Adrian W. DeWind to NAACP

Press Release

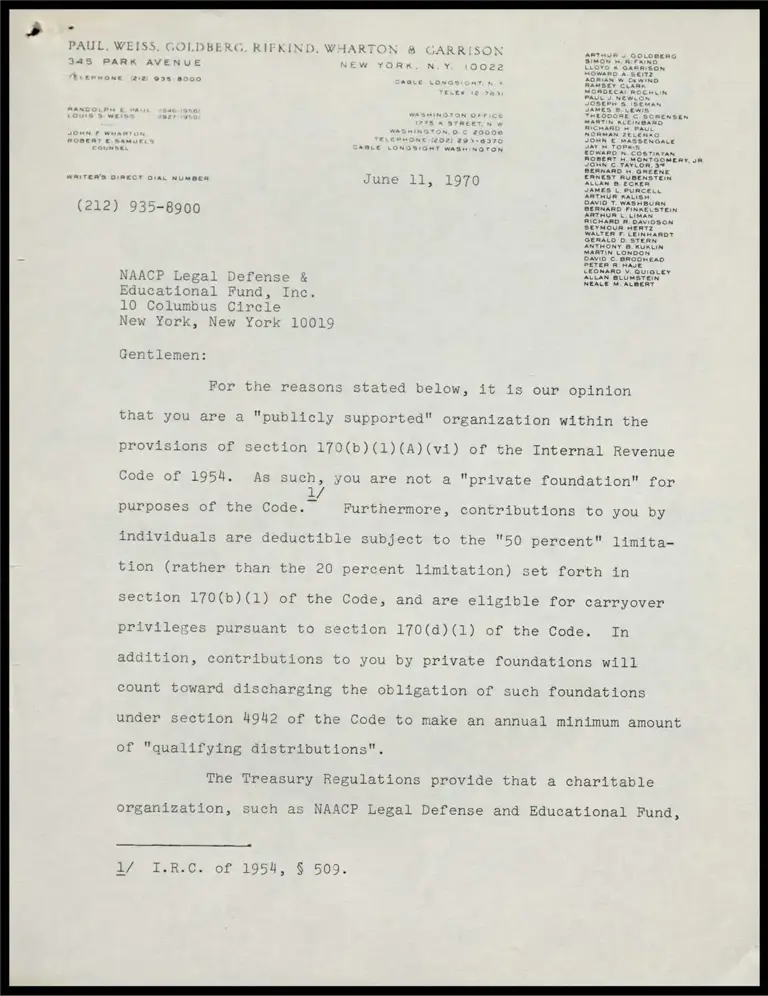

June 11, 1970

Cite this item

-

Press Releases, Loose Pages. Adrian W. DeWind to NAACP, 1970. 8a10faea-bd92-ee11-be37-00224827e97b. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/da752e41-6f3f-43a9-ab25-79d223f1f5a9/adrian-w-dewind-to-naacp. Accessed February 21, 2026.

Copied!

PAUL

WRITER'S DIRECT O1AL NUMBER June 11, 1970

(212)

NEALE M ALBERT

10 Colum

N York,

or the reasons stated below, it is our opinion

are a "publicly supported" organization within the

Code of 1954. As such, you are not a "private foundation" for

We

the Code. Furthermore, contributions to you by

iduals ar deductible subject to the "50 percent" limita-

ther than the 20 percent limitation) set forth in

ection 170(b)(1) of the Code, and are eligible for carryover

pursuant to section 170(d)(1) of the Code. In

tion of such foundations

under section 4942 of the Code to make an annual minimum amount

of "qualifying distributions".

The Treasury Regulations provide that a charitable

NAACP Legal Defense and Educational Fund,

A/ I.R.C. of 1954, § 509.

PAUL. WEISS, GOLDBERG, RIFKIND, WHARTON 8 GARRISON

June ll,

Supported" if it meets

mechanical

its public

mes" test. Support for

does not include income

from the performance of its exempt

clude investment or other income received

Under the mechanical test, an organization will be

considered to be publicly Supported for its current taxable

€ taxable year, if for the four taxable

years preceding the current taxable year its total support from

governmental units and from donations from the general public

e of the organization's total support

ird or

U7

od. Donations during the four preceding

equalled one-th

during that pe

ars from any one non-governmental contributor or

related group of such contributors may be counted toward meeting

rd requirement only to the extent that the contribu-

tions from that contributor, or group of contributors, do not

2/ Reg. § 1.170-2(b)(5) (441) (a).

B/> IGk.Ce Of 1954, § 170(b)(1)(A) (vi); Reg. § 1.170-2(b)(5) (44).

ih Reg. § 1.170-2(b) (5) (444) (b).

PAUL. WEISS, GOLDBERG. RIFKIND, WHARTON 8 GARRISON

June 11, 1970

percent of the organization's

iod. An organization may

the mechanical test only

changes in the organiza-

3 ct $ fe) fo a ° be ° »peration.

circumstances" test, an organi-

publicly supported if it receives substan-

upport from a "representative number of persons in the

area in which it operates" (determined in light

r not the organization limits its activities to

eld which can be expected to appeal to a limited

pursuant to its organizational

operation, it makes bona fide solicita-

5/

ublic support". The proportion of

contributio om public sources to total support necessary

to qualify as a publicly supported organization under the

"facts and circumstances" test may be considerably less than

the proportion necessary to so qualify under the mechanical

test. In examples given by the regulations to illustrate

application of the "facts and circumstances" test, an art

ich solicited from the general public contributions

totaling $10,000 in each of its four most recent

and for the same taxable years received investment

§ 1.170-2(b) (5) (444) (e) (3).

A 5)

PAUL. WEISS, GOLDBERG, RIFKIND, WHARTON 8 GARRISON

ituting 75

held publicly supported; and

Stra was held publicly supported which received $10,000

contributions unrelated individuals (88.9

pport), and an additional $5,000

pport) from a "community chest"

You have furnished us with financial statements and

a breakdown of your sources of support for each of the years

1966 through 1969. This information shows aggregate support

9,087,310, of which $3,487,386, for that four-year period of

or approximately 38 percent, was derived from contributions

from individuals of not more than $1,000 each, contributions

received from "out of town campaigns" of not more than $500 each,

and net revenue from theatre benefits.

In light of the foregoing, it is virtually certain

ical test for your current taxable year ending December, 1970

and will be such for the following year, provided that there

bstantial changes in your character, purposes or

methods of operation during those years. However, to determine

with complete certainty whether you are publicly supported under

6/ Reg. § 1.170-2(b)(5) (411) (c)(5), examples 3 and 4.

s +

PAUL. WEISS, GOLDBERG, RIFKIND, WHARTON 8 GARRISON

st would require a ming detailed

of support. We do not believe of your various source

to undertake such a detailed analysis,

in our opinion, that you are in any

event a publicly supported organization under the "facts and

As noted above, the amount of support that you derive

from contributions from the general public is very substantial,

and as a percentage of your total support.

level of general support through broad-based

fund raisi using mail solicitation, dinners, and receptions,

under tt sional fund raisers. Your current

volume of mail solicitation involves a mailing of over 2,000,000

itation letters annually, including mailing to approximately

70,000 persons who have made contributions to you within the

ng 30 montk to approximately 1,800,000

prospects obtained from other mailing lists.

ing, it is our opinion that you

"bona fide solicitations for broad-based public support,"

that you receive substantial support from "a representative

" persons," and that you are a publicly supported

"facts and circumstances" test.

~ PAUL. WEISS, GOLDBERG, RIFKIND, WHARTON 8 GARRISON

p ve ere

V. vot LA. WL YZ