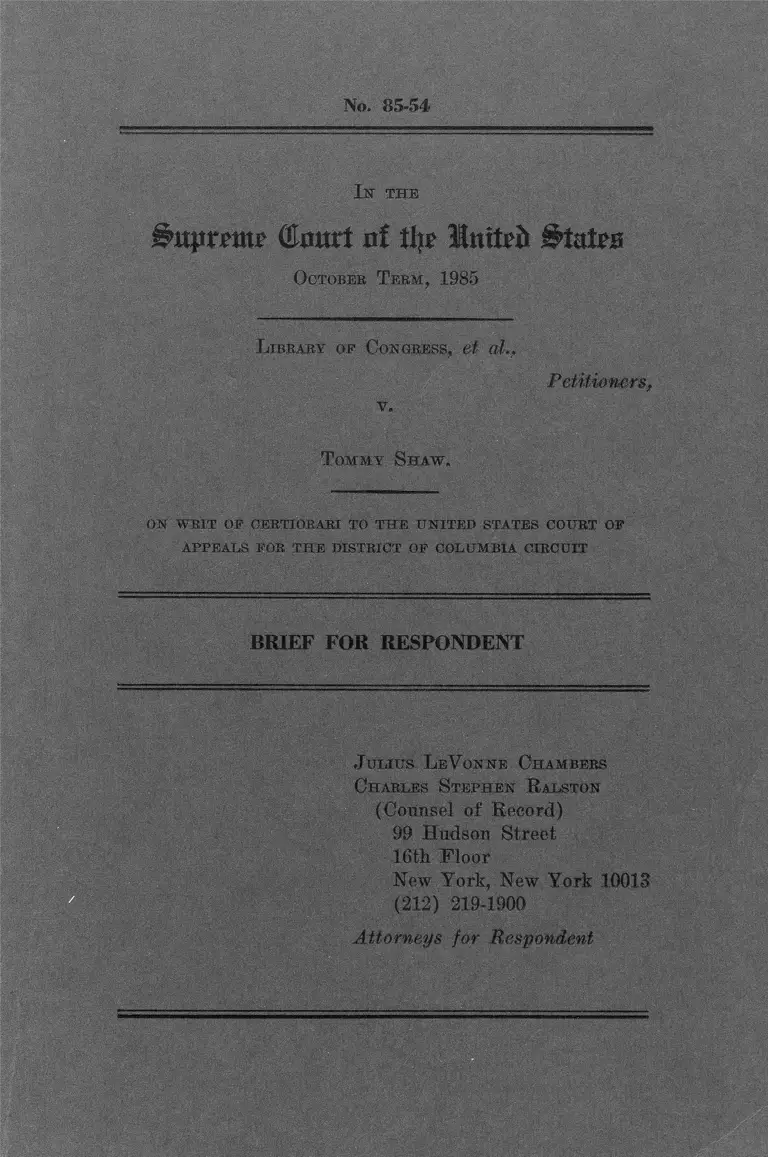

Library of Congress v. Shaw Brief for Respondent

Public Court Documents

October 7, 1985

Cite this item

-

Brief Collection, LDF Court Filings. Library of Congress v. Shaw Brief for Respondent, 1985. 2bfb0049-bb9a-ee11-be36-6045bdeb8873. LDF Archives, Thurgood Marshall Institute. https://ldfrecollection.org/archives/archives-search/archives-item/f12fa5bf-b86b-46ac-972e-1743a984dd1e/library-of-congress-v-shaw-brief-for-respondent. Accessed February 21, 2026.

Copied!

No. 85-54

I n t h e

&tt$*rptm> $nw t nf % ItnUb

October Term, 1985

L ibrary of Congress, et ah,

v.

Petitioners,

T ommy Shaw .

ON WRIT OF CERTIORARI TO THE UNITED STATES COURT OF

APPEARS FOR THE DISTRICT OF COLUMBIA CIRCUIT

BRIEF FOR RESPONDENT

J ulius L eV qnne Chambers

Charles Stephen R alston

(Counsel of Record)

99 Hudson Street

16th Floor

New York, New York 10013

(212) 219-1900

Attorneys for Respondent

QUESTIONS PRESENTED

1. whether pre-judgment adjustments

to compensate for delay in payment may be

part of the calculation of a reasonable

attorney's fee and other relief in a

Title vil case brought against the

federal aovernment under 42

U.S.C. §§ 2000e-16(c) and (d).

2. Whether 42 U.S.C. § 2000e-16

constitutes a complete abrogation of

sovereign immunity so that the same full

relief available in a Title VII action

against private and state and local

aovernment employers is also available

against federal government agencies.

i

TABLE OF CONTENTS

Questions Presented ................. i

Table of Authorities............... iv

STATUTES INVOLVED .................... 1

STATEMENT OF THE C A S E ............... 2

SUMMARY OF ARGUMENT................. 10

ARGUMENT

I. THERE IS NO BAR TO A DELAY

IN PAYMENT ADJUSTMENT TO AN

ATTORNEYS' FEE AWARD

AGAINST THE UNITED STATES . 12

A ♦________ Ad j ustments____ for

Pre-Judgment Delays In

Payment May Be Included In

Awards Of Equitable Relief

Against The Federal

Government In The Absence

Of Specific Statutory

Authorization.. . . . . . 14

B .______ The Inclusion of A

Factor To Compensate For

Pre-judgment ''Delays In

Payment Is A Necessary

Component In Calculating A

Reasonable Attorney's Fee. . 24

II. SECTION 717 OF THE EQUAL EMPLOY

MENT OPPORTUNITY ACT OF 1972 IS A

COMPLETE ABROGATION OF SOVEREIGN

IMMUNITY IN EMPLOYMENT DISCRIMI

NATION C A S E S ................... 39

A. Congressional Intent Is

Determinative Of The Extent

Sovereign Immunity Is

Waived By A Particular

Statutory Scheme. . . . . .

B. Congress Intended To

Waive All Sovereign

Immunity Bars To The Award

of Complete .Relief In Title

VII Cases. ...............

Conclusion . . . . . ........... . .

APPENDICES

I. Statutes Involved

II. Calculation of Loss of

Value Through Inflation

III. Memorandum of Attorney

General Griffin B. Bell for

United States Attorneys and

Agency General Counsel

(Aug. 31, 1977)

TABLE OF AUTHORITIES

Page

Cases:

Albemarle Paper Co. v. Moody, 422

U.S. 405 ( 1 9 7 5 ) ............ 37

Albrecht v. United States, 329 U.S.

599 ( 1 9 4 7 ) .................. 17

Alyeska Pipeline Service v.

Wilderness Soc., 421 U.S.

240 ( 1 9 7 5 ) .................. 36

Blake v. Califano, 626 F.2d 891

(D.C. Cir. 1 9 8 0 ) ........... 8

Blum v. Stenson, U.S. , 79

L.Ed.2d 891 (1984) . . . . 25, 32

Boston Sand Co. v. United States,

278 U.S. 41 (1928) . . . . . 40

Brooks-Scanlon Corp. v. United

States, 265 U.S. 106 (1924) . 17

Brown v. General Services

Administration, 425 U.S. 820

( 1 9 7 6 ) ............... 46, 50, 51

Chambers v. United States, 451

F . 2d 1045 (Ct. Cl. 1971) . • 49

Chandler v. Roudebush, 425

840 ( 19 7 6 ) ..........

U.S.

44, 46

Chisholm v. United States Postal

Service, 665 F.2d 482

(4th Cir. 1 9 8 1 ) ........... 33

iv

Copeland v. Marshall, 641 F.2d

880 (1980) . . . . . . 3,4,6,7,24

Franchise Tax Board of California

v. United States Postal

Service, U.S. ___, 81 L.Ed.

2d 446 ( 1984)............. 39

Franks v. Bowman Transportation

Company, 424 U.S. 747

( 1976) ........................ 54

Gautreaux v. Chicaqo Housinq

Authority, 690 F.2d 601

(7th Cir. 1 9 8 2 ) ........... 24

General Motors Corp. v. Devex

Corp., 461 U.S. 648

(1983). 15, 16, 17, 34, 35, 36, 37

Gnotta v. United States, 415

F. 2d 1271 (8th Cir. 1969) 50

Graves v. Barnes, 700 F.2d 220

(5th Cir. 1983) . . . . . . 24

Griffin v. Carlin, 755 F.2d 1516

(11th Cir. 1985). 33

Hensley v. Eckerhart, 461 U.S.

424 (1983)...... 25

Holly v. Chasen, 639 F.2d 795

(D.C. Cir. 1981), cert.

denied, 454 U.S. 822

(1981) . ................. 8

Institutionalized Juveniles v.

Secretary of Public Welfare,

758 F.2d 897 (3rd Cir.

19 8 5 )............. . 24

v

James v. Stockham Valves &

Fitting Co., 559 F .2d 310

(5th Cir. 1977) ......... 34

Johnson v. University College of

the University of Alabama,

706 F .2d 1205 (11th Cir.

1983) ...................... 6, 24

Jorstad v. IDS Realty Trust, 643

F . 2d 1305 (8th Cir. 1981 ) . 24

Laycock v. Parker, 103 Wis. 161,

79 N.W. 327 ( 18 9 9 ) ......... 20

Liqgett & M. Tobacco v. United

States, 274 U.S. 215 (1927) 1 7

Nagy v. United States Postal

Service, 773 F.2d 1190 (11th

Cir. 1985) .................. 40

Nedd v. United Mine Workers of

America, 488 F. Supp. 1208

(M.D. Pa. 1 9 8 0 ) ......... 19, 20

Newman v. Piqaie Park Enterprises,

390 U.S. 490 (1968) . . . . 26, 38

Parker v. Califano, 561 F.2d 320

(D.C. Cir. 19 7 7 ).......... 26

Parker v. Lewis, 670 F.2d 249

(D.C. Cir. 1 9 8 2 ) .......... 5

Phelps v. United States, 274 U.S.

341 (1927)................... 17

Ramos v. Lamm, 713 F.2d 546 (10th

Cir. 19 8 3 )................. 24

vi

Saunders v. Claytor, 629 F.2d 596

(9th Cir. 1980), cert, denied,

450 U.S. 980 (1981 ) . . . . 9, 33

Seabord Air Line R. Co. v.

United States, 261 U.S. 299

( 19 2 3 )................... 17, 18

Shultz v. Palmer, (No. 85-50) 33

Smith v. Califano, 446 F. Supp.

530 (D.D.C. 1978) . . . . . 53

Smith v. Phillips, 455 U.S. 209

( 1982)................... 10

Standard Oil Co. v. United States,

267 U.S. 76 (1925) . . . . . 41

Teamsters v. United States, 431

U.S. 324 ( 1977).......... 36

United States v. New York Tele

phone Co., 434 U.S. 159 (1977) 10

United States v. North American

Transportation and Tradinq Co.,

253 U.S. 330 (1920) . . . . . . 18

United States v. Sherman, 98 U.S.

565 ( 1878)............... 21 , 22

United States v. Testan, 424 U.S.

392 ( 1976)................. 49

Waite v. United States, 282 U.S.

508 ( 1931 ) ........... 16, 17, 36

vii

Statutes, orders, and regulations:

Equal Access to Justice Act . . . . 56

5 U.S.C. § 5596(b)............. 49

5 U.S.C. <? 7701 (g) (2) . . . . . 53

28 U.S.C. § 2516 . . . . 1, 10, 14, 23

42 U.S.C. § 2000e-5(q)......... 54, 55

42 U.S.C. § 2000e-5 (k ) ......... 44, 57

42 U.S.C. § 2000e-16 ........... Passim

P.L. 88-352, § 701(b)........... 48

P.L. 96-481 , § 206 ........... . 56

42 Stat. 1590, ch. 192 (5-15-22) . 40

Executive Order 11246 ........... 48

Executive Order 11478 ......... . 48

President's Reorganization Plan

No. 1 of 1978, 43 F.R. 28 71

( 1 9 7 8 ) ...................... 52

5 C.F.R. Part 713 ( 1 9 6 7 ) ......... 48

5 C.F.R. § 1201.37 ............... 53

29 C.F.R. Part 1613 .............. 48

29 C.F.R. § 1613.271(c)......... 53

viii

Other Authorities:

"Counsel Fees in Public Interest

Litigation", Report By the

Committee on Legal Assistance,

39 The Record of the Associa

tion of the Bar of the City of

New York 300 (1984) . . . . 25, 29

The Effect of Legal Fees on the

Adeauacv of Representation,

Hearings Before the Sub

committee on Representation

of Citizen Interests of the

Committee on the Judiciary,

United States Senate, 93rd

Cong., 1st Sess. (1973) . . 27

Hearings Before the General

Subcommittee on Labor of

the House Committee on

Education And Labor on

H.R. 1746, March 3, 4, and

18, 1971 ................. 48, 51

Hearings Before the Subcommittee

on Labor of the Senate

Committee on Labor and Public

Welfare, on S. 2515, S.2617,

and H.R. 1746, Oct. 4, 6,

and 7, 1971 ............... 50, 51

Hohenstein, "Subtract Inflation

from Your Income, Prices and

Profits," Legal Economics 35

(ABA Section on Economics of

Law Practice, Summer 1978) 1b

H. Rep. No. 92-238 (92d Cong. 1st

Sess., 1971) ............... 43

IX

Letter from Irving Jaffe, Acting

Assistant Attorney General, to

Senator John V. Tunney, May 6,

. 1975, 2 CCH Employment Practices

Guide 5327 ( 1 9 7 6 ) ......... 57

Memorandum of Attorney General

Griffin B. Bell for United

States Attorneys and Agency

General Counsel (Aug. 31,

1977), 2 CCH Employment

Practices Guide 1f 5046

(1977), .................... 59, 60

Note, "Interest in Judgments

Against the Federal Government:

The Need for Full Compensation,"

91 Yale L.J. 297 (1981) . . . . 20

1 Op. Atty. Gen. 268 (1819) . . . . 21

2 Op. Atty. Gen. 390 (1830) . . . . 22

5 Op. Atty. Gen. 138 (1849) . . . . 22

5 Op. Atty. Gen. 227 (1850) . . • . 22

Ralston, "The Federal Government

as Employer: Problems and

Issues in Enforcing the Anti-

Discrimination Laws," 10 Ga. L.

Rev. 717 ( 1 9 7 6 ) ............. 57

3. Rep. No. 92-415 (92d Cong. 1st

Sess., 1 9 7 1 ) ......... 34, *3, 45

Ft. Rep. No. 94-1558 (94th Conq.

2d Sess. 1976) . . . . 27, 28, 34

x

S. Rep. No. 94-1011 (94th Cong. 2d

Sess. 1 9 7 6 )............. .. . 27

Schlei & Grossman, Employment

Discrimination Law, (2d Ed.

1 9 8 3 ) ...................... 36, 47

Subcommittee on Labor, Senate

Committee on Labor and Public

Welfare, "Legislative History

of the Equal Employment Oppor

tunity Act

of 1972" . . . 45, 51, 52, 53, 55

United States Dept, of Labor, Bureau

of Labor Statistics, Monthly

Labor Review, May, 1985 . . . 2b

xi

No. 85-54

IN THE

SUPREME COURT OF THE UNITED STATES

October Term, 1985

LIBRARY OF CONGRESS, et a.I. ,

Petitioners

v.

TOMMY SHAW

On Writ of Certiorari to The

United States Court of Appeals

for the District of Columbia Circuit

BRIEF FOR RESPONDENT

STATUTES INVOLVED

In addition to those in petitioners'

brief, this case involves the following

statutes, the text of which are set out in

the appendix to this Brief:

42 U.S.C. § 2000e-16(a )-(c )

28 U.S.C. § 2516(a).

2

STATEMENT OF THE CASE

In general, petitioners' description

of the proceedings below is accurate.

Respondent does wish to emphasize a number

of points regarding the context in which

issue now before the Court arose.

This action began with the filing of

an administrative complaint charging

discrimination in employment against

respondent Tommy Shaw, an employee of the

Library of Congress. After respondent

retained counsel, a settlement of his

claim was negotiated. However, the

agency, on advice from the Comptroller

General, took the position that it could

not agree to an award of back pay. This

ruling, which the district court noted was

caused by the Library's failure to make it

clear that the claim arose under Title

VII, necessitated the filing of the

3

present action. Order and Judgment of the

District Court, Sept. 14, 1979; Pet. App.

p. 59a-60a. The government continued to

argue that an award of back pay was not

possible when a federal employee's claim

of discrimination was settled administra

tively, but the district court ruled for

the respondent and against the government

on cross-motions for summary judgment. As

a result of these proceedings, respondent

received a promotion and an appropriate

amount of back pay.

As petitioners note, at issue in this

case now are the fees remaining to be paid

to one of the respondent's attorneys for

work done as far back as 1978. The fee

award was not made by the district court

until 1980 since it decided to await the

en banc decision of the Court of Appeals

of the District of Columbia in Copeland v.

Marshall r 641 P.2d 880 (1980), which

4

established definitive standards for

awards of fees in Title VII cases in the

District, particularly in cases involving

the federal government. The government

made no objection to delaying the fee

1

disposition until Copeland was announced.

As the district court noted when it

made its award, the government neither

disputed respondent's entitlement to fees

2nor much of the amount to be awarded.

̂ The district court entered its judgment on

the merits on September 14, 1979. In that

order it announced its intention to await

the en banc decision in Copeland. See,

Order and Judgment of the District Court,

filed September 14, 1979. Copeland was

announced in September, 1980.

2 The government argued that a proper hourly

rate would be $60. It was not precise,

however, with regard to the number of

hours for which fees should be awarded,

but only suggested that the 103.75 hours

claimed should be reduced " significantly. "

See, Defendant's Memorandum of Points and

Authorities In Opposition to Shalon

Ralph's Motion for Attorney's Fees, pp.

3-5; 7-8. The district court subtracted

only 4.75 hours, for time spent on an

issue on which respondent did not prevail,

and awarded fees for a total of 99 hours.

Pet. App. pp. 63a-64a. The government did

not dispute this result on appeal.

5

Nevertheless, in keeping with its long

standing practice, the government did not

offer to pay that part of the fee that was

undisputed. (Pet. App. p. 68a.) Indeed,

payment of the undisputed amount was not

made until the present appeal was pending

and, then, it was a consequence of a

decision of the court of appeals in

another case, Parker v. Lewis, 670 F . 2d

249 (D.C. Cir. 1982), requiring payment of

the undisputed portions of a fee award

pending appeal.^ The Parker rule was

premised on the need to avoid delays in

payment and consequent hardships to Title

VII plaintiffs and their attorneys.

The court of appeals did, as recited in

its opinion (Pet. App. p. 6a, n. 24),

order payment of $6,779.50, the undisputed

amount. However, the parties had pre

viously entered into a stipulation for

such payment in the district court based

on Parker v. Lewis, supra. See, Stipula

tion to The Entry of An Order to Enforce

In Part the Judgment Awarding Counsel Fees

and Costs.

Copeland squarely held that in

actions against the federal government

delay in payment must be factored in when

calculating a reasonable fee. 641 F.2d at

893. Thus, the district court followed

Copeland and used one of the methods set

out in that decision to arrive at an

4appropriate amount for the delay. As

petitioners note in their brief, the

correctness of the district court's

calculation is still in dispute, since the

court of appeals remanded for clarifi

cation whether the hourly rate awarded

already included compensation for delay.

Three methods to compensate for delay are:

(1) the use of hourly rates current at the

time the award is made; (2) adjusting the

rates by year by an appropriate amount so

as to adjust for inflation; (3) adjusting

the lodestar amount by an appropriate

factor. See Johnson v. University College

of the University of Alabama, 706 F.2d

1205, 1210-11 (11th Cir. 1983). The

district court used the third method.

7

In addition to the en banc decision in

Copeland, panels of the court of appeals

had held that fees in Title VII actions

against federal agencies fees should be

adjusted for delay in payment. Thus, when

the present case arrived in the court of

appeals, there was already an en banc

decision and at least three panel deci

sions of that court that squarely held

that the district court was correct in

including a delay factor. Counsel for

respondent in the court of appeals (who

are also counsel here) not surprisingly

relied on the clear law of the circuit to

support the judgment of the district

court. Since there was no need to go

beyond the settled law of the circuit,

they did not argue at length the issues of

The court below noted "the seemingly clear

applicability of these precedents" but

decided not to rest "on stare decisis

alone." Pet. App. p. 9a.

8

waiver of sovereign immunity and other

matters presented now. Thus, the argument

made was essentially that the calculation

of a reasonable attorney's fee necessarily

included compensation for delay in

payment, an argument accepted even by the

dissenting judge below.

Moreover, panel decisions of the court

of appeals had also held that cost of

living adjustments were not available on

6backpay awards against the government

and that interest qua interest could not

7be assessed on a fee award. Again, since

the state of the law in the circuit

established the correctness of the

district court's decision, counsel for

Blake v. Califano, 626 F.2d 891 (D.C. Cir.

1980) .

Holly v. Chasen, 639 P.2d 795 {D.C. Cir.

1981) , cert, denied, 454 U.S. 822 (1981).

7

- 9

respondent (appellee there) did not feel

it either necessary or desirable to raise

8these other issues.

If the government's suggestion to the

court of appeals for rehearing e_n banc in

the present case had been granted,

respondent would, of course, have raised

and relied upon all of the arguments made

herein to support the judgment of the

district court. Thus, the government's

attempt (Pet. Brief, p. 18) to make some

thing out of counsel’s decision not to

raise these questions before a panel of

the court below when such issues were

decided by its earlier decisions is

As we have already noted in our Brief in

Opposition to the Petition for Writ of

Certiorari, we believe that the decisions

of lower courts holding that back pay

awards cannot be adjusted for inflation in

cases against the federal government are

incorrect. See infra at pp.35-38. Indeed,

that precise issue was presented to this

Court in Saunders v. Claytor, 629 F.2d 596

(9th Cir. 1980), cert, denied, 450 U.S.

980 ( 1981 ), but this Court has not

resolved the issue to date.

10

without substance. Of course, respondent

may rely here on any ground in support of

the judgment below. United States v. New

York Telephone Co., 434 U.S. 159, 166, n.

8 (1977); Smith v. Phillips, 455 U.S. 209,

215, n. 6 (1982).

SUMMARY OF ARGUMENT

I.

A. There is no sovereign immunity or

statutory bar to awards of pre-judgment

interest, or its equivalent, against the

United States where it is necessary to

provide complete equitable relief. The

cases the government relies on, as well as

28 U.S.C. § 2516, involve post-j udgment

interest, the purpose of which is entirely

different. Decisions of this Court make

the distinction clear and hold that

pre-judgment interest may be made in the

absence of specific statutory authority.

- 11 -

B. In calculating a reasonable

attorneys' fee, factoring in amounts to

compensate for delays in payment is

essential. Without such an adjustment, a

prevailing plaintiff's attorney will in

fact be awarded less than a market rate.

The result will be that attorneys will be

discouraged from representing federal

employees who have Title VII claims.

Therefore, pre-judgment interest or its

eouivalent is appropriate in awards of

fees against the United States.

II.

A. The extent of a waiver of sov

ereign immunity is a matter of Congres

sional intent. Whether interest on awards

against the government is permissible must

be determined from the purpose of the

particular statutory scheme.

12

B. Both the language of 42 U.S.C.

§ 2000e-16 and its legislative history

make it clear that Congress intended to

remove all sovereign immunity bars to the

granting of full relief to federal

employees who have equal employment

claims. The statute itself explicitly

provides that attorneys' fees are to be

awarded on the same basis as against "a

private person."

ARGUMENT

I.

THERE IS NO BAR TO A DELAY IN PAYMENT

ADJUSTMENT TO AN ATTORNEYS' FEE AWARD

AGAINST THE UNITED STATES

This case, in the government's view,

involves no more than whether the word

t

"interest" can be found somewhere in the

provisions of Title VII that apply to the

United States. We will demonstrate that:

- 13

1 . A long line of decisions of this

Court establishes that, even in the

absence of specific statutory authoriza

tion, pre-j udgment adjustments that

compensate for delay in payment and/or

deprivation of the use of funds -— whether

denominated "pre-judgment interest" or

otherwise -- are available against the

government to provide full compensation as

part of equitable relief.

2. The inclusion of a delay in

payment factor, as in this case, is a

necessary component of a reasonable

attorney's fee. Since the adjustment is

necessary to provide full compensation, it

is available here as a matter of legis

lative intent, consistent with the Court's

precedents.

3. Alternatively, there is no

sovereign immunity bar to an award of

interest against the government in a Title

14

VII action because 42 U.S.C. §2000e-16 is

a complete abrogation of sovereign

immunity. Congress' clear intent was to

ensure that employees of the United States

will enjoy the same scope of protection

from employment discrimination as do all

other employees. Therefore, Title VII is_

a statute that authorizes interest as part

of complete relief.

A. Adjustments For Pre-judgment Delays

In Payment May Be Included In

Awards Of Equitable Relief Against

The Federal Government In The Absence

of Specific Statutory Authority.'

The petitioners argue that decisions

of this Court, as codified in 28 U.S.C.

§ 2516, stand as an absolute bar to any

inclusion of a delay in payment factor in

calculating the value of a fee award

because the word "interest" does not

appear in Title VII. However, a close

examination of the cases cited by the

15

government demonstrates that they do not

support this proposition. Rather,

precisely the opposite is true; the

government has been led into a fatal error

by its failure to distinguish between the

nature and purpose of pre-j udgment

interest, which is involved here, and

post-judgment interest, which is not.

In General Motors Corp. v. Devex

Corp. , 461 U.S. 648 ( 1983), the Court

explained that, in a patent infringement

case, an award of prejudgment interest

from the time that the royalty payments

would have been received to the time of

the judgment, "merely serves to make the

patent owner whole, since his damages

consist not only of the value of the

royalty payments but also of the forgone

use of the money between the time of

infringement and the date of the judg

16

ment." Therefore, prejudgment interest

should ordinarily be awarded. 461 U.S. at

655-56.

The Court went on:

This very principle was the

basis of the decision in Waite

v. United States, 282 U.S. 508

(1931), which involved a patent

infringement suit against the

United States. The patent owner

had been awarded unliquidated

damages in the form of lost

profits, but had been denied an

award of prejudgment interest.

This Court held that an award of

prejudgment interest to the

patent owner was necessary to

ensure "complete justice as

between the plaintiff and the

United States," id., at 509 ,

even though the statute govern

ing such suits did not expressly

provide for interest^

461 U.S. at 656 (emphasis added). In

Waite itself, Justice Holmes noted that

the statute at issue granted "'recovery of

[the plaintiff's] reasonable and entire

compensation for such use.' We are of

- 17

opinion that interest should be allowed in

order to make the compensation 'entire'".

282 U.S. at 509.9

Waite cites and relies upon a series

of decisions in eminent domain actions

holding that the Fifth Amendment's "just

compensation" clause includes compensation

for delay between the time of the determi

nation of market value of the property and

when the award is made. Seaboard Air Line

R. Co. v. United States, 261 U.S. 299

(1923); Brooks-Scanlon Corp. v. United

States, 265 U.S. 106, 126 (1924); Liggett

& M. Tobacco Co. v. United States, 274

U.S. 215 (1927); Phelps v. United States,

274 U.S. 341 (1927). See also Albrecht v.

United States, 329 U.S. 599 (1947), and

cases cited icLat 602, n. 4. As explained

in General Motors Co. v. Devex, supra,

q” ■Interestingly, in Waite the government

conceded that pre-judgment interest was

proper.

- 18 -

without such an adjustment the patent or

property owner will not in fact be fully

compensated for the value of his property

and the loss of its use. Thus, "no

specific command to include interest is

necessary when interest or its equivalent

is a part of [just] compensation." Seaboard

Air Line R. Co. v. United States, 261 U.S.

at 306.10

The situation here is precisely

analogous. The government contends that

reimbursement for attorneys' fees is

limited to the dollar amount that was the

market value of the services at the time

In contrast, the rule is that interest is

not available in the absence of specific

statutory provision when land is taken

through purchase or a contract rather than

by an adverse condemnation proceeding.

See, e.g., United States v. North American

Transportation & Trading Co., 253 U.S. 330

(1920). In the former case the interest

is on the established amount agreed upon

as proper compensation, and therefore has

the character of post-judgment interest.

In the latter case, the interest is

pre-judgment and is therefore part of the

calculation of just compensation.

- 19

they were rendered. As we will demonstrate

at length below, however, full compensa

tion can only be made through an adjust

ment of that dollar amount to reflect loss

of value because of the passage of time.

The inclusion of pre-judgment

interest as part of the award of full

relief is well established in federal law.

See Nedd v. United Mine Workers of

America, 488 F. Supp. 1208, 1216-25 (M.D.

Pa. 1980) for a scholarly and comprehen

sive survey of the cases. An award is

left to the court's sound discretion based

on the weighing of four factors: (1)

responsibility for delays in prosecuting

an action; (2) undoing unjust enrichment;

(3) compensation of the victim of a legal

wrong; and (4) other equitable considera

tions. Ld. at 1220-24. The key to

pre-judgment interest is that it is a part

of the calculation of the judgment itself,

20

and is included when it is necessary to

provide "reasonable", "entire", or "just"

compensation.

Post-j udgment interest, on the other

hand, rests on an entirely different

basis. The traditional rationale for

assessing post-judgment interest was to

punish a debtor for failing to repay a

loan or another certain obligation the

amount of which had become fixed, such as

a judgment of a court. Laycock v. Parker,

103 Wis. 161, 179, 79 N.W. 327, 332

(1899). See, Note, "Interest in Judgments

Against the Federal Government: The Need

for Full Compensation," 91 Yale L.J. 297,

1 1 As Nedd points out, the common law

distinction between liquidated and

unliquidated damages does not determine,

under federal law, whether pre-judgment

interest is available. 488 F. Supp. at

1217. The government's suggestion to the

contrary (Pet. Brief, p. 23, n. 13) is

both incorrect and inconsistent with its

position that fee and back pay awards

against private employers may be adjusted

for delay in payment.

21

300-1 (1981). The no-interest rule

developed when interest was thus viewed as

a penalty. Sovereign immunity barred an

award of interest since the government had

to give its specific consent to being

penalized. As this Court explained:

Whenever interest is allowed

either by statute or by common

law, except in cases where there

has been a contract to pay

interest, it is allowed for delay

or default of the debtor. But

delay or default cannot be

attributed to the government. It

is presumed to be always ready to

pay what it owes.

United States v. Sherman, 98 U.S. 565,

567-8 (1878).

Thus, the 1819 Attorney General's

opinion from which the no-interest rule

derives involved interest on a claim in a

pre-determined amount. The opinion notes,

"Interest is in the nature of damages for

withholding money which the party ought to

pay, and would not or could not." 1 Op.

22

Atty. Gen. 268 (1819). Indeed, even the

opinions of the attorney general upon

which the government relies recognize that

in some instances interest is recoverable

where it is necessary for full compensa-

t ion, e,g. , where a "claimant shall have

paid interest; in which case, indeed,

interest becomes strictly a portion of the

principal of his claim." 2 Op. Atty. Gen.

390, 392 (1830). See also, 5 Op. Atty.

Gen. 1 38 ( 1 849); 5 Op. Atty. Gen. 226

(1850). United States v. Sherman also

recognizes the distinction, noting, "the

interest is no part of of the amount

recovered. It accrues only after the

recovery has been had." 98 U.S. at 567.

Similarly, virtually all of the cases

cited by the petitioners at pages 13—15 of

their brief involved the award of ordinary

post-judgment interest. They simply

apply the rule that a penalty for failure

23

to pay an established debt could not be

imposed on the government without its

consent. And, as the government concedes

here, 28 U.S.C. § 2516(a) and its prede

cessors, barring interest on "claims

against the United States" in the absence

of contract or specific statutory authori

zation, did no more than codify the rule

established by the attorney generals1

opinions and the post-judgment interest

cases.

Thus, it can be seen that the

Government has failed to recognize the

distinction between ordinary interest of

the pos t-j udgment kind contemplated by 28

U.S.C. § 2516, which serves as a penalty

or as income for the use of money fol

lowing a delay in the satisfaction of a

judgment, and prejudgment interest (or

other similar factors) which represents

part of the calculation of full relief in

24

the first instance. The cases upon which

the government relies involve the former

type of interest. This case involves the

latter.

B . The Inclusion Of A Factor To Compen-

sate For Pre-judgment Delays In

Payment Is A Necessary Component In

Calculating A Reasonable Attorney ' s

Fee.

Section 2000e-5(k) provides that the

court, in its discretion, shall award a

reasonable attorney's fee. The lower

courts have held, so far without excep

tion, that in civil rights cases compen

sation for delay in payment must be

1 2included in a reasonable fee. The

See, e.g., Copeland v. Marshall, 641 F. 2d

at 892-93; Institutionalized Juveniles v.

Secretary of~Public Welfare, 758 F.2d 897

( 3rd Cir. 1985) ; Graves v. Barnes, 700

F.2d 220, 224 (5th Cir. 1983); Gautreaux

v. Chicago Housing Authority, 690 F.2d

601, 612 (7th Cir. 1982);"Jorstad v. IDS

Realty Trust, 643 F.2d 1305, 1313 (8th

Cir. 1981); Ramos v. Lamm, 713 P.2d 546,

555 (10th Cir. 1983); Johnson v. Univer-

sity College of the University of Alabama,

706 F.2d 1205, 1210-1 1 ( 1 1th Cir. 1983).

25

government has not directly challenged the

correctness of those decisions insofar as

fees are to be calculated against every

other employer except itself. Neverthe

less, it is essential to understand why

such an adjustment is a prerequisite to a

reasonable fee in order to demonstrate the

fallacy of the government’s mechanical

equation of all pre-judgment adjustments

with post-judgment interest.

The legislative purpose of the various

civil rights attorneys’ fees act statutes

have been explored at length by this Court

in recent decisions and need not be

13repeated in detail here. Suffice it to

say that a key concern of Congress was

See also "Counsel Fees in Public Interest

Litigation," Report By the Committee on

Legal Assistance, 39 The Record of the

Association of the Bar of the City of New

York 300, 318 ( 1984).

̂̂ Hensley v. Eckerhart, 461 U .S . 4 24

(1983); Blum v. Stenson, U.S.

79 L.Ed.2d 891 (1984).

f

26

that if the fees that were available were

insufficient to attract the private bar,

there would not be an adequate level of

private enforcement of Title VII and the

other civil rights acts. As this Court

noted in its seminal decision in Newman v.

Piggie Park Enterprises, 390 U.S. 490

(1968) the resources of the federal

government itself were simply insufficient

for the level of enforcement necessary to

end the problem of racial discrimination

in our society. Thus, the statute provided

fees to ensure that "private attorneys

general" would furnish the essential level

of private enforcement.

The problem is even more acute when

the government is a defendant in a Title

VII case for, as has been noted in another

context, there is no public attorney

qeneral to bring actions on discrimina

tion claims of federal employees. Parker

- 27 -

v. Califano, 561 F.2d 320, 331 (D.C. Cir.

1977). Only private parties may bring

such actions and, therefore, without the

full involvement of the private bar the

statute will not be enforced.

In the legislative history of the

Civil Rights Attorneys Fee Act of 1976

Congress expressed these concerns at

length. Thus, there is a consistent

theme that unless fees are sufficiently

attractive to attact the private bar there

will be insufficient enforcement.14 15

The legislative history of the Fees

Act is replete with comparisons between

the situations of plaintiff's attorneys

and defendant's attorneys in civil rights

1 5cases. Ordinarily a defendant, particu

14 See S. Rep. No. 94-1011 (94th Cong. 2d

Sess. , 1976), 2-5; H. Rep. No. 94-1558

(94th Cong. 2d Sess., 1976), 2-3).

15 H. Rep. No. 94-1558, supra at 7; The

Effect of Legal Fees on the Adequacy of

Representation, Hearings" Before’ ""'the

Subcommittee ~oF~Ripre¥elTtaFIon~~oT~C I tTzerT

28

larly when it is a public agency, has

available far greater resources than the

1 6ordinary civil right litigant. Indeed,

this case is paradigmatic: a single

middle-class federal employee faced with

the full array of the legal and technical

resources of the Library of Congress and

the Department of Justice.

Such plaintiffs typically cannot pay

attorney's fees at all or, as here, only

a limited amount. Thus, the attorney must

look to the possible award of fees in the

future for compensation. If the eventual

award is not sufficiently equivalent to

fees the attorney could have obtained

through other types of practice at the

time the services are rendered, there will

be a "negative incentive to move away from 16

Interests of the Committee on the Judi

ciary, United States Senate, 93rd Cong.,

1st Sess. at 84; 834-36 (1973).

16 H. Rep. No. 94-1558, supra at 7.

29

civil rights litigation and to concentrate

efforts on more profitable aspects of the

1 7practice."

The disincentives are particularly

strono for the typical civil rights

lawyer, who tends to be a single practi

tioner or in a small firm. Given the

realities of paying off the massive loans

incurred to obtain a law degree and to set

up practice, paying rent, staff salaries,

and having enough left over to live on,

taking on a complex civil rights case must

be economically feasible for such a

lawyer.

To aive an example, assume an

attorney in 1975 with the choice of

accepting: (1 ) a fee-paying client whom

he could bill at his or her established

market rate of S 80 per hour, monthly; or

Counsel Fees In Public Interest Litiga

tion, op. cit. supra, n. 12, at 318,

325-26.

30

(2) a civil rights client for whose case

he or she would receive no fees until a

court award five years later in 1980. If,

in 1980, the lawyer received only the same

$80 per hour, he or she would have to be

extraordinarily altruistic to take on

client number two, wait five years, and

receive an $80 per hour devalued by

inflation and the loss of the use of that

money. There must be some basis to

encourage him or her to take the second

client over the first or Congress' intent

will be thwarted entirely.

In order for the lawyer to be paid

at a rate ecruivalent to the $80 market

rate in 1 975 he or she must be able to

receive $ 1 22.40 per hour in 1 9 8 0 . This

larger amount will do no more than

compensate the lawyer at the same effec-

18 A simple calculation based on the Consumer

Price Index is set out in detail in

appendix II to this Brief at pp. 2b-3b.

31

tive rate as he or she would have

received in 1975 dollars. Even that would

not cover the full value of the money, for

the lawyer (or fee-paying client) has lost

the value of the use of that money in the

interim, and has suffered attendant cash

1 qflow problems. ' Accordingly,, the 10%

adjustment per year ordered by the

district court on the basis of the rate

available on Treasury bonds, is the least

20that counsel was entitled to.

' For example, consider what counsel would

have had to spend to borrow sufficient

money to pay his or her 1975 bills in

reliance on a fee to be awarded in 1980.

With commercial interest rates in the 8 to

15% range, eighty 1975 dollars would have

cost about $155 by 1980.

2 0 Of course, the court should have compoun

ded the interest rather than simply

multiplying it by the number of years

passed. The court's mathematical error,

however, only results in a difference of

about $2.50 per hour in the government's

f avor.

32

Put in another way, paying the

attorney $80 per hour in 1980 would be the

same as if he or she had been paid $52 in

1975.21 Since the lesser amount is substan

tially below the established market rate,

it can not, a fortiori, be a reasonable

fee under this Court's decision in Blum v.

Stenson, ___ U.S. ___, 79 L.Ed. 2d 891

{ 1984).

Unfortunately, it is not unusual in

civil rights cases, particularly in Title

VII cases involving the federal govern

ment, for the entire process from the

beginning of the administrative process

through final decision in court on the

merits, to take many years. Many of

See Appendix II to this Brief at p. 3b.

For example, present counsel are involved

in one case against the Postal Service

begun by the filing by an administrative

complaint in 1971 and which was filed in

court in 1972. The case did not go to

trial until 1982, and a decision adverse

to plaintiffs was reversed by the court of

appeals in 1985. The case is now back in

33

these cases began in the mid-1970's and

the impact of the high rate of inflation

in the latter part of that period was

severe.

Congress was aware of the problem of

delay in payment when it enacted the 1976

Pees Act. Thus, it contemplated interim

fees in appropriate cases because civil

23rights litigation was often protracted. * 19

the trial court for further proceedings,

If plaintiffs were to win on the merits in

1986 there would be potential entitlement

to attorneys' fees going back as far as

1972. See, Griffin v. Carlin 755 F.2d

1516 ( 1 1 th Cir"I “9857: Griffin is not

unusual. See, Chisholm v~. United States

Postal Service, 765 F: 2d 482 (4th Cir.

19 81) (nine years from administrative

complaint to final disposition of merits) ;

Saunders v . Claytor, 629 F. 2d 596 (9th

C ir. 1 9 8 0) (six years between illegal

d i scharge and award of back pay and

attorneys' fees); Shultz v. Palmer (No.

85-50) (eight years between initial charge

and award of fees on that port ion of the

case that was settled).

H. Rep. No. 94-1558, supra at 8. The

legislative history of the Equal Employ

ment Opportunity Act of 1972 also reflects

Congress' awareness of the limited

resources of Title VII plaintiffs and the

problem of time delays attendant to such

34

As one court has noted, the risk of

financial drain will discourage the

bringing of Title VII suits and defendants

"may be tempted to seek victory through an

economic war of attrition against the

plaintiffs." James v. Stockham Valves &

Fitting Co., 559 F.2d 310, 358-59 (5th

Cir. 1977).

Thus, the reasons discussed supra at

pp. 15-20 that make pre-judgment interest

ordinarily available in patent cases apply

with full force to awards of attorneys'

fees, since the impact of delay is the

same. Full compensation cannot be

achieved unless the value of the "forgone

use of the money" between the time fees

are incurred "and the date of the judg

ment" (General Motors Corp. v. Devex, 461

litigation. Sen. Rep. No. 92-415 (92d

Cong. 1st Sess., 1971) p. 17.

35

U.S. at 656) is taken into account. Just

as in a patent infringement case, denying

pre-j udgroent interest to a prevailing

Title VII plaintiff "not only undercompen

sates [the employee] but also may grant a

windfall to the [discriminator] and create

an incentive to prolong litigation." 461

U.S. at 655 n. 10.

For similar reasons, the Court should

reject the government's contention that a

rule that fees may be adjusted for delay

in payment would be incongruous because

it is "settled law," that backpay awards

cannot be so adjusted. (Pet. Brief, pp.

20-21). There are three things wrong with

this argument. First, if anything is

24

This is the case whether the client has

paid the attorney as the case progressed,

or whether the fee was delayed in whole or

in part until the action was successfully

concluded. In the former instance, the

plaintiff will not be made whole unless

compensated for delay; in the latter, the

attorney will not otherwise receive a

reasonable fee.

36

"settled" it is that nothing is "settled

law" until this Court has spoken on the

2 5question. This Court has never deter

mined whether the lower courts have been

correct in holding that back pay awards

against the federal government cannot be

adjusted for delay in payment. See, Schlei

and Grossman, Employment Discrimination

Law, 1214 n. 175 (2d Ed. 1983).

Second, it is clear that the princi

ples enunciated in General Motors Corp. v.

Devex,(GMC) supra, and Waite v. United

States, supra, apply fully to back pay

awards. As GMC makes clear, "the standard

governing the award of prejudgment

interest . . . should be consistent with

Congress' overriding purpose of af-

_ _

See, e,g. , Alyeska Pipeline Service v.

Wilderness Soc., 421 U.S. 240, 270, n. 46

(1975) (overruling thirteen lower court

decisions on attorneys' fees) and Team-

sters v. United States, 431 U.S. 324, 378

n. 2 (1977) (overruling more than thirty

decisions by six courts of appeals).

37

fording . . . complete compensation." 461

U.S. at 655. That purpose is to place the

patent owner "in as good a position as he

would have been in" if there had not been

a violation. Ibid. This purpose is, of

course, precisely the same purpose

Congress had when it provided for equi

table make-whole relief in the form of

back pay in Title VII cases. Compare GMC

v. Devex, 461 U.S. at 655-656 (prejudgment

interest necessary to "make the patent

owner whole" and to ensure "complete

justice between the plaintiff and the

United States") with Albemarle Paper Co.

v. Woody, 422 U.S. 405, 418 (1975) (back

pay an equitable remedy necessary to "make

persons whole for injuries suffered on

account of unlawful employment discrimi

nation" and "to secure complete justice").

38

Third, as we will now demonstrate,

Congress intended by § 2000e-16 to

abrogate sovereign immunity in its

entirety in Title VII actions against the

government. Therefore, federal employees

are entitled the same full relief with

regard to both attorneys' fees and back

pay as are all other employees.^

The government's asserted dichotomy

between back pay as benefiting the

discriminated against employee and

attorneys' fees as benefiting the lawyer

is also simply wronq. The provision that

fees are to be paid by the defendant is

for the benefit of the prevailing civil

rights plaintiff just as much as is the

provision of back pay. Congress and this

Court recognize that without the possibil

ity of fee-shifting, attorneys would not

be available; without attorneys there will

be no civil rights plaintiffs to recover

back pay. See Newman v. Piggie Park

Enterprises, Inc., supra. For those

clients who can pay fees, their recovery

is as much make whole relief as is the

recovery of back pay.

39

II.

SECTION 717 OF THE EQUAL EMPLOYMENT

OPPORTUNITY ACT OF 1972 IS A COMPLETE

ABROGATION OF SOVEREIGN IMMUNITY IN

EMPLOYMENT DISCRIMINATION CASES.

A. Congressional Intent Is Determinative

Of The Extent Sovereign Immunity Is

Waived By A Particular Statutory

Scheme.

The government relies mechanically on

cases decided at a time when sovereign

immunity was viewed as an absolute and

impenetrable bar to actions brought

against the federal government. More

recent decisions of this Court, on the

other hand, establish that sovereign

immunity is a disfavored doctrine and that

conaress ional waivers of it will be

construed liberally. Thus, in Franchise

Tax Board of California v. United States

Postal Service, _____ U.S. ____, 81 L.Ed. 2d

446 (1984) this Court reaffirmed a line of

cases that have interpreted liberally "sue

and be sued" language as constituting the

40

total abrogation of sovereign immunity.

81 L.Ed.2d at 451. The lower courts have

correctly held that such language encom

passes an abrogation of the bar to an

award of interest in a Title VII case.

See, Nagy v. United States Postal Service,

773 F .2d 1190 (11th Cir. 1985) .

To what extent the sovereign immunity

of the federal government has been waived

by a particular statutory scheme depends,

of course, on the intent of Congress.

Indeed, this proposition is firmly

established by the very cases relied upon

by petitioners. Thus, for example, in

Boston Sand Co. v. United States, 278 U.S.

41 (1928), the Court did not simply rest

on the absence of the word "interest" from

27the private act in question. Rather, the

decision by Justice Holmes carefully

scrutinized the context of the statute. It

27 42 Stat. 1590, ch. 192 (5-15-22).

41 -

concluded that Congress did not intend to

"put the United States on the footing of a

private person in all respects." Id. at

47.

In Standard Oil Co. v. United States,

267 U.S. 76 (1925), in contrast, the Court

did find the United States liable for

interest under a statute that again was

silent on the subject. There, the United

States acted as if it were a private

insurer; therefore, it had without more

consented to be treated as a private

insurer. Id . at 79. As a result,

interest could be obtained even though it

was not expressly provided for by statute.

Thus, the rule established by the deci

sions of this Court is that the presence

or absence of a particular phrase or word

is not dispositive. Rather, one must look

42

to the intent of Congress as evidenced by

both the language and purpose of the

particular statutory scheme involved.

As we have explained in our Brief in

Opposition to the Petition for Writ of

Certiorari at pages 17-23, the decisions

embodying the no-interest rule dealt with

narrow and specific Acts, leases, and

contracts in regard to which the United

States was acting in its sovereign and

governmental capacity. By 42 U.S.C.

§ 200Oe- 1 6 ( § 717 of the Equal Employment

Opportunity Act of 1972), in contrast,

Congress had the specific and clear intent

that governmental agencies, in their

capacities as providers of employment

opportunities, would have the same status

as all other employers, private, state and

local, covered under the broad and

comprehensive provisions of Title VII.

43

Indeed, Congress intended that the federal

government serve as a model for all other

employers because:

The Federal service is an area

where equal employment opportun

ity is of paramount signi

ficance . . . . Accordingly

there can exist no justification

for anything but a vigorous

effort to accord Federal

employees the same rights and

impartial treatment which the

law seeks to afford employees in

the private sector.

House Report No. 92-238 (92d Cong. 1st

Sess. , 1971), pp. 22-23; see also Sen.

Report No. 92-415 (92d Cong. 1st. Sess.

1971) pp. 12-13.

B . Congress Intended To Waive All

Sovereign Immunity Bars To The Award

Of Complete Relief In Title VII

Cases

In the Equal Employment Opportunity

Act of 1972 Congress used, if anything,

even clearer language to evidence an

intent to abrogate sovereign immunity

44

totally than the phrase "sue and be sued."

Not only has it provided in the statute

that an action against the federal

government will be governed by precisely

the same relief provisions that govern

2 8actions against private employers, but it

has provided specifically that the

government will be liable for fees "the

same as a pr ivate 29person." It has,

moreover, stated explicitly in the

legislative history of the Act that

federal employees will "have the full

42 U.S.C. § 2000e-16(d) :

The provisions of section 200Qe-5(f)

through (k) of this title, as

applicable, shall govern civil

actions brought hereunder.

See Chandler v. Roudebush, 425 U.S. 840,

8 4 6-~48 ( 1976) for the meaning of the

phrase "as applicable." For the reasons

stated there, the phrase cannot be

construed as limiting the clear language

of 2000e-5(k) .

42 U.S.C. § 2000e-5(k), one of the

provisions incorporated by reference by

§ 2OO0e-16(d).

45

rights available in the courts as are

granted to individuals in the private

50sector under Title VII."

Strikingly absent from the govern

ment’s brief is any substantial discussion

. 31of the Act’s legislative history.

Similarly striking is the absence of any

reference whatsoever to the prior deci

sions of this Court discussing the history

and purpose of the Act. This Court has

held that § 2000e-16 provides federal

employees with a "careful blend of * 30

Sen. Rep. No. 92-415 (92d Cong., 1st

Sess., 1971), reprinted in Subcommittee on

Labor, Senate Commitee on Labor and Public

Welfare, "Legislative History of The Equal

Employment Opportunity Act of 1972"

(hereinafter "Legislative History") at

425.

The only citation in its brief, at p. 19,

to the legislative history is to the

entire lengthy compendium cited supra, n.

30. The government simply asserts that it

could find nothing in that substantial

book that casts any light on the issue

before the Court, presumedly because it

could not find the magic word "interest"

therein.

46

administrative and judicial enforcement

powers" intended "to accord federal

33employees the same right [s] " enjoyed by

other employees. This was accomplished by

providing that 42 U.S.C. § 2000e-5(f)-(k},

the provisions relating to relief for

non-federal employees, govern the

provision of relief to federal employees.

Brown v. General Services Administration,

425 U.S. 820, (1976), squarely held that:

Sections 706(f) through (k), 42

U.S.C. §S 2000e-5(f ) through

2000e-5(k) . . . . which are

incorporated "as applicable" by

§ 717(d), govern such issues as

venue, the appointment of

attorneys, attorneys' fees, and

the scope of relief.

425 U.S. at 832 (emphasis added).

Brown v. General Services Administration,

425 U.S. 820, 833 ( 1976) .

Chandler v. Roudebush, 425 U.S. 840, 848

(1976).

33

47

Crucial to an understanding of the

intent of Congress when it passed 42

U.S.C. §2000e-16 is the background of that

statute and the specific, underlying

problem it addressed. Existing sovereign

immunity doctrine had served as a bar both

to the recovery of full relief in the

administrative process and to the pursuit

34of such relief in court.' Congress passed

§ 2000e-16 to overcome that bar entirely.

When Congress enacted Title VII of

the Civil Rights Act of 1964, it did not

include the United States within the

definition of employer. However, it did

include a proviso that employment deci

sions of the government were to be free of

discrimination and entrusted to the

— — ..... “ “J

See Schlei & Grossman, Employment Discri

mination Law, Chap. 33, "Federal Employee

Litigation" ( 2d Ed. 1983) , for a summary

of the history of the 1964 and 1972 Acts

and of the Civil Service Reform Act of

1978 as they relate to federal employee

discrimination claims.

48

President the power to implement that

35proviso. Subsequently, Executive Orders

1 1 246 and 1 1 478 were issued along with

implementing regulations enacted by the

3 6then Civil Service Commission.

The regulations provided administra

tive procedures and certain remedies to

federal employees for discrimination in

employment. However, the scope of relief

available was severely limited because of

an opinion of the Comptroller General that

back pay could be awarded for a discrimi

nation claim only insofar as it was

permitted under the Back Pay Act (5 U.S.C.

3 7§ 5596(b)). Thus, a federal employee who 35 * 37

35 P.L. 88-352, § 701(b).

3® 5 C.F.R. Part 713 (1967). These regula

tions, as amended, are now found at 29

C.F.R. Part 1613.

37 Testimony of Irving Kator, Hearings Before

the General Subcommittee on Labor of the

House Committee On Education And Labor on

H.R. 1746, March 3, 4, and 18, 1971, p.

365.

49

succeeded in challenging a discharge could

receive the back pay he had been denied

thereby, while an employee who successful

ly challenged the denial of a promotion on

3 8the ground of discrimination could not.

The underlying basis for the Comptroller

General 1s opinion was that without an

explicit waiver of sovereian immunity by

Congress, the only relief available for

discrimination claims was that available

under existing statutory authority.

With regard to the availability of a

judicial remedy, there was a split in the

courts. While the Court of Claims held

that there was a right to bring an action

. 39based on discrimination, the Eighth

See, United States v. Testan, 424 U.S. 392

(1976)“, for a discussion of the distinc

tion between discharge and promotion

claims under the Back Pay Act in a case

that does not involve a discrimination

claim.

Chambers v. United States, 451 P. 2d 1045

(Ct. Cl. 1971).

39

50

Circuit in Gnotta v. United States, 415

F. 2d 1271 (8th Cir. 1969), held that

sovereign immunity precluded such an

action and that the various statutes upon

which such a claim might be based did not

constitute a sufficient waiver of sov

ereign immunity.

Thus, as this court has already held

in Brown v. GSA, one of the central

concerns discussed in the hearings and

committee reports involving § 2000e-16

were sovereign immunity bars to relief for

federal employees asserting claims of

discrimination. Thus, witnesses urged

that Congress must act to ensure the

availability of complete relief.^ Repre

sentatives of the Civil Service Com-

See, e .g . , testimony of Hon. Walter E.

Fauntroy, Hearings Before the Subcommittee

on Labor of the Senate Committee on Labor

and Public Welfare on S.2515, S.2617, antd

H.R. 1746, Oct. 4, 6, and 7, 1971, at p.

206.

51

mission, while acknowledging limitations

on the relief they could grant because of

the Comptroller General's ruling, attemp

ted to assure Congress that there was no

sovereign immunity bar to judicial

, . , 41relief.

The Senate Committee, however, noted

that "the testimony of the Civil Service

Commission notwithstanding . . . [ijn many

cases the employee must overcome a U.S.

Government defense of sovereign immunity"

and that "the remedial authority of the

Commission and the courts has also been in

doubt."* 42 Thus, it was made explicit in

Testimony of Irving Kator, Hearings cited

supra, n . 37, pp. 319-20,* Testimony of

Irving Kator, Hearings cited supra, n. 40,

p. 296.

42 Leaislative History at 425. As noted by

the government in its brief in Brown v.

GSA, supra, "Ultimately, the Committees

concluded that judicial review was not

available at all or that access was

doubtful and that some forms of relief

were definitely foreclosed." Brief for

Respondents in No. 74-768, p . 24.

52

the legislative reports that a central

purpose of § 2000e-16 was specifically to

remove sovereign immunity bars to relief

for federal employees, both in the

43administrative process and in court.

With regard to the administrative

process, Congress specified that the Civil

Service Commission (now the Equal Employ-

44ment Opportunity Commission) could grant

45back pay and all other relief necessary.

Legislative History at 425.

Jurisdiction over federal equal employment

opportunity matters was transferred to the

EEOC by the President's Reorganization

Plan No. 1 of 1978. 43 F.R. 28971 ( 1978).

Section 2000e-16(b) provides that the

Commission may enforce 2000e-16(a)

"through appropriate remedies, including

reinstatement or hiring of employees with

or without back pay, as will effectuate

the policies of this section . . . ." The

section-by-analysis accompanying the

conference report explained:

The Civil Service Commission would be

authorized to grant appropriate

remedies which may include, but are

not limited to, backpay for aggrieved

applicants or employees. Any remedy

5 3

The legislative history makes it clear

that there was no intent to limit the

relief available to that specified in the

statute. Rather, Congress recognized the

impossibility, in the context of Title

VII, of predetermining all the possible

types and scope of relief that might be

appropriate. Thus, at the same time

Congress was enacting § 2000e-16 it was

expanding the language of the relief

provisions of Title VII in 42 U.S.C.

needed to fully recompense the

employee for his loss, both financial

and professional, is considered

appropriate under this subsection.

Legislative History at 1851. {Emphasis

added.) The District Court for the

District of Columbia interpreted

§ 2000e-16(b) as authorizing the award of

attorneys’ fees administratively in an

employment discrimination case. Smith v.

Califano, 446 F. Supp. 530 (D.D.C. 1978).

Congress authorized the award of fees by

the Merit Systems Protection Board in EEO

cases in the Civil Service Reform Act of

1978, 5 U.S.C. § 7701(g)(2). Subse-

auently, both the MSPB and the EEOC

adopted regulations for the award of fees

in EEO cases. 5 C.F.R. § 1201.37; 29

C.F.R. § 1613.271(c).

54

§ 2000e-5(g). As held by this Court in

Franks v. Bowman Transportation Company,,

424 U.S. 747, 763-66 (1976), the legis

lative history of the amendment to

§ 2000e-5(g) makes it clear that the

"'most complete relief possible'" was to

be available, unlimited by the enumeration

in the statute of certain particular

remedies. 424 U.S. at 764.

When Congress provided a judicial

remedy for federal employees, it seized on

the simple expedient of incorporating the

relief provisions that were applicable to

all other employers into § 2000e-16. Thus,

it first provided that federal employees

46could bring a civil action and then made

all of the relief provisions applicable to

private, state, and local government

employers applicable to actions brought by

46 42 U.S.C. § 2Q00e-16(c)

5 5

federal employees. Again, Congress'

intent to make precisely the same relief

available to federal employees as is

available to all other employees is

1 48clear.

Thus, the clear language of the

statute, the legislative history, and the

entire background and purpose of the

statute allow no other interpretation than

that Congress intended to enact a complete

waiver of sovereign immunity in cases

raising claims of discrimination in

employment against federal agencies. The

waiver includes allowing attorneys' fees

47

42 U.S.C. § 2Q00e-16(d).

The Senate Report states, "aggrieved

employees . . . will also have the full

rights available in the courts as are

granted to individuals in the private

sector under Title VII." Legislative

History at 425.

5 6

on the same basis, in the same amount, and

calculated in the same manner as fees

. 49against other parties.

The petitioners’ attempt to rely on lower

court decisions decided under the Equal

Access to Justice Act is misplaced for a

number of reasons. (1) The purpose of

the EAJA is entirely different. It deals

specifically with typical governmental

actions and is limited to awarding fees

only when the positions taken by the

government were not "substantially

justified." (2) The EAJA’s purpose is

not to encourage the bringing of litiga

tion, but rather is to provide some

measure of reimbursement to those who must

defend against unjust governmental

actions. (3) The EAJA limits fees to $75

per hour and thus does not purport to

provide full or just compensation for

expenditures of attorneys fees. There

fore, particularly with regard to the

inclusion of pre-j udgment interest, it has

no relevance whatsoever to the calculation

of a "reasonable," i.e , , fully compensa

tory, fee. (4) Congress explicitly

provided that the EAJA did not alter,

limit, modify, repeal, invalidate, or

supersede any other statute, including the

civil rights acts, which provided for fees

against the United States. P.L. 96-481,

§ 206. This language was inserted in the

statute precisely because of concerns that

the EAJA might be relied upon to restrict

fee awards in civil rights cases.

5 7

Despite the evidence of the clear

intent of § 2000e-16, following its

enactment the government persisted in

arguing that sovereign immunity limited

the relief available to federal employees,

including the recovery of attorneys' fees.

Indeed, the government's first argument

was that no fees were available against

the government whatsoever because of

sovereign immunity. In fact, the govern

ment made the same "fortuity" argument

that it now makes at p. 20 of its brief

here: that is, when Congress incorporated

42 U.S.C. § 2000e-5(k) into § 2000e-16 it

really had no intent to impose on the

United States liability for fees when a

government employee prevailed in a Title

VII action where a federal agency was the

5 0defendant.' The government eventually

Letter from Irving Jaffe, Acting Attorney

General, to Senator John V. Tunney, May 6,

1975, printed in 2 CCH Employment Prac

tices Guide 1(5327 ( 1976). See Ralston,

58

5 1abandoned this argument in 1975 and

finally, in 1977, the Attorney General of

the United States officially disavowed any

reliance on arguments based on sovereign

immunity. He stated:

In a similar vein, the

Department will not urge

arguments that rely upon the

unique role of the Federal

Government. For example, the

Department recognizes that the

same kinds of relief should be

available against the Federal

Government as courts have found

appropriate in private sector

cases, including imposition of

affirmative action plans, back

pay and attorney's fees. See

Copeland v. Usery, 13 EPD

1(11,434 (D.D.C. 1976); Day v.

Mathews, 530 F.2d 1083 (D.C.

Cir. 1976); Sperling v. United

States, 515 F.2d 465 " ( 3d cir.

1975). Thus, while the Depart

ment might oppose particular

remedies in a given case, it

will not urge that different

standards be applied in cases

"The Federal Government as Employer:

Problems and Issues in Enforcing the

Anti-Discrimination Laws", 10 Ga. L. Rev.

717, 719 n. 13 ( 1976) .

51 Ibid.

- 5 9 -

against the Federal Government

than are applied in other

cases.

Memorandum of Attorney General Griffin B.

Bell for United States Attorneys and

Aqency General Counsel (Aug. 31, 1977), p.

2 . 52

This directive was in effect when the

services at issue here were rendered and

when the district court entered its award;

to the knowledge of counsel for respon

dent, it has never been withdrawn. If the

position taken in the present case

constitutes a repudiation of that an

nounced in 1977, we urge that it is in

error. As we have shown, Congress

intended to and in fact did confer "upon

Federal employees . . . the same substan

tive . . . [and] procedural rights . . .

__

The memorandum was published in 2 CCH

Employment Practices Guide f 5046 (1977).

For the convenience of the Court, the

memorandum is reproduced in Appendix III

to this Brief at pp. 1c-3c.

60

as it has conferred upon employees . . .

in private industry and in state and local

governments." (Ibid.) This Court should

affirm that the United States has "no

lesser obligations with respect to equal

employment opportunities than those it

seeks to impose upon private and state and

local government employees." (Ibid.) The

rights afforded federal employees include

the recovery of attorneys' fees and back

pay in their entirety, including both pre-

and post-judgment interest and other

necessary components of full make whole

relief.

61

CONCLUSION

For the foregoing reasons, the

decision of the court below should be

affirmed.

Respectfully submitted,

JULIUS LeVONNE CHAMBERS

CHARLES STEPHEN RALSTON

(Counsel of Record)

99 Hudson Street,

16th Floor

New York, N.Y. 10013

(212) 219-1900

Attorneys for Respondent

APPENDIX I

Statutes Involved

1a

42 P.S.C. § 2000e-16

(a) All personnel actions

affecting employees or applicants for

employment (except with regard to aliens

employed outside the limits of the United

States) in military departments as defined

in section 102 of title 5, United States

Code, in executive agencies as defined in

section 105 of title 5, United States Code

(including employees and applicants for

employment who are paid from nonappro-

priated funds), in the United States

Postal Service and the Postal Rate

Commission, in those units of the Govern

ment of the District of Columbia having

positions in the competitive service, and

in those units of the legislative and

judicial branches of the Federal Govern

ment having positions in the competitive

service, and in the Library of Congress

shall be made free from any discrimination

2a

based on race, color, religion, sex, or

national origin.

(b) Except as otherwise

provided in this subsection, the Civil

Service Commission shall have authority to

enforce the provisions of subsection (a)

through appropriate remedies, including

reinstatement or hiring of employees with

or without back pay, as will effectuate

the policies of this section, and shall

issue such rules, regulations, orders and

instructions as it deems necessary and

appropriate to carry out its responsibili

ties under this section. The Civil

Service Commission shall — -

(1) be responsible for the annual

review and approval of a

national and regional equal

employment opportunity plan

which each department and agency

and each appropriate unit

referred to in subsection (a) of

3 a

this section shall submit in

order to maintain an affirmative

program of equal employment

opportunity for all such

employees and applicants for

employment;

(2) be responsible for the review

and evaluation of the operation

of all agency equal employment

opportunity programs, perio

dically obtaining and publishing

(on at least a semi-annual

basis) progress reports from

each such department, agency, or

unit? and

(3) consult with and solicit the

recommendations of interested

individuals, groups, and

organizations relating to equal

employment opportunity.,

The head of each such department, agency,

or unit shall comply with such rules,

4 a

regulations, orders, and instructions

which shall include a provision that an

employee or applicant for employment shall

be notified of any final action taken on

any complaint of discrimination filed by

him thereunder. The plan submitted by

each department, agency, and unit shall

include, but not be limited to —

(1 ) provision for the establishment

of training and education

programs designed to provide a

maximum opportunity for employ

ees to advance so as to perform

at their highest potential; and

(2) a description of the qualifica

tions in terras of training and

experience relating to equal

employment opportunity for the

principal and operating

officials of each such depart

ment , agency or unit responsible

for carrying out the equal

5 a

employment opportunity program

and of the allocation of

personnel and resources proposed

by such department,, agency, or

unit to carry out its equal

employment opportunity program.

With respect to employment in the Library

of Congress, authorities granted in this

subsection to the Civil Service Commission

shall be exercised by the Librarian of

Congress.

(c ) Within thirty days of

receipt of notice of final action taken by

a department , a g e n c y , or unit referred to

in subsection 717(a), or by the Civil

Service Commission upon an appeal from a

decision or order of such department,

agency, or unit on a complaint of discri

mination based on race, color, religion,

sex or national origin, brought pursuant

to subsection (a) of this section,

Executive Order 11478 or any succeeding

6 a

executive orders? or after one hundred and

eighty days from the filing of the initial

charge with the department? agency? or

unit or with the Civil Service Commission

on appeal from a decision or order of such

department? agency? or unit? an employee

or applicant for employment? if aggrieved

by the final disposition of his complaint?

or by the failure to take final action on

his complaint? may file a civil action as

provided in section 706? in which civil

action the head of the department? agency?

or unit? as appropriate ? shall be the