against appellant

because he is a Negro and in failing to enforce the responsi

bility of the Authority to accord equal protection of the

laws to all persons.

The judgment below should be reversed.

Respectfully submitted,

Louis L. R edding

L eonard L. W illiams

923 Market Street

Wilmington 1, Delaware

Counsel for Appellant

Wilmington, Delaware

December 27, 1960

APPENDIX

Title 22 Delaware Code, Chapter 5, Sections 501-515:

§501. Findings and declaration of policy

It is determined and declared as a matter of legislative

finding that—

(1) Residential decentralization in incorporated cit

ies has been accompanied by an ever increasing trend

in the number of persons entering the business sections

by private automobile as compared with other modes

of transportation;

(2) The free circulation of traffic of all kinds through

the streets of cities is necessary to the health, safety,

and general welfare of the public whether residing in

the city or traveling to, through, or from the city, in

the course of lawful pursuits;

(3) The greatly increased use by the public of motor

vehicles of all kinds has caused serious traffic conges

tion on the streets of cities;

(4) The parking of motor vehicles on the streets has

contributed to this congestion to such an extent as to

interfere seriously with the primary use of such streets

for the movement of traffic;

(5) Such parking prevents the free circulation of

traffic in, through, and from the city, impedes rapid

and effective fighting of fires and the disposition of

police forces in the district and endangers the health,

safety, and welfare of the general public;

(6) Such parking threatens irreparable loss in valu

ations of property in the city which can no longer be

readily reached by vehicular traffic;

20

(7) This parking crisis, which threatens the welfare

of the community, can be reduced by providing suffi

cient off-street parking facilities properly located in the

several residential, commercial, and industrial areas of

the city;

(8) The establishment of a parking authority will

promote the public safety, convenience, and welfare;

(9) It is intended that the parking authority coop

erate with all existing parking facilities so that private

enterprise and government may mutually provide ade

quate parking services for the convenience of the pub

lic;

therefore it is declared to be the policy of this State to pro

mote the safety and welfare of the inhabitants thereof by

the creation in incorporated cities of bodies corporate and

politic to be known as “ Parking Authorities” which shall

exist and operate for the purposes contained in this chapter.

Such purposes are declared to be public uses for which

public money may be spent and private property may be

acquired by the exercise of the power of eminent domain.

§502. Definitions

As used in this chapter, unless the context requires a

different meaning—

“ Authority” means a body politic and corporate created

pursuant to this chapter;

“ Board” means the governing body of the Authority;

“ Bonds” means and includes the notes, bonds and other

evidence of indebtedness, or obligations, which the Author

ity is authorized to issue pursuant to section 504 of this

title;

21

“ City” means incorporated city or town;

“ Construction” means and includes acquisition and con

struction, and “ to construct” means and includes to acquire

and to construct, all in such manner as may be deemed

desirable;

“ Facility” or “ facilities” means lot or lots, buildings and

structures, above, at, or below the surface of the earth,

including equipment, entrances, exits, fencing, and all other

accessories necessary or desirable for the safety and con

venience of the parking of vehicles;

“Federal agency” means and includes the United States

of America, the President of the United States of America,

and any department or corporation agency or instrumental

ity heretofore, or hereafter created, designated, or estab

lished by the United States of America;

“ Improvement” means and includes extension, enlarge

ment, and improvement, and “ to improve” means and in

cludes to extend, to enlarge, and to improve, all in such

manner as may be deemed desirable.

“ Municipality” means any county, incorporated city or

incorporated town of this State;

“ Persons” means and includes natural persons;

“ Project” means any structure, facility, or undertaking

which the Authority is authorized to acquire, construct,

improve, maintain, or operate under the provisions of this

chapter.

§503. Method of incorporation

(a) Whenever the city council or other governing body

of a city desires to organize an Authority, under the pro

visions of this chapter, it shall adopt an ordinance signify

ing its intention to do so.

22

In the event that such ordinance sets forth the proposed

articles of incorporation in fnll it shall not be required,

any law to the contrary notwithstanding, in publishing such

ordinance, under the provisions of existing law, to publish

such proposed articles of incorporation in full, but it shall

be sufficient compliance with such law in such publication

to set forth briefly the substances of such proposed articles

of incorporation and to refer to the provisions of this chap

ter. Thereafter the city council shall cause a notice of such

ordinance to be published at least one time in a newspaper

published and of general circulation in the county in which

the Authority is to be organized. The notice shall contain

a brief statement of the substance of the ordinance, includ

ing the substance of such articles, making reference to this

chapter, and shall state that on a day certain, not less

than three days after publication of the notice, articles of

incorporation of the proposed Authority will be filed with

the Secretary of State of this State.

(b) On or before the day specified in the notice the city

council shall file with the Secretary of State articles of in

corporation together with proof of publication of the notice

referred to in subsection (a) of this section. The articles

of incorporation shall set forth—

(1) The name of the Authority;

(2) A statement that such Authority is formed under

the provisions of this chapter;

(3) The name of the city, together with the names

and addresses of its council members;

(4) The names, addresses and term of office of the

first members of the board of the Authority.

All of which matter shall be determined in accordance

with the provisions of this chapter. The articles of incur-

23

poration shall be executed by the incorporating city by its

proper officer and under its municipal seal.

(c) If the Secretary of State finds that the articles of

incorporation conform to law he shall forthwith, but not

prior to the day specified in the notice, endorse his ap

proval thereon, and when all proper fees and charges have

been paid shall file the articles and issue a certificate of

incorporation to which shall be attached a copy of the

approved articles. Upon the issuance of such certificate of

incorporation by the Secretary of State, the corporate ex

istence of the Authority shall begin when such certificate

has been recorded in the office for the recording of deeds

in the county where the principal office of the Authority

is to be located. The certificate of incorporation shall be

conclusive evidence of the fact that such Authority has

been incorporated, but proceedings may be instituted by

the State to dissolve any Authority which shall have been

formed without substantial compliance with the provisions

of this section.

(d) When the Authority has been organized and its of

ficers elected, the secretary shall certify to the Secretary

of State the names and addresses of its officers, as well as

the principal office of the Authority. Any change in the

location of the principal office shall likewise be certified

to the Secretary of State within 10 days after such change.

§504. Purpose and powers

(a) The Authority, incorporated under this chapter, shall

constitute a public body corporate and politic, exercising

public powers of the State as an agency thereof, and shall

be known as the Parking Authority of the city, but shall

in no way be deemed to be an instrumentality of the city

or engaged in the performance of a municipal function.

The Authority shall be for the purpose of conducting the

24

necessary research activity, to maintain current data lead

ing to efficient operation of off-street parking facilities, for

the fulfillment of public needs in relation to parking, es

tablishing a permanent coordinated system of parking fa

cilities, planning, designing, locating, acquiring, holding,

constructing, improving, maintaining and operating, own

ing, leasing, either in the capacity of lessor or lessee, land

and facilities to be devoted to the parking of vehicles of any

kind.

The Authority shall not have the power to directly en

gage in the sale of gasoline, the sale of automobile acces

sories, automobile repair and service or any other garage

service, other than the parking of vehicles, and the Au

thority shall not directly engage in the sale of any com

modity of trade or commerce; provided, however, that the

Authority shall have the power to lease space in any of its

facilities for use by the lessee for the sale of gasoline, the

sale of automobile accessories, automobile repair and ser

vice or any other garage service and to lease portions of

any of its garage buildings or structures for commercial

use by the lessee, where, in the opinion of the Authority,

such leasing is necessary and feasible for the financing and

operation of such facilities. Any such lease shall be granted

by the Authority to the highest and best bidder, upon terms

specified by the Authority, after due public notice has been

given, asking for competitive bids; provided, however, that

if after such public notice no bid is received and/or the

Authority rejects any bid or bids received, thereafter the

Authority may negotiate any such lease or leases without

further publie notice but on a basis more favorable than

that contained in any bid or bids rejected, if any. The

phrase “ due public notice,” as used in this section, shall

mean a notice published at least 10 days before the award

of any such lease in a newspaper of general circulation

25

published in a municipality where the Authority has its

principal office, and if no newspaper is published therein,

then by publication in a newspaper of general circulation

in the County where the Authority has its principal office.

The Authority may reject any or all bids if, in the opinion

of the Authority, any such lease granted as a result of any

such bid or bids would not be adequate or feasible for the

financing and operation of such facilities.

(b) Every Authority may exercise all powers necessary

or convenient for the carrying out of the aforesaid pur

poses including, but without limiting the generality of the

foregoing, the rights and powers described below.

(1) To have existence for a term of 50 years as a

corporation and thereafter until the principal and in

terest upon all of its bonds shall have been paid or

provisions made for such payment, and until all of its

other obligations shall have been discharged.

(2) To sue and be sued, implead and be impleaded,

complain and defend in all courts.

(3) To adopt, use and alter at will a corporate seal.

(4) To acquire, purchase, hold, lease as lessee, and

use any franchise, property, real, personal, or mixed,

tangible or intangible, or any interest therein, neces

sary or desirable for carrying out the purpose of the

Authority and to sell, lease as lessor, transfer, and

dispose of any property or interest therein at any

time required by it.

(5) To acquire by purchase, lease or otherwise, and

to construct, improve, maintain, repair, and operate

projects.

(6) To make by-laws for the management and regu

lation of its affairs.

26

(7) To appoint officers, agents, employees, and ser

vants, to prescribe their duties, and to fix their com

pensation.

(8) To fix, alter, charge, and collect rates and other

charges for its facilities at reasonable rates to be de

termined exclusively by it, subject to appeal as pro

vided in this paragraph, for the purposes of providing

for the payment of the expenses of the Authority, the

construction, improvement, repair, maintenance, and

operation of its facilities and properties, the payment

of the principal of and interest on its obligations, and

to fulfill the terms and provisions of any agreements

made with the purchasers or holders of any such ob

ligations or with the city. Any person questioning

the reasonableness of any rate fixed by the Authority

may bring suit against the Authority in the Superior

Court of the county wherein the project is located.

The Superior Court shall have exclusive jurisdiction to

determine the reasonableness of rates and other charges

fixed, altered, charged, or collected by the Authority.

Appeals may be taken to the Supreme Court within

30 days after the Superior Court has rendered a final

decision.

(9) To borrow money, make and issue negotiable

notes, bonds, refunding bonds, and other evidences of

indebtedness or obligations of the Authority; the bonds

to have a maturity date not longer than forty years

from the date of issue, except that no refunding bonds

shall have a maturity date longer than the life of the

Authority; and to secure the payment of such bonds or

any part thereof by pledge, or deed of trust of all, or

any of its revenues and receipts, and to make such

agreements with the purchasers or holders of such

bonds, or with others in connection with any such

bonds, whether issued or to be issued, as the Authority

27

deems advisable, and in general to provide for the se

curity for the bonds and the rights of the holders

thereof.

(10) To make contracts of every name and nature,

and to execute all instruments necessary or convenient

for the carrying on of its business.

(11) Without limitation of the foregoing to borrow

money and accept grants from, and to enter into con

tracts, leases, or other transactions with, any Federal

agency, State of Delaware, municipality, corporation

or authority.

(12) To have the power of eminent domain.

(13) To pledge, hypothecate, or otherwise encumber

all or any of the revenues or receipts of the Authority,

as security for all or any of the obligations of the

Authority.

(14) To do all acts and things necessary for the pro

motion of its business and the general welfare of the

Authority to carry out the powers granted to it by this

chapter or any other law.

(15) To enter into contracts with the State of Dela

ware, municipalities, corporations or authorities for

the use of any project of the Authority and fixing the

amount to be paid therefor.

(16) To enter into contracts of group insurance for

the benefit of its employees, and to set up a retirement

or pension fund for such employees, similar to that

existing in the municipality where the principal office

of the project is located.

(c) The Authority shall not at any time, or in any man

ner, pledge the credit or taxing power of the State of

28

Delaware or any political subdivision, nor shall any of its

obligations be deemed to be obligations of the State of

Delaware, or of any of its political subdivisions, nor shall

the State of Delaware or any political subdivision thereof

be liable for the payment of principal or of interest on

such obligations.

(d) In addition to the provisions in this chapter pro

vided for the financing of the costs of acquiring lands and

premises and for the construction and improvement of

parking projects, the Authority may by resolution, as pro

vided in this subsection, establish a benefit district.

(1) One benefit district may be designated for the con

demnation of lands for one or several parking stations.

The Authority shall determine the percentage of the costs

of condemnation which shall be assessable to such benefit

district. Not more than 80 per cent of such costs shall be

assessable to such benefit district or benefit districts.

(2) After a benefit district has been established, no fur

ther proceedings shall be taken unless there is filed with the

secretary of the Authority, within sixty days of the passage

of the resolution creating the benefit district, a petition

requesting the establishment of such public parking station

or stations. Such petition shall be signed by the resident

owners of real estate owning not less than 51 per cent of

the front feet of the real estate fronting or abutting upon

any street included within the limits of the benefit district.

In determining the sufficiency of the petition, lands owned

by the city, county, State or United States or by nonresi

dent owners of real estate within the benefit district shall

not be counted in the aggregate of lands within such benefit

district. After any petition has been signed by an owner

of land in the benefit district, the change of ownership of

the land shall not affect the petition. In any case where the

owners of lands within the benefit district are tenants in

29

common, each co-tenant shall be considered a landowner

to the extent of his undivided interest in the land. The

owner of a life estate shall also be deemed a landowner for

the purpose of this chapter. Guardians of minors or insane

persons may petition for their wards when authorized by

the proper court so to do. Resident owner of land, as de

fined in this paragraph, shall be any landowner residing in

the city and owning land in the benefit district. No suit

shall be maintained in any court to enjoin or in any way

contest the establishment of such parking stations or the

establishment of a benefit district unless the suit be insti

tuted and summons served within 30 days from and after

the date of the filing of such petition with the secretary

of the Authority.

(3) Whenever the Authority shall have acquired lands

for public parking stations and shall have declared and

ordered that not more than 80 per cent of the cost of estab

lishing or improving public parking stations, as provided

in this subsection, will be paid by the levy of special assess

ments upon real estate situate in any one or more benefit

districts, it shall cause to be made by some competent per

son an estimate, under oath, of the cost thereof, which esti

mate shall be filed with the secretary of the Authority. The

assessment against the benefit district shall be apportioned

among the various lots, tracts, pieces, and parcels of land

within the benefit district in accordance with the special

benefits accruing thereto, this apportionment of benefit

assessments to be made by three disinterested property

owners appointed by the mayor of the city or if such city

has no mayor, by its chief executive officer within 30 days

after the filing of the estimate of the cost of the improve

ment with the secretary of the Authority. As soon as the

amount chargeable against each piece of property is ascer

tained, the Authority of such city shall by resolution levy

such amount against this real estate in the benefit district,

30

which resolution shall be published once in a newspaper

of general circulation in such city. No suit to question the

validity of the proceedings of the Authority shall be com

menced after 30 days from the awarding of a contract for

such improvements and until the expiration of the 30 days

the contractor shall not be required to commence work un

der his contract. If no suit shall be filed within such 30

days then all proceedings theretofore had shall be held to

be regular, sufficient, and valid.

(4) The cost of condemnation and improvement of such

public parking stations may be levied and assessed in not

to exceed 10 installments, with interest on the whole amount

remaining due and unpaid each year at a rate of interest

not exceeding 5 per cent per annum. Any owner of land

within the benefit district may, within 30 days after the

assessment resolution is passed, pay the entire amount

assessed against the land. The Authority of such city may

assess, levy, and collect the cost of condemnation and im

provement of such public parking stations as is assessed

against the privately owned property in the benefit district.

The assessment shall constitute a lien from the date the

same is assessed by resolution, as provided in this para

graph, against the respective premises against which the

same is levied, in the same manner as city taxes on real

estate are constituted a lien, and shall be collectible in the

manner provided for the collection of taxes assessed against

the real estate of the City of Wilmington by monition

process, as provided in Chapter 143, Vol. 36, Laws of

Delaware.

(e) When any real property or any interest therein here

tofore or hereafter acquired by the Authority is no longer

needed for the purposes defined in this chapter, or when, in

the opinion of the Authority it is not desirable or feasible

to hold and use such property for said purposes, the Au

thority may sell the same at private or public sale as the

31

Authority shall determine, granting and conveying to the

purchaser thereof a fee simple marketable title thereto.

The Authority may make such sale for such price and upon

such terms and conditions as the Authority deems advisable

and for the best interests of the Authority and may accept

in payment, wholly or partly, cash, bonds, mortgages, deben

tures, notes, warrants, or other evidences of indebtedness

as the Authority may approve. The consideration received

from any such sale may be applied by the Authority, in its

discretion, to the repayment, in whole or in part, of any

funds contributed to the Authority by a municipality under

the provisions of section 508 of this title or retained by the

Authority for the purposes of this chapter. Without limita

tion of the foregoing, the Authority may accept as con

sideration in whole or in part for the sale of any such real

property, a covenant, agreement or undertaking on the part

of any purchaser to provide and maintain off-street park

ing facilities on such property or a portion thereof for the

fulfillment of public parking needs for such period and un

der such terms and conditions as the Authority shall deter

mine. Any such covenant, agreement or undertaking on the

part of the purchaser as aforesaid and the right of the Au

thority to fix and alter rates to be charged for any such

parking facilities as well as the right of appeal as in this

section provided, shall be set forth and reserved in the

deed or deeds of conveyance. Any such covenant, agree

ment or undertaking may be enforced by the Authority in

an action for specific performance brought in the Court of

Chancery of this State. As amended 49 Del. Laws, Ch. 72,

eff. May 14, 1953; 50 Del. Laws, Ch. 222, §1, eff. June 8,

1955; 50 Del. Laws, Ch. 279, §§1, 2, eff. June 13, 1955.

§505. Bonds

(a) The bonds of any Authority referred to and au

thorized to be issued by this chapter shall be authorized

32

by resolution of the board thereof, and shall be of such

series; bear such date or dates; mature at such time or

times not exceeding 40 years from their respective dates;

bear interest at such rate or rates, not exceeding 6 per cent

per annum payable semi-annually; be in such denomina

tions; be in such form, either coupon or fully registered,

without coupons; carry such registration, exchangeability,

and interchangeability privileges; be payable in such me

dium or payment and at such place or places; be subject to

such terms of redemption, not exceeding 105 per cent of the

principal amount thereof; and be entitled to such priorities

in the revenues or receipts of such Authority, as such reso

lution or resolutions may provide. The bonds shall be

signed by such officers as the Authority shall determine,

and coupon bonds shall have attached thereto interest

coupons bearings the facsimile signature of the treasurer of

the Authority, all as may be prescribed in such resolution

or resolutions. Any such bonds may be issued and delivered

notwithstanding that one or more of the officers signing

such bonds, or the treasurer whose facsimile signature shall

be upon the coupon, or any officer thereof, shall have ceased

to be such officer or officers at the time when such bonds

shall actually be delivered.

The bonds may be sold at public or private sale for such

price or prices as the Authority shall determine. The inter

est cost to maturity of the money received for any issue

of the bonds shall not exceed 6 per centum per annum.

Pending the preparation of the definitive bonds, interim

receipts may be issued to the purchaser or purchasers of

such bonds and may contain such terms and conditions as

the Authority may determine.

(b) Any resolution or resolutions authorizing any bonds

may contain provisions which shall be part of the contract

with the holders thereof as to (1) pledging the full faith

33

and credit of the Authority for such obligations or restrict

ing the same to all or any of the revenues of the Authority

from all or any projects or properties; (2) the construction,

improvement, operation, extension, enlargement, mainte

nance, and repair of the project, and the duties of the Au

thority with reference thereto; (3) the terms and provisions

of the bonds; (4) limitations on the purposes to which the

proceeds of the bonds then, or thereafter to be issued, or

of any loan or grant by the United States, may be applied;

(5) the rate of tolls and other charges for use of the facili

ties of, or for the services rendered by the Authority; (6)

the setting aside of reserves or sinking funds and the regu

lation and disposition thereof; (7) limitations on the issu

ance of additional bonds; (8) the terms and provisions of

any deed of trust or indenture securing the bonds, or under

which the same may be issued, and (9) any other additional

agreements with the holders of the bonds.

(c) Any Authority may enter into any deeds of trust

indentures, or other agreements, with any bank or trust

company or other person or persons in the United States

having power to enter into the same, including any Federal

agency, as security for such bonds, and may assign and

pledge all or any of the revenues or receipts of the Au

thority thereunder. Such deed of trust, indenture, or other

agreement, may contain such provisions as may be cus

tomary in such instruments, or as the Authority may au

thorize, including provisions as to: (1) the construction,

improvement, operation, maintenance, and repair of any

project and the duties of the Authority with reference

thereto; (2) the application of funds and the safeguarding

of funds on hand or on deposit; (3) the rights and remedies

of the trustee and holders of the bonds which may include

restrictions upon the individual right of action of such bond

holder, and (4) the terms and provisions of the bonds or the

resolutions authorizing the issuance of the same.

34

(d) The bonds shall have all the qualities of negotiable

instruments under the law merchant and the negotiable in

struments law of the State of Delaware.

§506. Remedies of bondholders

(a) The rights and the remedies conferred upon or

granted to the bondholders in this section shall be in addi

tion to, and not in limitation of, any rights and remedies

lawfully granted to such bondholders by the resolution or

resolutions providing for the issuance of bonds, or by any

deed of trust, indenture, or other agreement under which

the same may be issued. In the event that the Authority

shall default in the payment of principal of, or interest on

any of the bonds, after the principal or interest shall be

come due, whether at maturity or upon call for redemption,

and such default shall continue for a period of 30 days, or

in the event that the Authority shall fail or refuse to comply

with the provisions of this chapter, or shall default in any

agreement made with the holders of the bonds, the holders

of 25 per cent in aggregate principal amount of the bonds

then outstanding by instrument or instruments filed in the

office of the recorder of deeds of the county, and proved or

acknowledged in the same manner as a deed to be recorded,

may appoint a trustee to represent the bondholders for the

purpose provided in this section.

(b) Such trustee, and any trustee under any deed of

trust, indenture or other agreement, may, and upon written

request of the holders of 25 per cent or such other per

centages as may be specified in any deed of trust, indenture,

or other agreement, in principal amount of the bonds then

outstanding, shall, in his or its own name—

(1) By mandamus, or other suit, action or proceed

ing at law or in equity, enforce all rights of the bond

holders, including the right to require the Authority to

35

collect rates, rentals or other charges adequate to carry

out any agreement as to or pledge of the revenues or

receipts of the Authority, and to require the Authority

to carry out any other agreements with, or for the

benefit of the bondholders, and to perform its and

their duties under this chapter;

(2) Bring suit upon the bonds;

(3) By action or suit in equity require the Authority

to account as if it were the trustee of an express trust

for the bondholders;

(4) By action or suit in equity enjoin any acts or

things which may be unlawful or in violation of the

rights of the bondholders;

(5) By notice in writing to the Authority declare all

bonds due and payable, and if all defaults shall be made

good, then with the consent of the holders of 25 per

cent or such other percentages as may be specified in

any deed of trust, indenture, or other agreement, of

the principal amount of the bonds then outstanding, to

annul such declaration and its consequences.

(c) The Court of Chancery in and for the county where

in the Authority is located shall have jurisdiction of any

suit, action or proceedings by the trustee on behalf of the

bondholders. Any trustee when appointed or acting under

a deed of trust, indenture, or other agreement, and whether

or not all bonds have been declared due and payable, shall

be entitled as of right to the appointment of a receiver,

who may enter and take possession of the facilities of the

Authority or any part or parts thereof, the revenues or

receipts from which are, or may be, applicable to the pay

ment of the bonds in default, and operate and maintain

the same, and collect and receive all rentals and other

36

revenues thereafter arising therefrom, in the same manner

as the Authority or the board might do, and shall deposit

all such moneys in a separate account and apply the same

in such manner as the court shall direct. In any suit, action

or proceeding by the trustee the fees, counsel fees and ex

penses of the trustee, and of the receiver, if any, and all

costs and disbursements allowed by the court shall be a

first charge on any revenues and receipts derived from

the facilities of the Authority, the revenues or receipts

from which are or may be applicable to the payment of the

bonds in default. The trustee shall, in addition to the fore

going, have and possess all of the powers necessary or ap

propriate for the exercise of any functions specifically set

forth in this section, or incident to the general representa

tion of the bondholders in the enforcement and protection

of their rights.

(d) Nothing in this section, or any other section of this

chapter, shall authorize any receiver appointed pursuant

to this chapter for the purpose of operating and maintain

ing any facilities of the Authority to sell, assign, mortgage,

or otherwise dispose of, any of the assets of whatever kind

and character belonging to the Authority. It is the inten

tion of this chapter to limit the powers of such receiver to

the operation and maintenance of the facilities of the Au

thority as the court shall direct; and no holder of bonds of

the Authority, nor any trustee shall ever have the right in

any suit, action or proceedings at law or in equity to compel

a receiver, nor shall any receiver ever be authorized, or any

court be empowered to direct the receiver to sell, assign,

mortgage, or otherwise dispose of, any assets of whatever

kind or character belonging to the Authority.

§507. Governing body

(a) The powers of each Authority shall be exercised by

a board composed of five members, all of whom shall be resi

37

dents of the city creating the Authority. The mayor of the

city, or if such city or town has no mayor, its chief execu

tive officer, shall appoint the members of the board, one of

whom shall serve for one year, one for two years, one for

three years, one for four years, and one for five years from

the first day of July in the year in which such Authority is

created as provided in this chapter. Thereafter the mayor

shall not sooner than 60 days, nor later than 30 days prior

to July first in each year in which a vacancy occurs, ap

point a member of the board for a term of five years to

succeed the member whose term expires on the first day of

July next succeeding. Vacancies for unexpired terms that

occur more than 60 days before the end of a term shall be

promptly filled by appointment by the mayor. All such ap

pointments shall be subject to the confirmation of the city

council or other governing body of the city. Any member

of the board may be removed for cause by the mayor, or if

such city or town has no mayor, by its chief executive officer,

with the concurrence of two-thirds of all the members of

the council, or other governing body of the city or town,

and the person against whom such charges are made shall

be given a reasonable opportunity to make his defense.

(b) Members shall hold office until their successors have

been appointed and may succeed themselves. A member

shall receive no compensation for his services, but shall be

entitled to the necessary expenses, including traveling ex

penses, incurred in the discharge of his duties.

(c) The members of the board shall select from among

themselves a chairman, a vice-chairman, and such other

officers as the board may determine. The board may employ

a secretary, an executive director, its own counsel and legal

staff, and such technical experts and such other agents and

employees, permanent or temporary, as it may require, and

may determine the qualifications and fix the compensation

38

of such persons. Three members of the board shall consti

tute a quorum for its meetings. Members of the board

shall not be liable personally on the bonds or other obliga

tions of the Authority, and the rights of creditors shall be

solely against such Authority. The board may delegate to

one or more of its agents or employees such of its powers

as it deems necessary to carry out the purposes of this

chapter, subject always to the supervision and control of

the board. The board shall have full authority to manage

the properties and business of the Authority and to pre

scribe, amend, and repeal by-laws, rules and regulations

governing the manner in which the business of the Authority

may be conducted, and the powers granted to it may be

exercised and embodied.

§508. Acquisition of lands; cost financing by municipality