Eisen v. Carlisle & Jacquelin Court Opinion

Unannotated Secondary Research

December 19, 1966

3 pages

Cite this item

-

Case Files, Milliken Working Files. Eisen v. Carlisle & Jacquelin Court Opinion, 1966. 97964ebe-54e9-ef11-a730-7c1e5247dfc0. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/e7dc38b9-63a7-4cbf-9c86-a10302fdcee8/eisen-v-carlisle-jacquelin-court-opinion. Accessed February 21, 2026.

Copied!

! - ■ • . - •_ ; ’ ' ' ' • '

• ■ ■ ■ •'

* ■ ' - * V -> 'V > ‘ ■ i , . - ■ Si „ V ? S& /

: fX >• ' * ’ ?."*-rsi' y* £,|SS£§j$oii*« " SSSSi®

.^ fcs.,„„ .„. mh&M ----

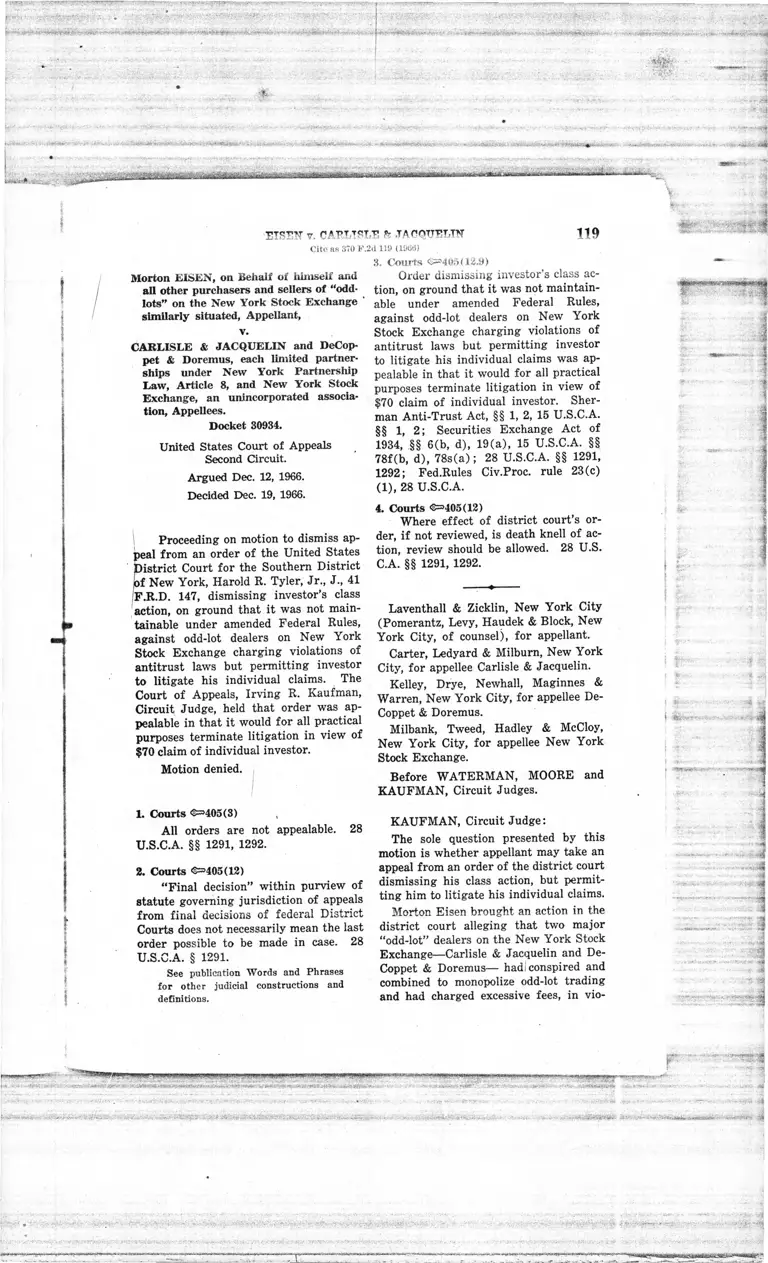

ETSEF v. CA R L ISL E ft .TAC OTTERIN' 119

Cite as 370 F.2d 119 (1908)

!

’

»

!

Morton EISEN, on Behalf of himself and

all other purchasers and sellers of “odd-

lots” on the New York Stock Exchange ’

similarly situated, Appellant,

v.

CARLISLE & JACQUELIN and DeCop-

pet & Doremus, each limited partner

ships under New York Partnership

Law, Article 8, and New York Stock

Exchange, an unincorporated associa

tion, Appellees.

Docket 30934.

United States Court of Appeals

Second Circuit.

Argued Dec. 12, 1966.

Decided Dec. 19, 1966.

Proceeding on motion to dismiss ap

peal from an order of the United States

District Court for the Southern District

jof New York, Harold R. Tyler, Jr., J., 41

,'F.R.D. 147, dismissing investor’s class

action, on ground that it was not main

tainable under amended Federal Rules,

against odd-lot dealers on New York

Stock Exchange charging violations of

antitrust laws but permitting investor

to litigate his individual claims. The

Court of Appeals, Irving R. Kaufman,

Circuit Judge, held that order was ap

pealable in that it would for all practical

purposes terminate litigation in view of

$70 claim of individual investor.

Motion denied.

3. Courts @=405(12.9)

Order dismissing investor’s class ac

tion, on ground that it was not maintain

able under amended Federal Rules,

against odd-lot dealers on New York

Stock Exchange charging violations of

antitrust laws but permitting investor

to litigate his individual claims was ap

pealable in that it would for all practical

purposes terminate litigation in view of

$70 claim of individual investor. Sher

man Anti-Trust Act, §§ 1, 2, 15 U.S.C.A.

§§ 1, 2; Securities Exchange Act of

1934, §§ 6(b, d), 19(a), 15 U.S.C.A. §§

78f(b, d), 78s(a ); 28 U.S.C.A. §§ 1291,

1292; Fed.Rules Civ.Proc. rule 23(c)

(1), 28 U.S.C.A.

4. Courts @=>405(12)

Where effect of district court’s or

der, if not reviewed, is death knell of ac

tion, review should be allowed. 28 U.S.

C.A. §§ 1291, 1292.

Laventhall & Zicklin, New York City

(Pomerantz, Levy, Haudek & Block, New

York City, of counsel), for appellant.

Carter, Ledyard & Milburn, New York

City, for appellee Carlisle & Jacquelin.

Kelley, Drye, Newhall, Maginnes &

Warren, New York City, for appellee De-

Coppet & Doremus.

Milbank, Tweed, Hadley & McCloy,

New York City, for appellee New York

Stock Exchange.

Before WATERMAN, MOORE and

KAUFMAN, Circuit Judges.

1. Courts @=405(3) .

All orders are not appealable. 28

U.S.C.A. §§ 1291, 1292.

2. Courts 3=405(12)

“ Final decision” within purview of

statute governing jurisdiction of appeals

from final decisions of federal District

Courts does not necessarily mean the last

order possible to be made in case. 28

U.S.C.A. § 1291.

See publication Words and Phrases

for other judicial constructions and

definitions.

KAUFMAN, Circuit Judge:

The sole question presented by this

motion is whether appellant may take an

appeal from an order of the district court

dismissing his class action, but permit

ting him to litigate his individual claims.

Morton Eisen brought an action in the

district court alleging that two major

“ odd-lot” dealers on the New York Stock

Exchange— Carlisle & Jacquelin and De-

Coppet & Doremus— hadi conspired and

combined to monopolize odd-lot trading

and had charged excessive fees, in vio-

■gv'rmW-

r-r-,r-s.,

-f

- I ' -4

>:.3

H*

'

■* !

? ••." -

■’’v .

120 370 FEDERAL REPORTER, 2d SERIES

lation of the Sherman Act. 15 U.S.C.

§§ 1, 2. Specifically, he challenged the

so-called “ odd-lot differentials ’ charged

by the appellees and other odd-lot dealers

for transactions involving other than 100

share lots of securities. The complaint

also charged the New York Stock Ex

change with having breached its duties,

allegedly prescribed by the Securities Ex

change Act of 1934, concerning suspen

sion of odd-lot trading. 15 U.S.C. §§

78f(b), 78f(d), 78s(a).

Eisen sued both for himself and on be

half of all odd-lot purchasers and sellers

on the Exchange. Appellees moved to

dismiss the class action, alleging that it

was not maintainable under amended

Rule 23(c) (1) of the Federal Rules of

Civil Procedure. Judge Tyler granted

’ the motion and dismissed the class ac

tion, but did not dismiss Eisen’s individ

ual claims or pass on their merits.

[I ]t is impossible to devise a formula

to resolve all marginal cases coming

within what might well be called the

“ twilight zone’’ of finality. Because

of this difficulty this Court has held

that the requirement of finality be giv

en a “practical rather than a technical

construction.” * * * [I]n deciding

the question of finality the most im

portant competing considerations are

“ the inconvenience and costs of piece

meal review on the one hand and the

danger of denying justice by delay on

the other.” 379 U.S. at 152-153, 85

S.Ct. at 311 (emphasis supplied).

[1 ,2 ] It is too clear for discussion

that all orders are not appealable. 28

U.S.C. § 1291 provides that the courts of

appeals have jurisdiction of appeals from

all “ final” decisions of the district

courts, while 28 U.S.C. § 1292 permits ap

peals from a narrowly limited class of in

terlocutory orders. But as the Supreme

Court has commented, “ [A ] decision

‘final’ within the meaning of § 1291 does

not necessarily mean the last order pos

sible to be made in a case.” Gillespie v.

United States Steel Corp., 379 U.S. 148,

152, 85 S.Ct. 308, 13 L.Ed.2d 199 (1964).

The question presented to us, therefore,

is whether Judge Tyler’s order dismiss

ing the class action fails within “ that

small class which finally determine

claims of right separable from, and col

lateral to, rights asserted in the action,

too important to be denied review and

too independent of the cause itself to

require that appellate consideration be

deferred until the whole case is adjudi

cated.” Cohen v. Beneficial Industrial

Loan Corp., 337 U.S. 541, 546, 69 S.Ct.

1221, 1225, 93 L.Ed. 1528 (1949).

[3] In the present case, these consid

erations, rather than being “ competi

tive,” lead to a single conclusion—that

the order dismissing this class action is

appealable. The alternatives are to ap

peal now or to end the lawsuit for all

practical purposes. Judge Tyler’s order

“ if unreviewed, will put an end to the

action” . Chabot v. National Securities

and Research Corp., 290 F.2d 657, 659

(2d Cir. 1961). We can safely assume

that no lawyer of competence is going to

undertake this complex and costly case to

recover $70 for Mr. Eisen. See Escott v.

Barehris Constr. Corp., 340 F.2d 731, 733

(2d Cir.), cert, denied sub nom. Drexel

& Co. v. Hall, 382 U.S. 816, 86 S.Ct. 37,^15

L.Ed.2d 63 (1965).

missec

vly

In making this determination, Justice

Black’s language in the Gillespie case is

instructive:

̂^ere are', therefore, most compelling

reasons to deny this motion to dismiss the

appeal; and permitting Eisen to proceed

in no way conflicts with any precedents

of this Court. Appellees rely on Oppen-

heimer v. F. J. Young & Co., 144 F.2d

387 (2d Cir. 1944), but that decision was

reached before the Supreme Court spoke

in Cohen, supra. While it is true that in

Lipsett v. United States, 359 F.2d 956

(2d Cir. 1966), we did not permit an ap

peal from the dismissal of a class action,

we reached that conclusion because the

facts did not come within the framework

the Cohen doctrine; the plaintiffsof

iaek-i

class ac

“ prettif

tion cor

[4]

the pro

bly har

situates

it will t

the lit

district

the dt

should

States

S.Ct. 9

v. Ns

Corp.,

Mot

The

B!

Th

B

C. -I.

it

was

Sta

Dis

J.,

pea

in!

■rmy. ?3 .. ... ,. .... ■ —• - •,— » I

. . . • " • ' . 1

- i<^vyt-w, ftjs*#*i¥>t*t®#.'*-*~}u « . w ’ » » - - , « i » S ! * * s < - • w f c * 5 * ■* « 5 s « S

aSyfc ■■■■■!

■ ■ •

*̂U**~i---------,“fc.

PURE OIL COMPANY v. BOYNE 121

Cito as ,‘170 F

lacked standing, and dismissal of the

class action allegations, we said, merely

“ prettified” the pleadings since the ac

tion could still continue.

[4] Dismissal of the class action in

the present case, however, will irrepara

bly harm Eisen and all others similarly

situated, for, as we have already noted,

it will for all practical purposes terminate

the litigation. Where the effect of a

district court’s order, if not reviewed, is

the death knell of the action, review

should be allowed. See Roberts v. United

States District Court, 339 U.S. 844, 70

S.Ct. 954, 94 L.Ed. 1326 (1950); Chabot

v. National Securities and Research

Corp., supra.

Motion denied.

M ICi U6t«> .

court docket noting court’s denial in

open court, of motions in admiralty suit

for rehearing and to amend court s find

ings was not a final judgment for pur

pose of computing time for taking an

appeal before effective date of rule mak

ing Federal Rules of Civil Procedure ap

plicable to suits in admiralty.

Affirmed.

1. Admiralty ^ 1 0 8

Minute entry by clerk in court docket

noting court’s denial, in open court, of

motions in admiralty suit for rehearing

and to amend court’s findings was not

a final judgment for purpose of com

puting time for taking appeal before ef

fective date of rule making Federal Rules

of Civil Procedure applicable to suits

in admiralty. Admiralty Rules, rule 56,

28 U.S.C.A.; 28 U.S.C.A. § 2107; Fed.

Rules Civ.Proc. rules 1, 81(a) (1), 28

U.S.C.A.

The PURE OIL COMPANY, Appellant,

v.

C. J. BOYNE et al., Appellees.

2. Federal Civil Procedure <©=2392, 2621

Courts render judgments and clerks

only enter them on court records.

BRENT TOWING COMPANY, Inc.,

j. Appellant,

{* j v.

The PURE OIL COMPANY, Appellee.

BRENT TOWING COMPANY, Inc.,

Claimant, etc., Appellant,

v.

C. J. BOYNE et al., d /b /a Caribbean Tow

ing Co., Claimants, etc., Appellees.

Nos. 22522, 22583.

United States Court of Appeals

Fifth Circuit.

Dec. 6, 1966.

3. Admiralty ^ lO S

Only document which could consti

tute final judgment for purpose of com

puting time for taking an appeal in

admiralty suit was the formal decree

entered by court approximately a month

and a half after clerk had noted in court

docket an oral order denying motions

for rehearing and to amend court s find

ings. 28 U.S.C.A. § 2107.

H. Barton Williams, Deutsch, Kerrigan

& Stiles, New Orleans, La., for Pure Oil

Co., W. Gerald Gaudet, New Orleans, La.,

of counsel.

Admiralty suit in which an appeal

was taken from a judgment of the United

States District Court for the Western

District of Louisiana, Richard J. Putnam,

J., 235 F.Supp. 299. The Court of Ap

peals, Thornberry, Circuit Judge, held,

inter alia, that minute entry by clerk in

370 F.2d—8Va

J. Y. Gilmore, Jr., Faris, Ellis, Cutrone,

Gilmore & Lautenschlaeger, New Orleans,

La., for C. J. Boyne and others.

George A. Frilot, III, Lemle & Kel-

leher, Eldon T. Harvey, III, New Orleans,

La., for Brent Towing Co., Inc.

Before THORNBERRY and COLE

MAN, Circuit Judges, and YOUNG, Dis

trict Judge.

H-J. - >

• 3*M3*<hiS5

I

3

.« saa&i- 41

ra sgg

t

4

...,

rKi. vf. vtwfeS

J

■ *>